Management Accounting Report for Whale Water Systems Analysis

VerifiedAdded on 2021/02/19

|18

|4869

|620

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its key functions, different types of systems, and reporting methods within the context of Whale Water Systems, a UK-based medium-sized enterprise. The report delves into the computation of costs using marginal and absorption costing techniques, presenting detailed cost cards and income statements for Primark Furniture PLC. It also explores the advantages and disadvantages of various planning tools used for budgetary control and examines how organizations adapt their management accounting systems to address financial challenges. The report covers essential topics such as financial accounting systems, cost accounting systems, and tax accounting systems, offering insights into their roles in decision-making and financial management. It includes an analysis of trading and profit and loss accounts, balance sheets, and cash flow statements, along with an examination of inventory management and job-costing systems. Overall, the report provides a thorough understanding of management accounting principles and their practical application.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1: Explanation about management accounting and key essential requirements of various kind

of management accounting systems:...........................................................................................3

P2: Explanation about different kind of methods applied for management accounting

reporting:.....................................................................................................................................5

TASK 2............................................................................................................................................7

P3: Computation of costs applying appropriate techniques of cost analysis to prepare an

income statement using marginal and absorption costs from:....................................................7

TASK 3............................................................................................................................................9

P4: Various advantages and disadvantages of different kind of planning tools used for

budgetary control:.......................................................................................................................9

TASK 4..........................................................................................................................................13

P5: Compare how organizations are adapting management accounting systems to respond to

financial problems:....................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

P1: Explanation about management accounting and key essential requirements of various kind

of management accounting systems:...........................................................................................3

P2: Explanation about different kind of methods applied for management accounting

reporting:.....................................................................................................................................5

TASK 2............................................................................................................................................7

P3: Computation of costs applying appropriate techniques of cost analysis to prepare an

income statement using marginal and absorption costs from:....................................................7

TASK 3............................................................................................................................................9

P4: Various advantages and disadvantages of different kind of planning tools used for

budgetary control:.......................................................................................................................9

TASK 4..........................................................................................................................................13

P5: Compare how organizations are adapting management accounting systems to respond to

financial problems:....................................................................................................................13

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................17

INTRODUCTION

Management accounting is significant business term which includes activities or

functions related to providing financial and monetary information to top level management

within a business organisation (Anessi-Pessina and et.al., 2016). This information is used by top

level management in strategy formulation and in decision making process. This report contains a

complete definition of management accounting, its key functions, requirement of different kind

of management accounting system and management accounting reporting methods in the context

of Whale Water Systems. It it is UK's medium size enterprise and engaged in manufacturing of

water systems. This report also contains computation of cots by applying cost analysis

techniques, advantages and disadvantages of planning tools and way by which organizations are

adapting management accounting systems to respond to financial problems.

TASK 1

P1: Explanation about management accounting and key essential requirements of various kind of

management accounting systems:

In business and trade context, systematic approaches of collecting, evaluating, analysing,

choosing and measuring organisation's internal monetary or financial information into relevant

accounts is referred as management accounting. Management accounting system provide a

systematic framework for preparation of various type of budgets and for effective planning

process within a business organisation. Following are the key elements of subjectivity in the

context of management accounting:

To utilise organisation's resources effectively to attain profitability level and growth.

To formulate methods and different strategies that assist in achievement of

predetermined goals and objectives (Arnaboldi, Lapsley and Steccolini, 2015).

In this context, Whale Water Systems is using various management accounting systems

in different circumstances in order to enhance accountability and productivity. Following are

some vital functions of various types of management accounting systems, are as follows:

Provide and modify data: In a business organisation various decisions taken by

managerial personnel based on relevant data and information. Various management accounting

systems like cost accounting, inventory management etc. provides useful data for decision

making process. These system also indicates towards need of modification in information to

Management accounting is significant business term which includes activities or

functions related to providing financial and monetary information to top level management

within a business organisation (Anessi-Pessina and et.al., 2016). This information is used by top

level management in strategy formulation and in decision making process. This report contains a

complete definition of management accounting, its key functions, requirement of different kind

of management accounting system and management accounting reporting methods in the context

of Whale Water Systems. It it is UK's medium size enterprise and engaged in manufacturing of

water systems. This report also contains computation of cots by applying cost analysis

techniques, advantages and disadvantages of planning tools and way by which organizations are

adapting management accounting systems to respond to financial problems.

TASK 1

P1: Explanation about management accounting and key essential requirements of various kind of

management accounting systems:

In business and trade context, systematic approaches of collecting, evaluating, analysing,

choosing and measuring organisation's internal monetary or financial information into relevant

accounts is referred as management accounting. Management accounting system provide a

systematic framework for preparation of various type of budgets and for effective planning

process within a business organisation. Following are the key elements of subjectivity in the

context of management accounting:

To utilise organisation's resources effectively to attain profitability level and growth.

To formulate methods and different strategies that assist in achievement of

predetermined goals and objectives (Arnaboldi, Lapsley and Steccolini, 2015).

In this context, Whale Water Systems is using various management accounting systems

in different circumstances in order to enhance accountability and productivity. Following are

some vital functions of various types of management accounting systems, are as follows:

Provide and modify data: In a business organisation various decisions taken by

managerial personnel based on relevant data and information. Various management accounting

systems like cost accounting, inventory management etc. provides useful data for decision

making process. These system also indicates towards need of modification in information to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

enhance the effectiveness of decisions taken. In Whale Water System, management use

information that is generated from various management accounting system to take decision

regarding manufacturing and production of water system and other related equipments.

Serves as a mean of communication: Management accounting systems provide a means

for communicating financial information across the various departments of a business. These

system act as a systematic means of communicating vital information among various

departments of a business organisation. In Whale Water System, Information generated through

inventory management system is communicated by cost accountants to production managers for

manufacturing and production processes, which is used by them to ensure availability of

adequate number of water pumps and systems.

There are different kind types of systems of management accounting which are applied

by Whale Water System to enhance accountability, effectiveness and efficiency of various

functions and activities. Following are some key management accounting systems as discussed

underneath:

Financial accounting system: This system of management accounting provide a

framework for managerial personnels of Whale Water System to produce financial results and

accounts which exhibits actual performance of company. This system is responsible for effective

maintenance of data or information related to accounting and financial records within company.

Through this system company maintain and records their production and manufacturing

activities to asses actual performance during a particular period which assist in taking business

decisions. This system also provide groundwork for auditing, accounting information system and

preparation of rules and procedures for internal controls (Bromiley and et.al, 2015).

Cost accounting system: A cost accounting system involves a detailed and critical

analysis of various cost and expenses which provide assistance to managers in taking cost

related decisions. In Whale Water system, this system is used by cost accountants and various

production heads to determine the cost of water system, different water pumps and other related

equipments. It is also used by managers and accountants for identification of any cost making

activities and functions. Main motive of this system is to optimise cost to maximise profitability.

This system also supports activities like product costing and activity based costing which assist

in enhancing accountability.

information that is generated from various management accounting system to take decision

regarding manufacturing and production of water system and other related equipments.

Serves as a mean of communication: Management accounting systems provide a means

for communicating financial information across the various departments of a business. These

system act as a systematic means of communicating vital information among various

departments of a business organisation. In Whale Water System, Information generated through

inventory management system is communicated by cost accountants to production managers for

manufacturing and production processes, which is used by them to ensure availability of

adequate number of water pumps and systems.

There are different kind types of systems of management accounting which are applied

by Whale Water System to enhance accountability, effectiveness and efficiency of various

functions and activities. Following are some key management accounting systems as discussed

underneath:

Financial accounting system: This system of management accounting provide a

framework for managerial personnels of Whale Water System to produce financial results and

accounts which exhibits actual performance of company. This system is responsible for effective

maintenance of data or information related to accounting and financial records within company.

Through this system company maintain and records their production and manufacturing

activities to asses actual performance during a particular period which assist in taking business

decisions. This system also provide groundwork for auditing, accounting information system and

preparation of rules and procedures for internal controls (Bromiley and et.al, 2015).

Cost accounting system: A cost accounting system involves a detailed and critical

analysis of various cost and expenses which provide assistance to managers in taking cost

related decisions. In Whale Water system, this system is used by cost accountants and various

production heads to determine the cost of water system, different water pumps and other related

equipments. It is also used by managers and accountants for identification of any cost making

activities and functions. Main motive of this system is to optimise cost to maximise profitability.

This system also supports activities like product costing and activity based costing which assist

in enhancing accountability.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Management accounting system: This system is used by companies to generate various

managerial reports for effective internal management. In Whale Water System this system is

used by managers to prepare various managerial reports to accomplish effective organisational

control and supports decision making activities. Main objective of this system is to establish

proper control over internal activities and function, and to identify any unproductive activity or

function. Managers with help of reports generated from management accounting system takes

vital business decisions related to profit management, investment management etc. Effective

profit and investment management is important to achieve sustainable growth and to make

expansion (Malinić and Todorović, 2012).

Tax accounting system: This management accounting system mainly emphasises on tax

related activities and functions, and proper compliance of tax regulations. In UK, Accounting of

tax may differ according to different structure and forms like individuals, partnerships and

corporate, but over objectives of this system is to proper compliance of tax regulations imposed

by HMRC. This system provide assistance in assessment of taxes and compliance of rules or

regulations related to tax. In Whale Water System this system is applied by management to

determine actual amount of various taxes like GST, International taxations etc. and timely

payment of taxes to avoid any legal complexities in near future.

P2: Explanation about different kind of methods applied for management accounting reporting:

In mediam sized business organisation like Whale Water System, reporting of day to day

activities and function is essential for strategic decision making regarding future performance.

For effective reporting various kind of management accounting reporting methods are used by

management which help in effective decision making. Following are some important kind of

management accounting reporting, as follows:

Trading and profit and loss accounts: Main objective of trading and profit and loss

account is to exhibit the gross and net profit earned by Whale Water System over a specific

period of time. In company accountants and managers are responsible for preparation of trading

and P&L account to assess the gross profit or gross loss earned by selling Water systems, pumps

and other equipments during a particular period of time. This is part of income statement which

also provide details about cost of goods sold, production and manufacturing expenses, selling

and distribution expenses and other related expenses.

managerial reports for effective internal management. In Whale Water System this system is

used by managers to prepare various managerial reports to accomplish effective organisational

control and supports decision making activities. Main objective of this system is to establish

proper control over internal activities and function, and to identify any unproductive activity or

function. Managers with help of reports generated from management accounting system takes

vital business decisions related to profit management, investment management etc. Effective

profit and investment management is important to achieve sustainable growth and to make

expansion (Malinić and Todorović, 2012).

Tax accounting system: This management accounting system mainly emphasises on tax

related activities and functions, and proper compliance of tax regulations. In UK, Accounting of

tax may differ according to different structure and forms like individuals, partnerships and

corporate, but over objectives of this system is to proper compliance of tax regulations imposed

by HMRC. This system provide assistance in assessment of taxes and compliance of rules or

regulations related to tax. In Whale Water System this system is applied by management to

determine actual amount of various taxes like GST, International taxations etc. and timely

payment of taxes to avoid any legal complexities in near future.

P2: Explanation about different kind of methods applied for management accounting reporting:

In mediam sized business organisation like Whale Water System, reporting of day to day

activities and function is essential for strategic decision making regarding future performance.

For effective reporting various kind of management accounting reporting methods are used by

management which help in effective decision making. Following are some important kind of

management accounting reporting, as follows:

Trading and profit and loss accounts: Main objective of trading and profit and loss

account is to exhibit the gross and net profit earned by Whale Water System over a specific

period of time. In company accountants and managers are responsible for preparation of trading

and P&L account to assess the gross profit or gross loss earned by selling Water systems, pumps

and other equipments during a particular period of time. This is part of income statement which

also provide details about cost of goods sold, production and manufacturing expenses, selling

and distribution expenses and other related expenses.

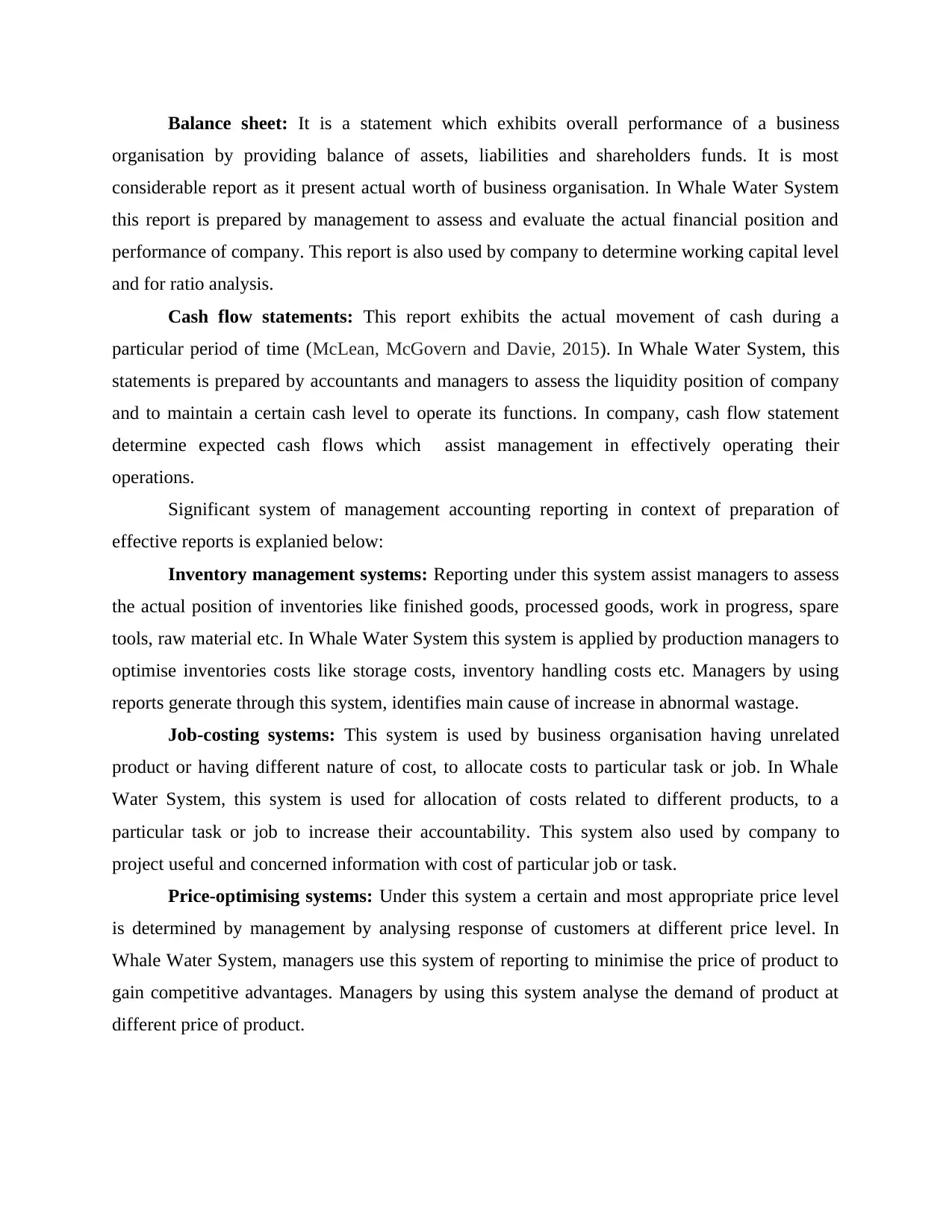

Balance sheet: It is a statement which exhibits overall performance of a business

organisation by providing balance of assets, liabilities and shareholders funds. It is most

considerable report as it present actual worth of business organisation. In Whale Water System

this report is prepared by management to assess and evaluate the actual financial position and

performance of company. This report is also used by company to determine working capital level

and for ratio analysis.

Cash flow statements: This report exhibits the actual movement of cash during a

particular period of time (McLean, McGovern and Davie, 2015). In Whale Water System, this

statements is prepared by accountants and managers to assess the liquidity position of company

and to maintain a certain cash level to operate its functions. In company, cash flow statement

determine expected cash flows which assist management in effectively operating their

operations.

Significant system of management accounting reporting in context of preparation of

effective reports is explanied below:

Inventory management systems: Reporting under this system assist managers to assess

the actual position of inventories like finished goods, processed goods, work in progress, spare

tools, raw material etc. In Whale Water System this system is applied by production managers to

optimise inventories costs like storage costs, inventory handling costs etc. Managers by using

reports generate through this system, identifies main cause of increase in abnormal wastage.

Job-costing systems: This system is used by business organisation having unrelated

product or having different nature of cost, to allocate costs to particular task or job. In Whale

Water System, this system is used for allocation of costs related to different products, to a

particular task or job to increase their accountability. This system also used by company to

project useful and concerned information with cost of particular job or task.

Price-optimising systems: Under this system a certain and most appropriate price level

is determined by management by analysing response of customers at different price level. In

Whale Water System, managers use this system of reporting to minimise the price of product to

gain competitive advantages. Managers by using this system analyse the demand of product at

different price of product.

organisation by providing balance of assets, liabilities and shareholders funds. It is most

considerable report as it present actual worth of business organisation. In Whale Water System

this report is prepared by management to assess and evaluate the actual financial position and

performance of company. This report is also used by company to determine working capital level

and for ratio analysis.

Cash flow statements: This report exhibits the actual movement of cash during a

particular period of time (McLean, McGovern and Davie, 2015). In Whale Water System, this

statements is prepared by accountants and managers to assess the liquidity position of company

and to maintain a certain cash level to operate its functions. In company, cash flow statement

determine expected cash flows which assist management in effectively operating their

operations.

Significant system of management accounting reporting in context of preparation of

effective reports is explanied below:

Inventory management systems: Reporting under this system assist managers to assess

the actual position of inventories like finished goods, processed goods, work in progress, spare

tools, raw material etc. In Whale Water System this system is applied by production managers to

optimise inventories costs like storage costs, inventory handling costs etc. Managers by using

reports generate through this system, identifies main cause of increase in abnormal wastage.

Job-costing systems: This system is used by business organisation having unrelated

product or having different nature of cost, to allocate costs to particular task or job. In Whale

Water System, this system is used for allocation of costs related to different products, to a

particular task or job to increase their accountability. This system also used by company to

project useful and concerned information with cost of particular job or task.

Price-optimising systems: Under this system a certain and most appropriate price level

is determined by management by analysing response of customers at different price level. In

Whale Water System, managers use this system of reporting to minimise the price of product to

gain competitive advantages. Managers by using this system analyse the demand of product at

different price of product.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

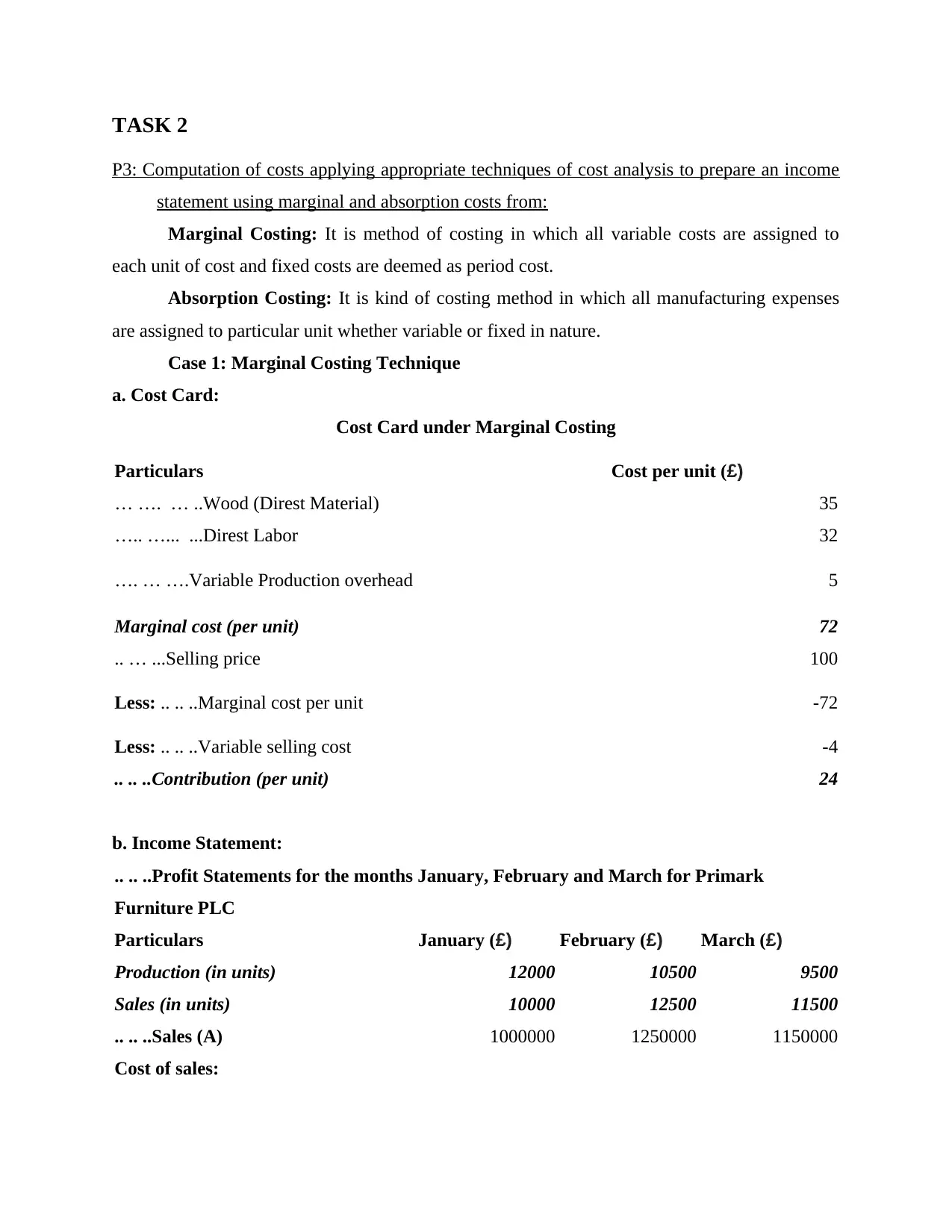

TASK 2

P3: Computation of costs applying appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs from:

Marginal Costing: It is method of costing in which all variable costs are assigned to

each unit of cost and fixed costs are deemed as period cost.

Absorption Costing: It is kind of costing method in which all manufacturing expenses

are assigned to particular unit whether variable or fixed in nature.

Case 1: Marginal Costing Technique

a. Cost Card:

Cost Card under Marginal Costing

Particulars Cost per unit (£)

… …. … ..Wood (Direst Material) 35

….. …... ...Direst Labor 32

…. … ….Variable Production overhead 5

Marginal cost (per unit) 72

.. … ...Selling price 100

Less: .. .. ..Marginal cost per unit -72

Less: .. .. ..Variable selling cost -4

.. .. ..Contribution (per unit) 24

b. Income Statement:

.. .. ..Profit Statements for the months January, February and March for Primark

Furniture PLC

Particulars January (£) February (£) March (£)

Production (in units) 12000 10500 9500

Sales (in units) 10000 12500 11500

.. .. ..Sales (A) 1000000 1250000 1150000

Cost of sales:

P3: Computation of costs applying appropriate techniques of cost analysis to prepare an income

statement using marginal and absorption costs from:

Marginal Costing: It is method of costing in which all variable costs are assigned to

each unit of cost and fixed costs are deemed as period cost.

Absorption Costing: It is kind of costing method in which all manufacturing expenses

are assigned to particular unit whether variable or fixed in nature.

Case 1: Marginal Costing Technique

a. Cost Card:

Cost Card under Marginal Costing

Particulars Cost per unit (£)

… …. … ..Wood (Direst Material) 35

….. …... ...Direst Labor 32

…. … ….Variable Production overhead 5

Marginal cost (per unit) 72

.. … ...Selling price 100

Less: .. .. ..Marginal cost per unit -72

Less: .. .. ..Variable selling cost -4

.. .. ..Contribution (per unit) 24

b. Income Statement:

.. .. ..Profit Statements for the months January, February and March for Primark

Furniture PLC

Particulars January (£) February (£) March (£)

Production (in units) 12000 10500 9500

Sales (in units) 10000 12500 11500

.. .. ..Sales (A) 1000000 1250000 1150000

Cost of sales:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

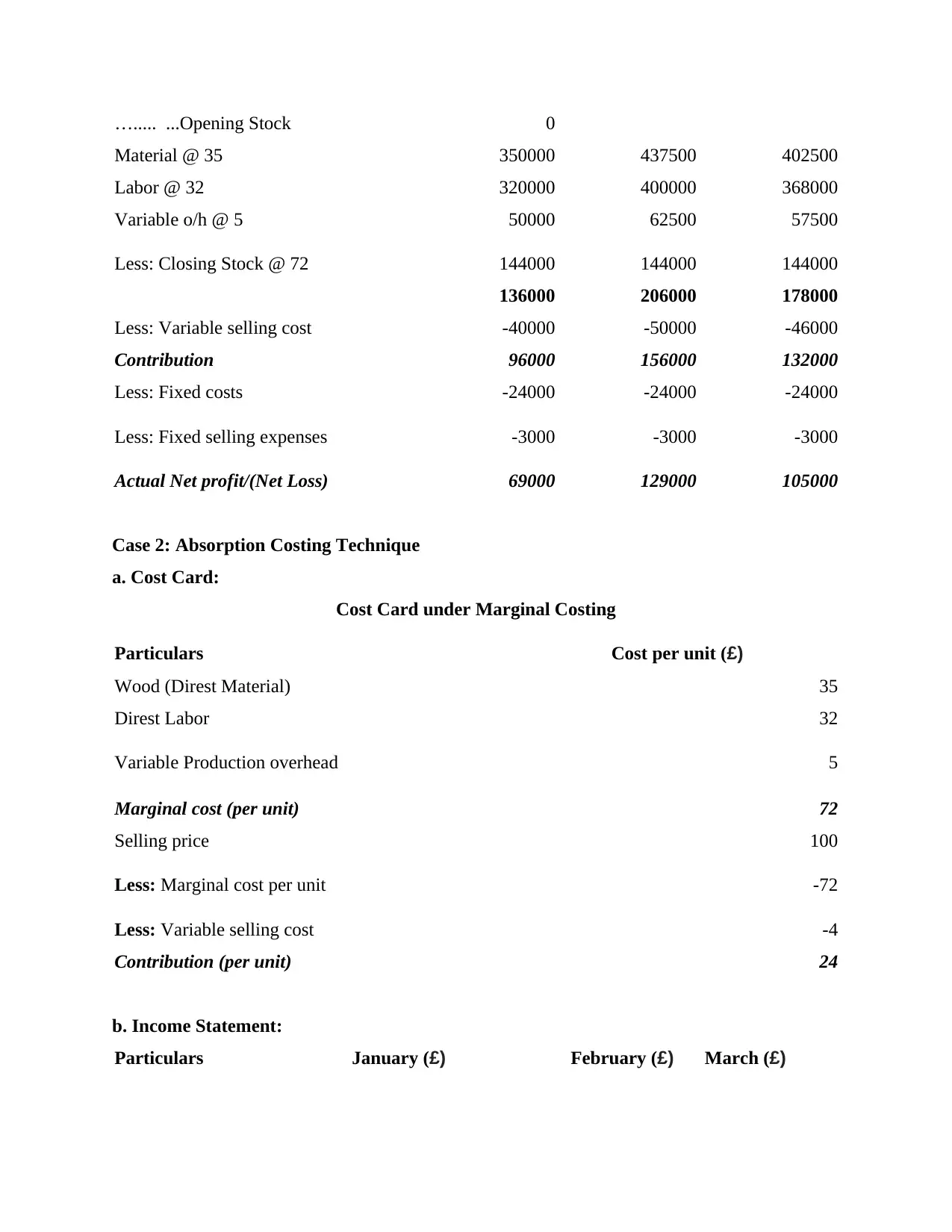

…..... ...Opening Stock 0

Material @ 35 350000 437500 402500

Labor @ 32 320000 400000 368000

Variable o/h @ 5 50000 62500 57500

Less: Closing Stock @ 72 144000 144000 144000

136000 206000 178000

Less: Variable selling cost -40000 -50000 -46000

Contribution 96000 156000 132000

Less: Fixed costs -24000 -24000 -24000

Less: Fixed selling expenses -3000 -3000 -3000

Actual Net profit/(Net Loss) 69000 129000 105000

Case 2: Absorption Costing Technique

a. Cost Card:

Cost Card under Marginal Costing

Particulars Cost per unit (£)

Wood (Direst Material) 35

Direst Labor 32

Variable Production overhead 5

Marginal cost (per unit) 72

Selling price 100

Less: Marginal cost per unit -72

Less: Variable selling cost -4

Contribution (per unit) 24

b. Income Statement:

Particulars January (£) February (£) March (£)

Material @ 35 350000 437500 402500

Labor @ 32 320000 400000 368000

Variable o/h @ 5 50000 62500 57500

Less: Closing Stock @ 72 144000 144000 144000

136000 206000 178000

Less: Variable selling cost -40000 -50000 -46000

Contribution 96000 156000 132000

Less: Fixed costs -24000 -24000 -24000

Less: Fixed selling expenses -3000 -3000 -3000

Actual Net profit/(Net Loss) 69000 129000 105000

Case 2: Absorption Costing Technique

a. Cost Card:

Cost Card under Marginal Costing

Particulars Cost per unit (£)

Wood (Direst Material) 35

Direst Labor 32

Variable Production overhead 5

Marginal cost (per unit) 72

Selling price 100

Less: Marginal cost per unit -72

Less: Variable selling cost -4

Contribution (per unit) 24

b. Income Statement:

Particulars January (£) February (£) March (£)

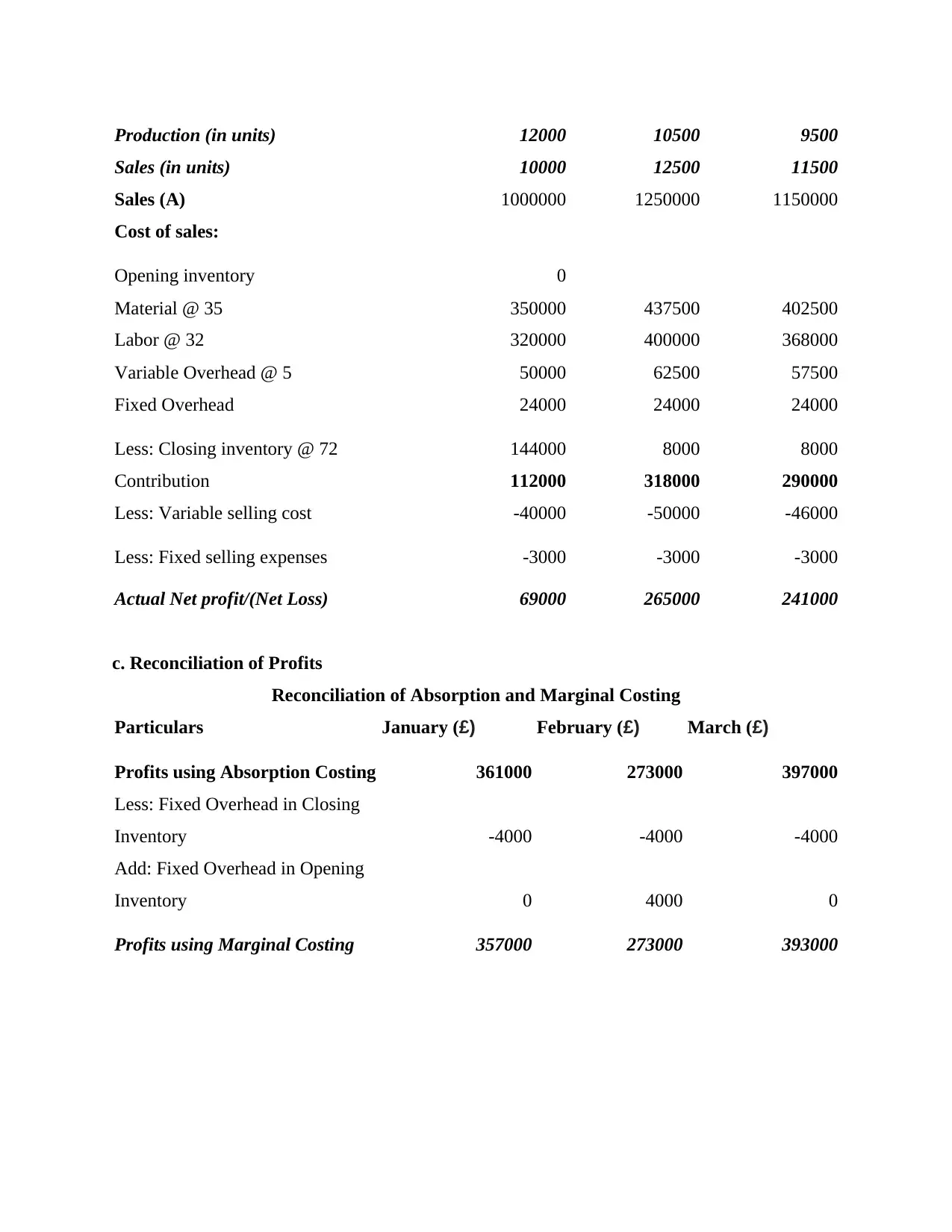

Production (in units) 12000 10500 9500

Sales (in units) 10000 12500 11500

Sales (A) 1000000 1250000 1150000

Cost of sales:

Opening inventory 0

Material @ 35 350000 437500 402500

Labor @ 32 320000 400000 368000

Variable Overhead @ 5 50000 62500 57500

Fixed Overhead 24000 24000 24000

Less: Closing inventory @ 72 144000 8000 8000

Contribution 112000 318000 290000

Less: Variable selling cost -40000 -50000 -46000

Less: Fixed selling expenses -3000 -3000 -3000

Actual Net profit/(Net Loss) 69000 265000 241000

c. Reconciliation of Profits

Reconciliation of Absorption and Marginal Costing

Particulars January (£) February (£) March (£)

Profits using Absorption Costing 361000 273000 397000

Less: Fixed Overhead in Closing

Inventory -4000 -4000 -4000

Add: Fixed Overhead in Opening

Inventory 0 4000 0

Profits using Marginal Costing 357000 273000 393000

Sales (in units) 10000 12500 11500

Sales (A) 1000000 1250000 1150000

Cost of sales:

Opening inventory 0

Material @ 35 350000 437500 402500

Labor @ 32 320000 400000 368000

Variable Overhead @ 5 50000 62500 57500

Fixed Overhead 24000 24000 24000

Less: Closing inventory @ 72 144000 8000 8000

Contribution 112000 318000 290000

Less: Variable selling cost -40000 -50000 -46000

Less: Fixed selling expenses -3000 -3000 -3000

Actual Net profit/(Net Loss) 69000 265000 241000

c. Reconciliation of Profits

Reconciliation of Absorption and Marginal Costing

Particulars January (£) February (£) March (£)

Profits using Absorption Costing 361000 273000 397000

Less: Fixed Overhead in Closing

Inventory -4000 -4000 -4000

Add: Fixed Overhead in Opening

Inventory 0 4000 0

Profits using Marginal Costing 357000 273000 393000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

TASK 3

P4: Various advantages and disadvantages of different kind of planning tools used for budgetary

control:

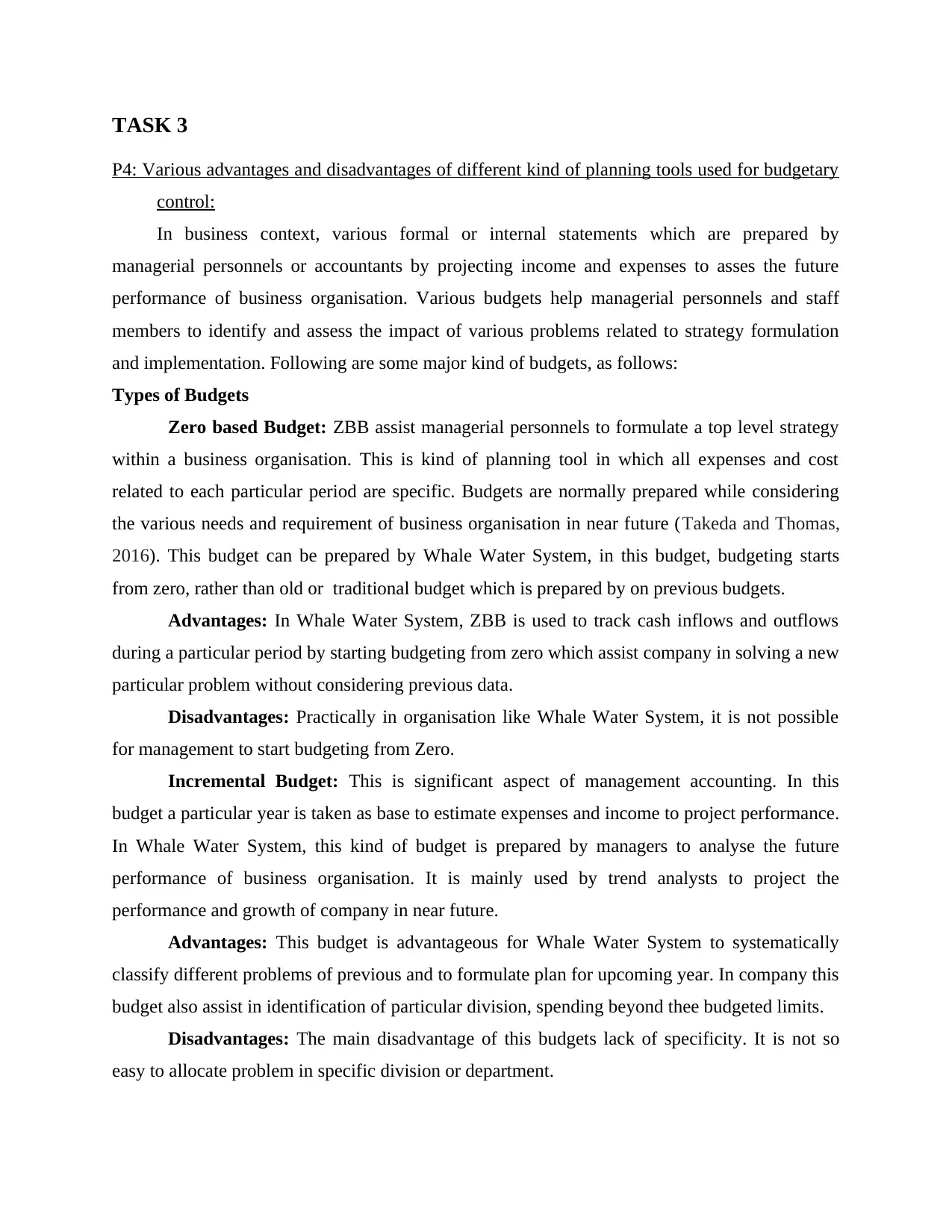

In business context, various formal or internal statements which are prepared by

managerial personnels or accountants by projecting income and expenses to asses the future

performance of business organisation. Various budgets help managerial personnels and staff

members to identify and assess the impact of various problems related to strategy formulation

and implementation. Following are some major kind of budgets, as follows:

Types of Budgets

Zero based Budget: ZBB assist managerial personnels to formulate a top level strategy

within a business organisation. This is kind of planning tool in which all expenses and cost

related to each particular period are specific. Budgets are normally prepared while considering

the various needs and requirement of business organisation in near future (Takeda and Thomas,

2016). This budget can be prepared by Whale Water System, in this budget, budgeting starts

from zero, rather than old or traditional budget which is prepared by on previous budgets.

Advantages: In Whale Water System, ZBB is used to track cash inflows and outflows

during a particular period by starting budgeting from zero which assist company in solving a new

particular problem without considering previous data.

Disadvantages: Practically in organisation like Whale Water System, it is not possible

for management to start budgeting from Zero.

Incremental Budget: This is significant aspect of management accounting. In this

budget a particular year is taken as base to estimate expenses and income to project performance.

In Whale Water System, this kind of budget is prepared by managers to analyse the future

performance of business organisation. It is mainly used by trend analysts to project the

performance and growth of company in near future.

Advantages: This budget is advantageous for Whale Water System to systematically

classify different problems of previous and to formulate plan for upcoming year. In company this

budget also assist in identification of particular division, spending beyond thee budgeted limits.

Disadvantages: The main disadvantage of this budgets lack of specificity. It is not so

easy to allocate problem in specific division or department.

P4: Various advantages and disadvantages of different kind of planning tools used for budgetary

control:

In business context, various formal or internal statements which are prepared by

managerial personnels or accountants by projecting income and expenses to asses the future

performance of business organisation. Various budgets help managerial personnels and staff

members to identify and assess the impact of various problems related to strategy formulation

and implementation. Following are some major kind of budgets, as follows:

Types of Budgets

Zero based Budget: ZBB assist managerial personnels to formulate a top level strategy

within a business organisation. This is kind of planning tool in which all expenses and cost

related to each particular period are specific. Budgets are normally prepared while considering

the various needs and requirement of business organisation in near future (Takeda and Thomas,

2016). This budget can be prepared by Whale Water System, in this budget, budgeting starts

from zero, rather than old or traditional budget which is prepared by on previous budgets.

Advantages: In Whale Water System, ZBB is used to track cash inflows and outflows

during a particular period by starting budgeting from zero which assist company in solving a new

particular problem without considering previous data.

Disadvantages: Practically in organisation like Whale Water System, it is not possible

for management to start budgeting from Zero.

Incremental Budget: This is significant aspect of management accounting. In this

budget a particular year is taken as base to estimate expenses and income to project performance.

In Whale Water System, this kind of budget is prepared by managers to analyse the future

performance of business organisation. It is mainly used by trend analysts to project the

performance and growth of company in near future.

Advantages: This budget is advantageous for Whale Water System to systematically

classify different problems of previous and to formulate plan for upcoming year. In company this

budget also assist in identification of particular division, spending beyond thee budgeted limits.

Disadvantages: The main disadvantage of this budgets lack of specificity. It is not so

easy to allocate problem in specific division or department.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Operating Budget: It is a kind of budgets that requires different kind of sub budgets in

order to meet essential goals of company in predefined time. Te process of preparing operational

budgets starts with developing budget that help to keep a systematic record of overall sales

revenues and expenses incurred on promoting valuable product of company (Yazdifar, H. and

et.al., 2012). This budgets mainly involves information about total Income and expenses which

are predicted by manager of company. In context of whale water system this budgets support in

acquiring short-term plan in which capital expenses is excluded as it is part of long-term cost.

There are various advantages and disadvantage of this budgets that are defined below:

Advantages: It is short in nature that help to perform daily activity in respective manner.

This budgets also help manager of whale water system to plan efficaciously about future so that

profit margin can be increased.

Disadvantages: This budgets mainly includes lots of time as manager have to daily

conduct a meeting for daily operations.

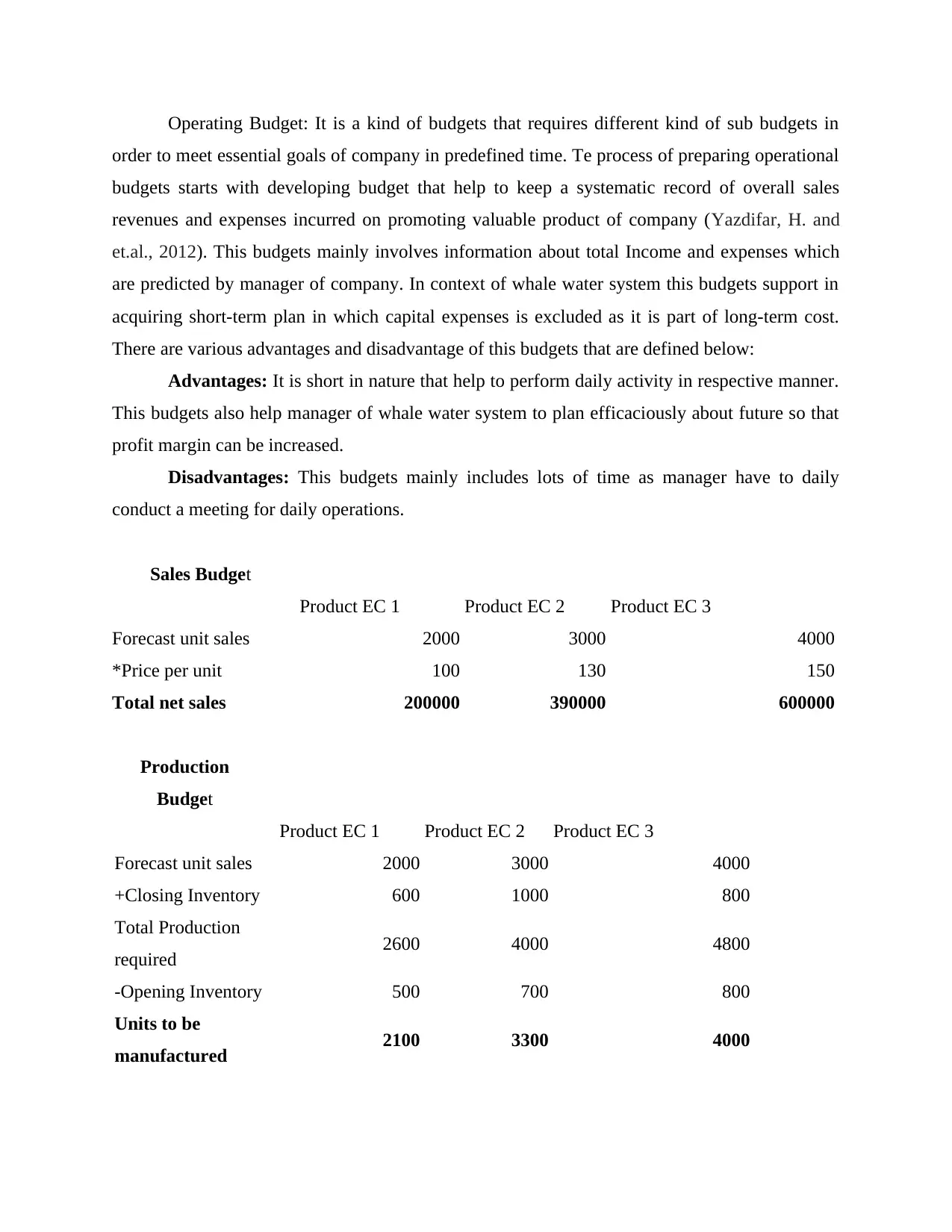

Sales Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

*Price per unit 100 130 150

Total net sales 200000 390000 600000

Production

Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

+Closing Inventory 600 1000 800

Total Production

required 2600 4000 4800

-Opening Inventory 500 700 800

Units to be

manufactured 2100 3300 4000

order to meet essential goals of company in predefined time. Te process of preparing operational

budgets starts with developing budget that help to keep a systematic record of overall sales

revenues and expenses incurred on promoting valuable product of company (Yazdifar, H. and

et.al., 2012). This budgets mainly involves information about total Income and expenses which

are predicted by manager of company. In context of whale water system this budgets support in

acquiring short-term plan in which capital expenses is excluded as it is part of long-term cost.

There are various advantages and disadvantage of this budgets that are defined below:

Advantages: It is short in nature that help to perform daily activity in respective manner.

This budgets also help manager of whale water system to plan efficaciously about future so that

profit margin can be increased.

Disadvantages: This budgets mainly includes lots of time as manager have to daily

conduct a meeting for daily operations.

Sales Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

*Price per unit 100 130 150

Total net sales 200000 390000 600000

Production

Budget

Product EC 1 Product EC 2 Product EC 3

Forecast unit sales 2000 3000 4000

+Closing Inventory 600 1000 800

Total Production

required 2600 4000 4800

-Opening Inventory 500 700 800

Units to be

manufactured 2100 3300 4000

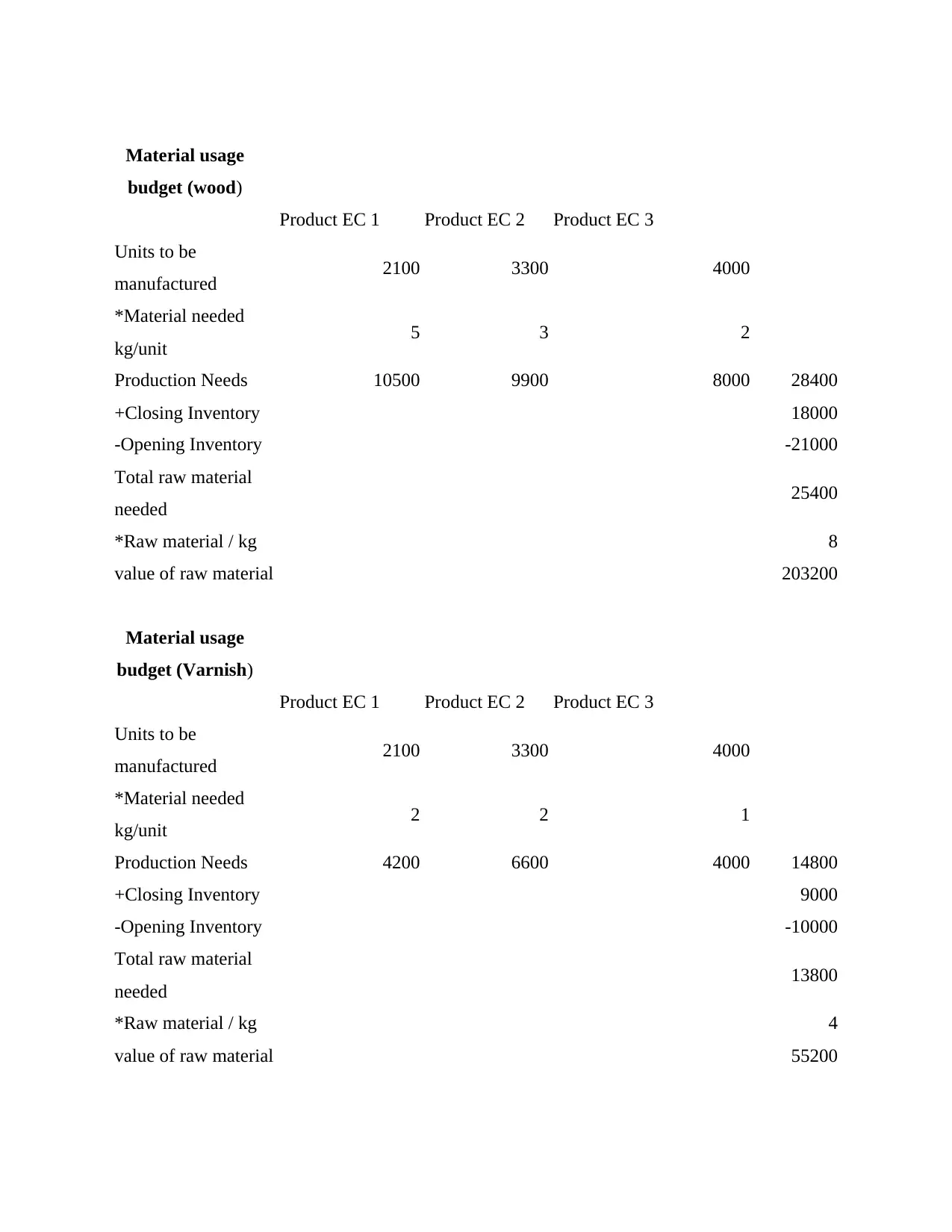

Material usage

budget (wood)

Product EC 1 Product EC 2 Product EC 3

Units to be

manufactured 2100 3300 4000

*Material needed

kg/unit 5 3 2

Production Needs 10500 9900 8000 28400

+Closing Inventory 18000

-Opening Inventory -21000

Total raw material

needed 25400

*Raw material / kg 8

value of raw material 203200

Material usage

budget (Varnish)

Product EC 1 Product EC 2 Product EC 3

Units to be

manufactured 2100 3300 4000

*Material needed

kg/unit 2 2 1

Production Needs 4200 6600 4000 14800

+Closing Inventory 9000

-Opening Inventory -10000

Total raw material

needed 13800

*Raw material / kg 4

value of raw material 55200

budget (wood)

Product EC 1 Product EC 2 Product EC 3

Units to be

manufactured 2100 3300 4000

*Material needed

kg/unit 5 3 2

Production Needs 10500 9900 8000 28400

+Closing Inventory 18000

-Opening Inventory -21000

Total raw material

needed 25400

*Raw material / kg 8

value of raw material 203200

Material usage

budget (Varnish)

Product EC 1 Product EC 2 Product EC 3

Units to be

manufactured 2100 3300 4000

*Material needed

kg/unit 2 2 1

Production Needs 4200 6600 4000 14800

+Closing Inventory 9000

-Opening Inventory -10000

Total raw material

needed 13800

*Raw material / kg 4

value of raw material 55200

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.