Management Accounting Report for Unit 5: Decision Making

VerifiedAdded on 2021/10/06

|14

|3241

|88

Report

AI Summary

This report provides a comprehensive overview of management accounting, starting with its introduction and integration of financial and non-financial information for effective decision-making. It compares management accounting with cost accounting, outlining the global management accounting principles and generally accepted management accounting principles. The report delves into the differences between management and financial accounting, along with different types of management accounting reports. Part B focuses on cost concepts, including fixed, variable, and marginal costs, as well as cost allocation methods, CVP analysis, and break-even analysis. Furthermore, it covers inventory management techniques like FIFO, LIFO, and WAC. Part C explores budgeting and budgetary control as planning tools, including the advantages and disadvantages of budgeting, and concludes with cash flow forecasting. The assignment provides a detailed analysis of the various components of management accounting and its practical applications.

From: Syed Munim Ajaz

To: Sir Mohsin

Unit: 5

Unit Name: Management Accounting

Submission Date:

To: Sir Mohsin

Unit: 5

Unit Name: Management Accounting

Submission Date:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION OF MANAGEMENT ACCOUNTING

It’s a comprehensive term which integrates financial and non-financial statements through

which management team can obtain useful information in order to take a better and effective

decision. A well-organized accounting management system plays a crucial role in offering

information about the account status to the management team.

Management accounting is having a wide scope and it contains all kinds of accounting

information.

LO1

COMPARISON BETWEEN MANAGEMENT ACCOUNTING

AND COST ACCOUNTING

A. Management Accounting

The term Management Accounting otherwise known as Managerial Accounting, encapsulates

the business practice of preparing management documents, reports and accounts that provide

precise fiscal as well as numerical data, in a timely manner, which is required by managers for

decision making on daily or short –term basis.

B. Cost Accounting

Another term closely linked with management accounting is known as Cost Accounting. This is a

critical function and it provides information that is used both for management accounting as

well as financial accounting.

It’s a comprehensive term which integrates financial and non-financial statements through

which management team can obtain useful information in order to take a better and effective

decision. A well-organized accounting management system plays a crucial role in offering

information about the account status to the management team.

Management accounting is having a wide scope and it contains all kinds of accounting

information.

LO1

COMPARISON BETWEEN MANAGEMENT ACCOUNTING

AND COST ACCOUNTING

A. Management Accounting

The term Management Accounting otherwise known as Managerial Accounting, encapsulates

the business practice of preparing management documents, reports and accounts that provide

precise fiscal as well as numerical data, in a timely manner, which is required by managers for

decision making on daily or short –term basis.

B. Cost Accounting

Another term closely linked with management accounting is known as Cost Accounting. This is a

critical function and it provides information that is used both for management accounting as

well as financial accounting.

THE GLOBAL MANAGEMENT ACCOUNTING PRINCIPLES

Management accounting is the sourcing, analysis, communication and use of decision-relevant

financial and non-financial information to generate and preserve value of organizations.

Management accounting requires a thorough understanding of the business (including the

business model) and its operating environment so that organizational risks and opportunities

are known. By managing and responding appropriately to risks, organizations can exploit

opportunities and generate value for stakeholders over time.

Management accounting lies at the heart of an organization, at the crossroads between finance

and management. It provides structured solutions to unstructured problems by translating the

complex into the simple and by making the simple compelling.

Bringing together both financial and non-financial considerations, it is the discipline that should

be used to run the organization, to control and improve performances.

The business model is the means by which the organization generates value. Because

management accounting requires a thorough understanding of the business model, as well as

the organizations market and macro-economic environment, it contributes to sustainable

success.

Management accounting helps organizations make better decisions by extracting value from

information. Rooting decisions in evidence, or basing them on informed judgment rather than

conjecture, makes sustainable success more achievable. All the Global Management Accounting

Principles flow from this ambition.

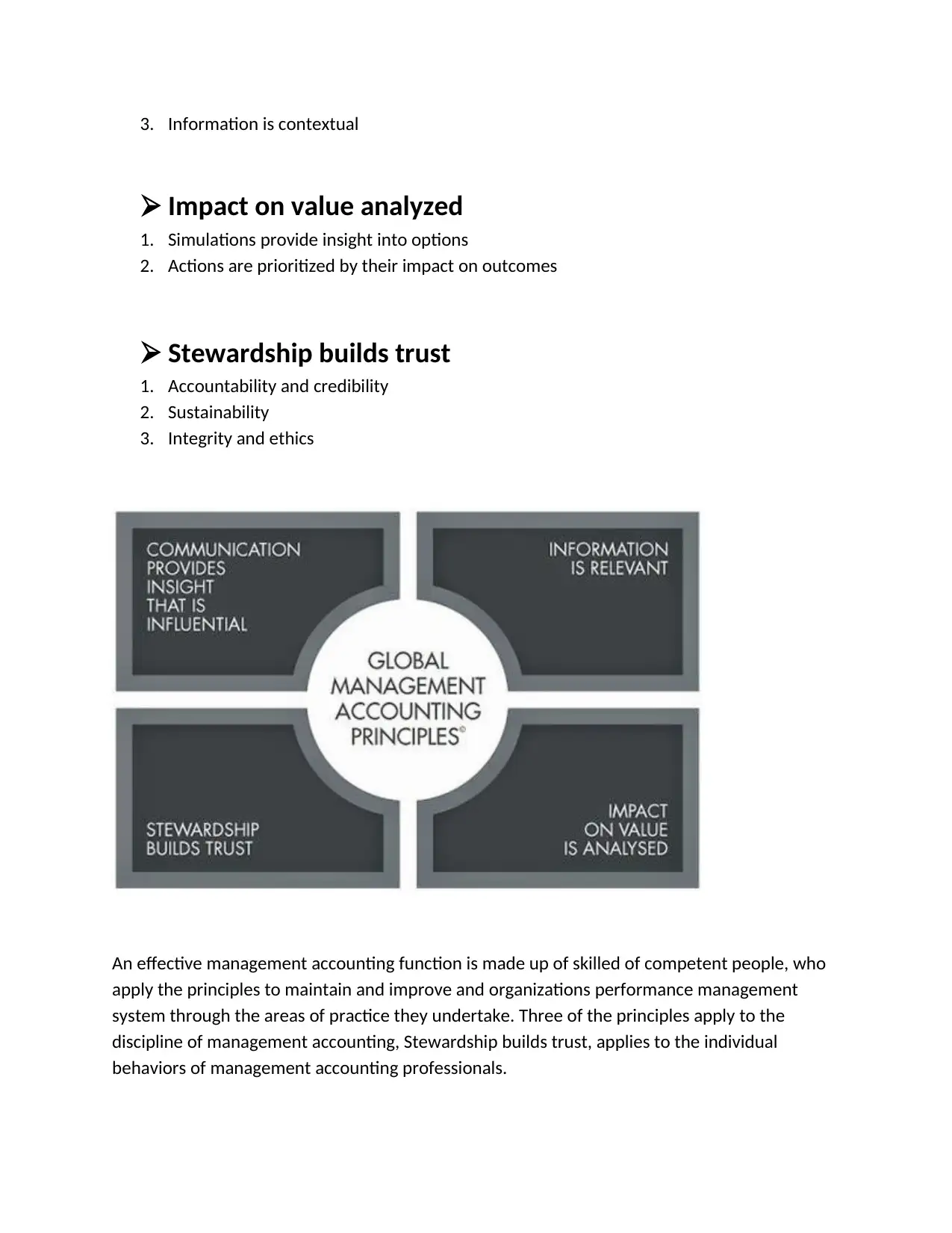

They describe the fundamental values, qualities, norms and features to which management

accounting professionals should aspire. Four overarching Principles to be considered

continuously rather than sequentially are key to achieving this:

Communication provides insight that is influential

1. Strategy development and execution is a conversation

2. Communication is tailored

3. Communication facilitates better decisions

Information is relevant

1. Information is the best available

2. Information is reliable and accessible

Management accounting is the sourcing, analysis, communication and use of decision-relevant

financial and non-financial information to generate and preserve value of organizations.

Management accounting requires a thorough understanding of the business (including the

business model) and its operating environment so that organizational risks and opportunities

are known. By managing and responding appropriately to risks, organizations can exploit

opportunities and generate value for stakeholders over time.

Management accounting lies at the heart of an organization, at the crossroads between finance

and management. It provides structured solutions to unstructured problems by translating the

complex into the simple and by making the simple compelling.

Bringing together both financial and non-financial considerations, it is the discipline that should

be used to run the organization, to control and improve performances.

The business model is the means by which the organization generates value. Because

management accounting requires a thorough understanding of the business model, as well as

the organizations market and macro-economic environment, it contributes to sustainable

success.

Management accounting helps organizations make better decisions by extracting value from

information. Rooting decisions in evidence, or basing them on informed judgment rather than

conjecture, makes sustainable success more achievable. All the Global Management Accounting

Principles flow from this ambition.

They describe the fundamental values, qualities, norms and features to which management

accounting professionals should aspire. Four overarching Principles to be considered

continuously rather than sequentially are key to achieving this:

Communication provides insight that is influential

1. Strategy development and execution is a conversation

2. Communication is tailored

3. Communication facilitates better decisions

Information is relevant

1. Information is the best available

2. Information is reliable and accessible

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3. Information is contextual

Impact on value analyzed

1. Simulations provide insight into options

2. Actions are prioritized by their impact on outcomes

Stewardship builds trust

1. Accountability and credibility

2. Sustainability

3. Integrity and ethics

An effective management accounting function is made up of skilled of competent people, who

apply the principles to maintain and improve and organizations performance management

system through the areas of practice they undertake. Three of the principles apply to the

discipline of management accounting, Stewardship builds trust, applies to the individual

behaviors of management accounting professionals.

Impact on value analyzed

1. Simulations provide insight into options

2. Actions are prioritized by their impact on outcomes

Stewardship builds trust

1. Accountability and credibility

2. Sustainability

3. Integrity and ethics

An effective management accounting function is made up of skilled of competent people, who

apply the principles to maintain and improve and organizations performance management

system through the areas of practice they undertake. Three of the principles apply to the

discipline of management accounting, Stewardship builds trust, applies to the individual

behaviors of management accounting professionals.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

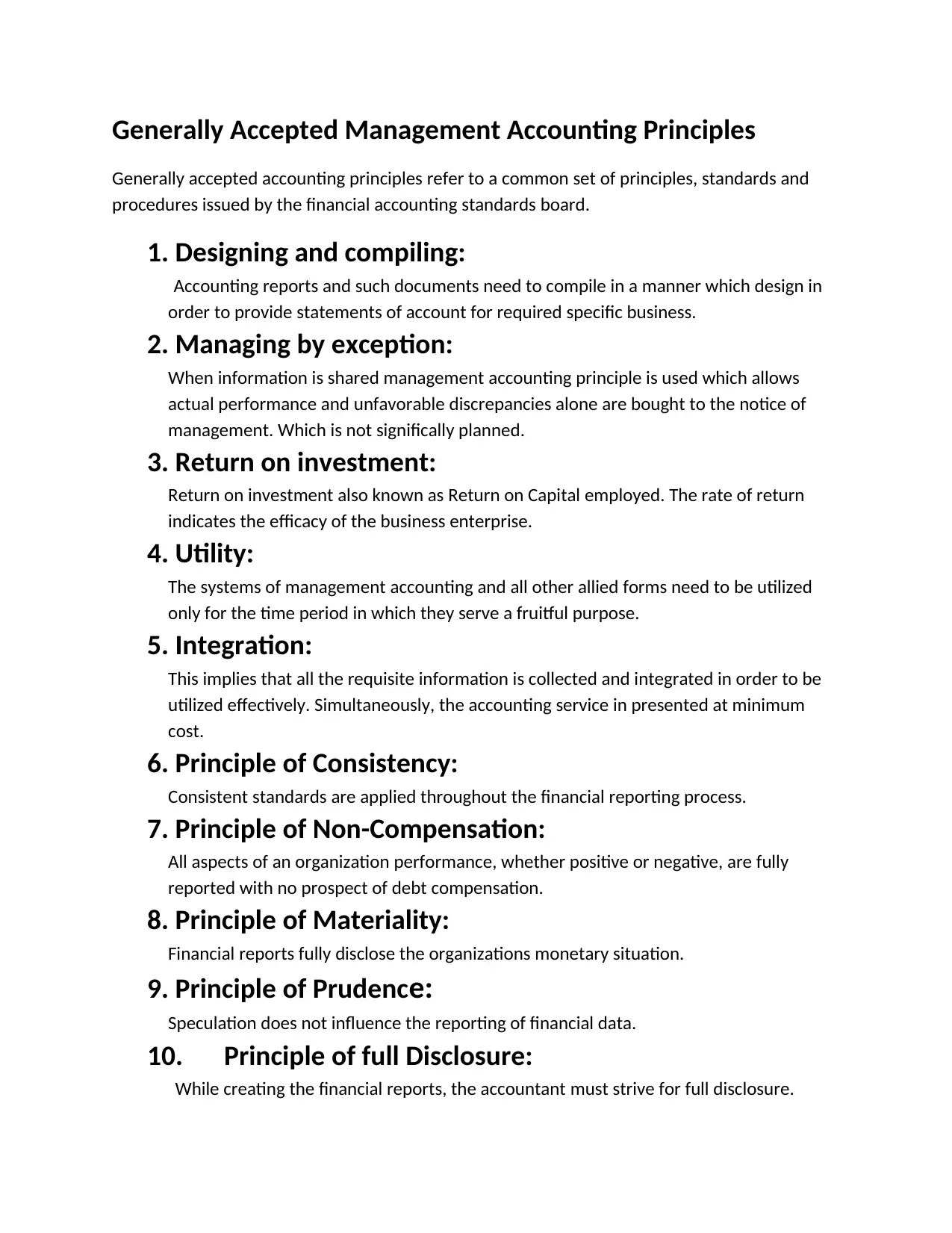

Generally Accepted Management Accounting Principles

Generally accepted accounting principles refer to a common set of principles, standards and

procedures issued by the financial accounting standards board.

1. Designing and compiling:

Accounting reports and such documents need to compile in a manner which design in

order to provide statements of account for required specific business.

2. Managing by exception:

When information is shared management accounting principle is used which allows

actual performance and unfavorable discrepancies alone are bought to the notice of

management. Which is not significally planned.

3. Return on investment:

Return on investment also known as Return on Capital employed. The rate of return

indicates the efficacy of the business enterprise.

4. Utility:

The systems of management accounting and all other allied forms need to be utilized

only for the time period in which they serve a fruitful purpose.

5. Integration:

This implies that all the requisite information is collected and integrated in order to be

utilized effectively. Simultaneously, the accounting service in presented at minimum

cost.

6. Principle of Consistency:

Consistent standards are applied throughout the financial reporting process.

7. Principle of Non-Compensation:

All aspects of an organization performance, whether positive or negative, are fully

reported with no prospect of debt compensation.

8. Principle of Materiality:

Financial reports fully disclose the organizations monetary situation.

9. Principle of Prudence:

Speculation does not influence the reporting of financial data.

10. Principle of full Disclosure:

While creating the financial reports, the accountant must strive for full disclosure.

Generally accepted accounting principles refer to a common set of principles, standards and

procedures issued by the financial accounting standards board.

1. Designing and compiling:

Accounting reports and such documents need to compile in a manner which design in

order to provide statements of account for required specific business.

2. Managing by exception:

When information is shared management accounting principle is used which allows

actual performance and unfavorable discrepancies alone are bought to the notice of

management. Which is not significally planned.

3. Return on investment:

Return on investment also known as Return on Capital employed. The rate of return

indicates the efficacy of the business enterprise.

4. Utility:

The systems of management accounting and all other allied forms need to be utilized

only for the time period in which they serve a fruitful purpose.

5. Integration:

This implies that all the requisite information is collected and integrated in order to be

utilized effectively. Simultaneously, the accounting service in presented at minimum

cost.

6. Principle of Consistency:

Consistent standards are applied throughout the financial reporting process.

7. Principle of Non-Compensation:

All aspects of an organization performance, whether positive or negative, are fully

reported with no prospect of debt compensation.

8. Principle of Materiality:

Financial reports fully disclose the organizations monetary situation.

9. Principle of Prudence:

Speculation does not influence the reporting of financial data.

10. Principle of full Disclosure:

While creating the financial reports, the accountant must strive for full disclosure.

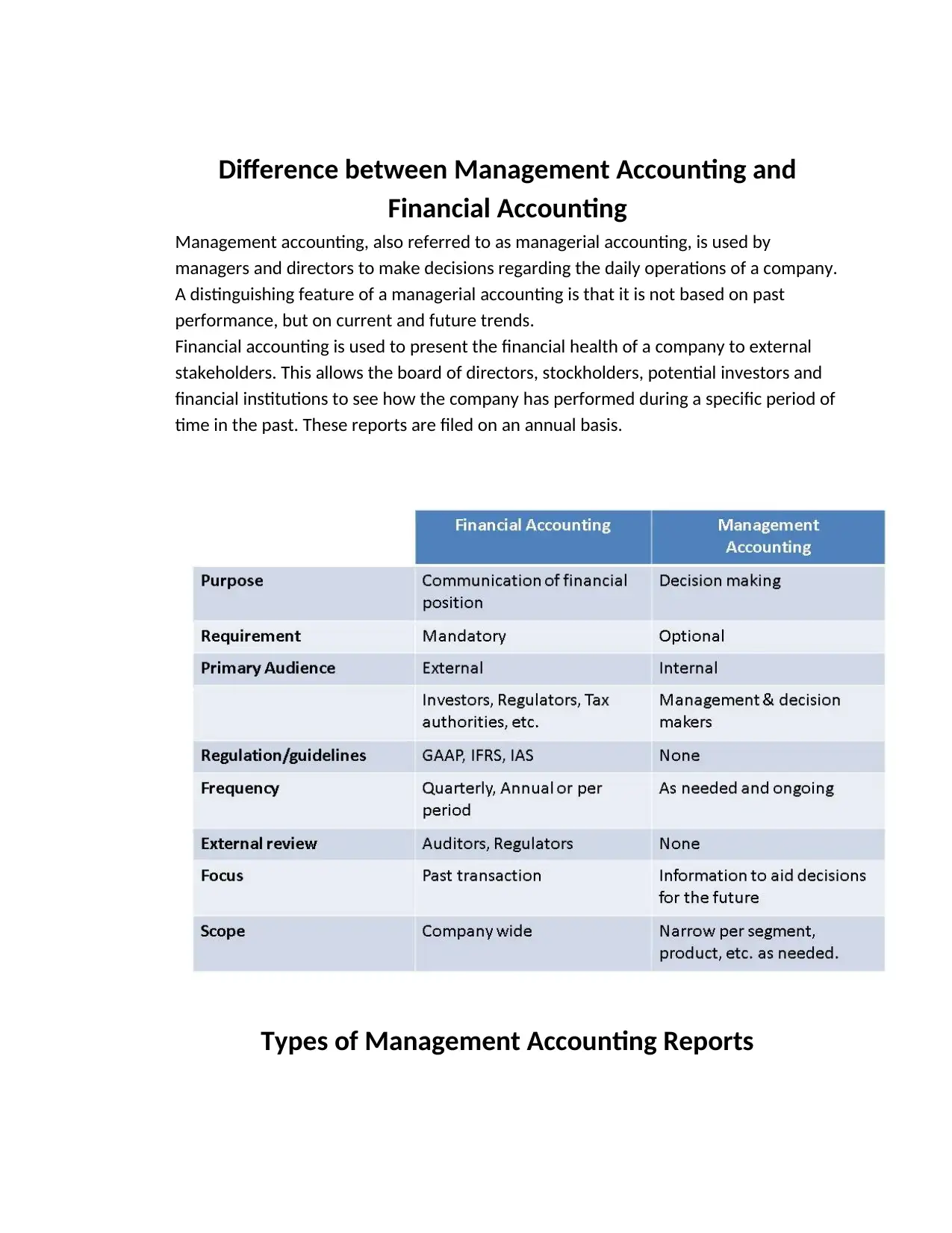

Difference between Management Accounting and

Financial Accounting

Management accounting, also referred to as managerial accounting, is used by

managers and directors to make decisions regarding the daily operations of a company.

A distinguishing feature of a managerial accounting is that it is not based on past

performance, but on current and future trends.

Financial accounting is used to present the financial health of a company to external

stakeholders. This allows the board of directors, stockholders, potential investors and

financial institutions to see how the company has performed during a specific period of

time in the past. These reports are filed on an annual basis.

Types of Management Accounting Reports

Financial Accounting

Management accounting, also referred to as managerial accounting, is used by

managers and directors to make decisions regarding the daily operations of a company.

A distinguishing feature of a managerial accounting is that it is not based on past

performance, but on current and future trends.

Financial accounting is used to present the financial health of a company to external

stakeholders. This allows the board of directors, stockholders, potential investors and

financial institutions to see how the company has performed during a specific period of

time in the past. These reports are filed on an annual basis.

Types of Management Accounting Reports

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1. Budgeting Reports: Budgetary reports set out the plan to analyze the company

performance while making evaluations about the departments’ performance

and control costs.

2. Accounts Receivable Aging Reports: This type of report is concerned with

managing account receivables for these companies which are engaged in

extending the credits to their customers.

3. Job Cost Reports: Job costs reports are concerned with identifying cost,

expenses, and profitability of each particular job.

4. Inventory and manufacturing reports: Companies involved in manufacturing

processes prepare these types of reports so that their manufacturing and

inventory process can become more efficient.

5. Performance reports: The differences calculated on a comparison of actual

results with budgeted performances are analyzed and information regarding

this is presented in performance reports.

6. Order information report: The order information report helps management to

see the trends in their business efficiently.

7. A business situation or opportunity reports: The reports are prepared for

management so that they can be well aware of the occurrence of a particular

event.

LO2

PART B

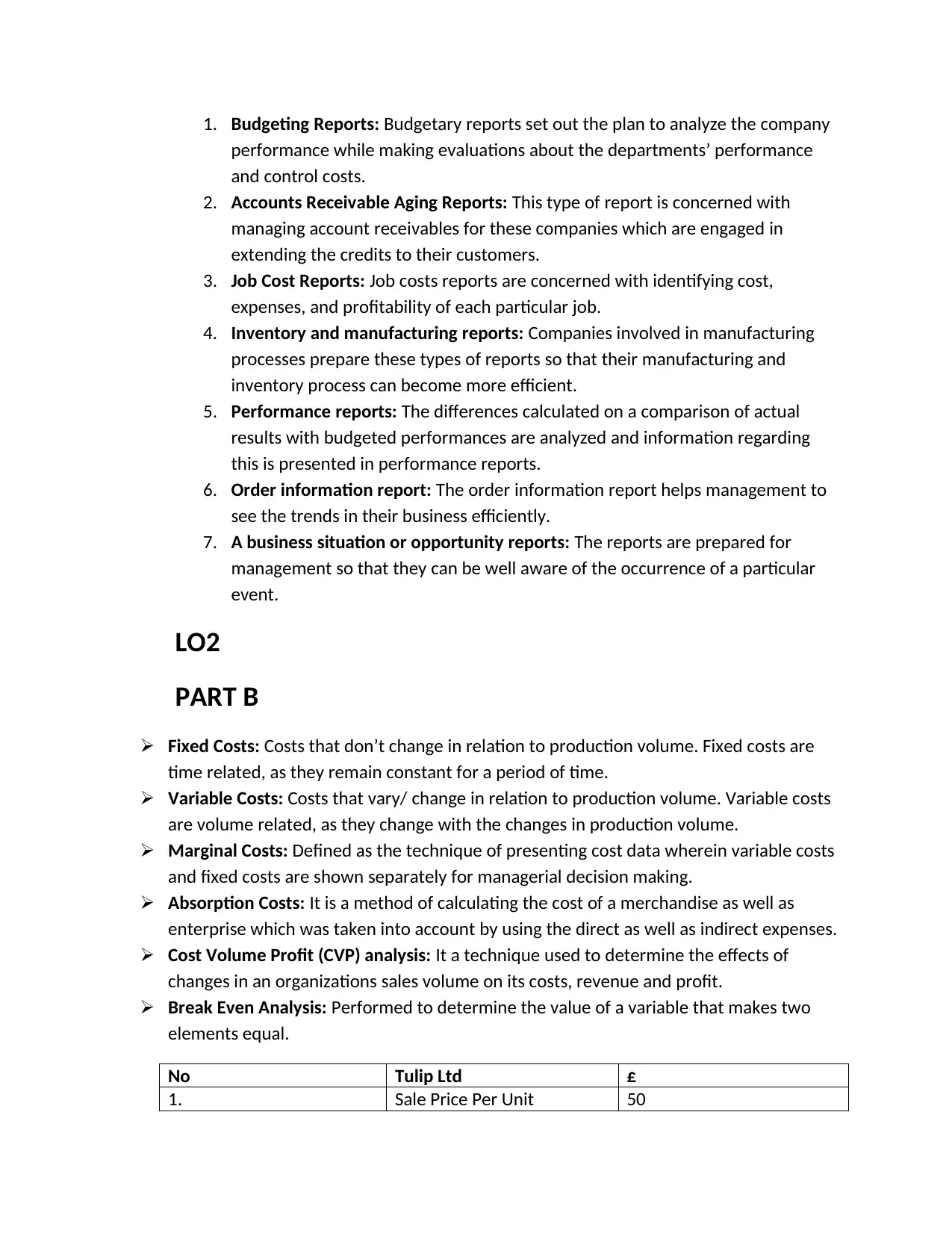

Fixed Costs: Costs that don’t change in relation to production volume. Fixed costs are

time related, as they remain constant for a period of time.

Variable Costs: Costs that vary/ change in relation to production volume. Variable costs

are volume related, as they change with the changes in production volume.

Marginal Costs: Defined as the technique of presenting cost data wherein variable costs

and fixed costs are shown separately for managerial decision making.

Absorption Costs: It is a method of calculating the cost of a merchandise as well as

enterprise which was taken into account by using the direct as well as indirect expenses.

Cost Volume Profit (CVP) analysis: It a technique used to determine the effects of

changes in an organizations sales volume on its costs, revenue and profit.

Break Even Analysis: Performed to determine the value of a variable that makes two

elements equal.

No Tulip Ltd £

1. Sale Price Per Unit 50

performance while making evaluations about the departments’ performance

and control costs.

2. Accounts Receivable Aging Reports: This type of report is concerned with

managing account receivables for these companies which are engaged in

extending the credits to their customers.

3. Job Cost Reports: Job costs reports are concerned with identifying cost,

expenses, and profitability of each particular job.

4. Inventory and manufacturing reports: Companies involved in manufacturing

processes prepare these types of reports so that their manufacturing and

inventory process can become more efficient.

5. Performance reports: The differences calculated on a comparison of actual

results with budgeted performances are analyzed and information regarding

this is presented in performance reports.

6. Order information report: The order information report helps management to

see the trends in their business efficiently.

7. A business situation or opportunity reports: The reports are prepared for

management so that they can be well aware of the occurrence of a particular

event.

LO2

PART B

Fixed Costs: Costs that don’t change in relation to production volume. Fixed costs are

time related, as they remain constant for a period of time.

Variable Costs: Costs that vary/ change in relation to production volume. Variable costs

are volume related, as they change with the changes in production volume.

Marginal Costs: Defined as the technique of presenting cost data wherein variable costs

and fixed costs are shown separately for managerial decision making.

Absorption Costs: It is a method of calculating the cost of a merchandise as well as

enterprise which was taken into account by using the direct as well as indirect expenses.

Cost Volume Profit (CVP) analysis: It a technique used to determine the effects of

changes in an organizations sales volume on its costs, revenue and profit.

Break Even Analysis: Performed to determine the value of a variable that makes two

elements equal.

No Tulip Ltd £

1. Sale Price Per Unit 50

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2. Variable Cost Per Unit 25

3. Fixed cost for the period in

total

50,000

4. Calculate Break-even point

in units

2000

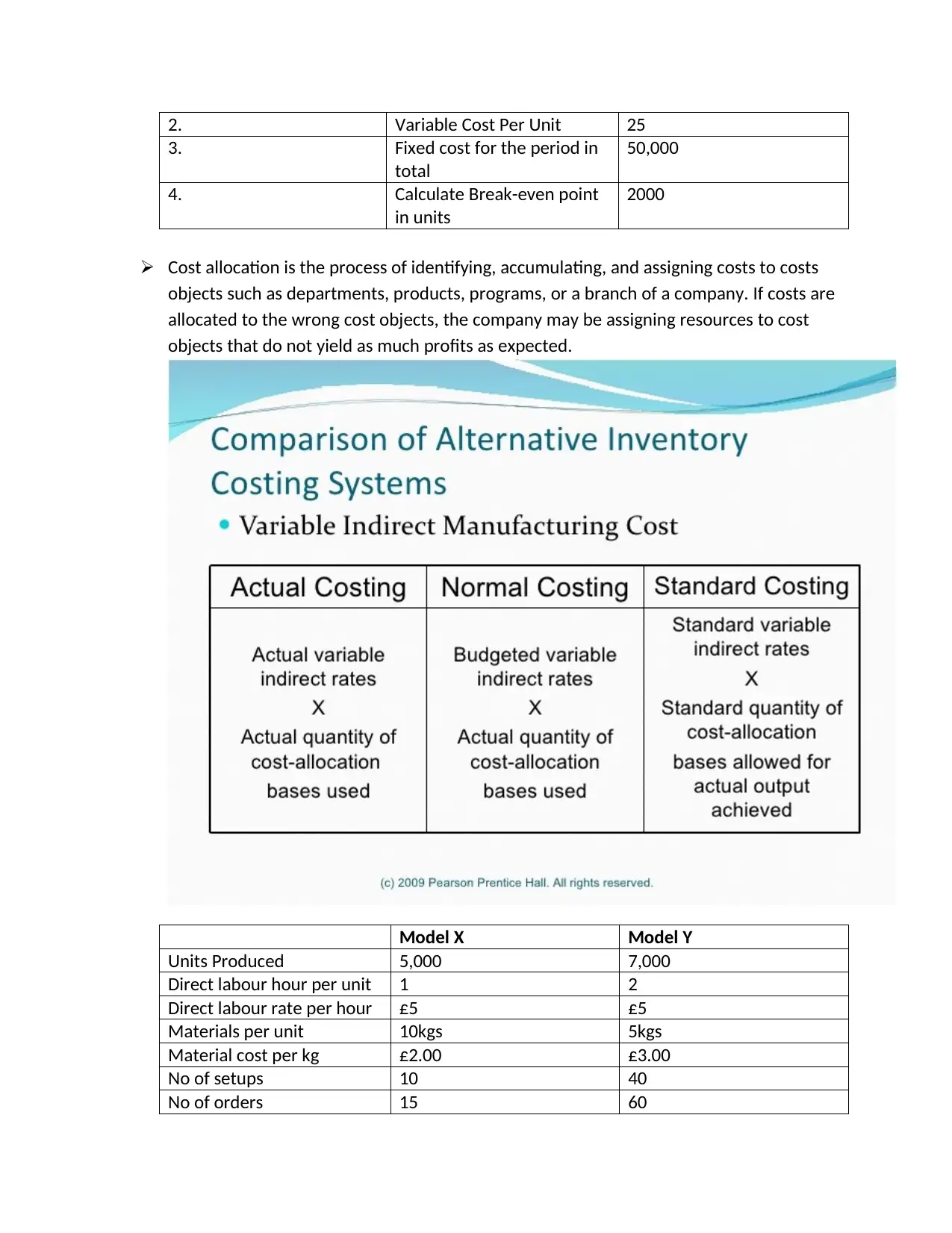

Cost allocation is the process of identifying, accumulating, and assigning costs to costs

objects such as departments, products, programs, or a branch of a company. If costs are

allocated to the wrong cost objects, the company may be assigning resources to cost

objects that do not yield as much profits as expected.

Model X Model Y

Units Produced 5,000 7,000

Direct labour hour per unit 1 2

Direct labour rate per hour £5 £5

Materials per unit 10kgs 5kgs

Material cost per kg £2.00 £3.00

No of setups 10 40

No of orders 15 60

3. Fixed cost for the period in

total

50,000

4. Calculate Break-even point

in units

2000

Cost allocation is the process of identifying, accumulating, and assigning costs to costs

objects such as departments, products, programs, or a branch of a company. If costs are

allocated to the wrong cost objects, the company may be assigning resources to cost

objects that do not yield as much profits as expected.

Model X Model Y

Units Produced 5,000 7,000

Direct labour hour per unit 1 2

Direct labour rate per hour £5 £5

Materials per unit 10kgs 5kgs

Material cost per kg £2.00 £3.00

No of setups 10 40

No of orders 15 60

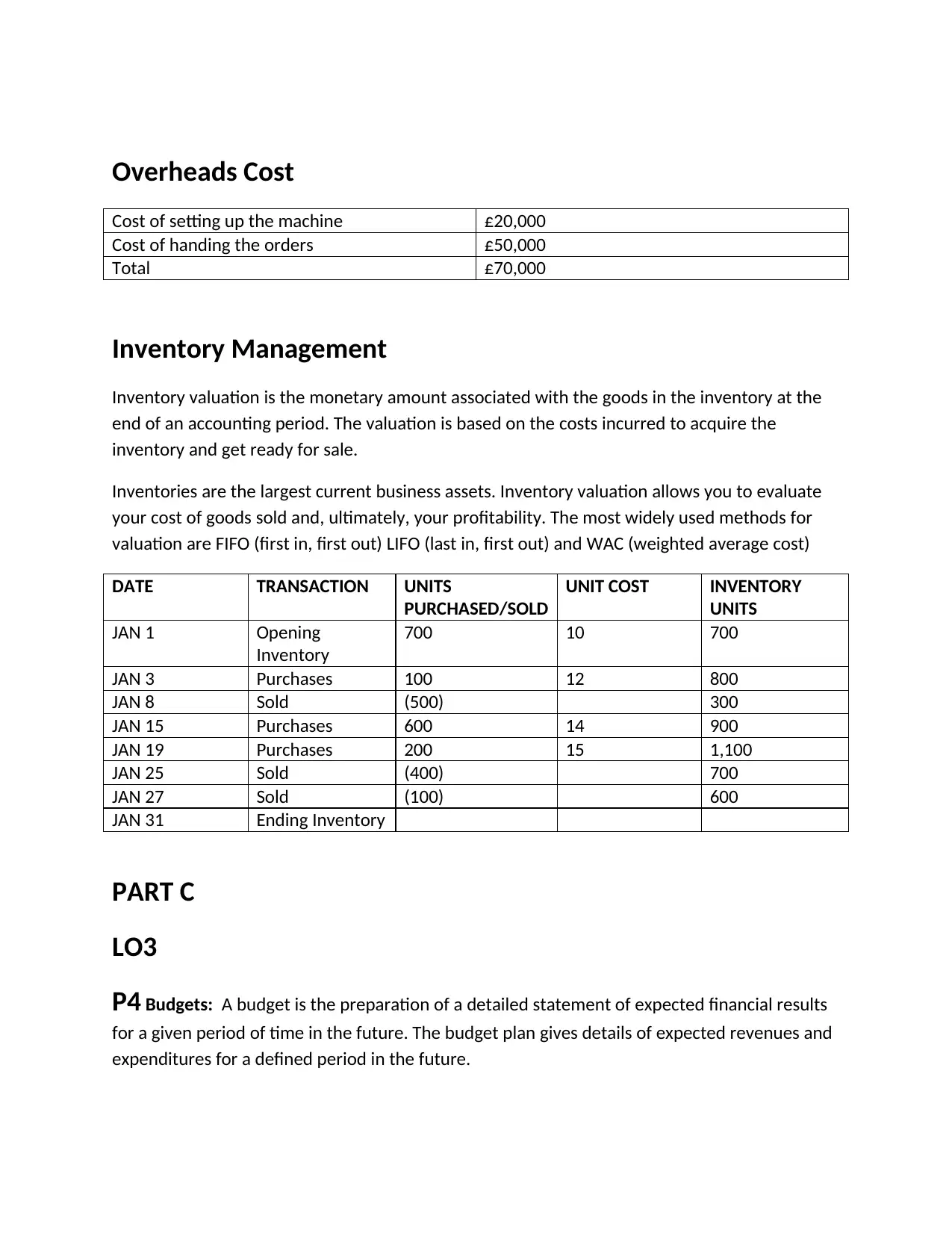

Overheads Cost

Cost of setting up the machine £20,000

Cost of handing the orders £50,000

Total £70,000

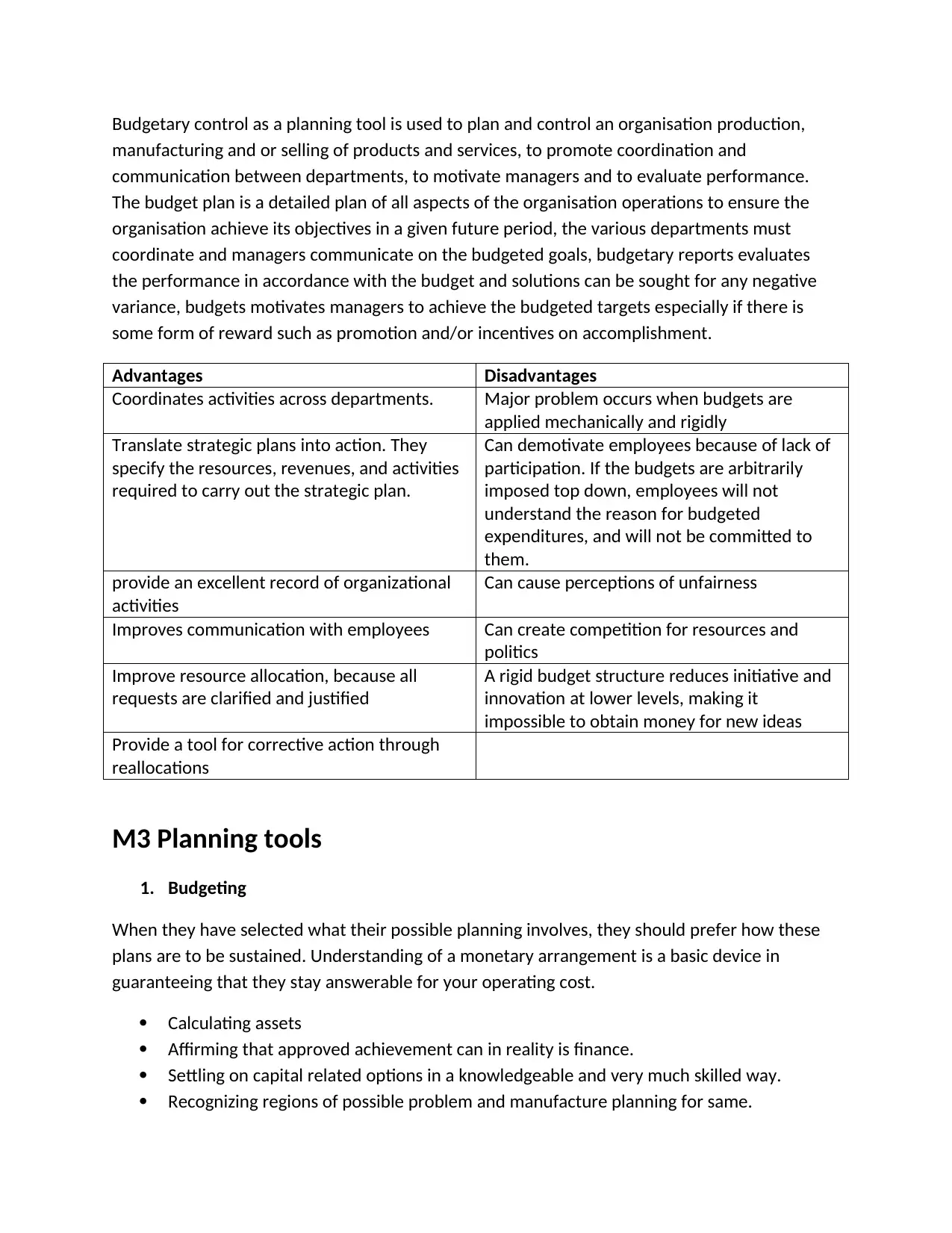

Inventory Management

Inventory valuation is the monetary amount associated with the goods in the inventory at the

end of an accounting period. The valuation is based on the costs incurred to acquire the

inventory and get ready for sale.

Inventories are the largest current business assets. Inventory valuation allows you to evaluate

your cost of goods sold and, ultimately, your profitability. The most widely used methods for

valuation are FIFO (first in, first out) LIFO (last in, first out) and WAC (weighted average cost)

DATE TRANSACTION UNITS

PURCHASED/SOLD

UNIT COST INVENTORY

UNITS

JAN 1 Opening

Inventory

700 10 700

JAN 3 Purchases 100 12 800

JAN 8 Sold (500) 300

JAN 15 Purchases 600 14 900

JAN 19 Purchases 200 15 1,100

JAN 25 Sold (400) 700

JAN 27 Sold (100) 600

JAN 31 Ending Inventory

PART C

LO3

P4 Budgets: A budget is the preparation of a detailed statement of expected financial results

for a given period of time in the future. The budget plan gives details of expected revenues and

expenditures for a defined period in the future.

Cost of setting up the machine £20,000

Cost of handing the orders £50,000

Total £70,000

Inventory Management

Inventory valuation is the monetary amount associated with the goods in the inventory at the

end of an accounting period. The valuation is based on the costs incurred to acquire the

inventory and get ready for sale.

Inventories are the largest current business assets. Inventory valuation allows you to evaluate

your cost of goods sold and, ultimately, your profitability. The most widely used methods for

valuation are FIFO (first in, first out) LIFO (last in, first out) and WAC (weighted average cost)

DATE TRANSACTION UNITS

PURCHASED/SOLD

UNIT COST INVENTORY

UNITS

JAN 1 Opening

Inventory

700 10 700

JAN 3 Purchases 100 12 800

JAN 8 Sold (500) 300

JAN 15 Purchases 600 14 900

JAN 19 Purchases 200 15 1,100

JAN 25 Sold (400) 700

JAN 27 Sold (100) 600

JAN 31 Ending Inventory

PART C

LO3

P4 Budgets: A budget is the preparation of a detailed statement of expected financial results

for a given period of time in the future. The budget plan gives details of expected revenues and

expenditures for a defined period in the future.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

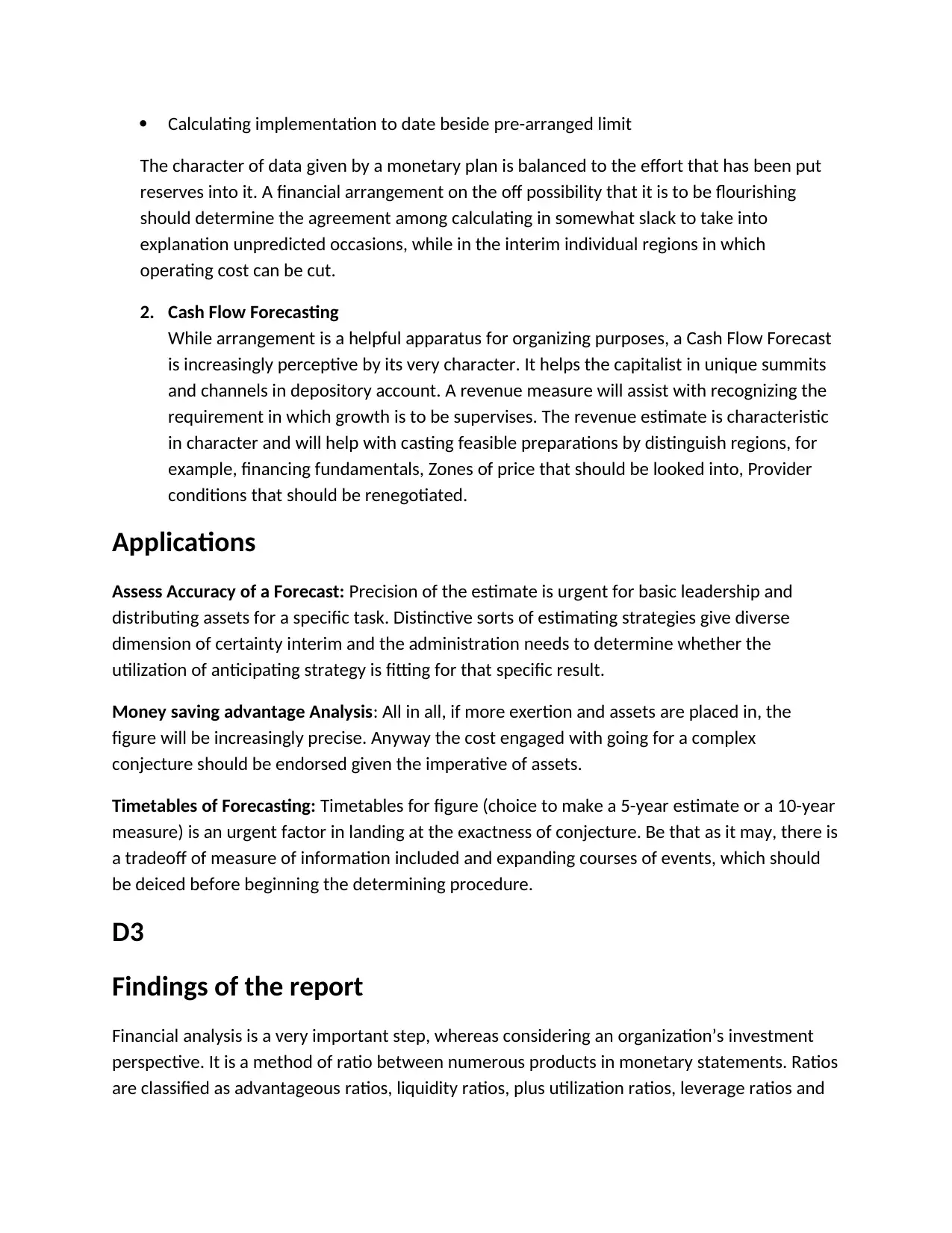

Budgetary control as a planning tool is used to plan and control an organisation production,

manufacturing and or selling of products and services, to promote coordination and

communication between departments, to motivate managers and to evaluate performance.

The budget plan is a detailed plan of all aspects of the organisation operations to ensure the

organisation achieve its objectives in a given future period, the various departments must

coordinate and managers communicate on the budgeted goals, budgetary reports evaluates

the performance in accordance with the budget and solutions can be sought for any negative

variance, budgets motivates managers to achieve the budgeted targets especially if there is

some form of reward such as promotion and/or incentives on accomplishment.

Advantages Disadvantages

Coordinates activities across departments. Major problem occurs when budgets are

applied mechanically and rigidly

Translate strategic plans into action. They

specify the resources, revenues, and activities

required to carry out the strategic plan.

Can demotivate employees because of lack of

participation. If the budgets are arbitrarily

imposed top down, employees will not

understand the reason for budgeted

expenditures, and will not be committed to

them.

provide an excellent record of organizational

activities

Can cause perceptions of unfairness

Improves communication with employees Can create competition for resources and

politics

Improve resource allocation, because all

requests are clarified and justified

A rigid budget structure reduces initiative and

innovation at lower levels, making it

impossible to obtain money for new ideas

Provide a tool for corrective action through

reallocations

M3 Planning tools

1. Budgeting

When they have selected what their possible planning involves, they should prefer how these

plans are to be sustained. Understanding of a monetary arrangement is a basic device in

guaranteeing that they stay answerable for your operating cost.

Calculating assets

Affirming that approved achievement can in reality is finance.

Settling on capital related options in a knowledgeable and very much skilled way.

Recognizing regions of possible problem and manufacture planning for same.

manufacturing and or selling of products and services, to promote coordination and

communication between departments, to motivate managers and to evaluate performance.

The budget plan is a detailed plan of all aspects of the organisation operations to ensure the

organisation achieve its objectives in a given future period, the various departments must

coordinate and managers communicate on the budgeted goals, budgetary reports evaluates

the performance in accordance with the budget and solutions can be sought for any negative

variance, budgets motivates managers to achieve the budgeted targets especially if there is

some form of reward such as promotion and/or incentives on accomplishment.

Advantages Disadvantages

Coordinates activities across departments. Major problem occurs when budgets are

applied mechanically and rigidly

Translate strategic plans into action. They

specify the resources, revenues, and activities

required to carry out the strategic plan.

Can demotivate employees because of lack of

participation. If the budgets are arbitrarily

imposed top down, employees will not

understand the reason for budgeted

expenditures, and will not be committed to

them.

provide an excellent record of organizational

activities

Can cause perceptions of unfairness

Improves communication with employees Can create competition for resources and

politics

Improve resource allocation, because all

requests are clarified and justified

A rigid budget structure reduces initiative and

innovation at lower levels, making it

impossible to obtain money for new ideas

Provide a tool for corrective action through

reallocations

M3 Planning tools

1. Budgeting

When they have selected what their possible planning involves, they should prefer how these

plans are to be sustained. Understanding of a monetary arrangement is a basic device in

guaranteeing that they stay answerable for your operating cost.

Calculating assets

Affirming that approved achievement can in reality is finance.

Settling on capital related options in a knowledgeable and very much skilled way.

Recognizing regions of possible problem and manufacture planning for same.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Calculating implementation to date beside pre-arranged limit

The character of data given by a monetary plan is balanced to the effort that has been put

reserves into it. A financial arrangement on the off possibility that it is to be flourishing

should determine the agreement among calculating in somewhat slack to take into

explanation unpredicted occasions, while in the interim individual regions in which

operating cost can be cut.

2. Cash Flow Forecasting

While arrangement is a helpful apparatus for organizing purposes, a Cash Flow Forecast

is increasingly perceptive by its very character. It helps the capitalist in unique summits

and channels in depository account. A revenue measure will assist with recognizing the

requirement in which growth is to be supervises. The revenue estimate is characteristic

in character and will help with casting feasible preparations by distinguish regions, for

example, financing fundamentals, Zones of price that should be looked into, Provider

conditions that should be renegotiated.

Applications

Assess Accuracy of a Forecast: Precision of the estimate is urgent for basic leadership and

distributing assets for a specific task. Distinctive sorts of estimating strategies give diverse

dimension of certainty interim and the administration needs to determine whether the

utilization of anticipating strategy is fitting for that specific result.

Money saving advantage Analysis: All in all, if more exertion and assets are placed in, the

figure will be increasingly precise. Anyway the cost engaged with going for a complex

conjecture should be endorsed given the imperative of assets.

Timetables of Forecasting: Timetables for figure (choice to make a 5-year estimate or a 10-year

measure) is an urgent factor in landing at the exactness of conjecture. Be that as it may, there is

a tradeoff of measure of information included and expanding courses of events, which should

be deiced before beginning the determining procedure.

D3

Findings of the report

Financial analysis is a very important step, whereas considering an organization’s investment

perspective. It is a method of ratio between numerous products in monetary statements. Ratios

are classified as advantageous ratios, liquidity ratios, plus utilization ratios, leverage ratios and

The character of data given by a monetary plan is balanced to the effort that has been put

reserves into it. A financial arrangement on the off possibility that it is to be flourishing

should determine the agreement among calculating in somewhat slack to take into

explanation unpredicted occasions, while in the interim individual regions in which

operating cost can be cut.

2. Cash Flow Forecasting

While arrangement is a helpful apparatus for organizing purposes, a Cash Flow Forecast

is increasingly perceptive by its very character. It helps the capitalist in unique summits

and channels in depository account. A revenue measure will assist with recognizing the

requirement in which growth is to be supervises. The revenue estimate is characteristic

in character and will help with casting feasible preparations by distinguish regions, for

example, financing fundamentals, Zones of price that should be looked into, Provider

conditions that should be renegotiated.

Applications

Assess Accuracy of a Forecast: Precision of the estimate is urgent for basic leadership and

distributing assets for a specific task. Distinctive sorts of estimating strategies give diverse

dimension of certainty interim and the administration needs to determine whether the

utilization of anticipating strategy is fitting for that specific result.

Money saving advantage Analysis: All in all, if more exertion and assets are placed in, the

figure will be increasingly precise. Anyway the cost engaged with going for a complex

conjecture should be endorsed given the imperative of assets.

Timetables of Forecasting: Timetables for figure (choice to make a 5-year estimate or a 10-year

measure) is an urgent factor in landing at the exactness of conjecture. Be that as it may, there is

a tradeoff of measure of information included and expanding courses of events, which should

be deiced before beginning the determining procedure.

D3

Findings of the report

Financial analysis is a very important step, whereas considering an organization’s investment

perspective. It is a method of ratio between numerous products in monetary statements. Ratios

are classified as advantageous ratios, liquidity ratios, plus utilization ratios, leverage ratios and

assessment ratios supported the suggestion they supply. A stability sheet, earning declaration is

the foremost essential financial declaration and if properly examined and taken will offers

precious visions into an organizations employment.

Financial Proportions are usually employed by at this time and capable investors, creditors and

financial establishments to judge an organization past achieve spot fashions in a very

employment and to match its progress with the common company progress. Internally, the

controller uses these ratios to watch progress and to line specific aims, objectives, and policy

actions.

LO4

P5

Key-performance indicators

KPI stands for the set of some standardized parameters that must be adopted by a company

compare the inner performance against applied individual standards. As an associate degree

example, most accepted level of short liquidity is 2:1 and, an enterprise can compare liquidity

of business against this applied commonplace to analysis the areas of problems.

Through the applying of KPI’s, structural performance is measured against applicable standards.

It will facilitate identifying the problem containing areas that need improvement. Once the

identification of such areas, associate degree economic strategy is made and enforced by

management to urge eliminate cash issues and insure property growth.

Benchmarking

This term stands for the tactic that’s expounded to comparison among industry-based-

standardized-values and aftereffect of business operations, as an associate degree example,

eighteen net profit is assumed higher in Retail market trade of the United Kingdom, so a

company is that’s gaining profits eighteen or lots of are assumed smart whereas a corporation

that’s not generating profits as per trade commonplace are assumed, low entertainer. Through

the applying of benchmarking, a business can improve the internal performance level up to

trade parameters to insure sensible profits and enlargement.

Financial governance

Financial governance is associate in nursing indicator of those moral rules that unit needed to

be applied terribly very business corporation to insure security from dirt that may occur due to

the foremost essential financial declaration and if properly examined and taken will offers

precious visions into an organizations employment.

Financial Proportions are usually employed by at this time and capable investors, creditors and

financial establishments to judge an organization past achieve spot fashions in a very

employment and to match its progress with the common company progress. Internally, the

controller uses these ratios to watch progress and to line specific aims, objectives, and policy

actions.

LO4

P5

Key-performance indicators

KPI stands for the set of some standardized parameters that must be adopted by a company

compare the inner performance against applied individual standards. As an associate degree

example, most accepted level of short liquidity is 2:1 and, an enterprise can compare liquidity

of business against this applied commonplace to analysis the areas of problems.

Through the applying of KPI’s, structural performance is measured against applicable standards.

It will facilitate identifying the problem containing areas that need improvement. Once the

identification of such areas, associate degree economic strategy is made and enforced by

management to urge eliminate cash issues and insure property growth.

Benchmarking

This term stands for the tactic that’s expounded to comparison among industry-based-

standardized-values and aftereffect of business operations, as an associate degree example,

eighteen net profit is assumed higher in Retail market trade of the United Kingdom, so a

company is that’s gaining profits eighteen or lots of are assumed smart whereas a corporation

that’s not generating profits as per trade commonplace are assumed, low entertainer. Through

the applying of benchmarking, a business can improve the internal performance level up to

trade parameters to insure sensible profits and enlargement.

Financial governance

Financial governance is associate in nursing indicator of those moral rules that unit needed to

be applied terribly very business corporation to insure security from dirt that may occur due to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.