Comprehensive Report on Management Accounting: Systems and Methods

VerifiedAdded on 2021/02/20

|16

|4300

|23

Report

AI Summary

This report delves into the core concepts of management accounting, examining its role in planning, organizing, monitoring, and controlling financial activities within a business. It explores different types of management accounting systems, including cost accounting, inventory management, job costing, and production control systems, highlighting their requirements and benefits. The report also discusses various methods of management accounting reporting, such as cash reports, production reports, sales reports, and budget reports, and provides a critical evaluation of their importance. Furthermore, it outlines different techniques of management accounting systems, like marginal costing and absorption costing, and explores planning tools for budgetary control, including fixed budgets, cash budgets, and zero-based budgets. The report emphasizes how these systems and techniques enable effective financial management and strategic decision-making within organizations.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

s

Table of Contents

INTRODUCTION.....................................................................................................................................4

MAIN BODY............................................................................................................................................4

Management accounting system and its requirements in business..................................................4

Methods of management accounting reporting .........................................................................6

1Different techniques of management accounting system...............................................................7

Different planning tools of budgetary control system.......................................................................8

Showing preparation of income statement using various techniques............................................10

Different ways in which various business organisations adopts the management accounting

systems in order to respond numerous financial problems.............................................................11

CONCLUSION.......................................................................................................................................13

REFERENCES.........................................................................................................................................15

Table of Contents

INTRODUCTION.....................................................................................................................................4

MAIN BODY............................................................................................................................................4

Management accounting system and its requirements in business..................................................4

Methods of management accounting reporting .........................................................................6

1Different techniques of management accounting system...............................................................7

Different planning tools of budgetary control system.......................................................................8

Showing preparation of income statement using various techniques............................................10

Different ways in which various business organisations adopts the management accounting

systems in order to respond numerous financial problems.............................................................11

CONCLUSION.......................................................................................................................................13

REFERENCES.........................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

It is a concept that enables a business organization to plan, organize, monitor and

control each financial activities of the business (van Helden, 2019) It includes analysis of

company’s actual condition and develops effective plans and strategies for the purpose of

helping the company in achieving its set goals and objectives. The present assignment shows

study of an overall management accounting system. It shows the essential requirements of

management accounting system within sent business organization. Further, in the present

study, a brief different description about different methods o management accounting

reporting is also been discussed. The study also shows different planning tools of budgetary

control that helps the managers in their effective management and plan formation

procedure. Furthermore, the assignment also provides information regarding various

management accounting system that help the managers in enabling the company in

developing efficiency of responding to various financial problems.

MAIN BODY

Management accounting system and its requirements in business

Management accounting system

Management accounting system refers to a part of managerial functions that is concerned

with planning, organizing monitoring and controlling a range of financial activities including

all the monitory and non monitory and non monitory transactions that company incurs for

achieving its set goals and objectives.

Adoption of effective management accounting system helps managers in improving their

own efficiency in planning, monitoring and controlling various financial and non financial

activities of the firm along with maintenance of a range of records of firm (Maalouf and El-

Fadel, 2019). In addition, management accounting system also provides various methods

through which managers can provide all material information to stakeholders of the business.

Types of management accounting system

Management accounting systems are of several types. Each type of management

accounting systems are required to be adopted by the business organization due to several

reasons. Major types of management accounting systems and the their essential requirements

within the business are as under:

Cost accounting system This system of management accounting is helpful in making

the company more cost efficient. The cost accounting is something that provide the method

It is a concept that enables a business organization to plan, organize, monitor and

control each financial activities of the business (van Helden, 2019) It includes analysis of

company’s actual condition and develops effective plans and strategies for the purpose of

helping the company in achieving its set goals and objectives. The present assignment shows

study of an overall management accounting system. It shows the essential requirements of

management accounting system within sent business organization. Further, in the present

study, a brief different description about different methods o management accounting

reporting is also been discussed. The study also shows different planning tools of budgetary

control that helps the managers in their effective management and plan formation

procedure. Furthermore, the assignment also provides information regarding various

management accounting system that help the managers in enabling the company in

developing efficiency of responding to various financial problems.

MAIN BODY

Management accounting system and its requirements in business

Management accounting system

Management accounting system refers to a part of managerial functions that is concerned

with planning, organizing monitoring and controlling a range of financial activities including

all the monitory and non monitory and non monitory transactions that company incurs for

achieving its set goals and objectives.

Adoption of effective management accounting system helps managers in improving their

own efficiency in planning, monitoring and controlling various financial and non financial

activities of the firm along with maintenance of a range of records of firm (Maalouf and El-

Fadel, 2019). In addition, management accounting system also provides various methods

through which managers can provide all material information to stakeholders of the business.

Types of management accounting system

Management accounting systems are of several types. Each type of management

accounting systems are required to be adopted by the business organization due to several

reasons. Major types of management accounting systems and the their essential requirements

within the business are as under:

Cost accounting system This system of management accounting is helpful in making

the company more cost efficient. The cost accounting is something that provide the method

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and set of rules that helps the managers in formulation of effective plans and policies for the

company and making the business more cost efficient and could improve its profitability as

well.

Benefits:

Adoption of cost accounting system is required in the business in order to develop

cost efficiency in the company.

It is required for preventing the organisation from cost wastage.

To determine cost incurred by business in each activity.

To determine actual cost of a single product or services produced by a company.

Inventory management system: Inventory management is a system of management

accounting which is being adopted by the company that needs to maintain a huge amount of

stocks with it ( Zhou, 2018). This system helps the managers in maintaining their eyes on

each movement of stock either within or outside the business organization.

Benefits:

To track each movement in the inventory.

To identify areas of wastage of inventory.

To determine the minimum and maximum amount of inventory

required by a business organisation during a specific time period.

Job costing system: Job costing system contains rules and regarding how the

company should maintain its books of accounts relating to costs incurred by the company in

case it provides customized goods and services to the firm. This system of management

accounting is helpful in determination of cost incurred in each customized product or services

rendered to the customers so that they could set the most appropriate price to be charged from

their customers so that the firm could generate appropriate amount of profit from its sales.;

Requirement

To maintain effective records of customised products.

To determine cost incurred by the organisation in producing each unit of

customised product or services.

To set the appropriate price of product or services to be charged from the

customers.

Production controlling system: Production controlling system is that category of

management accounting system that helps the managers in having their better control,

monitor and management over production activities of the firm. This technique provides

various methods through which business can maintain record of each production activity of

company and making the business more cost efficient and could improve its profitability as

well.

Benefits:

Adoption of cost accounting system is required in the business in order to develop

cost efficiency in the company.

It is required for preventing the organisation from cost wastage.

To determine cost incurred by business in each activity.

To determine actual cost of a single product or services produced by a company.

Inventory management system: Inventory management is a system of management

accounting which is being adopted by the company that needs to maintain a huge amount of

stocks with it ( Zhou, 2018). This system helps the managers in maintaining their eyes on

each movement of stock either within or outside the business organization.

Benefits:

To track each movement in the inventory.

To identify areas of wastage of inventory.

To determine the minimum and maximum amount of inventory

required by a business organisation during a specific time period.

Job costing system: Job costing system contains rules and regarding how the

company should maintain its books of accounts relating to costs incurred by the company in

case it provides customized goods and services to the firm. This system of management

accounting is helpful in determination of cost incurred in each customized product or services

rendered to the customers so that they could set the most appropriate price to be charged from

their customers so that the firm could generate appropriate amount of profit from its sales.;

Requirement

To maintain effective records of customised products.

To determine cost incurred by the organisation in producing each unit of

customised product or services.

To set the appropriate price of product or services to be charged from the

customers.

Production controlling system: Production controlling system is that category of

management accounting system that helps the managers in having their better control,

monitor and management over production activities of the firm. This technique provides

various methods through which business can maintain record of each production activity of

the organization ( Ayoubi,2018). In this regard, the managers can easily determine the need

of units to be required to produced by the business. Therefore, this method helps in setting the

most appropriate unit to be produced by the firm in a specific period in order to eliminate

chances of insufficiency of products in fulfilling the needs of company and excessive of

products within the business as well. In this order, this technique helps the firm in developing

effective management of production activities of the business organization.

Requirements:

To maintain records regarding various activities performed by a business for

production purpose.

To determine the minimum amount to be produced by the company for satisfying

demands of customers.

Methods of management accounting reporting

Management accounting reporting can be defined as a process of analysing each

business transaction and summarising them into a report format in such a way so that they

could provide a detailed information regarding various transactions that a business makes

during performing its business activities within a specific time period.

Methods of management accounting reporting

Methods of management accounting reporting are those that helps in successful

formulation of management accounting reports for the company (Arnold, 2018). The core

methods of management accounting reporting are as under:

Cash reports: Cash reports are those that contains details about the transaction made

by the company that has affected cash of the company. These reports help the

managers in monitoring the movement of cash in the business. In this regard, these

reports are helpful for managers at the time of framing their policies regarding cash

resources of the firm.

Production reports: Production reports refer to statement prepared by gathering,

analysing and summarising various activities of the business regarding its production.

Production reports help the managers in determining the overall production of the

company.

Sales reports: Sales reports are made by a managerial accountant in order to

summarising the transactions regarding overall sales activities of the company. These

reports contain details of unit of sales and revenue generate by the organisation by

selling those units in the market as well. Sales reports are important in the business in

order to maintain appropriate records of total revenue generated by business during a

specific time period.

of units to be required to produced by the business. Therefore, this method helps in setting the

most appropriate unit to be produced by the firm in a specific period in order to eliminate

chances of insufficiency of products in fulfilling the needs of company and excessive of

products within the business as well. In this order, this technique helps the firm in developing

effective management of production activities of the business organization.

Requirements:

To maintain records regarding various activities performed by a business for

production purpose.

To determine the minimum amount to be produced by the company for satisfying

demands of customers.

Methods of management accounting reporting

Management accounting reporting can be defined as a process of analysing each

business transaction and summarising them into a report format in such a way so that they

could provide a detailed information regarding various transactions that a business makes

during performing its business activities within a specific time period.

Methods of management accounting reporting

Methods of management accounting reporting are those that helps in successful

formulation of management accounting reports for the company (Arnold, 2018). The core

methods of management accounting reporting are as under:

Cash reports: Cash reports are those that contains details about the transaction made

by the company that has affected cash of the company. These reports help the

managers in monitoring the movement of cash in the business. In this regard, these

reports are helpful for managers at the time of framing their policies regarding cash

resources of the firm.

Production reports: Production reports refer to statement prepared by gathering,

analysing and summarising various activities of the business regarding its production.

Production reports help the managers in determining the overall production of the

company.

Sales reports: Sales reports are made by a managerial accountant in order to

summarising the transactions regarding overall sales activities of the company. These

reports contain details of unit of sales and revenue generate by the organisation by

selling those units in the market as well. Sales reports are important in the business in

order to maintain appropriate records of total revenue generated by business during a

specific time period.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Budget reports: Budgets are the statements showing estimated position of the

company. There are various categories of budget reports such as operational budgets,

sales budgets, production budgets, etc. Each budget shows estimated performance o

various departments that is needed to be performed so as to achieve the set goals and

objectives of the company. These reports help the managers in setting short term goals

of the business organisation.

Critical evaluation of management accounting and management accounting reporting

Management accounting and management accounting reporting are two essential

elements of overall managerial functions of a company. Both helps managers in their

effective management and controlling functioning (Duska, Duska and Kury, 2018).

Although, adoption of these systems within a business organisation requires professional

skills of the managers for which company may needs to spend more time and money on

management functions. But along with this, the adoption of these techniques can also result

more effective formulation of plans and strategies for the business in near future. In this

regard, it can be evaluated that a business organisation must adopt management accounting

system and management accounting reporting as it helps the managers in providing positive

results to the business.

1 Different techniques of management accounting system

2 Techniques of management accounting systems:

These are the techniques which are used for making income statements such as Marginal

costing and Absorption costing systems. These methods are adopted by different

organisations in order to form the income statements of the company as they both have

dissimilar met hods for calculating numerous of income statement, production cost is an

example.

Various techniques of management accounting systems can be classified as under

Marginal costing system: This technique is used for formulation of income

statement for a specific time period of time. This method considers all the fixed cost

incurred while production as a period cost. On the other hand, each variable cost

incurred for the production purpose are being considered as product cost. In this

order, only variable overheads become part of production cost while calculating

profits for the company.

Absorption costing system: This method considers each costs incurred by the

company for the production purpose as a part of production cost. In this regard, all the

overheads are being taken into account at the time of calculating cost of production of

the company. It is the major reason behind different arisen in the amount of cost of

production and profit generated by the company. Further, due to inclusion of all costs,

this method provides lower amount of profit generated by the company.

Different planning tools of budgetary control system

Budgetary control system

company. There are various categories of budget reports such as operational budgets,

sales budgets, production budgets, etc. Each budget shows estimated performance o

various departments that is needed to be performed so as to achieve the set goals and

objectives of the company. These reports help the managers in setting short term goals

of the business organisation.

Critical evaluation of management accounting and management accounting reporting

Management accounting and management accounting reporting are two essential

elements of overall managerial functions of a company. Both helps managers in their

effective management and controlling functioning (Duska, Duska and Kury, 2018).

Although, adoption of these systems within a business organisation requires professional

skills of the managers for which company may needs to spend more time and money on

management functions. But along with this, the adoption of these techniques can also result

more effective formulation of plans and strategies for the business in near future. In this

regard, it can be evaluated that a business organisation must adopt management accounting

system and management accounting reporting as it helps the managers in providing positive

results to the business.

1 Different techniques of management accounting system

2 Techniques of management accounting systems:

These are the techniques which are used for making income statements such as Marginal

costing and Absorption costing systems. These methods are adopted by different

organisations in order to form the income statements of the company as they both have

dissimilar met hods for calculating numerous of income statement, production cost is an

example.

Various techniques of management accounting systems can be classified as under

Marginal costing system: This technique is used for formulation of income

statement for a specific time period of time. This method considers all the fixed cost

incurred while production as a period cost. On the other hand, each variable cost

incurred for the production purpose are being considered as product cost. In this

order, only variable overheads become part of production cost while calculating

profits for the company.

Absorption costing system: This method considers each costs incurred by the

company for the production purpose as a part of production cost. In this regard, all the

overheads are being taken into account at the time of calculating cost of production of

the company. It is the major reason behind different arisen in the amount of cost of

production and profit generated by the company. Further, due to inclusion of all costs,

this method provides lower amount of profit generated by the company.

Different planning tools of budgetary control system

Budgetary control system

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The term budgetary control system refers to a process that includes analysis and

evaluation of the actual position of the company for the purpose of analysing efficiency of the

overall business. Further, it includes analysing the set goals and objectives to be achieved by

the business in its near future. By comparing both the results, the managers become able to

formulate their policies and strategies for the business organisation.

Planning tools for budgetary control system:

Planning tools for the budgetary control system are the tools that help the managers in

preparation of budgetary reports. Fixed budgets, zero based budgets, performance budgets,

operational budgets are some major planning tools of the budgetary control system of the

company. These can be understand as under:

Fixed budgets: Fixed budgets are those that are being prepared by estimating various

incomes and expenses of the company that could be generated by the managers

irrespective of the number of units produced by the company.

Advantages:

o Fixed budget is not required to be prepared on monthly or daily basis. It is

useful for the business until there is a change in any fixed income or expense

of the business.

o It is an easy task to prepare a fixed budget.

Disadvantages

o Fixed budget does not provide information regarding quantity of units to be

prepared by the business during a specific time period.

Cash budgets: Cash budget helps the managers in determining various areas in which

the company would need to invest its cash and cash equivalents (Apostolou and et.al.,

2019). In addition, these budgets also shows various sources from which the company

would be able to generate the cash in the future whenever it would be needed. In this

order, this planning tool of the budgetary control system helps the managers in

planning for the maintenance of sufficient amount of cash and cash equivalents of the

company in order to ensure smooth functioning of company.

Advantages:

It identifies the amount of cash needed in order to fulfil immediate

It helps in better budgeting

It helps in quickly identifying potential deficit

Disadvantages

evaluation of the actual position of the company for the purpose of analysing efficiency of the

overall business. Further, it includes analysing the set goals and objectives to be achieved by

the business in its near future. By comparing both the results, the managers become able to

formulate their policies and strategies for the business organisation.

Planning tools for budgetary control system:

Planning tools for the budgetary control system are the tools that help the managers in

preparation of budgetary reports. Fixed budgets, zero based budgets, performance budgets,

operational budgets are some major planning tools of the budgetary control system of the

company. These can be understand as under:

Fixed budgets: Fixed budgets are those that are being prepared by estimating various

incomes and expenses of the company that could be generated by the managers

irrespective of the number of units produced by the company.

Advantages:

o Fixed budget is not required to be prepared on monthly or daily basis. It is

useful for the business until there is a change in any fixed income or expense

of the business.

o It is an easy task to prepare a fixed budget.

Disadvantages

o Fixed budget does not provide information regarding quantity of units to be

prepared by the business during a specific time period.

Cash budgets: Cash budget helps the managers in determining various areas in which

the company would need to invest its cash and cash equivalents (Apostolou and et.al.,

2019). In addition, these budgets also shows various sources from which the company

would be able to generate the cash in the future whenever it would be needed. In this

order, this planning tool of the budgetary control system helps the managers in

planning for the maintenance of sufficient amount of cash and cash equivalents of the

company in order to ensure smooth functioning of company.

Advantages:

It identifies the amount of cash needed in order to fulfil immediate

It helps in better budgeting

It helps in quickly identifying potential deficit

Disadvantages

It does not provide flexibility

It limits our ability to create a credit profit

It limits our spending power

Zero based budgets: Zero based budgets are are prepared by starting analysing the

business organisation as a start up company. Managers does not consider any

previously developed budgets for preparing budgets for estimating near future. Rather

they analyses the goals and objectives of the company and developes their plans and

policies accordingly.

Advantages:

It make sure of inheritance Expenses

It identifies outsourcing opportunities

Disadvantages

It requires manpower

It consumes a lot of time

It is too complex and requires detailed attention

Performance budgets: Performance budgets are the statements showing estimated

performance of various business departments including managers’ own performance.

Therefore, preparation of performance budgets helps inn estimating overall efficiency

of the firm. Further, its advantages and disadvantages are as under:

Advantages:

It provides transparency in budget preparation

It helps to decrease unnecessary expenses

Disadvantages:

It does not provide quantitative information

It cannot be used for long term planning

Operational budgets: Operational budgets shows financial estimated performance of

the business organisation. It helps the managers in estimation of numerous incomes

and expenses of the company that is needed to be made by the firm in its near future.

In addition, it enables the managers in maintaining sufficient amount of funds so that

It limits our ability to create a credit profit

It limits our spending power

Zero based budgets: Zero based budgets are are prepared by starting analysing the

business organisation as a start up company. Managers does not consider any

previously developed budgets for preparing budgets for estimating near future. Rather

they analyses the goals and objectives of the company and developes their plans and

policies accordingly.

Advantages:

It make sure of inheritance Expenses

It identifies outsourcing opportunities

Disadvantages

It requires manpower

It consumes a lot of time

It is too complex and requires detailed attention

Performance budgets: Performance budgets are the statements showing estimated

performance of various business departments including managers’ own performance.

Therefore, preparation of performance budgets helps inn estimating overall efficiency

of the firm. Further, its advantages and disadvantages are as under:

Advantages:

It provides transparency in budget preparation

It helps to decrease unnecessary expenses

Disadvantages:

It does not provide quantitative information

It cannot be used for long term planning

Operational budgets: Operational budgets shows financial estimated performance of

the business organisation. It helps the managers in estimation of numerous incomes

and expenses of the company that is needed to be made by the firm in its near future.

In addition, it enables the managers in maintaining sufficient amount of funds so that

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

company can become able to pay all its debts. furthermore, the operational budgets

also helps in predicting the financial position of the business organisation.

Advantages:

It helps in managing expenses

It helps to increase accountability

It helps in facing various financial responsibilities

Disadvantages

Professional skills of managers are required to make it

It is an very lengthy process.

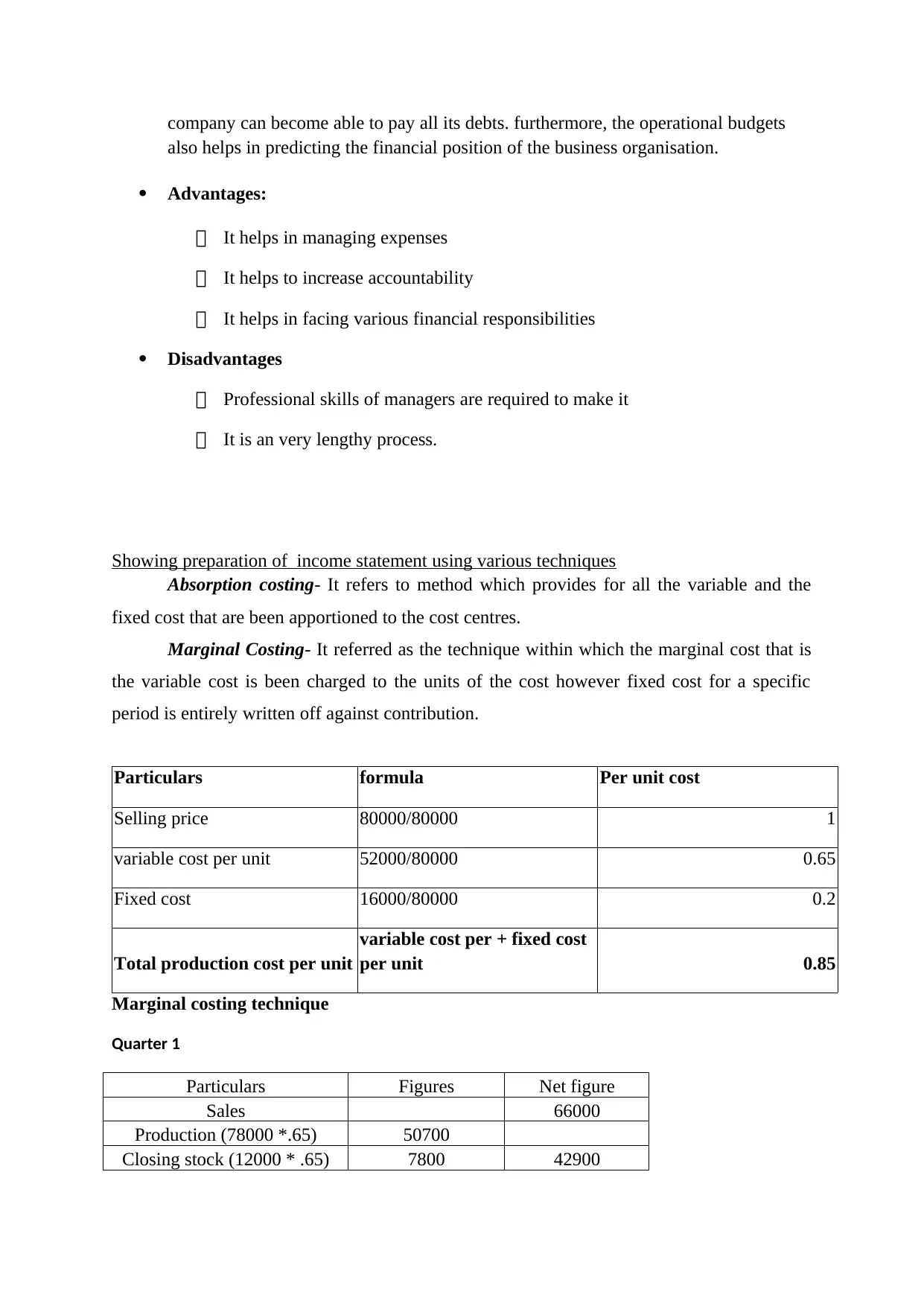

Showing preparation of income statement using various techniques

Absorption costing- It refers to method which provides for all the variable and the

fixed cost that are been apportioned to the cost centres.

Marginal Costing- It referred as the technique within which the marginal cost that is

the variable cost is been charged to the units of the cost however fixed cost for a specific

period is entirely written off against contribution.

Particulars formula Per unit cost

Selling price 80000/80000 1

variable cost per unit 52000/80000 0.65

Fixed cost 16000/80000 0.2

Total production cost per unit

variable cost per + fixed cost

per unit 0.85

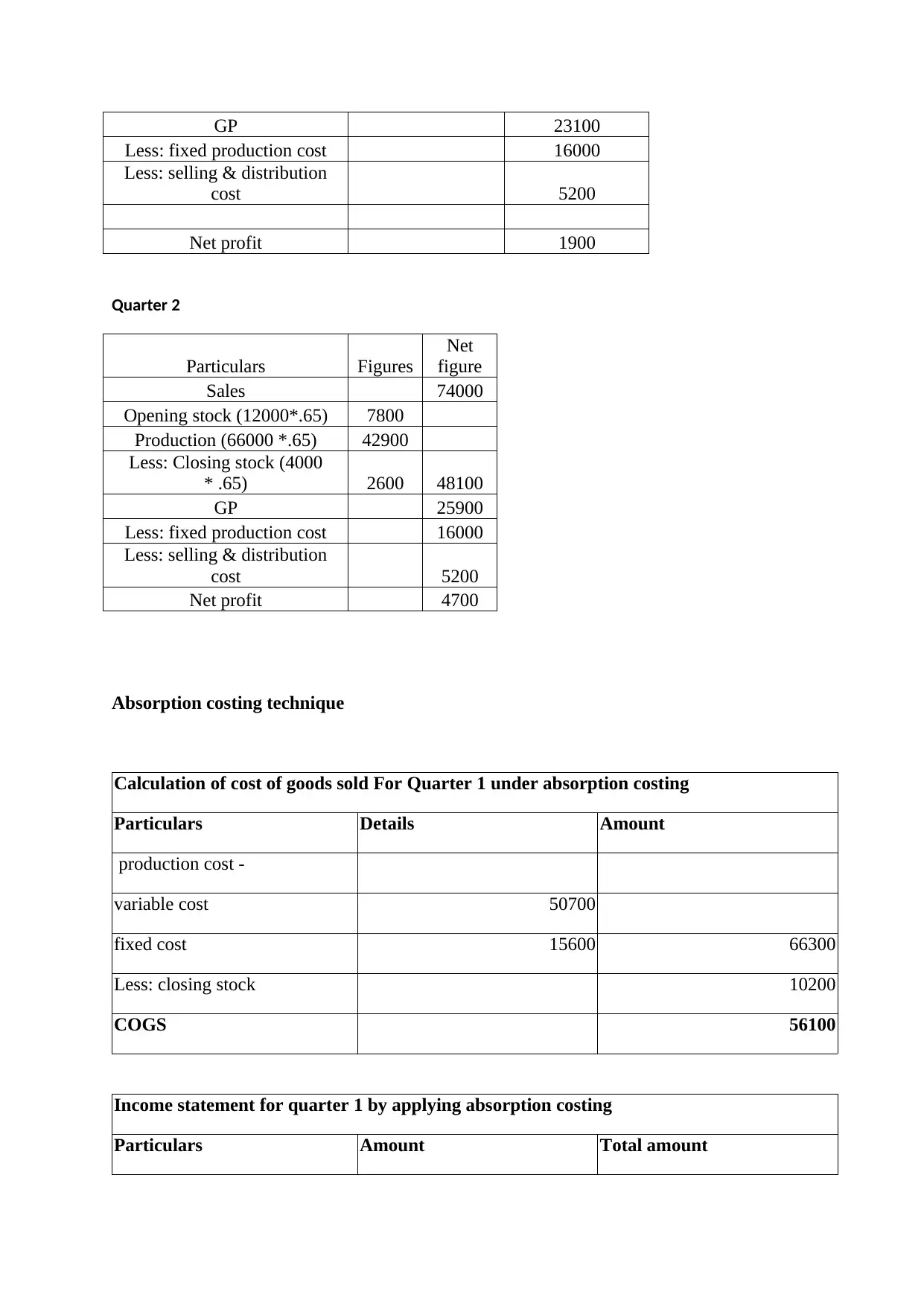

Marginal costing technique

Quarter 1

Particulars Figures Net figure

Sales 66000

Production (78000 *.65) 50700

Closing stock (12000 * .65) 7800 42900

also helps in predicting the financial position of the business organisation.

Advantages:

It helps in managing expenses

It helps to increase accountability

It helps in facing various financial responsibilities

Disadvantages

Professional skills of managers are required to make it

It is an very lengthy process.

Showing preparation of income statement using various techniques

Absorption costing- It refers to method which provides for all the variable and the

fixed cost that are been apportioned to the cost centres.

Marginal Costing- It referred as the technique within which the marginal cost that is

the variable cost is been charged to the units of the cost however fixed cost for a specific

period is entirely written off against contribution.

Particulars formula Per unit cost

Selling price 80000/80000 1

variable cost per unit 52000/80000 0.65

Fixed cost 16000/80000 0.2

Total production cost per unit

variable cost per + fixed cost

per unit 0.85

Marginal costing technique

Quarter 1

Particulars Figures Net figure

Sales 66000

Production (78000 *.65) 50700

Closing stock (12000 * .65) 7800 42900

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

GP 23100

Less: fixed production cost 16000

Less: selling & distribution

cost 5200

Net profit 1900

Quarter 2

Particulars Figures

Net

figure

Sales 74000

Opening stock (12000*.65) 7800

Production (66000 *.65) 42900

Less: Closing stock (4000

* .65) 2600 48100

GP 25900

Less: fixed production cost 16000

Less: selling & distribution

cost 5200

Net profit 4700

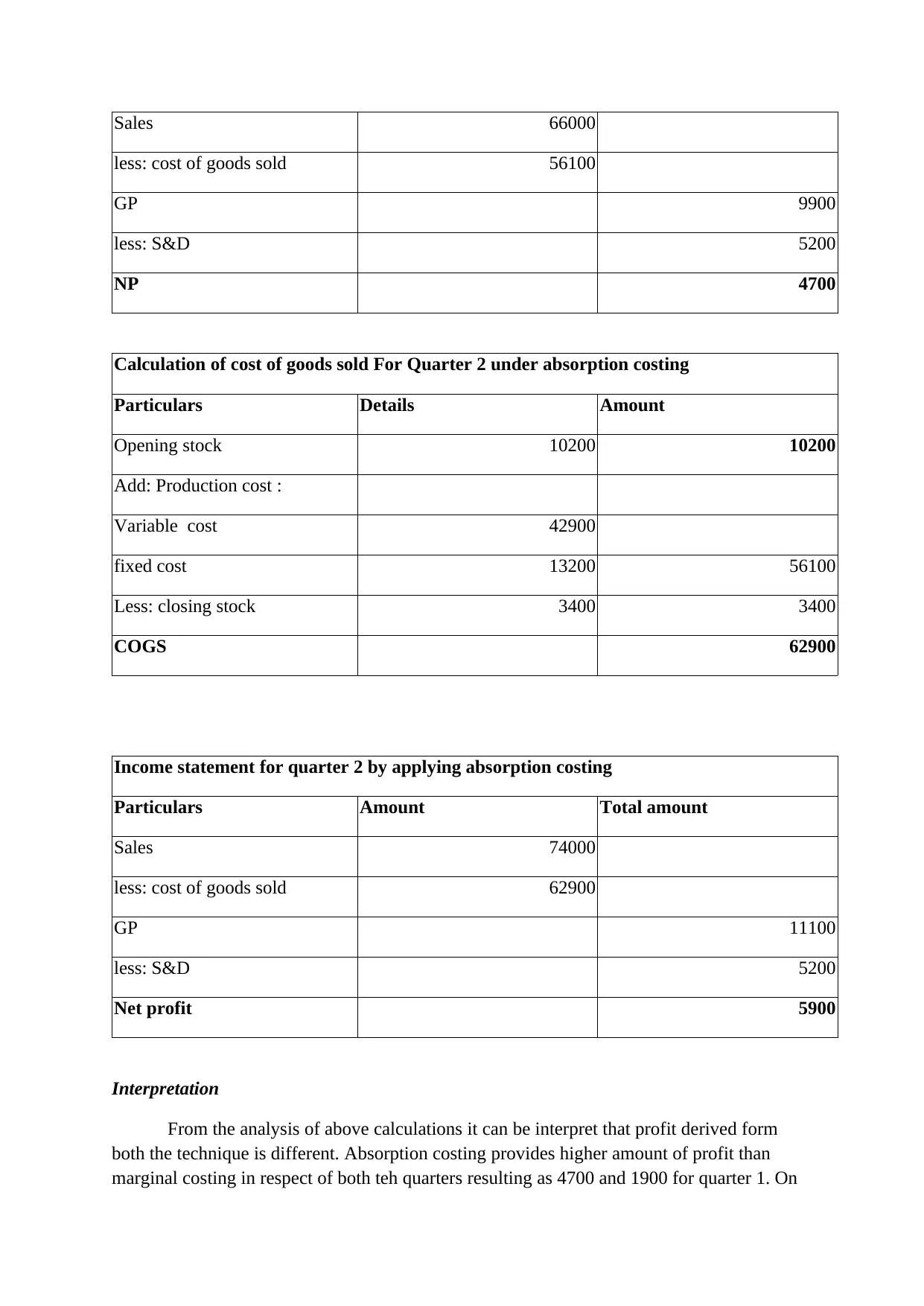

Absorption costing technique

Calculation of cost of goods sold For Quarter 1 under absorption costing

Particulars Details Amount

production cost -

variable cost 50700

fixed cost 15600 66300

Less: closing stock 10200

COGS 56100

Income statement for quarter 1 by applying absorption costing

Particulars Amount Total amount

Less: fixed production cost 16000

Less: selling & distribution

cost 5200

Net profit 1900

Quarter 2

Particulars Figures

Net

figure

Sales 74000

Opening stock (12000*.65) 7800

Production (66000 *.65) 42900

Less: Closing stock (4000

* .65) 2600 48100

GP 25900

Less: fixed production cost 16000

Less: selling & distribution

cost 5200

Net profit 4700

Absorption costing technique

Calculation of cost of goods sold For Quarter 1 under absorption costing

Particulars Details Amount

production cost -

variable cost 50700

fixed cost 15600 66300

Less: closing stock 10200

COGS 56100

Income statement for quarter 1 by applying absorption costing

Particulars Amount Total amount

Sales 66000

less: cost of goods sold 56100

GP 9900

less: S&D 5200

NP 4700

Calculation of cost of goods sold For Quarter 2 under absorption costing

Particulars Details Amount

Opening stock 10200 10200

Add: Production cost :

Variable cost 42900

fixed cost 13200 56100

Less: closing stock 3400 3400

COGS 62900

Income statement for quarter 2 by applying absorption costing

Particulars Amount Total amount

Sales 74000

less: cost of goods sold 62900

GP 11100

less: S&D 5200

Net profit 5900

Interpretation

From the analysis of above calculations it can be interpret that profit derived form

both the technique is different. Absorption costing provides higher amount of profit than

marginal costing in respect of both teh quarters resulting as 4700 and 1900 for quarter 1. On

less: cost of goods sold 56100

GP 9900

less: S&D 5200

NP 4700

Calculation of cost of goods sold For Quarter 2 under absorption costing

Particulars Details Amount

Opening stock 10200 10200

Add: Production cost :

Variable cost 42900

fixed cost 13200 56100

Less: closing stock 3400 3400

COGS 62900

Income statement for quarter 2 by applying absorption costing

Particulars Amount Total amount

Sales 74000

less: cost of goods sold 62900

GP 11100

less: S&D 5200

Net profit 5900

Interpretation

From the analysis of above calculations it can be interpret that profit derived form

both the technique is different. Absorption costing provides higher amount of profit than

marginal costing in respect of both teh quarters resulting as 4700 and 1900 for quarter 1. On

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.