Management Accounting Homework Solution: Costing and Statements

VerifiedAdded on 2023/04/06

|14

|1048

|317

Homework Assignment

AI Summary

This management accounting assignment solution addresses key concepts including job costing, process costing (weighted average and FIFO methods), and the preparation and analysis of income statements. The assignment begins with an analysis of job costing, including calculations and explanations. It then delves into cost flows and the importance of proper cost classification in income statements for effective decision-making. The solution further explores process costing, comparing and contrasting the weighted average and FIFO methods, and provides detailed calculations and interpretations. The document also examines the impact of different costing methods on reported profits and provides recommendations based on the specific scenario. Overall, the assignment provides a comprehensive understanding of core management accounting principles and their application in various business contexts.

Running head: MANAGEMENT ACCOUNTING

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Management Accounting

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT ACCOUNTING

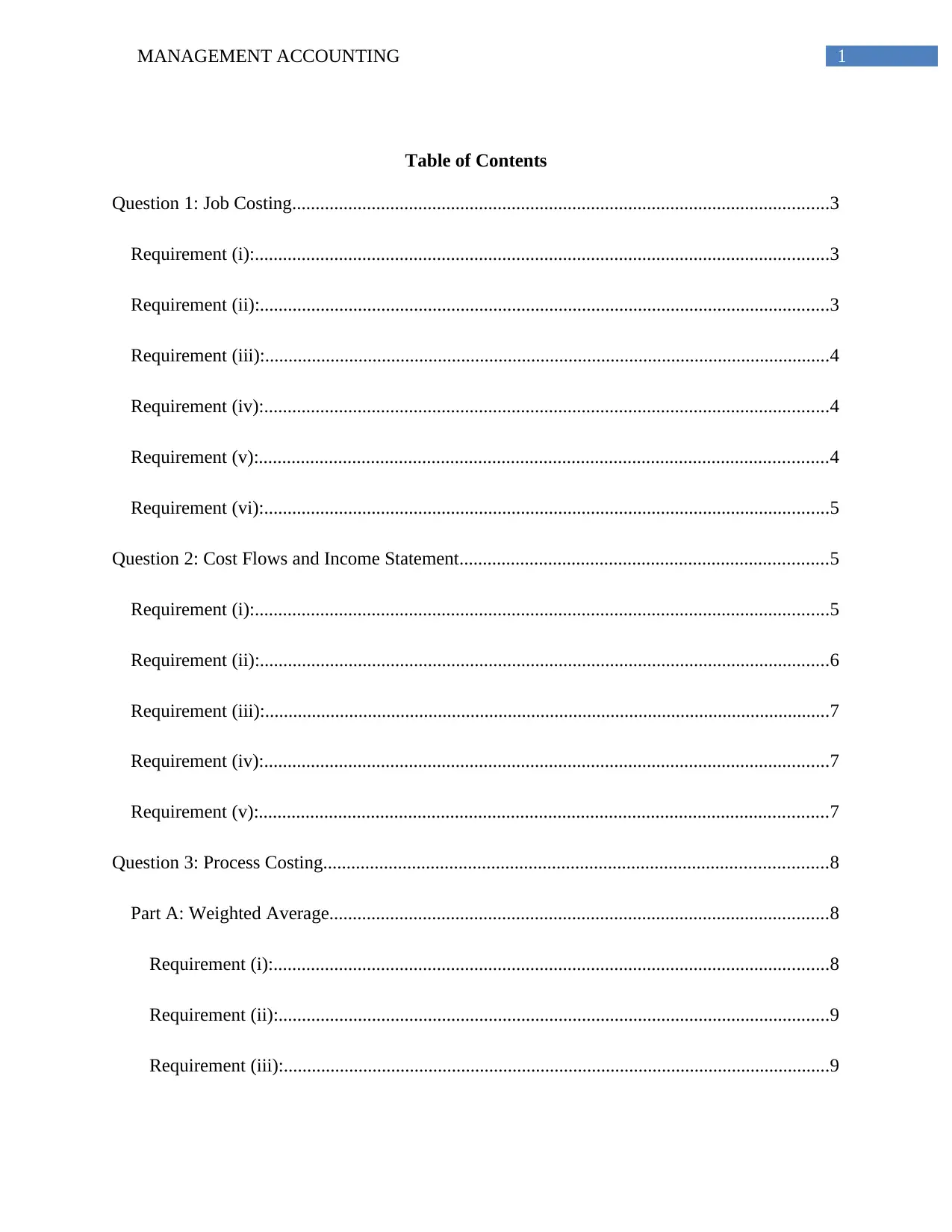

Table of Contents

Question 1: Job Costing...................................................................................................................3

Requirement (i):...........................................................................................................................3

Requirement (ii):..........................................................................................................................3

Requirement (iii):.........................................................................................................................4

Requirement (iv):.........................................................................................................................4

Requirement (v):..........................................................................................................................4

Requirement (vi):.........................................................................................................................5

Question 2: Cost Flows and Income Statement...............................................................................5

Requirement (i):...........................................................................................................................5

Requirement (ii):..........................................................................................................................6

Requirement (iii):.........................................................................................................................7

Requirement (iv):.........................................................................................................................7

Requirement (v):..........................................................................................................................7

Question 3: Process Costing............................................................................................................8

Part A: Weighted Average...........................................................................................................8

Requirement (i):.......................................................................................................................8

Requirement (ii):......................................................................................................................9

Requirement (iii):.....................................................................................................................9

Table of Contents

Question 1: Job Costing...................................................................................................................3

Requirement (i):...........................................................................................................................3

Requirement (ii):..........................................................................................................................3

Requirement (iii):.........................................................................................................................4

Requirement (iv):.........................................................................................................................4

Requirement (v):..........................................................................................................................4

Requirement (vi):.........................................................................................................................5

Question 2: Cost Flows and Income Statement...............................................................................5

Requirement (i):...........................................................................................................................5

Requirement (ii):..........................................................................................................................6

Requirement (iii):.........................................................................................................................7

Requirement (iv):.........................................................................................................................7

Requirement (v):..........................................................................................................................7

Question 3: Process Costing............................................................................................................8

Part A: Weighted Average...........................................................................................................8

Requirement (i):.......................................................................................................................8

Requirement (ii):......................................................................................................................9

Requirement (iii):.....................................................................................................................9

2MANAGEMENT ACCOUNTING

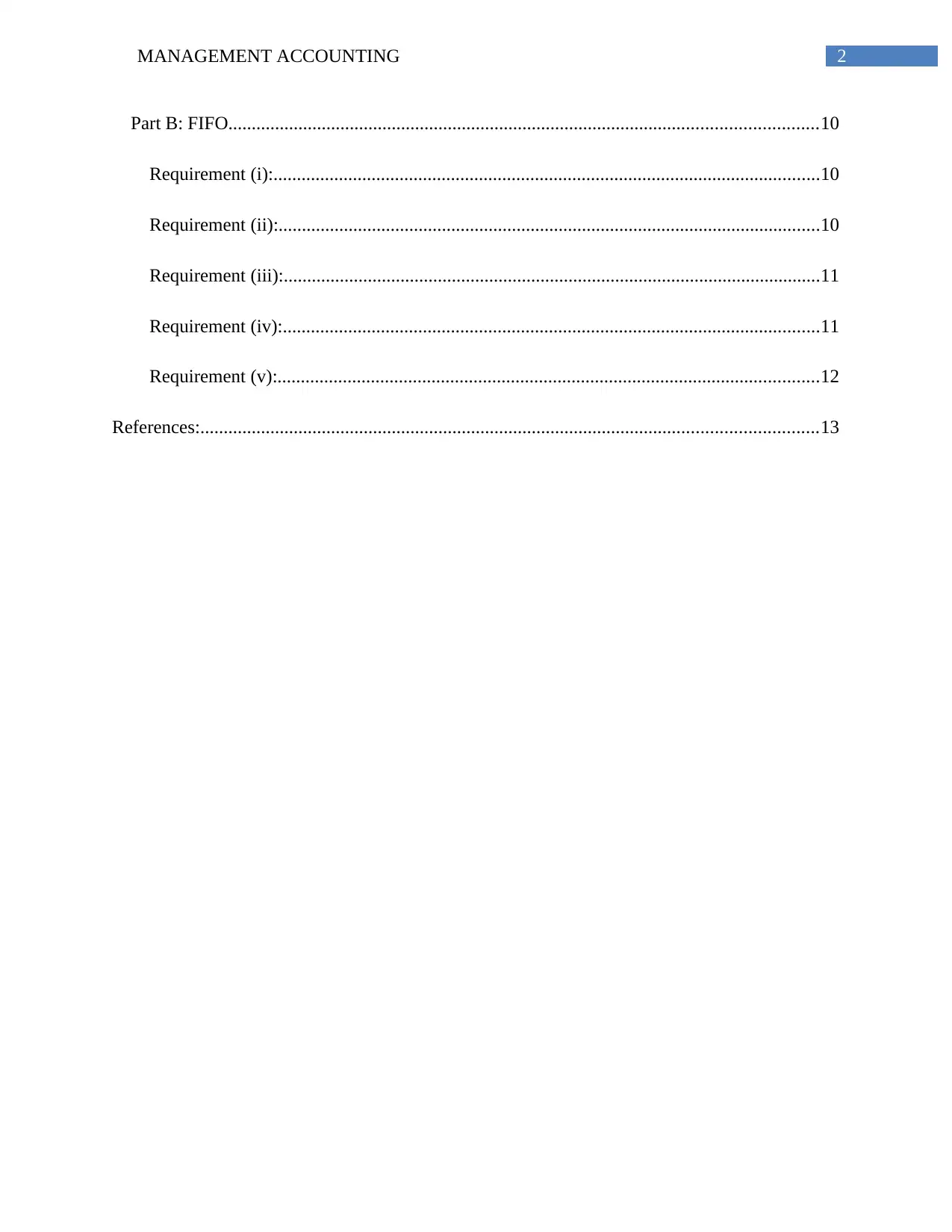

Part B: FIFO..............................................................................................................................10

Requirement (i):.....................................................................................................................10

Requirement (ii):....................................................................................................................10

Requirement (iii):...................................................................................................................11

Requirement (iv):...................................................................................................................11

Requirement (v):....................................................................................................................12

References:....................................................................................................................................13

Part B: FIFO..............................................................................................................................10

Requirement (i):.....................................................................................................................10

Requirement (ii):....................................................................................................................10

Requirement (iii):...................................................................................................................11

Requirement (iv):...................................................................................................................11

Requirement (v):....................................................................................................................12

References:....................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT ACCOUNTING

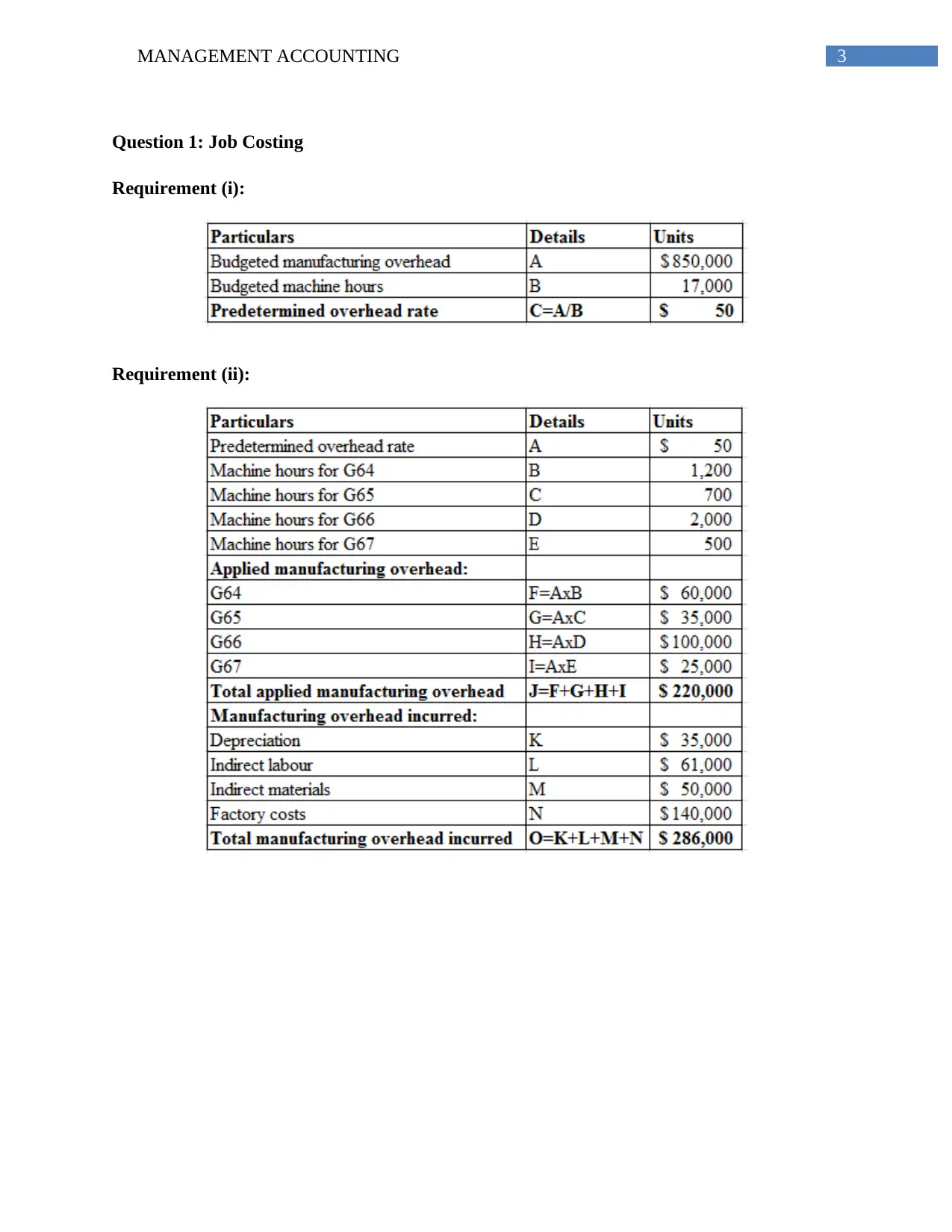

Question 1: Job Costing

Requirement (i):

Requirement (ii):

Question 1: Job Costing

Requirement (i):

Requirement (ii):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT ACCOUNTING

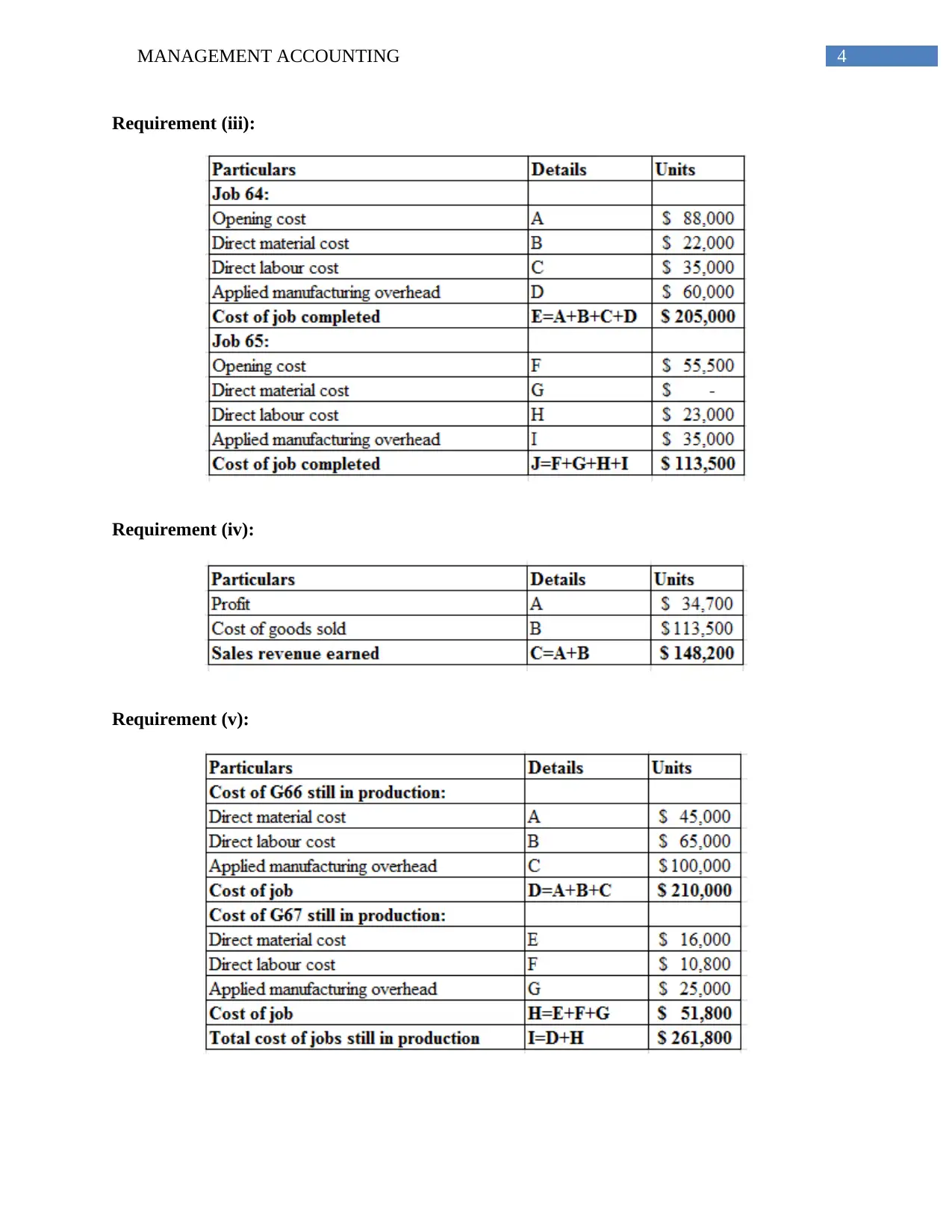

Requirement (iii):

Requirement (iv):

Requirement (v):

Requirement (iii):

Requirement (iv):

Requirement (v):

5MANAGEMENT ACCOUNTING

Requirement (vi):

The cost of finished goods inventory has increased by the cost of complete units

transferred to it ($205,000 and $113,500). However, the Job G65 has been sold, which has

resulted in increase in cost of finished goods inventory by $210,000.

Question 2: Cost Flows and Income Statement

Requirement (i):

LTC is identified as a manufacturer of plumbing and tap materials. The organisation does

not have any specialised accountant. It uses cost plus 50% mark-up in order to price its products.

After analysing the income statement of the organisation, it has been identified that it does not

categorise its costs in the income statement into direct and indirect or variable and fixed costs.

LTC considers all expenses together for calculating its overall expenses and the profit or loss is

computed by subtracting from overall expenses from overall revenue. The cost classification in

the income statement assists in better cost management, which could not be found in the income

statement of LTC (Fullerton, Kennedy & Widener, 2014).

Requirement (vi):

The cost of finished goods inventory has increased by the cost of complete units

transferred to it ($205,000 and $113,500). However, the Job G65 has been sold, which has

resulted in increase in cost of finished goods inventory by $210,000.

Question 2: Cost Flows and Income Statement

Requirement (i):

LTC is identified as a manufacturer of plumbing and tap materials. The organisation does

not have any specialised accountant. It uses cost plus 50% mark-up in order to price its products.

After analysing the income statement of the organisation, it has been identified that it does not

categorise its costs in the income statement into direct and indirect or variable and fixed costs.

LTC considers all expenses together for calculating its overall expenses and the profit or loss is

computed by subtracting from overall expenses from overall revenue. The cost classification in

the income statement assists in better cost management, which could not be found in the income

statement of LTC (Fullerton, Kennedy & Widener, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT ACCOUNTING

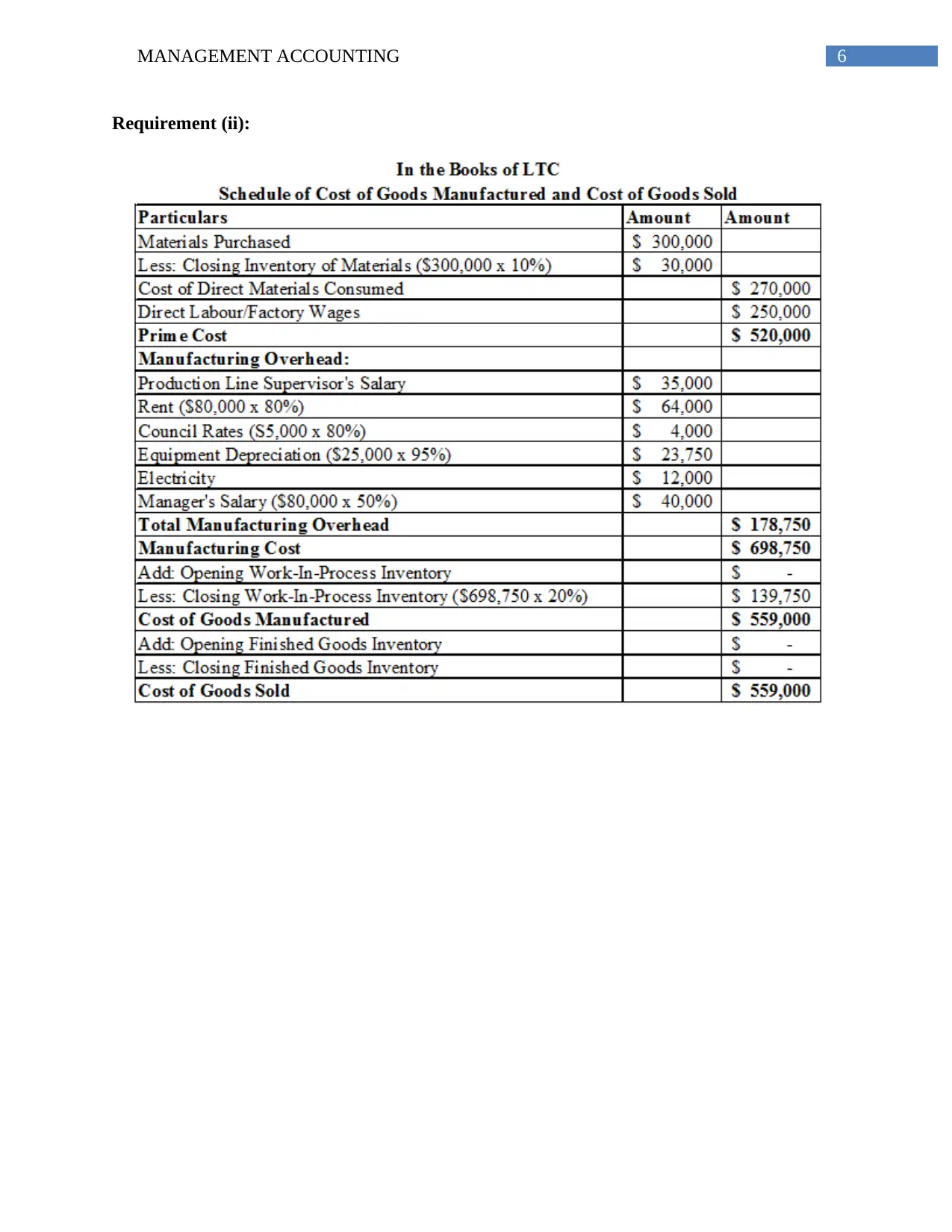

Requirement (ii):

Requirement (ii):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT ACCOUNTING

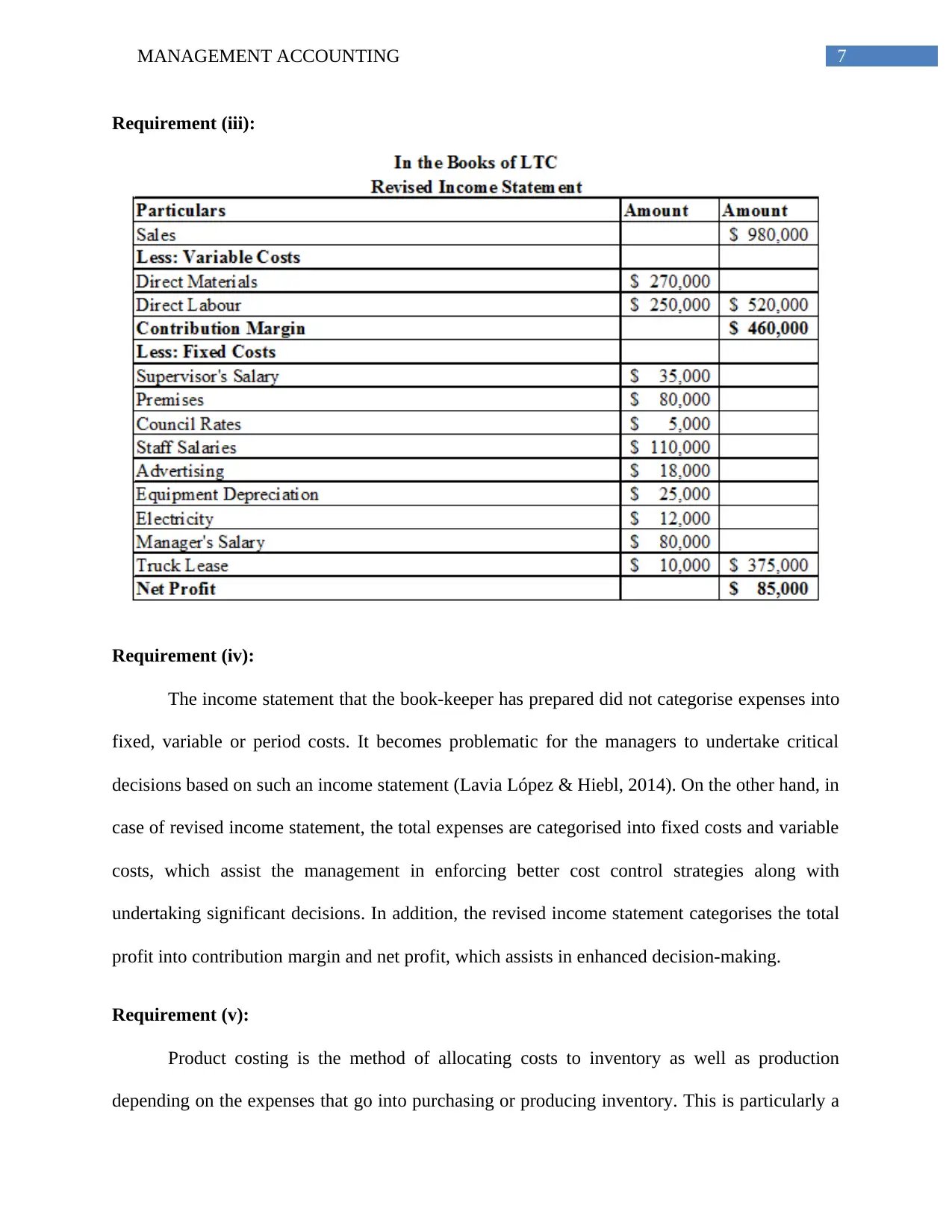

Requirement (iii):

Requirement (iv):

The income statement that the book-keeper has prepared did not categorise expenses into

fixed, variable or period costs. It becomes problematic for the managers to undertake critical

decisions based on such an income statement (Lavia López & Hiebl, 2014). On the other hand, in

case of revised income statement, the total expenses are categorised into fixed costs and variable

costs, which assist the management in enforcing better cost control strategies along with

undertaking significant decisions. In addition, the revised income statement categorises the total

profit into contribution margin and net profit, which assists in enhanced decision-making.

Requirement (v):

Product costing is the method of allocating costs to inventory as well as production

depending on the expenses that go into purchasing or producing inventory. This is particularly a

Requirement (iii):

Requirement (iv):

The income statement that the book-keeper has prepared did not categorise expenses into

fixed, variable or period costs. It becomes problematic for the managers to undertake critical

decisions based on such an income statement (Lavia López & Hiebl, 2014). On the other hand, in

case of revised income statement, the total expenses are categorised into fixed costs and variable

costs, which assist the management in enforcing better cost control strategies along with

undertaking significant decisions. In addition, the revised income statement categorises the total

profit into contribution margin and net profit, which assists in enhanced decision-making.

Requirement (v):

Product costing is the method of allocating costs to inventory as well as production

depending on the expenses that go into purchasing or producing inventory. This is particularly a

8MANAGEMENT ACCOUNTING

significant process for the manufacturers and there are a number of benefits to such customised

costing. With the help of product costing analysis, it becomes possible to ensure accuracy in

variable costing, in which product units are allocated to the variable costs related to their

creation, while leaving fixed costs to other expense accounts (Modell, 2014). This assists in

enforcing the value principle by attaching costs to the value created throughout the organisation.

Moreover, when a business manager undertakes decisions, they often include return on

investment and the amount of profit an organisation could obtain from a specific action. Product

costing could be a foundation on which these decisions would be undertaken. For instance, a

manager used to absorption costing where all production costs are related to products, it might

not be possible to realise the advantages of particular pricing contracts not appearing to include

profit (Otley, 2016). However, when variable costing is used, the manager might find that the

variable costs are the only expenses changing and that the contract would be profitable.

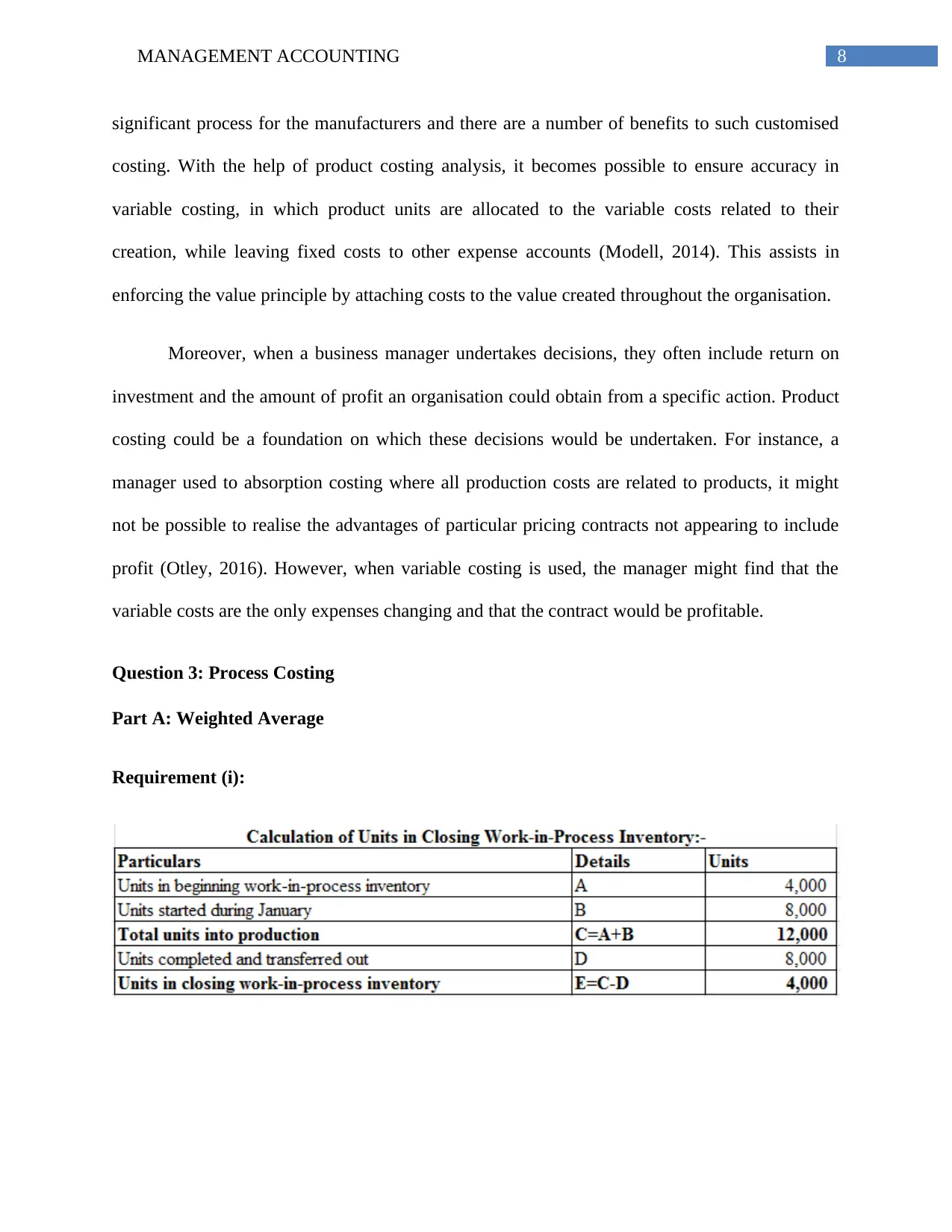

Question 3: Process Costing

Part A: Weighted Average

Requirement (i):

significant process for the manufacturers and there are a number of benefits to such customised

costing. With the help of product costing analysis, it becomes possible to ensure accuracy in

variable costing, in which product units are allocated to the variable costs related to their

creation, while leaving fixed costs to other expense accounts (Modell, 2014). This assists in

enforcing the value principle by attaching costs to the value created throughout the organisation.

Moreover, when a business manager undertakes decisions, they often include return on

investment and the amount of profit an organisation could obtain from a specific action. Product

costing could be a foundation on which these decisions would be undertaken. For instance, a

manager used to absorption costing where all production costs are related to products, it might

not be possible to realise the advantages of particular pricing contracts not appearing to include

profit (Otley, 2016). However, when variable costing is used, the manager might find that the

variable costs are the only expenses changing and that the contract would be profitable.

Question 3: Process Costing

Part A: Weighted Average

Requirement (i):

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

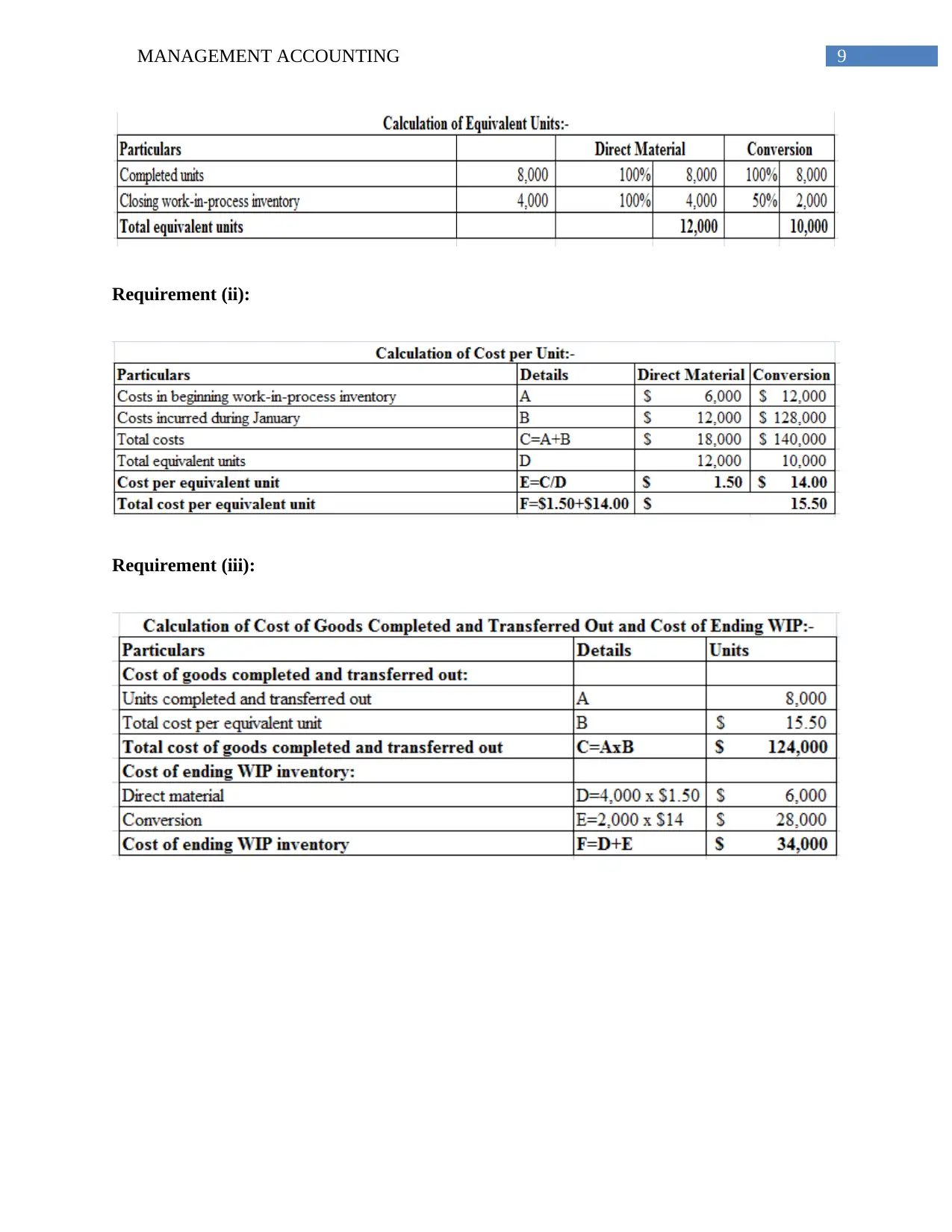

9MANAGEMENT ACCOUNTING

Requirement (ii):

Requirement (iii):

Requirement (ii):

Requirement (iii):

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

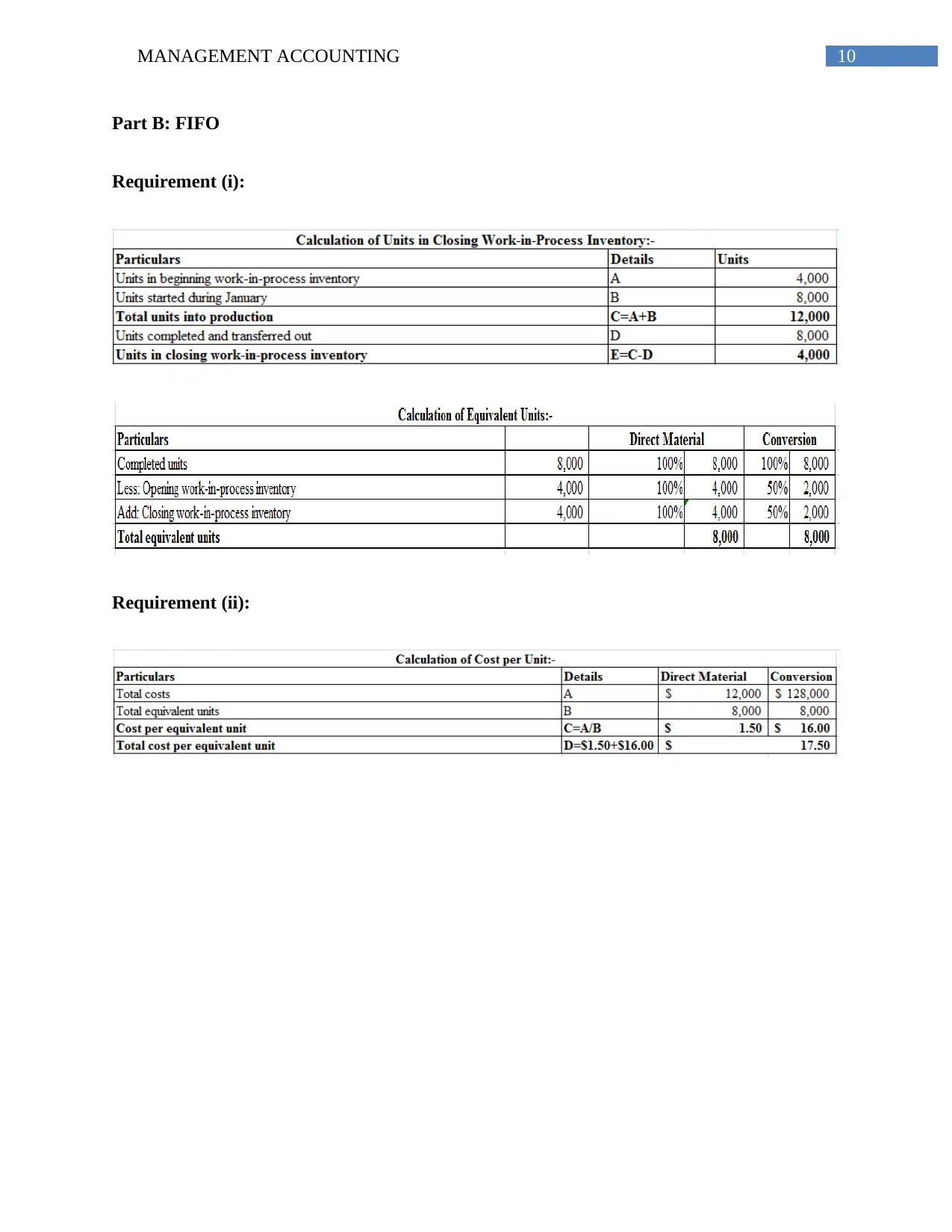

10MANAGEMENT ACCOUNTING

Part B: FIFO

Requirement (i):

Requirement (ii):

Part B: FIFO

Requirement (i):

Requirement (ii):

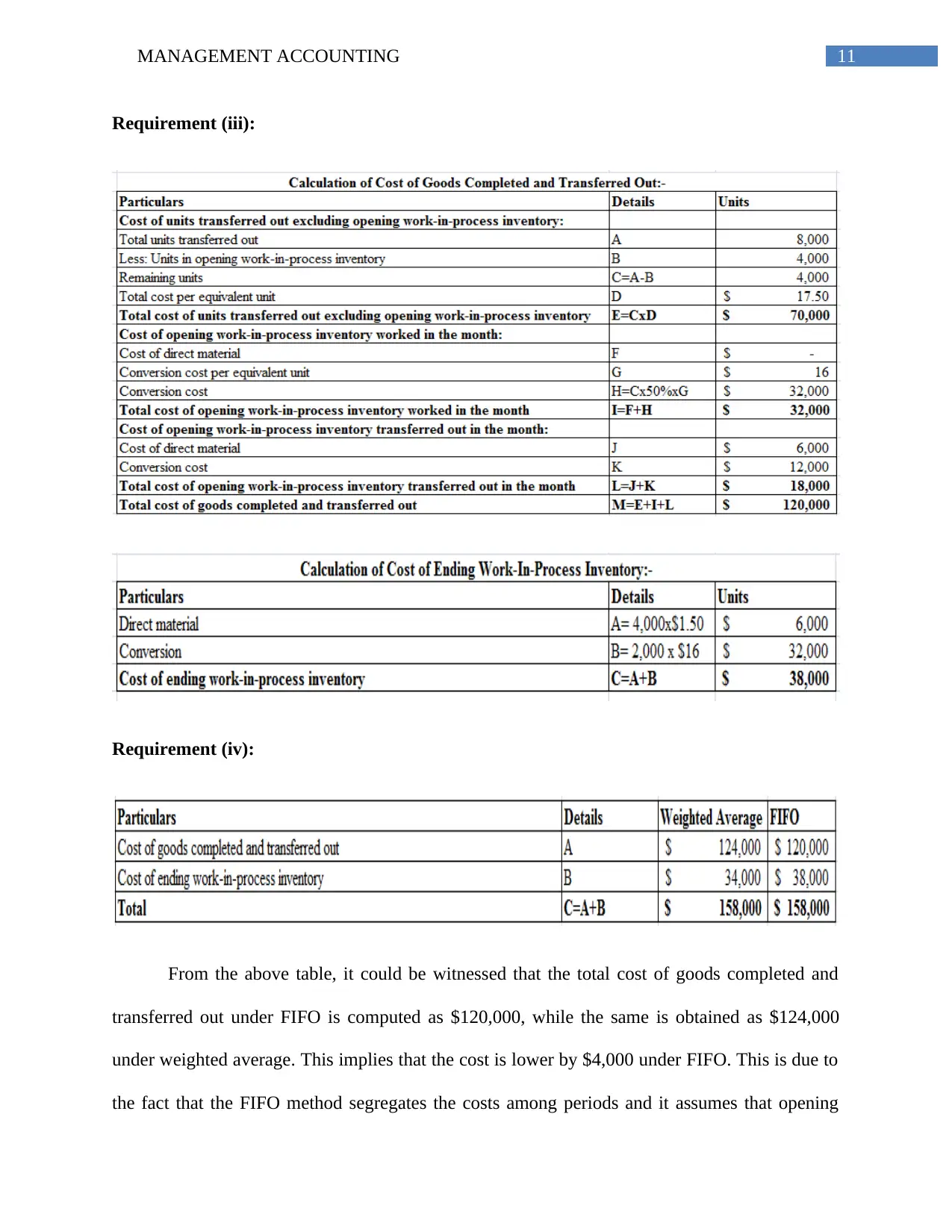

11MANAGEMENT ACCOUNTING

Requirement (iii):

Requirement (iv):

From the above table, it could be witnessed that the total cost of goods completed and

transferred out under FIFO is computed as $120,000, while the same is obtained as $124,000

under weighted average. This implies that the cost is lower by $4,000 under FIFO. This is due to

the fact that the FIFO method segregates the costs among periods and it assumes that opening

Requirement (iii):

Requirement (iv):

From the above table, it could be witnessed that the total cost of goods completed and

transferred out under FIFO is computed as $120,000, while the same is obtained as $124,000

under weighted average. This implies that the cost is lower by $4,000 under FIFO. This is due to

the fact that the FIFO method segregates the costs among periods and it assumes that opening

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.