Unit 5: Management Accounting Techniques and Analysis Report

VerifiedAdded on 2020/10/22

|18

|5188

|482

Report

AI Summary

This report provides a comprehensive overview of management accounting principles and their application within Network Critical Solutions. It begins by defining management accounting and exploring various accounting systems, including job costing, batch costing, inventory management, and price optimization. The report then delves into specific management accounting reporting techniques such as budget reporting, accounts receivable aging, inventory and manufacturing reports, and job cost reports. It assesses the benefits of a management accounting system, emphasizing its role in decision-making, cost control, and transparency. The report then examines marginal and absorption costing techniques, break-even analysis, and the application of management accounting in producing and interpreting financial reports. Furthermore, it explores planning tools for budgetary control, analyzing their advantages, disadvantages, and application in forecasting and comparing organizational performance. The report concludes by assessing how management accounting techniques can address financial obstacles and contribute to organizational gains.

UNIT 5 MA

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A. Explaining concept of management accounting along with types of accounting system.......1

B. Defining some management accounting reporting techniques to be used in business...........3

C. Ascertaining the fruitfulness of management accounting system in operational activities....5

D. Determining the integration of management accounting and system in industrial aspect......5

TASK 2............................................................................................................................................6

A.1 defining the concept of marginal and absorption costing techniques...................................6

2. Preparing the income statement based on costing techniques such as marginal and

absorption....................................................................................................................................6

B. Break even analysis.................................................................................................................8

C. Application of management accounting techniques in accurately producing financial reports

.....................................................................................................................................................9

D. Accurate interpretation of financial reports which is reflecting the appropriate business

reports........................................................................................................................................10

TASK 3..........................................................................................................................................10

A. Ascertaining the advantages and disadvantages of several kids of planning tools for

budgetary control techniques.....................................................................................................10

B. Application of planning tools in analyzing the budgets, preparing and forecasting them....12

C. Comparing the organisation with others in context with meeting the financial obstacles....13

D. Analysing the management accounting techniques will respond to meet the financial

obstacles.....................................................................................................................................14

E. Ascertaining the impacts of planning tools in meeting the organisational gains..................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

A. Explaining concept of management accounting along with types of accounting system.......1

B. Defining some management accounting reporting techniques to be used in business...........3

C. Ascertaining the fruitfulness of management accounting system in operational activities....5

D. Determining the integration of management accounting and system in industrial aspect......5

TASK 2............................................................................................................................................6

A.1 defining the concept of marginal and absorption costing techniques...................................6

2. Preparing the income statement based on costing techniques such as marginal and

absorption....................................................................................................................................6

B. Break even analysis.................................................................................................................8

C. Application of management accounting techniques in accurately producing financial reports

.....................................................................................................................................................9

D. Accurate interpretation of financial reports which is reflecting the appropriate business

reports........................................................................................................................................10

TASK 3..........................................................................................................................................10

A. Ascertaining the advantages and disadvantages of several kids of planning tools for

budgetary control techniques.....................................................................................................10

B. Application of planning tools in analyzing the budgets, preparing and forecasting them....12

C. Comparing the organisation with others in context with meeting the financial obstacles....13

D. Analysing the management accounting techniques will respond to meet the financial

obstacles.....................................................................................................................................14

E. Ascertaining the impacts of planning tools in meeting the organisational gains..................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

INTRODUCTION

The accounting influences in the work practice is comprised on various concepts, rules and

regulation which have been making adequate records of transactions. In the present report there

will be discussion made on the managerial accounting system and reporting techniques which

will be beneficial to the Network Critical Solutions. There will be discussion based on various

reporting, costing and accounting techniques which will articulate the valid information among

the accounting professionals in decision making.

This report also consisting of various information and details based on management

accounting methods in collecting information, recording in books and then communicating such

information among the organisational personnel. Moreover, there will be calculation relevant

with preparing the income statement by considering the marginal and absorption costing

techniques. Along with this, break even analysis will be based to determine the level of supply

and demand required in the operational practices.

TASK 1

A. Explaining concept of management accounting along with types of accounting system

Management accounting:

To records the generated information in the various books of accounts there will be use of

various techniques and accounting methods. Accounting is itself denoted as the method of

recording transaction based on monetary influences. The income, expenditures as well as assets

and liabilities had been recorded in the various accounts to have a summarised information

regarding the financial stability and ability of a firm in meeting the financial challenges. On the

other side, management is relevant with executing and directing the tasks in a manner which will

enable the firm in attaining the targeted goals before deadline.

However, in relation with the management accounting, there is management of overall

accounts which are being operated in the business in means of recording the reliable information

and summarizing it to have valid outcomes (Shah, Malik and Malik, 2011). Thus, such results

and outputs help the professionals in decisions making and planning for the future operational

practices. On the basis of such detailed analysis there will be formulation of adequate framework

and policies to reduce the costs implied in each activity as well as for the future gains. However,

there have been various benefits and profitability through implication of management accounting

practices in business activities of Network Critical Solutions.

1

The accounting influences in the work practice is comprised on various concepts, rules and

regulation which have been making adequate records of transactions. In the present report there

will be discussion made on the managerial accounting system and reporting techniques which

will be beneficial to the Network Critical Solutions. There will be discussion based on various

reporting, costing and accounting techniques which will articulate the valid information among

the accounting professionals in decision making.

This report also consisting of various information and details based on management

accounting methods in collecting information, recording in books and then communicating such

information among the organisational personnel. Moreover, there will be calculation relevant

with preparing the income statement by considering the marginal and absorption costing

techniques. Along with this, break even analysis will be based to determine the level of supply

and demand required in the operational practices.

TASK 1

A. Explaining concept of management accounting along with types of accounting system

Management accounting:

To records the generated information in the various books of accounts there will be use of

various techniques and accounting methods. Accounting is itself denoted as the method of

recording transaction based on monetary influences. The income, expenditures as well as assets

and liabilities had been recorded in the various accounts to have a summarised information

regarding the financial stability and ability of a firm in meeting the financial challenges. On the

other side, management is relevant with executing and directing the tasks in a manner which will

enable the firm in attaining the targeted goals before deadline.

However, in relation with the management accounting, there is management of overall

accounts which are being operated in the business in means of recording the reliable information

and summarizing it to have valid outcomes (Shah, Malik and Malik, 2011). Thus, such results

and outputs help the professionals in decisions making and planning for the future operational

practices. On the basis of such detailed analysis there will be formulation of adequate framework

and policies to reduce the costs implied in each activity as well as for the future gains. However,

there have been various benefits and profitability through implication of management accounting

practices in business activities of Network Critical Solutions.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Management accounting system:

This system consisting of accounting details relevant with all the units and areas of

operations had been done in Network Critical Solutions. It helps the managerial professionals in

articulating the business efficiency and encourage them to make innovative as well as accurate

decisions for the future operations. However, management accounting system is costs of various

elements which are to be considered by the accounting professionals such as:

Job costing:

This is a specific accounting methodology which is consisted of information relevant

with activities performed by the organisation. Therefore, there will be analysis over the costs

implicated in each operational activities of the firm. Mostly in the manufacturing units there have

been use of costing techniques which is consists of the information such as cost of material,

labour and overheads implied in producing a unit (Job costing, 2017). Thus, such ascertainment

of costs will define the charges to be levied on the products it also articulates the prices which

are to be charged from consumers. Along with this, it will also help the business in internal

planning and policy making for reducing such costs. It can be through changing the suppliers,

reducing the labour force as well as replacing them with robotic arms etc.

Batch costing:

By considering the concept of job costing technique where batch costing is somehow

similar to them. Therefore, there will ascertainment of costs such as indirect and indirect costs

which are implied in producing the product in the business (Bebbington and Thomson, 2013).

Network Critical Solutions will have effective operational practices as if the professionals

analyse the costs implied in a batch of production. It defines the total expenses which have been

made in such process as well as motivate the professionals for making relevant changes in the

practices.

Inventory management:

In this system there will be use of various techniques and operational analysis over

managing the inventories as per the demands arises in the market. Therefore, there will be proper

records of information such as total number of sales made in a period as well as efficiency of

business in producing the units which will meet the consumer demands in the market. Network

Critical Solutions will have accurate ascertainment of the demands and efficiency as they

manage the accounts for inventory (Gupta, Pevzner and Seethamraju, 2010). Along aside, it will

2

This system consisting of accounting details relevant with all the units and areas of

operations had been done in Network Critical Solutions. It helps the managerial professionals in

articulating the business efficiency and encourage them to make innovative as well as accurate

decisions for the future operations. However, management accounting system is costs of various

elements which are to be considered by the accounting professionals such as:

Job costing:

This is a specific accounting methodology which is consisted of information relevant

with activities performed by the organisation. Therefore, there will be analysis over the costs

implicated in each operational activities of the firm. Mostly in the manufacturing units there have

been use of costing techniques which is consists of the information such as cost of material,

labour and overheads implied in producing a unit (Job costing, 2017). Thus, such ascertainment

of costs will define the charges to be levied on the products it also articulates the prices which

are to be charged from consumers. Along with this, it will also help the business in internal

planning and policy making for reducing such costs. It can be through changing the suppliers,

reducing the labour force as well as replacing them with robotic arms etc.

Batch costing:

By considering the concept of job costing technique where batch costing is somehow

similar to them. Therefore, there will ascertainment of costs such as indirect and indirect costs

which are implied in producing the product in the business (Bebbington and Thomson, 2013).

Network Critical Solutions will have effective operational practices as if the professionals

analyse the costs implied in a batch of production. It defines the total expenses which have been

made in such process as well as motivate the professionals for making relevant changes in the

practices.

Inventory management:

In this system there will be use of various techniques and operational analysis over

managing the inventories as per the demands arises in the market. Therefore, there will be proper

records of information such as total number of sales made in a period as well as efficiency of

business in producing the units which will meet the consumer demands in the market. Network

Critical Solutions will have accurate ascertainment of the demands and efficiency as they

manage the accounts for inventory (Gupta, Pevzner and Seethamraju, 2010). Along aside, it will

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

also highlight the innovative ideas and policies to be made by the professionals in terms of

developing the techniques to enhance the business sales as well as improving the productivity.

Price Optimisation:

This is the techniques which helps organisational professionals in analysing the consumer

responses towards the products and services they are offering among them. It will be based on

past records and the sales growth over the period. Thus, professionals at Network Critical

Solutions will have appropriate information regarding the preferences and popularity of the

products and services in the market (Saeidi and Othman, 2017). It will bound them in

redesigning the products as well as making innovative changes in the operational practices which

will help them in governing the business tasks.

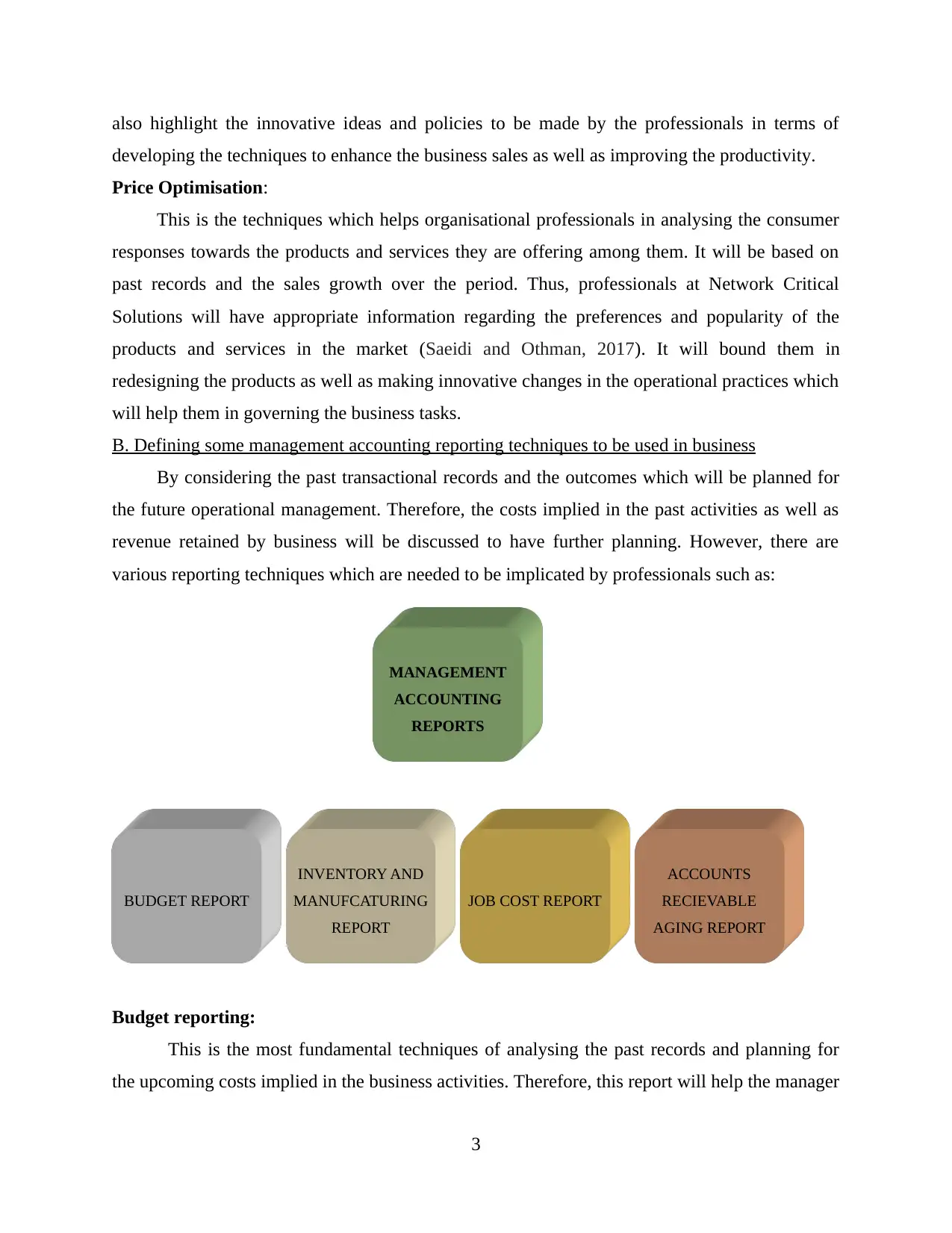

B. Defining some management accounting reporting techniques to be used in business

By considering the past transactional records and the outcomes which will be planned for

the future operational management. Therefore, the costs implied in the past activities as well as

revenue retained by business will be discussed to have further planning. However, there are

various reporting techniques which are needed to be implicated by professionals such as:

Budget reporting:

This is the most fundamental techniques of analysing the past records and planning for

the upcoming costs implied in the business activities. Therefore, this report will help the manager

3

MANAGEMENT

ACCOUNTING

REPORTS

BUDGET REPORT

INVENTORY AND

MANUFCATURING

REPORT

JOB COST REPORT

ACCOUNTS

RECIEVABLE

AGING REPORT

developing the techniques to enhance the business sales as well as improving the productivity.

Price Optimisation:

This is the techniques which helps organisational professionals in analysing the consumer

responses towards the products and services they are offering among them. It will be based on

past records and the sales growth over the period. Thus, professionals at Network Critical

Solutions will have appropriate information regarding the preferences and popularity of the

products and services in the market (Saeidi and Othman, 2017). It will bound them in

redesigning the products as well as making innovative changes in the operational practices which

will help them in governing the business tasks.

B. Defining some management accounting reporting techniques to be used in business

By considering the past transactional records and the outcomes which will be planned for

the future operational management. Therefore, the costs implied in the past activities as well as

revenue retained by business will be discussed to have further planning. However, there are

various reporting techniques which are needed to be implicated by professionals such as:

Budget reporting:

This is the most fundamental techniques of analysing the past records and planning for

the upcoming costs implied in the business activities. Therefore, this report will help the manager

3

MANAGEMENT

ACCOUNTING

REPORTS

BUDGET REPORT

INVENTORY AND

MANUFCATURING

REPORT

JOB COST REPORT

ACCOUNTS

RECIEVABLE

AGING REPORT

professionals in making accurate analysis over the costs required in the activities on which they

can develop policies and find alternatives to reduce the costs. This will also help the business in

allocating the funds in each task and the surety also attached to it that there will be proper

utilisation of funds (Managerial Accounting Reports, 2014). Thus, the chances of having

manipulation of funds as well as imbalanced expenses will be reduced. Network Critical

Solutions will have better financial control as they make budgets periodically.

Accounts receivable aging:

This is the report which is consists of information regarding debtor collection period of

the organisation. Thus, it determines that the time on which debtors will be recovered by the

business. Network Critical Solutions will have effective operational management as if the

duration of collecting accounts receivables will be shorter (Cooper, Ezzamel and Qu, 2017).

Therefore, it is also a source of revenue on which the firm will have gains based on sold products

among the individuals in the market. Thus, this reporting will help in analysing the potential

debtors of the industry on which the firm could relay and make discounts. It will also help them

in analysing efficiency of business in making qualitative changes in the operational practices.

Inventory and manufacturing report:

To get the adequate information based on demands and the level of supplied made by the

firm relation with meeting the targets. Therefore, this report will help the manufacturer in terms

of analysing the costs implied in the production process such as material, labour and overhead

costs which will centralize data and summarize is for having the adequate control over the

operational practices and administration of activities (Nitzl, 2018). Network Critical Solutions

can have information regarding opportunities stated in the market which will help them in

making innovative changes in the products as well as redesigning the practices to have

appropriate ascertainment of operations.

Job cost report:

Implication of costs in the activities on which leaders have evaluated the profitability and

specific types for managing the job activities. Therefore, there are analysis based on the costs

such as material, labour and overheads used in the manufacturing or processing period (Ax and

Greve, 2017). To analyse the costs required in such operations as well as the policies of the

professionals in making drastic changes in the operational ascertainment will enable

professionals in decision making and changing the plans for operations. Network Critical

4

can develop policies and find alternatives to reduce the costs. This will also help the business in

allocating the funds in each task and the surety also attached to it that there will be proper

utilisation of funds (Managerial Accounting Reports, 2014). Thus, the chances of having

manipulation of funds as well as imbalanced expenses will be reduced. Network Critical

Solutions will have better financial control as they make budgets periodically.

Accounts receivable aging:

This is the report which is consists of information regarding debtor collection period of

the organisation. Thus, it determines that the time on which debtors will be recovered by the

business. Network Critical Solutions will have effective operational management as if the

duration of collecting accounts receivables will be shorter (Cooper, Ezzamel and Qu, 2017).

Therefore, it is also a source of revenue on which the firm will have gains based on sold products

among the individuals in the market. Thus, this reporting will help in analysing the potential

debtors of the industry on which the firm could relay and make discounts. It will also help them

in analysing efficiency of business in making qualitative changes in the operational practices.

Inventory and manufacturing report:

To get the adequate information based on demands and the level of supplied made by the

firm relation with meeting the targets. Therefore, this report will help the manufacturer in terms

of analysing the costs implied in the production process such as material, labour and overhead

costs which will centralize data and summarize is for having the adequate control over the

operational practices and administration of activities (Nitzl, 2018). Network Critical Solutions

can have information regarding opportunities stated in the market which will help them in

making innovative changes in the products as well as redesigning the practices to have

appropriate ascertainment of operations.

Job cost report:

Implication of costs in the activities on which leaders have evaluated the profitability and

specific types for managing the job activities. Therefore, there are analysis based on the costs

such as material, labour and overheads used in the manufacturing or processing period (Ax and

Greve, 2017). To analyse the costs required in such operations as well as the policies of the

professionals in making drastic changes in the operational ascertainment will enable

professionals in decision making and changing the plans for operations. Network Critical

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Solutions have to implicate this reporting technique which will bring the appropriate details

regarding expenses and income generated in a unit.

C. Ascertaining the fruitfulness of management accounting system in operational activities

In consideration with the management accounting techniques which have been analysed to

be implicated in Network Critical Solutions, are associated with several benefits. Therefore,

there can be various gains in the business as well as growth in this process. Along with this, the

importance and fruitfulness of management accounting system can be analysed as:

It consisting of all information based on income, expenditures, direct or indirect costs

implied in the activities which enables the professionals in accurately analysing it and

decision making.

The alternative solution and innovative changes will be made the professionals which

affect positively in raising the efficiency of organisation.

Analysis over the costs implied in tasks will be controlled and administered properly

which will result in increasing the profitability in the firm (Bui and De Villiers, 2017).

It brings the overall details regarding the industrial efficiency which will be articulating

and simplifies the decisions making process in the financial statement of the business.

There will be transparency in the accounting reports which is consists of proper

information and details relevant gains and spending.

There have been fluctuations and changes in the business monetary funds which will

articulate the operational practices as per reaching to the objectives quickly.

D. Determining the integration of management accounting and system in industrial aspect

Network Critical Solutions will have implication of management accounting reporting

techniques which will be assistive and helpful in terms of masking adequate operational

increment and ascertainment of various business operations. However, as per the general

principles and concepts have been awarded by international boards such as International

Accounting Standard Board (IASB), International Financial Reporting standards (IFRS) and

Generally, accepted accounting Principles (GAAP). Howe veer, these are the integrators or

origins through which the concept of complicating the accounting techniques in the business

practices have been determined.

5

regarding expenses and income generated in a unit.

C. Ascertaining the fruitfulness of management accounting system in operational activities

In consideration with the management accounting techniques which have been analysed to

be implicated in Network Critical Solutions, are associated with several benefits. Therefore,

there can be various gains in the business as well as growth in this process. Along with this, the

importance and fruitfulness of management accounting system can be analysed as:

It consisting of all information based on income, expenditures, direct or indirect costs

implied in the activities which enables the professionals in accurately analysing it and

decision making.

The alternative solution and innovative changes will be made the professionals which

affect positively in raising the efficiency of organisation.

Analysis over the costs implied in tasks will be controlled and administered properly

which will result in increasing the profitability in the firm (Bui and De Villiers, 2017).

It brings the overall details regarding the industrial efficiency which will be articulating

and simplifies the decisions making process in the financial statement of the business.

There will be transparency in the accounting reports which is consists of proper

information and details relevant gains and spending.

There have been fluctuations and changes in the business monetary funds which will

articulate the operational practices as per reaching to the objectives quickly.

D. Determining the integration of management accounting and system in industrial aspect

Network Critical Solutions will have implication of management accounting reporting

techniques which will be assistive and helpful in terms of masking adequate operational

increment and ascertainment of various business operations. However, as per the general

principles and concepts have been awarded by international boards such as International

Accounting Standard Board (IASB), International Financial Reporting standards (IFRS) and

Generally, accepted accounting Principles (GAAP). Howe veer, these are the integrators or

origins through which the concept of complicating the accounting techniques in the business

practices have been determined.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 2

A.1 defining the concept of marginal and absorption costing techniques

The impact of costing system is for analysing the adequate and accurate outcomes which

will be helpful in developing the strategies and making qualified changes in the operations.

However, there have been use of two techniques of analysing profitability of the firm such as:

Marginal costing:

The marginal costing techniques is being used for analysing the outcomes which

determined as per bifurcating the fixed and variable costs (Shah, Malik and Malik, 2011).

Therefore, there will be use of only variable costs in the operations while fixed costs are

excluded from it and are not being considered in analysing the profit and loss for the period.

Absorption costing:

This technique is known as the all cost system which analysis the profitability through

implicating all costs in the process. Thus, there will be consideration of fixed and variable costs

which have been denoted as the product cost.

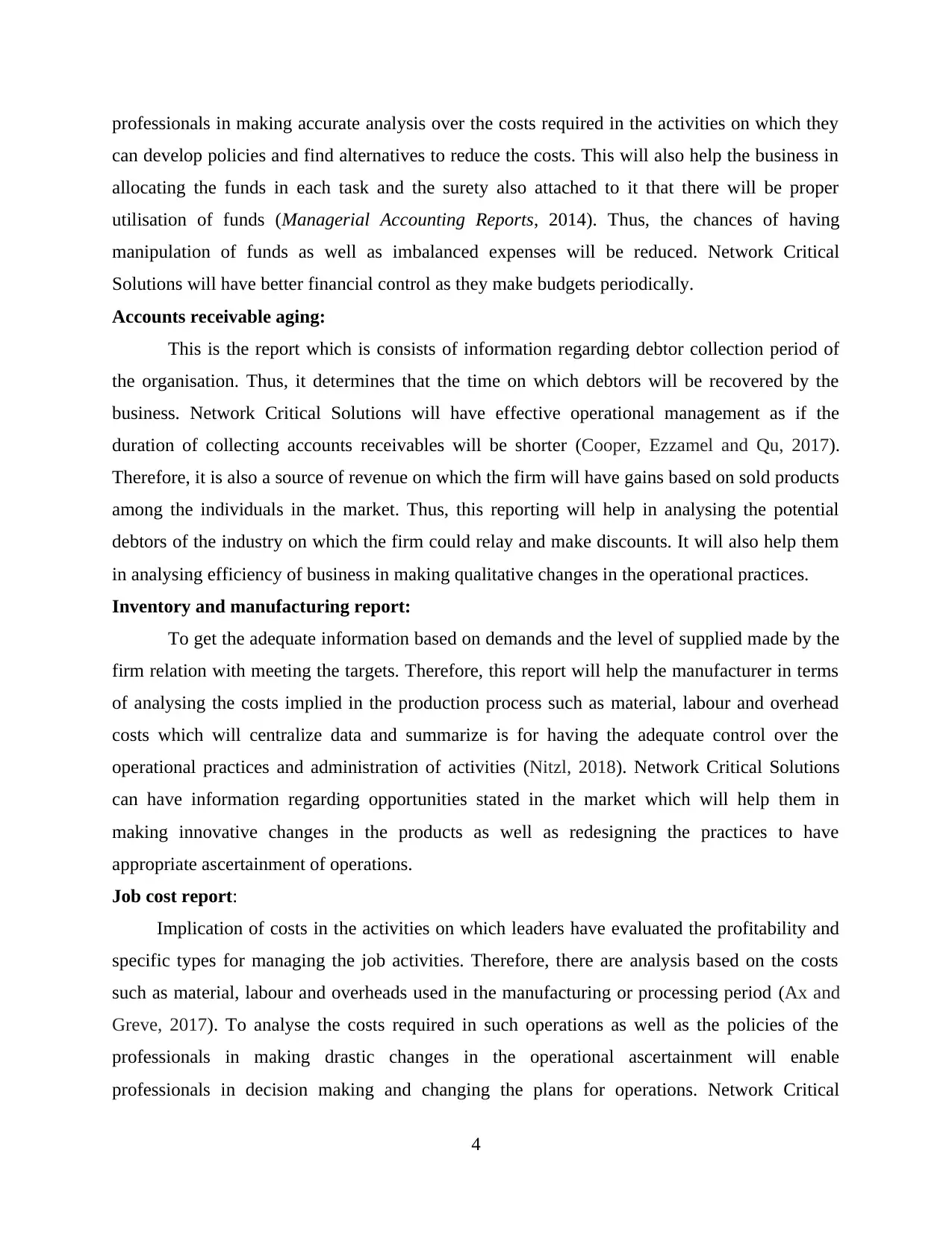

2. Preparing the income statement based on costing techniques such as marginal and absorption

Marginal Costing-:

Particulars Details Amount

(in £)

Selling Price 55

Units in numbers 600

Total Revenue 55*600 33000

Total Overheads

Units in numbers 600

Material Per Unit 7

Labour Per Unit 6

Variable manufacturing Overheads 2

Variable revenue Overhead 1

Total Overhead cost 16

Total Cost of Production 9600

Measurement of Contribution

Contribution 23400

Total fixed Costs analysis

6

A.1 defining the concept of marginal and absorption costing techniques

The impact of costing system is for analysing the adequate and accurate outcomes which

will be helpful in developing the strategies and making qualified changes in the operations.

However, there have been use of two techniques of analysing profitability of the firm such as:

Marginal costing:

The marginal costing techniques is being used for analysing the outcomes which

determined as per bifurcating the fixed and variable costs (Shah, Malik and Malik, 2011).

Therefore, there will be use of only variable costs in the operations while fixed costs are

excluded from it and are not being considered in analysing the profit and loss for the period.

Absorption costing:

This technique is known as the all cost system which analysis the profitability through

implicating all costs in the process. Thus, there will be consideration of fixed and variable costs

which have been denoted as the product cost.

2. Preparing the income statement based on costing techniques such as marginal and absorption

Marginal Costing-:

Particulars Details Amount

(in £)

Selling Price 55

Units in numbers 600

Total Revenue 55*600 33000

Total Overheads

Units in numbers 600

Material Per Unit 7

Labour Per Unit 6

Variable manufacturing Overheads 2

Variable revenue Overhead 1

Total Overhead cost 16

Total Cost of Production 9600

Measurement of Contribution

Contribution 23400

Total fixed Costs analysis

6

Production Overheads 3200

Administration Overheads 1200

Selling Costs 1500

Total Fixed Costs 5900

Net profit 17500

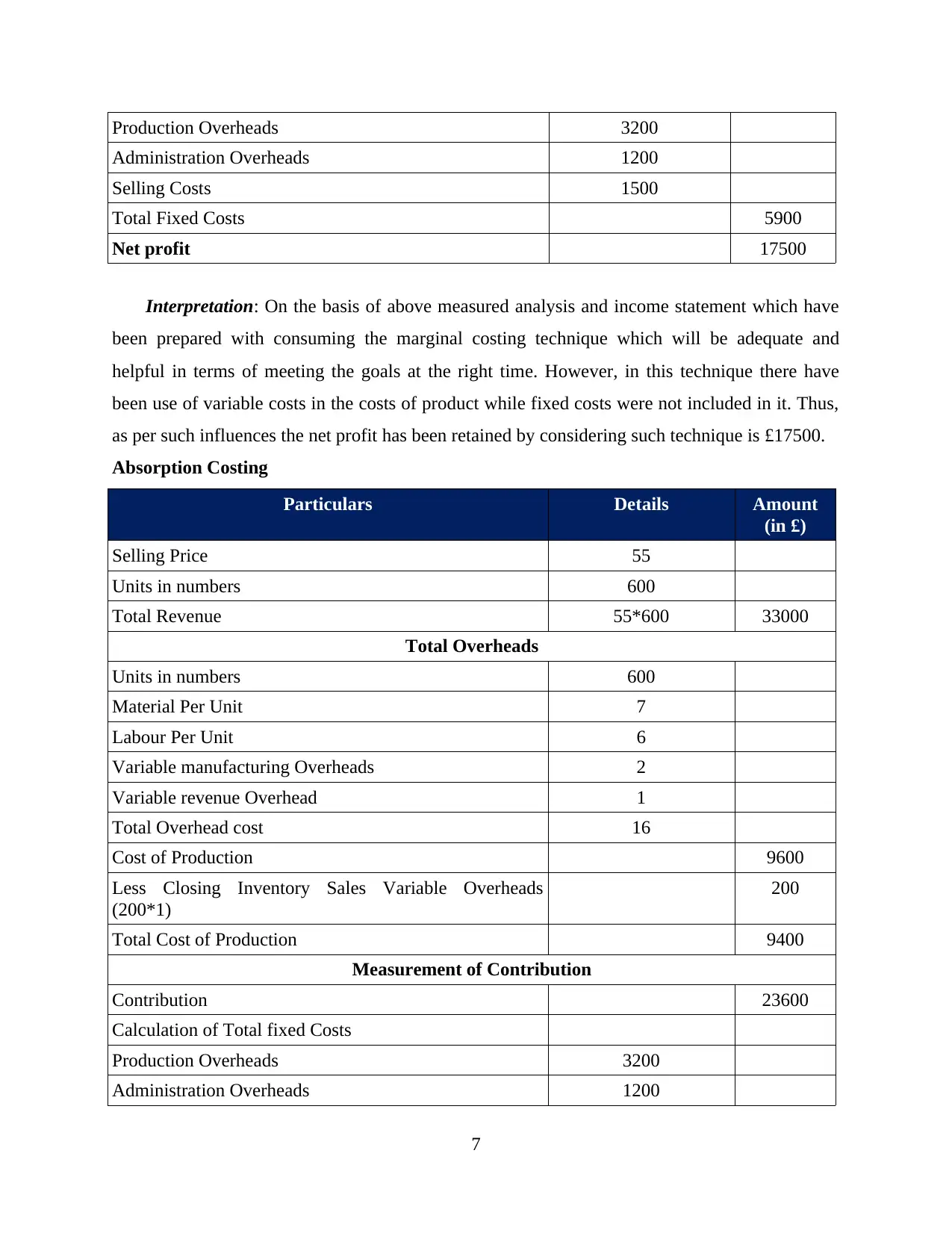

Interpretation: On the basis of above measured analysis and income statement which have

been prepared with consuming the marginal costing technique which will be adequate and

helpful in terms of meeting the goals at the right time. However, in this technique there have

been use of variable costs in the costs of product while fixed costs were not included in it. Thus,

as per such influences the net profit has been retained by considering such technique is £17500.

Absorption Costing

Particulars Details Amount

(in £)

Selling Price 55

Units in numbers 600

Total Revenue 55*600 33000

Total Overheads

Units in numbers 600

Material Per Unit 7

Labour Per Unit 6

Variable manufacturing Overheads 2

Variable revenue Overhead 1

Total Overhead cost 16

Cost of Production 9600

Less Closing Inventory Sales Variable Overheads

(200*1)

200

Total Cost of Production 9400

Measurement of Contribution

Contribution 23600

Calculation of Total fixed Costs

Production Overheads 3200

Administration Overheads 1200

7

Administration Overheads 1200

Selling Costs 1500

Total Fixed Costs 5900

Net profit 17500

Interpretation: On the basis of above measured analysis and income statement which have

been prepared with consuming the marginal costing technique which will be adequate and

helpful in terms of meeting the goals at the right time. However, in this technique there have

been use of variable costs in the costs of product while fixed costs were not included in it. Thus,

as per such influences the net profit has been retained by considering such technique is £17500.

Absorption Costing

Particulars Details Amount

(in £)

Selling Price 55

Units in numbers 600

Total Revenue 55*600 33000

Total Overheads

Units in numbers 600

Material Per Unit 7

Labour Per Unit 6

Variable manufacturing Overheads 2

Variable revenue Overhead 1

Total Overhead cost 16

Cost of Production 9600

Less Closing Inventory Sales Variable Overheads

(200*1)

200

Total Cost of Production 9400

Measurement of Contribution

Contribution 23600

Calculation of Total fixed Costs

Production Overheads 3200

Administration Overheads 1200

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Selling Costs 1500

Total F C 5900

Net profit 17700

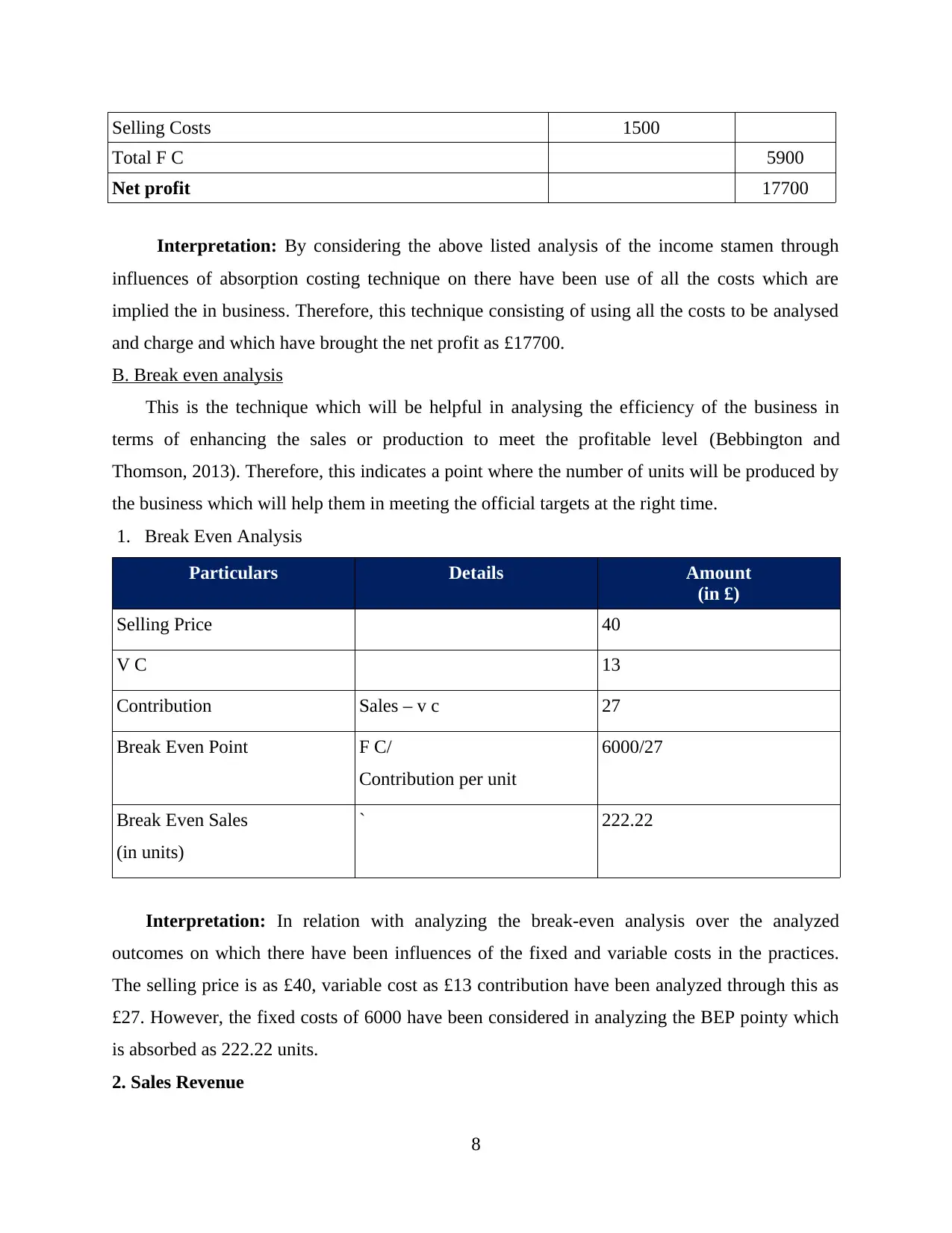

Interpretation: By considering the above listed analysis of the income stamen through

influences of absorption costing technique on there have been use of all the costs which are

implied the in business. Therefore, this technique consisting of using all the costs to be analysed

and charge and which have brought the net profit as £17700.

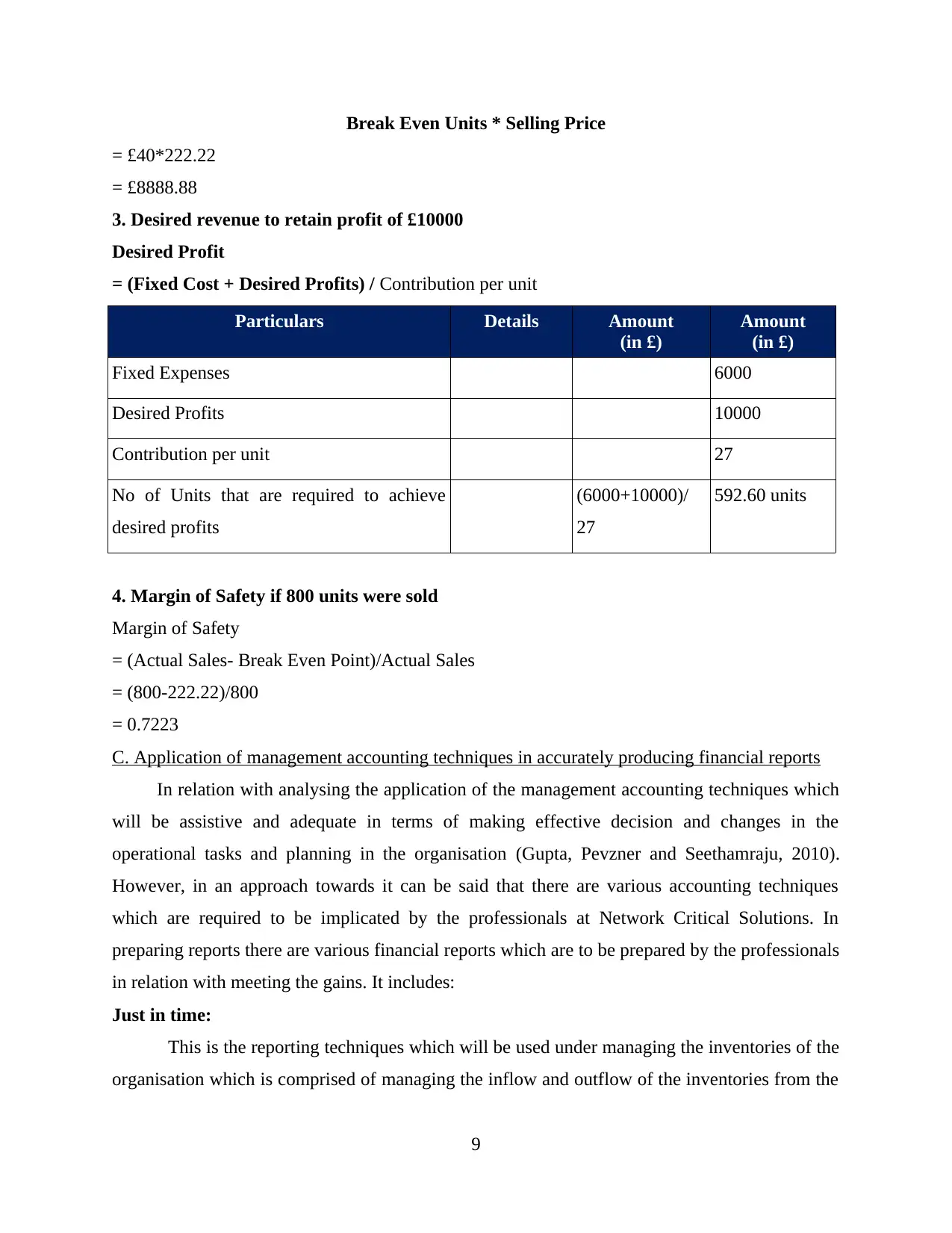

B. Break even analysis

This is the technique which will be helpful in analysing the efficiency of the business in

terms of enhancing the sales or production to meet the profitable level (Bebbington and

Thomson, 2013). Therefore, this indicates a point where the number of units will be produced by

the business which will help them in meeting the official targets at the right time.

1. Break Even Analysis

Particulars Details Amount

(in £)

Selling Price 40

V C 13

Contribution Sales – v c 27

Break Even Point F C/

Contribution per unit

6000/27

Break Even Sales

(in units)

` 222.22

Interpretation: In relation with analyzing the break-even analysis over the analyzed

outcomes on which there have been influences of the fixed and variable costs in the practices.

The selling price is as £40, variable cost as £13 contribution have been analyzed through this as

£27. However, the fixed costs of 6000 have been considered in analyzing the BEP pointy which

is absorbed as 222.22 units.

2. Sales Revenue

8

Total F C 5900

Net profit 17700

Interpretation: By considering the above listed analysis of the income stamen through

influences of absorption costing technique on there have been use of all the costs which are

implied the in business. Therefore, this technique consisting of using all the costs to be analysed

and charge and which have brought the net profit as £17700.

B. Break even analysis

This is the technique which will be helpful in analysing the efficiency of the business in

terms of enhancing the sales or production to meet the profitable level (Bebbington and

Thomson, 2013). Therefore, this indicates a point where the number of units will be produced by

the business which will help them in meeting the official targets at the right time.

1. Break Even Analysis

Particulars Details Amount

(in £)

Selling Price 40

V C 13

Contribution Sales – v c 27

Break Even Point F C/

Contribution per unit

6000/27

Break Even Sales

(in units)

` 222.22

Interpretation: In relation with analyzing the break-even analysis over the analyzed

outcomes on which there have been influences of the fixed and variable costs in the practices.

The selling price is as £40, variable cost as £13 contribution have been analyzed through this as

£27. However, the fixed costs of 6000 have been considered in analyzing the BEP pointy which

is absorbed as 222.22 units.

2. Sales Revenue

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Break Even Units * Selling Price

= £40*222.22

= £8888.88

3. Desired revenue to retain profit of £10000

Desired Profit

= (Fixed Cost + Desired Profits) / Contribution per unit

Particulars Details Amount

(in £)

Amount

(in £)

Fixed Expenses 6000

Desired Profits 10000

Contribution per unit 27

No of Units that are required to achieve

desired profits

(6000+10000)/

27

592.60 units

4. Margin of Safety if 800 units were sold

Margin of Safety

= (Actual Sales- Break Even Point)/Actual Sales

= (800-222.22)/800

= 0.7223

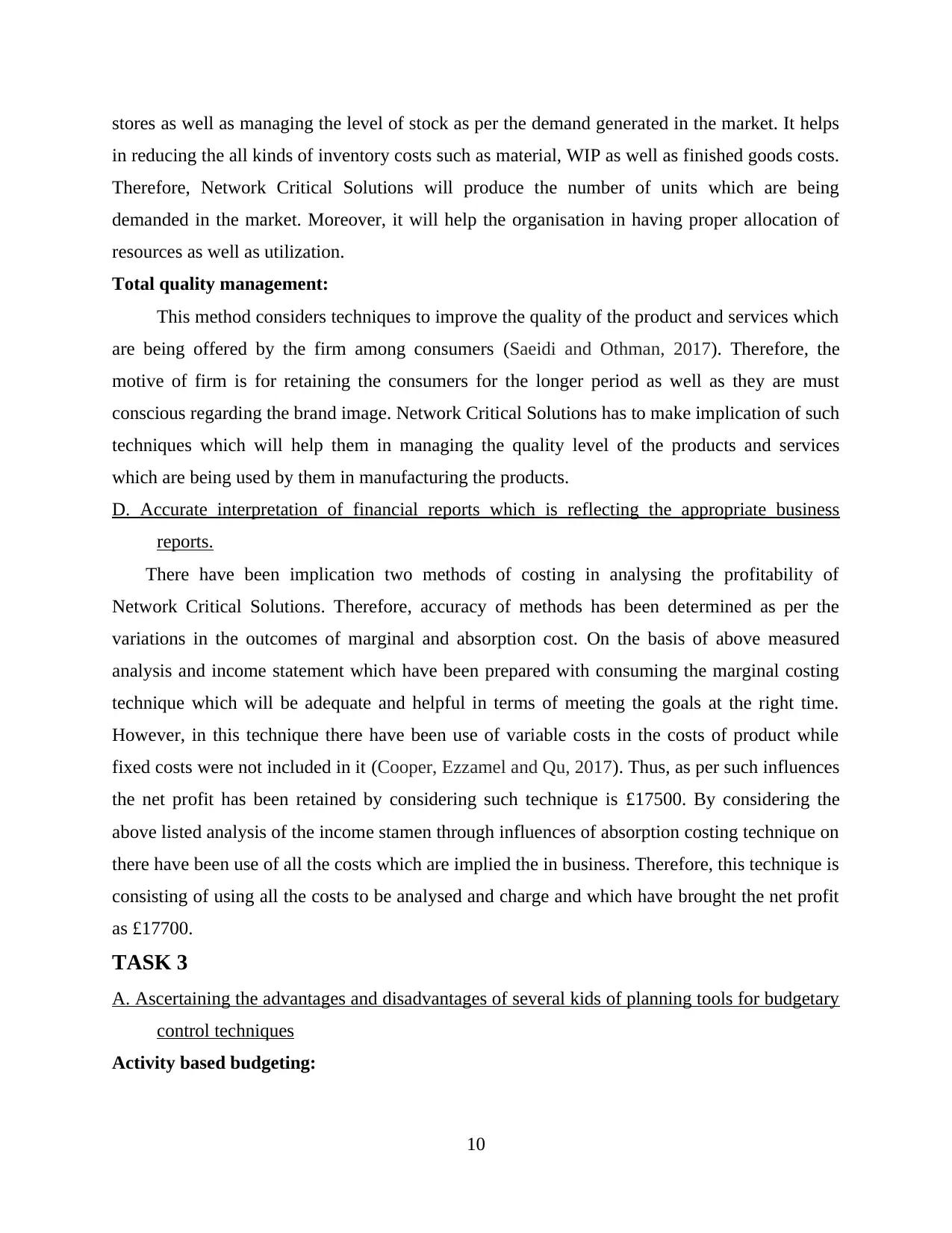

C. Application of management accounting techniques in accurately producing financial reports

In relation with analysing the application of the management accounting techniques which

will be assistive and adequate in terms of making effective decision and changes in the

operational tasks and planning in the organisation (Gupta, Pevzner and Seethamraju, 2010).

However, in an approach towards it can be said that there are various accounting techniques

which are required to be implicated by the professionals at Network Critical Solutions. In

preparing reports there are various financial reports which are to be prepared by the professionals

in relation with meeting the gains. It includes:

Just in time:

This is the reporting techniques which will be used under managing the inventories of the

organisation which is comprised of managing the inflow and outflow of the inventories from the

9

= £40*222.22

= £8888.88

3. Desired revenue to retain profit of £10000

Desired Profit

= (Fixed Cost + Desired Profits) / Contribution per unit

Particulars Details Amount

(in £)

Amount

(in £)

Fixed Expenses 6000

Desired Profits 10000

Contribution per unit 27

No of Units that are required to achieve

desired profits

(6000+10000)/

27

592.60 units

4. Margin of Safety if 800 units were sold

Margin of Safety

= (Actual Sales- Break Even Point)/Actual Sales

= (800-222.22)/800

= 0.7223

C. Application of management accounting techniques in accurately producing financial reports

In relation with analysing the application of the management accounting techniques which

will be assistive and adequate in terms of making effective decision and changes in the

operational tasks and planning in the organisation (Gupta, Pevzner and Seethamraju, 2010).

However, in an approach towards it can be said that there are various accounting techniques

which are required to be implicated by the professionals at Network Critical Solutions. In

preparing reports there are various financial reports which are to be prepared by the professionals

in relation with meeting the gains. It includes:

Just in time:

This is the reporting techniques which will be used under managing the inventories of the

organisation which is comprised of managing the inflow and outflow of the inventories from the

9

stores as well as managing the level of stock as per the demand generated in the market. It helps

in reducing the all kinds of inventory costs such as material, WIP as well as finished goods costs.

Therefore, Network Critical Solutions will produce the number of units which are being

demanded in the market. Moreover, it will help the organisation in having proper allocation of

resources as well as utilization.

Total quality management:

This method considers techniques to improve the quality of the product and services which

are being offered by the firm among consumers (Saeidi and Othman, 2017). Therefore, the

motive of firm is for retaining the consumers for the longer period as well as they are must

conscious regarding the brand image. Network Critical Solutions has to make implication of such

techniques which will help them in managing the quality level of the products and services

which are being used by them in manufacturing the products.

D. Accurate interpretation of financial reports which is reflecting the appropriate business

reports.

There have been implication two methods of costing in analysing the profitability of

Network Critical Solutions. Therefore, accuracy of methods has been determined as per the

variations in the outcomes of marginal and absorption cost. On the basis of above measured

analysis and income statement which have been prepared with consuming the marginal costing

technique which will be adequate and helpful in terms of meeting the goals at the right time.

However, in this technique there have been use of variable costs in the costs of product while

fixed costs were not included in it (Cooper, Ezzamel and Qu, 2017). Thus, as per such influences

the net profit has been retained by considering such technique is £17500. By considering the

above listed analysis of the income stamen through influences of absorption costing technique on

there have been use of all the costs which are implied the in business. Therefore, this technique is

consisting of using all the costs to be analysed and charge and which have brought the net profit

as £17700.

TASK 3

A. Ascertaining the advantages and disadvantages of several kids of planning tools for budgetary

control techniques

Activity based budgeting:

10

in reducing the all kinds of inventory costs such as material, WIP as well as finished goods costs.

Therefore, Network Critical Solutions will produce the number of units which are being

demanded in the market. Moreover, it will help the organisation in having proper allocation of

resources as well as utilization.

Total quality management:

This method considers techniques to improve the quality of the product and services which

are being offered by the firm among consumers (Saeidi and Othman, 2017). Therefore, the

motive of firm is for retaining the consumers for the longer period as well as they are must

conscious regarding the brand image. Network Critical Solutions has to make implication of such

techniques which will help them in managing the quality level of the products and services

which are being used by them in manufacturing the products.

D. Accurate interpretation of financial reports which is reflecting the appropriate business

reports.

There have been implication two methods of costing in analysing the profitability of

Network Critical Solutions. Therefore, accuracy of methods has been determined as per the

variations in the outcomes of marginal and absorption cost. On the basis of above measured

analysis and income statement which have been prepared with consuming the marginal costing

technique which will be adequate and helpful in terms of meeting the goals at the right time.

However, in this technique there have been use of variable costs in the costs of product while

fixed costs were not included in it (Cooper, Ezzamel and Qu, 2017). Thus, as per such influences

the net profit has been retained by considering such technique is £17500. By considering the

above listed analysis of the income stamen through influences of absorption costing technique on

there have been use of all the costs which are implied the in business. Therefore, this technique is

consisting of using all the costs to be analysed and charge and which have brought the net profit

as £17700.

TASK 3

A. Ascertaining the advantages and disadvantages of several kids of planning tools for budgetary

control techniques

Activity based budgeting:

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.