Management Accounting Report: Financial Reporting and Planning Tools

VerifiedAdded on 2020/12/30

|20

|6192

|352

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its core concepts, various systems, and practical applications within an organization. It begins by defining management accounting and contrasting it with financial accounting, emphasizing its role in internal decision-making and planning. The report then delves into different types of management accounting systems, including cost accounting, inventory management, and job costing, explaining their functionalities and benefits. It also explores various management accounting reporting methods, such as budget reports, accounts receivable aging reports, and performance reports. Furthermore, the report examines the benefits of management accounting systems and their integration within an organization, highlighting the role of financial reporting and planning tools in budgetary control. A case study of Excite Entertainment is included to illustrate the practical application of these concepts. The report also includes a comparison between different management accounting systems, used by the organization in resolving the financial problems which leads the organization towards sustainable success. Finally, it concludes with a summary of the key findings and insights.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

P1 Concept of management accounting and different types of management accounting systems

................................................................................................................................................3

P2 Different methods used for management accounting reporting........................................5

M1 & D1 Benefits of management accounting system and integration of management

accounting reporting in the organization................................................................................6

P3 Appropriate techniques to prepare income statement using marginal and absorption cost8

M2 & D2 Application of management techniques in preparation of financial reporting

documents.............................................................................................................................11

P4 Advantages and disadvantages of different types of planning tools for budgetary control11

M3 Use and application of different types of planning tools in forecasting budget............14

P5. Comparing the different management accounting systems used by the organization in

resolving the financial problems which leads the organization towards sustainable success. 15

Comparison between Excite entertainment and ABC company-.........................................17

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................19

Books and journal.................................................................................................................19

Online...................................................................................................................................20

INTRODUCTION...........................................................................................................................3

P1 Concept of management accounting and different types of management accounting systems

................................................................................................................................................3

P2 Different methods used for management accounting reporting........................................5

M1 & D1 Benefits of management accounting system and integration of management

accounting reporting in the organization................................................................................6

P3 Appropriate techniques to prepare income statement using marginal and absorption cost8

M2 & D2 Application of management techniques in preparation of financial reporting

documents.............................................................................................................................11

P4 Advantages and disadvantages of different types of planning tools for budgetary control11

M3 Use and application of different types of planning tools in forecasting budget............14

P5. Comparing the different management accounting systems used by the organization in

resolving the financial problems which leads the organization towards sustainable success. 15

Comparison between Excite entertainment and ABC company-.........................................17

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................19

Books and journal.................................................................................................................19

Online...................................................................................................................................20

INTRODUCTION

Management accounting is the representation of the accounting information in a way that

helps the managers in creation of its policies and the routine operations of the undertaking. It

relates with the utilization of the accounting data that is collected with help of cost accounting for

meeting the purpose in relation to the policy formulation, control, decision making and planning

by the management. It links the management of the company with the accounting because

accounting information is needed and plays a crucial role for the mangers in taking the most

appropriate decisions. The present study is based on Excite entertainment, a leisure and the

entertainment industry of the UK. The business of this company is to promote the concerts and the

festivals throughout the locations in UK. Furthermore, the report explains the concept and the

significance of the various systems of the management accounting. It also describes the several

reports that are prepared by the managers and the different planning tools of the budgetary

control.

P1 Concept of management accounting and different types of management accounting systems

Accounting that helps the management is simply known as management accounting. The

process to develop management reports and accounts that present brief, accurate and timely

information relate to finances to make day to day decisions for managers is what is known as

managemenrt accounting. It is a study of accounting which is related to management of the

company. It is required to know the financial situation in the business (Bromwich, 2016). It helps

in formulating policies and procedures and assist the management of the company in getting better

results. It also serves as a mean of communication through whole organization. It does not limit

itself to quantitative information but also takes qualitative information into consideration which

cannot be measured like employee's level of satisfaction etc. There is another branch of

accounting that is financial accounting which differs from management accounting in certain

way :

Financial accounting Management accounting

It is for the people outside of organization as it

contains only financial information about the

company.

It is for the internal users of the company and

contains both quantitative and qualitative

information.

Management accounting is the representation of the accounting information in a way that

helps the managers in creation of its policies and the routine operations of the undertaking. It

relates with the utilization of the accounting data that is collected with help of cost accounting for

meeting the purpose in relation to the policy formulation, control, decision making and planning

by the management. It links the management of the company with the accounting because

accounting information is needed and plays a crucial role for the mangers in taking the most

appropriate decisions. The present study is based on Excite entertainment, a leisure and the

entertainment industry of the UK. The business of this company is to promote the concerts and the

festivals throughout the locations in UK. Furthermore, the report explains the concept and the

significance of the various systems of the management accounting. It also describes the several

reports that are prepared by the managers and the different planning tools of the budgetary

control.

P1 Concept of management accounting and different types of management accounting systems

Accounting that helps the management is simply known as management accounting. The

process to develop management reports and accounts that present brief, accurate and timely

information relate to finances to make day to day decisions for managers is what is known as

managemenrt accounting. It is a study of accounting which is related to management of the

company. It is required to know the financial situation in the business (Bromwich, 2016). It helps

in formulating policies and procedures and assist the management of the company in getting better

results. It also serves as a mean of communication through whole organization. It does not limit

itself to quantitative information but also takes qualitative information into consideration which

cannot be measured like employee's level of satisfaction etc. There is another branch of

accounting that is financial accounting which differs from management accounting in certain

way :

Financial accounting Management accounting

It is for the people outside of organization as it

contains only financial information about the

company.

It is for the internal users of the company and

contains both quantitative and qualitative

information.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is required by law and need to be according

to I.A.S within Europe.

It depends upon historical information.

It is not compulsory to do management

accounting.

It is future oriented (Alsharari, 2015).

Different types of management accounting systems

Cost accounting system – A cost accounting system is used by the company to estimate

the cost of their products for analysis of profitability, inventory valuation and control of cost.

Estimating the cost of company's products and services is essential for profitable operations. The

company with cost management system can know which products of the company is profitable

and non profitable by analyzing correct cost of the product. In simple words, it tracks the flow of

inventory through various stages of production which includes raw materials, work in progress

and finished goods (Kastberg, 2016). In excite limited, it tracks raw materials as they go through

the stages of production and slowly turn into finished product. When raw materials are put into

production, the system immediately records use of materials by crediting raw material account

and debiting goods in process. It helps the production manager of the company tom see how much

inventory is in every stage of production at any point of time. There are two types of costs :

Direct cost – Direct costs are variable cost that can easily be recognized as projects of the

cost. It is calculated at the beginning of the cost sheet. The total of direct costs in the cost sheet is

called prime cost. Examples of direct costs are direct material, labour and wages.

Standard cost – It is also known as indirect cost which are not that easily identifiable.

They can also be called as fixed costs and are ascertained after calculating direct costs. The

aggregate of indirect costs are called overhead cost which include salary, rent etc.

Inventory management system – This system tracks goods through entire chain of supply

in the business or the part of the business in which it operates. It covers everything from

production to retail, warehousing and shipping the products to the consumers along with all the

movements of stock (Goddard, 2017). Each company has different requirements and inventory

management system includes bar coding, tools for reporting, forecasting for future needs of

inventory, tools accounting etc. In short it is then combination of software and hardware which

oversees maintenance of products that are in stock and are ready to sent to consumers. The two

methods of inventory valuation are :

LIFO – When the inventory comes in lase is sold at first known as last in first out.

to I.A.S within Europe.

It depends upon historical information.

It is not compulsory to do management

accounting.

It is future oriented (Alsharari, 2015).

Different types of management accounting systems

Cost accounting system – A cost accounting system is used by the company to estimate

the cost of their products for analysis of profitability, inventory valuation and control of cost.

Estimating the cost of company's products and services is essential for profitable operations. The

company with cost management system can know which products of the company is profitable

and non profitable by analyzing correct cost of the product. In simple words, it tracks the flow of

inventory through various stages of production which includes raw materials, work in progress

and finished goods (Kastberg, 2016). In excite limited, it tracks raw materials as they go through

the stages of production and slowly turn into finished product. When raw materials are put into

production, the system immediately records use of materials by crediting raw material account

and debiting goods in process. It helps the production manager of the company tom see how much

inventory is in every stage of production at any point of time. There are two types of costs :

Direct cost – Direct costs are variable cost that can easily be recognized as projects of the

cost. It is calculated at the beginning of the cost sheet. The total of direct costs in the cost sheet is

called prime cost. Examples of direct costs are direct material, labour and wages.

Standard cost – It is also known as indirect cost which are not that easily identifiable.

They can also be called as fixed costs and are ascertained after calculating direct costs. The

aggregate of indirect costs are called overhead cost which include salary, rent etc.

Inventory management system – This system tracks goods through entire chain of supply

in the business or the part of the business in which it operates. It covers everything from

production to retail, warehousing and shipping the products to the consumers along with all the

movements of stock (Goddard, 2017). Each company has different requirements and inventory

management system includes bar coding, tools for reporting, forecasting for future needs of

inventory, tools accounting etc. In short it is then combination of software and hardware which

oversees maintenance of products that are in stock and are ready to sent to consumers. The two

methods of inventory valuation are :

LIFO – When the inventory comes in lase is sold at first known as last in first out.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

FIFO - When the inventory arrived at first sold at first is known as first in first out.

Job costing system – Job order costing is a system that assigns and accumulates cost of

manufacturing of individual unit of output. It is used when products manufactured are different

from each other and each item has individual cost. The job costing system includes direct

material, labour, and overheads. It maintains separate account for each job from the date of

commencement till the date of completion which enables the company in knowing the cost of

each job. It enables the company in comparing actual cost with estimated cost for separate jobs

and helps in finding out profit or loss made on each job. The two process of this costing system

are :

Job costing – It does detailed accumulation of cost of production to individual specific

groups. It is used for unique products and small production runs. In job costing, record keeping is

required and time and material are charged to specific jobs. It is more likely to be used in the

company for billing to customers.

Process costing- It is used for standardized products and mostly used for large firms. It

aggregates cost therefore requires less keeping of records.

P2 Different methods used for management accounting reporting

Management accounting reports are used in the organization for the purpose of planning,

decision making, regulating and measuring performance in the company. These reports are

prepared throughout according to the requirements of the company. It can be created on weekly,

monthly or quarterly basis. As many decisions are based on the authenticity of these reports

therefore it is important that the information provided in these reports are clear, concise and

accurate. There reports need to be prepared by specialized person in timely manner as many

decisions are based on these reports. Managers also see these reports and take decisions regarding

bonus, incentives etc and convert them into useful information from the company. The reports

are :

Budget report – Budget reports are very important in measuring performances of the

company. The budget report is generated as a whole when business is small, and when business is

large it generates department wise. The estimation of budget is made on experience of manager

which helps the company in dealing with uncertainties (Robinson, c2016). A budget of the

company lists all the sources of earnings and expenditures which shows the clear picture of

Job costing system – Job order costing is a system that assigns and accumulates cost of

manufacturing of individual unit of output. It is used when products manufactured are different

from each other and each item has individual cost. The job costing system includes direct

material, labour, and overheads. It maintains separate account for each job from the date of

commencement till the date of completion which enables the company in knowing the cost of

each job. It enables the company in comparing actual cost with estimated cost for separate jobs

and helps in finding out profit or loss made on each job. The two process of this costing system

are :

Job costing – It does detailed accumulation of cost of production to individual specific

groups. It is used for unique products and small production runs. In job costing, record keeping is

required and time and material are charged to specific jobs. It is more likely to be used in the

company for billing to customers.

Process costing- It is used for standardized products and mostly used for large firms. It

aggregates cost therefore requires less keeping of records.

P2 Different methods used for management accounting reporting

Management accounting reports are used in the organization for the purpose of planning,

decision making, regulating and measuring performance in the company. These reports are

prepared throughout according to the requirements of the company. It can be created on weekly,

monthly or quarterly basis. As many decisions are based on the authenticity of these reports

therefore it is important that the information provided in these reports are clear, concise and

accurate. There reports need to be prepared by specialized person in timely manner as many

decisions are based on these reports. Managers also see these reports and take decisions regarding

bonus, incentives etc and convert them into useful information from the company. The reports

are :

Budget report – Budget reports are very important in measuring performances of the

company. The budget report is generated as a whole when business is small, and when business is

large it generates department wise. The estimation of budget is made on experience of manager

which helps the company in dealing with uncertainties (Robinson, c2016). A budget of the

company lists all the sources of earnings and expenditures which shows the clear picture of

company and shows the path to achieve goals and objectives of the company by staying in the

budget.

It guides the mangers to offer incentives to which employee, to cost cut where necessary

and negotiate with suppliers etc therefore budget report is essential for efficient working of the

organization.

Account receivable aging report – When business of the organization extends credit to its

creditors then these reports are important to the organization. These reports take balances that are

remaining from the client and break down the balance which is owed by the company from the

customers based on specific time periods like 30, 60, 90 days and so on. This helps the manager

of the company in finding out the defaulters and problems in collection process. In case the

company come to know that it has many defaulters the credit policies of company need to be

tighter as cash flow is important aspect of the company and if defaulter are high, cash flow of the

company will not be sufficient to meet daily working requirements. However, it is important to

ignore some bad debts but the company cannot make it a habit.

Performance report – These reports are created to review the performance of the company

as well its employees at the end of the term. The performance report for each department is

generated in large organizations to see and analyze that how each department is performing. The

managers use these reports to make key strategic decisions about the future of organization. The

performance related reports shows how the companies operations are being performed and how

employees are performing in the organization (Begg, 2016). When company set some standards

for performance and if it doesn't happen that way, these reports helps in pointing out the flaws in

their setup and strategy. Individuals are awarded for their commitment and performance based on

these reports and also decisions regarding bonuses and incentives is taken on the behalf of these

reports. The performance report is important for company to keep an accurate measure of their

strategy toward their mission.

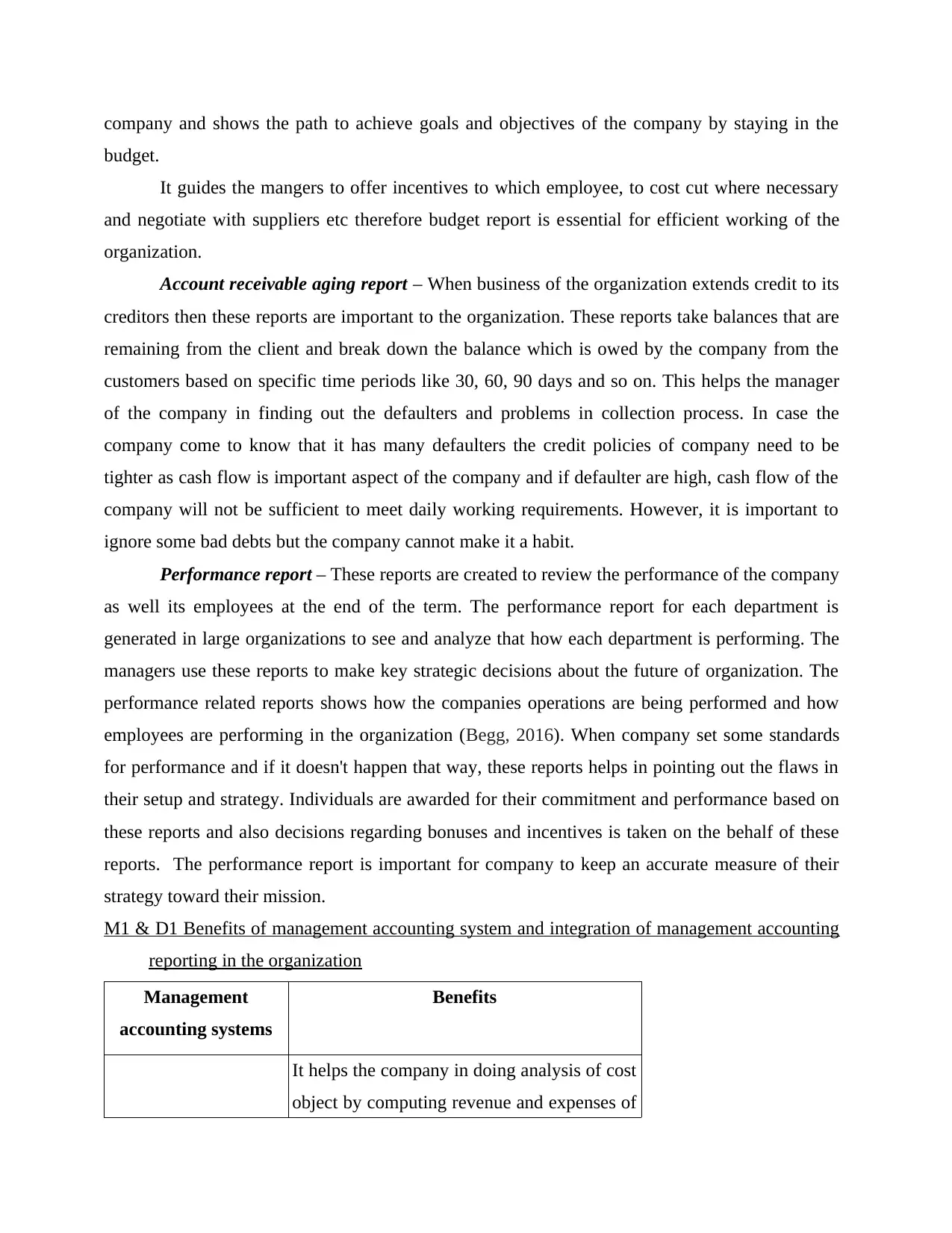

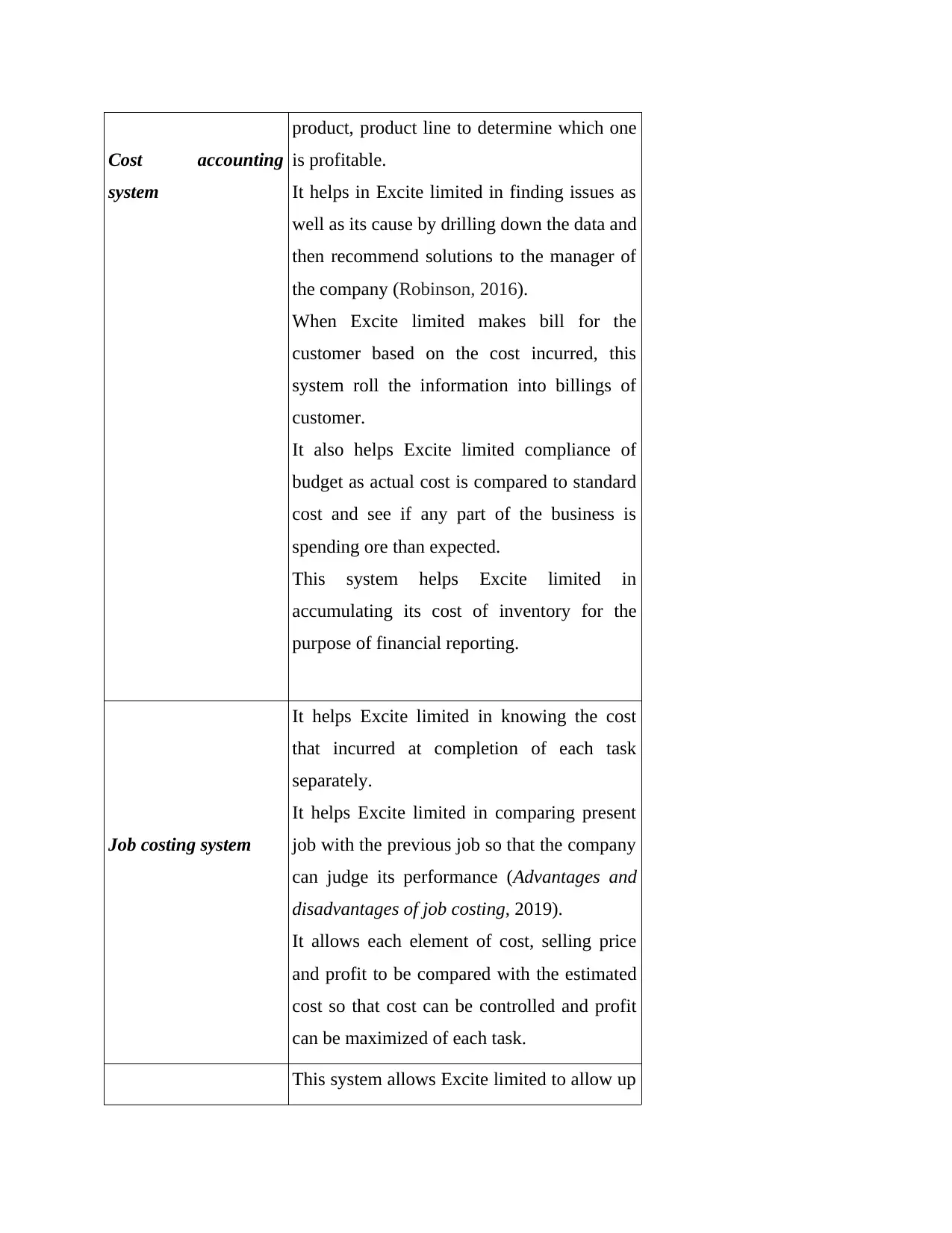

M1 & D1 Benefits of management accounting system and integration of management accounting

reporting in the organization

Management

accounting systems

Benefits

It helps the company in doing analysis of cost

object by computing revenue and expenses of

budget.

It guides the mangers to offer incentives to which employee, to cost cut where necessary

and negotiate with suppliers etc therefore budget report is essential for efficient working of the

organization.

Account receivable aging report – When business of the organization extends credit to its

creditors then these reports are important to the organization. These reports take balances that are

remaining from the client and break down the balance which is owed by the company from the

customers based on specific time periods like 30, 60, 90 days and so on. This helps the manager

of the company in finding out the defaulters and problems in collection process. In case the

company come to know that it has many defaulters the credit policies of company need to be

tighter as cash flow is important aspect of the company and if defaulter are high, cash flow of the

company will not be sufficient to meet daily working requirements. However, it is important to

ignore some bad debts but the company cannot make it a habit.

Performance report – These reports are created to review the performance of the company

as well its employees at the end of the term. The performance report for each department is

generated in large organizations to see and analyze that how each department is performing. The

managers use these reports to make key strategic decisions about the future of organization. The

performance related reports shows how the companies operations are being performed and how

employees are performing in the organization (Begg, 2016). When company set some standards

for performance and if it doesn't happen that way, these reports helps in pointing out the flaws in

their setup and strategy. Individuals are awarded for their commitment and performance based on

these reports and also decisions regarding bonuses and incentives is taken on the behalf of these

reports. The performance report is important for company to keep an accurate measure of their

strategy toward their mission.

M1 & D1 Benefits of management accounting system and integration of management accounting

reporting in the organization

Management

accounting systems

Benefits

It helps the company in doing analysis of cost

object by computing revenue and expenses of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost accounting

system

product, product line to determine which one

is profitable.

It helps in Excite limited in finding issues as

well as its cause by drilling down the data and

then recommend solutions to the manager of

the company (Robinson, 2016).

When Excite limited makes bill for the

customer based on the cost incurred, this

system roll the information into billings of

customer.

It also helps Excite limited compliance of

budget as actual cost is compared to standard

cost and see if any part of the business is

spending ore than expected.

This system helps Excite limited in

accumulating its cost of inventory for the

purpose of financial reporting.

Job costing system

It helps Excite limited in knowing the cost

that incurred at completion of each task

separately.

It helps Excite limited in comparing present

job with the previous job so that the company

can judge its performance (Advantages and

disadvantages of job costing, 2019).

It allows each element of cost, selling price

and profit to be compared with the estimated

cost so that cost can be controlled and profit

can be maximized of each task.

This system allows Excite limited to allow up

system

product, product line to determine which one

is profitable.

It helps in Excite limited in finding issues as

well as its cause by drilling down the data and

then recommend solutions to the manager of

the company (Robinson, 2016).

When Excite limited makes bill for the

customer based on the cost incurred, this

system roll the information into billings of

customer.

It also helps Excite limited compliance of

budget as actual cost is compared to standard

cost and see if any part of the business is

spending ore than expected.

This system helps Excite limited in

accumulating its cost of inventory for the

purpose of financial reporting.

Job costing system

It helps Excite limited in knowing the cost

that incurred at completion of each task

separately.

It helps Excite limited in comparing present

job with the previous job so that the company

can judge its performance (Advantages and

disadvantages of job costing, 2019).

It allows each element of cost, selling price

and profit to be compared with the estimated

cost so that cost can be controlled and profit

can be maximized of each task.

This system allows Excite limited to allow up

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inventory

management system

to date level of stock to be available to the

staff of the company when they need it. It

then gets deliver to the customer real quick

and results in retention of customers.

This system assists the company in making

forecast abut the requirement of inventory

which saves financing cost, warehousing rent,

lighting, security cost and all the holding

costs (Benefits of strong inventory

management system, 2017).

It provides flexibility to Excite limited to

adapt to situations that are unpredictable. It

gives strong visibility over inventory and

allow the organization to analyze and solve

problem as soon it occurs.

The management accounting system when integrated with management accounting reports

lead to increase in performance of the company and continuous improvement (Otley, 2016). In

excite limited, the company with the help of cost management system create budget and cost

reports, which helps the company in estimating the cost of each task of the company which align

to job costing system and helps the company in finding out the profitable product of the company.

This system along with the preparation of reports help in measuring effectiveness of all the major

activities which enhances the performances of employees departments etc. In excite limited, the

performance reports can show the performance of each employee and department and can

compared with the data generated from job costing system to evaluate the outcomes. These

systems monitor quality related cost and contribute to continuous improvement and help company

in delivering high quality service.

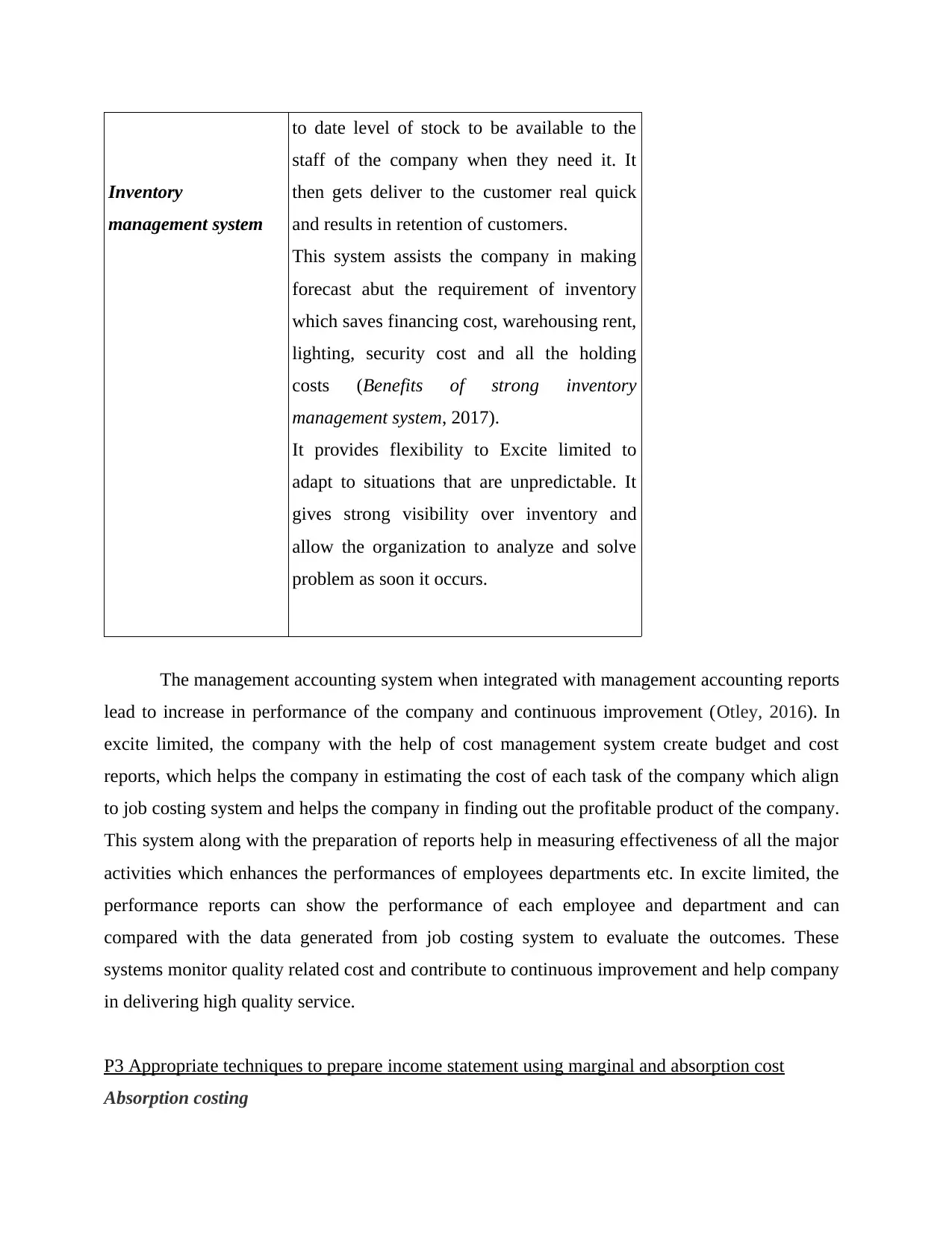

P3 Appropriate techniques to prepare income statement using marginal and absorption cost

Absorption costing

management system

to date level of stock to be available to the

staff of the company when they need it. It

then gets deliver to the customer real quick

and results in retention of customers.

This system assists the company in making

forecast abut the requirement of inventory

which saves financing cost, warehousing rent,

lighting, security cost and all the holding

costs (Benefits of strong inventory

management system, 2017).

It provides flexibility to Excite limited to

adapt to situations that are unpredictable. It

gives strong visibility over inventory and

allow the organization to analyze and solve

problem as soon it occurs.

The management accounting system when integrated with management accounting reports

lead to increase in performance of the company and continuous improvement (Otley, 2016). In

excite limited, the company with the help of cost management system create budget and cost

reports, which helps the company in estimating the cost of each task of the company which align

to job costing system and helps the company in finding out the profitable product of the company.

This system along with the preparation of reports help in measuring effectiveness of all the major

activities which enhances the performances of employees departments etc. In excite limited, the

performance reports can show the performance of each employee and department and can

compared with the data generated from job costing system to evaluate the outcomes. These

systems monitor quality related cost and contribute to continuous improvement and help company

in delivering high quality service.

P3 Appropriate techniques to prepare income statement using marginal and absorption cost

Absorption costing

Particulars Amount (in

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

Opening stock 500 10 5000

production 10000 10 100000

Closing stock 2500 10 25000

Cost of goods sold

(Opening stock + purchase –

closing stock) 80000

Net profit 40000

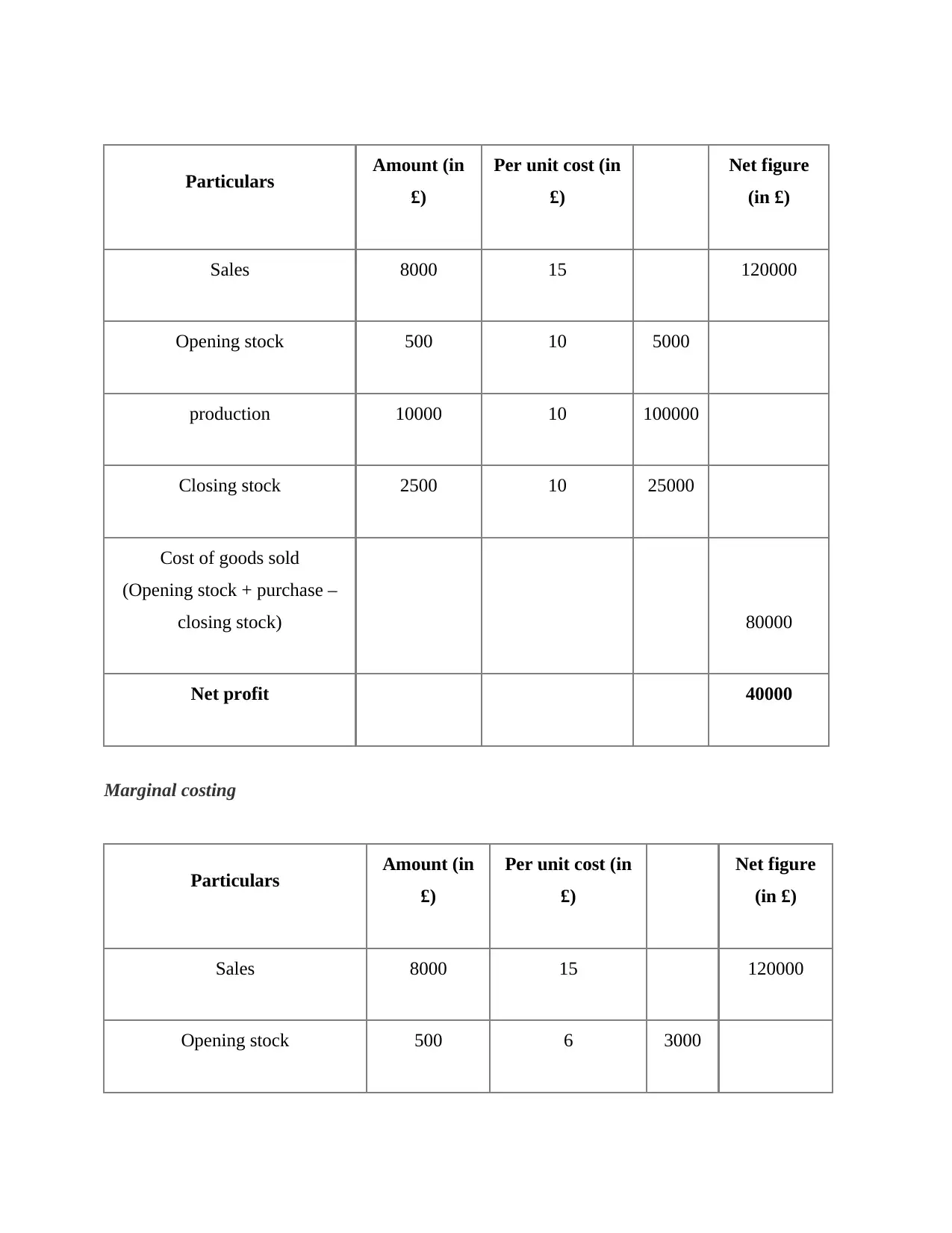

Marginal costing

Particulars Amount (in

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

Opening stock 500 6 3000

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

Opening stock 500 10 5000

production 10000 10 100000

Closing stock 2500 10 25000

Cost of goods sold

(Opening stock + purchase –

closing stock) 80000

Net profit 40000

Marginal costing

Particulars Amount (in

£)

Per unit cost (in

£)

Net figure

(in £)

Sales 8000 15 120000

Opening stock 500 6 3000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

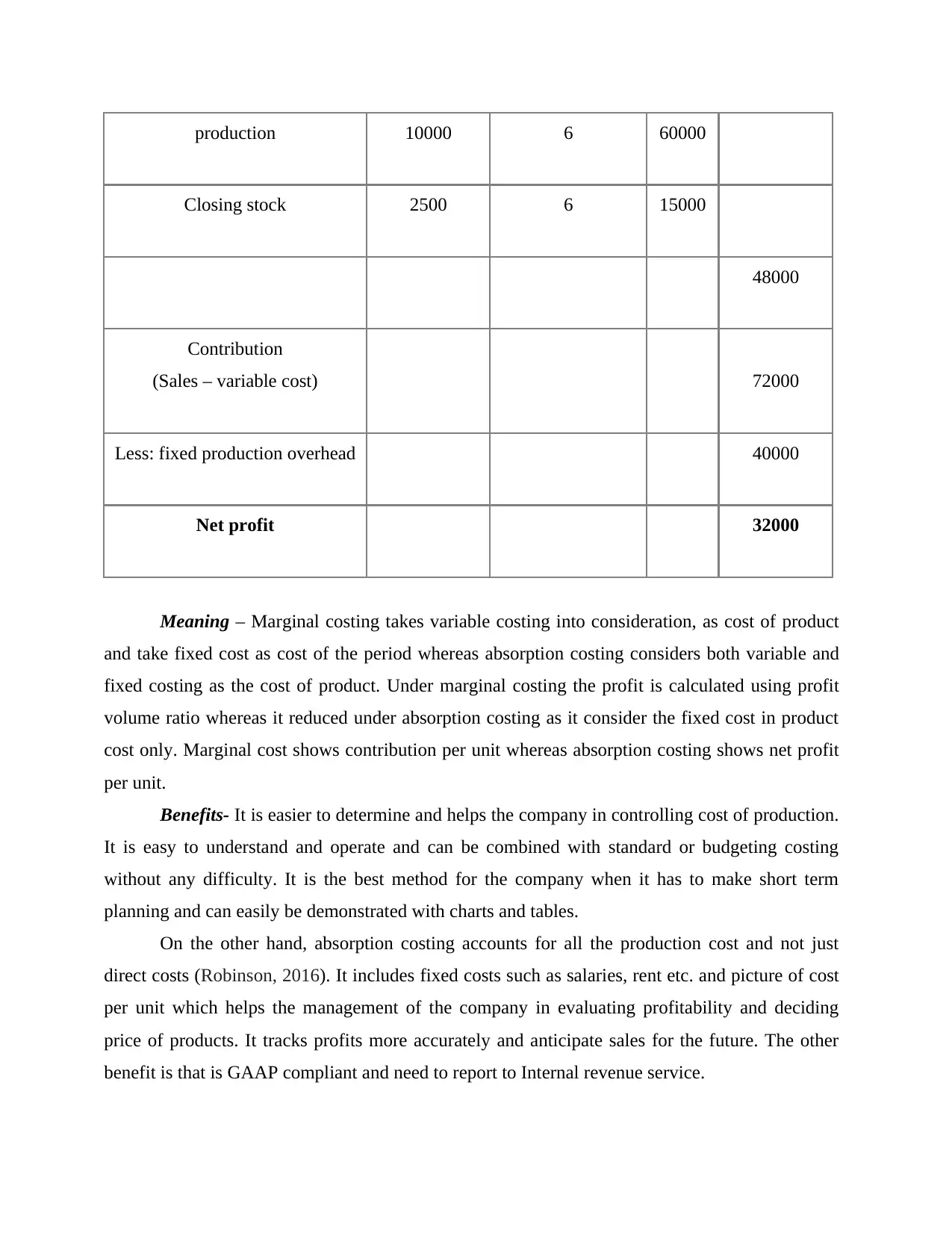

production 10000 6 60000

Closing stock 2500 6 15000

48000

Contribution

(Sales – variable cost) 72000

Less: fixed production overhead 40000

Net profit 32000

Meaning – Marginal costing takes variable costing into consideration, as cost of product

and take fixed cost as cost of the period whereas absorption costing considers both variable and

fixed costing as the cost of product. Under marginal costing the profit is calculated using profit

volume ratio whereas it reduced under absorption costing as it consider the fixed cost in product

cost only. Marginal cost shows contribution per unit whereas absorption costing shows net profit

per unit.

Benefits- It is easier to determine and helps the company in controlling cost of production.

It is easy to understand and operate and can be combined with standard or budgeting costing

without any difficulty. It is the best method for the company when it has to make short term

planning and can easily be demonstrated with charts and tables.

On the other hand, absorption costing accounts for all the production cost and not just

direct costs (Robinson, 2016). It includes fixed costs such as salaries, rent etc. and picture of cost

per unit which helps the management of the company in evaluating profitability and deciding

price of products. It tracks profits more accurately and anticipate sales for the future. The other

benefit is that is GAAP compliant and need to report to Internal revenue service.

Closing stock 2500 6 15000

48000

Contribution

(Sales – variable cost) 72000

Less: fixed production overhead 40000

Net profit 32000

Meaning – Marginal costing takes variable costing into consideration, as cost of product

and take fixed cost as cost of the period whereas absorption costing considers both variable and

fixed costing as the cost of product. Under marginal costing the profit is calculated using profit

volume ratio whereas it reduced under absorption costing as it consider the fixed cost in product

cost only. Marginal cost shows contribution per unit whereas absorption costing shows net profit

per unit.

Benefits- It is easier to determine and helps the company in controlling cost of production.

It is easy to understand and operate and can be combined with standard or budgeting costing

without any difficulty. It is the best method for the company when it has to make short term

planning and can easily be demonstrated with charts and tables.

On the other hand, absorption costing accounts for all the production cost and not just

direct costs (Robinson, 2016). It includes fixed costs such as salaries, rent etc. and picture of cost

per unit which helps the management of the company in evaluating profitability and deciding

price of products. It tracks profits more accurately and anticipate sales for the future. The other

benefit is that is GAAP compliant and need to report to Internal revenue service.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

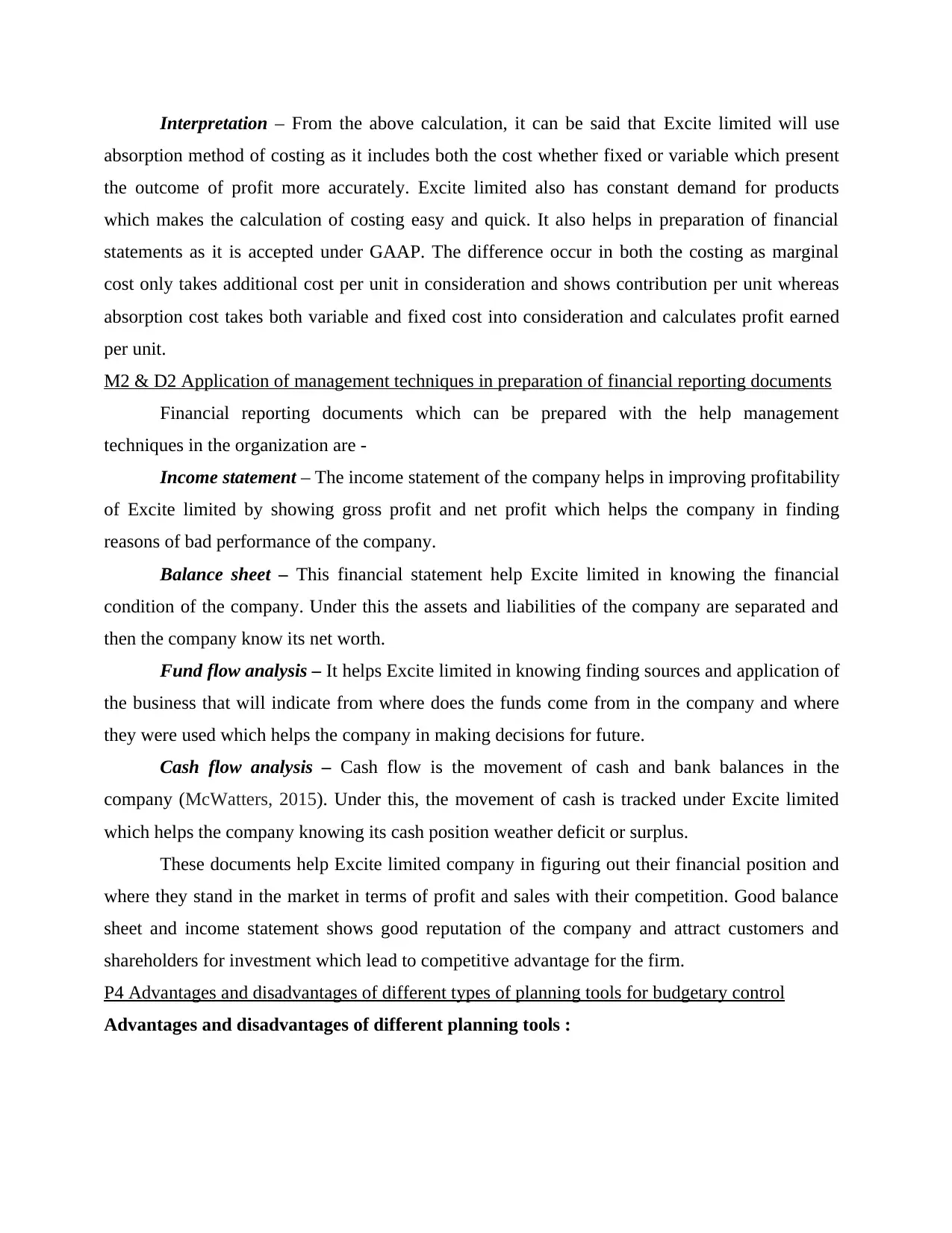

Interpretation – From the above calculation, it can be said that Excite limited will use

absorption method of costing as it includes both the cost whether fixed or variable which present

the outcome of profit more accurately. Excite limited also has constant demand for products

which makes the calculation of costing easy and quick. It also helps in preparation of financial

statements as it is accepted under GAAP. The difference occur in both the costing as marginal

cost only takes additional cost per unit in consideration and shows contribution per unit whereas

absorption cost takes both variable and fixed cost into consideration and calculates profit earned

per unit.

M2 & D2 Application of management techniques in preparation of financial reporting documents

Financial reporting documents which can be prepared with the help management

techniques in the organization are -

Income statement – The income statement of the company helps in improving profitability

of Excite limited by showing gross profit and net profit which helps the company in finding

reasons of bad performance of the company.

Balance sheet – This financial statement help Excite limited in knowing the financial

condition of the company. Under this the assets and liabilities of the company are separated and

then the company know its net worth.

Fund flow analysis – It helps Excite limited in knowing finding sources and application of

the business that will indicate from where does the funds come from in the company and where

they were used which helps the company in making decisions for future.

Cash flow analysis – Cash flow is the movement of cash and bank balances in the

company (McWatters, 2015). Under this, the movement of cash is tracked under Excite limited

which helps the company knowing its cash position weather deficit or surplus.

These documents help Excite limited company in figuring out their financial position and

where they stand in the market in terms of profit and sales with their competition. Good balance

sheet and income statement shows good reputation of the company and attract customers and

shareholders for investment which lead to competitive advantage for the firm.

P4 Advantages and disadvantages of different types of planning tools for budgetary control

Advantages and disadvantages of different planning tools :

absorption method of costing as it includes both the cost whether fixed or variable which present

the outcome of profit more accurately. Excite limited also has constant demand for products

which makes the calculation of costing easy and quick. It also helps in preparation of financial

statements as it is accepted under GAAP. The difference occur in both the costing as marginal

cost only takes additional cost per unit in consideration and shows contribution per unit whereas

absorption cost takes both variable and fixed cost into consideration and calculates profit earned

per unit.

M2 & D2 Application of management techniques in preparation of financial reporting documents

Financial reporting documents which can be prepared with the help management

techniques in the organization are -

Income statement – The income statement of the company helps in improving profitability

of Excite limited by showing gross profit and net profit which helps the company in finding

reasons of bad performance of the company.

Balance sheet – This financial statement help Excite limited in knowing the financial

condition of the company. Under this the assets and liabilities of the company are separated and

then the company know its net worth.

Fund flow analysis – It helps Excite limited in knowing finding sources and application of

the business that will indicate from where does the funds come from in the company and where

they were used which helps the company in making decisions for future.

Cash flow analysis – Cash flow is the movement of cash and bank balances in the

company (McWatters, 2015). Under this, the movement of cash is tracked under Excite limited

which helps the company knowing its cash position weather deficit or surplus.

These documents help Excite limited company in figuring out their financial position and

where they stand in the market in terms of profit and sales with their competition. Good balance

sheet and income statement shows good reputation of the company and attract customers and

shareholders for investment which lead to competitive advantage for the firm.

P4 Advantages and disadvantages of different types of planning tools for budgetary control

Advantages and disadvantages of different planning tools :

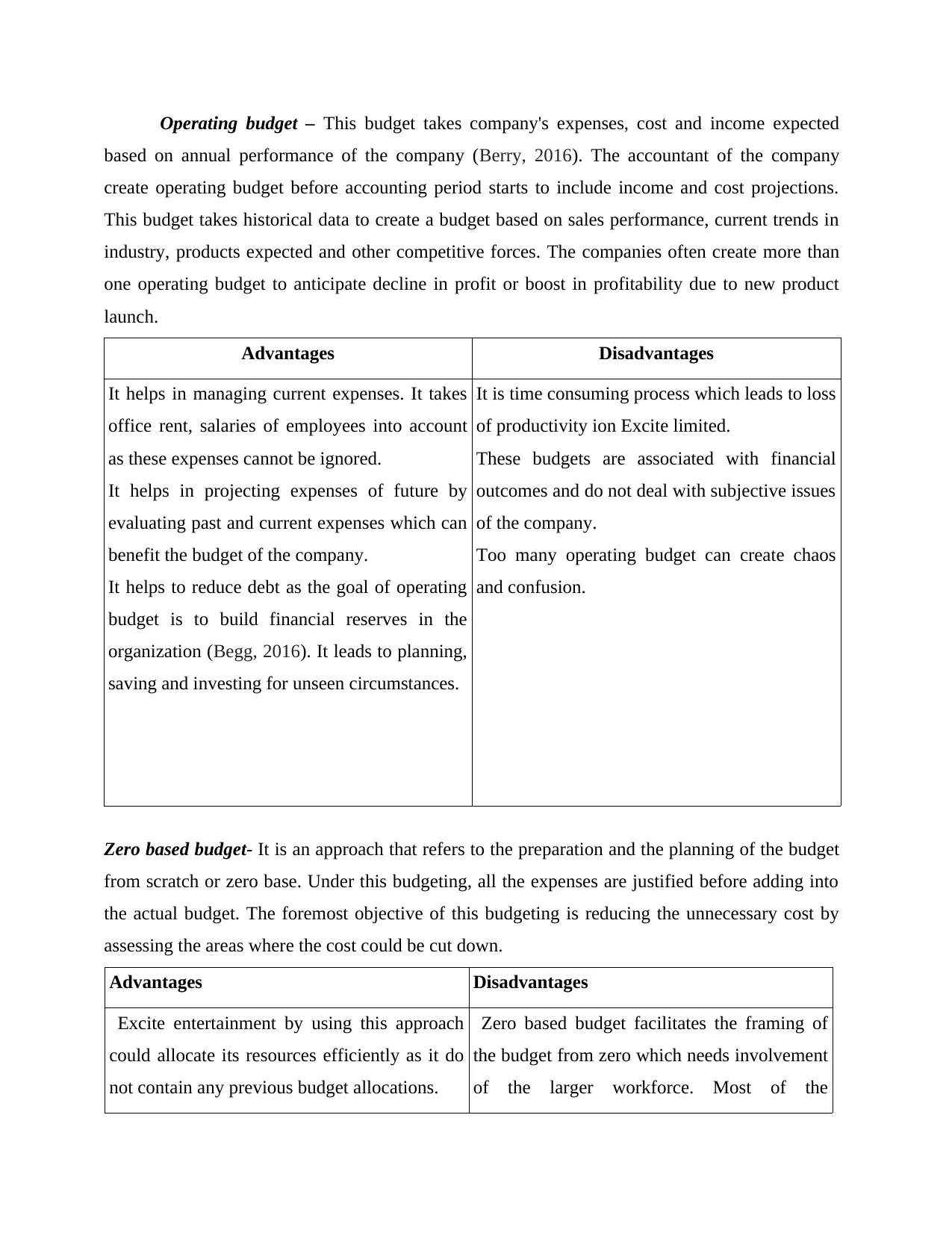

Operating budget – This budget takes company's expenses, cost and income expected

based on annual performance of the company (Berry, 2016). The accountant of the company

create operating budget before accounting period starts to include income and cost projections.

This budget takes historical data to create a budget based on sales performance, current trends in

industry, products expected and other competitive forces. The companies often create more than

one operating budget to anticipate decline in profit or boost in profitability due to new product

launch.

Advantages Disadvantages

It helps in managing current expenses. It takes

office rent, salaries of employees into account

as these expenses cannot be ignored.

It helps in projecting expenses of future by

evaluating past and current expenses which can

benefit the budget of the company.

It helps to reduce debt as the goal of operating

budget is to build financial reserves in the

organization (Begg, 2016). It leads to planning,

saving and investing for unseen circumstances.

It is time consuming process which leads to loss

of productivity ion Excite limited.

These budgets are associated with financial

outcomes and do not deal with subjective issues

of the company.

Too many operating budget can create chaos

and confusion.

Zero based budget- It is an approach that refers to the preparation and the planning of the budget

from scratch or zero base. Under this budgeting, all the expenses are justified before adding into

the actual budget. The foremost objective of this budgeting is reducing the unnecessary cost by

assessing the areas where the cost could be cut down.

Advantages Disadvantages

Excite entertainment by using this approach

could allocate its resources efficiently as it do

not contain any previous budget allocations.

Zero based budget facilitates the framing of

the budget from zero which needs involvement

of the larger workforce. Most of the

based on annual performance of the company (Berry, 2016). The accountant of the company

create operating budget before accounting period starts to include income and cost projections.

This budget takes historical data to create a budget based on sales performance, current trends in

industry, products expected and other competitive forces. The companies often create more than

one operating budget to anticipate decline in profit or boost in profitability due to new product

launch.

Advantages Disadvantages

It helps in managing current expenses. It takes

office rent, salaries of employees into account

as these expenses cannot be ignored.

It helps in projecting expenses of future by

evaluating past and current expenses which can

benefit the budget of the company.

It helps to reduce debt as the goal of operating

budget is to build financial reserves in the

organization (Begg, 2016). It leads to planning,

saving and investing for unseen circumstances.

It is time consuming process which leads to loss

of productivity ion Excite limited.

These budgets are associated with financial

outcomes and do not deal with subjective issues

of the company.

Too many operating budget can create chaos

and confusion.

Zero based budget- It is an approach that refers to the preparation and the planning of the budget

from scratch or zero base. Under this budgeting, all the expenses are justified before adding into

the actual budget. The foremost objective of this budgeting is reducing the unnecessary cost by

assessing the areas where the cost could be cut down.

Advantages Disadvantages

Excite entertainment by using this approach

could allocate its resources efficiently as it do

not contain any previous budget allocations.

Zero based budget facilitates the framing of

the budget from zero which needs involvement

of the larger workforce. Most of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.