A Comprehensive Report on Management Accounting at Burberry Group

VerifiedAdded on 2024/06/28

|21

|4715

|488

Report

AI Summary

This report provides a comprehensive analysis of management accounting systems, focusing on Burberry Group PLC. It explores the essential requirements of different management accounting systems, including cost management, job costing, inventory management, and price optimization. Various methods used for management accounting reporting, such as sales reports, budget reports, and performance reports, are explained. The report evaluates the benefits of management accounting systems within an organizational context, emphasizing planning, controlling, organizing, and decision-making. It also critically assesses the integration of management accounting systems and reporting within organizational processes. Furthermore, the report discusses benchmarking, cash flow budgeting, and discounted cash flow analysis as key components of effective management accounting practices for enhancing profitability and efficiency within organizations like Burberry Group PLC.

Accounting Management

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2

Table of Contents

Task 1...............................................................................................................................................4

Task 2.............................................................................................................................................10

References......................................................................................................................................20

3

Task 1...............................................................................................................................................4

Task 2.............................................................................................................................................10

References......................................................................................................................................20

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Task 1

Introduction

We all know that in a management system internal system is one of the most important things to

maintain. In order to maintain the proper management, internal information administration needs

to be maintained in a proper way. To improve the profit in any administration various methods

and techniques are used in a management accounting and it tracks the internal information. We

have many advantages in a management accounting system, but making resources work in the

administration is one of the prime advantages of management accounting. With the efficiency of

the resources, the profitability can be enlarged. To enlarge the effective expenses and diminish

the costing reports can be written on based of several departments.

Analysis will be done by Burberry group plc in this report as per the profitability and the

relevance of management accounting. Thomas Burberry is the founder of this company and this

company was established in the year 1863. In this company latest administration revenue is GBP

2732.8 million and headquarters of the company is situated in London. The comprehensive

analysis of the management accounting will be shown in this assignment.

Part 1

A. Explain management accounting and give the essential requirements of different types

of management accounting systems.

For tracking the internal information of the company about their financial background,

management is one of the finest systems. We all know that there are several different systems; by

this sense, we can say management system is an amalgamation of a diverse range of systems. It

will be discussed here-

Cost management –

Cost management can be defined as a procedure to make plan and control the budget of the

company. It is process of management accounting that gives a company to presage impending

expenses to support decline the chance of dealing over budget. The expenses can be decreased by

managing the profitability and the cost of the various production processes can be managed by

cost management system.

4

Introduction

We all know that in a management system internal system is one of the most important things to

maintain. In order to maintain the proper management, internal information administration needs

to be maintained in a proper way. To improve the profit in any administration various methods

and techniques are used in a management accounting and it tracks the internal information. We

have many advantages in a management accounting system, but making resources work in the

administration is one of the prime advantages of management accounting. With the efficiency of

the resources, the profitability can be enlarged. To enlarge the effective expenses and diminish

the costing reports can be written on based of several departments.

Analysis will be done by Burberry group plc in this report as per the profitability and the

relevance of management accounting. Thomas Burberry is the founder of this company and this

company was established in the year 1863. In this company latest administration revenue is GBP

2732.8 million and headquarters of the company is situated in London. The comprehensive

analysis of the management accounting will be shown in this assignment.

Part 1

A. Explain management accounting and give the essential requirements of different types

of management accounting systems.

For tracking the internal information of the company about their financial background,

management is one of the finest systems. We all know that there are several different systems; by

this sense, we can say management system is an amalgamation of a diverse range of systems. It

will be discussed here-

Cost management –

Cost management can be defined as a procedure to make plan and control the budget of the

company. It is process of management accounting that gives a company to presage impending

expenses to support decline the chance of dealing over budget. The expenses can be decreased by

managing the profitability and the cost of the various production processes can be managed by

cost management system.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Job costing-

In the various jobs of that are available in the production process, the cost is allotted with this

system. The various types of job can be pooled with this system and the nature of various jobs

can be understood. The overall expenditure can be reduced by this system.

Inventory management system –

In the administrations to manage the stock, various systems of managing inventory are used.

The usefulness of the resources can be enhanced by this system and it has the efficiency to

maintain proper system of managing inventory augments. With this system a company can see

completely small moving parts of its operations, allows making better decisions. Various

inventory managers’ focuses on different sections of chain –but small companies are usually

interested in sales end of its line.

Price optimization system –

By this procedure, the enthusiasm of the clients can be recognized with the help of this system in

the market; the worth of the product can be understood. To decreases all the expenses and

strengthen the profitability this system is used mainly.

B. Explain different methods used for management accounting reporting.

Sales report

From various other departments’ value of total sales can be consolidated in details. It can be seen

the various trends going in sales volume over specific time , but it analyzes its sales volume on

a certain time and analyzes the various steps of the selling process and the performance of the

sales dealer. To measure and calculate the performance of various products, several strategies

need to be implemented. It helps to restructure the entire budget report in an easy manner.

Budget report-

The performance of the administration can be compared by using this report. This is specially

made to calculate the expenditure and make a proper pale to maintain the expenses of the

5

In the various jobs of that are available in the production process, the cost is allotted with this

system. The various types of job can be pooled with this system and the nature of various jobs

can be understood. The overall expenditure can be reduced by this system.

Inventory management system –

In the administrations to manage the stock, various systems of managing inventory are used.

The usefulness of the resources can be enhanced by this system and it has the efficiency to

maintain proper system of managing inventory augments. With this system a company can see

completely small moving parts of its operations, allows making better decisions. Various

inventory managers’ focuses on different sections of chain –but small companies are usually

interested in sales end of its line.

Price optimization system –

By this procedure, the enthusiasm of the clients can be recognized with the help of this system in

the market; the worth of the product can be understood. To decreases all the expenses and

strengthen the profitability this system is used mainly.

B. Explain different methods used for management accounting reporting.

Sales report

From various other departments’ value of total sales can be consolidated in details. It can be seen

the various trends going in sales volume over specific time , but it analyzes its sales volume on

a certain time and analyzes the various steps of the selling process and the performance of the

sales dealer. To measure and calculate the performance of various products, several strategies

need to be implemented. It helps to restructure the entire budget report in an easy manner.

Budget report-

The performance of the administration can be compared by using this report. This is specially

made to calculate the expenditure and make a proper pale to maintain the expenses of the

5

administration. For any administration, it is valuable to have power over the performances in

several ways. In this report, communication within the segments can be augmented.

Performance report-

With this report, employee performance appraisal can be made and in this report with the help of

various presentation of segments that are enlisted. For controlling purposes, it is very useful. In

this report, employee motivation along with their efficiency of the resources can be managed.

Performance report statement that counts the results of few activity of its achievement over a

certain time frame. For example, the final performance report may be shown for each workers of

a company, or such a document may help management and the success in a project how good

budgetary constraints had been adhered.

C. Evaluate the benefits of management accounting systems and their application within an

organizational context.

The performance and the effectiveness of the administration can be augmented with this

management accounting system. It also provides several benefits. Those are given below-

Planning

Planning the goal of an administration management accounting is necessary. By this system,

lucidity of different processes in the administration can be improved. The goals for the future and

the allocation of resources can be done more successfully along with planning.

Controlling

By the system of management accounting, performance of the resources can be controlled and

quantified. The effectiveness of the administrative processes can be amplified by controlling. By

monitoring the performance, unproductive processes of any administration can be eliminated.

Organizing

Within different departments, it also helps to improve the administration. In various departments,

synchronization of the goal can be augmented with this system. The smoothness of different

departments can be augmented also by this system.

6

several ways. In this report, communication within the segments can be augmented.

Performance report-

With this report, employee performance appraisal can be made and in this report with the help of

various presentation of segments that are enlisted. For controlling purposes, it is very useful. In

this report, employee motivation along with their efficiency of the resources can be managed.

Performance report statement that counts the results of few activity of its achievement over a

certain time frame. For example, the final performance report may be shown for each workers of

a company, or such a document may help management and the success in a project how good

budgetary constraints had been adhered.

C. Evaluate the benefits of management accounting systems and their application within an

organizational context.

The performance and the effectiveness of the administration can be augmented with this

management accounting system. It also provides several benefits. Those are given below-

Planning

Planning the goal of an administration management accounting is necessary. By this system,

lucidity of different processes in the administration can be improved. The goals for the future and

the allocation of resources can be done more successfully along with planning.

Controlling

By the system of management accounting, performance of the resources can be controlled and

quantified. The effectiveness of the administrative processes can be amplified by controlling. By

monitoring the performance, unproductive processes of any administration can be eliminated.

Organizing

Within different departments, it also helps to improve the administration. In various departments,

synchronization of the goal can be augmented with this system. The smoothness of different

departments can be augmented also by this system.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Decision –making

For any organization, monitoring and tracking performance are the most important advantages.

The expenditure of the administration can be reduced by using this system and these factors also

helps in decision-making, strategy planning of the organization.

D. critically evaluates how management accounting systems and management accounting

reporting is integrated within organizational processes.

For an administration, both the system of reporting and accounting are interrelated and they are

uniformly important according to Harrison and Lock (2017). To augment the profitability all

these systems are very useful. To reduce the expenses and strengthen the effectiveness,

efficiency of all the resources these systems are always helpful. Processes and prosperity of the

administration can be increased in this way. The internal processes can be monitored perfectly by

management accounting. Cost management implementing different systems in administration

and reduces the risk appetite of the administration –George stated that on the other hand. Not all

the administrations are allowed to apply the systems for getting the advantages. More labor is

needed to be integrated because some of the systems are highly structured. Costing management

of administrations used to increase this way.

Part 2 –

Benchmarking

Benchmarking is one of strategic system that allows a company to set missions and count

productivity. This particular basis of the best company practices. This is a practice in which

measurement level has used as a point of reference to evaluate things by making a comparison.

As per the standard of the administration, one of the performances is set as the standard and the

others factors in a technique.

It researches the areas, which need change, and this is the first step of this method. The goal is to

set to target the particular area. To achieve its mission the resources allocation and the planning

is done.

7

For any organization, monitoring and tracking performance are the most important advantages.

The expenditure of the administration can be reduced by using this system and these factors also

helps in decision-making, strategy planning of the organization.

D. critically evaluates how management accounting systems and management accounting

reporting is integrated within organizational processes.

For an administration, both the system of reporting and accounting are interrelated and they are

uniformly important according to Harrison and Lock (2017). To augment the profitability all

these systems are very useful. To reduce the expenses and strengthen the effectiveness,

efficiency of all the resources these systems are always helpful. Processes and prosperity of the

administration can be increased in this way. The internal processes can be monitored perfectly by

management accounting. Cost management implementing different systems in administration

and reduces the risk appetite of the administration –George stated that on the other hand. Not all

the administrations are allowed to apply the systems for getting the advantages. More labor is

needed to be integrated because some of the systems are highly structured. Costing management

of administrations used to increase this way.

Part 2 –

Benchmarking

Benchmarking is one of strategic system that allows a company to set missions and count

productivity. This particular basis of the best company practices. This is a practice in which

measurement level has used as a point of reference to evaluate things by making a comparison.

As per the standard of the administration, one of the performances is set as the standard and the

others factors in a technique.

It researches the areas, which need change, and this is the first step of this method. The goal is to

set to target the particular area. To achieve its mission the resources allocation and the planning

is done.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In the second step of this process, the resources in the administration and the financial data are

analyzed (Propa et al., 2015). In this stage the growth and the profit is also analyzed and in this

stage, it has the ability to bear the expenses that can be determined by this process.

In the administration, the factors, which are affecting the profitability, are being analyzed and

that from the process that factors effectively eliminated. By the technique of internal data

analysis, the elimination process is done and finds the poor quality of any product

By applying this method in the administration the source, the scope of the market can be found.

It also gives the opportunity to find the different external environment analysis. In addition, the

competitor analysis is done.

These processes are taken, for the process of benchmarking to be done. The performance of the

administration and the efficiency of the administration can be augmented by this process. The

internal benchmarking and the competitive benchmarking these are two different, which can be

divided for benchmarking.

The internal processes and the similar processes of the internal administration both are compared

in the internal benchmarking process. In the administration, we can find the fault, loss and etc. in

this system it is very helpful to find out the reason behind it, and after that the competitive

benchmarking is finished (Roberts and Piller, 2016). The analysis of the competitors can be done

also in this stage. In an administration, there is lots of opportunity. By this system, opportunity

can be found also, it helps to find that. With the help of functional benchmarking, the similar

process can be measured and the profitability of the administration can be augmented.

Cash flow budgeting –

Most industries are profitable on notes, still involve into problem because they have not the cash

in hand to fund the operations. The owners in these companies might be familiar along their

salary statement, but they do not have any idea their salary balance. By this method cash inflow

and cash outflow can be managed. By this budgeting method, the estimated cash flow can be

determined (parmenter, 2015). To check the position of liquidity it is operated in the

administration. By quantifying the last cash flow in the administration, the assumptions of the

8

analyzed (Propa et al., 2015). In this stage the growth and the profit is also analyzed and in this

stage, it has the ability to bear the expenses that can be determined by this process.

In the administration, the factors, which are affecting the profitability, are being analyzed and

that from the process that factors effectively eliminated. By the technique of internal data

analysis, the elimination process is done and finds the poor quality of any product

By applying this method in the administration the source, the scope of the market can be found.

It also gives the opportunity to find the different external environment analysis. In addition, the

competitor analysis is done.

These processes are taken, for the process of benchmarking to be done. The performance of the

administration and the efficiency of the administration can be augmented by this process. The

internal benchmarking and the competitive benchmarking these are two different, which can be

divided for benchmarking.

The internal processes and the similar processes of the internal administration both are compared

in the internal benchmarking process. In the administration, we can find the fault, loss and etc. in

this system it is very helpful to find out the reason behind it, and after that the competitive

benchmarking is finished (Roberts and Piller, 2016). The analysis of the competitors can be done

also in this stage. In an administration, there is lots of opportunity. By this system, opportunity

can be found also, it helps to find that. With the help of functional benchmarking, the similar

process can be measured and the profitability of the administration can be augmented.

Cash flow budgeting –

Most industries are profitable on notes, still involve into problem because they have not the cash

in hand to fund the operations. The owners in these companies might be familiar along their

salary statement, but they do not have any idea their salary balance. By this method cash inflow

and cash outflow can be managed. By this budgeting method, the estimated cash flow can be

determined (parmenter, 2015). To check the position of liquidity it is operated in the

administration. By quantifying the last cash flow in the administration, the assumptions of the

8

cash flow can be done. In the administration for estimating the future amount of cash flow , the

data of the last cash flow is analyzed.

By this method, the uncertainly future can be handled and this method helps to quantify the total

cash Inflow and outflow. The real time expenditure of the administration should be

simultaneously with this budget. Operating, investing and financing –these are the main three

activities are outlined in this budget. The amount of outflow and inflow can be estimated by

these major activities. The effectiveness of the recourses can be augmented by this system. The

liquidity of cash flows budgeting and the profitability of the administration can be augmented

also.

Discounted cash flow analysis –

Different sub methods have been included in these methods. We can call it investment appraisal

techniques or it can be called modern method (pavlatos and kostakis, 2015). Profitability index,

discounted payback period, internal rate of return and net present value – there are the four major

techniques under this analysis.

The amount of return throughout the life cycle of the assets can be considered in the net present

value method. The future value of money is worthy to consider. By this method, profitability can

be determined and by this method, entire cash flow is used to calculate.

The attractiveness of the project has been quantified by the internal rate of return. The cost of

money may be compared to the rate of the return. If the cost of the capital is less than the rate,

the investment will be considered as to be profitable and attractive. The other methods can are

more difficult, it means it is simpler to calculate under this method.

The updated version of the payback method is discounted method. The total time to repay the

loan with the value in this method, the value can be calculated. From this method, the time and

the value both can be understood, so we can say it is helpful to us. Under this method, the actual

are being considered. Whether to accept or reject a project, profitability index plays the role of

deciding. The budget of the administration needs to be fitted with the project, for that to choose

the project this method is very useful. In this method, it is not possible to determine the required

date of return and for the sunk cost of the administration, it is not helpful.

9

data of the last cash flow is analyzed.

By this method, the uncertainly future can be handled and this method helps to quantify the total

cash Inflow and outflow. The real time expenditure of the administration should be

simultaneously with this budget. Operating, investing and financing –these are the main three

activities are outlined in this budget. The amount of outflow and inflow can be estimated by

these major activities. The effectiveness of the recourses can be augmented by this system. The

liquidity of cash flows budgeting and the profitability of the administration can be augmented

also.

Discounted cash flow analysis –

Different sub methods have been included in these methods. We can call it investment appraisal

techniques or it can be called modern method (pavlatos and kostakis, 2015). Profitability index,

discounted payback period, internal rate of return and net present value – there are the four major

techniques under this analysis.

The amount of return throughout the life cycle of the assets can be considered in the net present

value method. The future value of money is worthy to consider. By this method, profitability can

be determined and by this method, entire cash flow is used to calculate.

The attractiveness of the project has been quantified by the internal rate of return. The cost of

money may be compared to the rate of the return. If the cost of the capital is less than the rate,

the investment will be considered as to be profitable and attractive. The other methods can are

more difficult, it means it is simpler to calculate under this method.

The updated version of the payback method is discounted method. The total time to repay the

loan with the value in this method, the value can be calculated. From this method, the time and

the value both can be understood, so we can say it is helpful to us. Under this method, the actual

are being considered. Whether to accept or reject a project, profitability index plays the role of

deciding. The budget of the administration needs to be fitted with the project, for that to choose

the project this method is very useful. In this method, it is not possible to determine the required

date of return and for the sunk cost of the administration, it is not helpful.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Conclusion

From the above analysis, the different situations in the administration can be understood with the

help of management accounting. In the above portion of the detailed report, analysis of costing

has been described. The different areas had been served by management accounting with various

systems. The reporting system, which are reporting and analysis have been given by the

management accounting it can be described from the above analysis the management accounting

is necessary for the administration. The profitability of administration can be augmented by

proper application of these systems.

Task 2

Part 1

Methods of Costing

Cost evaluation is an indispensible part of the administration. Proper application of cost

management techniques can be helpful in terms of expenditure reduction. As opined by (Roberts

and Piller, 2016), there are different techniques of costing applied in accordance with the

necessity of that particular administrative system. Three different kinds of costing have been

described below.

Expenditure of Job Order

Job order costing method includes the allocated cost according to the particular job completion.

As per Roberts and Armitage (2017), this method helps towards the minimization of the

manufacturing cost.

Batch costing

The cost of batch costing method, can be calculated as the production batch required. This

method is beneficial for determining the efficiency and the usefulness of the internal resources.

Batch costing is required to merge the money wastage, system of quality controller and

registration of data in a particular administrative system.

Process costing

10

From the above analysis, the different situations in the administration can be understood with the

help of management accounting. In the above portion of the detailed report, analysis of costing

has been described. The different areas had been served by management accounting with various

systems. The reporting system, which are reporting and analysis have been given by the

management accounting it can be described from the above analysis the management accounting

is necessary for the administration. The profitability of administration can be augmented by

proper application of these systems.

Task 2

Part 1

Methods of Costing

Cost evaluation is an indispensible part of the administration. Proper application of cost

management techniques can be helpful in terms of expenditure reduction. As opined by (Roberts

and Piller, 2016), there are different techniques of costing applied in accordance with the

necessity of that particular administrative system. Three different kinds of costing have been

described below.

Expenditure of Job Order

Job order costing method includes the allocated cost according to the particular job completion.

As per Roberts and Armitage (2017), this method helps towards the minimization of the

manufacturing cost.

Batch costing

The cost of batch costing method, can be calculated as the production batch required. This

method is beneficial for determining the efficiency and the usefulness of the internal resources.

Batch costing is required to merge the money wastage, system of quality controller and

registration of data in a particular administrative system.

Process costing

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

In process costing, production cost is taken care of separately. The type and variation of

manufacturing processes can be understood with the help of this costing method. On the other

hand, process costing is essential to distinguish different processes.

Costing Methods

Marginal costing

According to Yu et al. (2019), marginal costing method is very much useful and this method

takes care of variable cost as a separate entity called unit cost of production. Here, after the

calculation is done, fixed production cost is required to be mentioned.

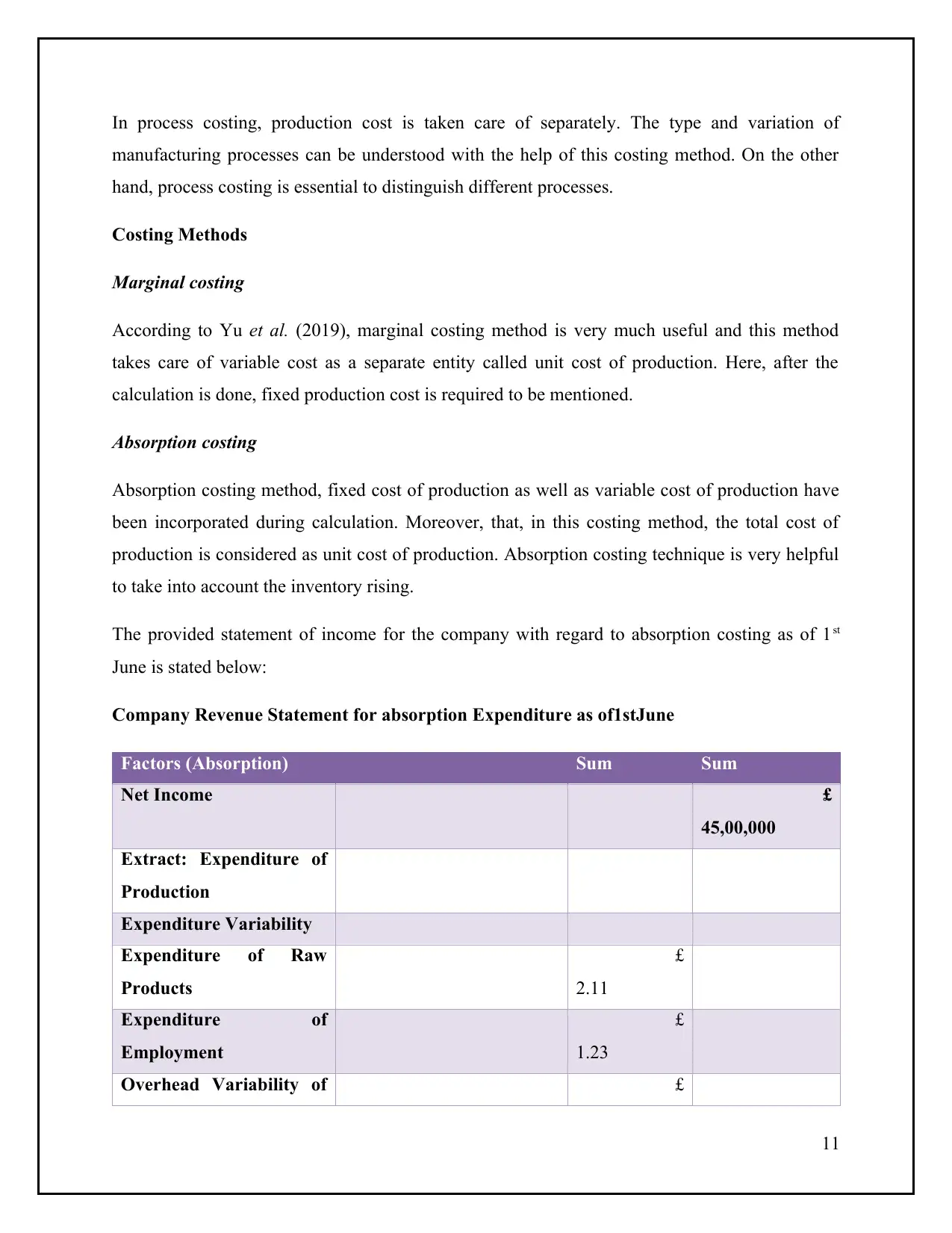

Absorption costing

Absorption costing method, fixed cost of production as well as variable cost of production have

been incorporated during calculation. Moreover, that, in this costing method, the total cost of

production is considered as unit cost of production. Absorption costing technique is very helpful

to take into account the inventory rising.

The provided statement of income for the company with regard to absorption costing as of 1st

June is stated below:

Company Revenue Statement for absorption Expenditure as of1stJune

Factors (Absorption) Sum Sum

Net Income £

45,00,000

Extract: Expenditure of

Production

Expenditure Variability

Expenditure of Raw

Products

£

2.11

Expenditure of

Employment

£

1.23

Overhead Variability of £

11

manufacturing processes can be understood with the help of this costing method. On the other

hand, process costing is essential to distinguish different processes.

Costing Methods

Marginal costing

According to Yu et al. (2019), marginal costing method is very much useful and this method

takes care of variable cost as a separate entity called unit cost of production. Here, after the

calculation is done, fixed production cost is required to be mentioned.

Absorption costing

Absorption costing method, fixed cost of production as well as variable cost of production have

been incorporated during calculation. Moreover, that, in this costing method, the total cost of

production is considered as unit cost of production. Absorption costing technique is very helpful

to take into account the inventory rising.

The provided statement of income for the company with regard to absorption costing as of 1st

June is stated below:

Company Revenue Statement for absorption Expenditure as of1stJune

Factors (Absorption) Sum Sum

Net Income £

45,00,000

Extract: Expenditure of

Production

Expenditure Variability

Expenditure of Raw

Products

£

2.11

Expenditure of

Employment

£

1.23

Overhead Variability of £

11

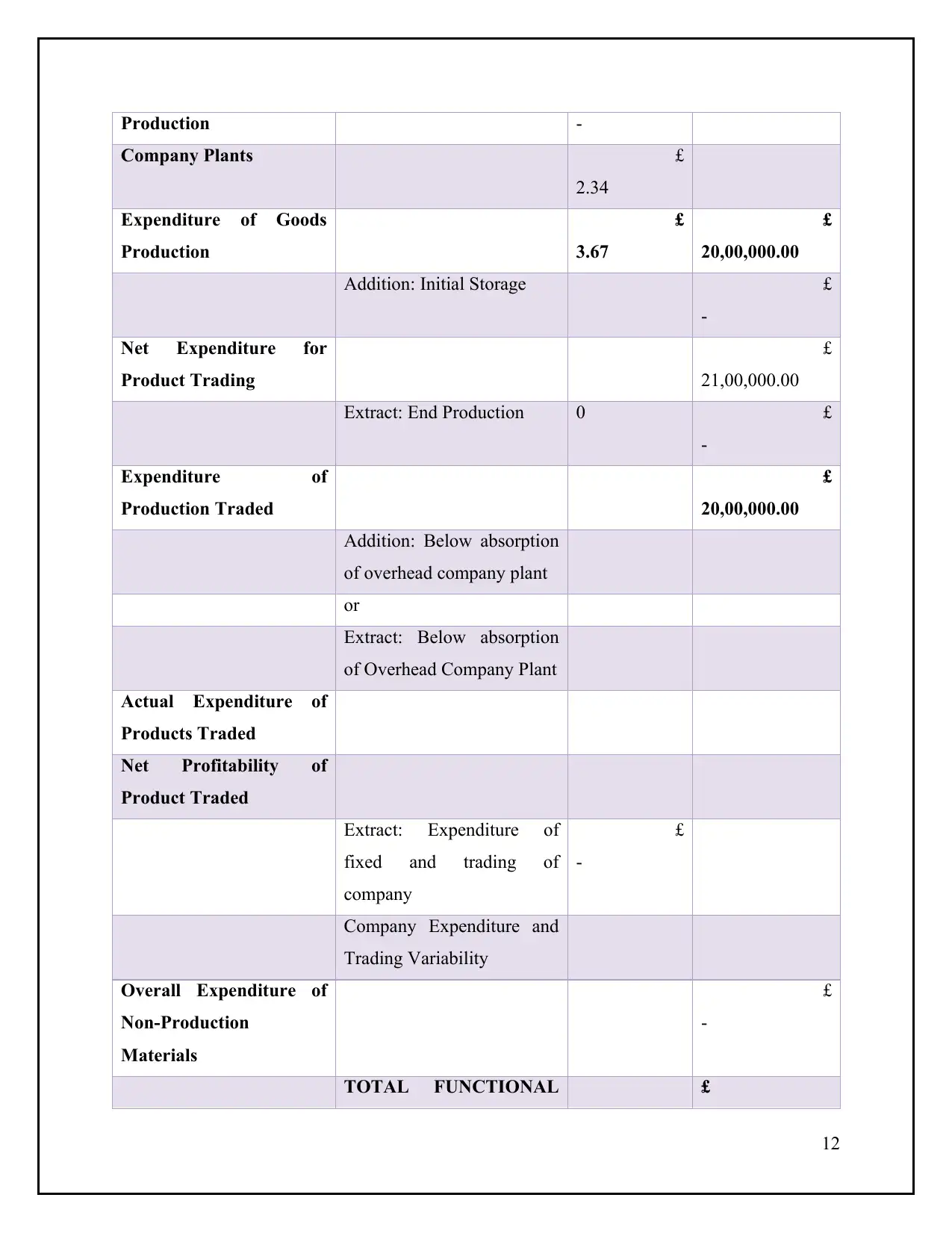

Production -

Company Plants £

2.34

Expenditure of Goods

Production

£

3.67

£

20,00,000.00

Addition: Initial Storage £

-

Net Expenditure for

Product Trading

£

21,00,000.00

Extract: End Production 0 £

-

Expenditure of

Production Traded

£

20,00,000.00

Addition: Below absorption

of overhead company plant

or

Extract: Below absorption

of Overhead Company Plant

Actual Expenditure of

Products Traded

Net Profitability of

Product Traded

Extract: Expenditure of

fixed and trading of

company

£

-

Company Expenditure and

Trading Variability

Overall Expenditure of

Non-Production

Materials

£

-

TOTAL FUNCTIONAL £

12

Company Plants £

2.34

Expenditure of Goods

Production

£

3.67

£

20,00,000.00

Addition: Initial Storage £

-

Net Expenditure for

Product Trading

£

21,00,000.00

Extract: End Production 0 £

-

Expenditure of

Production Traded

£

20,00,000.00

Addition: Below absorption

of overhead company plant

or

Extract: Below absorption

of Overhead Company Plant

Actual Expenditure of

Products Traded

Net Profitability of

Product Traded

Extract: Expenditure of

fixed and trading of

company

£

-

Company Expenditure and

Trading Variability

Overall Expenditure of

Non-Production

Materials

£

-

TOTAL FUNCTIONAL £

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.