Management Accounting: Financial Analysis and Reporting Methods

VerifiedAdded on 2023/06/17

|18

|5147

|456

Report

AI Summary

This report provides a comprehensive analysis of management accounting, exploring its essential requirements, reporting methods, and application within organizations. It delves into various management accounting systems, including inventory administration, cost accounting, and job costing, highlighting their benefits and applications. The report includes a detailed cost analysis using marginal and absorption costing techniques to prepare income statements, along with a discussion on the advantages and disadvantages of different planning tools for budgetary control. Furthermore, it examines how organizations are leveraging management accounting systems to address financial complexities and achieve sustainable success. The document concludes by emphasizing the critical role of management accounting in informed decision-making and strategic financial management. Desklib provides a platform for students to access this document and other solved assignments.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Introduction ................................................................................................................................................3

TASK 1..........................................................................................................................................................3

P1) Explain management accounting and also provide the essential requirements of different

management accoutring system..............................................................................................................3

P2) Methods of management accounting reporting................................................................................5

M1) Discuss advantage of management accounting system and also their application in organization

context.....................................................................................................................................................6

TASK 2..........................................................................................................................................................7

P3) Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.......................................................................................................7

Cost Card Using Absorption Costing........................................................................................................7

Cost Card Using Marginal Costing............................................................................................................8

Profit statements using Absorption costing (10000 units).......................................................................8

Profit statements using Marginal costing (10000 units)..........................................................................8

Difference between the marginal and absorption costing is explained below:.......................................9

Prepare a flexed budget for the actual activity for the year....................................................................9

M2) Apply different techniques of management accounting & also formulate suitable financial

documents ............................................................................................................................................10

TASK 3........................................................................................................................................................10

P4) Discuss benefits and drawbacks of different planning tools that are used for budgetary control..10

M3) Analyse different planning tools with their application in preparation of budgets........................11

TASK 4 .......................................................................................................................................................12

P5) Discuss comparison how organisations are applying management accounting system in order to

respond financial complexities..............................................................................................................12

M4) critically analyse how responding towards the financial problems and management accounting

can lead organisations towards sustainable success.............................................................................15

Conclusion................................................................................................................................................16

References.................................................................................................................................................17

Books & Journals....................................................................................................................................17

Introduction ................................................................................................................................................3

TASK 1..........................................................................................................................................................3

P1) Explain management accounting and also provide the essential requirements of different

management accoutring system..............................................................................................................3

P2) Methods of management accounting reporting................................................................................5

M1) Discuss advantage of management accounting system and also their application in organization

context.....................................................................................................................................................6

TASK 2..........................................................................................................................................................7

P3) Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs.......................................................................................................7

Cost Card Using Absorption Costing........................................................................................................7

Cost Card Using Marginal Costing............................................................................................................8

Profit statements using Absorption costing (10000 units).......................................................................8

Profit statements using Marginal costing (10000 units)..........................................................................8

Difference between the marginal and absorption costing is explained below:.......................................9

Prepare a flexed budget for the actual activity for the year....................................................................9

M2) Apply different techniques of management accounting & also formulate suitable financial

documents ............................................................................................................................................10

TASK 3........................................................................................................................................................10

P4) Discuss benefits and drawbacks of different planning tools that are used for budgetary control..10

M3) Analyse different planning tools with their application in preparation of budgets........................11

TASK 4 .......................................................................................................................................................12

P5) Discuss comparison how organisations are applying management accounting system in order to

respond financial complexities..............................................................................................................12

M4) critically analyse how responding towards the financial problems and management accounting

can lead organisations towards sustainable success.............................................................................15

Conclusion................................................................................................................................................16

References.................................................................................................................................................17

Books & Journals....................................................................................................................................17

Introduction

Management accounting is an important function of business that assists each and every

organization in order to analyze their financial conditions in an efficient manner. It is process of

identifying, classifying, measuring as well as communicating the financial outcomes to

stakeholders. The information is further circulated to the relevant parties of business so that they

can take suitable business related decisions in an efficient manner (Nsor-Ambala, 2020). In the

given scenario, a website called Girlboss has been started by Amoruso, The business is growing

tremendously hence the company is likely to evaluate the financial conditions for ensuring future

growth. The main aim of the report is to analyze different aspects of management accounting.

Here, the financial position of the business entity will analyze through different financial tools.

The report will cover the general concept of management accounting with the requirement of

different types of management accounting system. Further, it will cover methods used for

reporting of management accounting. Additionally, appropriate cost techniques to prepare

income statement will also include in the report. Here, the advantages and disadvantages of

different planning tools will also discuss in the study efficiently. Lastly, it will include a

comparison of how the organizations are adopting management accounting system to respond the

financial problems effectively.

TASK 1

P1) Explain management accounting and also provide the essential requirements of different

management accoutring system

Concept of management accounting

Management accounting refers to a process to establish the objective of the entity by

identification, measurement, interpretation, analysis and evaluation of the financial data. It is a

technique that assists the managers to take suitable financial decisions for the betterment of

business entity (Wei and Yao, 2020). Here, the major activity is to keep a track on cost and other

such elements in order to ensure adequate amount of profit in future period of time. In this, data

and information is presented in financial statements so that the managers can easily analyse the

Management accounting is an important function of business that assists each and every

organization in order to analyze their financial conditions in an efficient manner. It is process of

identifying, classifying, measuring as well as communicating the financial outcomes to

stakeholders. The information is further circulated to the relevant parties of business so that they

can take suitable business related decisions in an efficient manner (Nsor-Ambala, 2020). In the

given scenario, a website called Girlboss has been started by Amoruso, The business is growing

tremendously hence the company is likely to evaluate the financial conditions for ensuring future

growth. The main aim of the report is to analyze different aspects of management accounting.

Here, the financial position of the business entity will analyze through different financial tools.

The report will cover the general concept of management accounting with the requirement of

different types of management accounting system. Further, it will cover methods used for

reporting of management accounting. Additionally, appropriate cost techniques to prepare

income statement will also include in the report. Here, the advantages and disadvantages of

different planning tools will also discuss in the study efficiently. Lastly, it will include a

comparison of how the organizations are adopting management accounting system to respond the

financial problems effectively.

TASK 1

P1) Explain management accounting and also provide the essential requirements of different

management accoutring system

Concept of management accounting

Management accounting refers to a process to establish the objective of the entity by

identification, measurement, interpretation, analysis and evaluation of the financial data. It is a

technique that assists the managers to take suitable financial decisions for the betterment of

business entity (Wei and Yao, 2020). Here, the major activity is to keep a track on cost and other

such elements in order to ensure adequate amount of profit in future period of time. In this, data

and information is presented in financial statements so that the managers can easily analyse the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

existing financial position of the entity. It also allows to maintain liquidity within the firm in

order to pay direct expenses in timely manner.

Management accounting system:

Management accounting is related with preparing, analysing as well as controlling the

financial performance of an organization. In this context, the major accounting systems are

elaborated below.

Inventory administration system: This system is related with maintenance of adequate

amount of inventory in the business so that the manufacturing process can be continued

efficiently. The main focus of this approach is to maintain sufficient level of inventory in the

business in order to meet with the level of demand in the market. Under this approach, the

managers are likely to keep a check on the current level of inventory in the organization and

determining a reorder level to avoid the situation of deficiency and surplus in future period of

time (Mahmud, Manan and Hashim, 2019). Effective inventory management helps an entity to

maintain consistency in the production. Deficiency of inventory hampers the brand image of an

organization whereas surplus of the inventory can cause enhancement in the overall prediction

expands. Hence, it is imperative to follow the inventory administration system in order to meet

with the demand of the buyers efficiently. Here, approaches of inventory management are

elaborated below:

LIFO: This approach is based on last in and first out. In this, the units which are added in

the inventory in last are used on priority basis during prediction

FIFO: This is based on first in and first out wherein the units that are firstly included the

inventory are used on priority basis during the prediction.

Cost accounting system: The main aim of this accounting system is to keep a control

over the cost of prediction in order to manufacture the product or service within minimum

expenses. There are two crucial cost of production which are direct and indirect. Direct cost has a

direct link with the production (Agrawal, 2018). The major direct costs are the cost of raw

material, labour and more. However, indirect cost is not directly link with the production but also

plays a crucial role in the estimation of the overall cost of a printed. To earn potential amount of

order to pay direct expenses in timely manner.

Management accounting system:

Management accounting is related with preparing, analysing as well as controlling the

financial performance of an organization. In this context, the major accounting systems are

elaborated below.

Inventory administration system: This system is related with maintenance of adequate

amount of inventory in the business so that the manufacturing process can be continued

efficiently. The main focus of this approach is to maintain sufficient level of inventory in the

business in order to meet with the level of demand in the market. Under this approach, the

managers are likely to keep a check on the current level of inventory in the organization and

determining a reorder level to avoid the situation of deficiency and surplus in future period of

time (Mahmud, Manan and Hashim, 2019). Effective inventory management helps an entity to

maintain consistency in the production. Deficiency of inventory hampers the brand image of an

organization whereas surplus of the inventory can cause enhancement in the overall prediction

expands. Hence, it is imperative to follow the inventory administration system in order to meet

with the demand of the buyers efficiently. Here, approaches of inventory management are

elaborated below:

LIFO: This approach is based on last in and first out. In this, the units which are added in

the inventory in last are used on priority basis during prediction

FIFO: This is based on first in and first out wherein the units that are firstly included the

inventory are used on priority basis during the prediction.

Cost accounting system: The main aim of this accounting system is to keep a control

over the cost of prediction in order to manufacture the product or service within minimum

expenses. There are two crucial cost of production which are direct and indirect. Direct cost has a

direct link with the production (Agrawal, 2018). The major direct costs are the cost of raw

material, labour and more. However, indirect cost is not directly link with the production but also

plays a crucial role in the estimation of the overall cost of a printed. To earn potential amount of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

profit, it is imperative to keep control over the production cost. It not only helps in enhancing the

profit margin but also allows the entity to keep the price of the product at a minimum level.

Job costing system: In this, cost of each and every task is identified in order to calculate

the overall cost of a project. This technique is applied when the entire process is divided in

different tasks. This approach also helps in assessing the contribution of each and every job in

the completion of the overall task (Libby and Salterio, 2019) . In addition, it also allows the

managers to keep an appropriate control over the cost of production. Here, they can also

eliminate the unnecessary jobs from the process which will further reduce down the total

expense. This approach plays a crucial role in making optimum utilization of the available

resources.

P2) Methods of management accounting reporting

In management accounting, reports are prepared to assist the managers in order to take

constructive decisions for further growth of the entity. These reports include a complete financial

reflection of the entity that further assists the managers in taking suitable business decisions.

Financial statements like balance sheets, income statements are some of the reports that are used

by the managers during decision making. Here, the reports are prepared by the efficient

management accounting team and analysed by the managers of the organization. In this context,

methods of management accounting reporting are elaborated below.

Performance report: In organization, individuals having different competencies, skills

and abilities are likely to work together for betterment and growth. Different roles

responsibilities and duties are performed by them so that the entity can get success in future

period of time (Ahmed, 2018). It is imperative to keep a track on the performance of each and

every employee. For this purpose, the performance reports are prepared and further evaluated by

the managers efficiently. These reports allow the manager to evaluate the performance of

employees from predefined standards so that they can take necessary corrective actions for future

betterment.

Budget report: This report is prepared for a particular accounting. While preparing

budget, managers are likely to make forecast regarding future expense and income. This

profit margin but also allows the entity to keep the price of the product at a minimum level.

Job costing system: In this, cost of each and every task is identified in order to calculate

the overall cost of a project. This technique is applied when the entire process is divided in

different tasks. This approach also helps in assessing the contribution of each and every job in

the completion of the overall task (Libby and Salterio, 2019) . In addition, it also allows the

managers to keep an appropriate control over the cost of production. Here, they can also

eliminate the unnecessary jobs from the process which will further reduce down the total

expense. This approach plays a crucial role in making optimum utilization of the available

resources.

P2) Methods of management accounting reporting

In management accounting, reports are prepared to assist the managers in order to take

constructive decisions for further growth of the entity. These reports include a complete financial

reflection of the entity that further assists the managers in taking suitable business decisions.

Financial statements like balance sheets, income statements are some of the reports that are used

by the managers during decision making. Here, the reports are prepared by the efficient

management accounting team and analysed by the managers of the organization. In this context,

methods of management accounting reporting are elaborated below.

Performance report: In organization, individuals having different competencies, skills

and abilities are likely to work together for betterment and growth. Different roles

responsibilities and duties are performed by them so that the entity can get success in future

period of time (Ahmed, 2018). It is imperative to keep a track on the performance of each and

every employee. For this purpose, the performance reports are prepared and further evaluated by

the managers efficiently. These reports allow the manager to evaluate the performance of

employees from predefined standards so that they can take necessary corrective actions for future

betterment.

Budget report: This report is prepared for a particular accounting. While preparing

budget, managers are likely to make forecast regarding future expense and income. This

information further assists them in preparing an appropriate budget. Additionally, budget also

helps the entity in meeting with the future expenses in an efficient manner.

Inventory and manufacturing report: Inventory is an essential part of every business.

adequate amount of inventory makes an organization enable to address the market demand

efficiently. In this context, inventory reports are prepared so that the organization can maintain

standard level of inventory in order to avoid any future disruption in the manufacturing process.

This report includes the current level of inventory, reorder level and requirement of inventory in

future period of time (OTLEY, 2019). This report allows the manager to avoid the uncertain

situations such as surplus and deficiency of inventory in future. In addition, it also helps in

keeping the overall cost of production at a minimum level which is imperative to maintain

positive image of the company in market.

Account receivable report: The main aim of this report is to get the amount back from

debtors. In business, credit transactions are done usually. In this situation, account receivable

reports help in keeping an appropriate record of the products or services that are being sold on

credit. Along with the credit, dates are also mentioned in this report (Ostaev and Khosiev, 2018).

If a company has high balance of accounting receivable, it shows their inefficiency to recover the

amount from debtors. Therefore, the main aim of this report is to ensure the timely recovery of

debt.

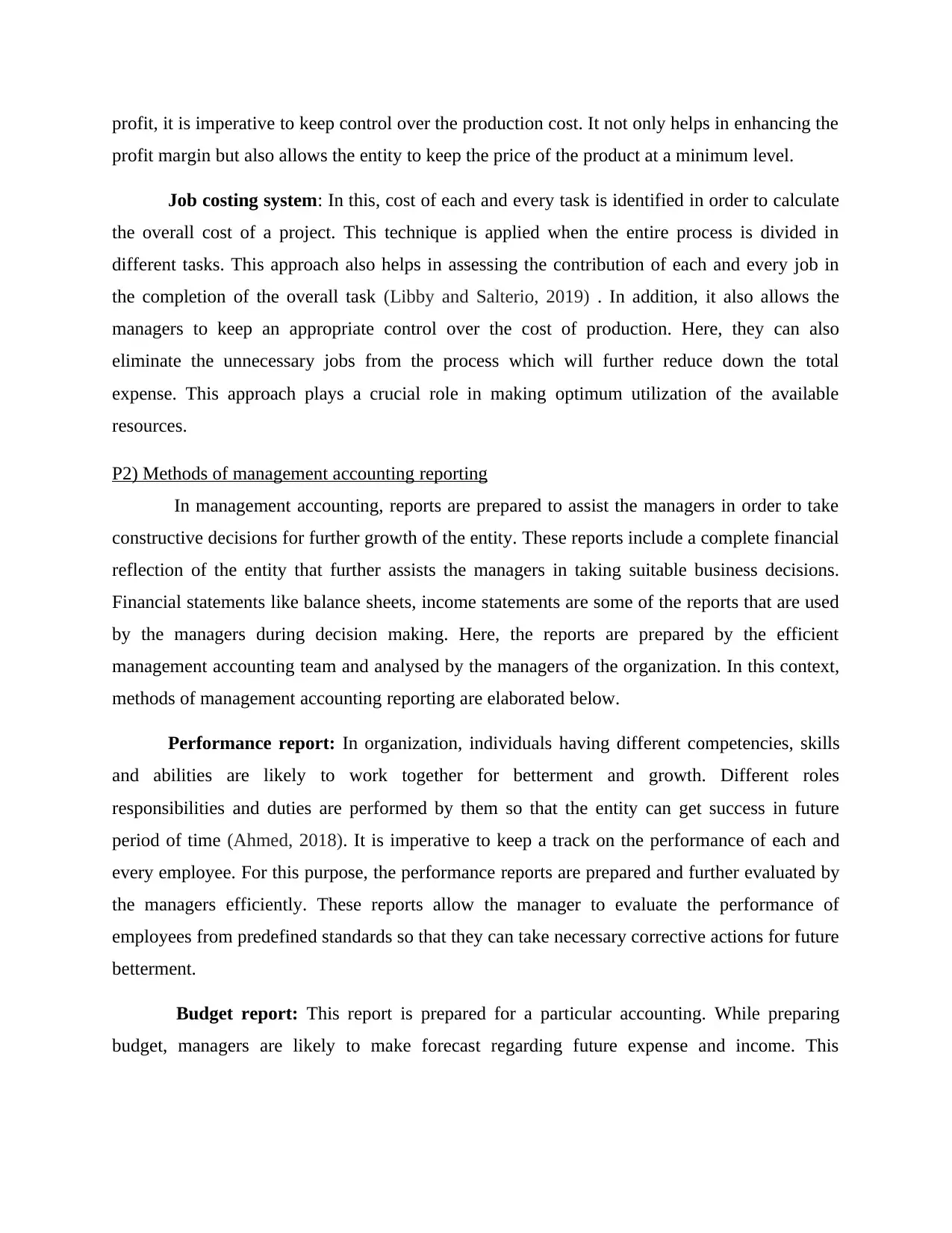

M1) Discuss advantage of management accounting system and also their application in

organization context

Accounting system Advantages

Inventory management system Benefits: This system is suitable in order to keep a track on

the level of inventory within the organization in order to

fulfil the market demand efficiently.

Application: It is applied to keep control on the production

cost and to make efficient use music the resources.

Cost accounting system Benefits: Effective application of this system makes the

helps the entity in meeting with the future expenses in an efficient manner.

Inventory and manufacturing report: Inventory is an essential part of every business.

adequate amount of inventory makes an organization enable to address the market demand

efficiently. In this context, inventory reports are prepared so that the organization can maintain

standard level of inventory in order to avoid any future disruption in the manufacturing process.

This report includes the current level of inventory, reorder level and requirement of inventory in

future period of time (OTLEY, 2019). This report allows the manager to avoid the uncertain

situations such as surplus and deficiency of inventory in future. In addition, it also helps in

keeping the overall cost of production at a minimum level which is imperative to maintain

positive image of the company in market.

Account receivable report: The main aim of this report is to get the amount back from

debtors. In business, credit transactions are done usually. In this situation, account receivable

reports help in keeping an appropriate record of the products or services that are being sold on

credit. Along with the credit, dates are also mentioned in this report (Ostaev and Khosiev, 2018).

If a company has high balance of accounting receivable, it shows their inefficiency to recover the

amount from debtors. Therefore, the main aim of this report is to ensure the timely recovery of

debt.

M1) Discuss advantage of management accounting system and also their application in

organization context

Accounting system Advantages

Inventory management system Benefits: This system is suitable in order to keep a track on

the level of inventory within the organization in order to

fulfil the market demand efficiently.

Application: It is applied to keep control on the production

cost and to make efficient use music the resources.

Cost accounting system Benefits: Effective application of this system makes the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

managers enable production cost at a minimum level.

Application: this approach is applied to minimise the

overall cost of production so that the form can earn higher

amount of profit.

Job order costing system Benefits: With this system, it is easy to evaluate the

significance of each and every job in the completion of the

entire project. This system further allows the manager to

continue with profitable task and eliminate those tasks which

are ineffective for the production (Nkundabanyanga,

Muhwezi and Tauringana, 2018).

Application: This approach is applied in order to know the

cost incurred in each and every product so that they can

easily identify profitable products from the overall portfolio.

It is wise to use this technique when the company is engaged

in a production of different products.

TASK 2

P3) Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

Cost Card Using Absorption CostingNovember

Sales = 70* 10000 = £ 700000

Direct Materials = £100000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

December

Sales = 70* 8000 = £ 560000

Application: this approach is applied to minimise the

overall cost of production so that the form can earn higher

amount of profit.

Job order costing system Benefits: With this system, it is easy to evaluate the

significance of each and every job in the completion of the

entire project. This system further allows the manager to

continue with profitable task and eliminate those tasks which

are ineffective for the production (Nkundabanyanga,

Muhwezi and Tauringana, 2018).

Application: This approach is applied in order to know the

cost incurred in each and every product so that they can

easily identify profitable products from the overall portfolio.

It is wise to use this technique when the company is engaged

in a production of different products.

TASK 2

P3) Calculate costs using appropriate techniques of cost analysis to prepare an income statement

using marginal and absorption costs

Cost Card Using Absorption CostingNovember

Sales = 70* 10000 = £ 700000

Direct Materials = £100000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

December

Sales = 70* 8000 = £ 560000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct Materials = £100000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

Inventory = £ 2000 units

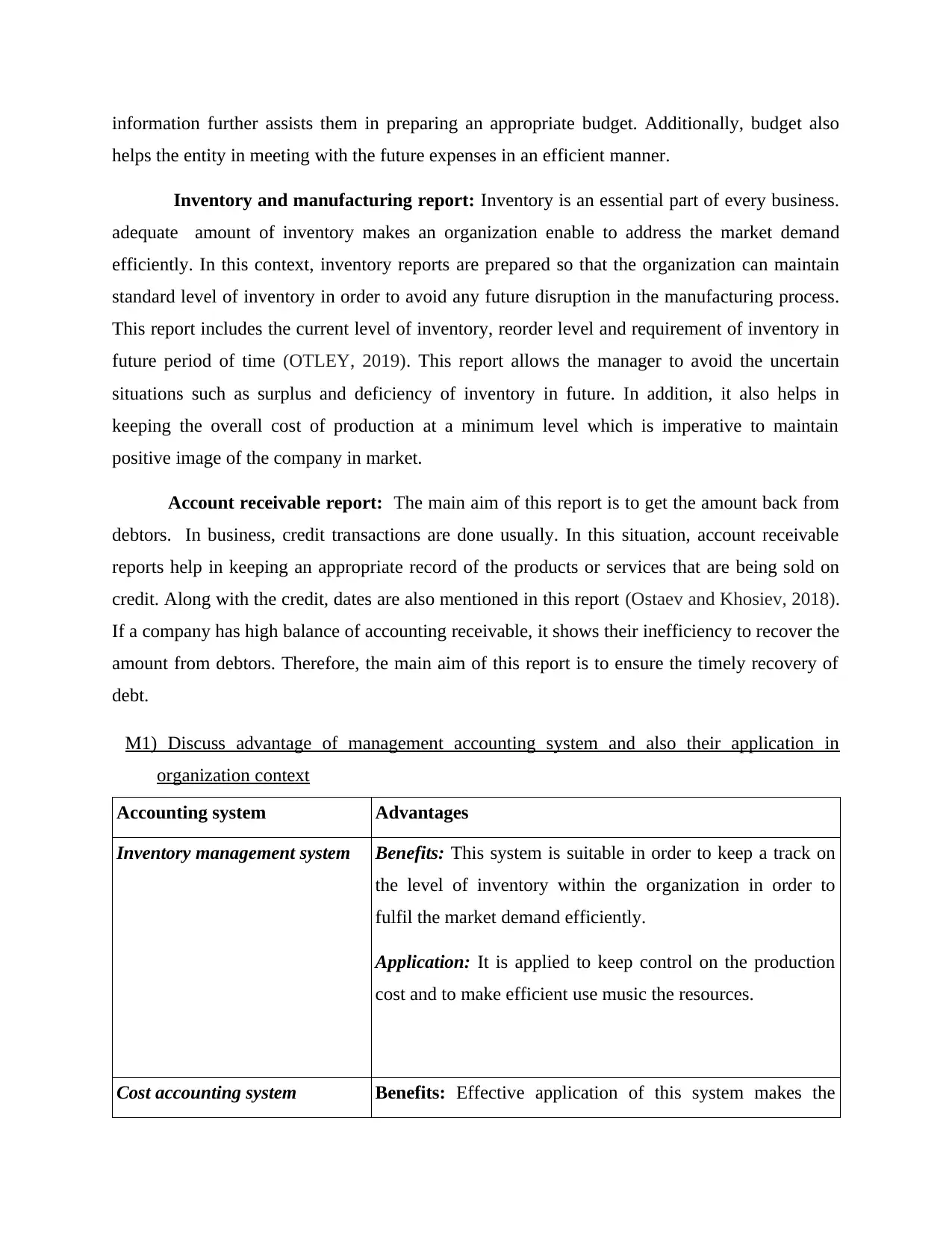

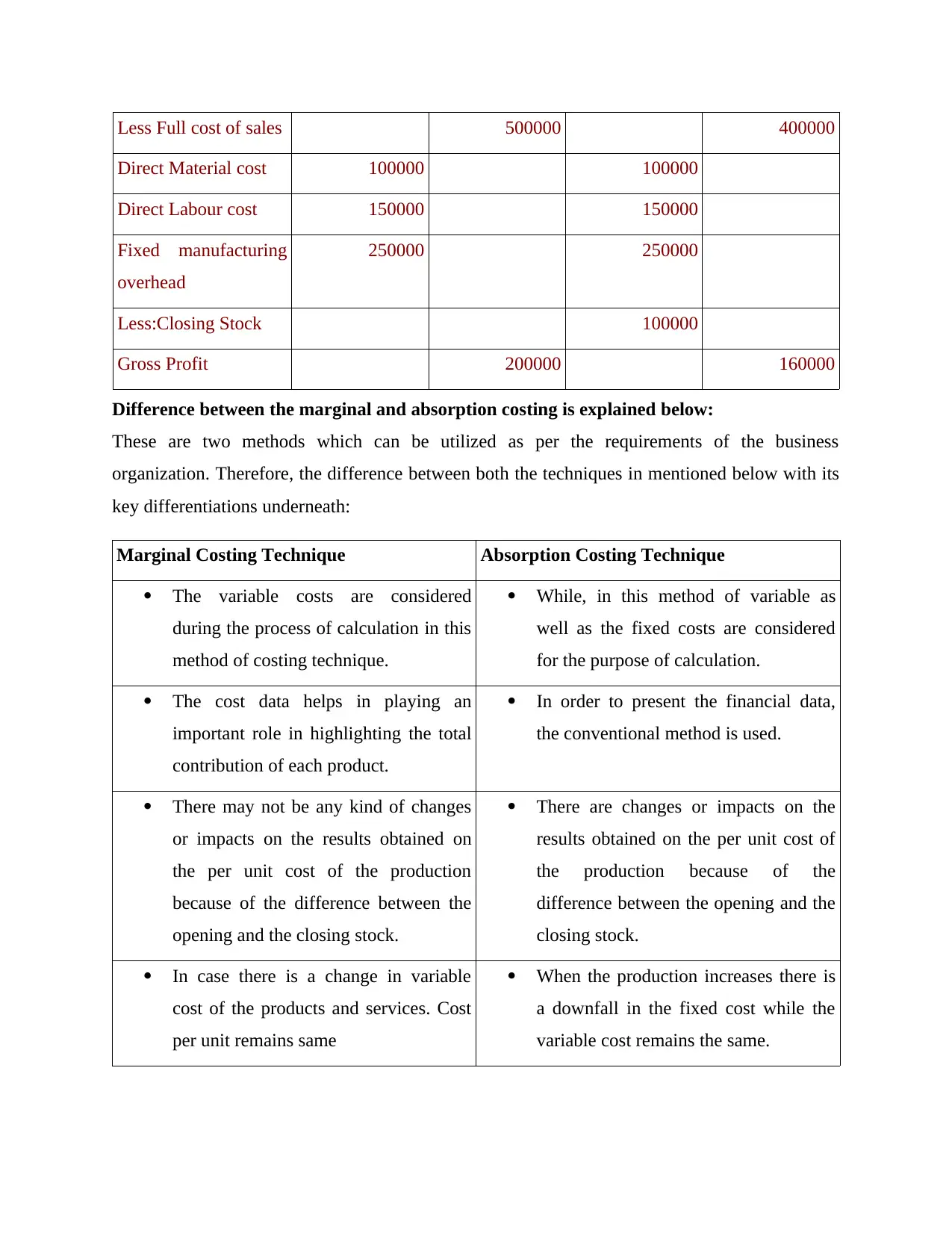

Profit statements using Absorption costing (10000 units)

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Less Full cost of sales 500000 400000

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Less:Closing Stock 100000

Gross Profit 200000 160000

Less: Under

absorption

0 50000

Profit 110000

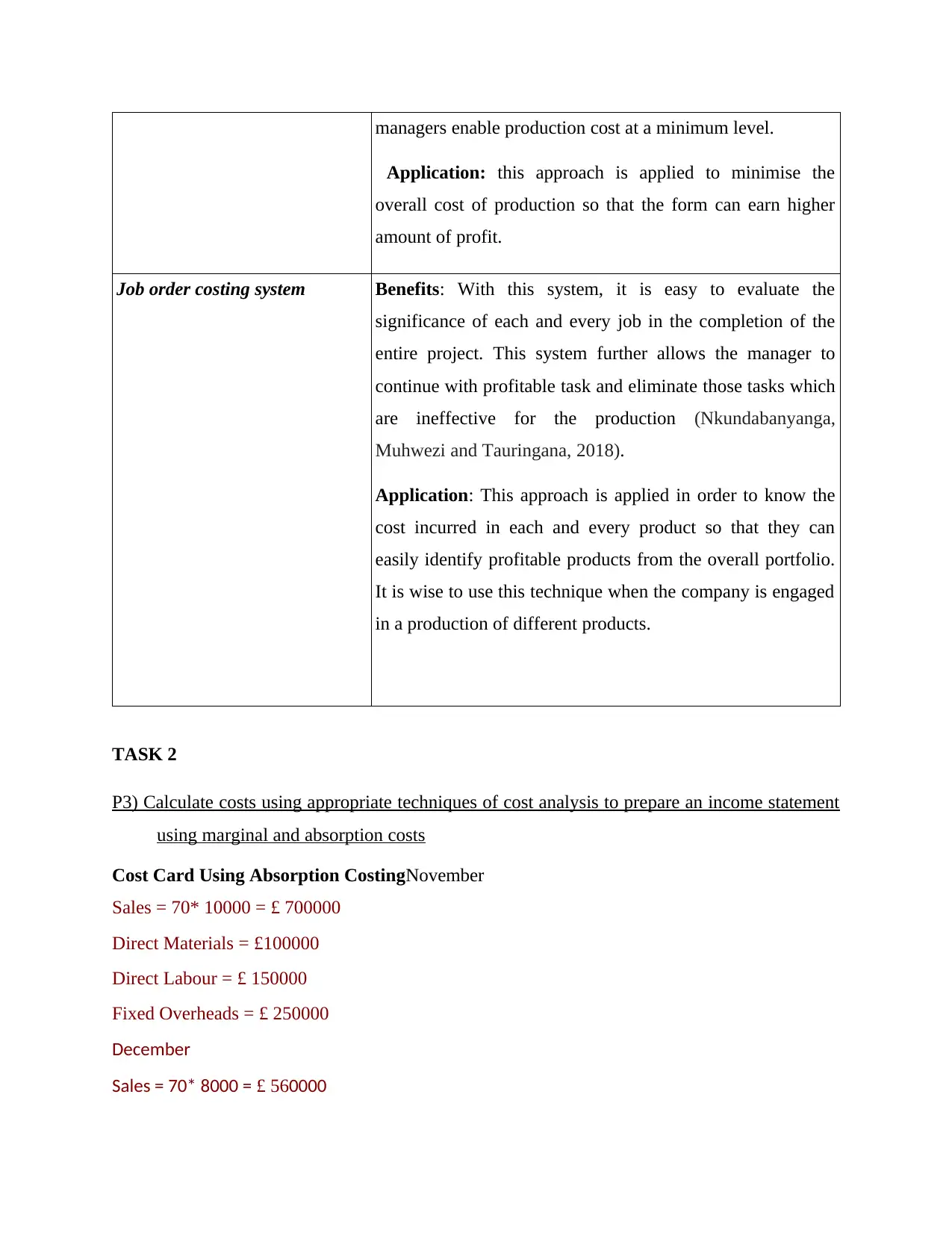

Profit statements using Marginal costing (10000 units)

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Direct Labour = £ 150000

Fixed Overheads = £ 250000

Inventory = £ 2000 units

Profit statements using Absorption costing (10000 units)

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Less Full cost of sales 500000 400000

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Less:Closing Stock 100000

Gross Profit 200000 160000

Less: Under

absorption

0 50000

Profit 110000

Profit statements using Marginal costing (10000 units)

Profit as Per

absorption costing

£s November

£s

£s December

£s

Turnover 700000 560000

Less Full cost of sales 500000 400000

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Less:Closing Stock 100000

Gross Profit 200000 160000

Difference between the marginal and absorption costing is explained below:

These are two methods which can be utilized as per the requirements of the business

organization. Therefore, the difference between both the techniques in mentioned below with its

key differentiations underneath:

Marginal Costing Technique Absorption Costing Technique

The variable costs are considered

during the process of calculation in this

method of costing technique.

While, in this method of variable as

well as the fixed costs are considered

for the purpose of calculation.

The cost data helps in playing an

important role in highlighting the total

contribution of each product.

In order to present the financial data,

the conventional method is used.

There may not be any kind of changes

or impacts on the results obtained on

the per unit cost of the production

because of the difference between the

opening and the closing stock.

There are changes or impacts on the

results obtained on the per unit cost of

the production because of the

difference between the opening and the

closing stock.

In case there is a change in variable

cost of the products and services. Cost

per unit remains same

When the production increases there is

a downfall in the fixed cost while the

variable cost remains the same.

Direct Material cost 100000 100000

Direct Labour cost 150000 150000

Fixed manufacturing

overhead

250000 250000

Less:Closing Stock 100000

Gross Profit 200000 160000

Difference between the marginal and absorption costing is explained below:

These are two methods which can be utilized as per the requirements of the business

organization. Therefore, the difference between both the techniques in mentioned below with its

key differentiations underneath:

Marginal Costing Technique Absorption Costing Technique

The variable costs are considered

during the process of calculation in this

method of costing technique.

While, in this method of variable as

well as the fixed costs are considered

for the purpose of calculation.

The cost data helps in playing an

important role in highlighting the total

contribution of each product.

In order to present the financial data,

the conventional method is used.

There may not be any kind of changes

or impacts on the results obtained on

the per unit cost of the production

because of the difference between the

opening and the closing stock.

There are changes or impacts on the

results obtained on the per unit cost of

the production because of the

difference between the opening and the

closing stock.

In case there is a change in variable

cost of the products and services. Cost

per unit remains same

When the production increases there is

a downfall in the fixed cost while the

variable cost remains the same.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

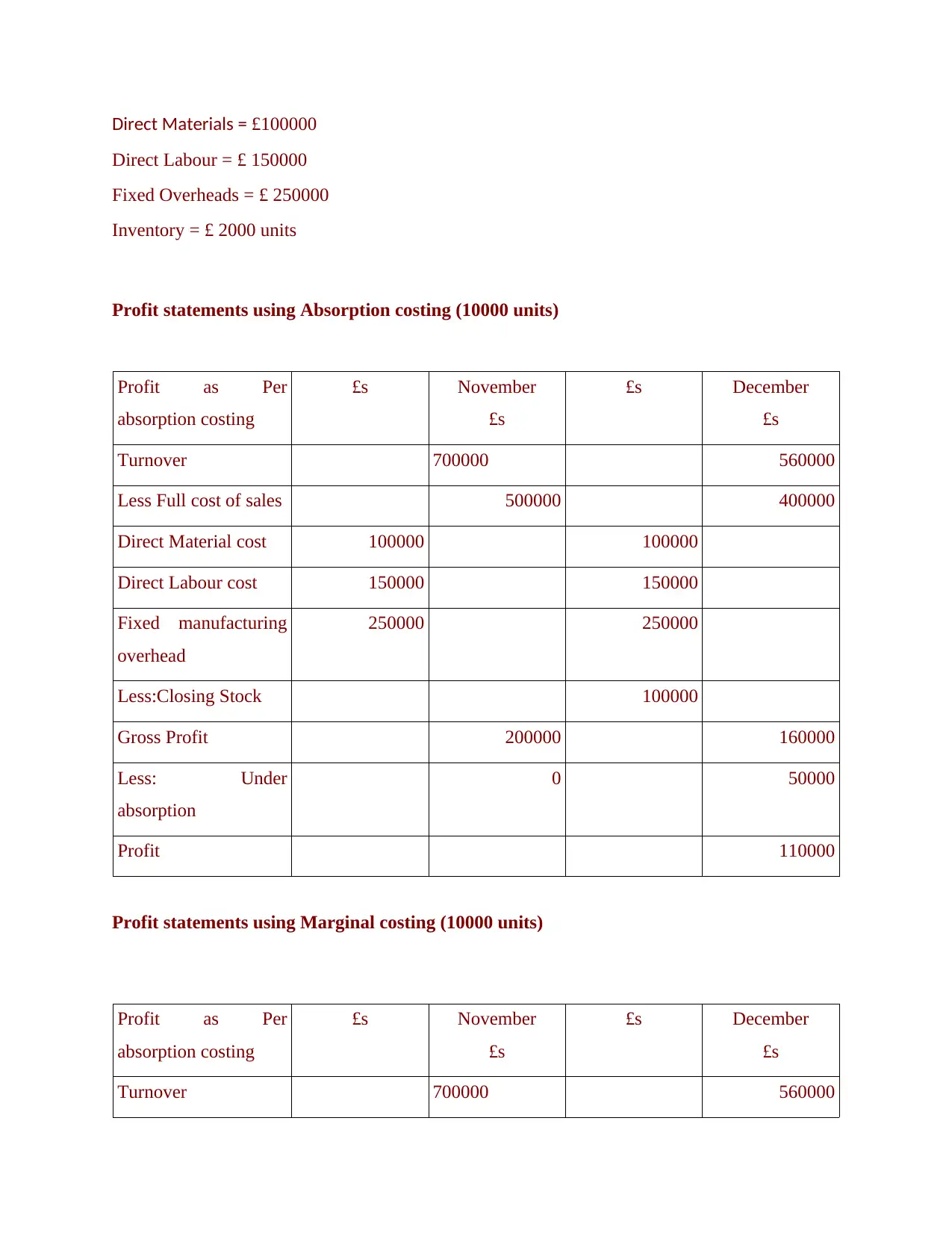

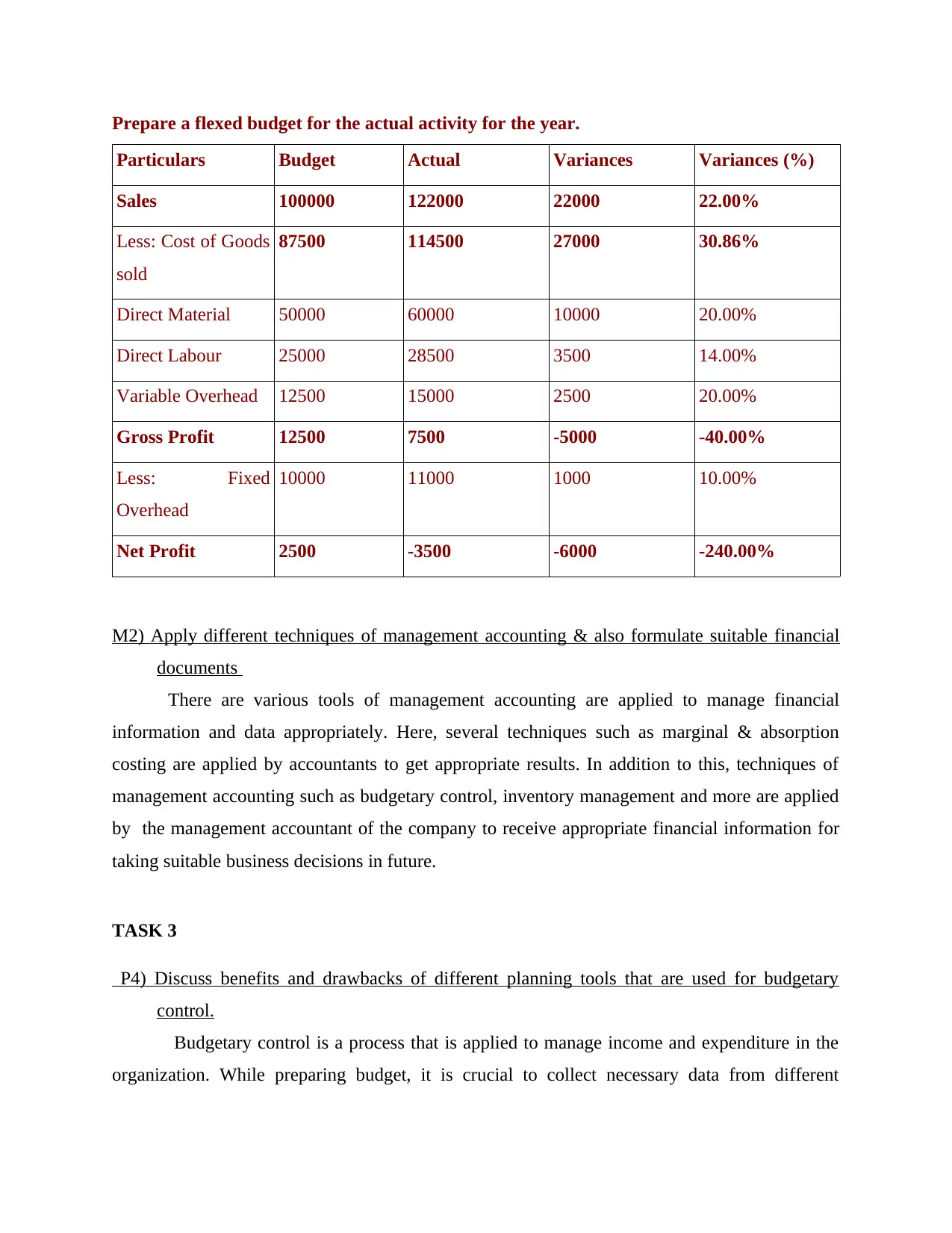

Prepare a flexed budget for the actual activity for the year.

Particulars Budget Actual Variances Variances (%)

Sales 100000 122000 22000 22.00%

Less: Cost of Goods

sold

87500 114500 27000 30.86%

Direct Material 50000 60000 10000 20.00%

Direct Labour 25000 28500 3500 14.00%

Variable Overhead 12500 15000 2500 20.00%

Gross Profit 12500 7500 -5000 -40.00%

Less: Fixed

Overhead

10000 11000 1000 10.00%

Net Profit 2500 -3500 -6000 -240.00%

M2) Apply different techniques of management accounting & also formulate suitable financial

documents

There are various tools of management accounting are applied to manage financial

information and data appropriately. Here, several techniques such as marginal & absorption

costing are applied by accountants to get appropriate results. In addition to this, techniques of

management accounting such as budgetary control, inventory management and more are applied

by the management accountant of the company to receive appropriate financial information for

taking suitable business decisions in future.

TASK 3

P4) Discuss benefits and drawbacks of different planning tools that are used for budgetary

control.

Budgetary control is a process that is applied to manage income and expenditure in the

organization. While preparing budget, it is crucial to collect necessary data from different

Particulars Budget Actual Variances Variances (%)

Sales 100000 122000 22000 22.00%

Less: Cost of Goods

sold

87500 114500 27000 30.86%

Direct Material 50000 60000 10000 20.00%

Direct Labour 25000 28500 3500 14.00%

Variable Overhead 12500 15000 2500 20.00%

Gross Profit 12500 7500 -5000 -40.00%

Less: Fixed

Overhead

10000 11000 1000 10.00%

Net Profit 2500 -3500 -6000 -240.00%

M2) Apply different techniques of management accounting & also formulate suitable financial

documents

There are various tools of management accounting are applied to manage financial

information and data appropriately. Here, several techniques such as marginal & absorption

costing are applied by accountants to get appropriate results. In addition to this, techniques of

management accounting such as budgetary control, inventory management and more are applied

by the management accountant of the company to receive appropriate financial information for

taking suitable business decisions in future.

TASK 3

P4) Discuss benefits and drawbacks of different planning tools that are used for budgetary

control.

Budgetary control is a process that is applied to manage income and expenditure in the

organization. While preparing budget, it is crucial to collect necessary data from different

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

departments of the organization. In this context, various planning tools used by the company are

given below:

Variance analysis: It is a tool that is applied for budgetary control. In this, the current

performance of the company is compared with the estimated performance. The main aim of this

analysis is to find the gap and applied suitable corrective actions in order to improve the future

situations.

Advantages: It allows the entity to predict the future and take suitable corrective actions

accordingly. In addition, it also improves the efficiency of the finance team to face the

future uncertainties effectively (Taschner and Charifzadeh, 2020).

Disadvantages: Here, it is required to set standards to analyze the performance. Setting

standard is quite complex and time taking process. Here, the finance team is required to

put huge efforts, time as well as resources while determining the variances.

Break even analysis: It refers to the financial calculation that demonstrates the number of

units which need to be sold in order to cover variable as well as fixed cost of prediction. In other

words, it is used to determine number of units which need to be sold to cover the total cost

(Scott, 2019).

Advantages: It is a useful tool which helps the entity to keep a control over cost and

assist the managers to maintain an adequate level of revenue in business.

Disadvantages: It is based on complex calculation that is not easy to understand for each

and every portion working within the finance department.

Zero base budgeting: It is highly used technique for the purpose of budgetary control. In

this, the budget of the upcoming year is considered as zero or nil. It is only possible when the

revue and expenses of the respective year will be equal. While applying this technique,

difference of expenses and revenue is regarded 0 and the excess amount is adjusted accordingly.

Advantages: The main advantage of zero based budgeting is to provide accurate results

to analysis of each and every item of cash flow. In addition, it also provides a clear

picture regarding the expense of each and every department and further helps in cost

reduction (Nyamwanza, Madzivire and Madzivire, 2020).

given below:

Variance analysis: It is a tool that is applied for budgetary control. In this, the current

performance of the company is compared with the estimated performance. The main aim of this

analysis is to find the gap and applied suitable corrective actions in order to improve the future

situations.

Advantages: It allows the entity to predict the future and take suitable corrective actions

accordingly. In addition, it also improves the efficiency of the finance team to face the

future uncertainties effectively (Taschner and Charifzadeh, 2020).

Disadvantages: Here, it is required to set standards to analyze the performance. Setting

standard is quite complex and time taking process. Here, the finance team is required to

put huge efforts, time as well as resources while determining the variances.

Break even analysis: It refers to the financial calculation that demonstrates the number of

units which need to be sold in order to cover variable as well as fixed cost of prediction. In other

words, it is used to determine number of units which need to be sold to cover the total cost

(Scott, 2019).

Advantages: It is a useful tool which helps the entity to keep a control over cost and

assist the managers to maintain an adequate level of revenue in business.

Disadvantages: It is based on complex calculation that is not easy to understand for each

and every portion working within the finance department.

Zero base budgeting: It is highly used technique for the purpose of budgetary control. In

this, the budget of the upcoming year is considered as zero or nil. It is only possible when the

revue and expenses of the respective year will be equal. While applying this technique,

difference of expenses and revenue is regarded 0 and the excess amount is adjusted accordingly.

Advantages: The main advantage of zero based budgeting is to provide accurate results

to analysis of each and every item of cash flow. In addition, it also provides a clear

picture regarding the expense of each and every department and further helps in cost

reduction (Nyamwanza, Madzivire and Madzivire, 2020).

Disadvantages: Implementing zero base budgeting is a time consuming process and also

requires proficient individuals for effective implementation.

M3) Analyse different planning tools with their application in preparation of budgets

It is analysed that sample of planning tools such as variance analysis, break even analysis,

zero based budgeting and more are used by an organization for the purpose of future planning.

Here, variance analysis helps in taking suitable corrective actions for future betterment. On other

side, break even analysis is helpful in managing a sufficient level of revenue in the business.

Additionally, zero based budgeting also helps managers in providing effective and appropriate

budget to enhance productivity of business.

TASK 4

P5) Discuss comparison how organisations are applying management accounting system in order

to respond financial complexities

In finance, there are several issues which are face by the finance department while preparing

necessary documents. These issues are elaborated below:

Poor cache administration: Cash is an important component to run the business

effectively. It is important in order to maintain adequate amount of liquidity and business.

However, the respective company is facing the issue related to poor cash administration

that woll hamper the daily opexrations of the entity.

High accounting receivables: In the respective business entity, there is issue of high

accounting receivables which demonstrates their inefficiency to recover the amount from

debtors.

Management accounting approach

Planning tools helps an organization to deal with the finance operations of the company

so that the financial position and the working can be analysed effectively (Li, H., 2018). In order

to achieve the objectives of the company it is highly necessary to utilize various techniques

namely budgetary control, zero budgeting and the variance analysis. In context to M & S, several

requires proficient individuals for effective implementation.

M3) Analyse different planning tools with their application in preparation of budgets

It is analysed that sample of planning tools such as variance analysis, break even analysis,

zero based budgeting and more are used by an organization for the purpose of future planning.

Here, variance analysis helps in taking suitable corrective actions for future betterment. On other

side, break even analysis is helpful in managing a sufficient level of revenue in the business.

Additionally, zero based budgeting also helps managers in providing effective and appropriate

budget to enhance productivity of business.

TASK 4

P5) Discuss comparison how organisations are applying management accounting system in order

to respond financial complexities

In finance, there are several issues which are face by the finance department while preparing

necessary documents. These issues are elaborated below:

Poor cache administration: Cash is an important component to run the business

effectively. It is important in order to maintain adequate amount of liquidity and business.

However, the respective company is facing the issue related to poor cash administration

that woll hamper the daily opexrations of the entity.

High accounting receivables: In the respective business entity, there is issue of high

accounting receivables which demonstrates their inefficiency to recover the amount from

debtors.

Management accounting approach

Planning tools helps an organization to deal with the finance operations of the company

so that the financial position and the working can be analysed effectively (Li, H., 2018). In order

to achieve the objectives of the company it is highly necessary to utilize various techniques

namely budgetary control, zero budgeting and the variance analysis. In context to M & S, several

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.