Detailed Management Accounting Report: Continental Clothing Limited

VerifiedAdded on 2023/01/18

|22

|5946

|26

Report

AI Summary

This report delves into the core concepts of management accounting, examining its role within business entities, and its impact on decision-making. It begins with an introduction to management accounting, followed by an exploration of various accounting systems such as cost accounting, inventory management, job costing, and price optimization systems. The report highlights the benefits of these systems, particularly in controlling costs and optimizing pricing strategies. The report analyzes microeconomic techniques like cost analysis, break-even analysis, and marginal costing. It also covers the presentation of financial information, the importance of reliable and understandable data, and different types of management accounting reports, including budget reports, performance reports, and inventory valuation reports. The report uses Continental Clothing Limited as a case study to illustrate the practical application of these concepts.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

TASK 1 ...........................................................................................................................................4

TASK 2............................................................................................................................................9

TASK 3..........................................................................................................................................18

TASK 4..........................................................................................................................................20

CONCLUSION..............................................................................................................................22

REFERENCES..............................................................................................................................23

INTRODUCTION...........................................................................................................................4

MAIN BODY...................................................................................................................................4

TASK 1 ...........................................................................................................................................4

TASK 2............................................................................................................................................9

TASK 3..........................................................................................................................................18

TASK 4..........................................................................................................................................20

CONCLUSION..............................................................................................................................22

REFERENCES..............................................................................................................................23

INTRODUCTION

Management accounting is an accounting procedure that starts from collection of

monetary & non monetary data and ends up with preparation of internal reports (Liff and

Wahlstrom, 2018). In this accounting different types of systems are included and each of them

has integration with departments. The main objective of this project report is to make

understanding about concept of management accounting and its role within business entities. For

better understanding of various tasks of the project report a company has been chosen that is

continental clothing limited, headquartered in London, United Kingdom. The company operates

in process of manufacturing different range of cloths.

The project report covers about role of management accounting for business entities as

well as various types of accounting systems. In the further part of project report, financial

statements are prepared as per monetary data on assumption basis. In addition, various kinds of

budgets and role of management accounting system is covered in order to sort out issue of

monetary aspects.

MAIN BODY

TASK 1

Management accounting- The word accounting management (MA) is a method of accounting

concerned with the process of collecting business entities' monetary and anti-monetary data in

order to generate internal control documents (Fleischman and Parker, 2017).

Definition of MA:

According of IMA, “MA is a profession which consists partnering in better decision making,

planning and performance management systems in order to control management in the

formulation of an organisation's strategy”.

Management accounting system: The term management accounting systems can be defined as

those systems which are linked with process of various kinds of activities of monetary and non

monetary transactions. There are different types of accounting systems such as cost accounting

systems, job costing system etc.

Management accounting is an accounting procedure that starts from collection of

monetary & non monetary data and ends up with preparation of internal reports (Liff and

Wahlstrom, 2018). In this accounting different types of systems are included and each of them

has integration with departments. The main objective of this project report is to make

understanding about concept of management accounting and its role within business entities. For

better understanding of various tasks of the project report a company has been chosen that is

continental clothing limited, headquartered in London, United Kingdom. The company operates

in process of manufacturing different range of cloths.

The project report covers about role of management accounting for business entities as

well as various types of accounting systems. In the further part of project report, financial

statements are prepared as per monetary data on assumption basis. In addition, various kinds of

budgets and role of management accounting system is covered in order to sort out issue of

monetary aspects.

MAIN BODY

TASK 1

Management accounting- The word accounting management (MA) is a method of accounting

concerned with the process of collecting business entities' monetary and anti-monetary data in

order to generate internal control documents (Fleischman and Parker, 2017).

Definition of MA:

According of IMA, “MA is a profession which consists partnering in better decision making,

planning and performance management systems in order to control management in the

formulation of an organisation's strategy”.

Management accounting system: The term management accounting systems can be defined as

those systems which are linked with process of various kinds of activities of monetary and non

monetary transactions. There are different types of accounting systems such as cost accounting

systems, job costing system etc.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Origin, role and principle of MA:

Origin- The source of MA can be traced back to the last 300 years when it was being used

throughout the industrialisation (Kerr, Rouse and de Villiers, 2015). Such accounting has grown

with the analysis of financial accounting. Nonetheless, this accounting is not necessary for

corporations in the present time frame.

Role of management accounting- MA plays a significant role in the context of business entities

for different departments. Specially, for managerial aspects this accounting is too crucial. Herein,

below some key role of MA are as follows:

Helps in effective planning- When making effective preparation for various types of

existing resources, this accounting plays a key role. It becomes feasible as executives can

examine future-oriented behaviours that result when better planning based on the

information gathered. Such as in the aspect of above continental clothing limited, their

managers make effective planning for various kinds of activities and operations.

Helps in better controlling- Furthermore, MA is helpful for companies to improve control

over different types of activities and operations. This is because executives are able to

concentrate on those tasks which lead to lower income or higher costs through the use of

key information from performance statements. Similar as in the above business entity,

their managers use this accounting system in order to control various kinds of aspects.

Helps in better decision making- As well as the MA plays a key role for companies in

order to take key decisions of various kinds of aspects (Cooper, R., 2017). The manager

of above business entity, continental clothing limited company utilise key information

from this accounting that helps in order to take corrective steps on right time.

So these are main role of management accounting for each kinds of business entity. As well as in

above continental clothing limited company, this accounting is helping them in effective manner.

Principles of MA:

Influence- It is a kind of MA principle that describes how interaction gives insight to

corporations. In general, the MA is helpful for the interaction of data on monetary and

anti-monetary elements.

Relevance- According to this rule, the information given by MA must be relevant to the

activities of corporations.

Origin- The source of MA can be traced back to the last 300 years when it was being used

throughout the industrialisation (Kerr, Rouse and de Villiers, 2015). Such accounting has grown

with the analysis of financial accounting. Nonetheless, this accounting is not necessary for

corporations in the present time frame.

Role of management accounting- MA plays a significant role in the context of business entities

for different departments. Specially, for managerial aspects this accounting is too crucial. Herein,

below some key role of MA are as follows:

Helps in effective planning- When making effective preparation for various types of

existing resources, this accounting plays a key role. It becomes feasible as executives can

examine future-oriented behaviours that result when better planning based on the

information gathered. Such as in the aspect of above continental clothing limited, their

managers make effective planning for various kinds of activities and operations.

Helps in better controlling- Furthermore, MA is helpful for companies to improve control

over different types of activities and operations. This is because executives are able to

concentrate on those tasks which lead to lower income or higher costs through the use of

key information from performance statements. Similar as in the above business entity,

their managers use this accounting system in order to control various kinds of aspects.

Helps in better decision making- As well as the MA plays a key role for companies in

order to take key decisions of various kinds of aspects (Cooper, R., 2017). The manager

of above business entity, continental clothing limited company utilise key information

from this accounting that helps in order to take corrective steps on right time.

So these are main role of management accounting for each kinds of business entity. As well as in

above continental clothing limited company, this accounting is helping them in effective manner.

Principles of MA:

Influence- It is a kind of MA principle that describes how interaction gives insight to

corporations. In general, the MA is helpful for the interaction of data on monetary and

anti-monetary elements.

Relevance- According to this rule, the information given by MA must be relevant to the

activities of corporations.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Value- The effect on value is projected. Management accounting ties the operations of

the enterprise to its core business structure and involves an extensive awareness of the

wider macroeconomic environment (Morillo, Díaz, Camacho and Montesinos, 2015).

Credibility- Stewardship is a form of integrity. Responsibility and transparency make the

judgment-making process much more transparent. Controlling near-term corporate

interests against long-term shareholder value increases confidence and efficiency.

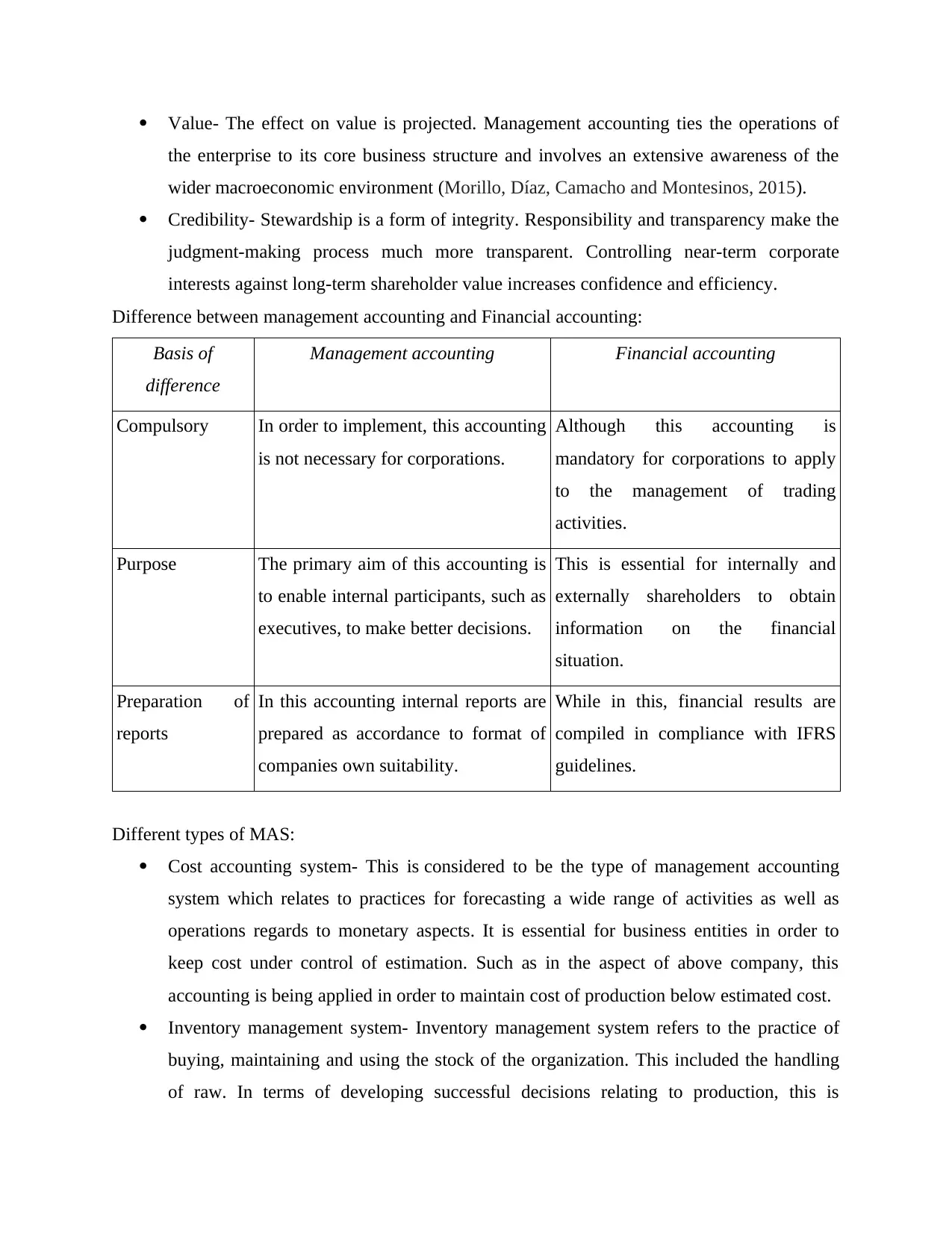

Difference between management accounting and Financial accounting:

Basis of

difference

Management accounting Financial accounting

Compulsory In order to implement, this accounting

is not necessary for corporations.

Although this accounting is

mandatory for corporations to apply

to the management of trading

activities.

Purpose The primary aim of this accounting is

to enable internal participants, such as

executives, to make better decisions.

This is essential for internally and

externally shareholders to obtain

information on the financial

situation.

Preparation of

reports

In this accounting internal reports are

prepared as accordance to format of

companies own suitability.

While in this, financial results are

compiled in compliance with IFRS

guidelines.

Different types of MAS:

Cost accounting system- This is considered to be the type of management accounting

system which relates to practices for forecasting a wide range of activities as well as

operations regards to monetary aspects. It is essential for business entities in order to

keep cost under control of estimation. Such as in the aspect of above company, this

accounting is being applied in order to maintain cost of production below estimated cost.

Inventory management system- Inventory management system refers to the practice of

buying, maintaining and using the stock of the organization. This included the handling

of raw. In terms of developing successful decisions relating to production, this is

the enterprise to its core business structure and involves an extensive awareness of the

wider macroeconomic environment (Morillo, Díaz, Camacho and Montesinos, 2015).

Credibility- Stewardship is a form of integrity. Responsibility and transparency make the

judgment-making process much more transparent. Controlling near-term corporate

interests against long-term shareholder value increases confidence and efficiency.

Difference between management accounting and Financial accounting:

Basis of

difference

Management accounting Financial accounting

Compulsory In order to implement, this accounting

is not necessary for corporations.

Although this accounting is

mandatory for corporations to apply

to the management of trading

activities.

Purpose The primary aim of this accounting is

to enable internal participants, such as

executives, to make better decisions.

This is essential for internally and

externally shareholders to obtain

information on the financial

situation.

Preparation of

reports

In this accounting internal reports are

prepared as accordance to format of

companies own suitability.

While in this, financial results are

compiled in compliance with IFRS

guidelines.

Different types of MAS:

Cost accounting system- This is considered to be the type of management accounting

system which relates to practices for forecasting a wide range of activities as well as

operations regards to monetary aspects. It is essential for business entities in order to

keep cost under control of estimation. Such as in the aspect of above company, this

accounting is being applied in order to maintain cost of production below estimated cost.

Inventory management system- Inventory management system refers to the practice of

buying, maintaining and using the stock of the organization. This included the handling

of raw. In terms of developing successful decisions relating to production, this is

consequently essential inside businesses across manufacturing units. In the continental

clothing limited company, their production department applies this accounting system in

order to manage raw material such as cotton, fibber etc.

Job costing system- Job order costing or job costing is a system for allocating and

accruing production costs to an individual output unit (Monden, 2019). It is used in those

business entities in which large numbers of products are produced. It is essential for

companies in order to keep cost of job under control. Under this two types of costs are

considered that are job costing and process costing like:

Job costing- Job costing is described as a mechanism of documenting the expense of a

manufacturing job. With job costing systems, the administrator or bookkeeper can keep a

record of the expense for each job, retaining data that is often more applicable to the

operation of the corporation.

Process costing- Process costing is a bookkeeping method that tracks and absorbs direct

costs and assigns indirect costs to the manufacturing process. Expenses are allocated to

products, generally in a large order, which may cover the entire production.

In the above company, they use this accounting system for controlling cost of job as well

as to analyse cost of produced each cloth.

Price optimisation system- It is a type of accounting system that involves a

comprehensive systematic practice for identifying the buyer's price and utility

requirements. This accounting system enables corporations to obtain a valuable scope of

industry trends and customer demand statistics. Basically, this accounting system is

necessary for corporations to make changes to the price levels of products and services.

In the context of the above-mentioned preferred corporation, their sales team makes

adjustments to pricing strategies in line with customer requirements.

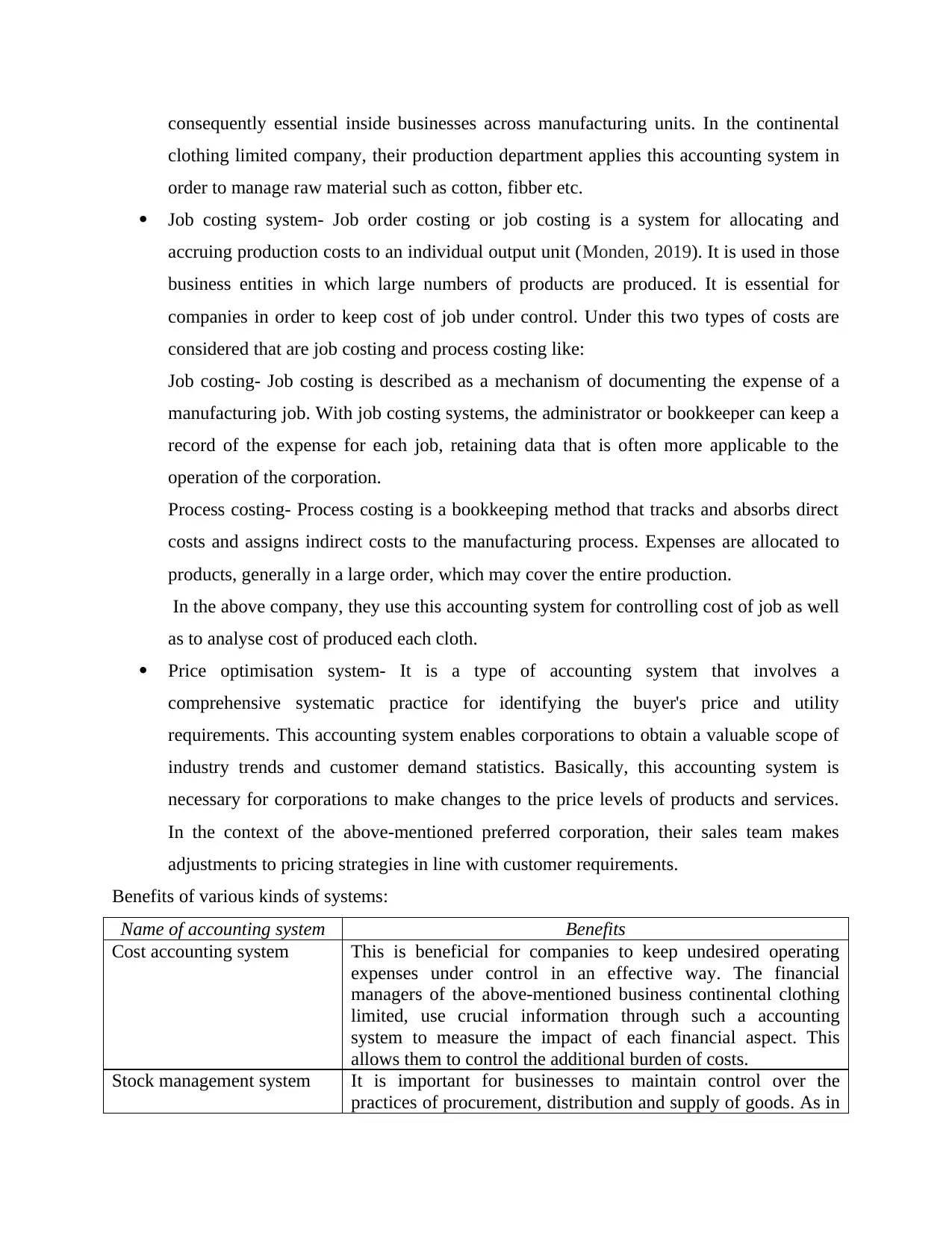

Benefits of various kinds of systems:

Name of accounting system Benefits

Cost accounting system This is beneficial for companies to keep undesired operating

expenses under control in an effective way. The financial

managers of the above-mentioned business continental clothing

limited, use crucial information through such a accounting

system to measure the impact of each financial aspect. This

allows them to control the additional burden of costs.

Stock management system It is important for businesses to maintain control over the

practices of procurement, distribution and supply of goods. As in

clothing limited company, their production department applies this accounting system in

order to manage raw material such as cotton, fibber etc.

Job costing system- Job order costing or job costing is a system for allocating and

accruing production costs to an individual output unit (Monden, 2019). It is used in those

business entities in which large numbers of products are produced. It is essential for

companies in order to keep cost of job under control. Under this two types of costs are

considered that are job costing and process costing like:

Job costing- Job costing is described as a mechanism of documenting the expense of a

manufacturing job. With job costing systems, the administrator or bookkeeper can keep a

record of the expense for each job, retaining data that is often more applicable to the

operation of the corporation.

Process costing- Process costing is a bookkeeping method that tracks and absorbs direct

costs and assigns indirect costs to the manufacturing process. Expenses are allocated to

products, generally in a large order, which may cover the entire production.

In the above company, they use this accounting system for controlling cost of job as well

as to analyse cost of produced each cloth.

Price optimisation system- It is a type of accounting system that involves a

comprehensive systematic practice for identifying the buyer's price and utility

requirements. This accounting system enables corporations to obtain a valuable scope of

industry trends and customer demand statistics. Basically, this accounting system is

necessary for corporations to make changes to the price levels of products and services.

In the context of the above-mentioned preferred corporation, their sales team makes

adjustments to pricing strategies in line with customer requirements.

Benefits of various kinds of systems:

Name of accounting system Benefits

Cost accounting system This is beneficial for companies to keep undesired operating

expenses under control in an effective way. The financial

managers of the above-mentioned business continental clothing

limited, use crucial information through such a accounting

system to measure the impact of each financial aspect. This

allows them to control the additional burden of costs.

Stock management system It is important for businesses to maintain control over the

practices of procurement, distribution and supply of goods. As in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the above mentioned business, this accounting system is

implemented by their production team with the aim of making

efficient use of the accumulated goods.

Job costing system This is useful for calculating the value of each production

generated by determining labour costs individually. The finance

manager of the above organization collect information on the

overall cost of the work involved in the different activities which

is calculated on the account of the value of each component.

Price optimisation system It is essential for companies to set prices for goods and services

at a suitable level. The marketing department of the above

organization dictate the price of the manufactured goods on the

basis of data collected from supplementary research on customer

requirements.

Presentation of financial information:

Why information needs to be reliable up-to-date and accurate:

• Relevance – Accounting data must be applicable to financial transactions so that correct

decisions can be made. In the shortage of the relevant information, administrators cannot take the

proper decision (Brustbauer, 2016).

• Up to date – The transactions in corporations are carried out on a regular basis, which is why it

is crucial to make changes to accounting information time to time.

• Accurate-In fact, the information should be correct because any mistake could lead to a large

financial loss for businesses.

Why the way in which the information is presented must be understandable:

The manner under which data is collected should be clear, as this information is used by

various business participants. As executives take massive decisions based of this accounting info,

and if they do not understand it, they will not be capable of taking the right action.

Various kind of managerial accounting report:

Management Accounting Reports are a form of document that is generated by bookkeepers in

order to provide descriptions of the various elements of financial and anti-financial terms. There

are some kinds of reports such as:

Budget report- It is a document that provides specific information on the expected

amount of revenue and spending as well as the amount of the variance that exists by

implemented by their production team with the aim of making

efficient use of the accumulated goods.

Job costing system This is useful for calculating the value of each production

generated by determining labour costs individually. The finance

manager of the above organization collect information on the

overall cost of the work involved in the different activities which

is calculated on the account of the value of each component.

Price optimisation system It is essential for companies to set prices for goods and services

at a suitable level. The marketing department of the above

organization dictate the price of the manufactured goods on the

basis of data collected from supplementary research on customer

requirements.

Presentation of financial information:

Why information needs to be reliable up-to-date and accurate:

• Relevance – Accounting data must be applicable to financial transactions so that correct

decisions can be made. In the shortage of the relevant information, administrators cannot take the

proper decision (Brustbauer, 2016).

• Up to date – The transactions in corporations are carried out on a regular basis, which is why it

is crucial to make changes to accounting information time to time.

• Accurate-In fact, the information should be correct because any mistake could lead to a large

financial loss for businesses.

Why the way in which the information is presented must be understandable:

The manner under which data is collected should be clear, as this information is used by

various business participants. As executives take massive decisions based of this accounting info,

and if they do not understand it, they will not be capable of taking the right action.

Various kind of managerial accounting report:

Management Accounting Reports are a form of document that is generated by bookkeepers in

order to provide descriptions of the various elements of financial and anti-financial terms. There

are some kinds of reports such as:

Budget report- It is a document that provides specific information on the expected

amount of revenue and spending as well as the amount of the variance that exists by

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

comparing it with the actual result. On the basis of this, administrators take further steps

in order to perform different sort of activities. As in the above company, their

administrators use the important information throughout this report and make the best

decisions.

Performance report- This is a type of document generated by the accountant containing

information on the results of each employee and operation. The aim of this report is to

assist managers to make decisions about the development and progress of their

employees (Meidell, and Kaarbøe, 2017). In the continental clothing limited company

gather key information by help of this budget about performance of each individual

progress as well as about each activity.

Inventory valuation report- It can be defined as a kinds of report that consists detailed

information about total number of stored inventories in form of raw material, finished

goods and work in progress. Under this report, information is included on the basis of

valuation of stock as per the LIFO, FIFO and weighted average cost method. The reports

are produced by help of these methods in which LIFO method valuate goods that comes

in last and utilised first for production. As well as in FIFO method, goods that comes in

first and consummated first. While in the weighted average cost method, cost of goods

sold is divided by number of units. These are beneficial for business entities in order to

take right decision regards to buying and production of goods. Such as in the above

company, this report is being produced by accountants in order to take corrective actions

for selling.

TASK 2

Micro economics techniques:

Cost-This may be defined as the money value that arises in the process of making or providing

any goods or services. There are various types of cost, such as fixed and variable, direct-indirect

costs, etc.

Cost analysis – It can be described as a method by which the actual costs incurred are calculated

in a systematic way (Tucker and Leach, 2017).

Cost Volume Benefit Analysis-This is a kind of analysis that is used to determine how shifts in

cost and volume can impact the profits of businesses. It is based on some assumptions such as:

in order to perform different sort of activities. As in the above company, their

administrators use the important information throughout this report and make the best

decisions.

Performance report- This is a type of document generated by the accountant containing

information on the results of each employee and operation. The aim of this report is to

assist managers to make decisions about the development and progress of their

employees (Meidell, and Kaarbøe, 2017). In the continental clothing limited company

gather key information by help of this budget about performance of each individual

progress as well as about each activity.

Inventory valuation report- It can be defined as a kinds of report that consists detailed

information about total number of stored inventories in form of raw material, finished

goods and work in progress. Under this report, information is included on the basis of

valuation of stock as per the LIFO, FIFO and weighted average cost method. The reports

are produced by help of these methods in which LIFO method valuate goods that comes

in last and utilised first for production. As well as in FIFO method, goods that comes in

first and consummated first. While in the weighted average cost method, cost of goods

sold is divided by number of units. These are beneficial for business entities in order to

take right decision regards to buying and production of goods. Such as in the above

company, this report is being produced by accountants in order to take corrective actions

for selling.

TASK 2

Micro economics techniques:

Cost-This may be defined as the money value that arises in the process of making or providing

any goods or services. There are various types of cost, such as fixed and variable, direct-indirect

costs, etc.

Cost analysis – It can be described as a method by which the actual costs incurred are calculated

in a systematic way (Tucker and Leach, 2017).

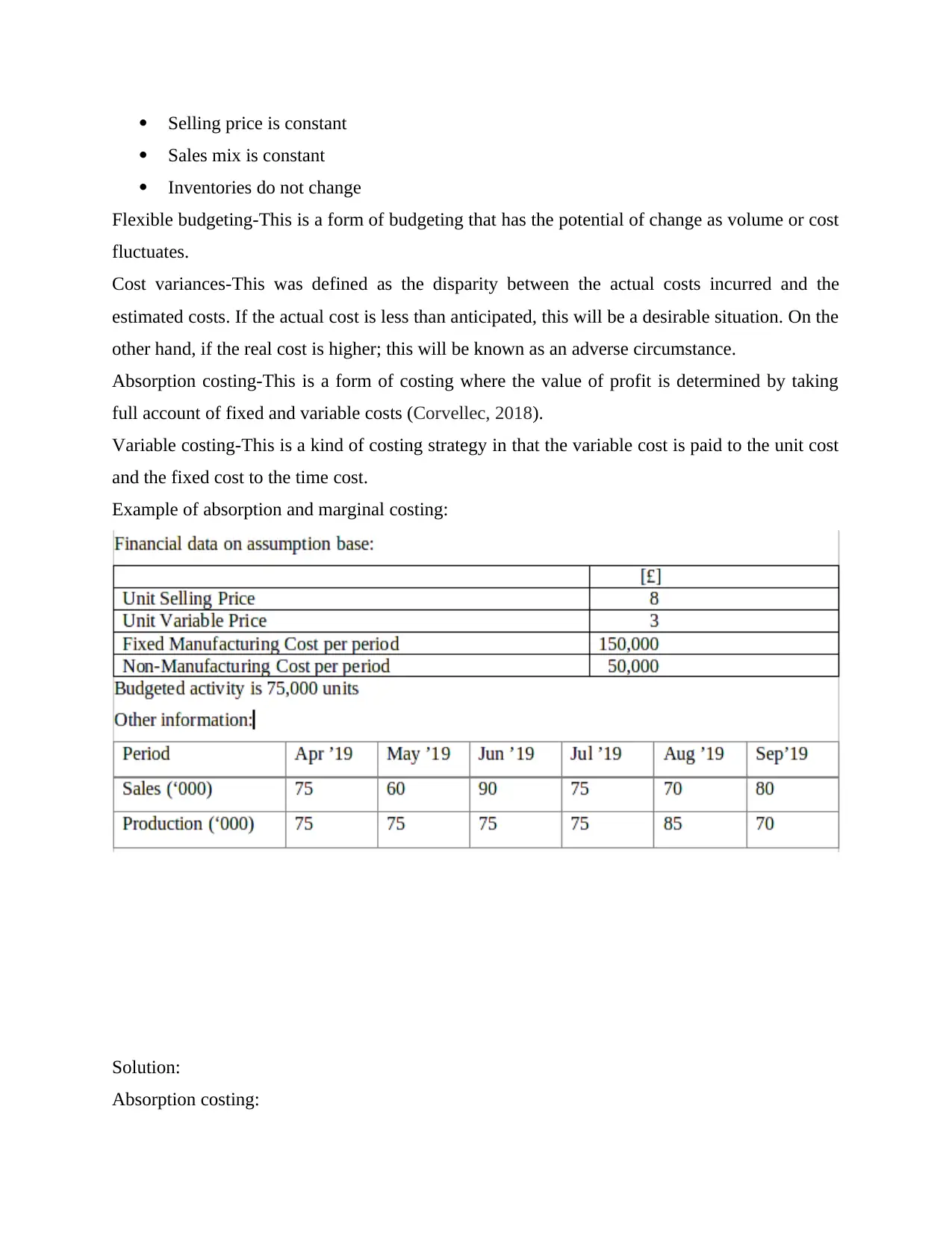

Cost Volume Benefit Analysis-This is a kind of analysis that is used to determine how shifts in

cost and volume can impact the profits of businesses. It is based on some assumptions such as:

Selling price is constant

Sales mix is constant

Inventories do not change

Flexible budgeting-This is a form of budgeting that has the potential of change as volume or cost

fluctuates.

Cost variances-This was defined as the disparity between the actual costs incurred and the

estimated costs. If the actual cost is less than anticipated, this will be a desirable situation. On the

other hand, if the real cost is higher; this will be known as an adverse circumstance.

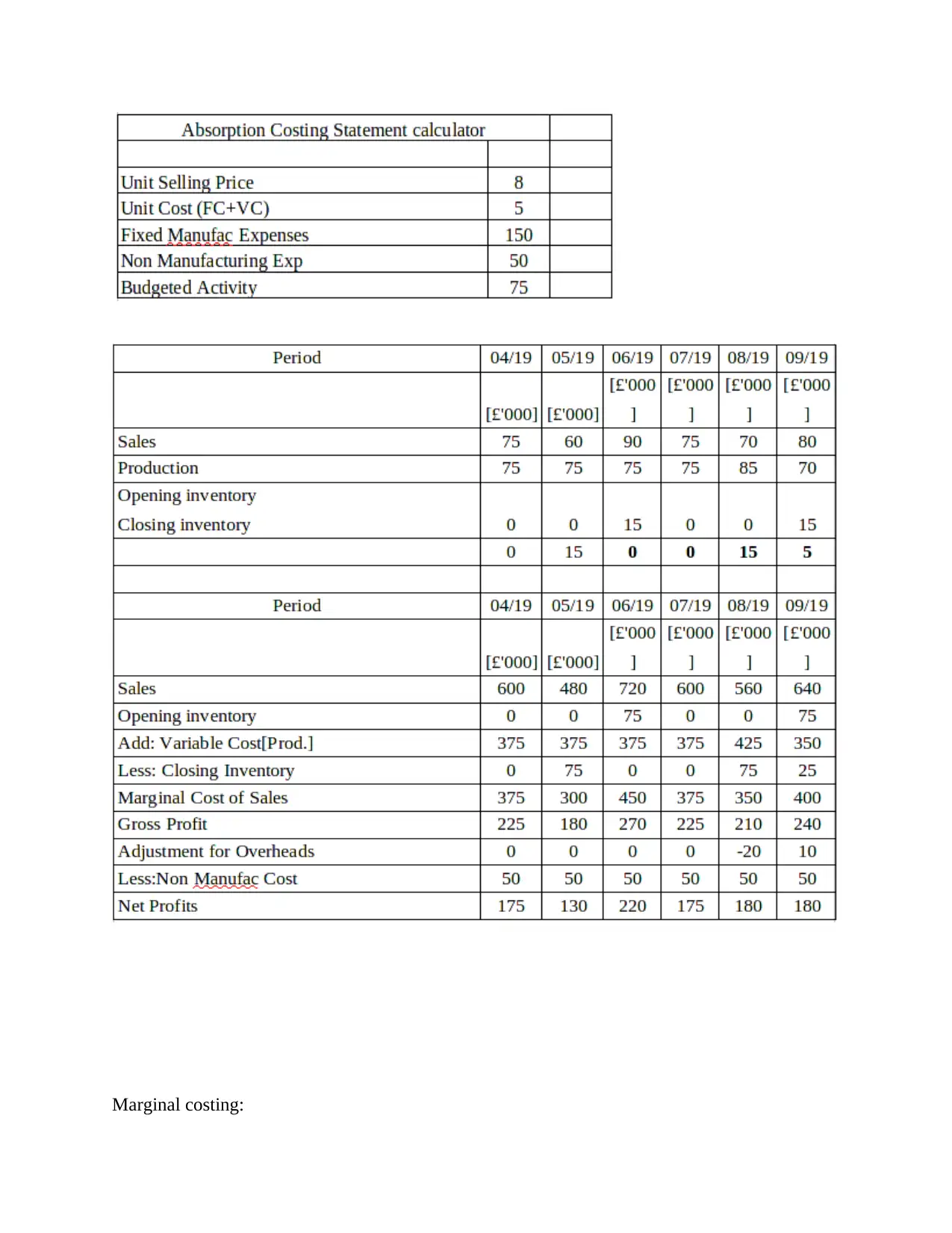

Absorption costing-This is a form of costing where the value of profit is determined by taking

full account of fixed and variable costs (Corvellec, 2018).

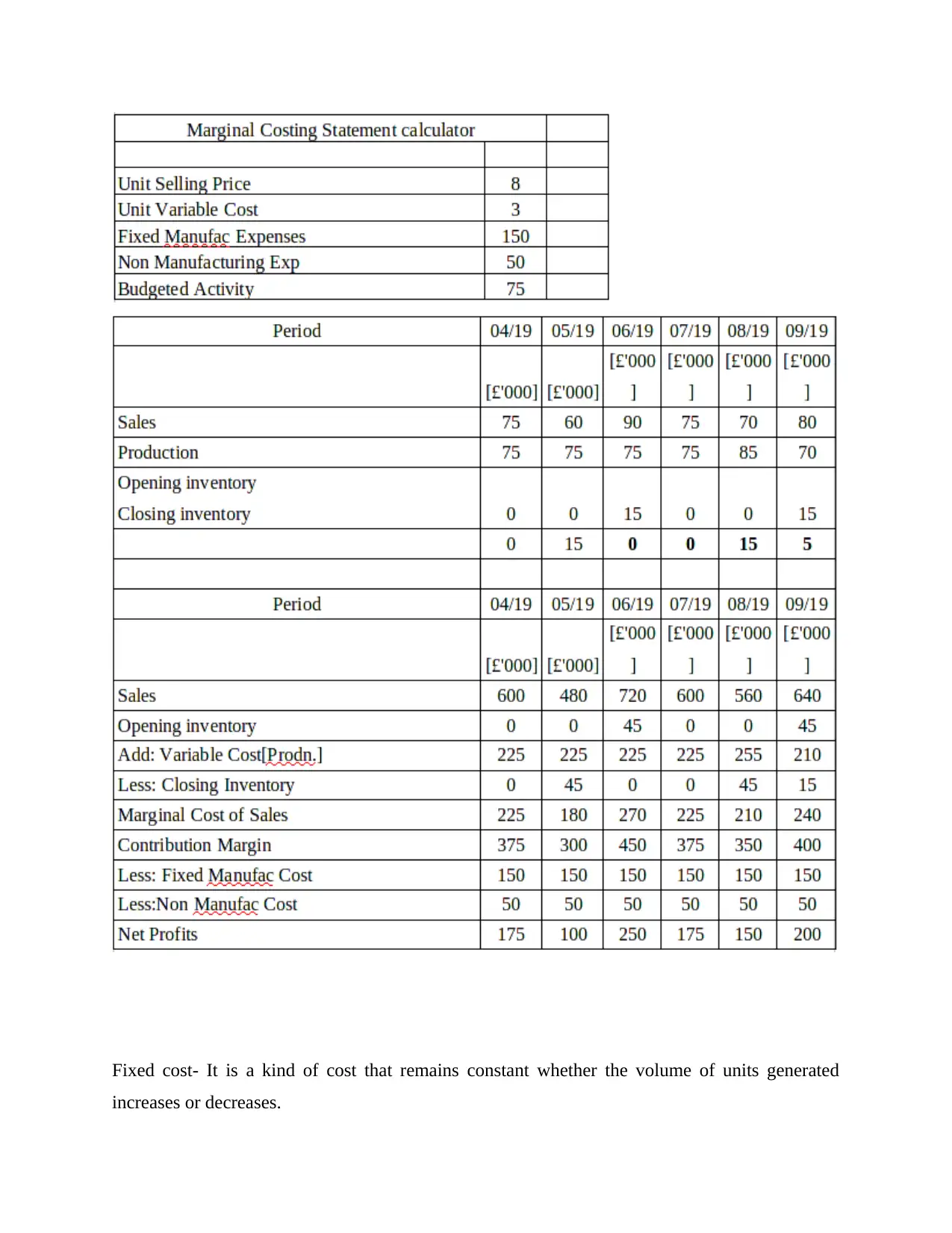

Variable costing-This is a kind of costing strategy in that the variable cost is paid to the unit cost

and the fixed cost to the time cost.

Example of absorption and marginal costing:

Solution:

Absorption costing:

Sales mix is constant

Inventories do not change

Flexible budgeting-This is a form of budgeting that has the potential of change as volume or cost

fluctuates.

Cost variances-This was defined as the disparity between the actual costs incurred and the

estimated costs. If the actual cost is less than anticipated, this will be a desirable situation. On the

other hand, if the real cost is higher; this will be known as an adverse circumstance.

Absorption costing-This is a form of costing where the value of profit is determined by taking

full account of fixed and variable costs (Corvellec, 2018).

Variable costing-This is a kind of costing strategy in that the variable cost is paid to the unit cost

and the fixed cost to the time cost.

Example of absorption and marginal costing:

Solution:

Absorption costing:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Marginal costing:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Fixed cost- It is a kind of cost that remains constant whether the volume of units generated

increases or decreases.

increases or decreases.

Variable cost-This cost is distinct from the fixed cost described above. It is the form of expense

that shifts in proportion to the change in manufacturing volume.

Cost allocation- This can be described as a kind of structured mechanism that relates to the

process of finding, monetizing and assigning costs to a specific objective.

Normal costing- It can be described as a form of expense that has actually happened in the

process of finishing various kinds of activities and operations (Cowton, 2018).

Standard costing- It is a form of expense that is projected to have not actually occurred. The

forecast of this cost is carried out in accordance with the accounting information provided in

recent years.

Activity based costing- This is a method of costing in that various activities are defined in order

to allocate costs to each operation in relation to output and services.

Role of costing in setting price:

Costs have a major part to play in setting prices for products and services. This is because

the price is determined by inserting the amount of revenue to the total production cost. For

example in the aspect of Continental clothing company, cost of a particular unit is of £10 then

price will be of £12. Herein, the price is set by adding £2 in actual cost of produced unit.

Cost of inventory:

Stock Costs-This is an expense that involves different types of spending, such as purchasing

costs, stock stocks and purchase costs. There is various kinds of inventory costs such as:

Ordering costs – This is a kind of expense that happens in the course of ordering the

manufacturer to purchase products. For instance, the expense of handling the supplier's

invoice in respect of an order is considered to be an ordering.

Carrying costs – This can be described as the sort of cost involved of holding the

maximum inventory (Mahmoudi, Jodeiri and Fatehifar, 2017).

Stock out price-This is an expense that is related to a loss of opportunity caused by stock

exhaustion.

Benefit of reducing cost of inventory for businesses:

that shifts in proportion to the change in manufacturing volume.

Cost allocation- This can be described as a kind of structured mechanism that relates to the

process of finding, monetizing and assigning costs to a specific objective.

Normal costing- It can be described as a form of expense that has actually happened in the

process of finishing various kinds of activities and operations (Cowton, 2018).

Standard costing- It is a form of expense that is projected to have not actually occurred. The

forecast of this cost is carried out in accordance with the accounting information provided in

recent years.

Activity based costing- This is a method of costing in that various activities are defined in order

to allocate costs to each operation in relation to output and services.

Role of costing in setting price:

Costs have a major part to play in setting prices for products and services. This is because

the price is determined by inserting the amount of revenue to the total production cost. For

example in the aspect of Continental clothing company, cost of a particular unit is of £10 then

price will be of £12. Herein, the price is set by adding £2 in actual cost of produced unit.

Cost of inventory:

Stock Costs-This is an expense that involves different types of spending, such as purchasing

costs, stock stocks and purchase costs. There is various kinds of inventory costs such as:

Ordering costs – This is a kind of expense that happens in the course of ordering the

manufacturer to purchase products. For instance, the expense of handling the supplier's

invoice in respect of an order is considered to be an ordering.

Carrying costs – This can be described as the sort of cost involved of holding the

maximum inventory (Mahmoudi, Jodeiri and Fatehifar, 2017).

Stock out price-This is an expense that is related to a loss of opportunity caused by stock

exhaustion.

Benefit of reducing cost of inventory for businesses:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.