Management Accounting Report: Budgeting, Costing, and Analysis

VerifiedAdded on 2020/02/17

|22

|5782

|85

Report

AI Summary

This report delves into various aspects of management accounting, starting with the importance of budgets for organizations and the administrative procedures involved in the budgeting process. It explores cost classification, including fixed, variable, and semi-variable costs, along with the high-low method for cost calculation and its limitations. The report differentiates between job costing, batch costing, process costing, and service costing, and analyzes profit and loss statements using absorption costing and marginal costing. It provides advice on production decisions, calculation of profit maximization, and the impact of increased labor hours. Furthermore, it examines different types of budgets, the preparation of a cash budget, and the management of cash flows. The report also covers flexible budgets, variance analysis, and financial performance improvement strategies, including break-even analysis and margin of safety. Finally, the report provides recommendations for enhancing the financial performance of a company.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................4

TASK 1............................................................................................................................................4

A. Importance of budgets for an organisation.............................................................................4

B. Administrative procedure used in budgeting process.............................................................4

C. Stages included in budgeting process.....................................................................................5

TASK 2............................................................................................................................................5

a) Classification of costs on various basis...................................................................................5

b) calculation of fixed and variable cost by high low method....................................................6

c) limitations of high low method and other method that can be used.......................................6

TASK 3............................................................................................................................................7

a) difference between job costing, batch costing, process costing and service costing..............7

b) Profit and loss statement on the basis of absorption costing..................................................8

c) calculation of profit or loss by marginal costing for west area.............................................10

TASK 4..........................................................................................................................................11

a) Advise regarding whether to cease production of A and D..................................................11

b) Calculation of various figures on the basis of marginal cost statement provided................11

c) combination of products to maximise profits.......................................................................12

d) calculation of profit if labour hours increased by 80000......................................................13

TASK 5..........................................................................................................................................13

a) Different types of budgets and their importance...................................................................13

b) preparation of cash budget and management of cash flows.................................................14

TASK 6.........................................................................................................................................15

(I) preparation of flexible budget and calculation of total variances........................................15

(II) analysis of various cost variances.......................................................................................16

(III) Reporting of the findings to board.....................................................................................16

TASK 7..........................................................................................................................................17

INTRODUCTION...........................................................................................................................4

TASK 1............................................................................................................................................4

A. Importance of budgets for an organisation.............................................................................4

B. Administrative procedure used in budgeting process.............................................................4

C. Stages included in budgeting process.....................................................................................5

TASK 2............................................................................................................................................5

a) Classification of costs on various basis...................................................................................5

b) calculation of fixed and variable cost by high low method....................................................6

c) limitations of high low method and other method that can be used.......................................6

TASK 3............................................................................................................................................7

a) difference between job costing, batch costing, process costing and service costing..............7

b) Profit and loss statement on the basis of absorption costing..................................................8

c) calculation of profit or loss by marginal costing for west area.............................................10

TASK 4..........................................................................................................................................11

a) Advise regarding whether to cease production of A and D..................................................11

b) Calculation of various figures on the basis of marginal cost statement provided................11

c) combination of products to maximise profits.......................................................................12

d) calculation of profit if labour hours increased by 80000......................................................13

TASK 5..........................................................................................................................................13

a) Different types of budgets and their importance...................................................................13

b) preparation of cash budget and management of cash flows.................................................14

TASK 6.........................................................................................................................................15

(I) preparation of flexible budget and calculation of total variances........................................15

(II) analysis of various cost variances.......................................................................................16

(III) Reporting of the findings to board.....................................................................................16

TASK 7..........................................................................................................................................17

a) calculation of break even point and margin of safety...........................................................17

b) Calculation of profit and loss of the shop.............................................................................17

c) Calculation of desired sales to earn profit of 300000...........................................................18

d) calculation of number of shoes to be sold at break even......................................................18

e) Recommendation for the improvement of financial performance of INK Ltd.....................18

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................19

b) Calculation of profit and loss of the shop.............................................................................17

c) Calculation of desired sales to earn profit of 300000...........................................................18

d) calculation of number of shoes to be sold at break even......................................................18

e) Recommendation for the improvement of financial performance of INK Ltd.....................18

CONCLUSION..............................................................................................................................19

REFERENCES..............................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is the process in which it is required that various accounts and

reports are required to be prepared on the basis of this decisions will be taken by the managers.

For the preparation of these reports information will be required which should be collected on

the timely basis (Bromwich and Bhimani, 2005). There are various techniques that can be used

for the purpose of preparation of better reports such as budgets, ratios, different methods of

costing, etc. In this assignment all these will be used to create an understanding of how budgets

can be used for the purpose of taking decisions and maximise the profits of the company.

TASK 1

A. Importance of budgets for an organisation.

Budgets are estimates that are made in relation to cost, revenues and resources by which

it can be ascertained what is to be achieved and what will be the growth in the future ( Chapman

and et.al. 2006). Budgeting is important for an organisation as with the help of this it will be

possible to achieve the set targets and also wasteful expenditure that is incurring can be

controlled. With the help of budgets it will be easy to adapt to the changes that will be occurring.

It will tell that how the available finance should be spend so that maximum profit can be earned

from it. As by budgets the objectives are set so the work will be carried out in the most effective

manner in order to achieve those targets.

B. Administrative procedure used in budgeting process.

Administrative procedure is the set of rules or process that are required to be undertaken

in order to prepare a budget. For the preparation of budgets firstly it will be required that budget

centres are established which will be the units that will have the responsibility of preparation of

budgets. In this there can various cost centres that will be included in it (Ezzamel and et.al.

2003). Than a committee will be established which will consist of the senior members. In this

representative from every department will be present. Committee will work in order to maintain

Management accounting is the process in which it is required that various accounts and

reports are required to be prepared on the basis of this decisions will be taken by the managers.

For the preparation of these reports information will be required which should be collected on

the timely basis (Bromwich and Bhimani, 2005). There are various techniques that can be used

for the purpose of preparation of better reports such as budgets, ratios, different methods of

costing, etc. In this assignment all these will be used to create an understanding of how budgets

can be used for the purpose of taking decisions and maximise the profits of the company.

TASK 1

A. Importance of budgets for an organisation.

Budgets are estimates that are made in relation to cost, revenues and resources by which

it can be ascertained what is to be achieved and what will be the growth in the future ( Chapman

and et.al. 2006). Budgeting is important for an organisation as with the help of this it will be

possible to achieve the set targets and also wasteful expenditure that is incurring can be

controlled. With the help of budgets it will be easy to adapt to the changes that will be occurring.

It will tell that how the available finance should be spend so that maximum profit can be earned

from it. As by budgets the objectives are set so the work will be carried out in the most effective

manner in order to achieve those targets.

B. Administrative procedure used in budgeting process.

Administrative procedure is the set of rules or process that are required to be undertaken

in order to prepare a budget. For the preparation of budgets firstly it will be required that budget

centres are established which will be the units that will have the responsibility of preparation of

budgets. In this there can various cost centres that will be included in it (Ezzamel and et.al.

2003). Than a committee will be established which will consist of the senior members. In this

representative from every department will be present. Committee will work in order to maintain

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the coordination, decide about the time when the budgets will be required to be prepared, will

provide the information that will be required in order to prepare a budget and lastly actual and

budgeted figures will be compared by it so that deviations if any will be identified and

investigation can be carried out in relation to such deviations.

C. Stages included in budgeting process.

In the preparation of budget various stages will be required to be completed. Firstly it will

needed that relevant information should be collected which will be required for making a budget

and for this sources from where information can be obtained will be identified (Hansen, Mowen

and Guan, 2007). After this plan will be made in which it will be decided that in what aspect is

the budget required to be prepared. will it me made by the help of historical data or on the basis

of projections and than it is required that approval is obtained for the preparation of budgets. It

will be needed to identify the reason for which budget is required to be prepared. After all this

completed budget will be prepared which will describe the future projections that are required to

be achieved by the company. It will specify the break evens by which it will be ascertained that

what is the level that is necessary to be achieved so that company can survive in the market. It is

needed that once the budget is prepared it should be reviewed in order to deal with the loop holes

if any that are present in the budget.

TASK 2

a) Classification of costs on various basis.

In the production of a product or in provision of a service there are various costs that are

included and those are described below :

Direct cost : these are those cost that are directly related to the producing of product or

service (Nixon and Burns, 2012). It can be related to material, labour or other expense

and can be ascertained in an easy and accurate manner. Example of it can be material that

will be used in manufacturing a machine.

Indirect cost : the cost that cannot be ascertained easily and is not related in a direct

manner for the production of goods or service will be indirect cost. The example of it can

be any expenditure such as power which is made on combined basis and difficult to be

calculated on individual basis,

provide the information that will be required in order to prepare a budget and lastly actual and

budgeted figures will be compared by it so that deviations if any will be identified and

investigation can be carried out in relation to such deviations.

C. Stages included in budgeting process.

In the preparation of budget various stages will be required to be completed. Firstly it will

needed that relevant information should be collected which will be required for making a budget

and for this sources from where information can be obtained will be identified (Hansen, Mowen

and Guan, 2007). After this plan will be made in which it will be decided that in what aspect is

the budget required to be prepared. will it me made by the help of historical data or on the basis

of projections and than it is required that approval is obtained for the preparation of budgets. It

will be needed to identify the reason for which budget is required to be prepared. After all this

completed budget will be prepared which will describe the future projections that are required to

be achieved by the company. It will specify the break evens by which it will be ascertained that

what is the level that is necessary to be achieved so that company can survive in the market. It is

needed that once the budget is prepared it should be reviewed in order to deal with the loop holes

if any that are present in the budget.

TASK 2

a) Classification of costs on various basis.

In the production of a product or in provision of a service there are various costs that are

included and those are described below :

Direct cost : these are those cost that are directly related to the producing of product or

service (Nixon and Burns, 2012). It can be related to material, labour or other expense

and can be ascertained in an easy and accurate manner. Example of it can be material that

will be used in manufacturing a machine.

Indirect cost : the cost that cannot be ascertained easily and is not related in a direct

manner for the production of goods or service will be indirect cost. The example of it can

be any expenditure such as power which is made on combined basis and difficult to be

calculated on individual basis,

Fixed cost :the cost that does not change with the change in level of production is fixed

cost. Such as rent paid for the premise that will be paid irrespective of the fact that how

many units are produced.

Stepped Fixed cost : the expense that remains fixed upto a level and will change after

that level is passed and the activity is shifted (DRURY, 2013). An example of this can be

that a new machinery will be purchased after a fixed level of production is achieved.

variable cost :the cost that is dependent on the units produced and changes with change

in each unit produced such as material used to produce a single unit.

Semi variable cost : the cost that remain fixed for a particular level of production and

after that changes with every unit produced. An example of it can be wages which will be

fixed till a level and after that more workers will be required to be hired.

b) calculation of fixed and variable cost by high low method.

1. Calculation of variable expense per unit

variable cost per unit = Change in cost at highest and lowest level

Change in units

= 92000 - 42000

8100 - 3100

= 50000

5000

= £ 10 per unit

2. Calculation of Fixed cost

Total cost - ( variable cost per unit * no. of units)

92000 - ( 10 * 8100)

92000 - 81000

fixed cost = 11000

this method is used as electricity expenses consist of fixed and variable portion which can be

differentiated by this method and moreover this is simple and easy to use and provide correct

answers.

cost. Such as rent paid for the premise that will be paid irrespective of the fact that how

many units are produced.

Stepped Fixed cost : the expense that remains fixed upto a level and will change after

that level is passed and the activity is shifted (DRURY, 2013). An example of this can be

that a new machinery will be purchased after a fixed level of production is achieved.

variable cost :the cost that is dependent on the units produced and changes with change

in each unit produced such as material used to produce a single unit.

Semi variable cost : the cost that remain fixed for a particular level of production and

after that changes with every unit produced. An example of it can be wages which will be

fixed till a level and after that more workers will be required to be hired.

b) calculation of fixed and variable cost by high low method.

1. Calculation of variable expense per unit

variable cost per unit = Change in cost at highest and lowest level

Change in units

= 92000 - 42000

8100 - 3100

= 50000

5000

= £ 10 per unit

2. Calculation of Fixed cost

Total cost - ( variable cost per unit * no. of units)

92000 - ( 10 * 8100)

92000 - 81000

fixed cost = 11000

this method is used as electricity expenses consist of fixed and variable portion which can be

differentiated by this method and moreover this is simple and easy to use and provide correct

answers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

c) limitations of high low method and other method that can be used.

Together with the advantages there are certain disadvantages also which are there in high low

method (Lambert and Sponem, 2012). The results that are obtained by this method are estimates

and not the exact numbers and this proves to be a disadvantage. Another disadvantage will be

that as only two set of data is used so the variation that takes place in the cost on the monthly

basis is not considered.

Due to the disadvantages present in high low method there is another method which can be used

in place of it which will overcome the faults present in high low method. The method that can be

used is least squares method (Kotas, 2014). This method uses different values which are plotted

on the graph. And then line is drawn on the basis of all the points and wherever the line will

intersect the Y axis it will show the level of fixed cost. The slope of line can be used to calculate

the variable cost. By using this method the disadvantage of high low method in relation to using

limited data will get removed.

TASK 3

a) difference between job costing, batch costing, process costing and service costing.

Job costing : when the goods are produced and services are provided on the basis of the

orders placed by customers than in that situation job costing is used (Hoque, 2002). In

this method the goods are produced according to the specifications of the customers and

cost is calculated when the job is completed and it will be based on each job performed

on different basis.

Batch Costing : when the goods are produced in batches or groups than in that case batch

costing is required to be used. It is applied when production is done on mass basis and not

on customers specification. In this the cost will be calculated for the whole batch that has

been produced and than it will be divided on per unit basis.

Process costing : this type of costing is used when the production of any good requires

performance of various processes and cost is calculated for each process differently.

After this the cost is allocated to all the units that are produced (Herzig and et.al. 2012).

This method is best for those who are involved in large scale production.

Service costing : this costing is for those organisation who are involved in providing

services and not in production of goods. In this cost is calculated by adding all the

Together with the advantages there are certain disadvantages also which are there in high low

method (Lambert and Sponem, 2012). The results that are obtained by this method are estimates

and not the exact numbers and this proves to be a disadvantage. Another disadvantage will be

that as only two set of data is used so the variation that takes place in the cost on the monthly

basis is not considered.

Due to the disadvantages present in high low method there is another method which can be used

in place of it which will overcome the faults present in high low method. The method that can be

used is least squares method (Kotas, 2014). This method uses different values which are plotted

on the graph. And then line is drawn on the basis of all the points and wherever the line will

intersect the Y axis it will show the level of fixed cost. The slope of line can be used to calculate

the variable cost. By using this method the disadvantage of high low method in relation to using

limited data will get removed.

TASK 3

a) difference between job costing, batch costing, process costing and service costing.

Job costing : when the goods are produced and services are provided on the basis of the

orders placed by customers than in that situation job costing is used (Hoque, 2002). In

this method the goods are produced according to the specifications of the customers and

cost is calculated when the job is completed and it will be based on each job performed

on different basis.

Batch Costing : when the goods are produced in batches or groups than in that case batch

costing is required to be used. It is applied when production is done on mass basis and not

on customers specification. In this the cost will be calculated for the whole batch that has

been produced and than it will be divided on per unit basis.

Process costing : this type of costing is used when the production of any good requires

performance of various processes and cost is calculated for each process differently.

After this the cost is allocated to all the units that are produced (Herzig and et.al. 2012).

This method is best for those who are involved in large scale production.

Service costing : this costing is for those organisation who are involved in providing

services and not in production of goods. In this cost is calculated by adding all the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

expenses that have been incurred in providing the particular service. The cost are

collected on the timely basis and than on the basis of that cost sheet is made which will

show all the expenses that are done in relation to that particular service.

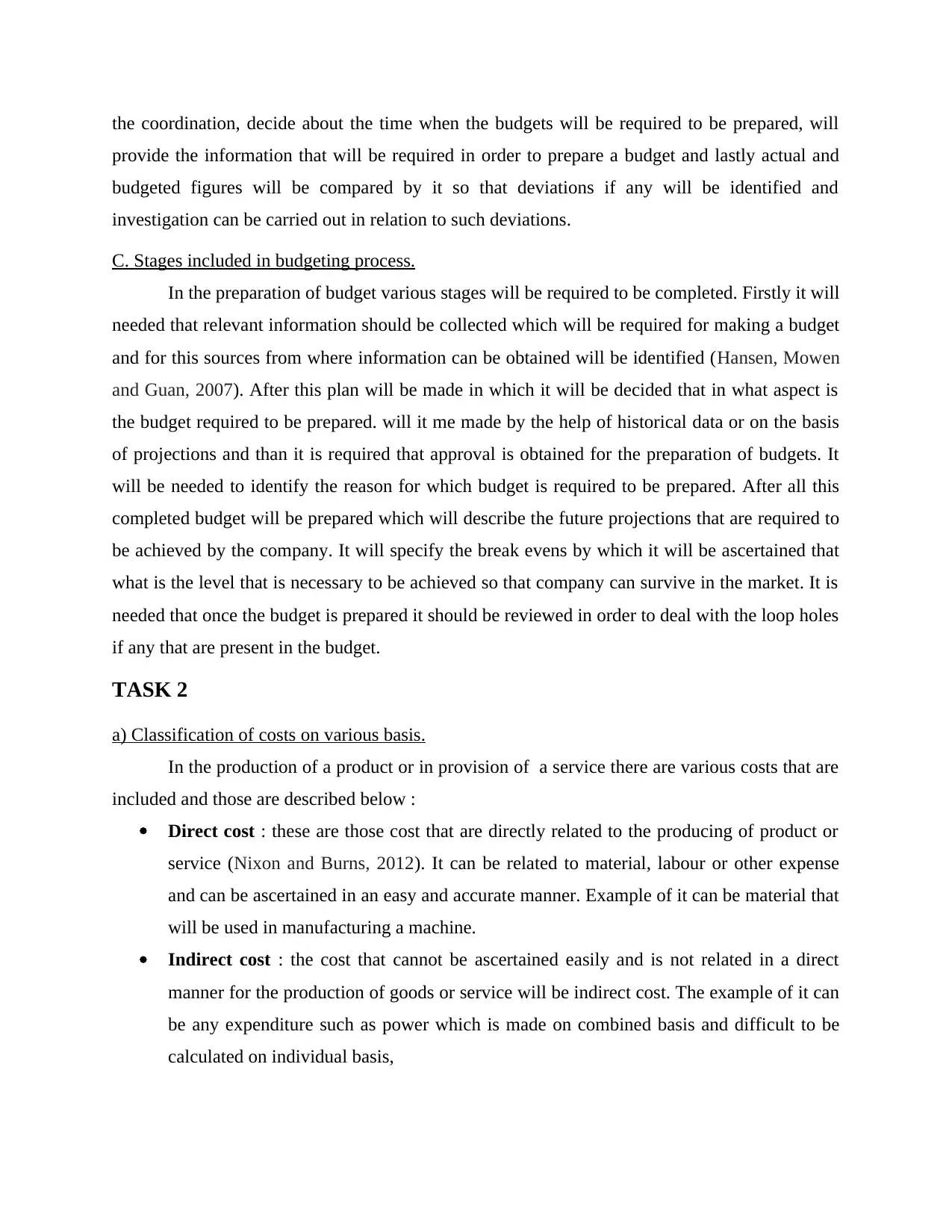

b) Profit and loss statement on the basis of absorption costing.

Beta Ltd is the subsidiary of Cotswolds CO. Ltd. And is involved in distribution of three

products in two areas (Horngren and et.al. 2005). Below given are profit and loss statements for

each area and in total by absorption costing.

Profit and loss statement for both areas in total :

Particulars Standard Super De-luxe Total

A Sales value 4880000 3840000 4080000 12800000

B Purchase cost 3904000 2880000 2992000 9776000

C Transportation cost

(Variable)

122000 96000 102000 320000

D Transportation cost (fixed) 97600 76800 81600 256000

E Gross profit (A-B-C-D) 756400 787200 904400 2448000

F Advertisement cost

(variable)

122000 80000 68000 270000

G Advertisement cost (Fixed) 244000 160000 136000 540000

H Packaging cost (variable) 92000 60000 36000 188000

I Packaging cost (Fixed) 184000 120000 72000 376000

J Profit (E-F-G-H-I) 114400 367200 592400 1074000

Working notes :

1. allocation of transportation cost :

it will be allocated on the basis of sales value so cost per rupee of sales will be calculated and it

will be multiplied by sales value of each product to get the transportation cost of that product.

Transportation cost per rupee of sales = total cost

total sales value

collected on the timely basis and than on the basis of that cost sheet is made which will

show all the expenses that are done in relation to that particular service.

b) Profit and loss statement on the basis of absorption costing.

Beta Ltd is the subsidiary of Cotswolds CO. Ltd. And is involved in distribution of three

products in two areas (Horngren and et.al. 2005). Below given are profit and loss statements for

each area and in total by absorption costing.

Profit and loss statement for both areas in total :

Particulars Standard Super De-luxe Total

A Sales value 4880000 3840000 4080000 12800000

B Purchase cost 3904000 2880000 2992000 9776000

C Transportation cost

(Variable)

122000 96000 102000 320000

D Transportation cost (fixed) 97600 76800 81600 256000

E Gross profit (A-B-C-D) 756400 787200 904400 2448000

F Advertisement cost

(variable)

122000 80000 68000 270000

G Advertisement cost (Fixed) 244000 160000 136000 540000

H Packaging cost (variable) 92000 60000 36000 188000

I Packaging cost (Fixed) 184000 120000 72000 376000

J Profit (E-F-G-H-I) 114400 367200 592400 1074000

Working notes :

1. allocation of transportation cost :

it will be allocated on the basis of sales value so cost per rupee of sales will be calculated and it

will be multiplied by sales value of each product to get the transportation cost of that product.

Transportation cost per rupee of sales = total cost

total sales value

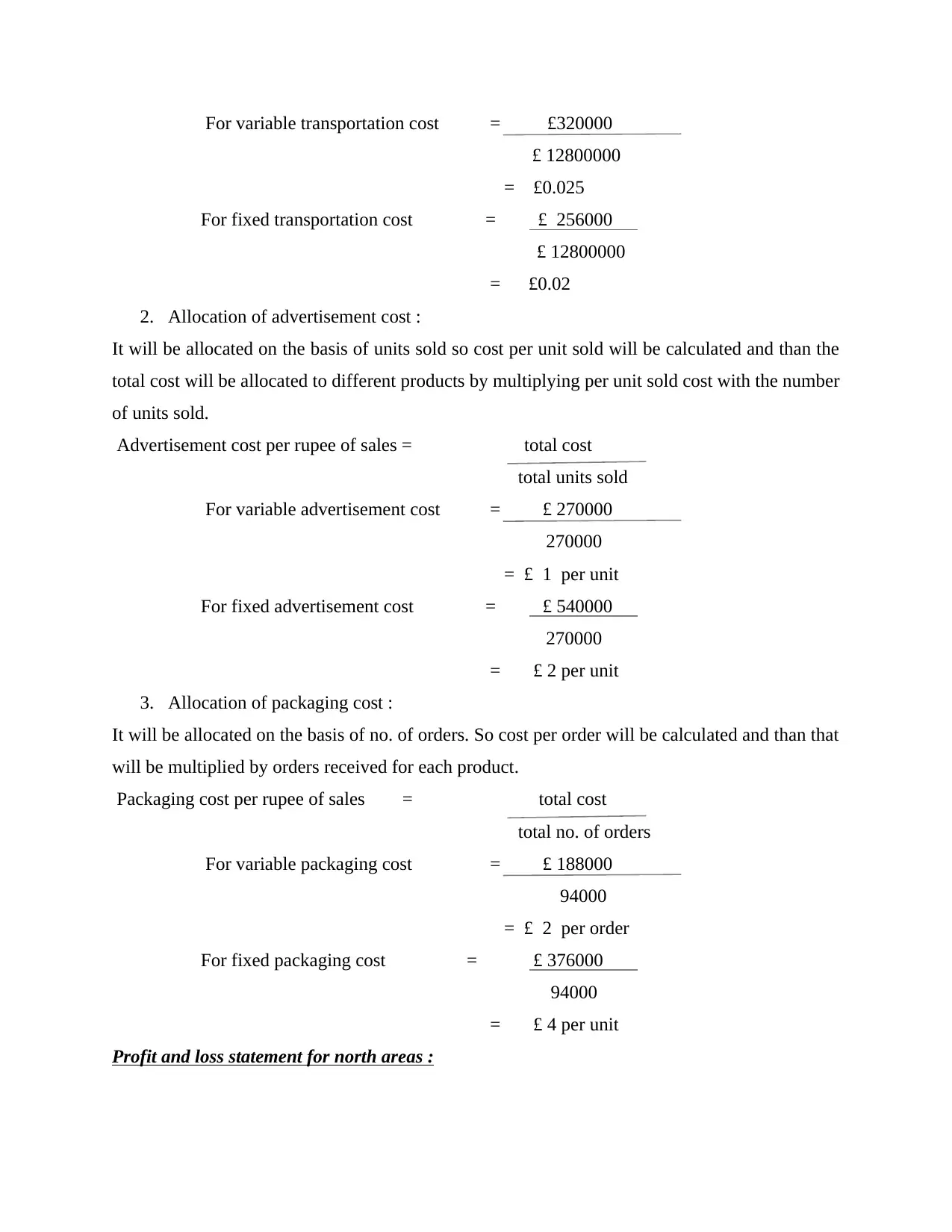

For variable transportation cost = £320000

£ 12800000

= £0.025

For fixed transportation cost = £ 256000

£ 12800000

= £0.02

2. Allocation of advertisement cost :

It will be allocated on the basis of units sold so cost per unit sold will be calculated and than the

total cost will be allocated to different products by multiplying per unit sold cost with the number

of units sold.

Advertisement cost per rupee of sales = total cost

total units sold

For variable advertisement cost = £ 270000

270000

= £ 1 per unit

For fixed advertisement cost = £ 540000

270000

= £ 2 per unit

3. Allocation of packaging cost :

It will be allocated on the basis of no. of orders. So cost per order will be calculated and than that

will be multiplied by orders received for each product.

Packaging cost per rupee of sales = total cost

total no. of orders

For variable packaging cost = £ 188000

94000

= £ 2 per order

For fixed packaging cost = £ 376000

94000

= £ 4 per unit

Profit and loss statement for north areas :

£ 12800000

= £0.025

For fixed transportation cost = £ 256000

£ 12800000

= £0.02

2. Allocation of advertisement cost :

It will be allocated on the basis of units sold so cost per unit sold will be calculated and than the

total cost will be allocated to different products by multiplying per unit sold cost with the number

of units sold.

Advertisement cost per rupee of sales = total cost

total units sold

For variable advertisement cost = £ 270000

270000

= £ 1 per unit

For fixed advertisement cost = £ 540000

270000

= £ 2 per unit

3. Allocation of packaging cost :

It will be allocated on the basis of no. of orders. So cost per order will be calculated and than that

will be multiplied by orders received for each product.

Packaging cost per rupee of sales = total cost

total no. of orders

For variable packaging cost = £ 188000

94000

= £ 2 per order

For fixed packaging cost = £ 376000

94000

= £ 4 per unit

Profit and loss statement for north areas :

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

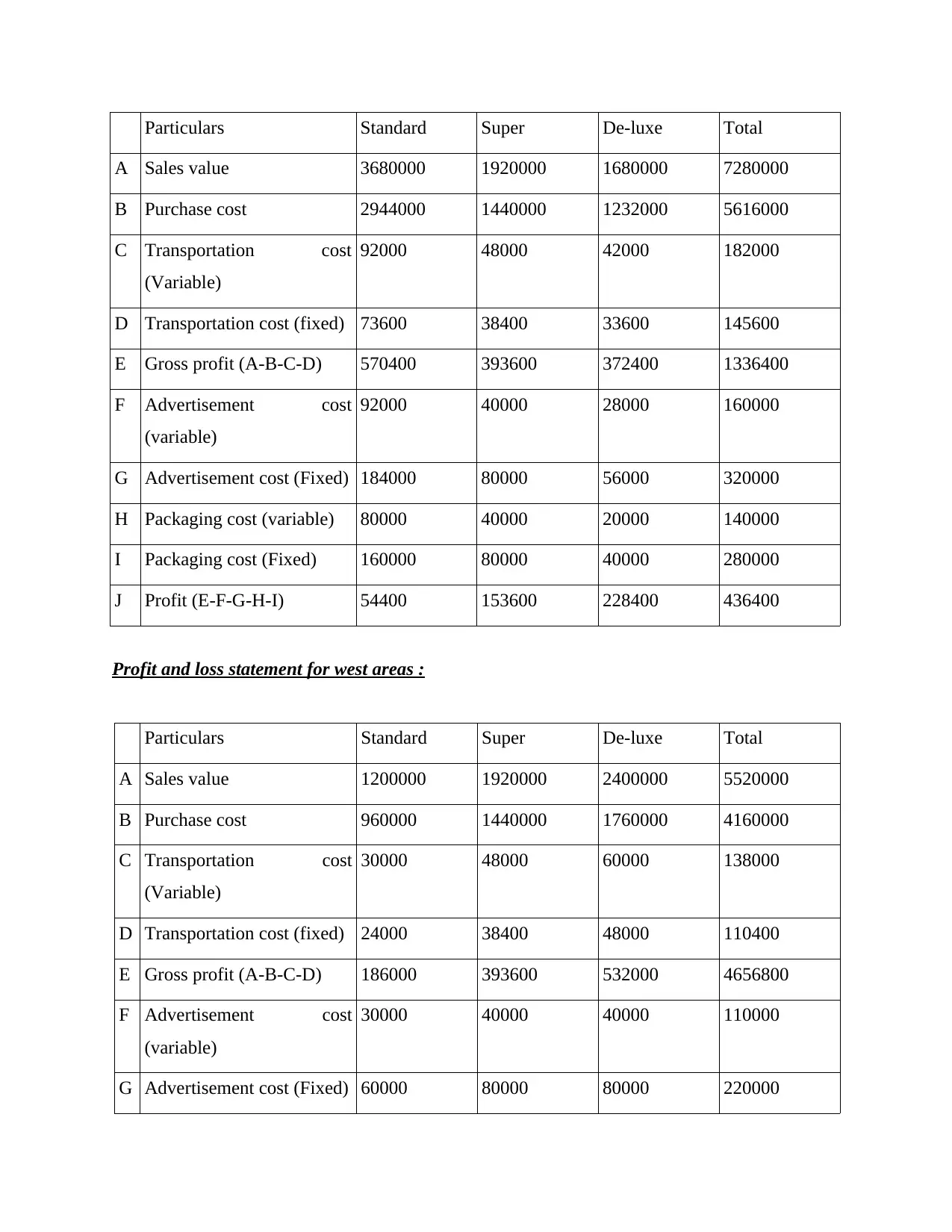

Particulars Standard Super De-luxe Total

A Sales value 3680000 1920000 1680000 7280000

B Purchase cost 2944000 1440000 1232000 5616000

C Transportation cost

(Variable)

92000 48000 42000 182000

D Transportation cost (fixed) 73600 38400 33600 145600

E Gross profit (A-B-C-D) 570400 393600 372400 1336400

F Advertisement cost

(variable)

92000 40000 28000 160000

G Advertisement cost (Fixed) 184000 80000 56000 320000

H Packaging cost (variable) 80000 40000 20000 140000

I Packaging cost (Fixed) 160000 80000 40000 280000

J Profit (E-F-G-H-I) 54400 153600 228400 436400

Profit and loss statement for west areas :

Particulars Standard Super De-luxe Total

A Sales value 1200000 1920000 2400000 5520000

B Purchase cost 960000 1440000 1760000 4160000

C Transportation cost

(Variable)

30000 48000 60000 138000

D Transportation cost (fixed) 24000 38400 48000 110400

E Gross profit (A-B-C-D) 186000 393600 532000 4656800

F Advertisement cost

(variable)

30000 40000 40000 110000

G Advertisement cost (Fixed) 60000 80000 80000 220000

A Sales value 3680000 1920000 1680000 7280000

B Purchase cost 2944000 1440000 1232000 5616000

C Transportation cost

(Variable)

92000 48000 42000 182000

D Transportation cost (fixed) 73600 38400 33600 145600

E Gross profit (A-B-C-D) 570400 393600 372400 1336400

F Advertisement cost

(variable)

92000 40000 28000 160000

G Advertisement cost (Fixed) 184000 80000 56000 320000

H Packaging cost (variable) 80000 40000 20000 140000

I Packaging cost (Fixed) 160000 80000 40000 280000

J Profit (E-F-G-H-I) 54400 153600 228400 436400

Profit and loss statement for west areas :

Particulars Standard Super De-luxe Total

A Sales value 1200000 1920000 2400000 5520000

B Purchase cost 960000 1440000 1760000 4160000

C Transportation cost

(Variable)

30000 48000 60000 138000

D Transportation cost (fixed) 24000 38400 48000 110400

E Gross profit (A-B-C-D) 186000 393600 532000 4656800

F Advertisement cost

(variable)

30000 40000 40000 110000

G Advertisement cost (Fixed) 60000 80000 80000 220000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

H Packaging cost (variable) 12000 20000 16000 48000

I Packaging cost (Fixed) 24000 40000 32000 96000

J Profit (E-F-G-H-I) 60000 213600 364000 637600

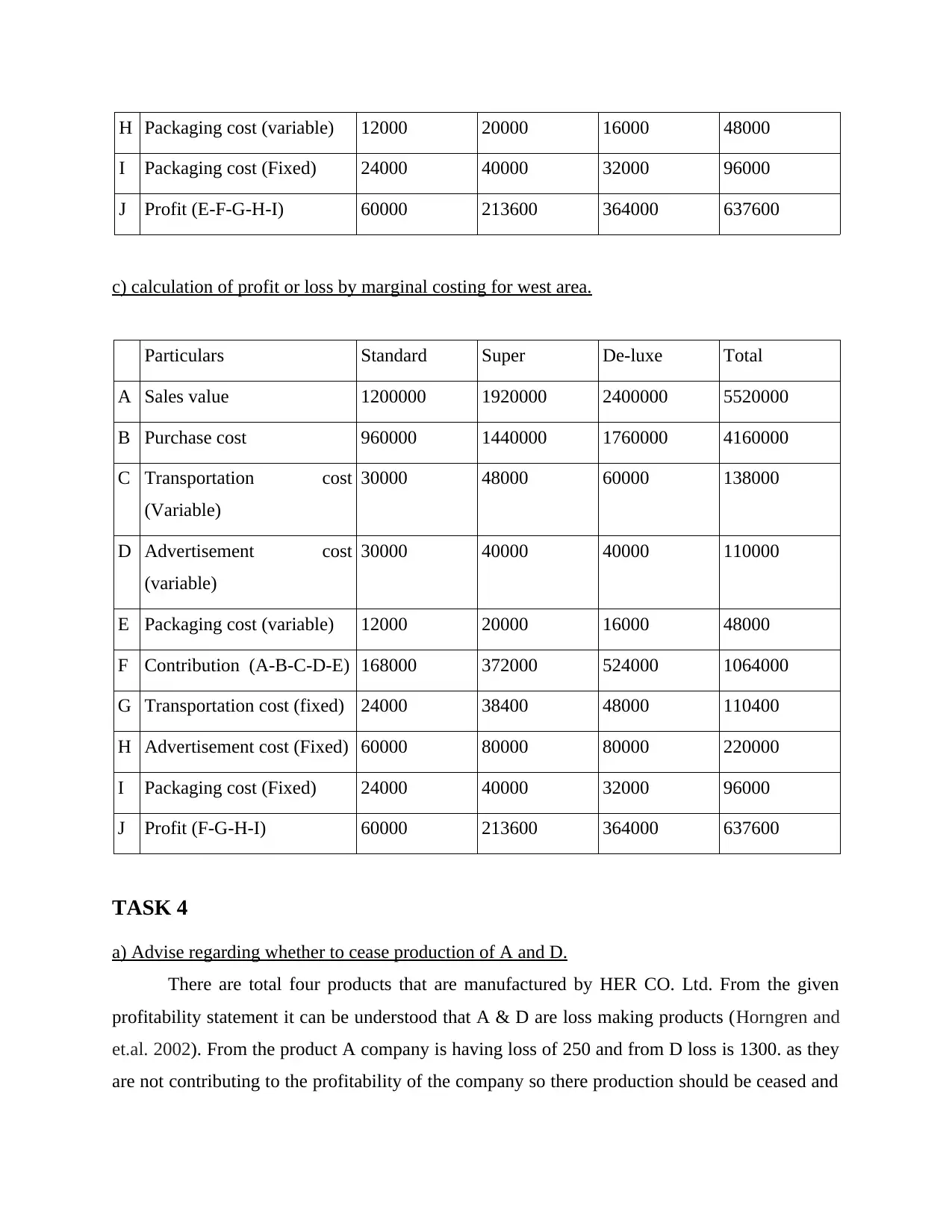

c) calculation of profit or loss by marginal costing for west area.

Particulars Standard Super De-luxe Total

A Sales value 1200000 1920000 2400000 5520000

B Purchase cost 960000 1440000 1760000 4160000

C Transportation cost

(Variable)

30000 48000 60000 138000

D Advertisement cost

(variable)

30000 40000 40000 110000

E Packaging cost (variable) 12000 20000 16000 48000

F Contribution (A-B-C-D-E) 168000 372000 524000 1064000

G Transportation cost (fixed) 24000 38400 48000 110400

H Advertisement cost (Fixed) 60000 80000 80000 220000

I Packaging cost (Fixed) 24000 40000 32000 96000

J Profit (F-G-H-I) 60000 213600 364000 637600

TASK 4

a) Advise regarding whether to cease production of A and D.

There are total four products that are manufactured by HER CO. Ltd. From the given

profitability statement it can be understood that A & D are loss making products (Horngren and

et.al. 2002). From the product A company is having loss of 250 and from D loss is 1300. as they

are not contributing to the profitability of the company so there production should be ceased and

I Packaging cost (Fixed) 24000 40000 32000 96000

J Profit (E-F-G-H-I) 60000 213600 364000 637600

c) calculation of profit or loss by marginal costing for west area.

Particulars Standard Super De-luxe Total

A Sales value 1200000 1920000 2400000 5520000

B Purchase cost 960000 1440000 1760000 4160000

C Transportation cost

(Variable)

30000 48000 60000 138000

D Advertisement cost

(variable)

30000 40000 40000 110000

E Packaging cost (variable) 12000 20000 16000 48000

F Contribution (A-B-C-D-E) 168000 372000 524000 1064000

G Transportation cost (fixed) 24000 38400 48000 110400

H Advertisement cost (Fixed) 60000 80000 80000 220000

I Packaging cost (Fixed) 24000 40000 32000 96000

J Profit (F-G-H-I) 60000 213600 364000 637600

TASK 4

a) Advise regarding whether to cease production of A and D.

There are total four products that are manufactured by HER CO. Ltd. From the given

profitability statement it can be understood that A & D are loss making products (Horngren and

et.al. 2002). From the product A company is having loss of 250 and from D loss is 1300. as they

are not contributing to the profitability of the company so there production should be ceased and

the cost that will be saved due to their non production will be applied to the production of

product B & E. by doing so the contribution of the products will increase thereby increasing the

total profitability of the company.

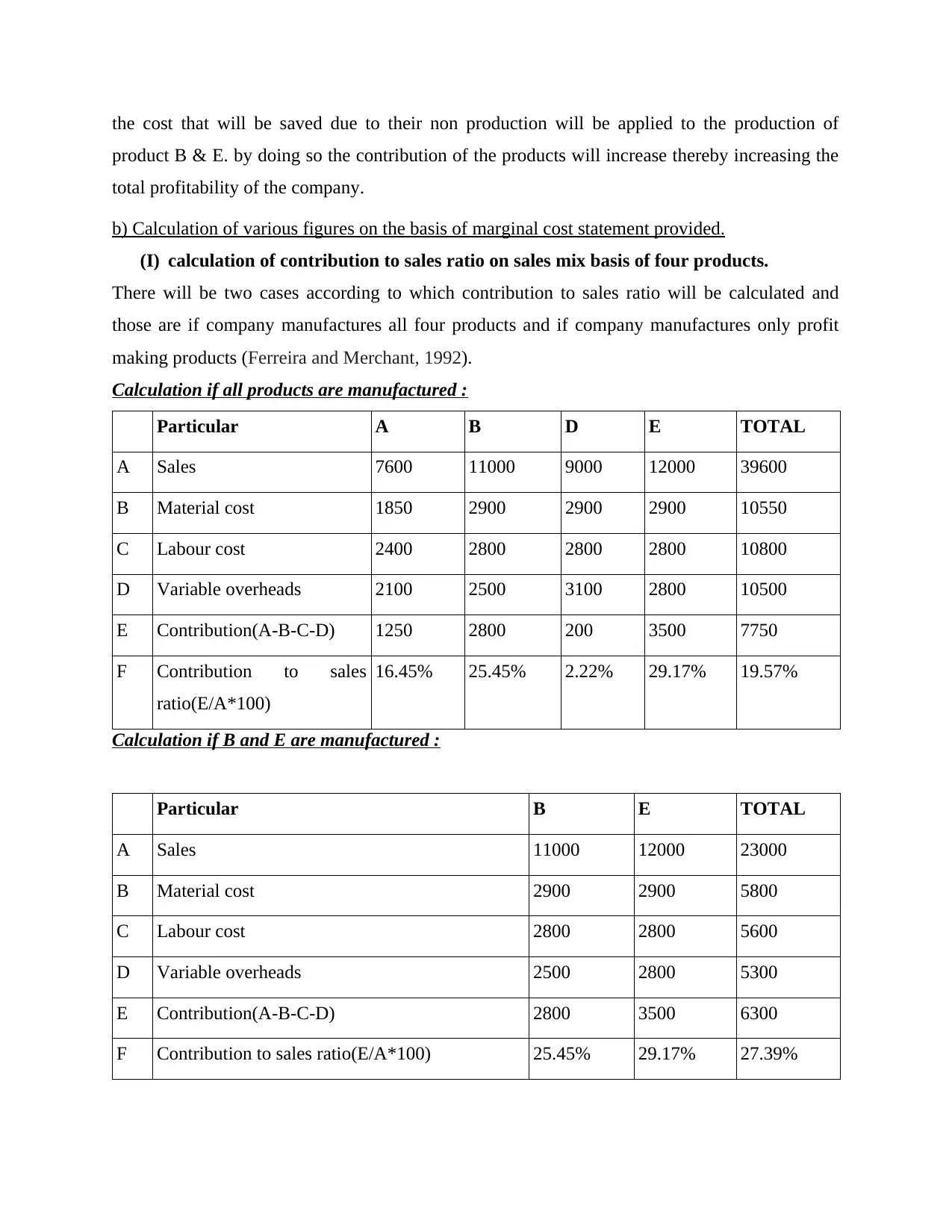

b) Calculation of various figures on the basis of marginal cost statement provided.

(I) calculation of contribution to sales ratio on sales mix basis of four products.

There will be two cases according to which contribution to sales ratio will be calculated and

those are if company manufactures all four products and if company manufactures only profit

making products (Ferreira and Merchant, 1992).

Calculation if all products are manufactured :

Particular A B D E TOTAL

A Sales 7600 11000 9000 12000 39600

B Material cost 1850 2900 2900 2900 10550

C Labour cost 2400 2800 2800 2800 10800

D Variable overheads 2100 2500 3100 2800 10500

E Contribution(A-B-C-D) 1250 2800 200 3500 7750

F Contribution to sales

ratio(E/A*100)

16.45% 25.45% 2.22% 29.17% 19.57%

Calculation if B and E are manufactured :

Particular B E TOTAL

A Sales 11000 12000 23000

B Material cost 2900 2900 5800

C Labour cost 2800 2800 5600

D Variable overheads 2500 2800 5300

E Contribution(A-B-C-D) 2800 3500 6300

F Contribution to sales ratio(E/A*100) 25.45% 29.17% 27.39%

product B & E. by doing so the contribution of the products will increase thereby increasing the

total profitability of the company.

b) Calculation of various figures on the basis of marginal cost statement provided.

(I) calculation of contribution to sales ratio on sales mix basis of four products.

There will be two cases according to which contribution to sales ratio will be calculated and

those are if company manufactures all four products and if company manufactures only profit

making products (Ferreira and Merchant, 1992).

Calculation if all products are manufactured :

Particular A B D E TOTAL

A Sales 7600 11000 9000 12000 39600

B Material cost 1850 2900 2900 2900 10550

C Labour cost 2400 2800 2800 2800 10800

D Variable overheads 2100 2500 3100 2800 10500

E Contribution(A-B-C-D) 1250 2800 200 3500 7750

F Contribution to sales

ratio(E/A*100)

16.45% 25.45% 2.22% 29.17% 19.57%

Calculation if B and E are manufactured :

Particular B E TOTAL

A Sales 11000 12000 23000

B Material cost 2900 2900 5800

C Labour cost 2800 2800 5600

D Variable overheads 2500 2800 5300

E Contribution(A-B-C-D) 2800 3500 6300

F Contribution to sales ratio(E/A*100) 25.45% 29.17% 27.39%

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.