Management Accounting Information Analysis - University Assignment

VerifiedAdded on 2020/04/13

|5

|607

|33

Homework Assignment

AI Summary

This assignment solution focuses on management accounting information, specifically addressing standard costing and variance analysis. It includes calculations for direct material and direct labor variances, identifying both favorable and unfavorable variances. The solution demonstrates the impact of changes in information on the calculated variances. The document also provides a calculation of labor rate and efficiency variances, and presents a diagram for the labor rate variance. This resource is valuable for students studying management accounting, providing a clear understanding of cost analysis and variance interpretation.

Running head: MANAGEMENT ACCOUNTING INFORMATION

Management accounting information

Name of the student

Name of the university

Author note

Management accounting information

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT ACCOUNTING INFORMATION

Table of Contents

Question 1..................................................................................................................................2

1. Standard cost...................................................................................................................2

2. Variances.........................................................................................................................2

3. Changes in the solution with change in information.......................................................3

Question 2..................................................................................................................................3

Table of Contents

Question 1..................................................................................................................................2

1. Standard cost...................................................................................................................2

2. Variances.........................................................................................................................2

3. Changes in the solution with change in information.......................................................3

Question 2..................................................................................................................................3

2MANAGEMENT ACCOUNTING INFORMATION

Question 1

Total production (units) 1200

Standard cost per unit

Direct material $ 24.00

Direct labour $ 64.00

Total cost per unit $ 88.00

1. Standard cost

Standard material cost for January = $ 24 * 1200 units = $ 28,800

Standard labour cost for January = $ 64 * 1200 units = $ 76,800

2. Variances

a. Direct material price variance = (Actual quantity purchased * actual price) – (actual

quantity purchased * standard price)

= (19000*1.30) – (19000*1.2)

= 1900 (Unfavourable)

b. Direct material quantity variance = (standard quantity – actual quantity) * standard

price

= [(1200*20) – 19000] * $ 24

= $ 120,000 (Favourable)

c. Direct labour rate variance = (actual hours worked * actual rate) – (actual hours

worked * standard rate)

= (4200 * $ 17) – (4200 * $ 16)

= $ 4200 (Unfavourable)

d. Direct labour efficiency variance = (actual hours worked * standard rate) – (standard

hours allowed * standard rate)

Question 1

Total production (units) 1200

Standard cost per unit

Direct material $ 24.00

Direct labour $ 64.00

Total cost per unit $ 88.00

1. Standard cost

Standard material cost for January = $ 24 * 1200 units = $ 28,800

Standard labour cost for January = $ 64 * 1200 units = $ 76,800

2. Variances

a. Direct material price variance = (Actual quantity purchased * actual price) – (actual

quantity purchased * standard price)

= (19000*1.30) – (19000*1.2)

= 1900 (Unfavourable)

b. Direct material quantity variance = (standard quantity – actual quantity) * standard

price

= [(1200*20) – 19000] * $ 24

= $ 120,000 (Favourable)

c. Direct labour rate variance = (actual hours worked * actual rate) – (actual hours

worked * standard rate)

= (4200 * $ 17) – (4200 * $ 16)

= $ 4200 (Unfavourable)

d. Direct labour efficiency variance = (actual hours worked * standard rate) – (standard

hours allowed * standard rate)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT ACCOUNTING INFORMATION

= (4200 * $ 16) – (1200*4*16)

= $ 9600 (Favourable)

3. Changes in the solution with change in information

a. Direct material price variance = (Actual quantity purchased * actual price) – (actual

quantity purchased * standard price)

= (19000*1.30) – (19000*1.4)

= 1900 (Favourable)

b. Direct material quantity variance = (standard quantity – actual quantity) * standard

price

= [(1200*20) – 19000] * 20*$ 1.4

= $ 140,000 (Favourable)

c. Direct labour rate variance = (actual hours worked * actual rate) – (actual hours

worked * standard rate)

= (4200 * $ 17) – (4200 * $ 18)

= $ 4200 (Favourable)

d. Direct labour efficiency variance = (actual hours worked * standard rate) – (standard

hours allowed * standard rate)

= (4200 * $ 18) – (1200*4*18)

= $ 10,800 (Favourable)

Question 2

a. Direct labour rate variance = (actual hours worked * actual rate) – (actual hours

worked * standard rate)

= $ 120,250 – ($ 120,250/$ 18.50 * $ 18)

= $ 120,250 – $117,000 = $ 3,250 (Unfavourable)

= (4200 * $ 16) – (1200*4*16)

= $ 9600 (Favourable)

3. Changes in the solution with change in information

a. Direct material price variance = (Actual quantity purchased * actual price) – (actual

quantity purchased * standard price)

= (19000*1.30) – (19000*1.4)

= 1900 (Favourable)

b. Direct material quantity variance = (standard quantity – actual quantity) * standard

price

= [(1200*20) – 19000] * 20*$ 1.4

= $ 140,000 (Favourable)

c. Direct labour rate variance = (actual hours worked * actual rate) – (actual hours

worked * standard rate)

= (4200 * $ 17) – (4200 * $ 18)

= $ 4200 (Favourable)

d. Direct labour efficiency variance = (actual hours worked * standard rate) – (standard

hours allowed * standard rate)

= (4200 * $ 18) – (1200*4*18)

= $ 10,800 (Favourable)

Question 2

a. Direct labour rate variance = (actual hours worked * actual rate) – (actual hours

worked * standard rate)

= $ 120,250 – ($ 120,250/$ 18.50 * $ 18)

= $ 120,250 – $117,000 = $ 3,250 (Unfavourable)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT ACCOUNTING INFORMATION

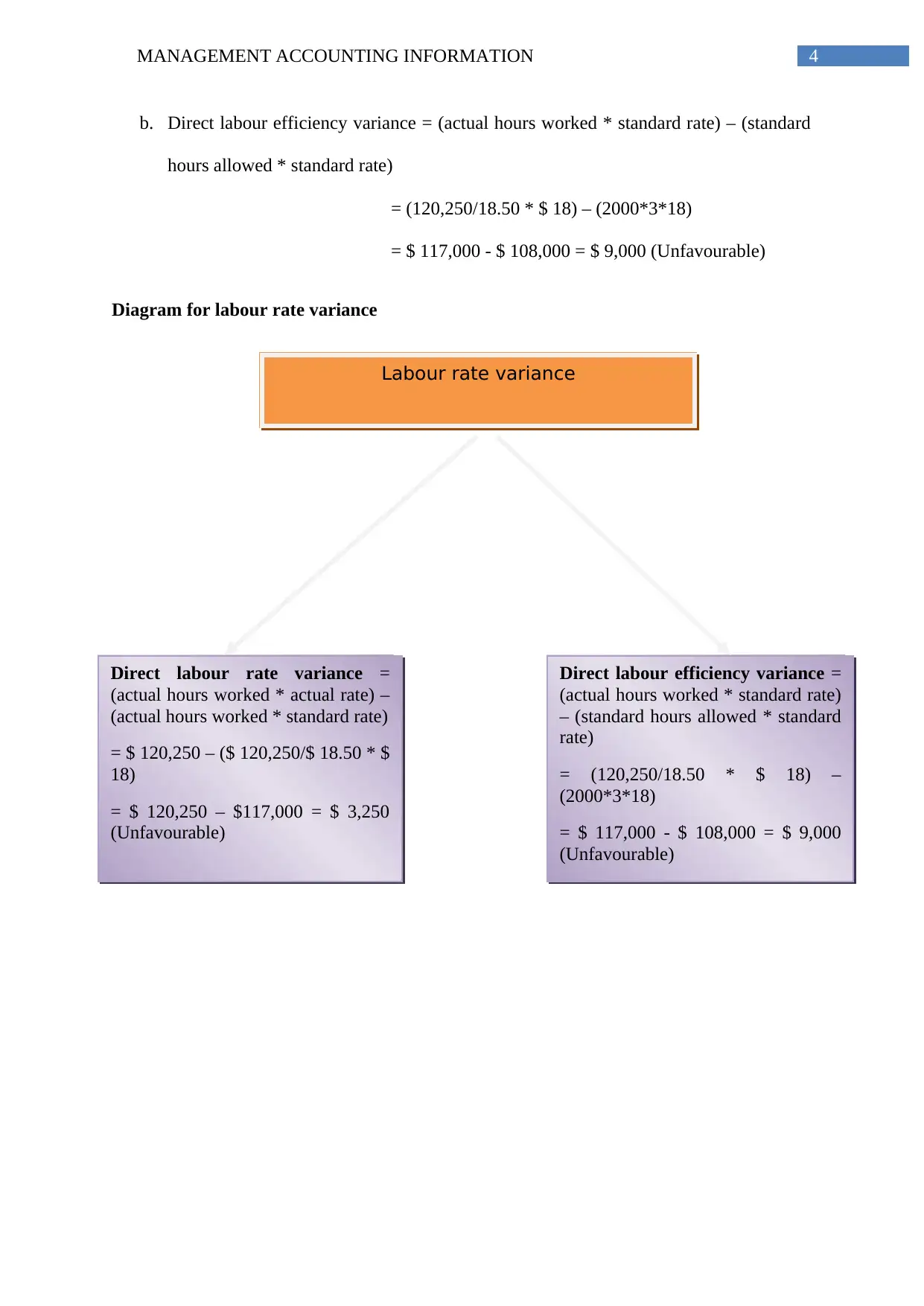

b. Direct labour efficiency variance = (actual hours worked * standard rate) – (standard

hours allowed * standard rate)

= (120,250/18.50 * $ 18) – (2000*3*18)

= $ 117,000 - $ 108,000 = $ 9,000 (Unfavourable)

Diagram for labour rate variance

Labour rate variance

Direct labour rate variance =

(actual hours worked * actual rate) –

(actual hours worked * standard rate)

= $ 120,250 – ($ 120,250/$ 18.50 * $

18)

= $ 120,250 – $117,000 = $ 3,250

(Unfavourable)

Direct labour efficiency variance =

(actual hours worked * standard rate)

– (standard hours allowed * standard

rate)

= (120,250/18.50 * $ 18) –

(2000*3*18)

= $ 117,000 - $ 108,000 = $ 9,000

(Unfavourable)

b. Direct labour efficiency variance = (actual hours worked * standard rate) – (standard

hours allowed * standard rate)

= (120,250/18.50 * $ 18) – (2000*3*18)

= $ 117,000 - $ 108,000 = $ 9,000 (Unfavourable)

Diagram for labour rate variance

Labour rate variance

Direct labour rate variance =

(actual hours worked * actual rate) –

(actual hours worked * standard rate)

= $ 120,250 – ($ 120,250/$ 18.50 * $

18)

= $ 120,250 – $117,000 = $ 3,250

(Unfavourable)

Direct labour efficiency variance =

(actual hours worked * standard rate)

– (standard hours allowed * standard

rate)

= (120,250/18.50 * $ 18) –

(2000*3*18)

= $ 117,000 - $ 108,000 = $ 9,000

(Unfavourable)

1 out of 5

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.