Management Accounting: Systems, Reporting & Financial Solutions

VerifiedAdded on 2023/06/15

|17

|5222

|431

Report

AI Summary

This report provides a comprehensive overview of management accounting, emphasizing its role in organizational decision-making and financial management. It begins by explaining management accounting and its essential requirements, detailing various methods used for reporting, including budgeting documents, job pricing analysis, and productivity monitoring frameworks. The report includes a calculation of costs using different techniques, such as marginal and absorption costing, to prepare an income statement. It further analyzes the advantages and disadvantages of different planning tools used for budgetary control and assesses how organizations adapt management accounting systems to respond to financial problems. The case study of Nasty Gal Vintage illustrates the practical application of these concepts, highlighting how effective management accounting can lead organizations to sustainable success. This document provides valuable insights into the integration of management accounting within organizational processes and its impact on strategic decision-making.

Management

accounting

accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

P1. Explain management accounting and give the essential requirements of different types of

management accounting systems.................................................................................................1

P2. Explain different methods used for management accounting reporting................................3

M1. Evaluate the benefits of management accounting systems and their application within an

organisational context..................................................................................................................6

Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes...............................................................6

TASK 2............................................................................................................................................6

P3. Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs...........................................................................6

Absorption costing...........................................................................................................................8

Flexed Budget for the actual activity...........................................................................................9

M2. Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.....................................................................................................9

PART B.........................................................................................................................................10

P4. Explain the advantages and disadvantages of different types of planning tools used for

budgetary control.......................................................................................................................10

M3. Analyse the use of different planning tools and their application for preparing and

forecasting budgets....................................................................................................................11

PART C.........................................................................................................................................11

P5. Compare how organisations are adapting management accounting systems to respond to

financial problems.....................................................................................................................11

Contents...........................................................................................................................................2

INTRODUCTION...........................................................................................................................1

PART A...........................................................................................................................................1

P1. Explain management accounting and give the essential requirements of different types of

management accounting systems.................................................................................................1

P2. Explain different methods used for management accounting reporting................................3

M1. Evaluate the benefits of management accounting systems and their application within an

organisational context..................................................................................................................6

Critically evaluate how management accounting systems and management accounting

reporting is integrated within organisational processes...............................................................6

TASK 2............................................................................................................................................6

P3. Calculate costs using appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs...........................................................................6

Absorption costing...........................................................................................................................8

Flexed Budget for the actual activity...........................................................................................9

M2. Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents.....................................................................................................9

PART B.........................................................................................................................................10

P4. Explain the advantages and disadvantages of different types of planning tools used for

budgetary control.......................................................................................................................10

M3. Analyse the use of different planning tools and their application for preparing and

forecasting budgets....................................................................................................................11

PART C.........................................................................................................................................11

P5. Compare how organisations are adapting management accounting systems to respond to

financial problems.....................................................................................................................11

M4. Analyse how, in responding to financial problems, management accounting can lead

organisations to sustainable success..........................................................................................13

Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success..............................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

organisations to sustainable success..........................................................................................13

Evaluate how planning tools for accounting respond appropriately to solving financial

problems to lead organisations to sustainable success..............................................................13

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Managerial accountancy is the act of evaluating a company's costs and activities by creating

quarterly data such as from an income statement, a capital structure, and a monetary statement,

among others (Ahadiat, 2013). It aids the company in understanding its existing fiscal place in

the industry, on the foundation of that which managers make subsequent decisions in attempt to

attain stated aims and targets. Administration is responsible for converting accounting

transactions into material should possess so that successful policies and initiatives may be

developed. Each company, regardless of company scale, must keep its general ledger in order to

portray information to its investors in the hopes of receiving the most monetary assistance

possible. The company which is discussed in the report is Nasty Gal Vintage which is named

after a Betty David record is selling vintage clothing on eBay and also engages in a lot of

activities apart from that and thus it is very crucial to analyse and evaluate all of its aspects as it

is a company which has covered a larger market share in terms of volume and thus is very

profitable and lucrative in the industry so far. The proposal covers a wide range of managerial

accountancy techniques as well as their key needs in company operations. In particular, the

managerial type of monitoring and several accounting methodologies for determining the income

statement performance are described in this study. In addition, the study specifically explains

multiple kinds of budgeting technology to enable managers in budgeting process, as well as their

benefits and drawbacks. Besides that, all other areas of managerial accountancy in the

framework of Nasty Gal Vintage are described in this document.

PART A

P1. Explain management accounting and give the essential requirements of different types of

management accounting systems

Managerial accountancy is the amount of available knowledge to enable managers

interprets fiscal facts into relevant and reliable statistics so that successful approaches and

strategies may be developed for the improvement of a company (Alleyne and Weekes-Marshall,

2011). As a result, managerial accountancy is an important aspect of a business that helps

companies recognise their real economic presence in the world by producing yearly fiscal

statements. For this reason, administration is made responsible for performing these activities

utilizing traditional managerial accountancy methods such as pricing optimization, stock

Managerial accountancy is the act of evaluating a company's costs and activities by creating

quarterly data such as from an income statement, a capital structure, and a monetary statement,

among others (Ahadiat, 2013). It aids the company in understanding its existing fiscal place in

the industry, on the foundation of that which managers make subsequent decisions in attempt to

attain stated aims and targets. Administration is responsible for converting accounting

transactions into material should possess so that successful policies and initiatives may be

developed. Each company, regardless of company scale, must keep its general ledger in order to

portray information to its investors in the hopes of receiving the most monetary assistance

possible. The company which is discussed in the report is Nasty Gal Vintage which is named

after a Betty David record is selling vintage clothing on eBay and also engages in a lot of

activities apart from that and thus it is very crucial to analyse and evaluate all of its aspects as it

is a company which has covered a larger market share in terms of volume and thus is very

profitable and lucrative in the industry so far. The proposal covers a wide range of managerial

accountancy techniques as well as their key needs in company operations. In particular, the

managerial type of monitoring and several accounting methodologies for determining the income

statement performance are described in this study. In addition, the study specifically explains

multiple kinds of budgeting technology to enable managers in budgeting process, as well as their

benefits and drawbacks. Besides that, all other areas of managerial accountancy in the

framework of Nasty Gal Vintage are described in this document.

PART A

P1. Explain management accounting and give the essential requirements of different types of

management accounting systems

Managerial accountancy is the amount of available knowledge to enable managers

interprets fiscal facts into relevant and reliable statistics so that successful approaches and

strategies may be developed for the improvement of a company (Alleyne and Weekes-Marshall,

2011). As a result, managerial accountancy is an important aspect of a business that helps

companies recognise their real economic presence in the world by producing yearly fiscal

statements. For this reason, administration is made responsible for performing these activities

utilizing traditional managerial accountancy methods such as pricing optimization, stock

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

administration, and standard costing, among others. Nasty Gal Vintage would be capable of

achieving potential development and intended targets once the administration has gathered more

trustworthy and useful information from finance statements produced by the accounting

supervisor. It is critical for Nasty Gal Vintage administration to determine if the company is

moving in the correct path or if adjustments to current programs and strategies are required. With

these bookkeeping methods, it could be simply obtained.

Use of managerial accountancy processes is crucial: Greater productivity: Utilizing various managerial accountancy techniques aids in

determining the firm's and industry's present positions. For instance, a cost optimization

technology can assists managers in determining how customers perceive the rates

imposed by a business for its goods and operations. This would aid managers in

formulating market strategy that would result in a large consumer foundation.

Assessment of effectiveness: It assists in determining and assessing an organization's

total results by evaluating real to quality standards that aids administration in recognising

any discrepancies, if any, that limit the firm's ability to expand. It allows managers to

create efficient rules and strategies for managing and controlling corporate activities,

resulting in increased overall productivity (Bloom, Sadun and Van Reenen, 2016).

Efficient managerial influence: Assist managers in monitoring and regulating company

transactions by creating efficient strategies for the future in order to accomplish stated

aims and targets within a certain period of timeline by evaluating operational expenses

and procedures.

Various accountancy methods for administration:

Cost optimization methods: These processes assist managers in evaluating the

accordance with its terms of prospective consumers in relation to the cost the business is

charging for their solutions and goods at the moment. It aids managers in formulating

successful marketing approaches after calculating the overall responsibility of providing

goods to the desired audience. This would support the business in preventing committed

consumers from switching to competitors' goods and solutions. Nasty Gal Vintage for

instance, manufactures apparel and other products, and so confronts stiff rivalry in the

marketplace. As a result, implementing such a method can assist an organization in

maintaining devoted clients by establishing rates based on their desire to pay. Such a

achieving potential development and intended targets once the administration has gathered more

trustworthy and useful information from finance statements produced by the accounting

supervisor. It is critical for Nasty Gal Vintage administration to determine if the company is

moving in the correct path or if adjustments to current programs and strategies are required. With

these bookkeeping methods, it could be simply obtained.

Use of managerial accountancy processes is crucial: Greater productivity: Utilizing various managerial accountancy techniques aids in

determining the firm's and industry's present positions. For instance, a cost optimization

technology can assists managers in determining how customers perceive the rates

imposed by a business for its goods and operations. This would aid managers in

formulating market strategy that would result in a large consumer foundation.

Assessment of effectiveness: It assists in determining and assessing an organization's

total results by evaluating real to quality standards that aids administration in recognising

any discrepancies, if any, that limit the firm's ability to expand. It allows managers to

create efficient rules and strategies for managing and controlling corporate activities,

resulting in increased overall productivity (Bloom, Sadun and Van Reenen, 2016).

Efficient managerial influence: Assist managers in monitoring and regulating company

transactions by creating efficient strategies for the future in order to accomplish stated

aims and targets within a certain period of timeline by evaluating operational expenses

and procedures.

Various accountancy methods for administration:

Cost optimization methods: These processes assist managers in evaluating the

accordance with its terms of prospective consumers in relation to the cost the business is

charging for their solutions and goods at the moment. It aids managers in formulating

successful marketing approaches after calculating the overall responsibility of providing

goods to the desired audience. This would support the business in preventing committed

consumers from switching to competitors' goods and solutions. Nasty Gal Vintage for

instance, manufactures apparel and other products, and so confronts stiff rivalry in the

marketplace. As a result, implementing such a method can assist an organization in

maintaining devoted clients by establishing rates based on their desire to pay. Such a

method is much more useful in evaluating the purchase intention of prospective

consumers, on the basis of which price policy decisions are formed. It aids the

organisation in maintaining satisfied consumers for a prolonged length of duration by

increasing overall sense of happiness (Caglio and Ditillo, 2012).

Stock control technology: It is a very efficient financial administration framework that

allows Nasty Gal Vintage mangers to determine the real stock on hand. This would allow

managers to determine whether or not the business has enough products to fulfil customer

necessities. Employing such a method enables the organisation save money on stock

because the sales management simply orders product from vendors whenever the

business needs it.

Standard costing method: This is an accountancy method that informs control of the

project price involved in the production of particular goods and activities. For this, Nasty

Gal Vintage administration must initially evaluate the viability of creating goods and

their consumer expectations, on the foundation of which decisions on costing system to

make certain items with the goal of achieving optimum productivity must be established.

For instance, the need for apparel grows with the increase in festivities, therefore

allocating the highest expense to create clothes results in a lucrative conclusion for Nasty

Gal Vintage. Job pricing method: This type of accountancy scheme aids managers in allocating costs

to a single item or set of goods following determining potential results. Utilizing such a

method, knowledge about estimated expenses is communicated to a customer, and

expenses are compensated. It assists the finance director in determining the amount of

price that must be expended during the production cycle. Nasty Gal Vintage for

instance, manufactures apparels and other products which have a large customer base

both online and offline, resulting in a large number of clothing related items that are

produced in response to marketplace need, with correct standard costing facilitated

through the use of such an accountancy information framework (Chathurangani and

Madhusanka, 2019).

P2. Explain different methods used for management accounting reporting

Financial management reporting can help with strategy, judgement call, regulation, and

measurement and reporting. According to the regulations, such plans are produced on a regular

consumers, on the basis of which price policy decisions are formed. It aids the

organisation in maintaining satisfied consumers for a prolonged length of duration by

increasing overall sense of happiness (Caglio and Ditillo, 2012).

Stock control technology: It is a very efficient financial administration framework that

allows Nasty Gal Vintage mangers to determine the real stock on hand. This would allow

managers to determine whether or not the business has enough products to fulfil customer

necessities. Employing such a method enables the organisation save money on stock

because the sales management simply orders product from vendors whenever the

business needs it.

Standard costing method: This is an accountancy method that informs control of the

project price involved in the production of particular goods and activities. For this, Nasty

Gal Vintage administration must initially evaluate the viability of creating goods and

their consumer expectations, on the foundation of which decisions on costing system to

make certain items with the goal of achieving optimum productivity must be established.

For instance, the need for apparel grows with the increase in festivities, therefore

allocating the highest expense to create clothes results in a lucrative conclusion for Nasty

Gal Vintage. Job pricing method: This type of accountancy scheme aids managers in allocating costs

to a single item or set of goods following determining potential results. Utilizing such a

method, knowledge about estimated expenses is communicated to a customer, and

expenses are compensated. It assists the finance director in determining the amount of

price that must be expended during the production cycle. Nasty Gal Vintage for

instance, manufactures apparels and other products which have a large customer base

both online and offline, resulting in a large number of clothing related items that are

produced in response to marketplace need, with correct standard costing facilitated

through the use of such an accountancy information framework (Chathurangani and

Madhusanka, 2019).

P2. Explain different methods used for management accounting reporting

Financial management reporting can help with strategy, judgement call, regulation, and

measurement and reporting. According to the regulations, such plans are produced on a regular

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

schedule all through the budgeting and forecasting cycle. Even though a lot of important choices

rest on the accuracy of such a study. Such data are evaluated by managers, who transform them

into meaningful data for the company. Nasty Gal Vantage employs a variety of techniques for

creating financial statements, including the following:

Budgeting document: This type of management accounting is particularly useful for

assessing a financial operations and helping managers review their divisions' activities

and keep costs under line. To comprehend the strategies of their firm, the firm creates a

bigger plan. The predicted cost is based on real spending from prior seasons. The budget

of a company is made up of all of the company's performance and expenses. Nasty Gal

Vantage must meet its respective aims and targets within the allocated cost. Management

accountancy reports are linked to budgets and assist managers in providing rewards,

awards, and efficiency gains to staff as well as negotiating a deal with customers and

subcontractors. As a result, a financial plan is critical for any business (Christensen and

et, 2015).

Job pricing analysis: This study details all costs associated with a certain program that

was sponsored by the company. They're usually paired with an expected earnings figure

so that the management may assess the company's effectiveness. It aids in the

identification of the company's higher-earning regions, allowing managers to focus on

extra requirements instead of spending energy and money on jobs with lower

profitability. Job pricing reports are also useful for tracking spending as a program

progresses, allowing you to identify and eliminate inefficiency as expenditures run out of

hand. Nasty Gal Vantage's administration may simply examine the recordings of jobs

completed as well as the overall productivity of team members using this application in a

methodical and effective manner.

Productivity monitoring framework: At the time of termination, such sort of analysis is

generated to evaluate the organizational effectiveness as a group rather than for each

individual worker. Managers at Nasty Gal Vantage utilize this information to make

important policy options about the team's growth. This type of analysis provides a

detailed look into a company's operations. In order to preserve detailed measurements of

their approach against the company's goal, success reports serve a crucial part in a

rest on the accuracy of such a study. Such data are evaluated by managers, who transform them

into meaningful data for the company. Nasty Gal Vantage employs a variety of techniques for

creating financial statements, including the following:

Budgeting document: This type of management accounting is particularly useful for

assessing a financial operations and helping managers review their divisions' activities

and keep costs under line. To comprehend the strategies of their firm, the firm creates a

bigger plan. The predicted cost is based on real spending from prior seasons. The budget

of a company is made up of all of the company's performance and expenses. Nasty Gal

Vantage must meet its respective aims and targets within the allocated cost. Management

accountancy reports are linked to budgets and assist managers in providing rewards,

awards, and efficiency gains to staff as well as negotiating a deal with customers and

subcontractors. As a result, a financial plan is critical for any business (Christensen and

et, 2015).

Job pricing analysis: This study details all costs associated with a certain program that

was sponsored by the company. They're usually paired with an expected earnings figure

so that the management may assess the company's effectiveness. It aids in the

identification of the company's higher-earning regions, allowing managers to focus on

extra requirements instead of spending energy and money on jobs with lower

profitability. Job pricing reports are also useful for tracking spending as a program

progresses, allowing you to identify and eliminate inefficiency as expenditures run out of

hand. Nasty Gal Vantage's administration may simply examine the recordings of jobs

completed as well as the overall productivity of team members using this application in a

methodical and effective manner.

Productivity monitoring framework: At the time of termination, such sort of analysis is

generated to evaluate the organizational effectiveness as a group rather than for each

individual worker. Managers at Nasty Gal Vantage utilize this information to make

important policy options about the team's growth. This type of analysis provides a

detailed look into a company's operations. In order to preserve detailed measurements of

their approach against the company's goal, success reports serve a crucial part in a

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company. The primary emphasis of this research is on fiscal conflicts that aid in

evaluating and controlling an organization's true quality (Cinquini and Tenucci, 2010).

Production and stock document: This is an essential summary that aids in the

productive and successful management of actual count and production methods. Direct

labour expenses, stock wastage, and per-unit operating expenses are all included in this

analysis. Nasty Gal Vantage's management analyze the firm's numerous parts and

components to discover opportunities for development, and reward the best-performing

departments with rewards and compensation.

Accounts receivables ageing analysis: If a firm expands credits to its customers, this

analysis is a comprehensive method of controlling working capital. Nasty Gal Vantage's

management uses an accounts receivables ageing analysis to discover problems with the

firm's recovery technique. Whenever a large percentage of customers are unable to repay

their loans, the lending rules of the company must be tightened. Periodic accounts

receivables ageing method is highly helpful in preventing the collecting team from

neglecting older receivables.

Price management accountancy indicates: This analysis is important when a

management wants to figure out how much an item costs in their company. Outgoings,

natural resources, personnel, or any additional costs are considered. The statistics are split

by the price of the completed article. These price sections highlight all of the data

pertaining to the manufacturing method. The ability to realise the stock's pricing as well

as its market value is provided by the expense management analysis. Calculation of

profitability and tracking via such analysis provide a comprehensive overview of the

costs associated with the study's manufacturing and purchase. This study includes weekly

employment prices, stock wastage, and operating prices since it provides an accurate

picture of all expenditures that is critical for maximum capacity utilization across all

divisions (da Silva, Llewellyn and Anderson-Gough, 2017).

It is critical for managers to utilize such techniques in order to make sure that the company

operates effectively and efficiently. Such strategies are suitable for examining manufacturing

costs and estimating profitability. It's critical for Nasty Gal Vantage's success. To develop a

financial statement that will aid in the achievement of specific goals within the allocated

expenditure.

evaluating and controlling an organization's true quality (Cinquini and Tenucci, 2010).

Production and stock document: This is an essential summary that aids in the

productive and successful management of actual count and production methods. Direct

labour expenses, stock wastage, and per-unit operating expenses are all included in this

analysis. Nasty Gal Vantage's management analyze the firm's numerous parts and

components to discover opportunities for development, and reward the best-performing

departments with rewards and compensation.

Accounts receivables ageing analysis: If a firm expands credits to its customers, this

analysis is a comprehensive method of controlling working capital. Nasty Gal Vantage's

management uses an accounts receivables ageing analysis to discover problems with the

firm's recovery technique. Whenever a large percentage of customers are unable to repay

their loans, the lending rules of the company must be tightened. Periodic accounts

receivables ageing method is highly helpful in preventing the collecting team from

neglecting older receivables.

Price management accountancy indicates: This analysis is important when a

management wants to figure out how much an item costs in their company. Outgoings,

natural resources, personnel, or any additional costs are considered. The statistics are split

by the price of the completed article. These price sections highlight all of the data

pertaining to the manufacturing method. The ability to realise the stock's pricing as well

as its market value is provided by the expense management analysis. Calculation of

profitability and tracking via such analysis provide a comprehensive overview of the

costs associated with the study's manufacturing and purchase. This study includes weekly

employment prices, stock wastage, and operating prices since it provides an accurate

picture of all expenditures that is critical for maximum capacity utilization across all

divisions (da Silva, Llewellyn and Anderson-Gough, 2017).

It is critical for managers to utilize such techniques in order to make sure that the company

operates effectively and efficiently. Such strategies are suitable for examining manufacturing

costs and estimating profitability. It's critical for Nasty Gal Vantage's success. To develop a

financial statement that will aid in the achievement of specific goals within the allocated

expenditure.

M1. Evaluate the benefits of management accounting systems and their application within an

organisational context

Accountancy for administration serves a critical function in effectively controlling and

maintaining monetary operations. It is critical for a company to use a variety of financial

reporting, like task bookkeeping methods and pricing optimization, to achieve optimal and

productive valued outcomes. This form of accountancy information methodology is utilised with

the goal of boosting a firm's revenue and efficiency so that it would achieve a long-term place in

the market in which it is operational. Managerial accountancy aids managers in the creation of

statistics relating to employee productivity. The gathering of precise and reliable data aids

managers in carrying out all company activities and tasks efficiently.

Critically evaluate how management accounting systems and management accounting reporting

is integrated within organisational processes

It is critical for Nasty Gal Vantage's management to develop presentations using necessary

details and historical statistics in necessary for the firm to work effectively and efficiently.

Managers could also assess an entire efficiency of the system. This is indeed critical while

making investing selections. Another of the key goals of utilizing a reporting platform is to

enhance the company's development. Nasty Gal Vantage uses a variety of monitoring

methodologies and approaches, including progress reports, budgeting reports, accounts

receivables reports, job pricing reports, and stock and distribution reports. Such techniques aid in

reducing waste and increasing profitability (Galinova, 2017).

TASK 2

P3. Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

Cost: It relates to the quantity of money spent to create or purchase anything in addition to

make a gain from the sale of those commodities. To put it another way, expense is primarily a

value of the energy, money, duration and commodities, liabilities, as well as other factors that

must be spent in the implementation of various company operations. These costs are associated

to the materials, personnel, running costs, and other costs involved in the manufacturing

processes. The organization has three ways for determining net income throughout this case.

Nasty Gal Vantage is a producing firm; therefore it must calculate the expenses associated with

organisational context

Accountancy for administration serves a critical function in effectively controlling and

maintaining monetary operations. It is critical for a company to use a variety of financial

reporting, like task bookkeeping methods and pricing optimization, to achieve optimal and

productive valued outcomes. This form of accountancy information methodology is utilised with

the goal of boosting a firm's revenue and efficiency so that it would achieve a long-term place in

the market in which it is operational. Managerial accountancy aids managers in the creation of

statistics relating to employee productivity. The gathering of precise and reliable data aids

managers in carrying out all company activities and tasks efficiently.

Critically evaluate how management accounting systems and management accounting reporting

is integrated within organisational processes

It is critical for Nasty Gal Vantage's management to develop presentations using necessary

details and historical statistics in necessary for the firm to work effectively and efficiently.

Managers could also assess an entire efficiency of the system. This is indeed critical while

making investing selections. Another of the key goals of utilizing a reporting platform is to

enhance the company's development. Nasty Gal Vantage uses a variety of monitoring

methodologies and approaches, including progress reports, budgeting reports, accounts

receivables reports, job pricing reports, and stock and distribution reports. Such techniques aid in

reducing waste and increasing profitability (Galinova, 2017).

TASK 2

P3. Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

Cost: It relates to the quantity of money spent to create or purchase anything in addition to

make a gain from the sale of those commodities. To put it another way, expense is primarily a

value of the energy, money, duration and commodities, liabilities, as well as other factors that

must be spent in the implementation of various company operations. These costs are associated

to the materials, personnel, running costs, and other costs involved in the manufacturing

processes. The organization has three ways for determining net income throughout this case.

Nasty Gal Vantage is a producing firm; therefore it must calculate the expenses associated with

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

various commercial efforts to attain good financial performance and long-term viability. It

instructs managers to reduce waste as much as possible to maximize revenues. Marginal costing

and absorption costing are the 2 most used pricing approaches. It is also described in the

following sections:

Marginal pricing is a way of calculating net efficiency that only considers variable

expenses. When an organisation produces one additional piece of production in addition

to the original production, this strategy is helpful. Sometimes it raises or lowers the

overall price of manufacturing, depending on the amount of products generated. Marginal

cost, often called as variable cost, comprises personnel and commodity expenses, as well

as a fraction of the set rate that is projected (Harper and Dunn, 2018).

Absorption pricing is yet another useful accounting system that incorporates all sorts of

expenses, including adjustable and permanent expenses that have an impact on net

income. When calculating net income, it takes into account both dynamic and permanent

costs. For instance, direct expenses comprise the price of labour, the price of basic

commodities, and the expense of maintenance. Owing to the existence of permanent

costs, the net income of the firm diminishes, making it a little less appealing to most

businesses.

Cost Cards

November

Sales = 70* 10000 = £ 700000

Direct Materials = £100000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

December

Sales = 70* 8000 = £ 560000

Direct Materials = £100000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

Inventory = £ 2000 units

instructs managers to reduce waste as much as possible to maximize revenues. Marginal costing

and absorption costing are the 2 most used pricing approaches. It is also described in the

following sections:

Marginal pricing is a way of calculating net efficiency that only considers variable

expenses. When an organisation produces one additional piece of production in addition

to the original production, this strategy is helpful. Sometimes it raises or lowers the

overall price of manufacturing, depending on the amount of products generated. Marginal

cost, often called as variable cost, comprises personnel and commodity expenses, as well

as a fraction of the set rate that is projected (Harper and Dunn, 2018).

Absorption pricing is yet another useful accounting system that incorporates all sorts of

expenses, including adjustable and permanent expenses that have an impact on net

income. When calculating net income, it takes into account both dynamic and permanent

costs. For instance, direct expenses comprise the price of labour, the price of basic

commodities, and the expense of maintenance. Owing to the existence of permanent

costs, the net income of the firm diminishes, making it a little less appealing to most

businesses.

Cost Cards

November

Sales = 70* 10000 = £ 700000

Direct Materials = £100000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

December

Sales = 70* 8000 = £ 560000

Direct Materials = £100000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

Inventory = £ 2000 units

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

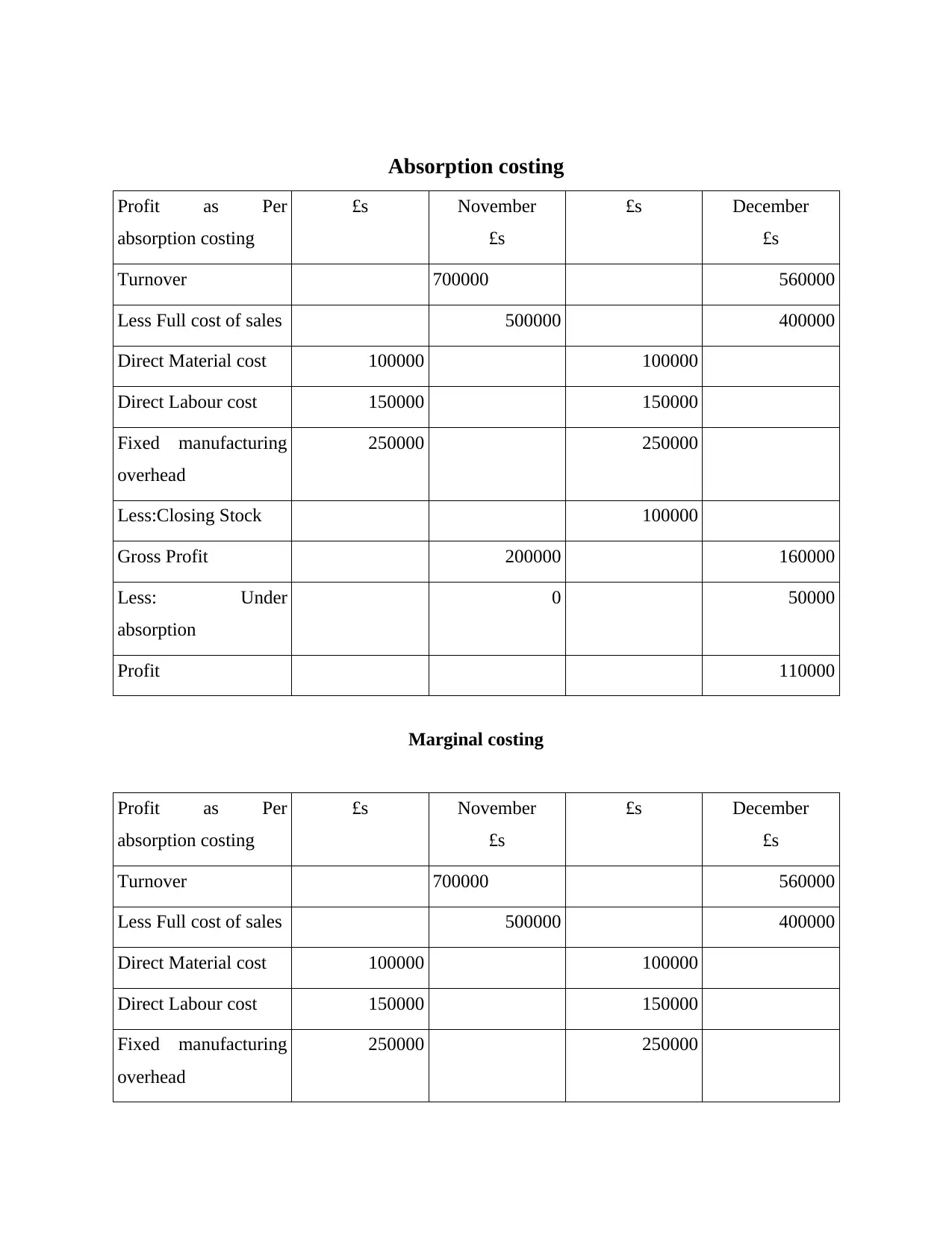

Absorption costing

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Less Full cost of sales 500000 400000

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Less:Closing Stock 100000

Gross Profit 200000 160000

Less: Under

absorption

0 50000

Profit 110000

Marginal costing

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Less Full cost of sales 500000 400000

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Less Full cost of sales 500000 400000

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Less:Closing Stock 100000

Gross Profit 200000 160000

Less: Under

absorption

0 50000

Profit 110000

Marginal costing

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Less Full cost of sales 500000 400000

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Less:Closing Stock 100000

Gross Profit 200000 160000

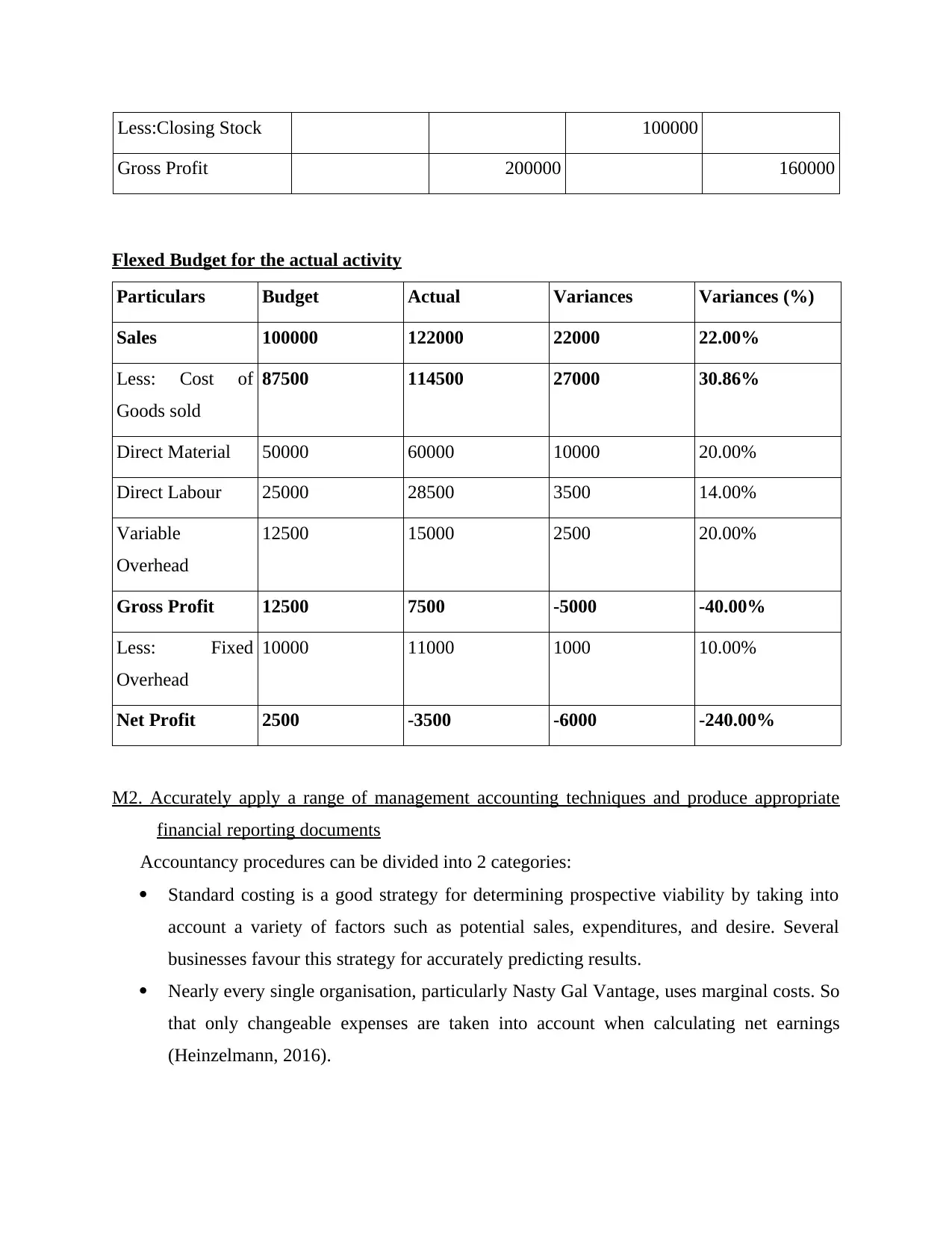

Flexed Budget for the actual activity

Particulars Budget Actual Variances Variances (%)

Sales 100000 122000 22000 22.00%

Less: Cost of

Goods sold

87500 114500 27000 30.86%

Direct Material 50000 60000 10000 20.00%

Direct Labour 25000 28500 3500 14.00%

Variable

Overhead

12500 15000 2500 20.00%

Gross Profit 12500 7500 -5000 -40.00%

Less: Fixed

Overhead

10000 11000 1000 10.00%

Net Profit 2500 -3500 -6000 -240.00%

M2. Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents

Accountancy procedures can be divided into 2 categories:

Standard costing is a good strategy for determining prospective viability by taking into

account a variety of factors such as potential sales, expenditures, and desire. Several

businesses favour this strategy for accurately predicting results.

Nearly every single organisation, particularly Nasty Gal Vantage, uses marginal costs. So

that only changeable expenses are taken into account when calculating net earnings

(Heinzelmann, 2016).

Gross Profit 200000 160000

Flexed Budget for the actual activity

Particulars Budget Actual Variances Variances (%)

Sales 100000 122000 22000 22.00%

Less: Cost of

Goods sold

87500 114500 27000 30.86%

Direct Material 50000 60000 10000 20.00%

Direct Labour 25000 28500 3500 14.00%

Variable

Overhead

12500 15000 2500 20.00%

Gross Profit 12500 7500 -5000 -40.00%

Less: Fixed

Overhead

10000 11000 1000 10.00%

Net Profit 2500 -3500 -6000 -240.00%

M2. Accurately apply a range of management accounting techniques and produce appropriate

financial reporting documents

Accountancy procedures can be divided into 2 categories:

Standard costing is a good strategy for determining prospective viability by taking into

account a variety of factors such as potential sales, expenditures, and desire. Several

businesses favour this strategy for accurately predicting results.

Nearly every single organisation, particularly Nasty Gal Vantage, uses marginal costs. So

that only changeable expenses are taken into account when calculating net earnings

(Heinzelmann, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.