Management Accounting System Analysis Report for Taj Stores

VerifiedAdded on 2020/06/05

|17

|5363

|43

Report

AI Summary

This report provides a comprehensive analysis of management accounting, focusing on its application within a retail business, Taj Stores. It covers essential requirements of different management accounting systems, various reporting methods like inventory control and accounts receivable, and the advantages of such systems. The report delves into cost analysis techniques, comparing marginal and absorption costing for income statement preparation. It also examines budgetary control, exploring the advantages and disadvantages of different planning tools. Furthermore, it discusses how organizations are adopting management accounting systems to solve financial problems and improve decision-making, with a conclusion summarizing key findings and referencing relevant sources.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting and essential requirements of its different types..........................1

P2 Various methods used for management accounting reporting...............................................3

M1 Advantages of management accounting systems and their application................................5

D1 Management accounting systems and management accounting reporting...........................5

TASK 2............................................................................................................................................5

P3 Techniques of cost analysis to prepare an income statement using marginal and absorption

costs.............................................................................................................................................5

M2 Management accounting techniques and financial reporting documents.............................9

D2 Financial reports that accurately apply and interpret data.....................................................9

TASK 3 .........................................................................................................................................10

P4 Advantages and disadvantages of different types of planning tools for budgetary control.10

M3 Use of various planning tools and their application...........................................................11

D3 Planning tools for accounting respond to solving financial problems................................11

TASK 4 .........................................................................................................................................12

P5 Organisation are adopting management accounting system................................................12

M4 Evaluation of financial problems.......................................................................................13

CONCLUSION.............................................................................................................................13

REFERANCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1. Management accounting and essential requirements of its different types..........................1

P2 Various methods used for management accounting reporting...............................................3

M1 Advantages of management accounting systems and their application................................5

D1 Management accounting systems and management accounting reporting...........................5

TASK 2............................................................................................................................................5

P3 Techniques of cost analysis to prepare an income statement using marginal and absorption

costs.............................................................................................................................................5

M2 Management accounting techniques and financial reporting documents.............................9

D2 Financial reports that accurately apply and interpret data.....................................................9

TASK 3 .........................................................................................................................................10

P4 Advantages and disadvantages of different types of planning tools for budgetary control.10

M3 Use of various planning tools and their application...........................................................11

D3 Planning tools for accounting respond to solving financial problems................................11

TASK 4 .........................................................................................................................................12

P5 Organisation are adopting management accounting system................................................12

M4 Evaluation of financial problems.......................................................................................13

CONCLUSION.............................................................................................................................13

REFERANCES..............................................................................................................................14

FROM: MANAGEMENT ACCOUNTING OFFICER

TO,

GENERAL MANAGER

TAJ STORES

SUB: MANAGEMENT ACCOUNTING SYSTEM

INTRODUCTION

Management accounting refers to a process of making the management reports as well as

accounts which gives timely and accurate statistical data or information needed by managers on

daily basis or to take the short term decisions. It provides accounting information and data to the

managers in a business firm and with the help of this, managers can take the good financial

decisions in a better and effective way. It is a procedure of determining, analysing, examining,

interpreting and also, communicating information and data in order to achieve common goals

and objectives of firm (Arroyo, 2012). Taj Stores is small retail business firm which deals in

household materials. It provides various different household products to consumers. In the

present business report, management accounting and necessary requirements of various kinds of

management accounting systems are described. Under this given report mentions about the

various methods which organisation uses. It is necessary that management should prepare

accounting reports in an effective and proper manner. There are some advantages and

disadvantages of various types of planning tools and techniques are also discussed which firm

uses for budgetary control in this report.

TASK 1

P1. Management accounting and essential requirements of its different types

Management accounting helps in developing the managing reports which provide

accurate data and information to managers. If data will be proper then employer can perform

business related activities in an effective manner. It is beneficial in taking the short as well as

long term decisions. Employer uses this accounting provision of accounting data or information

1

TO,

GENERAL MANAGER

TAJ STORES

SUB: MANAGEMENT ACCOUNTING SYSTEM

INTRODUCTION

Management accounting refers to a process of making the management reports as well as

accounts which gives timely and accurate statistical data or information needed by managers on

daily basis or to take the short term decisions. It provides accounting information and data to the

managers in a business firm and with the help of this, managers can take the good financial

decisions in a better and effective way. It is a procedure of determining, analysing, examining,

interpreting and also, communicating information and data in order to achieve common goals

and objectives of firm (Arroyo, 2012). Taj Stores is small retail business firm which deals in

household materials. It provides various different household products to consumers. In the

present business report, management accounting and necessary requirements of various kinds of

management accounting systems are described. Under this given report mentions about the

various methods which organisation uses. It is necessary that management should prepare

accounting reports in an effective and proper manner. There are some advantages and

disadvantages of various types of planning tools and techniques are also discussed which firm

uses for budgetary control in this report.

TASK 1

P1. Management accounting and essential requirements of its different types

Management accounting helps in developing the managing reports which provide

accurate data and information to managers. If data will be proper then employer can perform

business related activities in an effective manner. It is beneficial in taking the short as well as

long term decisions. Employer uses this accounting provision of accounting data or information

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

to take better decisions in favour of company (Baldvinsdottir, Mitchell and Nørreklit, 2010).

With the help of this, performance of company or business will get improved. Management

accounting helps in measuring and recording all the operations related to business for internal

business in order to increase development and profitability of Taj Stores in United Kingdom. The

accounts manager of this company uses many accounting provisions to perform in a better way.

Management accounting is helpful in formulating different financial accounts as well as

reports which give relevant and exact financial data in a specific time period. Managers use that

data in taking their daily decisions. It will be helpful for manager in taking their long as well as

the short term goals and targets of an organisation. With the help of this, managers can take data

or information in a proper manner and also, perform its business operations properly.

Management accounting helps in providing relevant data to an organisation which is concerned

with the financial position of firm. It included information regarding ledgers, entries and also

budgets. It is concerned as a primary aspect of an accounting system which leads managers

regarding the information of accounts in order to determine total sales volume of an organisation,

accounts payable and receivable (Bodie, 2013). It is necessary for the financial manager to

collect all necessary information and data and use during examining the performance level of

company and it will be helpful in taking the better decisions in favour of an organisation. For

investors, this type of accounting information is necessary in order to take idea regarding

financial services of company and take better or effective decisions in order to invest the capital

of firm.

With the help of using proper accounting system, issues related with developing and

implementation of new and effective plans and policies will be resolved in an easy and effective

manner. The manager of TAJ stores can be resolved all the issues in a quick way so that it will

not develop the impact on growth and profitability of an organisation. In context to this, it is

noticed that the burden of managing finance on TAJ Stores increased because this firm do its

business related operations at large scale (Burritt, Schaltegger and Zvezdov, 2011). It is

necessary for the small firms to utilize management accounting system from many advantages.

Generally on the small firms has small resources along will the finance so these cannot do its

business operations on large scale. The small companies cannot deal with high risk. In order to

identify the mistakes and defaults, it is necessary for manager to utilize the proper utilisation of

resources and management accounting system so that firm can perform its business operations in

2

With the help of this, performance of company or business will get improved. Management

accounting helps in measuring and recording all the operations related to business for internal

business in order to increase development and profitability of Taj Stores in United Kingdom. The

accounts manager of this company uses many accounting provisions to perform in a better way.

Management accounting is helpful in formulating different financial accounts as well as

reports which give relevant and exact financial data in a specific time period. Managers use that

data in taking their daily decisions. It will be helpful for manager in taking their long as well as

the short term goals and targets of an organisation. With the help of this, managers can take data

or information in a proper manner and also, perform its business operations properly.

Management accounting helps in providing relevant data to an organisation which is concerned

with the financial position of firm. It included information regarding ledgers, entries and also

budgets. It is concerned as a primary aspect of an accounting system which leads managers

regarding the information of accounts in order to determine total sales volume of an organisation,

accounts payable and receivable (Bodie, 2013). It is necessary for the financial manager to

collect all necessary information and data and use during examining the performance level of

company and it will be helpful in taking the better decisions in favour of an organisation. For

investors, this type of accounting information is necessary in order to take idea regarding

financial services of company and take better or effective decisions in order to invest the capital

of firm.

With the help of using proper accounting system, issues related with developing and

implementation of new and effective plans and policies will be resolved in an easy and effective

manner. The manager of TAJ stores can be resolved all the issues in a quick way so that it will

not develop the impact on growth and profitability of an organisation. In context to this, it is

noticed that the burden of managing finance on TAJ Stores increased because this firm do its

business related operations at large scale (Burritt, Schaltegger and Zvezdov, 2011). It is

necessary for the small firms to utilize management accounting system from many advantages.

Generally on the small firms has small resources along will the finance so these cannot do its

business operations on large scale. The small companies cannot deal with high risk. In order to

identify the mistakes and defaults, it is necessary for manager to utilize the proper utilisation of

resources and management accounting system so that firm can perform its business operations in

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

a proper manner. It will be helpful in minimizing the confusion among different units so that

organisation can perform its operation in a given period of time. In order to minimize

unnecessary cost, it is essential for the manager to allocate effective resources in a proper

manner.

Significance of management accounting

Helps in achieving group goals- With the help of using effective accounting system, it is

essential for managers to arrange and use resources in a proper manner so that firm can achieve

its organisational objectives in a proper manner.

Proper resource utilisation- It is necessary that firm should utilise its resources in a

proper manner at the time of manufacturing process. With the help of this, results will be

achieved in a given period of time at minimum price.

Kinds of accounting systems

Job Costing System- It refers to a method of recording the production cost. It is a

procedure of assigning prices or costs which are involved in business. In this context, the

overhead costs can be incurred during production process of particular products (Chenhall and

Smith, 2011). There is a need for company to increase the jobs and also give many advantages

for earning more profit.

Cost accounting system- It is an important management accounting system. With the help

of this, firm can reduce its wastage in production process. Taj stores is a small company and it

needs to increase its revenue and profit level.

Price optimisation- The cost of any goods and services are based on its demand. With the

help of this firm can identify the exact value of goods. It is necessary that company should

provide the good quality of services and products to consumers at reasonable cost.

Inventory management system- It refers to a supervision of stock items and also non-

capitalised inventory. It is very essential completion which determines the supply chain along it

an impact on financial balance sheet. It is a management of stock as well as inventory.

P2 Various methods used for management accounting reporting

Every type of business firm has to develop different types of report so it is necessary for

company to evaluate its work and complete each task in an effective manner (Contrafatto and

Burns, 2013). The reporting system is a systematic procedure of providing data or informative to

the decided management stages so that firm can measuring the potentially of company. In

3

organisation can perform its operation in a given period of time. In order to minimize

unnecessary cost, it is essential for the manager to allocate effective resources in a proper

manner.

Significance of management accounting

Helps in achieving group goals- With the help of using effective accounting system, it is

essential for managers to arrange and use resources in a proper manner so that firm can achieve

its organisational objectives in a proper manner.

Proper resource utilisation- It is necessary that firm should utilise its resources in a

proper manner at the time of manufacturing process. With the help of this, results will be

achieved in a given period of time at minimum price.

Kinds of accounting systems

Job Costing System- It refers to a method of recording the production cost. It is a

procedure of assigning prices or costs which are involved in business. In this context, the

overhead costs can be incurred during production process of particular products (Chenhall and

Smith, 2011). There is a need for company to increase the jobs and also give many advantages

for earning more profit.

Cost accounting system- It is an important management accounting system. With the help

of this, firm can reduce its wastage in production process. Taj stores is a small company and it

needs to increase its revenue and profit level.

Price optimisation- The cost of any goods and services are based on its demand. With the

help of this firm can identify the exact value of goods. It is necessary that company should

provide the good quality of services and products to consumers at reasonable cost.

Inventory management system- It refers to a supervision of stock items and also non-

capitalised inventory. It is very essential completion which determines the supply chain along it

an impact on financial balance sheet. It is a management of stock as well as inventory.

P2 Various methods used for management accounting reporting

Every type of business firm has to develop different types of report so it is necessary for

company to evaluate its work and complete each task in an effective manner (Contrafatto and

Burns, 2013). The reporting system is a systematic procedure of providing data or informative to

the decided management stages so that firm can measuring the potentially of company. In

3

regards to thus, there are different kinds of methodologies which are necessary in utilization

through an affiliation given below as above:

Inventory control reporting- With the help of this a report investigation can be if firm

can manage an inventory in an effective or proper manner and also evaluate those areas which

are necessary for improvement in the future context. Manager can search the real issues and

problems which are concerned with the merchandise.

For an example- Firm can settle the Under along with the over stock without any kind of

postponed.

This management report us helpful in determining the more goods which are necessary

for firm in order to enhancing the sale sin particular period of time. This kind of techniques used

through the TAJ stored in a proper manner and with the help of this this company minimise its

carrying expenses. In addition to this, it can be evaluated that the how much cost will be require

in order to show in different outlets (Elbashir, Collier and Sutton, 2011). There are different

kinds of selling cost used by company in order to doing the business operations in a proper

manner. The full work of firm will be finished with the help of evaluating the past faults and

mistakes.

Account receivable report- The TAJ Stores conducting its business in London city from

many years. So, this company has large number of customers which buy the goods and services

from them on Credit. In regards to this, manager develop a report under which it keep the record

regarding all the credit amount which given to people by this company. With the help of this

employer can know about the invest amount. Manager can make or record this kind of account

on the weekly, quarterly and monthly basis.

Account payable reporting- With the help of using the document, employer of TAJ

stores, can identify the cost which firm pay to its suppliers (Granlund, 2011). It is basic for the

manager of an organisation to pay the credits on timely basis and with the help of this company

can maintain the good relations with the suppliers and consumers. Under this report, there is no

specific time in the manufacturing and firm prepare the report on the basis of policy of an

organisation. In context to thus, it will be helpful in finding out the finance which has to the

company and require in future time period.

Performance reporting- With the help of this, employer of TAJ Stores can determine or

measure the performance level of different departments. In this company many departments are

4

through an affiliation given below as above:

Inventory control reporting- With the help of this a report investigation can be if firm

can manage an inventory in an effective or proper manner and also evaluate those areas which

are necessary for improvement in the future context. Manager can search the real issues and

problems which are concerned with the merchandise.

For an example- Firm can settle the Under along with the over stock without any kind of

postponed.

This management report us helpful in determining the more goods which are necessary

for firm in order to enhancing the sale sin particular period of time. This kind of techniques used

through the TAJ stored in a proper manner and with the help of this this company minimise its

carrying expenses. In addition to this, it can be evaluated that the how much cost will be require

in order to show in different outlets (Elbashir, Collier and Sutton, 2011). There are different

kinds of selling cost used by company in order to doing the business operations in a proper

manner. The full work of firm will be finished with the help of evaluating the past faults and

mistakes.

Account receivable report- The TAJ Stores conducting its business in London city from

many years. So, this company has large number of customers which buy the goods and services

from them on Credit. In regards to this, manager develop a report under which it keep the record

regarding all the credit amount which given to people by this company. With the help of this

employer can know about the invest amount. Manager can make or record this kind of account

on the weekly, quarterly and monthly basis.

Account payable reporting- With the help of using the document, employer of TAJ

stores, can identify the cost which firm pay to its suppliers (Granlund, 2011). It is basic for the

manager of an organisation to pay the credits on timely basis and with the help of this company

can maintain the good relations with the suppliers and consumers. Under this report, there is no

specific time in the manufacturing and firm prepare the report on the basis of policy of an

organisation. In context to thus, it will be helpful in finding out the finance which has to the

company and require in future time period.

Performance reporting- With the help of this, employer of TAJ Stores can determine or

measure the performance level of different departments. In this company many departments are

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

working and they work together in context accomplishing the common goals of an organisation.

But along with this it is necessary for firm to prepare a financial report in an effective or proper

manner.

Budget reporting- It is essential for the business firm to prepare an effective or proper

budget for the company. With the help of this company can do its business operations in a proper

manner and also compare between the actual budget with the performance level. The proper

budget is helpful in know about the current performance of over all organisation.

M1 Advantages of management accounting systems and their application

Concept of management accounting use by many enterprises as this ensure management

of various business operation which help in increase profits of enterprise. TAJ stores also use this

as this help them to record daily transactions of business in an appropriate manner (Koh and Tan,

2011). This enhance effectiveness of business operations and also increase efficiency of various

activities. Further, it make the process of decision making more easy which provide various

advantages to enterprise and contribute more in growth of company.

D1 Management accounting systems and management accounting reporting

In TAJ stores, different employees and department perform their roles and

responsibilities differ from each other but towards a common objective. Effective use of

reporting system help firm to increase output and profits. Success and growth of an enter[prose

largely depend on reporting system as consists relevant information related with financial

position of firm. One of the main aim of reporting is to analyse the business performance and of

employees also and make efforts to enhance the same. Stakeholders make decision of

investment after analyse the financial reports of company.

TASK 2

P3 Techniques of cost analysis to prepare an income statement using marginal and absorption

costs

An income statement of any business firm is helpful in determining their income level

and also expenses. It is a single method which helps in develop or formulate the profit and loss

account. There is a discussion about the absorption as well as the marginal costing given below

as above:

5

But along with this it is necessary for firm to prepare a financial report in an effective or proper

manner.

Budget reporting- It is essential for the business firm to prepare an effective or proper

budget for the company. With the help of this company can do its business operations in a proper

manner and also compare between the actual budget with the performance level. The proper

budget is helpful in know about the current performance of over all organisation.

M1 Advantages of management accounting systems and their application

Concept of management accounting use by many enterprises as this ensure management

of various business operation which help in increase profits of enterprise. TAJ stores also use this

as this help them to record daily transactions of business in an appropriate manner (Koh and Tan,

2011). This enhance effectiveness of business operations and also increase efficiency of various

activities. Further, it make the process of decision making more easy which provide various

advantages to enterprise and contribute more in growth of company.

D1 Management accounting systems and management accounting reporting

In TAJ stores, different employees and department perform their roles and

responsibilities differ from each other but towards a common objective. Effective use of

reporting system help firm to increase output and profits. Success and growth of an enter[prose

largely depend on reporting system as consists relevant information related with financial

position of firm. One of the main aim of reporting is to analyse the business performance and of

employees also and make efforts to enhance the same. Stakeholders make decision of

investment after analyse the financial reports of company.

TASK 2

P3 Techniques of cost analysis to prepare an income statement using marginal and absorption

costs

An income statement of any business firm is helpful in determining their income level

and also expenses. It is a single method which helps in develop or formulate the profit and loss

account. There is a discussion about the absorption as well as the marginal costing given below

as above:

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Marginal costing- In this the fixed expenses are taken according to the periodic. It

decrease and also enhance in a total cost of manufacturing in developing the one extra unit. It is

an effective costing technique where the variable cost as well as the fixed cost is charged for a

specific time period (Kotas, 2014). If in case this cited business firm is going to introduce any

new services or products for satisfying the needs and wants of consumers then in this case it is

necessary for firm to spend more money on the process of manufacturing. In addition to thus

there are many different things which firm has to be included like for an instance labour, raw

materials, overhead etc.

Absorption cost- It is different from marginal costing. It is necessary that firm should

allocate the selling units by using the fixed as well as the variable cost. Along with this, there are

some other expenses which firm can never involved at the time of developing the income

statement such as administration cost (Liao, Chu and Hsiao, 2012). This kind of tool is regarded

as the conventional method related to the accounting. In context to this, it is an obsolete tool

which is adopted through many business firms.

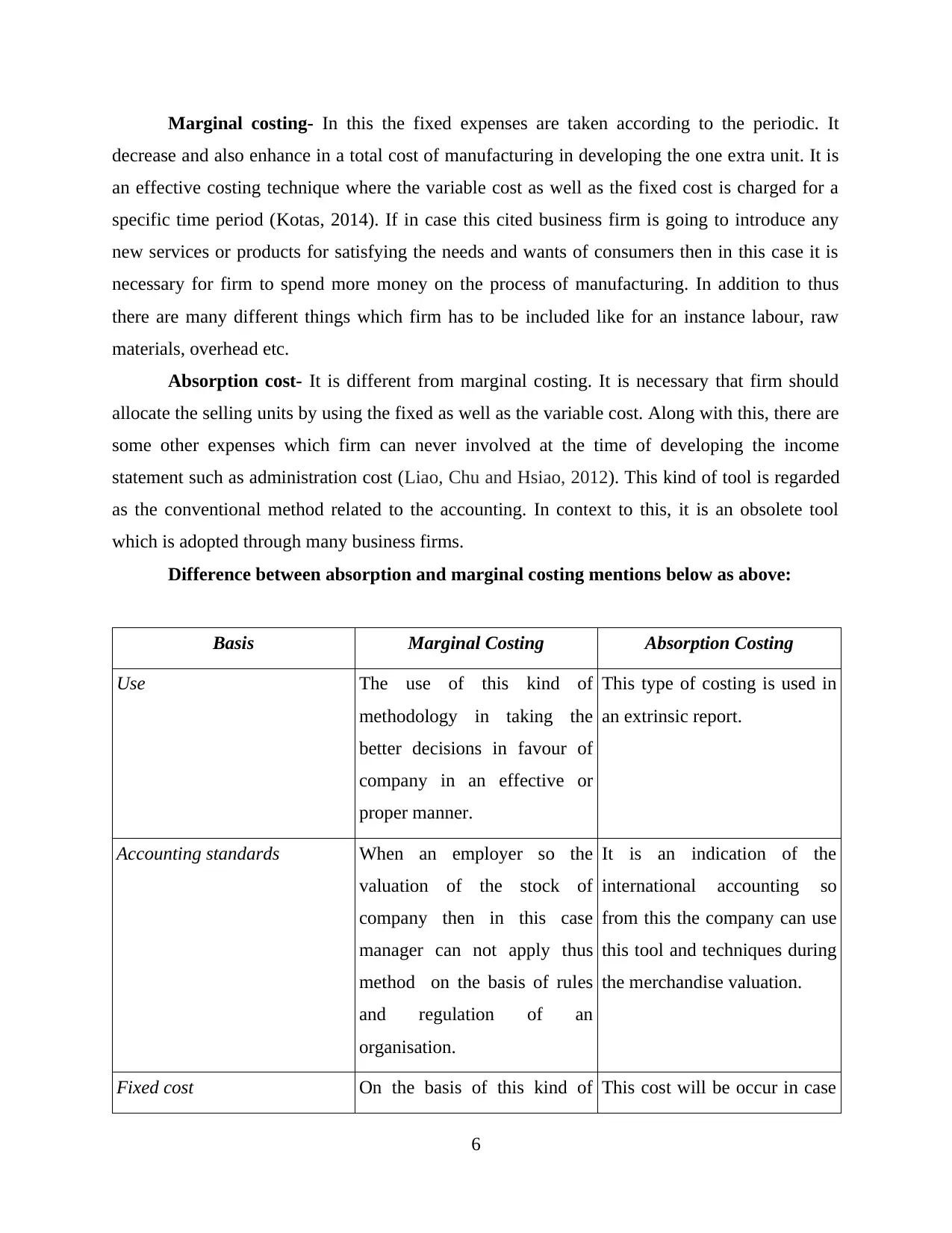

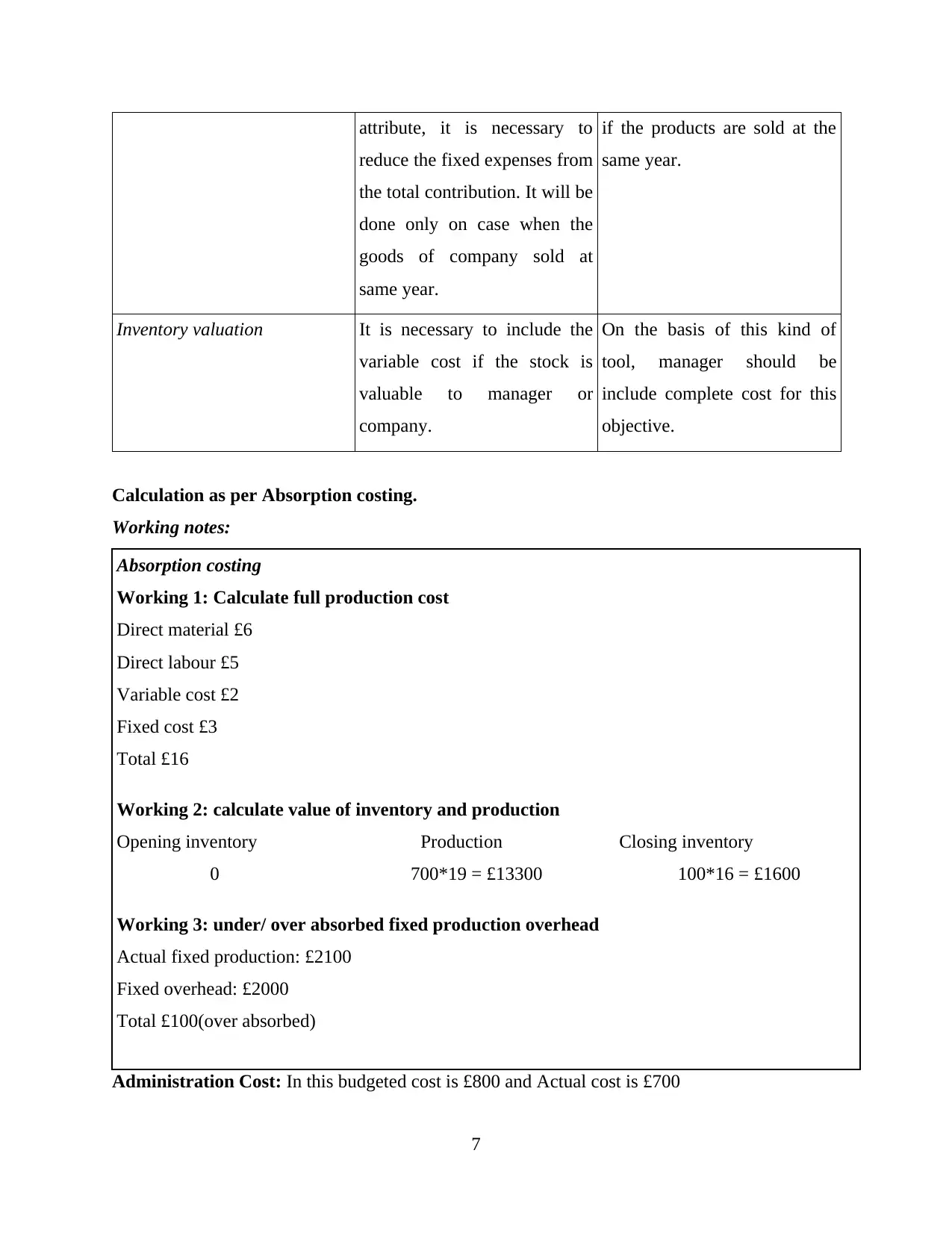

Difference between absorption and marginal costing mentions below as above:

Basis Marginal Costing Absorption Costing

Use The use of this kind of

methodology in taking the

better decisions in favour of

company in an effective or

proper manner.

This type of costing is used in

an extrinsic report.

Accounting standards When an employer so the

valuation of the stock of

company then in this case

manager can not apply thus

method on the basis of rules

and regulation of an

organisation.

It is an indication of the

international accounting so

from this the company can use

this tool and techniques during

the merchandise valuation.

Fixed cost On the basis of this kind of This cost will be occur in case

6

decrease and also enhance in a total cost of manufacturing in developing the one extra unit. It is

an effective costing technique where the variable cost as well as the fixed cost is charged for a

specific time period (Kotas, 2014). If in case this cited business firm is going to introduce any

new services or products for satisfying the needs and wants of consumers then in this case it is

necessary for firm to spend more money on the process of manufacturing. In addition to thus

there are many different things which firm has to be included like for an instance labour, raw

materials, overhead etc.

Absorption cost- It is different from marginal costing. It is necessary that firm should

allocate the selling units by using the fixed as well as the variable cost. Along with this, there are

some other expenses which firm can never involved at the time of developing the income

statement such as administration cost (Liao, Chu and Hsiao, 2012). This kind of tool is regarded

as the conventional method related to the accounting. In context to this, it is an obsolete tool

which is adopted through many business firms.

Difference between absorption and marginal costing mentions below as above:

Basis Marginal Costing Absorption Costing

Use The use of this kind of

methodology in taking the

better decisions in favour of

company in an effective or

proper manner.

This type of costing is used in

an extrinsic report.

Accounting standards When an employer so the

valuation of the stock of

company then in this case

manager can not apply thus

method on the basis of rules

and regulation of an

organisation.

It is an indication of the

international accounting so

from this the company can use

this tool and techniques during

the merchandise valuation.

Fixed cost On the basis of this kind of This cost will be occur in case

6

attribute, it is necessary to

reduce the fixed expenses from

the total contribution. It will be

done only on case when the

goods of company sold at

same year.

if the products are sold at the

same year.

Inventory valuation It is necessary to include the

variable cost if the stock is

valuable to manager or

company.

On the basis of this kind of

tool, manager should be

include complete cost for this

objective.

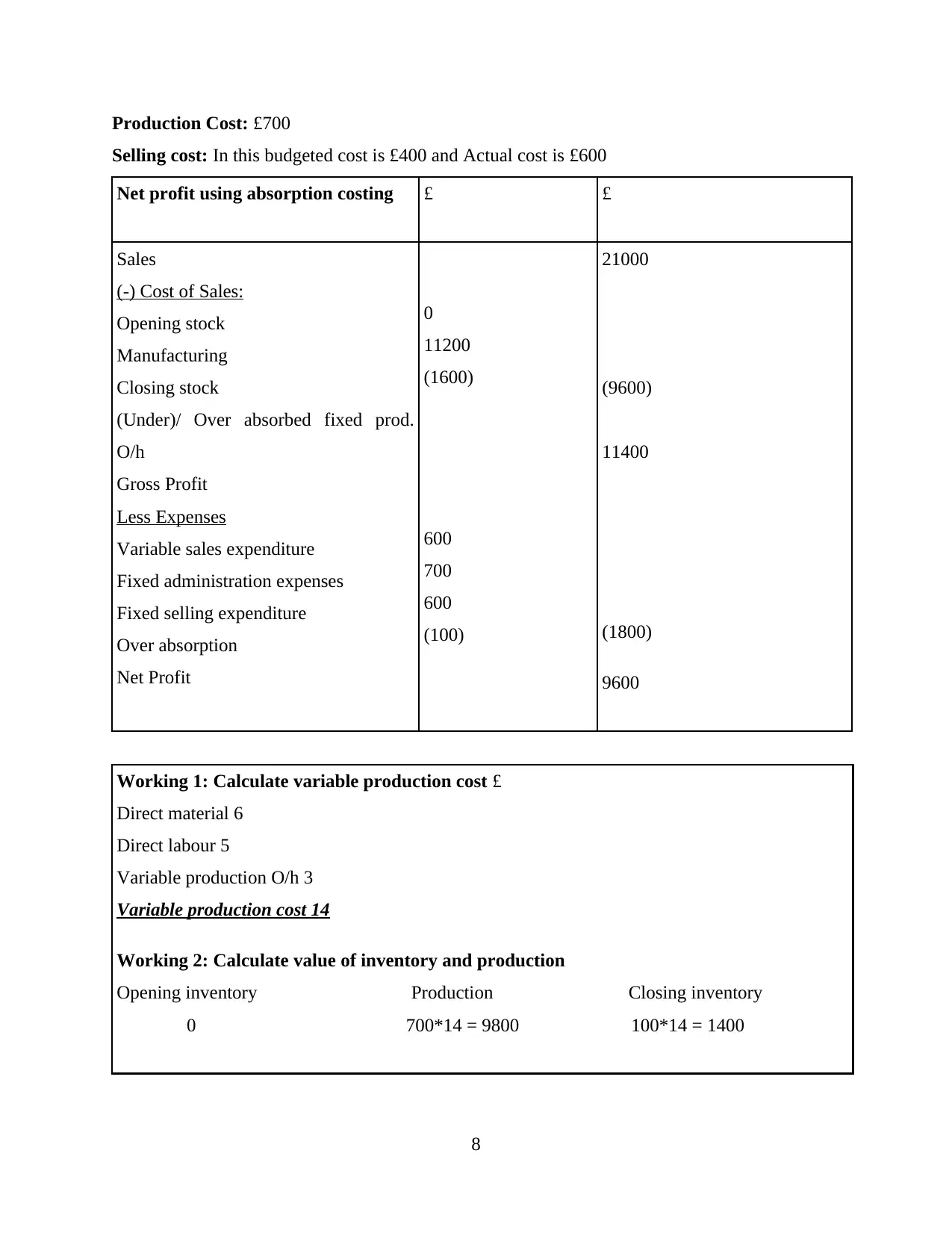

Calculation as per Absorption costing.

Working notes:

Absorption costing

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*19 = £13300 100*16 = £1600

Working 3: under/ over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

Administration Cost: In this budgeted cost is £800 and Actual cost is £700

7

reduce the fixed expenses from

the total contribution. It will be

done only on case when the

goods of company sold at

same year.

if the products are sold at the

same year.

Inventory valuation It is necessary to include the

variable cost if the stock is

valuable to manager or

company.

On the basis of this kind of

tool, manager should be

include complete cost for this

objective.

Calculation as per Absorption costing.

Working notes:

Absorption costing

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*19 = £13300 100*16 = £1600

Working 3: under/ over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

Administration Cost: In this budgeted cost is £800 and Actual cost is £700

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Production Cost: £700

Selling cost: In this budgeted cost is £400 and Actual cost is £600

Net profit using absorption costing £ £

Sales

(-) Cost of Sales:

Opening stock

Manufacturing

Closing stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

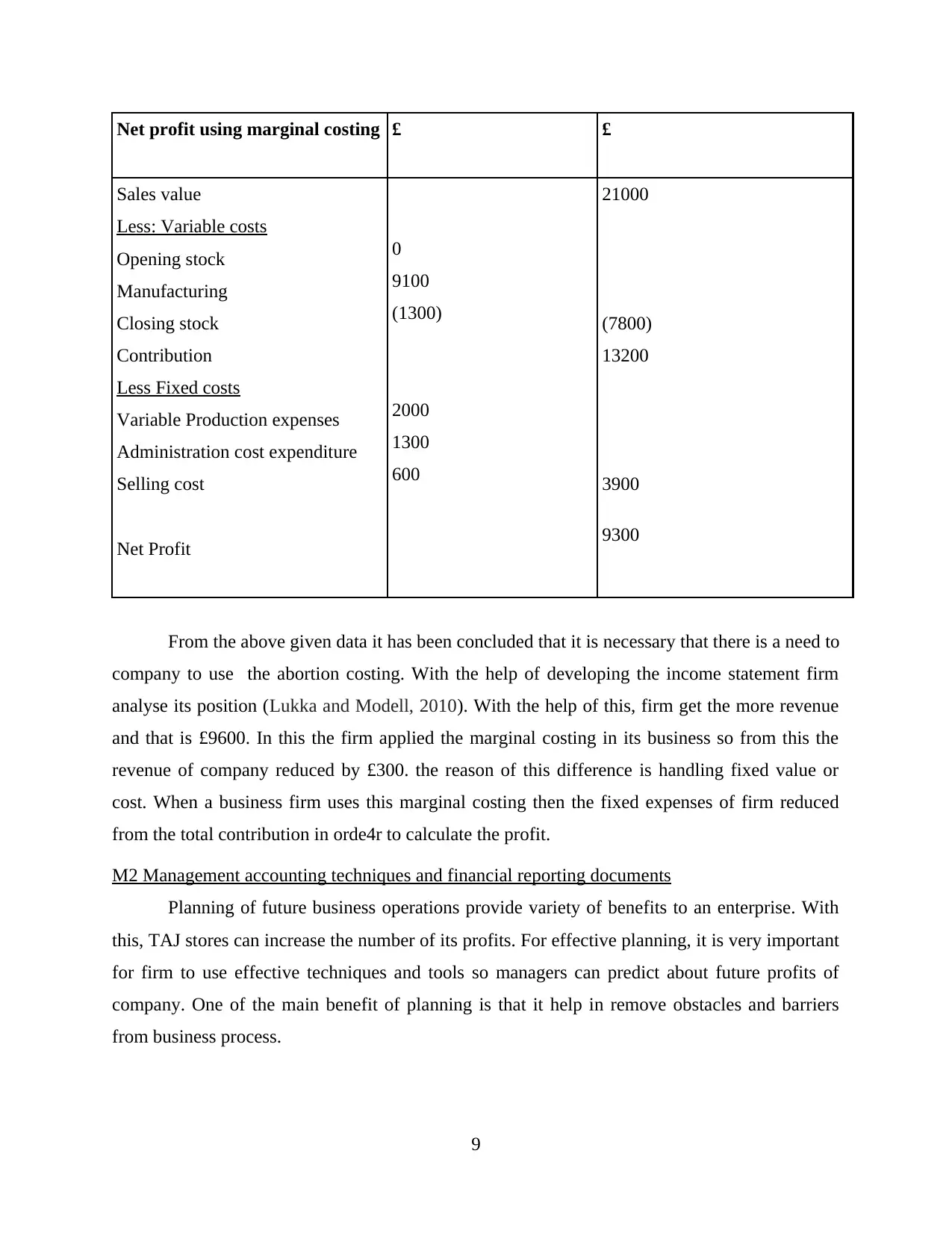

Working 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*14 = 9800 100*14 = 1400

8

Selling cost: In this budgeted cost is £400 and Actual cost is £600

Net profit using absorption costing £ £

Sales

(-) Cost of Sales:

Opening stock

Manufacturing

Closing stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

Working 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening inventory Production Closing inventory

0 700*14 = 9800 100*14 = 1400

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Net profit using marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

From the above given data it has been concluded that it is necessary that there is a need to

company to use the abortion costing. With the help of developing the income statement firm

analyse its position (Lukka and Modell, 2010). With the help of this, firm get the more revenue

and that is £9600. In this the firm applied the marginal costing in its business so from this the

revenue of company reduced by £300. the reason of this difference is handling fixed value or

cost. When a business firm uses this marginal costing then the fixed expenses of firm reduced

from the total contribution in orde4r to calculate the profit.

M2 Management accounting techniques and financial reporting documents

Planning of future business operations provide variety of benefits to an enterprise. With

this, TAJ stores can increase the number of its profits. For effective planning, it is very important

for firm to use effective techniques and tools so managers can predict about future profits of

company. One of the main benefit of planning is that it help in remove obstacles and barriers

from business process.

9

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

From the above given data it has been concluded that it is necessary that there is a need to

company to use the abortion costing. With the help of developing the income statement firm

analyse its position (Lukka and Modell, 2010). With the help of this, firm get the more revenue

and that is £9600. In this the firm applied the marginal costing in its business so from this the

revenue of company reduced by £300. the reason of this difference is handling fixed value or

cost. When a business firm uses this marginal costing then the fixed expenses of firm reduced

from the total contribution in orde4r to calculate the profit.

M2 Management accounting techniques and financial reporting documents

Planning of future business operations provide variety of benefits to an enterprise. With

this, TAJ stores can increase the number of its profits. For effective planning, it is very important

for firm to use effective techniques and tools so managers can predict about future profits of

company. One of the main benefit of planning is that it help in remove obstacles and barriers

from business process.

9

D2 Financial reports that accurately apply and interpret data

From above calculation, it can be summarised that there are two methods of costing

which can be used by TAJ stores in order to achieve reliable results. Both methods are showing

different results. Use of absorption costing is showing a profits of 7800 however amount of

profits is 7500 after use of marginal costing (Parker, 2012). Variation of 300 arise because of

fixed cost which is not consider in marginal costing. In order to get reliable results it is essential

for firm to choose a right costing method.

TASK 3

P4 Advantages and disadvantages of different types of planning tools for budgetary control

Budget- Budget is related to the future activities and also expenses. This is called as a

planned and also relevant information for specific period of time related to business activities

and operations. It is helpful in evaluating all the expenses and also costs in which TAJ Stores

expand in manufacturing of goods as well as services (Qian, Burritt and Monroe, 2011). It is

regarded as the comprehensive design of accounting planning and the operation for a particular

gap. Basically it is developed for more than the 1 year but this can only be applied in case the

results of company are not in company favour.

Budgetary control- It is also an important or essential tool related to the budgeting

which can influence a management in order to carried out the business operations such as

planning, directing, controlling and also determining. It is concerned with all the activities of an

organisation which is segmented in to two different parts and it is called as budget centre.

Budgetary Control Process

Discuss with the concern employers- It is necessary for an employer to do the proper

evaluation with the help of taking information as well as data with each other. There is a need to

manager to developing a proper budget and manage all the expenses an also cost.

Do better assumption- After gathering the feedback or review from the employer, top

management should prepare an assumption in context to overcome from all the losses. The main

purpose of budget planning is to control and manage all the activities, additional costs and

operations in future,

Fixed data of company for budget to achieving goals of company- In this step of process,

an accurate list of relevant data is formulated through collecting from all functions of an

10

From above calculation, it can be summarised that there are two methods of costing

which can be used by TAJ stores in order to achieve reliable results. Both methods are showing

different results. Use of absorption costing is showing a profits of 7800 however amount of

profits is 7500 after use of marginal costing (Parker, 2012). Variation of 300 arise because of

fixed cost which is not consider in marginal costing. In order to get reliable results it is essential

for firm to choose a right costing method.

TASK 3

P4 Advantages and disadvantages of different types of planning tools for budgetary control

Budget- Budget is related to the future activities and also expenses. This is called as a

planned and also relevant information for specific period of time related to business activities

and operations. It is helpful in evaluating all the expenses and also costs in which TAJ Stores

expand in manufacturing of goods as well as services (Qian, Burritt and Monroe, 2011). It is

regarded as the comprehensive design of accounting planning and the operation for a particular

gap. Basically it is developed for more than the 1 year but this can only be applied in case the

results of company are not in company favour.

Budgetary control- It is also an important or essential tool related to the budgeting

which can influence a management in order to carried out the business operations such as

planning, directing, controlling and also determining. It is concerned with all the activities of an

organisation which is segmented in to two different parts and it is called as budget centre.

Budgetary Control Process

Discuss with the concern employers- It is necessary for an employer to do the proper

evaluation with the help of taking information as well as data with each other. There is a need to

manager to developing a proper budget and manage all the expenses an also cost.

Do better assumption- After gathering the feedback or review from the employer, top

management should prepare an assumption in context to overcome from all the losses. The main

purpose of budget planning is to control and manage all the activities, additional costs and

operations in future,

Fixed data of company for budget to achieving goals of company- In this step of process,

an accurate list of relevant data is formulated through collecting from all functions of an

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.