Management Accounting: Report, Analysis, and Financial Reporting

VerifiedAdded on 2022/12/26

|29

|4421

|90

Report

AI Summary

This report delves into the core concepts of management accounting, encompassing its systems, applications, and integration within organizational processes. It begins by defining management accounting and its significance in providing crucial information to managers for effective decision-making. The report explores various management accounting systems, including inventory management, job costing, and price optimization, detailing their key features and benefits. It then critically evaluates the integration of these systems within organizational frameworks. The report presents financial reporting documents, including income statements and cost of goods sold calculations, along with detailed analyses using techniques like high-low method, FIFO, LIFO, and weighted average costing. Finally, it covers break-even analysis and profit calculations, providing a comprehensive overview of management accounting principles and their practical application in business scenarios.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

The terms management accounting is made up of two different terms: the management

and the accounting. This can be described as a mechanism that provides information tools to an

organization's managers to assist them in making decisions. It helps in managerial effectiveness

by presenting all relevant information and statistics to executives, enabling them to make

informed decisions and monitor all other aspects of the business (Ameen, Ahmed and Abd

Hafez, 2018). The study covers multiple tasks which covers different aspects of MA like systems

and reports of MA, key planning tools, ratio analysis and preparation of budget.

Section One

1.1 Management accounting and essential requirements of multiple forms of management

accounting systems:

Managerial accounting corresponds to vital practice of recognizing, assessing, interpreting,

evaluating and efficiently reporting key fiscal details about managerial personnel for pursuits of

enterprise objectives. This varies from the concept of financial accounting due to the fact the

meant motive of managerial accounting is to provide assistance to users inner to corporation in

developing well-informed commercial enterprise decisions. Managerial accounting comprises

multiple facets of accounting aimed toward improving the quality of records brought to

management regarding business operation metrics. Managerial accountants within enterprise use

information concerned with the costs and incomes form sales of products/services

(Abdusalomova, 2019).

MA system implies to effective mechanism which comprises activities or tasks that

contribute towards supply of key information for decision-making. Management accounting

system generally require use of both accounting as well as managerial data which help managing

personnel in decision making. Key importance of management accounting is in managerial

decision-making. Management accounting provide comprehensive details and facts which are

ultimately used by managers in developing management policies and creation of base for

decision making.

The terms management accounting is made up of two different terms: the management

and the accounting. This can be described as a mechanism that provides information tools to an

organization's managers to assist them in making decisions. It helps in managerial effectiveness

by presenting all relevant information and statistics to executives, enabling them to make

informed decisions and monitor all other aspects of the business (Ameen, Ahmed and Abd

Hafez, 2018). The study covers multiple tasks which covers different aspects of MA like systems

and reports of MA, key planning tools, ratio analysis and preparation of budget.

Section One

1.1 Management accounting and essential requirements of multiple forms of management

accounting systems:

Managerial accounting corresponds to vital practice of recognizing, assessing, interpreting,

evaluating and efficiently reporting key fiscal details about managerial personnel for pursuits of

enterprise objectives. This varies from the concept of financial accounting due to the fact the

meant motive of managerial accounting is to provide assistance to users inner to corporation in

developing well-informed commercial enterprise decisions. Managerial accounting comprises

multiple facets of accounting aimed toward improving the quality of records brought to

management regarding business operation metrics. Managerial accountants within enterprise use

information concerned with the costs and incomes form sales of products/services

(Abdusalomova, 2019).

MA system implies to effective mechanism which comprises activities or tasks that

contribute towards supply of key information for decision-making. Management accounting

system generally require use of both accounting as well as managerial data which help managing

personnel in decision making. Key importance of management accounting is in managerial

decision-making. Management accounting provide comprehensive details and facts which are

ultimately used by managers in developing management policies and creation of base for

decision making.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1.2 Different methods of management accounting reporting:

Management accounting within a business context involves multiple systems which enable

organization to make effective decisions. In this regard following is detailed discussion about the

multiple systems of MA along with their crucial requirements, as follows:

Inventory management system: This system is dedicated towards recording of different kind of

inventories of an enterprise. Management should adopt this system for facilitating effective

management of inventories. In business, inventories directly affect business’s gross profitability,

thus it’s key task of management to manage their inventory items properly. This system

primarily requires use of detailed accurate and relevant information of inventories like WIP,

Finished goods, raw-materials etc. This system also requires use of method of inventory

valuation like FIFO, LIFO or average cost method (Allain, Lemaire and Lux, 2021). Here are

key features of these methods, as follows:

FIFO: Herein this approach, key assumption for valuing stock is that first bought stock-

items are sold first.

LIFO: As opposite to FIFO approach, this system assumed that last purchased stock are

sold first in a particular sequence.

Average Cost method: In this approach, simple average of all the inventories costs are

used to value stock.

Job costing System: Job costing system is cost-control mechanism that attributes production

costs to every product, allowing executives to keep tracking of expenses/costs. Manufacturing

costs are measured using work costing systems, which divide them into overheads, material

costs, including production overhead and measure them at product’s actual value. Job costing is

an efficacious technique for allocating cost of product as well as keep tracking of

order's expenditure, particularly when a company 's items are not comparable. To enhance cost

oversight and increase profitability, mostly businesses now use computer based job costing

processes. Main requirement within a business relating to job costing system is to proper

allocation of costs to each of the order received by a business. Job costing produces distinct

"buckets" of details for every job, which the cost accountant may analyze to decide whether this

should be attributed towards such job. There's a fair risk that costs would be wrongly attributed if

Management accounting within a business context involves multiple systems which enable

organization to make effective decisions. In this regard following is detailed discussion about the

multiple systems of MA along with their crucial requirements, as follows:

Inventory management system: This system is dedicated towards recording of different kind of

inventories of an enterprise. Management should adopt this system for facilitating effective

management of inventories. In business, inventories directly affect business’s gross profitability,

thus it’s key task of management to manage their inventory items properly. This system

primarily requires use of detailed accurate and relevant information of inventories like WIP,

Finished goods, raw-materials etc. This system also requires use of method of inventory

valuation like FIFO, LIFO or average cost method (Allain, Lemaire and Lux, 2021). Here are

key features of these methods, as follows:

FIFO: Herein this approach, key assumption for valuing stock is that first bought stock-

items are sold first.

LIFO: As opposite to FIFO approach, this system assumed that last purchased stock are

sold first in a particular sequence.

Average Cost method: In this approach, simple average of all the inventories costs are

used to value stock.

Job costing System: Job costing system is cost-control mechanism that attributes production

costs to every product, allowing executives to keep tracking of expenses/costs. Manufacturing

costs are measured using work costing systems, which divide them into overheads, material

costs, including production overhead and measure them at product’s actual value. Job costing is

an efficacious technique for allocating cost of product as well as keep tracking of

order's expenditure, particularly when a company 's items are not comparable. To enhance cost

oversight and increase profitability, mostly businesses now use computer based job costing

processes. Main requirement within a business relating to job costing system is to proper

allocation of costs to each of the order received by a business. Job costing produces distinct

"buckets" of details for every job, which the cost accountant may analyze to decide whether this

should be attributed towards such job. There's a fair risk that costs would be wrongly attributed if

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

there're a lot of different jobs under progress, but this costing system's design allows this highly

auditable (Abdusalomova, 2020).

Price optimization System: Setting prices which are acceptable for each particular selling

situation in a B2B business could be a difficult challenge. To establish a systematically and

logically relevant price classification framework, price optimization system investigates all

variables that affect price. The micro-segments that result are generally based on product, order,

including customer behavior. Price optimization system is technique by which a corporation

evaluates how responsive its current clients can be to price increases in order to decide how

much business this can produce under specified profit margins. If a corporation wants to

connect business volumes with profits, as well as, more significantly, whether it wishes to

expand profits while retaining same levels, optimum pricing is needed. The price-optimization

system requires critical analysis of each aspect which explain the relationship among quantities

demanded and sales (Turner, Way, Hodari and Witteman, 2017).

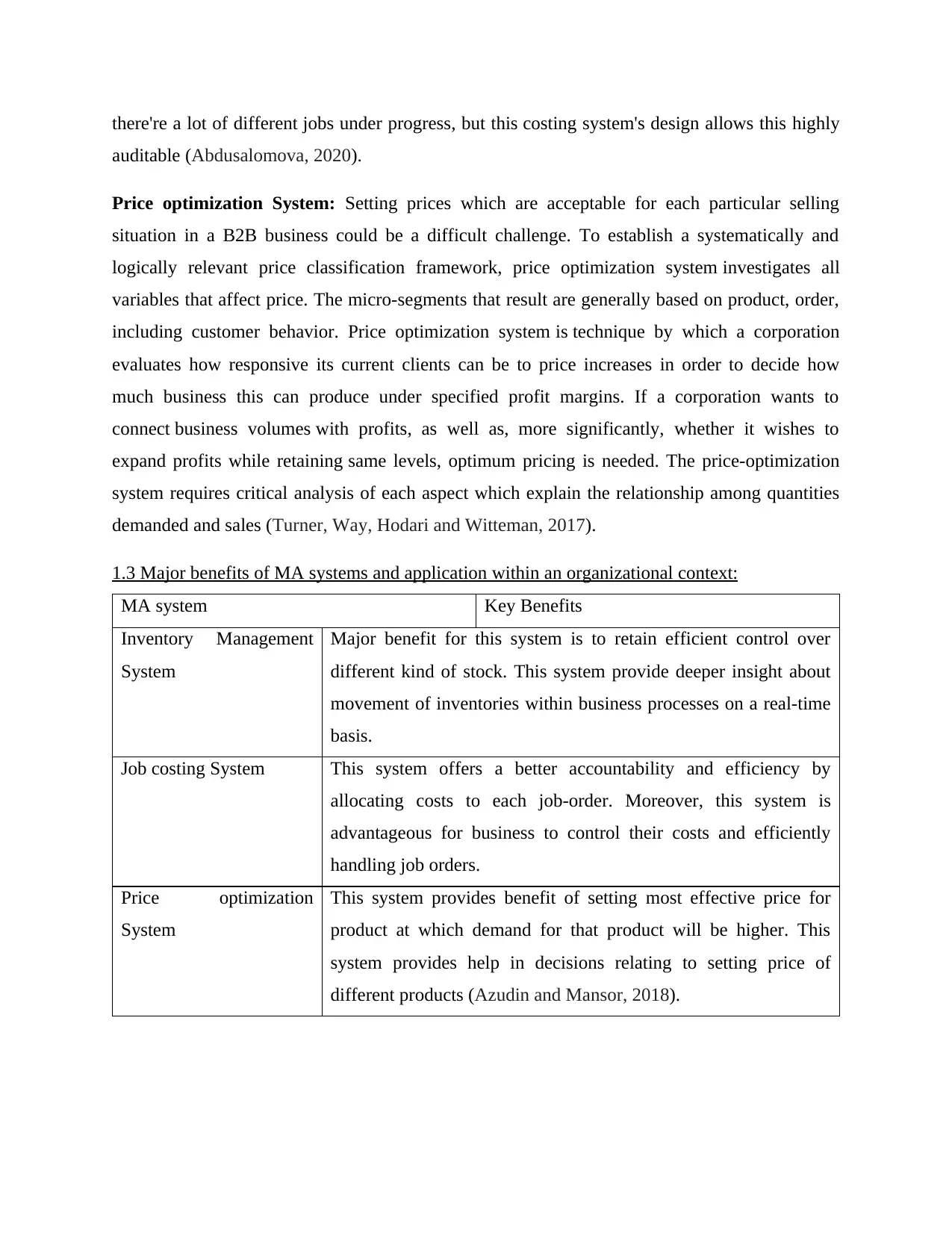

1.3 Major benefits of MA systems and application within an organizational context:

MA system Key Benefits

Inventory Management

System

Major benefit for this system is to retain efficient control over

different kind of stock. This system provide deeper insight about

movement of inventories within business processes on a real-time

basis.

Job costing System This system offers a better accountability and efficiency by

allocating costs to each job-order. Moreover, this system is

advantageous for business to control their costs and efficiently

handling job orders.

Price optimization

System

This system provides benefit of setting most effective price for

product at which demand for that product will be higher. This

system provides help in decisions relating to setting price of

different products (Azudin and Mansor, 2018).

auditable (Abdusalomova, 2020).

Price optimization System: Setting prices which are acceptable for each particular selling

situation in a B2B business could be a difficult challenge. To establish a systematically and

logically relevant price classification framework, price optimization system investigates all

variables that affect price. The micro-segments that result are generally based on product, order,

including customer behavior. Price optimization system is technique by which a corporation

evaluates how responsive its current clients can be to price increases in order to decide how

much business this can produce under specified profit margins. If a corporation wants to

connect business volumes with profits, as well as, more significantly, whether it wishes to

expand profits while retaining same levels, optimum pricing is needed. The price-optimization

system requires critical analysis of each aspect which explain the relationship among quantities

demanded and sales (Turner, Way, Hodari and Witteman, 2017).

1.3 Major benefits of MA systems and application within an organizational context:

MA system Key Benefits

Inventory Management

System

Major benefit for this system is to retain efficient control over

different kind of stock. This system provide deeper insight about

movement of inventories within business processes on a real-time

basis.

Job costing System This system offers a better accountability and efficiency by

allocating costs to each job-order. Moreover, this system is

advantageous for business to control their costs and efficiently

handling job orders.

Price optimization

System

This system provides benefit of setting most effective price for

product at which demand for that product will be higher. This

system provides help in decisions relating to setting price of

different products (Azudin and Mansor, 2018).

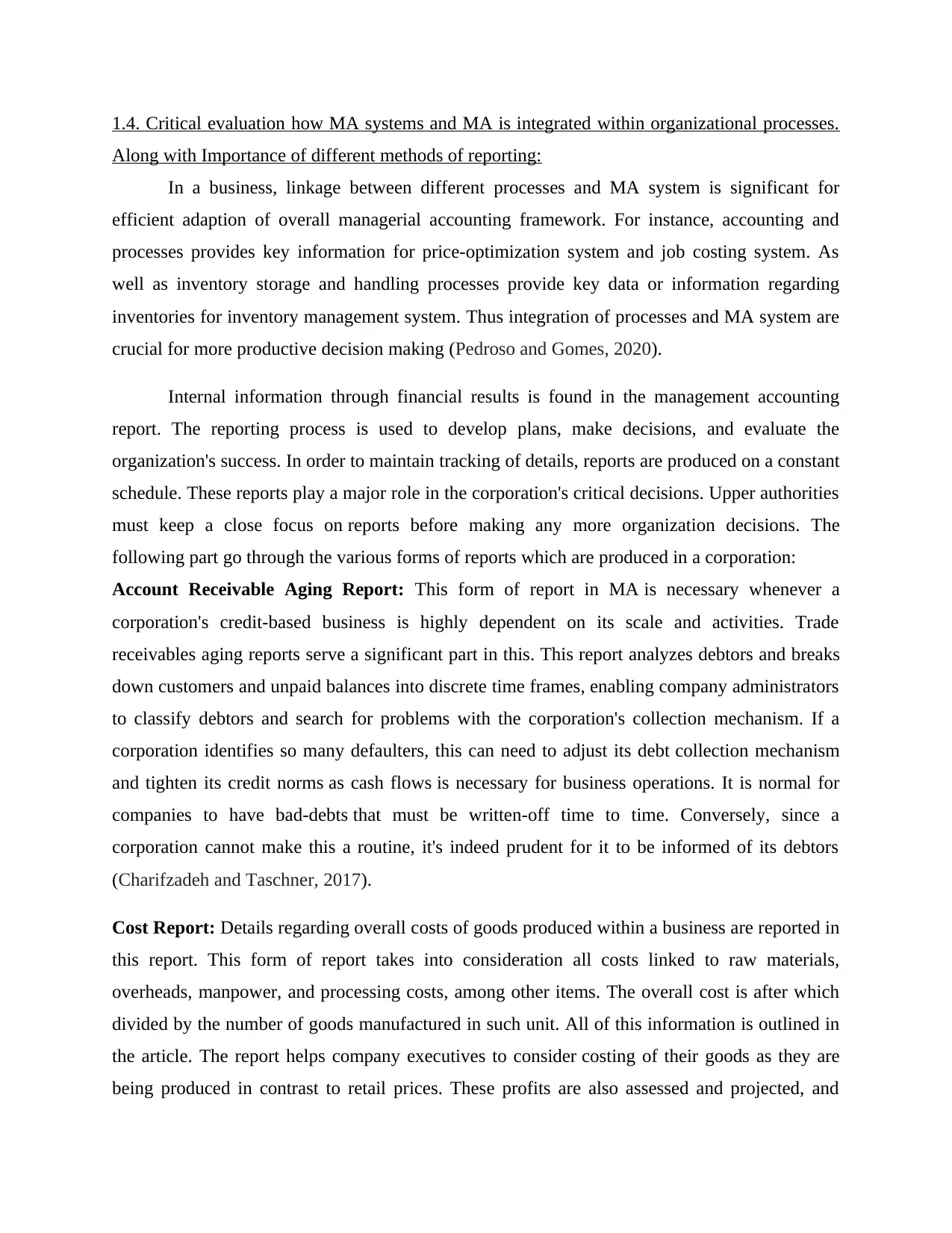

1.4. Critical evaluation how MA systems and MA is integrated within organizational processes.

Along with Importance of different methods of reporting:

In a business, linkage between different processes and MA system is significant for

efficient adaption of overall managerial accounting framework. For instance, accounting and

processes provides key information for price-optimization system and job costing system. As

well as inventory storage and handling processes provide key data or information regarding

inventories for inventory management system. Thus integration of processes and MA system are

crucial for more productive decision making (Pedroso and Gomes, 2020).

Internal information through financial results is found in the management accounting

report. The reporting process is used to develop plans, make decisions, and evaluate the

organization's success. In order to maintain tracking of details, reports are produced on a constant

schedule. These reports play a major role in the corporation's critical decisions. Upper authorities

must keep a close focus on reports before making any more organization decisions. The

following part go through the various forms of reports which are produced in a corporation:

Account Receivable Aging Report: This form of report in MA is necessary whenever a

corporation's credit-based business is highly dependent on its scale and activities. Trade

receivables aging reports serve a significant part in this. This report analyzes debtors and breaks

down customers and unpaid balances into discrete time frames, enabling company administrators

to classify debtors and search for problems with the corporation's collection mechanism. If a

corporation identifies so many defaulters, this can need to adjust its debt collection mechanism

and tighten its credit norms as cash flows is necessary for business operations. It is normal for

companies to have bad-debts that must be written-off time to time. Conversely, since a

corporation cannot make this a routine, it's indeed prudent for it to be informed of its debtors

(Charifzadeh and Taschner, 2017).

Cost Report: Details regarding overall costs of goods produced within a business are reported in

this report. This form of report takes into consideration all costs linked to raw materials,

overheads, manpower, and processing costs, among other items. The overall cost is after which

divided by the number of goods manufactured in such unit. All of this information is outlined in

the article. The report helps company executives to consider costing of their goods as they are

being produced in contrast to retail prices. These profits are also assessed and projected, and

Along with Importance of different methods of reporting:

In a business, linkage between different processes and MA system is significant for

efficient adaption of overall managerial accounting framework. For instance, accounting and

processes provides key information for price-optimization system and job costing system. As

well as inventory storage and handling processes provide key data or information regarding

inventories for inventory management system. Thus integration of processes and MA system are

crucial for more productive decision making (Pedroso and Gomes, 2020).

Internal information through financial results is found in the management accounting

report. The reporting process is used to develop plans, make decisions, and evaluate the

organization's success. In order to maintain tracking of details, reports are produced on a constant

schedule. These reports play a major role in the corporation's critical decisions. Upper authorities

must keep a close focus on reports before making any more organization decisions. The

following part go through the various forms of reports which are produced in a corporation:

Account Receivable Aging Report: This form of report in MA is necessary whenever a

corporation's credit-based business is highly dependent on its scale and activities. Trade

receivables aging reports serve a significant part in this. This report analyzes debtors and breaks

down customers and unpaid balances into discrete time frames, enabling company administrators

to classify debtors and search for problems with the corporation's collection mechanism. If a

corporation identifies so many defaulters, this can need to adjust its debt collection mechanism

and tighten its credit norms as cash flows is necessary for business operations. It is normal for

companies to have bad-debts that must be written-off time to time. Conversely, since a

corporation cannot make this a routine, it's indeed prudent for it to be informed of its debtors

(Charifzadeh and Taschner, 2017).

Cost Report: Details regarding overall costs of goods produced within a business are reported in

this report. This form of report takes into consideration all costs linked to raw materials,

overheads, manpower, and processing costs, among other items. The overall cost is after which

divided by the number of goods manufactured in such unit. All of this information is outlined in

the article. The report helps company executives to consider costing of their goods as they are

being produced in contrast to retail prices. These profits are also assessed and projected, and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

such reports give a good picture of almost all of the expenses incurred during the manufacturing

phase and material acquisition.

Performance Report: This report is key type of the report which represents individual's or a

collective performance of a team within the business. This kind of report acts as a reference for

administrators to keep a close eye on their personnel and their results on quarterly, monthly-

basis, or yearly basis. Additionally, they may assist in the assessment of a company's overall

performance. Such reports encourage managers to use them to assist them in taking tactical

decisions about the corporation's future Individuals are often honored based on their success and

contributions towards business. They are often compensated for their loyalty and contributions

to retain their power, as well as under are dealing with as needed (Pervan and Dropulić, 2019).

phase and material acquisition.

Performance Report: This report is key type of the report which represents individual's or a

collective performance of a team within the business. This kind of report acts as a reference for

administrators to keep a close eye on their personnel and their results on quarterly, monthly-

basis, or yearly basis. Additionally, they may assist in the assessment of a company's overall

performance. Such reports encourage managers to use them to assist them in taking tactical

decisions about the corporation's future Individuals are often honored based on their success and

contributions towards business. They are often compensated for their loyalty and contributions

to retain their power, as well as under are dealing with as needed (Pervan and Dropulić, 2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

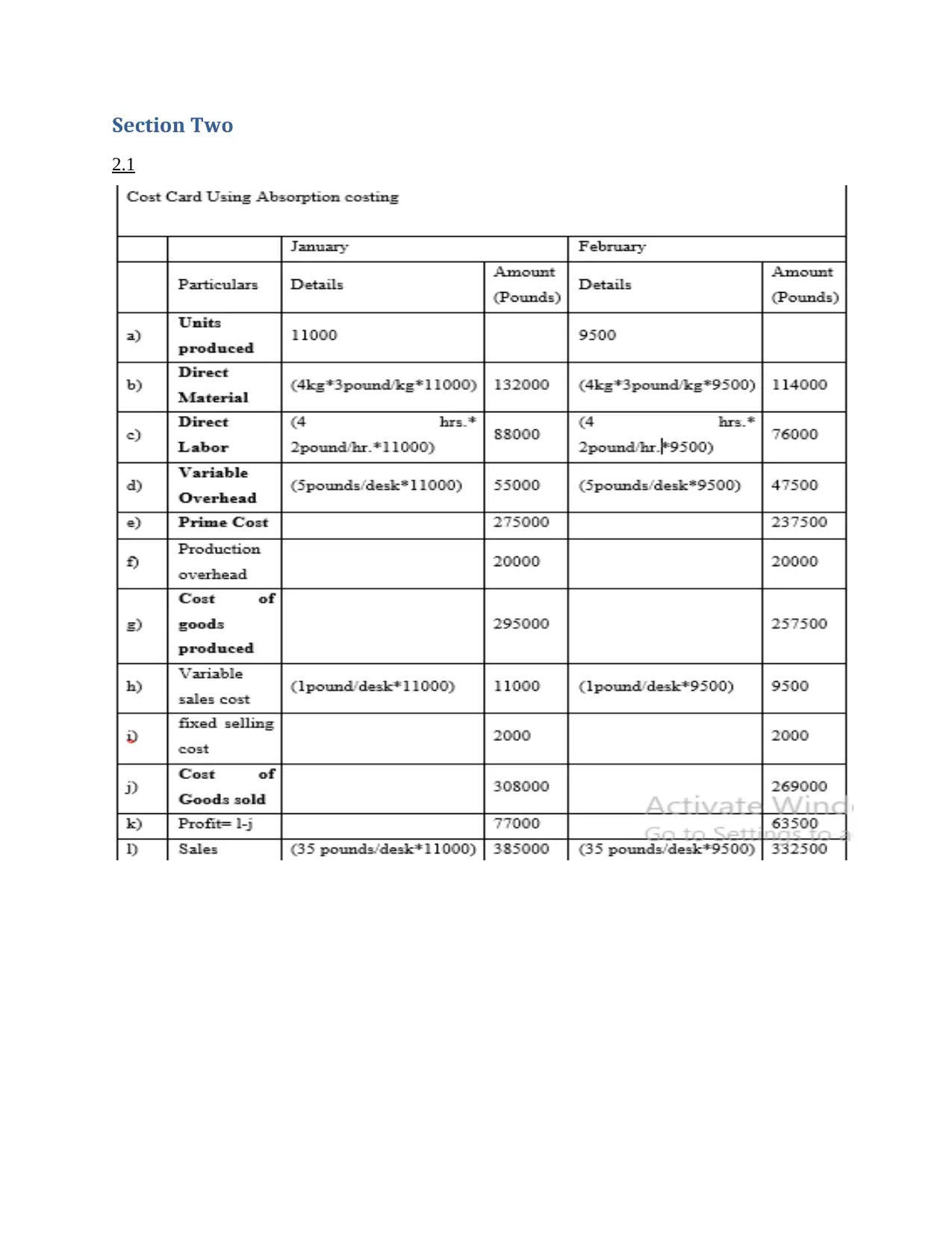

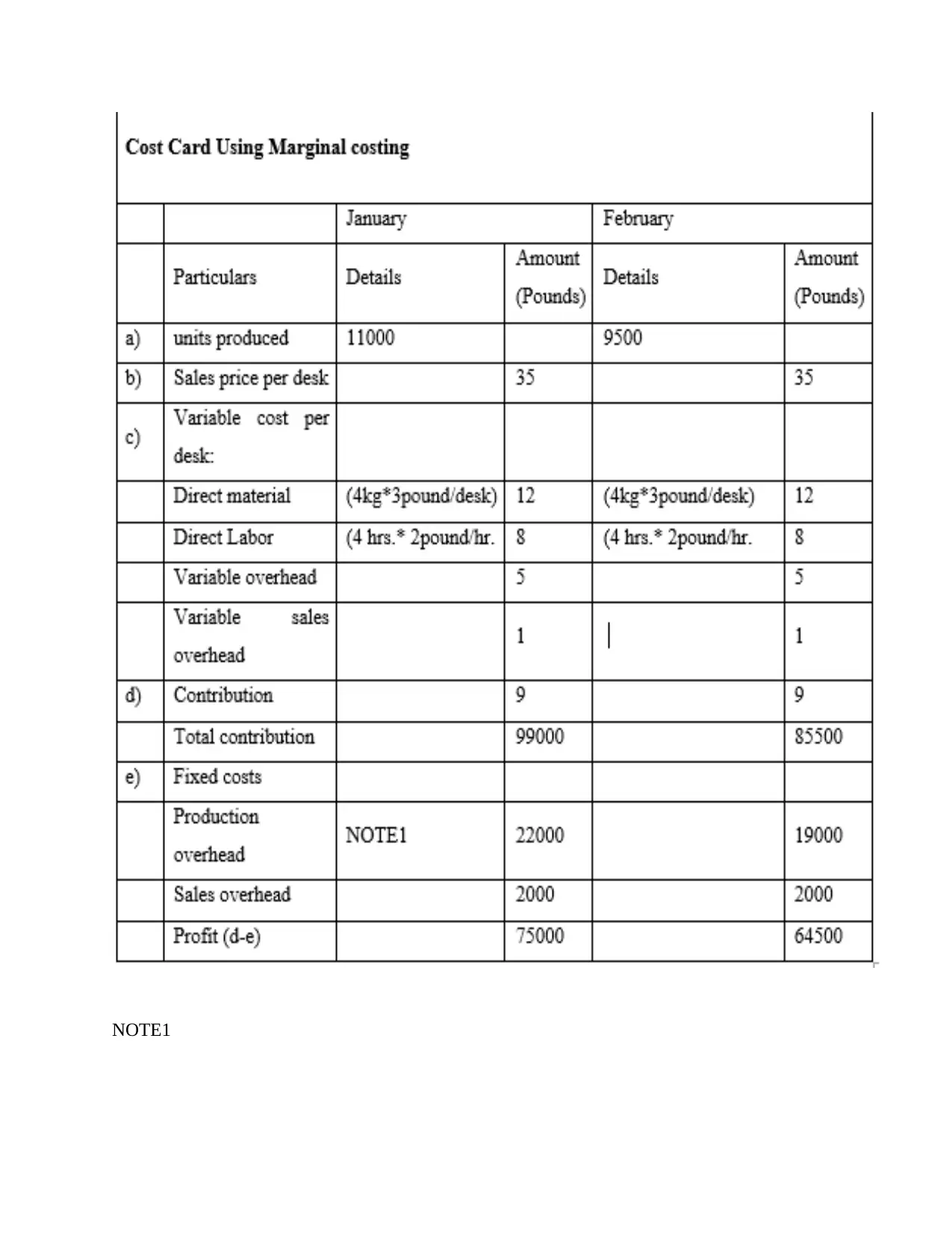

Section Two

2.1

2.1

NOTE1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

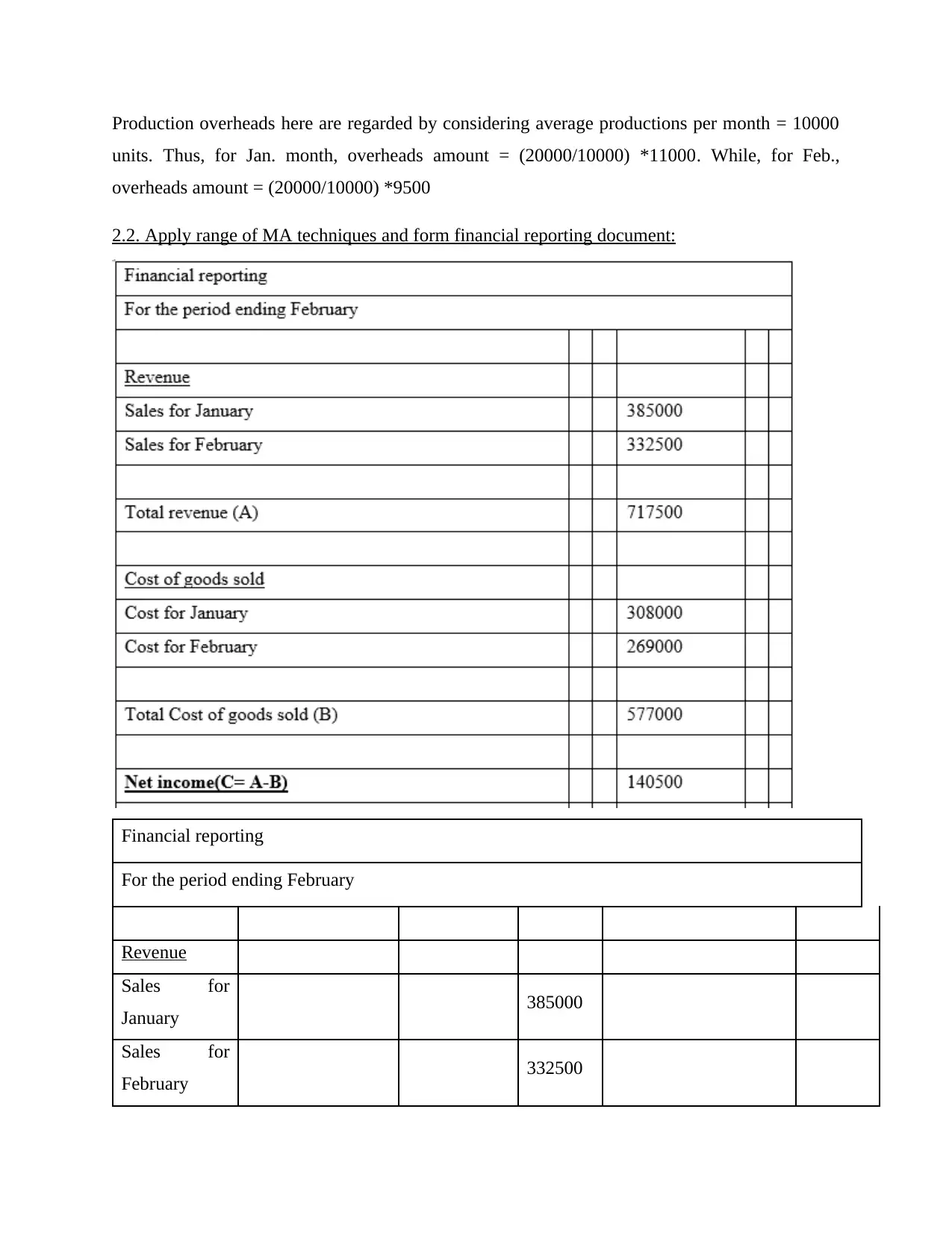

Production overheads here are regarded by considering average productions per month = 10000

units. Thus, for Jan. month, overheads amount = (20000/10000) *11000. While, for Feb.,

overheads amount = (20000/10000) *9500

2.2. Apply range of MA techniques and form financial reporting document:

Financial reporting

For the period ending February

Revenue

Sales for

January 385000

Sales for

February 332500

units. Thus, for Jan. month, overheads amount = (20000/10000) *11000. While, for Feb.,

overheads amount = (20000/10000) *9500

2.2. Apply range of MA techniques and form financial reporting document:

Financial reporting

For the period ending February

Revenue

Sales for

January 385000

Sales for

February 332500

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total revenue

(A) 717500

Cost of goods

sold

Cost for

January 308000

Cost for

February 269000

Total Cost of

goods sold

(B)

577000

Net

income(C=

A-B)

140500

Working

Notes- Cost

of Goods sold

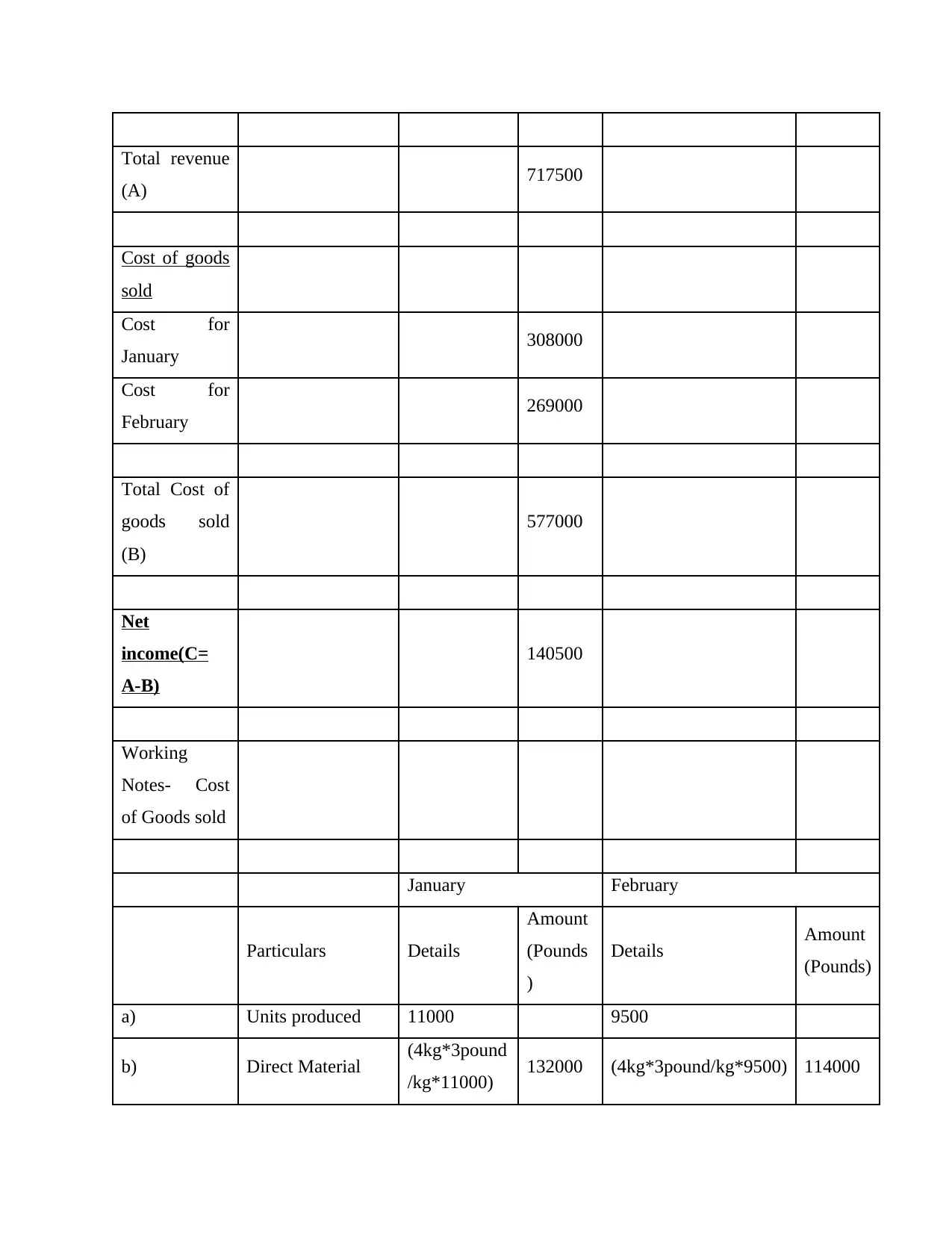

January February

Particulars Details

Amount

(Pounds

)

Details Amount

(Pounds)

a) Units produced 11000 9500

b) Direct Material (4kg*3pound

/kg*11000) 132000 (4kg*3pound/kg*9500) 114000

(A) 717500

Cost of goods

sold

Cost for

January 308000

Cost for

February 269000

Total Cost of

goods sold

(B)

577000

Net

income(C=

A-B)

140500

Working

Notes- Cost

of Goods sold

January February

Particulars Details

Amount

(Pounds

)

Details Amount

(Pounds)

a) Units produced 11000 9500

b) Direct Material (4kg*3pound

/kg*11000) 132000 (4kg*3pound/kg*9500) 114000

c) Direct Labor

(4 hrs*

2pound/hr*1

1000)

88000 (4 hrs*

2pound/hr*9500) 76000

d) Variable Overhead (5pounds/

desk*11000) 55000 (5pounds/desk*9500) 47500

e) Prime Cost 275000 237500

f) Production

overhead 20000 20000

g) Cost of goods

produced 295000 257500

h) Variable sales cost (1pound/

desk*11000) 11000 (1pound/desk*9500) 9500

i) fixed selling cost 2000 2000

j) Cost of Goods sold 308000 269000

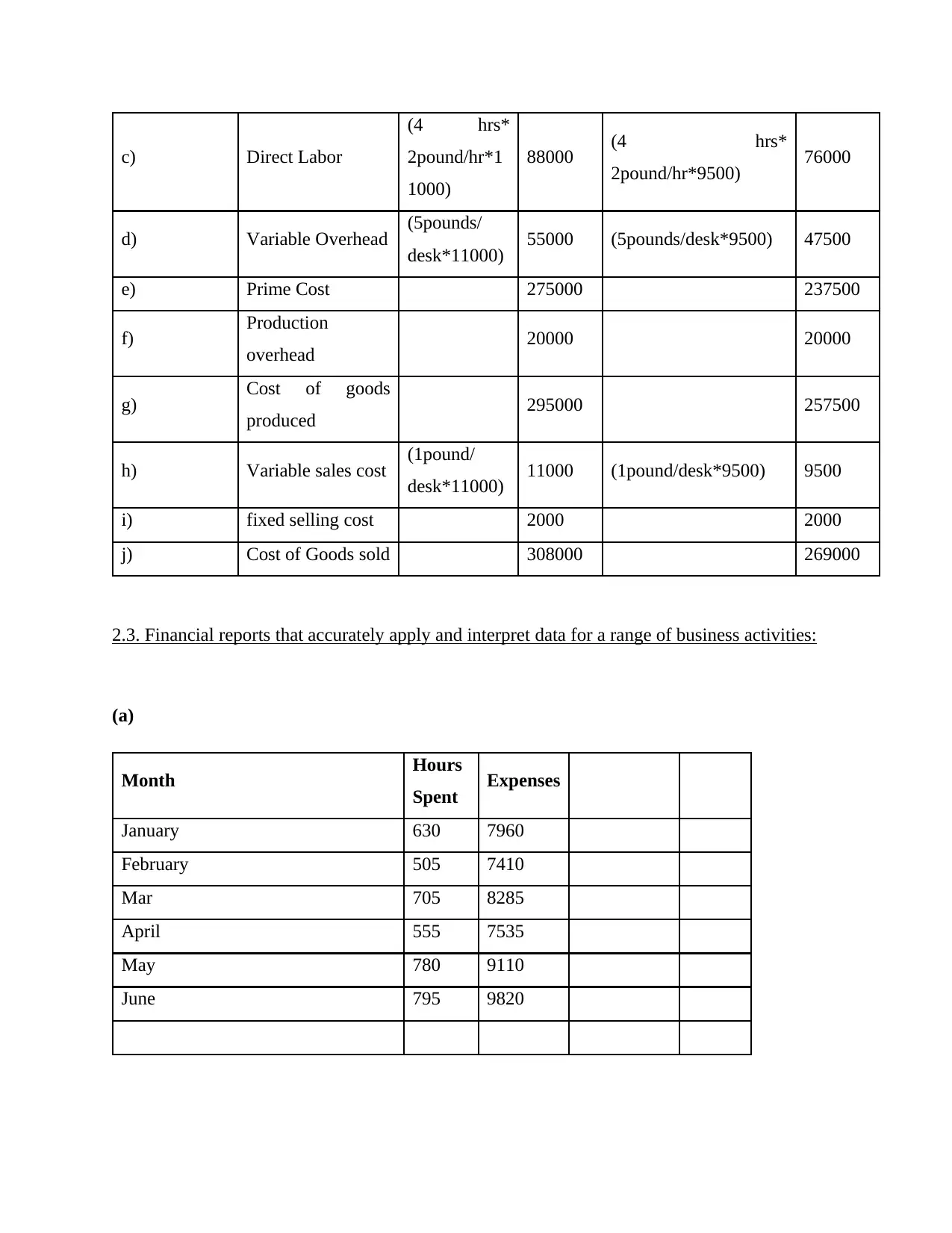

2.3. Financial reports that accurately apply and interpret data for a range of business activities:

(a)

Month Hours

Spent Expenses

January 630 7960

February 505 7410

Mar 705 8285

April 555 7535

May 780 9110

June 795 9820

(4 hrs*

2pound/hr*1

1000)

88000 (4 hrs*

2pound/hr*9500) 76000

d) Variable Overhead (5pounds/

desk*11000) 55000 (5pounds/desk*9500) 47500

e) Prime Cost 275000 237500

f) Production

overhead 20000 20000

g) Cost of goods

produced 295000 257500

h) Variable sales cost (1pound/

desk*11000) 11000 (1pound/desk*9500) 9500

i) fixed selling cost 2000 2000

j) Cost of Goods sold 308000 269000

2.3. Financial reports that accurately apply and interpret data for a range of business activities:

(a)

Month Hours

Spent Expenses

January 630 7960

February 505 7410

Mar 705 8285

April 555 7535

May 780 9110

June 795 9820

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 29

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.