Management Accounting Report: CARWOW's Financial Strategies

VerifiedAdded on 2020/06/05

|17

|5329

|35

Report

AI Summary

This management accounting report provides a detailed analysis of financial strategies and methods applicable to CARWOW, a car sales company. The report explores various aspects of management accounting, including inventory management, job costing, profit optimization, and cost accounting systems. It examines the different types of management accounting, such as inventory control, job costing, and profit optimization systems, and their essential requirements. The report also discusses various accounting methods like inventory control reporting, accounts receivable and payable reporting, performance reporting, and budget reporting. Furthermore, it delves into marginal and abnormal costs within the context of CARWOW's financial operations, including the application of absorption costing and its impact on income statements. The report emphasizes how these accounting principles help in making informed decisions, optimizing financial performance, and ensuring effective resource allocation within the organization. This report is designed to provide a comprehensive overview of financial planning and cost analysis, essential for the company's growth and success.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REPORT

From:- Management Accounting officer

To:- General Manager of company

Subject:- It is required to produce the report for the general manager that include management

accounting with different methods which is available for the costing and it helps in creating

report which will be useful for business.

From:- Management Accounting officer

To:- General Manager of company

Subject:- It is required to produce the report for the general manager that include management

accounting with different methods which is available for the costing and it helps in creating

report which will be useful for business.

INTRODUCTION

Management accounting helps a company to take effective decisions related to

organisation and it records like financial and non-financial that assists in making investment in a

perfect way. Moreover, companies try to have a research of market and receive information

about where to invest the amount so that maximum revenues can be collected. Hence, nowadays,

technology is helping company to bring effectiveness in their accounting system so that they can

maintain their records at one place only (Ward, 2012). Although, few issues are also faced by

organisation likewise not making proper decision and making changes in policy and procedure of

firm and bring efficiency in working by reducing wastage of resources and utilising such in

maximum mannerism so that higher profit and income can be attained. The report is based on

CARWOW which sells new cars to customers and working at a small scale. Although, company

is looking forward to increase their business and use new technology to improve their working

criteria as well. Financial management is such which uses different methods and uses of it in the

report. Apart from this, planning tools and comparison in between two firms and such thing help

in solving financial problems of company in better manner.

TASK 1

P1. Different types of management accounting and its essential requirements

Management and accounting such which help company to collect information and

somewhere this also relate with their various operation like sales data, raw materials and changes

in stock as well, although all criteria is being used and transformed into a useful data and it will

be used for analysing the data. Therefore, this is something which also gathers data like

operational and cost which somewhere help in compare budget expenses with real scenario.

Moreover, management accounting department is that which also helps top executive of

CARWOW with their information which will help in making proper decision for organisation

(Vasile and Man, 2012). Hence, it has been seen that financial and management accounting is

different from each other as MA includes the internal system of company and this also executes

various steps of management and on the other side, they also provide information and data to the

industry. Although with information, CARWOW can make an effective decision and strategy

which will allow them to fight and make themselves stable in market. Management accounting

and their different types is as follows:

1

Management accounting helps a company to take effective decisions related to

organisation and it records like financial and non-financial that assists in making investment in a

perfect way. Moreover, companies try to have a research of market and receive information

about where to invest the amount so that maximum revenues can be collected. Hence, nowadays,

technology is helping company to bring effectiveness in their accounting system so that they can

maintain their records at one place only (Ward, 2012). Although, few issues are also faced by

organisation likewise not making proper decision and making changes in policy and procedure of

firm and bring efficiency in working by reducing wastage of resources and utilising such in

maximum mannerism so that higher profit and income can be attained. The report is based on

CARWOW which sells new cars to customers and working at a small scale. Although, company

is looking forward to increase their business and use new technology to improve their working

criteria as well. Financial management is such which uses different methods and uses of it in the

report. Apart from this, planning tools and comparison in between two firms and such thing help

in solving financial problems of company in better manner.

TASK 1

P1. Different types of management accounting and its essential requirements

Management and accounting such which help company to collect information and

somewhere this also relate with their various operation like sales data, raw materials and changes

in stock as well, although all criteria is being used and transformed into a useful data and it will

be used for analysing the data. Therefore, this is something which also gathers data like

operational and cost which somewhere help in compare budget expenses with real scenario.

Moreover, management accounting department is that which also helps top executive of

CARWOW with their information which will help in making proper decision for organisation

(Vasile and Man, 2012). Hence, it has been seen that financial and management accounting is

different from each other as MA includes the internal system of company and this also executes

various steps of management and on the other side, they also provide information and data to the

industry. Although with information, CARWOW can make an effective decision and strategy

which will allow them to fight and make themselves stable in market. Management accounting

and their different types is as follows:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory management system: It has been seen that various types of plans and policies

which help in making a control over the inventories in better manner. Although this is something

which is being a continuous process and CARWOW is that which help company to take effective

decision related to their money and investment. Normally, the common issues faced by company

is over stock of different things and under stock as well. If company is suffering from under

stock then CARWOW is not being able to provide the cars to their customer on time and this

lead to affect in their relation as well (Vasile and Man, 2012). If, company is having an over

stock and this is also an issue for company as this leads to wastage of resources as many people

is not aware about CARWOW so selling and using the service of firm is at lower level only.

For all such, the inventory control software is there which can track the orders and

deliveries of cars. Implementing and executing such on time will help the firm to reduce the

criteria of under stock and over stock as well. Entity is having another method that is Bar code

reader, although, this can help business to track the cars that it is being taken out from showroom

or not and is it delivered to customer in better way or not. Moreover there is another method is

there like EOQ which help entity to reduce the wastage in entity and somewhere this help them

to perform in perfect way as well. All such scenario help CARWOW to make an proper

accounting and produce effective policy to reduce all such criteria in company.

Job Costing System: In an organisation, there are many jobs which can help business to

earn higher income and profit as well as well as somewhere they are increasing the cost of

company. Therefore, this costing system has the responsibility to identify such job which can

help to earn higher revenues and attainment of goals and objectives can also be there. Although

with all such, CARWOW is having a prime motto of providing efficient services to customers so

that they can make them satisfied and in the future, can take corrective measures (Van der Stede,

2011).

Profit Optimization System: Pricing is that factor in market which has to be set

according to the customers so that they can buy cars in an easy manner. If the price does not set

at reasonable way then the consumer move towards different companies as because millions of

people are there who does not have such income as they can spend on car. Prices also should not

be set lower because having such situation make customer to think that quality product would

not be there. This will bring down side in sell of cars and will not be able to earn higher profit as

well.

2

which help in making a control over the inventories in better manner. Although this is something

which is being a continuous process and CARWOW is that which help company to take effective

decision related to their money and investment. Normally, the common issues faced by company

is over stock of different things and under stock as well. If company is suffering from under

stock then CARWOW is not being able to provide the cars to their customer on time and this

lead to affect in their relation as well (Vasile and Man, 2012). If, company is having an over

stock and this is also an issue for company as this leads to wastage of resources as many people

is not aware about CARWOW so selling and using the service of firm is at lower level only.

For all such, the inventory control software is there which can track the orders and

deliveries of cars. Implementing and executing such on time will help the firm to reduce the

criteria of under stock and over stock as well. Entity is having another method that is Bar code

reader, although, this can help business to track the cars that it is being taken out from showroom

or not and is it delivered to customer in better way or not. Moreover there is another method is

there like EOQ which help entity to reduce the wastage in entity and somewhere this help them

to perform in perfect way as well. All such scenario help CARWOW to make an proper

accounting and produce effective policy to reduce all such criteria in company.

Job Costing System: In an organisation, there are many jobs which can help business to

earn higher income and profit as well as well as somewhere they are increasing the cost of

company. Therefore, this costing system has the responsibility to identify such job which can

help to earn higher revenues and attainment of goals and objectives can also be there. Although

with all such, CARWOW is having a prime motto of providing efficient services to customers so

that they can make them satisfied and in the future, can take corrective measures (Van der Stede,

2011).

Profit Optimization System: Pricing is that factor in market which has to be set

according to the customers so that they can buy cars in an easy manner. If the price does not set

at reasonable way then the consumer move towards different companies as because millions of

people are there who does not have such income as they can spend on car. Prices also should not

be set lower because having such situation make customer to think that quality product would

not be there. This will bring down side in sell of cars and will not be able to earn higher profit as

well.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost accounting System: This helps the business to calculate real cost gained in

performing every function of company so that profitability, inventory and control on cost can be

seen. Although, it helps in reducing expenses and can take corrective actions to minimise the

wastage of resources. This also makes organisation to reduce the labour and material cost with

such expenses can be minimised as well (Van der Meer-Kooistra and Vosselman, 2012).

P2 Various methods which help in accounting report.

Accounting is such which is needed concept in the organisation like CARWOW. This

report of accounting is such which help senior manager of firm to make an effective decision and

strategy in company so that higher profit with controlling and monitoring can be attained in

proper scenario. This is something which can help them to complete their task on time and even

in better way as well. Although some of the method of accounting system is like:

Inventory Control Reporting: This is something which is being used by company to

check the stock in warehouses. This concept help business to know that their warehouses is being

managed in right manner or not. If it is not section then the warehouses is such which needs

improvement required in better manner (Vakalfotis, Ballantine and Wall, 2013). This also help in

minimising the chances of over and under stocking in perfect way.

Application:- Therefore the application of such is very effective on CARWOW as they can help

this method to analyse their warehouses anytime. With this they can manage their accounts and

reporting can be done in corrective measure and such thing bring improvement in warehouses as

well. Although such thing can help in making customer happy by providing them services on

time and with this they can earn higher profitability as well. Chances of problem and issues is

that which can reduce the wastage and can make report in effective way.

Account Receivable Reporting: This concept is such which help to manage the cask

flow of company. Moreover, this make firm to have an account as from which party or customer

the money has to receive and how much. In this report information about party and date, time

and amount is included and such help in minimising the consequences in cash flow as well

(Suomala, Lyly-Yrjänäinen and Lukka, 2014).

Application:- This scenario is also helpful for the company CARWOW as this can make them to

know that from which party the amount is remaining and how much to receive from them and

within which time period as well. This is something which also help in weekly, monthly and

3

performing every function of company so that profitability, inventory and control on cost can be

seen. Although, it helps in reducing expenses and can take corrective actions to minimise the

wastage of resources. This also makes organisation to reduce the labour and material cost with

such expenses can be minimised as well (Van der Meer-Kooistra and Vosselman, 2012).

P2 Various methods which help in accounting report.

Accounting is such which is needed concept in the organisation like CARWOW. This

report of accounting is such which help senior manager of firm to make an effective decision and

strategy in company so that higher profit with controlling and monitoring can be attained in

proper scenario. This is something which can help them to complete their task on time and even

in better way as well. Although some of the method of accounting system is like:

Inventory Control Reporting: This is something which is being used by company to

check the stock in warehouses. This concept help business to know that their warehouses is being

managed in right manner or not. If it is not section then the warehouses is such which needs

improvement required in better manner (Vakalfotis, Ballantine and Wall, 2013). This also help in

minimising the chances of over and under stocking in perfect way.

Application:- Therefore the application of such is very effective on CARWOW as they can help

this method to analyse their warehouses anytime. With this they can manage their accounts and

reporting can be done in corrective measure and such thing bring improvement in warehouses as

well. Although such thing can help in making customer happy by providing them services on

time and with this they can earn higher profitability as well. Chances of problem and issues is

that which can reduce the wastage and can make report in effective way.

Account Receivable Reporting: This concept is such which help to manage the cask

flow of company. Moreover, this make firm to have an account as from which party or customer

the money has to receive and how much. In this report information about party and date, time

and amount is included and such help in minimising the consequences in cash flow as well

(Suomala, Lyly-Yrjänäinen and Lukka, 2014).

Application:- This scenario is also helpful for the company CARWOW as this can make them to

know that from which party the amount is remaining and how much to receive from them and

within which time period as well. This is something which also help in weekly, monthly and

3

quarterly as well. Effective policy and procedure does also help to have a better working scenario

in company.

Account Payable reporting: This method is somewhere opposite of receivable reporting

as in this the method help company to know that to whom the amount has to be paid and this also

help them to make an effective relation in between the supplier and firm (Parker, 2012). This

also make them to have and bring a positive image in the eyes of supplier and customer as well

Application:- The firm CARWOW uses various methods and this is something which help in

payable reporting which somewhere bring business in smoother manner. Availability of

resources is such thing which help employees to perform in better manner and thus such scenario

is that which also bring better goodwill of company. Paying payment and amount on time make

supplier to provide healthy relation among most important trust in between both the parties.

Performance Reporting: This is something which is being used by every company not

only CARWOW as such concept help to identify the performance of employees and staff in

organisation and to make effective measure to improve the performance and productivity of

company and this will help firm to attain their goal and objective in right manner as well.

Identify help business to know that where the pitfalls and consequences are there (Otley and

Emmanuel, 2013).

Application:- This method is Applicable in CARWOW as with such thing company can identify

performance of employees and can find out where the issues and problems are faced by them and

bringing proper policy and procedure for them. This will help them to perform in right contrast

as well.

Budget Reporting: Budget is that which company to know that which department or

division is taking most the amount in company. Although this kind of thing is known as expense

in performing, it also help in making compare estimated amount and this is equal to budget or

not in proper manner or not. Moreover, the fund has to be used in effective manner and it will

make to reduce the expenses as well, so that proper decision can be taken in right prospect.

Application:- The CARWOW is that company who uses their fund in better manner and this is

something which has to be done in right prospect and utilisation can be done where required.

Available funds help company to make effective decision and bring strength in their minds as

they can work in right manner as well.

4

in company.

Account Payable reporting: This method is somewhere opposite of receivable reporting

as in this the method help company to know that to whom the amount has to be paid and this also

help them to make an effective relation in between the supplier and firm (Parker, 2012). This

also make them to have and bring a positive image in the eyes of supplier and customer as well

Application:- The firm CARWOW uses various methods and this is something which help in

payable reporting which somewhere bring business in smoother manner. Availability of

resources is such thing which help employees to perform in better manner and thus such scenario

is that which also bring better goodwill of company. Paying payment and amount on time make

supplier to provide healthy relation among most important trust in between both the parties.

Performance Reporting: This is something which is being used by every company not

only CARWOW as such concept help to identify the performance of employees and staff in

organisation and to make effective measure to improve the performance and productivity of

company and this will help firm to attain their goal and objective in right manner as well.

Identify help business to know that where the pitfalls and consequences are there (Otley and

Emmanuel, 2013).

Application:- This method is Applicable in CARWOW as with such thing company can identify

performance of employees and can find out where the issues and problems are faced by them and

bringing proper policy and procedure for them. This will help them to perform in right contrast

as well.

Budget Reporting: Budget is that which company to know that which department or

division is taking most the amount in company. Although this kind of thing is known as expense

in performing, it also help in making compare estimated amount and this is equal to budget or

not in proper manner or not. Moreover, the fund has to be used in effective manner and it will

make to reduce the expenses as well, so that proper decision can be taken in right prospect.

Application:- The CARWOW is that company who uses their fund in better manner and this is

something which has to be done in right prospect and utilisation can be done where required.

Available funds help company to make effective decision and bring strength in their minds as

they can work in right manner as well.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 2

P3 Marginal cost and abnormal cost in CARWOW.

In accounting system there is a income statement which helps and thus it includes the

document of the company and it also help to manage the accounting and it does report to needed

concept of small business like CARWOW. Moreover, it is the summary of various thing like

revenues and expenses which has been taken into various course and business also and thus it

also include operating and non-operating activities, although this also help to calculate the net

profit and or the loss in such a particular year (Macintosh and Quattrone, 2010). Various

methods which somewhere help in making statement as well and some of those are as follows:

Absorption cost: This method is such which is being used with the selling and

administration expenses which also requires and it also include the income statement as well.

Although this is that which also include the cost of finished stock and somewhere this is such

which is consist of the direct labour and material, variable and fixed cost overhead. Therefore,

this is something which also include the costing criteria which is being very much significant for

firms and this is used for adequate decision as well and can be made with the minimisation of

wastage of the resources in efficient manner. Hence, this method was earlier used at the time of

traditional accounting. As this also assisted in reducing wastage and this somewhere resulted into

the traditional cost as well.

Marginal Costing: This is something which is normally include the cost which occurred

due to additional production made in and somewhere because of their fixed cost get affected as

well (Lukka and Vinnari, 2014). This is the thing which is being included as extra production

and manufacturing of product and service make out into variable cost and it has to be considered

as the income statement. Although the cost is such which is being related to labour and raw

material which is being used to manufacture additional part of product.

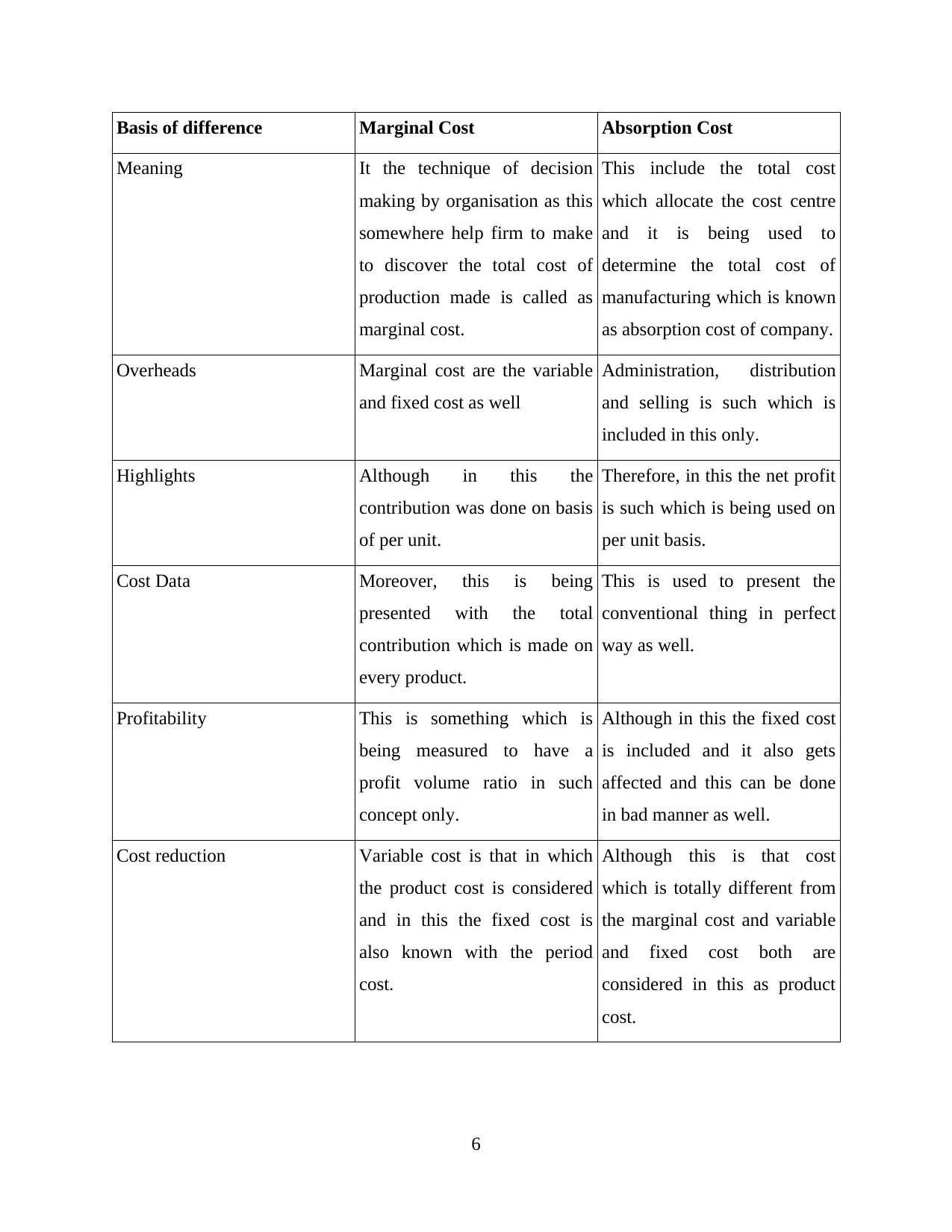

The difference among the marginal and absorption cost is discussed as below:

5

P3 Marginal cost and abnormal cost in CARWOW.

In accounting system there is a income statement which helps and thus it includes the

document of the company and it also help to manage the accounting and it does report to needed

concept of small business like CARWOW. Moreover, it is the summary of various thing like

revenues and expenses which has been taken into various course and business also and thus it

also include operating and non-operating activities, although this also help to calculate the net

profit and or the loss in such a particular year (Macintosh and Quattrone, 2010). Various

methods which somewhere help in making statement as well and some of those are as follows:

Absorption cost: This method is such which is being used with the selling and

administration expenses which also requires and it also include the income statement as well.

Although this is that which also include the cost of finished stock and somewhere this is such

which is consist of the direct labour and material, variable and fixed cost overhead. Therefore,

this is something which also include the costing criteria which is being very much significant for

firms and this is used for adequate decision as well and can be made with the minimisation of

wastage of the resources in efficient manner. Hence, this method was earlier used at the time of

traditional accounting. As this also assisted in reducing wastage and this somewhere resulted into

the traditional cost as well.

Marginal Costing: This is something which is normally include the cost which occurred

due to additional production made in and somewhere because of their fixed cost get affected as

well (Lukka and Vinnari, 2014). This is the thing which is being included as extra production

and manufacturing of product and service make out into variable cost and it has to be considered

as the income statement. Although the cost is such which is being related to labour and raw

material which is being used to manufacture additional part of product.

The difference among the marginal and absorption cost is discussed as below:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Basis of difference Marginal Cost Absorption Cost

Meaning It the technique of decision

making by organisation as this

somewhere help firm to make

to discover the total cost of

production made is called as

marginal cost.

This include the total cost

which allocate the cost centre

and it is being used to

determine the total cost of

manufacturing which is known

as absorption cost of company.

Overheads Marginal cost are the variable

and fixed cost as well

Administration, distribution

and selling is such which is

included in this only.

Highlights Although in this the

contribution was done on basis

of per unit.

Therefore, in this the net profit

is such which is being used on

per unit basis.

Cost Data Moreover, this is being

presented with the total

contribution which is made on

every product.

This is used to present the

conventional thing in perfect

way as well.

Profitability This is something which is

being measured to have a

profit volume ratio in such

concept only.

Although in this the fixed cost

is included and it also gets

affected and this can be done

in bad manner as well.

Cost reduction Variable cost is that in which

the product cost is considered

and in this the fixed cost is

also known with the period

cost.

Although this is that cost

which is totally different from

the marginal cost and variable

and fixed cost both are

considered in this as product

cost.

6

Meaning It the technique of decision

making by organisation as this

somewhere help firm to make

to discover the total cost of

production made is called as

marginal cost.

This include the total cost

which allocate the cost centre

and it is being used to

determine the total cost of

manufacturing which is known

as absorption cost of company.

Overheads Marginal cost are the variable

and fixed cost as well

Administration, distribution

and selling is such which is

included in this only.

Highlights Although in this the

contribution was done on basis

of per unit.

Therefore, in this the net profit

is such which is being used on

per unit basis.

Cost Data Moreover, this is being

presented with the total

contribution which is made on

every product.

This is used to present the

conventional thing in perfect

way as well.

Profitability This is something which is

being measured to have a

profit volume ratio in such

concept only.

Although in this the fixed cost

is included and it also gets

affected and this can be done

in bad manner as well.

Cost reduction Variable cost is that in which

the product cost is considered

and in this the fixed cost is

also known with the period

cost.

Although this is that cost

which is totally different from

the marginal cost and variable

and fixed cost both are

considered in this as product

cost.

6

There is a calculation ad this is being done on the basis of absorption cost and although

this help company to make an effective decision related to budget as well.

7

this help company to make an effective decision related to budget as well.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

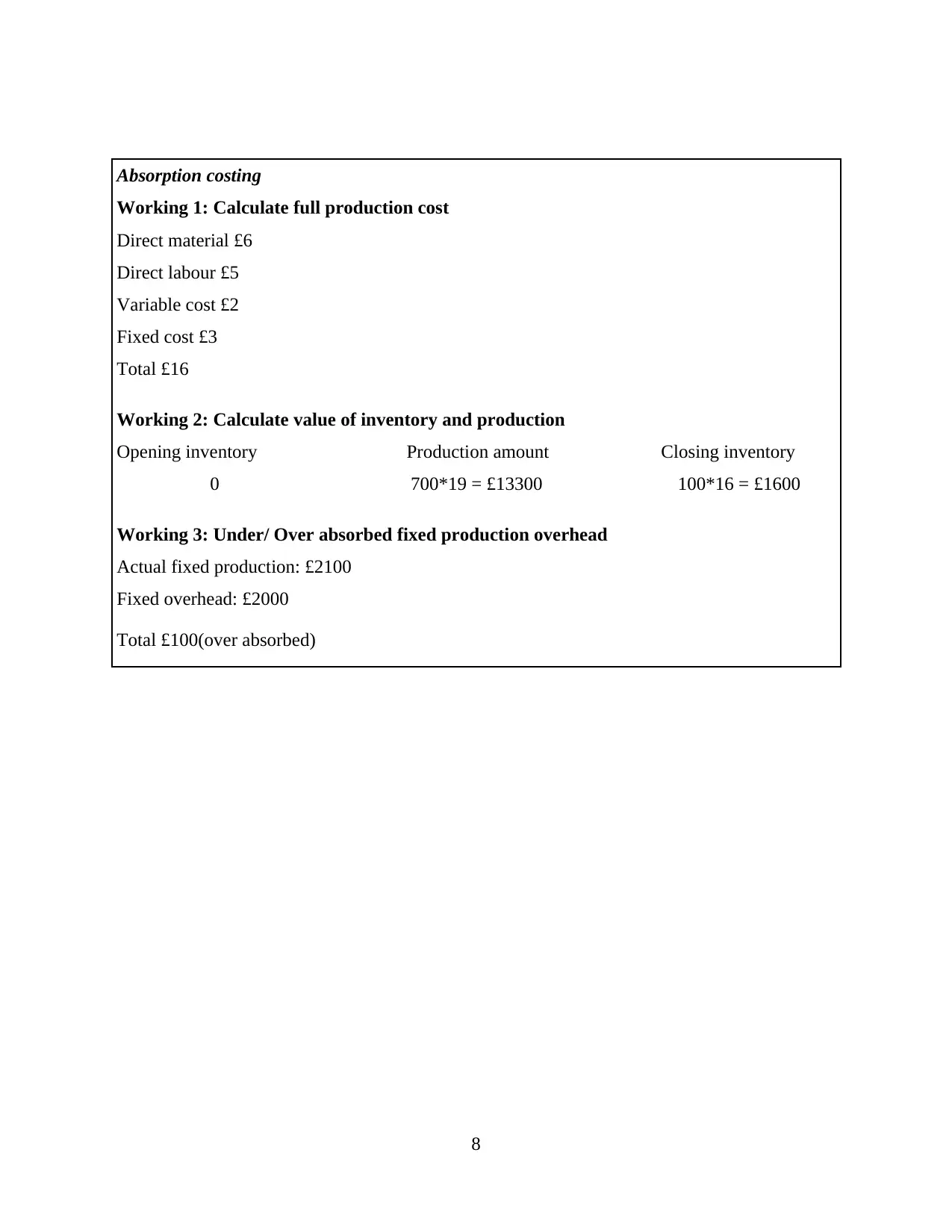

Absorption costing

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: Calculate value of inventory and production

Opening inventory Production amount Closing inventory

0 700*19 = £13300 100*16 = £1600

Working 3: Under/ Over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

8

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: Calculate value of inventory and production

Opening inventory Production amount Closing inventory

0 700*19 = £13300 100*16 = £1600

Working 3: Under/ Over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

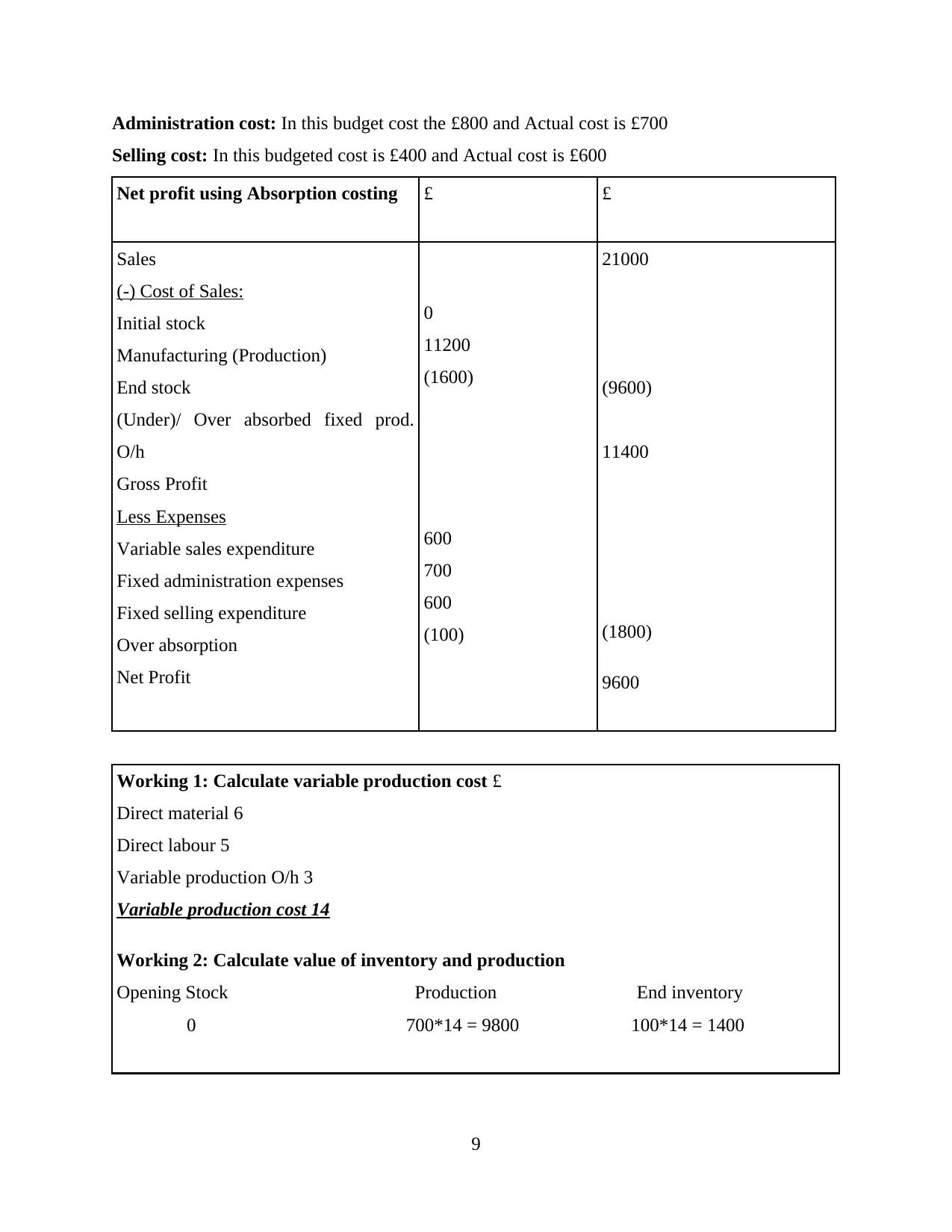

Administration cost: In this budget cost the £800 and Actual cost is £700

Selling cost: In this budgeted cost is £400 and Actual cost is £600

Net profit using Absorption costing £ £

Sales

(-) Cost of Sales:

Initial stock

Manufacturing (Production)

End stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

Working 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening Stock Production End inventory

0 700*14 = 9800 100*14 = 1400

9

Selling cost: In this budgeted cost is £400 and Actual cost is £600

Net profit using Absorption costing £ £

Sales

(-) Cost of Sales:

Initial stock

Manufacturing (Production)

End stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

Working 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening Stock Production End inventory

0 700*14 = 9800 100*14 = 1400

9

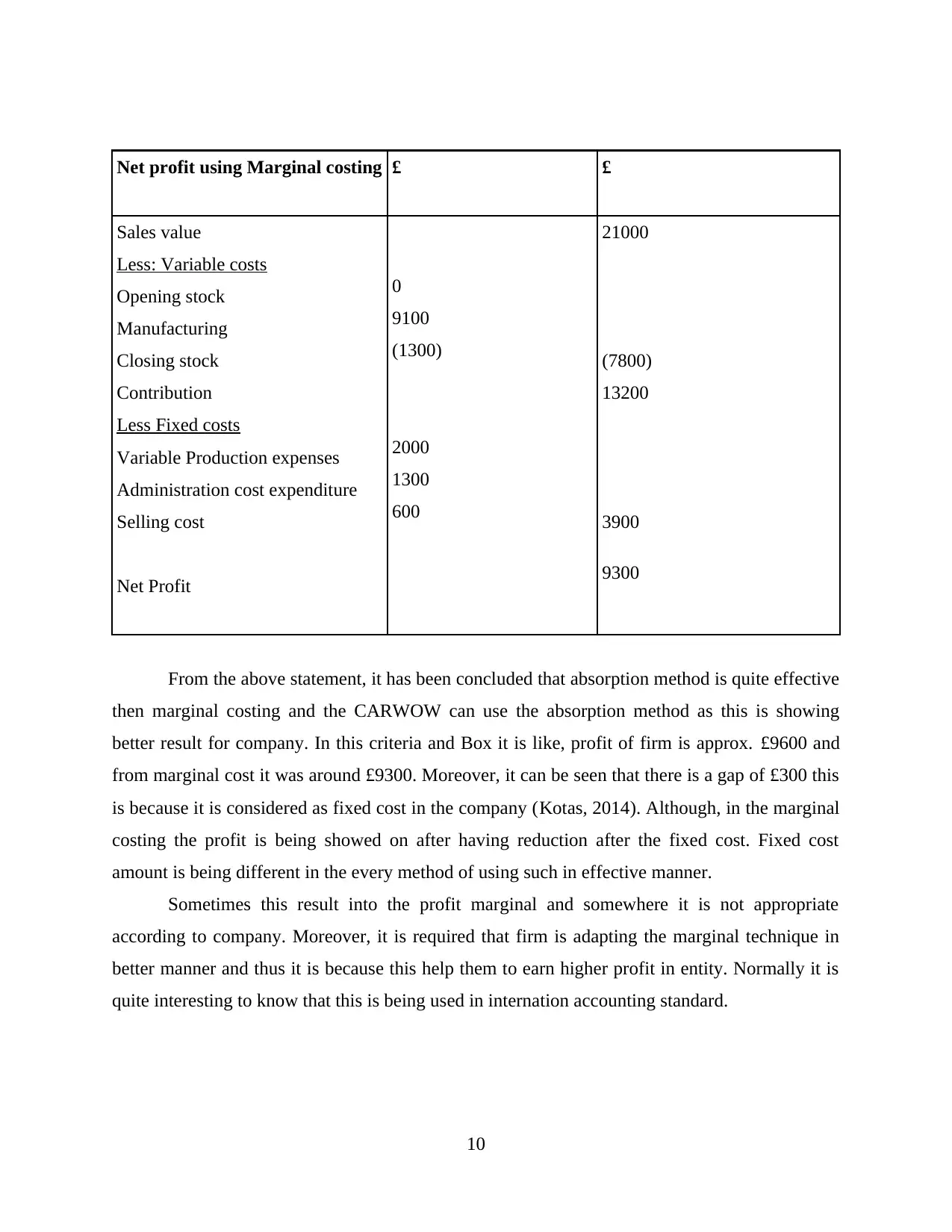

Net profit using Marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

From the above statement, it has been concluded that absorption method is quite effective

then marginal costing and the CARWOW can use the absorption method as this is showing

better result for company. In this criteria and Box it is like, profit of firm is approx. £9600 and

from marginal cost it was around £9300. Moreover, it can be seen that there is a gap of £300 this

is because it is considered as fixed cost in the company (Kotas, 2014). Although, in the marginal

costing the profit is being showed on after having reduction after the fixed cost. Fixed cost

amount is being different in the every method of using such in effective manner.

Sometimes this result into the profit marginal and somewhere it is not appropriate

according to company. Moreover, it is required that firm is adapting the marginal technique in

better manner and thus it is because this help them to earn higher profit in entity. Normally it is

quite interesting to know that this is being used in internation accounting standard.

10

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

From the above statement, it has been concluded that absorption method is quite effective

then marginal costing and the CARWOW can use the absorption method as this is showing

better result for company. In this criteria and Box it is like, profit of firm is approx. £9600 and

from marginal cost it was around £9300. Moreover, it can be seen that there is a gap of £300 this

is because it is considered as fixed cost in the company (Kotas, 2014). Although, in the marginal

costing the profit is being showed on after having reduction after the fixed cost. Fixed cost

amount is being different in the every method of using such in effective manner.

Sometimes this result into the profit marginal and somewhere it is not appropriate

according to company. Moreover, it is required that firm is adapting the marginal technique in

better manner and thus it is because this help them to earn higher profit in entity. Normally it is

quite interesting to know that this is being used in internation accounting standard.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.