Management Accounting Report: KEF Limited Analysis and Techniques

VerifiedAdded on 2023/01/18

|16

|4739

|65

Report

AI Summary

This report delves into the realm of management accounting, focusing on its definition, types, and benefits. It provides an in-depth analysis of various management accounting reports, including inventory management, cost accounting, and performance reports, illustrating how these reports integrate within organizational processes. The report then proceeds to detail the preparation of income statements using absorption and marginal costing methods, comparing their advantages and disadvantages. It also explores the limitations and importance of planning tools such as budgetary control. Finally, it presents a comparative analysis of organizations to solve financial issues with the help of accounting systems, offering insights into the application of management accounting in resolving financial challenges, using KEF limited as a case study.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

P1.Description of management accounting and its types.............................................................3

M1. Benefits of Management accounting....................................................................................4

P2. Analysis of wide range of management accounting reports..................................................5

D1.Way in which management accounting systems and reporting are integrated within

organizational process..................................................................................................................6

TASK 2............................................................................................................................................6

P3. Preparation of income statements as per the costing methods...............................................6

M2. Management accounting techniques to produce financial reporting documents................10

D2. Interpretation of produced income statements....................................................................10

TASK 3..........................................................................................................................................10

P4. Description of limitation and importance of planning tools of budgetary control..............10

M3 Planning tools for preparation and forecasting of budgets..................................................11

TASK 4..........................................................................................................................................12

P5.Comparison of organizations to solve the financial issues with the help of accounting

systems.......................................................................................................................................12

M4. Management accounting to solve the financial issues........................................................13

D3. Planning tools to solve the financial issues.........................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

P1.Description of management accounting and its types.............................................................3

M1. Benefits of Management accounting....................................................................................4

P2. Analysis of wide range of management accounting reports..................................................5

D1.Way in which management accounting systems and reporting are integrated within

organizational process..................................................................................................................6

TASK 2............................................................................................................................................6

P3. Preparation of income statements as per the costing methods...............................................6

M2. Management accounting techniques to produce financial reporting documents................10

D2. Interpretation of produced income statements....................................................................10

TASK 3..........................................................................................................................................10

P4. Description of limitation and importance of planning tools of budgetary control..............10

M3 Planning tools for preparation and forecasting of budgets..................................................11

TASK 4..........................................................................................................................................12

P5.Comparison of organizations to solve the financial issues with the help of accounting

systems.......................................................................................................................................12

M4. Management accounting to solve the financial issues........................................................13

D3. Planning tools to solve the financial issues.........................................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting is also recognized as managerial accounting that is concerned

with the compilation, evaluation, presentation and distribution of quantitative and qualitative

data for internal clients (Drake, Roulstone and Thornock, 2016). Within this accounting, the

paired data on monetary and anti-monetary elements is being used to generate reports that play

an important part in the efficient judgment-making of executives and board members. In the

present time frame, this accounting is seen as one of the key elements of proper distribution and

use of monetary and non-monetary capital. In the project report a company has been chosen that

is KEF limited company. This company operates in manufacturing industry and located in

United Kingdom. In the project document, the term management accounting is explained in great

detail as well as its various forms of accounting systems and reports In addition, multiple

accounting strategies and planning methods are identified.

MAIN BODY

P1.Description of management accounting and its types.

Management accounting- This is associated with process of collecting financial and non financial

data in order to produce internal reports. These reports help to management department in order

to take right decision of various aspects. This accounting plays a significant role that are as

followings:

Helps in better decision making- It helps to companies in taking correct decisions on right

time. This becomes possible because it provides necessary data on time to managers on

time when its needed.

Helps in planning- Another importance of management accounting is that it helps to

companies in making planning of various kinds of aspects in an effective manner.

Helps in controlling- In addition, this accounting helps to companies in making control of

different types of activities and operations.

Types of MAS:

Cost accounting system- This accounting system is also known as the costing or value

method for goods. In particular, it can be described as a type of accounting system that is

affiliated with an effective prediction of the cost of goods and services. In essence, this

accounting system is required by companies to ensure to make a better assessment of the

degree of productivity as well as in order to control costs. As in the above-mentioned

business, their executives concentrate on applying this accounting system that keeps

manufacturing costs in line with expectations.

Management accounting is also recognized as managerial accounting that is concerned

with the compilation, evaluation, presentation and distribution of quantitative and qualitative

data for internal clients (Drake, Roulstone and Thornock, 2016). Within this accounting, the

paired data on monetary and anti-monetary elements is being used to generate reports that play

an important part in the efficient judgment-making of executives and board members. In the

present time frame, this accounting is seen as one of the key elements of proper distribution and

use of monetary and non-monetary capital. In the project report a company has been chosen that

is KEF limited company. This company operates in manufacturing industry and located in

United Kingdom. In the project document, the term management accounting is explained in great

detail as well as its various forms of accounting systems and reports In addition, multiple

accounting strategies and planning methods are identified.

MAIN BODY

P1.Description of management accounting and its types.

Management accounting- This is associated with process of collecting financial and non financial

data in order to produce internal reports. These reports help to management department in order

to take right decision of various aspects. This accounting plays a significant role that are as

followings:

Helps in better decision making- It helps to companies in taking correct decisions on right

time. This becomes possible because it provides necessary data on time to managers on

time when its needed.

Helps in planning- Another importance of management accounting is that it helps to

companies in making planning of various kinds of aspects in an effective manner.

Helps in controlling- In addition, this accounting helps to companies in making control of

different types of activities and operations.

Types of MAS:

Cost accounting system- This accounting system is also known as the costing or value

method for goods. In particular, it can be described as a type of accounting system that is

affiliated with an effective prediction of the cost of goods and services. In essence, this

accounting system is required by companies to ensure to make a better assessment of the

degree of productivity as well as in order to control costs. As in the above-mentioned

business, their executives concentrate on applying this accounting system that keeps

manufacturing costs in line with expectations.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Stock management system- It is an accounting system that is consistent with the method

of monitoring the records of the inventory which has been ordered, acquired and used in

manufacturing (EBRAHIMI and MOGHADASPOUR, 2015). Under this accounting

system, inventory assessment is carried out using different techniques, such as the last in

the first out, the weighted average etc. It is therefore important for businesses to estimate

the need for product to be manufactured by determining the availability of inventory

volume in factories. As in the aspect of the above-mentioned organization, this

accounting system is applied in order to know the quantitative aspect of the materials

required.

Job order costing system- This accounting system is characterized as a structured process

for monitoring costs and profit on the basis of ' job ' involved in the processing of any

specific tasks. Essentially, corporations are required to get an estimate of each output unit

or of any product. In the organization mentioned above. This accounting system is

applied by their executives to aid in the measurement of each of the production units,

which contributes to a reasonable price setting.

Price optimization system- It can be characterized as a method for assessing variations in

demand at different price rates. This accounting system is commonly used by businesses

to adjust the prices of their serviced goods, taking into account how their consumers

would respond to the fixed price model. Essentially, under this framework, businesses are

given the idea of setting prices at a rate that is appropriate to all potential buyers. This is

achieved by examining different external environmental factors, like consumer demand

for products, customer attitude towards client products, etc. It is therefore important for

companies to keep prices at an efficient level in line with market conditions and

consumer approach. In the case of the business mentioned above, they adapt this

accounting system to the determination of prices of their products manufactured. As well

as delivering goods to their consumer segments according to their estimated price point

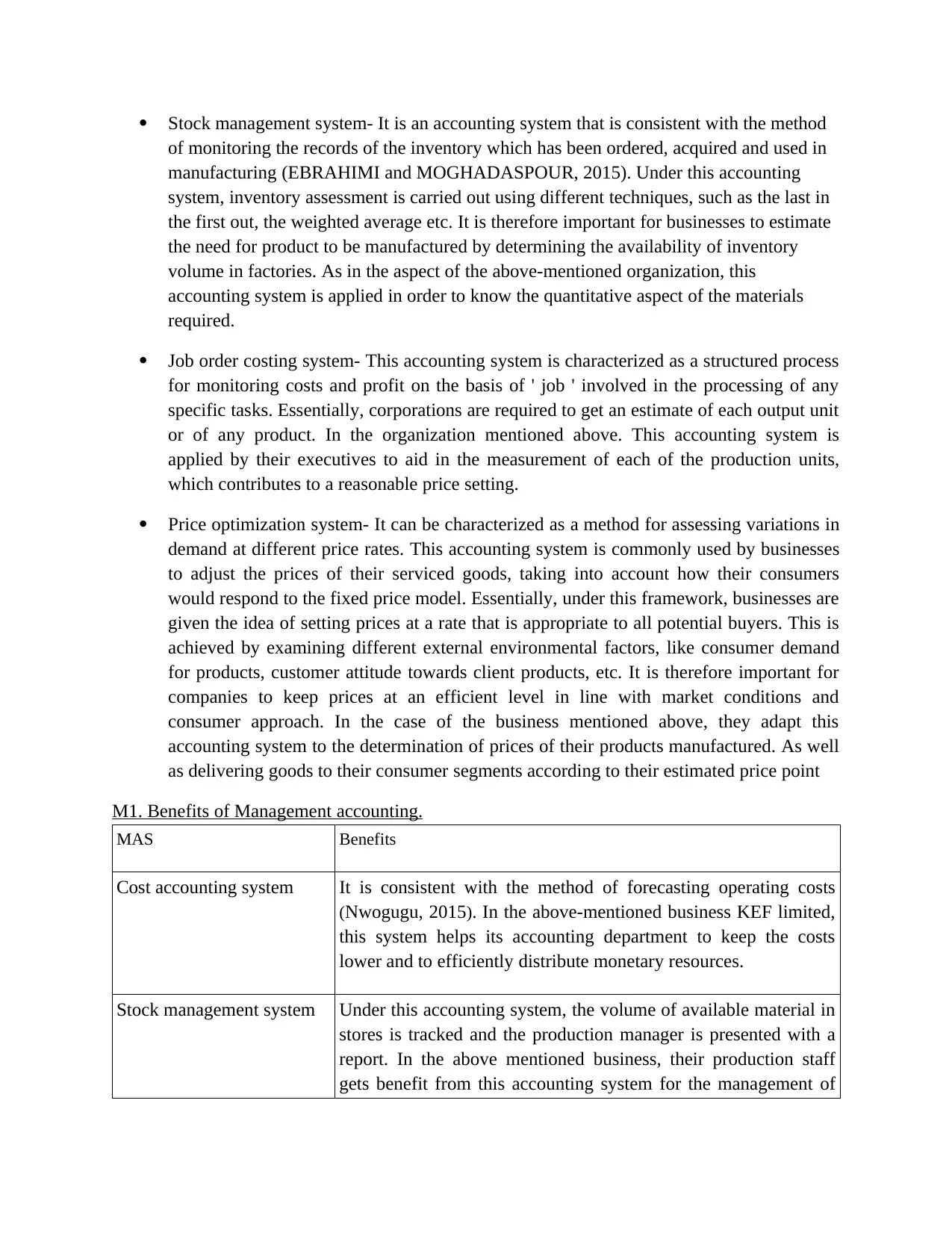

M1. Benefits of Management accounting.

MAS Benefits

Cost accounting system It is consistent with the method of forecasting operating costs

(Nwogugu, 2015). In the above-mentioned business KEF limited,

this system helps its accounting department to keep the costs

lower and to efficiently distribute monetary resources.

Stock management system Under this accounting system, the volume of available material in

stores is tracked and the production manager is presented with a

report. In the above mentioned business, their production staff

gets benefit from this accounting system for the management of

of monitoring the records of the inventory which has been ordered, acquired and used in

manufacturing (EBRAHIMI and MOGHADASPOUR, 2015). Under this accounting

system, inventory assessment is carried out using different techniques, such as the last in

the first out, the weighted average etc. It is therefore important for businesses to estimate

the need for product to be manufactured by determining the availability of inventory

volume in factories. As in the aspect of the above-mentioned organization, this

accounting system is applied in order to know the quantitative aspect of the materials

required.

Job order costing system- This accounting system is characterized as a structured process

for monitoring costs and profit on the basis of ' job ' involved in the processing of any

specific tasks. Essentially, corporations are required to get an estimate of each output unit

or of any product. In the organization mentioned above. This accounting system is

applied by their executives to aid in the measurement of each of the production units,

which contributes to a reasonable price setting.

Price optimization system- It can be characterized as a method for assessing variations in

demand at different price rates. This accounting system is commonly used by businesses

to adjust the prices of their serviced goods, taking into account how their consumers

would respond to the fixed price model. Essentially, under this framework, businesses are

given the idea of setting prices at a rate that is appropriate to all potential buyers. This is

achieved by examining different external environmental factors, like consumer demand

for products, customer attitude towards client products, etc. It is therefore important for

companies to keep prices at an efficient level in line with market conditions and

consumer approach. In the case of the business mentioned above, they adapt this

accounting system to the determination of prices of their products manufactured. As well

as delivering goods to their consumer segments according to their estimated price point

M1. Benefits of Management accounting.

MAS Benefits

Cost accounting system It is consistent with the method of forecasting operating costs

(Nwogugu, 2015). In the above-mentioned business KEF limited,

this system helps its accounting department to keep the costs

lower and to efficiently distribute monetary resources.

Stock management system Under this accounting system, the volume of available material in

stores is tracked and the production manager is presented with a

report. In the above mentioned business, their production staff

gets benefit from this accounting system for the management of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

inventories.

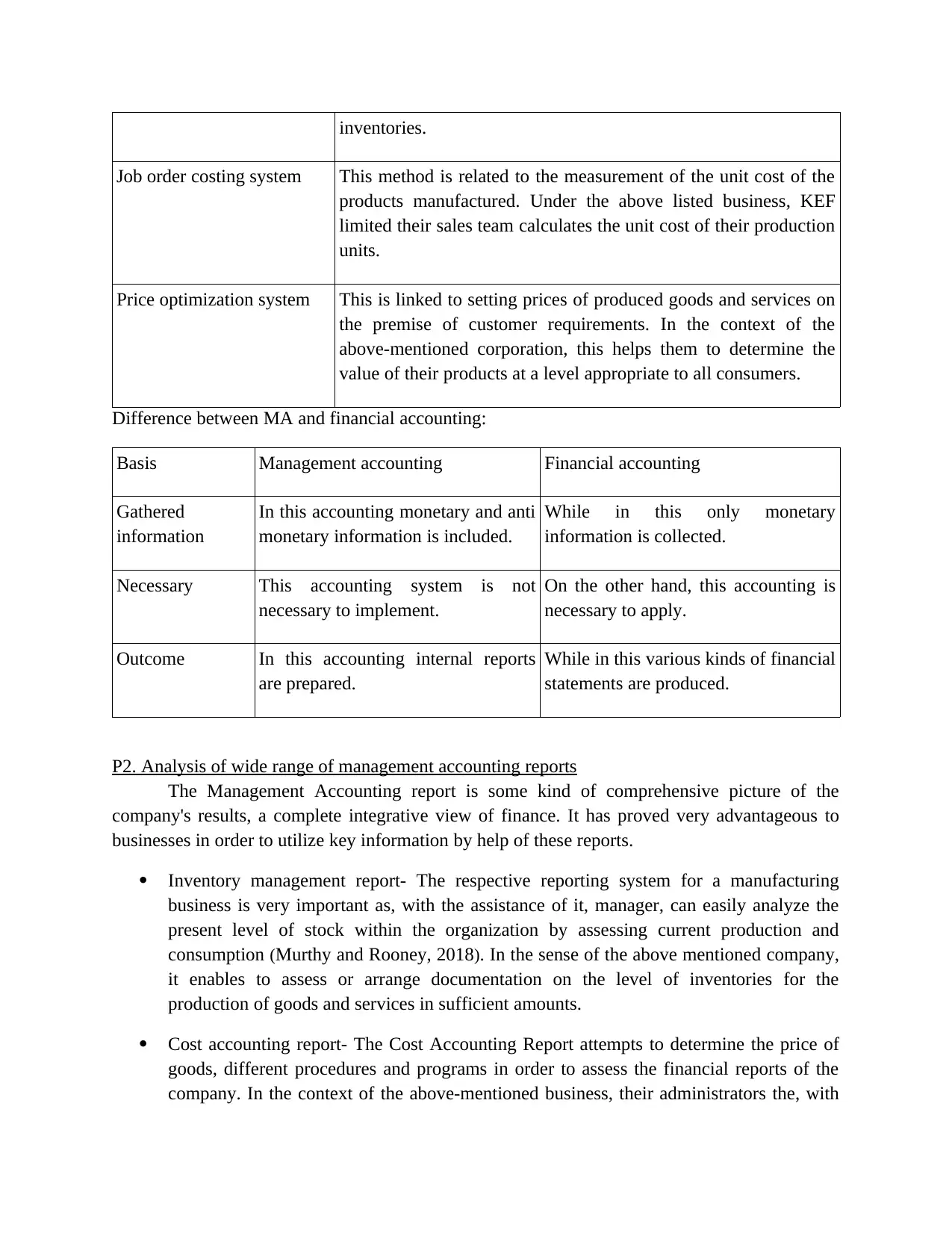

Job order costing system This method is related to the measurement of the unit cost of the

products manufactured. Under the above listed business, KEF

limited their sales team calculates the unit cost of their production

units.

Price optimization system This is linked to setting prices of produced goods and services on

the premise of customer requirements. In the context of the

above-mentioned corporation, this helps them to determine the

value of their products at a level appropriate to all consumers.

Difference between MA and financial accounting:

Basis Management accounting Financial accounting

Gathered

information

In this accounting monetary and anti

monetary information is included.

While in this only monetary

information is collected.

Necessary This accounting system is not

necessary to implement.

On the other hand, this accounting is

necessary to apply.

Outcome In this accounting internal reports

are prepared.

While in this various kinds of financial

statements are produced.

P2. Analysis of wide range of management accounting reports

The Management Accounting report is some kind of comprehensive picture of the

company's results, a complete integrative view of finance. It has proved very advantageous to

businesses in order to utilize key information by help of these reports.

Inventory management report- The respective reporting system for a manufacturing

business is very important as, with the assistance of it, manager, can easily analyze the

present level of stock within the organization by assessing current production and

consumption (Murthy and Rooney, 2018). In the sense of the above mentioned company,

it enables to assess or arrange documentation on the level of inventories for the

production of goods and services in sufficient amounts.

Cost accounting report- The Cost Accounting Report attempts to determine the price of

goods, different procedures and programs in order to assess the financial reports of the

company. In the context of the above-mentioned business, their administrators the, with

Job order costing system This method is related to the measurement of the unit cost of the

products manufactured. Under the above listed business, KEF

limited their sales team calculates the unit cost of their production

units.

Price optimization system This is linked to setting prices of produced goods and services on

the premise of customer requirements. In the context of the

above-mentioned corporation, this helps them to determine the

value of their products at a level appropriate to all consumers.

Difference between MA and financial accounting:

Basis Management accounting Financial accounting

Gathered

information

In this accounting monetary and anti

monetary information is included.

While in this only monetary

information is collected.

Necessary This accounting system is not

necessary to implement.

On the other hand, this accounting is

necessary to apply.

Outcome In this accounting internal reports

are prepared.

While in this various kinds of financial

statements are produced.

P2. Analysis of wide range of management accounting reports

The Management Accounting report is some kind of comprehensive picture of the

company's results, a complete integrative view of finance. It has proved very advantageous to

businesses in order to utilize key information by help of these reports.

Inventory management report- The respective reporting system for a manufacturing

business is very important as, with the assistance of it, manager, can easily analyze the

present level of stock within the organization by assessing current production and

consumption (Murthy and Rooney, 2018). In the sense of the above mentioned company,

it enables to assess or arrange documentation on the level of inventories for the

production of goods and services in sufficient amounts.

Cost accounting report- The Cost Accounting Report attempts to determine the price of

goods, different procedures and programs in order to assess the financial reports of the

company. In the context of the above-mentioned business, their administrators the, with

the aid of the relevant report receive assistance from managers in preparing and reducing

costs and procedures internally.

Performance report- Performance report collects vital information relevant to the quality

of the project by reviewing, generating and submitting information to the appropriate

stakeholders engaged in reporting on performance. The performance report is a

significant part of the communications Management Plan, which includes the information

needed by shareholders at each level of the company in a comprehensive layout. In the

scope of the above business, reports are drawn up using one of the more effective

methods for reporting practices

D1.Way in which management accounting systems and reporting are integrated within

organizational process

Essential types of accounting systems are included in MAS, like the cost accounting

system, the costing system, the inventory management system and many more. All these are

consistent with the business process of the organization. It can be demonstrated from the

illustration of above KEF limited company. As the cost accounting process is interlinked with

the accounting department as well as the stock control system is interlinked with the

manufacturing department. The same as the MA documents are also interlinked.

TASK 2

P3. Preparation of income statements as per the costing methods.

Cost – It can be defined as total of expenditures which occurs due to completing different kinds

of operations and activities. There are different types of costs such as:

Direct cost- It can be defined as a type of cost that are directly accountable to a particular cost

object.

Indirect cost- This is a type of cost which is not directly accountable to any particular cost object.

Variable cost – This is a kinds of cost that changes in proportionate to change in volume of

production.

Fixed cost- This is a kinds of cost that does not change in proportionate to change in volume of

production.

In the companies, various kind of methods are used by accountants to prepare income statements.

Majorly, there are two types of costing methods that are absorption and marginal costing. The

detailed description of these two methods is done below which is as followings:

costs and procedures internally.

Performance report- Performance report collects vital information relevant to the quality

of the project by reviewing, generating and submitting information to the appropriate

stakeholders engaged in reporting on performance. The performance report is a

significant part of the communications Management Plan, which includes the information

needed by shareholders at each level of the company in a comprehensive layout. In the

scope of the above business, reports are drawn up using one of the more effective

methods for reporting practices

D1.Way in which management accounting systems and reporting are integrated within

organizational process

Essential types of accounting systems are included in MAS, like the cost accounting

system, the costing system, the inventory management system and many more. All these are

consistent with the business process of the organization. It can be demonstrated from the

illustration of above KEF limited company. As the cost accounting process is interlinked with

the accounting department as well as the stock control system is interlinked with the

manufacturing department. The same as the MA documents are also interlinked.

TASK 2

P3. Preparation of income statements as per the costing methods.

Cost – It can be defined as total of expenditures which occurs due to completing different kinds

of operations and activities. There are different types of costs such as:

Direct cost- It can be defined as a type of cost that are directly accountable to a particular cost

object.

Indirect cost- This is a type of cost which is not directly accountable to any particular cost object.

Variable cost – This is a kinds of cost that changes in proportionate to change in volume of

production.

Fixed cost- This is a kinds of cost that does not change in proportionate to change in volume of

production.

In the companies, various kind of methods are used by accountants to prepare income statements.

Majorly, there are two types of costing methods that are absorption and marginal costing. The

detailed description of these two methods is done below which is as followings:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Absorption costing method- It is a form of costing system that assigns the whole

production costs to the value of the unit produced. In particular, in this system, the overall

production costs, like direct material, labor costs are fully absorbed (Berry, Broadbent

and Otley, 2016).

Advantage- In this costing total occurred costs are considered into account of production.

Disadvantage- This is not beneficial for analysis of enhanced operations or to make

compare of product lines.

Marginal costing method- This is an entirely different technique of costing in that the

whole cost of production is not taken as unit cost. Whereas fixed expenditure is allocated

as the cost of the duration, dynamic spending is taken as the cost of the unit generated.

Advantage- One of the key benefit of this accounting is that it ignores the carry forward

of recent period's fixed overheads.

Disadvantage- This method is not suitable for long term price setting procedures.

ABC costing- In this costing technique costs are assigned as per the each activity

individual so that performance can be evaluated.

Advantage- It helps in analyzing accurate product costing.

Disadvantage- One of the key drawback of this costing is that it consumes too much cost

and time.

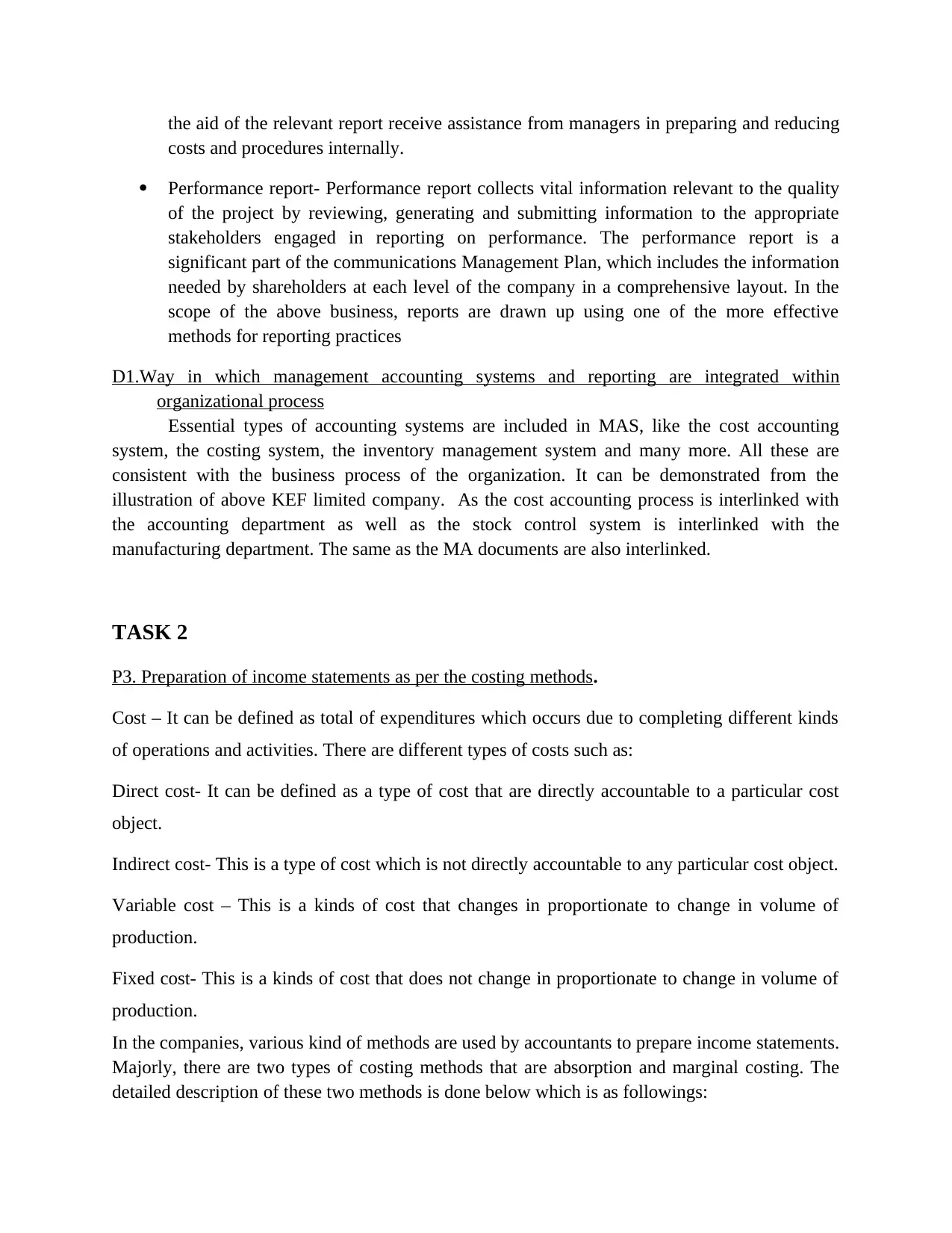

Preparation of profit and loss statements under absorption costing:

Absorption costing Marginal costing

Direct material 15 15

Direct labor 25 25

Variable production OH's 10 10

Fixed production OH's (130000/20000) 6.5

Total cost 56.5 50

production costs to the value of the unit produced. In particular, in this system, the overall

production costs, like direct material, labor costs are fully absorbed (Berry, Broadbent

and Otley, 2016).

Advantage- In this costing total occurred costs are considered into account of production.

Disadvantage- This is not beneficial for analysis of enhanced operations or to make

compare of product lines.

Marginal costing method- This is an entirely different technique of costing in that the

whole cost of production is not taken as unit cost. Whereas fixed expenditure is allocated

as the cost of the duration, dynamic spending is taken as the cost of the unit generated.

Advantage- One of the key benefit of this accounting is that it ignores the carry forward

of recent period's fixed overheads.

Disadvantage- This method is not suitable for long term price setting procedures.

ABC costing- In this costing technique costs are assigned as per the each activity

individual so that performance can be evaluated.

Advantage- It helps in analyzing accurate product costing.

Disadvantage- One of the key drawback of this costing is that it consumes too much cost

and time.

Preparation of profit and loss statements under absorption costing:

Absorption costing Marginal costing

Direct material 15 15

Direct labor 25 25

Variable production OH's 10 10

Fixed production OH's (130000/20000) 6.5

Total cost 56.5 50

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

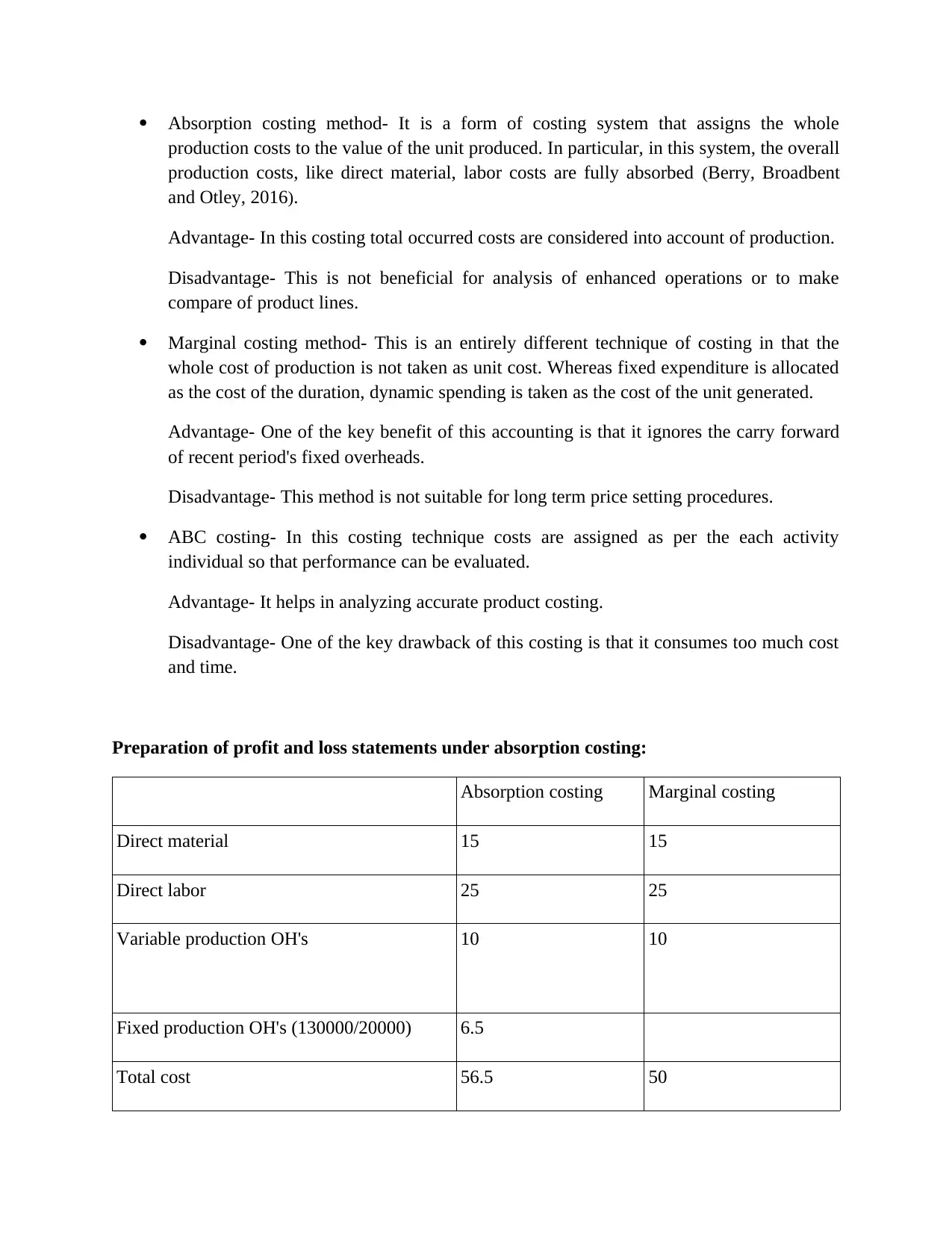

Statement of profit or loss using absorption costing for June:

No. of units £/Unit £ £

Sales 18000 70 1260000

Cost of sales: 0 56.5 0

Opening stock 19000 56.5 1073500

Add- Production 1073500

Less- Closing stock 1000 56.5 56500 -1017000

Profit 243000

Less- Under absorption 13000

Reconciled profit with the marginal

costing

230000

Statement of profit or loss using marginal costing for June:

No. of units £/Unit £ £

Sales 18000 70 1260000

Prime cost:

Opening stock 0 50 0

Add- Production 19000 50 950000

Less- Closing stock 1000 50 50000 -900000

Contribution 360000

No. of units £/Unit £ £

Sales 18000 70 1260000

Cost of sales: 0 56.5 0

Opening stock 19000 56.5 1073500

Add- Production 1073500

Less- Closing stock 1000 56.5 56500 -1017000

Profit 243000

Less- Under absorption 13000

Reconciled profit with the marginal

costing

230000

Statement of profit or loss using marginal costing for June:

No. of units £/Unit £ £

Sales 18000 70 1260000

Prime cost:

Opening stock 0 50 0

Add- Production 19000 50 950000

Less- Closing stock 1000 50 50000 -900000

Contribution 360000

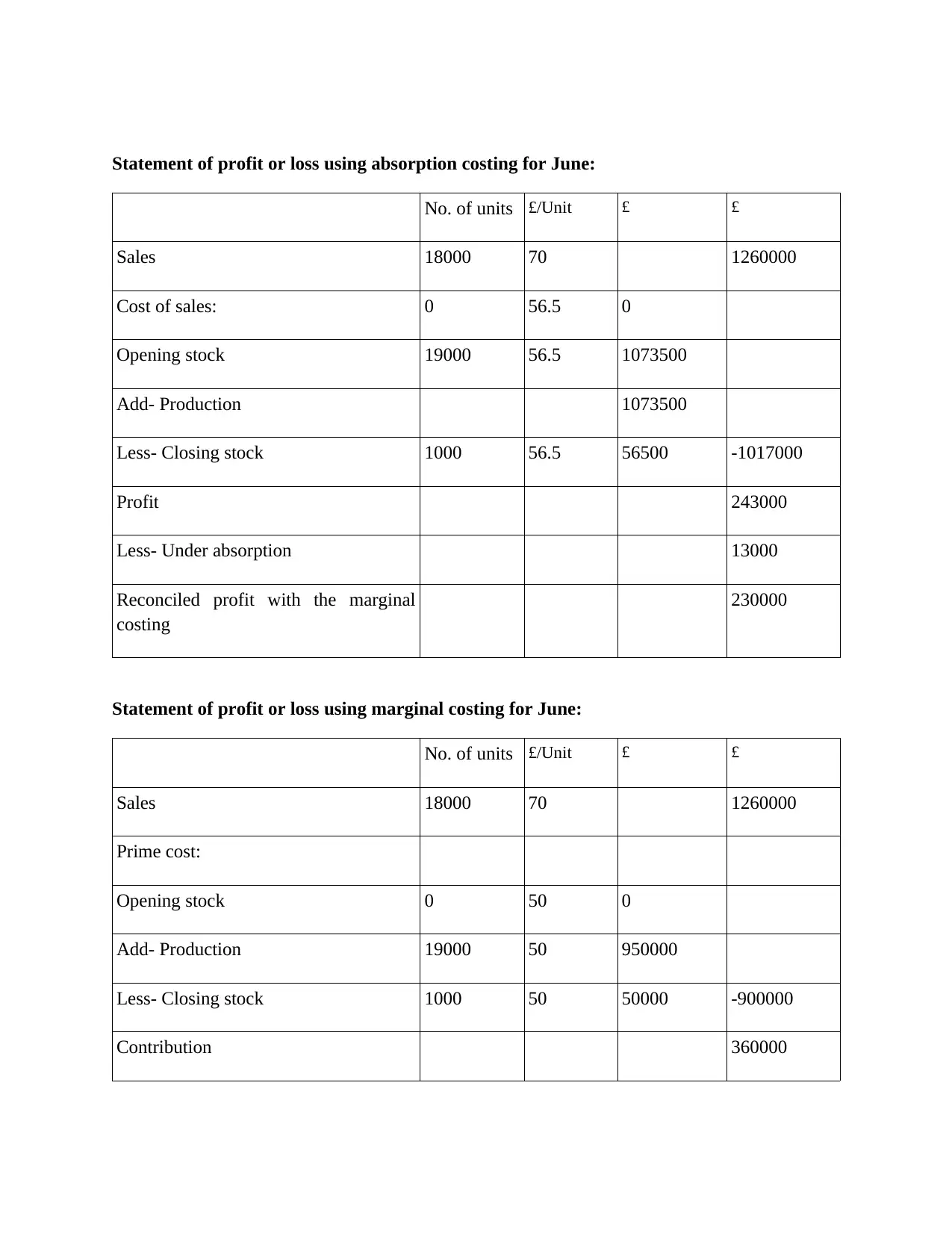

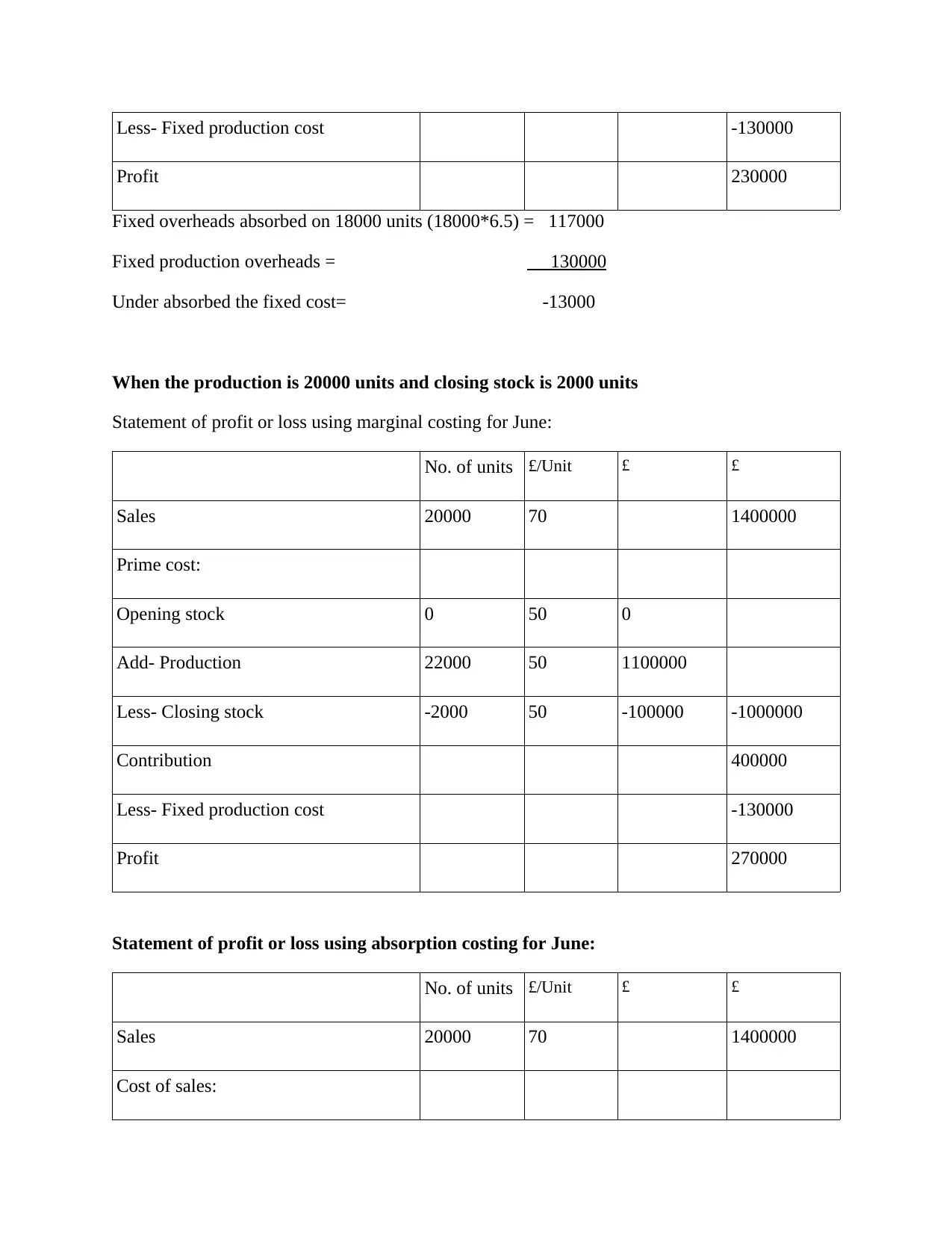

Less- Fixed production cost -130000

Profit 230000

Fixed overheads absorbed on 18000 units (18000*6.5) = 117000

Fixed production overheads = 130000

Under absorbed the fixed cost= -13000

When the production is 20000 units and closing stock is 2000 units

Statement of profit or loss using marginal costing for June:

No. of units £/Unit £ £

Sales 20000 70 1400000

Prime cost:

Opening stock 0 50 0

Add- Production 22000 50 1100000

Less- Closing stock -2000 50 -100000 -1000000

Contribution 400000

Less- Fixed production cost -130000

Profit 270000

Statement of profit or loss using absorption costing for June:

No. of units £/Unit £ £

Sales 20000 70 1400000

Cost of sales:

Profit 230000

Fixed overheads absorbed on 18000 units (18000*6.5) = 117000

Fixed production overheads = 130000

Under absorbed the fixed cost= -13000

When the production is 20000 units and closing stock is 2000 units

Statement of profit or loss using marginal costing for June:

No. of units £/Unit £ £

Sales 20000 70 1400000

Prime cost:

Opening stock 0 50 0

Add- Production 22000 50 1100000

Less- Closing stock -2000 50 -100000 -1000000

Contribution 400000

Less- Fixed production cost -130000

Profit 270000

Statement of profit or loss using absorption costing for June:

No. of units £/Unit £ £

Sales 20000 70 1400000

Cost of sales:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

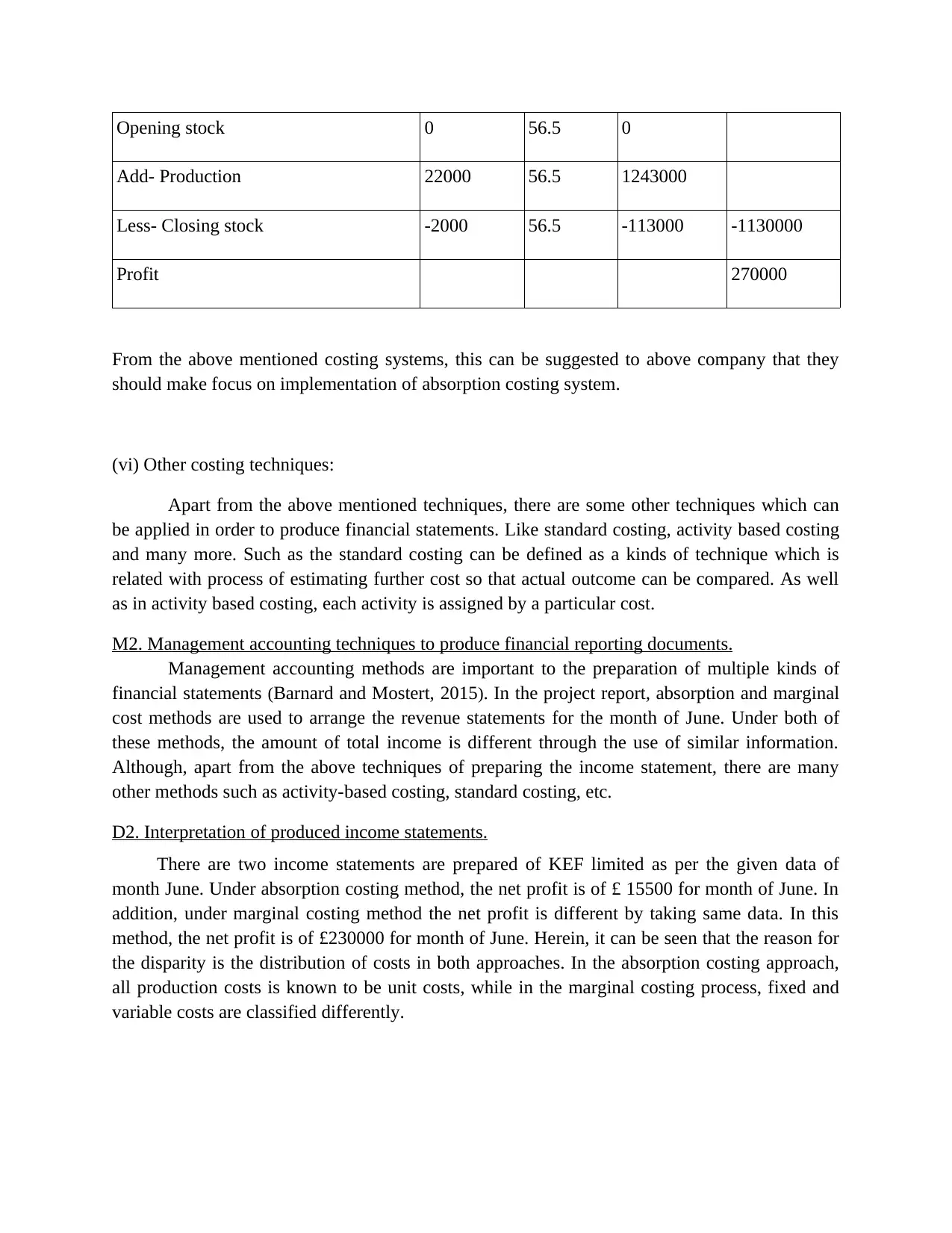

Opening stock 0 56.5 0

Add- Production 22000 56.5 1243000

Less- Closing stock -2000 56.5 -113000 -1130000

Profit 270000

From the above mentioned costing systems, this can be suggested to above company that they

should make focus on implementation of absorption costing system.

(vi) Other costing techniques:

Apart from the above mentioned techniques, there are some other techniques which can

be applied in order to produce financial statements. Like standard costing, activity based costing

and many more. Such as the standard costing can be defined as a kinds of technique which is

related with process of estimating further cost so that actual outcome can be compared. As well

as in activity based costing, each activity is assigned by a particular cost.

M2. Management accounting techniques to produce financial reporting documents.

Management accounting methods are important to the preparation of multiple kinds of

financial statements (Barnard and Mostert, 2015). In the project report, absorption and marginal

cost methods are used to arrange the revenue statements for the month of June. Under both of

these methods, the amount of total income is different through the use of similar information.

Although, apart from the above techniques of preparing the income statement, there are many

other methods such as activity-based costing, standard costing, etc.

D2. Interpretation of produced income statements.

There are two income statements are prepared of KEF limited as per the given data of

month June. Under absorption costing method, the net profit is of £ 15500 for month of June. In

addition, under marginal costing method the net profit is different by taking same data. In this

method, the net profit is of £230000 for month of June. Herein, it can be seen that the reason for

the disparity is the distribution of costs in both approaches. In the absorption costing approach,

all production costs is known to be unit costs, while in the marginal costing process, fixed and

variable costs are classified differently.

Add- Production 22000 56.5 1243000

Less- Closing stock -2000 56.5 -113000 -1130000

Profit 270000

From the above mentioned costing systems, this can be suggested to above company that they

should make focus on implementation of absorption costing system.

(vi) Other costing techniques:

Apart from the above mentioned techniques, there are some other techniques which can

be applied in order to produce financial statements. Like standard costing, activity based costing

and many more. Such as the standard costing can be defined as a kinds of technique which is

related with process of estimating further cost so that actual outcome can be compared. As well

as in activity based costing, each activity is assigned by a particular cost.

M2. Management accounting techniques to produce financial reporting documents.

Management accounting methods are important to the preparation of multiple kinds of

financial statements (Barnard and Mostert, 2015). In the project report, absorption and marginal

cost methods are used to arrange the revenue statements for the month of June. Under both of

these methods, the amount of total income is different through the use of similar information.

Although, apart from the above techniques of preparing the income statement, there are many

other methods such as activity-based costing, standard costing, etc.

D2. Interpretation of produced income statements.

There are two income statements are prepared of KEF limited as per the given data of

month June. Under absorption costing method, the net profit is of £ 15500 for month of June. In

addition, under marginal costing method the net profit is different by taking same data. In this

method, the net profit is of £230000 for month of June. Herein, it can be seen that the reason for

the disparity is the distribution of costs in both approaches. In the absorption costing approach,

all production costs is known to be unit costs, while in the marginal costing process, fixed and

variable costs are classified differently.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3

P4. Description of limitation and importance of planning tools of budgetary control.

Budgetary control- This can be characterized as a form of technique connected with the

process of deciding the financial goals of organizations through the use of various types of

budgets. Such companies become able to identify what areas they need to work on in an

effective manner. For instance, in the organization chosen above, their administrators have

set targets to calculate the current financial state of the multiple business activities.

Cash budget- It is a sort of budget that is generated by businesses with the aim of

projecting a futuristic need for money (Rickards and Ritsert, 2018).. It is accomplished

only by estimating items that can lead to cash invoices and cash outflows. This budget is

used by the above-mentioned company KEF limited in its production of products for the

purpose of determining need for cash.

Advantage- The growing benefit is that this plan is compatible with all sorts of

associations. This is because every agency needs cash and assists with effective cash

prediction.

Disadvantage- Lack of stability is the main problem of this spending plan and, as a result

of this, businesses cannot distribute cash at the period of revenue possibilities.

Sales budget- This budget is used by businesses in the title of the income spending plan. It

is a type of budget that is connected to the estimation of the number of items to be traded

by an organization in the coming time span. The budget offers an approximation of future

profits on the basis of financial data from past years and on the basis of market situation. In

the above-mentioned business, their executives use this budget to make an estimate of the

sales of their manufacturing units.

Advantage- Its benefit is that, on the basis of an estimate, businesses allocate funds to

various activities.

Disadvantage- The drawback is that it takes so much space and is not given even after a

guarantee of success.

Capital budget- It is a form of budget that is being evaluated by companies with large

hedged assets, such as factory, equipment, etc. It is used by organizations to make

decisions on deep-term investment (Krause and Tse, 2016). Essentially, it is very important

for businesses, because any wrong choice will result in huge losses for businesses. As in

the above-mentioned company, their executives use this to make major capital expenditure

judgments.

P4. Description of limitation and importance of planning tools of budgetary control.

Budgetary control- This can be characterized as a form of technique connected with the

process of deciding the financial goals of organizations through the use of various types of

budgets. Such companies become able to identify what areas they need to work on in an

effective manner. For instance, in the organization chosen above, their administrators have

set targets to calculate the current financial state of the multiple business activities.

Cash budget- It is a sort of budget that is generated by businesses with the aim of

projecting a futuristic need for money (Rickards and Ritsert, 2018).. It is accomplished

only by estimating items that can lead to cash invoices and cash outflows. This budget is

used by the above-mentioned company KEF limited in its production of products for the

purpose of determining need for cash.

Advantage- The growing benefit is that this plan is compatible with all sorts of

associations. This is because every agency needs cash and assists with effective cash

prediction.

Disadvantage- Lack of stability is the main problem of this spending plan and, as a result

of this, businesses cannot distribute cash at the period of revenue possibilities.

Sales budget- This budget is used by businesses in the title of the income spending plan. It

is a type of budget that is connected to the estimation of the number of items to be traded

by an organization in the coming time span. The budget offers an approximation of future

profits on the basis of financial data from past years and on the basis of market situation. In

the above-mentioned business, their executives use this budget to make an estimate of the

sales of their manufacturing units.

Advantage- Its benefit is that, on the basis of an estimate, businesses allocate funds to

various activities.

Disadvantage- The drawback is that it takes so much space and is not given even after a

guarantee of success.

Capital budget- It is a form of budget that is being evaluated by companies with large

hedged assets, such as factory, equipment, etc. It is used by organizations to make

decisions on deep-term investment (Krause and Tse, 2016). Essentially, it is very important

for businesses, because any wrong choice will result in huge losses for businesses. As in

the above-mentioned company, their executives use this to make major capital expenditure

judgments.

Advantages- This budget helps businesses to properly identify potential risks and prospects

that contribute to a secure choice of projects.

Disadvantages- The drawback of this budget is greater cost intake and, in some situations,

a bad decision will result in a massive loss of organization economic resources.

M3 Planning tools for preparation and forecasting of budgets.

This is crucial for companies to develop their budgets precisely because all plans and

techniques are focused on them. Planning tools play an important role in this scenario, since

various types of budgets are included in these plan tools and each of them includes financial data

required for the preparing of the spending plan (Corvellec, 2018). This can be understood, as in

the illustration of the corporation chosen above, KEF limited the use of certain planning tools,

such as cash budget, capital budget, etc. These budgets assist their bookkeepers to create a proper

estimate of profits and costs. It can therefore be indicated that the planning tools are linked to the

operation for planning budgets.

TASK 4

P5.Comparison of organizations to solve the financial issues with the help of accounting systems

Financial problem- Financial issues are one of the growing challenges facing many

businesses (Fayol, 2016). This is because any mistake in the resource allocation can escalate to a

financial issue. When organizations do not concentrate on working out their financial difficulties,

they may become a financial crisis. Below are some financial problems, which are as follows:

Decreased revenues- The revenue amount of the corporations is directly related to how

many units are sold over a given time period. If sales decrease, the income diagram will

automatically decrease. The reason for this financial problem may be greater product

profitability or poor company's brand image, etc. The organization concerned referred to

it above is facing this problem as a result of a reduction in the number of sales units.

Continuously increasing in expenses- This financial problem occurs in businesses due to

internal disputes between businesses, such as poor governance of economic resources and

inefficient distribution of funds, etc.

Ways to find out exact financial issue:

Ratio analysis- It's one of the increasing strategies for finding the exact problem.

Accordingly, a significant number of ratios are measured and evaluated in order to

subtract the financial issue (Bierer, Götze, Meynerts and Sygulla, 2015). As in the above-

that contribute to a secure choice of projects.

Disadvantages- The drawback of this budget is greater cost intake and, in some situations,

a bad decision will result in a massive loss of organization economic resources.

M3 Planning tools for preparation and forecasting of budgets.

This is crucial for companies to develop their budgets precisely because all plans and

techniques are focused on them. Planning tools play an important role in this scenario, since

various types of budgets are included in these plan tools and each of them includes financial data

required for the preparing of the spending plan (Corvellec, 2018). This can be understood, as in

the illustration of the corporation chosen above, KEF limited the use of certain planning tools,

such as cash budget, capital budget, etc. These budgets assist their bookkeepers to create a proper

estimate of profits and costs. It can therefore be indicated that the planning tools are linked to the

operation for planning budgets.

TASK 4

P5.Comparison of organizations to solve the financial issues with the help of accounting systems

Financial problem- Financial issues are one of the growing challenges facing many

businesses (Fayol, 2016). This is because any mistake in the resource allocation can escalate to a

financial issue. When organizations do not concentrate on working out their financial difficulties,

they may become a financial crisis. Below are some financial problems, which are as follows:

Decreased revenues- The revenue amount of the corporations is directly related to how

many units are sold over a given time period. If sales decrease, the income diagram will

automatically decrease. The reason for this financial problem may be greater product

profitability or poor company's brand image, etc. The organization concerned referred to

it above is facing this problem as a result of a reduction in the number of sales units.

Continuously increasing in expenses- This financial problem occurs in businesses due to

internal disputes between businesses, such as poor governance of economic resources and

inefficient distribution of funds, etc.

Ways to find out exact financial issue:

Ratio analysis- It's one of the increasing strategies for finding the exact problem.

Accordingly, a significant number of ratios are measured and evaluated in order to

subtract the financial issue (Bierer, Götze, Meynerts and Sygulla, 2015). As in the above-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.