Management Accounting Report: Financial Strategies for Sollatak Ltd

VerifiedAdded on 2020/11/23

|17

|5513

|474

Report

AI Summary

This report delves into the realm of management accounting, utilizing Sollatak Ltd, a technology company, as a case study to analyze its financial position and operational efficiency. It encompasses a detailed exploration of various management accounting systems, including cost accounting, price optimization, inventory management, and job costing, evaluating their benefits and applications. The report further examines different methods of management accounting reporting, such as performance reports, accounts receivable aging reports, inventory management reports, and job cost reporting, and their role in decision-making. It then proceeds to illustrate the preparation of income statements using marginal and absorption costing techniques, assessing their impact on financial reporting. Moreover, it explores budgetary control, its advantages and disadvantages, and the use of planning tools for forecasting. Finally, the report addresses the response of management accounting systems to financial problems, emphasizing how these systems can guide an organization towards sustainable success. The report's structure includes an introduction outlining the project's objectives, followed by four tasks that cover the core aspects of management accounting and its practical applications within Sollatak Ltd.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and its types of management accounting systems....................1

P2 Different methods used for management accounting reporting........................................3

M1 Evaluate the benefits of management accounting systems and its applications..............5

TASK 2............................................................................................................................................6

P3 Preparation of income statements by using cost techniques.............................................6

M2 Application of management accounting techniques to produce financial reporting

documents...............................................................................................................................8

D2 Financial resorts and interpretation of data of business activities....................................8

TASK 3............................................................................................................................................9

P4 Budgetary control and advantages and disadvantages of planning tools used in budgetary

control.....................................................................................................................................9

M3 Use of different management tools and their application for preparing and forecasting

budget...................................................................................................................................11

D3 Evaluation of planning tools to respond financial problems..........................................11

TASK 4..........................................................................................................................................11

P5 Response of management accounting system to financial problems..............................11

M4 In responding to financial problems management accounting can lead organisation to

sustainable success...............................................................................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and its types of management accounting systems....................1

P2 Different methods used for management accounting reporting........................................3

M1 Evaluate the benefits of management accounting systems and its applications..............5

TASK 2............................................................................................................................................6

P3 Preparation of income statements by using cost techniques.............................................6

M2 Application of management accounting techniques to produce financial reporting

documents...............................................................................................................................8

D2 Financial resorts and interpretation of data of business activities....................................8

TASK 3............................................................................................................................................9

P4 Budgetary control and advantages and disadvantages of planning tools used in budgetary

control.....................................................................................................................................9

M3 Use of different management tools and their application for preparing and forecasting

budget...................................................................................................................................11

D3 Evaluation of planning tools to respond financial problems..........................................11

TASK 4..........................................................................................................................................11

P5 Response of management accounting system to financial problems..............................11

M4 In responding to financial problems management accounting can lead organisation to

sustainable success...............................................................................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Management accounting is technique used in analysis of company's financial position in

the current accounting period by interpreting it's costs and operations (Morden, 2016). Company

can adopt for various management accounting systems tools for effective and efficient working

in business to achieve desired objectives. Management accounting reporting methods is properly

planned, organised, controlled, monitors by management for enhancing companies performance.

Evaluation of different costs and its techniques used in achieving favourable net income with the

help of marginal and absorption costing and appropriate use of budgetary-control planning tools

considering its merits and demerits. Management has to focus on factors responsible for financial

problem.

Sollatak Ltd, a technology company deals in power and energy consumption solutions by

offering different electrical equipments in UK market. Main motive of this report is that

company wants to provide services related to power with the help of proper utilisation of

resources. The project includes various management accounting systems, reporting techniques,

different types of costs for net operating income calculation and use of budgetary control tools,

financial techniques for resolving financial issues.

TASK 1

P1 Management accounting and its types of management accounting systems

Management accounting is the representation of accounting data in order to change

companies policies which is to be acquired by the management. It is a process of analysis and

interpretation of management reports which provide accuracy in business financial reports for

daily operations and short term decisions.

Types of management accounting systems are:

Cost accounting system

Price optimisation system

Inventory management system

Job costing system

Cost accounting systems: This structure is used by an organisation in cost estimation of

their product, so that they study company's profitability, valuation of inventory and cost control.

Organisation should estimate accuracy in product cost for profitable operations. They must have

1

Management accounting is technique used in analysis of company's financial position in

the current accounting period by interpreting it's costs and operations (Morden, 2016). Company

can adopt for various management accounting systems tools for effective and efficient working

in business to achieve desired objectives. Management accounting reporting methods is properly

planned, organised, controlled, monitors by management for enhancing companies performance.

Evaluation of different costs and its techniques used in achieving favourable net income with the

help of marginal and absorption costing and appropriate use of budgetary-control planning tools

considering its merits and demerits. Management has to focus on factors responsible for financial

problem.

Sollatak Ltd, a technology company deals in power and energy consumption solutions by

offering different electrical equipments in UK market. Main motive of this report is that

company wants to provide services related to power with the help of proper utilisation of

resources. The project includes various management accounting systems, reporting techniques,

different types of costs for net operating income calculation and use of budgetary control tools,

financial techniques for resolving financial issues.

TASK 1

P1 Management accounting and its types of management accounting systems

Management accounting is the representation of accounting data in order to change

companies policies which is to be acquired by the management. It is a process of analysis and

interpretation of management reports which provide accuracy in business financial reports for

daily operations and short term decisions.

Types of management accounting systems are:

Cost accounting system

Price optimisation system

Inventory management system

Job costing system

Cost accounting systems: This structure is used by an organisation in cost estimation of

their product, so that they study company's profitability, valuation of inventory and cost control.

Organisation should estimate accuracy in product cost for profitable operations. They must have

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

a knowledge regarding which commodity is profitable or not, and this is judged only when

commodity is estimated correctly. Cost accounting system is analysed on the basis of actual,

normal and standard costing. Actual costing: It is based on the actual cost of product incurred like actual cost of

materials used, actual labour cost and actual variable overheads which is used in

determination of actual costing of commodity. This is the most essay method of costing

which doesn't required any pre planned cost but sometimes it takes more time to

formulate the valuation of closing stock and cost of goods sold because all actual costs

must be observe and allocated. Normal costing: It is designed to derive product cost based on actual direct costs i.e.

actual cost of material and labour as well as standard overhead rate which is applied in

product's actual usage irrespective of different allocation bases.

Standard costing: It is based on predetermined materials, direct labour and

manufacturing overheads costs. This costing method is used for valuation of

manufacturer's inventories and cost of goods sold.

Price optimisation system: It is a process of identifying maximum price which the

customer is willing to pay (Mistry, Sharma, Low, 2014). It calculated the variation in demand at

different level of prices and combined it with recommended prices of costs & levels of inventory

which will maximise profits. This system is used as a solution which allows for price

improvement and will recommends change in price the helps organisation to achieve specified

objectives.

Inventory management system: It is framework used in managing inventory on daily

bases by tracking stock levels, orders and their sales. This system is mainly used in

manufacturing industries for creating bill of materials, inventory tracking, work order, product

identification and other inventory related details. This system is also used to avoid excessive

product stock which impact on loss of revenue. Below are the methods of inventory management

systems: FIFO system: First in first out method is used for valuation of inventory on the bases of

flow of goods that means goods which is purchased first are to be sold at first. This shows

actual flow of goods.

2

commodity is estimated correctly. Cost accounting system is analysed on the basis of actual,

normal and standard costing. Actual costing: It is based on the actual cost of product incurred like actual cost of

materials used, actual labour cost and actual variable overheads which is used in

determination of actual costing of commodity. This is the most essay method of costing

which doesn't required any pre planned cost but sometimes it takes more time to

formulate the valuation of closing stock and cost of goods sold because all actual costs

must be observe and allocated. Normal costing: It is designed to derive product cost based on actual direct costs i.e.

actual cost of material and labour as well as standard overhead rate which is applied in

product's actual usage irrespective of different allocation bases.

Standard costing: It is based on predetermined materials, direct labour and

manufacturing overheads costs. This costing method is used for valuation of

manufacturer's inventories and cost of goods sold.

Price optimisation system: It is a process of identifying maximum price which the

customer is willing to pay (Mistry, Sharma, Low, 2014). It calculated the variation in demand at

different level of prices and combined it with recommended prices of costs & levels of inventory

which will maximise profits. This system is used as a solution which allows for price

improvement and will recommends change in price the helps organisation to achieve specified

objectives.

Inventory management system: It is framework used in managing inventory on daily

bases by tracking stock levels, orders and their sales. This system is mainly used in

manufacturing industries for creating bill of materials, inventory tracking, work order, product

identification and other inventory related details. This system is also used to avoid excessive

product stock which impact on loss of revenue. Below are the methods of inventory management

systems: FIFO system: First in first out method is used for valuation of inventory on the bases of

flow of goods that means goods which is purchased first are to be sold at first. This shows

actual flow of goods.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LIFO system: Last in fast out method is also applicable for inventory valuation which

means goods purchases in last are sold at first. This system assigns the cost of new stock

to cost of goods sold and cost of first stock to closing stock account.

Prioritize with ABC: ABC analysis is used to prioritize company's inventory

management. In this system, company separates product which requires lot of

concentration with the products which don't required any attention.

Job Costing system: This system helps in tracking of expenses and maintaining

information used in unique product creation which is much related to business operations. In this

costing system cost of manufacturing job is recorded instead of process. Following are the types

of Job costing systems: Process costing: This costing method is used to identify the product cost at each level of

manufacturing. It helps in tracking that where the company's money is used in production

and distribution processes.

Contract costing: In this costing method company tracks their costs linked with a

customer in a way of specific contract. Generally, large scale construction company uses

this costing method of their businesses.

P2 Different methods used for management accounting reporting

Management accounting analyse company's reports for planning, implementing, decision

making and measures performance. Throughout the accounting period, these reports are

generated on regular basis as per the requirement of businesses. Many important decisions are

depend on the genuineness of these reports. These reports are generated & converted into useful

information for future references.

Following are the types of management accounting reports:

Performance report

Account receivable aging reports

inventory management reports

Job cost reporting

Performance report: This report is created to show the company's performance with

proper utilisation of resources within a specific period of time. This report compares actual

output with standard output and variation between these two for and whenever there is a

unfavourable variations the company is expected to take necessary actions. With the help of this

3

means goods purchases in last are sold at first. This system assigns the cost of new stock

to cost of goods sold and cost of first stock to closing stock account.

Prioritize with ABC: ABC analysis is used to prioritize company's inventory

management. In this system, company separates product which requires lot of

concentration with the products which don't required any attention.

Job Costing system: This system helps in tracking of expenses and maintaining

information used in unique product creation which is much related to business operations. In this

costing system cost of manufacturing job is recorded instead of process. Following are the types

of Job costing systems: Process costing: This costing method is used to identify the product cost at each level of

manufacturing. It helps in tracking that where the company's money is used in production

and distribution processes.

Contract costing: In this costing method company tracks their costs linked with a

customer in a way of specific contract. Generally, large scale construction company uses

this costing method of their businesses.

P2 Different methods used for management accounting reporting

Management accounting analyse company's reports for planning, implementing, decision

making and measures performance. Throughout the accounting period, these reports are

generated on regular basis as per the requirement of businesses. Many important decisions are

depend on the genuineness of these reports. These reports are generated & converted into useful

information for future references.

Following are the types of management accounting reports:

Performance report

Account receivable aging reports

inventory management reports

Job cost reporting

Performance report: This report is created to show the company's performance with

proper utilisation of resources within a specific period of time. This report compares actual

output with standard output and variation between these two for and whenever there is a

unfavourable variations the company is expected to take necessary actions. With the help of this

3

report employees get details regarding their present status versus original plan and government

issues performance report to show the services rendered by them (Lambert, Sponem, 2012).

Account receivable ageing reports: This report is used for determination of credit

effectiveness and collection period, which listed unpaid customer bills and unused credit

vouchers by date wise. This reports is used as a recovery tool and it also contain information of

every customer. A standard account receivable report lists bills and vouchers in 30 days

outstanding. This report also give detail information regarding the average collection period

which shows number of days for collection of dues. By this company can improve their

payments and inflow of cash in business. If company's ageing reports shows collection of

invoices much slower than standard, it means company should slow down their sales practices or

it will be facing more credit risk in future also.

Inventory management reports: This report contains a detail information about

inventory ordering, storing and its usage by reviewing and analysis of inventory. There are three

useful inventory management reports like inventory ranking report, hits report and daily average

sales report which helps management to take decision regarding inventory levels, which product

is to purchase or not. This report is firstly related to inventory status by location and duration,

secondly by company's profitability and inventory demand and thirdly by inventory integrity.

Economic order quantity model is one of the examples of inventory management reports model

which defines the order quantity which minimize the amount of total holding and ordering cost.

Job cost reporting: It is a report which provides critical information regarding present

status of job which helps in estimating the way of finishing that job in cost and sales orientation.

When there are many job in development its is difficult to manage, therefore it is important to

interpret the reports which will helpful in identification of issues related to job cost (Albelda,

2011). This report contains all the data of other reports that means it listed individual job in

which company is working and detailed the total cost find on the job in the previous process. Job

cost is combination of material cost, labour cost, field cost, pay off damages and sub contacting

cost. Proper job cost report starts with a accurate estimation. Company should begins individual

job by considering the estimates in similar cost group which is used to determined the actual job

cost information.

Importance of using job costing report is to collect information about manufacturing date, time

and year of a product or group of commodities.

4

issues performance report to show the services rendered by them (Lambert, Sponem, 2012).

Account receivable ageing reports: This report is used for determination of credit

effectiveness and collection period, which listed unpaid customer bills and unused credit

vouchers by date wise. This reports is used as a recovery tool and it also contain information of

every customer. A standard account receivable report lists bills and vouchers in 30 days

outstanding. This report also give detail information regarding the average collection period

which shows number of days for collection of dues. By this company can improve their

payments and inflow of cash in business. If company's ageing reports shows collection of

invoices much slower than standard, it means company should slow down their sales practices or

it will be facing more credit risk in future also.

Inventory management reports: This report contains a detail information about

inventory ordering, storing and its usage by reviewing and analysis of inventory. There are three

useful inventory management reports like inventory ranking report, hits report and daily average

sales report which helps management to take decision regarding inventory levels, which product

is to purchase or not. This report is firstly related to inventory status by location and duration,

secondly by company's profitability and inventory demand and thirdly by inventory integrity.

Economic order quantity model is one of the examples of inventory management reports model

which defines the order quantity which minimize the amount of total holding and ordering cost.

Job cost reporting: It is a report which provides critical information regarding present

status of job which helps in estimating the way of finishing that job in cost and sales orientation.

When there are many job in development its is difficult to manage, therefore it is important to

interpret the reports which will helpful in identification of issues related to job cost (Albelda,

2011). This report contains all the data of other reports that means it listed individual job in

which company is working and detailed the total cost find on the job in the previous process. Job

cost is combination of material cost, labour cost, field cost, pay off damages and sub contacting

cost. Proper job cost report starts with a accurate estimation. Company should begins individual

job by considering the estimates in similar cost group which is used to determined the actual job

cost information.

Importance of using job costing report is to collect information about manufacturing date, time

and year of a product or group of commodities.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

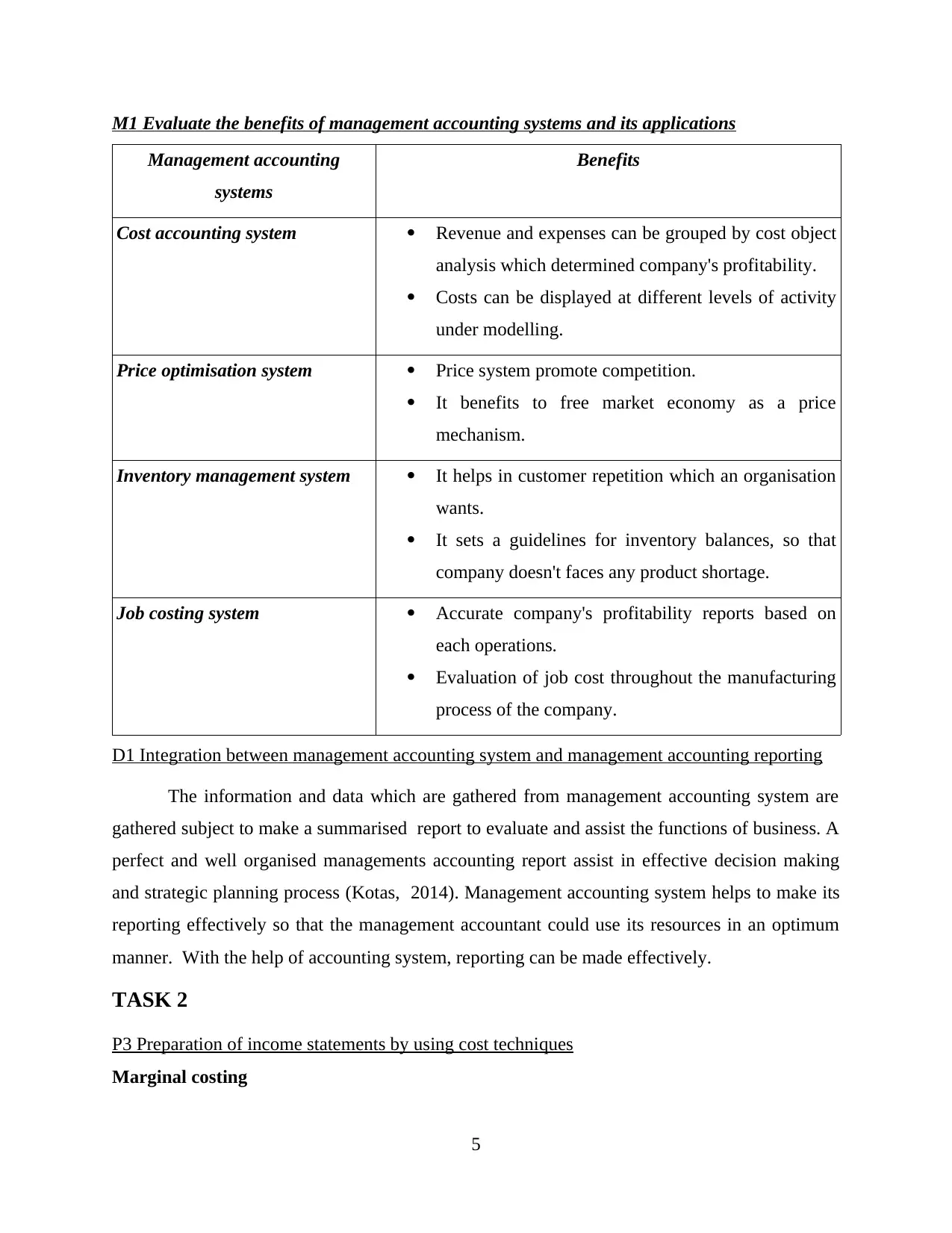

M1 Evaluate the benefits of management accounting systems and its applications

Management accounting

systems

Benefits

Cost accounting system Revenue and expenses can be grouped by cost object

analysis which determined company's profitability.

Costs can be displayed at different levels of activity

under modelling.

Price optimisation system Price system promote competition.

It benefits to free market economy as a price

mechanism.

Inventory management system It helps in customer repetition which an organisation

wants.

It sets a guidelines for inventory balances, so that

company doesn't faces any product shortage.

Job costing system Accurate company's profitability reports based on

each operations.

Evaluation of job cost throughout the manufacturing

process of the company.

D1 Integration between management accounting system and management accounting reporting

The information and data which are gathered from management accounting system are

gathered subject to make a summarised report to evaluate and assist the functions of business. A

perfect and well organised managements accounting report assist in effective decision making

and strategic planning process (Kotas, 2014). Management accounting system helps to make its

reporting effectively so that the management accountant could use its resources in an optimum

manner. With the help of accounting system, reporting can be made effectively.

TASK 2

P3 Preparation of income statements by using cost techniques

Marginal costing

5

Management accounting

systems

Benefits

Cost accounting system Revenue and expenses can be grouped by cost object

analysis which determined company's profitability.

Costs can be displayed at different levels of activity

under modelling.

Price optimisation system Price system promote competition.

It benefits to free market economy as a price

mechanism.

Inventory management system It helps in customer repetition which an organisation

wants.

It sets a guidelines for inventory balances, so that

company doesn't faces any product shortage.

Job costing system Accurate company's profitability reports based on

each operations.

Evaluation of job cost throughout the manufacturing

process of the company.

D1 Integration between management accounting system and management accounting reporting

The information and data which are gathered from management accounting system are

gathered subject to make a summarised report to evaluate and assist the functions of business. A

perfect and well organised managements accounting report assist in effective decision making

and strategic planning process (Kotas, 2014). Management accounting system helps to make its

reporting effectively so that the management accountant could use its resources in an optimum

manner. With the help of accounting system, reporting can be made effectively.

TASK 2

P3 Preparation of income statements by using cost techniques

Marginal costing

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

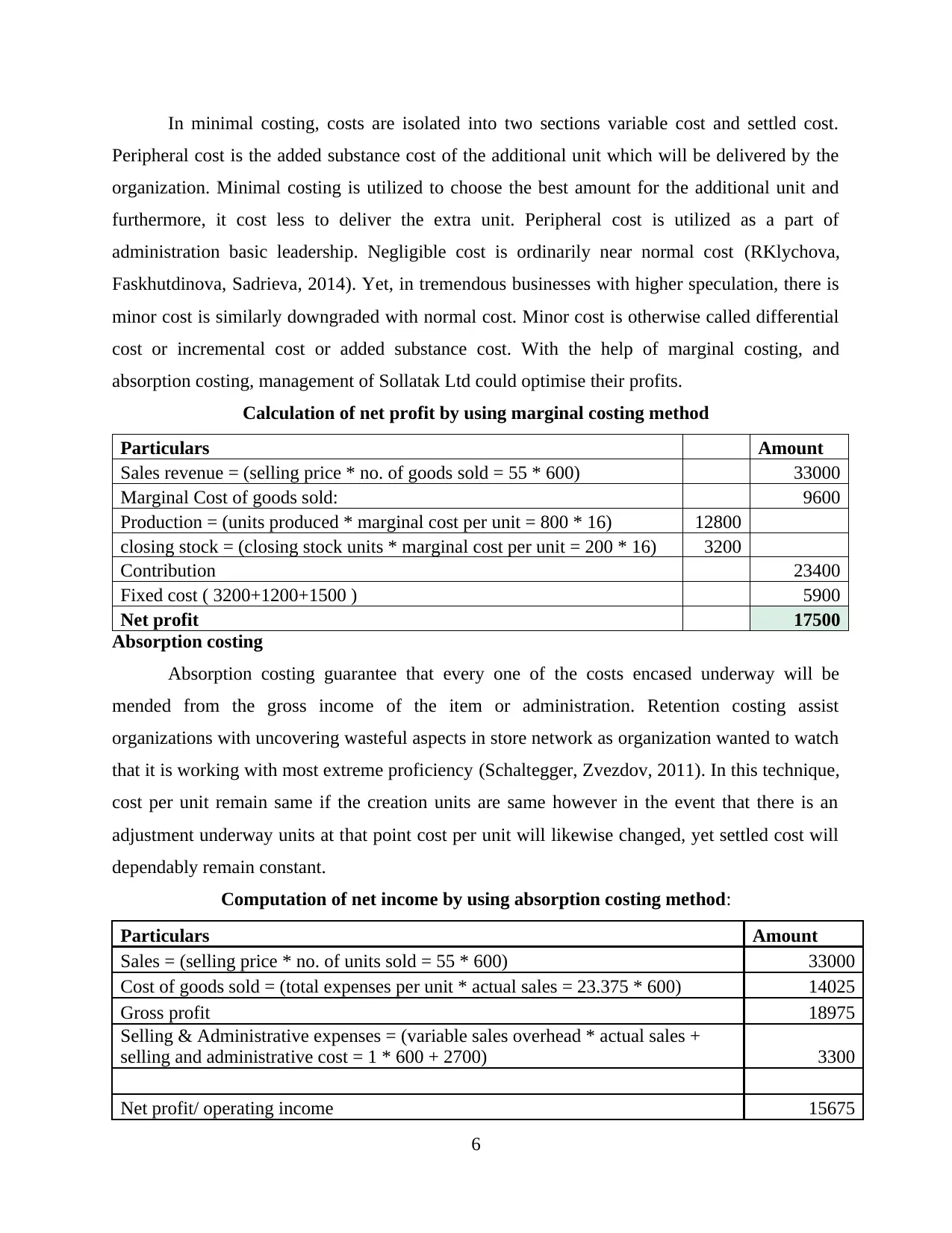

In minimal costing, costs are isolated into two sections variable cost and settled cost.

Peripheral cost is the added substance cost of the additional unit which will be delivered by the

organization. Minimal costing is utilized to choose the best amount for the additional unit and

furthermore, it cost less to deliver the extra unit. Peripheral cost is utilized as a part of

administration basic leadership. Negligible cost is ordinarily near normal cost (RKlychova,

Faskhutdinova, Sadrieva, 2014). Yet, in tremendous businesses with higher speculation, there is

minor cost is similarly downgraded with normal cost. Minor cost is otherwise called differential

cost or incremental cost or added substance cost. With the help of marginal costing, and

absorption costing, management of Sollatak Ltd could optimise their profits.

Calculation of net profit by using marginal costing method

Particulars Amount

Sales revenue = (selling price * no. of goods sold = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = (units produced * marginal cost per unit = 800 * 16) 12800

closing stock = (closing stock units * marginal cost per unit = 200 * 16) 3200

Contribution 23400

Fixed cost ( 3200+1200+1500 ) 5900

Net profit 17500

Absorption costing

Absorption costing guarantee that every one of the costs encased underway will be

mended from the gross income of the item or administration. Retention costing assist

organizations with uncovering wasteful aspects in store network as organization wanted to watch

that it is working with most extreme proficiency (Schaltegger, Zvezdov, 2011). In this technique,

cost per unit remain same if the creation units are same however in the event that there is an

adjustment underway units at that point cost per unit will likewise changed, yet settled cost will

dependably remain constant.

Computation of net income by using absorption costing method:

Particulars Amount

Sales = (selling price * no. of units sold = 55 * 600) 33000

Cost of goods sold = (total expenses per unit * actual sales = 23.375 * 600) 14025

Gross profit 18975

Selling & Administrative expenses = (variable sales overhead * actual sales +

selling and administrative cost = 1 * 600 + 2700) 3300

Net profit/ operating income 15675

6

Peripheral cost is the added substance cost of the additional unit which will be delivered by the

organization. Minimal costing is utilized to choose the best amount for the additional unit and

furthermore, it cost less to deliver the extra unit. Peripheral cost is utilized as a part of

administration basic leadership. Negligible cost is ordinarily near normal cost (RKlychova,

Faskhutdinova, Sadrieva, 2014). Yet, in tremendous businesses with higher speculation, there is

minor cost is similarly downgraded with normal cost. Minor cost is otherwise called differential

cost or incremental cost or added substance cost. With the help of marginal costing, and

absorption costing, management of Sollatak Ltd could optimise their profits.

Calculation of net profit by using marginal costing method

Particulars Amount

Sales revenue = (selling price * no. of goods sold = 55 * 600) 33000

Marginal Cost of goods sold: 9600

Production = (units produced * marginal cost per unit = 800 * 16) 12800

closing stock = (closing stock units * marginal cost per unit = 200 * 16) 3200

Contribution 23400

Fixed cost ( 3200+1200+1500 ) 5900

Net profit 17500

Absorption costing

Absorption costing guarantee that every one of the costs encased underway will be

mended from the gross income of the item or administration. Retention costing assist

organizations with uncovering wasteful aspects in store network as organization wanted to watch

that it is working with most extreme proficiency (Schaltegger, Zvezdov, 2011). In this technique,

cost per unit remain same if the creation units are same however in the event that there is an

adjustment underway units at that point cost per unit will likewise changed, yet settled cost will

dependably remain constant.

Computation of net income by using absorption costing method:

Particulars Amount

Sales = (selling price * no. of units sold = 55 * 600) 33000

Cost of goods sold = (total expenses per unit * actual sales = 23.375 * 600) 14025

Gross profit 18975

Selling & Administrative expenses = (variable sales overhead * actual sales +

selling and administrative cost = 1 * 600 + 2700) 3300

Net profit/ operating income 15675

6

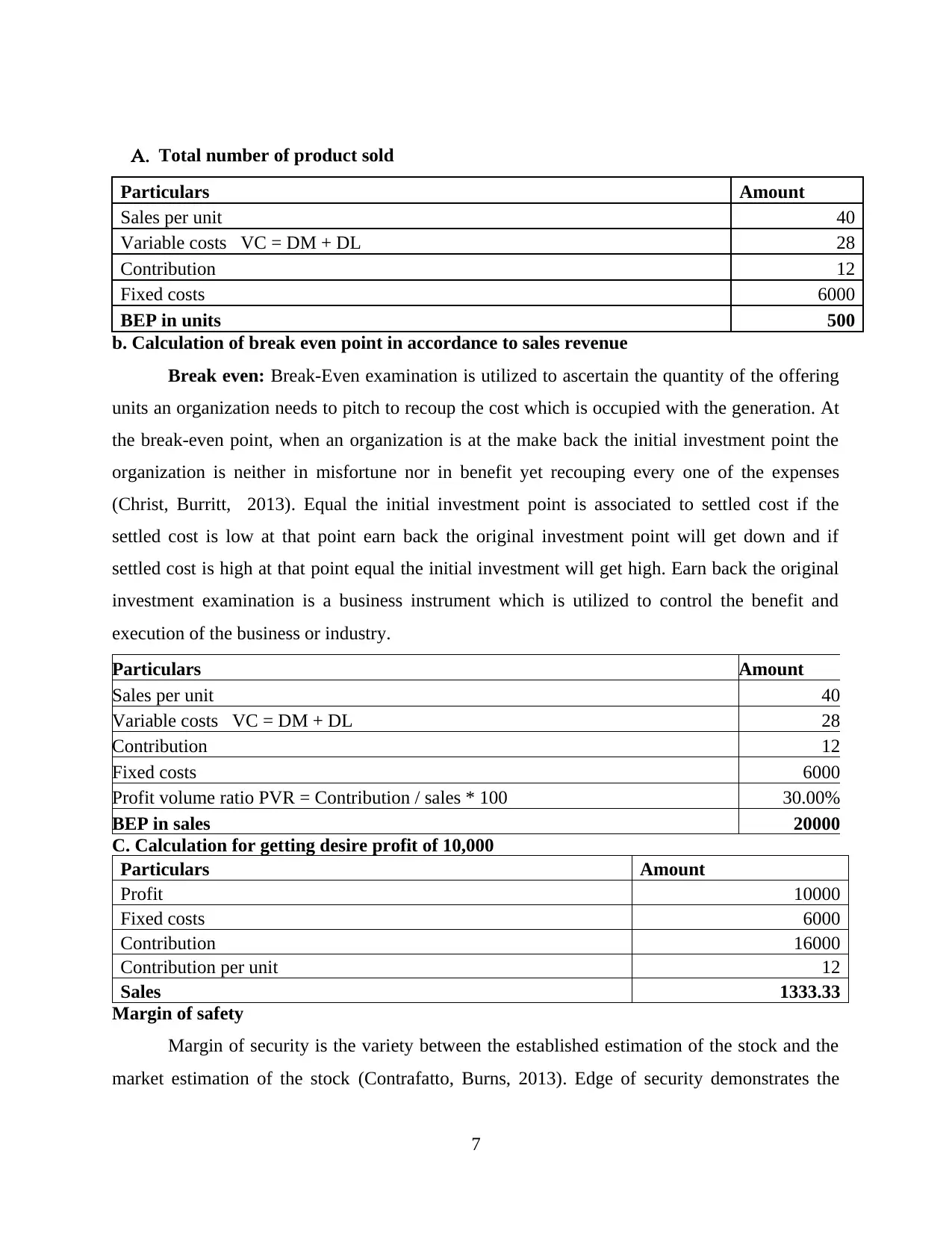

A. Total number of product sold

Particulars Amount

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of break even point in accordance to sales revenue

Break even: Break-Even examination is utilized to ascertain the quantity of the offering

units an organization needs to pitch to recoup the cost which is occupied with the generation. At

the break-even point, when an organization is at the make back the initial investment point the

organization is neither in misfortune nor in benefit yet recouping every one of the expenses

(Christ, Burritt, 2013). Equal the initial investment point is associated to settled cost if the

settled cost is low at that point earn back the original investment point will get down and if

settled cost is high at that point equal the initial investment will get high. Earn back the original

investment examination is a business instrument which is utilized to control the benefit and

execution of the business or industry.

Particulars Amount

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution / sales * 100 30.00%

BEP in sales 20000

C. Calculation for getting desire profit of 10,000

Particulars Amount

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety

Margin of security is the variety between the established estimation of the stock and the

market estimation of the stock (Contrafatto, Burns, 2013). Edge of security demonstrates the

7

Particulars Amount

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

BEP in units 500

b. Calculation of break even point in accordance to sales revenue

Break even: Break-Even examination is utilized to ascertain the quantity of the offering

units an organization needs to pitch to recoup the cost which is occupied with the generation. At

the break-even point, when an organization is at the make back the initial investment point the

organization is neither in misfortune nor in benefit yet recouping every one of the expenses

(Christ, Burritt, 2013). Equal the initial investment point is associated to settled cost if the

settled cost is low at that point earn back the original investment point will get down and if

settled cost is high at that point equal the initial investment will get high. Earn back the original

investment examination is a business instrument which is utilized to control the benefit and

execution of the business or industry.

Particulars Amount

Sales per unit 40

Variable costs VC = DM + DL 28

Contribution 12

Fixed costs 6000

Profit volume ratio PVR = Contribution / sales * 100 30.00%

BEP in sales 20000

C. Calculation for getting desire profit of 10,000

Particulars Amount

Profit 10000

Fixed costs 6000

Contribution 16000

Contribution per unit 12

Sales 1333.33

Margin of safety

Margin of security is the variety between the established estimation of the stock and the

market estimation of the stock (Contrafatto, Burns, 2013). Edge of security demonstrates the

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

contrast between add up to deals or genuine deals and make back the initial investment deals.

Edge of security show the level of offers that if the deals is less then the level at that point,

organization won't have the capacity to pick up benefits. An organization must ensure that there

is an extensive edge of well-being in its storage facility with the goal that labourers are not in

chance. In the event that the level of edge of security is high at that point there is less hazard in

the business.

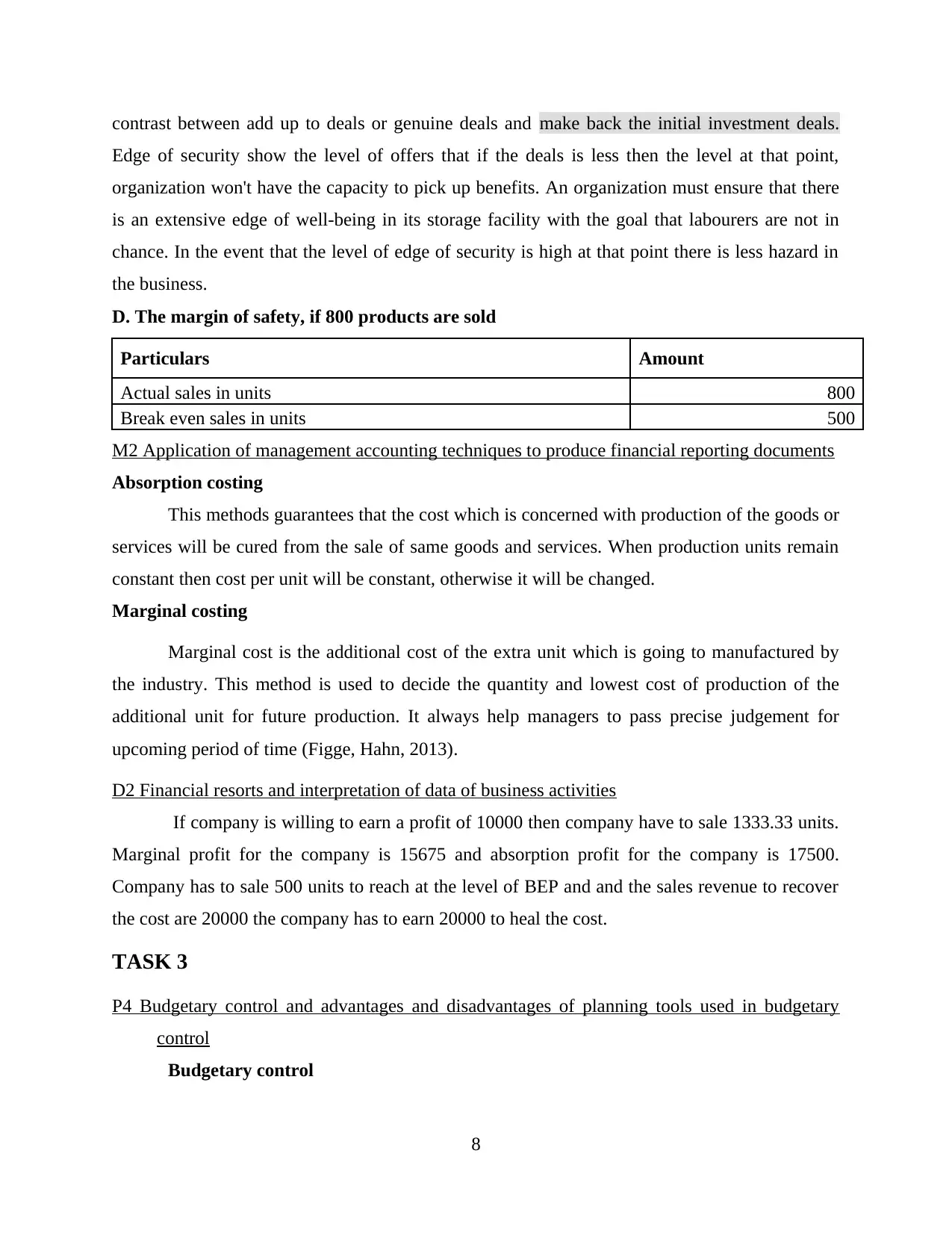

D. The margin of safety, if 800 products are sold

Particulars Amount

Actual sales in units 800

Break even sales in units 500

M2 Application of management accounting techniques to produce financial reporting documents

Absorption costing

This methods guarantees that the cost which is concerned with production of the goods or

services will be cured from the sale of same goods and services. When production units remain

constant then cost per unit will be constant, otherwise it will be changed.

Marginal costing

Marginal cost is the additional cost of the extra unit which is going to manufactured by

the industry. This method is used to decide the quantity and lowest cost of production of the

additional unit for future production. It always help managers to pass precise judgement for

upcoming period of time (Figge, Hahn, 2013).

D2 Financial resorts and interpretation of data of business activities

If company is willing to earn a profit of 10000 then company have to sale 1333.33 units.

Marginal profit for the company is 15675 and absorption profit for the company is 17500.

Company has to sale 500 units to reach at the level of BEP and and the sales revenue to recover

the cost are 20000 the company has to earn 20000 to heal the cost.

TASK 3

P4 Budgetary control and advantages and disadvantages of planning tools used in budgetary

control

Budgetary control

8

Edge of security show the level of offers that if the deals is less then the level at that point,

organization won't have the capacity to pick up benefits. An organization must ensure that there

is an extensive edge of well-being in its storage facility with the goal that labourers are not in

chance. In the event that the level of edge of security is high at that point there is less hazard in

the business.

D. The margin of safety, if 800 products are sold

Particulars Amount

Actual sales in units 800

Break even sales in units 500

M2 Application of management accounting techniques to produce financial reporting documents

Absorption costing

This methods guarantees that the cost which is concerned with production of the goods or

services will be cured from the sale of same goods and services. When production units remain

constant then cost per unit will be constant, otherwise it will be changed.

Marginal costing

Marginal cost is the additional cost of the extra unit which is going to manufactured by

the industry. This method is used to decide the quantity and lowest cost of production of the

additional unit for future production. It always help managers to pass precise judgement for

upcoming period of time (Figge, Hahn, 2013).

D2 Financial resorts and interpretation of data of business activities

If company is willing to earn a profit of 10000 then company have to sale 1333.33 units.

Marginal profit for the company is 15675 and absorption profit for the company is 17500.

Company has to sale 500 units to reach at the level of BEP and and the sales revenue to recover

the cost are 20000 the company has to earn 20000 to heal the cost.

TASK 3

P4 Budgetary control and advantages and disadvantages of planning tools used in budgetary

control

Budgetary control

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

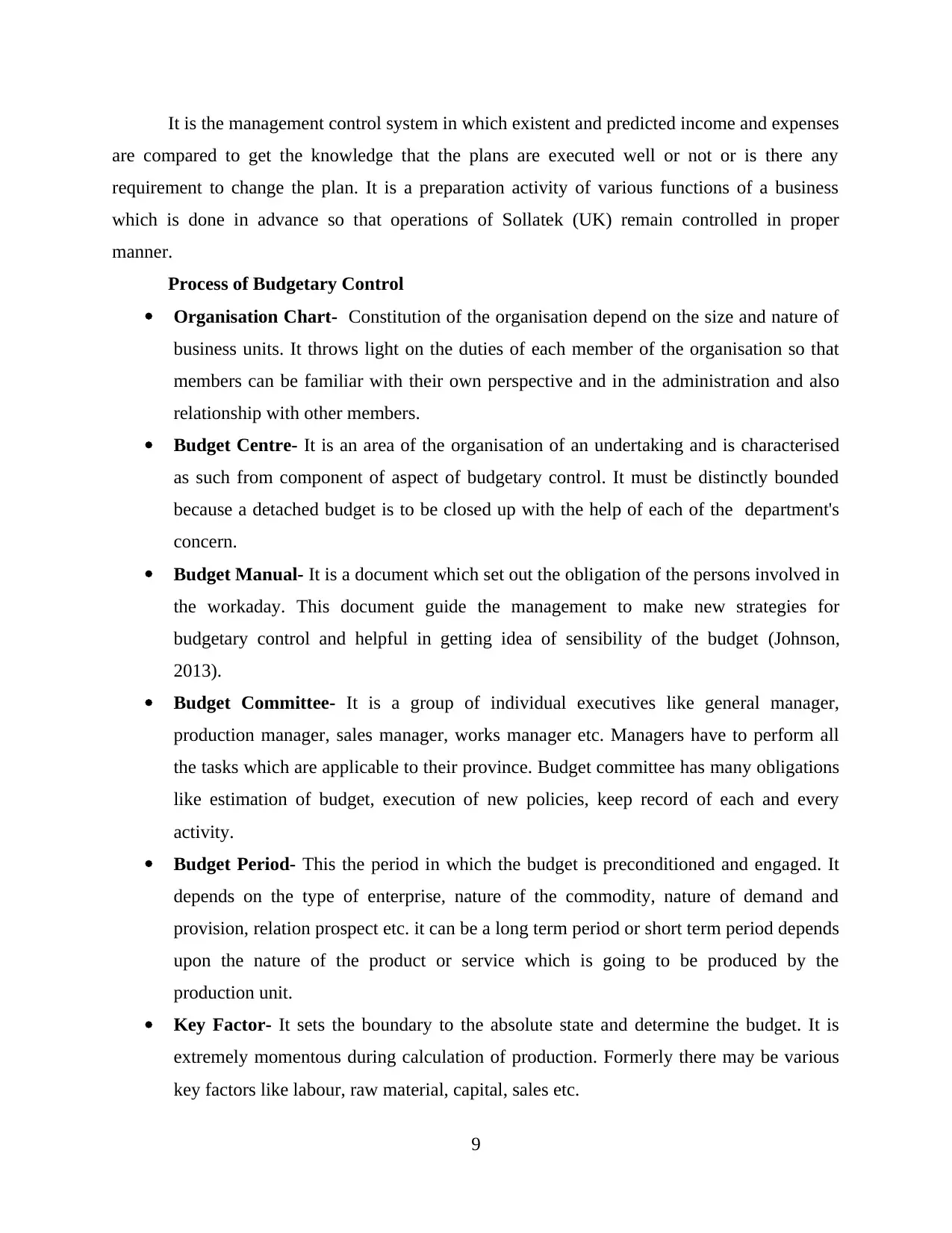

It is the management control system in which existent and predicted income and expenses

are compared to get the knowledge that the plans are executed well or not or is there any

requirement to change the plan. It is a preparation activity of various functions of a business

which is done in advance so that operations of Sollatek (UK) remain controlled in proper

manner.

Process of Budgetary Control

Organisation Chart- Constitution of the organisation depend on the size and nature of

business units. It throws light on the duties of each member of the organisation so that

members can be familiar with their own perspective and in the administration and also

relationship with other members.

Budget Centre- It is an area of the organisation of an undertaking and is characterised

as such from component of aspect of budgetary control. It must be distinctly bounded

because a detached budget is to be closed up with the help of each of the department's

concern.

Budget Manual- It is a document which set out the obligation of the persons involved in

the workaday. This document guide the management to make new strategies for

budgetary control and helpful in getting idea of sensibility of the budget (Johnson,

2013).

Budget Committee- It is a group of individual executives like general manager,

production manager, sales manager, works manager etc. Managers have to perform all

the tasks which are applicable to their province. Budget committee has many obligations

like estimation of budget, execution of new policies, keep record of each and every

activity.

Budget Period- This the period in which the budget is preconditioned and engaged. It

depends on the type of enterprise, nature of the commodity, nature of demand and

provision, relation prospect etc. it can be a long term period or short term period depends

upon the nature of the product or service which is going to be produced by the

production unit.

Key Factor- It sets the boundary to the absolute state and determine the budget. It is

extremely momentous during calculation of production. Formerly there may be various

key factors like labour, raw material, capital, sales etc.

9

are compared to get the knowledge that the plans are executed well or not or is there any

requirement to change the plan. It is a preparation activity of various functions of a business

which is done in advance so that operations of Sollatek (UK) remain controlled in proper

manner.

Process of Budgetary Control

Organisation Chart- Constitution of the organisation depend on the size and nature of

business units. It throws light on the duties of each member of the organisation so that

members can be familiar with their own perspective and in the administration and also

relationship with other members.

Budget Centre- It is an area of the organisation of an undertaking and is characterised

as such from component of aspect of budgetary control. It must be distinctly bounded

because a detached budget is to be closed up with the help of each of the department's

concern.

Budget Manual- It is a document which set out the obligation of the persons involved in

the workaday. This document guide the management to make new strategies for

budgetary control and helpful in getting idea of sensibility of the budget (Johnson,

2013).

Budget Committee- It is a group of individual executives like general manager,

production manager, sales manager, works manager etc. Managers have to perform all

the tasks which are applicable to their province. Budget committee has many obligations

like estimation of budget, execution of new policies, keep record of each and every

activity.

Budget Period- This the period in which the budget is preconditioned and engaged. It

depends on the type of enterprise, nature of the commodity, nature of demand and

provision, relation prospect etc. it can be a long term period or short term period depends

upon the nature of the product or service which is going to be produced by the

production unit.

Key Factor- It sets the boundary to the absolute state and determine the budget. It is

extremely momentous during calculation of production. Formerly there may be various

key factors like labour, raw material, capital, sales etc.

9

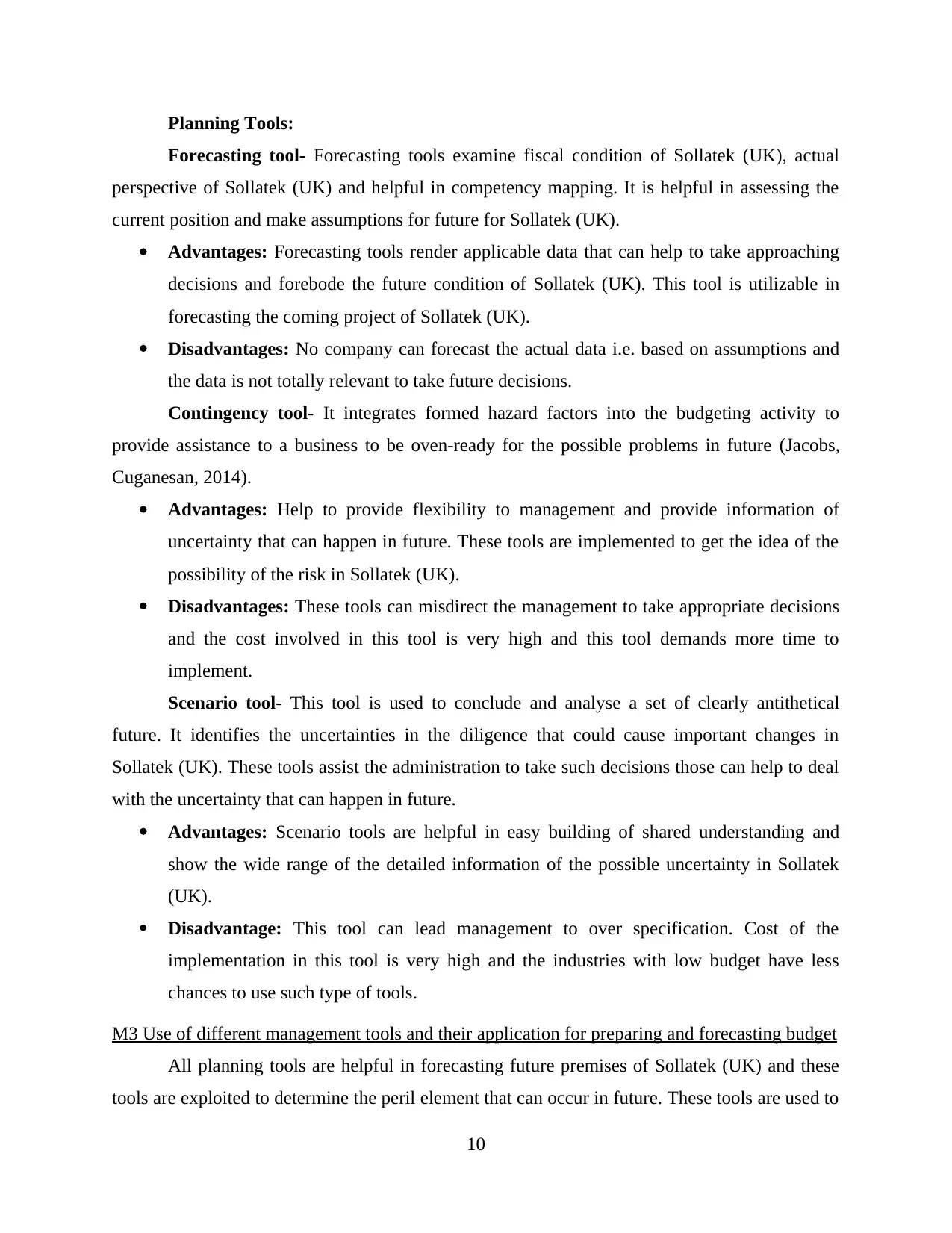

Planning Tools:

Forecasting tool- Forecasting tools examine fiscal condition of Sollatek (UK), actual

perspective of Sollatek (UK) and helpful in competency mapping. It is helpful in assessing the

current position and make assumptions for future for Sollatek (UK).

Advantages: Forecasting tools render applicable data that can help to take approaching

decisions and forebode the future condition of Sollatek (UK). This tool is utilizable in

forecasting the coming project of Sollatek (UK).

Disadvantages: No company can forecast the actual data i.e. based on assumptions and

the data is not totally relevant to take future decisions.

Contingency tool- It integrates formed hazard factors into the budgeting activity to

provide assistance to a business to be oven-ready for the possible problems in future (Jacobs,

Cuganesan, 2014).

Advantages: Help to provide flexibility to management and provide information of

uncertainty that can happen in future. These tools are implemented to get the idea of the

possibility of the risk in Sollatek (UK).

Disadvantages: These tools can misdirect the management to take appropriate decisions

and the cost involved in this tool is very high and this tool demands more time to

implement.

Scenario tool- This tool is used to conclude and analyse a set of clearly antithetical

future. It identifies the uncertainties in the diligence that could cause important changes in

Sollatek (UK). These tools assist the administration to take such decisions those can help to deal

with the uncertainty that can happen in future.

Advantages: Scenario tools are helpful in easy building of shared understanding and

show the wide range of the detailed information of the possible uncertainty in Sollatek

(UK).

Disadvantage: This tool can lead management to over specification. Cost of the

implementation in this tool is very high and the industries with low budget have less

chances to use such type of tools.

M3 Use of different management tools and their application for preparing and forecasting budget

All planning tools are helpful in forecasting future premises of Sollatek (UK) and these

tools are exploited to determine the peril element that can occur in future. These tools are used to

10

Forecasting tool- Forecasting tools examine fiscal condition of Sollatek (UK), actual

perspective of Sollatek (UK) and helpful in competency mapping. It is helpful in assessing the

current position and make assumptions for future for Sollatek (UK).

Advantages: Forecasting tools render applicable data that can help to take approaching

decisions and forebode the future condition of Sollatek (UK). This tool is utilizable in

forecasting the coming project of Sollatek (UK).

Disadvantages: No company can forecast the actual data i.e. based on assumptions and

the data is not totally relevant to take future decisions.

Contingency tool- It integrates formed hazard factors into the budgeting activity to

provide assistance to a business to be oven-ready for the possible problems in future (Jacobs,

Cuganesan, 2014).

Advantages: Help to provide flexibility to management and provide information of

uncertainty that can happen in future. These tools are implemented to get the idea of the

possibility of the risk in Sollatek (UK).

Disadvantages: These tools can misdirect the management to take appropriate decisions

and the cost involved in this tool is very high and this tool demands more time to

implement.

Scenario tool- This tool is used to conclude and analyse a set of clearly antithetical

future. It identifies the uncertainties in the diligence that could cause important changes in

Sollatek (UK). These tools assist the administration to take such decisions those can help to deal

with the uncertainty that can happen in future.

Advantages: Scenario tools are helpful in easy building of shared understanding and

show the wide range of the detailed information of the possible uncertainty in Sollatek

(UK).

Disadvantage: This tool can lead management to over specification. Cost of the

implementation in this tool is very high and the industries with low budget have less

chances to use such type of tools.

M3 Use of different management tools and their application for preparing and forecasting budget

All planning tools are helpful in forecasting future premises of Sollatek (UK) and these

tools are exploited to determine the peril element that can occur in future. These tools are used to

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.