Management Accounting Report: LCBB5002 - XLG Case Study Analysis

VerifiedAdded on 2023/01/06

|15

|3174

|42

Report

AI Summary

This report delves into the core concepts of management accounting, focusing on variance analysis and its application in assessing managerial performance within the context of a case study involving XLG. The report calculates sales price and sales volume contribution variances, offering a practical understanding of their computation and implications. It provides an efficacious analysis of the merits and demerits associated with using variances to evaluate managers, highlighting the strengths and weaknesses of this approach. Furthermore, the report addresses the make-or-buy decision, evaluating the factors influencing whether XLG should manufacture FAMA Q in-house or import it, considering cost, logistical challenges, and market dynamics. The analysis considers both the costs of production and the costs of purchasing, and the impact of lockdown on costs, to assess the optimal course of action for XLG. The report concludes with a recommendation based on the evidence provided.

Management Accounting

Contents

Contents

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

Computation of the Sales price variances and sales volume contribution variances:............4

Efficacious analysis of all major merits as-well-as demerits relating to the application of

variances in assessing managers' performance:......................................................................8

Part B....................................................................................................................................11

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

MAIN BODY...................................................................................................................................4

Computation of the Sales price variances and sales volume contribution variances:............4

Efficacious analysis of all major merits as-well-as demerits relating to the application of

variances in assessing managers' performance:......................................................................8

Part B....................................................................................................................................11

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Under management accounting, managing personnel apply accounting information

provisions to effectively comprehend themselves before determining matters within their

organisations, which helps to manage and control effectively all functions and outcomes.

Management accounting allows for effective reporting of the company's financial status with

facts and information needed (Hutaibat and Alhatabat, 2019). It recognizes, tracks, analyses,

interprets and incorporates information so an entity can achieve its objectives. This study

comprises multiple aspects of directly or indirectly concerned with management accounting in

context of provided case-study of XLG. A practical calculation of different variances is covered

in report along with vital advantages and demerits of variances in relation to the assessment of

managerial performance. Moreover, this study helps to take decision whether to import FAMA Q

or in-house the production of FAMA Q based on respective case-study.

MAIN BODY

Computation of the Sales price variances and sales volume contribution variances:

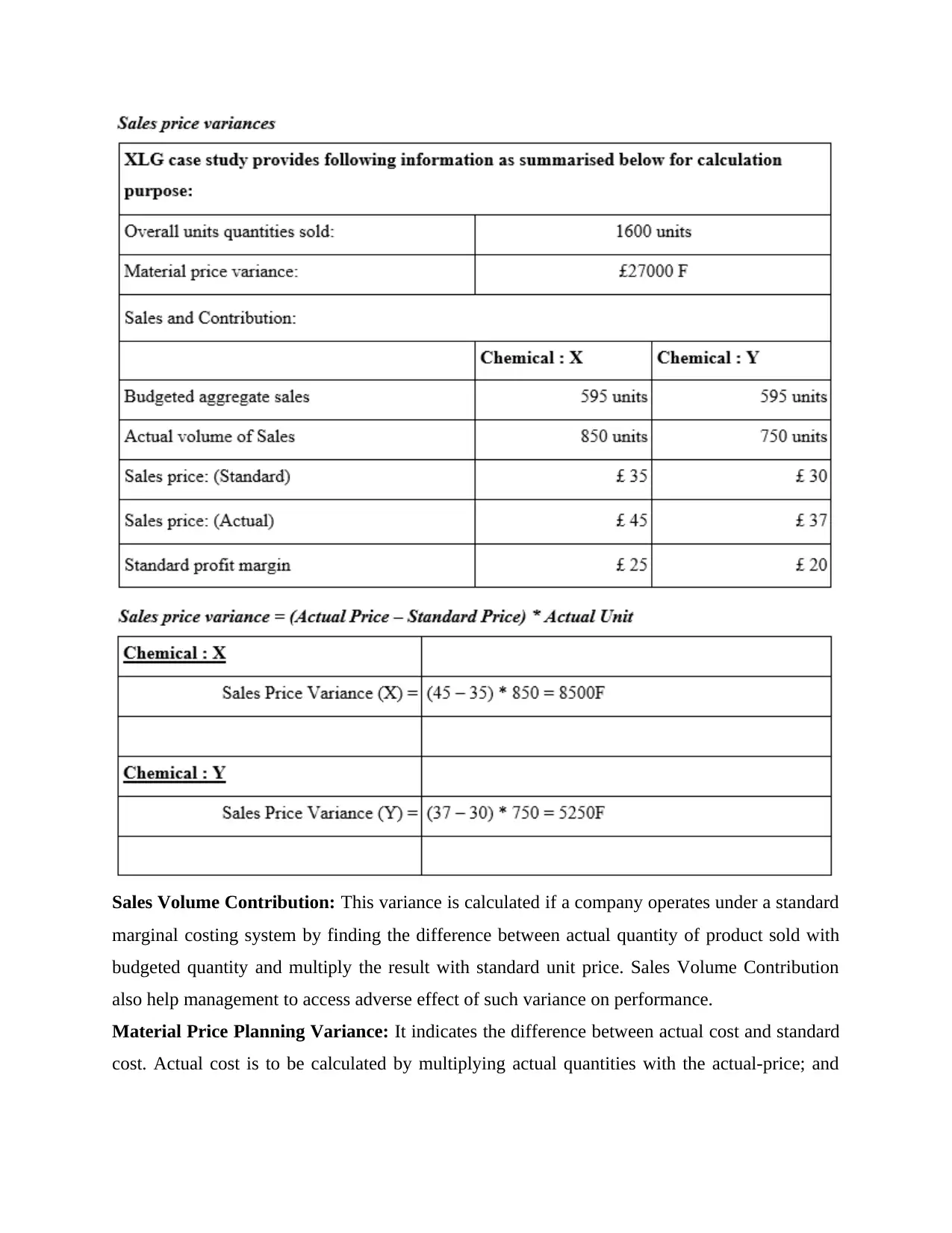

Sales Price Variance: It is the difference between actual and standard selling price. Change in

the market condition is the main reason of such deviations. As product sold for lower price

than anticipated than it reflects unfavourable result and if the price is higher than budgeted it

shows favourable results.

Under management accounting, managing personnel apply accounting information

provisions to effectively comprehend themselves before determining matters within their

organisations, which helps to manage and control effectively all functions and outcomes.

Management accounting allows for effective reporting of the company's financial status with

facts and information needed (Hutaibat and Alhatabat, 2019). It recognizes, tracks, analyses,

interprets and incorporates information so an entity can achieve its objectives. This study

comprises multiple aspects of directly or indirectly concerned with management accounting in

context of provided case-study of XLG. A practical calculation of different variances is covered

in report along with vital advantages and demerits of variances in relation to the assessment of

managerial performance. Moreover, this study helps to take decision whether to import FAMA Q

or in-house the production of FAMA Q based on respective case-study.

MAIN BODY

Computation of the Sales price variances and sales volume contribution variances:

Sales Price Variance: It is the difference between actual and standard selling price. Change in

the market condition is the main reason of such deviations. As product sold for lower price

than anticipated than it reflects unfavourable result and if the price is higher than budgeted it

shows favourable results.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

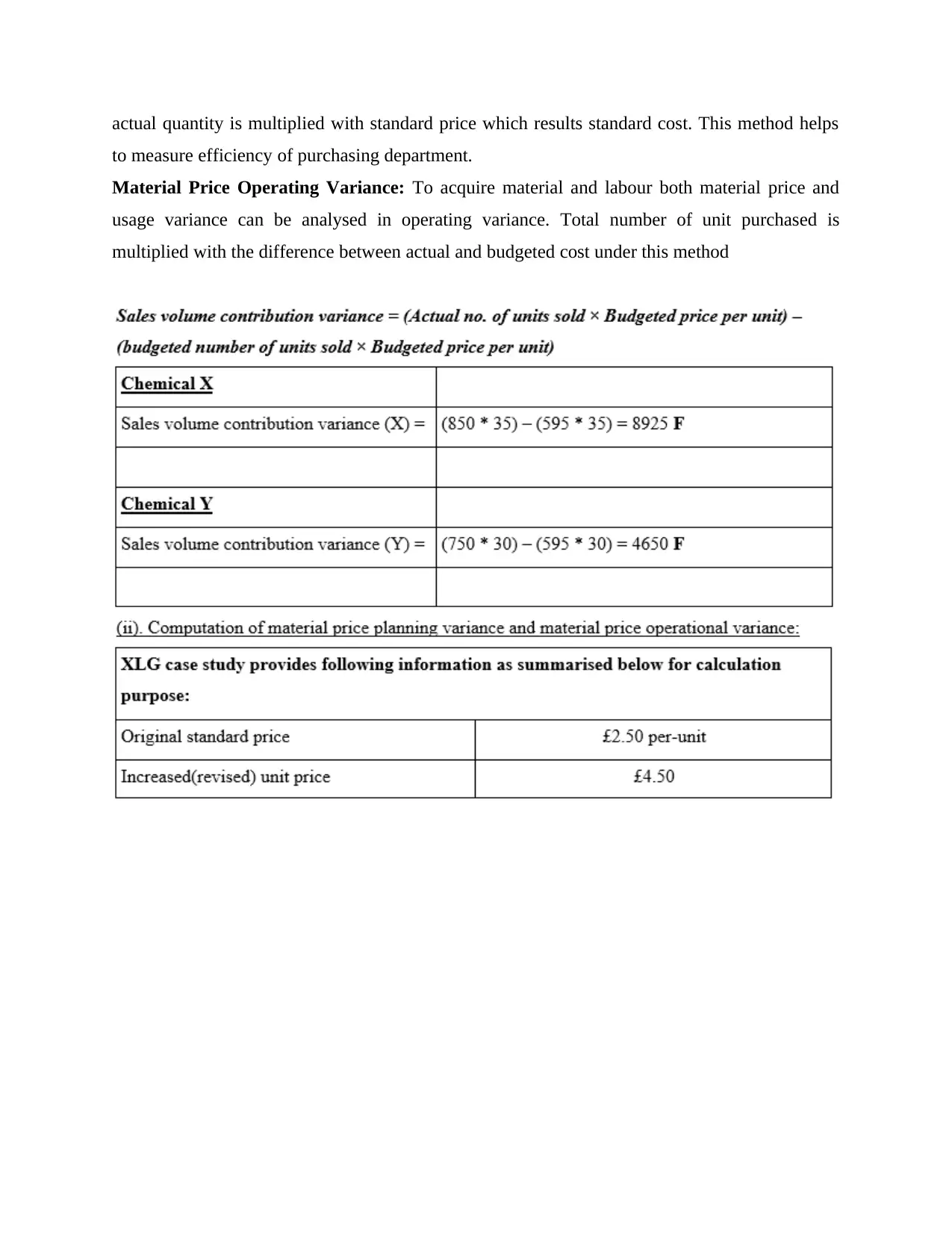

Sales Volume Contribution: This variance is calculated if a company operates under a standard

marginal costing system by finding the difference between actual quantity of product sold with

budgeted quantity and multiply the result with standard unit price. Sales Volume Contribution

also help management to access adverse effect of such variance on performance.

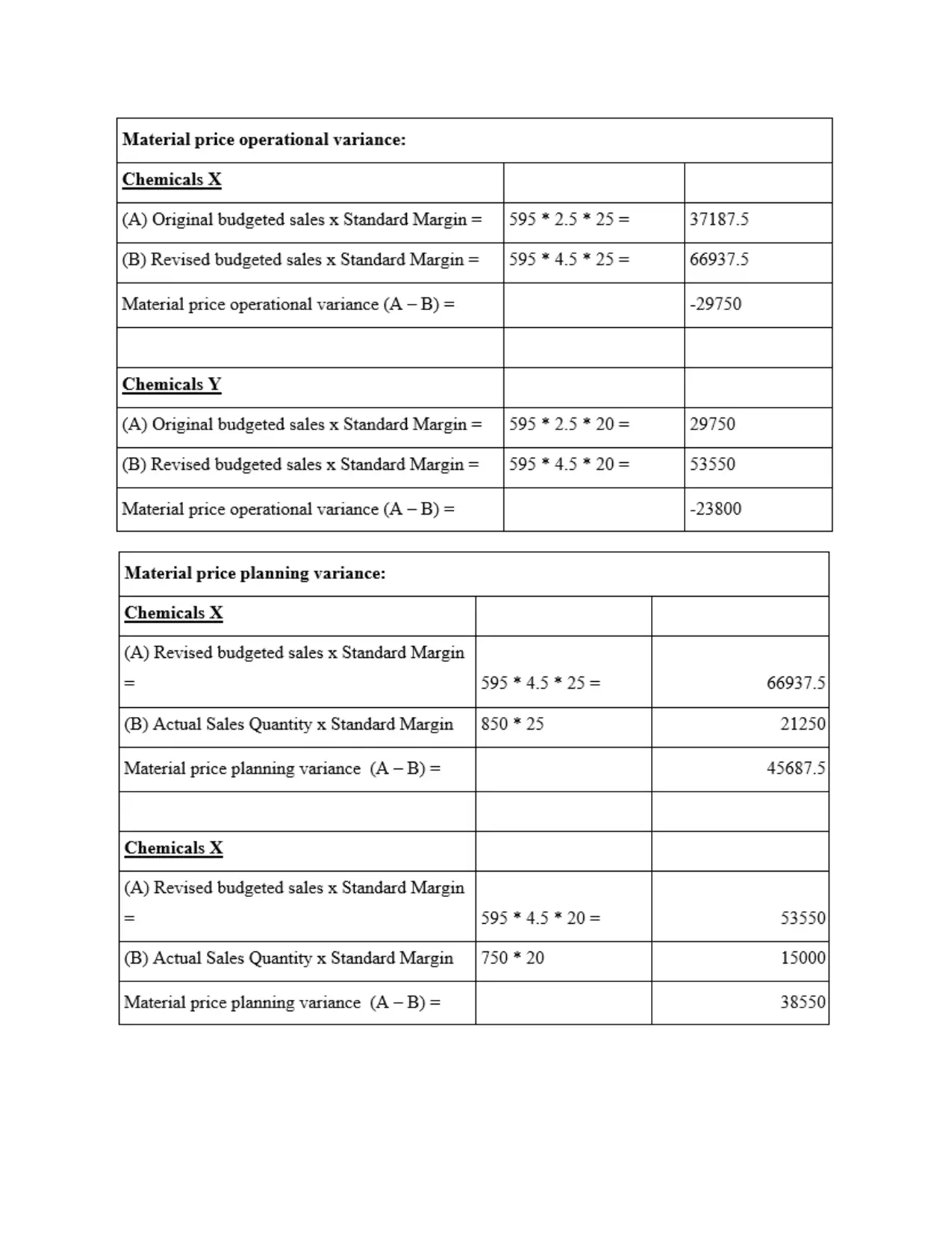

Material Price Planning Variance: It indicates the difference between actual cost and standard

cost. Actual cost is to be calculated by multiplying actual quantities with the actual-price; and

marginal costing system by finding the difference between actual quantity of product sold with

budgeted quantity and multiply the result with standard unit price. Sales Volume Contribution

also help management to access adverse effect of such variance on performance.

Material Price Planning Variance: It indicates the difference between actual cost and standard

cost. Actual cost is to be calculated by multiplying actual quantities with the actual-price; and

actual quantity is multiplied with standard price which results standard cost. This method helps

to measure efficiency of purchasing department.

Material Price Operating Variance: To acquire material and labour both material price and

usage variance can be analysed in operating variance. Total number of unit purchased is

multiplied with the difference between actual and budgeted cost under this method

to measure efficiency of purchasing department.

Material Price Operating Variance: To acquire material and labour both material price and

usage variance can be analysed in operating variance. Total number of unit purchased is

multiplied with the difference between actual and budgeted cost under this method

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Efficacious analysis of all major merits as-well-as demerits relating to the application of

variances in assessing managers' performance:

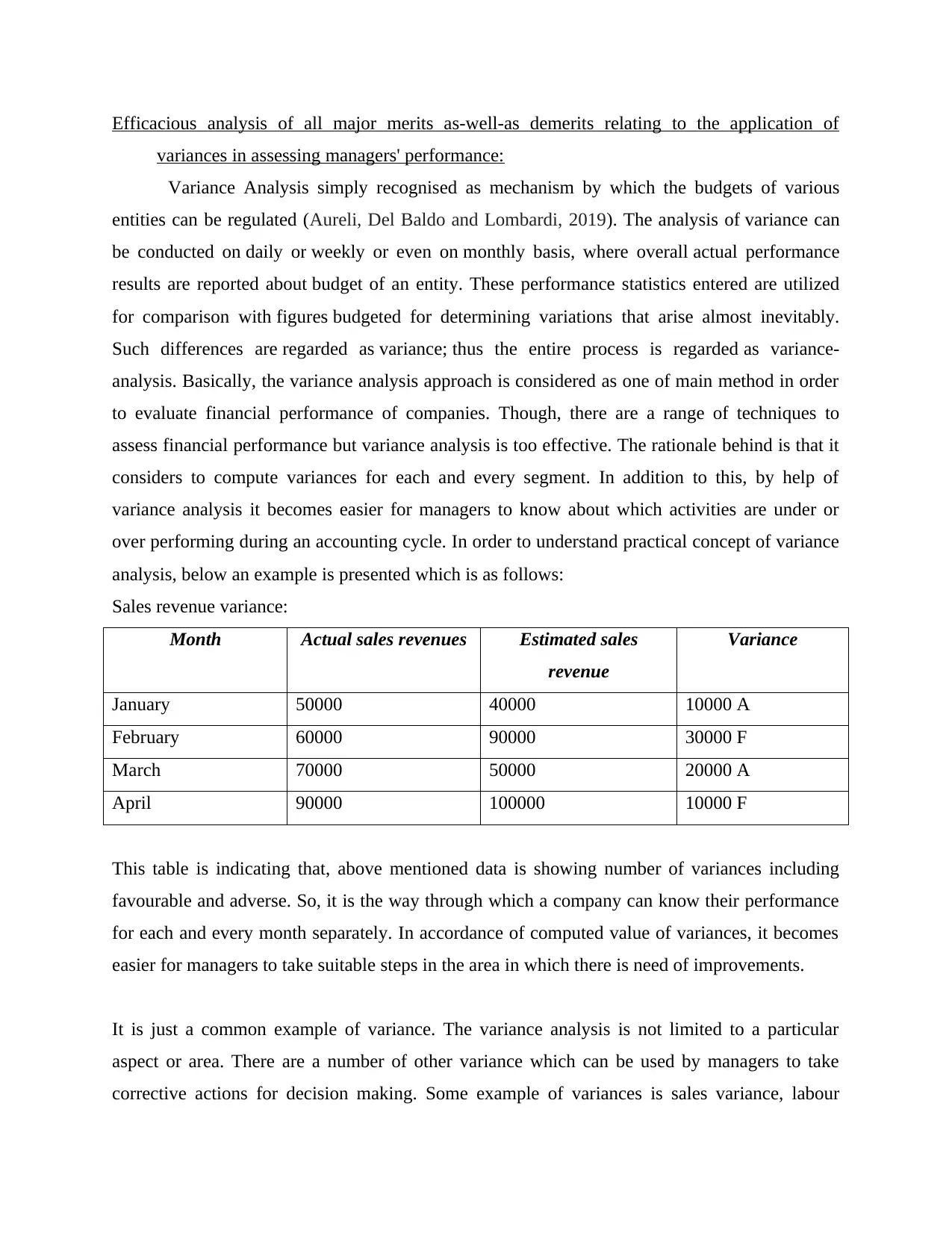

Variance Analysis simply recognised as mechanism by which the budgets of various

entities can be regulated (Aureli, Del Baldo and Lombardi, 2019). The analysis of variance can

be conducted on daily or weekly or even on monthly basis, where overall actual performance

results are reported about budget of an entity. These performance statistics entered are utilized

for comparison with figures budgeted for determining variations that arise almost inevitably.

Such differences are regarded as variance; thus the entire process is regarded as variance-

analysis. Basically, the variance analysis approach is considered as one of main method in order

to evaluate financial performance of companies. Though, there are a range of techniques to

assess financial performance but variance analysis is too effective. The rationale behind is that it

considers to compute variances for each and every segment. In addition to this, by help of

variance analysis it becomes easier for managers to know about which activities are under or

over performing during an accounting cycle. In order to understand practical concept of variance

analysis, below an example is presented which is as follows:

Sales revenue variance:

Month Actual sales revenues Estimated sales

revenue

Variance

January 50000 40000 10000 A

February 60000 90000 30000 F

March 70000 50000 20000 A

April 90000 100000 10000 F

This table is indicating that, above mentioned data is showing number of variances including

favourable and adverse. So, it is the way through which a company can know their performance

for each and every month separately. In accordance of computed value of variances, it becomes

easier for managers to take suitable steps in the area in which there is need of improvements.

It is just a common example of variance. The variance analysis is not limited to a particular

aspect or area. There are a number of other variance which can be used by managers to take

corrective actions for decision making. Some example of variances is sales variance, labour

variances in assessing managers' performance:

Variance Analysis simply recognised as mechanism by which the budgets of various

entities can be regulated (Aureli, Del Baldo and Lombardi, 2019). The analysis of variance can

be conducted on daily or weekly or even on monthly basis, where overall actual performance

results are reported about budget of an entity. These performance statistics entered are utilized

for comparison with figures budgeted for determining variations that arise almost inevitably.

Such differences are regarded as variance; thus the entire process is regarded as variance-

analysis. Basically, the variance analysis approach is considered as one of main method in order

to evaluate financial performance of companies. Though, there are a range of techniques to

assess financial performance but variance analysis is too effective. The rationale behind is that it

considers to compute variances for each and every segment. In addition to this, by help of

variance analysis it becomes easier for managers to know about which activities are under or

over performing during an accounting cycle. In order to understand practical concept of variance

analysis, below an example is presented which is as follows:

Sales revenue variance:

Month Actual sales revenues Estimated sales

revenue

Variance

January 50000 40000 10000 A

February 60000 90000 30000 F

March 70000 50000 20000 A

April 90000 100000 10000 F

This table is indicating that, above mentioned data is showing number of variances including

favourable and adverse. So, it is the way through which a company can know their performance

for each and every month separately. In accordance of computed value of variances, it becomes

easier for managers to take suitable steps in the area in which there is need of improvements.

It is just a common example of variance. The variance analysis is not limited to a particular

aspect or area. There are a number of other variance which can be used by managers to take

corrective actions for decision making. Some example of variances is sales variance, labour

variance, material variance and many more. In relation to mentioned company of case study, this

can be stated that there are a range of variances which have been computed with an aim of taking

corrective decision about make or buy.

In a scenario at which budgeted-figures surpasses that sum of actual outcomes,

then variance recognized is favourable which means that the money spent was less than the

amount budgeted. An unfavourable variance originates when actual-outputs are more than

budgeted (Zandi, Khalid and Islam, 2019). Variances act as effective indicator which support

management's decisions. For proper study of variances within an organisation, it is appropriate to

conduct the task along with some basic measurements in 4 phases. First, one has to do what is

alluded to as budget flexion. This is accomplished by the implementation of a new budget in

order to equate it with initial budget as well as actual budget reached during the financial year.

Column section of original, updated and current budget shall be drawn up and the various

income shall be measured. The gross and fixed expenses are excluded from the overall revenue

value in the estimation of the benefit. The value from the initial and updated estimates is first

applied to variance between both the two. The next phase includes comparing the profits made

by actual and initial budget in order to achieve real difference as observed in the financial year.

The second significant aspect is variance analysis. If the information is derived from original,

updated and real estimate, variance can be easily evaluated. For instance, If the variation is

attributable to price at which separate sales are made, this is recognised as sales price variance.'

In both situations, price of product involved is measured in order to ascertain differences and

hence variances. Following points provide detailed discussion regarding merits and demerits

linked to use of variances for assessing managers' actual performance:

Merits:

Variances are effective evaluation tool which enable management to evaluate each major

aspect to organisation as to find out the weak areas which are detrimental in performance

of organisation (Gamayuni, 2019).

The analysis of variance offers insight as to what is occurring in economic and strategic

world in which business works. The early signs of economic slowdown which result in

negative variations in statistical categories tracked by the organisation.

Variances identified assist managers in making a periodic comparative analysis of

individual costs with model costs in order to assess output and to undertake steps to retain

can be stated that there are a range of variances which have been computed with an aim of taking

corrective decision about make or buy.

In a scenario at which budgeted-figures surpasses that sum of actual outcomes,

then variance recognized is favourable which means that the money spent was less than the

amount budgeted. An unfavourable variance originates when actual-outputs are more than

budgeted (Zandi, Khalid and Islam, 2019). Variances act as effective indicator which support

management's decisions. For proper study of variances within an organisation, it is appropriate to

conduct the task along with some basic measurements in 4 phases. First, one has to do what is

alluded to as budget flexion. This is accomplished by the implementation of a new budget in

order to equate it with initial budget as well as actual budget reached during the financial year.

Column section of original, updated and current budget shall be drawn up and the various

income shall be measured. The gross and fixed expenses are excluded from the overall revenue

value in the estimation of the benefit. The value from the initial and updated estimates is first

applied to variance between both the two. The next phase includes comparing the profits made

by actual and initial budget in order to achieve real difference as observed in the financial year.

The second significant aspect is variance analysis. If the information is derived from original,

updated and real estimate, variance can be easily evaluated. For instance, If the variation is

attributable to price at which separate sales are made, this is recognised as sales price variance.'

In both situations, price of product involved is measured in order to ascertain differences and

hence variances. Following points provide detailed discussion regarding merits and demerits

linked to use of variances for assessing managers' actual performance:

Merits:

Variances are effective evaluation tool which enable management to evaluate each major

aspect to organisation as to find out the weak areas which are detrimental in performance

of organisation (Gamayuni, 2019).

The analysis of variance offers insight as to what is occurring in economic and strategic

world in which business works. The early signs of economic slowdown which result in

negative variations in statistical categories tracked by the organisation.

Variances identified assist managers in making a periodic comparative analysis of

individual costs with model costs in order to assess output and to undertake steps to retain

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

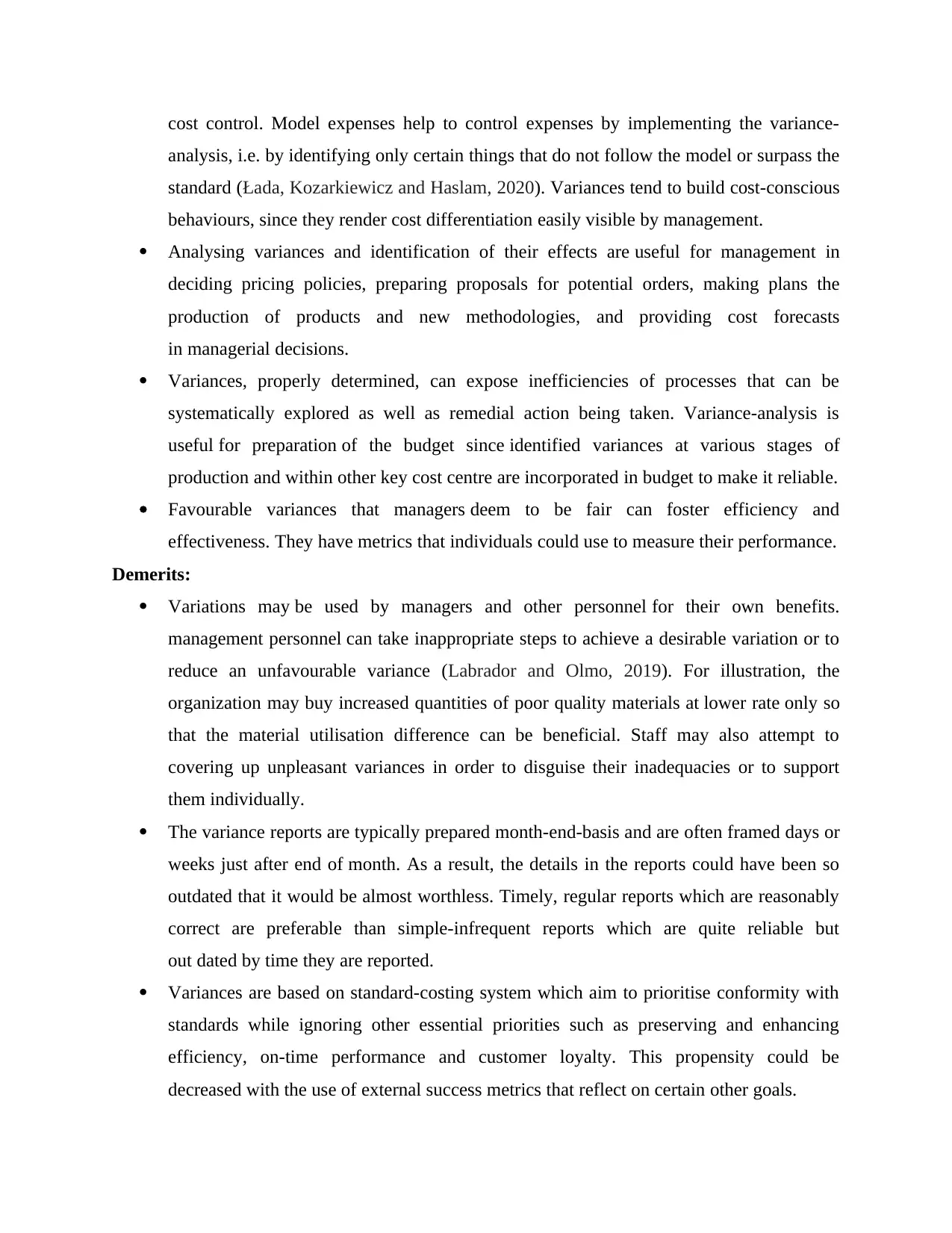

cost control. Model expenses help to control expenses by implementing the variance-

analysis, i.e. by identifying only certain things that do not follow the model or surpass the

standard (Łada, Kozarkiewicz and Haslam, 2020). Variances tend to build cost-conscious

behaviours, since they render cost differentiation easily visible by management.

Analysing variances and identification of their effects are useful for management in

deciding pricing policies, preparing proposals for potential orders, making plans the

production of products and new methodologies, and providing cost forecasts

in managerial decisions.

Variances, properly determined, can expose inefficiencies of processes that can be

systematically explored as well as remedial action being taken. Variance-analysis is

useful for preparation of the budget since identified variances at various stages of

production and within other key cost centre are incorporated in budget to make it reliable.

Favourable variances that managers deem to be fair can foster efficiency and

effectiveness. They have metrics that individuals could use to measure their performance.

Demerits:

Variations may be used by managers and other personnel for their own benefits.

management personnel can take inappropriate steps to achieve a desirable variation or to

reduce an unfavourable variance (Labrador and Olmo, 2019). For illustration, the

organization may buy increased quantities of poor quality materials at lower rate only so

that the material utilisation difference can be beneficial. Staff may also attempt to

covering up unpleasant variances in order to disguise their inadequacies or to support

them individually.

The variance reports are typically prepared month-end-basis and are often framed days or

weeks just after end of month. As a result, the details in the reports could have been so

outdated that it would be almost worthless. Timely, regular reports which are reasonably

correct are preferable than simple-infrequent reports which are quite reliable but

out dated by time they are reported.

Variances are based on standard-costing system which aim to prioritise conformity with

standards while ignoring other essential priorities such as preserving and enhancing

efficiency, on-time performance and customer loyalty. This propensity could be

decreased with the use of external success metrics that reflect on certain other goals.

analysis, i.e. by identifying only certain things that do not follow the model or surpass the

standard (Łada, Kozarkiewicz and Haslam, 2020). Variances tend to build cost-conscious

behaviours, since they render cost differentiation easily visible by management.

Analysing variances and identification of their effects are useful for management in

deciding pricing policies, preparing proposals for potential orders, making plans the

production of products and new methodologies, and providing cost forecasts

in managerial decisions.

Variances, properly determined, can expose inefficiencies of processes that can be

systematically explored as well as remedial action being taken. Variance-analysis is

useful for preparation of the budget since identified variances at various stages of

production and within other key cost centre are incorporated in budget to make it reliable.

Favourable variances that managers deem to be fair can foster efficiency and

effectiveness. They have metrics that individuals could use to measure their performance.

Demerits:

Variations may be used by managers and other personnel for their own benefits.

management personnel can take inappropriate steps to achieve a desirable variation or to

reduce an unfavourable variance (Labrador and Olmo, 2019). For illustration, the

organization may buy increased quantities of poor quality materials at lower rate only so

that the material utilisation difference can be beneficial. Staff may also attempt to

covering up unpleasant variances in order to disguise their inadequacies or to support

them individually.

The variance reports are typically prepared month-end-basis and are often framed days or

weeks just after end of month. As a result, the details in the reports could have been so

outdated that it would be almost worthless. Timely, regular reports which are reasonably

correct are preferable than simple-infrequent reports which are quite reliable but

out dated by time they are reported.

Variances are based on standard-costing system which aim to prioritise conformity with

standards while ignoring other essential priorities such as preserving and enhancing

efficiency, on-time performance and customer loyalty. This propensity could be

decreased with the use of external success metrics that reflect on certain other goals.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Taking decision considering merely favourable and unfavourable variance and ignorance

of other factors may lead to inappropriate decisions as well as some time lead to rigidity

in decision-making.

In a sector where business environment changes rapidly, decisions and performance

evaluation based on variances analysis is not appropriate, because variance analysis is

based on just difference between standards established by management and actual

performance (Johanson and Madsen, 2019).

Standards used to derive variances are based on management's perceptions, observation

and experiences, thus there are huge chances that such standards are inappropriate or not

consistent with industry standards.

So these are some common advantages and disadvantages of variance analysis. Though, the

demerits are not so sensible and applicable for all types of companies. It needs to be

implemented in a perfect manner so that valuation of financial performance of a firm can be

done.

Part B

Make-or - buy choices is a process by which a company opts for in-house production or product

buying. Make-or - buy decisions often refer to a sourcing process that conforms with the

advantages and expenses of producing an internal production performance or picking an

alternative provider for product lines (Liem and Hien, 2020). To measure costs correctly, a

business should consider those factors that are important to the purchase and distribution of the

materials for the production of in-house manufacturing.

In the sense of in-house manufacturing, a company needs to consider costs associated with the

procurement of the finished commodity and the costs of the processing. The related expenses

which include extra work done to produce the items, storage needs, overall cost of storage, cost

of materials and much more. On the other hand, the buying costs associated with a provider's sale

of the commodity which include the price of the item itself, other delivery or processing fees and

the relevant local taxes. In addition, expense relating to the handling of purchased products and

labour costs involved with purchasing products in storage is often included in the category of

manufacturers' purchases of goods.

of other factors may lead to inappropriate decisions as well as some time lead to rigidity

in decision-making.

In a sector where business environment changes rapidly, decisions and performance

evaluation based on variances analysis is not appropriate, because variance analysis is

based on just difference between standards established by management and actual

performance (Johanson and Madsen, 2019).

Standards used to derive variances are based on management's perceptions, observation

and experiences, thus there are huge chances that such standards are inappropriate or not

consistent with industry standards.

So these are some common advantages and disadvantages of variance analysis. Though, the

demerits are not so sensible and applicable for all types of companies. It needs to be

implemented in a perfect manner so that valuation of financial performance of a firm can be

done.

Part B

Make-or - buy choices is a process by which a company opts for in-house production or product

buying. Make-or - buy decisions often refer to a sourcing process that conforms with the

advantages and expenses of producing an internal production performance or picking an

alternative provider for product lines (Liem and Hien, 2020). To measure costs correctly, a

business should consider those factors that are important to the purchase and distribution of the

materials for the production of in-house manufacturing.

In the sense of in-house manufacturing, a company needs to consider costs associated with the

procurement of the finished commodity and the costs of the processing. The related expenses

which include extra work done to produce the items, storage needs, overall cost of storage, cost

of materials and much more. On the other hand, the buying costs associated with a provider's sale

of the commodity which include the price of the item itself, other delivery or processing fees and

the relevant local taxes. In addition, expense relating to the handling of purchased products and

labour costs involved with purchasing products in storage is often included in the category of

manufacturers' purchases of goods.

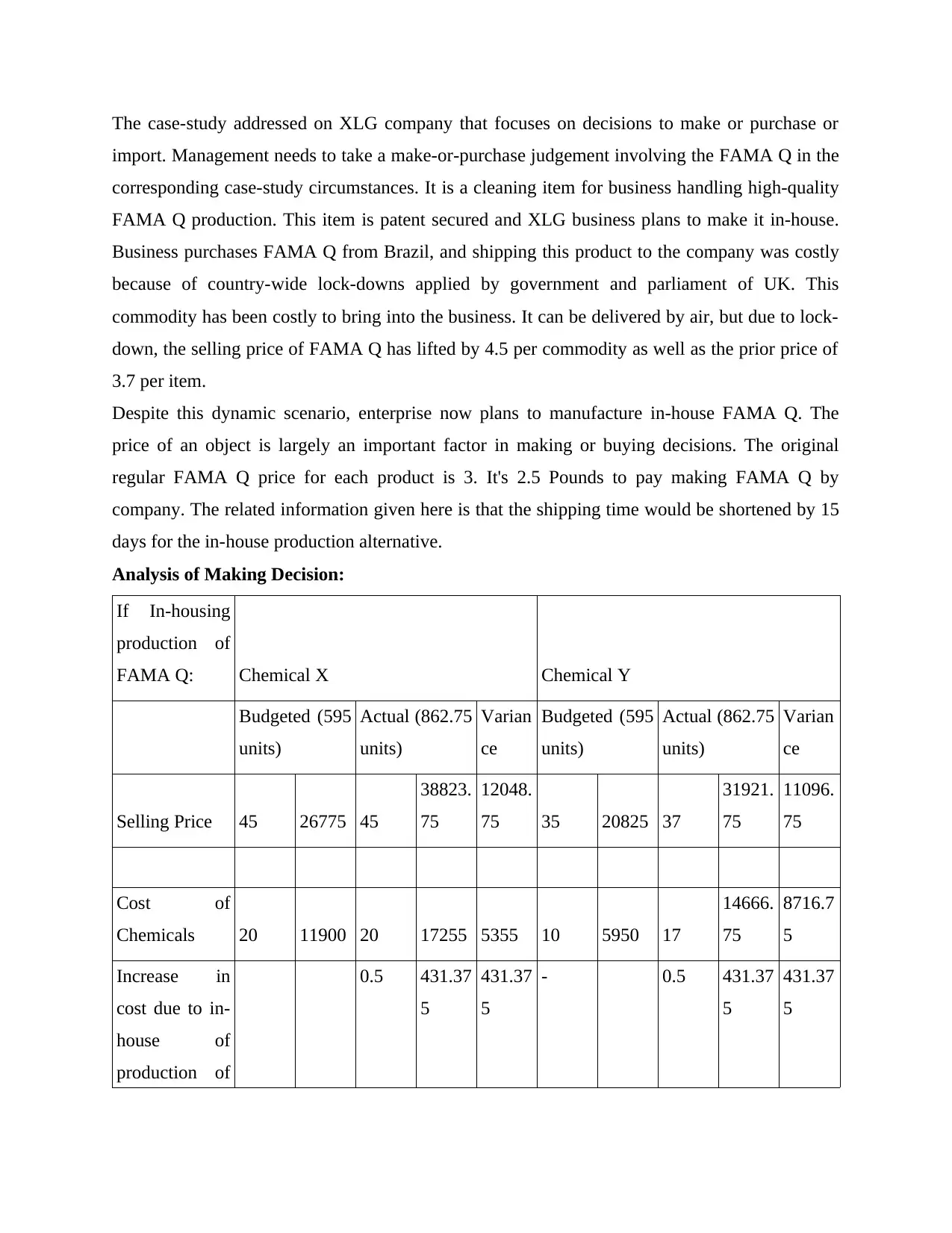

The case-study addressed on XLG company that focuses on decisions to make or purchase or

import. Management needs to take a make-or-purchase judgement involving the FAMA Q in the

corresponding case-study circumstances. It is a cleaning item for business handling high-quality

FAMA Q production. This item is patent secured and XLG business plans to make it in-house.

Business purchases FAMA Q from Brazil, and shipping this product to the company was costly

because of country-wide lock-downs applied by government and parliament of UK. This

commodity has been costly to bring into the business. It can be delivered by air, but due to lock-

down, the selling price of FAMA Q has lifted by 4.5 per commodity as well as the prior price of

3.7 per item.

Despite this dynamic scenario, enterprise now plans to manufacture in-house FAMA Q. The

price of an object is largely an important factor in making or buying decisions. The original

regular FAMA Q price for each product is 3. It's 2.5 Pounds to pay making FAMA Q by

company. The related information given here is that the shipping time would be shortened by 15

days for the in-house production alternative.

Analysis of Making Decision:

If In-housing

production of

FAMA Q: Chemical X Chemical Y

Budgeted (595

units)

Actual (862.75

units)

Varian

ce

Budgeted (595

units)

Actual (862.75

units)

Varian

ce

Selling Price 45 26775 45

38823.

75

12048.

75 35 20825 37

31921.

75

11096.

75

Cost of

Chemicals 20 11900 20 17255 5355 10 5950 17

14666.

75

8716.7

5

Increase in

cost due to in-

house of

production of

0.5 431.37

5

431.37

5

- 0.5 431.37

5

431.37

5

import. Management needs to take a make-or-purchase judgement involving the FAMA Q in the

corresponding case-study circumstances. It is a cleaning item for business handling high-quality

FAMA Q production. This item is patent secured and XLG business plans to make it in-house.

Business purchases FAMA Q from Brazil, and shipping this product to the company was costly

because of country-wide lock-downs applied by government and parliament of UK. This

commodity has been costly to bring into the business. It can be delivered by air, but due to lock-

down, the selling price of FAMA Q has lifted by 4.5 per commodity as well as the prior price of

3.7 per item.

Despite this dynamic scenario, enterprise now plans to manufacture in-house FAMA Q. The

price of an object is largely an important factor in making or buying decisions. The original

regular FAMA Q price for each product is 3. It's 2.5 Pounds to pay making FAMA Q by

company. The related information given here is that the shipping time would be shortened by 15

days for the in-house production alternative.

Analysis of Making Decision:

If In-housing

production of

FAMA Q: Chemical X Chemical Y

Budgeted (595

units)

Actual (862.75

units)

Varian

ce

Budgeted (595

units)

Actual (862.75

units)

Varian

ce

Selling Price 45 26775 45

38823.

75

12048.

75 35 20825 37

31921.

75

11096.

75

Cost of

Chemicals 20 11900 20 17255 5355 10 5950 17

14666.

75

8716.7

5

Increase in

cost due to in-

house of

production of

0.5 431.37

5

431.37

5

- 0.5 431.37

5

431.37

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.