Report on Management Accounting Systems and Techniques for Business

VerifiedAdded on 2020/12/10

|17

|5429

|184

Report

AI Summary

This report provides a comprehensive analysis of management accounting systems and techniques, focusing on their application within an organizational context, using Italian Continental Stores as a case study. It explores the core concepts of management accounting, differentiating it from financial accounting and outlining various systems such as job costing, price optimization, inventory management, and cost accounting. The report delves into different reporting methods, including budget reports and inventory management reports. Furthermore, it examines cost calculation techniques like marginal and absorption costing, along with the advantages and disadvantages of planning tools used in budgetary control. The implementation of management accounting systems to address financial problems and challenges is also discussed, alongside an evaluation of these systems' effectiveness.

MANAGEMENT ACCOUNTING

SYSTEMS & TECHNIQUES

SYSTEMS & TECHNIQUES

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and requirement of different accounting systems..........................1

P2 Various reporting methods used in management reporting...................................................5

M1 Benefits of management accounting systems and their application with in organisation....7

D1 Integration between the management accounting system and management accounting

reports..........................................................................................................................................7

TASK 2............................................................................................................................................8

P3 Calculation of cost using appropriate techniques as marginal and absorption......................8

M2 Application of range of management accounting techniques and financial reporting.......10

TASK 3..........................................................................................................................................10

P4 Advantages and disadvantages of various type of planning tools used in budgetary control

process.......................................................................................................................................10

M3 implementation off planning tools for preparing and forecasting budgets.........................11

D3 Planning tools for accounting respond to solve financial problems....................................11

TASK 4..........................................................................................................................................11

P5 Implement of management accounting system to respond financial problems with

comparison................................................................................................................................11

M4 Evaluation of MA systems subject to respond financial problems....................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and requirement of different accounting systems..........................1

P2 Various reporting methods used in management reporting...................................................5

M1 Benefits of management accounting systems and their application with in organisation....7

D1 Integration between the management accounting system and management accounting

reports..........................................................................................................................................7

TASK 2............................................................................................................................................8

P3 Calculation of cost using appropriate techniques as marginal and absorption......................8

M2 Application of range of management accounting techniques and financial reporting.......10

TASK 3..........................................................................................................................................10

P4 Advantages and disadvantages of various type of planning tools used in budgetary control

process.......................................................................................................................................10

M3 implementation off planning tools for preparing and forecasting budgets.........................11

D3 Planning tools for accounting respond to solve financial problems....................................11

TASK 4..........................................................................................................................................11

P5 Implement of management accounting system to respond financial problems with

comparison................................................................................................................................11

M4 Evaluation of MA systems subject to respond financial problems....................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management accounting has become an essential element to manage and operate the

functions and operations of business. Effective management and control of operations mainly

helps in determining the policies and plans for analysing opportunities and risk assessment. An

organised and well structured management accounting system deals with different type of

uncertainties and plans for better evaluation and control (Nahar and Yaacob, 2011). Italian

Continental Stores food retailer that supply is the chosen organisation to execute the

management accounting concept.

This report is prepared to analyse the management accounting concept and its

requirements in different organisational context are defined in this report. Profit evaluation by

implementing marginal and absorption costing are considered in this report. Use of various

planning tools are introduced for effective decision making process and evaluating the business

plans. Implementation of management accounting system in terms of determining the financial

problems and challenges and how the system be able to respond these problems in adequate way

are considered in this report.

TASK 1

P1 Management accounting and requirement of different accounting systems

Management Accounting

Management accounting is a process of preparing management reports and provide

accurate accounts on time to help managers for taking day to day and short term decision. These

information may be produced in financial and statistical form. It involves in partnering in

management decision making, devising performance management system and planning and it

assist the management committed to control the functions of business (Maas, Schaltegger and

Crutzen, 2016).

Management accounting analyses information and advise strategies for business strategy

and drive sustainable business success. It is also considered as managerial accounting. It is used

for analysing and recording essential transactions to business activities for company and increase

efficiency and productivity. Objectives of management accounting is to assist in planning,

organising, motivating, coordinating, controlling, communicating and interpreting financial

information.

1

Management accounting has become an essential element to manage and operate the

functions and operations of business. Effective management and control of operations mainly

helps in determining the policies and plans for analysing opportunities and risk assessment. An

organised and well structured management accounting system deals with different type of

uncertainties and plans for better evaluation and control (Nahar and Yaacob, 2011). Italian

Continental Stores food retailer that supply is the chosen organisation to execute the

management accounting concept.

This report is prepared to analyse the management accounting concept and its

requirements in different organisational context are defined in this report. Profit evaluation by

implementing marginal and absorption costing are considered in this report. Use of various

planning tools are introduced for effective decision making process and evaluating the business

plans. Implementation of management accounting system in terms of determining the financial

problems and challenges and how the system be able to respond these problems in adequate way

are considered in this report.

TASK 1

P1 Management accounting and requirement of different accounting systems

Management Accounting

Management accounting is a process of preparing management reports and provide

accurate accounts on time to help managers for taking day to day and short term decision. These

information may be produced in financial and statistical form. It involves in partnering in

management decision making, devising performance management system and planning and it

assist the management committed to control the functions of business (Maas, Schaltegger and

Crutzen, 2016).

Management accounting analyses information and advise strategies for business strategy

and drive sustainable business success. It is also considered as managerial accounting. It is used

for analysing and recording essential transactions to business activities for company and increase

efficiency and productivity. Objectives of management accounting is to assist in planning,

organising, motivating, coordinating, controlling, communicating and interpreting financial

information.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

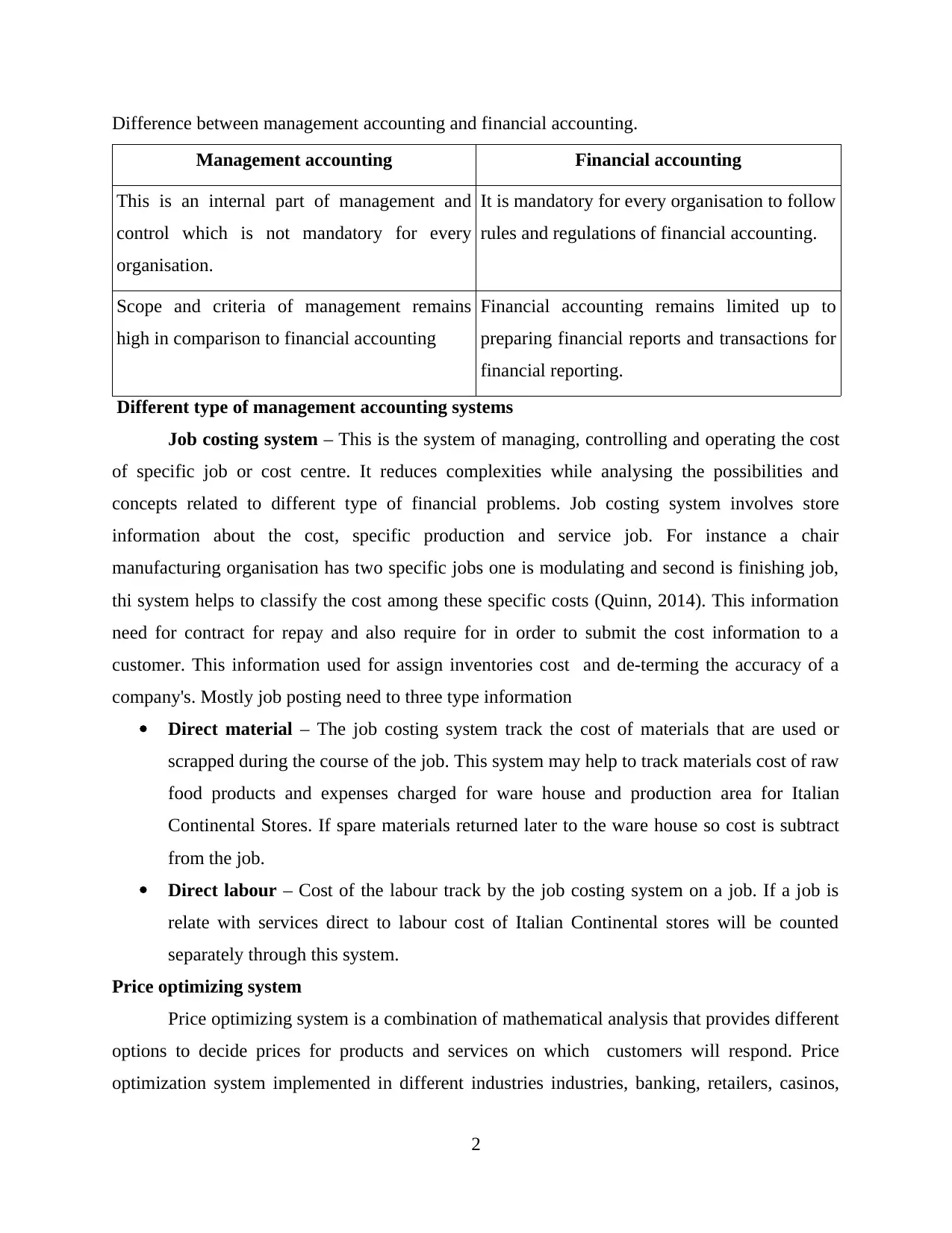

Difference between management accounting and financial accounting.

Management accounting Financial accounting

This is an internal part of management and

control which is not mandatory for every

organisation.

It is mandatory for every organisation to follow

rules and regulations of financial accounting.

Scope and criteria of management remains

high in comparison to financial accounting

Financial accounting remains limited up to

preparing financial reports and transactions for

financial reporting.

Different type of management accounting systems

Job costing system – This is the system of managing, controlling and operating the cost

of specific job or cost centre. It reduces complexities while analysing the possibilities and

concepts related to different type of financial problems. Job costing system involves store

information about the cost, specific production and service job. For instance a chair

manufacturing organisation has two specific jobs one is modulating and second is finishing job,

thi system helps to classify the cost among these specific costs (Quinn, 2014). This information

need for contract for repay and also require for in order to submit the cost information to a

customer. This information used for assign inventories cost and de-terming the accuracy of a

company's. Mostly job posting need to three type information

Direct material – The job costing system track the cost of materials that are used or

scrapped during the course of the job. This system may help to track materials cost of raw

food products and expenses charged for ware house and production area for Italian

Continental Stores. If spare materials returned later to the ware house so cost is subtract

from the job.

Direct labour – Cost of the labour track by the job costing system on a job. If a job is

relate with services direct to labour cost of Italian Continental stores will be counted

separately through this system.

Price optimizing system

Price optimizing system is a combination of mathematical analysis that provides different

options to decide prices for products and services on which customers will respond. Price

optimization system implemented in different industries industries, banking, retailers, casinos,

2

Management accounting Financial accounting

This is an internal part of management and

control which is not mandatory for every

organisation.

It is mandatory for every organisation to follow

rules and regulations of financial accounting.

Scope and criteria of management remains

high in comparison to financial accounting

Financial accounting remains limited up to

preparing financial reports and transactions for

financial reporting.

Different type of management accounting systems

Job costing system – This is the system of managing, controlling and operating the cost

of specific job or cost centre. It reduces complexities while analysing the possibilities and

concepts related to different type of financial problems. Job costing system involves store

information about the cost, specific production and service job. For instance a chair

manufacturing organisation has two specific jobs one is modulating and second is finishing job,

thi system helps to classify the cost among these specific costs (Quinn, 2014). This information

need for contract for repay and also require for in order to submit the cost information to a

customer. This information used for assign inventories cost and de-terming the accuracy of a

company's. Mostly job posting need to three type information

Direct material – The job costing system track the cost of materials that are used or

scrapped during the course of the job. This system may help to track materials cost of raw

food products and expenses charged for ware house and production area for Italian

Continental Stores. If spare materials returned later to the ware house so cost is subtract

from the job.

Direct labour – Cost of the labour track by the job costing system on a job. If a job is

relate with services direct to labour cost of Italian Continental stores will be counted

separately through this system.

Price optimizing system

Price optimizing system is a combination of mathematical analysis that provides different

options to decide prices for products and services on which customers will respond. Price

optimization system implemented in different industries industries, banking, retailers, casinos,

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

hotels, car rental, cruise lines and insurance industries. Price optimization system objective is

maximizing of operating profit and used for determining the price of Italian Continental stores.

Price optimization includes operating costs, inventories and historic prices and sales (van der

Steen, 2011). This system used to take control of the prices of resources, deciding the prices of

the multiple products.

Inventory management system

This type of management accounting system is a system helps to manage and control of

inventories with in the organisation. This management system tracking goods through supply

chain. It can be fulfil the management requirements in the form of better reporting and

forecasting capabilities, better organization, improved supplier, vendor and partner relationship,

reduced labour loss and reduction in storage costs (Hiebl, Feldbauer-Durstmüller and Duller,

2013). Through this system Italian Continental stores would be able to achieve efficient and

effective flow of inventory with organization on the point of view of sale. Inventory are managed

in following ways:

Raw materials – Any material, such as oil, cotton or sugar that are basic substance in its

natural, modified or semi processed state, used for production as input and transformation

into a finished goods.

Working-in-progress – the stock are yet to be manufacture to finished goods are

considered in WIP stock. Started but not completed and this item will be show in a profit

and loss account.

Finished goods – These are the goods have been passed through manufacturing process

but which are on hold for delivery and selling.

Perceptual inventory – Perpetual inventory system describe method of accounting for

inventory that records transactions of sale and purchase through the use of computerized.

This inventory system information related to inventory like changes in inventory, amount

of inventory in stock and level of goods of hand. Modern shipping and receiving

department are the examples of price.

Periodic inventory – Periodic inventory system method of maintain inventory on a

periodic basis for the valuation for financial reporting purpose. This method at the

beginning keep track of the inventory and record transaction according to assets section

3

maximizing of operating profit and used for determining the price of Italian Continental stores.

Price optimization includes operating costs, inventories and historic prices and sales (van der

Steen, 2011). This system used to take control of the prices of resources, deciding the prices of

the multiple products.

Inventory management system

This type of management accounting system is a system helps to manage and control of

inventories with in the organisation. This management system tracking goods through supply

chain. It can be fulfil the management requirements in the form of better reporting and

forecasting capabilities, better organization, improved supplier, vendor and partner relationship,

reduced labour loss and reduction in storage costs (Hiebl, Feldbauer-Durstmüller and Duller,

2013). Through this system Italian Continental stores would be able to achieve efficient and

effective flow of inventory with organization on the point of view of sale. Inventory are managed

in following ways:

Raw materials – Any material, such as oil, cotton or sugar that are basic substance in its

natural, modified or semi processed state, used for production as input and transformation

into a finished goods.

Working-in-progress – the stock are yet to be manufacture to finished goods are

considered in WIP stock. Started but not completed and this item will be show in a profit

and loss account.

Finished goods – These are the goods have been passed through manufacturing process

but which are on hold for delivery and selling.

Perceptual inventory – Perpetual inventory system describe method of accounting for

inventory that records transactions of sale and purchase through the use of computerized.

This inventory system information related to inventory like changes in inventory, amount

of inventory in stock and level of goods of hand. Modern shipping and receiving

department are the examples of price.

Periodic inventory – Periodic inventory system method of maintain inventory on a

periodic basis for the valuation for financial reporting purpose. This method at the

beginning keep track of the inventory and record transaction according to assets section

3

like purchase, sales. For instance, a retailer record sales and purchase every Saturday and

two weeks for invoice entered into system.

FIFO – The inventory system of first in first out used to calculate the value of inventory

and this method commonly use for inventory. This method assume that first purchase and

first sold of the inventory. FIFO method giving cost of latest purchase and this method

best for sell and purchase of food, drinks. For example – on 1 march have begging

inventory 68 units @ $15.00 per unit,

on 5 march purchase inventory 120 units @ $16.00 per unit

on 9 march sale inventory of 94 units @ $ 19.00 per unit

It will be counted as 68 units will be sold out @ $19 per units form goods purchased on 5

march and 26 units will be sold out from the goods purchased on 9 march.

LIFO banned by HMRC – Last in first out method use for inventories and according to

this method the last item purchase that would be first sold. This system was abolished by

HM revenues and customs because this system reduce the value of closing stock and tax

liability to users that was the main reason to avoid the LIO method.

Just In time – The just in time inventory system of management strategy that match raw

materials orders from suppliers directly with production schedules. This method to

forecast demand accurately according to require procedure further along the production

line. Now it has mean producing with minimum waste. For instance, drop shipping

retailers, fast food restaurant production, auto mobile manufacturing.

Cost accounting system

The cost accounting system is considered framework to determine the cost and

profitability of product and services for organisation. In the analysis is made of organisational

profitability, inventory and cost control (Jansen, 2011). It will help Italian Continental Stores to

determine the cost of particular product like cost of grocery items, cost of packaged goods,

beverages. When the raw materials go for production that time this system immediately record

the use of the materials. These products go through many stages before they can be called

finished goods.

Actual costing – Actual costing is a cost accounting system that recording of product

cost like actual cost of material, labour and overhead. Key point of this costing system

that they only uses actual cost of product. For example, managers can use this formula to

4

two weeks for invoice entered into system.

FIFO – The inventory system of first in first out used to calculate the value of inventory

and this method commonly use for inventory. This method assume that first purchase and

first sold of the inventory. FIFO method giving cost of latest purchase and this method

best for sell and purchase of food, drinks. For example – on 1 march have begging

inventory 68 units @ $15.00 per unit,

on 5 march purchase inventory 120 units @ $16.00 per unit

on 9 march sale inventory of 94 units @ $ 19.00 per unit

It will be counted as 68 units will be sold out @ $19 per units form goods purchased on 5

march and 26 units will be sold out from the goods purchased on 9 march.

LIFO banned by HMRC – Last in first out method use for inventories and according to

this method the last item purchase that would be first sold. This system was abolished by

HM revenues and customs because this system reduce the value of closing stock and tax

liability to users that was the main reason to avoid the LIO method.

Just In time – The just in time inventory system of management strategy that match raw

materials orders from suppliers directly with production schedules. This method to

forecast demand accurately according to require procedure further along the production

line. Now it has mean producing with minimum waste. For instance, drop shipping

retailers, fast food restaurant production, auto mobile manufacturing.

Cost accounting system

The cost accounting system is considered framework to determine the cost and

profitability of product and services for organisation. In the analysis is made of organisational

profitability, inventory and cost control (Jansen, 2011). It will help Italian Continental Stores to

determine the cost of particular product like cost of grocery items, cost of packaged goods,

beverages. When the raw materials go for production that time this system immediately record

the use of the materials. These products go through many stages before they can be called

finished goods.

Actual costing – Actual costing is a cost accounting system that recording of product

cost like actual cost of material, labour and overhead. Key point of this costing system

that they only uses actual cost of product. For example, managers can use this formula to

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

calculate the total production costs, so first need find out how many hours it took and

how much company paying and the same is done for materials after that on these

information basis getting actual cost.

Normal costing – normal costing method using for fast and fairly calculate production

cost. In this method including direct material, direct labour and overhead for calculation.

Example, For calculate to normal cost the company produced 10000 coffee tables and

they used actual material $50 per table and direct cost were $20 per table and

manufacturing overhead $10.00 so company determines cost $80 to produce one coffee

table.

Standard costing – Standard costing that an accounting method that identify the

differences between actual cost and cost that have occurred (Busco and Scapens, 2011).

For example, managers using two plans for calculation firstly they use them plan for

future and secondly they uses reasonable cost in accounting period. After budgeting

process they getting present cost and actual cost no matching each other so difference

will be come.

P2 Various reporting methods used in management reporting.

Management Accounting Report

Management accounting reporting provides a structure to understand information and

data produced by different management accounting system (Ramljak and Rogošić, 2012).

Management accounting reports helps to understand performance of business by evaluating

supplied information and also assist in planning, regulating and decision making process. These

reports are made according to requirements, as these can be made at the end of accounting year

or on quarterly basis. Importance can be understood as sometimes many critical and crucial

future operation decisions are dependent on results of these reports, useful for managers, owners

and shareholders. Various types of management accounting reports are:

Budget Report: It is a fundamental internal report, prepared by every organization

whether big or small to estimate costs. Budget is made keeping in mind all the sources of

earnings and expenditures, earlier performance, previous experiences, goals, mission, objectives

of business (Senftlechner and Hiebl, 2015). It is used to compare actual performance at

beginning to budgeted performance, and then finding variances. Format of budget is somehow

5

how much company paying and the same is done for materials after that on these

information basis getting actual cost.

Normal costing – normal costing method using for fast and fairly calculate production

cost. In this method including direct material, direct labour and overhead for calculation.

Example, For calculate to normal cost the company produced 10000 coffee tables and

they used actual material $50 per table and direct cost were $20 per table and

manufacturing overhead $10.00 so company determines cost $80 to produce one coffee

table.

Standard costing – Standard costing that an accounting method that identify the

differences between actual cost and cost that have occurred (Busco and Scapens, 2011).

For example, managers using two plans for calculation firstly they use them plan for

future and secondly they uses reasonable cost in accounting period. After budgeting

process they getting present cost and actual cost no matching each other so difference

will be come.

P2 Various reporting methods used in management reporting.

Management Accounting Report

Management accounting reporting provides a structure to understand information and

data produced by different management accounting system (Ramljak and Rogošić, 2012).

Management accounting reports helps to understand performance of business by evaluating

supplied information and also assist in planning, regulating and decision making process. These

reports are made according to requirements, as these can be made at the end of accounting year

or on quarterly basis. Importance can be understood as sometimes many critical and crucial

future operation decisions are dependent on results of these reports, useful for managers, owners

and shareholders. Various types of management accounting reports are:

Budget Report: It is a fundamental internal report, prepared by every organization

whether big or small to estimate costs. Budget is made keeping in mind all the sources of

earnings and expenditures, earlier performance, previous experiences, goals, mission, objectives

of business (Senftlechner and Hiebl, 2015). It is used to compare actual performance at

beginning to budgeted performance, and then finding variances. Format of budget is somehow

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

similar to income statement. For example, flexible budget, overhead budget will help to

understand the budget requirements for Italian continental stores.

Inventory Management Report: Inventory management refers to the management of

raw materials, components and finished goods. These reports includes inventory waste, labour

costs, per-unit overhead cost etc. used for efficient management process. Strategies of inventory

management are very important for business and varies according to size of organization. Good

inventory management system allows smoother delivery of orders and communication. For

example, Italian continental Stores will be able to deliver inventory, inventory by warehouse,

expiring inventory, inventory in stock and track details of received inventory ( Endenich,

Brandau and Hoffjan, 2011).

Financial Report: Financial reporting system is an important part of Accounting and

Report system of an organization. These reports discloses financial status to various stakeholders

such as management, investors and government and can be static or dynamic. All the important

aspects of financial and accounting department are recorded and analysed. These can be prepared

on quarterly and annually basis. Purpose for preparing financial reports are effective managerial

decision making and improving company's overall financial health. For example, balance sheet,

income statements, cash flow statements, statement of shareholder's equity etc.

Account Receivable Report: This type of report prepared when a business is heavily

involved in lending activities and lists customers according to overdue credit balances. This

helps in aligning customers with their repayment capabilities, estimating bad debts and creating

provisions for doubtful debts. It helps Italian continental stores limited in building good customer

relationship through the way of giving them long-term credit options, also in keeping cash flow

healthy (Kokubu and Kitada, 2015).

Account Payable Report: These reports are prepared with intention to record invoices of

overdue payment. Time factor is very important because it depends on the frequency of business

owner to pay debts and need to be updated monthly. These reports calculate an organisation's

total expenditure and payments of various departments but for a small business these are used to

verify bill payments. For example, reconciliation of accounts, Voucher activity report, history of

payments. it will help Italian continental stores limited in managing cash flows and record of

timely payments. Company can identify suppliers to be paid soon and those to whom it can pay

later.

6

understand the budget requirements for Italian continental stores.

Inventory Management Report: Inventory management refers to the management of

raw materials, components and finished goods. These reports includes inventory waste, labour

costs, per-unit overhead cost etc. used for efficient management process. Strategies of inventory

management are very important for business and varies according to size of organization. Good

inventory management system allows smoother delivery of orders and communication. For

example, Italian continental Stores will be able to deliver inventory, inventory by warehouse,

expiring inventory, inventory in stock and track details of received inventory ( Endenich,

Brandau and Hoffjan, 2011).

Financial Report: Financial reporting system is an important part of Accounting and

Report system of an organization. These reports discloses financial status to various stakeholders

such as management, investors and government and can be static or dynamic. All the important

aspects of financial and accounting department are recorded and analysed. These can be prepared

on quarterly and annually basis. Purpose for preparing financial reports are effective managerial

decision making and improving company's overall financial health. For example, balance sheet,

income statements, cash flow statements, statement of shareholder's equity etc.

Account Receivable Report: This type of report prepared when a business is heavily

involved in lending activities and lists customers according to overdue credit balances. This

helps in aligning customers with their repayment capabilities, estimating bad debts and creating

provisions for doubtful debts. It helps Italian continental stores limited in building good customer

relationship through the way of giving them long-term credit options, also in keeping cash flow

healthy (Kokubu and Kitada, 2015).

Account Payable Report: These reports are prepared with intention to record invoices of

overdue payment. Time factor is very important because it depends on the frequency of business

owner to pay debts and need to be updated monthly. These reports calculate an organisation's

total expenditure and payments of various departments but for a small business these are used to

verify bill payments. For example, reconciliation of accounts, Voucher activity report, history of

payments. it will help Italian continental stores limited in managing cash flows and record of

timely payments. Company can identify suppliers to be paid soon and those to whom it can pay

later.

6

M1 Benefits of management accounting systems and their application with in organisation

Job costing system: Instead of keeping eye on short-term goals, management accounting

system focuses on long-term perspectives. This system can be implemented by analysing short

term and long term perspective of Italian continental stores.

Inventory management: Implementation of this accounting system mainly based upon

the inventories nature in which Italian continental stores deals. It would be beneficial for

company to categorise stocks and inventories.

Costing system: It is required to determine the cost of raw material and manufacturing

cost of different products of Italian continental stores.

Price optimisation: This can be implemented by evaluating the nature and interest of

customers and price is determined accordingly (Nielsen, Mitchell and Nørreklit, 2015).

D1 Integration between the management accounting system and management accounting reports

Budget report:- With the help of these reports, Italian Continental Stores limited can

keep track of expenses and incomes which is necessary in this type of retail industry. Budget

helps in optimally utilising limited resources because needs are unlimited and these helps

organisation to know areas where money can be saved. Another benefit from budget report is

that they can be used to determine restraints and obstructs.

Inventory management report:- these reports remains directly linked with the inventory

management systems. helps in It helps in reducing inventory holding cost because with the help

of these reports problem of unsold stock and stock-out resolves. Reduces time and cost of

maintaining inventory results to increase in profits. Sales will also increase due to the

improvement in delivery performance. Italian continental stores limited maintains level of EOQ

(Economic Order Quantity) with the help of these reports.

Financial report:- These reports helps Italian continental stores limited in preparing

budgets, keeping track of financial information and transactions, assists in performing

comparative study of different accounting years to predict future growth.

Account receivable report:- Accounts receivable report keeps record of outstanding

payment for goods sold. It helps Italian continental stores limited in building good customer

relationship through the way of giving them long-term credit options, also in keeping cash flow

healthy (Klychova, Faskhutdinova and Sadrieva, 2014).

7

Job costing system: Instead of keeping eye on short-term goals, management accounting

system focuses on long-term perspectives. This system can be implemented by analysing short

term and long term perspective of Italian continental stores.

Inventory management: Implementation of this accounting system mainly based upon

the inventories nature in which Italian continental stores deals. It would be beneficial for

company to categorise stocks and inventories.

Costing system: It is required to determine the cost of raw material and manufacturing

cost of different products of Italian continental stores.

Price optimisation: This can be implemented by evaluating the nature and interest of

customers and price is determined accordingly (Nielsen, Mitchell and Nørreklit, 2015).

D1 Integration between the management accounting system and management accounting reports

Budget report:- With the help of these reports, Italian Continental Stores limited can

keep track of expenses and incomes which is necessary in this type of retail industry. Budget

helps in optimally utilising limited resources because needs are unlimited and these helps

organisation to know areas where money can be saved. Another benefit from budget report is

that they can be used to determine restraints and obstructs.

Inventory management report:- these reports remains directly linked with the inventory

management systems. helps in It helps in reducing inventory holding cost because with the help

of these reports problem of unsold stock and stock-out resolves. Reduces time and cost of

maintaining inventory results to increase in profits. Sales will also increase due to the

improvement in delivery performance. Italian continental stores limited maintains level of EOQ

(Economic Order Quantity) with the help of these reports.

Financial report:- These reports helps Italian continental stores limited in preparing

budgets, keeping track of financial information and transactions, assists in performing

comparative study of different accounting years to predict future growth.

Account receivable report:- Accounts receivable report keeps record of outstanding

payment for goods sold. It helps Italian continental stores limited in building good customer

relationship through the way of giving them long-term credit options, also in keeping cash flow

healthy (Klychova, Faskhutdinova and Sadrieva, 2014).

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Account payable report:- Account payable report is record of creditors to whom

company owes money and it will help Italian continental stores limited in managing cash flows

and record of timely payments. Company can identify suppliers to be paid soon and those to

whom it can pay later.

TASK 2

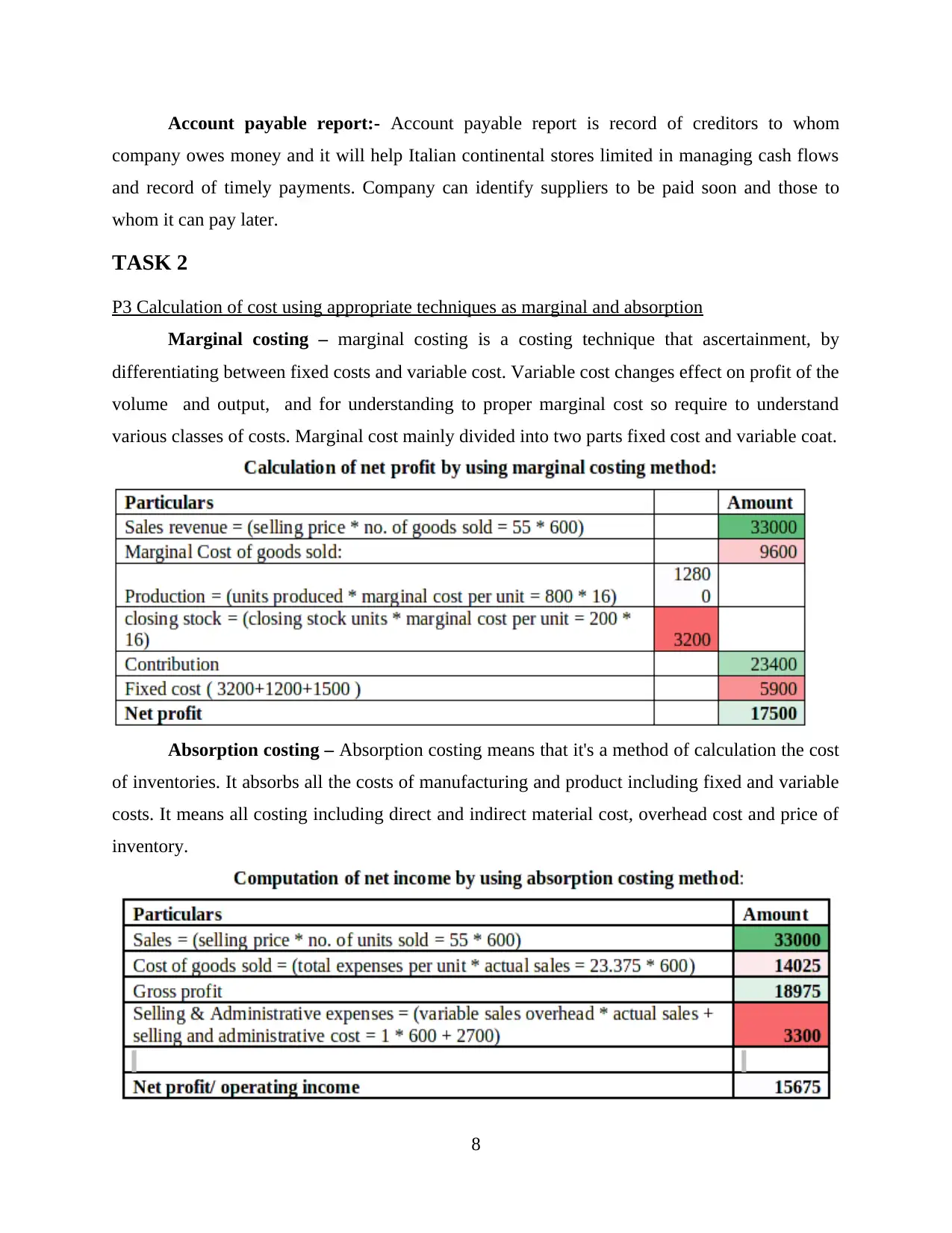

P3 Calculation of cost using appropriate techniques as marginal and absorption

Marginal costing – marginal costing is a costing technique that ascertainment, by

differentiating between fixed costs and variable cost. Variable cost changes effect on profit of the

volume and output, and for understanding to proper marginal cost so require to understand

various classes of costs. Marginal cost mainly divided into two parts fixed cost and variable coat.

Absorption costing – Absorption costing means that it's a method of calculation the cost

of inventories. It absorbs all the costs of manufacturing and product including fixed and variable

costs. It means all costing including direct and indirect material cost, overhead cost and price of

inventory.

8

company owes money and it will help Italian continental stores limited in managing cash flows

and record of timely payments. Company can identify suppliers to be paid soon and those to

whom it can pay later.

TASK 2

P3 Calculation of cost using appropriate techniques as marginal and absorption

Marginal costing – marginal costing is a costing technique that ascertainment, by

differentiating between fixed costs and variable cost. Variable cost changes effect on profit of the

volume and output, and for understanding to proper marginal cost so require to understand

various classes of costs. Marginal cost mainly divided into two parts fixed cost and variable coat.

Absorption costing – Absorption costing means that it's a method of calculation the cost

of inventories. It absorbs all the costs of manufacturing and product including fixed and variable

costs. It means all costing including direct and indirect material cost, overhead cost and price of

inventory.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

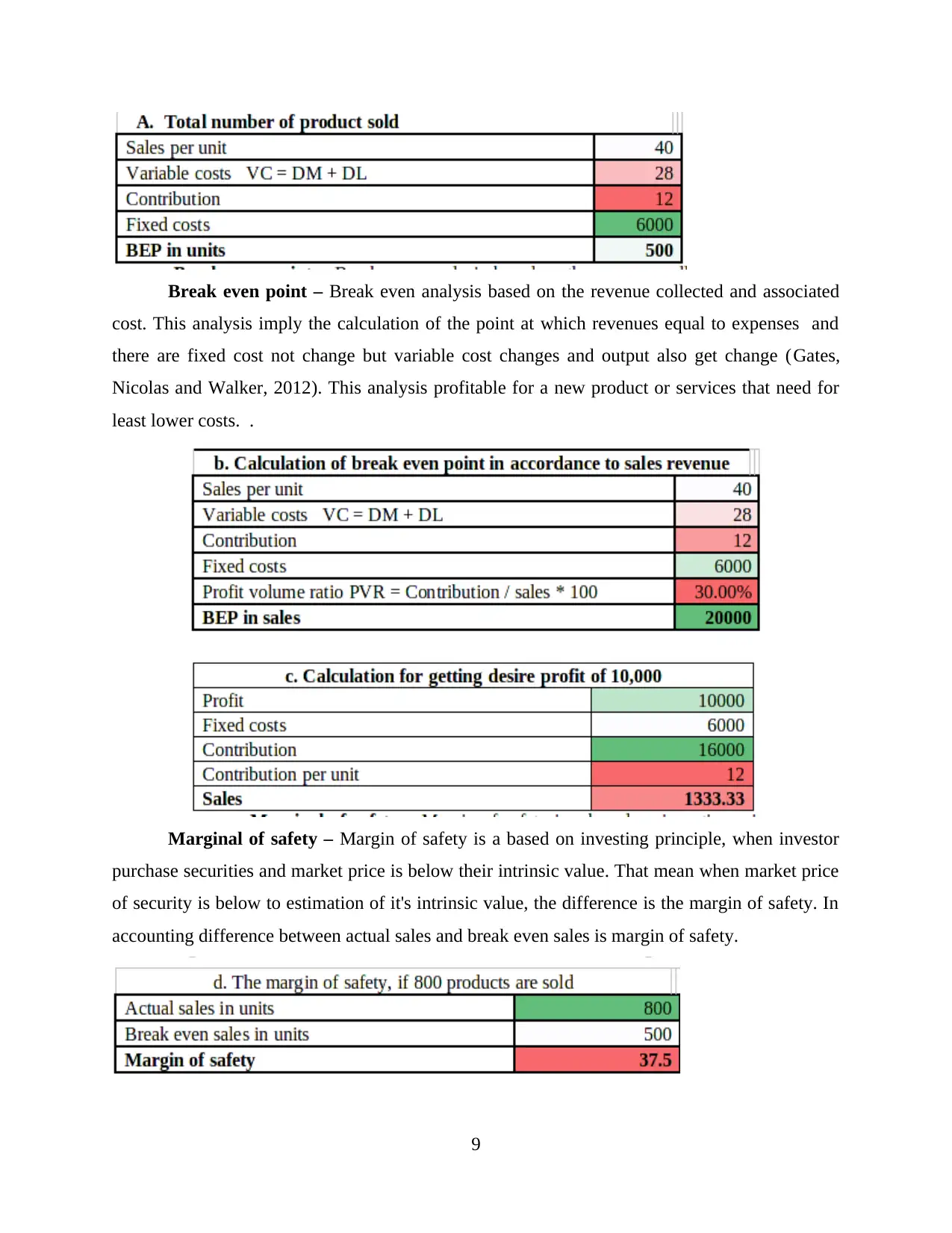

Break even point – Break even analysis based on the revenue collected and associated

cost. This analysis imply the calculation of the point at which revenues equal to expenses and

there are fixed cost not change but variable cost changes and output also get change (Gates,

Nicolas and Walker, 2012). This analysis profitable for a new product or services that need for

least lower costs. .

Marginal of safety – Margin of safety is a based on investing principle, when investor

purchase securities and market price is below their intrinsic value. That mean when market price

of security is below to estimation of it's intrinsic value, the difference is the margin of safety. In

accounting difference between actual sales and break even sales is margin of safety.

9

cost. This analysis imply the calculation of the point at which revenues equal to expenses and

there are fixed cost not change but variable cost changes and output also get change (Gates,

Nicolas and Walker, 2012). This analysis profitable for a new product or services that need for

least lower costs. .

Marginal of safety – Margin of safety is a based on investing principle, when investor

purchase securities and market price is below their intrinsic value. That mean when market price

of security is below to estimation of it's intrinsic value, the difference is the margin of safety. In

accounting difference between actual sales and break even sales is margin of safety.

9

M2 Application of range of management accounting techniques and financial reporting

There is an evaluation of profit done by using marginal and absorption costing, it is

determined that the profit form marginal costing was calculated £17500 and profit form

absorption was calculated as £15675. Break even point shows the following results in terms of

sale price and volume subsequently 500 units and £20000 in sales. Margin of safety was

evaluated as 37.5 units to maintain minimum level of stocks in organisation.

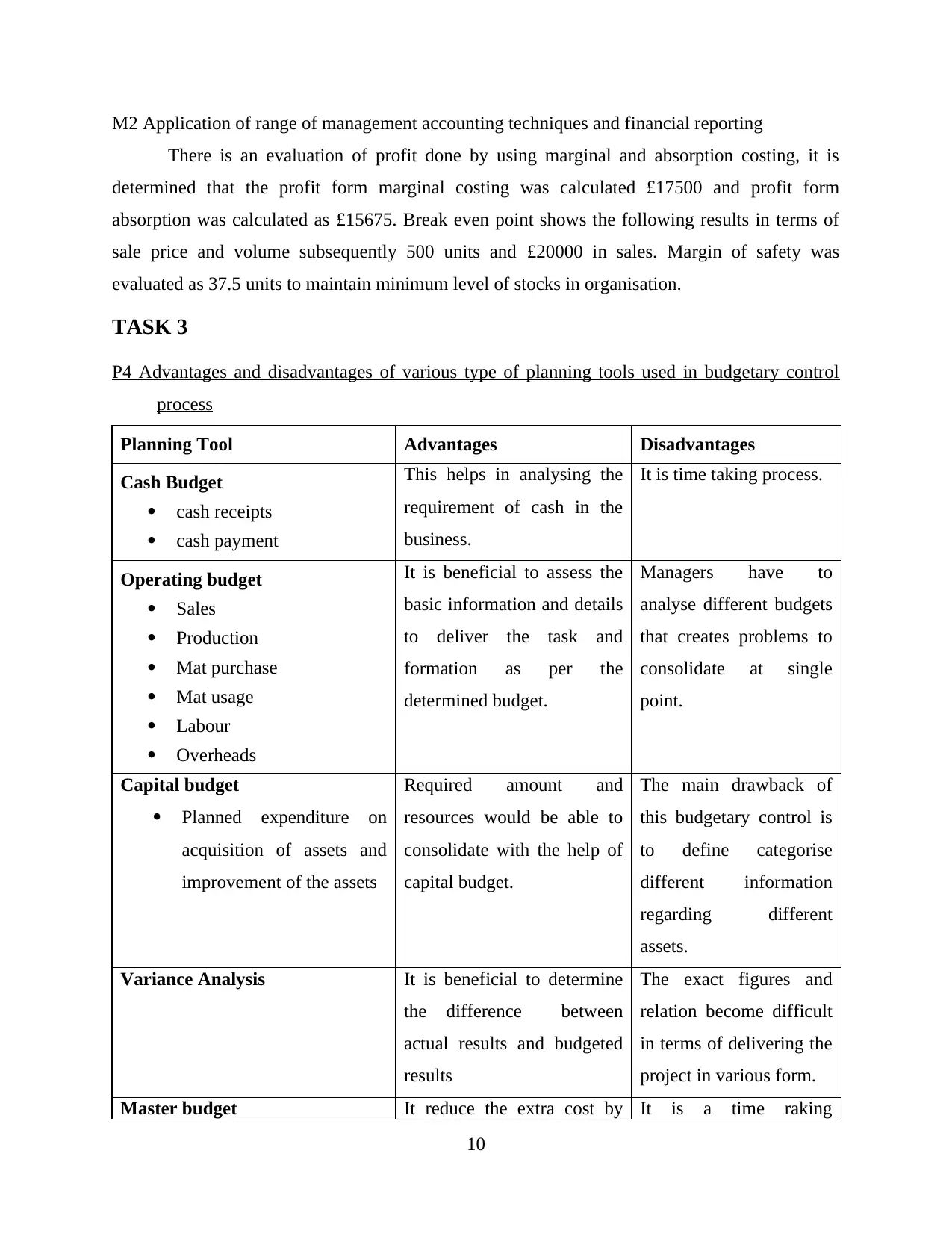

TASK 3

P4 Advantages and disadvantages of various type of planning tools used in budgetary control

process

Planning Tool Advantages Disadvantages

Cash Budget

cash receipts

cash payment

This helps in analysing the

requirement of cash in the

business.

It is time taking process.

Operating budget

Sales

Production

Mat purchase

Mat usage

Labour

Overheads

It is beneficial to assess the

basic information and details

to deliver the task and

formation as per the

determined budget.

Managers have to

analyse different budgets

that creates problems to

consolidate at single

point.

Capital budget

Planned expenditure on

acquisition of assets and

improvement of the assets

Required amount and

resources would be able to

consolidate with the help of

capital budget.

The main drawback of

this budgetary control is

to define categorise

different information

regarding different

assets.

Variance Analysis It is beneficial to determine

the difference between

actual results and budgeted

results

The exact figures and

relation become difficult

in terms of delivering the

project in various form.

Master budget It reduce the extra cost by It is a time raking

10

There is an evaluation of profit done by using marginal and absorption costing, it is

determined that the profit form marginal costing was calculated £17500 and profit form

absorption was calculated as £15675. Break even point shows the following results in terms of

sale price and volume subsequently 500 units and £20000 in sales. Margin of safety was

evaluated as 37.5 units to maintain minimum level of stocks in organisation.

TASK 3

P4 Advantages and disadvantages of various type of planning tools used in budgetary control

process

Planning Tool Advantages Disadvantages

Cash Budget

cash receipts

cash payment

This helps in analysing the

requirement of cash in the

business.

It is time taking process.

Operating budget

Sales

Production

Mat purchase

Mat usage

Labour

Overheads

It is beneficial to assess the

basic information and details

to deliver the task and

formation as per the

determined budget.

Managers have to

analyse different budgets

that creates problems to

consolidate at single

point.

Capital budget

Planned expenditure on

acquisition of assets and

improvement of the assets

Required amount and

resources would be able to

consolidate with the help of

capital budget.

The main drawback of

this budgetary control is

to define categorise

different information

regarding different

assets.

Variance Analysis It is beneficial to determine

the difference between

actual results and budgeted

results

The exact figures and

relation become difficult

in terms of delivering the

project in various form.

Master budget It reduce the extra cost by It is a time raking

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.