Management Accounting Report: Cost Analysis, Planning and Adaptation

VerifiedAdded on 2022/12/27

|17

|4043

|197

Report

AI Summary

This report provides a comprehensive overview of management accounting, encompassing its principles, methods, and practical applications. It begins with an explanation of management accounting and its essential requirements, followed by an exploration of different reporting methods. The report then delves into cost analysis techniques, including marginal and absorption costing, used to prepare income statements. Budgetary control and its planning tools are discussed, along with their advantages and disadvantages. Finally, the report examines how organizations adapt management accounting systems to address financial problems, providing a well-rounded understanding of the subject matter. The report includes practical examples and calculations to illustrate key concepts.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

.........................................................................................................................................................3

Introduction......................................................................................................................................3

Task1................................................................................................................................................3

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems................................................................................................3

P2 Explain different methods used for management accounting reporting................................5

Task2................................................................................................................................................6

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs...........................................................................6

Task3..............................................................................................................................................10

P4 Explain the advantages and disadvantages of different type of planning tool used in

budgetary control......................................................................................................................10

Task4..............................................................................................................................................12

P5 Compare how organizations are adapting management.....................................................12

accounting systems to respond to financial problems..............................................................12

Conclusion.....................................................................................................................................14

REFERENCES..............................................................................................................................15

.........................................................................................................................................................3

Introduction......................................................................................................................................3

Task1................................................................................................................................................3

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems................................................................................................3

P2 Explain different methods used for management accounting reporting................................5

Task2................................................................................................................................................6

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs...........................................................................6

Task3..............................................................................................................................................10

P4 Explain the advantages and disadvantages of different type of planning tool used in

budgetary control......................................................................................................................10

Task4..............................................................................................................................................12

P5 Compare how organizations are adapting management.....................................................12

accounting systems to respond to financial problems..............................................................12

Conclusion.....................................................................................................................................14

REFERENCES..............................................................................................................................15

Introduction

Management accounting can be referred to as a collaborative process that includes

measuring, analyzing, interpretting as well as communicating information to the managers.It is

mainly concerned with accounting all the information that are done within the operations (Bui

and De Villiers, 2017.). They include a series of information in context of cost of products as

well as serivces purchased by the company are doing their business. This information is mainly

gained from the company's budget and undertake variance analysis.

Amazon, is one of the top multi national company that it's head office in Seattle. It is

engaged in e-commerce services in U.K as well as throughout the world. Along with this, it has

concentrated to cloud computing, digital sttreaming as well as Artificial Intelligence. This prject

covers diverse aspect of management accounting that includes detail understanding of it,

different method used in this, technique utilized in management accounting, detail understanding

of planning tools used . Along with this,it also includes a comparision analysis of how the

accounting is appropriate in providing financial problems.

Task1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting is a valuable tool that enables financial managers to make

decisions. It is utilizes by all the managers in making effective decisions (Chenhall and Moers,

2015). This is one of the effective tool used by number of companies in order fulfil their goals. It

is must for the company to understand the essential requirements that can be stated below:

Principles of Manangement Accounting

Influence: Clear communication flow is vital for every Organizations. It is important for

the company do follow this in order to have a clear informatin regarding management

Management accounting can be referred to as a collaborative process that includes

measuring, analyzing, interpretting as well as communicating information to the managers.It is

mainly concerned with accounting all the information that are done within the operations (Bui

and De Villiers, 2017.). They include a series of information in context of cost of products as

well as serivces purchased by the company are doing their business. This information is mainly

gained from the company's budget and undertake variance analysis.

Amazon, is one of the top multi national company that it's head office in Seattle. It is

engaged in e-commerce services in U.K as well as throughout the world. Along with this, it has

concentrated to cloud computing, digital sttreaming as well as Artificial Intelligence. This prject

covers diverse aspect of management accounting that includes detail understanding of it,

different method used in this, technique utilized in management accounting, detail understanding

of planning tools used . Along with this,it also includes a comparision analysis of how the

accounting is appropriate in providing financial problems.

Task1

P1 Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting is a valuable tool that enables financial managers to make

decisions. It is utilizes by all the managers in making effective decisions (Chenhall and Moers,

2015). This is one of the effective tool used by number of companies in order fulfil their goals. It

is must for the company to understand the essential requirements that can be stated below:

Principles of Manangement Accounting

Influence: Clear communication flow is vital for every Organizations. It is important for

the company do follow this in order to have a clear informatin regarding management

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

accounting. This strengthen the process of decision making and yield vital results. This

sound communication will minimize the number of issues that arises in Amazon and

further integrates diverse thought process. This is further fruitful for as the action taken

by one departmenrt impacts other departments and can easily be changed in the timely

manner.

Relevant: It is comman phenomenen, that information is useful for one and all. It is just

that different information is required due to diverse requirements of diverse individuals as

well business in order to realize their aims (Cleary, 2015.). Management accounting is

fruitful in meeting diverse requirements in order to evakuate different methods in order to

take one of the most favourable decisions. This enables to get a easy access to different

requirements of requirement of each of their shareholders in order to get the most

relevant information in order to fulfil their purpose of existance.

Value: Value is important for each and every Organization. Managemet accouting

enables the company to link the company's processes to it's different models. This is

beneficial for the company to well informated about the changes occuring in the external

environment.This enables the company to assess information and derive the best value in

order to enrich the journey's of their customers and make them feel highly valued.

Creditablity: Creditablity is vital part of any Organization. It can be referred to as proper

investigation in order to make their decision making effective to meeting their objectives

(Collis and Hussey, 2017). This further aids in engaging the decision making that

maximizes the welfare of the share holder in the long term as it improves trust as well as

the realiblity. The Experienced managers that are engaged in management accounting

are known to be ethical, aware as well as aware of the company's principles as well as

inter personnal commitments. This is favourable for the company in improving

creditablity as well as reputation and in turn stregthen the various processes of the

company.

It is even vital for the company to understand different roles of managemet accounting.

Some of it's important role can be described in detail below:

Planning: Management accounting plays a vital role in planning effeciently by providing

the necessary as well as the most accurate informations. The financial information is

sound communication will minimize the number of issues that arises in Amazon and

further integrates diverse thought process. This is further fruitful for as the action taken

by one departmenrt impacts other departments and can easily be changed in the timely

manner.

Relevant: It is comman phenomenen, that information is useful for one and all. It is just

that different information is required due to diverse requirements of diverse individuals as

well business in order to realize their aims (Cleary, 2015.). Management accounting is

fruitful in meeting diverse requirements in order to evakuate different methods in order to

take one of the most favourable decisions. This enables to get a easy access to different

requirements of requirement of each of their shareholders in order to get the most

relevant information in order to fulfil their purpose of existance.

Value: Value is important for each and every Organization. Managemet accouting

enables the company to link the company's processes to it's different models. This is

beneficial for the company to well informated about the changes occuring in the external

environment.This enables the company to assess information and derive the best value in

order to enrich the journey's of their customers and make them feel highly valued.

Creditablity: Creditablity is vital part of any Organization. It can be referred to as proper

investigation in order to make their decision making effective to meeting their objectives

(Collis and Hussey, 2017). This further aids in engaging the decision making that

maximizes the welfare of the share holder in the long term as it improves trust as well as

the realiblity. The Experienced managers that are engaged in management accounting

are known to be ethical, aware as well as aware of the company's principles as well as

inter personnal commitments. This is favourable for the company in improving

creditablity as well as reputation and in turn stregthen the various processes of the

company.

It is even vital for the company to understand different roles of managemet accounting.

Some of it's important role can be described in detail below:

Planning: Management accounting plays a vital role in planning effeciently by providing

the necessary as well as the most accurate informations. The financial information is

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

provided through different statements that includes sales budgets, cost-price-volume

analysis and capital budgets.

Increases Effeciency: The accounting enhances the effeciency to drastic level in doing

business operations. It does this by budgeting, ratio analysis, variance analysis and many

other critical analysis.

Enhances Labour efficiency: The management accounting even is beneficial for the

labour efficiency (Drury, 2018). It undertake this, through standard costing by creating a

relation between bonus and productivity.

Achievement in Management effeciency: The accounting is benefecial for increasing the

effeciency as well as effectiveness. This is done, as the managers are provided with

correct and the most authentic informations.

P2 Explain different methods used for management accounting reporting

Types of Management Accounting Reports:

Managment accounting mainly focussed of information gained through the aid of

financial accounting. There are different type of report s that is helpful for the managementin

planning, regulating as well as evaluating financial performance. These information are

generated with the aid of continuasly in generating accounting the requirement. Some of the

report can be mentioned below for more detail

Budget Reports: These reports are mainly critical for measuring the performance of the

company. While in some large Organizations, the different budget reports are generated

department wise(Kostyukova and et. al., 2018.). It is must for the company to detail reports for

present their schemes. The estimate of this budget is mainly made on the base of their previous

experiences. In order to make their budget valuable it is must for considering the unforseen

circumstances that may arise in the future. This can further guide the managers to offer various

employees incentives, cut cost as well as negotiate the terms with their suppliers and vendors.

Accouting Recievable Aging Reports: As Most of the firm realies of extending credit it is must

for them to prepare accounting recievable aging reports. This is useful for the company in order

to break down the balances into specified period and identify defaulters and address issues in

completing the collection process of the company. If there are large number of defaulters then

the company needs to strengthen their credit policy in order to maintain it's liquadity in order to

meet to enhance it's financial performance.

analysis and capital budgets.

Increases Effeciency: The accounting enhances the effeciency to drastic level in doing

business operations. It does this by budgeting, ratio analysis, variance analysis and many

other critical analysis.

Enhances Labour efficiency: The management accounting even is beneficial for the

labour efficiency (Drury, 2018). It undertake this, through standard costing by creating a

relation between bonus and productivity.

Achievement in Management effeciency: The accounting is benefecial for increasing the

effeciency as well as effectiveness. This is done, as the managers are provided with

correct and the most authentic informations.

P2 Explain different methods used for management accounting reporting

Types of Management Accounting Reports:

Managment accounting mainly focussed of information gained through the aid of

financial accounting. There are different type of report s that is helpful for the managementin

planning, regulating as well as evaluating financial performance. These information are

generated with the aid of continuasly in generating accounting the requirement. Some of the

report can be mentioned below for more detail

Budget Reports: These reports are mainly critical for measuring the performance of the

company. While in some large Organizations, the different budget reports are generated

department wise(Kostyukova and et. al., 2018.). It is must for the company to detail reports for

present their schemes. The estimate of this budget is mainly made on the base of their previous

experiences. In order to make their budget valuable it is must for considering the unforseen

circumstances that may arise in the future. This can further guide the managers to offer various

employees incentives, cut cost as well as negotiate the terms with their suppliers and vendors.

Accouting Recievable Aging Reports: As Most of the firm realies of extending credit it is must

for them to prepare accounting recievable aging reports. This is useful for the company in order

to break down the balances into specified period and identify defaulters and address issues in

completing the collection process of the company. If there are large number of defaulters then

the company needs to strengthen their credit policy in order to maintain it's liquadity in order to

meet to enhance it's financial performance.

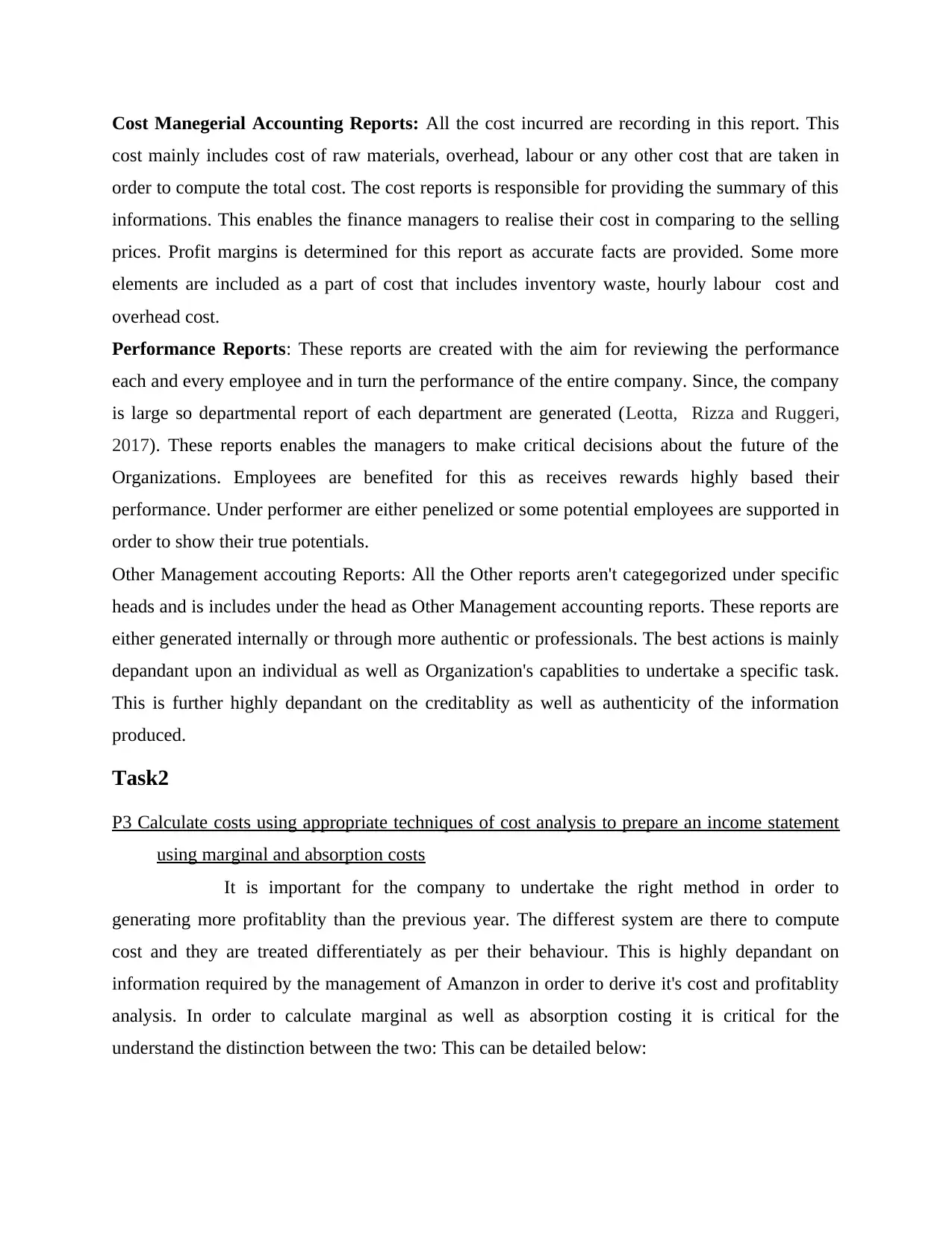

Cost Manegerial Accounting Reports: All the cost incurred are recording in this report. This

cost mainly includes cost of raw materials, overhead, labour or any other cost that are taken in

order to compute the total cost. The cost reports is responsible for providing the summary of this

informations. This enables the finance managers to realise their cost in comparing to the selling

prices. Profit margins is determined for this report as accurate facts are provided. Some more

elements are included as a part of cost that includes inventory waste, hourly labour cost and

overhead cost.

Performance Reports: These reports are created with the aim for reviewing the performance

each and every employee and in turn the performance of the entire company. Since, the company

is large so departmental report of each department are generated (Leotta, Rizza and Ruggeri,

2017). These reports enables the managers to make critical decisions about the future of the

Organizations. Employees are benefited for this as receives rewards highly based their

performance. Under performer are either penelized or some potential employees are supported in

order to show their true potentials.

Other Management accouting Reports: All the Other reports aren't categegorized under specific

heads and is includes under the head as Other Management accounting reports. These reports are

either generated internally or through more authentic or professionals. The best actions is mainly

depandant upon an individual as well as Organization's capablities to undertake a specific task.

This is further highly depandant on the creditablity as well as authenticity of the information

produced.

Task2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

It is important for the company to undertake the right method in order to

generating more profitablity than the previous year. The differest system are there to compute

cost and they are treated differentiately as per their behaviour. This is highly depandant on

information required by the management of Amanzon in order to derive it's cost and profitablity

analysis. In order to calculate marginal as well as absorption costing it is critical for the

understand the distinction between the two: This can be detailed below:

cost mainly includes cost of raw materials, overhead, labour or any other cost that are taken in

order to compute the total cost. The cost reports is responsible for providing the summary of this

informations. This enables the finance managers to realise their cost in comparing to the selling

prices. Profit margins is determined for this report as accurate facts are provided. Some more

elements are included as a part of cost that includes inventory waste, hourly labour cost and

overhead cost.

Performance Reports: These reports are created with the aim for reviewing the performance

each and every employee and in turn the performance of the entire company. Since, the company

is large so departmental report of each department are generated (Leotta, Rizza and Ruggeri,

2017). These reports enables the managers to make critical decisions about the future of the

Organizations. Employees are benefited for this as receives rewards highly based their

performance. Under performer are either penelized or some potential employees are supported in

order to show their true potentials.

Other Management accouting Reports: All the Other reports aren't categegorized under specific

heads and is includes under the head as Other Management accounting reports. These reports are

either generated internally or through more authentic or professionals. The best actions is mainly

depandant upon an individual as well as Organization's capablities to undertake a specific task.

This is further highly depandant on the creditablity as well as authenticity of the information

produced.

Task2

P3 Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

It is important for the company to undertake the right method in order to

generating more profitablity than the previous year. The differest system are there to compute

cost and they are treated differentiately as per their behaviour. This is highly depandant on

information required by the management of Amanzon in order to derive it's cost and profitablity

analysis. In order to calculate marginal as well as absorption costing it is critical for the

understand the distinction between the two: This can be detailed below:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

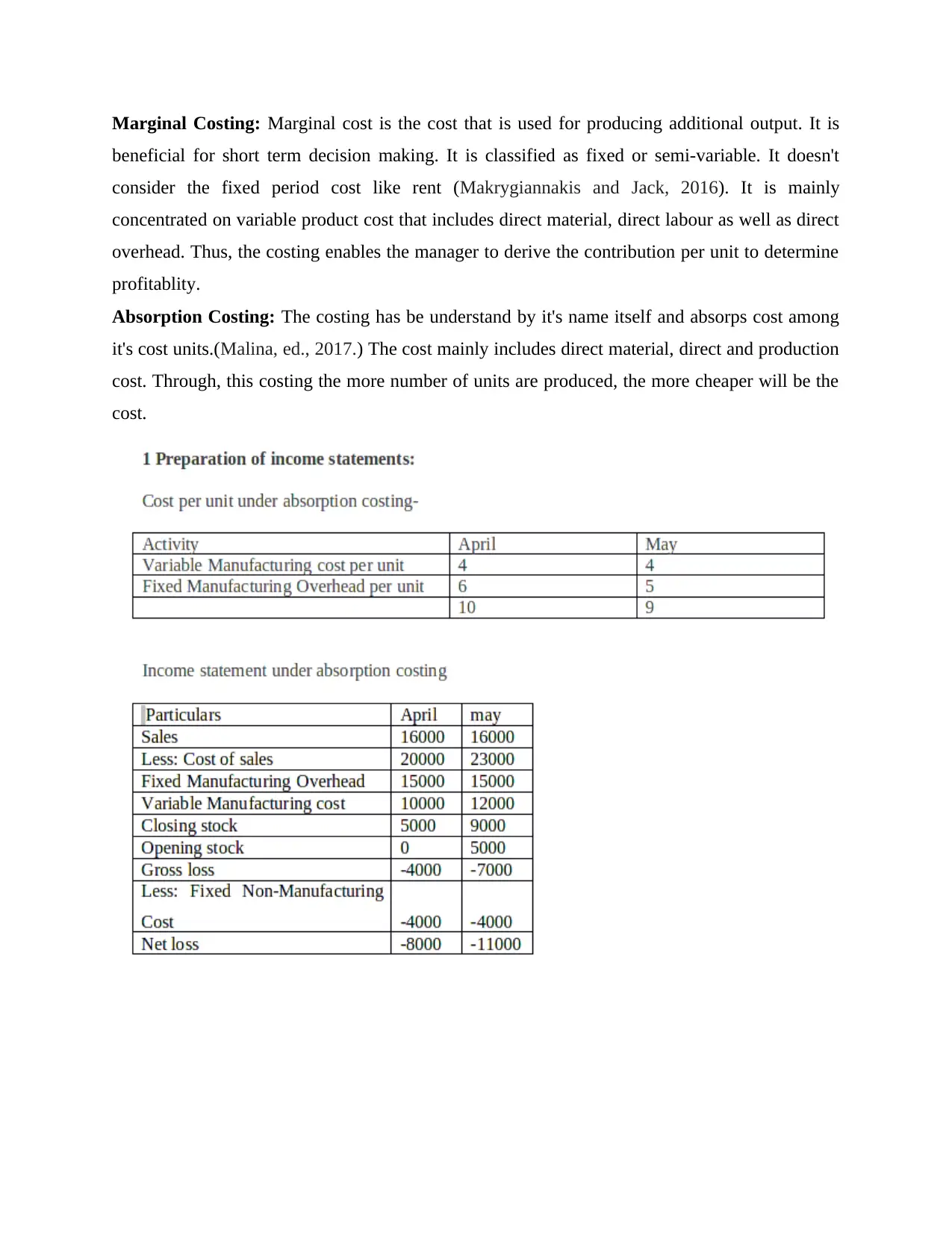

Marginal Costing: Marginal cost is the cost that is used for producing additional output. It is

beneficial for short term decision making. It is classified as fixed or semi-variable. It doesn't

consider the fixed period cost like rent (Makrygiannakis and Jack, 2016). It is mainly

concentrated on variable product cost that includes direct material, direct labour as well as direct

overhead. Thus, the costing enables the manager to derive the contribution per unit to determine

profitablity.

Absorption Costing: The costing has be understand by it's name itself and absorps cost among

it's cost units.(Malina, ed., 2017.) The cost mainly includes direct material, direct and production

cost. Through, this costing the more number of units are produced, the more cheaper will be the

cost.

beneficial for short term decision making. It is classified as fixed or semi-variable. It doesn't

consider the fixed period cost like rent (Makrygiannakis and Jack, 2016). It is mainly

concentrated on variable product cost that includes direct material, direct labour as well as direct

overhead. Thus, the costing enables the manager to derive the contribution per unit to determine

profitablity.

Absorption Costing: The costing has be understand by it's name itself and absorps cost among

it's cost units.(Malina, ed., 2017.) The cost mainly includes direct material, direct and production

cost. Through, this costing the more number of units are produced, the more cheaper will be the

cost.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

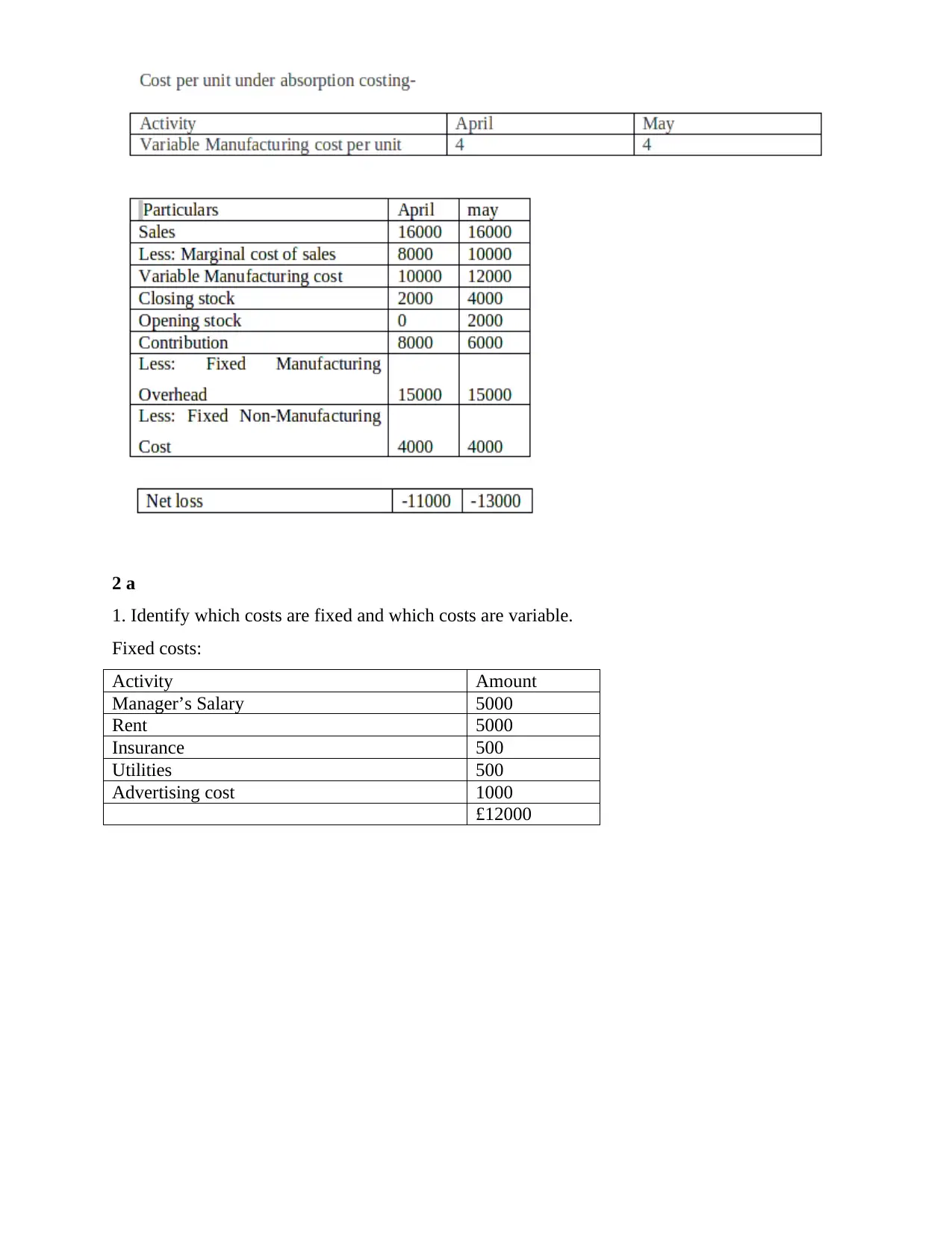

2 a

1. Identify which costs are fixed and which costs are variable.

Fixed costs:

Activity Amount

Manager’s Salary 5000

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

£12000

1. Identify which costs are fixed and which costs are variable.

Fixed costs:

Activity Amount

Manager’s Salary 5000

Rent 5000

Insurance 500

Utilities 500

Advertising cost 1000

£12000

Variable cost:

Activity Amount

Direct material costs per Pizza 3.50

Direct labor costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£5.50

3. What would be the Margin of Safety if the organization managed to sell 2500 Pizzas?

Margin of safety= Sales units-BEP in Units

= 2500-3000

= -500 Units

4. If the manager’s salary is increased to £6,000, how will this affect the BEP in units and in

sales value?

Activity Amount

Direct material costs per Pizza 3.50

Direct labor costs per Pizza 1.50

Direct overhead costs per Pizza 0.50

£5.50

3. What would be the Margin of Safety if the organization managed to sell 2500 Pizzas?

Margin of safety= Sales units-BEP in Units

= 2500-3000

= -500 Units

4. If the manager’s salary is increased to £6,000, how will this affect the BEP in units and in

sales value?

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

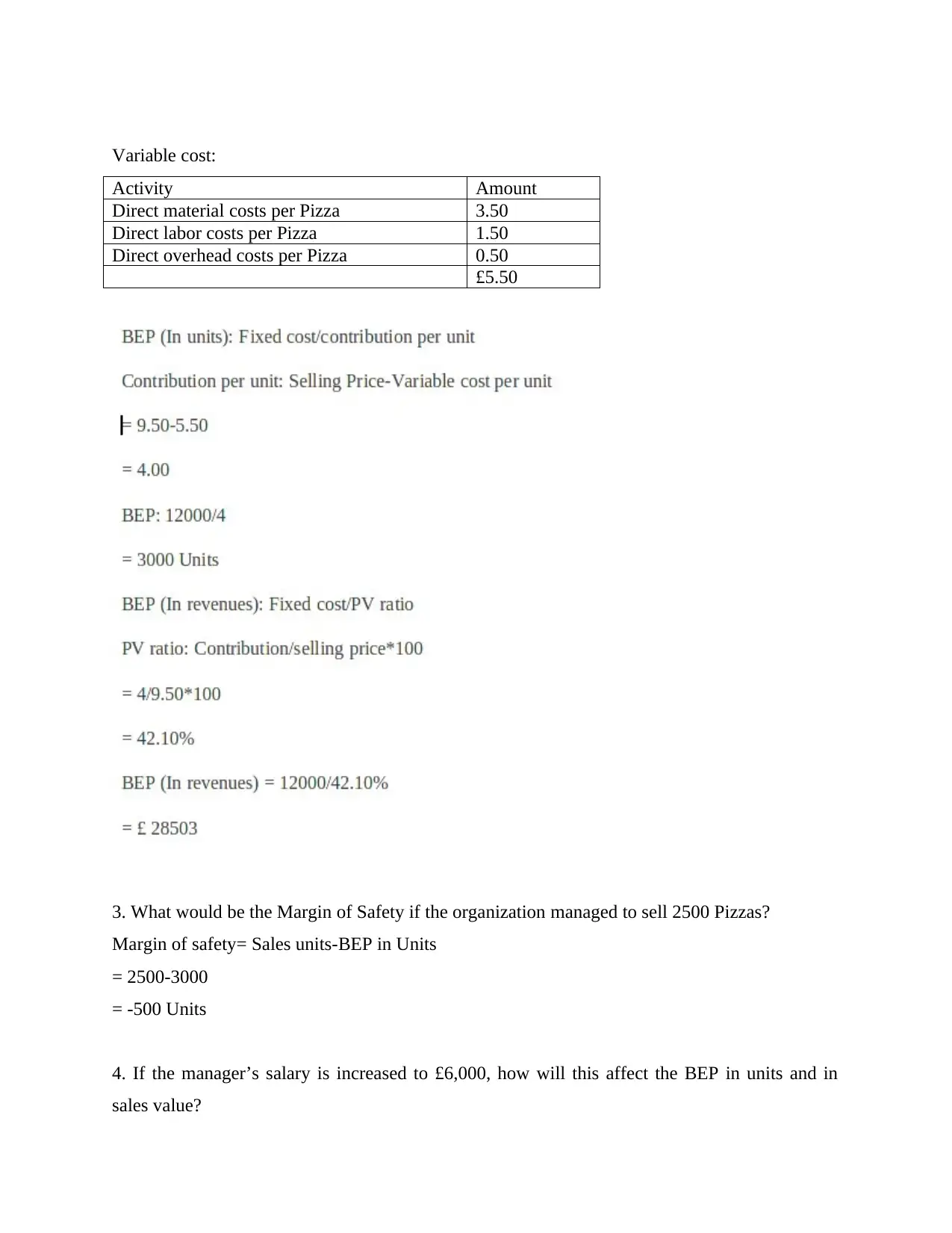

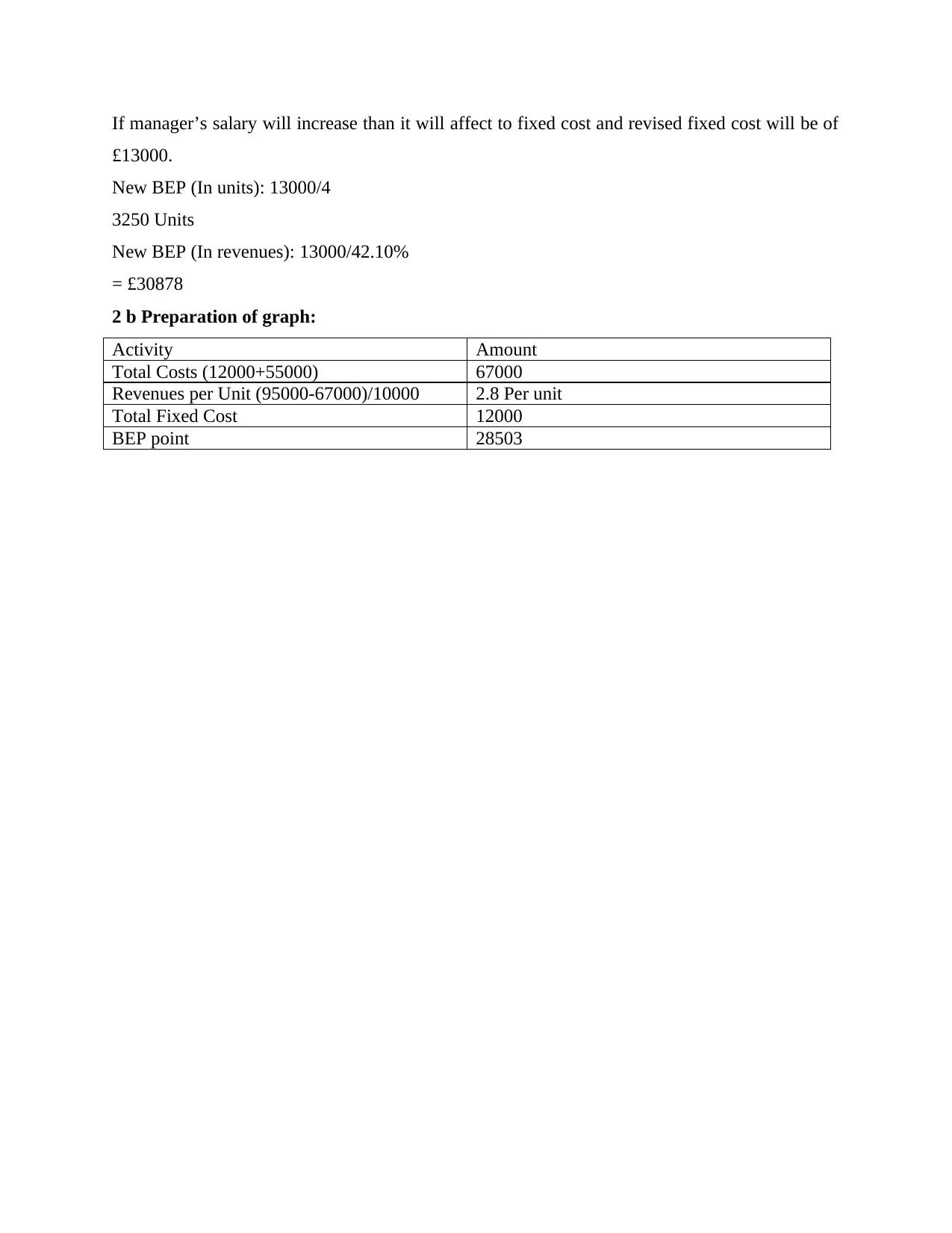

If manager’s salary will increase than it will affect to fixed cost and revised fixed cost will be of

£13000.

New BEP (In units): 13000/4

3250 Units

New BEP (In revenues): 13000/42.10%

= £30878

2 b Preparation of graph:

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

£13000.

New BEP (In units): 13000/4

3250 Units

New BEP (In revenues): 13000/42.10%

= £30878

2 b Preparation of graph:

Activity Amount

Total Costs (12000+55000) 67000

Revenues per Unit (95000-67000)/10000 2.8 Per unit

Total Fixed Cost 12000

BEP point 28503

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

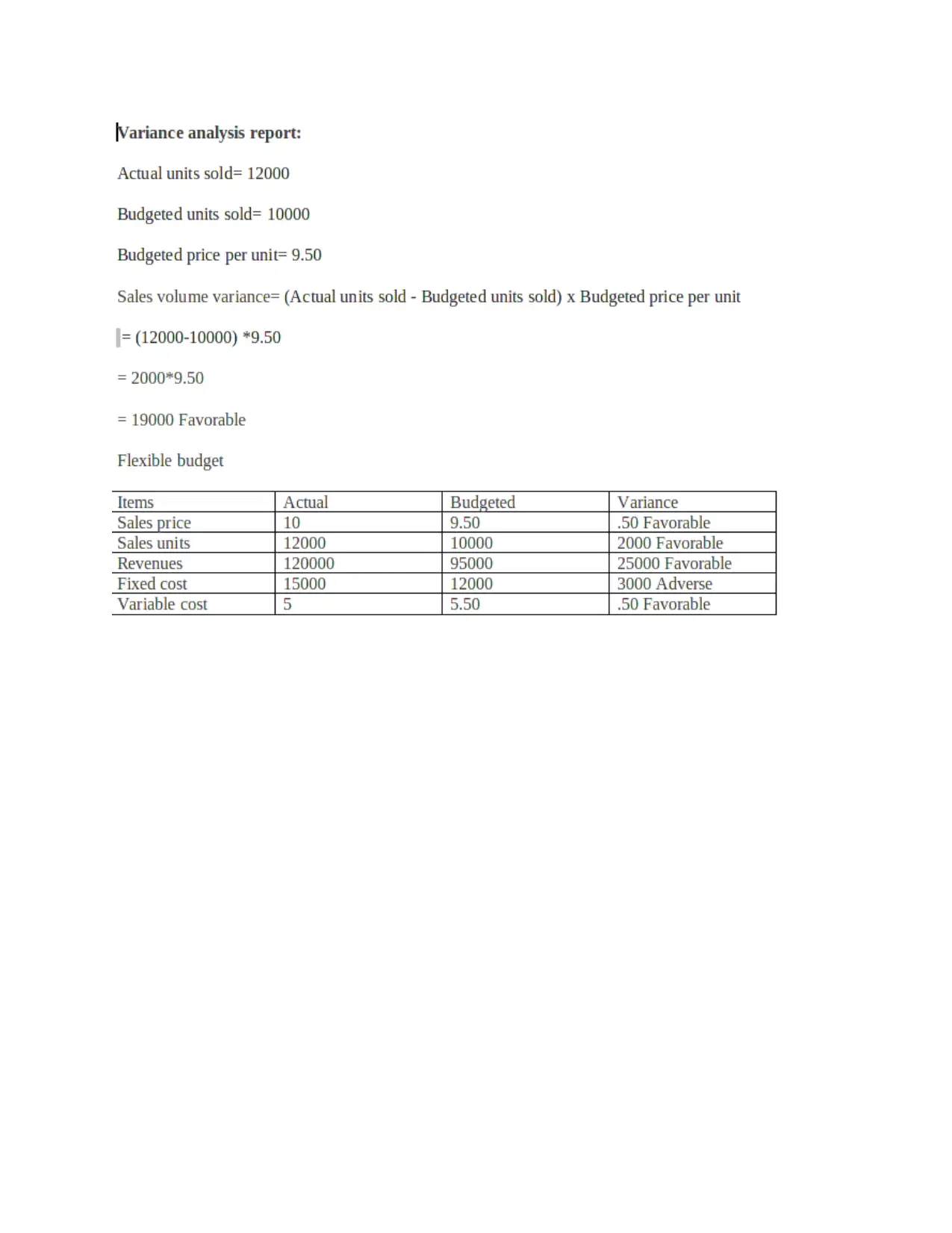

Task3

P4 Explain the advantages and disadvantages of different type of planning tool used in budgetary

control.

Budgetary control, is mainly used for taking approprite controling measures in order to

compute cost. This is done by preparing number of budgets in order to ensure proper co-

ordination among various department (Manyaeva, Piskunov and Fomin, 2016.). This will enable

the company to compare their actual performance with that of set standards. Thereby, indulging

in constant improvement and maximizing the profitablity. Some of the main planning tools can

be mentioned below for it's better understanding:

Cash Budget: This budget can simply be referred to as forcast of reciepts and payment.

This enables to compare the actual cash with that of budgeted cash.

Advantages: Cash budget enables the company to settle debt as and when occurred. This is

further beneficial for the company for being pro-active and setting aside cash for emergency

situations. The budget helps in identifying the issue occur in order to address the issues in order

to enhance it for better results.

Disadvantages: One of the main disadvantages of this document is that, the company needs to

create and maintain a number of documents in order to protect their valuable and hard earned

cash. Another limitation of cash is a the society is moving towards cashless society. This

includes payment through debit card, credit card, paytm, phonepe, etc.

Sales Budget: The sales budget consist of the information of the sales with respect to

particular year. It is calculated by budgetted unit sales and it's selling price.

Advantages: It is a vital planning tool that acts as a guide as it provides target in order to set

expection in order to perform as per capality required. As, the employees are aware of the

maximum limit they can incur in order to achieve the desired results.

Disadvantages: This is very complex process as it requires a lot and time in order prepare the

fullinformation of the sales incurred in a particular year. This budget is mainly based on

assumption and predictions made by the management and it is quite unpredictable.

P4 Explain the advantages and disadvantages of different type of planning tool used in budgetary

control.

Budgetary control, is mainly used for taking approprite controling measures in order to

compute cost. This is done by preparing number of budgets in order to ensure proper co-

ordination among various department (Manyaeva, Piskunov and Fomin, 2016.). This will enable

the company to compare their actual performance with that of set standards. Thereby, indulging

in constant improvement and maximizing the profitablity. Some of the main planning tools can

be mentioned below for it's better understanding:

Cash Budget: This budget can simply be referred to as forcast of reciepts and payment.

This enables to compare the actual cash with that of budgeted cash.

Advantages: Cash budget enables the company to settle debt as and when occurred. This is

further beneficial for the company for being pro-active and setting aside cash for emergency

situations. The budget helps in identifying the issue occur in order to address the issues in order

to enhance it for better results.

Disadvantages: One of the main disadvantages of this document is that, the company needs to

create and maintain a number of documents in order to protect their valuable and hard earned

cash. Another limitation of cash is a the society is moving towards cashless society. This

includes payment through debit card, credit card, paytm, phonepe, etc.

Sales Budget: The sales budget consist of the information of the sales with respect to

particular year. It is calculated by budgetted unit sales and it's selling price.

Advantages: It is a vital planning tool that acts as a guide as it provides target in order to set

expection in order to perform as per capality required. As, the employees are aware of the

maximum limit they can incur in order to achieve the desired results.

Disadvantages: This is very complex process as it requires a lot and time in order prepare the

fullinformation of the sales incurred in a particular year. This budget is mainly based on

assumption and predictions made by the management and it is quite unpredictable.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.