Management Accounting Report: Systems, Methods, and Financial Analysis

VerifiedAdded on 2023/01/19

|18

|4711

|99

Report

AI Summary

This report delves into the realm of management accounting, focusing on its application within Excite Entertainment Ltd., a UK-based leisure and entertainment company. The report begins by differentiating between management and financial accounting systems, highlighting the importance of management accounting in organizational planning and decision-making. It then explores various management accounting systems, including cost accounting, inventory management, and job costing, outlining their benefits and applications. The report further examines management accounting reporting methods, such as performance reports and account receivable reports, and their integration within the organization. Additionally, it calculates income statements using both marginal and absorption costing methods, illustrating their impact on financial reporting. The report also discusses the advantages and disadvantages of different planning tools for budgetary control and concludes with the use of management accounting systems to solve financial problems.

Management Accounting

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

TASK 1.......................................................................................................................................................3

Section (A) Understanding of management accounting systems.............................................................3

Section(B) Methods used for management accounting reporting............................................................6

TASK 2.......................................................................................................................................................7

Calculation of Income statement using marginal and absorption costs....................................................7

TASK 3.....................................................................................................................................................10

Report on advantages and disadvantages of different types of planning tools for budgetary control.....10

TASK 4.....................................................................................................................................................12

Use of management accounting system to solve financial problem.......................................................12

CONCLUSION........................................................................................................................................15

REFERENCES........................................................................................................................................17

2

TASK 1.......................................................................................................................................................3

Section (A) Understanding of management accounting systems.............................................................3

Section(B) Methods used for management accounting reporting............................................................6

TASK 2.......................................................................................................................................................7

Calculation of Income statement using marginal and absorption costs....................................................7

TASK 3.....................................................................................................................................................10

Report on advantages and disadvantages of different types of planning tools for budgetary control.....10

TASK 4.....................................................................................................................................................12

Use of management accounting system to solve financial problem.......................................................12

CONCLUSION........................................................................................................................................15

REFERENCES........................................................................................................................................17

2

INTRODUCTION

Management accounting is defined as a process of analyzing financial statements which

includes profit and loss account, balance sheet, cash-flow statement etc. so as to frame an

effective plans and policies for the achievement of an organizational goals and objectives. It gets

supported by financial accounting who is liable to prepare final accounts on annual basis. The

concept of management accounting plays an important role in strengthening financial position of

organisations by contributing efforts in improving financial performance and sustain in

competitive market for longer period of time. The present assignment report is based on Excite

Entertainment Ltd. which is engaged in leisure and entertainment industry in the UK. The

report discusses the various systems and reporting of management accounting along with their

application within an organization. Along with this, the report also briefly explains different cost

accounting methods and its suitability for an organization, planning tools to control budget in

addition with this merits and demerits, application of management accounting systems to resolve

financial issues faced by an organization etc.

TASK 1

Section (A) Understanding of management accounting systems.

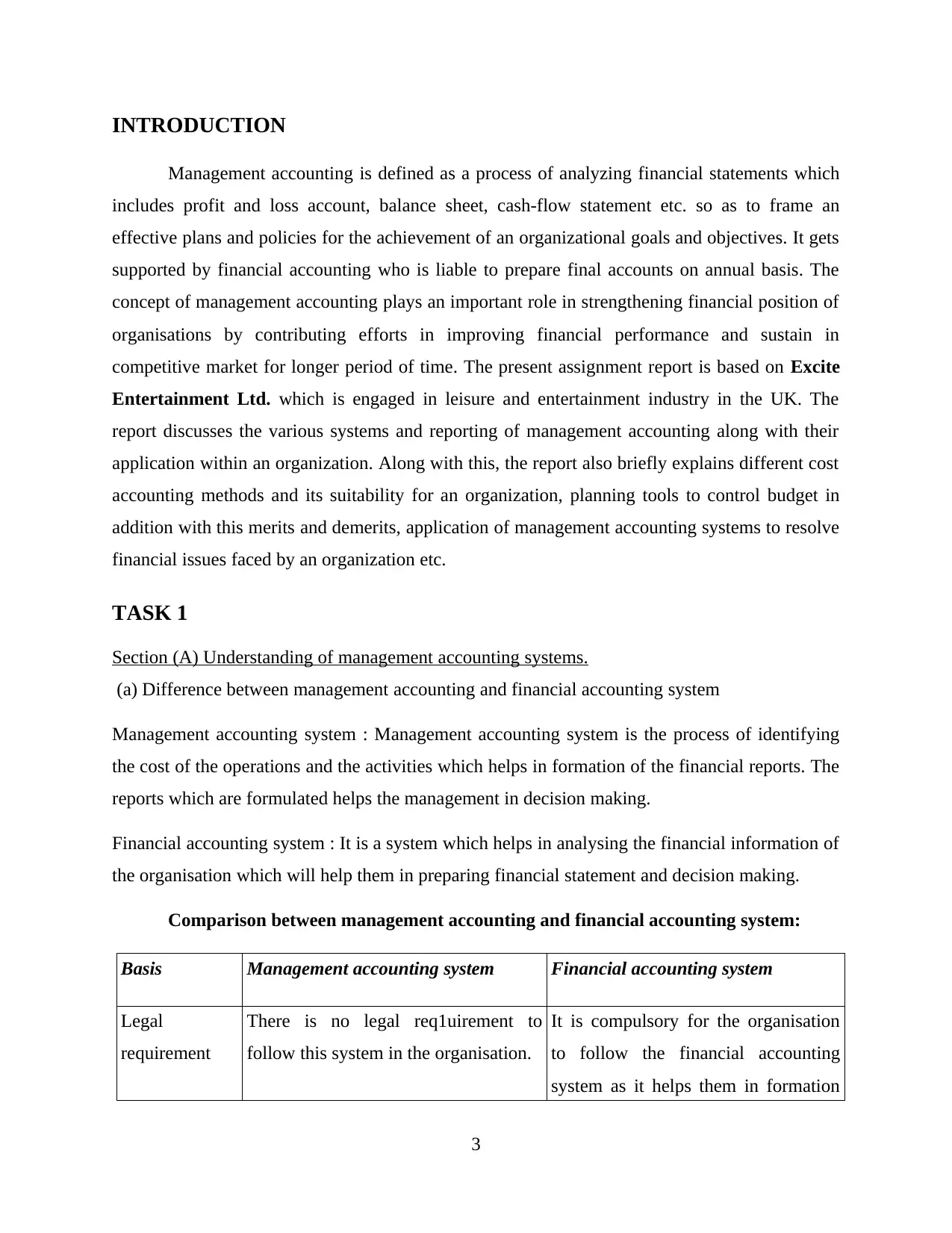

(a) Difference between management accounting and financial accounting system

Management accounting system : Management accounting system is the process of identifying

the cost of the operations and the activities which helps in formation of the financial reports. The

reports which are formulated helps the management in decision making.

Financial accounting system : It is a system which helps in analysing the financial information of

the organisation which will help them in preparing financial statement and decision making.

Comparison between management accounting and financial accounting system:

Basis Management accounting system Financial accounting system

Legal

requirement

There is no legal req1uirement to

follow this system in the organisation.

It is compulsory for the organisation

to follow the financial accounting

system as it helps them in formation

3

Management accounting is defined as a process of analyzing financial statements which

includes profit and loss account, balance sheet, cash-flow statement etc. so as to frame an

effective plans and policies for the achievement of an organizational goals and objectives. It gets

supported by financial accounting who is liable to prepare final accounts on annual basis. The

concept of management accounting plays an important role in strengthening financial position of

organisations by contributing efforts in improving financial performance and sustain in

competitive market for longer period of time. The present assignment report is based on Excite

Entertainment Ltd. which is engaged in leisure and entertainment industry in the UK. The

report discusses the various systems and reporting of management accounting along with their

application within an organization. Along with this, the report also briefly explains different cost

accounting methods and its suitability for an organization, planning tools to control budget in

addition with this merits and demerits, application of management accounting systems to resolve

financial issues faced by an organization etc.

TASK 1

Section (A) Understanding of management accounting systems.

(a) Difference between management accounting and financial accounting system

Management accounting system : Management accounting system is the process of identifying

the cost of the operations and the activities which helps in formation of the financial reports. The

reports which are formulated helps the management in decision making.

Financial accounting system : It is a system which helps in analysing the financial information of

the organisation which will help them in preparing financial statement and decision making.

Comparison between management accounting and financial accounting system:

Basis Management accounting system Financial accounting system

Legal

requirement

There is no legal req1uirement to

follow this system in the organisation.

It is compulsory for the organisation

to follow the financial accounting

system as it helps them in formation

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

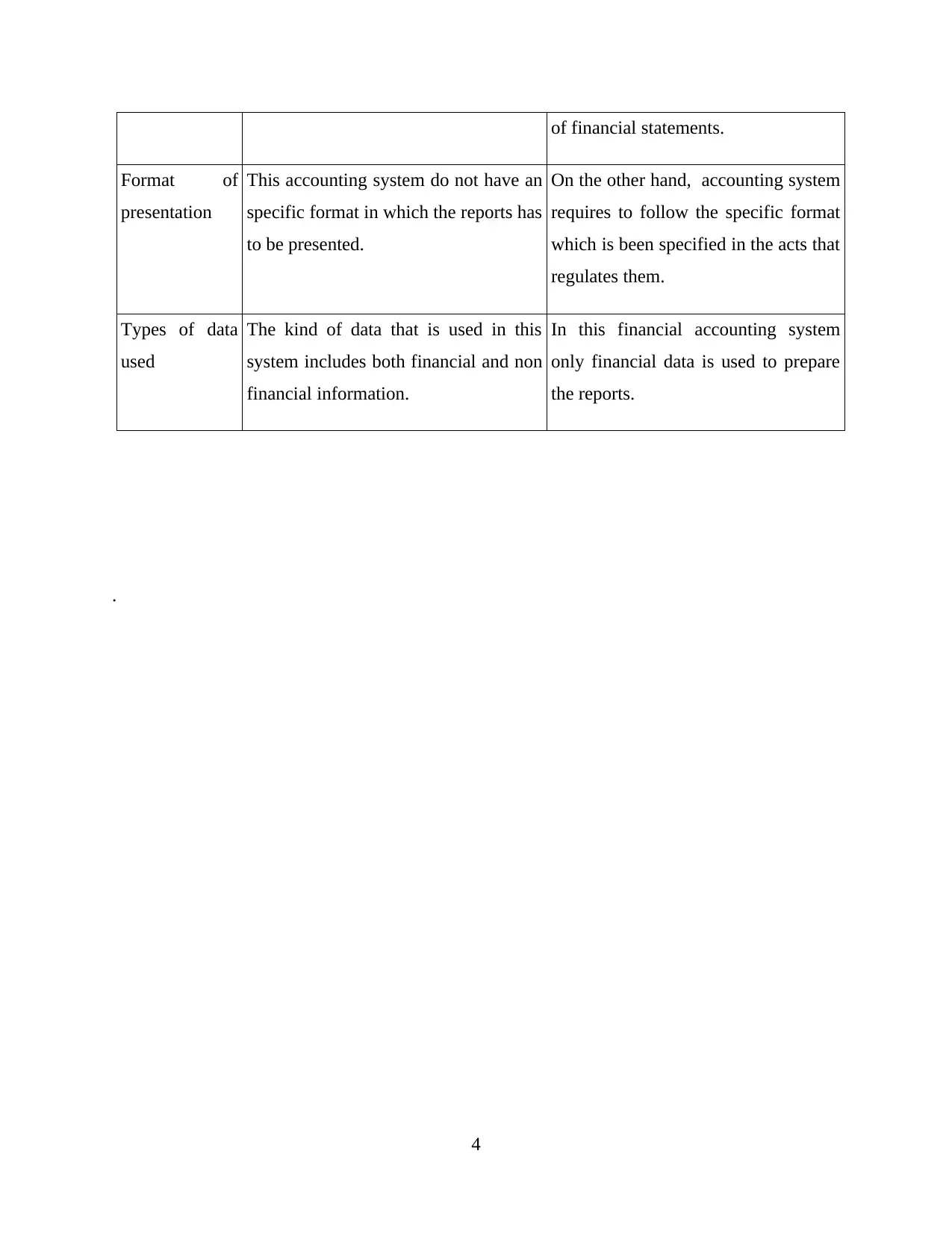

of financial statements.

Format of

presentation

This accounting system do not have an

specific format in which the reports has

to be presented.

On the other hand, accounting system

requires to follow the specific format

which is been specified in the acts that

regulates them.

Types of data

used

The kind of data that is used in this

system includes both financial and non

financial information.

In this financial accounting system

only financial data is used to prepare

the reports.

.

4

Format of

presentation

This accounting system do not have an

specific format in which the reports has

to be presented.

On the other hand, accounting system

requires to follow the specific format

which is been specified in the acts that

regulates them.

Types of data

used

The kind of data that is used in this

system includes both financial and non

financial information.

In this financial accounting system

only financial data is used to prepare

the reports.

.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Excite Entertainment Ltd. have various options to opt among different management

accounting systems in order to strengthen their financial position in market. Using of following

systems of management accounting enable managers to make suitable actions and plans for

future improvements in company’s current performance:

(b) Cost accounting system: This is a system which provides an estimation of total cost

incurred in execution of different business activities. It makes easy for manager of Excite

Entertainment Ltd. to prepare an effective budget by analyzing the total cost incurred in project

held in previous year (Badolato, Donelson and Ege, 2014). This reduces the changes of

incurring unnecessary expenses. There are different type of costs which includes direct cost,

standard cost, process cost etc. Here is the description of these kind of costs in briefly manner:

Direct cost- It is such kind of cost which can be directly traced to a specific cost center

like product, process, department etc.

Standard costing- It is a type of costing which is connected with an analysis of variances

between actual and estimated costs. Using such system facilitate an organization to

evaluate the level of differences between the actual and standard cost. It assists managers

to know the exact reason behind the differences of cost of standard and actual. Normally,

the standard cost is lower than the actual cost.

(c) Inventory management system- It is a system which communicates an organization about the

current availability of inventory in warehouses that facilitates the manager to make decision

whether to order further inventory to meet customers’ demands on time. It helps Excite

Entertainment Ltd. in retaining their loyal customers by providing them event services in the

quantity and time they want. Inventory management system consists of two kinds of methods

which includes FIFO (First in first out) and LIFO (Last in first out). FIFO states that the stock

that were acquired by an organization earlier but sold at the time when client latently ordered. On

the other hand, LIFO states that the stock came at last in warehouses will be sold at first. These

methods enable Excite Entertainment Ltd. to maintain adequate amount of inventory in

warehouses so that the chances of failing in suppling ordered products to their clients on time can

be eliminated (Englund and Gerdin, 2014).

5

accounting systems in order to strengthen their financial position in market. Using of following

systems of management accounting enable managers to make suitable actions and plans for

future improvements in company’s current performance:

(b) Cost accounting system: This is a system which provides an estimation of total cost

incurred in execution of different business activities. It makes easy for manager of Excite

Entertainment Ltd. to prepare an effective budget by analyzing the total cost incurred in project

held in previous year (Badolato, Donelson and Ege, 2014). This reduces the changes of

incurring unnecessary expenses. There are different type of costs which includes direct cost,

standard cost, process cost etc. Here is the description of these kind of costs in briefly manner:

Direct cost- It is such kind of cost which can be directly traced to a specific cost center

like product, process, department etc.

Standard costing- It is a type of costing which is connected with an analysis of variances

between actual and estimated costs. Using such system facilitate an organization to

evaluate the level of differences between the actual and standard cost. It assists managers

to know the exact reason behind the differences of cost of standard and actual. Normally,

the standard cost is lower than the actual cost.

(c) Inventory management system- It is a system which communicates an organization about the

current availability of inventory in warehouses that facilitates the manager to make decision

whether to order further inventory to meet customers’ demands on time. It helps Excite

Entertainment Ltd. in retaining their loyal customers by providing them event services in the

quantity and time they want. Inventory management system consists of two kinds of methods

which includes FIFO (First in first out) and LIFO (Last in first out). FIFO states that the stock

that were acquired by an organization earlier but sold at the time when client latently ordered. On

the other hand, LIFO states that the stock came at last in warehouses will be sold at first. These

methods enable Excite Entertainment Ltd. to maintain adequate amount of inventory in

warehouses so that the chances of failing in suppling ordered products to their clients on time can

be eliminated (Englund and Gerdin, 2014).

5

(d) Job costing system- It is a system which provides an information about the cost invested in

different business activities along with the return received by company in future. Using of such

system by Excite Entertainment Ltd. assist their manager to make decision whether to invest

more in conducting an event who ensure success so that maximum profitability can be achieved.

Benefits of management accounting systems:

1. Advantage of cost accounting system- This will help in allocating cost to different

business activities on the basis of outcomes received in previous year by executing the

same activities. This helps Excite Entertainment Ltd. in reducing cost and increase

reserve funds which increases their financial stability in market.

2. Advantage of inventory management system- Using of such kind of system helps

Excite Entertainment Ltd. in maintaining sufficient amount of stock related with

conducting an event in warehouses on regular basis so that the client who had given

orders to an organisation can be delivered on time. Thus, it increases the loyalty of

clients which supports an organisation to achieve high sustainability in market for

longer period of time.

Section(B) Methods used for management accounting reporting.

Management accounting reporting is necessarily required to maintain by Excite

Entertainment Ltd. in order to identify their actual financial position of an organization so that

further actions can be taken for further improvement. It consists of different types which includes

budget report, account receivable report, cost accounting report, job costing report etc. These are

further discussed as under:

Performance report- It is the report which contains information about the current level of

performance of an organisation by facilitating managers to compare their actual with desired

performance level. It assists managers of Excite Entertainment Ltd. to identify the reason behind

non-performance or differences in actual and desired level which makes easy for them to make

an effective decision. This report encourages managers to focus on motivating the employees to

perform better through providing training and development programs, training sessions etc. This

will make positive impact on overall performance level of an organisation (Garrison and et. al.,

2010).

6

different business activities along with the return received by company in future. Using of such

system by Excite Entertainment Ltd. assist their manager to make decision whether to invest

more in conducting an event who ensure success so that maximum profitability can be achieved.

Benefits of management accounting systems:

1. Advantage of cost accounting system- This will help in allocating cost to different

business activities on the basis of outcomes received in previous year by executing the

same activities. This helps Excite Entertainment Ltd. in reducing cost and increase

reserve funds which increases their financial stability in market.

2. Advantage of inventory management system- Using of such kind of system helps

Excite Entertainment Ltd. in maintaining sufficient amount of stock related with

conducting an event in warehouses on regular basis so that the client who had given

orders to an organisation can be delivered on time. Thus, it increases the loyalty of

clients which supports an organisation to achieve high sustainability in market for

longer period of time.

Section(B) Methods used for management accounting reporting.

Management accounting reporting is necessarily required to maintain by Excite

Entertainment Ltd. in order to identify their actual financial position of an organization so that

further actions can be taken for further improvement. It consists of different types which includes

budget report, account receivable report, cost accounting report, job costing report etc. These are

further discussed as under:

Performance report- It is the report which contains information about the current level of

performance of an organisation by facilitating managers to compare their actual with desired

performance level. It assists managers of Excite Entertainment Ltd. to identify the reason behind

non-performance or differences in actual and desired level which makes easy for them to make

an effective decision. This report encourages managers to focus on motivating the employees to

perform better through providing training and development programs, training sessions etc. This

will make positive impact on overall performance level of an organisation (Garrison and et. al.,

2010).

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Account receivable ageing report- It is such type of report which communicates the

information about the list of debtors whose payment is due so that managers can be identifying

such unpaid debtors and take steps to recover the unpaid amount along with agreed interest rate.

This will be more useful for Excite Entertainment Ltd. if preparing such kind of report as it helps

them to update their existing credit policies which ensures them to get payment on due date

without facing any losses.

Cost managerial accounting report- This kind of report provides details about the total

cost invested by an organisation till yet in execution of different business activities. Preparing

such report by Excite Entertainment Ltd. facilitate them to prepare an effective budget on the

basis of information available related with cost incurred in project executed in previous year.

This will save the cost and increases the revenue of an organisation thus more beneficial to

prepare (Hawkey, Webb and Winskel, 2013).

Management accounting system and management reporting system are integrated with

process of organisation;

Both the concepts of management accounting and reporting system are integrated with

each other due to which Excite Entertainment Ltd. requires to get different resources such as

machines, human resources etc. to implement such systems and prepare reporting on timely

basis. For an instance, cost accounting system facilitates an organisation to provide information

about the total cost incurred in different business activities which are later on recorded under the

cost managerial report on the basis of which managers took decision for the betterment of an

organisation (Kanellou and Spathis, 2013).

TASK 2

Calculation of Income statement using marginal and absorption costs

Marginal Costing Method - It is a costing technique wherein the marginal cost i.e.

variable cost is charged to units of cost, while the fixed cost for the period is completely written

off against the contribution. Marginal Costing assist the managers of Excite Entertainment Ltd.

in taking end number of business decisions such as replacement of machines used in organizing

of an event, discontinuing a product or service, etc. It can also help the management in

7

information about the list of debtors whose payment is due so that managers can be identifying

such unpaid debtors and take steps to recover the unpaid amount along with agreed interest rate.

This will be more useful for Excite Entertainment Ltd. if preparing such kind of report as it helps

them to update their existing credit policies which ensures them to get payment on due date

without facing any losses.

Cost managerial accounting report- This kind of report provides details about the total

cost invested by an organisation till yet in execution of different business activities. Preparing

such report by Excite Entertainment Ltd. facilitate them to prepare an effective budget on the

basis of information available related with cost incurred in project executed in previous year.

This will save the cost and increases the revenue of an organisation thus more beneficial to

prepare (Hawkey, Webb and Winskel, 2013).

Management accounting system and management reporting system are integrated with

process of organisation;

Both the concepts of management accounting and reporting system are integrated with

each other due to which Excite Entertainment Ltd. requires to get different resources such as

machines, human resources etc. to implement such systems and prepare reporting on timely

basis. For an instance, cost accounting system facilitates an organisation to provide information

about the total cost incurred in different business activities which are later on recorded under the

cost managerial report on the basis of which managers took decision for the betterment of an

organisation (Kanellou and Spathis, 2013).

TASK 2

Calculation of Income statement using marginal and absorption costs

Marginal Costing Method - It is a costing technique wherein the marginal cost i.e.

variable cost is charged to units of cost, while the fixed cost for the period is completely written

off against the contribution. Marginal Costing assist the managers of Excite Entertainment Ltd.

in taking end number of business decisions such as replacement of machines used in organizing

of an event, discontinuing a product or service, etc. It can also help the management in

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ascertaining the appropriate level of activity through break even analysis that reflect the impact

of increasing or decreasing production level.

Absorption Costing Method – It is a technique that assumes both fixed costs and

variable costs as product costs which means that all costs including direct, material costs, and

indirect like overhead costs are included in the price of inventory. It indicates that all of the

manufacturing costs have been assigned to the units produced (Absorption costing, 2018).

Absorption costing avoids the separation of costs into fixed and variable elements. The pricing of

product ensures that all the costs are covered. For Example: Excite Entertainment Ltd. with the

help of absorption costing method can be able to absorb fixed costs in advance and sell their

products on a more realistic “selling price” as well as profits.

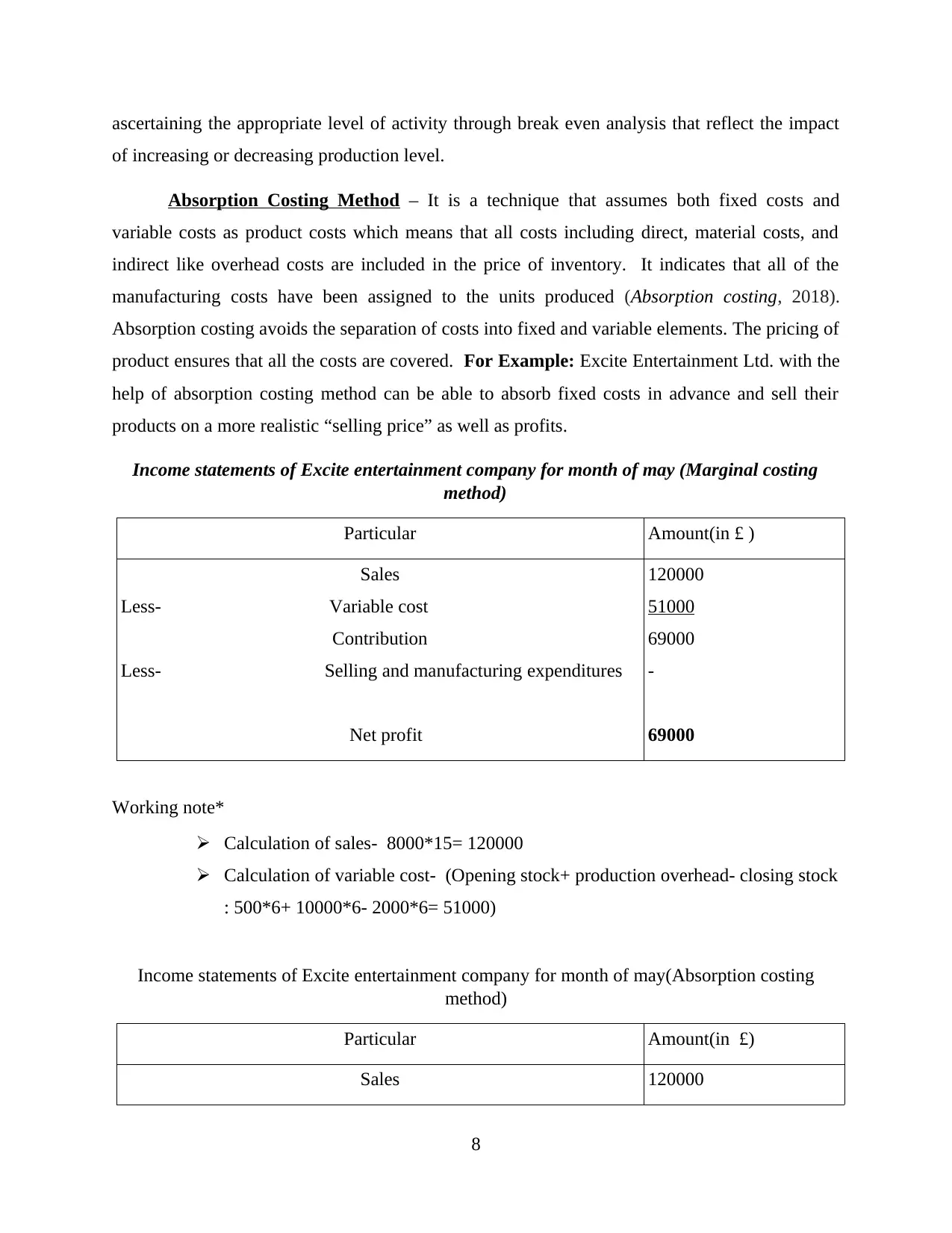

Income statements of Excite entertainment company for month of may (Marginal costing

method)

Particular Amount(in £ )

Sales

Less- Variable cost

Contribution

Less- Selling and manufacturing expenditures

Net profit

120000

51000

69000

-

69000

Working note*

Calculation of sales- 8000*15= 120000

Calculation of variable cost- (Opening stock+ production overhead- closing stock

: 500*6+ 10000*6- 2000*6= 51000)

Income statements of Excite entertainment company for month of may(Absorption costing

method)

Particular Amount(in £)

Sales 120000

8

of increasing or decreasing production level.

Absorption Costing Method – It is a technique that assumes both fixed costs and

variable costs as product costs which means that all costs including direct, material costs, and

indirect like overhead costs are included in the price of inventory. It indicates that all of the

manufacturing costs have been assigned to the units produced (Absorption costing, 2018).

Absorption costing avoids the separation of costs into fixed and variable elements. The pricing of

product ensures that all the costs are covered. For Example: Excite Entertainment Ltd. with the

help of absorption costing method can be able to absorb fixed costs in advance and sell their

products on a more realistic “selling price” as well as profits.

Income statements of Excite entertainment company for month of may (Marginal costing

method)

Particular Amount(in £ )

Sales

Less- Variable cost

Contribution

Less- Selling and manufacturing expenditures

Net profit

120000

51000

69000

-

69000

Working note*

Calculation of sales- 8000*15= 120000

Calculation of variable cost- (Opening stock+ production overhead- closing stock

: 500*6+ 10000*6- 2000*6= 51000)

Income statements of Excite entertainment company for month of may(Absorption costing

method)

Particular Amount(in £)

Sales 120000

8

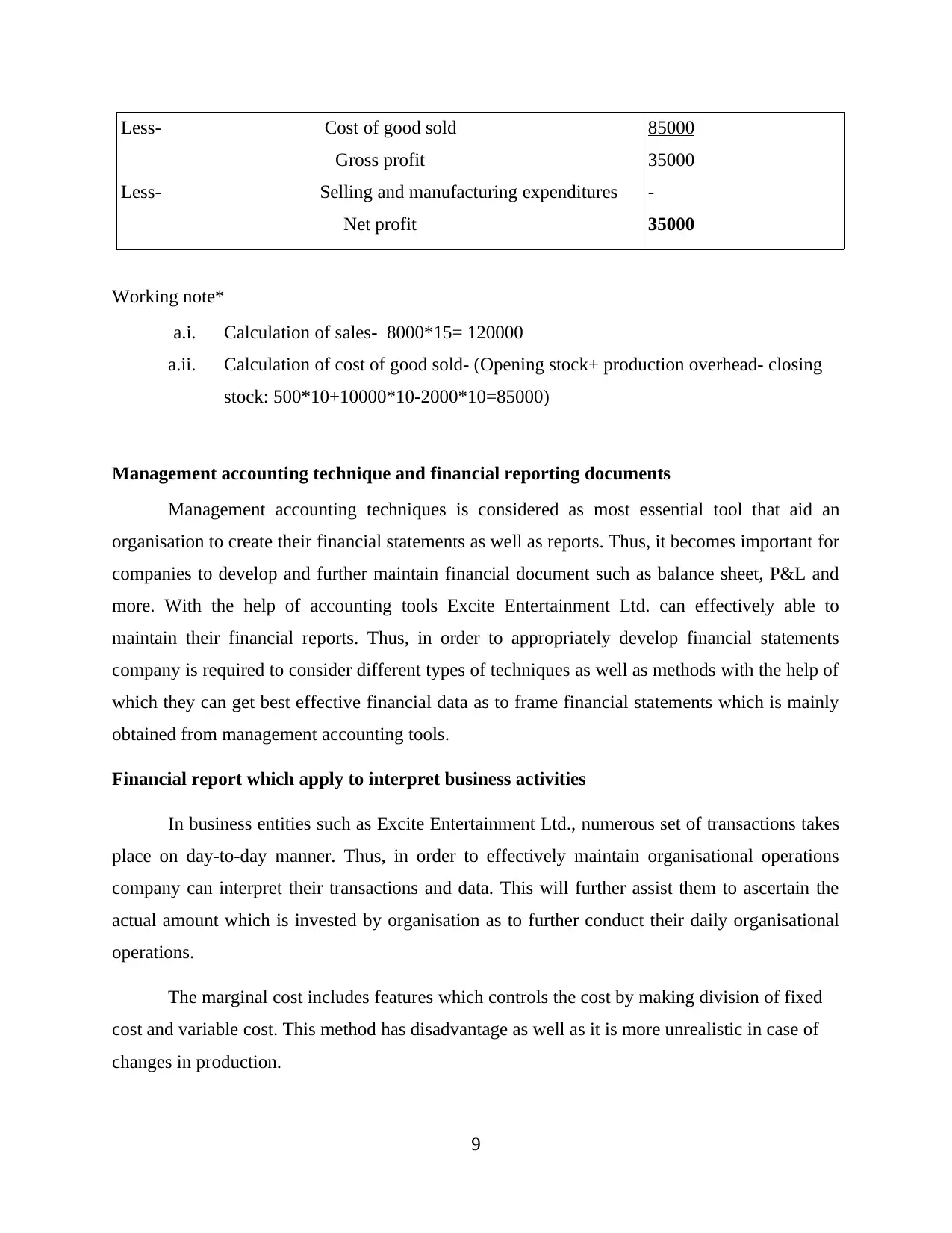

Less- Cost of good sold

Gross profit

Less- Selling and manufacturing expenditures

Net profit

85000

35000

-

35000

Working note*

a.i. Calculation of sales- 8000*15= 120000

a.ii. Calculation of cost of good sold- (Opening stock+ production overhead- closing

stock: 500*10+10000*10-2000*10=85000)

Management accounting technique and financial reporting documents

Management accounting techniques is considered as most essential tool that aid an

organisation to create their financial statements as well as reports. Thus, it becomes important for

companies to develop and further maintain financial document such as balance sheet, P&L and

more. With the help of accounting tools Excite Entertainment Ltd. can effectively able to

maintain their financial reports. Thus, in order to appropriately develop financial statements

company is required to consider different types of techniques as well as methods with the help of

which they can get best effective financial data as to frame financial statements which is mainly

obtained from management accounting tools.

Financial report which apply to interpret business activities

In business entities such as Excite Entertainment Ltd., numerous set of transactions takes

place on day-to-day manner. Thus, in order to effectively maintain organisational operations

company can interpret their transactions and data. This will further assist them to ascertain the

actual amount which is invested by organisation as to further conduct their daily organisational

operations.

The marginal cost includes features which controls the cost by making division of fixed

cost and variable cost. This method has disadvantage as well as it is more unrealistic in case of

changes in production.

9

Gross profit

Less- Selling and manufacturing expenditures

Net profit

85000

35000

-

35000

Working note*

a.i. Calculation of sales- 8000*15= 120000

a.ii. Calculation of cost of good sold- (Opening stock+ production overhead- closing

stock: 500*10+10000*10-2000*10=85000)

Management accounting technique and financial reporting documents

Management accounting techniques is considered as most essential tool that aid an

organisation to create their financial statements as well as reports. Thus, it becomes important for

companies to develop and further maintain financial document such as balance sheet, P&L and

more. With the help of accounting tools Excite Entertainment Ltd. can effectively able to

maintain their financial reports. Thus, in order to appropriately develop financial statements

company is required to consider different types of techniques as well as methods with the help of

which they can get best effective financial data as to frame financial statements which is mainly

obtained from management accounting tools.

Financial report which apply to interpret business activities

In business entities such as Excite Entertainment Ltd., numerous set of transactions takes

place on day-to-day manner. Thus, in order to effectively maintain organisational operations

company can interpret their transactions and data. This will further assist them to ascertain the

actual amount which is invested by organisation as to further conduct their daily organisational

operations.

The marginal cost includes features which controls the cost by making division of fixed

cost and variable cost. This method has disadvantage as well as it is more unrealistic in case of

changes in production.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The Excite entertainment limited company Prefer to adopt absorption costing method as

it consider both variable and fixed cost due to which the net profitability of company is clearly

shown in financial statements. This will easily attract and retain their loyal shareholders.

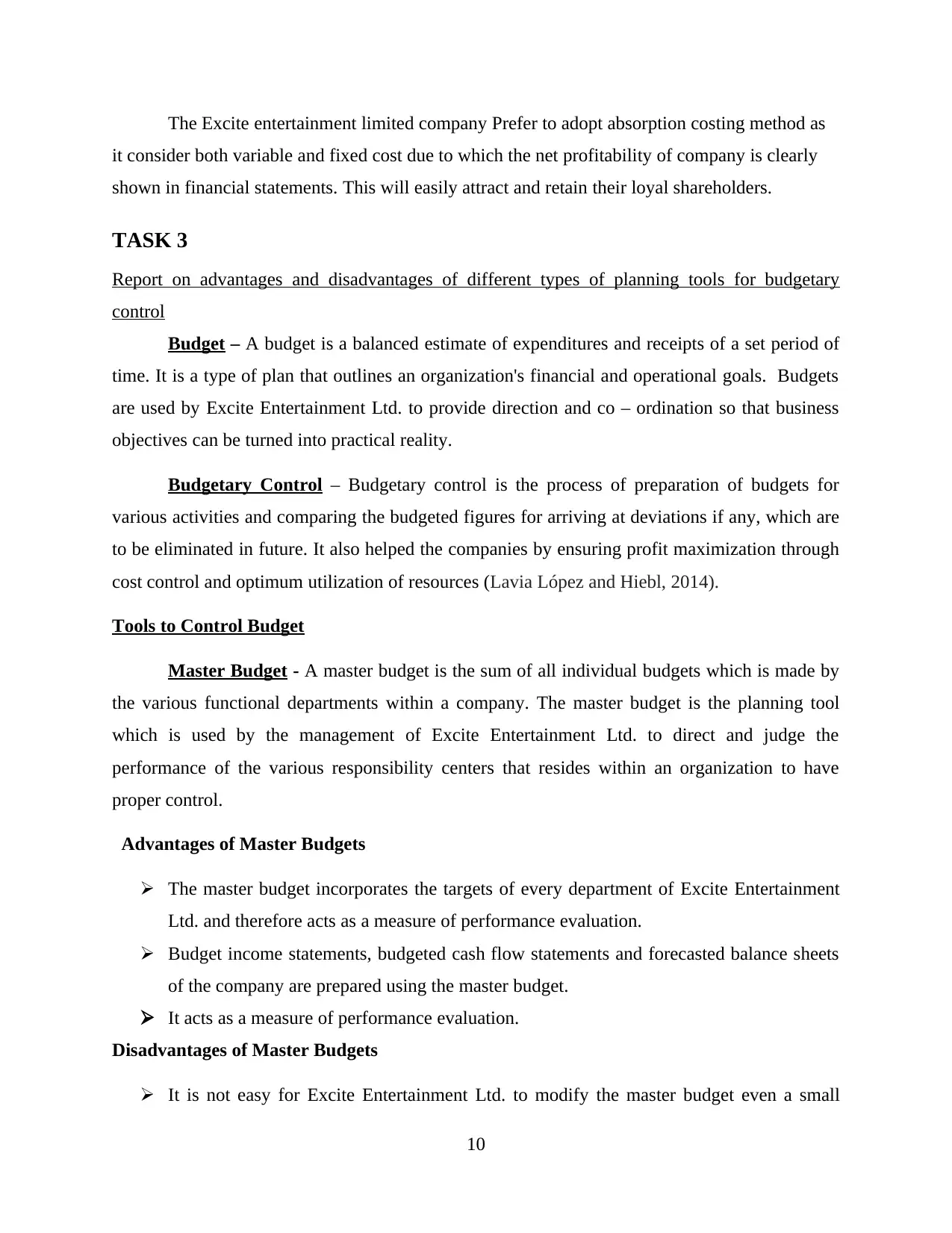

TASK 3

Report on advantages and disadvantages of different types of planning tools for budgetary

control

Budget – A budget is a balanced estimate of expenditures and receipts of a set period of

time. It is a type of plan that outlines an organization's financial and operational goals. Budgets

are used by Excite Entertainment Ltd. to provide direction and co – ordination so that business

objectives can be turned into practical reality.

Budgetary Control – Budgetary control is the process of preparation of budgets for

various activities and comparing the budgeted figures for arriving at deviations if any, which are

to be eliminated in future. It also helped the companies by ensuring profit maximization through

cost control and optimum utilization of resources (Lavia López and Hiebl, 2014).

Tools to Control Budget

Master Budget - A master budget is the sum of all individual budgets which is made by

the various functional departments within a company. The master budget is the planning tool

which is used by the management of Excite Entertainment Ltd. to direct and judge the

performance of the various responsibility centers that resides within an organization to have

proper control.

Advantages of Master Budgets

The master budget incorporates the targets of every department of Excite Entertainment

Ltd. and therefore acts as a measure of performance evaluation.

Budget income statements, budgeted cash flow statements and forecasted balance sheets

of the company are prepared using the master budget.

It acts as a measure of performance evaluation.

Disadvantages of Master Budgets

It is not easy for Excite Entertainment Ltd. to modify the master budget even a small

10

it consider both variable and fixed cost due to which the net profitability of company is clearly

shown in financial statements. This will easily attract and retain their loyal shareholders.

TASK 3

Report on advantages and disadvantages of different types of planning tools for budgetary

control

Budget – A budget is a balanced estimate of expenditures and receipts of a set period of

time. It is a type of plan that outlines an organization's financial and operational goals. Budgets

are used by Excite Entertainment Ltd. to provide direction and co – ordination so that business

objectives can be turned into practical reality.

Budgetary Control – Budgetary control is the process of preparation of budgets for

various activities and comparing the budgeted figures for arriving at deviations if any, which are

to be eliminated in future. It also helped the companies by ensuring profit maximization through

cost control and optimum utilization of resources (Lavia López and Hiebl, 2014).

Tools to Control Budget

Master Budget - A master budget is the sum of all individual budgets which is made by

the various functional departments within a company. The master budget is the planning tool

which is used by the management of Excite Entertainment Ltd. to direct and judge the

performance of the various responsibility centers that resides within an organization to have

proper control.

Advantages of Master Budgets

The master budget incorporates the targets of every department of Excite Entertainment

Ltd. and therefore acts as a measure of performance evaluation.

Budget income statements, budgeted cash flow statements and forecasted balance sheets

of the company are prepared using the master budget.

It acts as a measure of performance evaluation.

Disadvantages of Master Budgets

It is not easy for Excite Entertainment Ltd. to modify the master budget even a small

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

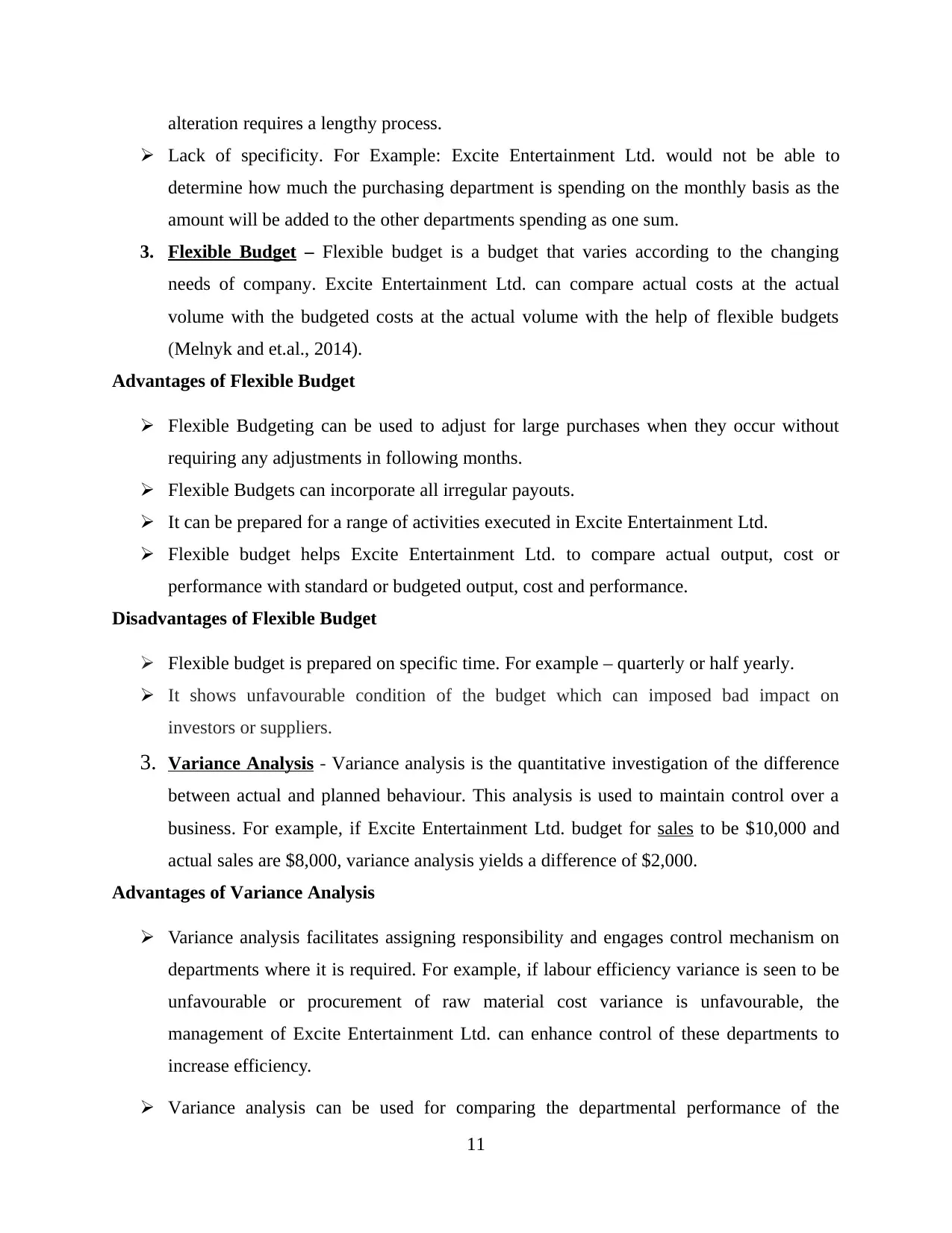

alteration requires a lengthy process.

Lack of specificity. For Example: Excite Entertainment Ltd. would not be able to

determine how much the purchasing department is spending on the monthly basis as the

amount will be added to the other departments spending as one sum.

3. Flexible Budget – Flexible budget is a budget that varies according to the changing

needs of company. Excite Entertainment Ltd. can compare actual costs at the actual

volume with the budgeted costs at the actual volume with the help of flexible budgets

(Melnyk and et.al., 2014).

Advantages of Flexible Budget

Flexible Budgeting can be used to adjust for large purchases when they occur without

requiring any adjustments in following months.

Flexible Budgets can incorporate all irregular payouts.

It can be prepared for a range of activities executed in Excite Entertainment Ltd.

Flexible budget helps Excite Entertainment Ltd. to compare actual output, cost or

performance with standard or budgeted output, cost and performance.

Disadvantages of Flexible Budget

Flexible budget is prepared on specific time. For example – quarterly or half yearly.

It shows unfavourable condition of the budget which can imposed bad impact on

investors or suppliers.

3. Variance Analysis - Variance analysis is the quantitative investigation of the difference

between actual and planned behaviour. This analysis is used to maintain control over a

business. For example, if Excite Entertainment Ltd. budget for sales to be $10,000 and

actual sales are $8,000, variance analysis yields a difference of $2,000.

Advantages of Variance Analysis

Variance analysis facilitates assigning responsibility and engages control mechanism on

departments where it is required. For example, if labour efficiency variance is seen to be

unfavourable or procurement of raw material cost variance is unfavourable, the

management of Excite Entertainment Ltd. can enhance control of these departments to

increase efficiency.

Variance analysis can be used for comparing the departmental performance of the

11

Lack of specificity. For Example: Excite Entertainment Ltd. would not be able to

determine how much the purchasing department is spending on the monthly basis as the

amount will be added to the other departments spending as one sum.

3. Flexible Budget – Flexible budget is a budget that varies according to the changing

needs of company. Excite Entertainment Ltd. can compare actual costs at the actual

volume with the budgeted costs at the actual volume with the help of flexible budgets

(Melnyk and et.al., 2014).

Advantages of Flexible Budget

Flexible Budgeting can be used to adjust for large purchases when they occur without

requiring any adjustments in following months.

Flexible Budgets can incorporate all irregular payouts.

It can be prepared for a range of activities executed in Excite Entertainment Ltd.

Flexible budget helps Excite Entertainment Ltd. to compare actual output, cost or

performance with standard or budgeted output, cost and performance.

Disadvantages of Flexible Budget

Flexible budget is prepared on specific time. For example – quarterly or half yearly.

It shows unfavourable condition of the budget which can imposed bad impact on

investors or suppliers.

3. Variance Analysis - Variance analysis is the quantitative investigation of the difference

between actual and planned behaviour. This analysis is used to maintain control over a

business. For example, if Excite Entertainment Ltd. budget for sales to be $10,000 and

actual sales are $8,000, variance analysis yields a difference of $2,000.

Advantages of Variance Analysis

Variance analysis facilitates assigning responsibility and engages control mechanism on

departments where it is required. For example, if labour efficiency variance is seen to be

unfavourable or procurement of raw material cost variance is unfavourable, the

management of Excite Entertainment Ltd. can enhance control of these departments to

increase efficiency.

Variance analysis can be used for comparing the departmental performance of the

11

organisation.

Disadvantages of Variance Analysis

Time delay. The accounting staff complies variances at the end of the month but

management needs the feedback much faster than once a month (Nganga, 2014).

Comparison of actual results to an arbitrary standard that may have been derived from

political bargaining. The resulting variance may not yield any useful information

(Veprauskaitė and Adams, 2013).

Usage of different planning tools for preparing and forecasting budgets

Budgetary control is a process in which various tool and techniques are required to

prepare financial budget and aim for spending money in coming years. It guides company to

spend their resources in best possible way and also minimize the cost for the company. This help

Excite Entertainment Ltd. from making blueprint and planning for financial planning and

through they can get estimation of money spend throughout business process. There are various

kind of planning tools and method for making financial budget which are forecasting tools,

contingency planning and flexible budget. Therefore, flexible budget help in making different

kinds of budget for operation and their nature change constantly. Forecasting budget provide

insight for future budget and manager make budget according the forecast. At last contingency

planning act as a support for strategies, planning and scheduling various kind of operation which

are required to meet business goals.

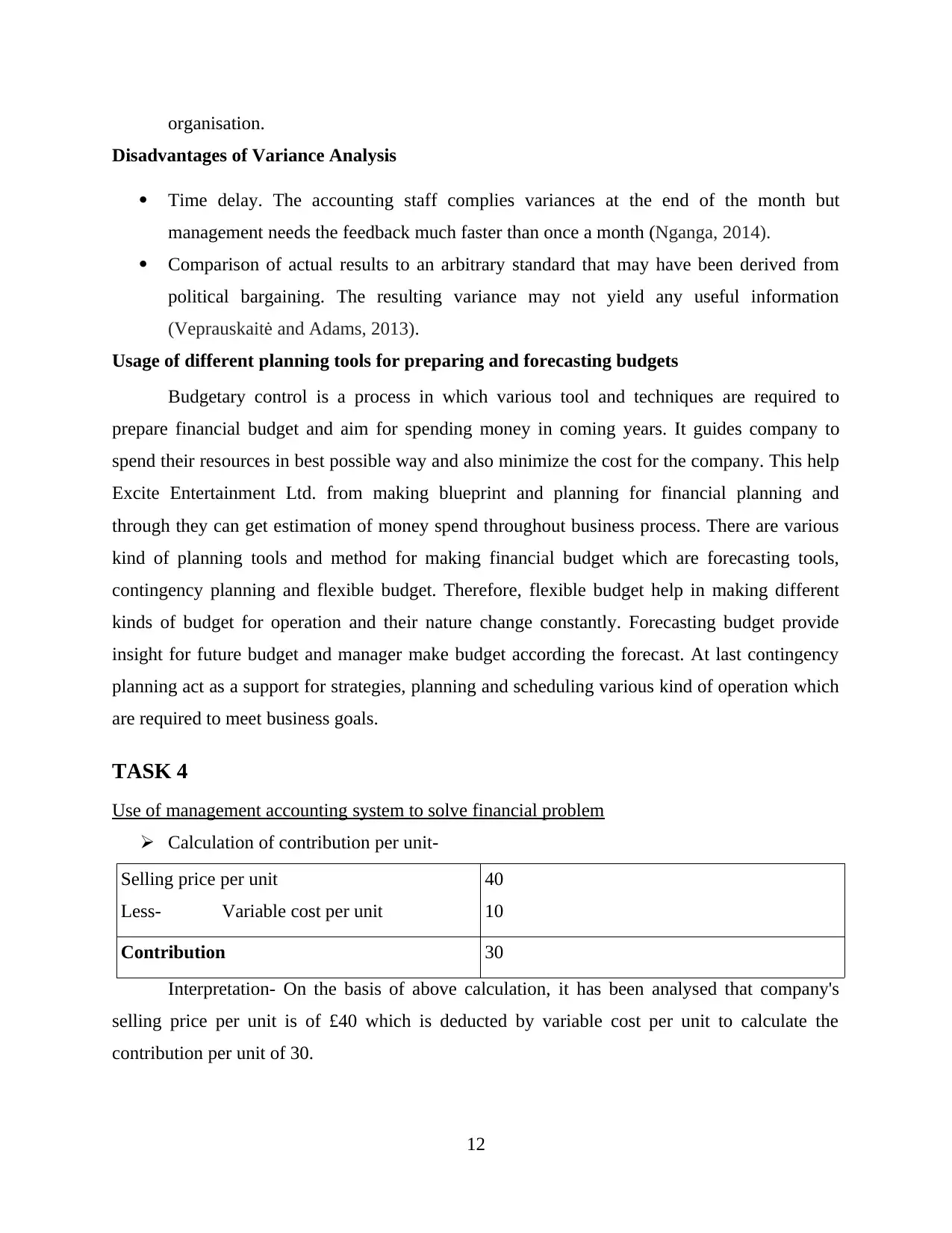

TASK 4

Use of management accounting system to solve financial problem

Calculation of contribution per unit-

Selling price per unit

Less- Variable cost per unit

40

10

Contribution 30

Interpretation- On the basis of above calculation, it has been analysed that company's

selling price per unit is of £40 which is deducted by variable cost per unit to calculate the

contribution per unit of 30.

12

Disadvantages of Variance Analysis

Time delay. The accounting staff complies variances at the end of the month but

management needs the feedback much faster than once a month (Nganga, 2014).

Comparison of actual results to an arbitrary standard that may have been derived from

political bargaining. The resulting variance may not yield any useful information

(Veprauskaitė and Adams, 2013).

Usage of different planning tools for preparing and forecasting budgets

Budgetary control is a process in which various tool and techniques are required to

prepare financial budget and aim for spending money in coming years. It guides company to

spend their resources in best possible way and also minimize the cost for the company. This help

Excite Entertainment Ltd. from making blueprint and planning for financial planning and

through they can get estimation of money spend throughout business process. There are various

kind of planning tools and method for making financial budget which are forecasting tools,

contingency planning and flexible budget. Therefore, flexible budget help in making different

kinds of budget for operation and their nature change constantly. Forecasting budget provide

insight for future budget and manager make budget according the forecast. At last contingency

planning act as a support for strategies, planning and scheduling various kind of operation which

are required to meet business goals.

TASK 4

Use of management accounting system to solve financial problem

Calculation of contribution per unit-

Selling price per unit

Less- Variable cost per unit

40

10

Contribution 30

Interpretation- On the basis of above calculation, it has been analysed that company's

selling price per unit is of £40 which is deducted by variable cost per unit to calculate the

contribution per unit of 30.

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.