Detailed Management Accounting Report: Unit 5, Cost Analysis

VerifiedAdded on 2023/01/19

|22

|4340

|68

Report

AI Summary

This report provides a comprehensive overview of management accounting principles, focusing on cost analysis techniques and their application within a business context. The report begins with an introduction to management accounting, highlighting its importance in organizational decision-making, and then delves into specific accounting systems such as price optimization, inventory management, and cost accounting. Task 1 explores the essential requirements of a management accounting system and the various types of reports, including cost management, budget, and performance reports, along with their benefits. Task 2 focuses on cost analysis techniques, including marginal and absorption costing, used to prepare income statements. The report also examines the advantages and disadvantages of planning tools and the adaptation of management accounting to respond to financial problems, concluding with a summary of key findings and references.

Unit 5 Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1 ...........................................................................................................................................1

P1 Management accounting system and their essential requirement.....................................1

P2 Type of management accounting reports and its importance to management..................4

M1 Various type of system and their benefits .......................................................................5

TASK 2............................................................................................................................................6

P3 Cost analysis techniques to prepare income statement to calculate cost...........................6

M2 Range of management accounting techniques...............................................................11

P4 Advantage and disadvantage of various types of planning tool......................................11

M3 Evaluation of planning tool for preparing budgets........................................................12

P5 Adaption of management according to respond financial problem................................13

CONCLUSION .............................................................................................................................15

REFERENCES..............................................................................................................................16

INTRODUCTION...........................................................................................................................1

TASK 1 ...........................................................................................................................................1

P1 Management accounting system and their essential requirement.....................................1

P2 Type of management accounting reports and its importance to management..................4

M1 Various type of system and their benefits .......................................................................5

TASK 2............................................................................................................................................6

P3 Cost analysis techniques to prepare income statement to calculate cost...........................6

M2 Range of management accounting techniques...............................................................11

P4 Advantage and disadvantage of various types of planning tool......................................11

M3 Evaluation of planning tool for preparing budgets........................................................12

P5 Adaption of management according to respond financial problem................................13

CONCLUSION .............................................................................................................................15

REFERENCES..............................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting known as managerial accounting system that aid organisation to

operate their business operations. Management accounts are of different types which is essential

for managers to undertake as to formulate decisions in best effective manner. With the help of

accounting system managers can make internal decision-making process related to financial and

non-financial aspects in best effective manner. Management accounting system benefits

organisation to take advantage of different tools, techniques and methods and conduct operations

of company in best effective manner. As to effectively understand concept and practices of

management accounting Essentra Packaging is used in present report. In this project formative

discussion has been made on management accounting concepts. Further report include

managerial techniques along with disadvantages and advantages of planning tool.

TASK 1

P1 Management accounting system and their essential requirement

Management accounting: It is a systematic process that include different types of

activities such as presentation, analysation and collection of non-monetary and monetary terms.

By undertaking management accounting organisation can effectively able to take numerous

advantages through which their can further able to accomplish their daily basis operations related

to planning, organizing, staffing, decision-making and controlling in best effective manner. Thus,

it is essential for Essentra Packaging to understand importance of management accounting in

order to conduct their daily basis operations. This will significantly aid them to accomplish their

short as well as long term objectives in best effective manner.

Reliability:

It is essential for an organisation to have all the essential and related data as well as

information in reliable manner. This will further aid company to undertake best effective form

decision-making process in order to improve future performance of organisation.

Up to date:

It is the basis responsibility to company managers to make sure that informations that are

covered in accounting statements are accurate and up-to-date. With the help of best effective

form of accounting system organisation can effectively able to maintain financial records as to

operate their business functioning in best effective manner while assuring market stability.

1

Management accounting known as managerial accounting system that aid organisation to

operate their business operations. Management accounts are of different types which is essential

for managers to undertake as to formulate decisions in best effective manner. With the help of

accounting system managers can make internal decision-making process related to financial and

non-financial aspects in best effective manner. Management accounting system benefits

organisation to take advantage of different tools, techniques and methods and conduct operations

of company in best effective manner. As to effectively understand concept and practices of

management accounting Essentra Packaging is used in present report. In this project formative

discussion has been made on management accounting concepts. Further report include

managerial techniques along with disadvantages and advantages of planning tool.

TASK 1

P1 Management accounting system and their essential requirement

Management accounting: It is a systematic process that include different types of

activities such as presentation, analysation and collection of non-monetary and monetary terms.

By undertaking management accounting organisation can effectively able to take numerous

advantages through which their can further able to accomplish their daily basis operations related

to planning, organizing, staffing, decision-making and controlling in best effective manner. Thus,

it is essential for Essentra Packaging to understand importance of management accounting in

order to conduct their daily basis operations. This will significantly aid them to accomplish their

short as well as long term objectives in best effective manner.

Reliability:

It is essential for an organisation to have all the essential and related data as well as

information in reliable manner. This will further aid company to undertake best effective form

decision-making process in order to improve future performance of organisation.

Up to date:

It is the basis responsibility to company managers to make sure that informations that are

covered in accounting statements are accurate and up-to-date. With the help of best effective

form of accounting system organisation can effectively able to maintain financial records as to

operate their business functioning in best effective manner while assuring market stability.

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Different Types of accounting system:

Price optimisation system –

Price optimisation system aid organisation to evaluate price of their related products as

well as services. This will allow Essentra Packaging to review perceptions of customers on

different pricing level. With the help this company can able to gain sustainable advancements in

marketplace with larger competitive edge organisation is required to set price of products and

services in a well structured manner. This will allow company to significantly increase overall

profitability of organisation. In order to accomplish this organisation is required to identify

behaviour of customers related to products and service.

Inventory management system -

Organisation is required to manage their day to day function, for this they are required to

keep constant track of their inventory segment. Inventory management system allow company to

have regular track on their utilization of resources. This will allow them to reduce unnecessary

amount of wastage. Further it has been identified that, it is essential for Essentra Packaging to

undertake different strategies related to inventory management as this will benefit them to

control their excess wastage and expenses. With the help of this company can effectively able to

engage in cost-effective manufacturing process. This will significantly aid company to enhance

their profitability and productivity. Thus, It is essential for Essentra Packaging to implement

inventory management system within their operational system as to gain maximum advantages

while reducing necessary amount of wastage.

LIFO –

◦ This method indicates that those stock that come at the end will go out first. Thus,

LIFO method is last in first out.

FIFO –

◦ FIFO method is stock coming first and sale out first. Thus, in FIFO there is the

process of first in first out.

AVOC –

◦ AVOC method included calculations of cost of inventory on average basis.

Cost accounting system –

2

Price optimisation system –

Price optimisation system aid organisation to evaluate price of their related products as

well as services. This will allow Essentra Packaging to review perceptions of customers on

different pricing level. With the help this company can able to gain sustainable advancements in

marketplace with larger competitive edge organisation is required to set price of products and

services in a well structured manner. This will allow company to significantly increase overall

profitability of organisation. In order to accomplish this organisation is required to identify

behaviour of customers related to products and service.

Inventory management system -

Organisation is required to manage their day to day function, for this they are required to

keep constant track of their inventory segment. Inventory management system allow company to

have regular track on their utilization of resources. This will allow them to reduce unnecessary

amount of wastage. Further it has been identified that, it is essential for Essentra Packaging to

undertake different strategies related to inventory management as this will benefit them to

control their excess wastage and expenses. With the help of this company can effectively able to

engage in cost-effective manufacturing process. This will significantly aid company to enhance

their profitability and productivity. Thus, It is essential for Essentra Packaging to implement

inventory management system within their operational system as to gain maximum advantages

while reducing necessary amount of wastage.

LIFO –

◦ This method indicates that those stock that come at the end will go out first. Thus,

LIFO method is last in first out.

FIFO –

◦ FIFO method is stock coming first and sale out first. Thus, in FIFO there is the

process of first in first out.

AVOC –

◦ AVOC method included calculations of cost of inventory on average basis.

Cost accounting system –

2

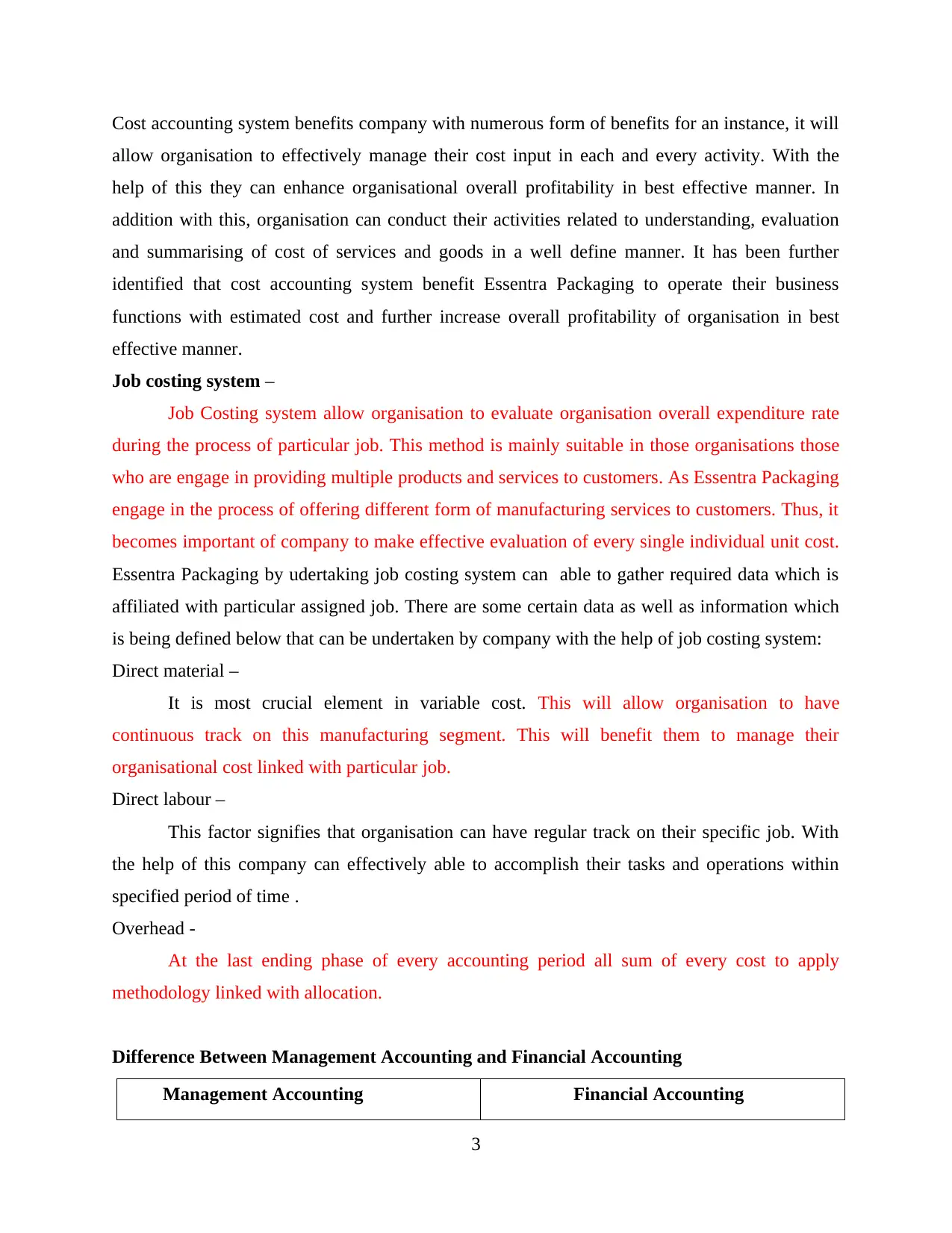

Cost accounting system benefits company with numerous form of benefits for an instance, it will

allow organisation to effectively manage their cost input in each and every activity. With the

help of this they can enhance organisational overall profitability in best effective manner. In

addition with this, organisation can conduct their activities related to understanding, evaluation

and summarising of cost of services and goods in a well define manner. It has been further

identified that cost accounting system benefit Essentra Packaging to operate their business

functions with estimated cost and further increase overall profitability of organisation in best

effective manner.

Job costing system –

Job Costing system allow organisation to evaluate organisation overall expenditure rate

during the process of particular job. This method is mainly suitable in those organisations those

who are engage in providing multiple products and services to customers. As Essentra Packaging

engage in the process of offering different form of manufacturing services to customers. Thus, it

becomes important of company to make effective evaluation of every single individual unit cost.

Essentra Packaging by udertaking job costing system can able to gather required data which is

affiliated with particular assigned job. There are some certain data as well as information which

is being defined below that can be undertaken by company with the help of job costing system:

Direct material –

It is most crucial element in variable cost. This will allow organisation to have

continuous track on this manufacturing segment. This will benefit them to manage their

organisational cost linked with particular job.

Direct labour –

This factor signifies that organisation can have regular track on their specific job. With

the help of this company can effectively able to accomplish their tasks and operations within

specified period of time .

Overhead -

At the last ending phase of every accounting period all sum of every cost to apply

methodology linked with allocation.

Difference Between Management Accounting and Financial Accounting

Management Accounting Financial Accounting

3

allow organisation to effectively manage their cost input in each and every activity. With the

help of this they can enhance organisational overall profitability in best effective manner. In

addition with this, organisation can conduct their activities related to understanding, evaluation

and summarising of cost of services and goods in a well define manner. It has been further

identified that cost accounting system benefit Essentra Packaging to operate their business

functions with estimated cost and further increase overall profitability of organisation in best

effective manner.

Job costing system –

Job Costing system allow organisation to evaluate organisation overall expenditure rate

during the process of particular job. This method is mainly suitable in those organisations those

who are engage in providing multiple products and services to customers. As Essentra Packaging

engage in the process of offering different form of manufacturing services to customers. Thus, it

becomes important of company to make effective evaluation of every single individual unit cost.

Essentra Packaging by udertaking job costing system can able to gather required data which is

affiliated with particular assigned job. There are some certain data as well as information which

is being defined below that can be undertaken by company with the help of job costing system:

Direct material –

It is most crucial element in variable cost. This will allow organisation to have

continuous track on this manufacturing segment. This will benefit them to manage their

organisational cost linked with particular job.

Direct labour –

This factor signifies that organisation can have regular track on their specific job. With

the help of this company can effectively able to accomplish their tasks and operations within

specified period of time .

Overhead -

At the last ending phase of every accounting period all sum of every cost to apply

methodology linked with allocation.

Difference Between Management Accounting and Financial Accounting

Management Accounting Financial Accounting

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

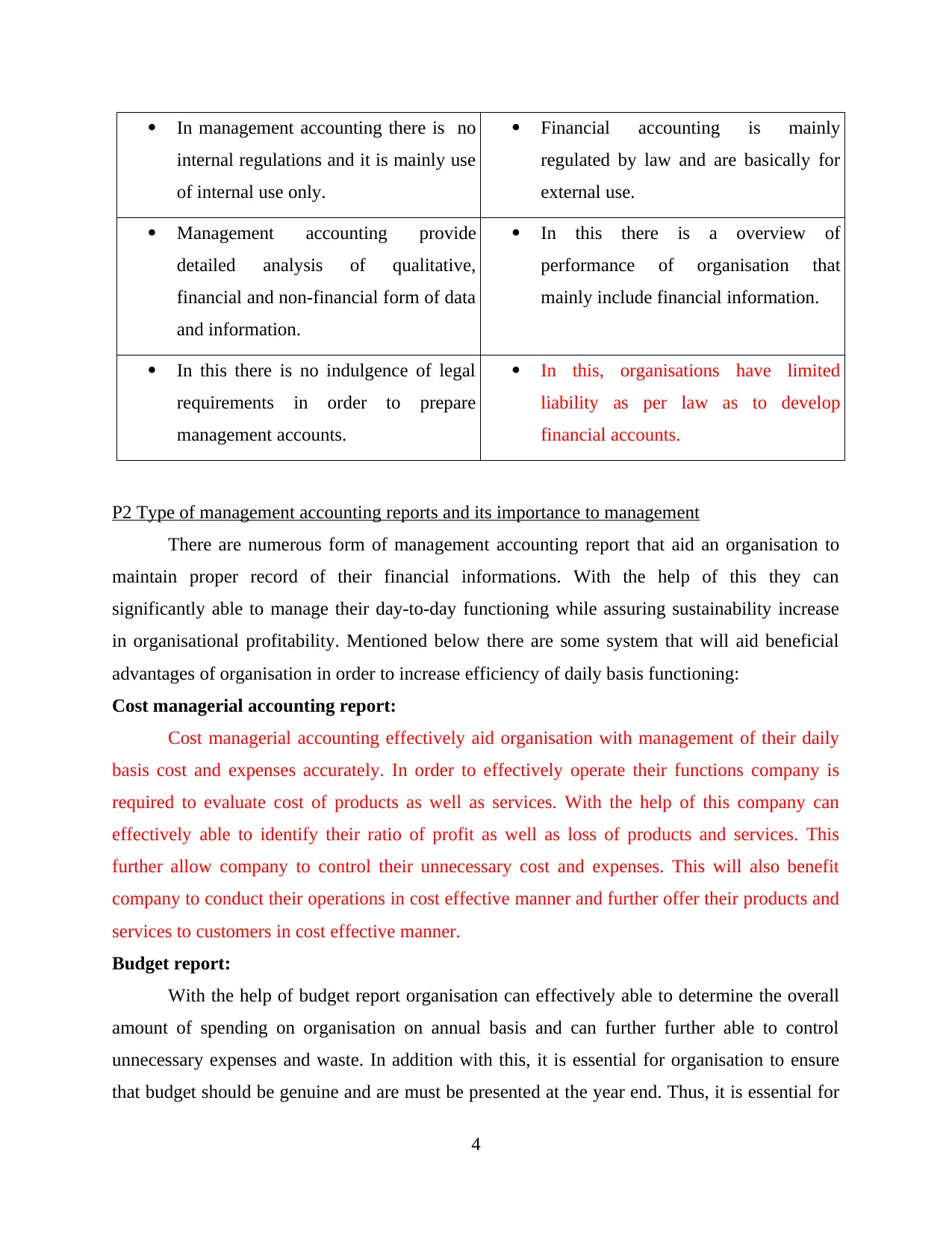

In management accounting there is no

internal regulations and it is mainly use

of internal use only.

Financial accounting is mainly

regulated by law and are basically for

external use.

Management accounting provide

detailed analysis of qualitative,

financial and non-financial form of data

and information.

In this there is a overview of

performance of organisation that

mainly include financial information.

In this there is no indulgence of legal

requirements in order to prepare

management accounts.

In this, organisations have limited

liability as per law as to develop

financial accounts.

P2 Type of management accounting reports and its importance to management

There are numerous form of management accounting report that aid an organisation to

maintain proper record of their financial informations. With the help of this they can

significantly able to manage their day-to-day functioning while assuring sustainability increase

in organisational profitability. Mentioned below there are some system that will aid beneficial

advantages of organisation in order to increase efficiency of daily basis functioning:

Cost managerial accounting report:

Cost managerial accounting effectively aid organisation with management of their daily

basis cost and expenses accurately. In order to effectively operate their functions company is

required to evaluate cost of products as well as services. With the help of this company can

effectively able to identify their ratio of profit as well as loss of products and services. This

further allow company to control their unnecessary cost and expenses. This will also benefit

company to conduct their operations in cost effective manner and further offer their products and

services to customers in cost effective manner.

Budget report:

With the help of budget report organisation can effectively able to determine the overall

amount of spending on organisation on annual basis and can further further able to control

unnecessary expenses and waste. In addition with this, it is essential for organisation to ensure

that budget should be genuine and are must be presented at the year end. Thus, it is essential for

4

internal regulations and it is mainly use

of internal use only.

Financial accounting is mainly

regulated by law and are basically for

external use.

Management accounting provide

detailed analysis of qualitative,

financial and non-financial form of data

and information.

In this there is a overview of

performance of organisation that

mainly include financial information.

In this there is no indulgence of legal

requirements in order to prepare

management accounts.

In this, organisations have limited

liability as per law as to develop

financial accounts.

P2 Type of management accounting reports and its importance to management

There are numerous form of management accounting report that aid an organisation to

maintain proper record of their financial informations. With the help of this they can

significantly able to manage their day-to-day functioning while assuring sustainability increase

in organisational profitability. Mentioned below there are some system that will aid beneficial

advantages of organisation in order to increase efficiency of daily basis functioning:

Cost managerial accounting report:

Cost managerial accounting effectively aid organisation with management of their daily

basis cost and expenses accurately. In order to effectively operate their functions company is

required to evaluate cost of products as well as services. With the help of this company can

effectively able to identify their ratio of profit as well as loss of products and services. This

further allow company to control their unnecessary cost and expenses. This will also benefit

company to conduct their operations in cost effective manner and further offer their products and

services to customers in cost effective manner.

Budget report:

With the help of budget report organisation can effectively able to determine the overall

amount of spending on organisation on annual basis and can further further able to control

unnecessary expenses and waste. In addition with this, it is essential for organisation to ensure

that budget should be genuine and are must be presented at the year end. Thus, it is essential for

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

organisation to undertake this form of budget report in order to conduct comparison between

actual report and budget within accounting. After the completion of this report it is essential to

present this in front of upper level of manager in order to effectively access budget authenticity.

With the help of this company can effectively able to manage their cost as well as expenses in

best effective manner.

Performance report:

It is a systematic layout that basically include cost that incurred during the completion

of project. In this leader of an organisation effectively consider all essential resources in order to

achieve long term and short term objectives of organisation. With the help of performance report

organisation can effectively able to have accurate information related to organisation actual

position. This will further aid them to balance performance with set standards. With the

effectively evaluation of performance leader can able to undertake strategies and can further

implement plans and policies in order to effectively accomplish organisational goals in best

effective manner. In addition with this, it has been determined that performance report aid

organisation to accomplish their organisation goals and objectives in best effective manner. With

the help of performance report organisation can effectively able to identify the fund that are

required by them in order to expand their short and long term goals. This will allow them to

expand their services at international market in best effective manner. In order to ensure

efficiency of performance it is the basic responsibility of supervisors as to effectively have track

on their plan in order to ensure that all the activities are operated on continuous basis. With the

help of this managers can effectively able to expand their business while gaining more

competitive advancements.

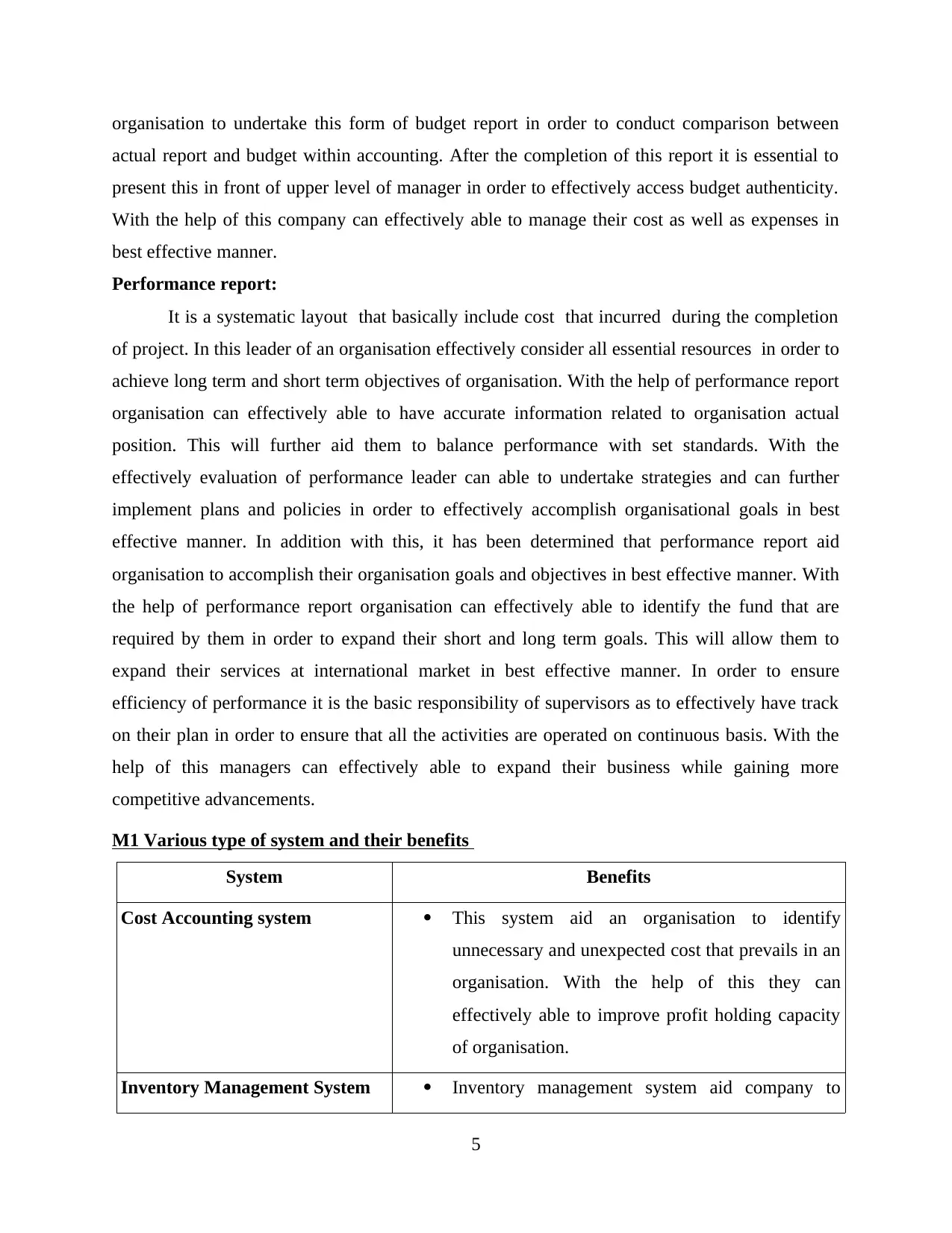

M1 Various type of system and their benefits

System Benefits

Cost Accounting system This system aid an organisation to identify

unnecessary and unexpected cost that prevails in an

organisation. With the help of this they can

effectively able to improve profit holding capacity

of organisation.

Inventory Management System Inventory management system aid company to

5

actual report and budget within accounting. After the completion of this report it is essential to

present this in front of upper level of manager in order to effectively access budget authenticity.

With the help of this company can effectively able to manage their cost as well as expenses in

best effective manner.

Performance report:

It is a systematic layout that basically include cost that incurred during the completion

of project. In this leader of an organisation effectively consider all essential resources in order to

achieve long term and short term objectives of organisation. With the help of performance report

organisation can effectively able to have accurate information related to organisation actual

position. This will further aid them to balance performance with set standards. With the

effectively evaluation of performance leader can able to undertake strategies and can further

implement plans and policies in order to effectively accomplish organisational goals in best

effective manner. In addition with this, it has been determined that performance report aid

organisation to accomplish their organisation goals and objectives in best effective manner. With

the help of performance report organisation can effectively able to identify the fund that are

required by them in order to expand their short and long term goals. This will allow them to

expand their services at international market in best effective manner. In order to ensure

efficiency of performance it is the basic responsibility of supervisors as to effectively have track

on their plan in order to ensure that all the activities are operated on continuous basis. With the

help of this managers can effectively able to expand their business while gaining more

competitive advancements.

M1 Various type of system and their benefits

System Benefits

Cost Accounting system This system aid an organisation to identify

unnecessary and unexpected cost that prevails in an

organisation. With the help of this they can

effectively able to improve profit holding capacity

of organisation.

Inventory Management System Inventory management system aid company to

5

have proper and effective record of inventory ratio.

This will allow organisation to offer their products

and services according to defined cost.

Job Costing system Job costing system benefit organisation to identify

their functioning in best effective manner and can

maintain profit holding capacity of organisation.

Price Optimisation System Price optimisation system aid organisation to

effectively analyse current market condition and

then offer their products and services according to

need. With the help of this they can effectively able

to gain more competitive advancements while

increasing consumer base.

TASK 2

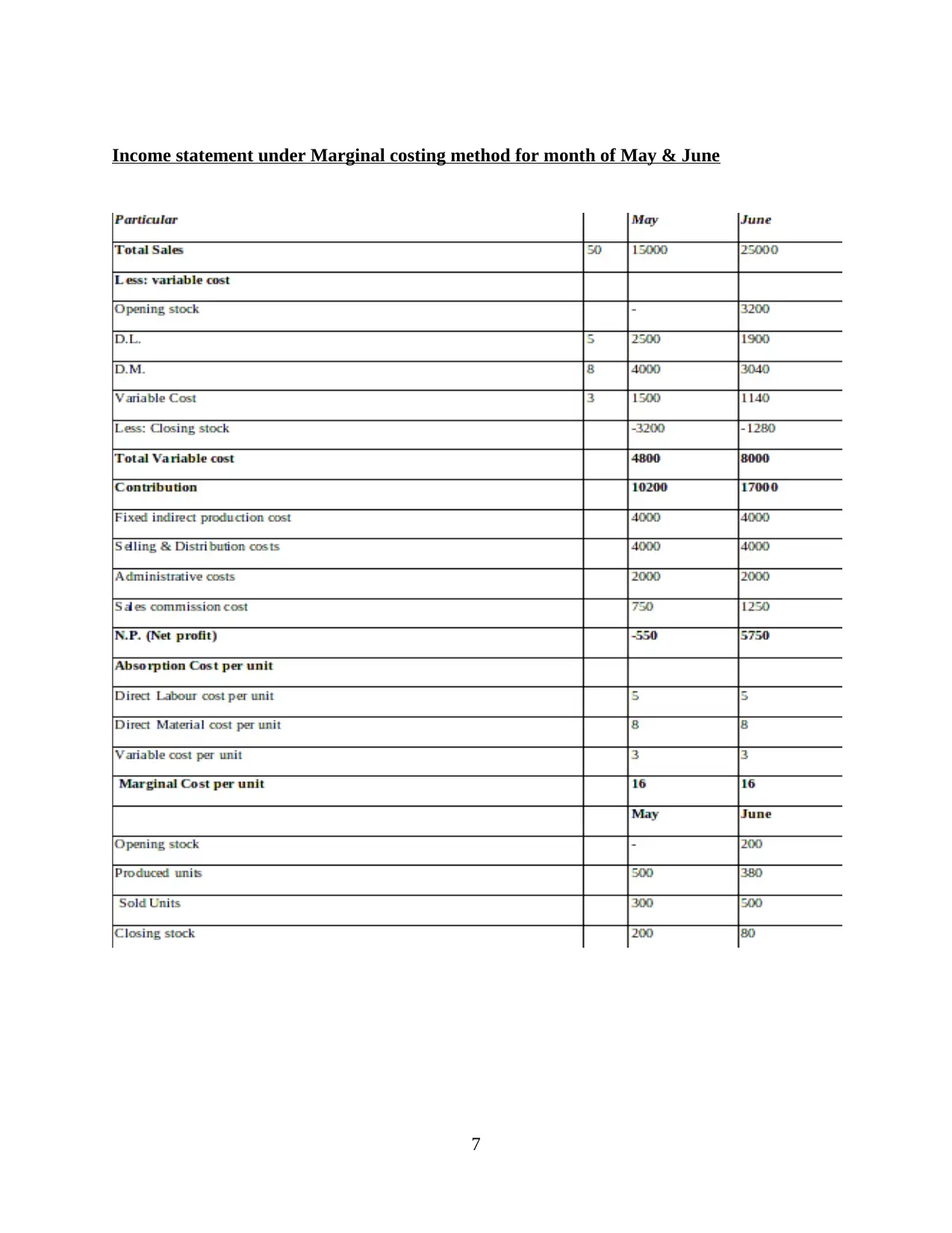

P3 Cost analysis techniques to prepare income statement to calculate cost

Marginal Costing:

Marginal costs is considered as a variable cost that cover material costs, labour costs and

portion of fixed costs such as administration, selling expenses and overheads. This is a procedure

within charging of variable expense is done all-out of expenses. Organisation can effectively able

to take long term advantages with the help of marginal costing technique. In addition with this

they can further able to increase overall net benefit of organisation. Formula in order to

appropriately calculate marginal cost is being defined below

Marginal Cost= Direct material+ Direct Labour+ Direct expenses+ Variable overheads.

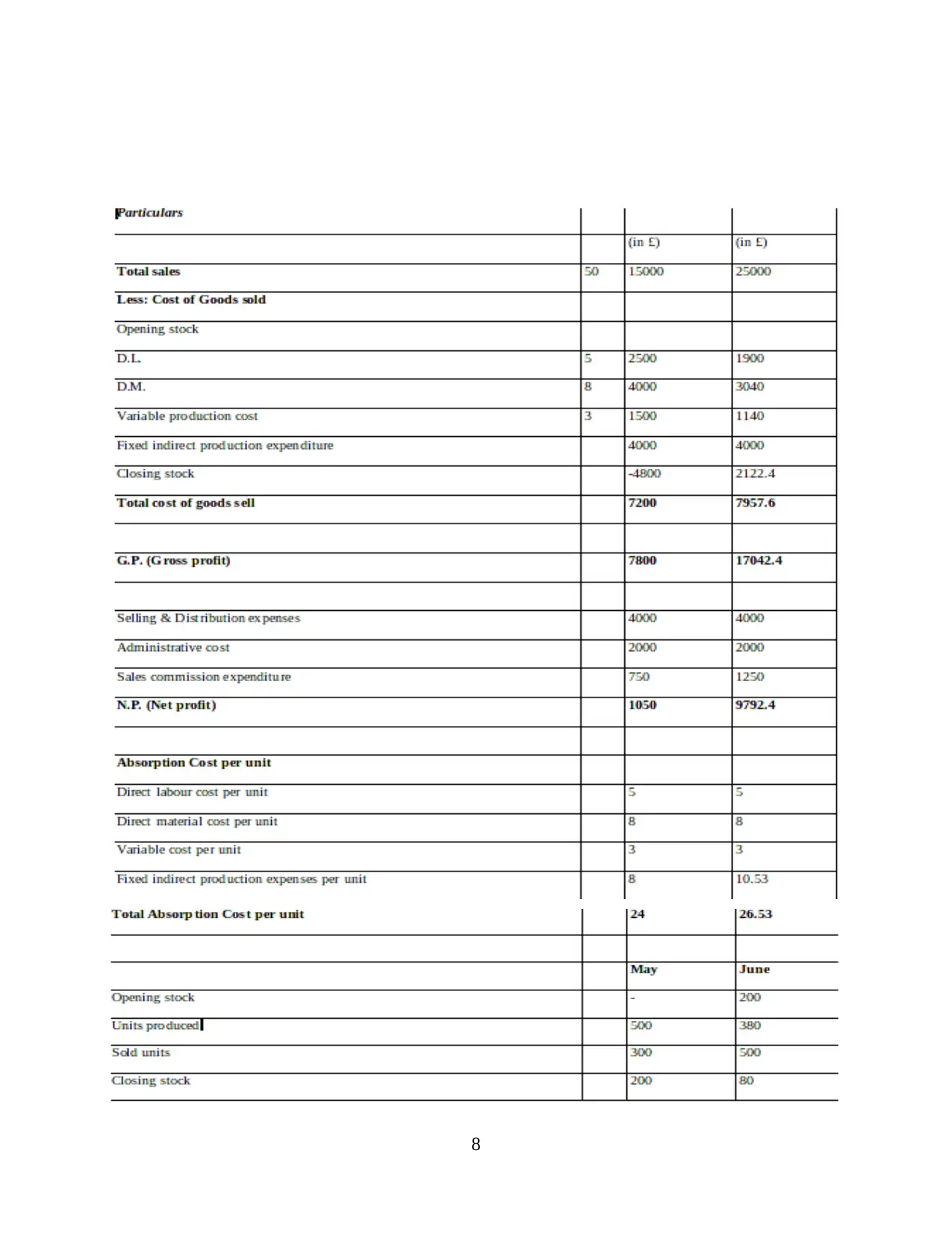

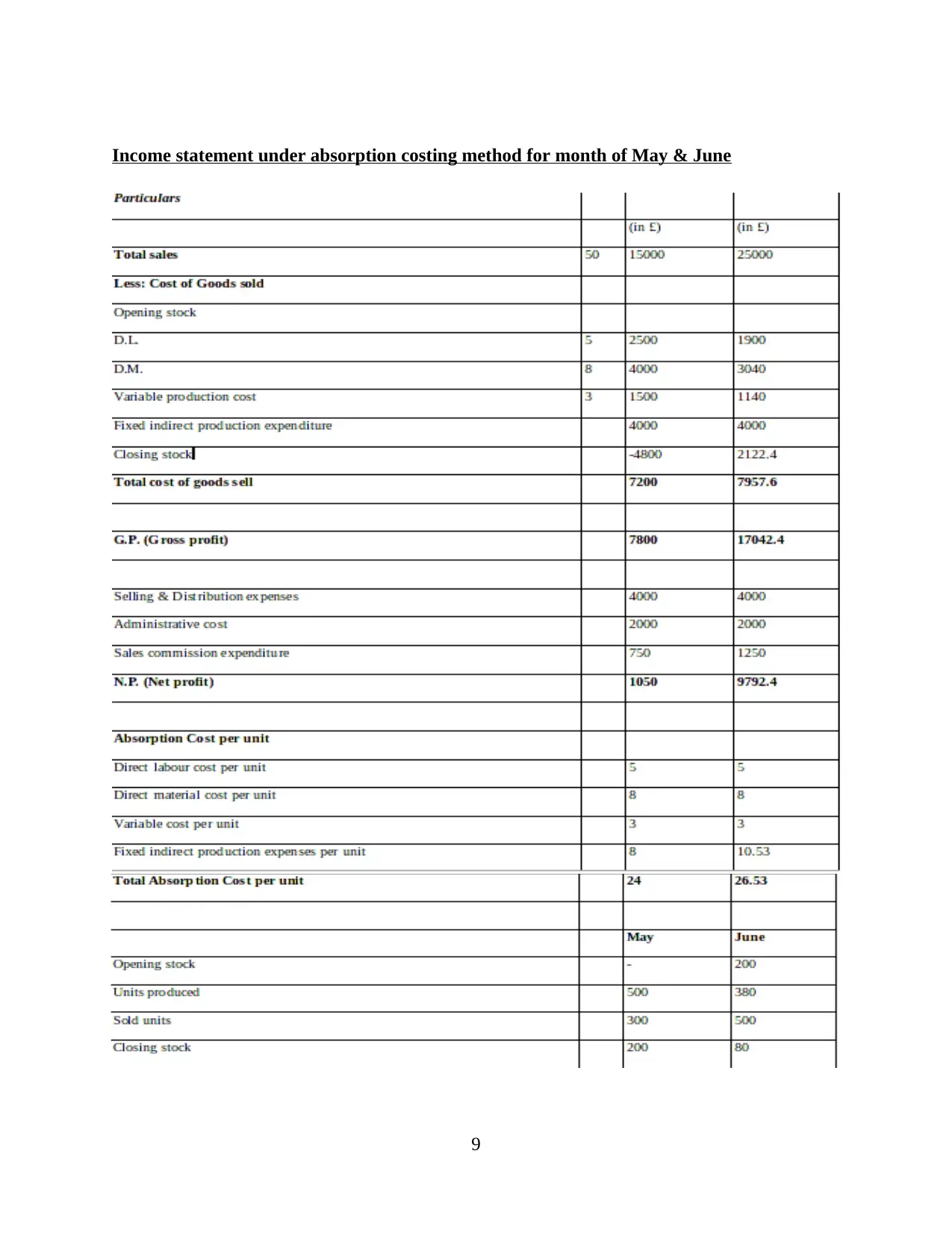

Absorption costing:

This costing approach is related to cost strategies and is also known as administrative and

cost bookkeeping. With the help of absorption costing company can incorporate their cost related

to conception of particular decent. Further it has been identified that fixed cost also include

compensation, different overheads and cost of crude material.

6

This will allow organisation to offer their products

and services according to defined cost.

Job Costing system Job costing system benefit organisation to identify

their functioning in best effective manner and can

maintain profit holding capacity of organisation.

Price Optimisation System Price optimisation system aid organisation to

effectively analyse current market condition and

then offer their products and services according to

need. With the help of this they can effectively able

to gain more competitive advancements while

increasing consumer base.

TASK 2

P3 Cost analysis techniques to prepare income statement to calculate cost

Marginal Costing:

Marginal costs is considered as a variable cost that cover material costs, labour costs and

portion of fixed costs such as administration, selling expenses and overheads. This is a procedure

within charging of variable expense is done all-out of expenses. Organisation can effectively able

to take long term advantages with the help of marginal costing technique. In addition with this

they can further able to increase overall net benefit of organisation. Formula in order to

appropriately calculate marginal cost is being defined below

Marginal Cost= Direct material+ Direct Labour+ Direct expenses+ Variable overheads.

Absorption costing:

This costing approach is related to cost strategies and is also known as administrative and

cost bookkeeping. With the help of absorption costing company can incorporate their cost related

to conception of particular decent. Further it has been identified that fixed cost also include

compensation, different overheads and cost of crude material.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Income statement under Marginal costing method for month of May & June

7

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

Income statement under absorption costing method for month of May & June

9

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.