Management Accounting Systems, Techniques, and Financial Reporting

VerifiedAdded on 2021/02/20

|17

|5021

|28

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its various systems, techniques, and applications within an organization. It begins with an introduction to management accounting, explaining its role in financial data maintenance, analysis, and decision-making. The report then delves into different types of management accounting systems, including cost accounting, inventory management, job costing, and price optimization systems, detailing their functionalities and benefits. It further explores various methods used in management accounting reporting, such as budget reports, performance reports, accounts receivable reports, and cost management reports. The report also includes practical examples, like the application of management accounting systems in Leonard Business Services, and demonstrates cost calculations using marginal and absorption costing techniques to prepare income statements. Additionally, the report discusses the advantages and disadvantages of planning tools used for budgetary control and compares how organizations adapt management accounting systems to respond to financial problems, concluding with the role of management accounting towards the sustainability of the organization. The report provides detailed calculations, interpretations, and analysis to illustrate the concepts.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

LO1..................................................................................................................................................1

P1. Various types of Management Accounting Systems............................................................1

P2, Different Method used for Management Accounting Reporting..........................................2

M1. Benefits of Management Accounting System and its application in context of

organization.................................................................................................................................3

LO2..................................................................................................................................................4

P3. Calculation of costs using appropriate techniques of cost analysis in order to prepare

income statement ........................................................................................................................4

M2. Range of Management Accounting Techniques to produce financial reporting documents

.....................................................................................................................................................8

LO3..................................................................................................................................................9

P4. Advantages and Disadvantages of various types of planning tools used for budgetary

control.........................................................................................................................................9

M3. Use and application of different planning tools in preparing and forecasting the budget.10

LO4................................................................................................................................................11

P5.Compare how organisations are adapting management accounting systems to respond to

financial problems. ...................................................................................................................11

M4 Role of management accounting towards the sustainability of the organization...............12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

LO1..................................................................................................................................................1

P1. Various types of Management Accounting Systems............................................................1

P2, Different Method used for Management Accounting Reporting..........................................2

M1. Benefits of Management Accounting System and its application in context of

organization.................................................................................................................................3

LO2..................................................................................................................................................4

P3. Calculation of costs using appropriate techniques of cost analysis in order to prepare

income statement ........................................................................................................................4

M2. Range of Management Accounting Techniques to produce financial reporting documents

.....................................................................................................................................................8

LO3..................................................................................................................................................9

P4. Advantages and Disadvantages of various types of planning tools used for budgetary

control.........................................................................................................................................9

M3. Use and application of different planning tools in preparing and forecasting the budget.10

LO4................................................................................................................................................11

P5.Compare how organisations are adapting management accounting systems to respond to

financial problems. ...................................................................................................................11

M4 Role of management accounting towards the sustainability of the organization...............12

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

Management Accounting refers to maintaining the financial data of the company. It

comprises of recording, transacting and analysing the information of the business. It is helpful in

providing the financial and statistical information of the organization. Assignment is based on

Leonard Business Services. It is a financial advisory company. This firm is located in London in

United Kingdom. It provides financial assistance and business solutions to its clients.

The Project report will explain the management accounting and will evaluate the benefits

of the management accounting systems. It will explicate various methods that is being used for

the management accounting reporting. The Study will apply a range of management accounting

techniques in order to produce financial reporting. Furthermore, the study will explain the

disadvantages and advantages of various types of planning tools. It will do comparison on how

the organisations adopts the management accounting systems in order to respond the financial

problems. Lastly, it will report will provide conclusion.

MAIN BODY

LO1

P1. Various types of Management Accounting Systems

Management Accounting

It refers to the preparation of financial statements and recording business transactions in

order to provide statistical information of the Company. It is used to assist the planning,

controlling and formulation of polices which are required to operate a firm. It facilitates

managers to take decision of the organization. It is helpful in identifying the business problems.

Various Management accounting systems are explained below -

Cost Accounting System – This systems is being designed to evaluate the business cost.

Through this the business costs can be estimated. It is helpful in inventory valuation and

profitability analysis (Cost Accounting Systems, 2019). To control the enterprise cost this

accounting system is being used. It is of two types Job order costing and Process costing.

The cost allocation is carried out under this system. It is based either on activity based

costing system and traditional costing system.

Inventory Management System – It refers to the use of barcode scanners, barcode

printers and desktop software in order to streamline and control the inventory of the

business. It is helpful in determining the current inventory level of the Company. In case

1

Management Accounting refers to maintaining the financial data of the company. It

comprises of recording, transacting and analysing the information of the business. It is helpful in

providing the financial and statistical information of the organization. Assignment is based on

Leonard Business Services. It is a financial advisory company. This firm is located in London in

United Kingdom. It provides financial assistance and business solutions to its clients.

The Project report will explain the management accounting and will evaluate the benefits

of the management accounting systems. It will explicate various methods that is being used for

the management accounting reporting. The Study will apply a range of management accounting

techniques in order to produce financial reporting. Furthermore, the study will explain the

disadvantages and advantages of various types of planning tools. It will do comparison on how

the organisations adopts the management accounting systems in order to respond the financial

problems. Lastly, it will report will provide conclusion.

MAIN BODY

LO1

P1. Various types of Management Accounting Systems

Management Accounting

It refers to the preparation of financial statements and recording business transactions in

order to provide statistical information of the Company. It is used to assist the planning,

controlling and formulation of polices which are required to operate a firm. It facilitates

managers to take decision of the organization. It is helpful in identifying the business problems.

Various Management accounting systems are explained below -

Cost Accounting System – This systems is being designed to evaluate the business cost.

Through this the business costs can be estimated. It is helpful in inventory valuation and

profitability analysis (Cost Accounting Systems, 2019). To control the enterprise cost this

accounting system is being used. It is of two types Job order costing and Process costing.

The cost allocation is carried out under this system. It is based either on activity based

costing system and traditional costing system.

Inventory Management System – It refers to the use of barcode scanners, barcode

printers and desktop software in order to streamline and control the inventory of the

business. It is helpful in determining the current inventory level of the Company. In case

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

of under-stock and overstock situations the company is able to mange it (Nitzl, 2016). As

this system automatically tracks when the stock levels are below the average level. It is

helpful in relocating, receiving and disposal of the inventory.

Job Costing System – It involves the process of accumulating the costs. It is helpful in

submitting the cost information in regards to particular production job. It allocates the

manufacturing costs of the individual batches of the goods. There are three types of Job

costing system namely, Direct Materials, Overhead costs and Direct Labour. It is trim to

identify the customers requirements as some allows to charged only certain costs

(Senftlechner and Hiebl, 2015). It is helpful for determining the cost of manufacturing

within the workplace of the organization.

Price Optimization System – It refers to the mathematical programs that are used to

evaluate how the demand differs at various price levels. This system is used to

recommanded the prices and for improving the profits (Burritt, Herzig, Schaltegger and

Viere, 2019). It is adopted by the organization as it helpful in assessing the demand and

for fixing the prices. It defines different price levels of the products and services in order

to meet the business objective.

P2, Different Method used for Management Accounting Reporting

Management accounting reports is being used for regulating, planning, decision-making

and for measuring the business performance. Thus, various methods which are used in

Management accounting reports are explained as follows -

Budget Report – It refers to the report that describes the budget in respect to the

expenses so that it can be control during a period of time. It is critical for the

measurement of business performance of the organization and it is helpful in generating

overall profitability of the business (Bui and Villiers, 2017). Estimations in this type of

report are being made on the basis of the former data and reports. It is helpful for the

administration in meeting with the unanticipated event and for dealing with the

unfortunate conditions in the future.

Performance Report – It refers to the report that evaluates the actual performance of

the business. It is helpful in determining the variances through comparing the actual

outcomes with the predetermined budget. When the unfavourable variances is being

2

this system automatically tracks when the stock levels are below the average level. It is

helpful in relocating, receiving and disposal of the inventory.

Job Costing System – It involves the process of accumulating the costs. It is helpful in

submitting the cost information in regards to particular production job. It allocates the

manufacturing costs of the individual batches of the goods. There are three types of Job

costing system namely, Direct Materials, Overhead costs and Direct Labour. It is trim to

identify the customers requirements as some allows to charged only certain costs

(Senftlechner and Hiebl, 2015). It is helpful for determining the cost of manufacturing

within the workplace of the organization.

Price Optimization System – It refers to the mathematical programs that are used to

evaluate how the demand differs at various price levels. This system is used to

recommanded the prices and for improving the profits (Burritt, Herzig, Schaltegger and

Viere, 2019). It is adopted by the organization as it helpful in assessing the demand and

for fixing the prices. It defines different price levels of the products and services in order

to meet the business objective.

P2, Different Method used for Management Accounting Reporting

Management accounting reports is being used for regulating, planning, decision-making

and for measuring the business performance. Thus, various methods which are used in

Management accounting reports are explained as follows -

Budget Report – It refers to the report that describes the budget in respect to the

expenses so that it can be control during a period of time. It is critical for the

measurement of business performance of the organization and it is helpful in generating

overall profitability of the business (Bui and Villiers, 2017). Estimations in this type of

report are being made on the basis of the former data and reports. It is helpful for the

administration in meeting with the unanticipated event and for dealing with the

unfortunate conditions in the future.

Performance Report – It refers to the report that evaluates the actual performance of

the business. It is helpful in determining the variances through comparing the actual

outcomes with the predetermined budget. When the unfavourable variances is being

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

determined the organization take action in order to improve them. It compares the actual

revenues with the projected costs.

Accounts Receivable Report – Accounts receivable refers to the amount that is owned

by the seller and need to be collected by the customers. This can be easily convertible

into the cash (Sands,Lee, and Gunarathne, 2015). Thus, the business owners makes

report to determined the total amount which is due from the customers. It helps to

determine the details in respect to the defaulters which is made by the customers for the

purpose of alternating the credit policies. Maintaining cash flow is crucial for the cost-

efficient management of the business.

Cost Management Report - The margins of the net income is being estimated and

monitored by using the cost management report as it is helpful for providing the clear

image associated to each and every cost that is obtain in the process of the manufacturing

and in protuberance of the notification (Thomas, 2016). This is helpful in determining the

business expenses in order to do optimum utilization of resources in the business. This

report is helpful in computing the manufacturing costs.

M1. Benefits of Management Accounting System and its application in context of organization

Leonard Business Services used various Management accounting Systems in order to do

planning and measuring the performance of the organization. It is helpful in taking the business

decisions. Various benefits of the management accounting system is discussed below -

Cost Accounting System

Cost Accounting system is helpful in measuring the business performance and in

improving the efficiency of the enterprise (Lopez-Valeiras, Gomez-Condeand Naranjo-

Gil, 2015).

It puts light upon the activities which are unprofitable for the business. Thus, the Leonard

Business Services takes measures in order to eliminate the unprofitable activities.

It is helpful in determining the business costs and expenses.

Inventory Management System

This System is helpful in controlling the inventory of the Leonard Business.

It is helpful in minimising the delay time of production.

This system keeps track record of the inventory level and immediately informs when the

stock levels are below the average level.

3

revenues with the projected costs.

Accounts Receivable Report – Accounts receivable refers to the amount that is owned

by the seller and need to be collected by the customers. This can be easily convertible

into the cash (Sands,Lee, and Gunarathne, 2015). Thus, the business owners makes

report to determined the total amount which is due from the customers. It helps to

determine the details in respect to the defaulters which is made by the customers for the

purpose of alternating the credit policies. Maintaining cash flow is crucial for the cost-

efficient management of the business.

Cost Management Report - The margins of the net income is being estimated and

monitored by using the cost management report as it is helpful for providing the clear

image associated to each and every cost that is obtain in the process of the manufacturing

and in protuberance of the notification (Thomas, 2016). This is helpful in determining the

business expenses in order to do optimum utilization of resources in the business. This

report is helpful in computing the manufacturing costs.

M1. Benefits of Management Accounting System and its application in context of organization

Leonard Business Services used various Management accounting Systems in order to do

planning and measuring the performance of the organization. It is helpful in taking the business

decisions. Various benefits of the management accounting system is discussed below -

Cost Accounting System

Cost Accounting system is helpful in measuring the business performance and in

improving the efficiency of the enterprise (Lopez-Valeiras, Gomez-Condeand Naranjo-

Gil, 2015).

It puts light upon the activities which are unprofitable for the business. Thus, the Leonard

Business Services takes measures in order to eliminate the unprofitable activities.

It is helpful in determining the business costs and expenses.

Inventory Management System

This System is helpful in controlling the inventory of the Leonard Business.

It is helpful in minimising the delay time of production.

This system keeps track record of the inventory level and immediately informs when the

stock levels are below the average level.

3

Job Costing System

Leonard Business Services use this system in order to determined the unpaid invoices of

the business (Eldenburg, Krishnan and Krishnan, 2017).

It is helpful in determining the overdue payments of the business.

This System is helpful in listing the unpaid customers of the Company.

Price Optimization System

This system is helpful in minimising the business risk of Leonard Business Services.

Price Optimization System focuses on reducing the business costs (Collisand Hussey, ,

2017).

It is helpful in determining the business costs associated with each activity.

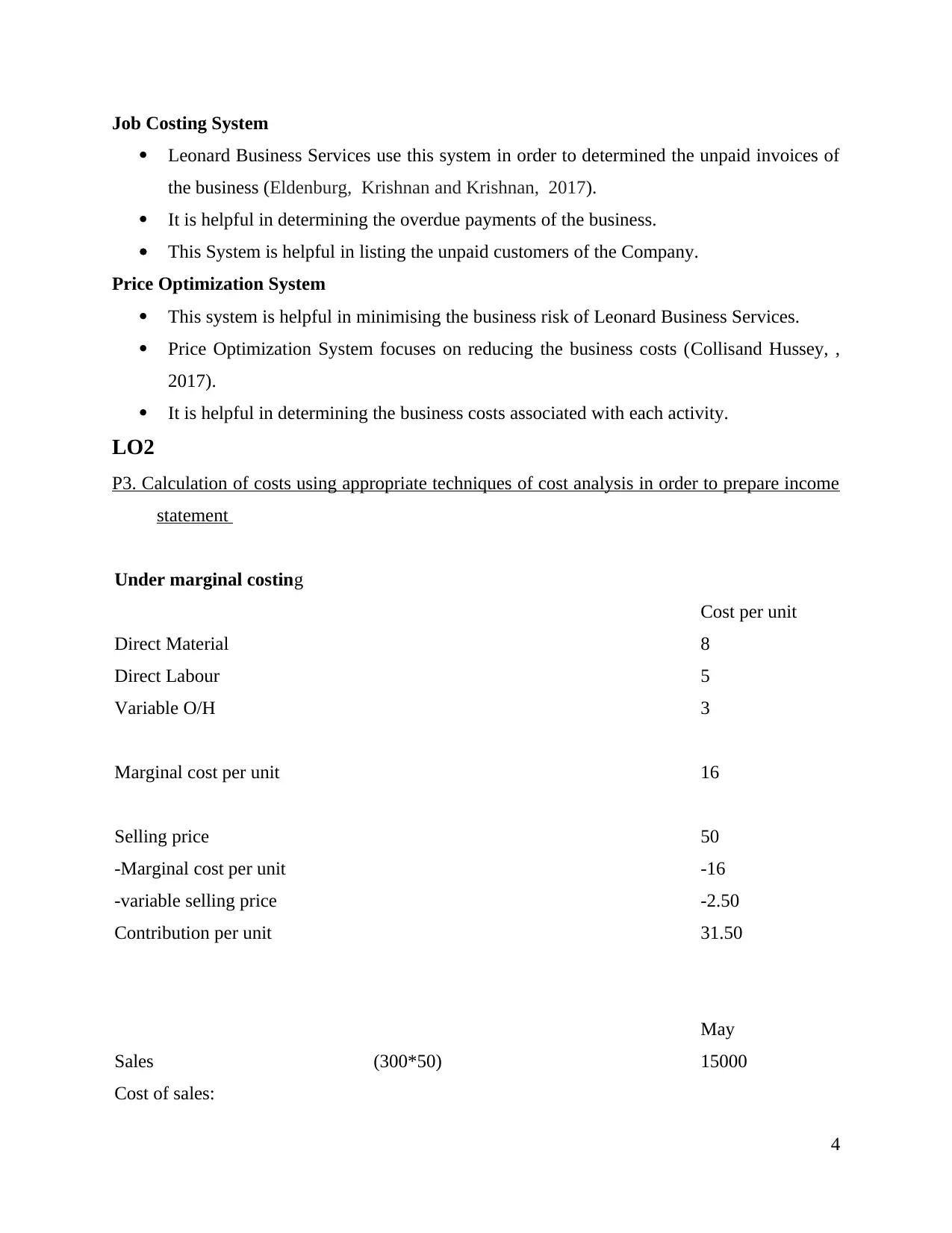

LO2

P3. Calculation of costs using appropriate techniques of cost analysis in order to prepare income

statement

Under marginal costing

Cost per unit

Direct Material 8

Direct Labour 5

Variable O/H 3

Marginal cost per unit 16

Selling price 50

-Marginal cost per unit -16

-variable selling price -2.50

Contribution per unit 31.50

May

Sales (300*50) 15000

Cost of sales:

4

Leonard Business Services use this system in order to determined the unpaid invoices of

the business (Eldenburg, Krishnan and Krishnan, 2017).

It is helpful in determining the overdue payments of the business.

This System is helpful in listing the unpaid customers of the Company.

Price Optimization System

This system is helpful in minimising the business risk of Leonard Business Services.

Price Optimization System focuses on reducing the business costs (Collisand Hussey, ,

2017).

It is helpful in determining the business costs associated with each activity.

LO2

P3. Calculation of costs using appropriate techniques of cost analysis in order to prepare income

statement

Under marginal costing

Cost per unit

Direct Material 8

Direct Labour 5

Variable O/H 3

Marginal cost per unit 16

Selling price 50

-Marginal cost per unit -16

-variable selling price -2.50

Contribution per unit 31.50

May

Sales (300*50) 15000

Cost of sales:

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

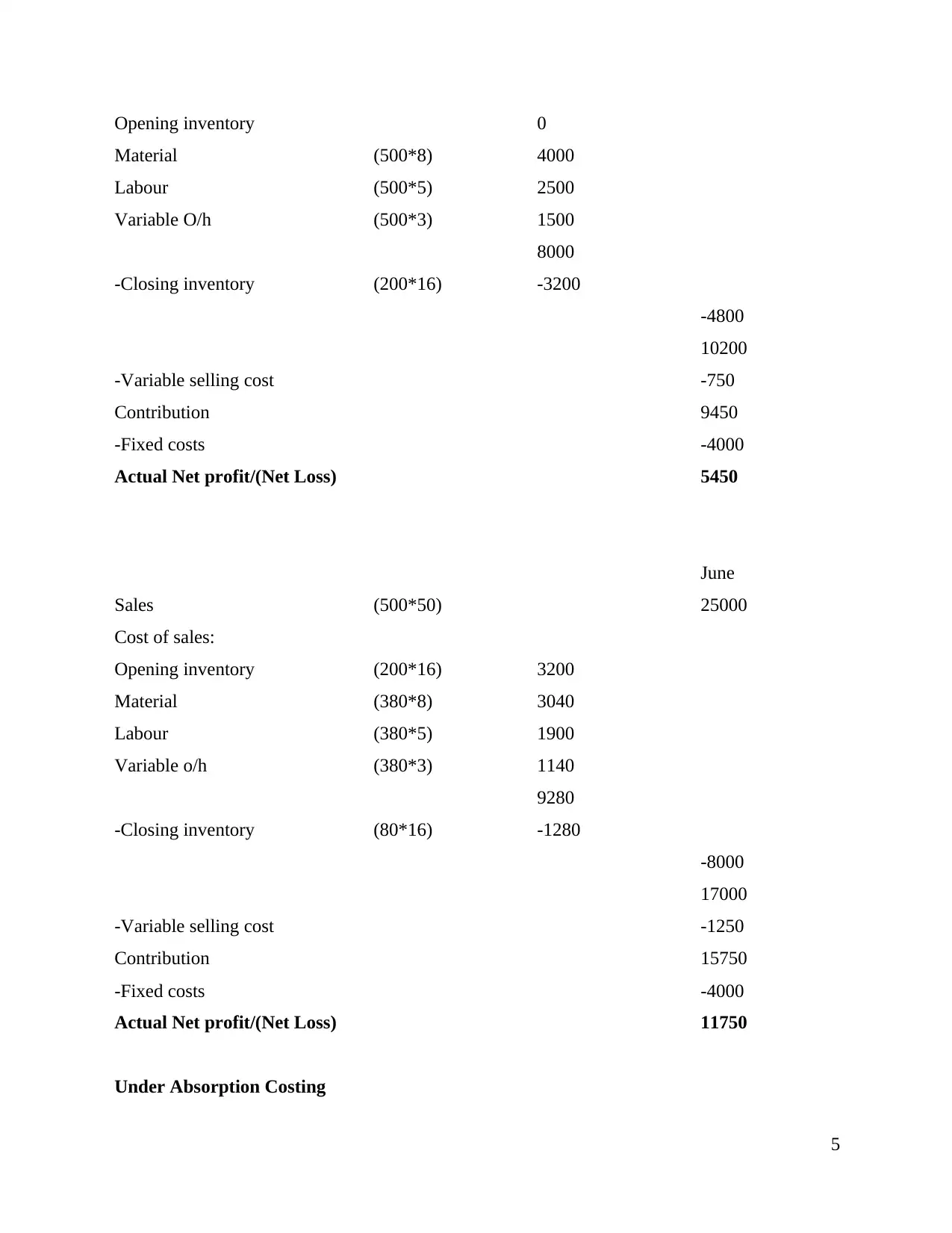

Opening inventory 0

Material (500*8) 4000

Labour (500*5) 2500

Variable O/h (500*3) 1500

8000

-Closing inventory (200*16) -3200

-4800

10200

-Variable selling cost -750

Contribution 9450

-Fixed costs -4000

Actual Net profit/(Net Loss) 5450

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*16) 3200

Material (380*8) 3040

Labour (380*5) 1900

Variable o/h (380*3) 1140

9280

-Closing inventory (80*16) -1280

-8000

17000

-Variable selling cost -1250

Contribution 15750

-Fixed costs -4000

Actual Net profit/(Net Loss) 11750

Under Absorption Costing

5

Material (500*8) 4000

Labour (500*5) 2500

Variable O/h (500*3) 1500

8000

-Closing inventory (200*16) -3200

-4800

10200

-Variable selling cost -750

Contribution 9450

-Fixed costs -4000

Actual Net profit/(Net Loss) 5450

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*16) 3200

Material (380*8) 3040

Labour (380*5) 1900

Variable o/h (380*3) 1140

9280

-Closing inventory (80*16) -1280

-8000

17000

-Variable selling cost -1250

Contribution 15750

-Fixed costs -4000

Actual Net profit/(Net Loss) 11750

Under Absorption Costing

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

May

sales (300*50) 15000

Cost of sales:

Opening inventory 0

Material (500*8) 4000

Labour (500*5) 2500

Fixed o/h 4000

Variable o/h (500*3) 1500

12000

-Closing inventory (200*16) -3200

-8800

Gross Profit/Loss 6200

-Variable selling cost -750

Actual Net profit/(Net Loss) 5450

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*16) 3200

Material (380*8) 3040

Labour (380*5) 1900

Fixed O/h 4000

Variable O/h (380*3) 1140

13280

-Closing inventory (80*16) -1280

-12000

Gross Profit/Loss 13000

-Variable selling cost -1250

Actual Net profit/(Net Loss) 11750

6

sales (300*50) 15000

Cost of sales:

Opening inventory 0

Material (500*8) 4000

Labour (500*5) 2500

Fixed o/h 4000

Variable o/h (500*3) 1500

12000

-Closing inventory (200*16) -3200

-8800

Gross Profit/Loss 6200

-Variable selling cost -750

Actual Net profit/(Net Loss) 5450

June

Sales (500*50) 25000

Cost of sales:

Opening inventory (200*16) 3200

Material (380*8) 3040

Labour (380*5) 1900

Fixed O/h 4000

Variable O/h (380*3) 1140

13280

-Closing inventory (80*16) -1280

-12000

Gross Profit/Loss 13000

-Variable selling cost -1250

Actual Net profit/(Net Loss) 11750

6

Interpretation

The Leonard Business Services can use two methods in order to calculate the actual net

profit namely, Marginal Costing and Absorption costing. Under Marginal costing the fixed

Selling costs and fixed costs both are deducted from the gross profit. Expenses is being deduced

from gross profit under absorption costing method. The amount remain same using both the

methods. Thus, the Leonard Business Services can use any method as the amount of profit

remains same during the calculation of any of the method.

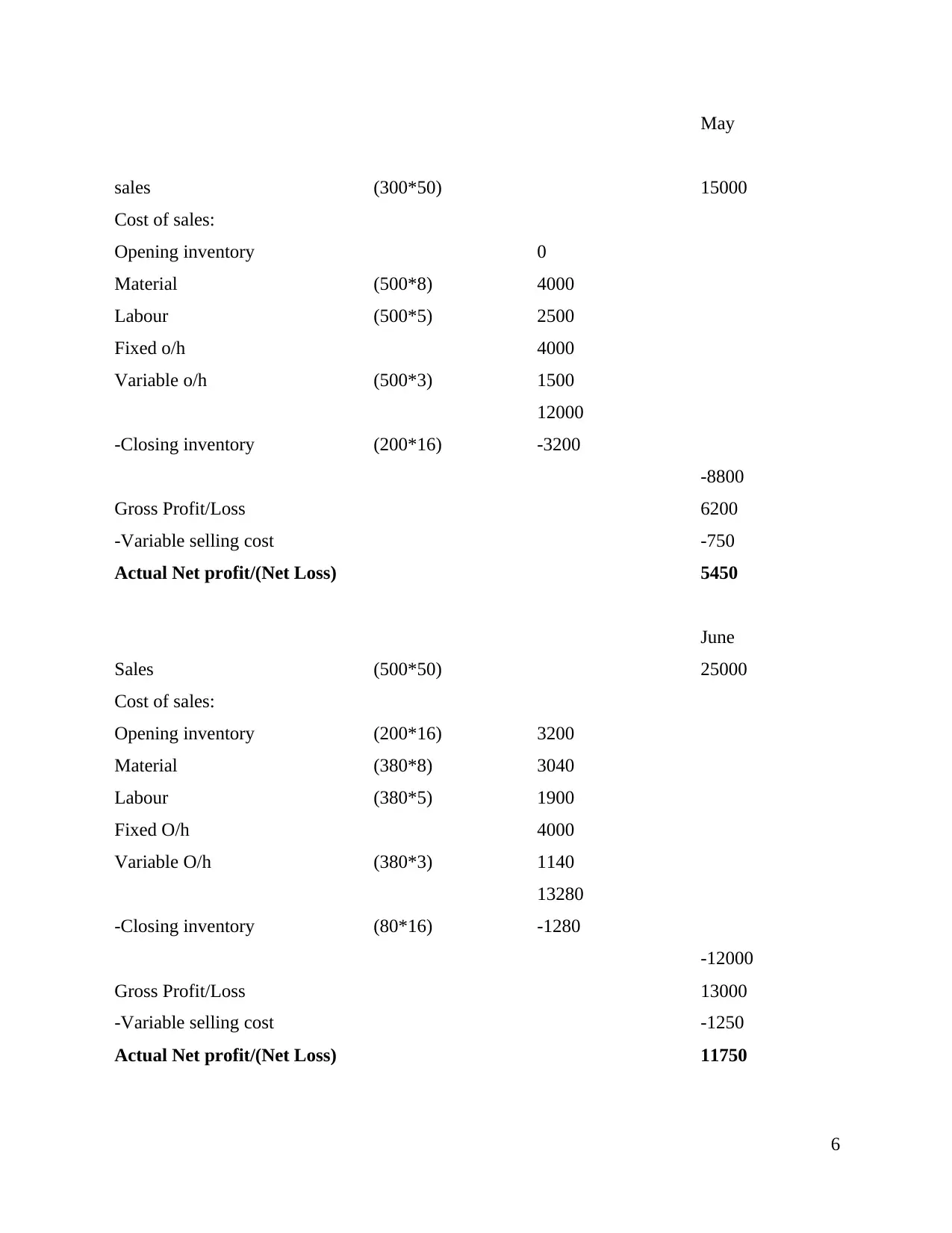

Budgeted Cost at 1 unit Budgeted cost at 1000 units Actual cost at 1000 units

Material (in kg)

cost per

unit

Total

cost

Material

(in kg)

cost per

unit

Total

cost

Material

(in kg)

cost per

unit

Total

cost

2 10 20 2000 10 20000 2200 9.5 20900

Interpretation

The Actual cost which is being absorbed is £9.5 whereas the budgeted cost for the

material consumed is £10.

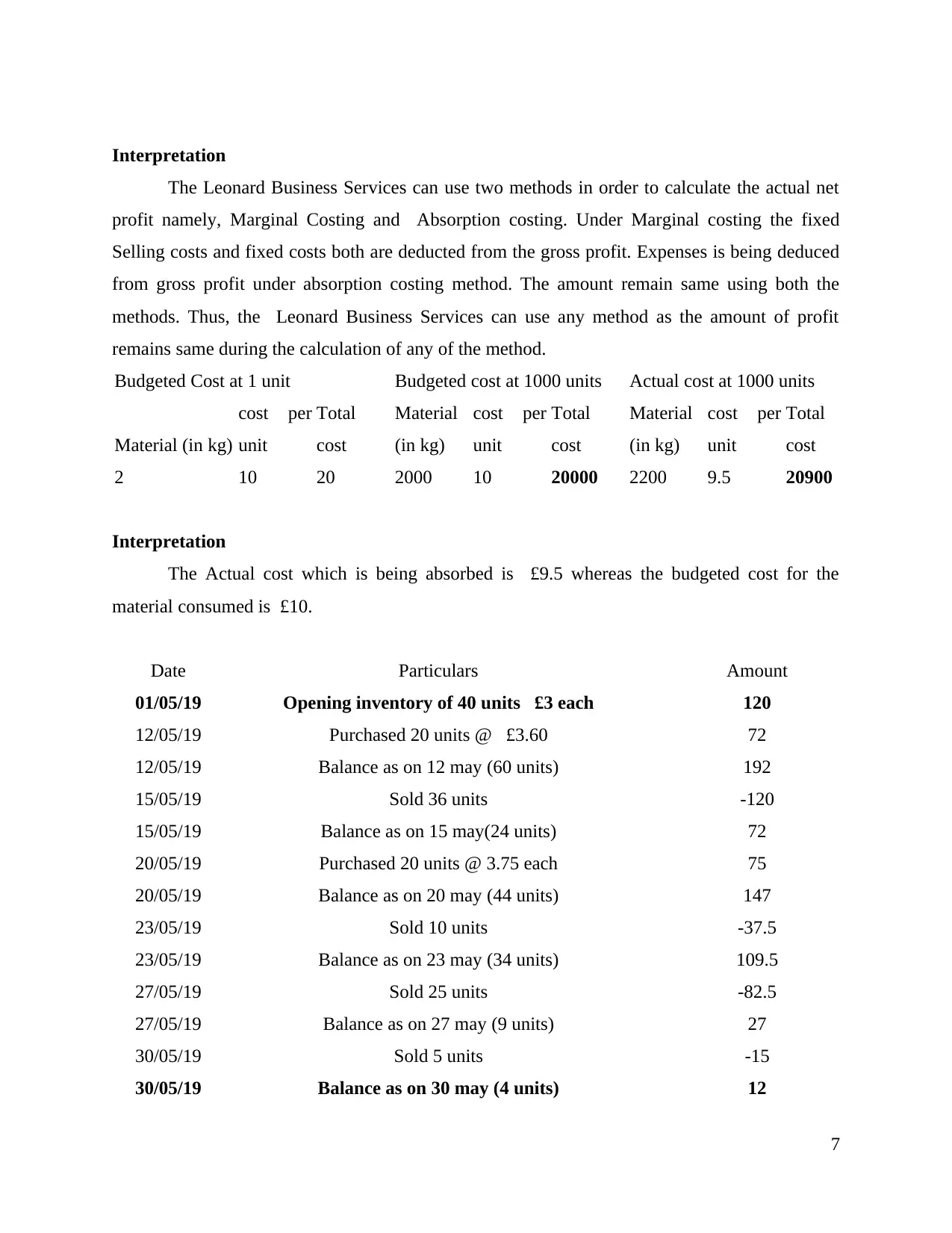

Date Particulars Amount

01/05/19 Opening inventory of 40 units £3 each 120

12/05/19 Purchased 20 units @ £3.60 72

12/05/19 Balance as on 12 may (60 units) 192

15/05/19 Sold 36 units -120

15/05/19 Balance as on 15 may(24 units) 72

20/05/19 Purchased 20 units @ 3.75 each 75

20/05/19 Balance as on 20 may (44 units) 147

23/05/19 Sold 10 units -37.5

23/05/19 Balance as on 23 may (34 units) 109.5

27/05/19 Sold 25 units -82.5

27/05/19 Balance as on 27 may (9 units) 27

30/05/19 Sold 5 units -15

30/05/19 Balance as on 30 may (4 units) 12

7

The Leonard Business Services can use two methods in order to calculate the actual net

profit namely, Marginal Costing and Absorption costing. Under Marginal costing the fixed

Selling costs and fixed costs both are deducted from the gross profit. Expenses is being deduced

from gross profit under absorption costing method. The amount remain same using both the

methods. Thus, the Leonard Business Services can use any method as the amount of profit

remains same during the calculation of any of the method.

Budgeted Cost at 1 unit Budgeted cost at 1000 units Actual cost at 1000 units

Material (in kg)

cost per

unit

Total

cost

Material

(in kg)

cost per

unit

Total

cost

Material

(in kg)

cost per

unit

Total

cost

2 10 20 2000 10 20000 2200 9.5 20900

Interpretation

The Actual cost which is being absorbed is £9.5 whereas the budgeted cost for the

material consumed is £10.

Date Particulars Amount

01/05/19 Opening inventory of 40 units £3 each 120

12/05/19 Purchased 20 units @ £3.60 72

12/05/19 Balance as on 12 may (60 units) 192

15/05/19 Sold 36 units -120

15/05/19 Balance as on 15 may(24 units) 72

20/05/19 Purchased 20 units @ 3.75 each 75

20/05/19 Balance as on 20 may (44 units) 147

23/05/19 Sold 10 units -37.5

23/05/19 Balance as on 23 may (34 units) 109.5

27/05/19 Sold 25 units -82.5

27/05/19 Balance as on 27 may (9 units) 27

30/05/19 Sold 5 units -15

30/05/19 Balance as on 30 may (4 units) 12

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Interpretation

The Leonard Business Services uses LIFO method in order to calculate the closing

inventory for the financial year. The units which is purchased is being assumed under this

method in order to sold later on. On 3 of May 4 units are remaining. The items which are later

purchased are assumed to be first sold in this method than the items which are purchased on

earlier basis.

M2. Range of Management Accounting Techniques to produce financial reporting documents

There are two types of management accounting techniques in order to produce financial

documentation of the business namely, Modern Controlling Technique and Traditional

Controlling Technique.

Modern Controlling Technique

Management Audit – It is the assessment of the polices and methods of the business. It

is helpful in identifying the weakness and strengths of the business. Thus, it is helpful in

improving the management efficiency. This is helpful for assessing the business

efficiency of the manage (Management Audit: Meaning and Objective, 2019). Thus, this

makes them able to take managerial decisions and helps in utilization of resources.

Management Audit is helpful to deliberate the suggestions of the experts and functioning

of the organization.

Social Responsibility Audit – It is helpful for assessing the Company performance as

per the corporate social responsibility. It determines the responsibilities in context of the

environment and stakeholders of the business. It assess the company's objectives and

goals. It determines the benchmarks of the social responsibilities (Järvenpää and

Länsiluoto, 2016).

Traditional Controlling Technique

Budgetary Control – It refers to the comparison of the actual budget and results with the

projected budget. It includes comparison of the results with the adjusted performance.

Budgets are helpful in doing planning as costs and expenses of the business are

determined (Messner, Becker Schäffe and Binder, 2016). Budgets involves estimates of

the business costs. It is helpful for anticipating losses and controlling the business

expenses.

8

The Leonard Business Services uses LIFO method in order to calculate the closing

inventory for the financial year. The units which is purchased is being assumed under this

method in order to sold later on. On 3 of May 4 units are remaining. The items which are later

purchased are assumed to be first sold in this method than the items which are purchased on

earlier basis.

M2. Range of Management Accounting Techniques to produce financial reporting documents

There are two types of management accounting techniques in order to produce financial

documentation of the business namely, Modern Controlling Technique and Traditional

Controlling Technique.

Modern Controlling Technique

Management Audit – It is the assessment of the polices and methods of the business. It

is helpful in identifying the weakness and strengths of the business. Thus, it is helpful in

improving the management efficiency. This is helpful for assessing the business

efficiency of the manage (Management Audit: Meaning and Objective, 2019). Thus, this

makes them able to take managerial decisions and helps in utilization of resources.

Management Audit is helpful to deliberate the suggestions of the experts and functioning

of the organization.

Social Responsibility Audit – It is helpful for assessing the Company performance as

per the corporate social responsibility. It determines the responsibilities in context of the

environment and stakeholders of the business. It assess the company's objectives and

goals. It determines the benchmarks of the social responsibilities (Järvenpää and

Länsiluoto, 2016).

Traditional Controlling Technique

Budgetary Control – It refers to the comparison of the actual budget and results with the

projected budget. It includes comparison of the results with the adjusted performance.

Budgets are helpful in doing planning as costs and expenses of the business are

determined (Messner, Becker Schäffe and Binder, 2016). Budgets involves estimates of

the business costs. It is helpful for anticipating losses and controlling the business

expenses.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Cost Control – It is a business practice that aims in reducing the business expenses. In

order to control the business costs the prices is being negotiates. It is helpful in tracking

the costs (Nørreklit, ed., 2017). To follow the cost controlling techniques budget is being

prepared by the company.

LO3

P4. Advantages and Disadvantages of various types of planning tools used for budgetary control

Planning tools are helpful in determining the business performance. It is helpful for

controlling and monitoring the performance of the organization.

Types of planning tools used for budgetary control

Activity Based Budgeting

This system is being used to eliminate the business costs of unnecessary activities. This

system is helpful for the company as it saves the business costs of the enterprise. This also

helpful for the organization in order to take competitive edge as it minimise the business costs

than its competitors.

Advantages

It is helpful for providing the practical costs of the business enterprise for the specific

products.

It allocates production overhead that accurately helps in procedure of enterprise.

It identifies wasteful processes in order to make further improvement in it.

It determines the net profit and margins in more fine manner.

Disadvantages

Processes of Activity based budgeting is time consuming.

It costs more than previously accumulated.

The Activity based budgeting requires more efforts as to gather the data.

Zero Based Budgeting

It is the type of the method which justify the expenses on individual basis for each

accounting period. It determines the costs of each department of the business. It starts with the

zero base.

Advantages

This budgeting method is helpful in giving the clear cut picture of the finance which is

available in the business.

9

order to control the business costs the prices is being negotiates. It is helpful in tracking

the costs (Nørreklit, ed., 2017). To follow the cost controlling techniques budget is being

prepared by the company.

LO3

P4. Advantages and Disadvantages of various types of planning tools used for budgetary control

Planning tools are helpful in determining the business performance. It is helpful for

controlling and monitoring the performance of the organization.

Types of planning tools used for budgetary control

Activity Based Budgeting

This system is being used to eliminate the business costs of unnecessary activities. This

system is helpful for the company as it saves the business costs of the enterprise. This also

helpful for the organization in order to take competitive edge as it minimise the business costs

than its competitors.

Advantages

It is helpful for providing the practical costs of the business enterprise for the specific

products.

It allocates production overhead that accurately helps in procedure of enterprise.

It identifies wasteful processes in order to make further improvement in it.

It determines the net profit and margins in more fine manner.

Disadvantages

Processes of Activity based budgeting is time consuming.

It costs more than previously accumulated.

The Activity based budgeting requires more efforts as to gather the data.

Zero Based Budgeting

It is the type of the method which justify the expenses on individual basis for each

accounting period. It determines the costs of each department of the business. It starts with the

zero base.

Advantages

This budgeting method is helpful in giving the clear cut picture of the finance which is

available in the business.

9

It is helpful in saving the business costs through identifying the faults in operations.

It is helpful in utilization of business operations.

Disadvantages

It is time consuming process.

It involves a lot of paper work during preparation of the budget.

It is too expensive in case of the business organization which are larger in scale.

Incremental Budgeting

This budget is being prepared on the basis of identifying the past results. The profits are

taken as it is while preparing the financial statement of the next year. This is for the businesses

who don't wants to spend huge costs in order to formulate the budgets.

Advantages

It is one of the easiest method.

It provides the operational stability.

It ensures that funds are keep on flowing in the organization (Benne and James, 2017).

It facilitated ease in order to operate different departments of the business.

Disadvantages

It is based on the past results. Thus, there is chances of error in it.

It surrogate overspending. The expenditure of one year also reflects for the next year.

It is risk taking method.

It assumes the changes which is based on past results.

M3. Use and application of different planning tools in preparing and forecasting the budget

There are various planning tools for the purpose of preparing and forecasting the budget

of Leonard Business Solutions Company. These planning tools are as follows -

Activity Based Budgeting – In this budgeting process, Company will first analysis those

activities which incur the costs and generate the revenue for the business. After that, Company

will decide the numbers of units which is related to that activities which incurred cost and

generate revenue. The number of units will be considered as a base and on the basis of this base,

Company will calculate the cost per unit and accordingly forecast the budget for future number

of units.

Traditional Budgeting – In this budgeting process, Company look upon the previous year's

budget and accordingly plan the future budget on the base of previous year budget. If company

10

It is helpful in utilization of business operations.

Disadvantages

It is time consuming process.

It involves a lot of paper work during preparation of the budget.

It is too expensive in case of the business organization which are larger in scale.

Incremental Budgeting

This budget is being prepared on the basis of identifying the past results. The profits are

taken as it is while preparing the financial statement of the next year. This is for the businesses

who don't wants to spend huge costs in order to formulate the budgets.

Advantages

It is one of the easiest method.

It provides the operational stability.

It ensures that funds are keep on flowing in the organization (Benne and James, 2017).

It facilitated ease in order to operate different departments of the business.

Disadvantages

It is based on the past results. Thus, there is chances of error in it.

It surrogate overspending. The expenditure of one year also reflects for the next year.

It is risk taking method.

It assumes the changes which is based on past results.

M3. Use and application of different planning tools in preparing and forecasting the budget

There are various planning tools for the purpose of preparing and forecasting the budget

of Leonard Business Solutions Company. These planning tools are as follows -

Activity Based Budgeting – In this budgeting process, Company will first analysis those

activities which incur the costs and generate the revenue for the business. After that, Company

will decide the numbers of units which is related to that activities which incurred cost and

generate revenue. The number of units will be considered as a base and on the basis of this base,

Company will calculate the cost per unit and accordingly forecast the budget for future number

of units.

Traditional Budgeting – In this budgeting process, Company look upon the previous year's

budget and accordingly plan the future budget on the base of previous year budget. If company

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.