Management Accounting Report: KEF Ltd Financial Performance Analysis

VerifiedAdded on 2021/02/20

|17

|4361

|26

Report

AI Summary

This report delves into the core concepts of management accounting, focusing on its application within the context of KEF Ltd, a medium-sized manufacturing enterprise. It begins by defining management accounting and outlining its essential requirements, exploring various systems like inventory management, cost accounting, price optimization, and job costing. The report then examines different methods of reporting, including budget reports, accounts receivable reports, performance reports, and cost accounting reports, evaluating their advantages and applications. A significant portion of the report is dedicated to financial analysis, including the preparation of income statements using both absorption and marginal costing techniques, the calculation of per-unit production costs, and the determination of total production costs. The report also compares actual and budgeted profits and discusses budgetary control tools. Finally, the report explores how management accounting systems can assist in resolving financial problems, ultimately leading the company towards sustainable success. The report concludes with a comparison of different organizations in respect of adopting the systems of management accounting in order to respond financial problems.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

Explaining the meaning of management accounting and essential requirements of the

management accounting systems................................................................................................1

Explaining several methods of reporting under management accounting..................................2

Evaluating the advantages and the application of the management accounting systems............3

Evaluating the integration in between the management accounting reporting and the systems. 4

LO2..................................................................................................................................................4

Preparation of the income statement for the month of June &Calculation of per unit

production cost &computing total cost of production &Advising the best technique for

evaluating the net profits ............................................................................................................5

Interpreting the difference in the actual and the budgeted profit for the month of June ............6

LO3..................................................................................................................................................8

Explaining the benefits and the limitation of the several planning tools under the budgetary

control ........................................................................................................................................8

Analysing the uses and the application of planning tools used for forecasting the budget .......9

Evaluating the use of the planning tools in responding to resolving the financial problems....10

LO4................................................................................................................................................10

Comparing different organization in respect of adopting the systems of management

accounting in order to respond financial problems...................................................................10

Analysing the ways in which resolving the financial problems leads the company towards

sustainable success....................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

LO1..................................................................................................................................................1

Explaining the meaning of management accounting and essential requirements of the

management accounting systems................................................................................................1

Explaining several methods of reporting under management accounting..................................2

Evaluating the advantages and the application of the management accounting systems............3

Evaluating the integration in between the management accounting reporting and the systems. 4

LO2..................................................................................................................................................4

Preparation of the income statement for the month of June &Calculation of per unit

production cost &computing total cost of production &Advising the best technique for

evaluating the net profits ............................................................................................................5

Interpreting the difference in the actual and the budgeted profit for the month of June ............6

LO3..................................................................................................................................................8

Explaining the benefits and the limitation of the several planning tools under the budgetary

control ........................................................................................................................................8

Analysing the uses and the application of planning tools used for forecasting the budget .......9

Evaluating the use of the planning tools in responding to resolving the financial problems....10

LO4................................................................................................................................................10

Comparing different organization in respect of adopting the systems of management

accounting in order to respond financial problems...................................................................10

Analysing the ways in which resolving the financial problems leads the company towards

sustainable success....................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION

Management accounting is defined as a process of preparing and presenting all the

financial as well as statistical information of the business in form of internal managerial report.

With the help of such report, it aids the management of the company in decision making process

related to business operations and investments. The present report is on KEF Ltd. Which is a

medium sized enterprise engaged in the manufacturing business. It will define about different

management accounting system and their use in business issues. Statements will be produced

using Absorption and Marginal costing techniques. Further, it will discuss about various types of

budgetary planning tools by use of which, company can make more profit and improves its

business performance. At last, it will streamline about techniques of management accounting

which can assist in resolving financial problems of the company.

LO1.

Explaining the meaning of management accounting and essential requirements of the

management accounting systems

Management accounting is the process of formulating the management reports and the

accounts which provides for the accurate and the timely financial as well as the statistical

information needed by the managers in order to make the routing and the short term decisions

(Management accounting and its importance, 2019). There are various management accounting

system that plays an essential role in efficient functioning of the business as follows-

Inventory management system- It refers to the system that includes proper planning of

the purchases, storing and handling the material or stock within the organization. It aims for

reaching the optimal inventory for the company and a detailed information regarding the material

that is to be purchased, the quantity of the material and the place from which it is to be purchased

with adequate details of associated storage cost (Huang and et.al., 2015). This system is essential

for tracing the supply of the goods and in maintaining the adequate level of the inventory in the

organization.

Cost accounting system- This system of MA considered as the framework that is used by

the organization in order to estimate their product cost for the purpose of making the profitability

analysis, valuation of the inventory and the controlling the cost. It is critical for the organization

to estimate accurate cost in producing the product which in turn results in the profitable

1

Management accounting is defined as a process of preparing and presenting all the

financial as well as statistical information of the business in form of internal managerial report.

With the help of such report, it aids the management of the company in decision making process

related to business operations and investments. The present report is on KEF Ltd. Which is a

medium sized enterprise engaged in the manufacturing business. It will define about different

management accounting system and their use in business issues. Statements will be produced

using Absorption and Marginal costing techniques. Further, it will discuss about various types of

budgetary planning tools by use of which, company can make more profit and improves its

business performance. At last, it will streamline about techniques of management accounting

which can assist in resolving financial problems of the company.

LO1.

Explaining the meaning of management accounting and essential requirements of the

management accounting systems

Management accounting is the process of formulating the management reports and the

accounts which provides for the accurate and the timely financial as well as the statistical

information needed by the managers in order to make the routing and the short term decisions

(Management accounting and its importance, 2019). There are various management accounting

system that plays an essential role in efficient functioning of the business as follows-

Inventory management system- It refers to the system that includes proper planning of

the purchases, storing and handling the material or stock within the organization. It aims for

reaching the optimal inventory for the company and a detailed information regarding the material

that is to be purchased, the quantity of the material and the place from which it is to be purchased

with adequate details of associated storage cost (Huang and et.al., 2015). This system is essential

for tracing the supply of the goods and in maintaining the adequate level of the inventory in the

organization.

Cost accounting system- This system of MA considered as the framework that is used by

the organization in order to estimate their product cost for the purpose of making the profitability

analysis, valuation of the inventory and the controlling the cost. It is critical for the organization

to estimate accurate cost in producing the product which in turn results in the profitable

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

operations (Gerrish and Spreen, 2017). Through this system the firm can know about the

products that are profitable and the which leads to loss anticipation of the correct cost.

Price optimization system- It is the system that act as the mathematical program which

computes the varying demand of the customers at various price levels and then combining the

data with the information relating to the cost and the level of inventory for recommending the

prices that improves the profits (Lasyoud and Alsharari, 2017). This system is crucial because it

allows the organization in using the pricing as the powerful tool of the profit lever, that is often

considered as underdeveloped. It also helps the enterprise in achieving its objective like customer

satisfaction, forecasting demand, creating promotion strategies.

Job costing system- It is the practice that include accumulating the information relating

to the associated cost with the particular production and the service job. It is counted as an

essential information as it helps in determining the adequacy in the estimating system of the

company which is to be made for quoting or fixing the best possible price that accounts for the

reasonable profits. Job costing system accumulates mainly three kinds of the cost that involve

direct material, labour and the overhead cost (Otley, 2016). It also facilitates managers in

keeping the track of the individual as well as the performance of the team in context of the cost

control, productivity and the efficiency.

Explaining several methods of reporting under management accounting

The reports prepared under managerial accounting are been used for regulating, decision

making, planning and in measuring the performance. The reports are formulated on the

continuous basis throughout the period of the accounting as per the requirements. Major crucial

decision of the organization depends upon the preparation of the reports with authenticity.

Managers analyse the reports for highlighting the particular pattern and converting it into the

useful information (Papa and et.al., 2017). There are several reports that are prepared by the

managers as follows-

Budget report- This report involves the anticipation of the sources of the earnings and the

expenditure for the organization. It plays a critical role in measuring the performance of an

overall enterprise. Estimations in the report are made on the basis of previous experiences so that

any unforeseen event in the future could be met. Firm could function its operations in budgeted

amount for achieving its goals and the mission effectively (Shil and Das, 2018). Budget report

2

products that are profitable and the which leads to loss anticipation of the correct cost.

Price optimization system- It is the system that act as the mathematical program which

computes the varying demand of the customers at various price levels and then combining the

data with the information relating to the cost and the level of inventory for recommending the

prices that improves the profits (Lasyoud and Alsharari, 2017). This system is crucial because it

allows the organization in using the pricing as the powerful tool of the profit lever, that is often

considered as underdeveloped. It also helps the enterprise in achieving its objective like customer

satisfaction, forecasting demand, creating promotion strategies.

Job costing system- It is the practice that include accumulating the information relating

to the associated cost with the particular production and the service job. It is counted as an

essential information as it helps in determining the adequacy in the estimating system of the

company which is to be made for quoting or fixing the best possible price that accounts for the

reasonable profits. Job costing system accumulates mainly three kinds of the cost that involve

direct material, labour and the overhead cost (Otley, 2016). It also facilitates managers in

keeping the track of the individual as well as the performance of the team in context of the cost

control, productivity and the efficiency.

Explaining several methods of reporting under management accounting

The reports prepared under managerial accounting are been used for regulating, decision

making, planning and in measuring the performance. The reports are formulated on the

continuous basis throughout the period of the accounting as per the requirements. Major crucial

decision of the organization depends upon the preparation of the reports with authenticity.

Managers analyse the reports for highlighting the particular pattern and converting it into the

useful information (Papa and et.al., 2017). There are several reports that are prepared by the

managers as follows-

Budget report- This report involves the anticipation of the sources of the earnings and the

expenditure for the organization. It plays a critical role in measuring the performance of an

overall enterprise. Estimations in the report are made on the basis of previous experiences so that

any unforeseen event in the future could be met. Firm could function its operations in budgeted

amount for achieving its goals and the mission effectively (Shil and Das, 2018). Budget report

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

guides the managers in offering the better incentives to the employee, renegotiating the terms

and cutting the cost.

Accounts receivable report- It includes the information in relation to the remaining

balances of the clients and the distributors that the organization need to collect into the particular

time periods. It helps the mangers in identifying the defaulters and the issues that are present in

the process of collection (Tsoutsos and et.al., 2017). If the resulted defaulters are large, then

organization need to tighten its credit policies which in turn helps in maintaining the cash flow

within the operations of the company.

Performance report- This report is been created in order to review the performance of

the overall organization and the employees. Mangers make use of this report for making strategic

decisions relating to the future of organization. Individual or the staff are rewarded towards their

commitment of working with excellence for achieving the vision and the goals of the company

(Toussaint and et.al., 2017). Performance report plays a vital role for the organization in keeping

the accurate measure of the developed strategy according to their mission.

Cost accounting report- It refers to the report that accounts for computing the cost of the

articles incurred in manufacturing the product. It includes all the cost such as material cost,

labour cost and the overhead cost. It provides for the summary of information relating to these

cost. Cost management accounting report allows the capacity to the managers in realizing cost

prices against the selling price of the product. This report provides for the estimation of the profit

margins and a clear picture of the cost involved in the production and the procurement of the

material (Said, 2016). It facilitates exact understanding relating to all the expenses that are

essential for attaining optimization in the use of the resources among all the departments.

Other reports- It involves the project reports, information reports, competitor analysis

report and the other reports that are critical for the business (Quattrone, 2016). These reports are

created by the professionals or been generated internally by the managers.

Evaluating the advantages and the application of the management accounting systems

Management accounting systems Benefits and applications

Inventory management system This system helps the organization in saving its

time and the money as it traces the inventory

so that accurate record keep is ensured.

3

and cutting the cost.

Accounts receivable report- It includes the information in relation to the remaining

balances of the clients and the distributors that the organization need to collect into the particular

time periods. It helps the mangers in identifying the defaulters and the issues that are present in

the process of collection (Tsoutsos and et.al., 2017). If the resulted defaulters are large, then

organization need to tighten its credit policies which in turn helps in maintaining the cash flow

within the operations of the company.

Performance report- This report is been created in order to review the performance of

the overall organization and the employees. Mangers make use of this report for making strategic

decisions relating to the future of organization. Individual or the staff are rewarded towards their

commitment of working with excellence for achieving the vision and the goals of the company

(Toussaint and et.al., 2017). Performance report plays a vital role for the organization in keeping

the accurate measure of the developed strategy according to their mission.

Cost accounting report- It refers to the report that accounts for computing the cost of the

articles incurred in manufacturing the product. It includes all the cost such as material cost,

labour cost and the overhead cost. It provides for the summary of information relating to these

cost. Cost management accounting report allows the capacity to the managers in realizing cost

prices against the selling price of the product. This report provides for the estimation of the profit

margins and a clear picture of the cost involved in the production and the procurement of the

material (Said, 2016). It facilitates exact understanding relating to all the expenses that are

essential for attaining optimization in the use of the resources among all the departments.

Other reports- It involves the project reports, information reports, competitor analysis

report and the other reports that are critical for the business (Quattrone, 2016). These reports are

created by the professionals or been generated internally by the managers.

Evaluating the advantages and the application of the management accounting systems

Management accounting systems Benefits and applications

Inventory management system This system helps the organization in saving its

time and the money as it traces the inventory

so that accurate record keep is ensured.

3

Price optimization system This system helps the business in assessing the

purchasing pattern of customers with respect to

their taste and the preferences (Ahmad and

Mohamed Zabri, 2015). It is applied by the

organization for making analysis of customer

behaviour which in turn assist the firm in

setting up better prices.

Cost accounting system It facilitates the analysis of cost objects where

the revenues and the expenses are been

accumulated by the cost object like product,

distribution channel, product line etc

(Donaghue and et.al., 2018). This in turn

enables the organization in determining the

profitable and unprofitable segments of the

product.

Job costing system It helps the company in keeping the track over

the performance of individual and the team

which in turn leads to cost control, productivity

and efficiency.

Evaluating the integration in between the management accounting reporting and the systems

Management accounting system and reporting highly interrelates as efficient functioning

of the systems helps in continuous improvement for the organization through the development

and the integration of the cost related information. This leads to effective preparation of the

reports by the managers which leads to achievement of the goal with high efficiency.

LO2.

Marginal Costing – The term Marginal costing is known as the system of accounting

where all the cost that are of variable nature are been charged against the cost units. However, in

case of fixed costs incurred in continuing the business operations for the definite period are been

written off in full against all the contribution made on aggregate basis (Gerrish and Spreen,

4

purchasing pattern of customers with respect to

their taste and the preferences (Ahmad and

Mohamed Zabri, 2015). It is applied by the

organization for making analysis of customer

behaviour which in turn assist the firm in

setting up better prices.

Cost accounting system It facilitates the analysis of cost objects where

the revenues and the expenses are been

accumulated by the cost object like product,

distribution channel, product line etc

(Donaghue and et.al., 2018). This in turn

enables the organization in determining the

profitable and unprofitable segments of the

product.

Job costing system It helps the company in keeping the track over

the performance of individual and the team

which in turn leads to cost control, productivity

and efficiency.

Evaluating the integration in between the management accounting reporting and the systems

Management accounting system and reporting highly interrelates as efficient functioning

of the systems helps in continuous improvement for the organization through the development

and the integration of the cost related information. This leads to effective preparation of the

reports by the managers which leads to achievement of the goal with high efficiency.

LO2.

Marginal Costing – The term Marginal costing is known as the system of accounting

where all the cost that are of variable nature are been charged against the cost units. However, in

case of fixed costs incurred in continuing the business operations for the definite period are been

written off in full against all the contribution made on aggregate basis (Gerrish and Spreen,

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

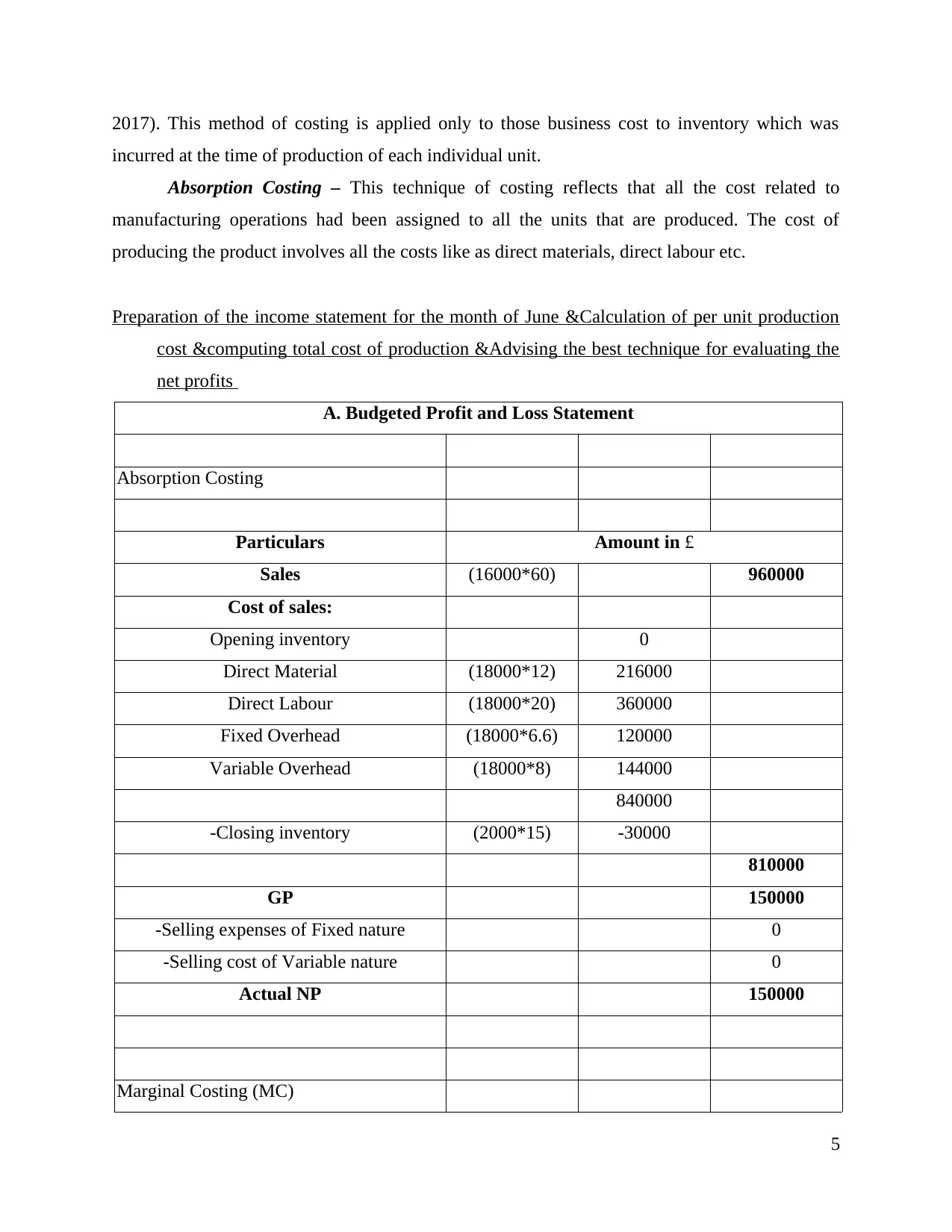

2017). This method of costing is applied only to those business cost to inventory which was

incurred at the time of production of each individual unit.

Absorption Costing – This technique of costing reflects that all the cost related to

manufacturing operations had been assigned to all the units that are produced. The cost of

producing the product involves all the costs like as direct materials, direct labour etc.

Preparation of the income statement for the month of June &Calculation of per unit production

cost &computing total cost of production &Advising the best technique for evaluating the

net profits

A. Budgeted Profit and Loss Statement

Absorption Costing

Particulars Amount in £

Sales (16000*60) 960000

Cost of sales:

Opening inventory 0

Direct Material (18000*12) 216000

Direct Labour (18000*20) 360000

Fixed Overhead (18000*6.6) 120000

Variable Overhead (18000*8) 144000

840000

-Closing inventory (2000*15) -30000

810000

GP 150000

-Selling expenses of Fixed nature 0

-Selling cost of Variable nature 0

Actual NP 150000

Marginal Costing (MC)

5

incurred at the time of production of each individual unit.

Absorption Costing – This technique of costing reflects that all the cost related to

manufacturing operations had been assigned to all the units that are produced. The cost of

producing the product involves all the costs like as direct materials, direct labour etc.

Preparation of the income statement for the month of June &Calculation of per unit production

cost &computing total cost of production &Advising the best technique for evaluating the

net profits

A. Budgeted Profit and Loss Statement

Absorption Costing

Particulars Amount in £

Sales (16000*60) 960000

Cost of sales:

Opening inventory 0

Direct Material (18000*12) 216000

Direct Labour (18000*20) 360000

Fixed Overhead (18000*6.6) 120000

Variable Overhead (18000*8) 144000

840000

-Closing inventory (2000*15) -30000

810000

GP 150000

-Selling expenses of Fixed nature 0

-Selling cost of Variable nature 0

Actual NP 150000

Marginal Costing (MC)

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

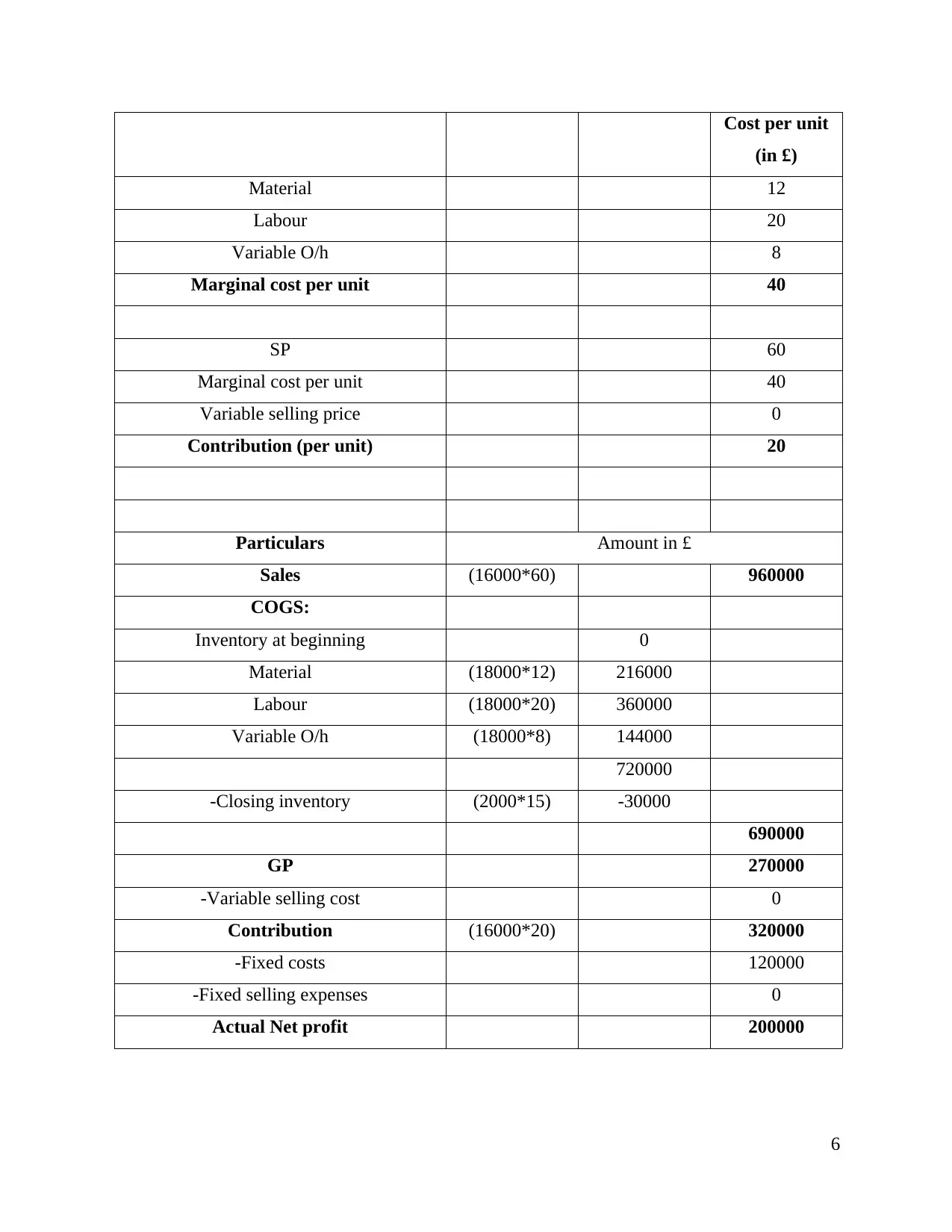

Cost per unit

(in £)

Material 12

Labour 20

Variable O/h 8

Marginal cost per unit 40

SP 60

Marginal cost per unit 40

Variable selling price 0

Contribution (per unit) 20

Particulars Amount in £

Sales (16000*60) 960000

COGS:

Inventory at beginning 0

Material (18000*12) 216000

Labour (18000*20) 360000

Variable O/h (18000*8) 144000

720000

-Closing inventory (2000*15) -30000

690000

GP 270000

-Variable selling cost 0

Contribution (16000*20) 320000

-Fixed costs 120000

-Fixed selling expenses 0

Actual Net profit 200000

6

(in £)

Material 12

Labour 20

Variable O/h 8

Marginal cost per unit 40

SP 60

Marginal cost per unit 40

Variable selling price 0

Contribution (per unit) 20

Particulars Amount in £

Sales (16000*60) 960000

COGS:

Inventory at beginning 0

Material (18000*12) 216000

Labour (18000*20) 360000

Variable O/h (18000*8) 144000

720000

-Closing inventory (2000*15) -30000

690000

GP 270000

-Variable selling cost 0

Contribution (16000*20) 320000

-Fixed costs 120000

-Fixed selling expenses 0

Actual Net profit 200000

6

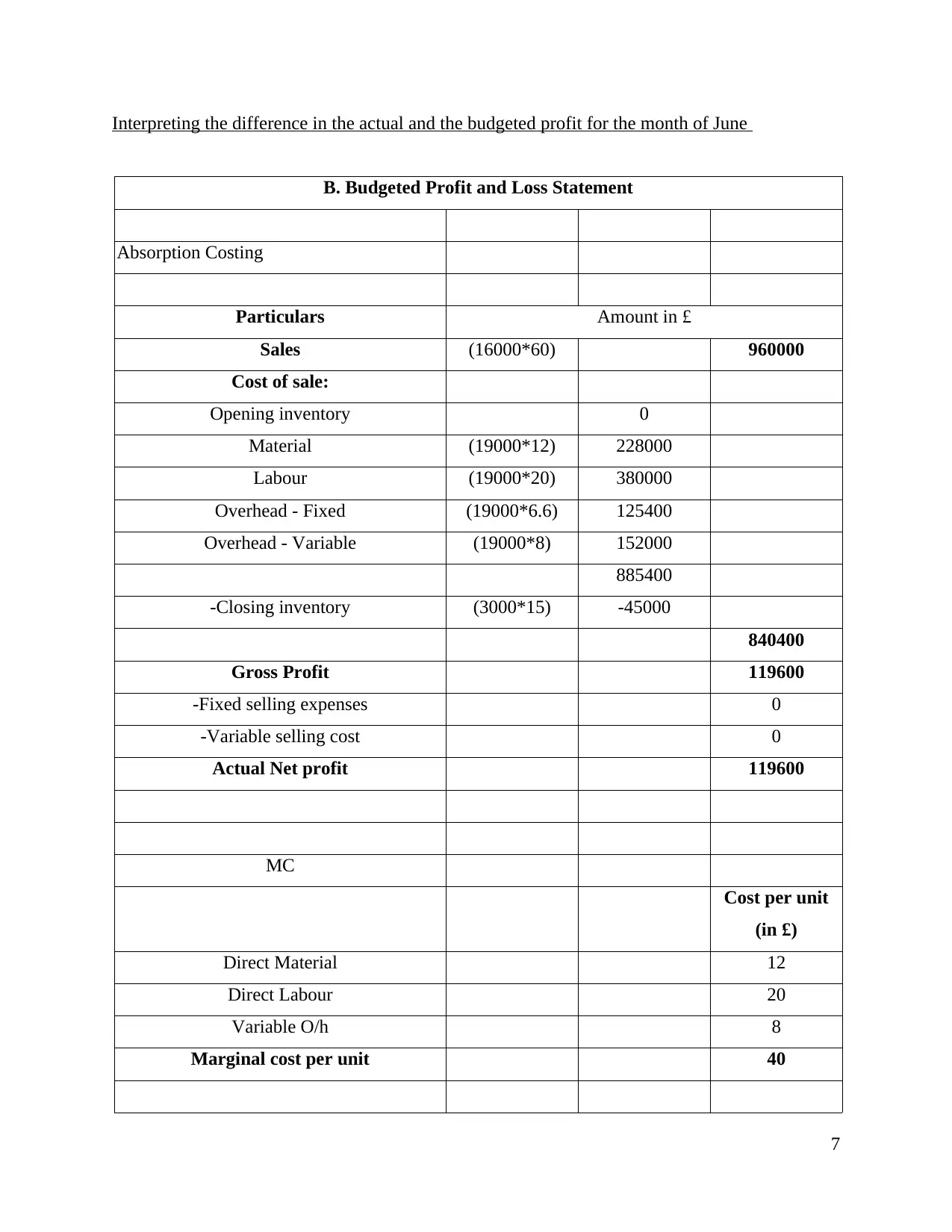

Interpreting the difference in the actual and the budgeted profit for the month of June

B. Budgeted Profit and Loss Statement

Absorption Costing

Particulars Amount in £

Sales (16000*60) 960000

Cost of sale:

Opening inventory 0

Material (19000*12) 228000

Labour (19000*20) 380000

Overhead - Fixed (19000*6.6) 125400

Overhead - Variable (19000*8) 152000

885400

-Closing inventory (3000*15) -45000

840400

Gross Profit 119600

-Fixed selling expenses 0

-Variable selling cost 0

Actual Net profit 119600

MC

Cost per unit

(in £)

Direct Material 12

Direct Labour 20

Variable O/h 8

Marginal cost per unit 40

7

B. Budgeted Profit and Loss Statement

Absorption Costing

Particulars Amount in £

Sales (16000*60) 960000

Cost of sale:

Opening inventory 0

Material (19000*12) 228000

Labour (19000*20) 380000

Overhead - Fixed (19000*6.6) 125400

Overhead - Variable (19000*8) 152000

885400

-Closing inventory (3000*15) -45000

840400

Gross Profit 119600

-Fixed selling expenses 0

-Variable selling cost 0

Actual Net profit 119600

MC

Cost per unit

(in £)

Direct Material 12

Direct Labour 20

Variable O/h 8

Marginal cost per unit 40

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

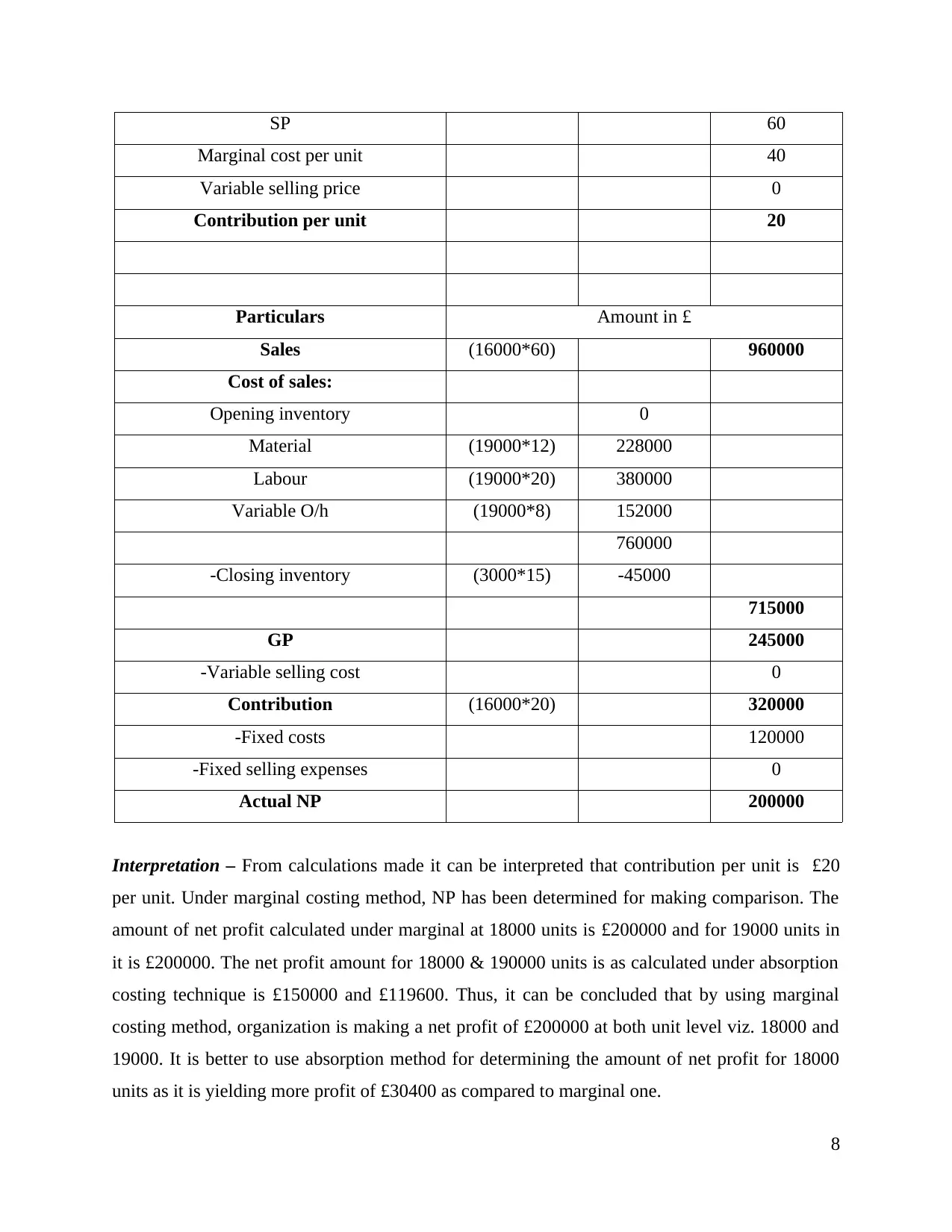

SP 60

Marginal cost per unit 40

Variable selling price 0

Contribution per unit 20

Particulars Amount in £

Sales (16000*60) 960000

Cost of sales:

Opening inventory 0

Material (19000*12) 228000

Labour (19000*20) 380000

Variable O/h (19000*8) 152000

760000

-Closing inventory (3000*15) -45000

715000

GP 245000

-Variable selling cost 0

Contribution (16000*20) 320000

-Fixed costs 120000

-Fixed selling expenses 0

Actual NP 200000

Interpretation – From calculations made it can be interpreted that contribution per unit is £20

per unit. Under marginal costing method, NP has been determined for making comparison. The

amount of net profit calculated under marginal at 18000 units is £200000 and for 19000 units in

it is £200000. The net profit amount for 18000 & 190000 units is as calculated under absorption

costing technique is £150000 and £119600. Thus, it can be concluded that by using marginal

costing method, organization is making a net profit of £200000 at both unit level viz. 18000 and

19000. It is better to use absorption method for determining the amount of net profit for 18000

units as it is yielding more profit of £30400 as compared to marginal one.

8

Marginal cost per unit 40

Variable selling price 0

Contribution per unit 20

Particulars Amount in £

Sales (16000*60) 960000

Cost of sales:

Opening inventory 0

Material (19000*12) 228000

Labour (19000*20) 380000

Variable O/h (19000*8) 152000

760000

-Closing inventory (3000*15) -45000

715000

GP 245000

-Variable selling cost 0

Contribution (16000*20) 320000

-Fixed costs 120000

-Fixed selling expenses 0

Actual NP 200000

Interpretation – From calculations made it can be interpreted that contribution per unit is £20

per unit. Under marginal costing method, NP has been determined for making comparison. The

amount of net profit calculated under marginal at 18000 units is £200000 and for 19000 units in

it is £200000. The net profit amount for 18000 & 190000 units is as calculated under absorption

costing technique is £150000 and £119600. Thus, it can be concluded that by using marginal

costing method, organization is making a net profit of £200000 at both unit level viz. 18000 and

19000. It is better to use absorption method for determining the amount of net profit for 18000

units as it is yielding more profit of £30400 as compared to marginal one.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LO3.

Explaining the benefits and the limitation of the several planning tools under the budgetary

control

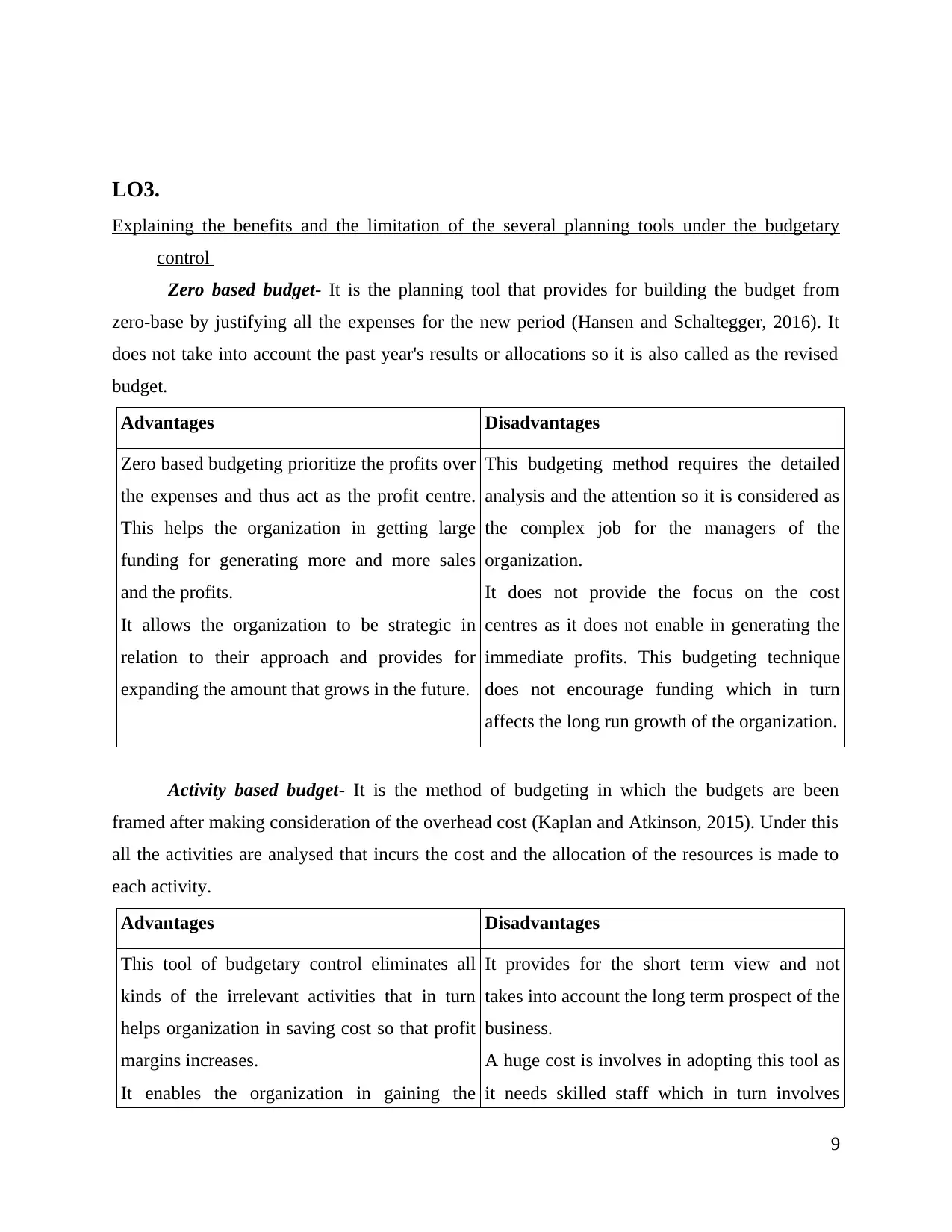

Zero based budget- It is the planning tool that provides for building the budget from

zero-base by justifying all the expenses for the new period (Hansen and Schaltegger, 2016). It

does not take into account the past year's results or allocations so it is also called as the revised

budget.

Advantages Disadvantages

Zero based budgeting prioritize the profits over

the expenses and thus act as the profit centre.

This helps the organization in getting large

funding for generating more and more sales

and the profits.

It allows the organization to be strategic in

relation to their approach and provides for

expanding the amount that grows in the future.

This budgeting method requires the detailed

analysis and the attention so it is considered as

the complex job for the managers of the

organization.

It does not provide the focus on the cost

centres as it does not enable in generating the

immediate profits. This budgeting technique

does not encourage funding which in turn

affects the long run growth of the organization.

Activity based budget- It is the method of budgeting in which the budgets are been

framed after making consideration of the overhead cost (Kaplan and Atkinson, 2015). Under this

all the activities are analysed that incurs the cost and the allocation of the resources is made to

each activity.

Advantages Disadvantages

This tool of budgetary control eliminates all

kinds of the irrelevant activities that in turn

helps organization in saving cost so that profit

margins increases.

It enables the organization in gaining the

It provides for the short term view and not

takes into account the long term prospect of the

business.

A huge cost is involves in adopting this tool as

it needs skilled staff which in turn involves

9

Explaining the benefits and the limitation of the several planning tools under the budgetary

control

Zero based budget- It is the planning tool that provides for building the budget from

zero-base by justifying all the expenses for the new period (Hansen and Schaltegger, 2016). It

does not take into account the past year's results or allocations so it is also called as the revised

budget.

Advantages Disadvantages

Zero based budgeting prioritize the profits over

the expenses and thus act as the profit centre.

This helps the organization in getting large

funding for generating more and more sales

and the profits.

It allows the organization to be strategic in

relation to their approach and provides for

expanding the amount that grows in the future.

This budgeting method requires the detailed

analysis and the attention so it is considered as

the complex job for the managers of the

organization.

It does not provide the focus on the cost

centres as it does not enable in generating the

immediate profits. This budgeting technique

does not encourage funding which in turn

affects the long run growth of the organization.

Activity based budget- It is the method of budgeting in which the budgets are been

framed after making consideration of the overhead cost (Kaplan and Atkinson, 2015). Under this

all the activities are analysed that incurs the cost and the allocation of the resources is made to

each activity.

Advantages Disadvantages

This tool of budgetary control eliminates all

kinds of the irrelevant activities that in turn

helps organization in saving cost so that profit

margins increases.

It enables the organization in gaining the

It provides for the short term view and not

takes into account the long term prospect of the

business.

A huge cost is involves in adopting this tool as

it needs skilled staff which in turn involves

9

competitive edge in the overall market. cost of training to the employees.

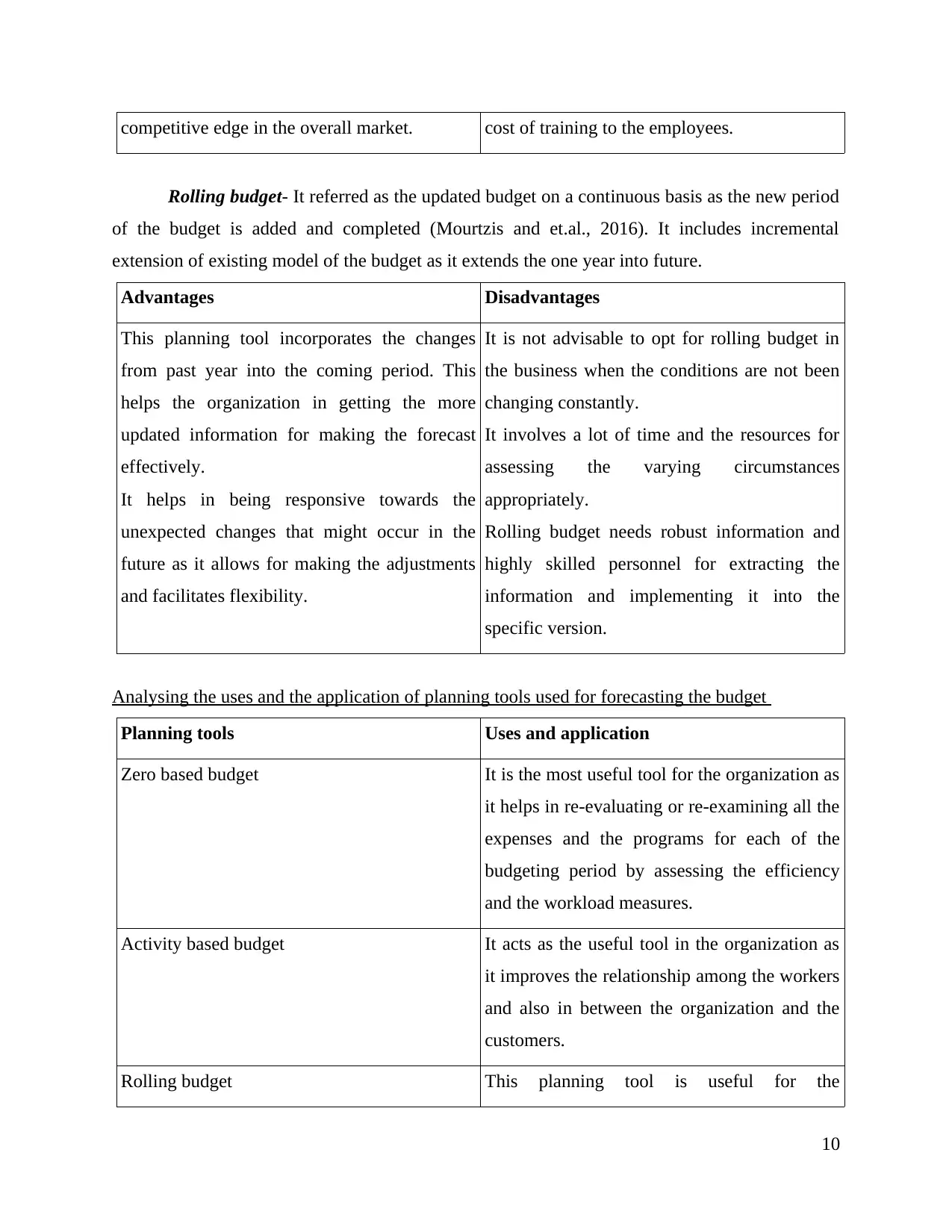

Rolling budget- It referred as the updated budget on a continuous basis as the new period

of the budget is added and completed (Mourtzis and et.al., 2016). It includes incremental

extension of existing model of the budget as it extends the one year into future.

Advantages Disadvantages

This planning tool incorporates the changes

from past year into the coming period. This

helps the organization in getting the more

updated information for making the forecast

effectively.

It helps in being responsive towards the

unexpected changes that might occur in the

future as it allows for making the adjustments

and facilitates flexibility.

It is not advisable to opt for rolling budget in

the business when the conditions are not been

changing constantly.

It involves a lot of time and the resources for

assessing the varying circumstances

appropriately.

Rolling budget needs robust information and

highly skilled personnel for extracting the

information and implementing it into the

specific version.

Analysing the uses and the application of planning tools used for forecasting the budget

Planning tools Uses and application

Zero based budget It is the most useful tool for the organization as

it helps in re-evaluating or re-examining all the

expenses and the programs for each of the

budgeting period by assessing the efficiency

and the workload measures.

Activity based budget It acts as the useful tool in the organization as

it improves the relationship among the workers

and also in between the organization and the

customers.

Rolling budget This planning tool is useful for the

10

Rolling budget- It referred as the updated budget on a continuous basis as the new period

of the budget is added and completed (Mourtzis and et.al., 2016). It includes incremental

extension of existing model of the budget as it extends the one year into future.

Advantages Disadvantages

This planning tool incorporates the changes

from past year into the coming period. This

helps the organization in getting the more

updated information for making the forecast

effectively.

It helps in being responsive towards the

unexpected changes that might occur in the

future as it allows for making the adjustments

and facilitates flexibility.

It is not advisable to opt for rolling budget in

the business when the conditions are not been

changing constantly.

It involves a lot of time and the resources for

assessing the varying circumstances

appropriately.

Rolling budget needs robust information and

highly skilled personnel for extracting the

information and implementing it into the

specific version.

Analysing the uses and the application of planning tools used for forecasting the budget

Planning tools Uses and application

Zero based budget It is the most useful tool for the organization as

it helps in re-evaluating or re-examining all the

expenses and the programs for each of the

budgeting period by assessing the efficiency

and the workload measures.

Activity based budget It acts as the useful tool in the organization as

it improves the relationship among the workers

and also in between the organization and the

customers.

Rolling budget This planning tool is useful for the

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.