Management Accounting Report: Costing, Budgeting, and Control

VerifiedAdded on 2020/11/23

|18

|5651

|144

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its role in business operations and decision-making. It begins by defining management accounting and contrasting it with financial accounting, highlighting their differences in purpose, audience, and reporting standards. The report then delves into various management accounting systems, including cost accounting, inventory accounting, and job costing systems, explaining their key requirements and applications. Furthermore, it examines different methods for managerial accounting reporting, such as budget reports and performance reports, and their significance in planning, control, and performance evaluation. The report also covers the preparation of income statements using absorption and marginal costing systems, along with a discussion of the advantages and disadvantages of budgetary control tools. Finally, it addresses how management accounting systems can be adapted to address financial problems, offering practical insights for effective financial management. This report offers valuable insights for students studying management accounting and provides a solid foundation for understanding its practical applications.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

LO 1.................................................................................................................................................3

P1. Explaining management accounting and key requirements of different types of

management accounting systems...........................................................................................3

P2. Different methods for managerial accounting reporting..................................................7

LO 2.................................................................................................................................................9

P3. Preparing income statement using absorption and marginal costing system...................9

P4 Advantages and disadvantages of the different types of planning tools used for budgetary

control...................................................................................................................................12

P5 Ways of adopting management accounting system to respond to financial problems ...14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

LO 1.................................................................................................................................................3

P1. Explaining management accounting and key requirements of different types of

management accounting systems...........................................................................................3

P2. Different methods for managerial accounting reporting..................................................7

LO 2.................................................................................................................................................9

P3. Preparing income statement using absorption and marginal costing system...................9

P4 Advantages and disadvantages of the different types of planning tools used for budgetary

control...................................................................................................................................12

P5 Ways of adopting management accounting system to respond to financial problems ...14

CONCLUSION..............................................................................................................................15

REFERENCES..............................................................................................................................17

INTRODUCTION

Management accounting can be defined as a branch of management through which various

information relating to the financial activities of the company are being summarised and

provided to the internal users of the company. This system helps the managers in developing

their plans and strategies for the business so that they can take appropriate decisions for the

business and enhance company's profitability and overall financial position. Deloitee is the most

leading accounting firm of UK. It was established on 1845 and currently it provides accounting

professional consultant and auditing services to thousands of business organisation in all over the

world. The present study describes management accounting along with its difference with the

financial accounting. It shows various types of management accounting systems and

management accounting reporting through which company can develop effective management of

various business activities.

It also shows preparation of income statements of the company using various

management accounting techniques. Furthermore, the assignment also shows different planning

tools of budgetary control that can be used by managers in their managerial functions in context

to the financial activities of business. In addition, it provides information about various

management accounting system through which company's ability to responding numerous

financial problems can be resolved.

MAIN BODY

LO 1

P1. Explaining management accounting and key requirements of different types of management

accounting systems

Management accounting

Management accounting helps the managers in managing various business operations. In

this system of management, manager’s analyses various income, expenses, profits, etc. of the

business (Management Accounting – Meaning, Advantages & Functions, 2018). With the help of

it, Excite Ltd. Can appropriate price of the product and generate appropriate profit as well.

In other words, management accounting can be defined as a process in which

professional skills and knowledge are being adopted by the managers so that managers can

Management accounting can be defined as a branch of management through which various

information relating to the financial activities of the company are being summarised and

provided to the internal users of the company. This system helps the managers in developing

their plans and strategies for the business so that they can take appropriate decisions for the

business and enhance company's profitability and overall financial position. Deloitee is the most

leading accounting firm of UK. It was established on 1845 and currently it provides accounting

professional consultant and auditing services to thousands of business organisation in all over the

world. The present study describes management accounting along with its difference with the

financial accounting. It shows various types of management accounting systems and

management accounting reporting through which company can develop effective management of

various business activities.

It also shows preparation of income statements of the company using various

management accounting techniques. Furthermore, the assignment also shows different planning

tools of budgetary control that can be used by managers in their managerial functions in context

to the financial activities of business. In addition, it provides information about various

management accounting system through which company's ability to responding numerous

financial problems can be resolved.

MAIN BODY

LO 1

P1. Explaining management accounting and key requirements of different types of management

accounting systems

Management accounting

Management accounting helps the managers in managing various business operations. In

this system of management, manager’s analyses various income, expenses, profits, etc. of the

business (Management Accounting – Meaning, Advantages & Functions, 2018). With the help of

it, Excite Ltd. Can appropriate price of the product and generate appropriate profit as well.

In other words, management accounting can be defined as a process in which

professional skills and knowledge are being adopted by the managers so that managers can

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

provide all the information with the help of which they can formulate effective plans and

strategies for controlling each business operations of the company.

Financial accounting

Financial accounting is a process of analysing and summarising various financial

activities of the company so that the stakeholders and other outsiders of company can analyse the

actual financial position of company. Further, it can be stated that financial accounting is a

branch of accounting through which the firm maintains a proper record of each financial

transaction of the company using numerous guidelines and rules provided in the accounting

standards of the company.

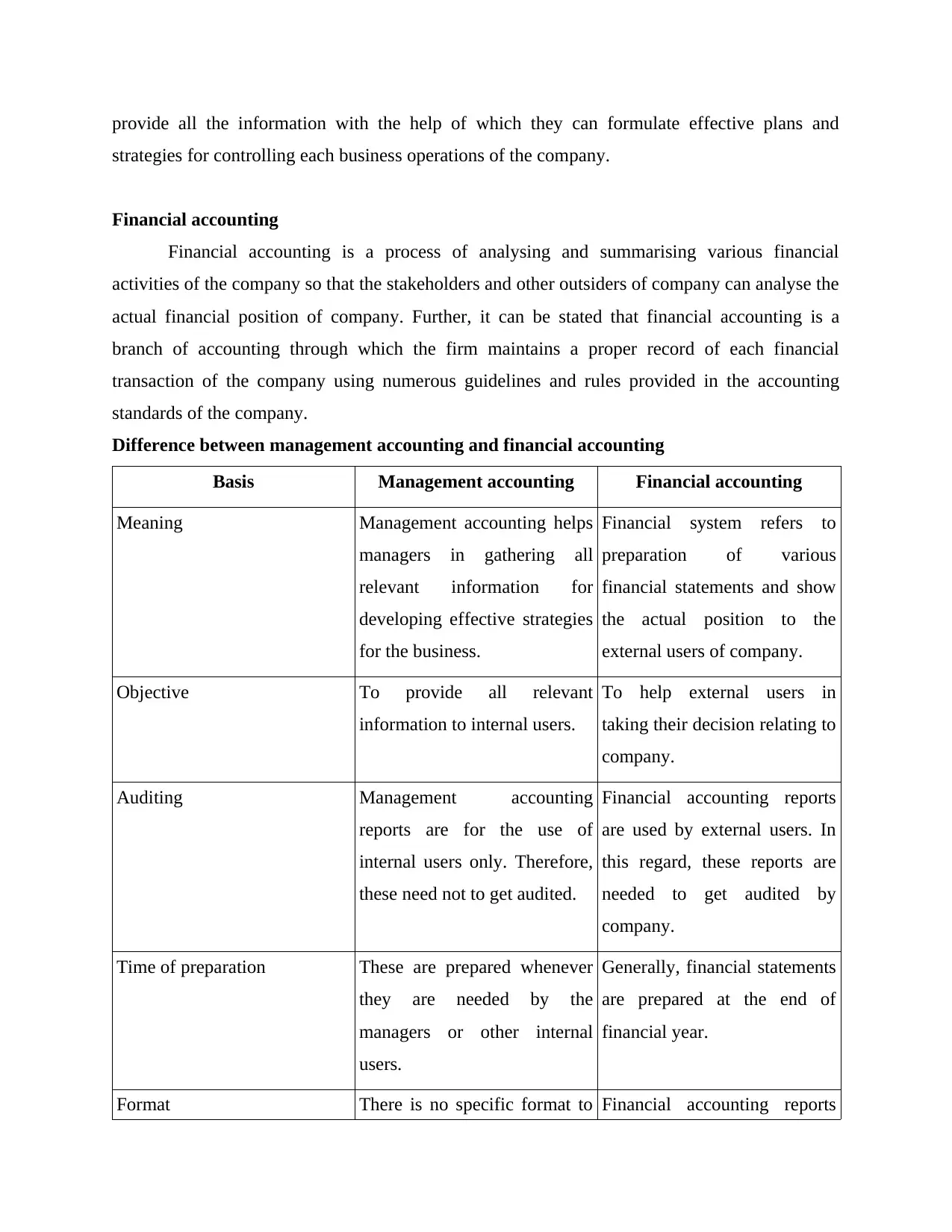

Difference between management accounting and financial accounting

Basis Management accounting Financial accounting

Meaning Management accounting helps

managers in gathering all

relevant information for

developing effective strategies

for the business.

Financial system refers to

preparation of various

financial statements and show

the actual position to the

external users of company.

Objective To provide all relevant

information to internal users.

To help external users in

taking their decision relating to

company.

Auditing Management accounting

reports are for the use of

internal users only. Therefore,

these need not to get audited.

Financial accounting reports

are used by external users. In

this regard, these reports are

needed to get audited by

company.

Time of preparation These are prepared whenever

they are needed by the

managers or other internal

users.

Generally, financial statements

are prepared at the end of

financial year.

Format There is no specific format to Financial accounting reports

strategies for controlling each business operations of the company.

Financial accounting

Financial accounting is a process of analysing and summarising various financial

activities of the company so that the stakeholders and other outsiders of company can analyse the

actual financial position of company. Further, it can be stated that financial accounting is a

branch of accounting through which the firm maintains a proper record of each financial

transaction of the company using numerous guidelines and rules provided in the accounting

standards of the company.

Difference between management accounting and financial accounting

Basis Management accounting Financial accounting

Meaning Management accounting helps

managers in gathering all

relevant information for

developing effective strategies

for the business.

Financial system refers to

preparation of various

financial statements and show

the actual position to the

external users of company.

Objective To provide all relevant

information to internal users.

To help external users in

taking their decision relating to

company.

Auditing Management accounting

reports are for the use of

internal users only. Therefore,

these need not to get audited.

Financial accounting reports

are used by external users. In

this regard, these reports are

needed to get audited by

company.

Time of preparation These are prepared whenever

they are needed by the

managers or other internal

users.

Generally, financial statements

are prepared at the end of

financial year.

Format There is no specific format to Financial accounting reports

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

prepare management

accounting reports.

are needed to be prepared in a

specific format.

a) cost accounting system

Cost accounting system:- Cost accounting is a term refers to the estimation of the cost

of the products for the profitability analysis, cost control and inventory valuation. From

estimating the accurate cost of the products and services which has been critically evaluated for

the operations of the profit and revenues. Each and every company must know about the

products which are profitable and which is not profitable for the company. It can only be

ascertained when it has been estimated and also the identify the correct cost of the products and

services (Maskell Baggaley and Grasso, 2016).

From the costing system it helps in estimating the costing values of all the raw materials

inventory, finished goods services and also the work in progress for the main purpose of the

financial statement preparation. Cost accounting is used for maintaining and putting the records

of the production activities from using of the perpetual inventory system.

It is a system of the accounting which has been designed for the manufacturers tracks

and also the flow of inventory which continually growing up from the variety of stages of the

production management. It is a method of accounting system which aim is to capture and record

the cost of the production by assessing the input cost of each and every step of the manufacturing

and production and also the fixed cost such as the depreciation of the capital equipment.

Direct cost accounting: - A direct cost accounting is a term which refers to the price

which is completely attributed to the production for the specific goods and services.

Some costs, like depreciation and administrative expenses which are more difficult for

assigning the specific products and it also considers the indirect cost of the products and

services (Schaltegger and Burritt, 2017.).

Standard cost accounting: - It is a type of practices in which all the substitute for the

expected cost and also the actual cost in the accounting records. Frequently, the variance

of the recorded for showing the difference between the actual cost and expected cost. It

also includes the creation of estimation cost for all of activities within the firm.

accounting reports.

are needed to be prepared in a

specific format.

a) cost accounting system

Cost accounting system:- Cost accounting is a term refers to the estimation of the cost

of the products for the profitability analysis, cost control and inventory valuation. From

estimating the accurate cost of the products and services which has been critically evaluated for

the operations of the profit and revenues. Each and every company must know about the

products which are profitable and which is not profitable for the company. It can only be

ascertained when it has been estimated and also the identify the correct cost of the products and

services (Maskell Baggaley and Grasso, 2016).

From the costing system it helps in estimating the costing values of all the raw materials

inventory, finished goods services and also the work in progress for the main purpose of the

financial statement preparation. Cost accounting is used for maintaining and putting the records

of the production activities from using of the perpetual inventory system.

It is a system of the accounting which has been designed for the manufacturers tracks

and also the flow of inventory which continually growing up from the variety of stages of the

production management. It is a method of accounting system which aim is to capture and record

the cost of the production by assessing the input cost of each and every step of the manufacturing

and production and also the fixed cost such as the depreciation of the capital equipment.

Direct cost accounting: - A direct cost accounting is a term which refers to the price

which is completely attributed to the production for the specific goods and services.

Some costs, like depreciation and administrative expenses which are more difficult for

assigning the specific products and it also considers the indirect cost of the products and

services (Schaltegger and Burritt, 2017.).

Standard cost accounting: - It is a type of practices in which all the substitute for the

expected cost and also the actual cost in the accounting records. Frequently, the variance

of the recorded for showing the difference between the actual cost and expected cost. It

also includes the creation of estimation cost for all of activities within the firm.

c) inventory accounting system

Inventory management system:- It is a type of software for tracking the inventory level,

sales, deliveries and also the orders. It can also be used for the manufacturing company and also

to create the work order, bill of the materials and other documents related to the production.

There are lots of companies which has been used the inventory management system for avoiding

the overstock of the products and outages. It is systematic tool for analysing and organising the

data of the inventory which generally stored in the spreadsheets and hard copy. It is made up of

the several keys and aspects for working together for creating the cohesive inventory of so many

organisation systems. There are lots of companies which has been used the inventory software

managements system for reducing the carrying cost because this software is always used for

tracking the products (Laudon and Laudon, 2016). It maintains the balance between too little and

too much of the inventory. Tracking the inventory as the transported between the locations. From

efficient inventory control methods, it reduces but cannot eliminated the business and also the

objectives of the sales which has been improved by them.

Inventory system and management is important for maintaining the right balances and

reports of the stock. From too much use of inventory it triggers the profit and loses. The main

aim and purpose is to supply the chain management, the flow of the goods of the manufacturing

and it also keeps the records of the each and every new and returned products and services. It

easily tracks the orders, sales and levels of inventory and deliveries. It creates a work order for

the manufacturing company and also the bill materials which is related to the production

management.

d) job costing system

Job costing system:- Job costing system is accumulating and assigning for the

manufacturing cost of an individual unit of the output. It is a method to record cost of

manufacturing job, from the job order costing system and the cost which has been required for

separate record of the job cost for each and every items. The job cost record all the report about

every item and also the direct labour and direct materials which were actually used and assigned

for the amount of manufacturing the overhead. The information and which is more useful for

determining the accuracy of the customers and company's estimating system. The importance of

the job costing system is it involves the direct cost, labour cost and also the overhead changes in

Inventory management system:- It is a type of software for tracking the inventory level,

sales, deliveries and also the orders. It can also be used for the manufacturing company and also

to create the work order, bill of the materials and other documents related to the production.

There are lots of companies which has been used the inventory management system for avoiding

the overstock of the products and outages. It is systematic tool for analysing and organising the

data of the inventory which generally stored in the spreadsheets and hard copy. It is made up of

the several keys and aspects for working together for creating the cohesive inventory of so many

organisation systems. There are lots of companies which has been used the inventory software

managements system for reducing the carrying cost because this software is always used for

tracking the products (Laudon and Laudon, 2016). It maintains the balance between too little and

too much of the inventory. Tracking the inventory as the transported between the locations. From

efficient inventory control methods, it reduces but cannot eliminated the business and also the

objectives of the sales which has been improved by them.

Inventory system and management is important for maintaining the right balances and

reports of the stock. From too much use of inventory it triggers the profit and loses. The main

aim and purpose is to supply the chain management, the flow of the goods of the manufacturing

and it also keeps the records of the each and every new and returned products and services. It

easily tracks the orders, sales and levels of inventory and deliveries. It creates a work order for

the manufacturing company and also the bill materials which is related to the production

management.

d) job costing system

Job costing system:- Job costing system is accumulating and assigning for the

manufacturing cost of an individual unit of the output. It is a method to record cost of

manufacturing job, from the job order costing system and the cost which has been required for

separate record of the job cost for each and every items. The job cost record all the report about

every item and also the direct labour and direct materials which were actually used and assigned

for the amount of manufacturing the overhead. The information and which is more useful for

determining the accuracy of the customers and company's estimating system. The importance of

the job costing system is it involves the direct cost, labour cost and also the overhead changes in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

the firm. It gives main advantage to the manager for being able for keeping the track of the

individuals and performance of the team in the terms of the cost control and productivity and

efficient (Loy and et.al., 2016.).

As long as the job costing system is considered, the company can compile the cost which

is recorded as the inventory assets and also the approaches has ensured the revenues and profits

which has been associated with the expenses and also the same period. The auditors of the

company have to verify the attempts the job costing system operations and also the ability to

compile the item of inventory cost which will be charge the cost as the expenses within the

correct form of inventory.

For example; manufacturing companies such as ABC using the job costing system to

allocate the order of the job cost and also the actual values and tracking the costs accurately for

generating the revenues and profits. In January 2015, company's project manager has been

prepared the yearly plan and also estimating the approximately 625,000 cost of overhead (Eone

and Baer, 2018). During this company has recorded various types of transaction which is known

as the job costing system.

There are three steps which has been accumulated the steps of the information and also the needs

of the job costing system;

Direct materials: - It is one of the job costing methods which is able to track the

materials of the cost that are used for the scrapped during job.

Direct labours:- It tracks the job costing of the labour which is used at the time of the

job.

Overhead: - It means the cost which is used at time of appreciation and equipment of

production and rent of the building (Maskell, Baggaley and Grasso, 2016).

P2. Different methods for managerial accounting reporting.

Management Accounting reporting is a process of formulation of the managerial report of

the company. This management accounting report assists Excite Entertainment Ltd in making of

plans, budgets, decision, monitoring, measuring performance and profitability level of the

company as well as of the individual employee as a whole. With the help of management

accounting report, the management of Excite Entertainment Ltd can make decision related to the

individuals and performance of the team in the terms of the cost control and productivity and

efficient (Loy and et.al., 2016.).

As long as the job costing system is considered, the company can compile the cost which

is recorded as the inventory assets and also the approaches has ensured the revenues and profits

which has been associated with the expenses and also the same period. The auditors of the

company have to verify the attempts the job costing system operations and also the ability to

compile the item of inventory cost which will be charge the cost as the expenses within the

correct form of inventory.

For example; manufacturing companies such as ABC using the job costing system to

allocate the order of the job cost and also the actual values and tracking the costs accurately for

generating the revenues and profits. In January 2015, company's project manager has been

prepared the yearly plan and also estimating the approximately 625,000 cost of overhead (Eone

and Baer, 2018). During this company has recorded various types of transaction which is known

as the job costing system.

There are three steps which has been accumulated the steps of the information and also the needs

of the job costing system;

Direct materials: - It is one of the job costing methods which is able to track the

materials of the cost that are used for the scrapped during job.

Direct labours:- It tracks the job costing of the labour which is used at the time of the

job.

Overhead: - It means the cost which is used at time of appreciation and equipment of

production and rent of the building (Maskell, Baggaley and Grasso, 2016).

P2. Different methods for managerial accounting reporting.

Management Accounting reporting is a process of formulation of the managerial report of

the company. This management accounting report assists Excite Entertainment Ltd in making of

plans, budgets, decision, monitoring, measuring performance and profitability level of the

company as well as of the individual employee as a whole. With the help of management

accounting report, the management of Excite Entertainment Ltd can make decision related to the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

business growth and expansion, improves its business performance and profit margins (Kraft,

Vashishtha and Venkatachalam, 2017). The management accounting report is based on the

internal managerial information of the company which is useful for both the management and its

stakeholders in making crucial business and investment related decision respectively. There are

different methods in which Excite Entertainment Ltd related to the management accounting

report:

1. Budget Reports – With the help of Budget report, Excite Entertainment Ltd can make

forecast and estimates of the amount of revenue and expenses which are going to be incurred in

the near future for carrying on any new business operations and task. Budgeting helps the

company in making projections related to the sales and revenue amount, cost expenditure by

taking the previous year data and information as a basis for preparation of new year budget.

Budget Report can helps Excite in minimizing the cost expenditure associated with the

unproductive business areas and thus helps in maximization of profit levels for the company.

2. Accounts Receivable Aging Reports – The Accounts Receivable Aging report is

considered as one of the most important management accounting report for company. This type

of report is useful in case when Excite Entertainment Ltd is relying heavily on the credit factor

for carrying on its business operations. It helps in determining the defaulters and the problem

which company is facing in its cash collection process. It also assists company in evaluating the

balance remaining on behalf of its client and time period in which it will be repaid.

3. Cost Managerial Accounting Reports - This report of the management accounting

helps the management of Excite in evaluating the actual cost value associated with the

manufacturing and production function of the specific unit or product (Bloomfield, 2015). The

cost managerial accounting report provides a detailed summary and overview of all the

information related to the cost incurred in carrying on manufacturing as well as production

functions. Thus, with the help of this report managers of Excite can determine the cost prices of

different items, goods produced in comparison with their selling prices. This comparison

between sell prices and cost price will help in making rough estimation of profit margins.

4. Performance Reports - The performance report of the company helps in determining and

reviewing the overall performance level of both the company as well as of its individual

employees as a whole. This report can help Excite Entertainment Ltd in making assessment

Vashishtha and Venkatachalam, 2017). The management accounting report is based on the

internal managerial information of the company which is useful for both the management and its

stakeholders in making crucial business and investment related decision respectively. There are

different methods in which Excite Entertainment Ltd related to the management accounting

report:

1. Budget Reports – With the help of Budget report, Excite Entertainment Ltd can make

forecast and estimates of the amount of revenue and expenses which are going to be incurred in

the near future for carrying on any new business operations and task. Budgeting helps the

company in making projections related to the sales and revenue amount, cost expenditure by

taking the previous year data and information as a basis for preparation of new year budget.

Budget Report can helps Excite in minimizing the cost expenditure associated with the

unproductive business areas and thus helps in maximization of profit levels for the company.

2. Accounts Receivable Aging Reports – The Accounts Receivable Aging report is

considered as one of the most important management accounting report for company. This type

of report is useful in case when Excite Entertainment Ltd is relying heavily on the credit factor

for carrying on its business operations. It helps in determining the defaulters and the problem

which company is facing in its cash collection process. It also assists company in evaluating the

balance remaining on behalf of its client and time period in which it will be repaid.

3. Cost Managerial Accounting Reports - This report of the management accounting

helps the management of Excite in evaluating the actual cost value associated with the

manufacturing and production function of the specific unit or product (Bloomfield, 2015). The

cost managerial accounting report provides a detailed summary and overview of all the

information related to the cost incurred in carrying on manufacturing as well as production

functions. Thus, with the help of this report managers of Excite can determine the cost prices of

different items, goods produced in comparison with their selling prices. This comparison

between sell prices and cost price will help in making rough estimation of profit margins.

4. Performance Reports - The performance report of the company helps in determining and

reviewing the overall performance level of both the company as well as of its individual

employees as a whole. This report can help Excite Entertainment Ltd in making assessment

related to the success and growth journey of the company in completing its business project.

Analysis can be made on the basis of comparison of the actual outcome of business project with

the budgeted one with the help of this report (Brierley, 2017). Managers can make use of this

report in making key strategic decisions about the future business operations by providing deep

insight about the working of a company.

LO 2

P3. Preparing income statement using absorption and marginal costing system

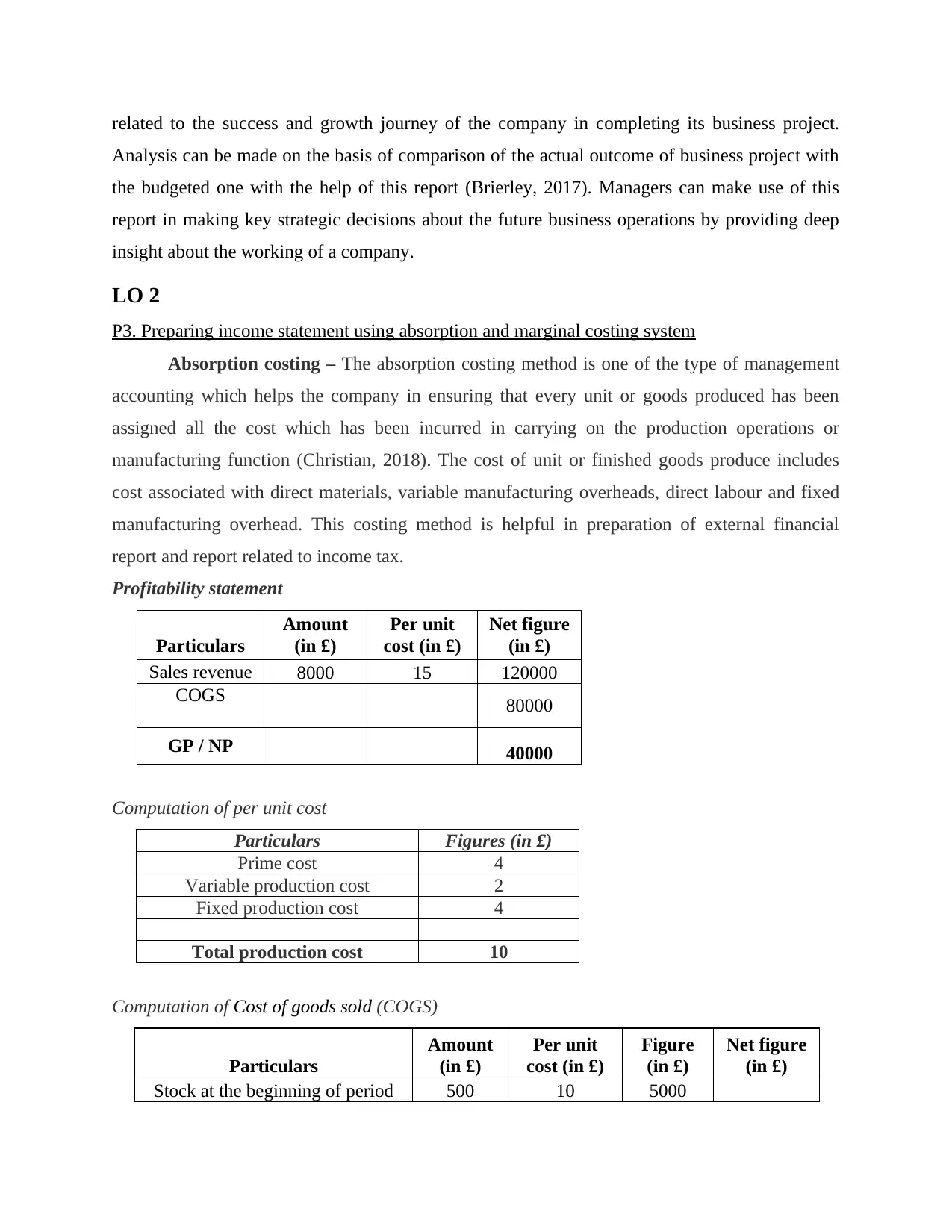

Absorption costing – The absorption costing method is one of the type of management

accounting which helps the company in ensuring that every unit or goods produced has been

assigned all the cost which has been incurred in carrying on the production operations or

manufacturing function (Christian, 2018). The cost of unit or finished goods produce includes

cost associated with direct materials, variable manufacturing overheads, direct labour and fixed

manufacturing overhead. This costing method is helpful in preparation of external financial

report and report related to income tax.

Profitability statement

Particulars

Amount

(in £)

Per unit

cost (in £)

Net figure

(in £)

Sales revenue 8000 15 120000

COGS 80000

GP / NP 40000

Computation of per unit cost

Particulars Figures (in £)

Prime cost 4

Variable production cost 2

Fixed production cost 4

Total production cost 10

Computation of Cost of goods sold (COGS)

Particulars

Amount

(in £)

Per unit

cost (in £)

Figure

(in £)

Net figure

(in £)

Stock at the beginning of period 500 10 5000

Analysis can be made on the basis of comparison of the actual outcome of business project with

the budgeted one with the help of this report (Brierley, 2017). Managers can make use of this

report in making key strategic decisions about the future business operations by providing deep

insight about the working of a company.

LO 2

P3. Preparing income statement using absorption and marginal costing system

Absorption costing – The absorption costing method is one of the type of management

accounting which helps the company in ensuring that every unit or goods produced has been

assigned all the cost which has been incurred in carrying on the production operations or

manufacturing function (Christian, 2018). The cost of unit or finished goods produce includes

cost associated with direct materials, variable manufacturing overheads, direct labour and fixed

manufacturing overhead. This costing method is helpful in preparation of external financial

report and report related to income tax.

Profitability statement

Particulars

Amount

(in £)

Per unit

cost (in £)

Net figure

(in £)

Sales revenue 8000 15 120000

COGS 80000

GP / NP 40000

Computation of per unit cost

Particulars Figures (in £)

Prime cost 4

Variable production cost 2

Fixed production cost 4

Total production cost 10

Computation of Cost of goods sold (COGS)

Particulars

Amount

(in £)

Per unit

cost (in £)

Figure

(in £)

Net figure

(in £)

Stock at the beginning of period 500 10 5000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Production 10000 10 100000

Inventory at the end of period 2500 10 25000

COGS = (Opening stock +

purchase – closing stock) 80000

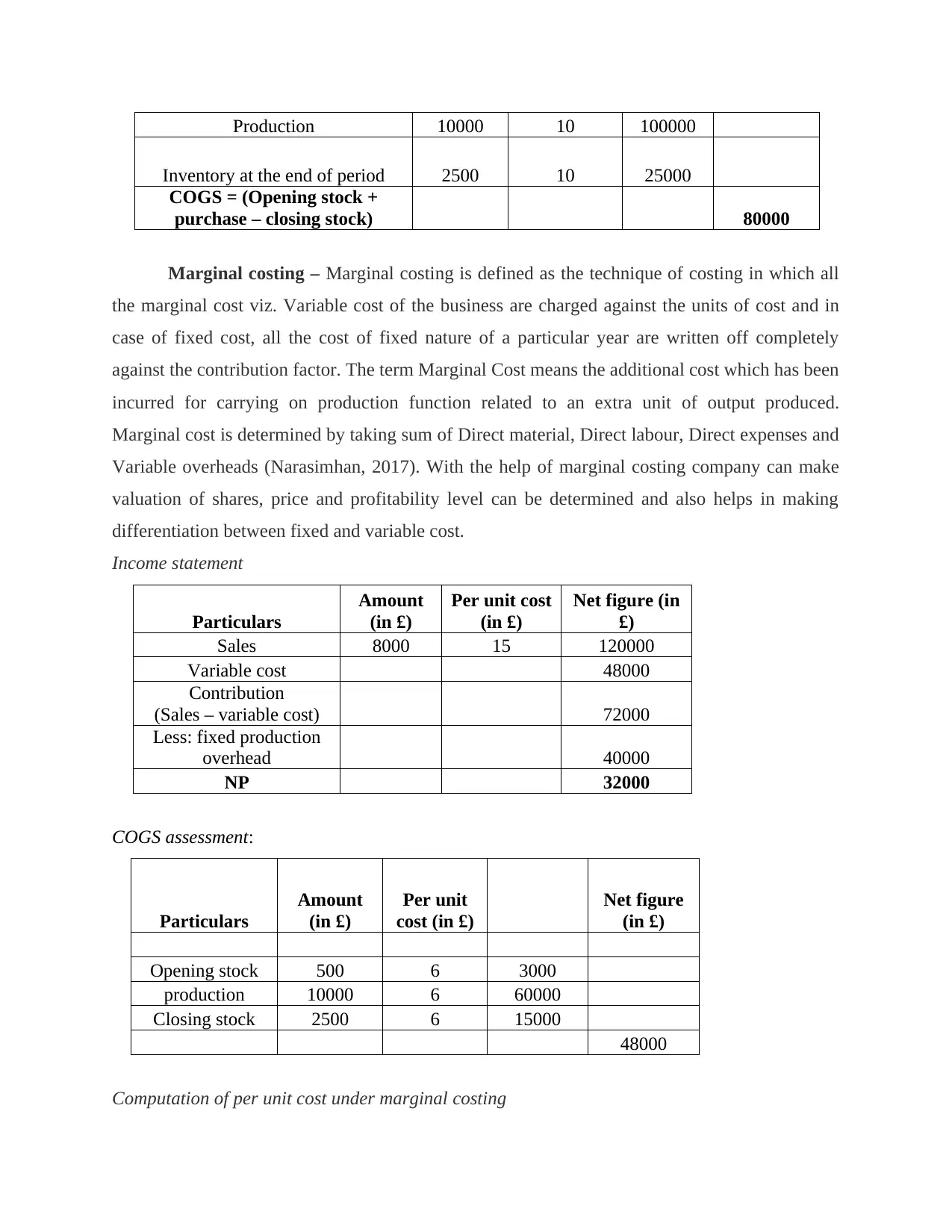

Marginal costing – Marginal costing is defined as the technique of costing in which all

the marginal cost viz. Variable cost of the business are charged against the units of cost and in

case of fixed cost, all the cost of fixed nature of a particular year are written off completely

against the contribution factor. The term Marginal Cost means the additional cost which has been

incurred for carrying on production function related to an extra unit of output produced.

Marginal cost is determined by taking sum of Direct material, Direct labour, Direct expenses and

Variable overheads (Narasimhan, 2017). With the help of marginal costing company can make

valuation of shares, price and profitability level can be determined and also helps in making

differentiation between fixed and variable cost.

Income statement

Particulars

Amount

(in £)

Per unit cost

(in £)

Net figure (in

£)

Sales 8000 15 120000

Variable cost 48000

Contribution

(Sales – variable cost) 72000

Less: fixed production

overhead 40000

NP 32000

COGS assessment:

Particulars

Amount

(in £)

Per unit

cost (in £)

Net figure

(in £)

Opening stock 500 6 3000

production 10000 6 60000

Closing stock 2500 6 15000

48000

Computation of per unit cost under marginal costing

Inventory at the end of period 2500 10 25000

COGS = (Opening stock +

purchase – closing stock) 80000

Marginal costing – Marginal costing is defined as the technique of costing in which all

the marginal cost viz. Variable cost of the business are charged against the units of cost and in

case of fixed cost, all the cost of fixed nature of a particular year are written off completely

against the contribution factor. The term Marginal Cost means the additional cost which has been

incurred for carrying on production function related to an extra unit of output produced.

Marginal cost is determined by taking sum of Direct material, Direct labour, Direct expenses and

Variable overheads (Narasimhan, 2017). With the help of marginal costing company can make

valuation of shares, price and profitability level can be determined and also helps in making

differentiation between fixed and variable cost.

Income statement

Particulars

Amount

(in £)

Per unit cost

(in £)

Net figure (in

£)

Sales 8000 15 120000

Variable cost 48000

Contribution

(Sales – variable cost) 72000

Less: fixed production

overhead 40000

NP 32000

COGS assessment:

Particulars

Amount

(in £)

Per unit

cost (in £)

Net figure

(in £)

Opening stock 500 6 3000

production 10000 6 60000

Closing stock 2500 6 15000

48000

Computation of per unit cost under marginal costing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Particulars Figures (in £)

Prime cost 4

Variable production cost 2

Total production cost 6

Interpretation: On the basis of above analysis, as per absorption costing method, Excite

Entertainment Ltd will attain profit margin of £60000 in the month of May. On the other side, in

case of marginal costing, profit accounts for £32000 respectively. Hence, for the purpose of cost

and profitability assessment company should focus on the adoption of absorption costing system

over marginal. Moreover, absorption method considers both fixed and variable expenses while

making assessment of cost as well as profit. In accordance with absorption costing, fixed

production expenses can be recovered by selling of products or services. Thus, by taking into

account absorption costing methods firm can assess appropriate cost as well as profit and thereby

would become able to do proper financial planning.

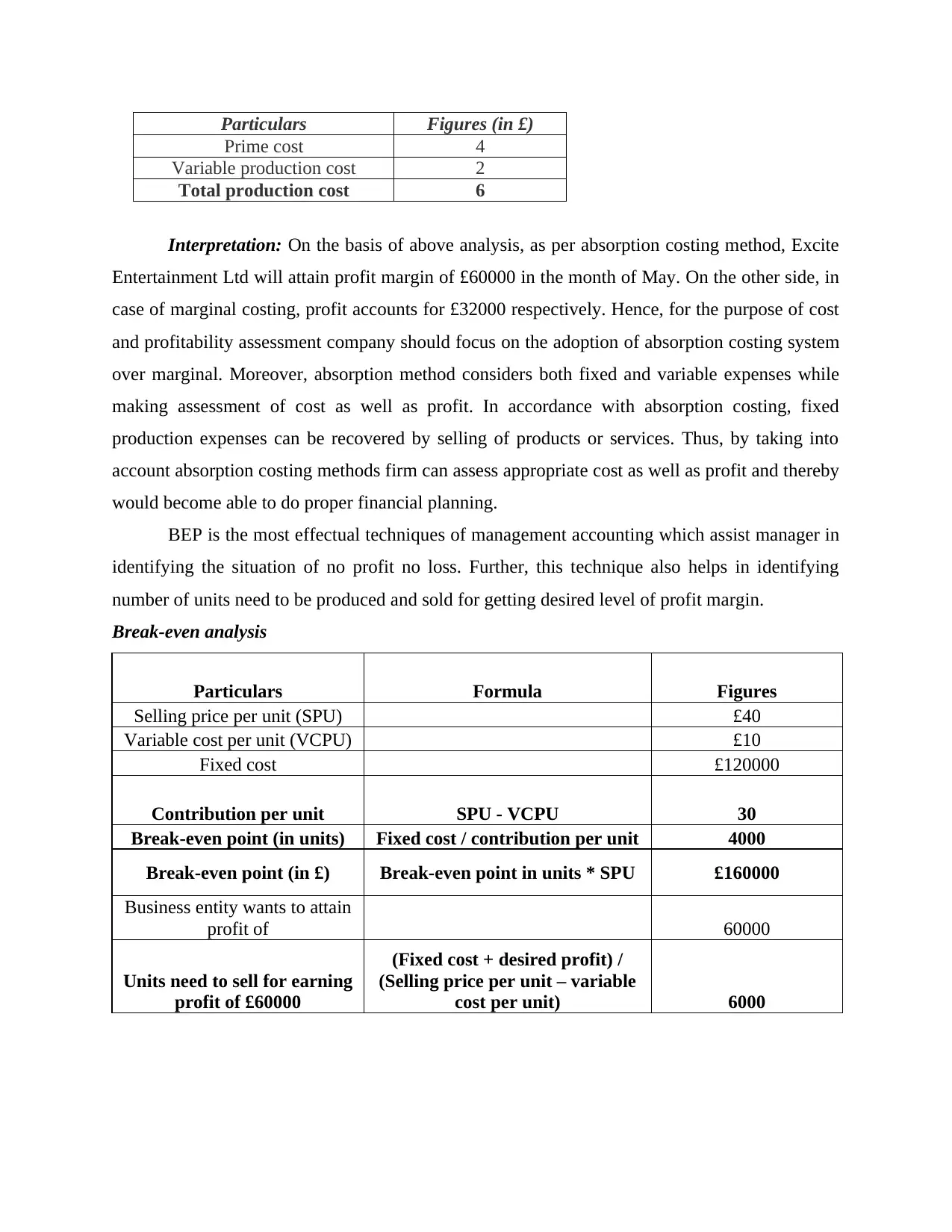

BEP is the most effectual techniques of management accounting which assist manager in

identifying the situation of no profit no loss. Further, this technique also helps in identifying

number of units need to be produced and sold for getting desired level of profit margin.

Break-even analysis

Particulars Formula Figures

Selling price per unit (SPU) £40

Variable cost per unit (VCPU) £10

Fixed cost £120000

Contribution per unit SPU - VCPU 30

Break-even point (in units) Fixed cost / contribution per unit 4000

Break-even point (in £) Break-even point in units * SPU £160000

Business entity wants to attain

profit of 60000

Units need to sell for earning

profit of £60000

(Fixed cost + desired profit) /

(Selling price per unit – variable

cost per unit) 6000

Prime cost 4

Variable production cost 2

Total production cost 6

Interpretation: On the basis of above analysis, as per absorption costing method, Excite

Entertainment Ltd will attain profit margin of £60000 in the month of May. On the other side, in

case of marginal costing, profit accounts for £32000 respectively. Hence, for the purpose of cost

and profitability assessment company should focus on the adoption of absorption costing system

over marginal. Moreover, absorption method considers both fixed and variable expenses while

making assessment of cost as well as profit. In accordance with absorption costing, fixed

production expenses can be recovered by selling of products or services. Thus, by taking into

account absorption costing methods firm can assess appropriate cost as well as profit and thereby

would become able to do proper financial planning.

BEP is the most effectual techniques of management accounting which assist manager in

identifying the situation of no profit no loss. Further, this technique also helps in identifying

number of units need to be produced and sold for getting desired level of profit margin.

Break-even analysis

Particulars Formula Figures

Selling price per unit (SPU) £40

Variable cost per unit (VCPU) £10

Fixed cost £120000

Contribution per unit SPU - VCPU 30

Break-even point (in units) Fixed cost / contribution per unit 4000

Break-even point (in £) Break-even point in units * SPU £160000

Business entity wants to attain

profit of 60000

Units need to sell for earning

profit of £60000

(Fixed cost + desired profit) /

(Selling price per unit – variable

cost per unit) 6000

The above depicted table shows that business unit needs to sell 6000 units for getting

profit of £60000. Further, it has assessed from the analysis that by selling 4000 units to the

customers’ business unit would become able to recover expenses and after it starts making profit.

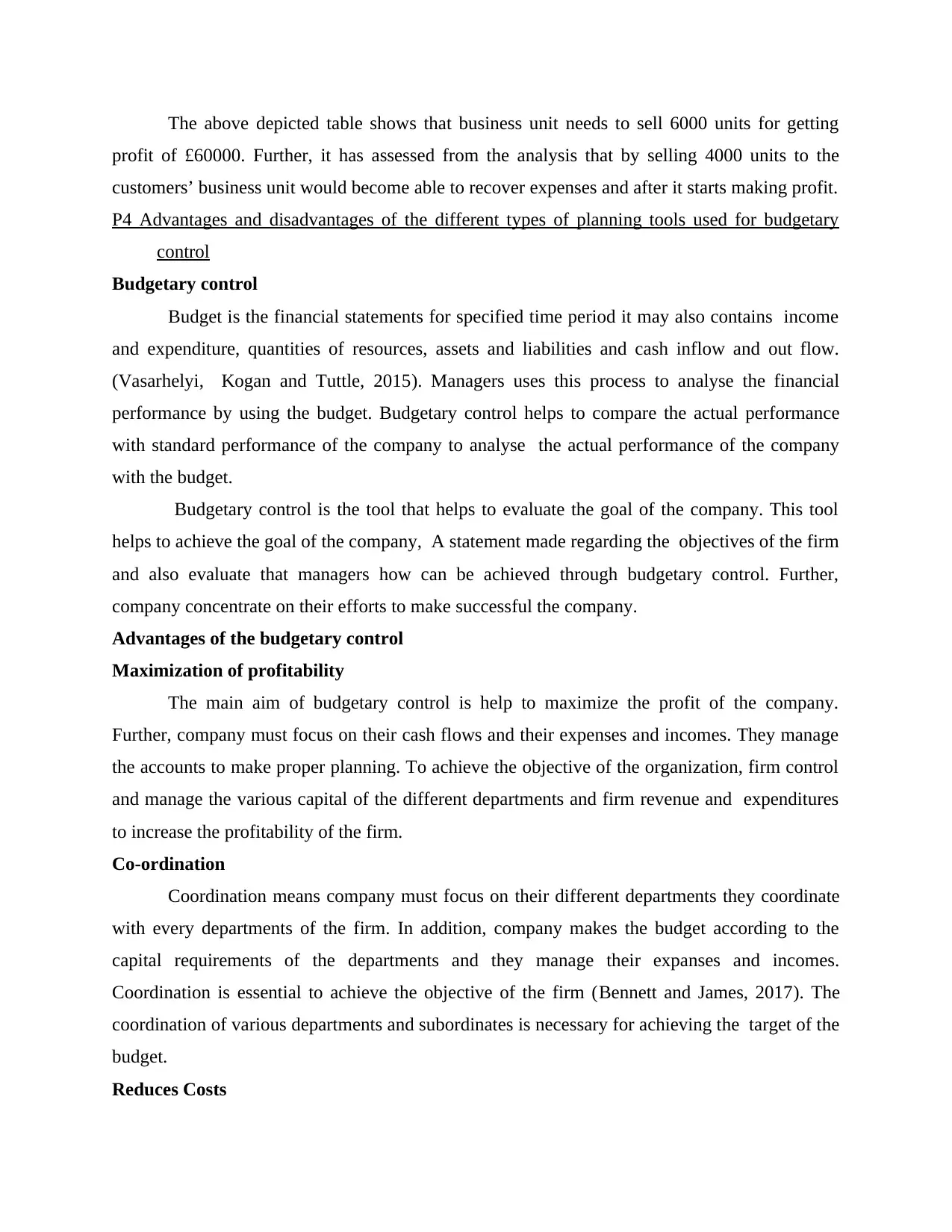

P4 Advantages and disadvantages of the different types of planning tools used for budgetary

control

Budgetary control

Budget is the financial statements for specified time period it may also contains income

and expenditure, quantities of resources, assets and liabilities and cash inflow and out flow.

(Vasarhelyi, Kogan and Tuttle, 2015). Managers uses this process to analyse the financial

performance by using the budget. Budgetary control helps to compare the actual performance

with standard performance of the company to analyse the actual performance of the company

with the budget.

Budgetary control is the tool that helps to evaluate the goal of the company. This tool

helps to achieve the goal of the company, A statement made regarding the objectives of the firm

and also evaluate that managers how can be achieved through budgetary control. Further,

company concentrate on their efforts to make successful the company.

Advantages of the budgetary control

Maximization of profitability

The main aim of budgetary control is help to maximize the profit of the company.

Further, company must focus on their cash flows and their expenses and incomes. They manage

the accounts to make proper planning. To achieve the objective of the organization, firm control

and manage the various capital of the different departments and firm revenue and expenditures

to increase the profitability of the firm.

Co-ordination

Coordination means company must focus on their different departments they coordinate

with every departments of the firm. In addition, company makes the budget according to the

capital requirements of the departments and they manage their expanses and incomes.

Coordination is essential to achieve the objective of the firm (Bennett and James, 2017). The

coordination of various departments and subordinates is necessary for achieving the target of the

budget.

Reduces Costs

profit of £60000. Further, it has assessed from the analysis that by selling 4000 units to the

customers’ business unit would become able to recover expenses and after it starts making profit.

P4 Advantages and disadvantages of the different types of planning tools used for budgetary

control

Budgetary control

Budget is the financial statements for specified time period it may also contains income

and expenditure, quantities of resources, assets and liabilities and cash inflow and out flow.

(Vasarhelyi, Kogan and Tuttle, 2015). Managers uses this process to analyse the financial

performance by using the budget. Budgetary control helps to compare the actual performance

with standard performance of the company to analyse the actual performance of the company

with the budget.

Budgetary control is the tool that helps to evaluate the goal of the company. This tool

helps to achieve the goal of the company, A statement made regarding the objectives of the firm

and also evaluate that managers how can be achieved through budgetary control. Further,

company concentrate on their efforts to make successful the company.

Advantages of the budgetary control

Maximization of profitability

The main aim of budgetary control is help to maximize the profit of the company.

Further, company must focus on their cash flows and their expenses and incomes. They manage

the accounts to make proper planning. To achieve the objective of the organization, firm control

and manage the various capital of the different departments and firm revenue and expenditures

to increase the profitability of the firm.

Co-ordination

Coordination means company must focus on their different departments they coordinate

with every departments of the firm. In addition, company makes the budget according to the

capital requirements of the departments and they manage their expanses and incomes.

Coordination is essential to achieve the objective of the firm (Bennett and James, 2017). The

coordination of various departments and subordinates is necessary for achieving the target of the

budget.

Reduces Costs

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.