Analysis of Management Accounting Systems and Techniques at Galway Plc

VerifiedAdded on 2021/02/22

|19

|5247

|45

Report

AI Summary

This report provides a comprehensive analysis of management accounting systems and techniques, specifically tailored for Galway Plc, a manufacturing company. It begins with an introduction to managerial accounting, emphasizing its role in decision-making and organizational goal achievement. The report explores different management accounting systems, including cost accounting, inventory management, job costing, and price optimization systems, detailing their benefits and applications within the context of Galway Plc. Furthermore, it examines various methods used for management accounting reporting, such as budget reports, aging reports, inventory reports, job cost reports, and performance reports. The report delves into cost analysis techniques, presenting calculations for both marginal and absorption costing, and concludes by discussing planning tools for budgetary control, including their advantages, disadvantages, and the adaptation of management accounting to address financial challenges within the company. The report is designed to provide financial advice to Galway Plc.

Management accounting systems and

techniques

techniques

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

Managerial accounting is a process of collecting and analysing information of expenses

incurred in the business to achieve and communicate that information to management to take

better decisions to achieve organisation goals and objectives (Otley, D., 2016). There are

different management system used for accounting are cost-accounting, price optimization etc. It

is beneficial in planning, organising, controlling, coordinating and decision making. This report

is based on Galway Plc manufactures company who need financial advise. The report will

contain importance of management accounting systems in the organisation, methods used for

reporting management accounting. Further report will contain techniques of cost analysis,

preparation of income statement using marginal and absorption costing. Lastly report tells about

different planning tools for budgetary control, their pros and cons and how companies are

adapting management accounting to face financial problems.

LO 1

P1 management accounting and types of management accounting systems.

Management Accounting:

It is also called cost accounting. It is a process of identifying, analysing, measuring,

interpreting and communicate information to management to achieve organisation goal. It refers

to the process of analysing operations and cost to make financial reports (Maas and et.al., 2016).

Management accounting is different from financial accounting, financial accounting focuses on

providing information to people outside the company and management accounting focuses on

providing information within the organisation which is useful for managers to make decisions. It

handles profit margins, forecasting, trends, capital budgeting and product costing etc.

It plays a major role in organisation. Its purpose is to support the decision of organisation

to compete in the market by collecting and communicating information. It is beneficial for

Galway Plc manufactures management to plan and evaluate company processes and strategies.

Its main role is budgeting. Budget is required for every organisation to carry out its production

and operation cost. Management accountant role in the company is to view historical data and

predict the future expense. It is beneficial for organisation to controls its operations, to plan,

organise, identify problems and make strategies to achieve goals (Cooperand et.al., 2017).

There are 4 types of management accounting systems:

1

Managerial accounting is a process of collecting and analysing information of expenses

incurred in the business to achieve and communicate that information to management to take

better decisions to achieve organisation goals and objectives (Otley, D., 2016). There are

different management system used for accounting are cost-accounting, price optimization etc. It

is beneficial in planning, organising, controlling, coordinating and decision making. This report

is based on Galway Plc manufactures company who need financial advise. The report will

contain importance of management accounting systems in the organisation, methods used for

reporting management accounting. Further report will contain techniques of cost analysis,

preparation of income statement using marginal and absorption costing. Lastly report tells about

different planning tools for budgetary control, their pros and cons and how companies are

adapting management accounting to face financial problems.

LO 1

P1 management accounting and types of management accounting systems.

Management Accounting:

It is also called cost accounting. It is a process of identifying, analysing, measuring,

interpreting and communicate information to management to achieve organisation goal. It refers

to the process of analysing operations and cost to make financial reports (Maas and et.al., 2016).

Management accounting is different from financial accounting, financial accounting focuses on

providing information to people outside the company and management accounting focuses on

providing information within the organisation which is useful for managers to make decisions. It

handles profit margins, forecasting, trends, capital budgeting and product costing etc.

It plays a major role in organisation. Its purpose is to support the decision of organisation

to compete in the market by collecting and communicating information. It is beneficial for

Galway Plc manufactures management to plan and evaluate company processes and strategies.

Its main role is budgeting. Budget is required for every organisation to carry out its production

and operation cost. Management accountant role in the company is to view historical data and

predict the future expense. It is beneficial for organisation to controls its operations, to plan,

organise, identify problems and make strategies to achieve goals (Cooperand et.al., 2017).

There are 4 types of management accounting systems:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Cost-accounting systems: It is also known as product costing or costing system. It is a

process in which firm estimates the cost of its products for inventory valuation and profitability

analysis. It manages the inventory flow in every stage of production. It measures the cost and

then compare input with the output of the company. It measures the financial performance of

company.

There are main 2 types of cost accounting:

Standard cost accounting uses ratios to measure the efficient use of materials in

producing products and services.

Activity based costing is an approach in which cost is monitored on the basis of activities,

resources consumed by each activity and final output cost determines the cost of the

product (van Helden and et.al., 2016).

It is beneficial for Galway Plc manufactures company to measure profitable, unprofitable

activities, to do proper planning, control and utilization of resources fully, guide in expansion of

production process and helps in decision making regarding labour and machines.

Inventory management systems: It is a process of managing company's inventory by

ordering and storing. It also includes managing raw materials, finished goods and warehousing

of such items. It is a current asset of the company. Generally company use one of the method

first-in-first-out (FIFO), weighted average and last-in-last-out (LIFO). Inventory generally

consist of 4 categories i.e. raw material that company purchase for producing goods, work-in-

progress represents materials which are in process to be transformed in finished goods,

completed goods ready for sale called finished goods and merchandise which company buys for

resale (Quattrone, P., 2016).

There are 2 methods of inventory management:

Just-in-time (manufacturing starts when there is a need)

Material required planning (record sales and then forecast requirement of material)

It is beneficial for Galway Plc manufactures company to forecast sales, reducing cost and

time, increase efficiency of employees, inventory turnover and to do accurate planning in making

decisions change in trend of product.

Job-costing systems: It is a process of assigning manufacturing cost to an individual

unit. It is used when a company produce different products and which have different prices.

Since there are variations in the item manufactured, job costing system is used to record each

2

process in which firm estimates the cost of its products for inventory valuation and profitability

analysis. It manages the inventory flow in every stage of production. It measures the cost and

then compare input with the output of the company. It measures the financial performance of

company.

There are main 2 types of cost accounting:

Standard cost accounting uses ratios to measure the efficient use of materials in

producing products and services.

Activity based costing is an approach in which cost is monitored on the basis of activities,

resources consumed by each activity and final output cost determines the cost of the

product (van Helden and et.al., 2016).

It is beneficial for Galway Plc manufactures company to measure profitable, unprofitable

activities, to do proper planning, control and utilization of resources fully, guide in expansion of

production process and helps in decision making regarding labour and machines.

Inventory management systems: It is a process of managing company's inventory by

ordering and storing. It also includes managing raw materials, finished goods and warehousing

of such items. It is a current asset of the company. Generally company use one of the method

first-in-first-out (FIFO), weighted average and last-in-last-out (LIFO). Inventory generally

consist of 4 categories i.e. raw material that company purchase for producing goods, work-in-

progress represents materials which are in process to be transformed in finished goods,

completed goods ready for sale called finished goods and merchandise which company buys for

resale (Quattrone, P., 2016).

There are 2 methods of inventory management:

Just-in-time (manufacturing starts when there is a need)

Material required planning (record sales and then forecast requirement of material)

It is beneficial for Galway Plc manufactures company to forecast sales, reducing cost and

time, increase efficiency of employees, inventory turnover and to do accurate planning in making

decisions change in trend of product.

Job-costing systems: It is a process of assigning manufacturing cost to an individual

unit. It is used when a company produce different products and which have different prices.

Since there are variations in the item manufactured, job costing system is used to record each

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

item. It records each item's direct labour and material which is actually used in producing 1 unit

of product (Malmi, T., 2016).

It is beneficial for Galway Plc manufactures company to know about the profit earned

from each job separately, it helps in cost control by comparing the each cost element, selling and

profit with estimated cost. Company can also implement budgetary control system. Actual cost

need to be compared with estimated cost so that proper action would be taken by company to

control or reduce excessive overhead.

Price-optimising systems: It is a process of analysing respond of customers on different

prices of products and services. This system helps in predicting the behaviour of customers to

buy product at different prices. It is a process to calculating the variation of demand at various

price levels, then collect and combine the data of cost and inventory to estimate prices which will

improve profits (Chenhall, and et.al., 2019).

It is beneficial for Galway Plc manufactures company to save time, provide transparency

of market, gives full control over the market and company can also price a product on the basis

of customers need and purchasing power. It helps company in targeting right audience.

P2 Methods used for management accounting reporting

Management accounting reporting:

It is also known as cost accounting. It produces internal periodic reports of company's

department, CEOs and managers. It includes the list of available cash, sales revenue, receivables

and current creditors of company. financial reporting includes historical data and is basically

used for people outside the organisation. The types are explained as below:

Budget report: Budget is basically an amount of money within which organisation has

to work. Budget guides the company to spend within the line. Budget helps in measuring

company's performance (Granlund and et.al., 2017). By viewing past year budget or data future

estimated budget is made. A company's budget has all the income and expenditures. It is also

known as profit plan.. It is beneficial for Galway Plc manufacturer's managers to give

incentives, cost cutting and negotiating with suppliers and vendors. It helps company to finish its

operations within the budgeted amount. It is an approach used by company to reduce cost.

Accounting receivable Aging report: This report is important for every company who

offers credit. It is important to check credit amount which is not been received to the company.

According to the age of product i.e. 30,60 and 90 days, it provides brief of credit balance. This

3

of product (Malmi, T., 2016).

It is beneficial for Galway Plc manufactures company to know about the profit earned

from each job separately, it helps in cost control by comparing the each cost element, selling and

profit with estimated cost. Company can also implement budgetary control system. Actual cost

need to be compared with estimated cost so that proper action would be taken by company to

control or reduce excessive overhead.

Price-optimising systems: It is a process of analysing respond of customers on different

prices of products and services. This system helps in predicting the behaviour of customers to

buy product at different prices. It is a process to calculating the variation of demand at various

price levels, then collect and combine the data of cost and inventory to estimate prices which will

improve profits (Chenhall, and et.al., 2019).

It is beneficial for Galway Plc manufactures company to save time, provide transparency

of market, gives full control over the market and company can also price a product on the basis

of customers need and purchasing power. It helps company in targeting right audience.

P2 Methods used for management accounting reporting

Management accounting reporting:

It is also known as cost accounting. It produces internal periodic reports of company's

department, CEOs and managers. It includes the list of available cash, sales revenue, receivables

and current creditors of company. financial reporting includes historical data and is basically

used for people outside the organisation. The types are explained as below:

Budget report: Budget is basically an amount of money within which organisation has

to work. Budget guides the company to spend within the line. Budget helps in measuring

company's performance (Granlund and et.al., 2017). By viewing past year budget or data future

estimated budget is made. A company's budget has all the income and expenditures. It is also

known as profit plan.. It is beneficial for Galway Plc manufacturer's managers to give

incentives, cost cutting and negotiating with suppliers and vendors. It helps company to finish its

operations within the budgeted amount. It is an approach used by company to reduce cost.

Accounting receivable Aging report: This report is important for every company who

offers credit. It is important to check credit amount which is not been received to the company.

According to the age of product i.e. 30,60 and 90 days, it provides brief of credit balance. This

3

report is beneficial for Galway Plc manufactures company to reset credit policies according to

the customer's payment capabilities (Ax and et.al., 2017). This report act as a primary tool used

for collection of cash to determine which bills are remaining for payment. Management of

company need to use this report to see the effectiveness of collection functions and credit. It is

sorted by customers name and what item they have purchased and with invoices which help

company to check the due payment.

Inventory and Manufacturing Report: This report is useful in managing the products

of company. Companies who produce products found this report very valuable. It keeps record of

all the products produced, labour, inventory cost and other overheads. It keeps a record of all the

data such as raw material, work-in-progess, finished goods and merchandising. It can be defined

as goods manufactured to sell. It is beneficial for Galway Plc manufactures company to keep

record because it keeps balance between customer service and inventory investment. Company

need to use this report to reduce cost of disuse inventory, become responsive to needs of

customers, reduce the gap between stock replacement and sales and make proper schedule for

loading the stock (Rikhardsson, P. M., 2017).

Job cost report: It is a process of viewing the total cost incurred in a project and

compared with the expected revenue. This benefits company to analyse its profitability of

specific job and then focus on that job fully to optimize it. It tracks the cost of ongoing projects.

It is beneficial for company to identify the problems and avoid it in future jobs. Company need to

track job cost report on weekly basis so that problems can be identified on time and resolved

before it goes controllable. Job cost report can tell whether low profit during the month or

quarter is the answer of bad job or downward trend in price of product.

Performance report: These report are formed for analysing as well as evaluating the

performance of the every employee at the term end, basically for future aspects implies this

performance review results for undergoing key strategic decisions with reference to the

organization (Shields, M. D., 2015). Here as per the requirement individuals are awarded with

the help of context of commitment also with the help of reference to the organization where each

and every performance are laid off and dealt accordingly. Such reports are vital to measure the

strategy towards the goals and objectives.

M1

4

the customer's payment capabilities (Ax and et.al., 2017). This report act as a primary tool used

for collection of cash to determine which bills are remaining for payment. Management of

company need to use this report to see the effectiveness of collection functions and credit. It is

sorted by customers name and what item they have purchased and with invoices which help

company to check the due payment.

Inventory and Manufacturing Report: This report is useful in managing the products

of company. Companies who produce products found this report very valuable. It keeps record of

all the products produced, labour, inventory cost and other overheads. It keeps a record of all the

data such as raw material, work-in-progess, finished goods and merchandising. It can be defined

as goods manufactured to sell. It is beneficial for Galway Plc manufactures company to keep

record because it keeps balance between customer service and inventory investment. Company

need to use this report to reduce cost of disuse inventory, become responsive to needs of

customers, reduce the gap between stock replacement and sales and make proper schedule for

loading the stock (Rikhardsson, P. M., 2017).

Job cost report: It is a process of viewing the total cost incurred in a project and

compared with the expected revenue. This benefits company to analyse its profitability of

specific job and then focus on that job fully to optimize it. It tracks the cost of ongoing projects.

It is beneficial for company to identify the problems and avoid it in future jobs. Company need to

track job cost report on weekly basis so that problems can be identified on time and resolved

before it goes controllable. Job cost report can tell whether low profit during the month or

quarter is the answer of bad job or downward trend in price of product.

Performance report: These report are formed for analysing as well as evaluating the

performance of the every employee at the term end, basically for future aspects implies this

performance review results for undergoing key strategic decisions with reference to the

organization (Shields, M. D., 2015). Here as per the requirement individuals are awarded with

the help of context of commitment also with the help of reference to the organization where each

and every performance are laid off and dealt accordingly. Such reports are vital to measure the

strategy towards the goals and objectives.

M1

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting is most beneficial tool that supports in controlling over cost and

managing budget in effective manner. It ensures minimising issue of over costing and generating

high revenues as well. Galway Plc Manufacture Company can tract each activity and can

measure overall performance significantly.

D1

Job costing, price optimising systems are integrated with budget and performance reports

of company. IF job costing is done properly then it would help Galway Plc manufactures firm in

generating high revenues and reflecting good performance of business. In the absence of this

integration company may get issue in analysing cost and managing its cost effectively.

LO2

P3 Marginal and absorption costing calculation

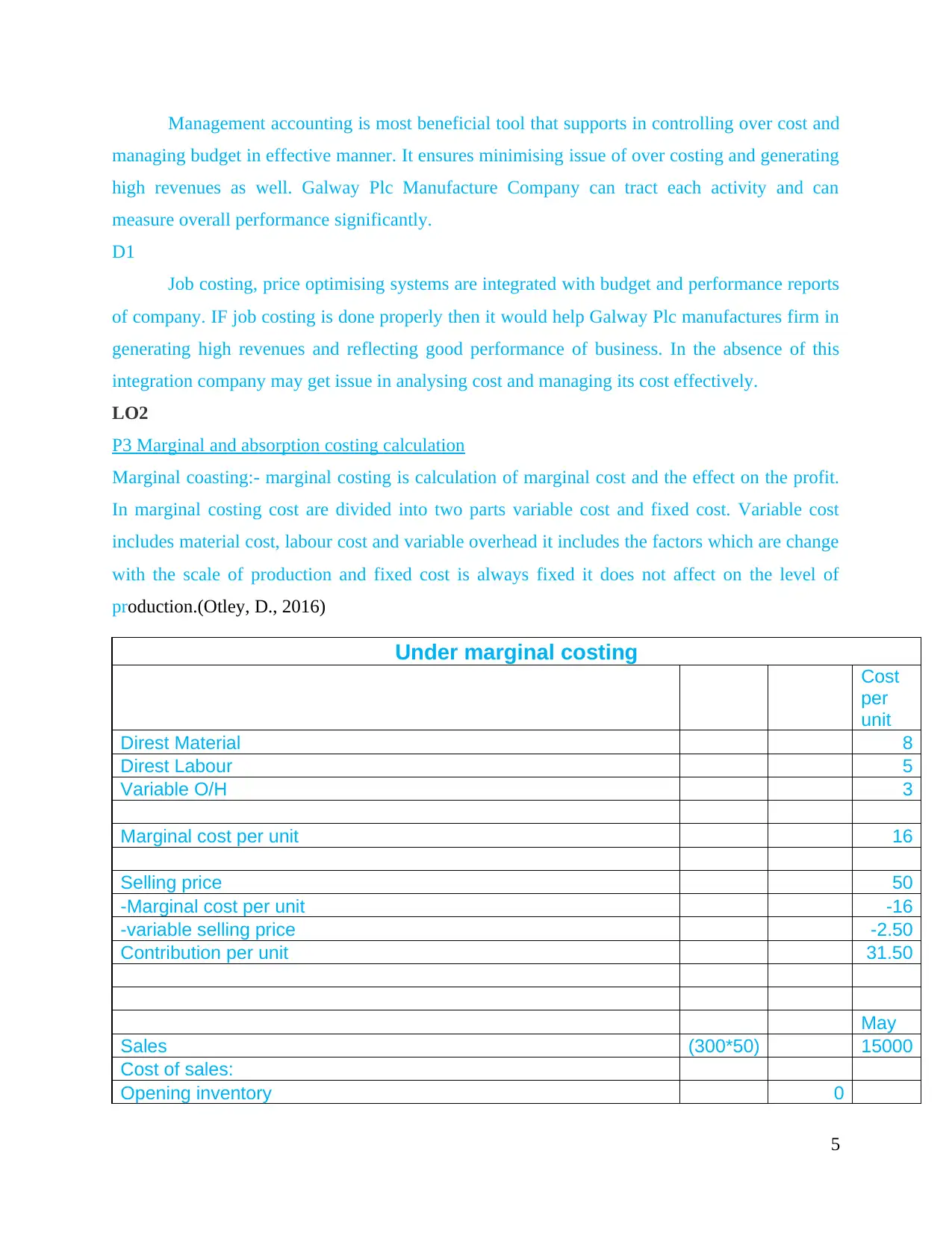

Marginal coasting:- marginal costing is calculation of marginal cost and the effect on the profit.

In marginal costing cost are divided into two parts variable cost and fixed cost. Variable cost

includes material cost, labour cost and variable overhead it includes the factors which are change

with the scale of production and fixed cost is always fixed it does not affect on the level of

production.(Otley, D., 2016)

Under marginal costing

Cost

per

unit

Direst Material 8

Direst Labour 5

Variable O/H 3

Marginal cost per unit 16

Selling price 50

-Marginal cost per unit -16

-variable selling price -2.50

Contribution per unit 31.50

May

Sales (300*50) 15000

Cost of sales:

Opening inventory 0

5

managing budget in effective manner. It ensures minimising issue of over costing and generating

high revenues as well. Galway Plc Manufacture Company can tract each activity and can

measure overall performance significantly.

D1

Job costing, price optimising systems are integrated with budget and performance reports

of company. IF job costing is done properly then it would help Galway Plc manufactures firm in

generating high revenues and reflecting good performance of business. In the absence of this

integration company may get issue in analysing cost and managing its cost effectively.

LO2

P3 Marginal and absorption costing calculation

Marginal coasting:- marginal costing is calculation of marginal cost and the effect on the profit.

In marginal costing cost are divided into two parts variable cost and fixed cost. Variable cost

includes material cost, labour cost and variable overhead it includes the factors which are change

with the scale of production and fixed cost is always fixed it does not affect on the level of

production.(Otley, D., 2016)

Under marginal costing

Cost

per

unit

Direst Material 8

Direst Labour 5

Variable O/H 3

Marginal cost per unit 16

Selling price 50

-Marginal cost per unit -16

-variable selling price -2.50

Contribution per unit 31.50

May

Sales (300*50) 15000

Cost of sales:

Opening inventory 0

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

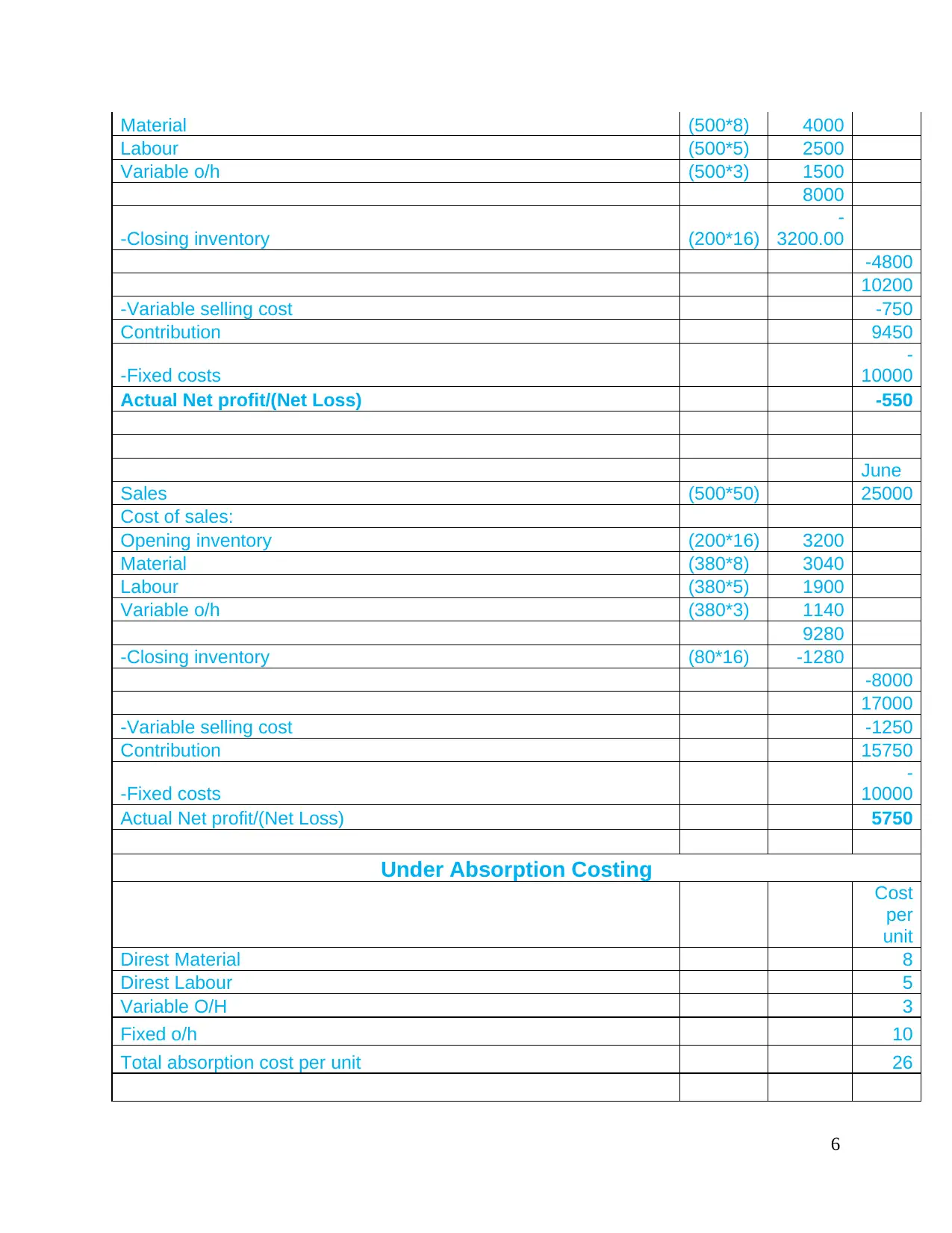

Material (500*8) 4000

Labour (500*5) 2500

Variable o/h (500*3) 1500

8000

-Closing inventory (200*16)

-

3200.00

-4800

10200

-Variable selling cost -750

Contribution 9450

-Fixed costs

-

10000

Actual Net profit/(Net Loss) -550

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*16) 3200

Material (380*8) 3040

Labour (380*5) 1900

Variable o/h (380*3) 1140

9280

-Closing inventory (80*16) -1280

-8000

17000

-Variable selling cost -1250

Contribution 15750

-Fixed costs

-

10000

Actual Net profit/(Net Loss) 5750

Under Absorption Costing

Cost

per

unit

Direst Material 8

Direst Labour 5

Variable O/H 3

Fixed o/h 10

Total absorption cost per unit 26

6

Labour (500*5) 2500

Variable o/h (500*3) 1500

8000

-Closing inventory (200*16)

-

3200.00

-4800

10200

-Variable selling cost -750

Contribution 9450

-Fixed costs

-

10000

Actual Net profit/(Net Loss) -550

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*16) 3200

Material (380*8) 3040

Labour (380*5) 1900

Variable o/h (380*3) 1140

9280

-Closing inventory (80*16) -1280

-8000

17000

-Variable selling cost -1250

Contribution 15750

-Fixed costs

-

10000

Actual Net profit/(Net Loss) 5750

Under Absorption Costing

Cost

per

unit

Direst Material 8

Direst Labour 5

Variable O/H 3

Fixed o/h 10

Total absorption cost per unit 26

6

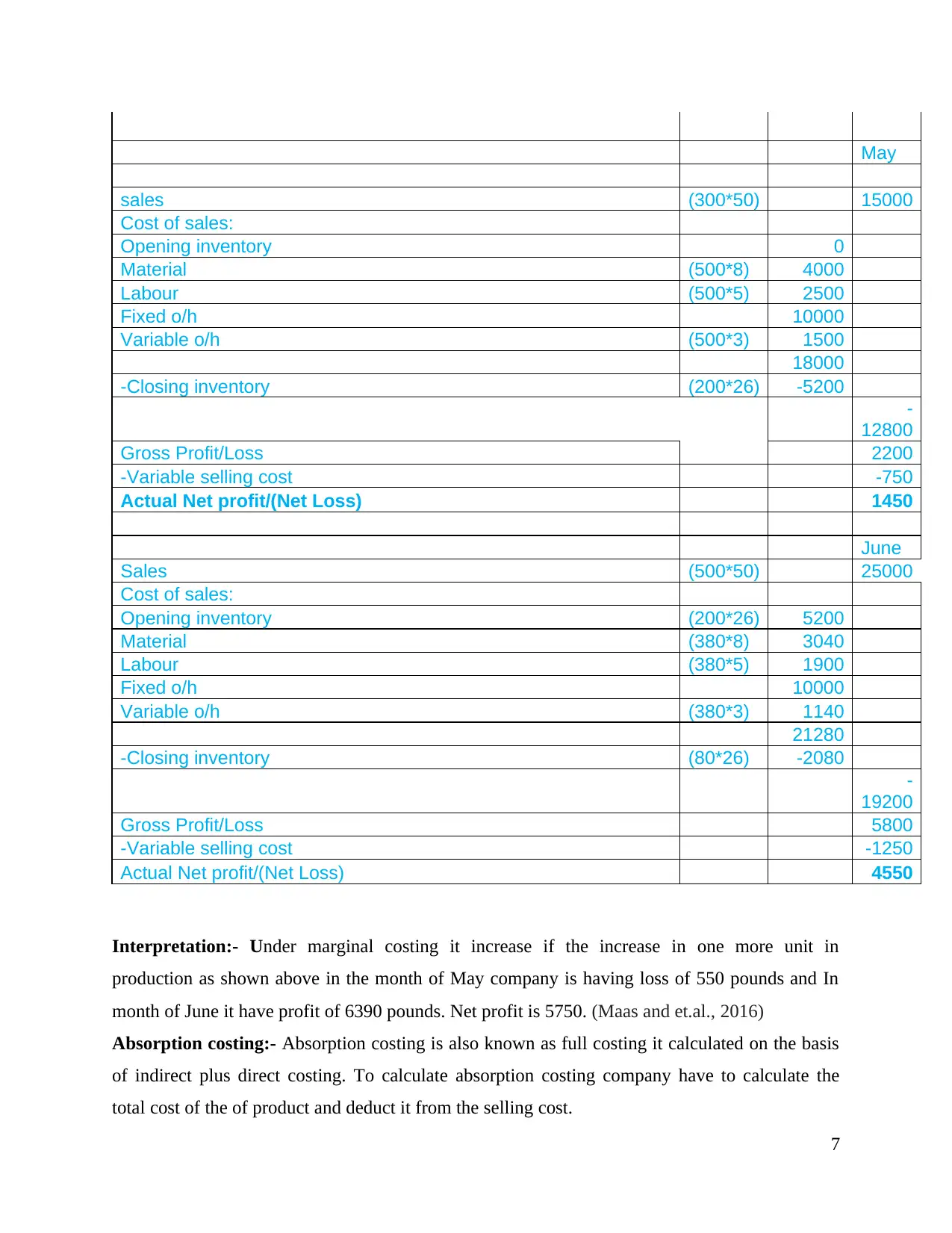

May

sales (300*50) 15000

Cost of sales:

Opening inventory 0

Material (500*8) 4000

Labour (500*5) 2500

Fixed o/h 10000

Variable o/h (500*3) 1500

18000

-Closing inventory (200*26) -5200

-

12800

Gross Profit/Loss 2200

-Variable selling cost -750

Actual Net profit/(Net Loss) 1450

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*26) 5200

Material (380*8) 3040

Labour (380*5) 1900

Fixed o/h 10000

Variable o/h (380*3) 1140

21280

-Closing inventory (80*26) -2080

-

19200

Gross Profit/Loss 5800

-Variable selling cost -1250

Actual Net profit/(Net Loss) 4550

Interpretation:- Under marginal costing it increase if the increase in one more unit in

production as shown above in the month of May company is having loss of 550 pounds and In

month of June it have profit of 6390 pounds. Net profit is 5750. (Maas and et.al., 2016)

Absorption costing:- Absorption costing is also known as full costing it calculated on the basis

of indirect plus direct costing. To calculate absorption costing company have to calculate the

total cost of the of product and deduct it from the selling cost.

7

sales (300*50) 15000

Cost of sales:

Opening inventory 0

Material (500*8) 4000

Labour (500*5) 2500

Fixed o/h 10000

Variable o/h (500*3) 1500

18000

-Closing inventory (200*26) -5200

-

12800

Gross Profit/Loss 2200

-Variable selling cost -750

Actual Net profit/(Net Loss) 1450

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*26) 5200

Material (380*8) 3040

Labour (380*5) 1900

Fixed o/h 10000

Variable o/h (380*3) 1140

21280

-Closing inventory (80*26) -2080

-

19200

Gross Profit/Loss 5800

-Variable selling cost -1250

Actual Net profit/(Net Loss) 4550

Interpretation:- Under marginal costing it increase if the increase in one more unit in

production as shown above in the month of May company is having loss of 550 pounds and In

month of June it have profit of 6390 pounds. Net profit is 5750. (Maas and et.al., 2016)

Absorption costing:- Absorption costing is also known as full costing it calculated on the basis

of indirect plus direct costing. To calculate absorption costing company have to calculate the

total cost of the of product and deduct it from the selling cost.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Absorption costing is a full cost method. In which it calculated on the basis of the total

cost of the production. Profit in the absorption costing is always more than the marginal coasting

method because it is calculated only on the basis of the full cost only. In above table it shows that

company if company use the absorption costing and sell 300 units than it will get profit of 37 net

profit is4550 And above table shows that the company have to choose absorption costing

method. (van Helden and et.al., 2016)

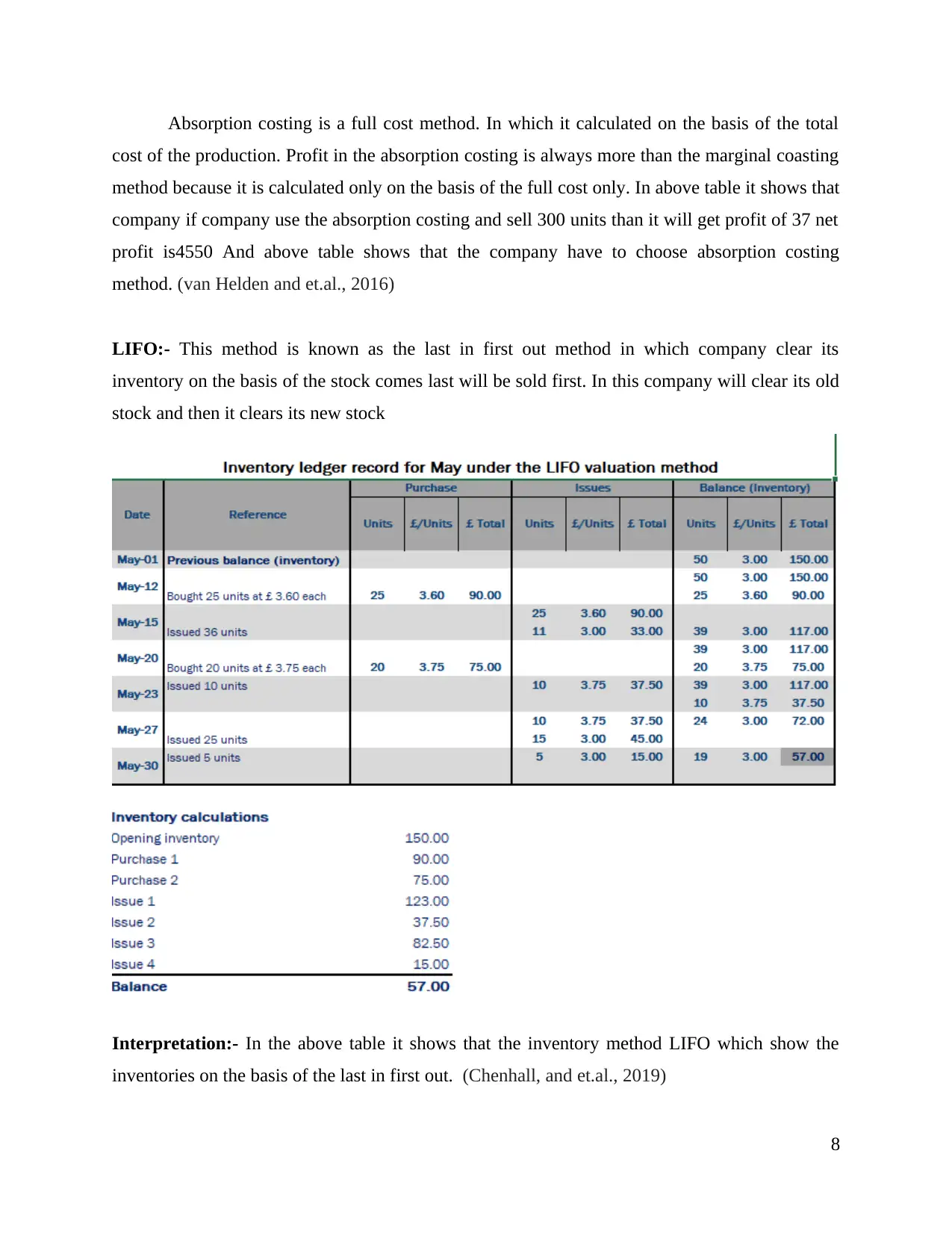

LIFO:- This method is known as the last in first out method in which company clear its

inventory on the basis of the stock comes last will be sold first. In this company will clear its old

stock and then it clears its new stock

Interpretation:- In the above table it shows that the inventory method LIFO which show the

inventories on the basis of the last in first out. (Chenhall, and et.al., 2019)

8

cost of the production. Profit in the absorption costing is always more than the marginal coasting

method because it is calculated only on the basis of the full cost only. In above table it shows that

company if company use the absorption costing and sell 300 units than it will get profit of 37 net

profit is4550 And above table shows that the company have to choose absorption costing

method. (van Helden and et.al., 2016)

LIFO:- This method is known as the last in first out method in which company clear its

inventory on the basis of the stock comes last will be sold first. In this company will clear its old

stock and then it clears its new stock

Interpretation:- In the above table it shows that the inventory method LIFO which show the

inventories on the basis of the last in first out. (Chenhall, and et.al., 2019)

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

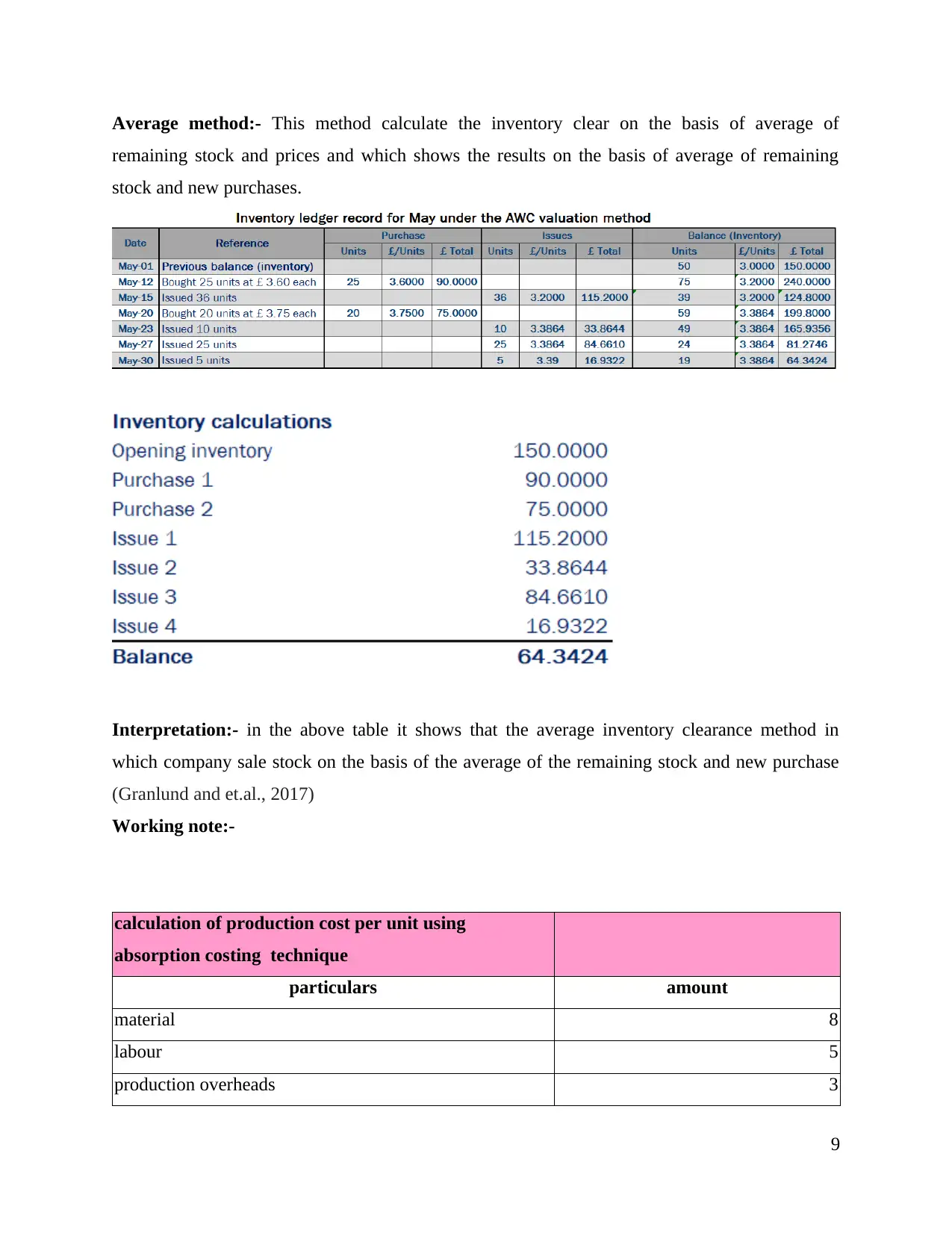

Average method:- This method calculate the inventory clear on the basis of average of

remaining stock and prices and which shows the results on the basis of average of remaining

stock and new purchases.

Interpretation:- in the above table it shows that the average inventory clearance method in

which company sale stock on the basis of the average of the remaining stock and new purchase

(Granlund and et.al., 2017)

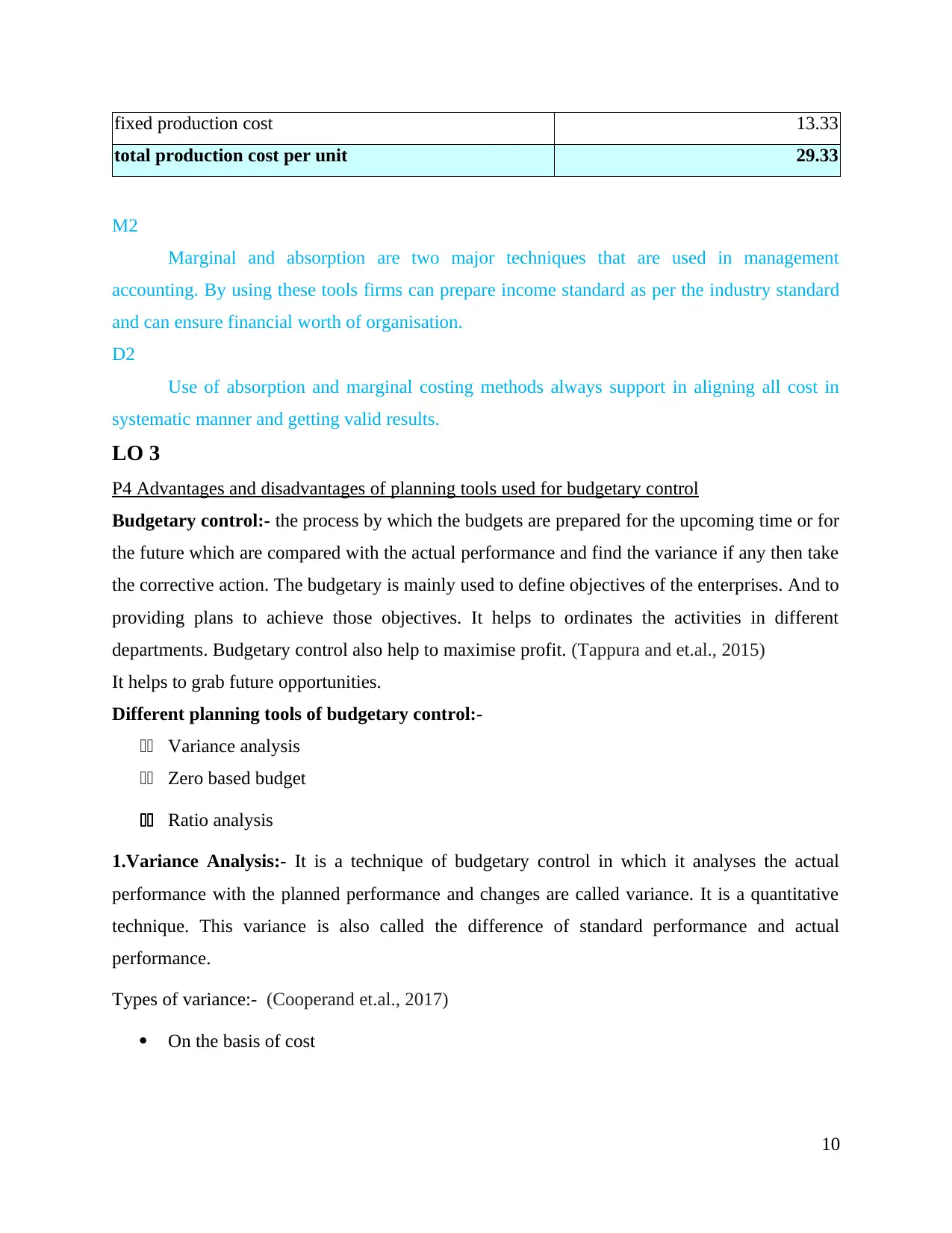

Working note:-

calculation of production cost per unit using

absorption costing technique

particulars amount

material 8

labour 5

production overheads 3

9

remaining stock and prices and which shows the results on the basis of average of remaining

stock and new purchases.

Interpretation:- in the above table it shows that the average inventory clearance method in

which company sale stock on the basis of the average of the remaining stock and new purchase

(Granlund and et.al., 2017)

Working note:-

calculation of production cost per unit using

absorption costing technique

particulars amount

material 8

labour 5

production overheads 3

9

fixed production cost 13.33

total production cost per unit 29.33

M2

Marginal and absorption are two major techniques that are used in management

accounting. By using these tools firms can prepare income standard as per the industry standard

and can ensure financial worth of organisation.

D2

Use of absorption and marginal costing methods always support in aligning all cost in

systematic manner and getting valid results.

LO 3

P4 Advantages and disadvantages of planning tools used for budgetary control

Budgetary control:- the process by which the budgets are prepared for the upcoming time or for

the future which are compared with the actual performance and find the variance if any then take

the corrective action. The budgetary is mainly used to define objectives of the enterprises. And to

providing plans to achieve those objectives. It helps to ordinates the activities in different

departments. Budgetary control also help to maximise profit. (Tappura and et.al., 2015)

It helps to grab future opportunities.

Different planning tools of budgetary control:-

11 Variance analysis

11 Zero based budget

11 Ratio analysis

1.Variance Analysis:- It is a technique of budgetary control in which it analyses the actual

performance with the planned performance and changes are called variance. It is a quantitative

technique. This variance is also called the difference of standard performance and actual

performance.

Types of variance:- (Cooperand et.al., 2017)

On the basis of cost

10

total production cost per unit 29.33

M2

Marginal and absorption are two major techniques that are used in management

accounting. By using these tools firms can prepare income standard as per the industry standard

and can ensure financial worth of organisation.

D2

Use of absorption and marginal costing methods always support in aligning all cost in

systematic manner and getting valid results.

LO 3

P4 Advantages and disadvantages of planning tools used for budgetary control

Budgetary control:- the process by which the budgets are prepared for the upcoming time or for

the future which are compared with the actual performance and find the variance if any then take

the corrective action. The budgetary is mainly used to define objectives of the enterprises. And to

providing plans to achieve those objectives. It helps to ordinates the activities in different

departments. Budgetary control also help to maximise profit. (Tappura and et.al., 2015)

It helps to grab future opportunities.

Different planning tools of budgetary control:-

11 Variance analysis

11 Zero based budget

11 Ratio analysis

1.Variance Analysis:- It is a technique of budgetary control in which it analyses the actual

performance with the planned performance and changes are called variance. It is a quantitative

technique. This variance is also called the difference of standard performance and actual

performance.

Types of variance:- (Cooperand et.al., 2017)

On the basis of cost

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.