Comprehensive Report on Management Accounting for Business Development

VerifiedAdded on 2020/07/23

|16

|3933

|89

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its concepts, systems, and implications for business operations, particularly for Zylla Company. It explores various management accounting techniques, including job costing, inventory management, price optimization, cost accounting, and auditing. The report delves into the implications of managerial accounting reports, such as inventory management reports, debtors aging reports, and budgetary reports, on business operations. Furthermore, it presents a detailed comparison of marginal and absorption costing techniques, with interpretations and recommendations for Zylla Company. The report also examines budgetary control techniques, including activity-based costing, zero-based budgeting, and incremental budgeting, along with their advantages and disadvantages. Finally, it addresses techniques for resolving financial problems in business, offering valuable insights for internal administration and operational improvements.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

P1 Concept of managements accounting and system of management accounting......................3

P2 Implication of managerial accounting reports into business operations.................................5

P3 preparation of income statement on the basis of marginal and absorption costing techniques

......................................................................................................................................................6

P4 Determining the budgetary control techniques as well as planning tools..............................7

P5 Ascertain the techniques for resolving the financial problems in business..........................12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................3

P1 Concept of managements accounting and system of management accounting......................3

P2 Implication of managerial accounting reports into business operations.................................5

P3 preparation of income statement on the basis of marginal and absorption costing techniques

......................................................................................................................................................6

P4 Determining the budgetary control techniques as well as planning tools..............................7

P5 Ascertain the techniques for resolving the financial problems in business..........................12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Managing internal activities of a firm which will require the accurate analysis and

determination of the facts which were to be resolved. Management accounting tools can be

assistive in terms of making improvement in the operational ability, financial health as well as

better cost mechanism. In the present report there will be discussion based on various budgetary

techniques, costing system, reporting methods as well as performance appraisal techniques that

will be helpful in internal administration. The report is also consists with the costing techniques

and planning tools that will be reflect increment in the operational level of Zylla Company.

P1 Concept of managements accounting and system of management accounting

Managements accounting:

This is the mathematical tools which help in analyzing the data set to ascertain the actual

requirements in the business. Moreover, such analyzed data set will be assistive to the

managerial professionals in terms of decision making and planning the forecasted budgets for the

operations (Cooper, Ezzamel and Qu, 2017). Similarly, implication of such technique will

improve managerial efficiency as targeted goals will be attain by organization in a very

prominent way.

Management accounting system:

There are various techniques which are needed to be implicated by the professionals of

Zylla Company in managing the business activities. These techniques will funnel the managers

as to have appropriate development of duties which are needed to be improved. Along with this

these techniques will help in improving firm’s operational efficiencies (Honggowati and et.al.,

2017). Thus, there are various accounting techniques which are as follows:

Managing internal activities of a firm which will require the accurate analysis and

determination of the facts which were to be resolved. Management accounting tools can be

assistive in terms of making improvement in the operational ability, financial health as well as

better cost mechanism. In the present report there will be discussion based on various budgetary

techniques, costing system, reporting methods as well as performance appraisal techniques that

will be helpful in internal administration. The report is also consists with the costing techniques

and planning tools that will be reflect increment in the operational level of Zylla Company.

P1 Concept of managements accounting and system of management accounting

Managements accounting:

This is the mathematical tools which help in analyzing the data set to ascertain the actual

requirements in the business. Moreover, such analyzed data set will be assistive to the

managerial professionals in terms of decision making and planning the forecasted budgets for the

operations (Cooper, Ezzamel and Qu, 2017). Similarly, implication of such technique will

improve managerial efficiency as targeted goals will be attain by organization in a very

prominent way.

Management accounting system:

There are various techniques which are needed to be implicated by the professionals of

Zylla Company in managing the business activities. These techniques will funnel the managers

as to have appropriate development of duties which are needed to be improved. Along with this

these techniques will help in improving firm’s operational efficiencies (Honggowati and et.al.,

2017). Thus, there are various accounting techniques which are as follows:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Job costing: To demonstrate the costs incurred in each operational tasks of the business

there has been determination of transaction activities. Therefore, this accounting system helps in

making the adequate record of all the costs such as direct material, labor and relevant costs.

Thus, costs will be beneficial to demonstrate the costs requirements in each department.

Inventory management: To keep the records of the imports and exports of inventory in

the business this will be based on managing the level of inventories. Therefore, the production

department needs to be conscious regarding consumer demand and the business profitability

(Miller and Rose, 2017). Therefore, the production of goods must be based on seasonal

requirements as well as analyzing the buyer’s demand. Zylla company will be helpful as if there

will be proper control over production and deliveries of goods to the consumers.

Price optimization: In relation with improving the operating profit of the business they

set different prices on their products and services. Thus, such variation made by professionals as

per delivering the products and services among consumers at different locations. They fetch their

behavior towards such prices (Turner and et.al., 2017). Moreover, the best or profitable prices will

be kept forward by them and which will be helpful in generating the appropriate amount of gains

to the firm. Zylla Company will have benefits as if they implicate such techniques into

operations.

Cost accounting: This technique will be helpful to Zylla Company as it demonstrate the

costs incurred in each business units. Therefore, to produce a product or services there will be

requirement of high amount of funds (Parker and Fleischman, 2017). Thus, to analyses the level of

funds invested in the business activity, the costing technique brings the most preferable analysis.

Auditing: Periodically making the internal audit will help the business in making the

adequate improvements in the work and work culture. It brings the internal information which

were relevant with the costs, gains, operating expenditures and relevant details that bounds the

managerial professionals to make effective decisions. Zylla Company will have appropriate

internal administration which in makes favorable improvements in the operational stability. It

helps in analyzing the profits, liabilities and assets during a period.

there has been determination of transaction activities. Therefore, this accounting system helps in

making the adequate record of all the costs such as direct material, labor and relevant costs.

Thus, costs will be beneficial to demonstrate the costs requirements in each department.

Inventory management: To keep the records of the imports and exports of inventory in

the business this will be based on managing the level of inventories. Therefore, the production

department needs to be conscious regarding consumer demand and the business profitability

(Miller and Rose, 2017). Therefore, the production of goods must be based on seasonal

requirements as well as analyzing the buyer’s demand. Zylla company will be helpful as if there

will be proper control over production and deliveries of goods to the consumers.

Price optimization: In relation with improving the operating profit of the business they

set different prices on their products and services. Thus, such variation made by professionals as

per delivering the products and services among consumers at different locations. They fetch their

behavior towards such prices (Turner and et.al., 2017). Moreover, the best or profitable prices will

be kept forward by them and which will be helpful in generating the appropriate amount of gains

to the firm. Zylla Company will have benefits as if they implicate such techniques into

operations.

Cost accounting: This technique will be helpful to Zylla Company as it demonstrate the

costs incurred in each business units. Therefore, to produce a product or services there will be

requirement of high amount of funds (Parker and Fleischman, 2017). Thus, to analyses the level of

funds invested in the business activity, the costing technique brings the most preferable analysis.

Auditing: Periodically making the internal audit will help the business in making the

adequate improvements in the work and work culture. It brings the internal information which

were relevant with the costs, gains, operating expenditures and relevant details that bounds the

managerial professionals to make effective decisions. Zylla Company will have appropriate

internal administration which in makes favorable improvements in the operational stability. It

helps in analyzing the profits, liabilities and assets during a period.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

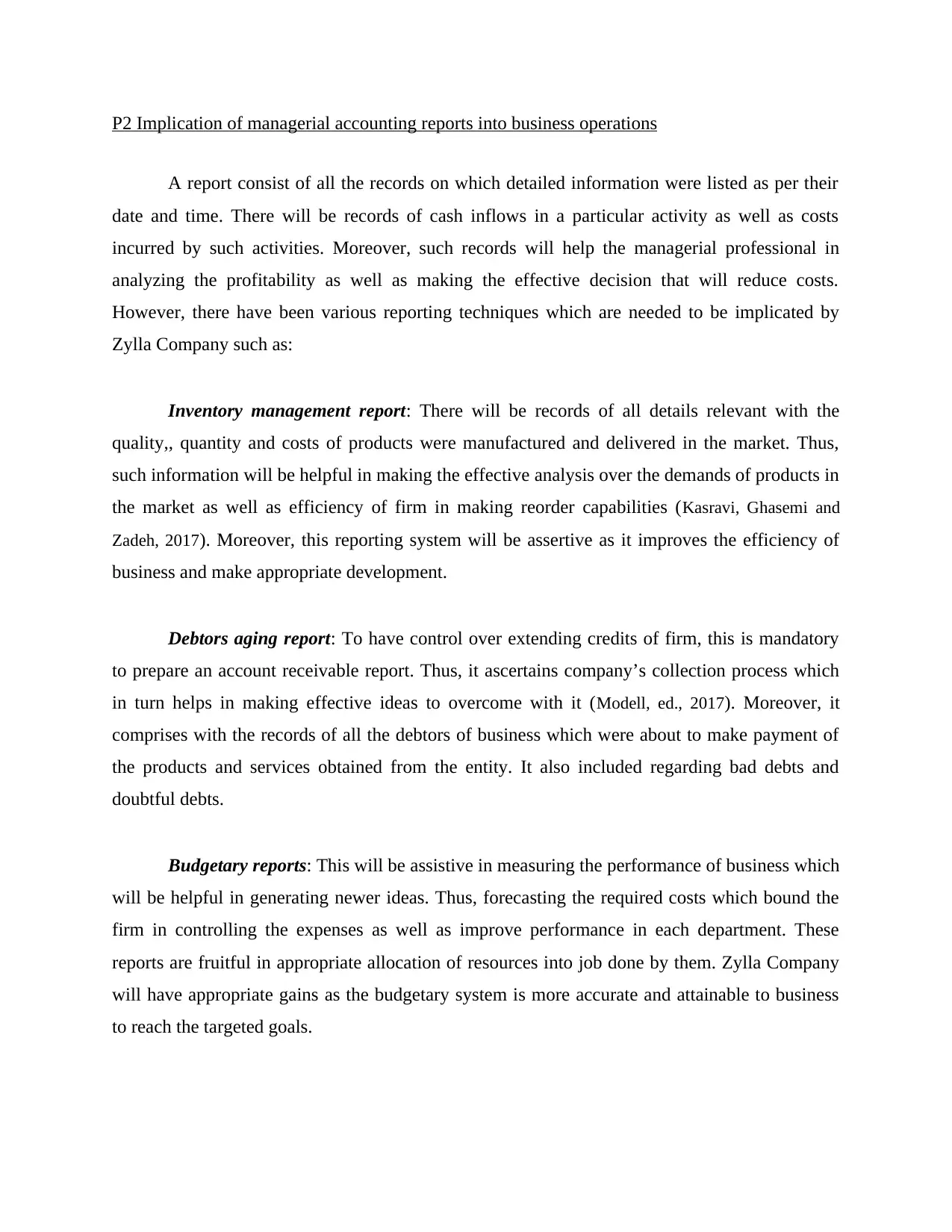

P2 Implication of managerial accounting reports into business operations

A report consist of all the records on which detailed information were listed as per their

date and time. There will be records of cash inflows in a particular activity as well as costs

incurred by such activities. Moreover, such records will help the managerial professional in

analyzing the profitability as well as making the effective decision that will reduce costs.

However, there have been various reporting techniques which are needed to be implicated by

Zylla Company such as:

Inventory management report: There will be records of all details relevant with the

quality,, quantity and costs of products were manufactured and delivered in the market. Thus,

such information will be helpful in making the effective analysis over the demands of products in

the market as well as efficiency of firm in making reorder capabilities (Kasravi, Ghasemi and

Zadeh, 2017). Moreover, this reporting system will be assertive as it improves the efficiency of

business and make appropriate development.

Debtors aging report: To have control over extending credits of firm, this is mandatory

to prepare an account receivable report. Thus, it ascertains company’s collection process which

in turn helps in making effective ideas to overcome with it (Modell, ed., 2017). Moreover, it

comprises with the records of all the debtors of business which were about to make payment of

the products and services obtained from the entity. It also included regarding bad debts and

doubtful debts.

Budgetary reports: This will be assistive in measuring the performance of business which

will be helpful in generating newer ideas. Thus, forecasting the required costs which bound the

firm in controlling the expenses as well as improve performance in each department. These

reports are fruitful in appropriate allocation of resources into job done by them. Zylla Company

will have appropriate gains as the budgetary system is more accurate and attainable to business

to reach the targeted goals.

A report consist of all the records on which detailed information were listed as per their

date and time. There will be records of cash inflows in a particular activity as well as costs

incurred by such activities. Moreover, such records will help the managerial professional in

analyzing the profitability as well as making the effective decision that will reduce costs.

However, there have been various reporting techniques which are needed to be implicated by

Zylla Company such as:

Inventory management report: There will be records of all details relevant with the

quality,, quantity and costs of products were manufactured and delivered in the market. Thus,

such information will be helpful in making the effective analysis over the demands of products in

the market as well as efficiency of firm in making reorder capabilities (Kasravi, Ghasemi and

Zadeh, 2017). Moreover, this reporting system will be assertive as it improves the efficiency of

business and make appropriate development.

Debtors aging report: To have control over extending credits of firm, this is mandatory

to prepare an account receivable report. Thus, it ascertains company’s collection process which

in turn helps in making effective ideas to overcome with it (Modell, ed., 2017). Moreover, it

comprises with the records of all the debtors of business which were about to make payment of

the products and services obtained from the entity. It also included regarding bad debts and

doubtful debts.

Budgetary reports: This will be assistive in measuring the performance of business which

will be helpful in generating newer ideas. Thus, forecasting the required costs which bound the

firm in controlling the expenses as well as improve performance in each department. These

reports are fruitful in appropriate allocation of resources into job done by them. Zylla Company

will have appropriate gains as the budgetary system is more accurate and attainable to business

to reach the targeted goals.

Cost accounting reports: It comprises with computing the costs incurred in

manufacturing and delivering the goods to the need users. Zylla Company will have effective

improvements in the business activities as the costs incurred in each business operation will be

under control. It ascertains the costs such as inventory used in production, labor costs, overheads

etc. Thus, these are the record which bound managers in generating innovating ideas as well as

proposing the alternatives which will help in reducing the manufacturing costs.

Performance reports: These are the reports which are prepared by the managerial heads

and professionals of the business in order to assess the performance made by workforce and

entity. Therefore, it will be a helpful source in terms of generating adequate gains and knowledge

from the market. Thus, such reports will have positive impacts over developing the operational

practices (Szychta and Dobroszek, 2017). In addition, this report helps in funneling the managers to

make effective analysis and produce the fruitful decision to bring reforms in work culture.

Moreover, it will have positive impacts over motivating employees to make productive efforts.

Zylla Company will have fruitful gains as if the managerial professionals will make adequate

analysis employee performance as well as encourage them with rewards, bonuses and incentive

benefits.

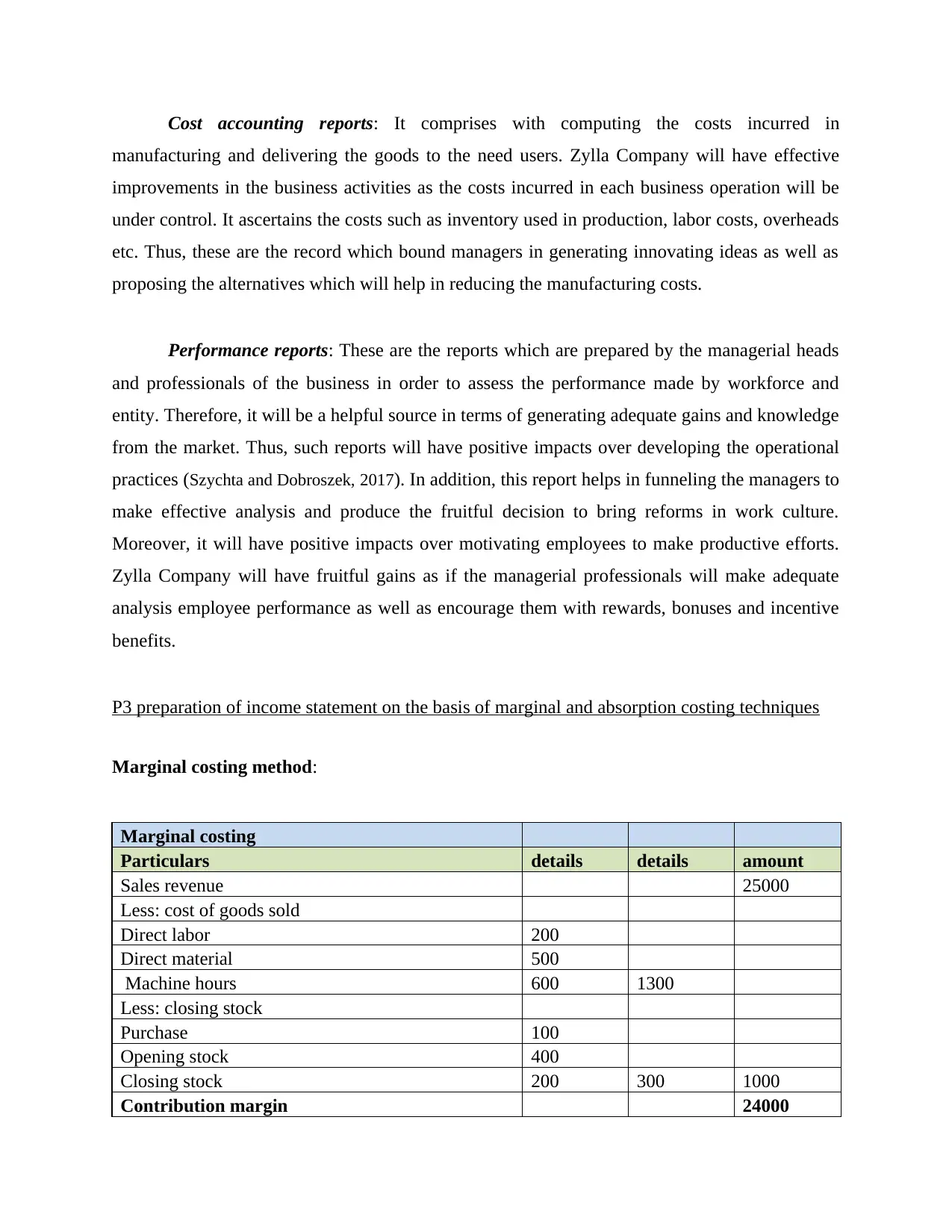

P3 preparation of income statement on the basis of marginal and absorption costing techniques

Marginal costing method:

Marginal costing

Particulars details details amount

Sales revenue 25000

Less: cost of goods sold

Direct labor 200

Direct material 500

Machine hours 600 1300

Less: closing stock

Purchase 100

Opening stock 400

Closing stock 200 300 1000

Contribution margin 24000

manufacturing and delivering the goods to the need users. Zylla Company will have effective

improvements in the business activities as the costs incurred in each business operation will be

under control. It ascertains the costs such as inventory used in production, labor costs, overheads

etc. Thus, these are the record which bound managers in generating innovating ideas as well as

proposing the alternatives which will help in reducing the manufacturing costs.

Performance reports: These are the reports which are prepared by the managerial heads

and professionals of the business in order to assess the performance made by workforce and

entity. Therefore, it will be a helpful source in terms of generating adequate gains and knowledge

from the market. Thus, such reports will have positive impacts over developing the operational

practices (Szychta and Dobroszek, 2017). In addition, this report helps in funneling the managers to

make effective analysis and produce the fruitful decision to bring reforms in work culture.

Moreover, it will have positive impacts over motivating employees to make productive efforts.

Zylla Company will have fruitful gains as if the managerial professionals will make adequate

analysis employee performance as well as encourage them with rewards, bonuses and incentive

benefits.

P3 preparation of income statement on the basis of marginal and absorption costing techniques

Marginal costing method:

Marginal costing

Particulars details details amount

Sales revenue 25000

Less: cost of goods sold

Direct labor 200

Direct material 500

Machine hours 600 1300

Less: closing stock

Purchase 100

Opening stock 400

Closing stock 200 300 1000

Contribution margin 24000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Less: variable selling overheads 350

Less: fixed expenses 250

Production overheads 1800

Fixed selling and administrative costs 200 1400

Net profit 22600

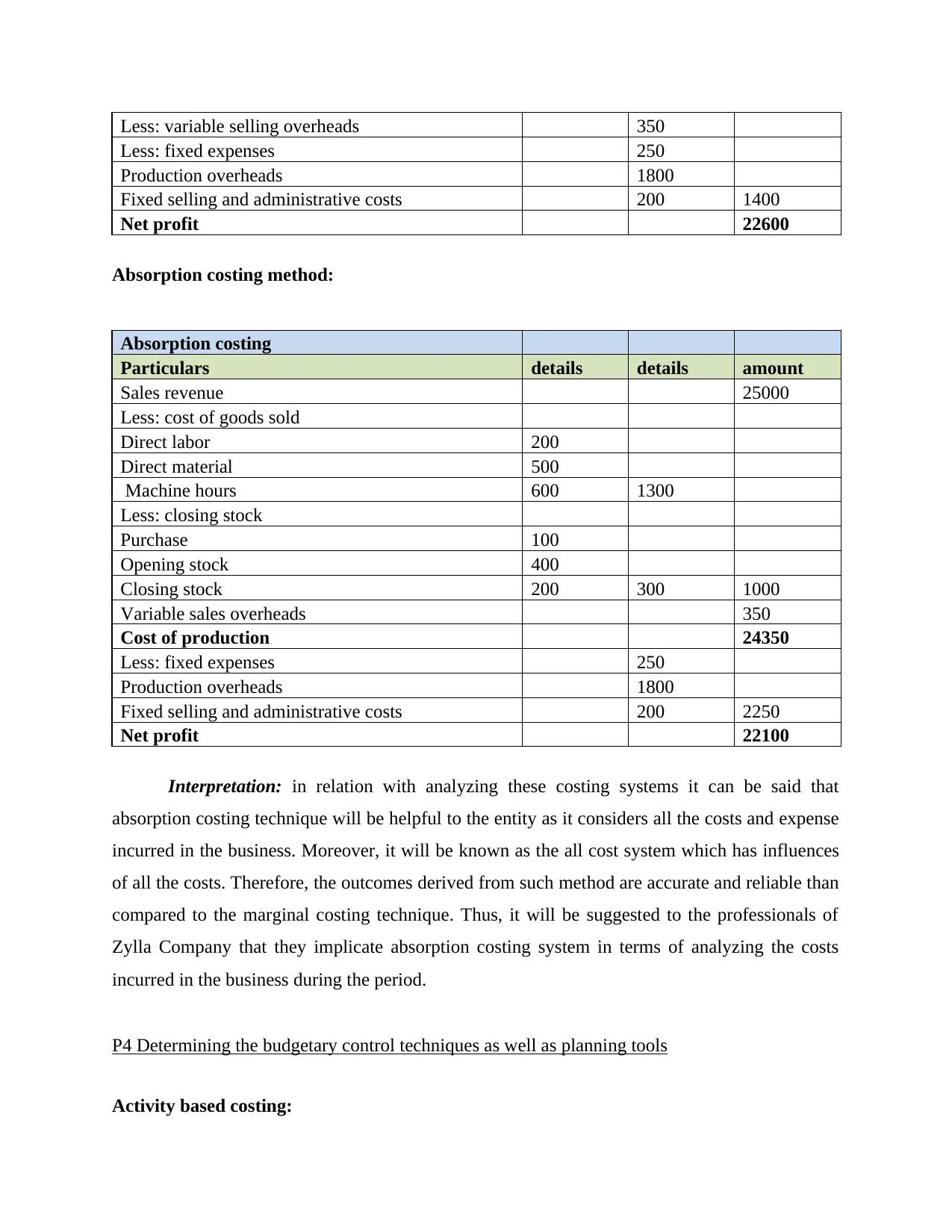

Absorption costing method:

Absorption costing

Particulars details details amount

Sales revenue 25000

Less: cost of goods sold

Direct labor 200

Direct material 500

Machine hours 600 1300

Less: closing stock

Purchase 100

Opening stock 400

Closing stock 200 300 1000

Variable sales overheads 350

Cost of production 24350

Less: fixed expenses 250

Production overheads 1800

Fixed selling and administrative costs 200 2250

Net profit 22100

Interpretation: in relation with analyzing these costing systems it can be said that

absorption costing technique will be helpful to the entity as it considers all the costs and expense

incurred in the business. Moreover, it will be known as the all cost system which has influences

of all the costs. Therefore, the outcomes derived from such method are accurate and reliable than

compared to the marginal costing technique. Thus, it will be suggested to the professionals of

Zylla Company that they implicate absorption costing system in terms of analyzing the costs

incurred in the business during the period.

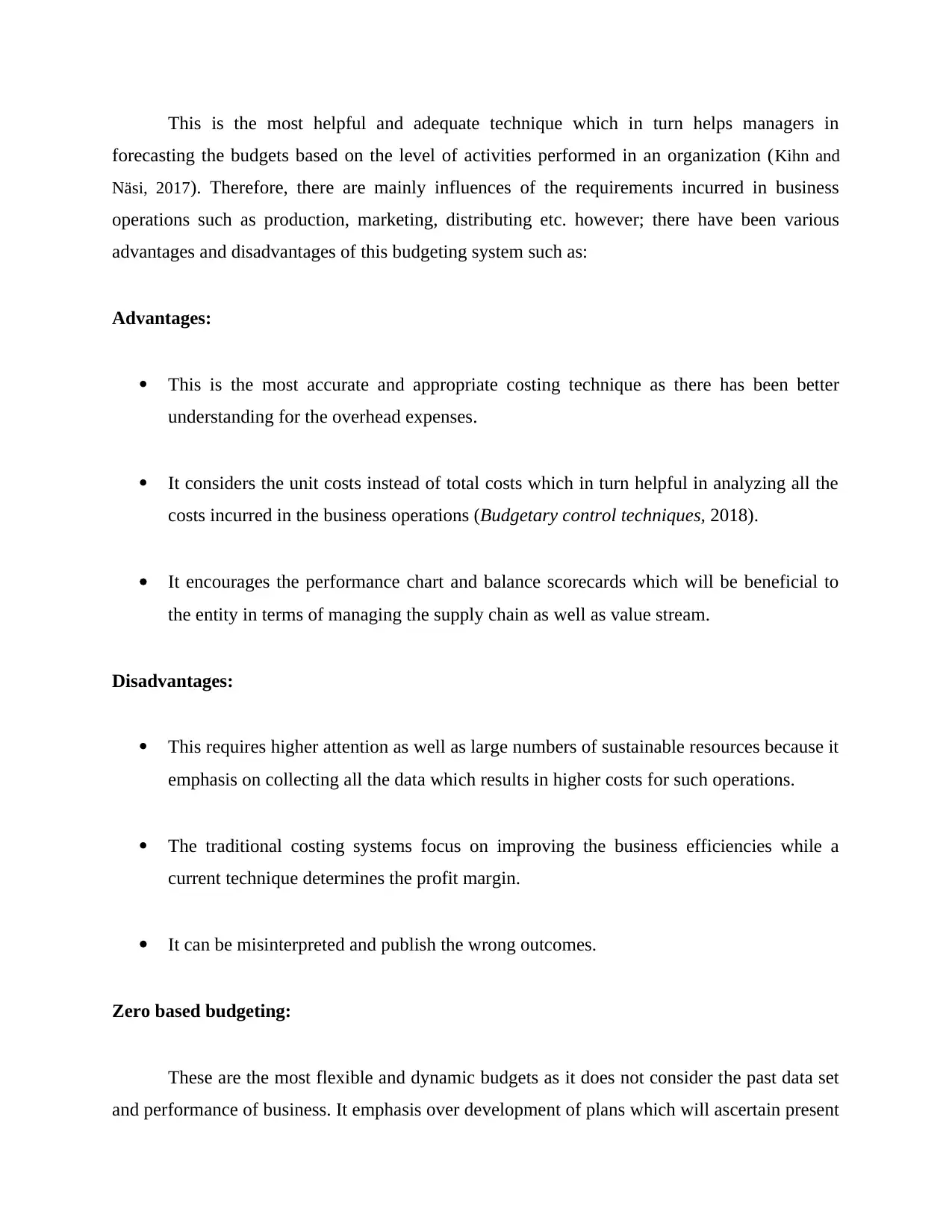

P4 Determining the budgetary control techniques as well as planning tools

Activity based costing:

Less: fixed expenses 250

Production overheads 1800

Fixed selling and administrative costs 200 1400

Net profit 22600

Absorption costing method:

Absorption costing

Particulars details details amount

Sales revenue 25000

Less: cost of goods sold

Direct labor 200

Direct material 500

Machine hours 600 1300

Less: closing stock

Purchase 100

Opening stock 400

Closing stock 200 300 1000

Variable sales overheads 350

Cost of production 24350

Less: fixed expenses 250

Production overheads 1800

Fixed selling and administrative costs 200 2250

Net profit 22100

Interpretation: in relation with analyzing these costing systems it can be said that

absorption costing technique will be helpful to the entity as it considers all the costs and expense

incurred in the business. Moreover, it will be known as the all cost system which has influences

of all the costs. Therefore, the outcomes derived from such method are accurate and reliable than

compared to the marginal costing technique. Thus, it will be suggested to the professionals of

Zylla Company that they implicate absorption costing system in terms of analyzing the costs

incurred in the business during the period.

P4 Determining the budgetary control techniques as well as planning tools

Activity based costing:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This is the most helpful and adequate technique which in turn helps managers in

forecasting the budgets based on the level of activities performed in an organization (Kihn and

Näsi, 2017). Therefore, there are mainly influences of the requirements incurred in business

operations such as production, marketing, distributing etc. however; there have been various

advantages and disadvantages of this budgeting system such as:

Advantages:

This is the most accurate and appropriate costing technique as there has been better

understanding for the overhead expenses.

It considers the unit costs instead of total costs which in turn helpful in analyzing all the

costs incurred in the business operations (Budgetary control techniques, 2018).

It encourages the performance chart and balance scorecards which will be beneficial to

the entity in terms of managing the supply chain as well as value stream.

Disadvantages:

This requires higher attention as well as large numbers of sustainable resources because it

emphasis on collecting all the data which results in higher costs for such operations.

The traditional costing systems focus on improving the business efficiencies while a

current technique determines the profit margin.

It can be misinterpreted and publish the wrong outcomes.

Zero based budgeting:

These are the most flexible and dynamic budgets as it does not consider the past data set

and performance of business. It emphasis over development of plans which will ascertain present

forecasting the budgets based on the level of activities performed in an organization (Kihn and

Näsi, 2017). Therefore, there are mainly influences of the requirements incurred in business

operations such as production, marketing, distributing etc. however; there have been various

advantages and disadvantages of this budgeting system such as:

Advantages:

This is the most accurate and appropriate costing technique as there has been better

understanding for the overhead expenses.

It considers the unit costs instead of total costs which in turn helpful in analyzing all the

costs incurred in the business operations (Budgetary control techniques, 2018).

It encourages the performance chart and balance scorecards which will be beneficial to

the entity in terms of managing the supply chain as well as value stream.

Disadvantages:

This requires higher attention as well as large numbers of sustainable resources because it

emphasis on collecting all the data which results in higher costs for such operations.

The traditional costing systems focus on improving the business efficiencies while a

current technique determines the profit margin.

It can be misinterpreted and publish the wrong outcomes.

Zero based budgeting:

These are the most flexible and dynamic budgets as it does not consider the past data set

and performance of business. It emphasis over development of plans which will ascertain present

and future needs. Similarly, due such facts these are the budgets which are mainly starts with

zero bases or nil balance (Lee and Herold, 2018). The costs will be added as per the requirements

of the industrial activities; Zylla Company will have appropriate budgets for the future as if they

implicate the use of such techniques.

Advantages:

The most satisfying advantage of this budgeting technique is that it is very flexible and

time changes in accordance with business requirements.

It comprises with lower costs as it dose not require focused operations as well as all the

budgets starts from the zero balance which is helpful in having comparatively lower

costs.

It does not require too much time in decision making or planning for the activities.

Disadvantages:

The flexible nature of the budgeting system dose not provides the accurate analysis over

the actual required costs in an activity.

There will be manipulation of funds by the managers in terms with meeting their personal

needs.

Incremental budgeting:

These are the methods which were base on the assumptions that there have been slight

changes in the budgeting process. Thus, it emphasizes over the previous period budgets and the

actual expenditure incurred in the business on which they propose the additional budgeting costs.

Thus, it believes that the demand of products and services will be increase day to day so to meet

such requirements there will be need of accurate funds (Cooper, Ezzamel and Qu, 2017).

zero bases or nil balance (Lee and Herold, 2018). The costs will be added as per the requirements

of the industrial activities; Zylla Company will have appropriate budgets for the future as if they

implicate the use of such techniques.

Advantages:

The most satisfying advantage of this budgeting technique is that it is very flexible and

time changes in accordance with business requirements.

It comprises with lower costs as it dose not require focused operations as well as all the

budgets starts from the zero balance which is helpful in having comparatively lower

costs.

It does not require too much time in decision making or planning for the activities.

Disadvantages:

The flexible nature of the budgeting system dose not provides the accurate analysis over

the actual required costs in an activity.

There will be manipulation of funds by the managers in terms with meeting their personal

needs.

Incremental budgeting:

These are the methods which were base on the assumptions that there have been slight

changes in the budgeting process. Thus, it emphasizes over the previous period budgets and the

actual expenditure incurred in the business on which they propose the additional budgeting costs.

Thus, it believes that the demand of products and services will be increase day to day so to meet

such requirements there will be need of accurate funds (Cooper, Ezzamel and Qu, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Moreover, before implicating this budgeting system in Zylla Company, there are various

advantages and disadvantages associated with this budgeting system such as:

Advantages:

It is the easiest and simple method as the managerial professionals or accountant did not

need to make higher decision they can only surplus the amount of budgets by reviewing

for the actual needs.

It brings the stability in funding terms which brings the fruitfulness to the entity in

retaining the favorable outcomes fro the many years.

It helps in balancing the operational work practices in the entity which ensures that all the

departments must make stable and consistent efforts for the longer period.

Disadvantages:

Due to incremental nature of this budgeting techniques which only emphases over

increasing the budgeting costs with considering minor changes.

It does not make clear analysis over the business needs as well as demands in the market.

Therefore, this encourages the managerial team to overspend over non profitable

activities.

Manager’s emphases over reducing the revenue growth while extending the higher

expanses due to which they would take higher variance advantages.

NPV:

This is the present value of future cash flow which ascertains the managerial

professionals in accurate planning for the proposed projects. Moreover, it helps in analyzing the

advantages and disadvantages associated with this budgeting system such as:

Advantages:

It is the easiest and simple method as the managerial professionals or accountant did not

need to make higher decision they can only surplus the amount of budgets by reviewing

for the actual needs.

It brings the stability in funding terms which brings the fruitfulness to the entity in

retaining the favorable outcomes fro the many years.

It helps in balancing the operational work practices in the entity which ensures that all the

departments must make stable and consistent efforts for the longer period.

Disadvantages:

Due to incremental nature of this budgeting techniques which only emphases over

increasing the budgeting costs with considering minor changes.

It does not make clear analysis over the business needs as well as demands in the market.

Therefore, this encourages the managerial team to overspend over non profitable

activities.

Manager’s emphases over reducing the revenue growth while extending the higher

expanses due to which they would take higher variance advantages.

NPV:

This is the present value of future cash flow which ascertains the managerial

professionals in accurate planning for the proposed projects. Moreover, it helps in analyzing the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

profitability of the plan which will be based on various years that will brings the accurate

outcomes to the professionals in analyzing and decision making (Honggowati and et.al., 2017).

Thus, it will suggest to the managers of Zylla Company in terms with implicating the use of such

techniques. Therefore, there are various advantages and disadvantages which are needed t be

consider by the industry such as:

Advantages:

It determines that the future value of the projects is worth less than comparison with

today’s value.

It considers the discounting of cash flows on the basis of periodical capital costs.

It brings the most accurate outcomes to the professionals of the business which will be

helpful in attracting the investors to the proposed plan.

Disadvantages:

The main disadvantages of this budgeting system are that it will require higher guess

work which in turn makes the unreliability over the gather information for the operations.

It emphases over increasing the costs of capital which will bring good or higher returns to

the firm.

It is time consuming process which will be in adequate and unfavorable to the business.

IRR:

The internal rate of return focuses over return generated by the business over the

proposed plan. Moreover, it can be said that it is a capital budgeting method which measured and

compared with cut off rates of a specific project plan. It brings the results to the professionals

outcomes to the professionals in analyzing and decision making (Honggowati and et.al., 2017).

Thus, it will suggest to the managers of Zylla Company in terms with implicating the use of such

techniques. Therefore, there are various advantages and disadvantages which are needed t be

consider by the industry such as:

Advantages:

It determines that the future value of the projects is worth less than comparison with

today’s value.

It considers the discounting of cash flows on the basis of periodical capital costs.

It brings the most accurate outcomes to the professionals of the business which will be

helpful in attracting the investors to the proposed plan.

Disadvantages:

The main disadvantages of this budgeting system are that it will require higher guess

work which in turn makes the unreliability over the gather information for the operations.

It emphases over increasing the costs of capital which will bring good or higher returns to

the firm.

It is time consuming process which will be in adequate and unfavorable to the business.

IRR:

The internal rate of return focuses over return generated by the business over the

proposed plan. Moreover, it can be said that it is a capital budgeting method which measured and

compared with cut off rates of a specific project plan. It brings the results to the professionals

that the initial investments by them in the project will giver the proportionate amount of return in

each period (Miller and Rose, 2017). However, there will be various advantages and disadvantages

of this planning tool such as:

Advantages:

It comprises with the appropriate consideration of the time value of money which in turn

will be helpful in making the accurate decisions as well as improving the business health.

There will be equal importance were given to all the cash flows with uniform ranking.

Disadvantages:

It is very complex in understanding and which require the attention of accounting

professionals.

The assumptions made in these plans are unrealistic as well as unreliable.

P5 Ascertain the techniques for resolving the financial problems in business.

To improve the financial health of the entities needed to have implication of various

techniques and performance appraisal techniques which will have positive impacts over the

productivity. Therefore, there are some tools and techniques which are needed to be applied by

Zylla Company for better operational management in the firm. There may be uncertainty of

losing the financial stability but proper administrating and execution will help the business in

efficient development (Turner and et.al., 2017). Moreover, there have been various performance

appraisals which will be fruitful to Zylla Company such as:

Key performance indicators:

each period (Miller and Rose, 2017). However, there will be various advantages and disadvantages

of this planning tool such as:

Advantages:

It comprises with the appropriate consideration of the time value of money which in turn

will be helpful in making the accurate decisions as well as improving the business health.

There will be equal importance were given to all the cash flows with uniform ranking.

Disadvantages:

It is very complex in understanding and which require the attention of accounting

professionals.

The assumptions made in these plans are unrealistic as well as unreliable.

P5 Ascertain the techniques for resolving the financial problems in business.

To improve the financial health of the entities needed to have implication of various

techniques and performance appraisal techniques which will have positive impacts over the

productivity. Therefore, there are some tools and techniques which are needed to be applied by

Zylla Company for better operational management in the firm. There may be uncertainty of

losing the financial stability but proper administrating and execution will help the business in

efficient development (Turner and et.al., 2017). Moreover, there have been various performance

appraisals which will be fruitful to Zylla Company such as:

Key performance indicators:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.