Management Accounting: Reporting, Techniques, and Internal Control

VerifiedAdded on 2021/02/20

|19

|4159

|109

Report

AI Summary

This report provides a comprehensive overview of management accounting, detailing its role in business operations and financial performance analysis. It explores the management accounting system, various types such as cost accounting, job costing, and inventory management, and their essential requirements. The report highlights different methods of management accounting reporting, including inventory, cash, cost, performance, and budget reports, along with the techniques of marginal and absorption costing. It includes detailed financial statements prepared using both marginal and absorption costing methods, along with an interpretation of the results. The report also analyzes effective planning tools used for budgetary control systems, outlining their benefits and drawbacks, and emphasizes the role of management accounting in improving a company's ability to respond to financial challenges.

Management Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

INTRODUCTION

A process of proper analysis of each activities that have effect over books of accounts

and financial performance of the company, monitoring each activity and imposing effective

control over it using professional skills is known as management accounting system. It can be

seen as an essential element to be an inclusive part of a business organisation. Management

accounting can also be defined as a set of numerous methods and concepts that enable managers

in determining various alternatives that can be used by them for the purpose of imposing more

effective control over the each financial activities of the business organisation. This system is

useful for managers in order to develop effective control over both financial and non financial

activities of the business.

The present study provides a brief description about management accounting and

management accounting system along with essential requirements of adopting various

management accounting systems within the firm. It highlights various methods that can be used

for effective management accounting reporting. It describes use of management accounting

techniques for effective internal control of the company.

Further, in the assignment, effective planning tools used by the manager for budgetary

control systems are also being defined along with their benefits and drawbacks. Furthermore, the

study includes various tools and techniques of management accounting system that help

managers in effectiveness within the company so as to improve its ability to respond various

financial problems of the business.

ACTIVITY 1

Management accounting and management accounting system

Management accounting

Management accounting is a branch of overall accounting system which includes a

process of partnering with management department of the company and help them in managing

various monitory and non monitory functions of the company by providing all relevant

information to the managers in such a way so that even a non commercial manager can easily

analyse the reports and evaluate company's actual position in order to formulate their effective

plans and strategies for the business (Management Accounting – Meaning, Advantages &

Functions. 2019).

Management accounting system

3

A process of proper analysis of each activities that have effect over books of accounts

and financial performance of the company, monitoring each activity and imposing effective

control over it using professional skills is known as management accounting system. It can be

seen as an essential element to be an inclusive part of a business organisation. Management

accounting can also be defined as a set of numerous methods and concepts that enable managers

in determining various alternatives that can be used by them for the purpose of imposing more

effective control over the each financial activities of the business organisation. This system is

useful for managers in order to develop effective control over both financial and non financial

activities of the business.

The present study provides a brief description about management accounting and

management accounting system along with essential requirements of adopting various

management accounting systems within the firm. It highlights various methods that can be used

for effective management accounting reporting. It describes use of management accounting

techniques for effective internal control of the company.

Further, in the assignment, effective planning tools used by the manager for budgetary

control systems are also being defined along with their benefits and drawbacks. Furthermore, the

study includes various tools and techniques of management accounting system that help

managers in effectiveness within the company so as to improve its ability to respond various

financial problems of the business.

ACTIVITY 1

Management accounting and management accounting system

Management accounting

Management accounting is a branch of overall accounting system which includes a

process of partnering with management department of the company and help them in managing

various monitory and non monitory functions of the company by providing all relevant

information to the managers in such a way so that even a non commercial manager can easily

analyse the reports and evaluate company's actual position in order to formulate their effective

plans and strategies for the business (Management Accounting – Meaning, Advantages &

Functions. 2019).

Management accounting system

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting system is a managerial function that includes gathering

information from managerial accountants and perform their tasks of planning, monitoring,

analysing, controlling etc. for financial activities of the company.

Essential requirement of different types of management accounting systems

Management accounting system can be categorised into various categories. such as cost

accounting system, inventory management system, job costing system, price optimisation

system, etc. Essential benefits of these systems can be determined as under:

● Job costing system: Job costing system is that type of management accounting system

that ensures that the company could generate sufficient amount of profit from the selling

their product and services to the customers. This system is Useful for those business

organisations that provides customised goods or services to its customers. Providing

customised products results in incurring different cost on various goods or services

produced by the business. This system enables the business in deciding appropriate price

to be charged for each product in order to generate reasonable profits. Its essential

requirements can be determined as under:

Requirements

▪ It helps in determination of cost incurred on production of each product or

services.

▪ It is required for setting price of customised product or services.

● Cost accounting system: Cost accounting system is a set of various methods, guidelines

and principles that helps in maintaining effective control over the overall cost system of

the company and development of cost efficiency within the business. This system is

useful for each type of business units. as being cost efficient is a basic requirement of

maintaining and improving cost effectively within the company.

Requirement

▪ It is required for ensuring cost efficiency within a business organisation.

▪ It enables the managers in detecting wastage of cost from each part of the firm.

4

information from managerial accountants and perform their tasks of planning, monitoring,

analysing, controlling etc. for financial activities of the company.

Essential requirement of different types of management accounting systems

Management accounting system can be categorised into various categories. such as cost

accounting system, inventory management system, job costing system, price optimisation

system, etc. Essential benefits of these systems can be determined as under:

● Job costing system: Job costing system is that type of management accounting system

that ensures that the company could generate sufficient amount of profit from the selling

their product and services to the customers. This system is Useful for those business

organisations that provides customised goods or services to its customers. Providing

customised products results in incurring different cost on various goods or services

produced by the business. This system enables the business in deciding appropriate price

to be charged for each product in order to generate reasonable profits. Its essential

requirements can be determined as under:

Requirements

▪ It helps in determination of cost incurred on production of each product or

services.

▪ It is required for setting price of customised product or services.

● Cost accounting system: Cost accounting system is a set of various methods, guidelines

and principles that helps in maintaining effective control over the overall cost system of

the company and development of cost efficiency within the business. This system is

useful for each type of business units. as being cost efficient is a basic requirement of

maintaining and improving cost effectively within the company.

Requirement

▪ It is required for ensuring cost efficiency within a business organisation.

▪ It enables the managers in detecting wastage of cost from each part of the firm.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

▪ It helps the managers in formation of effective strategies and plans so as to

monitor and analyse total cost incurred by the company during a specific time

period.

▪ It is required for determining each type of cost incurred by business on production

and other business operations.

● Price optimisation system: Price optimisation system is adopted by the companies for

the purpose of setting price to be charged from the customers against goods or services

provided to them. In this system of management accounting, the managers evaluated the

maximum price that a customer would be agree to pay against the goods or services

provided to them (Maas and et.al., 2016). They also analyse the minimum price that

would be needed to charged by the company for the products in order to eliminate

chances of suffering losses from the sales. Managers compares both prices and sets the

most appropriate price to be charged for the goods and services provided by the company

to its customers.

Requirements:

▪ It is required to be adopted by manufacturing units.

▪ It is required to set the optimum price of product so as to attract maximum

customers towards the company.

▪ It helps in sustaining the consumers with company for a long time.

● Inventory management system: Inventory management system refers to a system that

helps the managers in performing their managerial functions effectively for managing the

stock maintained by the company. It enables the firm in having effective monitoring of

movement of the stock. Furthermore, this system helps in maintaining detailed record of

each movement of stock within the business. In this order, this system helps the

company's managers in detecting the requirement of stock and eliminating its wastage as

well.

Requirement:

5

monitor and analyse total cost incurred by the company during a specific time

period.

▪ It is required for determining each type of cost incurred by business on production

and other business operations.

● Price optimisation system: Price optimisation system is adopted by the companies for

the purpose of setting price to be charged from the customers against goods or services

provided to them. In this system of management accounting, the managers evaluated the

maximum price that a customer would be agree to pay against the goods or services

provided to them (Maas and et.al., 2016). They also analyse the minimum price that

would be needed to charged by the company for the products in order to eliminate

chances of suffering losses from the sales. Managers compares both prices and sets the

most appropriate price to be charged for the goods and services provided by the company

to its customers.

Requirements:

▪ It is required to be adopted by manufacturing units.

▪ It is required to set the optimum price of product so as to attract maximum

customers towards the company.

▪ It helps in sustaining the consumers with company for a long time.

● Inventory management system: Inventory management system refers to a system that

helps the managers in performing their managerial functions effectively for managing the

stock maintained by the company. It enables the firm in having effective monitoring of

movement of the stock. Furthermore, this system helps in maintaining detailed record of

each movement of stock within the business. In this order, this system helps the

company's managers in detecting the requirement of stock and eliminating its wastage as

well.

Requirement:

5

▪ This system is required for maintaining detailed record of each unit of stock of

firm.

▪ It helps in detecting the minimum requirement of inventory with the help of

which managers become able to avoid insufficiency of stock.

▪ It is required for ensuring elimination of inventories within the business.

Hence, it can be evaluated that there are various types of management accounting system.

These can be adopted by the managers while managing various monitory and non monitory

activities of the business.

Different methods of management accounting reporting

Management accounting reporting:

A process of analysing, summarising and recording various financial transactions made

by the company using professional skills and techniques of managerial accountants and

providing it to the mangers for helping them in their decision making process. These are

effective tools that helps in formulation of several statements and documents so as to maintaining

records of each business activities. Major methods of management accounting reporting are as

under:

● Inventory reports: Inventory reports are those that provides detailed information about

flow of stock in the business organisation along with price of each unit of stock moved

within or outside the company. These reports are essential to maintain for manufacturing

units as they needs to purchase several types of stocks with them for their production

purpose. Formulation of this report helps them in maintaining record of each type of

inventory.

● Cash reports: Cast reports are essential report for organization because it helps in

manage cash weekly basis. All cash transaction includes in this report that means cash

comes and goes from organization so this transaction record in this report. It is very

useful because this report make easy tu calculates all transaction.

● Cost reports: it is a financial report that helps to identify cost and charges of products,

process and project (Types of Managerial Accounting Reports. 2019) . In order to report

6

firm.

▪ It helps in detecting the minimum requirement of inventory with the help of

which managers become able to avoid insufficiency of stock.

▪ It is required for ensuring elimination of inventories within the business.

Hence, it can be evaluated that there are various types of management accounting system.

These can be adopted by the managers while managing various monitory and non monitory

activities of the business.

Different methods of management accounting reporting

Management accounting reporting:

A process of analysing, summarising and recording various financial transactions made

by the company using professional skills and techniques of managerial accountants and

providing it to the mangers for helping them in their decision making process. These are

effective tools that helps in formulation of several statements and documents so as to maintaining

records of each business activities. Major methods of management accounting reporting are as

under:

● Inventory reports: Inventory reports are those that provides detailed information about

flow of stock in the business organisation along with price of each unit of stock moved

within or outside the company. These reports are essential to maintain for manufacturing

units as they needs to purchase several types of stocks with them for their production

purpose. Formulation of this report helps them in maintaining record of each type of

inventory.

● Cash reports: Cast reports are essential report for organization because it helps in

manage cash weekly basis. All cash transaction includes in this report that means cash

comes and goes from organization so this transaction record in this report. It is very

useful because this report make easy tu calculates all transaction.

● Cost reports: it is a financial report that helps to identify cost and charges of products,

process and project (Types of Managerial Accounting Reports. 2019) . In order to report

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the correct amounts on a organization financial statement. This report helps to control of

the organization. Organization get helps through this report and control on excess cost.

● Performance reports: this report includes all data and information about work

performance. It provides all needed information to stakeholders and it is very important

for organization to communication management plan.

● Budgets reports: budget report is a financial report that are make by organization

according to need. It prepares estimate of firm's cost and revenue for an operating period.

This report helps to organization in comparison of previous year and current year

estimates and make budget for future.

Different techniques of management accounting system

Techniques of management accounting systems:

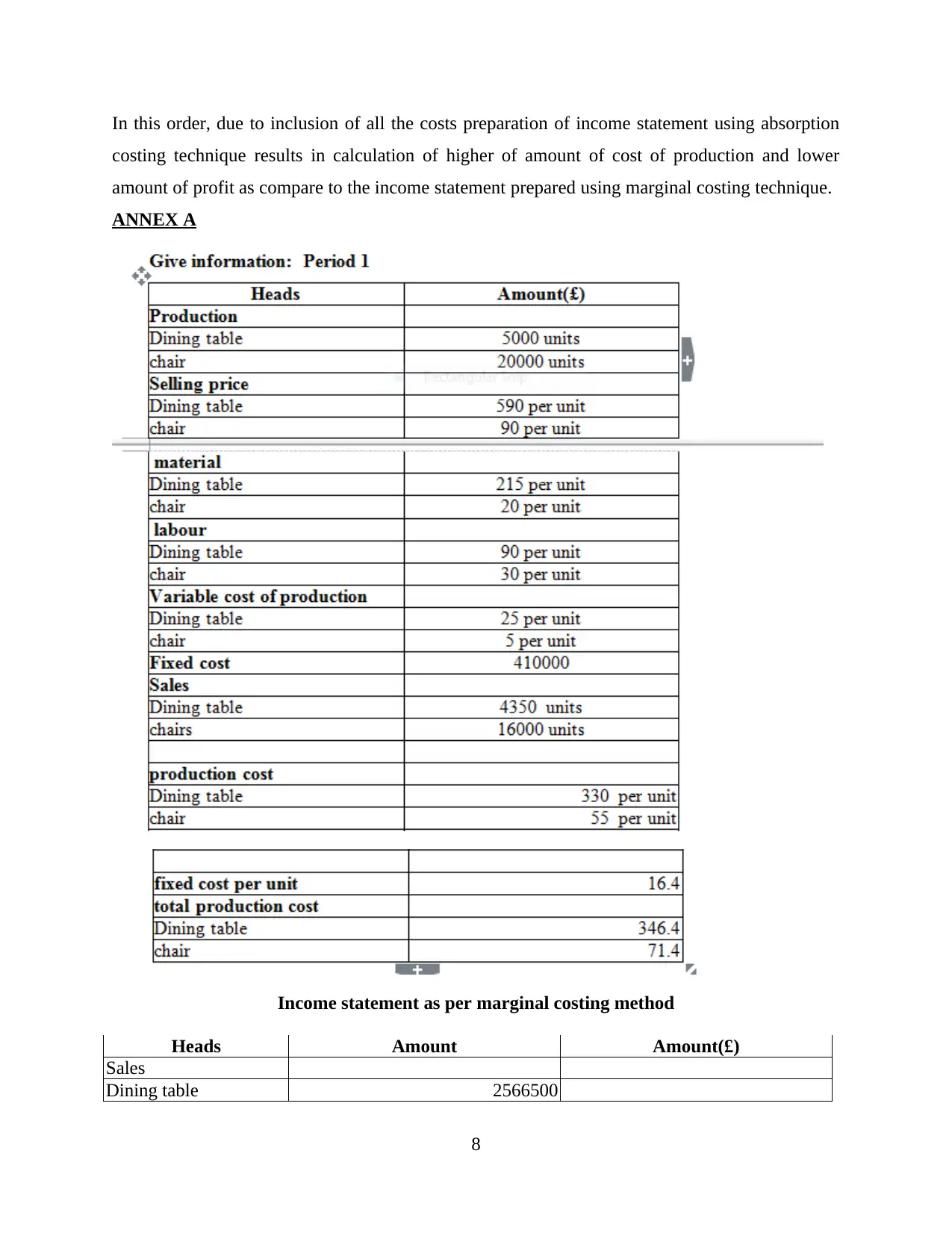

Techniques of management accounting systems are methods that can be used for the

purpose of preparing income statement of the company for determining financial position of the

company. Marginal costing system and absorption costing system are two major techniques used

by the managers for formulation of income statements (Bromwich and et.al., 2016). Each method

provides different results of regarding income generated by the business during a period as both

techniques provide different methods for calculating several elements of income statement such

as production cost.

Different techniques of management accounting system can be analysed as under:

● Marginal costing system: This is the technique for formulation of income statement of

the company for a specific time period. This technique considers variable cost as a

product cost. On the other hand, all the fixed costs incurred by a business is considered as

a product cost. In this regard, fixed cost are not considered as a part of production cost

while calculating profit for the business.

● Absorption costing system: Absorption costing is also another technique of producing

income statement of the company. In this technique each cost incurred by the firm for

production purpose including all the fixed and variable expenses are considered as a part

of production cost at the time of calculating profit for the year (Gullberg, 2016).

7

the organization. Organization get helps through this report and control on excess cost.

● Performance reports: this report includes all data and information about work

performance. It provides all needed information to stakeholders and it is very important

for organization to communication management plan.

● Budgets reports: budget report is a financial report that are make by organization

according to need. It prepares estimate of firm's cost and revenue for an operating period.

This report helps to organization in comparison of previous year and current year

estimates and make budget for future.

Different techniques of management accounting system

Techniques of management accounting systems:

Techniques of management accounting systems are methods that can be used for the

purpose of preparing income statement of the company for determining financial position of the

company. Marginal costing system and absorption costing system are two major techniques used

by the managers for formulation of income statements (Bromwich and et.al., 2016). Each method

provides different results of regarding income generated by the business during a period as both

techniques provide different methods for calculating several elements of income statement such

as production cost.

Different techniques of management accounting system can be analysed as under:

● Marginal costing system: This is the technique for formulation of income statement of

the company for a specific time period. This technique considers variable cost as a

product cost. On the other hand, all the fixed costs incurred by a business is considered as

a product cost. In this regard, fixed cost are not considered as a part of production cost

while calculating profit for the business.

● Absorption costing system: Absorption costing is also another technique of producing

income statement of the company. In this technique each cost incurred by the firm for

production purpose including all the fixed and variable expenses are considered as a part

of production cost at the time of calculating profit for the year (Gullberg, 2016).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

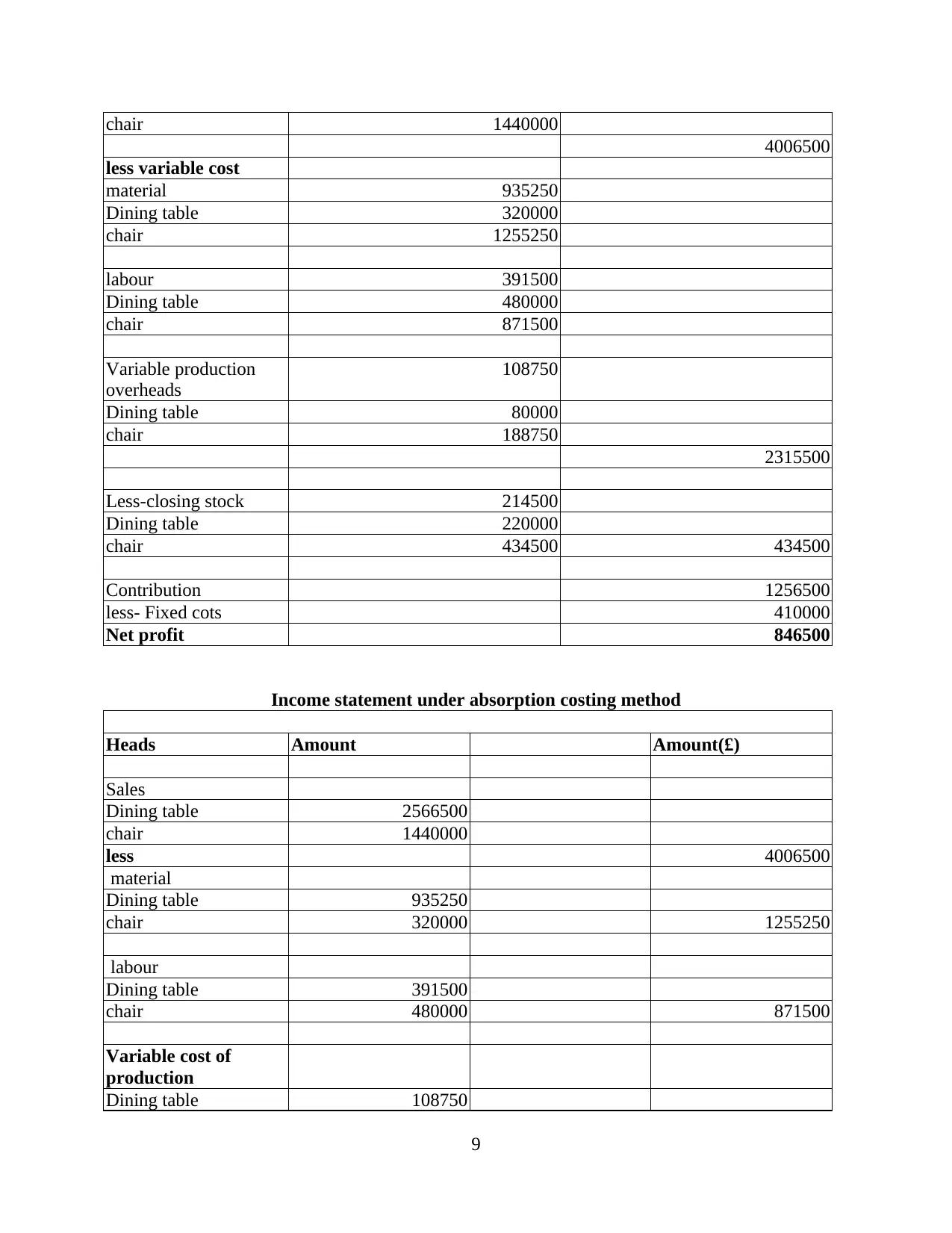

In this order, due to inclusion of all the costs preparation of income statement using absorption

costing technique results in calculation of higher of amount of cost of production and lower

amount of profit as compare to the income statement prepared using marginal costing technique.

ANNEX A

Income statement as per marginal costing method

Heads Amount Amount(£)

Sales

Dining table 2566500

8

costing technique results in calculation of higher of amount of cost of production and lower

amount of profit as compare to the income statement prepared using marginal costing technique.

ANNEX A

Income statement as per marginal costing method

Heads Amount Amount(£)

Sales

Dining table 2566500

8

chair 1440000

4006500

less variable cost

material 935250

Dining table 320000

chair 1255250

labour 391500

Dining table 480000

chair 871500

Variable production

overheads

108750

Dining table 80000

chair 188750

2315500

Less-closing stock 214500

Dining table 220000

chair 434500 434500

Contribution 1256500

less- Fixed cots 410000

Net profit 846500

Income statement under absorption costing method

Heads Amount Amount(£)

Sales

Dining table 2566500

chair 1440000

less 4006500

material

Dining table 935250

chair 320000 1255250

labour

Dining table 391500

chair 480000 871500

Variable cost of

production

Dining table 108750

9

4006500

less variable cost

material 935250

Dining table 320000

chair 1255250

labour 391500

Dining table 480000

chair 871500

Variable production

overheads

108750

Dining table 80000

chair 188750

2315500

Less-closing stock 214500

Dining table 220000

chair 434500 434500

Contribution 1256500

less- Fixed cots 410000

Net profit 846500

Income statement under absorption costing method

Heads Amount Amount(£)

Sales

Dining table 2566500

chair 1440000

less 4006500

material

Dining table 935250

chair 320000 1255250

labour

Dining table 391500

chair 480000 871500

Variable cost of

production

Dining table 108750

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

chair 80000

188750 2315500

less- Fixed cots 410000

Less-closing stock 410000

Dining table 225160

chair 285600 510760

510760

Net profit 770240

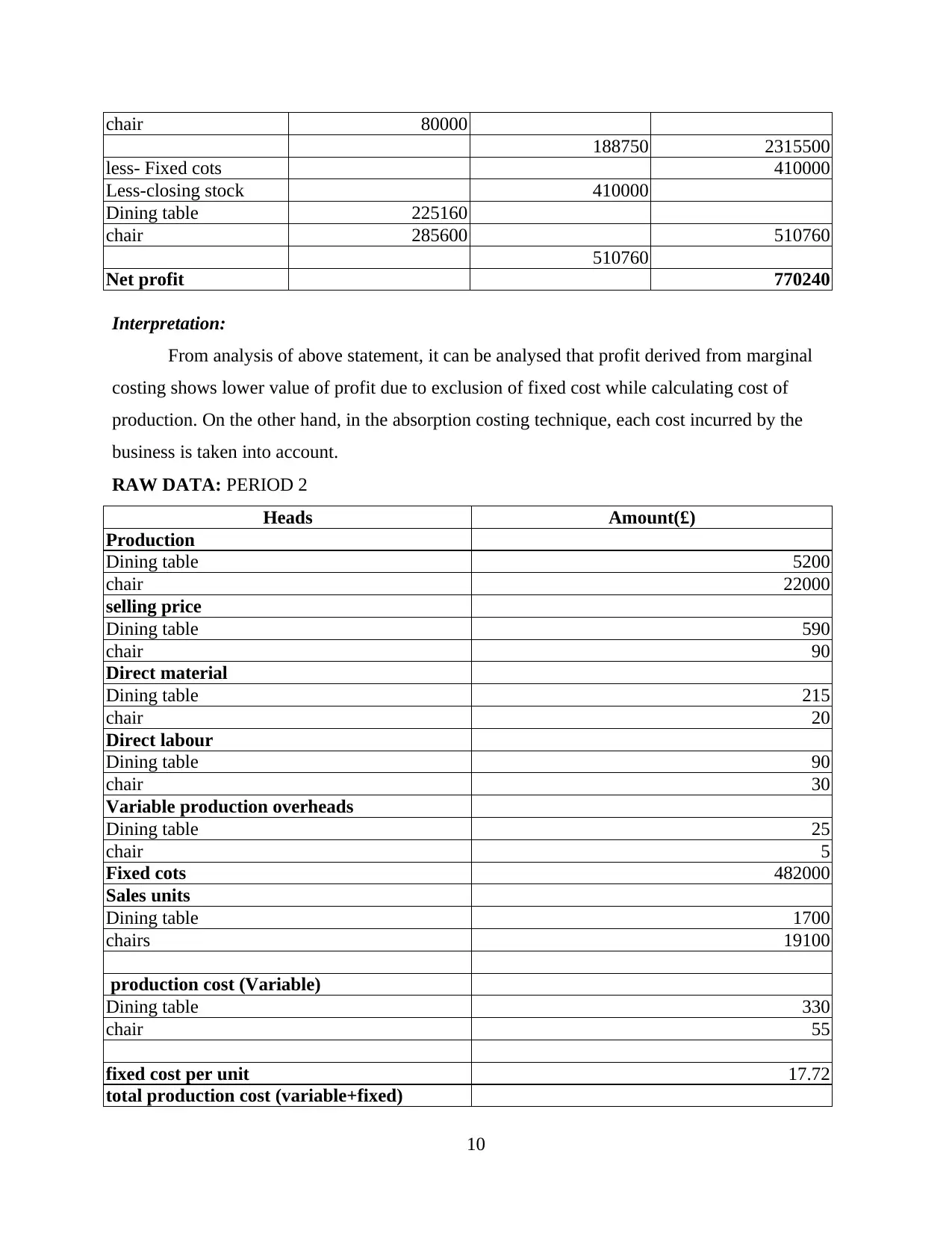

Interpretation:

From analysis of above statement, it can be analysed that profit derived from marginal

costing shows lower value of profit due to exclusion of fixed cost while calculating cost of

production. On the other hand, in the absorption costing technique, each cost incurred by the

business is taken into account.

RAW DATA: PERIOD 2

Heads Amount(£)

Production

Dining table 5200

chair 22000

selling price

Dining table 590

chair 90

Direct material

Dining table 215

chair 20

Direct labour

Dining table 90

chair 30

Variable production overheads

Dining table 25

chair 5

Fixed cots 482000

Sales units

Dining table 1700

chairs 19100

production cost (Variable)

Dining table 330

chair 55

fixed cost per unit 17.72

total production cost (variable+fixed)

10

188750 2315500

less- Fixed cots 410000

Less-closing stock 410000

Dining table 225160

chair 285600 510760

510760

Net profit 770240

Interpretation:

From analysis of above statement, it can be analysed that profit derived from marginal

costing shows lower value of profit due to exclusion of fixed cost while calculating cost of

production. On the other hand, in the absorption costing technique, each cost incurred by the

business is taken into account.

RAW DATA: PERIOD 2

Heads Amount(£)

Production

Dining table 5200

chair 22000

selling price

Dining table 590

chair 90

Direct material

Dining table 215

chair 20

Direct labour

Dining table 90

chair 30

Variable production overheads

Dining table 25

chair 5

Fixed cots 482000

Sales units

Dining table 1700

chairs 19100

production cost (Variable)

Dining table 330

chair 55

fixed cost per unit 17.72

total production cost (variable+fixed)

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Dining table 347.7

chair 72.7

closing stock units

(opening stock+purchases-sales)

Dining table 650

chair 4000

opening stock

Dining table 4150

chair 6900

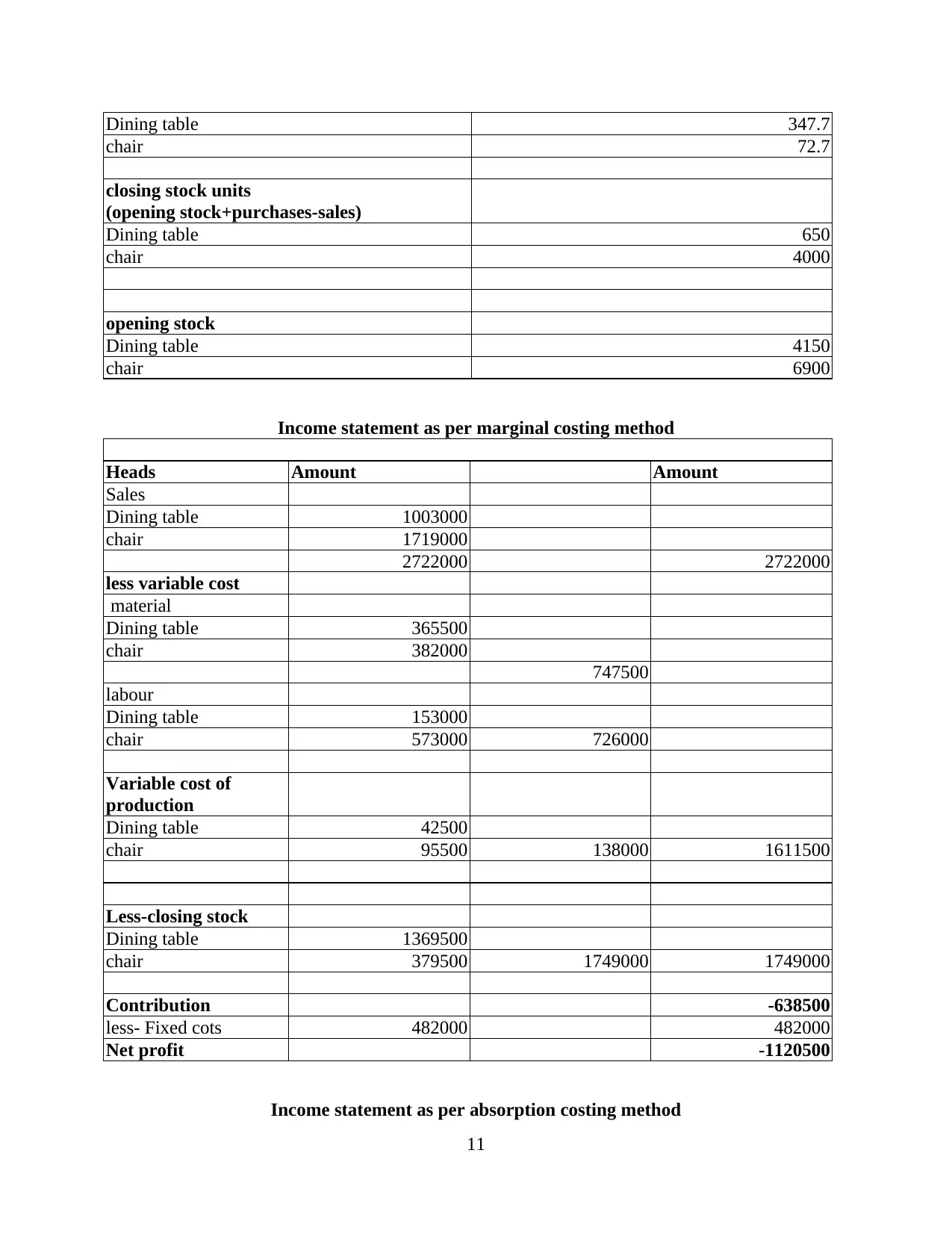

Income statement as per marginal costing method

Heads Amount Amount

Sales

Dining table 1003000

chair 1719000

2722000 2722000

less variable cost

material

Dining table 365500

chair 382000

747500

labour

Dining table 153000

chair 573000 726000

Variable cost of

production

Dining table 42500

chair 95500 138000 1611500

Less-closing stock

Dining table 1369500

chair 379500 1749000 1749000

Contribution -638500

less- Fixed cots 482000 482000

Net profit -1120500

Income statement as per absorption costing method

11

chair 72.7

closing stock units

(opening stock+purchases-sales)

Dining table 650

chair 4000

opening stock

Dining table 4150

chair 6900

Income statement as per marginal costing method

Heads Amount Amount

Sales

Dining table 1003000

chair 1719000

2722000 2722000

less variable cost

material

Dining table 365500

chair 382000

747500

labour

Dining table 153000

chair 573000 726000

Variable cost of

production

Dining table 42500

chair 95500 138000 1611500

Less-closing stock

Dining table 1369500

chair 379500 1749000 1749000

Contribution -638500

less- Fixed cots 482000 482000

Net profit -1120500

Income statement as per absorption costing method

11

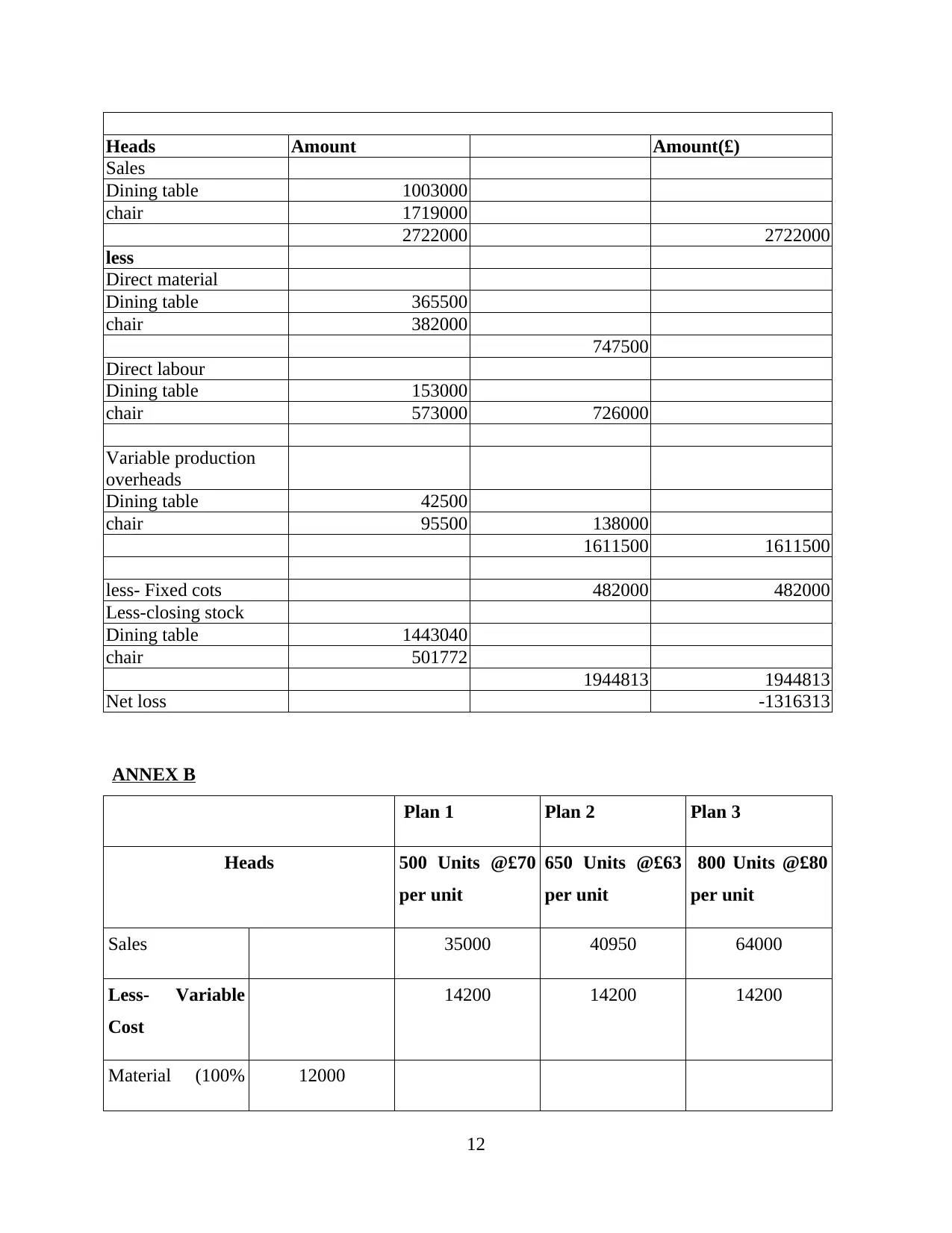

Heads Amount Amount(£)

Sales

Dining table 1003000

chair 1719000

2722000 2722000

less

Direct material

Dining table 365500

chair 382000

747500

Direct labour

Dining table 153000

chair 573000 726000

Variable production

overheads

Dining table 42500

chair 95500 138000

1611500 1611500

less- Fixed cots 482000 482000

Less-closing stock

Dining table 1443040

chair 501772

1944813 1944813

Net loss -1316313

ANNEX B

Plan 1 Plan 2 Plan 3

Heads 500 Units @£70

per unit

650 Units @£63

per unit

800 Units @£80

per unit

Sales 35000 40950 64000

Less- Variable

Cost

14200 14200 14200

Material (100% 12000

12

Sales

Dining table 1003000

chair 1719000

2722000 2722000

less

Direct material

Dining table 365500

chair 382000

747500

Direct labour

Dining table 153000

chair 573000 726000

Variable production

overheads

Dining table 42500

chair 95500 138000

1611500 1611500

less- Fixed cots 482000 482000

Less-closing stock

Dining table 1443040

chair 501772

1944813 1944813

Net loss -1316313

ANNEX B

Plan 1 Plan 2 Plan 3

Heads 500 Units @£70

per unit

650 Units @£63

per unit

800 Units @£80

per unit

Sales 35000 40950 64000

Less- Variable

Cost

14200 14200 14200

Material (100% 12000

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.