Management Accounting Concepts and Techniques: A Detailed Analysis

VerifiedAdded on 2022/12/29

|18

|5060

|33

Report

AI Summary

This report provides a comprehensive overview of management accounting concepts and techniques, focusing on their application within Connect Catering Services. It begins by defining management accounting and outlining its essential requirements in various systems, including planning, risk assessment, and performance management. The report then explores different methods used for management accounting reporting, such as budgeting reports, aging reports, performance reports, and cost managerial accounting reports. A significant portion of the report is dedicated to cost analysis, specifically comparing and contrasting marginal and absorption costing techniques, including the preparation of income statements using these methods. Furthermore, the report examines the advantages and disadvantages of different planning tools used for budgetary control and analyzes how organizations adapt their management accounting systems to address financial problems. The report concludes by summarizing the key findings and emphasizing the importance of management accounting in supporting effective decision-making within organizations.

Management Accounting

Concepts and Techniques

for Decision Makers

Concepts and Techniques

for Decision Makers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction......................................................................................................................................3

Task1................................................................................................................................................3

P1 Management accounting it's essential requirements of different types of management

accounting systems......................................................................................................................3

P2 Explain different methods used for management accounting reporting................................5

Task2................................................................................................................................................7

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs. .........................................................................7

Task3..............................................................................................................................................11

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control......................................................................................................................11

P5 Compare how organizations are adapting management accounting systems to respond to

financial problems.....................................................................................................................13

Conclusion.....................................................................................................................................14

REFERENCES..............................................................................................................................15

Introduction......................................................................................................................................3

Task1................................................................................................................................................3

P1 Management accounting it's essential requirements of different types of management

accounting systems......................................................................................................................3

P2 Explain different methods used for management accounting reporting................................5

Task2................................................................................................................................................7

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs. .........................................................................7

Task3..............................................................................................................................................11

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control......................................................................................................................11

P5 Compare how organizations are adapting management accounting systems to respond to

financial problems.....................................................................................................................13

Conclusion.....................................................................................................................................14

REFERENCES..............................................................................................................................15

Introduction

Management accounting can be defined as a application that includes measuring,

analysing, understanding and most importantly communicating and presenting to their managers

in order to accomplish organisation goals (Alsharari and et. al. , 2015.). It provides support to

the manager to make timely as well as inform decisions within the Organization. They utilize

information that is associated with cost along with sales generated in exchange of the goods and

services offer by the company to their customers. This ultimately helps them to make both short

term as well as long term decisions.

Connect catering services is the company that has been operating their business from last

thirty years in United Kingdom (U.K). They are family oriented and provide the best quality

foods as well as services. They do this by their highly talented and motivated workforce with the

aim of providing to ensure maximizing their customers satisfaction. This project is undertaken

to assist their Senior management for providing them a better understanding Management

accounting. This will be done by addressing their concerns relating to understanding as well as

application of different technique, usefulness of planning tool and also comparing how the

accounting will solve financial problems.

Task1

P1 Management accounting it's essential requirements of different types of management

accounting systems.

As Management accounting comprises of two words ''Management'' and ''Accounting''.In

simple terms it studies management aspect of accounting (Binns , 2018). It basically deals with

analysis,interpretation and presentation of accounting by referring to management and cost

accounting. The ultimate aim of management accounting is to plan,implement policies aid in

decision making process of handling day to day operations.

Management accounting can be defined as a application that includes measuring,

analysing, understanding and most importantly communicating and presenting to their managers

in order to accomplish organisation goals (Alsharari and et. al. , 2015.). It provides support to

the manager to make timely as well as inform decisions within the Organization. They utilize

information that is associated with cost along with sales generated in exchange of the goods and

services offer by the company to their customers. This ultimately helps them to make both short

term as well as long term decisions.

Connect catering services is the company that has been operating their business from last

thirty years in United Kingdom (U.K). They are family oriented and provide the best quality

foods as well as services. They do this by their highly talented and motivated workforce with the

aim of providing to ensure maximizing their customers satisfaction. This project is undertaken

to assist their Senior management for providing them a better understanding Management

accounting. This will be done by addressing their concerns relating to understanding as well as

application of different technique, usefulness of planning tool and also comparing how the

accounting will solve financial problems.

Task1

P1 Management accounting it's essential requirements of different types of management

accounting systems.

As Management accounting comprises of two words ''Management'' and ''Accounting''.In

simple terms it studies management aspect of accounting (Binns , 2018). It basically deals with

analysis,interpretation and presentation of accounting by referring to management and cost

accounting. The ultimate aim of management accounting is to plan,implement policies aid in

decision making process of handling day to day operations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting takes into accounts diverse areas of company's financial

outcome and fulfils different requirements which mainly includes revenues, sales, operating

expenses and cost controls. Below are the high-level areas which company mostly employees to

improve financial metrics of the company.

Planning, Forecasting and Budgeting:

Managerial accounting mainly involves predicting and planning in order to project the

direction relates to company's finances in the coming years to come. This planning requires a

high-level thinking in the form of preparation. This is done by altering different accounting

information in various functional budgets (Butler and Ghosh ., 2015. ).

Risk assessment:

Another crucial benefit of management accounting it easily identifies and assesses risk

factors within the organization and can be controlled and minimized through effective

management (Collier, 2015)

Performance management:

This is another important benefit of performance using managerial accounting can aid the

management to make effective decision in real time. This help them to maintain cost and remain

competitive in the long run (Dekker , 2016.).

Influence: Communication is one of the most important aspect in management accounting as it

improves the decision-making process. The accurate and integrated communication encourages

diverse thoughts which helps in generating new ideas which will aid the company in getting

closer to their desired objectives. Through effective discussion of the business requirement, it is

way easier to implement and get the most required information. It can be inferred that

recommendation are vital for managers as it allows them to gain authority.

It is also vital for the Company to go through different roles and principles of Management

accounting in order to be apply it appropriately: Some of the main roles can be explained below:

Relevance: Information is valuable for all it is just that each one of them need to segregate the

required information from the all the available resources. Management accounting check

accurately both the information that is important as well as people and method being employed

for making such decision. It is primary and most important for any company to look for the well-

being of all their shareholders to take the most relevant and valuable information for making the

appropriate decision and the same is important for doing the required arrangement for evaluation.

outcome and fulfils different requirements which mainly includes revenues, sales, operating

expenses and cost controls. Below are the high-level areas which company mostly employees to

improve financial metrics of the company.

Planning, Forecasting and Budgeting:

Managerial accounting mainly involves predicting and planning in order to project the

direction relates to company's finances in the coming years to come. This planning requires a

high-level thinking in the form of preparation. This is done by altering different accounting

information in various functional budgets (Butler and Ghosh ., 2015. ).

Risk assessment:

Another crucial benefit of management accounting it easily identifies and assesses risk

factors within the organization and can be controlled and minimized through effective

management (Collier, 2015)

Performance management:

This is another important benefit of performance using managerial accounting can aid the

management to make effective decision in real time. This help them to maintain cost and remain

competitive in the long run (Dekker , 2016.).

Influence: Communication is one of the most important aspect in management accounting as it

improves the decision-making process. The accurate and integrated communication encourages

diverse thoughts which helps in generating new ideas which will aid the company in getting

closer to their desired objectives. Through effective discussion of the business requirement, it is

way easier to implement and get the most required information. It can be inferred that

recommendation are vital for managers as it allows them to gain authority.

It is also vital for the Company to go through different roles and principles of Management

accounting in order to be apply it appropriately: Some of the main roles can be explained below:

Relevance: Information is valuable for all it is just that each one of them need to segregate the

required information from the all the available resources. Management accounting check

accurately both the information that is important as well as people and method being employed

for making such decision. It is primary and most important for any company to look for the well-

being of all their shareholders to take the most relevant and valuable information for making the

appropriate decision and the same is important for doing the required arrangement for evaluation.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Value: Management accounting links to its core model through which it derives value to its

customer. In simple terms, it can be referred as grabbing the available opportunity as well as

concentrating on risk, expenses and most importantly generating value from best available

opportunities. It also requires an in-depth knowledge of the micro economic environment. This

implies gathering information from all the direction where valuable information is can be

accessed, assessing all the available opportunities and carefully focusing on all the risks,

expenses and most importantly the value generated from the possible opportunity. This help to

analyse the situations in taking more informed decisions. This is ultimately helpful in analysing

the result of selecting the most appropriate, maximizes their profitability by discarding the waste

that is increasing the cost of the company.

Creditability: It is very much important for improving the decision making process to a large

extent (Gibassier and Schaltegger , 2015.). It is important to undergo a careful investigation that

helps in taking reliable decisions. Thereby, support the Company to fulfil their objectives. It is

important for management accounting experts to look towards the interest of all its stakeholder

and on a timely basis by taking regular feedbacks and addressing their overall issues at the

earliest. That in turn will be fruitful for the organization to improve their productivity on a

regular basis. This will further aid them in creating a positive impact in improving by being more

creditable and also aids the company enhance the value of their brand in comparison to their

competitors in the industry.

P2 Explain different methods used for management accounting reporting

There are diverse forms of management accounting reports that assist the management in

preparation of the management reports which enables them to make crucial business decisions.

(Jiambalvo , 2019.) It helps all the stakeholders of the company to assess reliability and get fair

as well as accurate financial information. The various reports are discussed as under:

Budgeting reports: The primary role of the budgetary reports is that it enables the company to

compare it’s current financial performance with that of planned or budgeted performance. A

budget is primarily made on the basis of historical performance of the company (Lavia López

and Hiebl , 2015) .But, a useful budget is one which is highly reliable that considers the

emergency or unforeseen conditions that may arise in the near future. The budget mainly

includes all their sources of earning and expenditures with the ultimate aim of getting closer to

customer. In simple terms, it can be referred as grabbing the available opportunity as well as

concentrating on risk, expenses and most importantly generating value from best available

opportunities. It also requires an in-depth knowledge of the micro economic environment. This

implies gathering information from all the direction where valuable information is can be

accessed, assessing all the available opportunities and carefully focusing on all the risks,

expenses and most importantly the value generated from the possible opportunity. This help to

analyse the situations in taking more informed decisions. This is ultimately helpful in analysing

the result of selecting the most appropriate, maximizes their profitability by discarding the waste

that is increasing the cost of the company.

Creditability: It is very much important for improving the decision making process to a large

extent (Gibassier and Schaltegger , 2015.). It is important to undergo a careful investigation that

helps in taking reliable decisions. Thereby, support the Company to fulfil their objectives. It is

important for management accounting experts to look towards the interest of all its stakeholder

and on a timely basis by taking regular feedbacks and addressing their overall issues at the

earliest. That in turn will be fruitful for the organization to improve their productivity on a

regular basis. This will further aid them in creating a positive impact in improving by being more

creditable and also aids the company enhance the value of their brand in comparison to their

competitors in the industry.

P2 Explain different methods used for management accounting reporting

There are diverse forms of management accounting reports that assist the management in

preparation of the management reports which enables them to make crucial business decisions.

(Jiambalvo , 2019.) It helps all the stakeholders of the company to assess reliability and get fair

as well as accurate financial information. The various reports are discussed as under:

Budgeting reports: The primary role of the budgetary reports is that it enables the company to

compare it’s current financial performance with that of planned or budgeted performance. A

budget is primarily made on the basis of historical performance of the company (Lavia López

and Hiebl , 2015) .But, a useful budget is one which is highly reliable that considers the

emergency or unforeseen conditions that may arise in the near future. The budget mainly

includes all their sources of earning and expenditures with the ultimate aim of getting closer to

their goal along with staying within their respective budgeted amount. This reports helps the

employees to earn incentives that inspires them to accomplish the company's goal.

Account receivable aging report: The purpose of the report is to manage the account receivable

of the company and it's importance is highly dependent on the nature of activities it is involved

in. It would be easier for the manager to identify the defaulters of the company. The outstanding

balance is divided into specific periods and is helpful in identifying the problems that exists in

the collection process of the company (Kaplana and Atkinson, 2015.). If a particular situation

arises when there are many defaulter than company has to take strict action to reduce their credit

policy as cash flow is one of the primary concern for them. It aids the company to carefully the

net cash flow generated. Then, depending on their liquidity can plan to increase or decrease

their credit policy.

Performance reports: The main purpose for which this report is created is to monitor the

performance of all their talented workforce at each and every stage(McLaren and et. al., 2016.).

This report can be prepared on monthly as well as quarterly basis. These reports are generated to

review the performance management of company along with the individual performance of the

employees. In context of large organization even department performance reports are generated.

It helps the companies to provide systematic review of their total expenditure of particular period

and it also helps the managers to take significant decisions about the future action of the

company.

Cost managerial accounting report: This report is mainly responsible to compute the cost of all

the goods that are manufactured. This mainly includes cost of raw material, labour or any other

related cost to determine the profitability of the company. This reports, ultimately helps to

determines their profit margins and in turn takes appropriate measures for the same. This is

mostly beneficial for small businesses to analyze each job individually and determine whether it

is feasible to take similar projects in the future.

Inventory management: This report aids the company to produce as well as maintain their

inventory in order to improve the efficiency of their processes. This mainly comprises of items

such as wasted inventory, hourly labour cost and most importantly per unit overhead costs. It is

then beneficial for the firm to compare the different lines of their business and accordingly take

steps to reward high performing department and also focus on the areas that requires

improvement.

employees to earn incentives that inspires them to accomplish the company's goal.

Account receivable aging report: The purpose of the report is to manage the account receivable

of the company and it's importance is highly dependent on the nature of activities it is involved

in. It would be easier for the manager to identify the defaulters of the company. The outstanding

balance is divided into specific periods and is helpful in identifying the problems that exists in

the collection process of the company (Kaplana and Atkinson, 2015.). If a particular situation

arises when there are many defaulter than company has to take strict action to reduce their credit

policy as cash flow is one of the primary concern for them. It aids the company to carefully the

net cash flow generated. Then, depending on their liquidity can plan to increase or decrease

their credit policy.

Performance reports: The main purpose for which this report is created is to monitor the

performance of all their talented workforce at each and every stage(McLaren and et. al., 2016.).

This report can be prepared on monthly as well as quarterly basis. These reports are generated to

review the performance management of company along with the individual performance of the

employees. In context of large organization even department performance reports are generated.

It helps the companies to provide systematic review of their total expenditure of particular period

and it also helps the managers to take significant decisions about the future action of the

company.

Cost managerial accounting report: This report is mainly responsible to compute the cost of all

the goods that are manufactured. This mainly includes cost of raw material, labour or any other

related cost to determine the profitability of the company. This reports, ultimately helps to

determines their profit margins and in turn takes appropriate measures for the same. This is

mostly beneficial for small businesses to analyze each job individually and determine whether it

is feasible to take similar projects in the future.

Inventory management: This report aids the company to produce as well as maintain their

inventory in order to improve the efficiency of their processes. This mainly comprises of items

such as wasted inventory, hourly labour cost and most importantly per unit overhead costs. It is

then beneficial for the firm to compare the different lines of their business and accordingly take

steps to reward high performing department and also focus on the areas that requires

improvement.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Other Managerial reports: All the other managerial reports that aren't characterized under

specific reports comes under this report (March.Reichert and et. al., 2015.). This mainly include

order information report,project reports,and many other report that are important for almost

every business. The best results varies as per capabilities on the task force to foresee

requirement of the organizations. The individuals who are involved in professional services are

comparatively more capable to do the task as they have more skills or experience to do the

similar task. Henceforth, this report is a must for managers to get accurate,creditable as well as

original management accounting report.

Task2

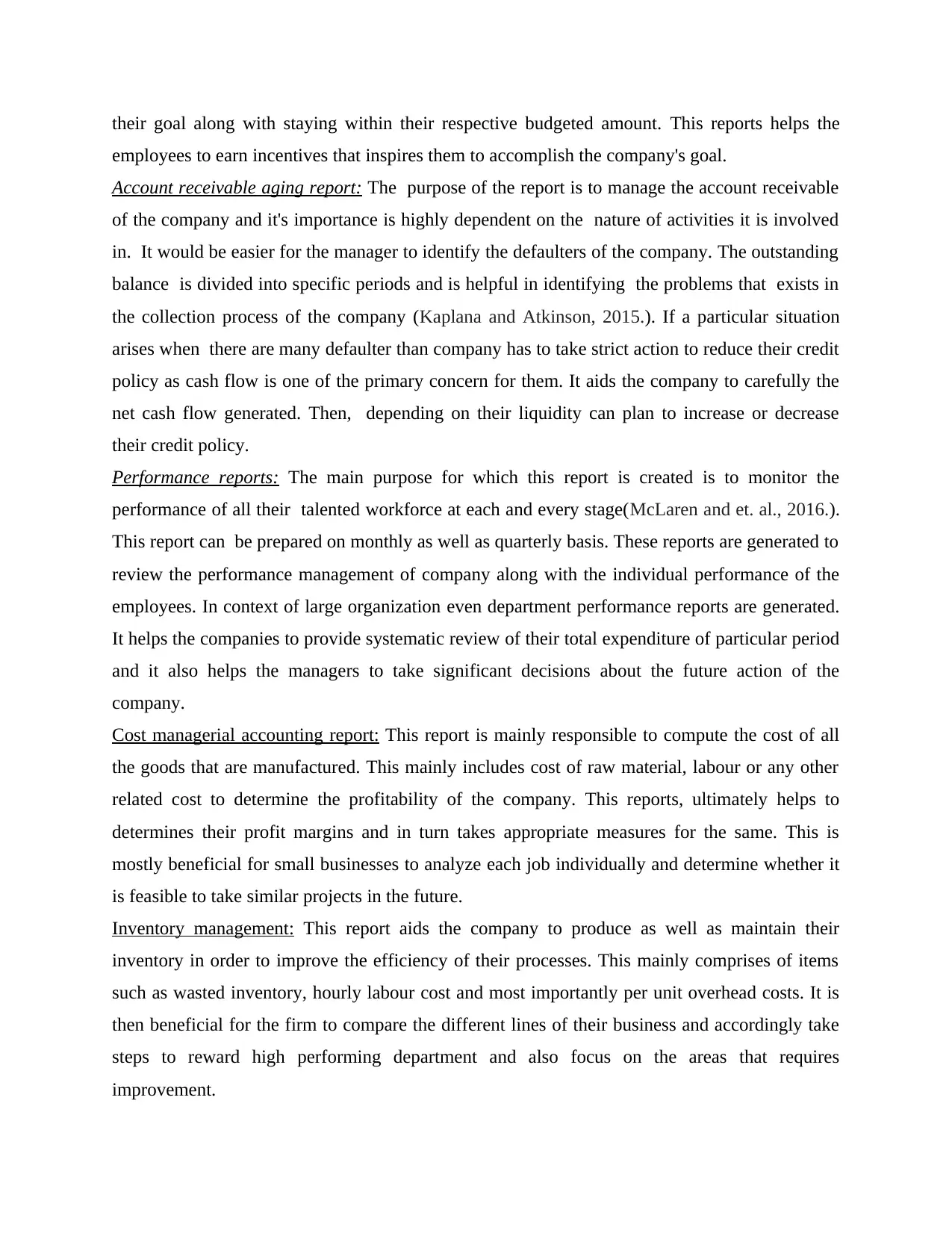

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

It is important to use appropriate technique and it' usefulness depends upon the nature of

company. There are various technique that can be used . As, it is specifically mentioned to apply

marginal as well as absorption costing. For it's better understanding we will understand it detail

both the techniques below:

Marginal Costing: This costing considers all the cost that are incurred at the initial level when

individual units are being produced(Schneider and et. al., 2015.). They have variety of

characteristics that they constitute. Some of these include classifying the cost into fixed as well

as variable cost. Also while calculating variable cost is taken into account. Adding to this, the

prices are computed as per marginal contribution and profitability is determined as per the

margin contribution generating in the particular financial year.

Absorption Costing: It is also called by another name as managerial accounting method and

computes all the costs that are related such as direct material, direct labour, rent are accounting

generally on the basis of financial year. This costing is mandatory and needed by generally

accepted accounting principles ( GAAP).

Some of the major difference in the two type of costings can include in the way different

cost are allocated. This can include fixed cost is distributed across the period in absorption

costing. While marginal costing treats as lump sum and assigns all these fixed cost altogether.

1 Preparation of income statements:

Cost per unit under absorption costing-

specific reports comes under this report (March.Reichert and et. al., 2015.). This mainly include

order information report,project reports,and many other report that are important for almost

every business. The best results varies as per capabilities on the task force to foresee

requirement of the organizations. The individuals who are involved in professional services are

comparatively more capable to do the task as they have more skills or experience to do the

similar task. Henceforth, this report is a must for managers to get accurate,creditable as well as

original management accounting report.

Task2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.

It is important to use appropriate technique and it' usefulness depends upon the nature of

company. There are various technique that can be used . As, it is specifically mentioned to apply

marginal as well as absorption costing. For it's better understanding we will understand it detail

both the techniques below:

Marginal Costing: This costing considers all the cost that are incurred at the initial level when

individual units are being produced(Schneider and et. al., 2015.). They have variety of

characteristics that they constitute. Some of these include classifying the cost into fixed as well

as variable cost. Also while calculating variable cost is taken into account. Adding to this, the

prices are computed as per marginal contribution and profitability is determined as per the

margin contribution generating in the particular financial year.

Absorption Costing: It is also called by another name as managerial accounting method and

computes all the costs that are related such as direct material, direct labour, rent are accounting

generally on the basis of financial year. This costing is mandatory and needed by generally

accepted accounting principles ( GAAP).

Some of the major difference in the two type of costings can include in the way different

cost are allocated. This can include fixed cost is distributed across the period in absorption

costing. While marginal costing treats as lump sum and assigns all these fixed cost altogether.

1 Preparation of income statements:

Cost per unit under absorption costing-

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Activity April May

Variable Manufacturing cost per unit 4 4

Fixed Manufacturing Overhead per

unit

6 5

10 9

Income statement under absorption costing

Particulars April may

Sales 16000 16000

Less: Cost of sales 20000 23000

Fixed Manufacturing

Overhead 15000 15000

Variable Manufacturing cost 10000 12000

Closing stock 5000 9000

Opening stock 0 5000

Gross loss -4000 -7000

Less: Fixed Non-

Manufacturing Cost -4000 -4000

Net loss -8000 -11000

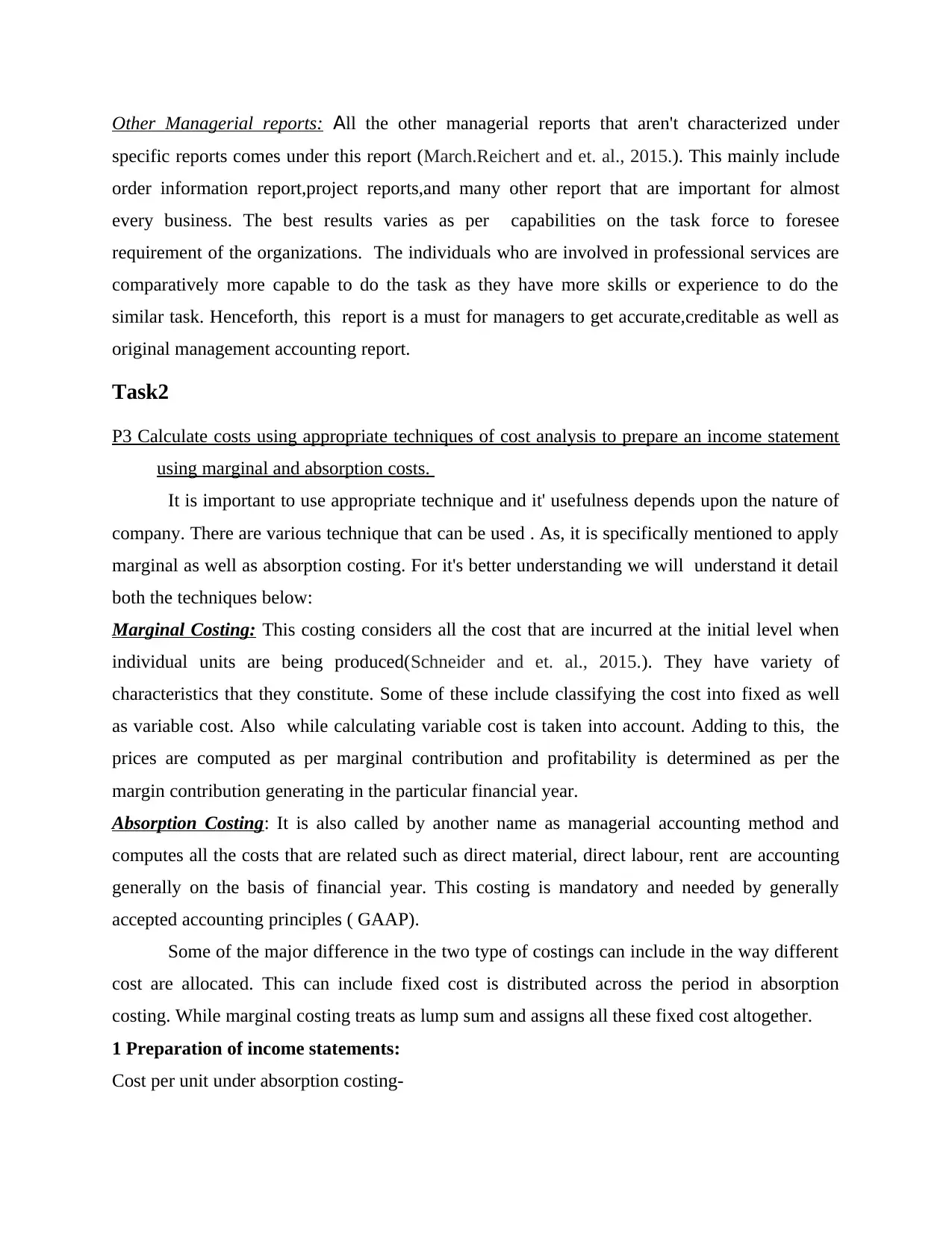

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Particulars April may

Sales 16000 16000

Less: Marginal cost of sales 8000 10000

Variable Manufacturing cost 10000 12000

Closing stock 2000 4000

Opening stock 0 2000

Contribution 8000 6000

Less: Fixed Manufacturing

Overhead 15000 15000

Variable Manufacturing cost per unit 4 4

Fixed Manufacturing Overhead per

unit

6 5

10 9

Income statement under absorption costing

Particulars April may

Sales 16000 16000

Less: Cost of sales 20000 23000

Fixed Manufacturing

Overhead 15000 15000

Variable Manufacturing cost 10000 12000

Closing stock 5000 9000

Opening stock 0 5000

Gross loss -4000 -7000

Less: Fixed Non-

Manufacturing Cost -4000 -4000

Net loss -8000 -11000

Cost per unit under absorption costing-

Activity April May

Variable Manufacturing cost per unit 4 4

Particulars April may

Sales 16000 16000

Less: Marginal cost of sales 8000 10000

Variable Manufacturing cost 10000 12000

Closing stock 2000 4000

Opening stock 0 2000

Contribution 8000 6000

Less: Fixed Manufacturing

Overhead 15000 15000

Less: Fixed Non-

Manufacturing Cost 4000 4000

Net loss -11000 -13000

Reconciliation statement:

Particulars April may

Net loss under absorption

costing -8000 -11000

Less: Closing stock -3000 -2000

Net loss under marginal

costing -11000 -13000

2 a

1. Identify which costs are fixed and which costs are variable.

Fixed costs:

Activity Amount

Manager’s Salary 5000

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

£12000

Variable cost:

Activity Amount

Direct material costs per Pizza 3.50

Direct labour costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£5.50

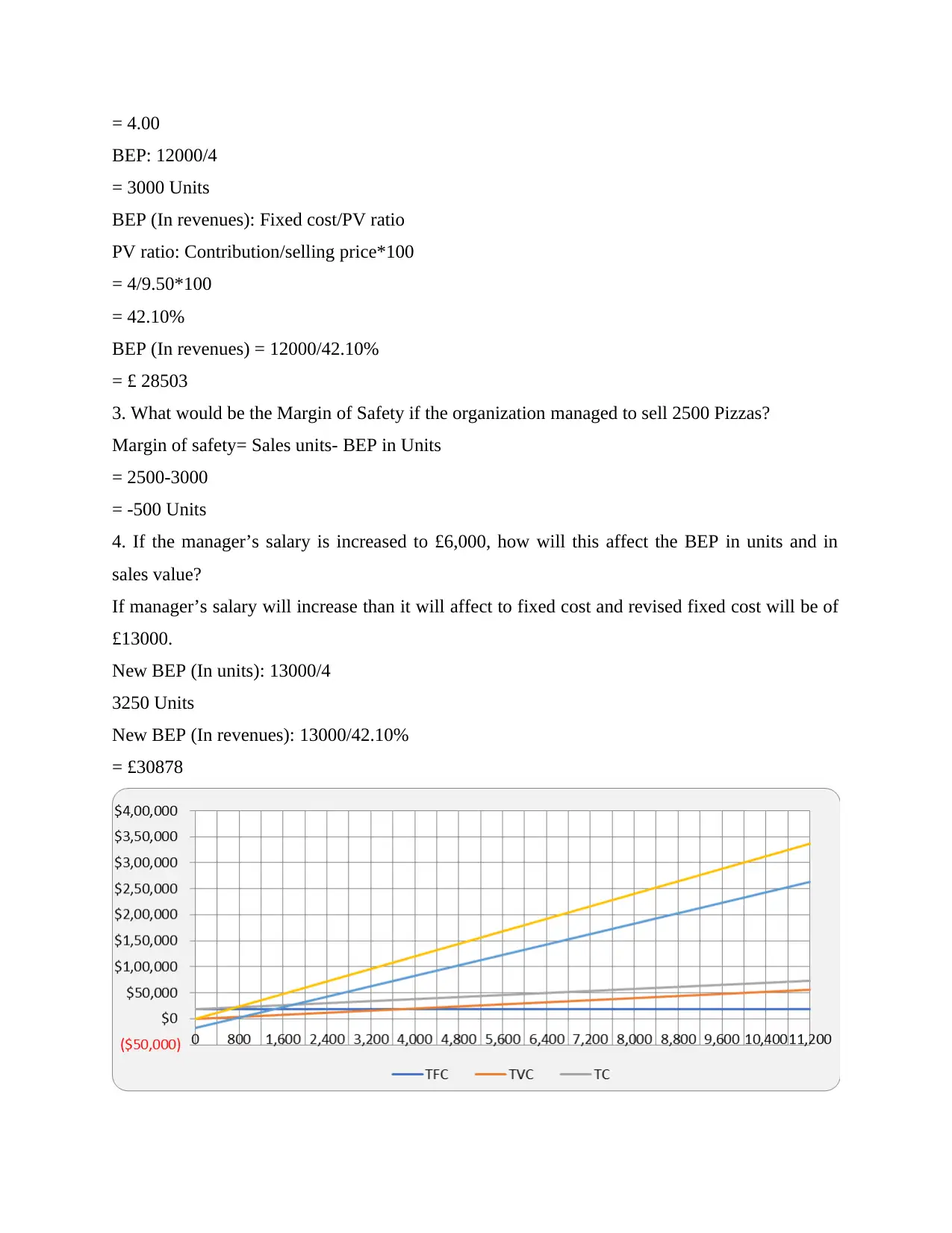

Break Even Point (BEP)

2. Show the Break-even point using a Break-even graph.

BEP (In units): Fixed cost/contribution per unit

Contribution per unit: Selling Price-Variable cost per unit

= 9.50-5.50

Manufacturing Cost 4000 4000

Net loss -11000 -13000

Reconciliation statement:

Particulars April may

Net loss under absorption

costing -8000 -11000

Less: Closing stock -3000 -2000

Net loss under marginal

costing -11000 -13000

2 a

1. Identify which costs are fixed and which costs are variable.

Fixed costs:

Activity Amount

Manager’s Salary 5000

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

£12000

Variable cost:

Activity Amount

Direct material costs per Pizza 3.50

Direct labour costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£5.50

Break Even Point (BEP)

2. Show the Break-even point using a Break-even graph.

BEP (In units): Fixed cost/contribution per unit

Contribution per unit: Selling Price-Variable cost per unit

= 9.50-5.50

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

= 4.00

BEP: 12000/4

= 3000 Units

BEP (In revenues): Fixed cost/PV ratio

PV ratio: Contribution/selling price*100

= 4/9.50*100

= 42.10%

BEP (In revenues) = 12000/42.10%

= £ 28503

3. What would be the Margin of Safety if the organization managed to sell 2500 Pizzas?

Margin of safety= Sales units- BEP in Units

= 2500-3000

= -500 Units

4. If the manager’s salary is increased to £6,000, how will this affect the BEP in units and in

sales value?

If manager’s salary will increase than it will affect to fixed cost and revised fixed cost will be of

£13000.

New BEP (In units): 13000/4

3250 Units

New BEP (In revenues): 13000/42.10%

= £30878

BEP: 12000/4

= 3000 Units

BEP (In revenues): Fixed cost/PV ratio

PV ratio: Contribution/selling price*100

= 4/9.50*100

= 42.10%

BEP (In revenues) = 12000/42.10%

= £ 28503

3. What would be the Margin of Safety if the organization managed to sell 2500 Pizzas?

Margin of safety= Sales units- BEP in Units

= 2500-3000

= -500 Units

4. If the manager’s salary is increased to £6,000, how will this affect the BEP in units and in

sales value?

If manager’s salary will increase than it will affect to fixed cost and revised fixed cost will be of

£13000.

New BEP (In units): 13000/4

3250 Units

New BEP (In revenues): 13000/42.10%

= £30878

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

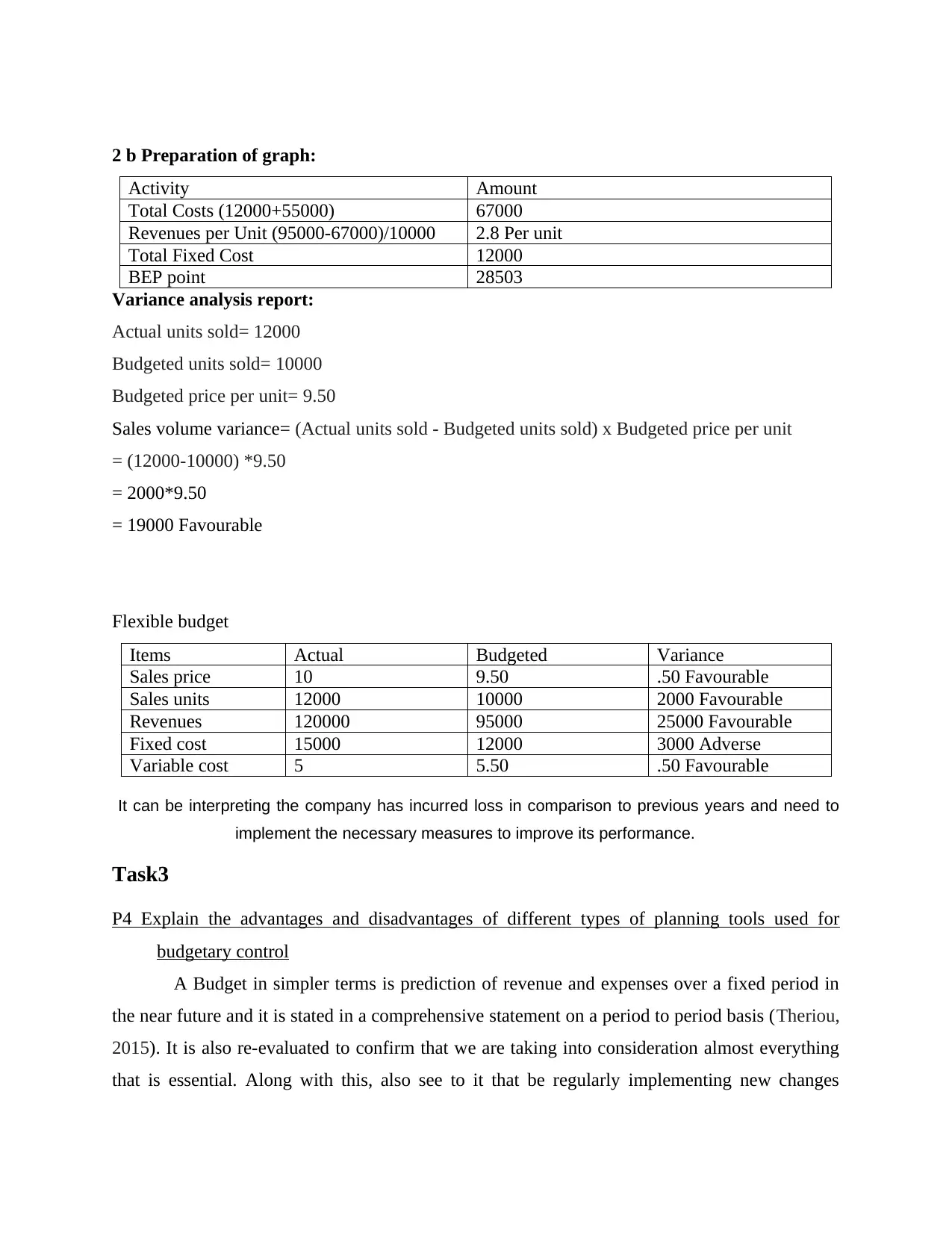

2 b Preparation of graph:

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

Variance analysis report:

Actual units sold= 12000

Budgeted units sold= 10000

Budgeted price per unit= 9.50

Sales volume variance= (Actual units sold - Budgeted units sold) x Budgeted price per unit

= (12000-10000) *9.50

= 2000*9.50

= 19000 Favourable

Flexible budget

Items Actual Budgeted Variance

Sales price 10 9.50 .50 Favourable

Sales units 12000 10000 2000 Favourable

Revenues 120000 95000 25000 Favourable

Fixed cost 15000 12000 3000 Adverse

Variable cost 5 5.50 .50 Favourable

It can be interpreting the company has incurred loss in comparison to previous years and need to

implement the necessary measures to improve its performance.

Task3

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control

A Budget in simpler terms is prediction of revenue and expenses over a fixed period in

the near future and it is stated in a comprehensive statement on a period to period basis (Theriou,

2015). It is also re-evaluated to confirm that we are taking into consideration almost everything

that is essential. Along with this, also see to it that be regularly implementing new changes

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

Variance analysis report:

Actual units sold= 12000

Budgeted units sold= 10000

Budgeted price per unit= 9.50

Sales volume variance= (Actual units sold - Budgeted units sold) x Budgeted price per unit

= (12000-10000) *9.50

= 2000*9.50

= 19000 Favourable

Flexible budget

Items Actual Budgeted Variance

Sales price 10 9.50 .50 Favourable

Sales units 12000 10000 2000 Favourable

Revenues 120000 95000 25000 Favourable

Fixed cost 15000 12000 3000 Adverse

Variable cost 5 5.50 .50 Favourable

It can be interpreting the company has incurred loss in comparison to previous years and need to

implement the necessary measures to improve its performance.

Task3

P4 Explain the advantages and disadvantages of different types of planning tools used for

budgetary control

A Budget in simpler terms is prediction of revenue and expenses over a fixed period in

the near future and it is stated in a comprehensive statement on a period to period basis (Theriou,

2015). It is also re-evaluated to confirm that we are taking into consideration almost everything

that is essential. Along with this, also see to it that be regularly implementing new changes

according to latest developments. It is made for variety of purposes, and it is generally made by

“Connecting Catering Services” mainly for performance measurement and improve their

productivity.

Main advantages of different type of planning tools are stated as follows: Identifies their Stand:Budget's first and fore mostly aids the entity to shift their focus

from short term to long term objectives. Budget for this company i.e. 'CONNECTING

CATERING SERVICES UK’ will help them know identify their competitive as well as

their solvency position. This further aids them to do improvement mainly by forecasting

the cash flow statement by different methods including historical average of last 3 to 5

years , latest year or others methods. Flexibility: The other advantage it has they follow a flexible structure. This will further

aid them to analyse their productivity in measurable terms in order to take significant

business decisions. These decisions consist of shutting down a line of business that is

suffering continues losses or add create new offering either by product or market

development (Williams and et. al., 2015). Planning: The budgets are based on well-structured plan. This will provide a fixed

amount each department is required to spend. This further aid them to make the best use

of amount each one of them are required to spend in order to maximize the return of

organization as a whole. Communication: The budget is considering the information collected regarding the

quantity of supplies required and accordingly discuss with all the different department

heads. This builds a two ways communication that provides a clear direction and in turn

improve the efficiency of the company.

Control: Budget is thoughtfully planned in advance. This helps to compare actual

performance by each of the department with that of their standard performance (Yaakob

and Gegov., 2016). This is dual advantage for the company. One is that they will be able

to reward the ones that has able to accomplish their task and another is that they will be

able to identify as their weak point and take necessary control measure to improve the

performance of the company.

Some of the main disadvantages of Budgetary Control can be stated below:

“Connecting Catering Services” mainly for performance measurement and improve their

productivity.

Main advantages of different type of planning tools are stated as follows: Identifies their Stand:Budget's first and fore mostly aids the entity to shift their focus

from short term to long term objectives. Budget for this company i.e. 'CONNECTING

CATERING SERVICES UK’ will help them know identify their competitive as well as

their solvency position. This further aids them to do improvement mainly by forecasting

the cash flow statement by different methods including historical average of last 3 to 5

years , latest year or others methods. Flexibility: The other advantage it has they follow a flexible structure. This will further

aid them to analyse their productivity in measurable terms in order to take significant

business decisions. These decisions consist of shutting down a line of business that is

suffering continues losses or add create new offering either by product or market

development (Williams and et. al., 2015). Planning: The budgets are based on well-structured plan. This will provide a fixed

amount each department is required to spend. This further aid them to make the best use

of amount each one of them are required to spend in order to maximize the return of

organization as a whole. Communication: The budget is considering the information collected regarding the

quantity of supplies required and accordingly discuss with all the different department

heads. This builds a two ways communication that provides a clear direction and in turn

improve the efficiency of the company.

Control: Budget is thoughtfully planned in advance. This helps to compare actual

performance by each of the department with that of their standard performance (Yaakob

and Gegov., 2016). This is dual advantage for the company. One is that they will be able

to reward the ones that has able to accomplish their task and another is that they will be

able to identify as their weak point and take necessary control measure to improve the

performance of the company.

Some of the main disadvantages of Budgetary Control can be stated below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.