Management Accounting: Cost Analysis, Budgeting and Control Methods

VerifiedAdded on 2023/06/14

|22

|5873

|194

Report

AI Summary

This report provides a detailed overview of management accounting, covering its definition, purpose, and various systems such as cost accounting, inventory management, price optimization, and job costing. It explores different management accounting reporting methods, including budget reports, accounts receivable aging reports, job cost reports, inventory and manufacturing reports, performance reports, and order information reports. The report also includes a cost analysis using marginal and absorption costing methods to prepare income statements under different sales scenarios, highlighting the impact of varying sales volumes on profitability. Additionally, it discusses various planning techniques for budgetary control, weighing the advantages and disadvantages of each method, and examines how organizations prioritize management accounting systems to address financial challenges, emphasizing the role of management accounting in decision-making and financial problem-solving.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

P1- Describing management accounting and requirements of various management accounting

systems........................................................................................................................................3

P2:- Various methods used in management accounting reporting-...........................................5

P3 Use appropriate methods of cost analysis and prepare an income statement using marginal

and absorption costing.................................................................................................................7

P4 Note down the advantages and disadvantages of different types of planning techniques

used for controlling budget related activities in P-Wear company. .........................................10

P5. Explain how organisations are prioritizing management accounting system for addressing

financial problems.....................................................................................................................13

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION ..........................................................................................................................3

TASK...............................................................................................................................................3

P1- Describing management accounting and requirements of various management accounting

systems........................................................................................................................................3

P2:- Various methods used in management accounting reporting-...........................................5

P3 Use appropriate methods of cost analysis and prepare an income statement using marginal

and absorption costing.................................................................................................................7

P4 Note down the advantages and disadvantages of different types of planning techniques

used for controlling budget related activities in P-Wear company. .........................................10

P5. Explain how organisations are prioritizing management accounting system for addressing

financial problems.....................................................................................................................13

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Management accounting is the process of organising, analysing, interpreting and

summarising the financial information to give information to the top managers of the company.

For decision makers, managerial accounting ease work by establishing a bridge between top

level leaders and other employees of an organisation (Alam and Hoque, 2021). This is a helpful

tool to coordinate the various activities of an enterprise. It is commonly used to make decisions

regarding goals of an organisation. In this report,task one include meaning and different types of

management accounting systems. Explaining the various types of methods used for reporting of

management accounting. Task two involves preparation of financial reports using marginal and

absorption costing to determine the cost of P-wear which is engaged in manufacturing PPE kits

for government and health care organisations. Analysing the impact of reduced sales on distinct

cost statements. In task three, it consists various planning tools used for budgetary control with

its pros and cons. Budgetary control is a procedure to compare budgeted and actual figure to find

deviations in the current performance. Besides, it also contains adoption of management

accounting system used by various organisations.

TASK

P1- Describing management accounting and requirements of various management accounting

systems

Management accounting refers to the internal process of presenting business transactions

in such a way that help managers to take short term as well long term decisions of an enterprise.

The information collected in various reports encompasses cost of several products and services.

Management accounting helps to attain targets of the organisation. Purpose of management

account are to make a choice between whether to “make or buy” which is essential for a

manufacturing concern. Determining rate of return and forecasting future is possible by taking

aid of management accounting and its several tools. There are numerous management

accounting system used in company are as given below-

cost accounting system- It is a system used to ascertain the value of each product separately

(Aslanertik and Yardımcı, 2019). This takes into account the expenses related to raw

material,work in progress and finished goods. It comprises job order costing and process

costing. Job order costing integrates the manufacturing cost of each task. Process costing

Management accounting is the process of organising, analysing, interpreting and

summarising the financial information to give information to the top managers of the company.

For decision makers, managerial accounting ease work by establishing a bridge between top

level leaders and other employees of an organisation (Alam and Hoque, 2021). This is a helpful

tool to coordinate the various activities of an enterprise. It is commonly used to make decisions

regarding goals of an organisation. In this report,task one include meaning and different types of

management accounting systems. Explaining the various types of methods used for reporting of

management accounting. Task two involves preparation of financial reports using marginal and

absorption costing to determine the cost of P-wear which is engaged in manufacturing PPE kits

for government and health care organisations. Analysing the impact of reduced sales on distinct

cost statements. In task three, it consists various planning tools used for budgetary control with

its pros and cons. Budgetary control is a procedure to compare budgeted and actual figure to find

deviations in the current performance. Besides, it also contains adoption of management

accounting system used by various organisations.

TASK

P1- Describing management accounting and requirements of various management accounting

systems

Management accounting refers to the internal process of presenting business transactions

in such a way that help managers to take short term as well long term decisions of an enterprise.

The information collected in various reports encompasses cost of several products and services.

Management accounting helps to attain targets of the organisation. Purpose of management

account are to make a choice between whether to “make or buy” which is essential for a

manufacturing concern. Determining rate of return and forecasting future is possible by taking

aid of management accounting and its several tools. There are numerous management

accounting system used in company are as given below-

cost accounting system- It is a system used to ascertain the value of each product separately

(Aslanertik and Yardımcı, 2019). This takes into account the expenses related to raw

material,work in progress and finished goods. It comprises job order costing and process

costing. Job order costing integrates the manufacturing cost of each task. Process costing

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

involves cost of each process included in manufacturing Personal protective equipment

(PPE). For improving efficiency in terms of cost and signifies where the allocated budget is

actually utilising, cost accounting systems are best suited for this purpose (Boyle, Boyle, and

Hermanson, 2020).

Inventory management system- It is a procedure in which various activities such as ordering,

utilising,carrying, storing inventory of a concern. P-wear is required to follow this system

because it is producing PPE kits which helps to protect workers from hazardous chemicals.

This includes management of correct quantity required in business. Inventory handling also

encompasses its ordering and carrying cost which needs to maintained at its minimum. In

stock management, ABC analysis plays a vital role because it orders items according to their

total value on an yearly basis. Economic order quantity and estimating maximum and

minimum reorder period also helps to solve the issues regarding stock piling and stock out.

Due to Stock piling blockage of the working capital issue is faced whereas stock out results

in dissatisfaction among customers and reduces goodwill of the P-wear.

Price optimising system- It is a mathematical framework that compute the variation in the

demand at various price levels. Varying prices to see its impact on the demand is examined

and integrating the data helps to ascertain profit that can be achieved at a specific price.

There are three elements of pricing which includes strategy of pricing , worth of product to

purchaser & seller and strategies that bring all elements together which contributes in

profitability of an organisation. It consists cost models,competitive management

analysis,customer elasticity models and optimisation techniques. If prices of PPE kits are too

high or low it will impact organisation's cost also because every expenses will be included in

its cost sheet. Besides profitability, safety of the workers contributes to welfare of society

and became most concern topic for any business so its manufacturing cost be optimally

required to be set.

Job costing- It is a process of monitoring all the costs and revenue related with a specific

project. Job costing components are labour, material and overheads (Brown, Pham, and

Sivabalan, 2020). Cost of material involves direct raw materials which is associated with

finished good and indirect materials helps to create final product. Finished goods such as

earplugs,surgical face masks are direct material cost whereas plastic and polyester are

indirect materials. A well maintained job cost system creates surplus of internal control.

(PPE). For improving efficiency in terms of cost and signifies where the allocated budget is

actually utilising, cost accounting systems are best suited for this purpose (Boyle, Boyle, and

Hermanson, 2020).

Inventory management system- It is a procedure in which various activities such as ordering,

utilising,carrying, storing inventory of a concern. P-wear is required to follow this system

because it is producing PPE kits which helps to protect workers from hazardous chemicals.

This includes management of correct quantity required in business. Inventory handling also

encompasses its ordering and carrying cost which needs to maintained at its minimum. In

stock management, ABC analysis plays a vital role because it orders items according to their

total value on an yearly basis. Economic order quantity and estimating maximum and

minimum reorder period also helps to solve the issues regarding stock piling and stock out.

Due to Stock piling blockage of the working capital issue is faced whereas stock out results

in dissatisfaction among customers and reduces goodwill of the P-wear.

Price optimising system- It is a mathematical framework that compute the variation in the

demand at various price levels. Varying prices to see its impact on the demand is examined

and integrating the data helps to ascertain profit that can be achieved at a specific price.

There are three elements of pricing which includes strategy of pricing , worth of product to

purchaser & seller and strategies that bring all elements together which contributes in

profitability of an organisation. It consists cost models,competitive management

analysis,customer elasticity models and optimisation techniques. If prices of PPE kits are too

high or low it will impact organisation's cost also because every expenses will be included in

its cost sheet. Besides profitability, safety of the workers contributes to welfare of society

and became most concern topic for any business so its manufacturing cost be optimally

required to be set.

Job costing- It is a process of monitoring all the costs and revenue related with a specific

project. Job costing components are labour, material and overheads (Brown, Pham, and

Sivabalan, 2020). Cost of material involves direct raw materials which is associated with

finished good and indirect materials helps to create final product. Finished goods such as

earplugs,surgical face masks are direct material cost whereas plastic and polyester are

indirect materials. A well maintained job cost system creates surplus of internal control.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Overall, allocation of cost delivers information regarding schedule of job, analytical review

and elaborating an enterprise as whole.

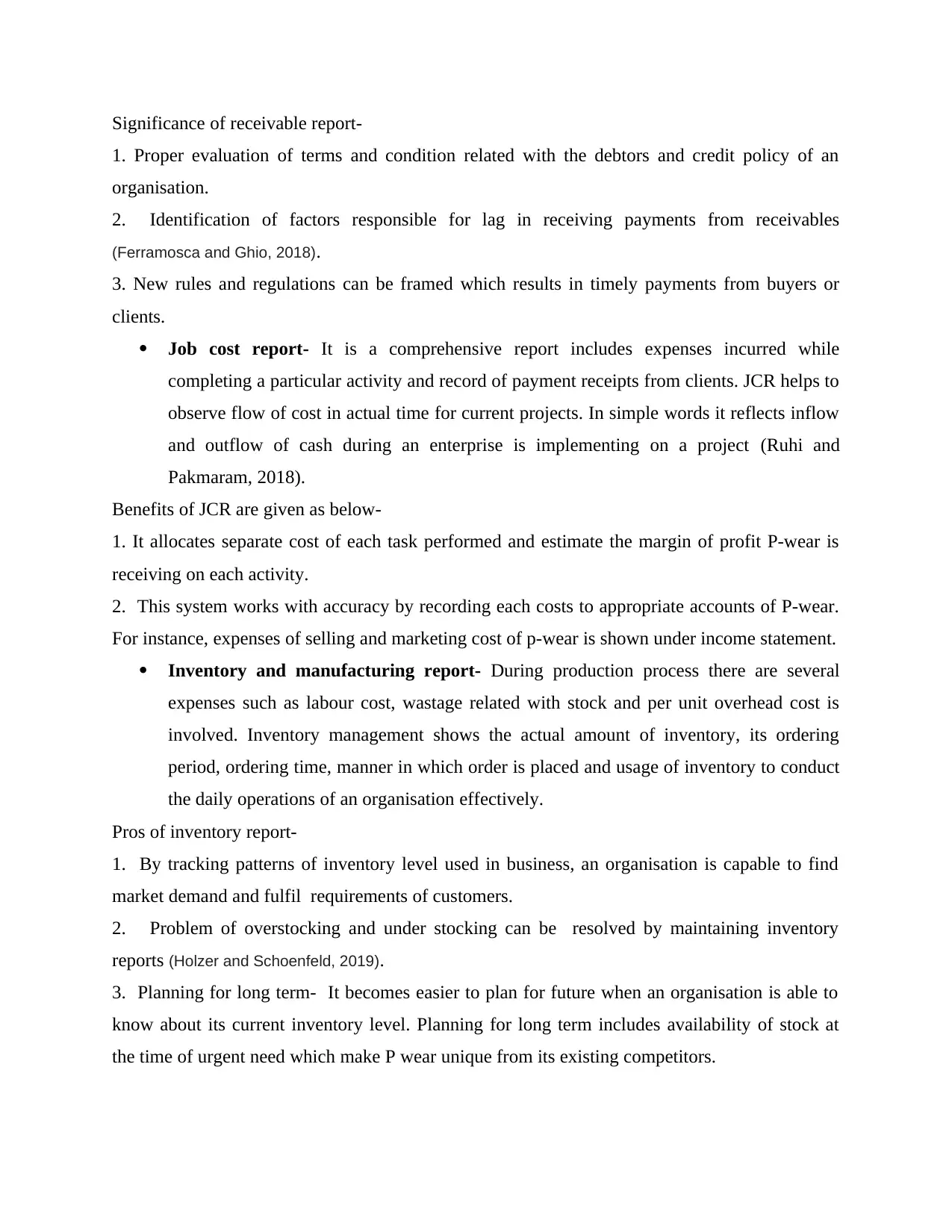

P2:- Various methods used in management accounting reporting-

Management accounting reports- These are the detailed synthesis of various records

created during an financial year. These reports helps to convey economical position of an

enterprise. It is useful in finding information necessary to take crucial decisions and forecast

future outcomes (Dianati Deilami, Abdollahi, and Pakzad, 2019). Managers find out a specific pattern

and follow the same or modify according to the various circumstances. Purpose of drafting

accounting reports are as follows-

1. Determining cash flows of the project.

2. Assets, liabilities and equity computation.

3. Analysing receivables and payable for a particular period.

There are numerous reports represented by a firm are described as given below-

Budget report- One of the fundamental report is budget preparation in managerial

accounting. In the beginning of an accounting year, line managers are provided with

budget. By providing these budgets,managers are able to know the extent of authority and

responsibility they can work within. Line mangers continuously monitor the performance

and make comparison between actual and standard performance. Deviations find out

while comparing can be major or minor. Top level authorities are acknowledged with

such deviations. This report is known as budget report.

Advantages of preparing budget report-

1.Corrective measures regarding deviation can be taken promptly.

2.Budget can be changed or modify according to various scenarios which makes it a flexible

approach of accounting.

Account receivable aging report-While selling or rendering goods or services to its

customers on credit, they became asset of an company because amount is outstanding

which organisation will receive on a later date. Aging of account receivable is a process

of arranging debtors by their due dates through bad debt can be predicted (Eaton, Grenier,

and Layman, 2019). It shows data of receivable in a table format known as aging schedule

which shows relationship between outstanding invoice and business bills with their due

period.

and elaborating an enterprise as whole.

P2:- Various methods used in management accounting reporting-

Management accounting reports- These are the detailed synthesis of various records

created during an financial year. These reports helps to convey economical position of an

enterprise. It is useful in finding information necessary to take crucial decisions and forecast

future outcomes (Dianati Deilami, Abdollahi, and Pakzad, 2019). Managers find out a specific pattern

and follow the same or modify according to the various circumstances. Purpose of drafting

accounting reports are as follows-

1. Determining cash flows of the project.

2. Assets, liabilities and equity computation.

3. Analysing receivables and payable for a particular period.

There are numerous reports represented by a firm are described as given below-

Budget report- One of the fundamental report is budget preparation in managerial

accounting. In the beginning of an accounting year, line managers are provided with

budget. By providing these budgets,managers are able to know the extent of authority and

responsibility they can work within. Line mangers continuously monitor the performance

and make comparison between actual and standard performance. Deviations find out

while comparing can be major or minor. Top level authorities are acknowledged with

such deviations. This report is known as budget report.

Advantages of preparing budget report-

1.Corrective measures regarding deviation can be taken promptly.

2.Budget can be changed or modify according to various scenarios which makes it a flexible

approach of accounting.

Account receivable aging report-While selling or rendering goods or services to its

customers on credit, they became asset of an company because amount is outstanding

which organisation will receive on a later date. Aging of account receivable is a process

of arranging debtors by their due dates through bad debt can be predicted (Eaton, Grenier,

and Layman, 2019). It shows data of receivable in a table format known as aging schedule

which shows relationship between outstanding invoice and business bills with their due

period.

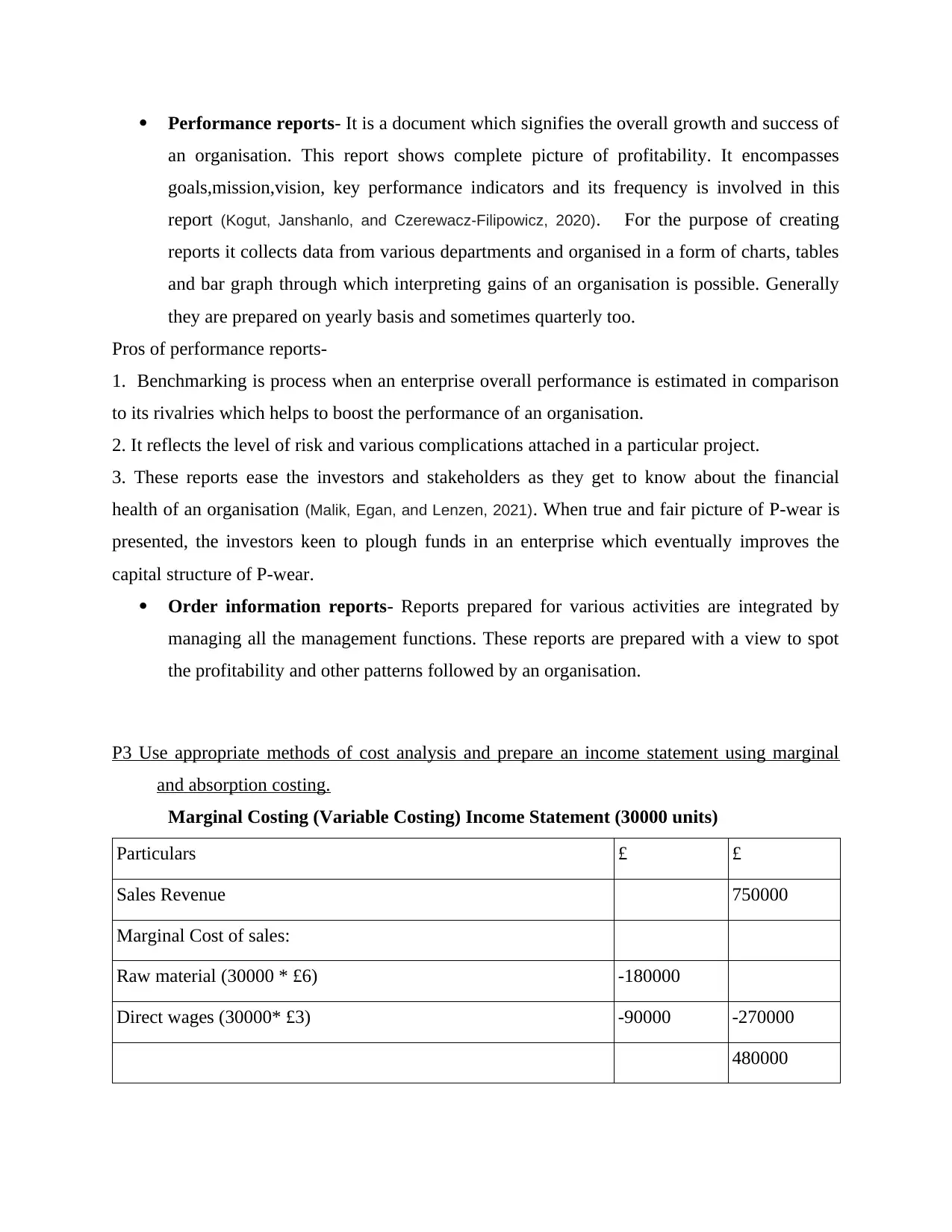

Significance of receivable report-

1. Proper evaluation of terms and condition related with the debtors and credit policy of an

organisation.

2. Identification of factors responsible for lag in receiving payments from receivables

(Ferramosca and Ghio, 2018).

3. New rules and regulations can be framed which results in timely payments from buyers or

clients.

Job cost report- It is a comprehensive report includes expenses incurred while

completing a particular activity and record of payment receipts from clients. JCR helps to

observe flow of cost in actual time for current projects. In simple words it reflects inflow

and outflow of cash during an enterprise is implementing on a project (Ruhi and

Pakmaram, 2018).

Benefits of JCR are given as below-

1. It allocates separate cost of each task performed and estimate the margin of profit P-wear is

receiving on each activity.

2. This system works with accuracy by recording each costs to appropriate accounts of P-wear.

For instance, expenses of selling and marketing cost of p-wear is shown under income statement.

Inventory and manufacturing report- During production process there are several

expenses such as labour cost, wastage related with stock and per unit overhead cost is

involved. Inventory management shows the actual amount of inventory, its ordering

period, ordering time, manner in which order is placed and usage of inventory to conduct

the daily operations of an organisation effectively.

Pros of inventory report-

1. By tracking patterns of inventory level used in business, an organisation is capable to find

market demand and fulfil requirements of customers.

2. Problem of overstocking and under stocking can be resolved by maintaining inventory

reports (Holzer and Schoenfeld, 2019).

3. Planning for long term- It becomes easier to plan for future when an organisation is able to

know about its current inventory level. Planning for long term includes availability of stock at

the time of urgent need which make P wear unique from its existing competitors.

1. Proper evaluation of terms and condition related with the debtors and credit policy of an

organisation.

2. Identification of factors responsible for lag in receiving payments from receivables

(Ferramosca and Ghio, 2018).

3. New rules and regulations can be framed which results in timely payments from buyers or

clients.

Job cost report- It is a comprehensive report includes expenses incurred while

completing a particular activity and record of payment receipts from clients. JCR helps to

observe flow of cost in actual time for current projects. In simple words it reflects inflow

and outflow of cash during an enterprise is implementing on a project (Ruhi and

Pakmaram, 2018).

Benefits of JCR are given as below-

1. It allocates separate cost of each task performed and estimate the margin of profit P-wear is

receiving on each activity.

2. This system works with accuracy by recording each costs to appropriate accounts of P-wear.

For instance, expenses of selling and marketing cost of p-wear is shown under income statement.

Inventory and manufacturing report- During production process there are several

expenses such as labour cost, wastage related with stock and per unit overhead cost is

involved. Inventory management shows the actual amount of inventory, its ordering

period, ordering time, manner in which order is placed and usage of inventory to conduct

the daily operations of an organisation effectively.

Pros of inventory report-

1. By tracking patterns of inventory level used in business, an organisation is capable to find

market demand and fulfil requirements of customers.

2. Problem of overstocking and under stocking can be resolved by maintaining inventory

reports (Holzer and Schoenfeld, 2019).

3. Planning for long term- It becomes easier to plan for future when an organisation is able to

know about its current inventory level. Planning for long term includes availability of stock at

the time of urgent need which make P wear unique from its existing competitors.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Performance reports- It is a document which signifies the overall growth and success of

an organisation. This report shows complete picture of profitability. It encompasses

goals,mission,vision, key performance indicators and its frequency is involved in this

report (Kogut, Janshanlo, and Czerewacz-Filipowicz, 2020). For the purpose of creating

reports it collects data from various departments and organised in a form of charts, tables

and bar graph through which interpreting gains of an organisation is possible. Generally

they are prepared on yearly basis and sometimes quarterly too.

Pros of performance reports-

1. Benchmarking is process when an enterprise overall performance is estimated in comparison

to its rivalries which helps to boost the performance of an organisation.

2. It reflects the level of risk and various complications attached in a particular project.

3. These reports ease the investors and stakeholders as they get to know about the financial

health of an organisation (Malik, Egan, and Lenzen, 2021). When true and fair picture of P-wear is

presented, the investors keen to plough funds in an enterprise which eventually improves the

capital structure of P-wear.

Order information reports- Reports prepared for various activities are integrated by

managing all the management functions. These reports are prepared with a view to spot

the profitability and other patterns followed by an organisation.

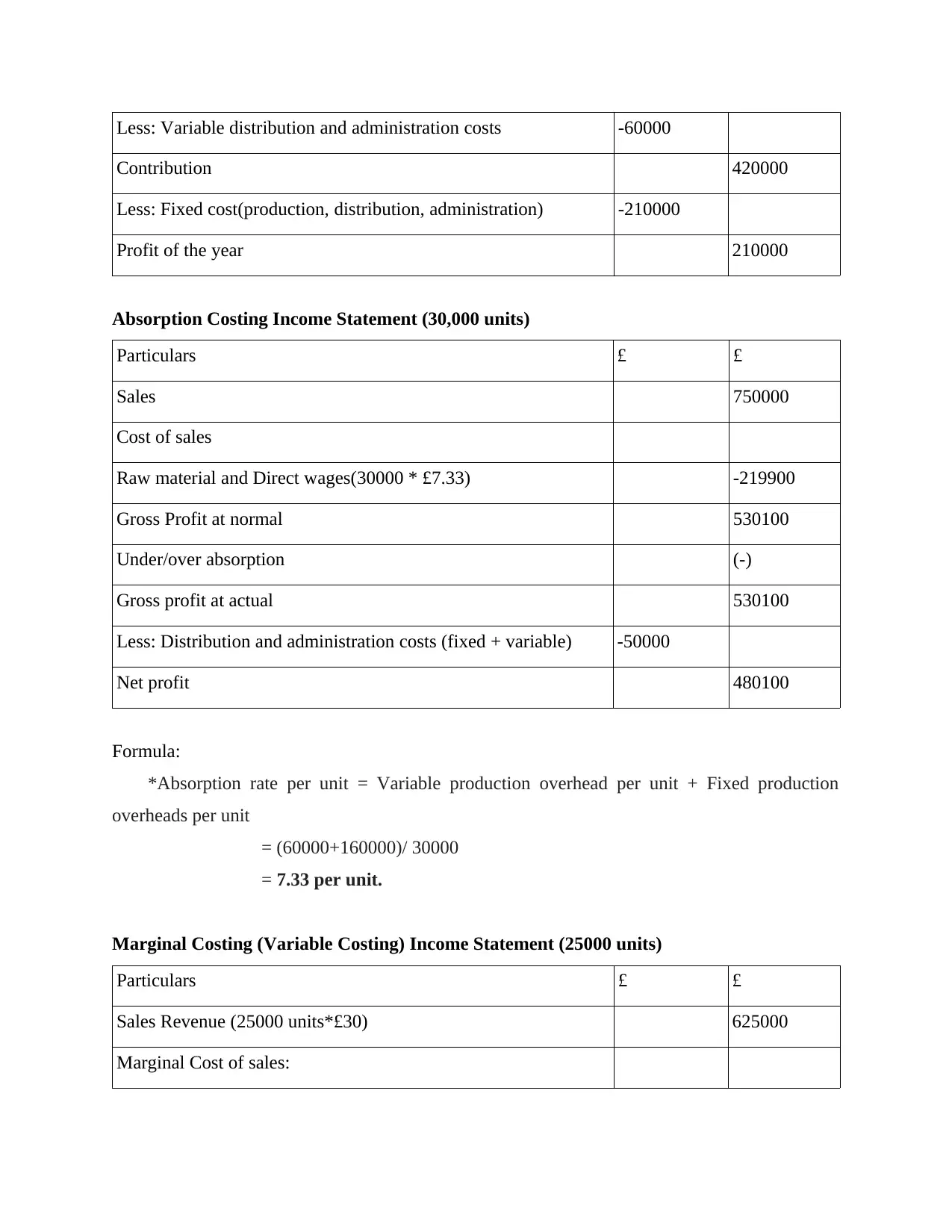

P3 Use appropriate methods of cost analysis and prepare an income statement using marginal

and absorption costing.

Marginal Costing (Variable Costing) Income Statement (30000 units)

Particulars £ £

Sales Revenue 750000

Marginal Cost of sales:

Raw material (30000 * £6) -180000

Direct wages (30000* £3) -90000 -270000

480000

an organisation. This report shows complete picture of profitability. It encompasses

goals,mission,vision, key performance indicators and its frequency is involved in this

report (Kogut, Janshanlo, and Czerewacz-Filipowicz, 2020). For the purpose of creating

reports it collects data from various departments and organised in a form of charts, tables

and bar graph through which interpreting gains of an organisation is possible. Generally

they are prepared on yearly basis and sometimes quarterly too.

Pros of performance reports-

1. Benchmarking is process when an enterprise overall performance is estimated in comparison

to its rivalries which helps to boost the performance of an organisation.

2. It reflects the level of risk and various complications attached in a particular project.

3. These reports ease the investors and stakeholders as they get to know about the financial

health of an organisation (Malik, Egan, and Lenzen, 2021). When true and fair picture of P-wear is

presented, the investors keen to plough funds in an enterprise which eventually improves the

capital structure of P-wear.

Order information reports- Reports prepared for various activities are integrated by

managing all the management functions. These reports are prepared with a view to spot

the profitability and other patterns followed by an organisation.

P3 Use appropriate methods of cost analysis and prepare an income statement using marginal

and absorption costing.

Marginal Costing (Variable Costing) Income Statement (30000 units)

Particulars £ £

Sales Revenue 750000

Marginal Cost of sales:

Raw material (30000 * £6) -180000

Direct wages (30000* £3) -90000 -270000

480000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less: Variable distribution and administration costs -60000

Contribution 420000

Less: Fixed cost(production, distribution, administration) -210000

Profit of the year 210000

Absorption Costing Income Statement (30,000 units)

Particulars £ £

Sales 750000

Cost of sales

Raw material and Direct wages(30000 * £7.33) -219900

Gross Profit at normal 530100

Under/over absorption (-)

Gross profit at actual 530100

Less: Distribution and administration costs (fixed + variable) -50000

Net profit 480100

Formula:

*Absorption rate per unit = Variable production overhead per unit + Fixed production

overheads per unit

= (60000+160000)/ 30000

= 7.33 per unit.

Marginal Costing (Variable Costing) Income Statement (25000 units)

Particulars £ £

Sales Revenue (25000 units*£30) 625000

Marginal Cost of sales:

Contribution 420000

Less: Fixed cost(production, distribution, administration) -210000

Profit of the year 210000

Absorption Costing Income Statement (30,000 units)

Particulars £ £

Sales 750000

Cost of sales

Raw material and Direct wages(30000 * £7.33) -219900

Gross Profit at normal 530100

Under/over absorption (-)

Gross profit at actual 530100

Less: Distribution and administration costs (fixed + variable) -50000

Net profit 480100

Formula:

*Absorption rate per unit = Variable production overhead per unit + Fixed production

overheads per unit

= (60000+160000)/ 30000

= 7.33 per unit.

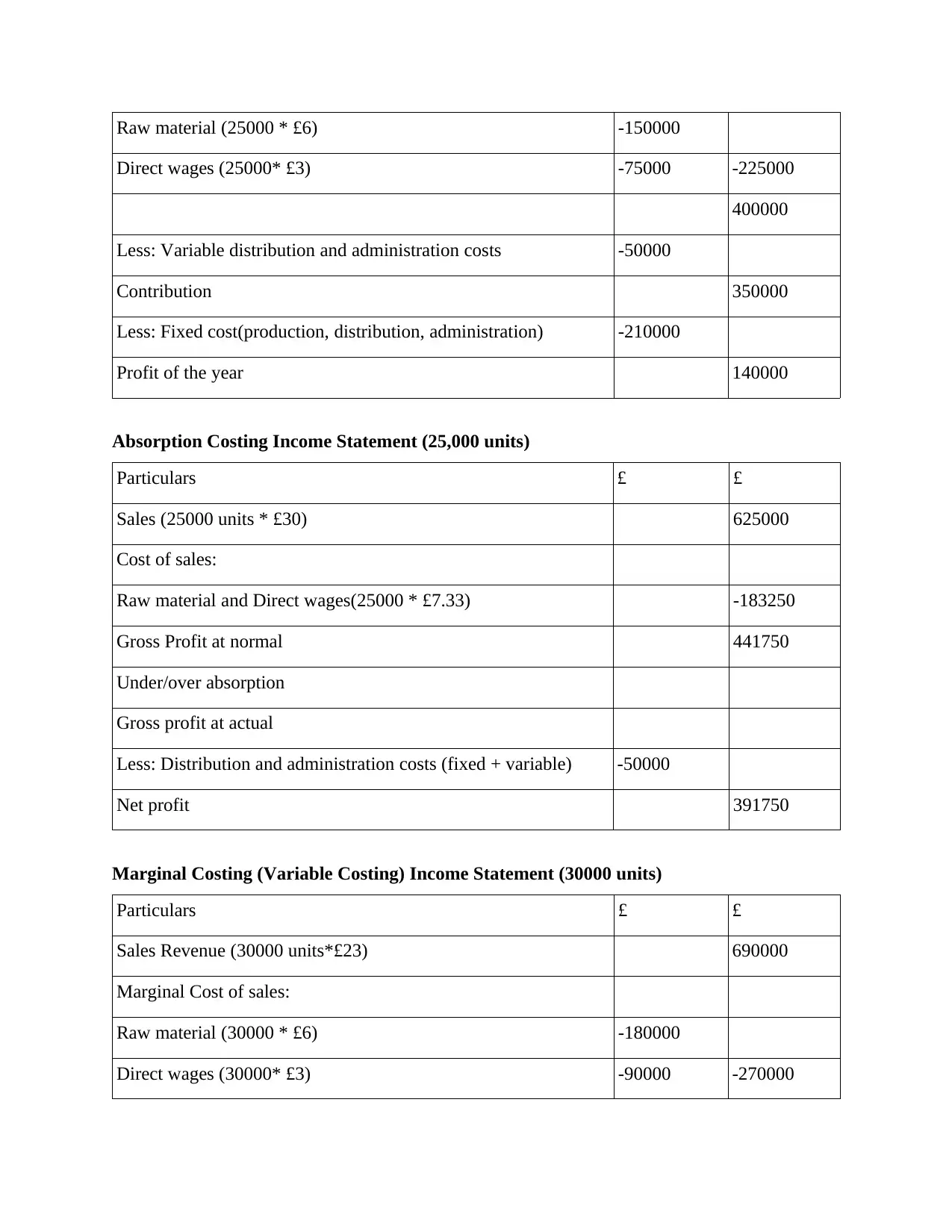

Marginal Costing (Variable Costing) Income Statement (25000 units)

Particulars £ £

Sales Revenue (25000 units*£30) 625000

Marginal Cost of sales:

Raw material (25000 * £6) -150000

Direct wages (25000* £3) -75000 -225000

400000

Less: Variable distribution and administration costs -50000

Contribution 350000

Less: Fixed cost(production, distribution, administration) -210000

Profit of the year 140000

Absorption Costing Income Statement (25,000 units)

Particulars £ £

Sales (25000 units * £30) 625000

Cost of sales:

Raw material and Direct wages(25000 * £7.33) -183250

Gross Profit at normal 441750

Under/over absorption

Gross profit at actual

Less: Distribution and administration costs (fixed + variable) -50000

Net profit 391750

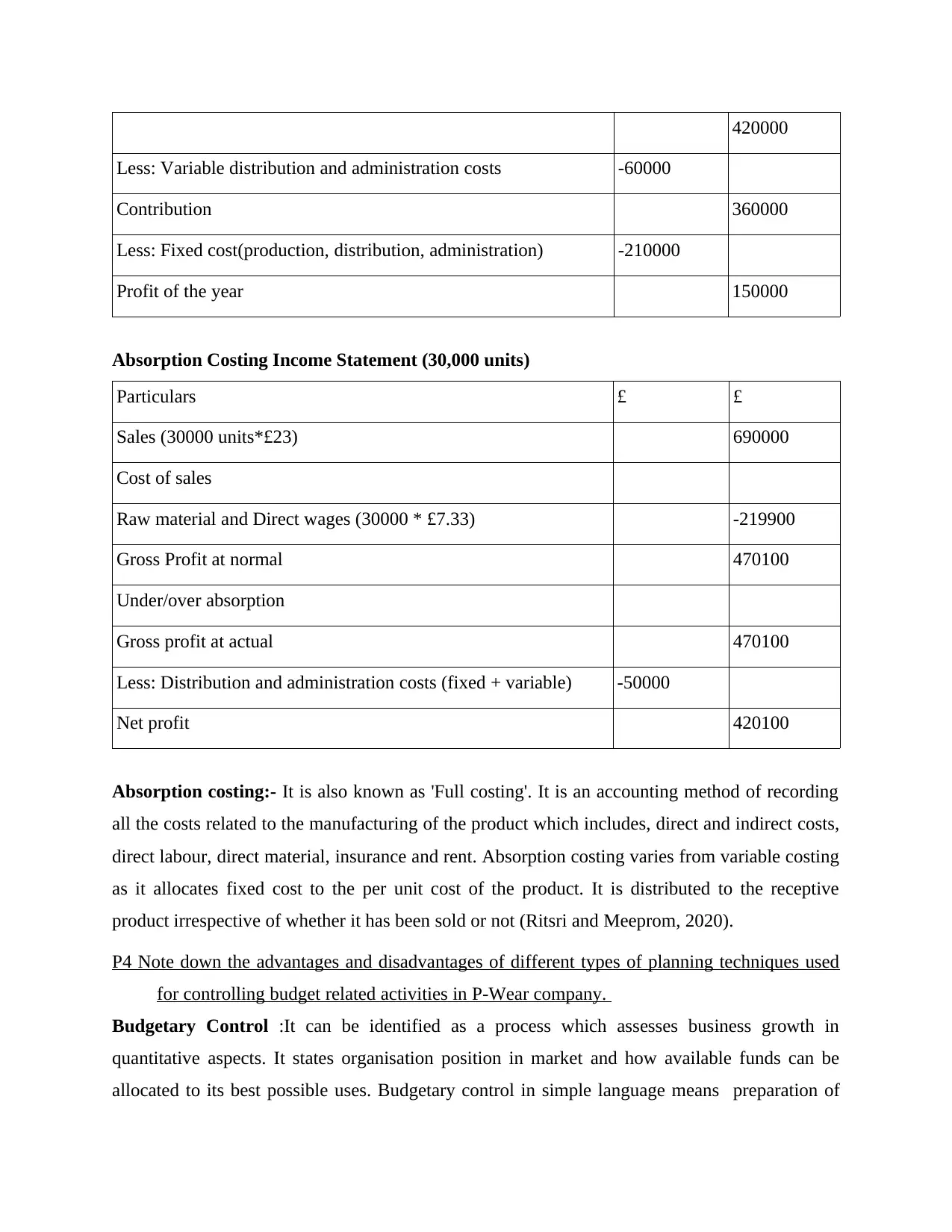

Marginal Costing (Variable Costing) Income Statement (30000 units)

Particulars £ £

Sales Revenue (30000 units*£23) 690000

Marginal Cost of sales:

Raw material (30000 * £6) -180000

Direct wages (30000* £3) -90000 -270000

Direct wages (25000* £3) -75000 -225000

400000

Less: Variable distribution and administration costs -50000

Contribution 350000

Less: Fixed cost(production, distribution, administration) -210000

Profit of the year 140000

Absorption Costing Income Statement (25,000 units)

Particulars £ £

Sales (25000 units * £30) 625000

Cost of sales:

Raw material and Direct wages(25000 * £7.33) -183250

Gross Profit at normal 441750

Under/over absorption

Gross profit at actual

Less: Distribution and administration costs (fixed + variable) -50000

Net profit 391750

Marginal Costing (Variable Costing) Income Statement (30000 units)

Particulars £ £

Sales Revenue (30000 units*£23) 690000

Marginal Cost of sales:

Raw material (30000 * £6) -180000

Direct wages (30000* £3) -90000 -270000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

420000

Less: Variable distribution and administration costs -60000

Contribution 360000

Less: Fixed cost(production, distribution, administration) -210000

Profit of the year 150000

Absorption Costing Income Statement (30,000 units)

Particulars £ £

Sales (30000 units*£23) 690000

Cost of sales

Raw material and Direct wages (30000 * £7.33) -219900

Gross Profit at normal 470100

Under/over absorption

Gross profit at actual 470100

Less: Distribution and administration costs (fixed + variable) -50000

Net profit 420100

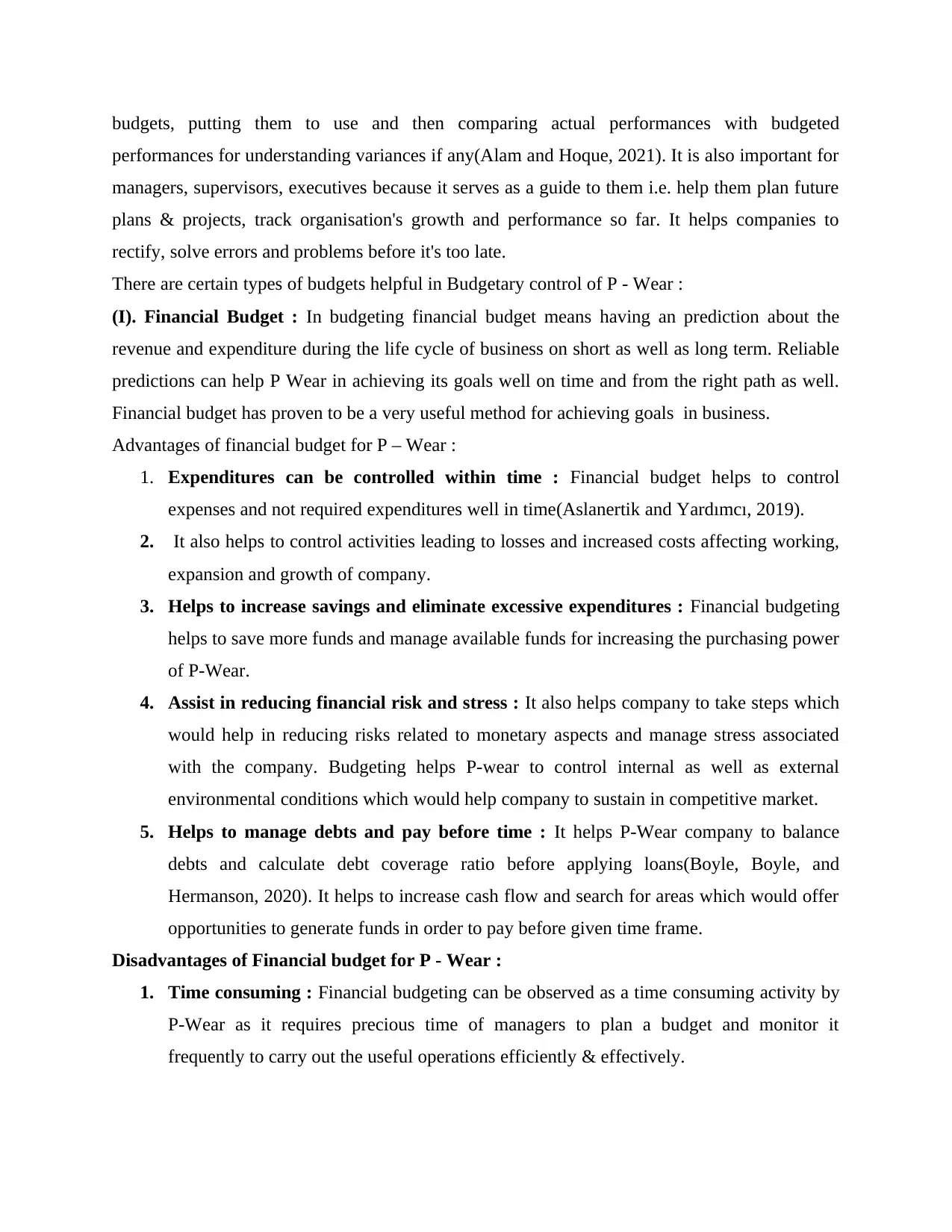

Absorption costing:- It is also known as 'Full costing'. It is an accounting method of recording

all the costs related to the manufacturing of the product which includes, direct and indirect costs,

direct labour, direct material, insurance and rent. Absorption costing varies from variable costing

as it allocates fixed cost to the per unit cost of the product. It is distributed to the receptive

product irrespective of whether it has been sold or not (Ritsri and Meeprom, 2020).

P4 Note down the advantages and disadvantages of different types of planning techniques used

for controlling budget related activities in P-Wear company.

Budgetary Control :It can be identified as a process which assesses business growth in

quantitative aspects. It states organisation position in market and how available funds can be

allocated to its best possible uses. Budgetary control in simple language means preparation of

Less: Variable distribution and administration costs -60000

Contribution 360000

Less: Fixed cost(production, distribution, administration) -210000

Profit of the year 150000

Absorption Costing Income Statement (30,000 units)

Particulars £ £

Sales (30000 units*£23) 690000

Cost of sales

Raw material and Direct wages (30000 * £7.33) -219900

Gross Profit at normal 470100

Under/over absorption

Gross profit at actual 470100

Less: Distribution and administration costs (fixed + variable) -50000

Net profit 420100

Absorption costing:- It is also known as 'Full costing'. It is an accounting method of recording

all the costs related to the manufacturing of the product which includes, direct and indirect costs,

direct labour, direct material, insurance and rent. Absorption costing varies from variable costing

as it allocates fixed cost to the per unit cost of the product. It is distributed to the receptive

product irrespective of whether it has been sold or not (Ritsri and Meeprom, 2020).

P4 Note down the advantages and disadvantages of different types of planning techniques used

for controlling budget related activities in P-Wear company.

Budgetary Control :It can be identified as a process which assesses business growth in

quantitative aspects. It states organisation position in market and how available funds can be

allocated to its best possible uses. Budgetary control in simple language means preparation of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

budgets, putting them to use and then comparing actual performances with budgeted

performances for understanding variances if any(Alam and Hoque, 2021). It is also important for

managers, supervisors, executives because it serves as a guide to them i.e. help them plan future

plans & projects, track organisation's growth and performance so far. It helps companies to

rectify, solve errors and problems before it's too late.

There are certain types of budgets helpful in Budgetary control of P - Wear :

(I). Financial Budget : In budgeting financial budget means having an prediction about the

revenue and expenditure during the life cycle of business on short as well as long term. Reliable

predictions can help P Wear in achieving its goals well on time and from the right path as well.

Financial budget has proven to be a very useful method for achieving goals in business.

Advantages of financial budget for P – Wear :

1. Expenditures can be controlled within time : Financial budget helps to control

expenses and not required expenditures well in time(Aslanertik and Yardımcı, 2019).

2. It also helps to control activities leading to losses and increased costs affecting working,

expansion and growth of company.

3. Helps to increase savings and eliminate excessive expenditures : Financial budgeting

helps to save more funds and manage available funds for increasing the purchasing power

of P-Wear.

4. Assist in reducing financial risk and stress : It also helps company to take steps which

would help in reducing risks related to monetary aspects and manage stress associated

with the company. Budgeting helps P-wear to control internal as well as external

environmental conditions which would help company to sustain in competitive market.

5. Helps to manage debts and pay before time : It helps P-Wear company to balance

debts and calculate debt coverage ratio before applying loans(Boyle, Boyle, and

Hermanson, 2020). It helps to increase cash flow and search for areas which would offer

opportunities to generate funds in order to pay before given time frame.

Disadvantages of Financial budget for P - Wear :

1. Time consuming : Financial budgeting can be observed as a time consuming activity by

P-Wear as it requires precious time of managers to plan a budget and monitor it

frequently to carry out the useful operations efficiently & effectively.

performances for understanding variances if any(Alam and Hoque, 2021). It is also important for

managers, supervisors, executives because it serves as a guide to them i.e. help them plan future

plans & projects, track organisation's growth and performance so far. It helps companies to

rectify, solve errors and problems before it's too late.

There are certain types of budgets helpful in Budgetary control of P - Wear :

(I). Financial Budget : In budgeting financial budget means having an prediction about the

revenue and expenditure during the life cycle of business on short as well as long term. Reliable

predictions can help P Wear in achieving its goals well on time and from the right path as well.

Financial budget has proven to be a very useful method for achieving goals in business.

Advantages of financial budget for P – Wear :

1. Expenditures can be controlled within time : Financial budget helps to control

expenses and not required expenditures well in time(Aslanertik and Yardımcı, 2019).

2. It also helps to control activities leading to losses and increased costs affecting working,

expansion and growth of company.

3. Helps to increase savings and eliminate excessive expenditures : Financial budgeting

helps to save more funds and manage available funds for increasing the purchasing power

of P-Wear.

4. Assist in reducing financial risk and stress : It also helps company to take steps which

would help in reducing risks related to monetary aspects and manage stress associated

with the company. Budgeting helps P-wear to control internal as well as external

environmental conditions which would help company to sustain in competitive market.

5. Helps to manage debts and pay before time : It helps P-Wear company to balance

debts and calculate debt coverage ratio before applying loans(Boyle, Boyle, and

Hermanson, 2020). It helps to increase cash flow and search for areas which would offer

opportunities to generate funds in order to pay before given time frame.

Disadvantages of Financial budget for P - Wear :

1. Time consuming : Financial budgeting can be observed as a time consuming activity by

P-Wear as it requires precious time of managers to plan a budget and monitor it

frequently to carry out the useful operations efficiently & effectively.

2. Difficult in managing expense allocation : Due to a complex process which involves

planning, applying, monitoring and controlling, it is not easy to manage expenditure and

allocate resources at right place & right time (Pinheiro and Costa, 2020).

3. Considers quantitative aspects only : It doesn't count qualitative factors affecting

working of P-Wear which results in poor functioning and not able to take preventive

measures for the same.

4. Inflexible decision making process : It is not easy for P-Wear to update changes easily

in a financial budget prepared for a certain duration(Brown, Pham, and Sivabalan, 2020).

It is a complex task to deal with and requires a lot of engagement by managers for

controlling the operations before time.

(II). Activity based budgeting : It can be explained as a method which helps to plan, record,

search, analyse and monitor operations which lead to expenditure generated in P-Wear company.

This helps to plan budgets for future uses and gives an idea about the reasons coming on the

ways resulting in hurdles, growth and expansion of the company.

Advantages of Activity based budgeting for P-Wear company :

1. Reduction in costs & expenses : Activity based budgeting helps P-Wear to reduce costs to

minimum, increase profits & revenues(Dianati Deilami, Abdollahi, and Pakzad, 2019). It helps

to reach the core reason causing increase in expenses and losses.

2. Managing budgets : It helps to assess working of company, analyse the progress of budget

i.e. whether the budgets so made are helpful or not and how much difference can be measured

between actual performance in reference to standard performance.

3. Improving control on budgets : As budgets are prepared for carrying out operations well in

time & in a view to control costs and expand growth. It helps to improve working of P-Wear

with having a proper control over the operations with the assistance of budgets so formed for the

period.

4. Elimination of wastage : Budgets not only help to control the operational work but it helps to

reduce wastage and cut down costs too (Dianati Deilami, Abdollahi, and Pakzad, 2019). It

further helps P-Wear to address issues related to increasing expenditure and wastage of

resources, materials as well.

Disadvantages of Activity based budgeting for P-Wear company :

planning, applying, monitoring and controlling, it is not easy to manage expenditure and

allocate resources at right place & right time (Pinheiro and Costa, 2020).

3. Considers quantitative aspects only : It doesn't count qualitative factors affecting

working of P-Wear which results in poor functioning and not able to take preventive

measures for the same.

4. Inflexible decision making process : It is not easy for P-Wear to update changes easily

in a financial budget prepared for a certain duration(Brown, Pham, and Sivabalan, 2020).

It is a complex task to deal with and requires a lot of engagement by managers for

controlling the operations before time.

(II). Activity based budgeting : It can be explained as a method which helps to plan, record,

search, analyse and monitor operations which lead to expenditure generated in P-Wear company.

This helps to plan budgets for future uses and gives an idea about the reasons coming on the

ways resulting in hurdles, growth and expansion of the company.

Advantages of Activity based budgeting for P-Wear company :

1. Reduction in costs & expenses : Activity based budgeting helps P-Wear to reduce costs to

minimum, increase profits & revenues(Dianati Deilami, Abdollahi, and Pakzad, 2019). It helps

to reach the core reason causing increase in expenses and losses.

2. Managing budgets : It helps to assess working of company, analyse the progress of budget

i.e. whether the budgets so made are helpful or not and how much difference can be measured

between actual performance in reference to standard performance.

3. Improving control on budgets : As budgets are prepared for carrying out operations well in

time & in a view to control costs and expand growth. It helps to improve working of P-Wear

with having a proper control over the operations with the assistance of budgets so formed for the

period.

4. Elimination of wastage : Budgets not only help to control the operational work but it helps to

reduce wastage and cut down costs too (Dianati Deilami, Abdollahi, and Pakzad, 2019). It

further helps P-Wear to address issues related to increasing expenditure and wastage of

resources, materials as well.

Disadvantages of Activity based budgeting for P-Wear company :

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.