Cost Analysis and Budgeting Report for Jeffrey & Sons - Accounting

VerifiedAdded on 2023/04/22

|20

|5817

|89

Report

AI Summary

This management accounting report examines the cost structure, budgeting processes, and performance analysis of Jeffrey & Sons, a manufacturing company producing branded products. The report begins with a detailed cost classification analysis, differentiating between direct and indirect costs, and then calculates unit costs and total job costs using job costing techniques. It further explores the calculation of costs using absorption costing, providing a comprehensive cost analysis of the company's "Exquisite" product. Task 2 focuses on preparing and analyzing a cost report for September, including variance analysis and identifying areas for potential improvement using performance indicators. The report also addresses budgeting methods, preparing different types of budgets, and a cash budget. Finally, the report concludes with variance calculations, the preparation of a reconciliation operating statement, and findings presented to management in accordance with identified responsibility centers.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Different type of cost classification.......................................................................................1

1.2 Calculation of Unit cost and total job cost.............................................................................2

1.3 Calculating cost of Exquisite using absorption costing technique........................................3

1.4 Analyzing cost of Exquisite...................................................................................................5

TASK 2............................................................................................................................................6

2.1 Preparing and analyzing cost report for the month of September.........................................6

2.2 Use of performance indicators to identify areas for potential improvement.........................8

2.3 Ways to reduce cost and enhance value, quality...................................................................9

TASK 3............................................................................................................................................9

3.1 Purpose and nature of budgeting process..............................................................................9

3.2 Selection of appropriate budgeting methods for organization.............................................10

3.3 Preparation of different types of budget..............................................................................11

3.4 Preparation of cash budget...................................................................................................12

TASK 4..........................................................................................................................................14

4.1 Calculation of variance........................................................................................................14

4.2 Preparation of reconciliation operating statement...............................................................15

4.3 Findings to management in accordance with identified responsibility centers...................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Different type of cost classification.......................................................................................1

1.2 Calculation of Unit cost and total job cost.............................................................................2

1.3 Calculating cost of Exquisite using absorption costing technique........................................3

1.4 Analyzing cost of Exquisite...................................................................................................5

TASK 2............................................................................................................................................6

2.1 Preparing and analyzing cost report for the month of September.........................................6

2.2 Use of performance indicators to identify areas for potential improvement.........................8

2.3 Ways to reduce cost and enhance value, quality...................................................................9

TASK 3............................................................................................................................................9

3.1 Purpose and nature of budgeting process..............................................................................9

3.2 Selection of appropriate budgeting methods for organization.............................................10

3.3 Preparation of different types of budget..............................................................................11

3.4 Preparation of cash budget...................................................................................................12

TASK 4..........................................................................................................................................14

4.1 Calculation of variance........................................................................................................14

4.2 Preparation of reconciliation operating statement...............................................................15

4.3 Findings to management in accordance with identified responsibility centers...................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION

Management accounting is regarded as the main field of accounting which supports in

combining norms of budgeting along with cost. With the help of undertaking different type of

methods, it is possible for business enterprise to determine the actual cost of production along

with the operational tasks so as to take large number of decisions in favor of the business.

Further, for this aspect it is necessary to record cost along with major expenses by undertaking

different effective methods of costing (Chapman, 2008). All these methods support business

enterprise in reducing overall cost with the motive to enhance profitability level. Moreover, it is

well known fact that every business enterprise prepares different type of accounts along with

reports so as to assess its overall performance in the market and corrective actions are taken if

business is not performing as per expectations. Statements such as annual report etc are fruitful

for business with the help of which information is shared with external shareholders of the

company and through this it is possible for them to satisfy need of parties associated with the

firm. The present report being carried out is based on organization named Jeffrey and Sons

where business is manufacturing branded products like Exquisite. Organization has mainly two

departments namely production and service. Various tasks have been covered in the study which

is different type of cost classification, calculation of unit cost etc.

TASK 1

1.1 Different type of cost classification

Cost is regarded as the overall expense which is being incurred by the business enterprise

for conducting major activities of the business. Cost of organization can be divided on the basis

of following elements which are:

Element: This factor supports in dividing cost into direct and indirect one. Further, direct costs

are those which are incurred for carrying out the production process. Main examples of direct

cost are labor, material, lightning, heating etc (Jiambalvo, 2001). On the other hand indirect costs

are those which are being required for carrying out manufacturing in appropriate manner. Main

examples of indirect cost are small tools etc.

Function: It is possible to classify the major costs on the basis of function along with activities.

Costs can be classified into different types which are finance, production, distribution, research

and development, quality check etc.

1

Management accounting is regarded as the main field of accounting which supports in

combining norms of budgeting along with cost. With the help of undertaking different type of

methods, it is possible for business enterprise to determine the actual cost of production along

with the operational tasks so as to take large number of decisions in favor of the business.

Further, for this aspect it is necessary to record cost along with major expenses by undertaking

different effective methods of costing (Chapman, 2008). All these methods support business

enterprise in reducing overall cost with the motive to enhance profitability level. Moreover, it is

well known fact that every business enterprise prepares different type of accounts along with

reports so as to assess its overall performance in the market and corrective actions are taken if

business is not performing as per expectations. Statements such as annual report etc are fruitful

for business with the help of which information is shared with external shareholders of the

company and through this it is possible for them to satisfy need of parties associated with the

firm. The present report being carried out is based on organization named Jeffrey and Sons

where business is manufacturing branded products like Exquisite. Organization has mainly two

departments namely production and service. Various tasks have been covered in the study which

is different type of cost classification, calculation of unit cost etc.

TASK 1

1.1 Different type of cost classification

Cost is regarded as the overall expense which is being incurred by the business enterprise

for conducting major activities of the business. Cost of organization can be divided on the basis

of following elements which are:

Element: This factor supports in dividing cost into direct and indirect one. Further, direct costs

are those which are incurred for carrying out the production process. Main examples of direct

cost are labor, material, lightning, heating etc (Jiambalvo, 2001). On the other hand indirect costs

are those which are being required for carrying out manufacturing in appropriate manner. Main

examples of indirect cost are small tools etc.

Function: It is possible to classify the major costs on the basis of function along with activities.

Costs can be classified into different types which are finance, production, distribution, research

and development, quality check etc.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Nature: Considering the nature of different costs it can be divided into material, labor and

overhead expense. Material expense are being incurred for carrying out the production process

where materials are purchased, labor expense is associated with payment of wages to different

workers and overhead expenses are linked with cost of business enterprise. Hence, in this way

nature of every cost differs from each other which business has to consider for carrying out

overall operations in effective manner (Keown, 2005).

Behavior: By undertaking, behavior as a factor it is possible to segregate cost into fixed, variable

and semi variable. Further, fixed cost is considered as the cost which does not changes with the

change in level of output. On the other hand, variable cost alters with the change in production

unit. Apart from this, semi variable cost contains features of both fixed and variable cost.

Therefore, in this way behavior of every cost differs from one another.

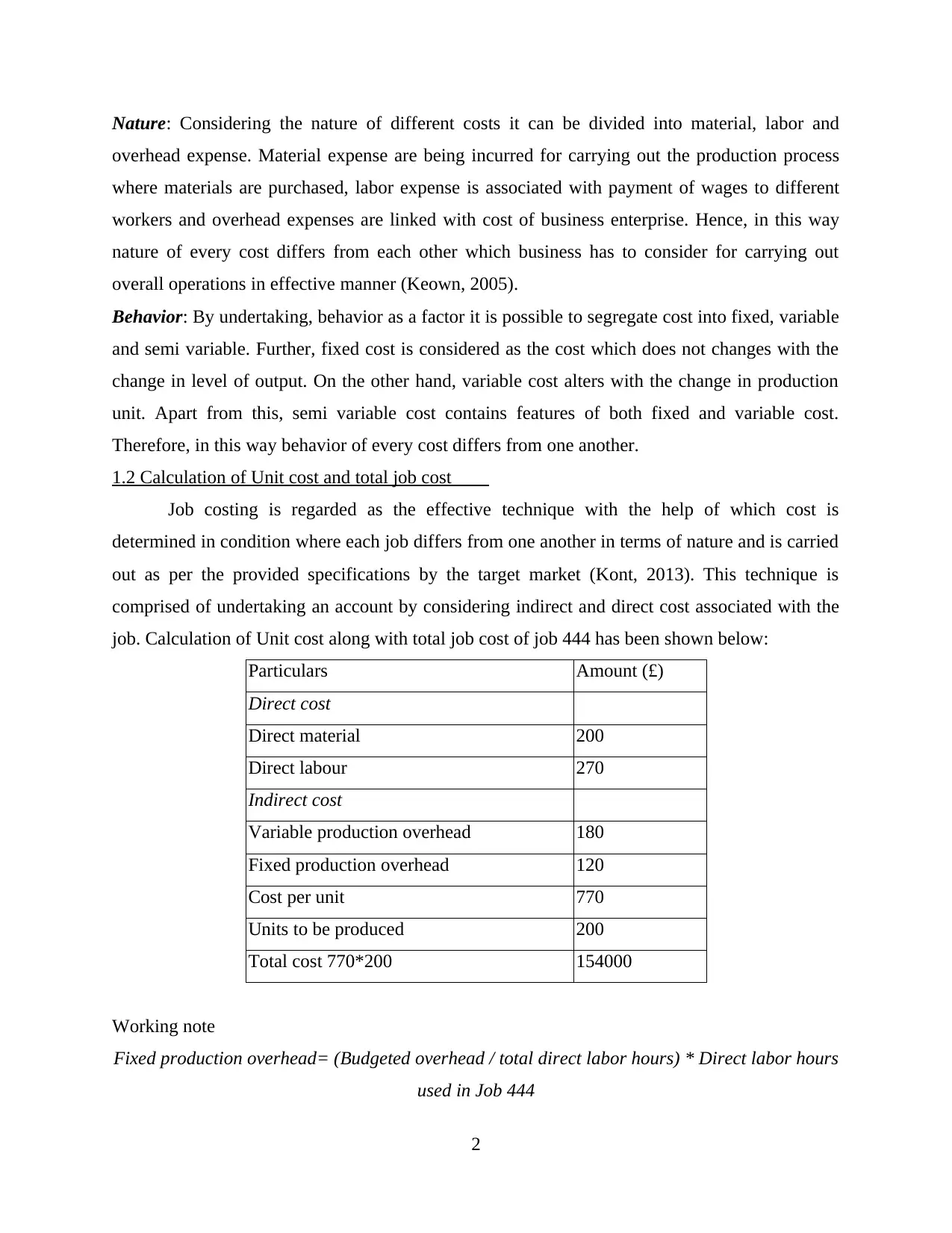

1.2 Calculation of Unit cost and total job cost

Job costing is regarded as the effective technique with the help of which cost is

determined in condition where each job differs from one another in terms of nature and is carried

out as per the provided specifications by the target market (Kont, 2013). This technique is

comprised of undertaking an account by considering indirect and direct cost associated with the

job. Calculation of Unit cost along with total job cost of job 444 has been shown below:

Particulars Amount (£)

Direct cost

Direct material 200

Direct labour 270

Indirect cost

Variable production overhead 180

Fixed production overhead 120

Cost per unit 770

Units to be produced 200

Total cost 770*200 154000

Working note

Fixed production overhead= (Budgeted overhead / total direct labor hours) * Direct labor hours

used in Job 444

2

overhead expense. Material expense are being incurred for carrying out the production process

where materials are purchased, labor expense is associated with payment of wages to different

workers and overhead expenses are linked with cost of business enterprise. Hence, in this way

nature of every cost differs from each other which business has to consider for carrying out

overall operations in effective manner (Keown, 2005).

Behavior: By undertaking, behavior as a factor it is possible to segregate cost into fixed, variable

and semi variable. Further, fixed cost is considered as the cost which does not changes with the

change in level of output. On the other hand, variable cost alters with the change in production

unit. Apart from this, semi variable cost contains features of both fixed and variable cost.

Therefore, in this way behavior of every cost differs from one another.

1.2 Calculation of Unit cost and total job cost

Job costing is regarded as the effective technique with the help of which cost is

determined in condition where each job differs from one another in terms of nature and is carried

out as per the provided specifications by the target market (Kont, 2013). This technique is

comprised of undertaking an account by considering indirect and direct cost associated with the

job. Calculation of Unit cost along with total job cost of job 444 has been shown below:

Particulars Amount (£)

Direct cost

Direct material 200

Direct labour 270

Indirect cost

Variable production overhead 180

Fixed production overhead 120

Cost per unit 770

Units to be produced 200

Total cost 770*200 154000

Working note

Fixed production overhead= (Budgeted overhead / total direct labor hours) * Direct labor hours

used in Job 444

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

=(£80000 / 20000 hours) * 30 hours

=£120

After doing the above calculations it can be said that per unit cost of job 444 is £3.85 and

total cost of this job will be £770.

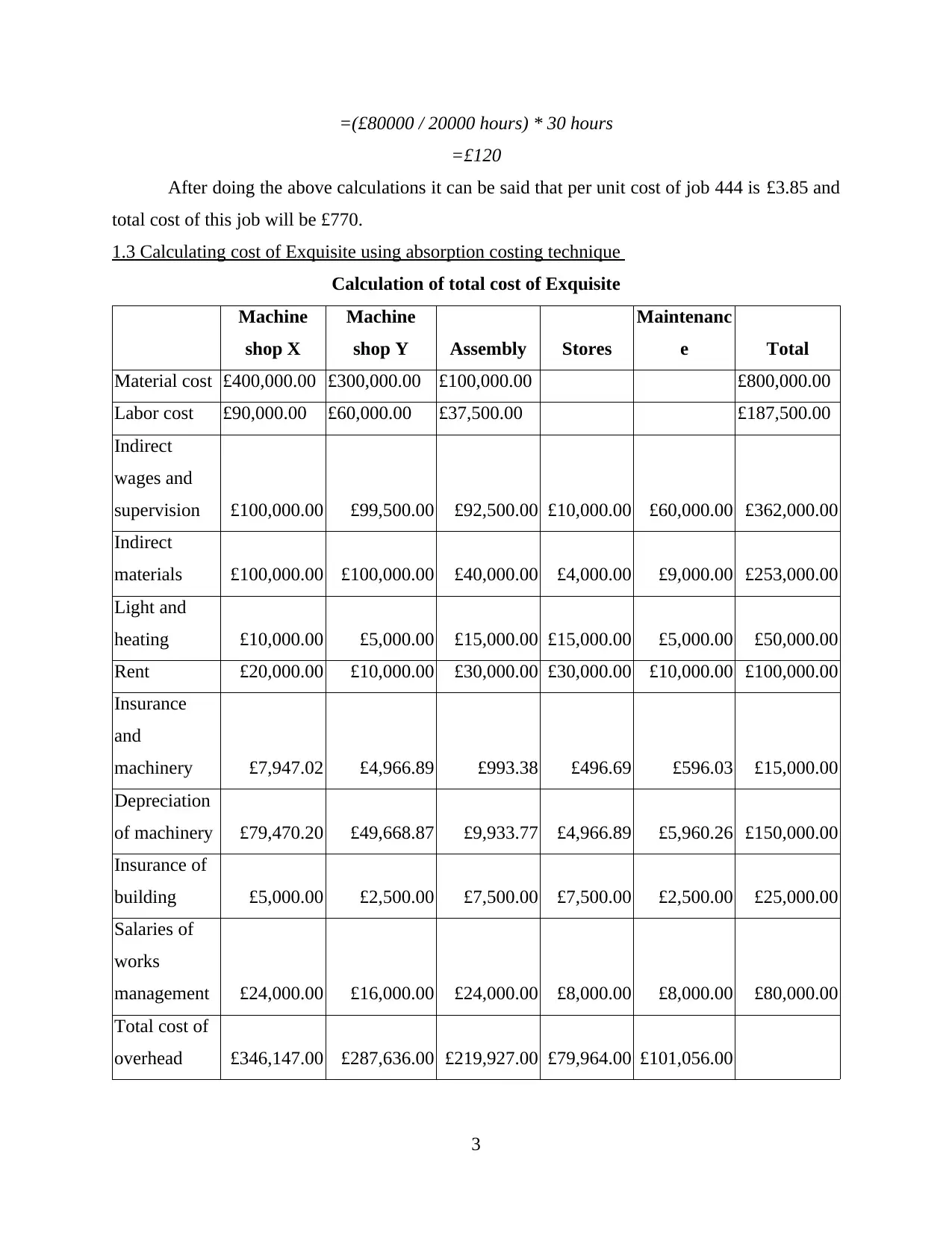

1.3 Calculating cost of Exquisite using absorption costing technique

Calculation of total cost of Exquisite

Machine

shop X

Machine

shop Y Assembly Stores

Maintenanc

e Total

Material cost £400,000.00 £300,000.00 £100,000.00 £800,000.00

Labor cost £90,000.00 £60,000.00 £37,500.00 £187,500.00

Indirect

wages and

supervision £100,000.00 £99,500.00 £92,500.00 £10,000.00 £60,000.00 £362,000.00

Indirect

materials £100,000.00 £100,000.00 £40,000.00 £4,000.00 £9,000.00 £253,000.00

Light and

heating £10,000.00 £5,000.00 £15,000.00 £15,000.00 £5,000.00 £50,000.00

Rent £20,000.00 £10,000.00 £30,000.00 £30,000.00 £10,000.00 £100,000.00

Insurance

and

machinery £7,947.02 £4,966.89 £993.38 £496.69 £596.03 £15,000.00

Depreciation

of machinery £79,470.20 £49,668.87 £9,933.77 £4,966.89 £5,960.26 £150,000.00

Insurance of

building £5,000.00 £2,500.00 £7,500.00 £7,500.00 £2,500.00 £25,000.00

Salaries of

works

management £24,000.00 £16,000.00 £24,000.00 £8,000.00 £8,000.00 £80,000.00

Total cost of

overhead £346,147.00 £287,636.00 £219,927.00 £79,964.00 £101,056.00

3

=£120

After doing the above calculations it can be said that per unit cost of job 444 is £3.85 and

total cost of this job will be £770.

1.3 Calculating cost of Exquisite using absorption costing technique

Calculation of total cost of Exquisite

Machine

shop X

Machine

shop Y Assembly Stores

Maintenanc

e Total

Material cost £400,000.00 £300,000.00 £100,000.00 £800,000.00

Labor cost £90,000.00 £60,000.00 £37,500.00 £187,500.00

Indirect

wages and

supervision £100,000.00 £99,500.00 £92,500.00 £10,000.00 £60,000.00 £362,000.00

Indirect

materials £100,000.00 £100,000.00 £40,000.00 £4,000.00 £9,000.00 £253,000.00

Light and

heating £10,000.00 £5,000.00 £15,000.00 £15,000.00 £5,000.00 £50,000.00

Rent £20,000.00 £10,000.00 £30,000.00 £30,000.00 £10,000.00 £100,000.00

Insurance

and

machinery £7,947.02 £4,966.89 £993.38 £496.69 £596.03 £15,000.00

Depreciation

of machinery £79,470.20 £49,668.87 £9,933.77 £4,966.89 £5,960.26 £150,000.00

Insurance of

building £5,000.00 £2,500.00 £7,500.00 £7,500.00 £2,500.00 £25,000.00

Salaries of

works

management £24,000.00 £16,000.00 £24,000.00 £8,000.00 £8,000.00 £80,000.00

Total cost of

overhead £346,147.00 £287,636.00 £219,927.00 £79,964.00 £101,056.00

3

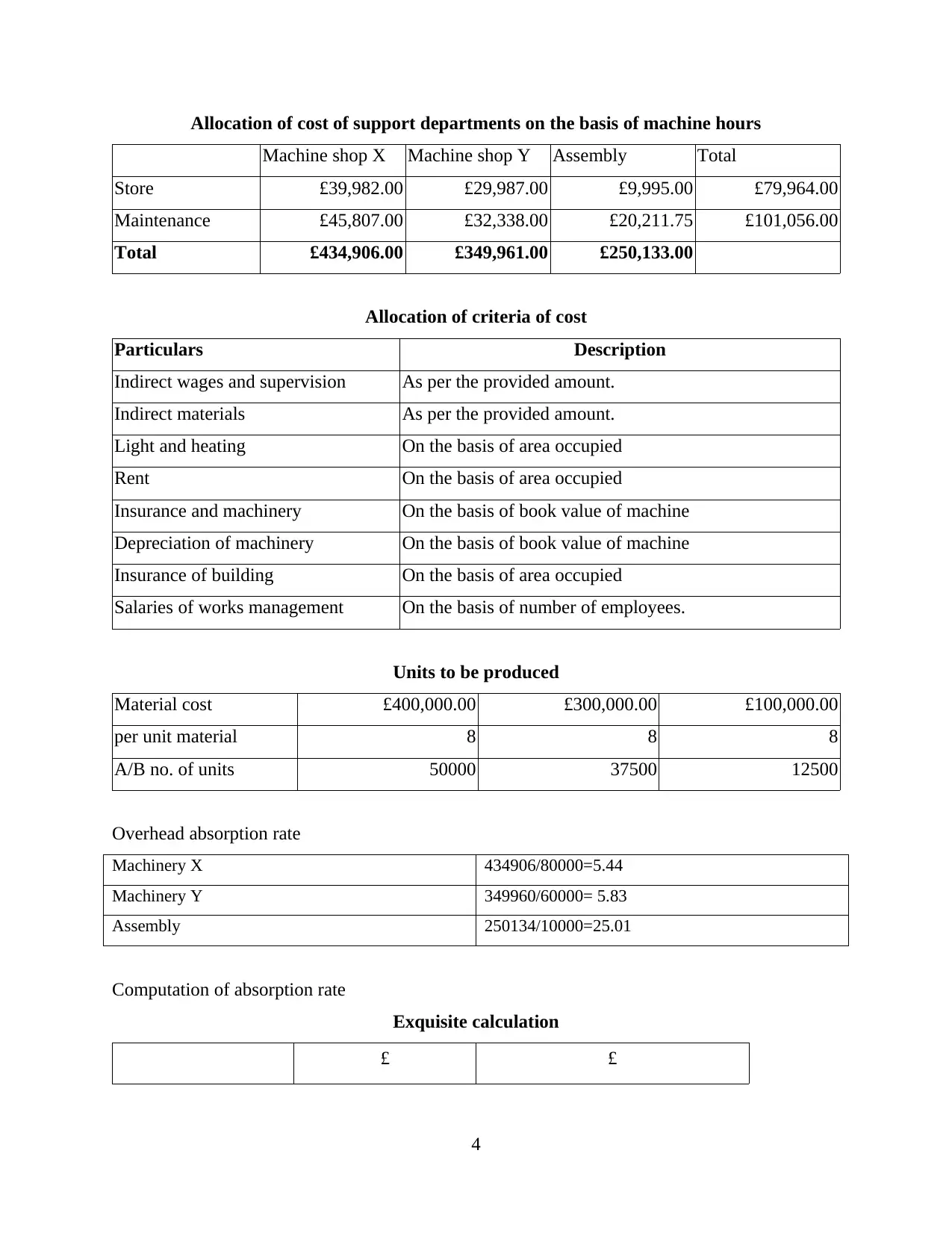

Allocation of cost of support departments on the basis of machine hours

Machine shop X Machine shop Y Assembly Total

Store £39,982.00 £29,987.00 £9,995.00 £79,964.00

Maintenance £45,807.00 £32,338.00 £20,211.75 £101,056.00

Total £434,906.00 £349,961.00 £250,133.00

Allocation of criteria of cost

Particulars Description

Indirect wages and supervision As per the provided amount.

Indirect materials As per the provided amount.

Light and heating On the basis of area occupied

Rent On the basis of area occupied

Insurance and machinery On the basis of book value of machine

Depreciation of machinery On the basis of book value of machine

Insurance of building On the basis of area occupied

Salaries of works management On the basis of number of employees.

Units to be produced

Material cost £400,000.00 £300,000.00 £100,000.00

per unit material 8 8 8

A/B no. of units 50000 37500 12500

Overhead absorption rate

Machinery X 434906/80000=5.44

Machinery Y 349960/60000= 5.83

Assembly 250134/10000=25.01

Computation of absorption rate

Exquisite calculation

£ £

4

Machine shop X Machine shop Y Assembly Total

Store £39,982.00 £29,987.00 £9,995.00 £79,964.00

Maintenance £45,807.00 £32,338.00 £20,211.75 £101,056.00

Total £434,906.00 £349,961.00 £250,133.00

Allocation of criteria of cost

Particulars Description

Indirect wages and supervision As per the provided amount.

Indirect materials As per the provided amount.

Light and heating On the basis of area occupied

Rent On the basis of area occupied

Insurance and machinery On the basis of book value of machine

Depreciation of machinery On the basis of book value of machine

Insurance of building On the basis of area occupied

Salaries of works management On the basis of number of employees.

Units to be produced

Material cost £400,000.00 £300,000.00 £100,000.00

per unit material 8 8 8

A/B no. of units 50000 37500 12500

Overhead absorption rate

Machinery X 434906/80000=5.44

Machinery Y 349960/60000= 5.83

Assembly 250134/10000=25.01

Computation of absorption rate

Exquisite calculation

£ £

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Materials 8

Labour 15

Overheads

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

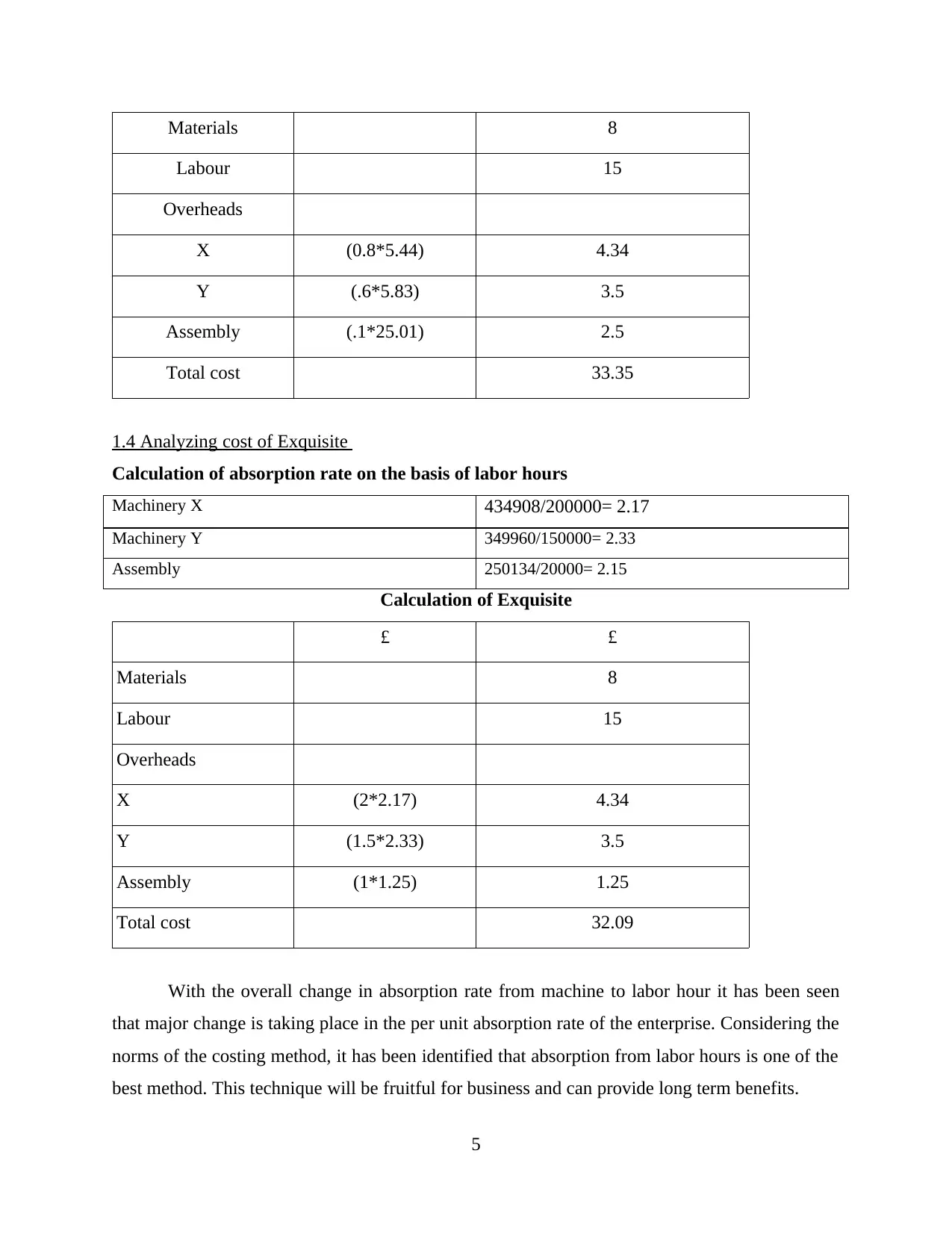

1.4 Analyzing cost of Exquisite

Calculation of absorption rate on the basis of labor hours

Machinery X 434908/200000= 2.17

Machinery Y 349960/150000= 2.33

Assembly 250134/20000= 2.15

Calculation of Exquisite

£ £

Materials 8

Labour 15

Overheads

X (2*2.17) 4.34

Y (1.5*2.33) 3.5

Assembly (1*1.25) 1.25

Total cost 32.09

With the overall change in absorption rate from machine to labor hour it has been seen

that major change is taking place in the per unit absorption rate of the enterprise. Considering the

norms of the costing method, it has been identified that absorption from labor hours is one of the

best method. This technique will be fruitful for business and can provide long term benefits.

5

Labour 15

Overheads

X (0.8*5.44) 4.34

Y (.6*5.83) 3.5

Assembly (.1*25.01) 2.5

Total cost 33.35

1.4 Analyzing cost of Exquisite

Calculation of absorption rate on the basis of labor hours

Machinery X 434908/200000= 2.17

Machinery Y 349960/150000= 2.33

Assembly 250134/20000= 2.15

Calculation of Exquisite

£ £

Materials 8

Labour 15

Overheads

X (2*2.17) 4.34

Y (1.5*2.33) 3.5

Assembly (1*1.25) 1.25

Total cost 32.09

With the overall change in absorption rate from machine to labor hour it has been seen

that major change is taking place in the per unit absorption rate of the enterprise. Considering the

norms of the costing method, it has been identified that absorption from labor hours is one of the

best method. This technique will be fruitful for business and can provide long term benefits.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

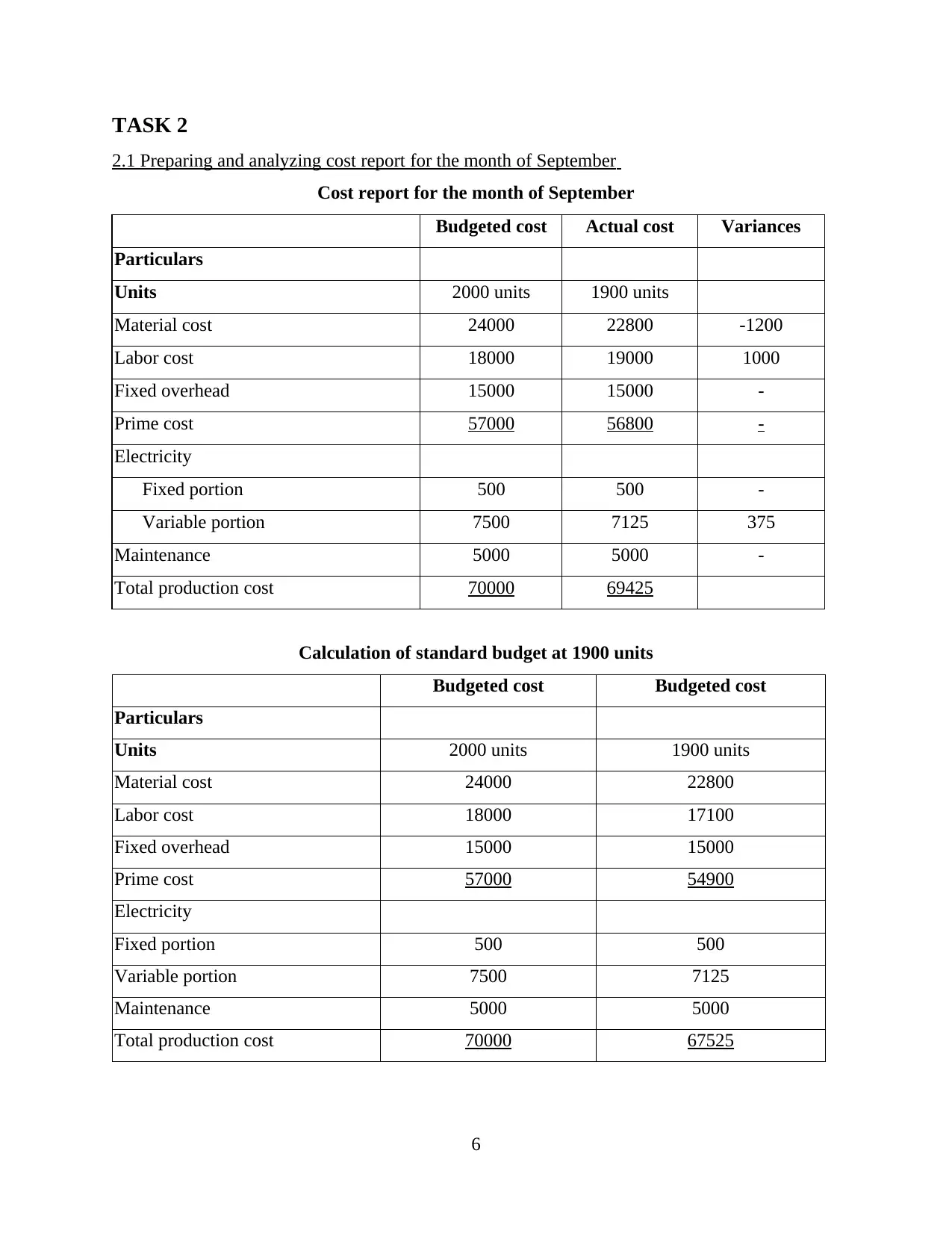

2.1 Preparing and analyzing cost report for the month of September

Cost report for the month of September

Budgeted cost Actual cost Variances

Particulars

Units 2000 units 1900 units

Material cost 24000 22800 -1200

Labor cost 18000 19000 1000

Fixed overhead 15000 15000 -

Prime cost 57000 56800 -

Electricity

Fixed portion 500 500 -

Variable portion 7500 7125 375

Maintenance 5000 5000 -

Total production cost 70000 69425

Calculation of standard budget at 1900 units

Budgeted cost Budgeted cost

Particulars

Units 2000 units 1900 units

Material cost 24000 22800

Labor cost 18000 17100

Fixed overhead 15000 15000

Prime cost 57000 54900

Electricity

Fixed portion 500 500

Variable portion 7500 7125

Maintenance 5000 5000

Total production cost 70000 67525

6

2.1 Preparing and analyzing cost report for the month of September

Cost report for the month of September

Budgeted cost Actual cost Variances

Particulars

Units 2000 units 1900 units

Material cost 24000 22800 -1200

Labor cost 18000 19000 1000

Fixed overhead 15000 15000 -

Prime cost 57000 56800 -

Electricity

Fixed portion 500 500 -

Variable portion 7500 7125 375

Maintenance 5000 5000 -

Total production cost 70000 69425

Calculation of standard budget at 1900 units

Budgeted cost Budgeted cost

Particulars

Units 2000 units 1900 units

Material cost 24000 22800

Labor cost 18000 17100

Fixed overhead 15000 15000

Prime cost 57000 54900

Electricity

Fixed portion 500 500

Variable portion 7500 7125

Maintenance 5000 5000

Total production cost 70000 67525

6

Calculation of variable cost – electricity = change in total cost / change in no of units to be

produced

= (8000-5000) (2000-1200)

= £3.75

Calculation of stepped cost

The maintenance cost associated with the business will not change as it is occurred on the

slot of 500. Further, by undertaking this aspect overall decrease in the 100 units will not bring

any kind of difference in the cost.

Variance analysis

Material cost: It is a kind of favorable variance in the amount of variable as no such kind of

change is present in the per unit cost and nature is material also changes rapidly. Considering this

aspect it is proportionate to the units that need to be manufactured. Further, this will have direct

impact on cost of material which will decrease (Lucey, 2002).

Labor cost: Cost report of the business is representing unfavorable variance in the cost of 1000.

Further, actual variance of 1900 is present and it is due to the reason that labor cost per unit is 9

and actual labor cost is 10. Further, this is having adverse impact on business enterprise where

business enterprise is required to pay additional amount of 1. Amount of 900 has been

compensated in the variance as the overall calculation of budget has been done on 9 whose units

are 20000 and overall actual calculation of 18000 units has been done on the basis of 10.

Fixed overhead: No variance is present in case of fixed cost as it does not changes with the

alteration in level of output. Further, with the increase or decrease in the level of production unit

there is no such change present in the amount of fixed expense (Obura and Bukenya, 2008).

Electricity: Nature of electricity as an expense is semi variable in nature. Further, this amount is

linked with both fixed and variable expense. Moreover, from doing the above calculations it has

been found that there is no such change present in the fixed proportion. Apart from this, amount

of variable portion has decreased significantly.

Maintenance: This cost is regarded as stepped one. Further, the level of maintenance cost

increased with the rise in slot of 500. By undertaking this aspect it can be said that there is no

such change in the amount of maintenance cost. It is due to the presence of reason that decrease

in 100 units will not make any such difference in the overall cost.

7

produced

= (8000-5000) (2000-1200)

= £3.75

Calculation of stepped cost

The maintenance cost associated with the business will not change as it is occurred on the

slot of 500. Further, by undertaking this aspect overall decrease in the 100 units will not bring

any kind of difference in the cost.

Variance analysis

Material cost: It is a kind of favorable variance in the amount of variable as no such kind of

change is present in the per unit cost and nature is material also changes rapidly. Considering this

aspect it is proportionate to the units that need to be manufactured. Further, this will have direct

impact on cost of material which will decrease (Lucey, 2002).

Labor cost: Cost report of the business is representing unfavorable variance in the cost of 1000.

Further, actual variance of 1900 is present and it is due to the reason that labor cost per unit is 9

and actual labor cost is 10. Further, this is having adverse impact on business enterprise where

business enterprise is required to pay additional amount of 1. Amount of 900 has been

compensated in the variance as the overall calculation of budget has been done on 9 whose units

are 20000 and overall actual calculation of 18000 units has been done on the basis of 10.

Fixed overhead: No variance is present in case of fixed cost as it does not changes with the

alteration in level of output. Further, with the increase or decrease in the level of production unit

there is no such change present in the amount of fixed expense (Obura and Bukenya, 2008).

Electricity: Nature of electricity as an expense is semi variable in nature. Further, this amount is

linked with both fixed and variable expense. Moreover, from doing the above calculations it has

been found that there is no such change present in the fixed proportion. Apart from this, amount

of variable portion has decreased significantly.

Maintenance: This cost is regarded as stepped one. Further, the level of maintenance cost

increased with the rise in slot of 500. By undertaking this aspect it can be said that there is no

such change in the amount of maintenance cost. It is due to the presence of reason that decrease

in 100 units will not make any such difference in the overall cost.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2.2 Use of performance indicators to identify areas for potential improvement

By undertaking different performance indicators it is possible for Jeffrey and Sons ltd to

identify the major areas where improvement is possible and it is beneficial for the business

enterprise in every possible manner.

Quality of products and services: By knowing the overall quality of product along with service it

is possible for business enterprise to improve the quality level. Further, it is required for business

enterprise to monitor all the operational tasks of the business for improvement. This will provide

base to management in identifying the major loopholes through which performance can be

enhanced due to which level of quality may be declined (Prior, 2004).

Financial statements: By undertaking different financial statements of the business it is possible

to identify the major changes in the position of Jeffrey and Son’s make. Further, in case if

conditions such as decrease in amount of sales along with profitability or increase in overall

amount of cost is present then business is required to make alteration in its operational strategies.

Financial statements prepared by the company will provide direct information regarding the

change in financial values of the business in a specific period of time (Key Performance

Indicators. 2014). Further, it is possible to identify the key areas where overall cost is increasing

and in turn it is having adverse impact on the profitability of the company.

Customer satisfaction: It is possible for business enterprise to bring improvement in its key

operations where undertaking review of its target market (Vaivio, 2008). Further, time to time

feedback can be taken from them through which management of Jeffrey and Sons can bring

possible improvement in its production process with the aim to enhance satisfaction level of its

target market.

Therefore, in this way these are some of the performance indicators for the business on

the basis of which potential improvement is possible for the firm. Further, all these indicators are

associated with the success and growth of firm in the market where supports in accomplishment

of desired aims along with objectives. Apart from this, it provides guidelines to the business

regarding the major areas where improvement is possible so that overall cost can be increased

and this will support in raising the profitability level.

8

By undertaking different performance indicators it is possible for Jeffrey and Sons ltd to

identify the major areas where improvement is possible and it is beneficial for the business

enterprise in every possible manner.

Quality of products and services: By knowing the overall quality of product along with service it

is possible for business enterprise to improve the quality level. Further, it is required for business

enterprise to monitor all the operational tasks of the business for improvement. This will provide

base to management in identifying the major loopholes through which performance can be

enhanced due to which level of quality may be declined (Prior, 2004).

Financial statements: By undertaking different financial statements of the business it is possible

to identify the major changes in the position of Jeffrey and Son’s make. Further, in case if

conditions such as decrease in amount of sales along with profitability or increase in overall

amount of cost is present then business is required to make alteration in its operational strategies.

Financial statements prepared by the company will provide direct information regarding the

change in financial values of the business in a specific period of time (Key Performance

Indicators. 2014). Further, it is possible to identify the key areas where overall cost is increasing

and in turn it is having adverse impact on the profitability of the company.

Customer satisfaction: It is possible for business enterprise to bring improvement in its key

operations where undertaking review of its target market (Vaivio, 2008). Further, time to time

feedback can be taken from them through which management of Jeffrey and Sons can bring

possible improvement in its production process with the aim to enhance satisfaction level of its

target market.

Therefore, in this way these are some of the performance indicators for the business on

the basis of which potential improvement is possible for the firm. Further, all these indicators are

associated with the success and growth of firm in the market where supports in accomplishment

of desired aims along with objectives. Apart from this, it provides guidelines to the business

regarding the major areas where improvement is possible so that overall cost can be increased

and this will support in raising the profitability level.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.3 Ways to reduce cost and enhance value, quality

Different effective ways are present with the help of which it is possible for company to

enhance quality of its products by reducing cost. Such appropriate techniques are discussed

below:

Total quality management: This method provides base to business enterprise in enhancing

quality level of the product. Further, it relies on the concept of improvement where major areas

are determined with the help of which quality level can be raised easily. It is well known fact that

different types of loopholes are present in the production process which can hamper entire

production process (Vance, 2002). Therefore, by undertaking this approach it is possible to

deliver quality products to the target market which is above their expectation level.

Kaizen costing: This technique supports in enhancing key operations of the business so that

overall aims and objectives of the business can be easily accomplished with the help of this.

Further, through this method motivation level of staff members can be enhanced easily through

which operational tasks can be carried out easily. Moreover, it is possible for business to

decrease wastage associated with the production process by making prevention of different

aspects which considers ineffective allocation of human resource, rise in production level as

compared with requirement, holding high inventory, poor strategies for transportation etc.

Just in time system and economic order quantity: By undertaking this technique it is possible

for business enterprise to decrease its storage along with carrying cost. Further, as per this

approach it is possible for business like Jeffrey and Son’s to purchase raw material as per

demand in the market (Arroyo, 2012). Apart from this, it can support business enterprise in

decreasing the overall level of the unwanted inventory of the business.

Management audit: This technique is also considered to be effective where it is possible for

business to monitor overall performance of the staff members so that standard results can be

accomplished easily. It provides base to employees in carrying out each and every activity as per

expectation and quality goals can be accomplished easily. Therefore, management of Jeffrey and

Son’s can make provision of surprise audit in its business strategies.

TASK 3

3.1 Purpose and nature of budgeting process

Purpose of budgeting process

9

Different effective ways are present with the help of which it is possible for company to

enhance quality of its products by reducing cost. Such appropriate techniques are discussed

below:

Total quality management: This method provides base to business enterprise in enhancing

quality level of the product. Further, it relies on the concept of improvement where major areas

are determined with the help of which quality level can be raised easily. It is well known fact that

different types of loopholes are present in the production process which can hamper entire

production process (Vance, 2002). Therefore, by undertaking this approach it is possible to

deliver quality products to the target market which is above their expectation level.

Kaizen costing: This technique supports in enhancing key operations of the business so that

overall aims and objectives of the business can be easily accomplished with the help of this.

Further, through this method motivation level of staff members can be enhanced easily through

which operational tasks can be carried out easily. Moreover, it is possible for business to

decrease wastage associated with the production process by making prevention of different

aspects which considers ineffective allocation of human resource, rise in production level as

compared with requirement, holding high inventory, poor strategies for transportation etc.

Just in time system and economic order quantity: By undertaking this technique it is possible

for business enterprise to decrease its storage along with carrying cost. Further, as per this

approach it is possible for business like Jeffrey and Son’s to purchase raw material as per

demand in the market (Arroyo, 2012). Apart from this, it can support business enterprise in

decreasing the overall level of the unwanted inventory of the business.

Management audit: This technique is also considered to be effective where it is possible for

business to monitor overall performance of the staff members so that standard results can be

accomplished easily. It provides base to employees in carrying out each and every activity as per

expectation and quality goals can be accomplished easily. Therefore, management of Jeffrey and

Son’s can make provision of surprise audit in its business strategies.

TASK 3

3.1 Purpose and nature of budgeting process

Purpose of budgeting process

9

Budgets can be regarded as the statements which are being developed with the motive to forecast

future operational tasks (Burns and et. al, 2004). Further, main stress is on estimation of future

expenses along with revenue so that resources can be allocated accordingly. Through this it

becomes easy to determine profit or loss for the business. With the help of this statement it is

possible to compare actual performance with expected one.

Nature of budgeting process

In the entire process of budgeting estimations are made by considering all the actual

values of the last accounting period. With the help of estimation, calculation of possible amount

of cash is done from the sale along with the other crucial tasks of the business. Considering this

aspect large numbers of expenses are considered which are material, labor and production.

Amount of expenditure is being deducted from the profit amount which is being estimated and

this supports in knowing the amount of deficit or surplus. Apart from this budget is being

reviewed on continuous basis and it is submitted to board of directors for its applicability

(Debbarshi, 2011).

3.2 Selection of appropriate budgeting methods for organization

Budgets can be easily prepared by undertaking different methods as per the need and

requirement of the business enterprise. Description of different type of budgeting methods has

been shown below:

Zero base budgeting: This budgeting technique is being considered in conditions where there is

previous base for preparation of budget. This type of condition takes place when changes take

place in the market conditions or development of new commodity. Further, in this technique

there is no such measure of forecasted and high possibility of variance is being present (Jack and

Mundy, 2013). This process of budgeting takes into consideration a process flow which takes

into consideration stages such as identification of business process, evaluating alternative

methods for accomplishing objective, determining alternative funding levels and last one is

setting priorities. All these stages have to be followed in proper sequence so as to take full

advantage of zero base budgeting. Main advantage of this technique is alternative analysis where

it is possible for managers to perform each and every activity in appropriate manner. Elimination

of non key activity is next benefit of this method where it has to be decided what the main

activities which are crucial for business are. On the other hand, main disadvantage of this method

involve bureaucracy, intangible justification, managerial time etc.

10

future operational tasks (Burns and et. al, 2004). Further, main stress is on estimation of future

expenses along with revenue so that resources can be allocated accordingly. Through this it

becomes easy to determine profit or loss for the business. With the help of this statement it is

possible to compare actual performance with expected one.

Nature of budgeting process

In the entire process of budgeting estimations are made by considering all the actual

values of the last accounting period. With the help of estimation, calculation of possible amount

of cash is done from the sale along with the other crucial tasks of the business. Considering this

aspect large numbers of expenses are considered which are material, labor and production.

Amount of expenditure is being deducted from the profit amount which is being estimated and

this supports in knowing the amount of deficit or surplus. Apart from this budget is being

reviewed on continuous basis and it is submitted to board of directors for its applicability

(Debbarshi, 2011).

3.2 Selection of appropriate budgeting methods for organization

Budgets can be easily prepared by undertaking different methods as per the need and

requirement of the business enterprise. Description of different type of budgeting methods has

been shown below:

Zero base budgeting: This budgeting technique is being considered in conditions where there is

previous base for preparation of budget. This type of condition takes place when changes take

place in the market conditions or development of new commodity. Further, in this technique

there is no such measure of forecasted and high possibility of variance is being present (Jack and

Mundy, 2013). This process of budgeting takes into consideration a process flow which takes

into consideration stages such as identification of business process, evaluating alternative

methods for accomplishing objective, determining alternative funding levels and last one is

setting priorities. All these stages have to be followed in proper sequence so as to take full

advantage of zero base budgeting. Main advantage of this technique is alternative analysis where

it is possible for managers to perform each and every activity in appropriate manner. Elimination

of non key activity is next benefit of this method where it has to be decided what the main

activities which are crucial for business are. On the other hand, main disadvantage of this method

involve bureaucracy, intangible justification, managerial time etc.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.