BTEC HND in Business: Management Accounting Systems & Techniques

VerifiedAdded on 2023/01/13

|17

|5148

|98

Report

AI Summary

This report delves into management accounting, defining it as a process that aids decision-making through financial data. It differentiates management accounting from financial reporting, highlighting its use by internal managers. The study assesses various aspects of management accounting, including its systems and reporting methods, within the context of Wow Fabrics, a leading UK clothing manufacturer. It demonstrates how management accounting tools can be applied in financial reporting, describes planning tools and their role in budgetary control, and compares how corporations adapt management accounting systems to address financial issues. The report covers cost accounting, inventory management, and job costing systems, along with an evaluation of different management accounting reports used by Wow Fabrics, such as cost accounting, inventory management, job costs, and performance reports. It also discusses the advantages and disadvantages of budgetary control planning tools and compares how corporations adapt management accounting systems to respond to financial challenges.

Management

Accounting

Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

Management Accounting and Systems:.......................................................................................3

Management Accounting Reporting Methods:............................................................................5

Computational assessment of costs applying techniques of cost-analysis for preparing income

statement though marginal/absorption costs:...............................................................................7

Advantages and disadvantages of different sorts of planning tools of budgetary control:........10

Comparison of how corporations are adapting management-accounting systems to responding

to financial issues:......................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................3

TASK...............................................................................................................................................3

Management Accounting and Systems:.......................................................................................3

Management Accounting Reporting Methods:............................................................................5

Computational assessment of costs applying techniques of cost-analysis for preparing income

statement though marginal/absorption costs:...............................................................................7

Advantages and disadvantages of different sorts of planning tools of budgetary control:........10

Comparison of how corporations are adapting management-accounting systems to responding

to financial issues:......................................................................................................................11

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Management accounting is often regarded as term managerial accounting and may be

characterized as a process-cycle of assisting decision-making managers with financial details and

infrastructure. It is utilized mainly by organisation's internal managers, and that's only thing that

renders it distinct from financial reporting and financial accounting. Throughout this mechanism,

financial data and documentation including receipt, financial reports statements are circulated

within company's management panel through financial administration (Agrawal, 2018).

This study assessment consists of numerous aspects of term management accounting

along with a comprehension discussion on its systems and reporting methods/approaches in

context of corporation Wow Fabrics. It is UK's leading clothing manufacturer and famous for its

premium quality clothing with unique designs (About Wow Fabrics. 2019). With help of

practical numerical task study shows how tools of management accounting can be used in

financial reporting. Study describes planning tools and their use in process of budgetary control.

Further, study contains comparison of two corporation in context of use of management

accounting for responding to financial issues.

TASK

Management Accounting and Systems:

Definition of MA:

Management Accounting simply defined as an organizing mechanism that gathers all of

the organization's unprocessed information, factual evidence and data and transforms it

into constructive and appropriate information, principally for decision-making purposes

(Drury, 2013). Phrase management accounting relates to procedure used by the enterprise

to evaluate multiple business transactions that are compiled within the enterprise from

multiple departments.

As per the views of Institute of Management Accountants (IMA) "Management

accounting can be defined as effective profession which includes contributing in

managerial decision-making, making efficient planning and performing managerial

systems as well as offering expertise in areas of financial reporting then controlling to aid

management-staff in developing and adapting of a strategy effectively” (McLellan, J.D.,

2014).

Management accounting is often regarded as term managerial accounting and may be

characterized as a process-cycle of assisting decision-making managers with financial details and

infrastructure. It is utilized mainly by organisation's internal managers, and that's only thing that

renders it distinct from financial reporting and financial accounting. Throughout this mechanism,

financial data and documentation including receipt, financial reports statements are circulated

within company's management panel through financial administration (Agrawal, 2018).

This study assessment consists of numerous aspects of term management accounting

along with a comprehension discussion on its systems and reporting methods/approaches in

context of corporation Wow Fabrics. It is UK's leading clothing manufacturer and famous for its

premium quality clothing with unique designs (About Wow Fabrics. 2019). With help of

practical numerical task study shows how tools of management accounting can be used in

financial reporting. Study describes planning tools and their use in process of budgetary control.

Further, study contains comparison of two corporation in context of use of management

accounting for responding to financial issues.

TASK

Management Accounting and Systems:

Definition of MA:

Management Accounting simply defined as an organizing mechanism that gathers all of

the organization's unprocessed information, factual evidence and data and transforms it

into constructive and appropriate information, principally for decision-making purposes

(Drury, 2013). Phrase management accounting relates to procedure used by the enterprise

to evaluate multiple business transactions that are compiled within the enterprise from

multiple departments.

As per the views of Institute of Management Accountants (IMA) "Management

accounting can be defined as effective profession which includes contributing in

managerial decision-making, making efficient planning and performing managerial

systems as well as offering expertise in areas of financial reporting then controlling to aid

management-staff in developing and adapting of a strategy effectively” (McLellan, J.D.,

2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This is the method that is widely used to classify their rank among large numbers of business

organisations. Management Accounting facilitates executives in preparing and drawing up

agendas by anticipating productions, sales, cash-flow of money and recirculation etc. i.e.

managing a broad variety of commercial business operations (Arnaboldi, Busco and Cuganesan,

2017). This encourages management to plan the business's practices/operations, first by planning

the operational budgets, and then by organizing the entire operations by combining all

operational budgets into single financial annual budget. Management Accounting's main target is

to satisfy the manager's requirements by supplying important information such that business can

be run in a proper direction. Under it informations may be gather from both external and internal

sources.

Role and Functions of management accounting:

Planning: Management Accounting helps executives plan and formulate plans by generating

production estimates, trading cash inflows and outflows, etc. It can also determine how much

will be required from alternatives plan of action or the anticipated return on investment from it,

as well as at same time determine on the scheduling of the operations to be carried out.

Facilitates control: Management accounting aims to turn broad priorities and targets into

concrete expectations for achieving within a specified time-frame and effectively secures the

successful accomplishment of those priorities. All this made possible by fiscal monitoring and

regular accounting, that is an important function of MA.

Provides data: MA acts as a critical data base for financial preparation. The reports and archives

are a archive of a huge array of data on the company's historical success, and is a must for

producing forward-looking predictions.

Analyses and interprets data: The accounting information for efficient strategy and judgment-

making is evaluated substantively. The information is provided in a statistical manner for this

reason, ratios are estimated and patterns are expected to be predicted.

Act as a means of communicating: Management accounting offers a mechanism for the inward,

downward as well as outward coordination of management activities through corporation. At

first it requires defining the viability and accuracy of the specific program parts. The later phases

it keeps both participants updated of their preparations and their positions in those preparations.

Decision-Making: Management accounting offers the accounting details and quantitative

evidence needed for decision-making process that vitally impacts the company 'sustainability and

organisations. Management Accounting facilitates executives in preparing and drawing up

agendas by anticipating productions, sales, cash-flow of money and recirculation etc. i.e.

managing a broad variety of commercial business operations (Arnaboldi, Busco and Cuganesan,

2017). This encourages management to plan the business's practices/operations, first by planning

the operational budgets, and then by organizing the entire operations by combining all

operational budgets into single financial annual budget. Management Accounting's main target is

to satisfy the manager's requirements by supplying important information such that business can

be run in a proper direction. Under it informations may be gather from both external and internal

sources.

Role and Functions of management accounting:

Planning: Management Accounting helps executives plan and formulate plans by generating

production estimates, trading cash inflows and outflows, etc. It can also determine how much

will be required from alternatives plan of action or the anticipated return on investment from it,

as well as at same time determine on the scheduling of the operations to be carried out.

Facilitates control: Management accounting aims to turn broad priorities and targets into

concrete expectations for achieving within a specified time-frame and effectively secures the

successful accomplishment of those priorities. All this made possible by fiscal monitoring and

regular accounting, that is an important function of MA.

Provides data: MA acts as a critical data base for financial preparation. The reports and archives

are a archive of a huge array of data on the company's historical success, and is a must for

producing forward-looking predictions.

Analyses and interprets data: The accounting information for efficient strategy and judgment-

making is evaluated substantively. The information is provided in a statistical manner for this

reason, ratios are estimated and patterns are expected to be predicted.

Act as a means of communicating: Management accounting offers a mechanism for the inward,

downward as well as outward coordination of management activities through corporation. At

first it requires defining the viability and accuracy of the specific program parts. The later phases

it keeps both participants updated of their preparations and their positions in those preparations.

Decision-Making: Management accounting offers the accounting details and quantitative

evidence needed for decision-making process that vitally impacts the company 'sustainability and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

performance. Accounting management offers extensive knowledge/information on different

options, and simple administration preference.

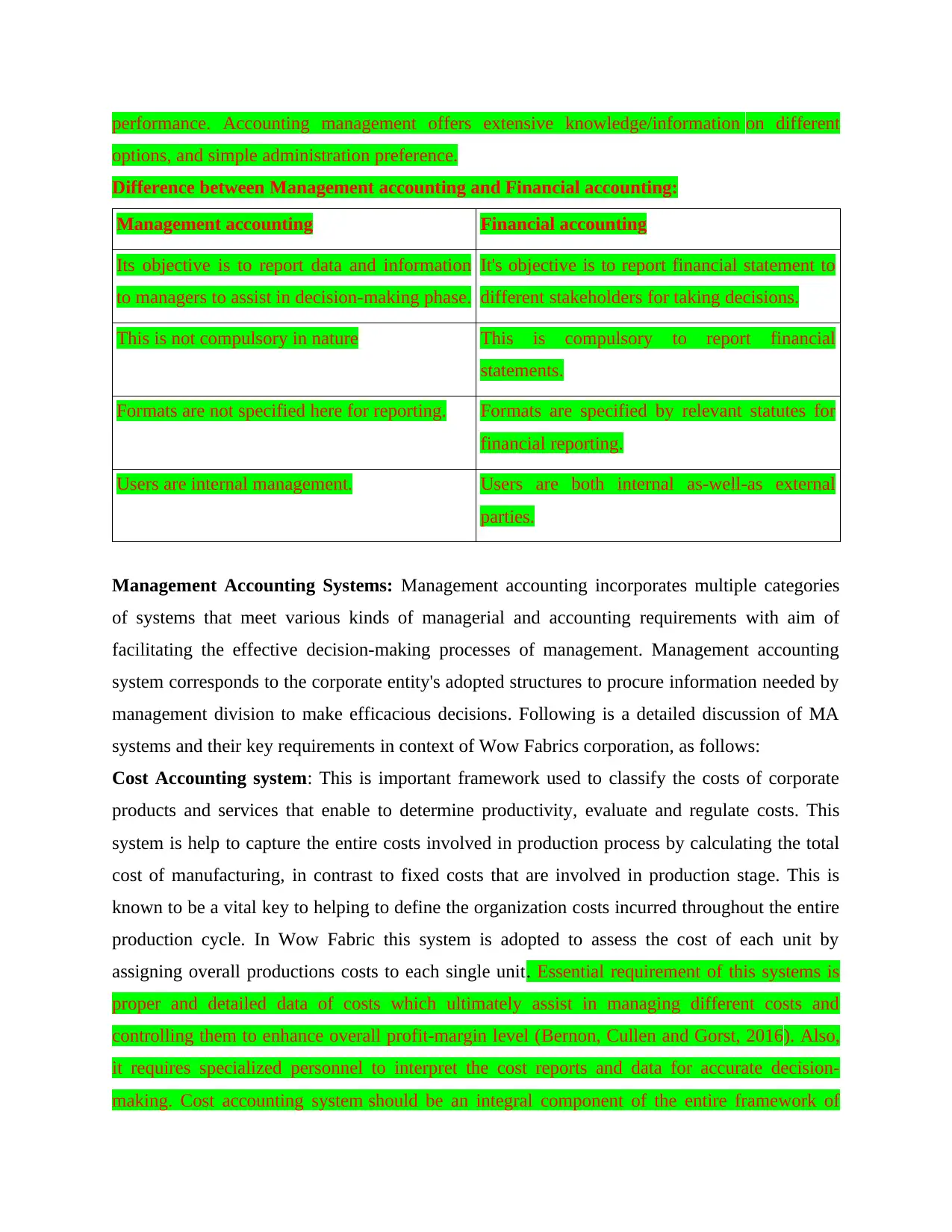

Difference between Management accounting and Financial accounting:

Management accounting Financial accounting

Its objective is to report data and information

to managers to assist in decision-making phase.

It's objective is to report financial statement to

different stakeholders for taking decisions.

This is not compulsory in nature This is compulsory to report financial

statements.

Formats are not specified here for reporting. Formats are specified by relevant statutes for

financial reporting.

Users are internal management. Users are both internal as-well-as external

parties.

Management Accounting Systems: Management accounting incorporates multiple categories

of systems that meet various kinds of managerial and accounting requirements with aim of

facilitating the effective decision-making processes of management. Management accounting

system corresponds to the corporate entity's adopted structures to procure information needed by

management division to make efficacious decisions. Following is a detailed discussion of MA

systems and their key requirements in context of Wow Fabrics corporation, as follows:

Cost Accounting system: This is important framework used to classify the costs of corporate

products and services that enable to determine productivity, evaluate and regulate costs. This

system is help to capture the entire costs involved in production process by calculating the total

cost of manufacturing, in contrast to fixed costs that are involved in production stage. This is

known to be a vital key to helping to define the organization costs incurred throughout the entire

production cycle. In Wow Fabric this system is adopted to assess the cost of each unit by

assigning overall productions costs to each single unit. Essential requirement of this systems is

proper and detailed data of costs which ultimately assist in managing different costs and

controlling them to enhance overall profit-margin level (Bernon, Cullen and Gorst, 2016). Also,

it requires specialized personnel to interpret the cost reports and data for accurate decision-

making. Cost accounting system should be an integral component of the entire framework of

options, and simple administration preference.

Difference between Management accounting and Financial accounting:

Management accounting Financial accounting

Its objective is to report data and information

to managers to assist in decision-making phase.

It's objective is to report financial statement to

different stakeholders for taking decisions.

This is not compulsory in nature This is compulsory to report financial

statements.

Formats are not specified here for reporting. Formats are specified by relevant statutes for

financial reporting.

Users are internal management. Users are both internal as-well-as external

parties.

Management Accounting Systems: Management accounting incorporates multiple categories

of systems that meet various kinds of managerial and accounting requirements with aim of

facilitating the effective decision-making processes of management. Management accounting

system corresponds to the corporate entity's adopted structures to procure information needed by

management division to make efficacious decisions. Following is a detailed discussion of MA

systems and their key requirements in context of Wow Fabrics corporation, as follows:

Cost Accounting system: This is important framework used to classify the costs of corporate

products and services that enable to determine productivity, evaluate and regulate costs. This

system is help to capture the entire costs involved in production process by calculating the total

cost of manufacturing, in contrast to fixed costs that are involved in production stage. This is

known to be a vital key to helping to define the organization costs incurred throughout the entire

production cycle. In Wow Fabric this system is adopted to assess the cost of each unit by

assigning overall productions costs to each single unit. Essential requirement of this systems is

proper and detailed data of costs which ultimately assist in managing different costs and

controlling them to enhance overall profit-margin level (Bernon, Cullen and Gorst, 2016). Also,

it requires specialized personnel to interpret the cost reports and data for accurate decision-

making. Cost accounting system should be an integral component of the entire framework of

MA, which should be combined with other aspects of the framework to the degree that it is

practicable. For the planned objective, this system requires use an acceptable accounting,

identification and calculation basis. Cost details generated for different reasons should be derived

from a shared source of data, and output reports should be compatible.

Inventory Management System: As name of this suggest this entire system is dedicated to

effective controlling, processing and handling of wide range and quality of stock items and

inventories. This is also technical approach as it involves some methods like FIFO, average cost

and LIFO to manage inventories and assess a certain value of inventories on year end. This

system requires detailed classification of inventories as per their nature, extent of use and value

in organisation. This system real time data of each inventory and stock item with aim to manage

them and control any excessive costs related to maintenance and storage of inventories. In

corporation Wow fabrics this system enables managing officials to track the actual movements

of different stocks and minimise overall inventories costs. Here are some methods to value

inventories, as follows:

LIFO: This is method to value stock, under it last purchased stock is issued first approach is used

to assess stock value.

FIFO: Under this technique, first purchased stock item is issued first approach is employed to

determine inventories costs.

Average cost: This approach emphasises on using an average cost of all stock items irrespective

to the order and sequence of purchase, to value inventories (Cattarino and et.al., 2016).

Job Costing Systems: This system is particularly concerned to processes/activities of combining

data and statistics about various costs / expenses associated with clearly defined job, an then

allocate all overheads to each job-task. That's important systems that make a significant

contribution to the maintenance of accountability within enterprises in various jobs. As In Wow

Fabrics corporation, managers critically analyse the processes and classify them as specific

definable jobs. Afterwards, they assign all the expenditures to each individual job after

acknowledging and categorizing jobs and corresponding costs, which eventually allows them to

reduce total production costs. it is critical in assigning or figuring out key organizational issues

inside the organization that are blamed for rising costs within the business. Such systems also

encourage managers to efficiently execute key initiatives linked to cost minimization and higher

profit margin. It includes thorough cost analysis to obtain more reliable and consistent outcomes,

practicable. For the planned objective, this system requires use an acceptable accounting,

identification and calculation basis. Cost details generated for different reasons should be derived

from a shared source of data, and output reports should be compatible.

Inventory Management System: As name of this suggest this entire system is dedicated to

effective controlling, processing and handling of wide range and quality of stock items and

inventories. This is also technical approach as it involves some methods like FIFO, average cost

and LIFO to manage inventories and assess a certain value of inventories on year end. This

system requires detailed classification of inventories as per their nature, extent of use and value

in organisation. This system real time data of each inventory and stock item with aim to manage

them and control any excessive costs related to maintenance and storage of inventories. In

corporation Wow fabrics this system enables managing officials to track the actual movements

of different stocks and minimise overall inventories costs. Here are some methods to value

inventories, as follows:

LIFO: This is method to value stock, under it last purchased stock is issued first approach is used

to assess stock value.

FIFO: Under this technique, first purchased stock item is issued first approach is employed to

determine inventories costs.

Average cost: This approach emphasises on using an average cost of all stock items irrespective

to the order and sequence of purchase, to value inventories (Cattarino and et.al., 2016).

Job Costing Systems: This system is particularly concerned to processes/activities of combining

data and statistics about various costs / expenses associated with clearly defined job, an then

allocate all overheads to each job-task. That's important systems that make a significant

contribution to the maintenance of accountability within enterprises in various jobs. As In Wow

Fabrics corporation, managers critically analyse the processes and classify them as specific

definable jobs. Afterwards, they assign all the expenditures to each individual job after

acknowledging and categorizing jobs and corresponding costs, which eventually allows them to

reduce total production costs. it is critical in assigning or figuring out key organizational issues

inside the organization that are blamed for rising costs within the business. Such systems also

encourage managers to efficiently execute key initiatives linked to cost minimization and higher

profit margin. It includes thorough cost analysis to obtain more reliable and consistent outcomes,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

as any mistakes in implementing such systems will lead to incorrect decision-making

(Commerford and et.al, 2016).

Management Accounting Reporting Methods:

Managerial accounting, often regarded as cost management, it focuses internally on the

information received via financial reporting. It is especially utilised for decision making, actively

planning, and managing. Normally, management accountants rely on corporation's basic FS

which contains P&L, CF statement and balance sheet, but under management accounting for

effective decisions they also use other forms of reporting to evaluate business or entity

performance in all financial as well as non-financial aspects. Here following is evaluation of

different reports of MA used by corporation Wow Fabrics, as follows:

Cost Accounting Report: These reports of management accounting specifically involves

detailed information of all the costs incurred by any corporation. This report facilitates

management with comprehensive information of costs by proper classification and

categorisation. This report helps managing staff in assessing any areas which leads to excessive

costs and thereby control costs. Each and every item of cost is defined here for supporting

effective decision-making. As in Wow Fabric, it is closely associated with cost accounting

frameworks and budgetary control as it supplies all the necessary informations. Managerial

decisions are majorly depending on this report's outcomes and findings (Cools, Stouthuysen and

Van den Abbeele, 2017).

Inventory Management Report: This report is one of the core reports of managerial accounting

which deals with comprehensive and quite detailed evaluation of inventories and stock items.

This assist managers in properly tracking inventories and handling stocks. In Wow Fabrics,

inventory heads and production managers jointly prepare this report to keep track of actual and

real time shift and movement of inventories. At the end of the each working day, this report

shows exact number of inventories in finished goods, in process and in raw materials, as well as

how much raw material are possessed to make finished items. This covers all the direct and

indirect information of inventories to help managers in taking any production and distribution

decision. It allows them to assess the real causes of increasing inventories costs as to minimise

them up to an acceptable level.

Job Costs Report: This is the beginning point for a large part of the information specified in

other reports. The report details every job and records the overall cost of job incurred during the

(Commerford and et.al, 2016).

Management Accounting Reporting Methods:

Managerial accounting, often regarded as cost management, it focuses internally on the

information received via financial reporting. It is especially utilised for decision making, actively

planning, and managing. Normally, management accountants rely on corporation's basic FS

which contains P&L, CF statement and balance sheet, but under management accounting for

effective decisions they also use other forms of reporting to evaluate business or entity

performance in all financial as well as non-financial aspects. Here following is evaluation of

different reports of MA used by corporation Wow Fabrics, as follows:

Cost Accounting Report: These reports of management accounting specifically involves

detailed information of all the costs incurred by any corporation. This report facilitates

management with comprehensive information of costs by proper classification and

categorisation. This report helps managing staff in assessing any areas which leads to excessive

costs and thereby control costs. Each and every item of cost is defined here for supporting

effective decision-making. As in Wow Fabric, it is closely associated with cost accounting

frameworks and budgetary control as it supplies all the necessary informations. Managerial

decisions are majorly depending on this report's outcomes and findings (Cools, Stouthuysen and

Van den Abbeele, 2017).

Inventory Management Report: This report is one of the core reports of managerial accounting

which deals with comprehensive and quite detailed evaluation of inventories and stock items.

This assist managers in properly tracking inventories and handling stocks. In Wow Fabrics,

inventory heads and production managers jointly prepare this report to keep track of actual and

real time shift and movement of inventories. At the end of the each working day, this report

shows exact number of inventories in finished goods, in process and in raw materials, as well as

how much raw material are possessed to make finished items. This covers all the direct and

indirect information of inventories to help managers in taking any production and distribution

decision. It allows them to assess the real causes of increasing inventories costs as to minimise

them up to an acceptable level.

Job Costs Report: This is the beginning point for a large part of the information specified in

other reports. The report details every job and records the overall cost of job incurred during the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

prior period. Job expenses are also grouped into following categories: labour costs, material costs

and other overheads. This report supports the processes adopted under job costing report. This

report is mainly used to assess the cost of each job in detailed manner. A job-cost report defines

each job process and basis for allocation of each costs. In Wow Fabrics managers develop job

cost report for job processes of manufacturing of clothings (Coyne, Coyne and Walker, 2016).

Performance Report: A performance report complies with an employee's results of an exercise

or function. This report can make a comparison actual results with a schedule or standards, and

the difference between both the 2 figures. When there's an adverse difference, the reader of

performance report is meant to take measures. This help to measure the performance of various

employees performing different tasks with aim to effective human-resource management. In

Wow Fabrics, this report is used by managing staff to allocate tasks and assess actual

performing-status of different working personnels.

All the discussed MA systems and reports should be efficiently integrated within

organisational processes as to effectively and quickly achieve all the objectives and goals. As in

Wow Fabrics, all inventory managers seek for accounting data generated from organisation's

accounting processes in order to establish an effective inventories management system. Thus a

proper integration of systems and reports within organisational processes/operation is essential to

boost the performance of corporation (Dauth, Pronobis and Schmid, 2017).

Computational assessment of costs applying techniques of cost-analysis for preparing income

statement though marginal/absorption costs:

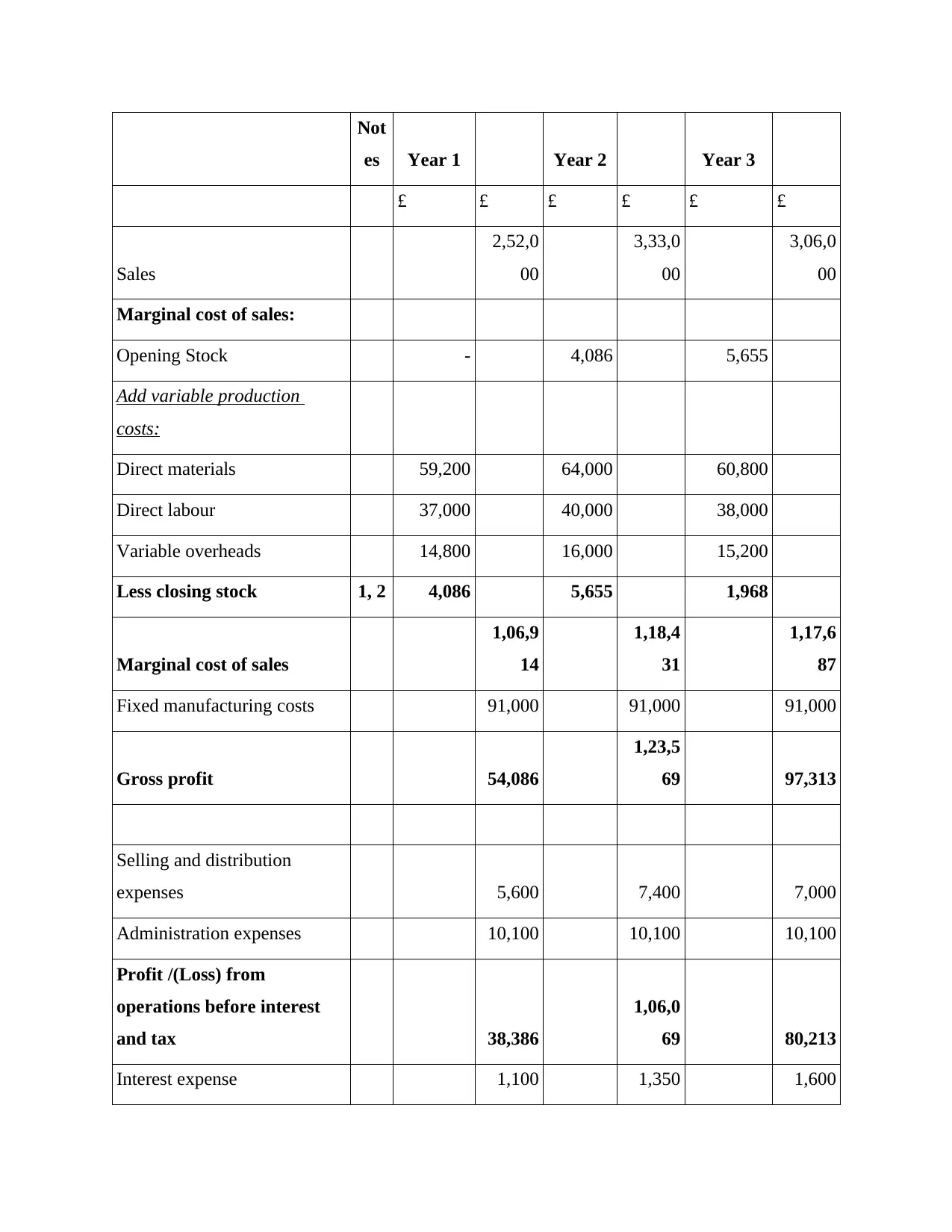

Marginal Costing: Under this method, contribution is assessed through deducting all marginal

costs from total revenue. Marginal costs are costs which relies on production's volume. While

Fixed costs are separately shown to determine net profit.

Marginal costing is used when organization determines break-even production rates for

short-term decision-making. The business focuses on 'special or even one-off' possibilities. The

business determines whether a commodity is to be created or purchased.

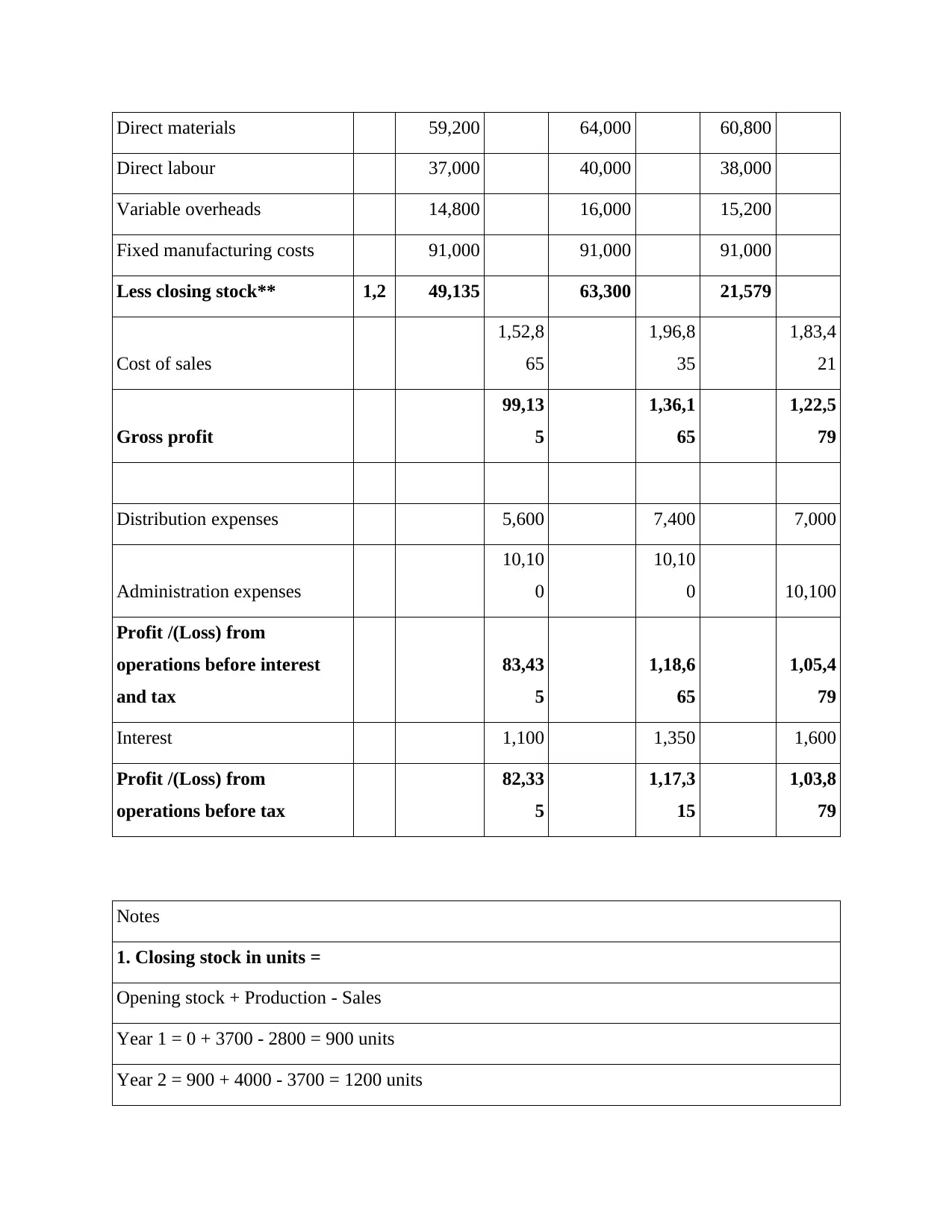

Absorption Costing: In this method all production costs variable and fixed are regraded as

absorption costs in order to assess gross profit (Elmassri, Harris and Carter, 2016).

MARGINAL COSTING

and other overheads. This report supports the processes adopted under job costing report. This

report is mainly used to assess the cost of each job in detailed manner. A job-cost report defines

each job process and basis for allocation of each costs. In Wow Fabrics managers develop job

cost report for job processes of manufacturing of clothings (Coyne, Coyne and Walker, 2016).

Performance Report: A performance report complies with an employee's results of an exercise

or function. This report can make a comparison actual results with a schedule or standards, and

the difference between both the 2 figures. When there's an adverse difference, the reader of

performance report is meant to take measures. This help to measure the performance of various

employees performing different tasks with aim to effective human-resource management. In

Wow Fabrics, this report is used by managing staff to allocate tasks and assess actual

performing-status of different working personnels.

All the discussed MA systems and reports should be efficiently integrated within

organisational processes as to effectively and quickly achieve all the objectives and goals. As in

Wow Fabrics, all inventory managers seek for accounting data generated from organisation's

accounting processes in order to establish an effective inventories management system. Thus a

proper integration of systems and reports within organisational processes/operation is essential to

boost the performance of corporation (Dauth, Pronobis and Schmid, 2017).

Computational assessment of costs applying techniques of cost-analysis for preparing income

statement though marginal/absorption costs:

Marginal Costing: Under this method, contribution is assessed through deducting all marginal

costs from total revenue. Marginal costs are costs which relies on production's volume. While

Fixed costs are separately shown to determine net profit.

Marginal costing is used when organization determines break-even production rates for

short-term decision-making. The business focuses on 'special or even one-off' possibilities. The

business determines whether a commodity is to be created or purchased.

Absorption Costing: In this method all production costs variable and fixed are regraded as

absorption costs in order to assess gross profit (Elmassri, Harris and Carter, 2016).

MARGINAL COSTING

Not

es Year 1 Year 2 Year 3

£ £ £ £ £ £

Sales

2,52,0

00

3,33,0

00

3,06,0

00

Marginal cost of sales:

Opening Stock - 4,086 5,655

Add variable production

costs:

Direct materials 59,200 64,000 60,800

Direct labour 37,000 40,000 38,000

Variable overheads 14,800 16,000 15,200

Less closing stock 1, 2 4,086 5,655 1,968

Marginal cost of sales

1,06,9

14

1,18,4

31

1,17,6

87

Fixed manufacturing costs 91,000 91,000 91,000

Gross profit 54,086

1,23,5

69 97,313

Selling and distribution

expenses 5,600 7,400 7,000

Administration expenses 10,100 10,100 10,100

Profit /(Loss) from

operations before interest

and tax 38,386

1,06,0

69 80,213

Interest expense 1,100 1,350 1,600

es Year 1 Year 2 Year 3

£ £ £ £ £ £

Sales

2,52,0

00

3,33,0

00

3,06,0

00

Marginal cost of sales:

Opening Stock - 4,086 5,655

Add variable production

costs:

Direct materials 59,200 64,000 60,800

Direct labour 37,000 40,000 38,000

Variable overheads 14,800 16,000 15,200

Less closing stock 1, 2 4,086 5,655 1,968

Marginal cost of sales

1,06,9

14

1,18,4

31

1,17,6

87

Fixed manufacturing costs 91,000 91,000 91,000

Gross profit 54,086

1,23,5

69 97,313

Selling and distribution

expenses 5,600 7,400 7,000

Administration expenses 10,100 10,100 10,100

Profit /(Loss) from

operations before interest

and tax 38,386

1,06,0

69 80,213

Interest expense 1,100 1,350 1,600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

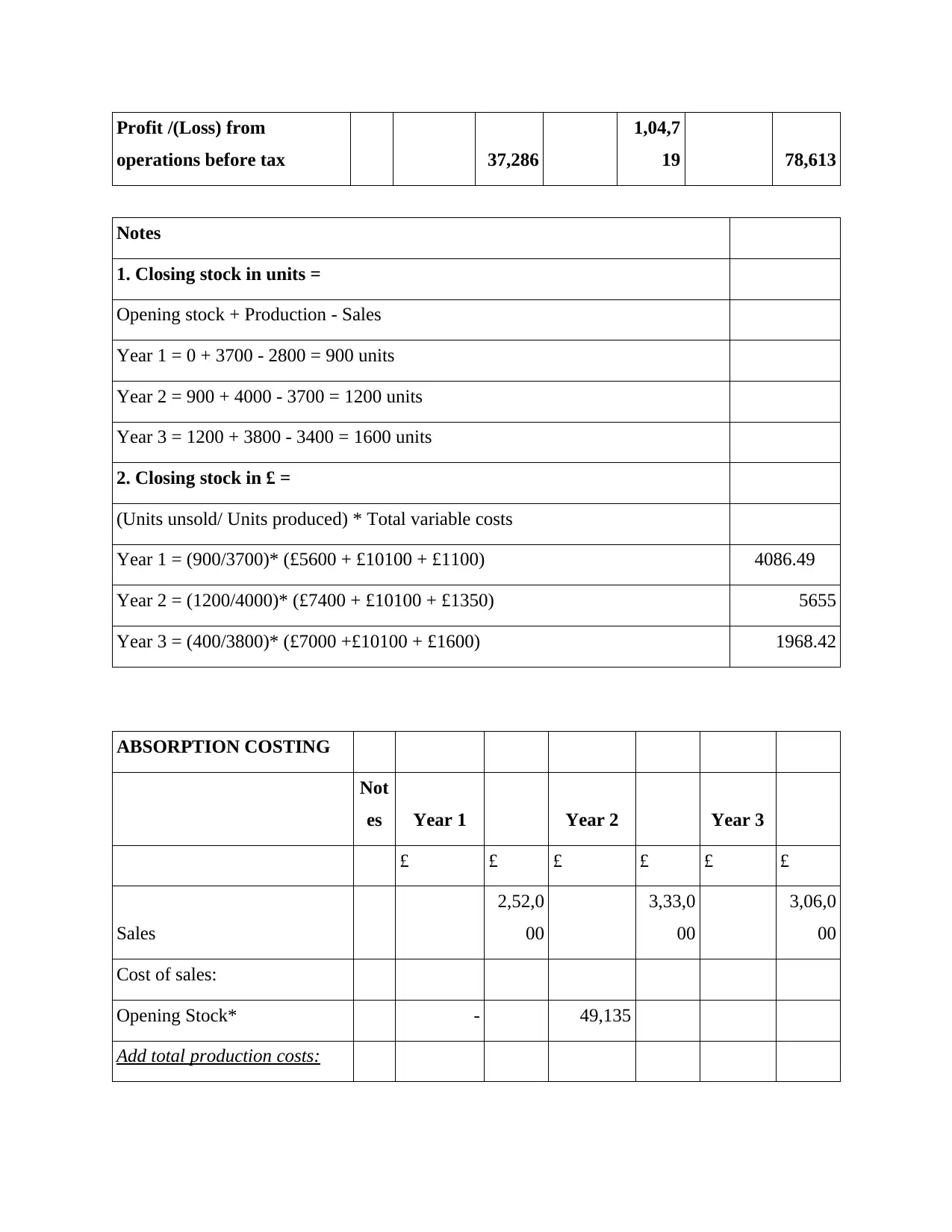

Profit /(Loss) from

operations before tax 37,286

1,04,7

19 78,613

Notes

1. Closing stock in units =

Opening stock + Production - Sales

Year 1 = 0 + 3700 - 2800 = 900 units

Year 2 = 900 + 4000 - 3700 = 1200 units

Year 3 = 1200 + 3800 - 3400 = 1600 units

2. Closing stock in £ =

(Units unsold/ Units produced) * Total variable costs

Year 1 = (900/3700)* (£5600 + £10100 + £1100) 4086.49

Year 2 = (1200/4000)* (£7400 + £10100 + £1350) 5655

Year 3 = (400/3800)* (£7000 +£10100 + £1600) 1968.42

ABSORPTION COSTING

Not

es Year 1 Year 2 Year 3

£ £ £ £ £ £

Sales

2,52,0

00

3,33,0

00

3,06,0

00

Cost of sales:

Opening Stock* - 49,135

Add total production costs:

operations before tax 37,286

1,04,7

19 78,613

Notes

1. Closing stock in units =

Opening stock + Production - Sales

Year 1 = 0 + 3700 - 2800 = 900 units

Year 2 = 900 + 4000 - 3700 = 1200 units

Year 3 = 1200 + 3800 - 3400 = 1600 units

2. Closing stock in £ =

(Units unsold/ Units produced) * Total variable costs

Year 1 = (900/3700)* (£5600 + £10100 + £1100) 4086.49

Year 2 = (1200/4000)* (£7400 + £10100 + £1350) 5655

Year 3 = (400/3800)* (£7000 +£10100 + £1600) 1968.42

ABSORPTION COSTING

Not

es Year 1 Year 2 Year 3

£ £ £ £ £ £

Sales

2,52,0

00

3,33,0

00

3,06,0

00

Cost of sales:

Opening Stock* - 49,135

Add total production costs:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Direct materials 59,200 64,000 60,800

Direct labour 37,000 40,000 38,000

Variable overheads 14,800 16,000 15,200

Fixed manufacturing costs 91,000 91,000 91,000

Less closing stock** 1,2 49,135 63,300 21,579

Cost of sales

1,52,8

65

1,96,8

35

1,83,4

21

Gross profit

99,13

5

1,36,1

65

1,22,5

79

Distribution expenses 5,600 7,400 7,000

Administration expenses

10,10

0

10,10

0 10,100

Profit /(Loss) from

operations before interest

and tax

83,43

5

1,18,6

65

1,05,4

79

Interest 1,100 1,350 1,600

Profit /(Loss) from

operations before tax

82,33

5

1,17,3

15

1,03,8

79

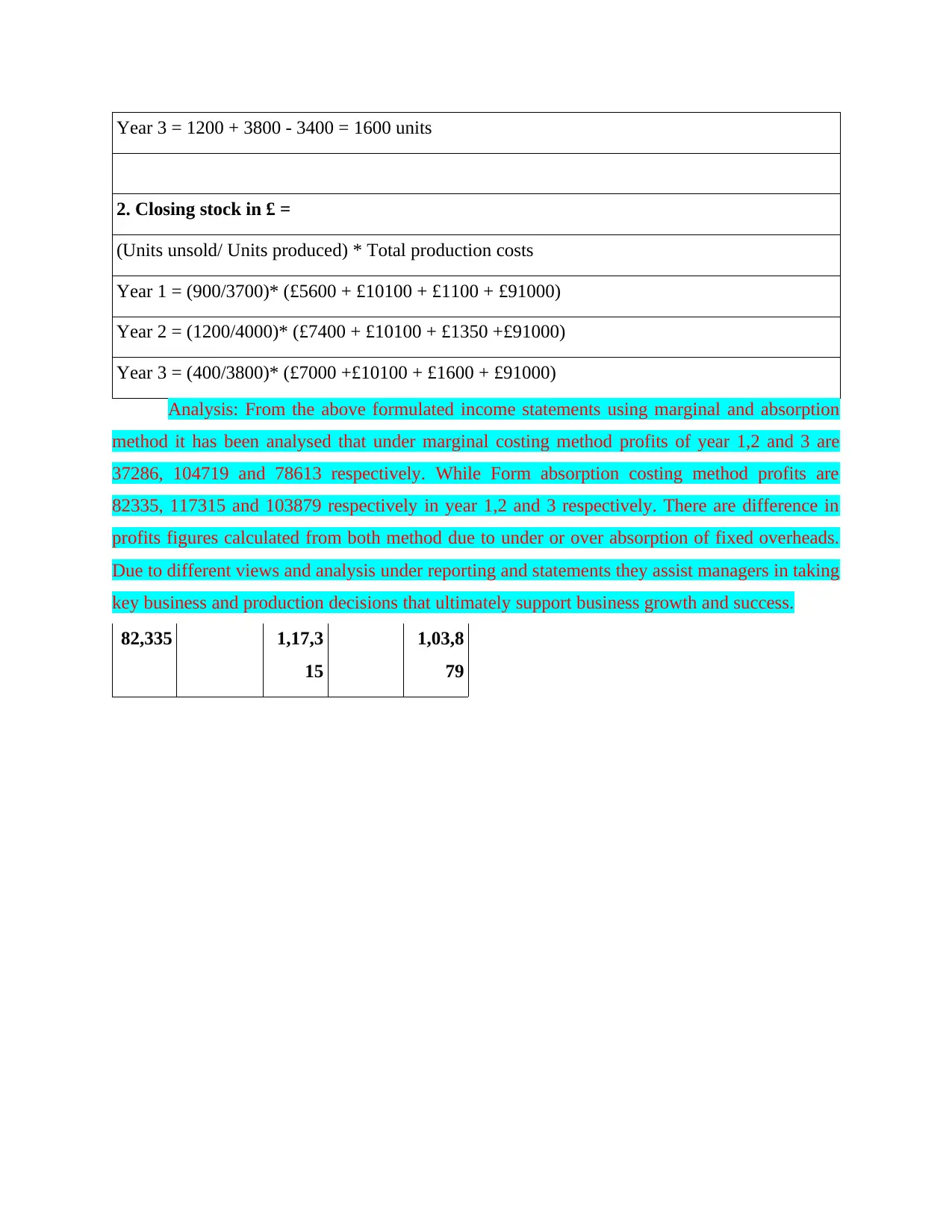

Notes

1. Closing stock in units =

Opening stock + Production - Sales

Year 1 = 0 + 3700 - 2800 = 900 units

Year 2 = 900 + 4000 - 3700 = 1200 units

Direct labour 37,000 40,000 38,000

Variable overheads 14,800 16,000 15,200

Fixed manufacturing costs 91,000 91,000 91,000

Less closing stock** 1,2 49,135 63,300 21,579

Cost of sales

1,52,8

65

1,96,8

35

1,83,4

21

Gross profit

99,13

5

1,36,1

65

1,22,5

79

Distribution expenses 5,600 7,400 7,000

Administration expenses

10,10

0

10,10

0 10,100

Profit /(Loss) from

operations before interest

and tax

83,43

5

1,18,6

65

1,05,4

79

Interest 1,100 1,350 1,600

Profit /(Loss) from

operations before tax

82,33

5

1,17,3

15

1,03,8

79

Notes

1. Closing stock in units =

Opening stock + Production - Sales

Year 1 = 0 + 3700 - 2800 = 900 units

Year 2 = 900 + 4000 - 3700 = 1200 units

Year 3 = 1200 + 3800 - 3400 = 1600 units

2. Closing stock in £ =

(Units unsold/ Units produced) * Total production costs

Year 1 = (900/3700)* (£5600 + £10100 + £1100 + £91000)

Year 2 = (1200/4000)* (£7400 + £10100 + £1350 +£91000)

Year 3 = (400/3800)* (£7000 +£10100 + £1600 + £91000)

Analysis: From the above formulated income statements using marginal and absorption

method it has been analysed that under marginal costing method profits of year 1,2 and 3 are

37286, 104719 and 78613 respectively. While Form absorption costing method profits are

82335, 117315 and 103879 respectively in year 1,2 and 3 respectively. There are difference in

profits figures calculated from both method due to under or over absorption of fixed overheads.

Due to different views and analysis under reporting and statements they assist managers in taking

key business and production decisions that ultimately support business growth and success.

82,335 1,17,3

15

1,03,8

79

2. Closing stock in £ =

(Units unsold/ Units produced) * Total production costs

Year 1 = (900/3700)* (£5600 + £10100 + £1100 + £91000)

Year 2 = (1200/4000)* (£7400 + £10100 + £1350 +£91000)

Year 3 = (400/3800)* (£7000 +£10100 + £1600 + £91000)

Analysis: From the above formulated income statements using marginal and absorption

method it has been analysed that under marginal costing method profits of year 1,2 and 3 are

37286, 104719 and 78613 respectively. While Form absorption costing method profits are

82335, 117315 and 103879 respectively in year 1,2 and 3 respectively. There are difference in

profits figures calculated from both method due to under or over absorption of fixed overheads.

Due to different views and analysis under reporting and statements they assist managers in taking

key business and production decisions that ultimately support business growth and success.

82,335 1,17,3

15

1,03,8

79

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.