Analysis of Management Accounting Techniques and Reporting

VerifiedAdded on 2020/10/04

|15

|4718

|39

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its application within the context of the Nero Company. It begins by defining management accounting and its various systems, including Management Information Systems (MIS), inventory control, job costing, and price optimizing systems, highlighting their advantages and importance in organizational contexts. The report then delves into different management accounting reporting methods, such as budgetary reporting, account receivable alignment, job costing reporting, and inventory management reporting, emphasizing their role in decision-making and strategic planning. Furthermore, it explores cost techniques like marginal and absorption costing, providing detailed calculations and analyses. The report also evaluates the advantages and disadvantages of various planning tools used in budgetary control, as well as how organizations adapt management accounting systems to respond to financial problems. Overall, the report showcases how management accounting is essential for effective financial reporting, cost analysis, and strategic decision-making, providing valuable insights into the dynamics of financial management within organizations.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

SECTION 1......................................................................................................................................1

P1Management accounting and necessity of various type of management accounting system. 1

P2 Different methods used for management accounting reporting.............................................3

M1 Benefits of management accounting system and their application in organisational context

.....................................................................................................................................................4

D1 Integration of management accounting reporting and management accounting system.......4

P3 Calculation of cost by using cost techniques such as marginal and absorption costing........5

M2 Accurate use of management accounting techniques for financial reporting.......................6

D2 Produce financial reports that accurately apply and interpret data for complex business

activities......................................................................................................................................7

SECTION 2......................................................................................................................................7

PART A...........................................................................................................................................7

P4 Advantages and disadvantages of various type of planning tools used in budgetary control7

M3 Use of different type of planning tools and their use for forecasting and preparing budget 9

D3 measurement of planning tools to respond financial problems to lead organisation............9

PART B............................................................................................................................................9

P5 Evaluate how organisations are adapting management accounting system to respond

finance problems.........................................................................................................................9

M4 How organisations are leading by using management accounting system to respond

problems....................................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

SECTION 1......................................................................................................................................1

P1Management accounting and necessity of various type of management accounting system. 1

P2 Different methods used for management accounting reporting.............................................3

M1 Benefits of management accounting system and their application in organisational context

.....................................................................................................................................................4

D1 Integration of management accounting reporting and management accounting system.......4

P3 Calculation of cost by using cost techniques such as marginal and absorption costing........5

M2 Accurate use of management accounting techniques for financial reporting.......................6

D2 Produce financial reports that accurately apply and interpret data for complex business

activities......................................................................................................................................7

SECTION 2......................................................................................................................................7

PART A...........................................................................................................................................7

P4 Advantages and disadvantages of various type of planning tools used in budgetary control7

M3 Use of different type of planning tools and their use for forecasting and preparing budget 9

D3 measurement of planning tools to respond financial problems to lead organisation............9

PART B............................................................................................................................................9

P5 Evaluate how organisations are adapting management accounting system to respond

finance problems.........................................................................................................................9

M4 How organisations are leading by using management accounting system to respond

problems....................................................................................................................................11

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................12

INTRODUCTION

Organisation are adapting management accounting to attain core competence subject to

management and operation. There are various type of management accounting system are used

by the organisation for effective management and operation. This unit is prepared to demonstrate

the dynamics of various management accounting system (Baldvinsdottir, Mitchell and Nørreklit,

2010). Wide range of management accounting techniques are used to calculate profit and cost of

products. Use of planning tools are used in management accounting defined in this context.

Various ways are compared in respect of use of management accounting to respond financial

problems. This unit is divided in 2 units in which Nero company is opted to evaluate the role of

management accounting subject to growth and development of organisation.

SECTION 1

P1Management accounting and necessity of various type of management accounting system

Management accounting

Managerial accounting is one of the popular aspect in respect of managing and operating

the business operations and function. Management accounting is a set of multiple standards,

principles, concepts, financial and accounting knowledge. It is required to understand the

meaning of management accounting in respect of responding financial problems and complex

issues. Essential decisions and plans depends upon effective management of financial resources.

It is also helpful to make important business strategies and plans for development and

growth of the organisation. It requires in depth knowledge about finance and accounting rule to

deliver the essential financial information and data (Fullerton, Kennedy and Widener, 2014).

These information and data are use to frame new business plans and strategies and decision

making process. Junior accountants and finance managers remain responsible to make strategies

and plans for better operation and management.

International accounting and financial standards, rules, guidelines and procedures are

considered in management accounting. IFRS, CIMA and ISA are the main governed authorities

which provides rules and guidelines in respect of retaining financial records and accounting

information in books and records.

Various type of management accounting system and their importance

Management Information System (MIS): Technology and advancement has given lots

of useful and important inventions to improve the tactics of business. MIS is also one of the

1

Organisation are adapting management accounting to attain core competence subject to

management and operation. There are various type of management accounting system are used

by the organisation for effective management and operation. This unit is prepared to demonstrate

the dynamics of various management accounting system (Baldvinsdottir, Mitchell and Nørreklit,

2010). Wide range of management accounting techniques are used to calculate profit and cost of

products. Use of planning tools are used in management accounting defined in this context.

Various ways are compared in respect of use of management accounting to respond financial

problems. This unit is divided in 2 units in which Nero company is opted to evaluate the role of

management accounting subject to growth and development of organisation.

SECTION 1

P1Management accounting and necessity of various type of management accounting system

Management accounting

Managerial accounting is one of the popular aspect in respect of managing and operating

the business operations and function. Management accounting is a set of multiple standards,

principles, concepts, financial and accounting knowledge. It is required to understand the

meaning of management accounting in respect of responding financial problems and complex

issues. Essential decisions and plans depends upon effective management of financial resources.

It is also helpful to make important business strategies and plans for development and

growth of the organisation. It requires in depth knowledge about finance and accounting rule to

deliver the essential financial information and data (Fullerton, Kennedy and Widener, 2014).

These information and data are use to frame new business plans and strategies and decision

making process. Junior accountants and finance managers remain responsible to make strategies

and plans for better operation and management.

International accounting and financial standards, rules, guidelines and procedures are

considered in management accounting. IFRS, CIMA and ISA are the main governed authorities

which provides rules and guidelines in respect of retaining financial records and accounting

information in books and records.

Various type of management accounting system and their importance

Management Information System (MIS): Technology and advancement has given lots

of useful and important inventions to improve the tactics of business. MIS is also one of the

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

example of advanced and structured system for managing and operating the departments of an

organisation. It is a system which is made of statistical and analytical software and programs.

Management information system helps provides computer based summarised information related

to departments and sections of an organisation. More over the information helps to identify the

affecting factors and conflicts which occurs in decision making and strategic planning. Basically

MIS system assist managers and accountants in decision making process.

Inventory control and management system: in manufacturing and retail industries

inventory management is one of the challenging task for managers and store keepers (Herzig,

Viere and Burritt, 2012). These are the organisation which face huge amount of fluctuating of

raw material and stock. Inventory management and control system helps provides a path to

manage and control the flow of raw stocks and finish goods in stores and in manufacturing

process. ABC system, LIFO, FIFO and weighted average method of calculating the cost of

inventory are the most common methods which are used by the organisation in present situation.

Job costing system: Organisations which operates more than one sections and

departments are considered as multi section and multi purpose organisation. Managers and

accountants would become eligible to manage the departments and sections in structured form.

There is a separate records and information are maintained for each department and section.

There is a consolidated and summarised information prepared by the managers and the

accountants which helps the senior authorities to make business plans.

Price optimising system: this is the method which helps to identifying the cost affecting

factors. This system remain essential for sales and production managers subject to making

pricing policy and cost consumption strategies. There is a detailed analysis done by the

accountants and the managers in order to identify the cost and profitability. All the prime cost

such as direct material, direct labour and direct expenses are consolidated in single form to

ascertain the net cost of the product. After adding profit margin the sale price of the product is

determined by the managers (Lambert and Sponem, 2012). This is also a part of decision making

in which cost accountants and finance managers contribute their skills and knowledge to

optimise the prices and cost of the product to attain profit.

Advantages of management accounting system

2

organisation. It is a system which is made of statistical and analytical software and programs.

Management information system helps provides computer based summarised information related

to departments and sections of an organisation. More over the information helps to identify the

affecting factors and conflicts which occurs in decision making and strategic planning. Basically

MIS system assist managers and accountants in decision making process.

Inventory control and management system: in manufacturing and retail industries

inventory management is one of the challenging task for managers and store keepers (Herzig,

Viere and Burritt, 2012). These are the organisation which face huge amount of fluctuating of

raw material and stock. Inventory management and control system helps provides a path to

manage and control the flow of raw stocks and finish goods in stores and in manufacturing

process. ABC system, LIFO, FIFO and weighted average method of calculating the cost of

inventory are the most common methods which are used by the organisation in present situation.

Job costing system: Organisations which operates more than one sections and

departments are considered as multi section and multi purpose organisation. Managers and

accountants would become eligible to manage the departments and sections in structured form.

There is a separate records and information are maintained for each department and section.

There is a consolidated and summarised information prepared by the managers and the

accountants which helps the senior authorities to make business plans.

Price optimising system: this is the method which helps to identifying the cost affecting

factors. This system remain essential for sales and production managers subject to making

pricing policy and cost consumption strategies. There is a detailed analysis done by the

accountants and the managers in order to identify the cost and profitability. All the prime cost

such as direct material, direct labour and direct expenses are consolidated in single form to

ascertain the net cost of the product. After adding profit margin the sale price of the product is

determined by the managers (Lambert and Sponem, 2012). This is also a part of decision making

in which cost accountants and finance managers contribute their skills and knowledge to

optimise the prices and cost of the product to attain profit.

Advantages of management accounting system

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Job costing helps the managers and accountants to maintain separate records and books

for individual departments and jobs. It helps to analyse the performance of the

organisation in respect of better control and management.

To attain financial core competence price optimising method helps the managers to make

effective pricing strategies (Van Helden and Northcott, 2010). There is lack of errors

found while calculating profit and cost of the product. This method helps to maintain the

consistency and discipline in order to get earlier results in decision making.

Inventory management and control provides a path to managers to control the flow of

stock and material in process and in stores. It bifurcate the stock as per the feasibility and

nature.

P2 Different methods used for management accounting reporting

Reporting is the part of decision making in subject to make effective strategies and plans.

Role of management accounting report is being considered essential in small and medium size

business and enterprises. Entity owners and directors evaluate the performance of the

organisation subject to evaluating the performance of organisation. It is one of the essential

requirement for better management and operation. With the help of reports forecasting and

budgeting process become more fluent and easy for managers and accountants. Different kind of

management accounting reporting methods are used in organisation such as:

Budgetary reporting method: Budget reports help to consolidate the information of

subject to identify the information in respect of analysing the performance of organisation.

Budgets build the strong credibility and feasibility of the accounting to make future aspect and

feasibility. Budgetary reporting methods are used to summarise the complex and critical

forecasting situations in for better control and effectiveness (Lukka and Modell, 2010). Mostly

budgets are prepared on the basis of expenditure and income of prior period and last financial

statements. Budgets helps to create sustainability with in for the better growth and development

of organisation. These reports remain beneficial for investors, financiers, stakeholders, stock

holders and government.

Account receivable alignment: this method helps to track the records of debtors and

clients subject to getting the payments. This is one of the essential tool which helps to manage

the cash flow for companies which remain associated with providing credit. It helps the

managers to bifurcate the time limit for getting the payments from debtors and clients. Senior

3

for individual departments and jobs. It helps to analyse the performance of the

organisation in respect of better control and management.

To attain financial core competence price optimising method helps the managers to make

effective pricing strategies (Van Helden and Northcott, 2010). There is lack of errors

found while calculating profit and cost of the product. This method helps to maintain the

consistency and discipline in order to get earlier results in decision making.

Inventory management and control provides a path to managers to control the flow of

stock and material in process and in stores. It bifurcate the stock as per the feasibility and

nature.

P2 Different methods used for management accounting reporting

Reporting is the part of decision making in subject to make effective strategies and plans.

Role of management accounting report is being considered essential in small and medium size

business and enterprises. Entity owners and directors evaluate the performance of the

organisation subject to evaluating the performance of organisation. It is one of the essential

requirement for better management and operation. With the help of reports forecasting and

budgeting process become more fluent and easy for managers and accountants. Different kind of

management accounting reporting methods are used in organisation such as:

Budgetary reporting method: Budget reports help to consolidate the information of

subject to identify the information in respect of analysing the performance of organisation.

Budgets build the strong credibility and feasibility of the accounting to make future aspect and

feasibility. Budgetary reporting methods are used to summarise the complex and critical

forecasting situations in for better control and effectiveness (Lukka and Modell, 2010). Mostly

budgets are prepared on the basis of expenditure and income of prior period and last financial

statements. Budgets helps to create sustainability with in for the better growth and development

of organisation. These reports remain beneficial for investors, financiers, stakeholders, stock

holders and government.

Account receivable alignment: this method helps to track the records of debtors and

clients subject to getting the payments. This is one of the essential tool which helps to manage

the cash flow for companies which remain associated with providing credit. It helps the

managers to bifurcate the time limit for getting the payments from debtors and clients. Senior

3

management authority become eligible to make the credit policy as per the credibility of

customers and debtors. Mostly account receivable reports are maintained subject to analysing

optimum credit policy such as 30 days, 60 days and 90 days. This provides effective strategy in

order to manage the collection process of organisation.

Job costing reporting method: this reporting method analyse the various type of costing

methods which helps to classify the expenditure and income. Previous records such as income

and expenditure statements, cash flow statements and financial position statements are used to

analyse the information and making budget for upcoming events and projects (Macintosh and

Quattrone, 2010). This reporting method helps to make the reports for individual task, project

and job centres. Individual analysation of expenditure and income are dine in respect of

individual job centres. This method basically used to identify high earning areas of the business

and providing effective strategies in order to increase the performance and profitability of low

cost areas.

Inventory and management reporting methods: this reporting method helps

storekeepers, management authorities and factory departments to track the records of inventories

and stock. This method assist managers to produce inventory management reports such as stock

in stores, inventories in process and finished goods products (van der Steen, 2011). There is a

detailed information provided in inventory management reports such as cost per unit, raw

material usage and labour cost per unit. There is a comparison done in respect of analysing the

prices and profit margin subject to organise the stores and production departments. This method

helps to assemble different product line and bifurcate the product type. Best product department

are bifurcated after analysing these reports.

M1 Benefits of management accounting system and their application in organisational context

Scope of management accounting has become vast in order to manage and operating

business operations effectively and efficiently. With the help of management accounting system

managers and accountants become eligible to sort out the complex business situations and

financial problems. Being a part of decision making and strategic control it is very useful for the

organisation.

D1 Integration of management accounting reporting and management accounting system

Management accounting system assist mangers and accountants to maintain an order of

management and recording the transactions to track daily business activities. Whereas,

4

customers and debtors. Mostly account receivable reports are maintained subject to analysing

optimum credit policy such as 30 days, 60 days and 90 days. This provides effective strategy in

order to manage the collection process of organisation.

Job costing reporting method: this reporting method analyse the various type of costing

methods which helps to classify the expenditure and income. Previous records such as income

and expenditure statements, cash flow statements and financial position statements are used to

analyse the information and making budget for upcoming events and projects (Macintosh and

Quattrone, 2010). This reporting method helps to make the reports for individual task, project

and job centres. Individual analysation of expenditure and income are dine in respect of

individual job centres. This method basically used to identify high earning areas of the business

and providing effective strategies in order to increase the performance and profitability of low

cost areas.

Inventory and management reporting methods: this reporting method helps

storekeepers, management authorities and factory departments to track the records of inventories

and stock. This method assist managers to produce inventory management reports such as stock

in stores, inventories in process and finished goods products (van der Steen, 2011). There is a

detailed information provided in inventory management reports such as cost per unit, raw

material usage and labour cost per unit. There is a comparison done in respect of analysing the

prices and profit margin subject to organise the stores and production departments. This method

helps to assemble different product line and bifurcate the product type. Best product department

are bifurcated after analysing these reports.

M1 Benefits of management accounting system and their application in organisational context

Scope of management accounting has become vast in order to manage and operating

business operations effectively and efficiently. With the help of management accounting system

managers and accountants become eligible to sort out the complex business situations and

financial problems. Being a part of decision making and strategic control it is very useful for the

organisation.

D1 Integration of management accounting reporting and management accounting system

Management accounting system assist mangers and accountants to maintain an order of

management and recording the transactions to track daily business activities. Whereas,

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management accounting reporting provides consolidated information of various departments and

sections which are used in decision making process.

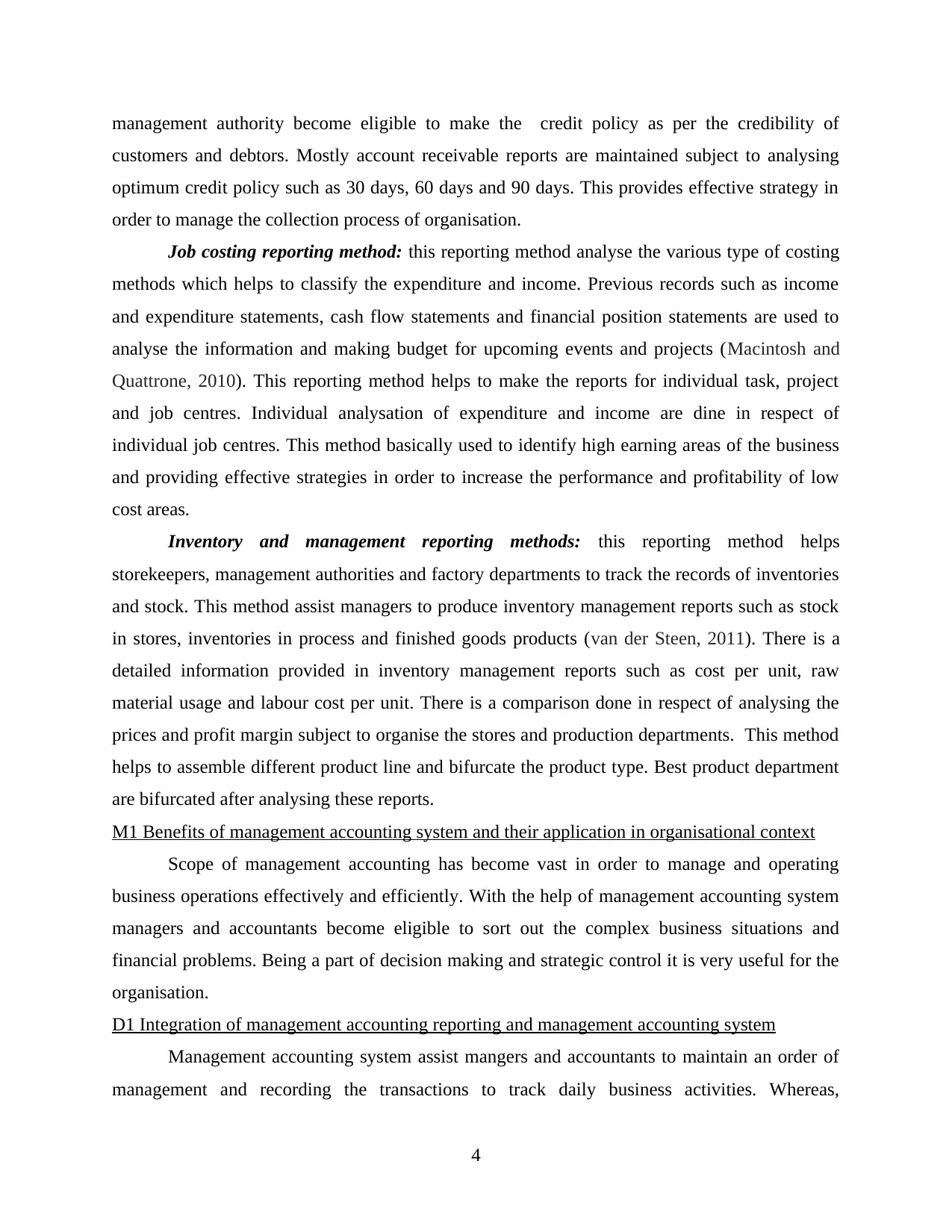

P3 Calculation of cost by using cost techniques such as marginal and absorption costing

Analysing the cost structure and making pricing strategies are the essential task for

managers and accountants (Parker, 2012). Various type of cost techniques are used to analyse the

cost and profit for the calculating profit. Below are two major cost evaluation techniques are

defined which are being used in organisation rapidly.

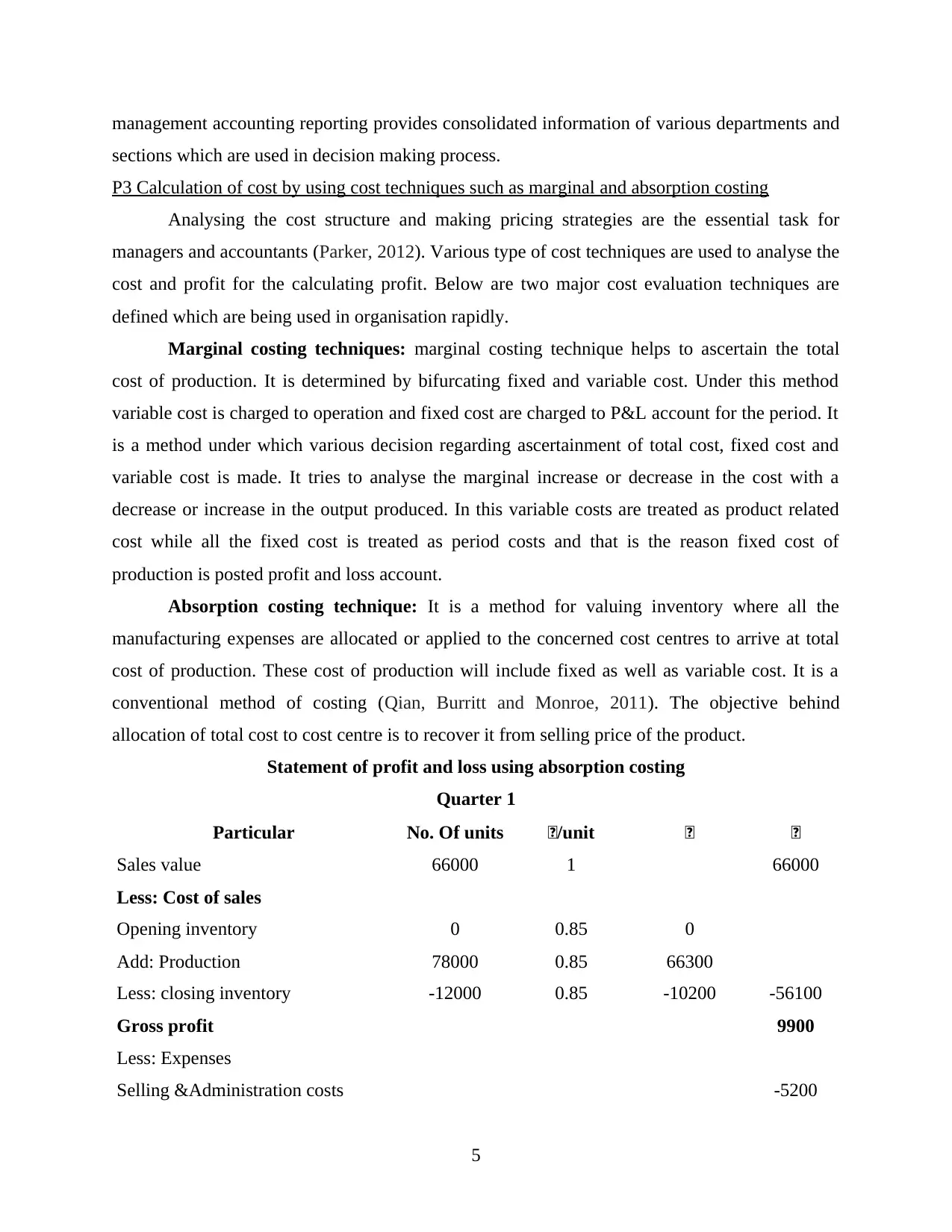

Marginal costing techniques: marginal costing technique helps to ascertain the total

cost of production. It is determined by bifurcating fixed and variable cost. Under this method

variable cost is charged to operation and fixed cost are charged to P&L account for the period. It

is a method under which various decision regarding ascertainment of total cost, fixed cost and

variable cost is made. It tries to analyse the marginal increase or decrease in the cost with a

decrease or increase in the output produced. In this variable costs are treated as product related

cost while all the fixed cost is treated as period costs and that is the reason fixed cost of

production is posted profit and loss account.

Absorption costing technique: It is a method for valuing inventory where all the

manufacturing expenses are allocated or applied to the concerned cost centres to arrive at total

cost of production. These cost of production will include fixed as well as variable cost. It is a

conventional method of costing (Qian, Burritt and Monroe, 2011). The objective behind

allocation of total cost to cost centre is to recover it from selling price of the product.

Statement of profit and loss using absorption costing

Quarter 1

Particular No. Of units £/unit £ £

Sales value 66000 1 66000

Less: Cost of sales

Opening inventory 0 0.85 0

Add: Production 78000 0.85 66300

Less: closing inventory -12000 0.85 -10200 -56100

Gross profit 9900

Less: Expenses

Selling &Administration costs -5200

5

sections which are used in decision making process.

P3 Calculation of cost by using cost techniques such as marginal and absorption costing

Analysing the cost structure and making pricing strategies are the essential task for

managers and accountants (Parker, 2012). Various type of cost techniques are used to analyse the

cost and profit for the calculating profit. Below are two major cost evaluation techniques are

defined which are being used in organisation rapidly.

Marginal costing techniques: marginal costing technique helps to ascertain the total

cost of production. It is determined by bifurcating fixed and variable cost. Under this method

variable cost is charged to operation and fixed cost are charged to P&L account for the period. It

is a method under which various decision regarding ascertainment of total cost, fixed cost and

variable cost is made. It tries to analyse the marginal increase or decrease in the cost with a

decrease or increase in the output produced. In this variable costs are treated as product related

cost while all the fixed cost is treated as period costs and that is the reason fixed cost of

production is posted profit and loss account.

Absorption costing technique: It is a method for valuing inventory where all the

manufacturing expenses are allocated or applied to the concerned cost centres to arrive at total

cost of production. These cost of production will include fixed as well as variable cost. It is a

conventional method of costing (Qian, Burritt and Monroe, 2011). The objective behind

allocation of total cost to cost centre is to recover it from selling price of the product.

Statement of profit and loss using absorption costing

Quarter 1

Particular No. Of units £/unit £ £

Sales value 66000 1 66000

Less: Cost of sales

Opening inventory 0 0.85 0

Add: Production 78000 0.85 66300

Less: closing inventory -12000 0.85 -10200 -56100

Gross profit 9900

Less: Expenses

Selling &Administration costs -5200

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Profit 4700

-Under absorption -2800

Profit reconciled 1900

Quarter2

Particular No. Of units £/unit £ £

Sales value 74000 1 74000

Less: Cost of sales

Opening inventory 12000 0.85 10200

+Production 66000 0.85 56100

66300

-closing inventory -4000 0.85 -3400 -62900

Gross profit 11100

Expenses

Selling &Administration costs -5200

Profit 5900

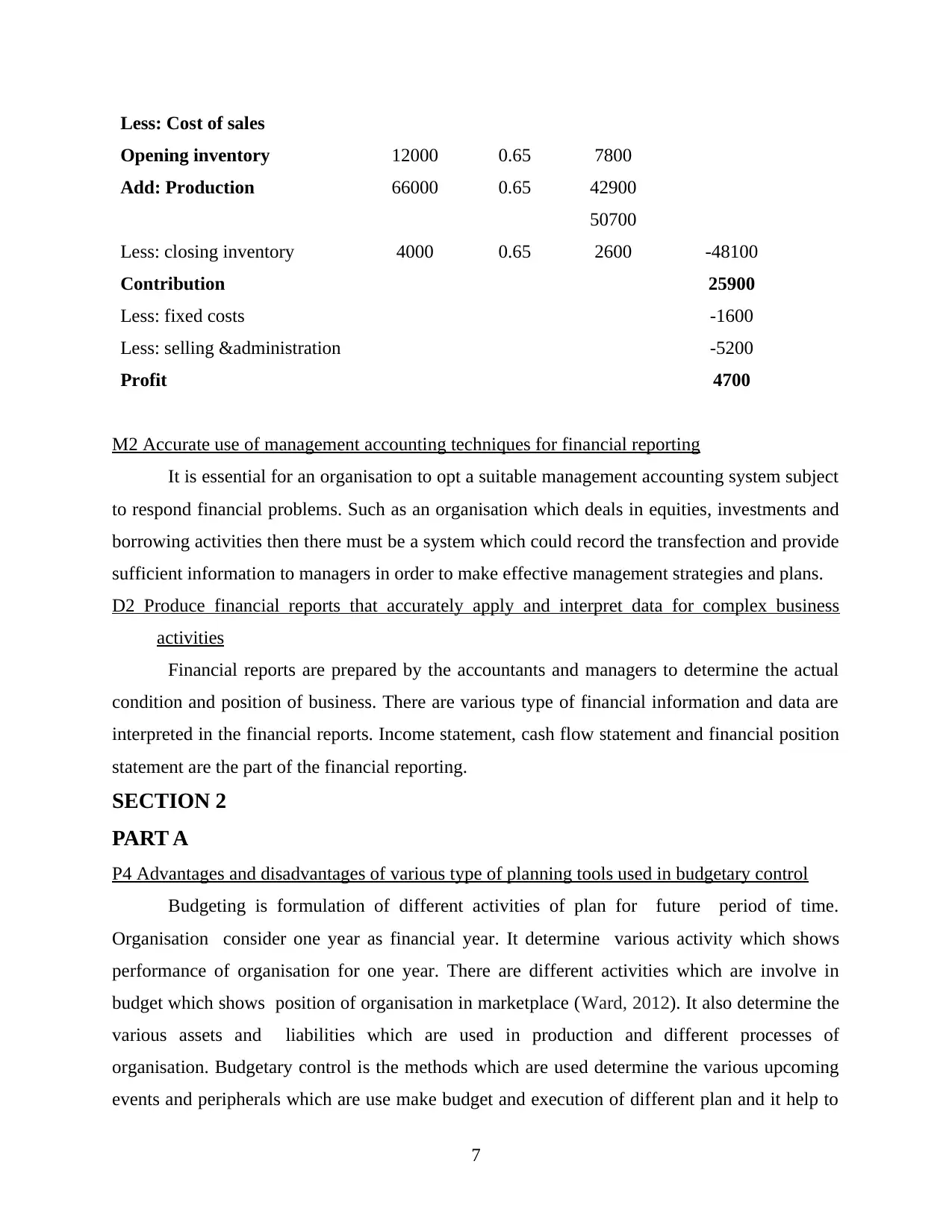

Statement of profit and loss using marginal costing

Quarter 1

Particular No. Of units £/unit £ £

Sales value 66000 1 66000

Less: Cost of sales

Opening inventory 0 0.65 0

Add: Production 78000 0.65 50700

50700

Less: closing inventory 12000 0.65 -7800 -42900

Contribution 23100

Less: fixed costs -16000

Less: selling &administration -5200

Profit 1900

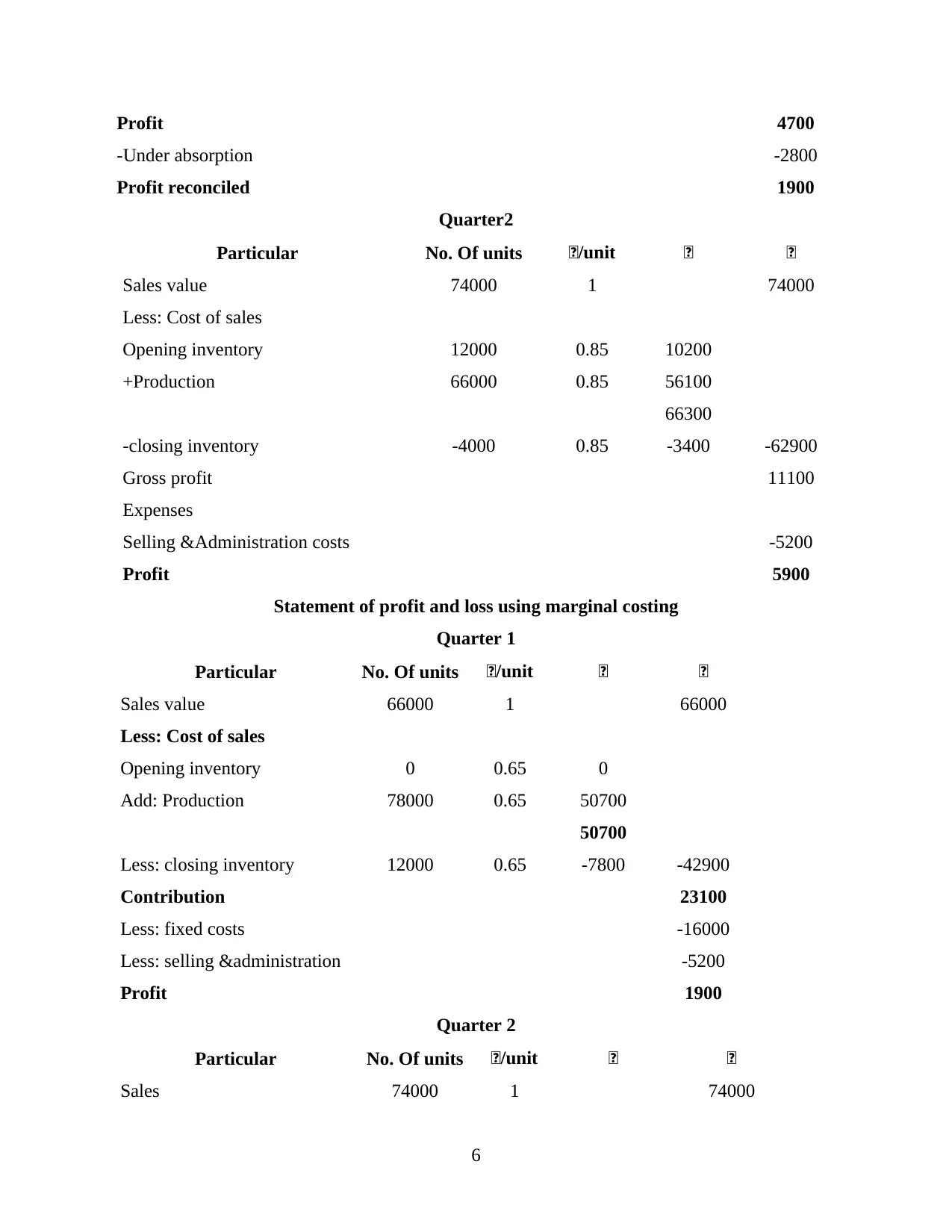

Quarter 2

Particular No. Of units £/unit £ £

Sales 74000 1 74000

6

-Under absorption -2800

Profit reconciled 1900

Quarter2

Particular No. Of units £/unit £ £

Sales value 74000 1 74000

Less: Cost of sales

Opening inventory 12000 0.85 10200

+Production 66000 0.85 56100

66300

-closing inventory -4000 0.85 -3400 -62900

Gross profit 11100

Expenses

Selling &Administration costs -5200

Profit 5900

Statement of profit and loss using marginal costing

Quarter 1

Particular No. Of units £/unit £ £

Sales value 66000 1 66000

Less: Cost of sales

Opening inventory 0 0.65 0

Add: Production 78000 0.65 50700

50700

Less: closing inventory 12000 0.65 -7800 -42900

Contribution 23100

Less: fixed costs -16000

Less: selling &administration -5200

Profit 1900

Quarter 2

Particular No. Of units £/unit £ £

Sales 74000 1 74000

6

Less: Cost of sales

Opening inventory 12000 0.65 7800

Add: Production 66000 0.65 42900

50700

Less: closing inventory 4000 0.65 2600 -48100

Contribution 25900

Less: fixed costs -1600

Less: selling &administration -5200

Profit 4700

M2 Accurate use of management accounting techniques for financial reporting

It is essential for an organisation to opt a suitable management accounting system subject

to respond financial problems. Such as an organisation which deals in equities, investments and

borrowing activities then there must be a system which could record the transfection and provide

sufficient information to managers in order to make effective management strategies and plans.

D2 Produce financial reports that accurately apply and interpret data for complex business

activities

Financial reports are prepared by the accountants and managers to determine the actual

condition and position of business. There are various type of financial information and data are

interpreted in the financial reports. Income statement, cash flow statement and financial position

statement are the part of the financial reporting.

SECTION 2

PART A

P4 Advantages and disadvantages of various type of planning tools used in budgetary control

Budgeting is formulation of different activities of plan for future period of time.

Organisation consider one year as financial year. It determine various activity which shows

performance of organisation for one year. There are different activities which are involve in

budget which shows position of organisation in marketplace (Ward, 2012). It also determine the

various assets and liabilities which are used in production and different processes of

organisation. Budgetary control is the methods which are used determine the various upcoming

events and peripherals which are use make budget and execution of different plan and it help to

7

Opening inventory 12000 0.65 7800

Add: Production 66000 0.65 42900

50700

Less: closing inventory 4000 0.65 2600 -48100

Contribution 25900

Less: fixed costs -1600

Less: selling &administration -5200

Profit 4700

M2 Accurate use of management accounting techniques for financial reporting

It is essential for an organisation to opt a suitable management accounting system subject

to respond financial problems. Such as an organisation which deals in equities, investments and

borrowing activities then there must be a system which could record the transfection and provide

sufficient information to managers in order to make effective management strategies and plans.

D2 Produce financial reports that accurately apply and interpret data for complex business

activities

Financial reports are prepared by the accountants and managers to determine the actual

condition and position of business. There are various type of financial information and data are

interpreted in the financial reports. Income statement, cash flow statement and financial position

statement are the part of the financial reporting.

SECTION 2

PART A

P4 Advantages and disadvantages of various type of planning tools used in budgetary control

Budgeting is formulation of different activities of plan for future period of time.

Organisation consider one year as financial year. It determine various activity which shows

performance of organisation for one year. There are different activities which are involve in

budget which shows position of organisation in marketplace (Ward, 2012). It also determine the

various assets and liabilities which are used in production and different processes of

organisation. Budgetary control is the methods which are used determine the various upcoming

events and peripherals which are use make budget and execution of different plan and it help to

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

determine the calculation of future costs. Budget provide rough figures of expenditure and saving

which are made in one financial year. There are various financial statement which are prepared

by the organisation in order to resolve the various issues and problems. Budgetary control

process help to analyses the various result and outcomes which are evaluated with projects.

Advantages of budgetary control process

This process aids to determine production cost and manufacturing cost. It provide

rough estimate which are concerned to different operation of organisation for one

financial years. It aids to make future plan and strategies to put control over different cost

of organisation.

While making various types of plan and budget organisation have strong financial and

capital structure which help to face different situation of business.

There are various factors and tools which aids to determine profitability and credibility

to perform different task with respects to budgets and plans.

Disadvantages of budgetary control process

It is very complex process which possesses lots of risk and uncertainness. It did not give

certain figure of expenses and incomes in order to achieve different goals and objectives

of organisations (Williams, 2014).

It resists new employees and manager to participate in making budget . The result and

outcomes are also remain uncertain while proposing various plan

Different types of planning tools which are used by different organisation in order to make

budget, there are various advantages and disadvantages of these planing tools.

Incremental budgeting methods: The budget is based on incremental distribution for

next fiscal year. It consists of whole organisation and various department which are

involve in making budget. There are various advantages and disadvantages of this

methods are given below:

Advantages

Incremental budgeting suits different organisation because it requires different funds

with little deviations.

It is used as a techniques by different organisation to eliminate various rivalries among

different organisations.

Disadvantages

8

which are made in one financial year. There are various financial statement which are prepared

by the organisation in order to resolve the various issues and problems. Budgetary control

process help to analyses the various result and outcomes which are evaluated with projects.

Advantages of budgetary control process

This process aids to determine production cost and manufacturing cost. It provide

rough estimate which are concerned to different operation of organisation for one

financial years. It aids to make future plan and strategies to put control over different cost

of organisation.

While making various types of plan and budget organisation have strong financial and

capital structure which help to face different situation of business.

There are various factors and tools which aids to determine profitability and credibility

to perform different task with respects to budgets and plans.

Disadvantages of budgetary control process

It is very complex process which possesses lots of risk and uncertainness. It did not give

certain figure of expenses and incomes in order to achieve different goals and objectives

of organisations (Williams, 2014).

It resists new employees and manager to participate in making budget . The result and

outcomes are also remain uncertain while proposing various plan

Different types of planning tools which are used by different organisation in order to make

budget, there are various advantages and disadvantages of these planing tools.

Incremental budgeting methods: The budget is based on incremental distribution for

next fiscal year. It consists of whole organisation and various department which are

involve in making budget. There are various advantages and disadvantages of this

methods are given below:

Advantages

Incremental budgeting suits different organisation because it requires different funds

with little deviations.

It is used as a techniques by different organisation to eliminate various rivalries among

different organisations.

Disadvantages

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It did not help to tackle large amount of risk which causes waste of resources in

organisations.

Incremental budgeting did not give fixed amount of investment of capital of

organisation.

Zero based budgeting : This method is concerned with calculation of all expenses and income

for justified period. All activities concerned with budget are start wit zero. There are different

advantages and disadvantages of zero based budget which are given below:

Advantages:

There are different cost which are saved while performing various operation.

This methods help to determine various opportunities in order to remove unproductive

activities of organisation.

Disadvantages

This method is very time consuming process.

This methods needs various experts in order to make budget.

Activity based budget: This methods is concerned with different activities which are related to

different cost in various functional area. It aids to calculate different rates like inflation,

recession and any other calculation (Zimmerman and Yahya-Zadeh, 2011).

Advantages:

It is more efficient in calculating various products, customers.

It help to determine position of company in marketplace.

Disadvantages

It is very time consuming processes to determine different process of budget.

This method is very complex method of budgeting due to lots of implemented in it.

M3 Use of different type of planning tools and their use for forecasting and preparing budget

Planning tools such as forecasting reports, graphs, trend analysis and situational analysis

help managers to resolve the uncertain and complex accounting situations. It not only helps to

forecast the future aspect and events but also helps managers to make budgets. Situational

analyse provides vast information about future opportunities for growth and development.

D3 measurement of planning tools to respond financial problems to lead organisation

Business organisations and small business entities are understanding the scope and role of

planning tools for future sustainable of business. Planning tools helps the organisation to make

9

organisations.

Incremental budgeting did not give fixed amount of investment of capital of

organisation.

Zero based budgeting : This method is concerned with calculation of all expenses and income

for justified period. All activities concerned with budget are start wit zero. There are different

advantages and disadvantages of zero based budget which are given below:

Advantages:

There are different cost which are saved while performing various operation.

This methods help to determine various opportunities in order to remove unproductive

activities of organisation.

Disadvantages

This method is very time consuming process.

This methods needs various experts in order to make budget.

Activity based budget: This methods is concerned with different activities which are related to

different cost in various functional area. It aids to calculate different rates like inflation,

recession and any other calculation (Zimmerman and Yahya-Zadeh, 2011).

Advantages:

It is more efficient in calculating various products, customers.

It help to determine position of company in marketplace.

Disadvantages

It is very time consuming processes to determine different process of budget.

This method is very complex method of budgeting due to lots of implemented in it.

M3 Use of different type of planning tools and their use for forecasting and preparing budget

Planning tools such as forecasting reports, graphs, trend analysis and situational analysis

help managers to resolve the uncertain and complex accounting situations. It not only helps to

forecast the future aspect and events but also helps managers to make budgets. Situational

analyse provides vast information about future opportunities for growth and development.

D3 measurement of planning tools to respond financial problems to lead organisation

Business organisations and small business entities are understanding the scope and role of

planning tools for future sustainable of business. Planning tools helps the organisation to make

9

budgets and forecasting future events in order to maintain ethical environment. Budgets are

prepared on the basis of past financial records and financial statements. With the help of

planning tools managers become eligible to make accurate budgets and financial reports.

PART B

P5 Evaluate how organisations are adapting management accounting system to respond finance

problems

Management accounting is concerned with collection of data and information and

preparation of accounts and final accounts with the use of that information (Renz and Herman,

2016). The accounts that are being prepared are usually used for internal sources like

management, employees etc. for the purpose of various decision making and various ways are

identified to run company even more efficiently and to enhance the productivity of the company.

To maintain these accounting information a management accounting system is managed by the

company for storing information and data recording. The reports generated through this systems

are usually confidential in nature.

The reports which are generated includes budgeting, break even charts, trend charts and

forecasting etc. A accounting system helps in providing a large visibility of operations of the

company as each and every transaction is electronically recorded and informations are available

for management at the earliest. It has replaced manual accounting and has made a

transformational change in the area of business. It is seen as more useful for small and medium

enterprises as they can access information and data regarding accounting which was manual

before. Companies are adapting to such accounting systems so as to achieve a competitive edge

and core competence in overall operations of the company. Narrow limited should implement a

better management accounting system which will aid its functional as well as administrative

department (Soin and Collier, 2013).

A good management accounting system can enhances company's productivity by a

reduction in cost through efficiency. It is said that an effective management accounting system

covers and reaches to every department of the organization like finance, IT, Marketing, HR,

Operations and sales. The various aspects of management accounting system are product costing,

cost analysis, constraint analysis etc. The various components of management accounting

includes budgets, performance reports it is made for comparison of actual performance with the

budgeted one. Journal entries are made, ledgers are prepared after that trial balance, p&l and

10

prepared on the basis of past financial records and financial statements. With the help of

planning tools managers become eligible to make accurate budgets and financial reports.

PART B

P5 Evaluate how organisations are adapting management accounting system to respond finance

problems

Management accounting is concerned with collection of data and information and

preparation of accounts and final accounts with the use of that information (Renz and Herman,

2016). The accounts that are being prepared are usually used for internal sources like

management, employees etc. for the purpose of various decision making and various ways are

identified to run company even more efficiently and to enhance the productivity of the company.

To maintain these accounting information a management accounting system is managed by the

company for storing information and data recording. The reports generated through this systems

are usually confidential in nature.

The reports which are generated includes budgeting, break even charts, trend charts and

forecasting etc. A accounting system helps in providing a large visibility of operations of the

company as each and every transaction is electronically recorded and informations are available

for management at the earliest. It has replaced manual accounting and has made a

transformational change in the area of business. It is seen as more useful for small and medium

enterprises as they can access information and data regarding accounting which was manual

before. Companies are adapting to such accounting systems so as to achieve a competitive edge

and core competence in overall operations of the company. Narrow limited should implement a

better management accounting system which will aid its functional as well as administrative

department (Soin and Collier, 2013).

A good management accounting system can enhances company's productivity by a

reduction in cost through efficiency. It is said that an effective management accounting system

covers and reaches to every department of the organization like finance, IT, Marketing, HR,

Operations and sales. The various aspects of management accounting system are product costing,

cost analysis, constraint analysis etc. The various components of management accounting

includes budgets, performance reports it is made for comparison of actual performance with the

budgeted one. Journal entries are made, ledgers are prepared after that trial balance, p&l and

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.