Management Accounting Report: Costing, Budgeting, and Planning

VerifiedAdded on 2020/11/23

|18

|5496

|64

Report

AI Summary

This report provides a comprehensive overview of management accounting, exploring its significance and various systems. It begins by defining management accounting and highlighting its importance in business decision-making and financial reporting. The report then delves into different types of management accounting systems, including cost accounting, inventory management, price optimizing, and job costing systems, detailing their functionalities and applications. It further examines various methods used in management accounting reporting, such as budget reports, performance reports, and account receivable aging reports. The report also emphasizes the benefits of management accounting systems, like cost reduction, inventory control, and optimal pricing, and their impact on achieving organizational goals. Furthermore, the report includes practical examples using marginal and absorption costing to analyze financial performance and evaluate profitability. It concludes by discussing the adoption of management accounting systems in resolving financial problems and the use of planning tools in budgetary control, providing a holistic view of the subject.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION............................................................................................................................3

TASK 1............................................................................................................................................3

Management Accounting & need of different management accounting system.........................3

Methods used for management accounting reporting.................................................................4

Importance of management accounting systems and their use...................................................5

Critical Evaluation of Management accounting system & reports..............................................5

TASK 2............................................................................................................................................6

TASK 3............................................................................................................................................7

Pros & Cons of planning tools used in budgetary control...........................................................7

Use of planning tool in preparation & forecasting of budget......................................................9

TASK 4............................................................................................................................................9

Adoption of management accounting system for resolving financial problems.........................9

Use of Planning tools in resolving financial problems..............................................................11

CONCLUSION..............................................................................................................................12

REFERENCES...............................................................................................................................14

INTRODUCTION............................................................................................................................3

TASK 1............................................................................................................................................3

Management Accounting & need of different management accounting system.........................3

Methods used for management accounting reporting.................................................................4

Importance of management accounting systems and their use...................................................5

Critical Evaluation of Management accounting system & reports..............................................5

TASK 2............................................................................................................................................6

TASK 3............................................................................................................................................7

Pros & Cons of planning tools used in budgetary control...........................................................7

Use of planning tool in preparation & forecasting of budget......................................................9

TASK 4............................................................................................................................................9

Adoption of management accounting system for resolving financial problems.........................9

Use of Planning tools in resolving financial problems..............................................................11

CONCLUSION..............................................................................................................................12

REFERENCES...............................................................................................................................14

INTRODUCTION

Management Accounting is a process used by companies to for managing & maintaining

various types of cost incurred in business. This report explains meaning of management

accounting. Further, this report includes types of management accounting systems and

advantage & disadvantage of accounting systems. Furthermore, this report elaborate benefits of

management accounting system (Shields and Shelleman, 2016). Moreover, this report includes

techniques of management accounting and explains those techniques with the help of practical.

Further, this report highlights advantage & disadvantage of different planning tools used in

budgetary control. At last, this report elaborate use of management accounting system in

resolving financial problems.

TASK 1

Management Accounting & need of different management accounting system

Management Accounting

Its is an accounting process in which various cost incurred during business operations are

evaluated with the purpose of taking business decisions and preparing financial reports of

organisations (Holopainen, Niskanen and Rissanen, 2019). Management accountant of ABC Ltd.

also uses management accounting for making strategic decisions and for resolving problems

occurring in manufacturing process. Use of this accounting process by company enable it in

achieving its goals & objectives. It also minimises & manages cost of manufacturing which in

turn enhances profits of ABC Ltd(Laux and Stocken, 2018).

Management Accounting System

This system is used by organisations for evaluating & analysing assorted types of cost

which is essential in manufacturing of products & services of business (Spraakman and et.al.,

2015). There are many types of management accounting systems available and used by

companies. They all are required for different purpose, which are discussed below-

Cost Accounting System- It is a type of managerial accounting system which are used

by accountant of ABC Ltd. to find out cost of its products & services. Thus, it is also known as

Product costing system (Dai and Vasarhelyi, 2017). This system is required to use by company

as it helps in assessing profits included in a particular product because firm can set its profit

margin only after estimating cost of goods & services. Cost accounting system is also essential in

Management Accounting is a process used by companies to for managing & maintaining

various types of cost incurred in business. This report explains meaning of management

accounting. Further, this report includes types of management accounting systems and

advantage & disadvantage of accounting systems. Furthermore, this report elaborate benefits of

management accounting system (Shields and Shelleman, 2016). Moreover, this report includes

techniques of management accounting and explains those techniques with the help of practical.

Further, this report highlights advantage & disadvantage of different planning tools used in

budgetary control. At last, this report elaborate use of management accounting system in

resolving financial problems.

TASK 1

Management Accounting & need of different management accounting system

Management Accounting

Its is an accounting process in which various cost incurred during business operations are

evaluated with the purpose of taking business decisions and preparing financial reports of

organisations (Holopainen, Niskanen and Rissanen, 2019). Management accountant of ABC Ltd.

also uses management accounting for making strategic decisions and for resolving problems

occurring in manufacturing process. Use of this accounting process by company enable it in

achieving its goals & objectives. It also minimises & manages cost of manufacturing which in

turn enhances profits of ABC Ltd(Laux and Stocken, 2018).

Management Accounting System

This system is used by organisations for evaluating & analysing assorted types of cost

which is essential in manufacturing of products & services of business (Spraakman and et.al.,

2015). There are many types of management accounting systems available and used by

companies. They all are required for different purpose, which are discussed below-

Cost Accounting System- It is a type of managerial accounting system which are used

by accountant of ABC Ltd. to find out cost of its products & services. Thus, it is also known as

Product costing system (Dai and Vasarhelyi, 2017). This system is required to use by company

as it helps in assessing profits included in a particular product because firm can set its profit

margin only after estimating cost of goods & services. Cost accounting system is also essential in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

valuation of inventory and it also helps business in purchasing stock at a price which minimises

cost or in accordance with estimated cost. Further, this system is also used by ABC Ltd. for

managing cost of its products.

There are two types of cost accounting system, Job Order Costing & Process Costing. Job

Order Costing is required for estimating cost incurred in manufacturing of each job while Process

Costing is important in estimating cost of each process (Ahmad and Mohamed Zabri, 2015).

Inventory Management System- ABC Ltd. use a software to manage all of its sales,

inventory level such as closing & opening stock and orders received for its products. Thus, it is a

a system software and it is also required to generate bills, for preparation of other order

documents (Szychta and Dobroszek, 2016). By using this system software companies

productivity is increased as it has it is having sufficient inventory which can be used any time.

Use of this system is also required as it reduces unnecessary wastage of raw material and with

this firm can track as how much inventory is placed at what place. Thus, this system is also

essential to used by companies as it enhances their performance & sales volume which in turn

maximises profits of ABC Ltd.

Price Optimising System- Price Optimising is a system in which company does a

statistical analysis to set a price for its final products & services. Company analyse response of

consumers on different prices and on that basis decide final price of its products & services. This

management accounting system is required to use by ABC Ltd as it helps in maintaining

profitability level of company and it is also beneficial in retailing customers. Use of this system

is also required in achieving goals of company by offering goods & services at an affordable

price(Hoyle, Schaefer Doupnik, 2015).

Job Costing System- This system is used for evaluating cost of manufacturing of each of

its product (Shields and Shelleman, 2016). Thus, this system is required to use by ABC Ltd as it

helps company in achieving more profits by minimising cost of manufacturing of each of its

product. Different methods of Job Costing are discussed below-

Costing Method- A method through which managers of business organisations calculates

cost of each of business activities separately is termed as Costing Method.(Kastberg and

Siverbo, 2016)

cost or in accordance with estimated cost. Further, this system is also used by ABC Ltd. for

managing cost of its products.

There are two types of cost accounting system, Job Order Costing & Process Costing. Job

Order Costing is required for estimating cost incurred in manufacturing of each job while Process

Costing is important in estimating cost of each process (Ahmad and Mohamed Zabri, 2015).

Inventory Management System- ABC Ltd. use a software to manage all of its sales,

inventory level such as closing & opening stock and orders received for its products. Thus, it is a

a system software and it is also required to generate bills, for preparation of other order

documents (Szychta and Dobroszek, 2016). By using this system software companies

productivity is increased as it has it is having sufficient inventory which can be used any time.

Use of this system is also required as it reduces unnecessary wastage of raw material and with

this firm can track as how much inventory is placed at what place. Thus, this system is also

essential to used by companies as it enhances their performance & sales volume which in turn

maximises profits of ABC Ltd.

Price Optimising System- Price Optimising is a system in which company does a

statistical analysis to set a price for its final products & services. Company analyse response of

consumers on different prices and on that basis decide final price of its products & services. This

management accounting system is required to use by ABC Ltd as it helps in maintaining

profitability level of company and it is also beneficial in retailing customers. Use of this system

is also required in achieving goals of company by offering goods & services at an affordable

price(Hoyle, Schaefer Doupnik, 2015).

Job Costing System- This system is used for evaluating cost of manufacturing of each of

its product (Shields and Shelleman, 2016). Thus, this system is required to use by ABC Ltd as it

helps company in achieving more profits by minimising cost of manufacturing of each of its

product. Different methods of Job Costing are discussed below-

Costing Method- A method through which managers of business organisations calculates

cost of each of business activities separately is termed as Costing Method.(Kastberg and

Siverbo, 2016)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contract Costing Method- Under this method cost incurred in a specific contract with

customer is monitored and controlled. For Example- A contract is made between a

customer and a civil engineer for construction of a building than overall cost associated in

this contract is determined on the basis of this method(Holopainen, Niskanen and

Rissanen, 2019).

Batch Costing Method- A method which calculating cost of each job is known as batch

costing method. Batch contains number of units but it is not necessary that each batch

will contain same number of units(Kastberg and Siverbo, 2016).

Process Costing Method- A costing method used to determine cost of each production

unit. This method is very useful for business organisation as it helps in ascertaining cost

of each product and with this production managers of firm is enable to minimise cost of

production(Shields and Shelleman, 2016).

Methods used for management accounting reporting

Management accounting is also used in preparation of reports which helps in strategic

planning, making important decisions related to manufacturing and for evaluating performance

of companies (Guenther and et.al., 2015). Various methods are used for management accounting

reports which are discussed below-

Budget Reports- In this method a report on estimated budget of future expenses &

income of company is prepared. By using this method accountant of ABC Ltd can evaluate &

measure performance of its business operations and this report also helps firm in eliminating

unnecessary cost. This report is prepared on the basis of past years budget thus, it is time

consuming and does not require extra cost (Barry and Dent, 2017).

Performance Reports- ABC Ltd prepare performance report to assess overall

performance of its business with this company can check whether its business is profitable or not

(Azudin and Mansor, 2018). On the basis of this performance report managers & accountants of

firm make decisions so that they can achieve higher profits in future and with this report

company also able to achieve its objectives easily.

Account Receivable Ageing Report- This report is prepared by organisation which

sales their goods & services on credit. Company prepare this report in finding out as in how

much time customers give money due on bills (Kastberg and Siverbo, 2016). ABC Ltd has to use

customer is monitored and controlled. For Example- A contract is made between a

customer and a civil engineer for construction of a building than overall cost associated in

this contract is determined on the basis of this method(Holopainen, Niskanen and

Rissanen, 2019).

Batch Costing Method- A method which calculating cost of each job is known as batch

costing method. Batch contains number of units but it is not necessary that each batch

will contain same number of units(Kastberg and Siverbo, 2016).

Process Costing Method- A costing method used to determine cost of each production

unit. This method is very useful for business organisation as it helps in ascertaining cost

of each product and with this production managers of firm is enable to minimise cost of

production(Shields and Shelleman, 2016).

Methods used for management accounting reporting

Management accounting is also used in preparation of reports which helps in strategic

planning, making important decisions related to manufacturing and for evaluating performance

of companies (Guenther and et.al., 2015). Various methods are used for management accounting

reports which are discussed below-

Budget Reports- In this method a report on estimated budget of future expenses &

income of company is prepared. By using this method accountant of ABC Ltd can evaluate &

measure performance of its business operations and this report also helps firm in eliminating

unnecessary cost. This report is prepared on the basis of past years budget thus, it is time

consuming and does not require extra cost (Barry and Dent, 2017).

Performance Reports- ABC Ltd prepare performance report to assess overall

performance of its business with this company can check whether its business is profitable or not

(Azudin and Mansor, 2018). On the basis of this performance report managers & accountants of

firm make decisions so that they can achieve higher profits in future and with this report

company also able to achieve its objectives easily.

Account Receivable Ageing Report- This report is prepared by organisation which

sales their goods & services on credit. Company prepare this report in finding out as in how

much time customers give money due on bills (Kastberg and Siverbo, 2016). ABC Ltd has to use

this method as it helps in collecting credit from customer and on the basis of this report firm can

makes decisions related to its credit policy.

Importance of management accounting systems and their use

Benefits of Managerial Accounting Systems & their Application

Management accounting system helps company in maintaining its profitability, making

decisions and also beneficial in meeting its objectives. Different accounting systems has their

own benefits in companies operations-

Cost Accounting System is beneficial for ABC Ltd in managing & minimising cost of its

products & services which in turn maximises profits & market share of firm (Holopainen,

Niskanen and Rissanen, 2019). It is also helpful in making important decisions regarding

reduction in cost of a particular product.

Inventory Management system is beneficial for ABC Ltd in tracking level of inventory

and it also reduces problem of scarcity of stock (Spraakman and et.al., 2015). This further

important for company in maximising its product output which further enhances sales

volume of firm(Gooneratne, and Hoque, 2016).

Price Costing System is beneficial for ABC Ltd in offering its goods & services at a price

which is favourable for customers (Dai and Vasarhelyi, 2017). If company is able to offer

goods at price which is satisfactory to customers than profits and customer base of

company get increased.

Implementation of various management system benefits company in making all important

decisions in regards to price, cost and inventory which in turn leads to organisation goals

and helps in providing quality product at an affordable price (Ahmad and Mohamed

Zabri, 2015).

Critical Evaluation of Management accounting system & reports

As per (Ofosu, 2018), management accounting system & management accounting report

are integrated as for preparation of budget report an estimation of cost of manufacturing of goods

& services are required and this is become possible by implementing cost accounting system in

organisation (Szychta and Dobroszek, 2016). Price Optimisation and inventory management

system helps in making of performance report because if ABC Ltd has sufficient inventory and it

makes decisions related to its credit policy.

Importance of management accounting systems and their use

Benefits of Managerial Accounting Systems & their Application

Management accounting system helps company in maintaining its profitability, making

decisions and also beneficial in meeting its objectives. Different accounting systems has their

own benefits in companies operations-

Cost Accounting System is beneficial for ABC Ltd in managing & minimising cost of its

products & services which in turn maximises profits & market share of firm (Holopainen,

Niskanen and Rissanen, 2019). It is also helpful in making important decisions regarding

reduction in cost of a particular product.

Inventory Management system is beneficial for ABC Ltd in tracking level of inventory

and it also reduces problem of scarcity of stock (Spraakman and et.al., 2015). This further

important for company in maximising its product output which further enhances sales

volume of firm(Gooneratne, and Hoque, 2016).

Price Costing System is beneficial for ABC Ltd in offering its goods & services at a price

which is favourable for customers (Dai and Vasarhelyi, 2017). If company is able to offer

goods at price which is satisfactory to customers than profits and customer base of

company get increased.

Implementation of various management system benefits company in making all important

decisions in regards to price, cost and inventory which in turn leads to organisation goals

and helps in providing quality product at an affordable price (Ahmad and Mohamed

Zabri, 2015).

Critical Evaluation of Management accounting system & reports

As per (Ofosu, 2018), management accounting system & management accounting report

are integrated as for preparation of budget report an estimation of cost of manufacturing of goods

& services are required and this is become possible by implementing cost accounting system in

organisation (Szychta and Dobroszek, 2016). Price Optimisation and inventory management

system helps in making of performance report because if ABC Ltd has sufficient inventory and it

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

is able to offer its product and services at an affordable price than performance of firm is can be

evaluated which helps in preparation of performance report.

On the other hand, According to (Chenhall and Moers, 2015) managerial reports are

prepared for achieving & evaluating over all performance of company and management systems

are used for analysing manufacturing of products & services. Records are beneficial for company

in making budget and analysing cash flows while management accounting is not helpful in

analysing overall profitability & performance of firm.

TASK 2

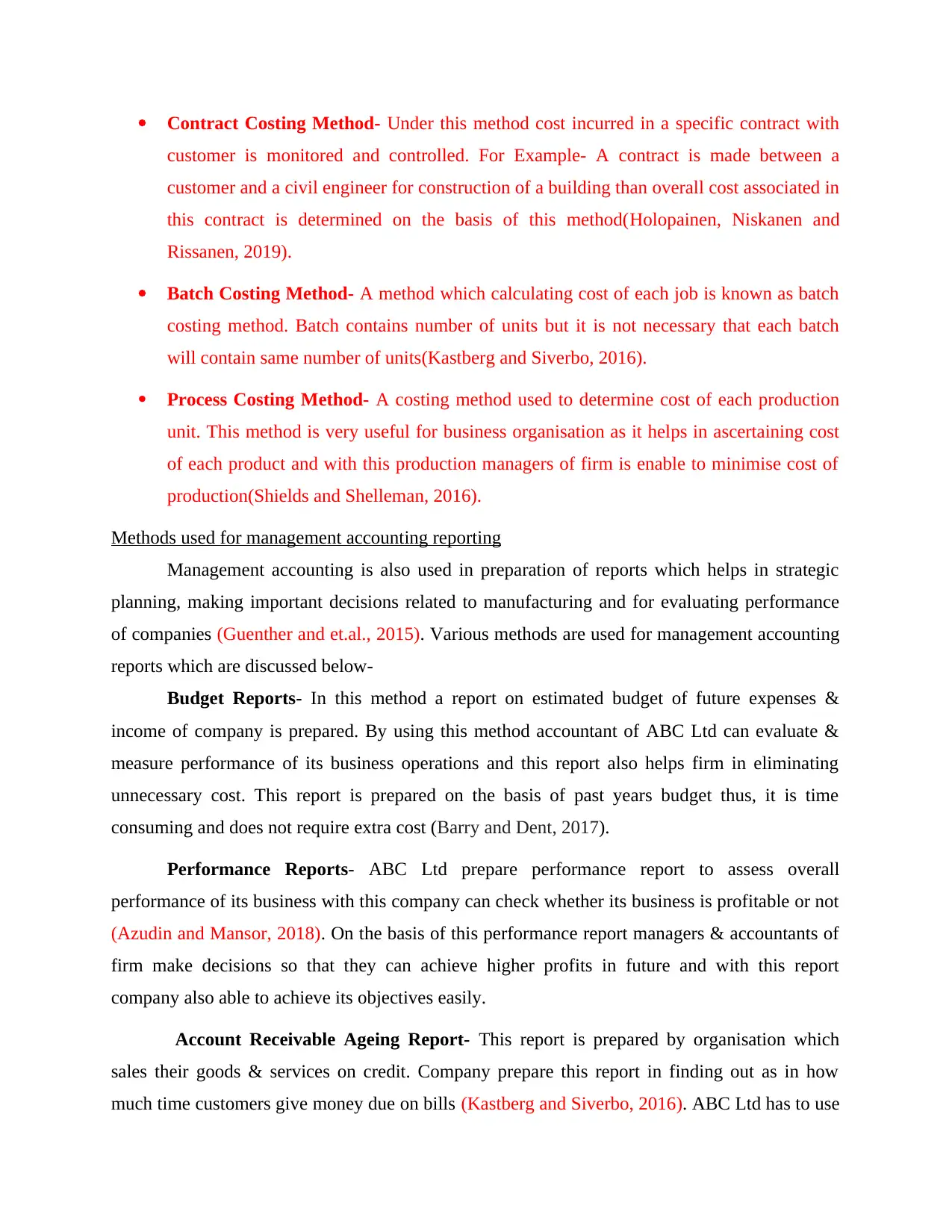

a) Marginal Costing

Budgeted Income Statement

Particulars Amount

Sales (16000 units @ £50 per unit) £800000

Less- Variable Cost @ £35 per unit (£560000)

Contribution £240000

Less- Fixed Cost (£100000)

Profit £140000

From the above income statement it is evaluated that company can achieve profit of

£140000 if it is able to sales 16000 units at a price of £50 per unit.

Actual Income Statement

Particulars Amount

Sales (16000 units @ £50 per unit) £800000

Less- Variable Cost @ £35 per unit (£560000)

Less- Closing Stock (3000 units @ £50 per unit) (£150000)

Contribution £90000

evaluated which helps in preparation of performance report.

On the other hand, According to (Chenhall and Moers, 2015) managerial reports are

prepared for achieving & evaluating over all performance of company and management systems

are used for analysing manufacturing of products & services. Records are beneficial for company

in making budget and analysing cash flows while management accounting is not helpful in

analysing overall profitability & performance of firm.

TASK 2

a) Marginal Costing

Budgeted Income Statement

Particulars Amount

Sales (16000 units @ £50 per unit) £800000

Less- Variable Cost @ £35 per unit (£560000)

Contribution £240000

Less- Fixed Cost (£100000)

Profit £140000

From the above income statement it is evaluated that company can achieve profit of

£140000 if it is able to sales 16000 units at a price of £50 per unit.

Actual Income Statement

Particulars Amount

Sales (16000 units @ £50 per unit) £800000

Less- Variable Cost @ £35 per unit (£560000)

Less- Closing Stock (3000 units @ £50 per unit) (£150000)

Contribution £90000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less- Fixed Cost (£100000)

Loss £10000

By evaluating above statement of profit and loss it is interpreted that business firm is

suffering from loss at budgeted sales of 16000 units as company is having a closing balance of

3000 units so all 16000 units are not sold from produced units.

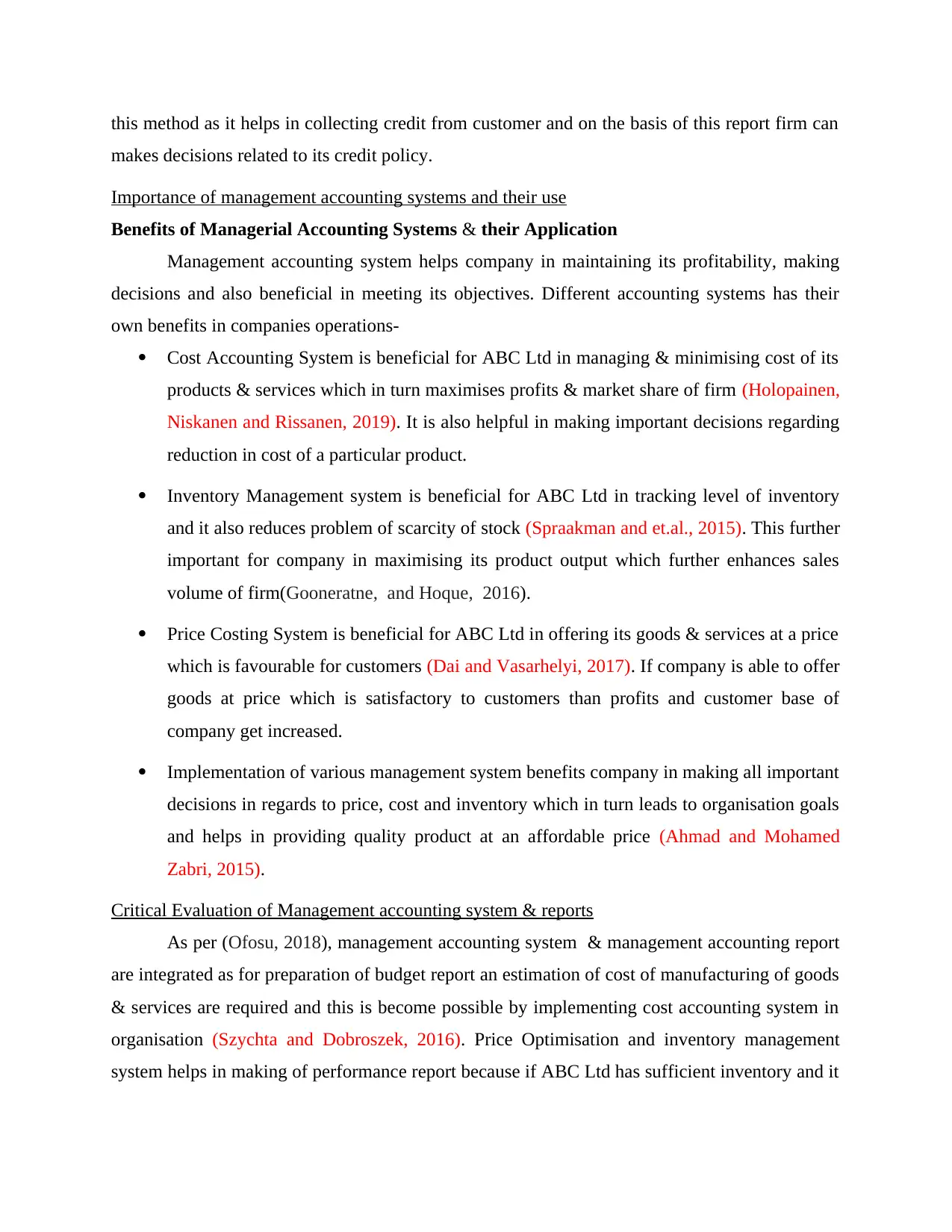

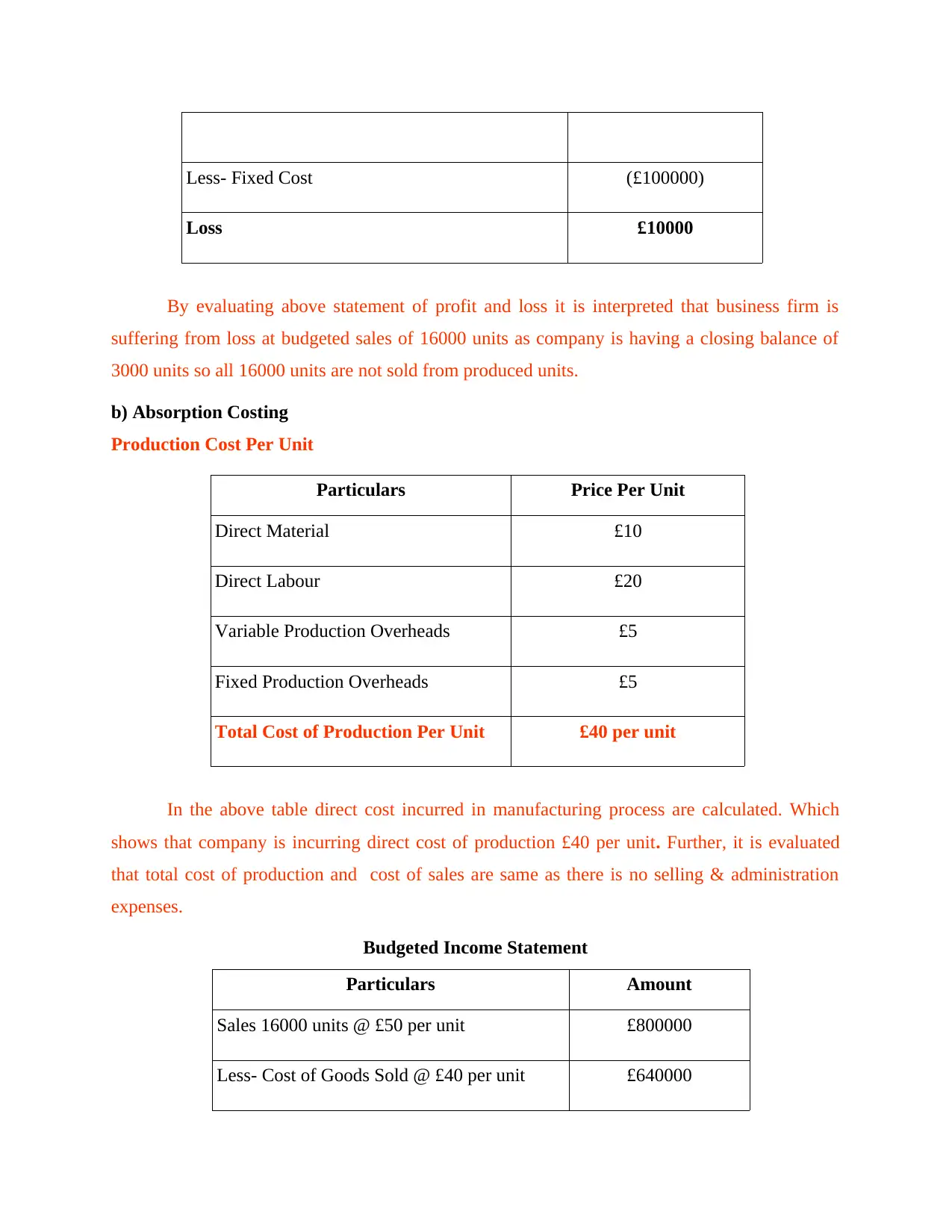

b) Absorption Costing

Production Cost Per Unit

Particulars Price Per Unit

Direct Material £10

Direct Labour £20

Variable Production Overheads £5

Fixed Production Overheads £5

Total Cost of Production Per Unit £40 per unit

In the above table direct cost incurred in manufacturing process are calculated. Which

shows that company is incurring direct cost of production £40 per unit. Further, it is evaluated

that total cost of production and cost of sales are same as there is no selling & administration

expenses.

Budgeted Income Statement

Particulars Amount

Sales 16000 units @ £50 per unit £800000

Less- Cost of Goods Sold @ £40 per unit £640000

Loss £10000

By evaluating above statement of profit and loss it is interpreted that business firm is

suffering from loss at budgeted sales of 16000 units as company is having a closing balance of

3000 units so all 16000 units are not sold from produced units.

b) Absorption Costing

Production Cost Per Unit

Particulars Price Per Unit

Direct Material £10

Direct Labour £20

Variable Production Overheads £5

Fixed Production Overheads £5

Total Cost of Production Per Unit £40 per unit

In the above table direct cost incurred in manufacturing process are calculated. Which

shows that company is incurring direct cost of production £40 per unit. Further, it is evaluated

that total cost of production and cost of sales are same as there is no selling & administration

expenses.

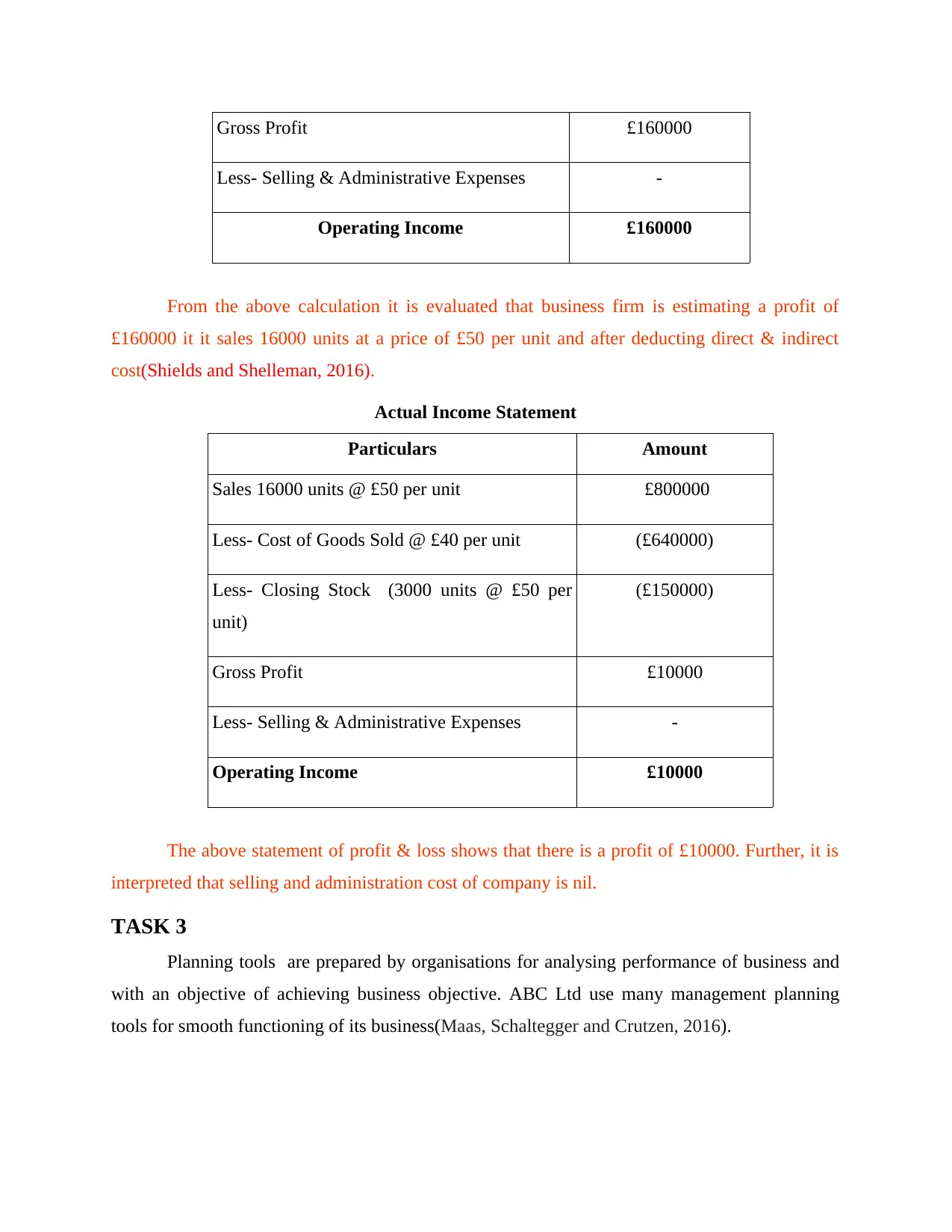

Budgeted Income Statement

Particulars Amount

Sales 16000 units @ £50 per unit £800000

Less- Cost of Goods Sold @ £40 per unit £640000

Gross Profit £160000

Less- Selling & Administrative Expenses -

Operating Income £160000

From the above calculation it is evaluated that business firm is estimating a profit of

£160000 it it sales 16000 units at a price of £50 per unit and after deducting direct & indirect

cost(Shields and Shelleman, 2016).

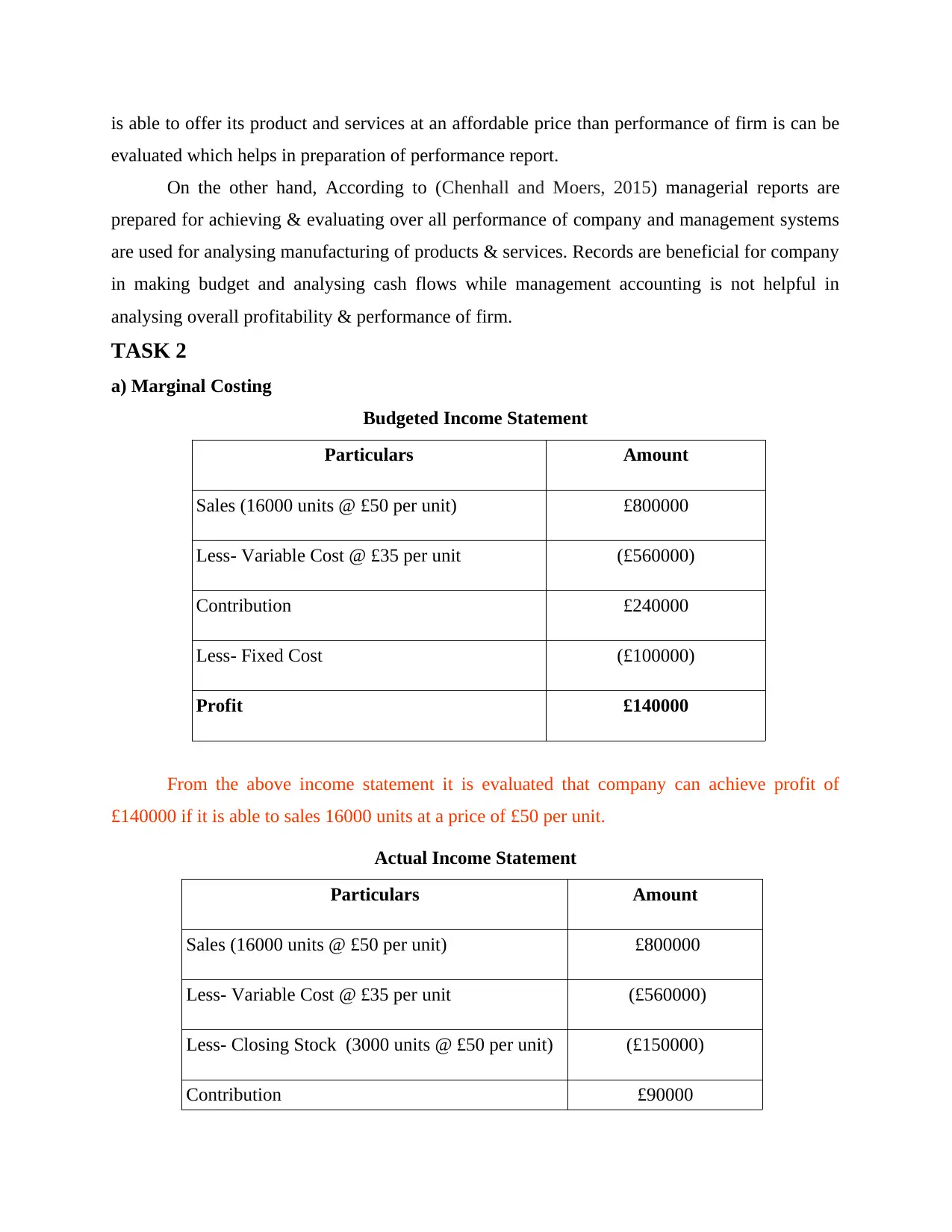

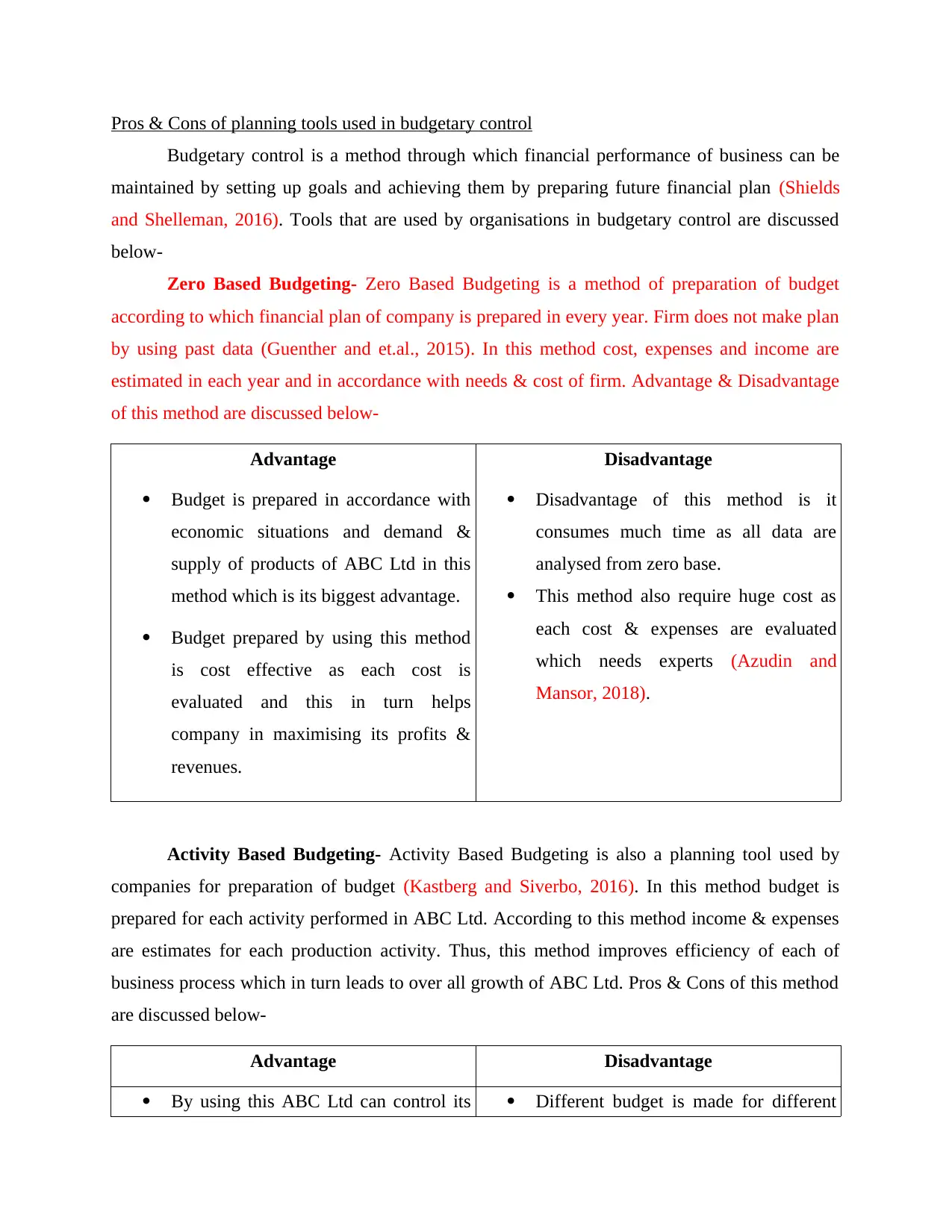

Actual Income Statement

Particulars Amount

Sales 16000 units @ £50 per unit £800000

Less- Cost of Goods Sold @ £40 per unit (£640000)

Less- Closing Stock (3000 units @ £50 per

unit)

(£150000)

Gross Profit £10000

Less- Selling & Administrative Expenses -

Operating Income £10000

The above statement of profit & loss shows that there is a profit of £10000. Further, it is

interpreted that selling and administration cost of company is nil.

TASK 3

Planning tools are prepared by organisations for analysing performance of business and

with an objective of achieving business objective. ABC Ltd use many management planning

tools for smooth functioning of its business(Maas, Schaltegger and Crutzen, 2016).

Less- Selling & Administrative Expenses -

Operating Income £160000

From the above calculation it is evaluated that business firm is estimating a profit of

£160000 it it sales 16000 units at a price of £50 per unit and after deducting direct & indirect

cost(Shields and Shelleman, 2016).

Actual Income Statement

Particulars Amount

Sales 16000 units @ £50 per unit £800000

Less- Cost of Goods Sold @ £40 per unit (£640000)

Less- Closing Stock (3000 units @ £50 per

unit)

(£150000)

Gross Profit £10000

Less- Selling & Administrative Expenses -

Operating Income £10000

The above statement of profit & loss shows that there is a profit of £10000. Further, it is

interpreted that selling and administration cost of company is nil.

TASK 3

Planning tools are prepared by organisations for analysing performance of business and

with an objective of achieving business objective. ABC Ltd use many management planning

tools for smooth functioning of its business(Maas, Schaltegger and Crutzen, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

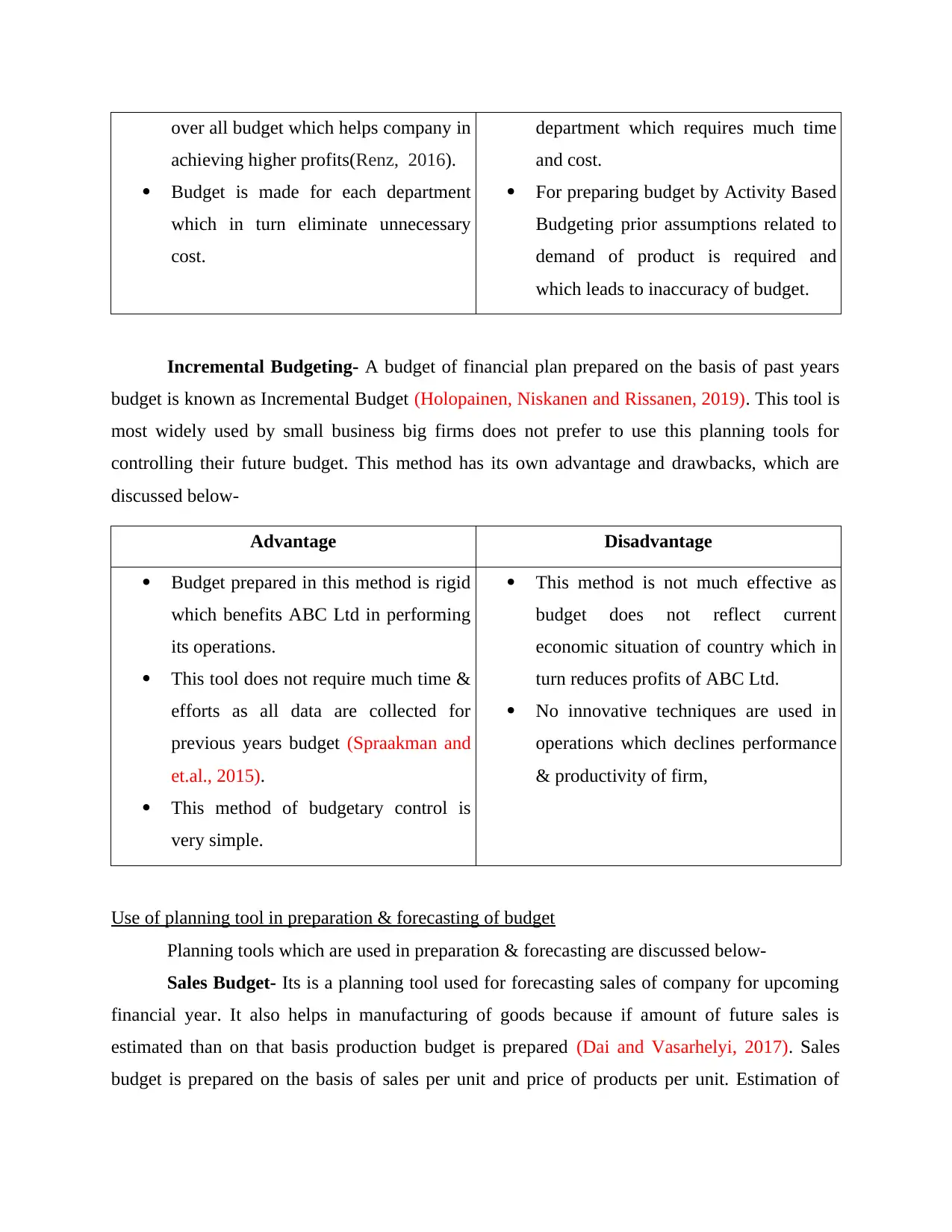

Pros & Cons of planning tools used in budgetary control

Budgetary control is a method through which financial performance of business can be

maintained by setting up goals and achieving them by preparing future financial plan (Shields

and Shelleman, 2016). Tools that are used by organisations in budgetary control are discussed

below-

Zero Based Budgeting- Zero Based Budgeting is a method of preparation of budget

according to which financial plan of company is prepared in every year. Firm does not make plan

by using past data (Guenther and et.al., 2015). In this method cost, expenses and income are

estimated in each year and in accordance with needs & cost of firm. Advantage & Disadvantage

of this method are discussed below-

Advantage Disadvantage

Budget is prepared in accordance with

economic situations and demand &

supply of products of ABC Ltd in this

method which is its biggest advantage.

Budget prepared by using this method

is cost effective as each cost is

evaluated and this in turn helps

company in maximising its profits &

revenues.

Disadvantage of this method is it

consumes much time as all data are

analysed from zero base.

This method also require huge cost as

each cost & expenses are evaluated

which needs experts (Azudin and

Mansor, 2018).

Activity Based Budgeting- Activity Based Budgeting is also a planning tool used by

companies for preparation of budget (Kastberg and Siverbo, 2016). In this method budget is

prepared for each activity performed in ABC Ltd. According to this method income & expenses

are estimates for each production activity. Thus, this method improves efficiency of each of

business process which in turn leads to over all growth of ABC Ltd. Pros & Cons of this method

are discussed below-

Advantage Disadvantage

By using this ABC Ltd can control its Different budget is made for different

Budgetary control is a method through which financial performance of business can be

maintained by setting up goals and achieving them by preparing future financial plan (Shields

and Shelleman, 2016). Tools that are used by organisations in budgetary control are discussed

below-

Zero Based Budgeting- Zero Based Budgeting is a method of preparation of budget

according to which financial plan of company is prepared in every year. Firm does not make plan

by using past data (Guenther and et.al., 2015). In this method cost, expenses and income are

estimated in each year and in accordance with needs & cost of firm. Advantage & Disadvantage

of this method are discussed below-

Advantage Disadvantage

Budget is prepared in accordance with

economic situations and demand &

supply of products of ABC Ltd in this

method which is its biggest advantage.

Budget prepared by using this method

is cost effective as each cost is

evaluated and this in turn helps

company in maximising its profits &

revenues.

Disadvantage of this method is it

consumes much time as all data are

analysed from zero base.

This method also require huge cost as

each cost & expenses are evaluated

which needs experts (Azudin and

Mansor, 2018).

Activity Based Budgeting- Activity Based Budgeting is also a planning tool used by

companies for preparation of budget (Kastberg and Siverbo, 2016). In this method budget is

prepared for each activity performed in ABC Ltd. According to this method income & expenses

are estimates for each production activity. Thus, this method improves efficiency of each of

business process which in turn leads to over all growth of ABC Ltd. Pros & Cons of this method

are discussed below-

Advantage Disadvantage

By using this ABC Ltd can control its Different budget is made for different

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

over all budget which helps company in

achieving higher profits(Renz, 2016).

Budget is made for each department

which in turn eliminate unnecessary

cost.

department which requires much time

and cost.

For preparing budget by Activity Based

Budgeting prior assumptions related to

demand of product is required and

which leads to inaccuracy of budget.

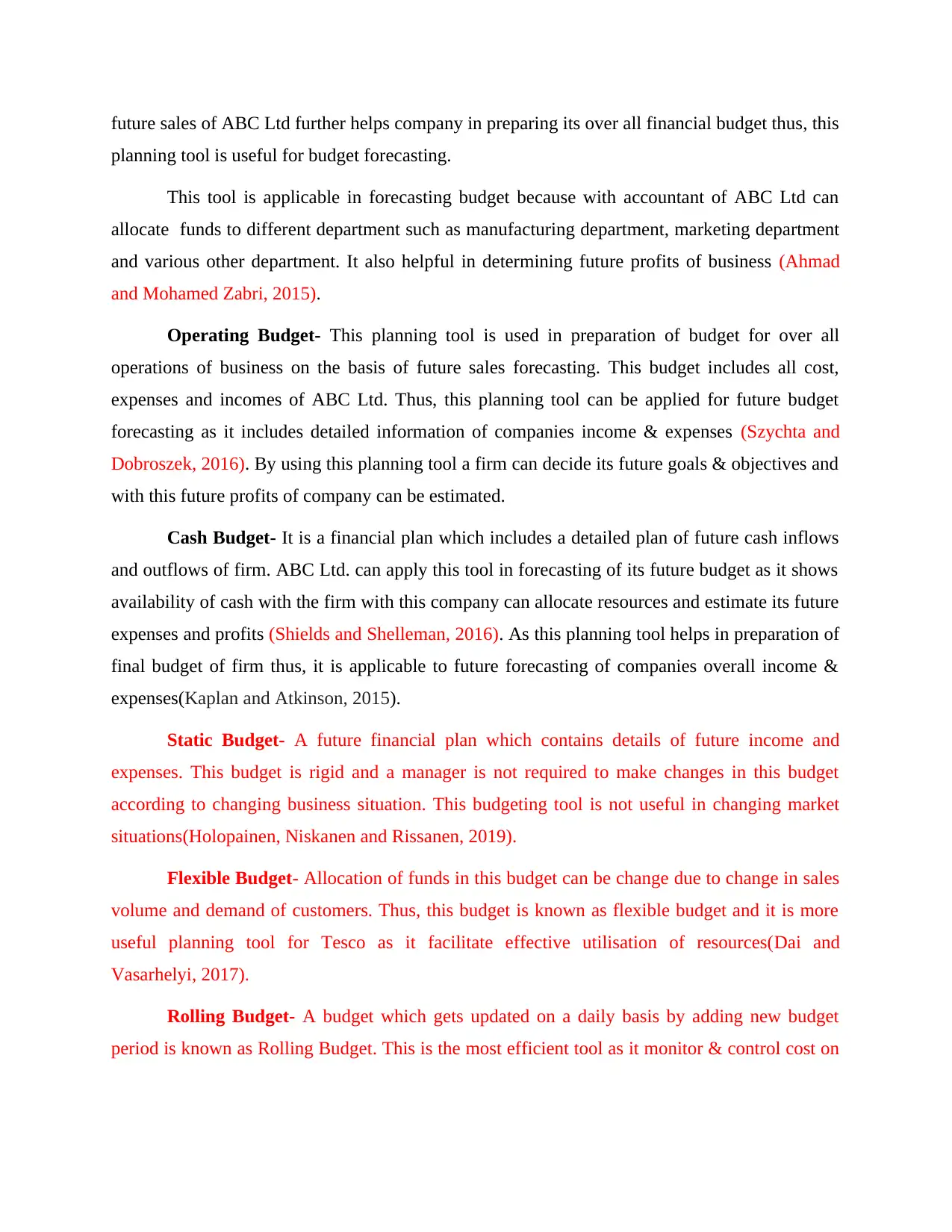

Incremental Budgeting- A budget of financial plan prepared on the basis of past years

budget is known as Incremental Budget (Holopainen, Niskanen and Rissanen, 2019). This tool is

most widely used by small business big firms does not prefer to use this planning tools for

controlling their future budget. This method has its own advantage and drawbacks, which are

discussed below-

Advantage Disadvantage

Budget prepared in this method is rigid

which benefits ABC Ltd in performing

its operations.

This tool does not require much time &

efforts as all data are collected for

previous years budget (Spraakman and

et.al., 2015).

This method of budgetary control is

very simple.

This method is not much effective as

budget does not reflect current

economic situation of country which in

turn reduces profits of ABC Ltd.

No innovative techniques are used in

operations which declines performance

& productivity of firm,

Use of planning tool in preparation & forecasting of budget

Planning tools which are used in preparation & forecasting are discussed below-

Sales Budget- Its is a planning tool used for forecasting sales of company for upcoming

financial year. It also helps in manufacturing of goods because if amount of future sales is

estimated than on that basis production budget is prepared (Dai and Vasarhelyi, 2017). Sales

budget is prepared on the basis of sales per unit and price of products per unit. Estimation of

achieving higher profits(Renz, 2016).

Budget is made for each department

which in turn eliminate unnecessary

cost.

department which requires much time

and cost.

For preparing budget by Activity Based

Budgeting prior assumptions related to

demand of product is required and

which leads to inaccuracy of budget.

Incremental Budgeting- A budget of financial plan prepared on the basis of past years

budget is known as Incremental Budget (Holopainen, Niskanen and Rissanen, 2019). This tool is

most widely used by small business big firms does not prefer to use this planning tools for

controlling their future budget. This method has its own advantage and drawbacks, which are

discussed below-

Advantage Disadvantage

Budget prepared in this method is rigid

which benefits ABC Ltd in performing

its operations.

This tool does not require much time &

efforts as all data are collected for

previous years budget (Spraakman and

et.al., 2015).

This method of budgetary control is

very simple.

This method is not much effective as

budget does not reflect current

economic situation of country which in

turn reduces profits of ABC Ltd.

No innovative techniques are used in

operations which declines performance

& productivity of firm,

Use of planning tool in preparation & forecasting of budget

Planning tools which are used in preparation & forecasting are discussed below-

Sales Budget- Its is a planning tool used for forecasting sales of company for upcoming

financial year. It also helps in manufacturing of goods because if amount of future sales is

estimated than on that basis production budget is prepared (Dai and Vasarhelyi, 2017). Sales

budget is prepared on the basis of sales per unit and price of products per unit. Estimation of

future sales of ABC Ltd further helps company in preparing its over all financial budget thus, this

planning tool is useful for budget forecasting.

This tool is applicable in forecasting budget because with accountant of ABC Ltd can

allocate funds to different department such as manufacturing department, marketing department

and various other department. It also helpful in determining future profits of business (Ahmad

and Mohamed Zabri, 2015).

Operating Budget- This planning tool is used in preparation of budget for over all

operations of business on the basis of future sales forecasting. This budget includes all cost,

expenses and incomes of ABC Ltd. Thus, this planning tool can be applied for future budget

forecasting as it includes detailed information of companies income & expenses (Szychta and

Dobroszek, 2016). By using this planning tool a firm can decide its future goals & objectives and

with this future profits of company can be estimated.

Cash Budget- It is a financial plan which includes a detailed plan of future cash inflows

and outflows of firm. ABC Ltd. can apply this tool in forecasting of its future budget as it shows

availability of cash with the firm with this company can allocate resources and estimate its future

expenses and profits (Shields and Shelleman, 2016). As this planning tool helps in preparation of

final budget of firm thus, it is applicable to future forecasting of companies overall income &

expenses(Kaplan and Atkinson, 2015).

Static Budget- A future financial plan which contains details of future income and

expenses. This budget is rigid and a manager is not required to make changes in this budget

according to changing business situation. This budgeting tool is not useful in changing market

situations(Holopainen, Niskanen and Rissanen, 2019).

Flexible Budget- Allocation of funds in this budget can be change due to change in sales

volume and demand of customers. Thus, this budget is known as flexible budget and it is more

useful planning tool for Tesco as it facilitate effective utilisation of resources(Dai and

Vasarhelyi, 2017).

Rolling Budget- A budget which gets updated on a daily basis by adding new budget

period is known as Rolling Budget. This is the most efficient tool as it monitor & control cost on

planning tool is useful for budget forecasting.

This tool is applicable in forecasting budget because with accountant of ABC Ltd can

allocate funds to different department such as manufacturing department, marketing department

and various other department. It also helpful in determining future profits of business (Ahmad

and Mohamed Zabri, 2015).

Operating Budget- This planning tool is used in preparation of budget for over all

operations of business on the basis of future sales forecasting. This budget includes all cost,

expenses and incomes of ABC Ltd. Thus, this planning tool can be applied for future budget

forecasting as it includes detailed information of companies income & expenses (Szychta and

Dobroszek, 2016). By using this planning tool a firm can decide its future goals & objectives and

with this future profits of company can be estimated.

Cash Budget- It is a financial plan which includes a detailed plan of future cash inflows

and outflows of firm. ABC Ltd. can apply this tool in forecasting of its future budget as it shows

availability of cash with the firm with this company can allocate resources and estimate its future

expenses and profits (Shields and Shelleman, 2016). As this planning tool helps in preparation of

final budget of firm thus, it is applicable to future forecasting of companies overall income &

expenses(Kaplan and Atkinson, 2015).

Static Budget- A future financial plan which contains details of future income and

expenses. This budget is rigid and a manager is not required to make changes in this budget

according to changing business situation. This budgeting tool is not useful in changing market

situations(Holopainen, Niskanen and Rissanen, 2019).

Flexible Budget- Allocation of funds in this budget can be change due to change in sales

volume and demand of customers. Thus, this budget is known as flexible budget and it is more

useful planning tool for Tesco as it facilitate effective utilisation of resources(Dai and

Vasarhelyi, 2017).

Rolling Budget- A budget which gets updated on a daily basis by adding new budget

period is known as Rolling Budget. This is the most efficient tool as it monitor & control cost on

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.