Analysis of Management Accounting Practices: Turramurra Furniture

VerifiedAdded on 2020/05/16

|17

|2801

|177

Report

AI Summary

This report provides a detailed analysis of the management accounting practices employed by the Turramurra Furniture Company, a specialist manufacturer of computer furniture. The report addresses seven key questions, starting with an introduction to job order costing and its suitability for the company's product differentiation. It then delves into the work-in-process balance, the cost of chairs in finished goods inventory, and the computation of under or over-applied overhead. The report explores various transactions for adjusting over-applied overheads and the process for adjusting the cost of material. Finally, it discusses the application of Activity Based Costing (ABC) as a potential improvement to the company's overhead allocation methods. The report concludes that while job order costing is effective, ABC could further refine the allocation of overhead costs and improve decision-making. This report is contributed by a student and published on Desklib, a platform providing AI-based study tools.

Running head: MANAGEMENT ACCOUNTING

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

MANAGEMENT ACCOUNTING

Table of Contents

Introduction......................................................................................................................................3

Answer to Question (a)....................................................................................................................4

Introduction..................................................................................................................................4

Suitable Circumstances for Job Order Costing System...............................................................4

Answer to Question (b)....................................................................................................................6

Work-in Process Balance.................................................................................................................6

Introduction..................................................................................................................................6

Work-in-Process Balance............................................................................................................6

Answer to Question (c)....................................................................................................................7

Cost of Chair in Finished Goods Inventory.....................................................................................7

Introduction..................................................................................................................................7

Answer to Question (d)....................................................................................................................8

Computation of the Under or Over Applied Overhead...................................................................8

Introduction..................................................................................................................................8

Answer to Question (e)....................................................................................................................9

Introduction..................................................................................................................................9

Different Transactions for Adjusting Over Applied Overheads..................................................9

Answer to Question (f)..................................................................................................................10

Process for Adjusting the Over Applied Cost of Material.........................................................10

MANAGEMENT ACCOUNTING

Table of Contents

Introduction......................................................................................................................................3

Answer to Question (a)....................................................................................................................4

Introduction..................................................................................................................................4

Suitable Circumstances for Job Order Costing System...............................................................4

Answer to Question (b)....................................................................................................................6

Work-in Process Balance.................................................................................................................6

Introduction..................................................................................................................................6

Work-in-Process Balance............................................................................................................6

Answer to Question (c)....................................................................................................................7

Cost of Chair in Finished Goods Inventory.....................................................................................7

Introduction..................................................................................................................................7

Answer to Question (d)....................................................................................................................8

Computation of the Under or Over Applied Overhead...................................................................8

Introduction..................................................................................................................................8

Answer to Question (e)....................................................................................................................9

Introduction..................................................................................................................................9

Different Transactions for Adjusting Over Applied Overheads..................................................9

Answer to Question (f)..................................................................................................................10

Process for Adjusting the Over Applied Cost of Material.........................................................10

2

MANAGEMENT ACCOUNTING

Answer to Question (g)..................................................................................................................11

Introduction................................................................................................................................11

Activity Based Costing..............................................................................................................11

Conclusion.....................................................................................................................................13

Reference List................................................................................................................................14

MANAGEMENT ACCOUNTING

Answer to Question (g)..................................................................................................................11

Introduction................................................................................................................................11

Activity Based Costing..............................................................................................................11

Conclusion.....................................................................................................................................13

Reference List................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

MANAGEMENT ACCOUNTING

Introduction

Turramurra Furniture Company is a specialist manufacturing organization that

concentrates on manufacturing furniture that can be used with computers. The company makes

use of the FIFO costing process in order to allocate and assign their costs and expenses to the

Finished Goods and has their financial records maintained as a financial report on the basis of an

accounting year. The company has their own style of recording accounts and therefore it applies

its manufacturing overhead based on the machine hour operations. There are several kinds of

furniture with respect to the use of computers are manufactured by the firm and therefore has

different job numbers. This paper has therefore been framed in order to discover the related costs

of Turramurra Furniture Company and even addresses the process that can be used for the

assumption of cost in accordance to the job order process system. There are seven questions that

would be addressed in this paper, which would be helpful in identifying the management

accounting process of Turramurra Furniture Company.

MANAGEMENT ACCOUNTING

Introduction

Turramurra Furniture Company is a specialist manufacturing organization that

concentrates on manufacturing furniture that can be used with computers. The company makes

use of the FIFO costing process in order to allocate and assign their costs and expenses to the

Finished Goods and has their financial records maintained as a financial report on the basis of an

accounting year. The company has their own style of recording accounts and therefore it applies

its manufacturing overhead based on the machine hour operations. There are several kinds of

furniture with respect to the use of computers are manufactured by the firm and therefore has

different job numbers. This paper has therefore been framed in order to discover the related costs

of Turramurra Furniture Company and even addresses the process that can be used for the

assumption of cost in accordance to the job order process system. There are seven questions that

would be addressed in this paper, which would be helpful in identifying the management

accounting process of Turramurra Furniture Company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

MANAGEMENT ACCOUNTING

Answer to Question (a)

Introduction

Job order costing even known as job costing is a process that is used for allocating the

cost of manufacturing to a single product or even in product batches. This system of costing is

used specifically in circumstances when the products that have been manufactured are uniquely

different from each other (Ma and Sakellariou 2017).

As the products that have been produced has differentiations of their own, the process of

job order costing is undertaken which would create a job cost record for every item and even in

situations of a special order (Öker and Adıgüzelv 2016). The record for the job cost will

document the direct labour and direct materials which is utilised over the manufacturing

overheads that is allocated to every job. The job cost records even act as a subsidiary

documentation or ledger for the expenses in the inventory of the work-in-process, cost of goods

sold and the inventory of the finished goods.

Suitable Circumstances for Job Order Costing System

This costing process is exploited by the manufacturing industries in order to record the

production process and the total number of products that have been manufactured on batch and

even in a day. There are definite circumstances during which the job order costing method can be

exploited by any individuals and any organizations (Garibaldi, Moen and Sommervoll 2016).

The job order costing system is sued by the companies that manufactures different varieties of

products. This process is even used by the organizations that are associated with the service

sector. The organizations that are associated with the production units make use of this costing

MANAGEMENT ACCOUNTING

Answer to Question (a)

Introduction

Job order costing even known as job costing is a process that is used for allocating the

cost of manufacturing to a single product or even in product batches. This system of costing is

used specifically in circumstances when the products that have been manufactured are uniquely

different from each other (Ma and Sakellariou 2017).

As the products that have been produced has differentiations of their own, the process of

job order costing is undertaken which would create a job cost record for every item and even in

situations of a special order (Öker and Adıgüzelv 2016). The record for the job cost will

document the direct labour and direct materials which is utilised over the manufacturing

overheads that is allocated to every job. The job cost records even act as a subsidiary

documentation or ledger for the expenses in the inventory of the work-in-process, cost of goods

sold and the inventory of the finished goods.

Suitable Circumstances for Job Order Costing System

This costing process is exploited by the manufacturing industries in order to record the

production process and the total number of products that have been manufactured on batch and

even in a day. There are definite circumstances during which the job order costing method can be

exploited by any individuals and any organizations (Garibaldi, Moen and Sommervoll 2016).

The job order costing system is sued by the companies that manufactures different varieties of

products. This process is even used by the organizations that are associated with the service

sector. The organizations that are associated with the production units make use of this costing

5

MANAGEMENT ACCOUNTING

system generally manufacture customised services and items. The services and products that

have been produced with a unique identity are known as batches and jobs (Kaplan et al. 2014).

When an organization allows jobs and orders for variable products, the cost allotment for the

product becomes difficult to ascertain. In accordance to this, record for every cost for every

single job is preserved because of the fact that every sort of jobs have several related services

and products (Dong, Liu and Lin 2014). The cost per unit for a specific job is generated by

dividing the overall cost that is allocated for a job by the total number of specific units linked

with the job. The three fundamental elements of job order costing system are the factory

overhead, the labour cost and the materials associated with it.

MANAGEMENT ACCOUNTING

system generally manufacture customised services and items. The services and products that

have been produced with a unique identity are known as batches and jobs (Kaplan et al. 2014).

When an organization allows jobs and orders for variable products, the cost allotment for the

product becomes difficult to ascertain. In accordance to this, record for every cost for every

single job is preserved because of the fact that every sort of jobs have several related services

and products (Dong, Liu and Lin 2014). The cost per unit for a specific job is generated by

dividing the overall cost that is allocated for a job by the total number of specific units linked

with the job. The three fundamental elements of job order costing system are the factory

overhead, the labour cost and the materials associated with it.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

MANAGEMENT ACCOUNTING

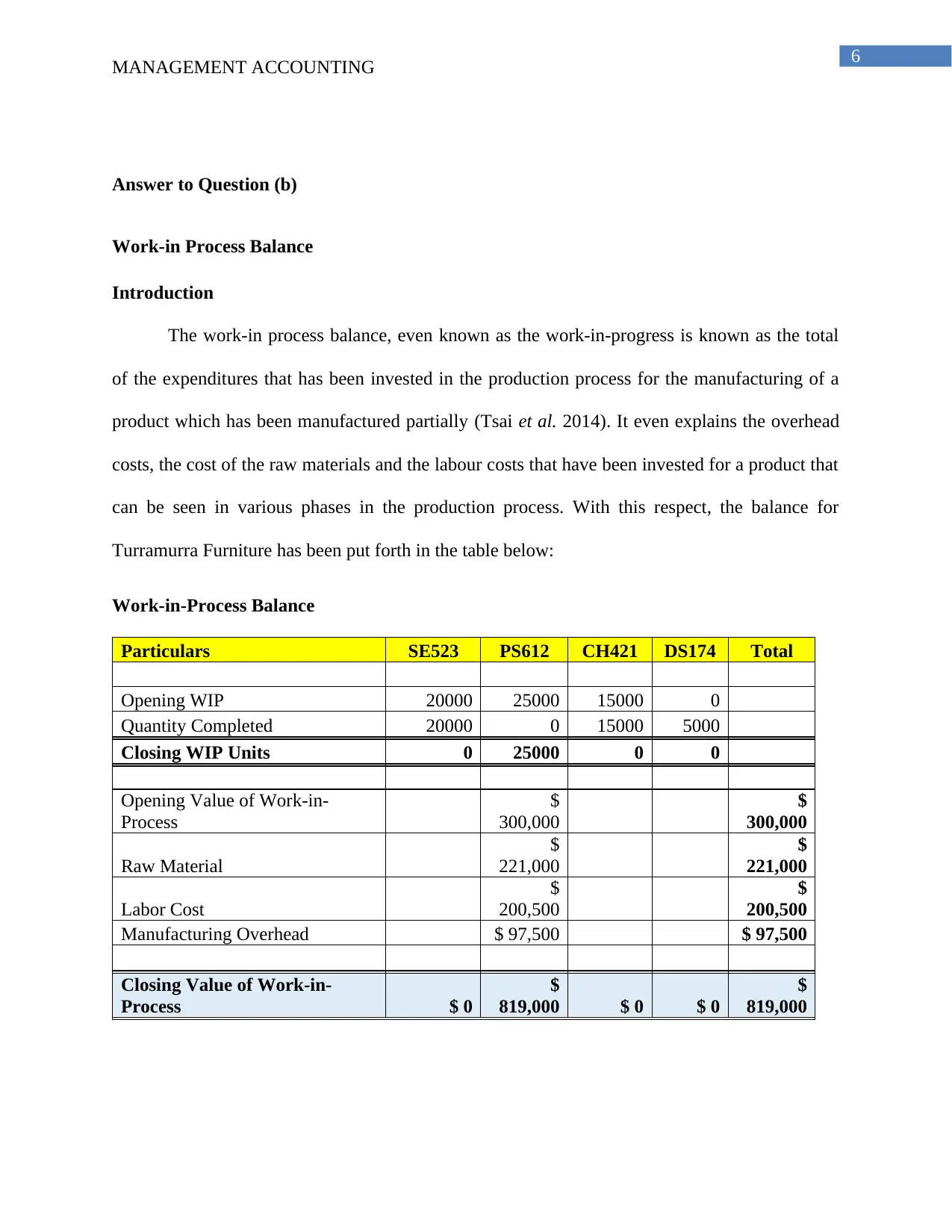

Answer to Question (b)

Work-in Process Balance

Introduction

The work-in process balance, even known as the work-in-progress is known as the total

of the expenditures that has been invested in the production process for the manufacturing of a

product which has been manufactured partially (Tsai et al. 2014). It even explains the overhead

costs, the cost of the raw materials and the labour costs that have been invested for a product that

can be seen in various phases in the production process. With this respect, the balance for

Turramurra Furniture has been put forth in the table below:

Work-in-Process Balance

Particulars SE523 PS612 CH421 DS174 Total

Opening WIP 20000 25000 15000 0

Quantity Completed 20000 0 15000 5000

Closing WIP Units 0 25000 0 0

Opening Value of Work-in-

Process

$

300,000

$

300,000

Raw Material

$

221,000

$

221,000

Labor Cost

$

200,500

$

200,500

Manufacturing Overhead $ 97,500 $ 97,500

Closing Value of Work-in-

Process $ 0

$

819,000 $ 0 $ 0

$

819,000

MANAGEMENT ACCOUNTING

Answer to Question (b)

Work-in Process Balance

Introduction

The work-in process balance, even known as the work-in-progress is known as the total

of the expenditures that has been invested in the production process for the manufacturing of a

product which has been manufactured partially (Tsai et al. 2014). It even explains the overhead

costs, the cost of the raw materials and the labour costs that have been invested for a product that

can be seen in various phases in the production process. With this respect, the balance for

Turramurra Furniture has been put forth in the table below:

Work-in-Process Balance

Particulars SE523 PS612 CH421 DS174 Total

Opening WIP 20000 25000 15000 0

Quantity Completed 20000 0 15000 5000

Closing WIP Units 0 25000 0 0

Opening Value of Work-in-

Process

$

300,000

$

300,000

Raw Material

$

221,000

$

221,000

Labor Cost

$

200,500

$

200,500

Manufacturing Overhead $ 97,500 $ 97,500

Closing Value of Work-in-

Process $ 0

$

819,000 $ 0 $ 0

$

819,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

MANAGEMENT ACCOUNTING

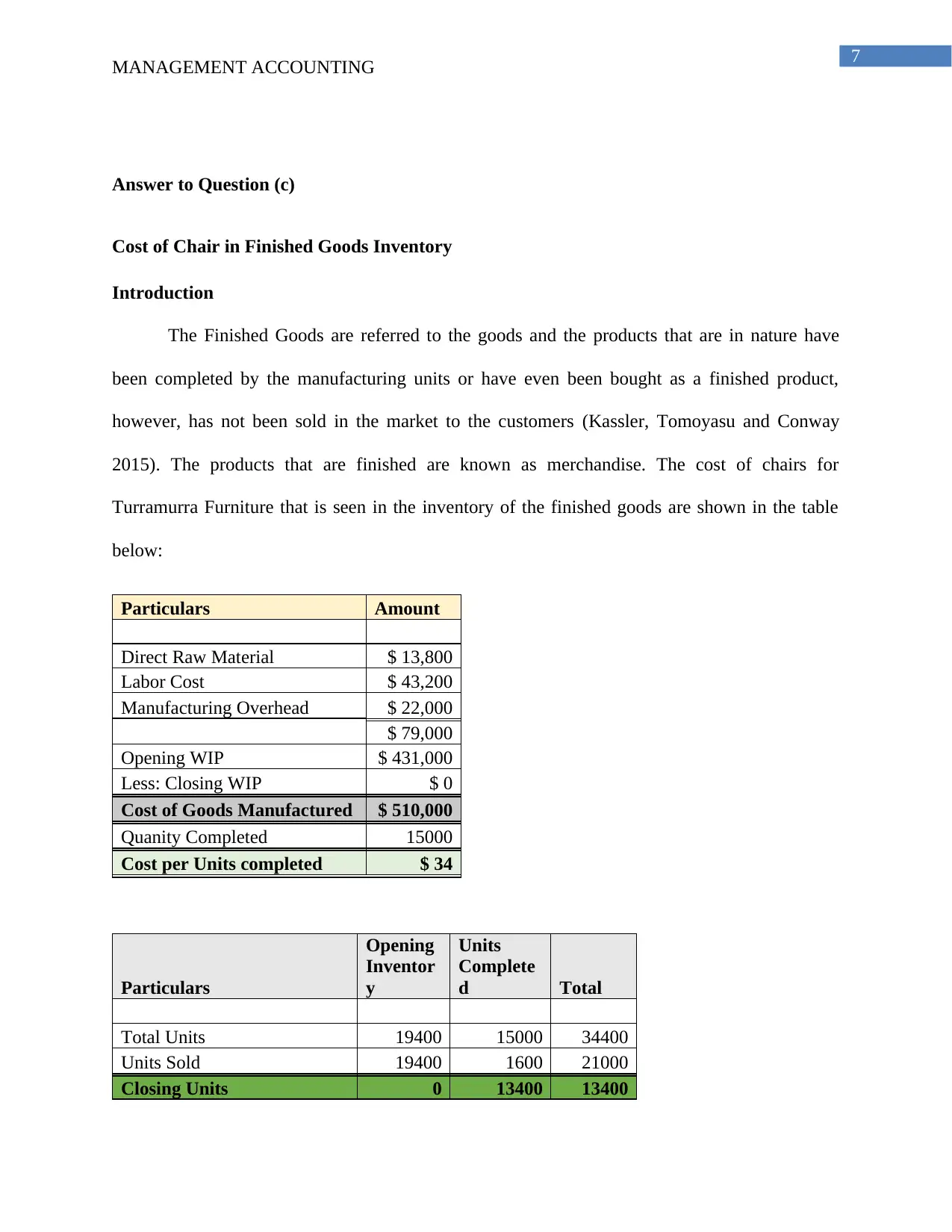

Answer to Question (c)

Cost of Chair in Finished Goods Inventory

Introduction

The Finished Goods are referred to the goods and the products that are in nature have

been completed by the manufacturing units or have even been bought as a finished product,

however, has not been sold in the market to the customers (Kassler, Tomoyasu and Conway

2015). The products that are finished are known as merchandise. The cost of chairs for

Turramurra Furniture that is seen in the inventory of the finished goods are shown in the table

below:

Particulars Amount

Direct Raw Material $ 13,800

Labor Cost $ 43,200

Manufacturing Overhead $ 22,000

$ 79,000

Opening WIP $ 431,000

Less: Closing WIP $ 0

Cost of Goods Manufactured $ 510,000

Quanity Completed 15000

Cost per Units completed $ 34

Particulars

Opening

Inventor

y

Units

Complete

d Total

Total Units 19400 15000 34400

Units Sold 19400 1600 21000

Closing Units 0 13400 13400

MANAGEMENT ACCOUNTING

Answer to Question (c)

Cost of Chair in Finished Goods Inventory

Introduction

The Finished Goods are referred to the goods and the products that are in nature have

been completed by the manufacturing units or have even been bought as a finished product,

however, has not been sold in the market to the customers (Kassler, Tomoyasu and Conway

2015). The products that are finished are known as merchandise. The cost of chairs for

Turramurra Furniture that is seen in the inventory of the finished goods are shown in the table

below:

Particulars Amount

Direct Raw Material $ 13,800

Labor Cost $ 43,200

Manufacturing Overhead $ 22,000

$ 79,000

Opening WIP $ 431,000

Less: Closing WIP $ 0

Cost of Goods Manufactured $ 510,000

Quanity Completed 15000

Cost per Units completed $ 34

Particulars

Opening

Inventor

y

Units

Complete

d Total

Total Units 19400 15000 34400

Units Sold 19400 1600 21000

Closing Units 0 13400 13400

8

MANAGEMENT ACCOUNTING

Cost per unit $ 35 $ 34

Value of Closing Inventory $ 0 $ 455,600

$

455,600

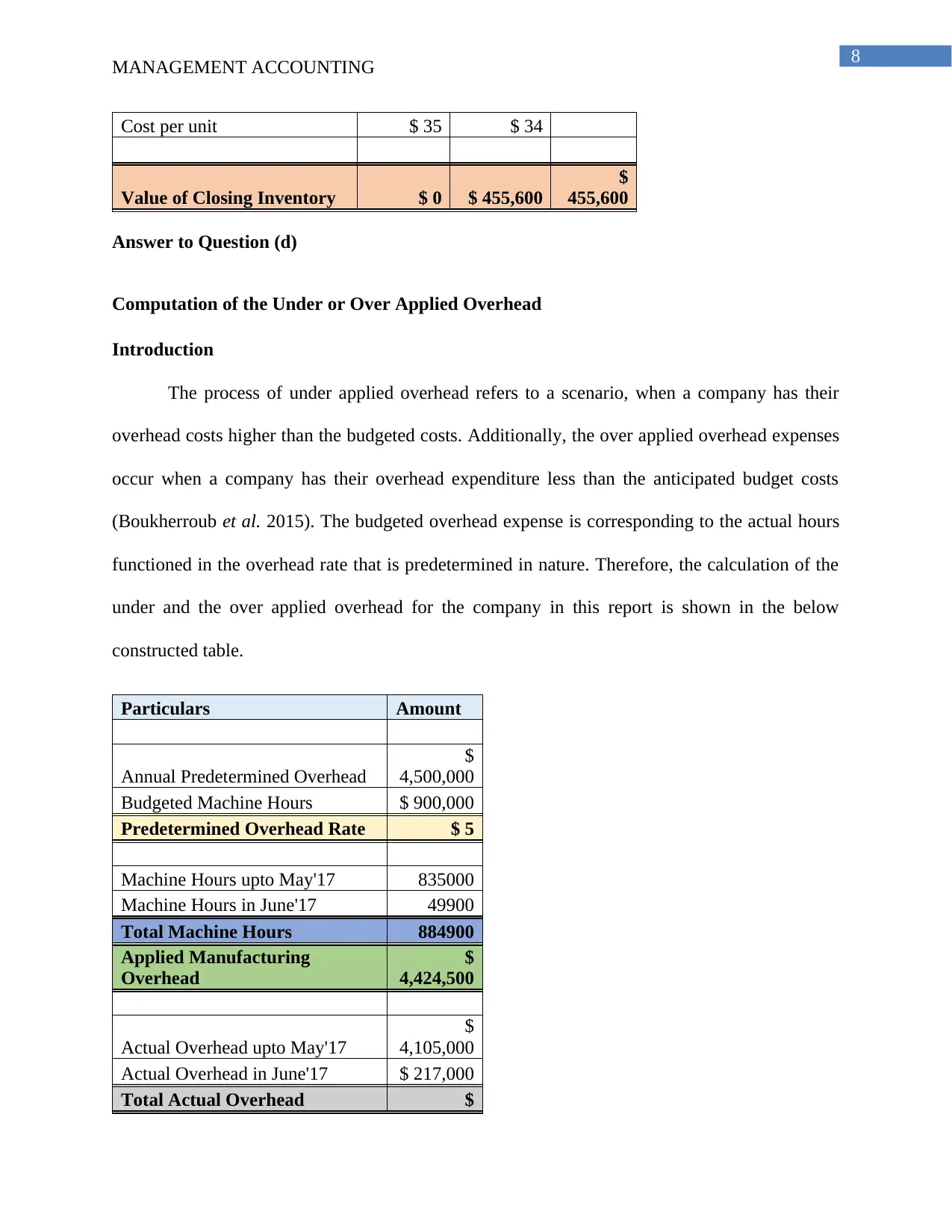

Answer to Question (d)

Computation of the Under or Over Applied Overhead

Introduction

The process of under applied overhead refers to a scenario, when a company has their

overhead costs higher than the budgeted costs. Additionally, the over applied overhead expenses

occur when a company has their overhead expenditure less than the anticipated budget costs

(Boukherroub et al. 2015). The budgeted overhead expense is corresponding to the actual hours

functioned in the overhead rate that is predetermined in nature. Therefore, the calculation of the

under and the over applied overhead for the company in this report is shown in the below

constructed table.

Particulars Amount

Annual Predetermined Overhead

$

4,500,000

Budgeted Machine Hours $ 900,000

Predetermined Overhead Rate $ 5

Machine Hours upto May'17 835000

Machine Hours in June'17 49900

Total Machine Hours 884900

Applied Manufacturing

Overhead

$

4,424,500

Actual Overhead upto May'17

$

4,105,000

Actual Overhead in June'17 $ 217,000

Total Actual Overhead $

MANAGEMENT ACCOUNTING

Cost per unit $ 35 $ 34

Value of Closing Inventory $ 0 $ 455,600

$

455,600

Answer to Question (d)

Computation of the Under or Over Applied Overhead

Introduction

The process of under applied overhead refers to a scenario, when a company has their

overhead costs higher than the budgeted costs. Additionally, the over applied overhead expenses

occur when a company has their overhead expenditure less than the anticipated budget costs

(Boukherroub et al. 2015). The budgeted overhead expense is corresponding to the actual hours

functioned in the overhead rate that is predetermined in nature. Therefore, the calculation of the

under and the over applied overhead for the company in this report is shown in the below

constructed table.

Particulars Amount

Annual Predetermined Overhead

$

4,500,000

Budgeted Machine Hours $ 900,000

Predetermined Overhead Rate $ 5

Machine Hours upto May'17 835000

Machine Hours in June'17 49900

Total Machine Hours 884900

Applied Manufacturing

Overhead

$

4,424,500

Actual Overhead upto May'17

$

4,105,000

Actual Overhead in June'17 $ 217,000

Total Actual Overhead $

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

MANAGEMENT ACCOUNTING

4,322,000

Over Applied Overhead

Expenses $ 102,500

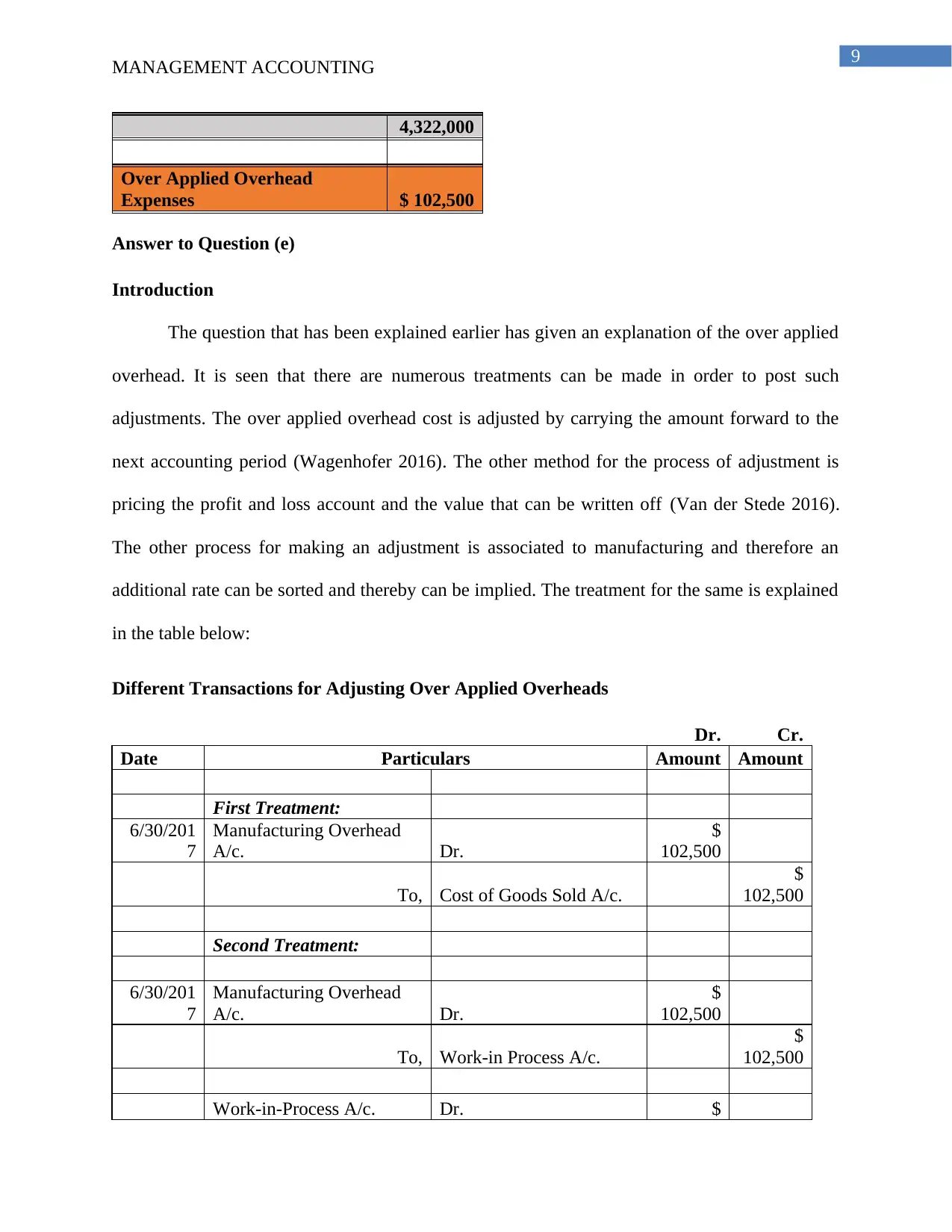

Answer to Question (e)

Introduction

The question that has been explained earlier has given an explanation of the over applied

overhead. It is seen that there are numerous treatments can be made in order to post such

adjustments. The over applied overhead cost is adjusted by carrying the amount forward to the

next accounting period (Wagenhofer 2016). The other method for the process of adjustment is

pricing the profit and loss account and the value that can be written off (Van der Stede 2016).

The other process for making an adjustment is associated to manufacturing and therefore an

additional rate can be sorted and thereby can be implied. The treatment for the same is explained

in the table below:

Different Transactions for Adjusting Over Applied Overheads

Dr. Cr.

Date Particulars Amount Amount

First Treatment:

6/30/201

7

Manufacturing Overhead

A/c. Dr.

$

102,500

To, Cost of Goods Sold A/c.

$

102,500

Second Treatment:

6/30/201

7

Manufacturing Overhead

A/c. Dr.

$

102,500

To, Work-in Process A/c.

$

102,500

Work-in-Process A/c. Dr. $

MANAGEMENT ACCOUNTING

4,322,000

Over Applied Overhead

Expenses $ 102,500

Answer to Question (e)

Introduction

The question that has been explained earlier has given an explanation of the over applied

overhead. It is seen that there are numerous treatments can be made in order to post such

adjustments. The over applied overhead cost is adjusted by carrying the amount forward to the

next accounting period (Wagenhofer 2016). The other method for the process of adjustment is

pricing the profit and loss account and the value that can be written off (Van der Stede 2016).

The other process for making an adjustment is associated to manufacturing and therefore an

additional rate can be sorted and thereby can be implied. The treatment for the same is explained

in the table below:

Different Transactions for Adjusting Over Applied Overheads

Dr. Cr.

Date Particulars Amount Amount

First Treatment:

6/30/201

7

Manufacturing Overhead

A/c. Dr.

$

102,500

To, Cost of Goods Sold A/c.

$

102,500

Second Treatment:

6/30/201

7

Manufacturing Overhead

A/c. Dr.

$

102,500

To, Work-in Process A/c.

$

102,500

Work-in-Process A/c. Dr. $

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

MANAGEMENT ACCOUNTING

102,500

To, Cost of Goods Sold A/c.

$

102,500

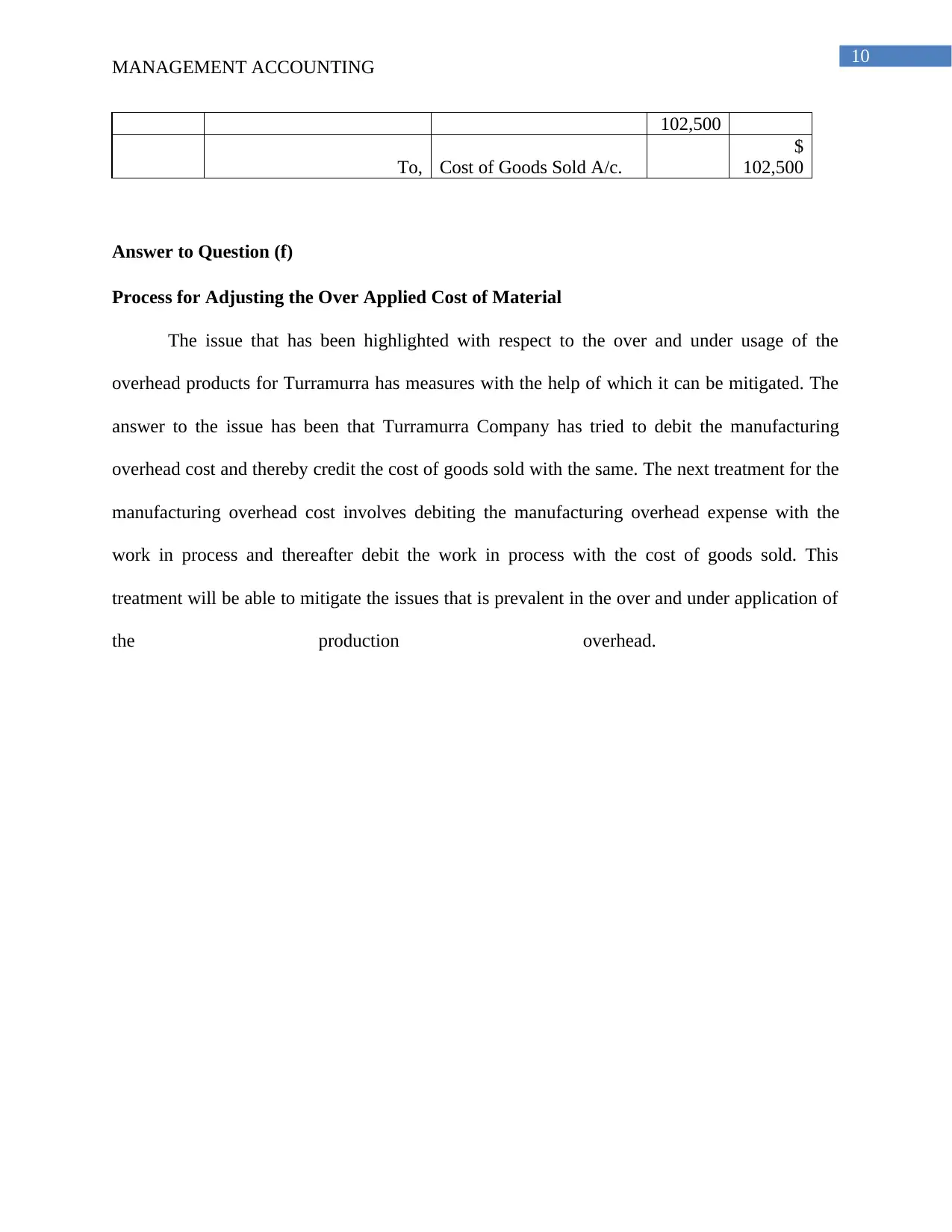

Answer to Question (f)

Process for Adjusting the Over Applied Cost of Material

The issue that has been highlighted with respect to the over and under usage of the

overhead products for Turramurra has measures with the help of which it can be mitigated. The

answer to the issue has been that Turramurra Company has tried to debit the manufacturing

overhead cost and thereby credit the cost of goods sold with the same. The next treatment for the

manufacturing overhead cost involves debiting the manufacturing overhead expense with the

work in process and thereafter debit the work in process with the cost of goods sold. This

treatment will be able to mitigate the issues that is prevalent in the over and under application of

the production overhead.

MANAGEMENT ACCOUNTING

102,500

To, Cost of Goods Sold A/c.

$

102,500

Answer to Question (f)

Process for Adjusting the Over Applied Cost of Material

The issue that has been highlighted with respect to the over and under usage of the

overhead products for Turramurra has measures with the help of which it can be mitigated. The

answer to the issue has been that Turramurra Company has tried to debit the manufacturing

overhead cost and thereby credit the cost of goods sold with the same. The next treatment for the

manufacturing overhead cost involves debiting the manufacturing overhead expense with the

work in process and thereafter debit the work in process with the cost of goods sold. This

treatment will be able to mitigate the issues that is prevalent in the over and under application of

the production overhead.

11

MANAGEMENT ACCOUNTING

Answer to Question (g)

Introduction

The method of Activity Based Costing is one of the essential accounting process that

have been in use in the service and the product industries and is even used by individual entities

(Tucker and Parker 2014). This question would therefore look to address the method of costing.

Activity Based Costing

Turramurra Furniture Company has been facing issue with respect to the calculation and

the implementation of the overhead costs and has the wish to incorporate Activity Based Costing

as the company has the desire to expand and improve and develop their variety of products and

therefore is concerned about the overhead treatment (Taylor and Scapens 2016). The process of

Activity Based Costing is generally used by the manufacturing organizations as it improves the

reliability of the costing information and therefore the companies can gain idea about the true

and authentic costs and enhanced categorisation of the expenses that the company has incurred

during the process of production (Luft 2016). The process of costing is exploited for the purpose

of understanding the customer profitability, product costing and evaluation of the level of profit,

target costing and service costing. This process has been extensively popular as the companies

can frame an appropriate corporate plan and policy and concentrate on if the costs are treated

effectively (Suomala, Lyly-Yrjänäinen and Lukka 2014). The process of Activity Based Costing

makes use of several costing pools managed by the activities in order to allocate the overhead

MANAGEMENT ACCOUNTING

Answer to Question (g)

Introduction

The method of Activity Based Costing is one of the essential accounting process that

have been in use in the service and the product industries and is even used by individual entities

(Tucker and Parker 2014). This question would therefore look to address the method of costing.

Activity Based Costing

Turramurra Furniture Company has been facing issue with respect to the calculation and

the implementation of the overhead costs and has the wish to incorporate Activity Based Costing

as the company has the desire to expand and improve and develop their variety of products and

therefore is concerned about the overhead treatment (Taylor and Scapens 2016). The process of

Activity Based Costing is generally used by the manufacturing organizations as it improves the

reliability of the costing information and therefore the companies can gain idea about the true

and authentic costs and enhanced categorisation of the expenses that the company has incurred

during the process of production (Luft 2016). The process of costing is exploited for the purpose

of understanding the customer profitability, product costing and evaluation of the level of profit,

target costing and service costing. This process has been extensively popular as the companies

can frame an appropriate corporate plan and policy and concentrate on if the costs are treated

effectively (Suomala, Lyly-Yrjänäinen and Lukka 2014). The process of Activity Based Costing

makes use of several costing pools managed by the activities in order to allocate the overhead

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.