Management Accounting Report: Analysis of Agmet's Financials

VerifiedAdded on 2020/01/16

|20

|6546

|197

Report

AI Summary

This report examines management accounting practices for Agmet, a chemical manufacturing company, focusing on cost accounting systems, financial reporting methods, and budgetary control. It analyzes different types of management accounting systems and their essential requirements, evaluating their benefits and application within Agmet. The report includes the preparation and interpretation of income statements using absorption and marginal costing techniques, along with an analysis of planning tools used for budgetary control. It further evaluates how these tools address financial problems and contribute to organizational success, comparing how organizations adapt management accounting systems to respond to financial challenges. The report provides a comprehensive overview of management accounting principles and their practical application within a business context.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1Explain management accounting and give the essential requirements of different types of

management accounting systems.................................................................................................1

M1 Evaluate the benefits of management accounting systems and their application within

Agmet..........................................................................................................................................3

P2 Explanation regarding different methods used for management accounting reporting.........4

D1 Critical evaluation about how management accounting systems and management

accounting reporting is integrated within organisational processes............................................6

TASK 2............................................................................................................................................8

P3 & M2 Preparation of income statements as per the method of absorption and marginal

costing techniques........................................................................................................................8

D2 Interpretation of the data and information which have been calculated above in the

statements of income under absorption and marginal costing techniques.................................11

TASK 3..........................................................................................................................................12

P4 Advantages and disadvantages of different types of planning tools used for budgetary

control........................................................................................................................................12

M3 Analysis over the use of different planning tools and their application for preparing and

forecasting budgets with special reference................................................................................12

D3 & M4 Evaluate how planning tools for accounting respond appropriately to solving

financial problems to lead organisations to sustainable success...............................................14

TASK 4..........................................................................................................................................15

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems.....................................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1Explain management accounting and give the essential requirements of different types of

management accounting systems.................................................................................................1

M1 Evaluate the benefits of management accounting systems and their application within

Agmet..........................................................................................................................................3

P2 Explanation regarding different methods used for management accounting reporting.........4

D1 Critical evaluation about how management accounting systems and management

accounting reporting is integrated within organisational processes............................................6

TASK 2............................................................................................................................................8

P3 & M2 Preparation of income statements as per the method of absorption and marginal

costing techniques........................................................................................................................8

D2 Interpretation of the data and information which have been calculated above in the

statements of income under absorption and marginal costing techniques.................................11

TASK 3..........................................................................................................................................12

P4 Advantages and disadvantages of different types of planning tools used for budgetary

control........................................................................................................................................12

M3 Analysis over the use of different planning tools and their application for preparing and

forecasting budgets with special reference................................................................................12

D3 & M4 Evaluate how planning tools for accounting respond appropriately to solving

financial problems to lead organisations to sustainable success...............................................14

TASK 4..........................................................................................................................................15

P5 Compare how organisations are adapting management accounting systems to respond to

financial problems.....................................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Management accounting can be considered as a technique though which management of

any enterprise can easily manage their available resources(Renz, 2016). As a small business

enterprise Agmet is having less resources whether in terms of financial or in terms of non

financial sources. Hence it is important for such enterprise to manage their sources for attaining

the objectives of the enterprise which are predetermined by its managerial personnel’s including

top level management. This report has been framed on the case study of Agmet which is a

chemical manufacturing company in United Kingdom (Gibassier, 2017). Its employing less than

50 employees and they are having less £500,000 hence it can be said that they need to employ

techniques of cost and management accounting in its financial and organisational structure. In

this report the concept of cost accounting have been defined with their essential requirements.

Further there are two statements as per the method of absorption and marginal costing and such

statements are presented with there interpretation.

TASK 1

P1Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting can be referred as the combination of both financial accounting

concepts and managerial principles. Hence it can be said that Agmet and its management through

optimizing the principles which are there in cost accounting can achieve the goals and objectives

which are there in the organisational structure since from beginning and the short term goals

which are there in current period. As short term goals can only contribute towards the managing

the long term goals and objectives (Quinn, 2011). There are many essential requirements of

management accounting as same as financial accounting hence it can be said that just like

financial reporting frameworks management accounting is also having certain requirements

which needs to be fulfilled so that the users can get the clear image of the company so that they

can make their decisions in respect of it. It have the combination of principles and data which

makes it reliable and the plans which are framed according to it are also ethical and achievable.

Because of it the managers and employees will not get frustrated in achieving the targets which

are determined by the top level management. Agmet can abolish the competitive factors out of

the chemical manufacturing market (Ibarrondo-Dávila, López-Alonso and Rubio-Gámez, 2015).

1

Management accounting can be considered as a technique though which management of

any enterprise can easily manage their available resources(Renz, 2016). As a small business

enterprise Agmet is having less resources whether in terms of financial or in terms of non

financial sources. Hence it is important for such enterprise to manage their sources for attaining

the objectives of the enterprise which are predetermined by its managerial personnel’s including

top level management. This report has been framed on the case study of Agmet which is a

chemical manufacturing company in United Kingdom (Gibassier, 2017). Its employing less than

50 employees and they are having less £500,000 hence it can be said that they need to employ

techniques of cost and management accounting in its financial and organisational structure. In

this report the concept of cost accounting have been defined with their essential requirements.

Further there are two statements as per the method of absorption and marginal costing and such

statements are presented with there interpretation.

TASK 1

P1Explain management accounting and give the essential requirements of different types of

management accounting systems

Management accounting can be referred as the combination of both financial accounting

concepts and managerial principles. Hence it can be said that Agmet and its management through

optimizing the principles which are there in cost accounting can achieve the goals and objectives

which are there in the organisational structure since from beginning and the short term goals

which are there in current period. As short term goals can only contribute towards the managing

the long term goals and objectives (Quinn, 2011). There are many essential requirements of

management accounting as same as financial accounting hence it can be said that just like

financial reporting frameworks management accounting is also having certain requirements

which needs to be fulfilled so that the users can get the clear image of the company so that they

can make their decisions in respect of it. It have the combination of principles and data which

makes it reliable and the plans which are framed according to it are also ethical and achievable.

Because of it the managers and employees will not get frustrated in achieving the targets which

are determined by the top level management. Agmet can abolish the competitive factors out of

the chemical manufacturing market (Ibarrondo-Dávila, López-Alonso and Rubio-Gámez, 2015).

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It allows firm to capture a major market share within the targeted market. The essential

requirements of management accounting techniques are mentioned below:

Traditional Accounting system: This can be defined as the system in which cost is

allocated among the various departments which are accountable for such cost and price. Through

this requirement cost can be easily traced with its responsible department further it can be said

that the revenue of each and every department in the manufacturing units of Agmet can be traced

out easily (Pipan and Czarniawska, 2010).

Lean Accounting System: This system is actually deals with the changes which are

there in management and systems. Hence it can be said that when there is a change in the capital

and organisational structure then lean accounting system can be helpful to cop up with such

changes.

Cost accounting system: It is a system which helps business to evaluate the cost of

goods and services provided by the company in order to measure profits, also known as product

costing system. Agmet can make use of this system and calculate its cost and can evaluate

profits, for preparing financial statement. The company can compute production cost separately

for each operation by the help of such accounting system.

Job costing system: It helps in collecting information about cost related with specific

job. With the help of this system, Agmet can submit required cost information to its customer

under contract where costs are refundable. Business can also keep a check over accuracy of

estimating system, which helps to quotes prices for obtaining targeted profits. This helps

company to evaluate the expenses incurred on direct materials, direct labour and overheads.

Batch costing system: It is specific order costing, which evaluates the cost in batches

also includes fixed and variable costs. Company can compute per unit cost by dividend the total

batch cost by number of units produced. For instance, when company receives order and there

are common products among several orders, the production can be done in batches and with the

help of these system, Agmet can identify total cost on each batch performed.

Inventory management system: It is a software system, which keeps a record of

inventory levels, sales and various orders placed in a reporting year. The company can keep a

record of work orders, bills of material and production to avoid overstock. This will assist

Agment to calculate inventory of raw material, finished products and work in progress to manage

inventory level.

2

requirements of management accounting techniques are mentioned below:

Traditional Accounting system: This can be defined as the system in which cost is

allocated among the various departments which are accountable for such cost and price. Through

this requirement cost can be easily traced with its responsible department further it can be said

that the revenue of each and every department in the manufacturing units of Agmet can be traced

out easily (Pipan and Czarniawska, 2010).

Lean Accounting System: This system is actually deals with the changes which are

there in management and systems. Hence it can be said that when there is a change in the capital

and organisational structure then lean accounting system can be helpful to cop up with such

changes.

Cost accounting system: It is a system which helps business to evaluate the cost of

goods and services provided by the company in order to measure profits, also known as product

costing system. Agmet can make use of this system and calculate its cost and can evaluate

profits, for preparing financial statement. The company can compute production cost separately

for each operation by the help of such accounting system.

Job costing system: It helps in collecting information about cost related with specific

job. With the help of this system, Agmet can submit required cost information to its customer

under contract where costs are refundable. Business can also keep a check over accuracy of

estimating system, which helps to quotes prices for obtaining targeted profits. This helps

company to evaluate the expenses incurred on direct materials, direct labour and overheads.

Batch costing system: It is specific order costing, which evaluates the cost in batches

also includes fixed and variable costs. Company can compute per unit cost by dividend the total

batch cost by number of units produced. For instance, when company receives order and there

are common products among several orders, the production can be done in batches and with the

help of these system, Agmet can identify total cost on each batch performed.

Inventory management system: It is a software system, which keeps a record of

inventory levels, sales and various orders placed in a reporting year. The company can keep a

record of work orders, bills of material and production to avoid overstock. This will assist

Agment to calculate inventory of raw material, finished products and work in progress to manage

inventory level.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Price optimization system: It is a mathematical analysis, price optimization is prediction

of behaviours of buyers to different prices by which company gets to know how buyers will react

to prices of products and services provided by the company. This helps company to decide

pricing in order to maximize their profits with satisfaction of consumers. Pricing strategy of

Agmet can be done by segmenting customers. This can be done by identifying common needs,

common interests, similar lifestyles.

M1 Evaluate the benefits of management accounting systems and their application within Agmet

There are several benefits of management accounting system though which it can be

clearly observed that such techniques can be utilized in responding towards various problems

that may occur during several processes of management has been carried out. Such benefits are

mentioned below:

Improvement in cash flow: These methods and principles can assist an enterprise in

managing the cash flow from various activities. Cash flow statement shows three

sections out of which first one is about operating activities and the second one is about

investing and it is followed by financing activities(Nandan, 2010).

Reduction in expenses: There are lots of expenses in each and every functions and

activities of hence they are required to assist the enterprise in the proper functionality so

that the expenses can be controlled and managed as there is very less revenue earned

through the turnover of Agmet. So managerial personnels should implement these

methods and principles for coordinating with the expenses. Through reduction which is

made in negative cash flow efficiency at its best level and high productivity rate can be

achieved. Hence it can be said that the enterprise should implement the methods so as to

become an effective firm with high annual turnover and less operating and non operating

expenses.

Framing managerial decisions: Management should implement better decisions so as to

achieve the organisational structure which comprises of each and every activity and

elements which may lead to success and positive results so that the organisation can

achieve the results which are positive And they will get what their strategies are aimed

at. Managerial decisions should be based on some ethical and credible data and

information so that the decisions will lead the Agmet into the right path towards

successful destinations(Macintoshand and Quattrone, 2010).

3

of behaviours of buyers to different prices by which company gets to know how buyers will react

to prices of products and services provided by the company. This helps company to decide

pricing in order to maximize their profits with satisfaction of consumers. Pricing strategy of

Agmet can be done by segmenting customers. This can be done by identifying common needs,

common interests, similar lifestyles.

M1 Evaluate the benefits of management accounting systems and their application within Agmet

There are several benefits of management accounting system though which it can be

clearly observed that such techniques can be utilized in responding towards various problems

that may occur during several processes of management has been carried out. Such benefits are

mentioned below:

Improvement in cash flow: These methods and principles can assist an enterprise in

managing the cash flow from various activities. Cash flow statement shows three

sections out of which first one is about operating activities and the second one is about

investing and it is followed by financing activities(Nandan, 2010).

Reduction in expenses: There are lots of expenses in each and every functions and

activities of hence they are required to assist the enterprise in the proper functionality so

that the expenses can be controlled and managed as there is very less revenue earned

through the turnover of Agmet. So managerial personnels should implement these

methods and principles for coordinating with the expenses. Through reduction which is

made in negative cash flow efficiency at its best level and high productivity rate can be

achieved. Hence it can be said that the enterprise should implement the methods so as to

become an effective firm with high annual turnover and less operating and non operating

expenses.

Framing managerial decisions: Management should implement better decisions so as to

achieve the organisational structure which comprises of each and every activity and

elements which may lead to success and positive results so that the organisation can

achieve the results which are positive And they will get what their strategies are aimed

at. Managerial decisions should be based on some ethical and credible data and

information so that the decisions will lead the Agmet into the right path towards

successful destinations(Macintoshand and Quattrone, 2010).

3

Financial Planning : through implementation of the techniques and methods of financial

and cost accounting, management can introduce better cost structure which can be

considered as the optimum capital composition. In optimum capital structure the

financial resources are having less obligations but they are capable enough to generate

high returns in accordance with the plans and strategies which were previously

determined by the top level management of the cited firm.

P2 Explanation regarding different methods used for management accounting reporting

There are several methods which can be used by the cited enterprise for the management

of business affairs and to get the right return which have been estimated and observed by the top

level management of Agmet. Finally it can be said that the different methods which are used for

the financial reporting can help the management and other team who are responsible and

accountable for the preparation of the financial statements. As these methods presents the results

which are more credible and reliable hence they can predict the future image of enterprise and it

is the basic objective of financial reporting and its framework. There are several methods of

financial paling and reporting and these methods are mentioned below in detail with their

detailed features.

Job cost report: It is used to evaluate incur cost of organization from particular jobs. It

also compares actual cost and estimated cost in order to show profit margins. Agmet’s

manager can maintain these reports to avoid waste of resources and allocating resources.

It also helps to keep an eye on sales recovery, work in progress, value added and profit

summary.

Sales reports: A data maintained of calls made and sale of products and services during

specific period of time by manager or sales person. Daily check over sales cycle is a long

and complicated process that is why Agmet's sales manager can maintain sales report to

keep a track of customers interested, success rate, campaigning and closing rate.

Accounts receivable reports (AR): It is account receivable aging, data that file unpaid

customer invoices and unused credit memos according to dates. The company can use

this as an indicator to determine financial health of its customers. With the help of AR,

manager can maintain a snap shot of outstanding money due from the consumer and

create right credit extending decisions.

4

and cost accounting, management can introduce better cost structure which can be

considered as the optimum capital composition. In optimum capital structure the

financial resources are having less obligations but they are capable enough to generate

high returns in accordance with the plans and strategies which were previously

determined by the top level management of the cited firm.

P2 Explanation regarding different methods used for management accounting reporting

There are several methods which can be used by the cited enterprise for the management

of business affairs and to get the right return which have been estimated and observed by the top

level management of Agmet. Finally it can be said that the different methods which are used for

the financial reporting can help the management and other team who are responsible and

accountable for the preparation of the financial statements. As these methods presents the results

which are more credible and reliable hence they can predict the future image of enterprise and it

is the basic objective of financial reporting and its framework. There are several methods of

financial paling and reporting and these methods are mentioned below in detail with their

detailed features.

Job cost report: It is used to evaluate incur cost of organization from particular jobs. It

also compares actual cost and estimated cost in order to show profit margins. Agmet’s

manager can maintain these reports to avoid waste of resources and allocating resources.

It also helps to keep an eye on sales recovery, work in progress, value added and profit

summary.

Sales reports: A data maintained of calls made and sale of products and services during

specific period of time by manager or sales person. Daily check over sales cycle is a long

and complicated process that is why Agmet's sales manager can maintain sales report to

keep a track of customers interested, success rate, campaigning and closing rate.

Accounts receivable reports (AR): It is account receivable aging, data that file unpaid

customer invoices and unused credit memos according to dates. The company can use

this as an indicator to determine financial health of its customers. With the help of AR,

manager can maintain a snap shot of outstanding money due from the consumer and

create right credit extending decisions.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory management reports: It is a synopsis of items belonging to an organization

inclusive account of stock and supply. Manager should maintain inventory reports in

order to improve productivity in store and also enables Agmet to improve efficiency of

ordering and delivery through proper inventory management.

Ratio Analysis: ratio analysis can be presented as the techniques which in fact consist of

ratios and other calculative tasks(Lukkaand and Modell, 2010). These calculations and

task are scientific and universally accepted hence it can be said that through using the

ratio analysis the management can lead to organisational benefits and they can frame

better strategies and reporting framework through optimizing the profitability, efficiency

and turnover ratios. As through it they can easily estimate that whether they are capable

enough to pay off the debts of the enterprise so that goodwill of Agmet in chemical

market can be maintained.

Fund Flow Analysis: This analysis is done on a statement which contain the working over

the working capital and it also consists of the tools through which the sources and

application of funds can be targeted and calculated easily so that the managerial

personnels can control over the different areas in which the sources have been utilized.

So far as the matter of sources from where the finance and funding is acquired then it can

said that better steps can be taken by the top managerial and middle level managerial

personnels for acquiring the finance as well as they can get better sources through which

they can acquire the funds(Luftand and Shields, 2010).

Cash flow analysis: Cash flow analysis and its controls can be applied in the top

managerial activities as through it they can manage the cash inflow and cash out flow. As

the cash flow statement consists of three sections hence it can be said that there are three

segments through which the managerial personnel’s can observe that how much fund or

cash is utilized in which activity. Further they can observe that how much cash is in

category of inflow and how much is in the category of outflow (Kihn and Ihantola, 2015).

Operating activities and its cash flow can assist them to make strategies and decisions

regarding the operational activities and through investing activities they can find out the

total cash used or generated through investing activities. Further the third section of cash

flow is all about the financing activity so the cash flow which is generated from the

activities of finance can lead to take decisions in reference of financial planning. Hence

5

inclusive account of stock and supply. Manager should maintain inventory reports in

order to improve productivity in store and also enables Agmet to improve efficiency of

ordering and delivery through proper inventory management.

Ratio Analysis: ratio analysis can be presented as the techniques which in fact consist of

ratios and other calculative tasks(Lukkaand and Modell, 2010). These calculations and

task are scientific and universally accepted hence it can be said that through using the

ratio analysis the management can lead to organisational benefits and they can frame

better strategies and reporting framework through optimizing the profitability, efficiency

and turnover ratios. As through it they can easily estimate that whether they are capable

enough to pay off the debts of the enterprise so that goodwill of Agmet in chemical

market can be maintained.

Fund Flow Analysis: This analysis is done on a statement which contain the working over

the working capital and it also consists of the tools through which the sources and

application of funds can be targeted and calculated easily so that the managerial

personnels can control over the different areas in which the sources have been utilized.

So far as the matter of sources from where the finance and funding is acquired then it can

said that better steps can be taken by the top managerial and middle level managerial

personnels for acquiring the finance as well as they can get better sources through which

they can acquire the funds(Luftand and Shields, 2010).

Cash flow analysis: Cash flow analysis and its controls can be applied in the top

managerial activities as through it they can manage the cash inflow and cash out flow. As

the cash flow statement consists of three sections hence it can be said that there are three

segments through which the managerial personnel’s can observe that how much fund or

cash is utilized in which activity. Further they can observe that how much cash is in

category of inflow and how much is in the category of outflow (Kihn and Ihantola, 2015).

Operating activities and its cash flow can assist them to make strategies and decisions

regarding the operational activities and through investing activities they can find out the

total cash used or generated through investing activities. Further the third section of cash

flow is all about the financing activity so the cash flow which is generated from the

activities of finance can lead to take decisions in reference of financial planning. Hence

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

it can be said that cash flow analysis techniques can be used for can be said that the

management should utilize the methods of financial and cost accounting for getting better

results (Lowe and De Loo, 2014).

D1 Critical evaluation about how management accounting systems and management accounting

reporting is integrated within organisational processes

Management accounting system can be integrated into the the organisation for managing

the operations of business entity. As Agmet is a small business enterprise which is in fact dealing

in chemical productionj(Kaplan and Atkinson, 2015). As it is having a high competitive market

just because of this they are required to make a brief plan in which the techniques and methods

of management accounting should be integrated in order to manage the activities so that the

management can get effective results with appropriate line up of different principles. They

should make an organisational composition in which each accountable person from each and

every department should work upon their operations effectively through optimizing the

proficiencies of cost accounting. As managerial decisions can be taken only by the managers due

to which it can be proved that management accounting and its tools cannot replace the

managerial personnels. But they can assist them in taking the right decisions and to frame right

conclusion towards the targets and goals. Reporting should be integrated in the accounting

system so that the stakeholders can get right information and they can achieve better decision

making so that management can get the right targets and they can also get the right objectives

which can allow them to survive in the competitive market of the UK. They should utilize the

tools for planning and forecasting like budgetary control for managing the expenditures in

different areas. As they can prepare the sales budget through which they can decide that how

much they have to sale in a given time period and through which what return or revenue they can

get. Other than sales budget they can also utilize the tool of production budget through which

they can clearly estimate that how much quantity of chemicals they are required to produce for

meeting the level of requirement of chemical as per the buyer behaviour in the open market of

UK and other markets at which the cited enterprise is dealing(Jansen, 2011). Financial budget

and cash flow budget shows two different areas in which this can be integrated. First one shows

the finance department of company so it can be clearly observed and advised to use financial

budget in the finance department of Agmet so that they can calculate that how much fund is to be

deposited or invested at which responsibility centres. Further through cash flow budget they can

6

management should utilize the methods of financial and cost accounting for getting better

results (Lowe and De Loo, 2014).

D1 Critical evaluation about how management accounting systems and management accounting

reporting is integrated within organisational processes

Management accounting system can be integrated into the the organisation for managing

the operations of business entity. As Agmet is a small business enterprise which is in fact dealing

in chemical productionj(Kaplan and Atkinson, 2015). As it is having a high competitive market

just because of this they are required to make a brief plan in which the techniques and methods

of management accounting should be integrated in order to manage the activities so that the

management can get effective results with appropriate line up of different principles. They

should make an organisational composition in which each accountable person from each and

every department should work upon their operations effectively through optimizing the

proficiencies of cost accounting. As managerial decisions can be taken only by the managers due

to which it can be proved that management accounting and its tools cannot replace the

managerial personnels. But they can assist them in taking the right decisions and to frame right

conclusion towards the targets and goals. Reporting should be integrated in the accounting

system so that the stakeholders can get right information and they can achieve better decision

making so that management can get the right targets and they can also get the right objectives

which can allow them to survive in the competitive market of the UK. They should utilize the

tools for planning and forecasting like budgetary control for managing the expenditures in

different areas. As they can prepare the sales budget through which they can decide that how

much they have to sale in a given time period and through which what return or revenue they can

get. Other than sales budget they can also utilize the tool of production budget through which

they can clearly estimate that how much quantity of chemicals they are required to produce for

meeting the level of requirement of chemical as per the buyer behaviour in the open market of

UK and other markets at which the cited enterprise is dealing(Jansen, 2011). Financial budget

and cash flow budget shows two different areas in which this can be integrated. First one shows

the finance department of company so it can be clearly observed and advised to use financial

budget in the finance department of Agmet so that they can calculate that how much fund is to be

deposited or invested at which responsibility centres. Further through cash flow budget they can

6

clearly estimate that how much investment is tob be made by the cited enterprise in the

operating, investing and financing activities.

TASK 2

P3 & M2 Preparation of income statements as per the method of absorption and marginal costing

techniques

Absorption Costing:

Absorption costing is the method of costing a product in which all the cost like the fixed

and the variable cost are appropriate to the cost centres where they are accounted for using the

absorption rates. This method focuses on the aspect that all the cost incurred on the projects are

recurred from the overall selling price of the goods and the service is also known as full

absorption costing. Total absorption cost not only includes the cost of the labour and the material

but also all the manufacturing overheads. The cost of each direct centre can be the direct or the

indirect cost.

Marginal Costing: Marginal costing is defined as the cost of one more or one units of the

output produced in the economy(Hiebl, 2014). Marginal cost distinguishes the fixed and

the variable cost as classified: The marginal cost of the product it is the variables is is

normally taken to be the cost of direct labour, direct material and the variable part of the

overheads etc. It is formally defined as the system in which the variable cost are changed

to the cost units and the fixed cost of the written off of the cost in full against the

aggregate contribution .

Selling price £35

Unit costs

Direct materials £6

Direct Labour £5

Variable Production overhead £2

Variable sales overhead £1

Budgeted production for the period is 600 units

Fixed costs for the month are given below

Budgeted Absorption Costing:

7

operating, investing and financing activities.

TASK 2

P3 & M2 Preparation of income statements as per the method of absorption and marginal costing

techniques

Absorption Costing:

Absorption costing is the method of costing a product in which all the cost like the fixed

and the variable cost are appropriate to the cost centres where they are accounted for using the

absorption rates. This method focuses on the aspect that all the cost incurred on the projects are

recurred from the overall selling price of the goods and the service is also known as full

absorption costing. Total absorption cost not only includes the cost of the labour and the material

but also all the manufacturing overheads. The cost of each direct centre can be the direct or the

indirect cost.

Marginal Costing: Marginal costing is defined as the cost of one more or one units of the

output produced in the economy(Hiebl, 2014). Marginal cost distinguishes the fixed and

the variable cost as classified: The marginal cost of the product it is the variables is is

normally taken to be the cost of direct labour, direct material and the variable part of the

overheads etc. It is formally defined as the system in which the variable cost are changed

to the cost units and the fixed cost of the written off of the cost in full against the

aggregate contribution .

Selling price £35

Unit costs

Direct materials £6

Direct Labour £5

Variable Production overhead £2

Variable sales overhead £1

Budgeted production for the period is 600 units

Fixed costs for the month are given below

Budgeted Absorption Costing:

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

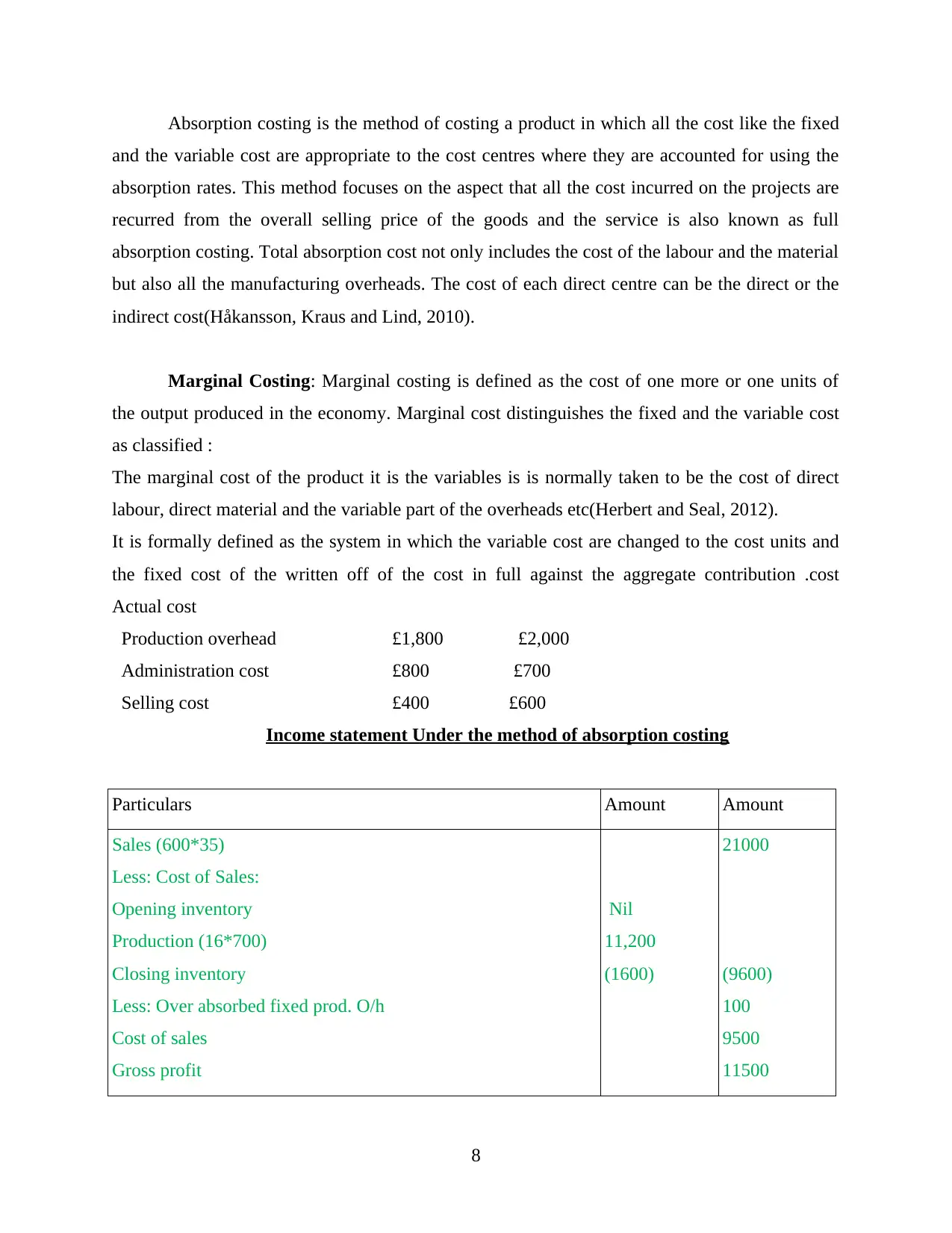

Absorption costing is the method of costing a product in which all the cost like the fixed

and the variable cost are appropriate to the cost centres where they are accounted for using the

absorption rates. This method focuses on the aspect that all the cost incurred on the projects are

recurred from the overall selling price of the goods and the service is also known as full

absorption costing. Total absorption cost not only includes the cost of the labour and the material

but also all the manufacturing overheads. The cost of each direct centre can be the direct or the

indirect cost(Håkansson, Kraus and Lind, 2010).

Marginal Costing: Marginal costing is defined as the cost of one more or one units of

the output produced in the economy. Marginal cost distinguishes the fixed and the variable cost

as classified :

The marginal cost of the product it is the variables is is normally taken to be the cost of direct

labour, direct material and the variable part of the overheads etc(Herbert and Seal, 2012).

It is formally defined as the system in which the variable cost are changed to the cost units and

the fixed cost of the written off of the cost in full against the aggregate contribution .cost

Actual cost

Production overhead £1,800 £2,000

Administration cost £800 £700

Selling cost £400 £600

Income statement Under the method of absorption costing

Particulars Amount Amount

Sales (600*35)

Less: Cost of Sales:

Opening inventory

Production (16*700)

Closing inventory

Less: Over absorbed fixed prod. O/h

Cost of sales

Gross profit

Nil

11,200

(1600)

21000

(9600)

100

9500

11500

8

and the variable cost are appropriate to the cost centres where they are accounted for using the

absorption rates. This method focuses on the aspect that all the cost incurred on the projects are

recurred from the overall selling price of the goods and the service is also known as full

absorption costing. Total absorption cost not only includes the cost of the labour and the material

but also all the manufacturing overheads. The cost of each direct centre can be the direct or the

indirect cost(Håkansson, Kraus and Lind, 2010).

Marginal Costing: Marginal costing is defined as the cost of one more or one units of

the output produced in the economy. Marginal cost distinguishes the fixed and the variable cost

as classified :

The marginal cost of the product it is the variables is is normally taken to be the cost of direct

labour, direct material and the variable part of the overheads etc(Herbert and Seal, 2012).

It is formally defined as the system in which the variable cost are changed to the cost units and

the fixed cost of the written off of the cost in full against the aggregate contribution .cost

Actual cost

Production overhead £1,800 £2,000

Administration cost £800 £700

Selling cost £400 £600

Income statement Under the method of absorption costing

Particulars Amount Amount

Sales (600*35)

Less: Cost of Sales:

Opening inventory

Production (16*700)

Closing inventory

Less: Over absorbed fixed prod. O/h

Cost of sales

Gross profit

Nil

11,200

(1600)

21000

(9600)

100

9500

11500

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

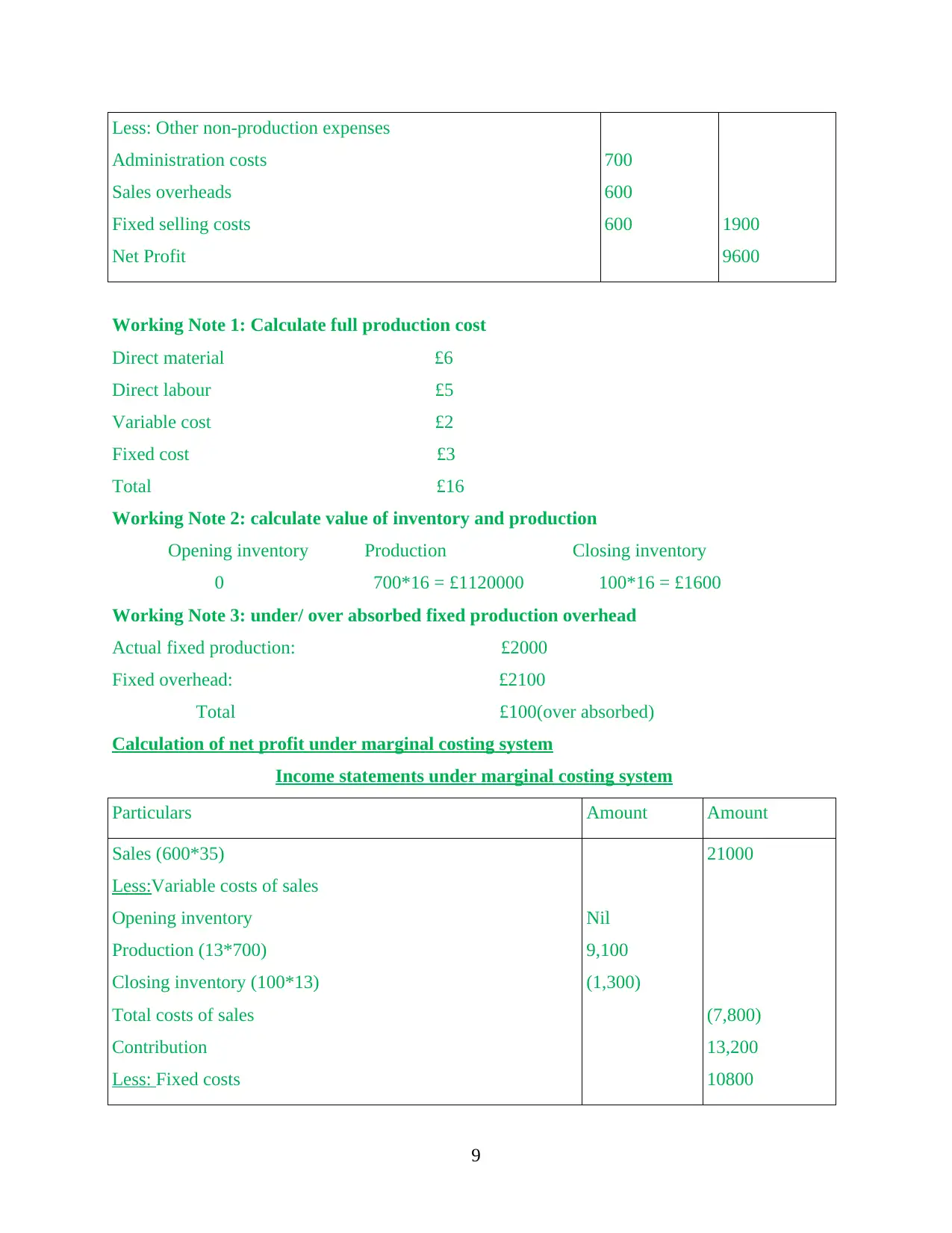

Less: Other non-production expenses

Administration costs

Sales overheads

Fixed selling costs

Net Profit

700

600

600 1900

9600

Working Note 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working Note 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*16 = £1120000 100*16 = £1600

Working Note 3: under/ over absorbed fixed production overhead

Actual fixed production: £2000

Fixed overhead: £2100

Total £100(over absorbed)

Calculation of net profit under marginal costing system

Income statements under marginal costing system

Particulars Amount Amount

Sales (600*35)

Less:Variable costs of sales

Opening inventory

Production (13*700)

Closing inventory (100*13)

Total costs of sales

Contribution

Less: Fixed costs

Nil

9,100

(1,300)

21000

(7,800)

13,200

10800

9

Administration costs

Sales overheads

Fixed selling costs

Net Profit

700

600

600 1900

9600

Working Note 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working Note 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*16 = £1120000 100*16 = £1600

Working Note 3: under/ over absorbed fixed production overhead

Actual fixed production: £2000

Fixed overhead: £2100

Total £100(over absorbed)

Calculation of net profit under marginal costing system

Income statements under marginal costing system

Particulars Amount Amount

Sales (600*35)

Less:Variable costs of sales

Opening inventory

Production (13*700)

Closing inventory (100*13)

Total costs of sales

Contribution

Less: Fixed costs

Nil

9,100

(1,300)

21000

(7,800)

13,200

10800

9

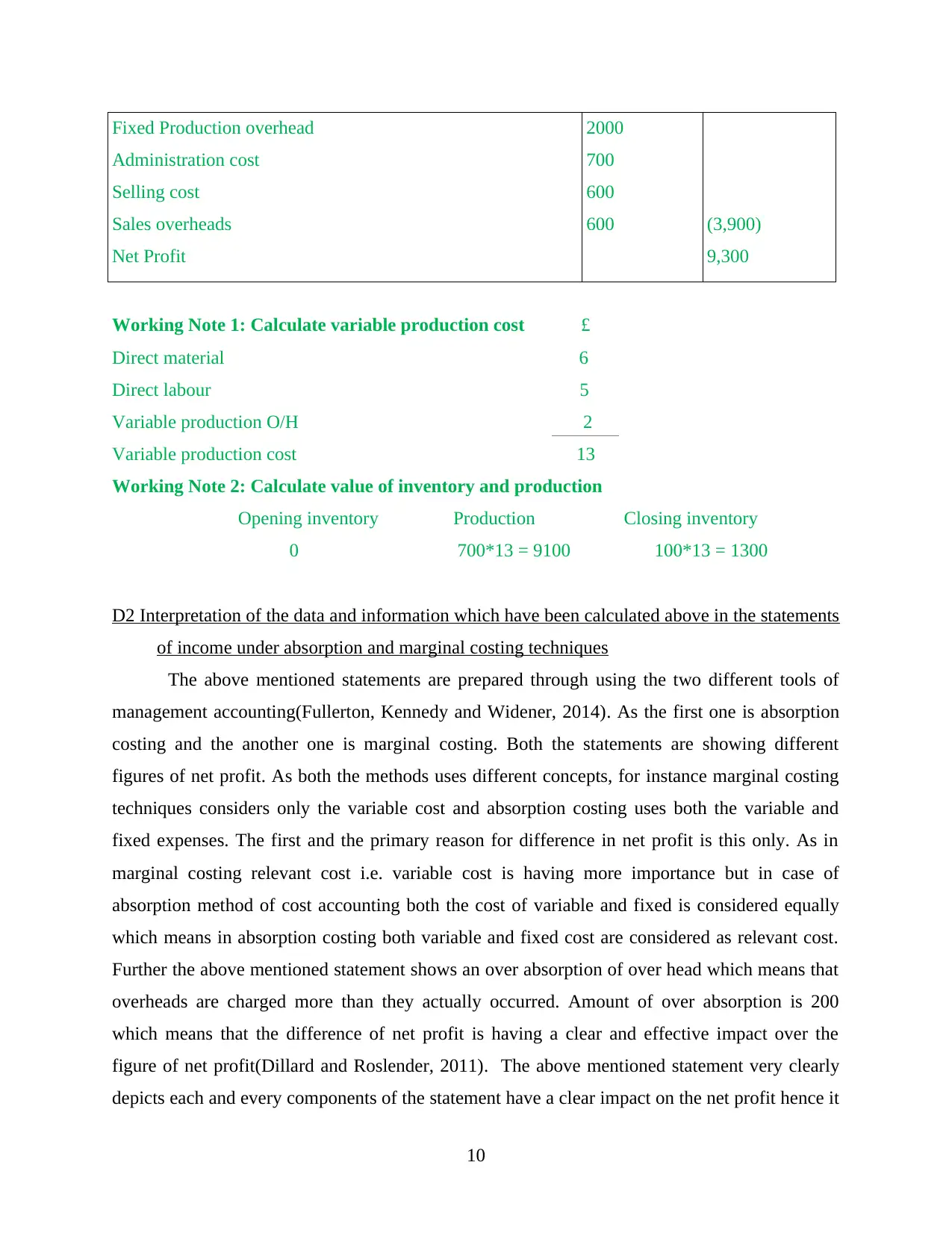

Fixed Production overhead

Administration cost

Selling cost

Sales overheads

Net Profit

2000

700

600

600 (3,900)

9,300

Working Note 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/H 2

Variable production cost 13

Working Note 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*13 = 9100 100*13 = 1300

D2 Interpretation of the data and information which have been calculated above in the statements

of income under absorption and marginal costing techniques

The above mentioned statements are prepared through using the two different tools of

management accounting(Fullerton, Kennedy and Widener, 2014). As the first one is absorption

costing and the another one is marginal costing. Both the statements are showing different

figures of net profit. As both the methods uses different concepts, for instance marginal costing

techniques considers only the variable cost and absorption costing uses both the variable and

fixed expenses. The first and the primary reason for difference in net profit is this only. As in

marginal costing relevant cost i.e. variable cost is having more importance but in case of

absorption method of cost accounting both the cost of variable and fixed is considered equally

which means in absorption costing both variable and fixed cost are considered as relevant cost.

Further the above mentioned statement shows an over absorption of over head which means that

overheads are charged more than they actually occurred. Amount of over absorption is 200

which means that the difference of net profit is having a clear and effective impact over the

figure of net profit(Dillard and Roslender, 2011). The above mentioned statement very clearly

depicts each and every components of the statement have a clear impact on the net profit hence it

10

Administration cost

Selling cost

Sales overheads

Net Profit

2000

700

600

600 (3,900)

9,300

Working Note 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/H 2

Variable production cost 13

Working Note 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*13 = 9100 100*13 = 1300

D2 Interpretation of the data and information which have been calculated above in the statements

of income under absorption and marginal costing techniques

The above mentioned statements are prepared through using the two different tools of

management accounting(Fullerton, Kennedy and Widener, 2014). As the first one is absorption

costing and the another one is marginal costing. Both the statements are showing different

figures of net profit. As both the methods uses different concepts, for instance marginal costing

techniques considers only the variable cost and absorption costing uses both the variable and

fixed expenses. The first and the primary reason for difference in net profit is this only. As in

marginal costing relevant cost i.e. variable cost is having more importance but in case of

absorption method of cost accounting both the cost of variable and fixed is considered equally

which means in absorption costing both variable and fixed cost are considered as relevant cost.

Further the above mentioned statement shows an over absorption of over head which means that

overheads are charged more than they actually occurred. Amount of over absorption is 200

which means that the difference of net profit is having a clear and effective impact over the

figure of net profit(Dillard and Roslender, 2011). The above mentioned statement very clearly

depicts each and every components of the statement have a clear impact on the net profit hence it

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.