Management Accounting Concepts, Techniques & Application in Decision

VerifiedAdded on 2023/01/06

|18

|4484

|71

Report

AI Summary

This report provides a comprehensive analysis of management accounting concepts and techniques used for decision-making within a business context. It explores various management accounting systems, including cost accounting and inventory management, and examines different reporting methods such as budget reporting, accounts receivable aging, and job cost reports. The report also delves into techniques of cost analysis for preparing income statements, comparing marginal costing and absorption costing methods. Furthermore, it discusses the advantages and disadvantages of planning tools for budgetary control and compares how organizations adopt management accounting systems to respond to financial problems. The analysis is contextualized with examples, such as Innocent Drinks, to illustrate the practical application of these concepts in enhancing financial performance and strategic decision-making. Desklib offers this assignment solution and many other resources for students.

Management Accounting

Concepts and Techniques for

Decision Makers

Concepts and Techniques for

Decision Makers

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION.....................................................................................................................................3

PART 1...................................................................................................................................................3

Management accounting and various types of management accounting systems............................3

Different methods used for management accounting reporting.......................................................5

Benefits of management accounting system and application within company context....................7

PART 2...................................................................................................................................................7

Techniques of cost analysis for preparing income statement............................................................7

PART 3.................................................................................................................................................11

Advantages and disadvantages of various types of planning tools used for budgetary control......11

Comparison of organisations adoption of management accounting systems for responding to

financial problems...........................................................................................................................13

CONCLUSION.......................................................................................................................................15

REFRENCES..........................................................................................................................................16

INTRODUCTION.....................................................................................................................................3

PART 1...................................................................................................................................................3

Management accounting and various types of management accounting systems............................3

Different methods used for management accounting reporting.......................................................5

Benefits of management accounting system and application within company context....................7

PART 2...................................................................................................................................................7

Techniques of cost analysis for preparing income statement............................................................7

PART 3.................................................................................................................................................11

Advantages and disadvantages of various types of planning tools used for budgetary control......11

Comparison of organisations adoption of management accounting systems for responding to

financial problems...........................................................................................................................13

CONCLUSION.......................................................................................................................................15

REFRENCES..........................................................................................................................................16

INTRODUCTION

Management accounting can be understood as one of the most important parameter

where reports preparing short term and long term decisions by analysing business working

operations , interpretation of financial information goals. Management accounting enables to

form evocative working scenarios within business and to develop functional growth, for

longer term within wide changing industry paradigms. Report will be analysing various new

working goals within management accounting aspects for stable productive growth goals and

to yield focus onto how keen scenarios can be actively reached on. The report will be

analysing management accounting systems and various methods used for reporting in context

of company where there are various parameters growth searched on. Innocent drinks is one of

the biggest company producing juices, having wide products sold within supermarkets and

various outlets where it sells more than two millions products within per weak globally. The

report shall be discussing analysis of how various techniques of costs analysis are used to

prepare income statement, financial reports. Report also explains advantages and

disadvantages of various planning tools which are used for budgetary control, along with

comparison of how companies are adopting management accounting systems for responding

to various financial problems within business scenarios.

PART 1

Management accounting and various types of management accounting systems

Management accounting can be understood as one of the most innovative and

working aspect within business scenario for gaining new functional scenario within working

parameters with high functional innovation and for generating structured financial reports of

companies (Taschner and Charifzadeh, 2020). Managers have been analysing management

accounting as provisions of accounting information in order to better inform themselves

before they reach to decision where matters of company play high importance. The

management accounting aids management and performance of control functions for

developing new evocative functional presentation of financial reports which governs

goodwill structure and wider working innovation among varied goals. Management

accounting is used within company working phenomenon where main objective is to analyse

statistical data and accurate decisions, where controlling enterprise enables to pool on

development for long term working innovative efficiency. Innocent drinks within

management accounting working avenues will be able to adopt professional skills and

Management accounting can be understood as one of the most important parameter

where reports preparing short term and long term decisions by analysing business working

operations , interpretation of financial information goals. Management accounting enables to

form evocative working scenarios within business and to develop functional growth, for

longer term within wide changing industry paradigms. Report will be analysing various new

working goals within management accounting aspects for stable productive growth goals and

to yield focus onto how keen scenarios can be actively reached on. The report will be

analysing management accounting systems and various methods used for reporting in context

of company where there are various parameters growth searched on. Innocent drinks is one of

the biggest company producing juices, having wide products sold within supermarkets and

various outlets where it sells more than two millions products within per weak globally. The

report shall be discussing analysis of how various techniques of costs analysis are used to

prepare income statement, financial reports. Report also explains advantages and

disadvantages of various planning tools which are used for budgetary control, along with

comparison of how companies are adopting management accounting systems for responding

to various financial problems within business scenarios.

PART 1

Management accounting and various types of management accounting systems

Management accounting can be understood as one of the most innovative and

working aspect within business scenario for gaining new functional scenario within working

parameters with high functional innovation and for generating structured financial reports of

companies (Taschner and Charifzadeh, 2020). Managers have been analysing management

accounting as provisions of accounting information in order to better inform themselves

before they reach to decision where matters of company play high importance. The

management accounting aids management and performance of control functions for

developing new evocative functional presentation of financial reports which governs

goodwill structure and wider working innovation among varied goals. Management

accounting is used within company working phenomenon where main objective is to analyse

statistical data and accurate decisions, where controlling enterprise enables to pool on

development for long term working innovative efficiency. Innocent drinks within

management accounting working avenues will be able to adopt professional skills and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

knowledge, for preparation of financial and accounting information parameters which forms

effective base for internal management functional goals.

There are various types of management accounting systems which can be analysed based on

their parameters and operational goals for developing effective new functional representation

of working efficiency which can be discussed as follows:

Cost accounting system

The cost accounting system can be understood as one of the most effective system

when it comes to estimating value of products for profitability analysis, cost control measures

and inventory value. Accurate cost accounting system within costing of products is very

essential for company to form varied working structure which assists in estimation of closing

value of materials, work in progress and varied range of finished products within financial

statements. Cost accounting systems must be practical, capable of bringing on accurate

functional representation working aspects under which there is varied analysis of all detailed

cost information of all products manufactured and sold. The essential requirements for

effective cost accounting system is that it simply records costs for purpose of fixing sales

prices and accomplished with focus on manufacturing goals. It has been recognized as one of

the most relevant aid to modern management where there is assistance of working goals, to

bring on wider relevance functional representation and to economic development

(Fleischman. and McLean, 2020).

Inventory management system

The inventory management system can be understood as one of the most innovative

process where company uses it to track goods throughout entire supply chain process from

purchasing to production and end sales, which enables to govern inventory management.

There are typically three kinds of inventory systems manual, periodic and perpetual where

technological requirements complexity and implementation increases and moves from first to

last, with efficiency parameters and accuracy goals for gaining stronger working parameters.

The essential requirements of inventory management are tracking activities of movement of

stock within company and developing analysis of daily counts, managing stock products with

clear description and organized work environment parameters for attaining effective goals.

Job costing:

effective base for internal management functional goals.

There are various types of management accounting systems which can be analysed based on

their parameters and operational goals for developing effective new functional representation

of working efficiency which can be discussed as follows:

Cost accounting system

The cost accounting system can be understood as one of the most effective system

when it comes to estimating value of products for profitability analysis, cost control measures

and inventory value. Accurate cost accounting system within costing of products is very

essential for company to form varied working structure which assists in estimation of closing

value of materials, work in progress and varied range of finished products within financial

statements. Cost accounting systems must be practical, capable of bringing on accurate

functional representation working aspects under which there is varied analysis of all detailed

cost information of all products manufactured and sold. The essential requirements for

effective cost accounting system is that it simply records costs for purpose of fixing sales

prices and accomplished with focus on manufacturing goals. It has been recognized as one of

the most relevant aid to modern management where there is assistance of working goals, to

bring on wider relevance functional representation and to economic development

(Fleischman. and McLean, 2020).

Inventory management system

The inventory management system can be understood as one of the most innovative

process where company uses it to track goods throughout entire supply chain process from

purchasing to production and end sales, which enables to govern inventory management.

There are typically three kinds of inventory systems manual, periodic and perpetual where

technological requirements complexity and implementation increases and moves from first to

last, with efficiency parameters and accuracy goals for gaining stronger working parameters.

The essential requirements of inventory management are tracking activities of movement of

stock within company and developing analysis of daily counts, managing stock products with

clear description and organized work environment parameters for attaining effective goals.

Job costing:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This is understood as accounting system which enables to track costs and revenues of

standardized reporting of wide profitability within job. For this accounting system to support

job costing it must allow job numbers. Expenses and revenues are analysed for obtaining

functional representation of working operations, which significantly enables management to

frame parameters (Abernethy and Wallis, 2019).

Different methods used for management accounting reporting.

Managerial accounting reports are used for providing information of varied functional

analysis of how financial decisions are taken place by working towards product lines,

investing on a goods that offers financial returns within company working scenarios and for

higher performance goals.

Budget reporting:

The budget reports can be understood as one of the most important management accounting

reporting method which enables to analyze business performance, managers to analyze

department’s performance and actual costs within estimated budgets. Budget reporting will

help Innocent drinks in context for wider management reporting to gain effective

performance goals structured within accounting system and how keen scenarios can be

obtained. Budget reporting helps to structure operational paradigms within business in

company structure where there are various departments goals and statements analyzed for

developing functional in depth growth which will generate new scenarios to establish in

potential arenas.

Accounts Receivable aging

Accounts Receivable aging reporting is critical tool for managing cash flows of company for

extending credit to wide range of consumers in business parameters where report breaks

down customer’s balances. This reporting method enables to develop analysis of how

consumers working aspects can be formed among management, for evocative working

scenarios within future goals and to gain exact analysis of how company is heading.

Accounts receivable reports enables to form varied working aspects of how is business

responding within consumer strength market and to form new working advancement of how

varied new technical growth can be measured. In case there are defaulters recognized who

have been not paying debts at time, then company may need complete transformation to

standardized reporting of wide profitability within job. For this accounting system to support

job costing it must allow job numbers. Expenses and revenues are analysed for obtaining

functional representation of working operations, which significantly enables management to

frame parameters (Abernethy and Wallis, 2019).

Different methods used for management accounting reporting.

Managerial accounting reports are used for providing information of varied functional

analysis of how financial decisions are taken place by working towards product lines,

investing on a goods that offers financial returns within company working scenarios and for

higher performance goals.

Budget reporting:

The budget reports can be understood as one of the most important management accounting

reporting method which enables to analyze business performance, managers to analyze

department’s performance and actual costs within estimated budgets. Budget reporting will

help Innocent drinks in context for wider management reporting to gain effective

performance goals structured within accounting system and how keen scenarios can be

obtained. Budget reporting helps to structure operational paradigms within business in

company structure where there are various departments goals and statements analyzed for

developing functional in depth growth which will generate new scenarios to establish in

potential arenas.

Accounts Receivable aging

Accounts Receivable aging reporting is critical tool for managing cash flows of company for

extending credit to wide range of consumers in business parameters where report breaks

down customer’s balances. This reporting method enables to develop analysis of how

consumers working aspects can be formed among management, for evocative working

scenarios within future goals and to gain exact analysis of how company is heading.

Accounts receivable reports enables to form varied working aspects of how is business

responding within consumer strength market and to form new working advancement of how

varied new technical growth can be measured. In case there are defaulters recognized who

have been not paying debts at time, then company may need complete transformation to

tighter credit policies as cash flow is critical for operation of business for gaining competitive

goodwill (Căpușneanu, Topor and Marin-Pantelescu, 2020).

Job cost reports

The job cost reports can be understood as specific project which are financed by small

businesses and are matched with estimates of revenue which can be evaluated based on jobs

profitability standards. Job cost reports play important role in estimating revenue within

business so that profitability can be measured by evaluating fundamentally where additional

efforts instead of wasting time and money on jobs can be put further. Job cost reports play

integral role in analyzing working expenses within projects so that progress in correct areas

of waste can be checked with regularity.

Inventory and manufacturing reports

This accounting report method is used within small businesses for producing products

and managerial accounting reports for making manufacturing accounting reports, where

identification of all inventory waste and labor costs can be done effectively. This report is

known for analysis overhead costs which later enable to compare parameters within busines

for highlighting arenas to improve best performing departments and to yield focus onto

various new governing scenarios. This method of reporting also develops functional growth

within inventory management and how various raw materials, operational programs are

effectively managed (Cescon, Costantini and Grassetti, 2019).

Performance reports

The performance reports are one of the most actively used within companies where

whole performances are analyzed from employees working scenarios till the whole working

scenarios which develop performance reports which are generally used for developing growth

goals. Managers within performance reports focus on making strategic key decisions where

future of company are analyzed to see varied functional aspects and performances where key

scenarios are also analyzed. Performance related managerial accounting reports also enable in

depth insight into working structure of company for gaining new relative functional aspects

which enable to develop functional performance to be formatted based on wider goals.

goodwill (Căpușneanu, Topor and Marin-Pantelescu, 2020).

Job cost reports

The job cost reports can be understood as specific project which are financed by small

businesses and are matched with estimates of revenue which can be evaluated based on jobs

profitability standards. Job cost reports play important role in estimating revenue within

business so that profitability can be measured by evaluating fundamentally where additional

efforts instead of wasting time and money on jobs can be put further. Job cost reports play

integral role in analyzing working expenses within projects so that progress in correct areas

of waste can be checked with regularity.

Inventory and manufacturing reports

This accounting report method is used within small businesses for producing products

and managerial accounting reports for making manufacturing accounting reports, where

identification of all inventory waste and labor costs can be done effectively. This report is

known for analysis overhead costs which later enable to compare parameters within busines

for highlighting arenas to improve best performing departments and to yield focus onto

various new governing scenarios. This method of reporting also develops functional growth

within inventory management and how various raw materials, operational programs are

effectively managed (Cescon, Costantini and Grassetti, 2019).

Performance reports

The performance reports are one of the most actively used within companies where

whole performances are analyzed from employees working scenarios till the whole working

scenarios which develop performance reports which are generally used for developing growth

goals. Managers within performance reports focus on making strategic key decisions where

future of company are analyzed to see varied functional aspects and performances where key

scenarios are also analyzed. Performance related managerial accounting reports also enable in

depth insight into working structure of company for gaining new relative functional aspects

which enable to develop functional performance to be formatted based on wider goals.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Benefits of management accounting system and application within company context

There are various benefits of management accounting systems which Innocent drinks

can functionally avail to which can be analysed based on long term structural business

scenarios by planning, controlling, service to customers for growing on wider paradigms.

Management accounting systems enable organising, coordinating, improvement of efficiency

and motivating by developing communication among various departments which also

develop focus onto how new technical growth can be operated among working functional

scope. Innocent drinks will be able to develop stable growth goals by using management

accounting systems and to yield strength of how innovation can be further expanded to varied

aspects. Management accounting systems provides deep insights into details of company

finance and resource flow, which also functionally will enable Innocent drinks to take timely

decisions based on actual data. It also determines how flows can be detected within

management and provides means to form long term strategies for scaling business paradigms,

for long term new competitive growth goals (Fleischman and McLean, 2020).

PART 2

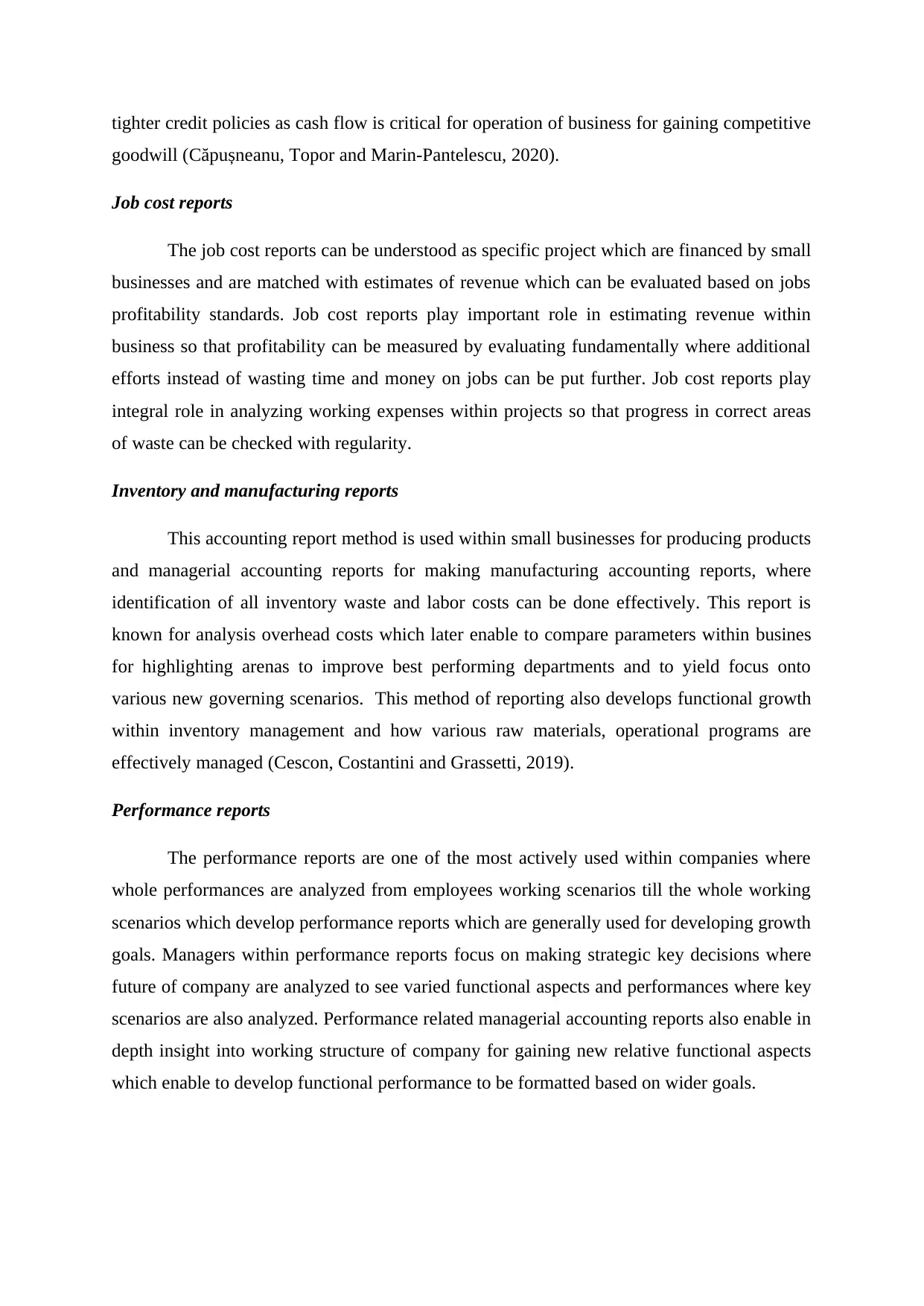

Techniques of cost analysis for preparing income statement

There are number of techniques which can be used by the organization for cost

analysis purpose. Some are described below.

Marginal costing system: Under this, the cost in relation to production includes only

the variable cost while the fixed manufacturing overhead is ignored (Averina, 2019). The

variable cost varies with the change in the output level.

Absorption costing system: In this technique of cost analysis, all the cost relevant or

associated with the production of the good is included (Căpușneanu and et.al, 2019). The

includes direct and indirect cost in evaluating the cost in relation to the production.

Cost profit volume analysis: This analysis assist the organization in determining the

impact of change in variable and fixed cost over the profitability of the company (Illie and

Sorina, 2017). It is very useful in taking business decision in relation to expansion.

Income statement as per Marginal Costing

Particulars April May

Sales Revenue (4000*14) 56000 (5000*14) 70000

There are various benefits of management accounting systems which Innocent drinks

can functionally avail to which can be analysed based on long term structural business

scenarios by planning, controlling, service to customers for growing on wider paradigms.

Management accounting systems enable organising, coordinating, improvement of efficiency

and motivating by developing communication among various departments which also

develop focus onto how new technical growth can be operated among working functional

scope. Innocent drinks will be able to develop stable growth goals by using management

accounting systems and to yield strength of how innovation can be further expanded to varied

aspects. Management accounting systems provides deep insights into details of company

finance and resource flow, which also functionally will enable Innocent drinks to take timely

decisions based on actual data. It also determines how flows can be detected within

management and provides means to form long term strategies for scaling business paradigms,

for long term new competitive growth goals (Fleischman and McLean, 2020).

PART 2

Techniques of cost analysis for preparing income statement

There are number of techniques which can be used by the organization for cost

analysis purpose. Some are described below.

Marginal costing system: Under this, the cost in relation to production includes only

the variable cost while the fixed manufacturing overhead is ignored (Averina, 2019). The

variable cost varies with the change in the output level.

Absorption costing system: In this technique of cost analysis, all the cost relevant or

associated with the production of the good is included (Căpușneanu and et.al, 2019). The

includes direct and indirect cost in evaluating the cost in relation to the production.

Cost profit volume analysis: This analysis assist the organization in determining the

impact of change in variable and fixed cost over the profitability of the company (Illie and

Sorina, 2017). It is very useful in taking business decision in relation to expansion.

Income statement as per Marginal Costing

Particulars April May

Sales Revenue (4000*14) 56000 (5000*14) 70000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Marginal Cost of Sales

Variable Production cost (6000*5) 30000 (6000*5) 30000

30000 30000

Add:

Opening Stock 0

(2000/6000*3

0000) 10000

Less:

Closing Stock

(2000/6000*3

0000) 10000

(3000/6000*3

0000) 15000

20000 25000

Contribution 36000 45000

Fixed manufacturing

overheads 18000 18000

Fixed Non-Manufacturing

Cost 5000 5000

Net Income 13000 22000

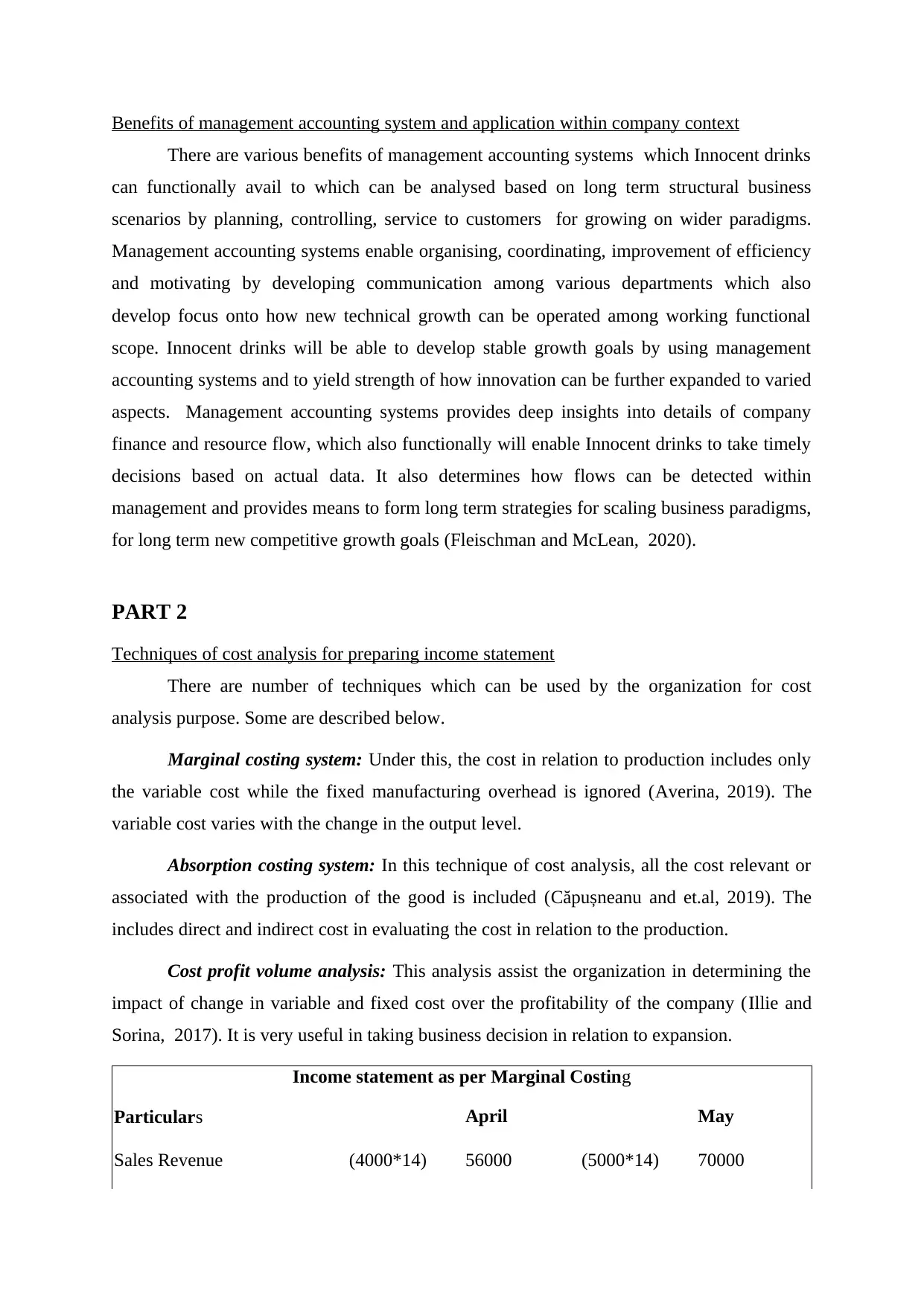

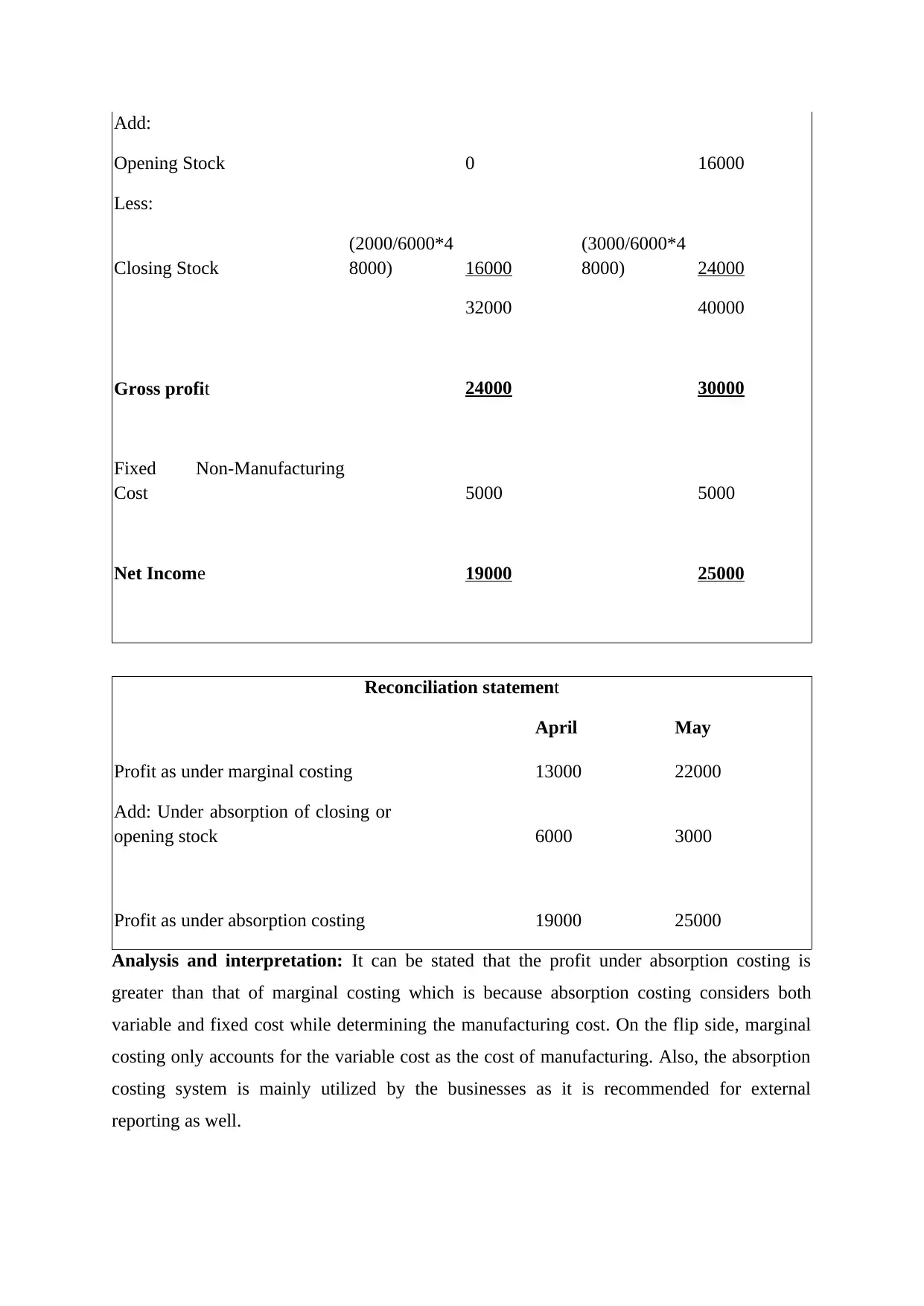

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (4000*14) 56000 (5000*14) 70000

Marginal Cost of Sales

Variable Production cost (6000*5) 30000 (6000*5) 30000

Fixed manufacturing

overheads 18000 18000

48000 48000

Variable Production cost (6000*5) 30000 (6000*5) 30000

30000 30000

Add:

Opening Stock 0

(2000/6000*3

0000) 10000

Less:

Closing Stock

(2000/6000*3

0000) 10000

(3000/6000*3

0000) 15000

20000 25000

Contribution 36000 45000

Fixed manufacturing

overheads 18000 18000

Fixed Non-Manufacturing

Cost 5000 5000

Net Income 13000 22000

Income statement as per Absorption Costing

Particulars January February

Sales Revenue (4000*14) 56000 (5000*14) 70000

Marginal Cost of Sales

Variable Production cost (6000*5) 30000 (6000*5) 30000

Fixed manufacturing

overheads 18000 18000

48000 48000

Add:

Opening Stock 0 16000

Less:

Closing Stock

(2000/6000*4

8000) 16000

(3000/6000*4

8000) 24000

32000 40000

Gross profit 24000 30000

Fixed Non-Manufacturing

Cost 5000 5000

Net Income 19000 25000

Reconciliation statement

April May

Profit as under marginal costing 13000 22000

Add: Under absorption of closing or

opening stock 6000 3000

Profit as under absorption costing 19000 25000

Analysis and interpretation: It can be stated that the profit under absorption costing is

greater than that of marginal costing which is because absorption costing considers both

variable and fixed cost while determining the manufacturing cost. On the flip side, marginal

costing only accounts for the variable cost as the cost of manufacturing. Also, the absorption

costing system is mainly utilized by the businesses as it is recommended for external

reporting as well.

Opening Stock 0 16000

Less:

Closing Stock

(2000/6000*4

8000) 16000

(3000/6000*4

8000) 24000

32000 40000

Gross profit 24000 30000

Fixed Non-Manufacturing

Cost 5000 5000

Net Income 19000 25000

Reconciliation statement

April May

Profit as under marginal costing 13000 22000

Add: Under absorption of closing or

opening stock 6000 3000

Profit as under absorption costing 19000 25000

Analysis and interpretation: It can be stated that the profit under absorption costing is

greater than that of marginal costing which is because absorption costing considers both

variable and fixed cost while determining the manufacturing cost. On the flip side, marginal

costing only accounts for the variable cost as the cost of manufacturing. Also, the absorption

costing system is mainly utilized by the businesses as it is recommended for external

reporting as well.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

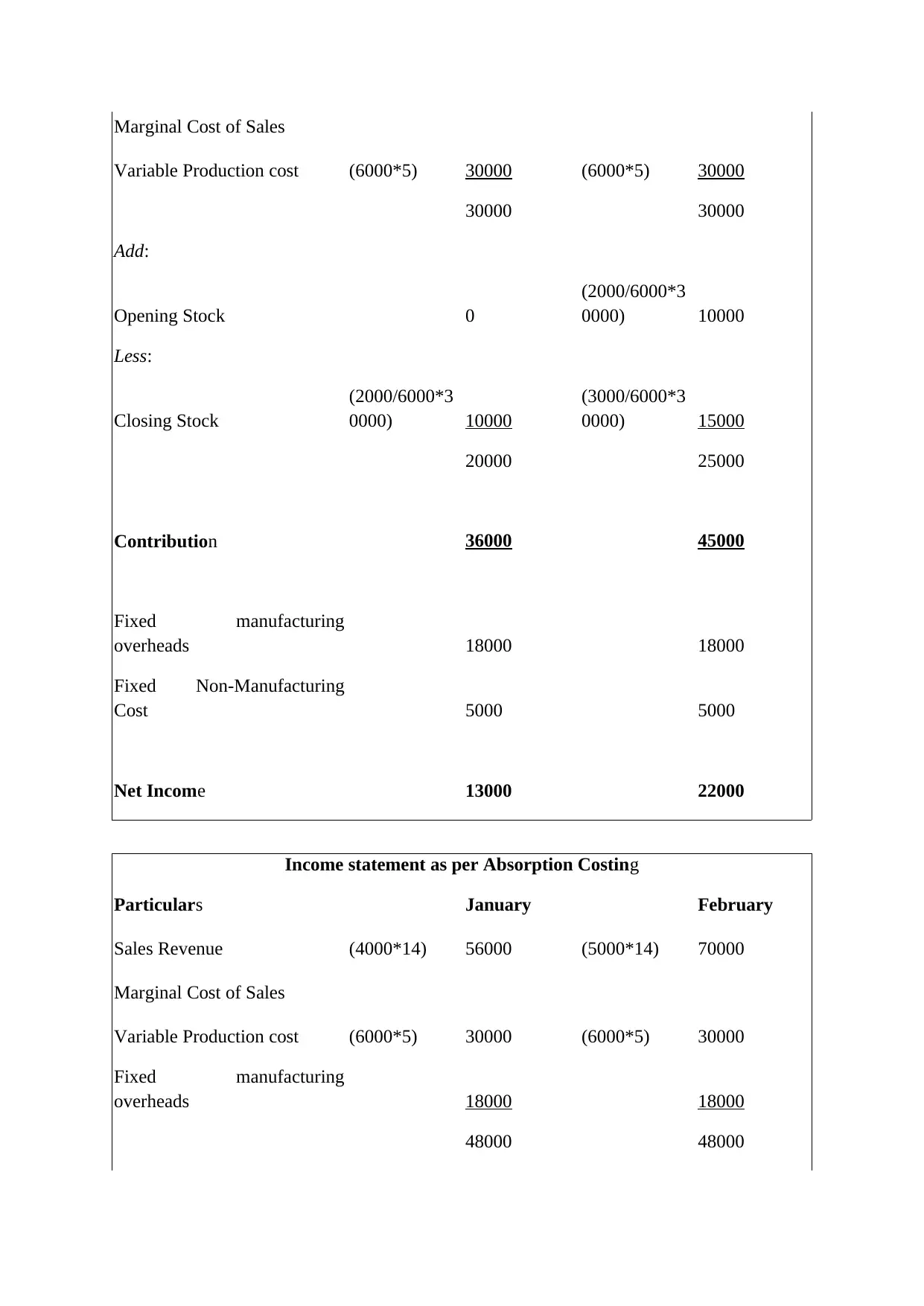

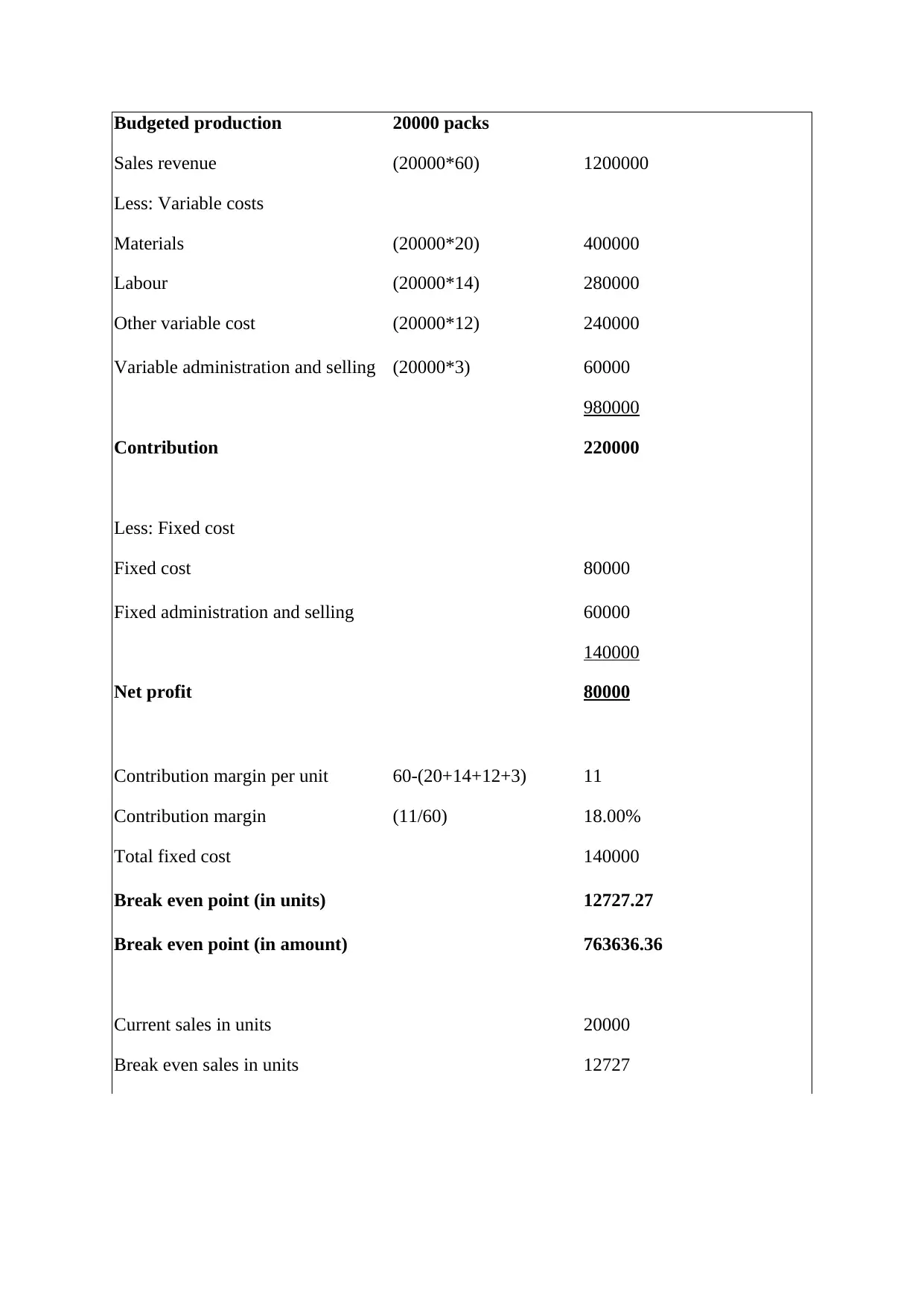

Budgeted production 20000 packs

Sales revenue (20000*60) 1200000

Less: Variable costs

Materials (20000*20) 400000

Labour (20000*14) 280000

Other variable cost (20000*12) 240000

Variable administration and selling (20000*3) 60000

980000

Contribution 220000

Less: Fixed cost

Fixed cost 80000

Fixed administration and selling 60000

140000

Net profit 80000

Contribution margin per unit 60-(20+14+12+3) 11

Contribution margin (11/60) 18.00%

Total fixed cost 140000

Break even point (in units) 12727.27

Break even point (in amount) 763636.36

Current sales in units 20000

Break even sales in units 12727

Sales revenue (20000*60) 1200000

Less: Variable costs

Materials (20000*20) 400000

Labour (20000*14) 280000

Other variable cost (20000*12) 240000

Variable administration and selling (20000*3) 60000

980000

Contribution 220000

Less: Fixed cost

Fixed cost 80000

Fixed administration and selling 60000

140000

Net profit 80000

Contribution margin per unit 60-(20+14+12+3) 11

Contribution margin (11/60) 18.00%

Total fixed cost 140000

Break even point (in units) 12727.27

Break even point (in amount) 763636.36

Current sales in units 20000

Break even sales in units 12727

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Margin of safety (in units) (20000-12727) 7273

Current sales 1200000

Break even sales 763636

Margin of safety (in amount) (1200000-763636) 436364

0

3181

6363

9545

12727

15909

19090

22272

25454

28636

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

2000000

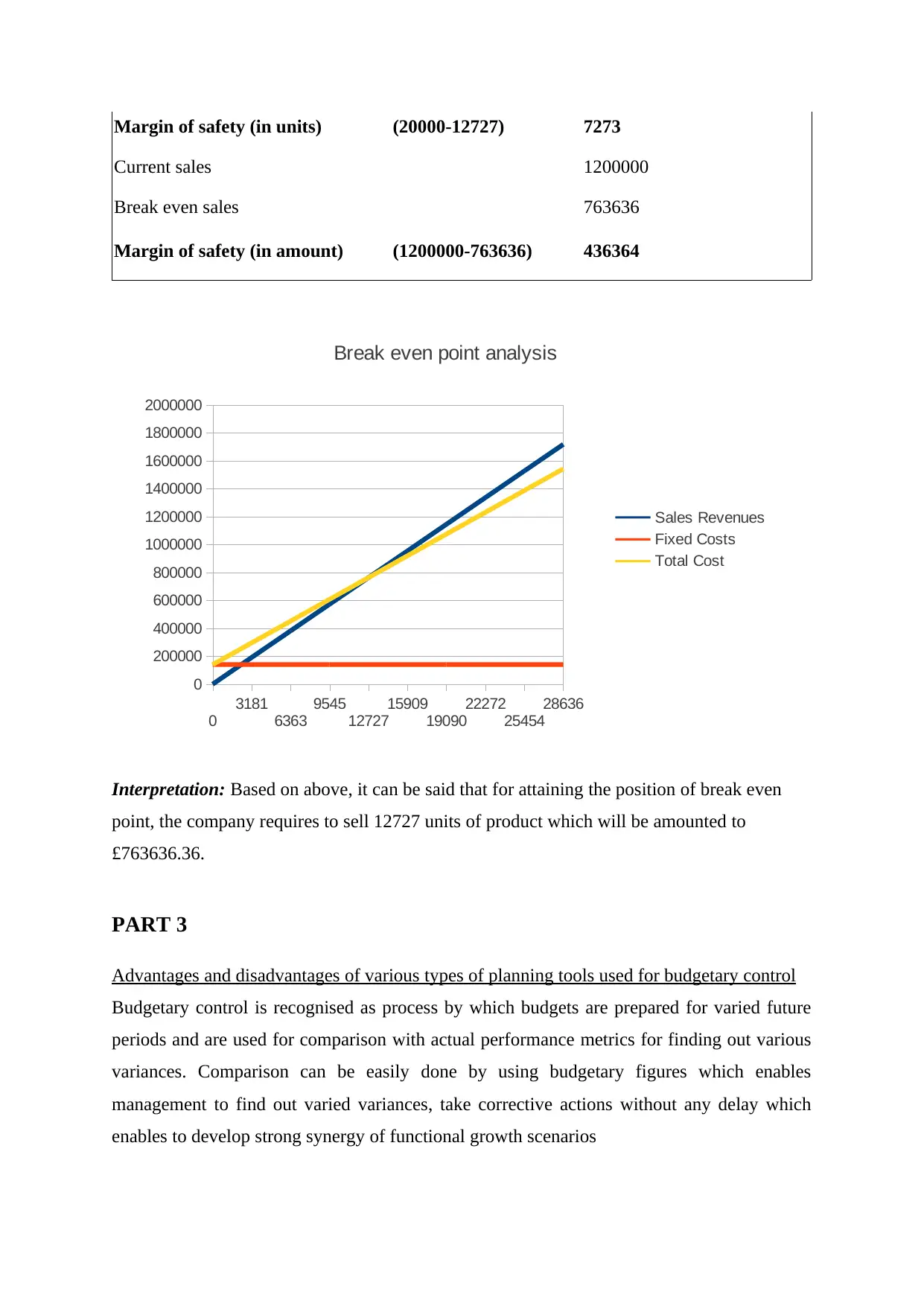

Break even point analysis

Sales Revenues

Fixed Costs

Total Cost

Interpretation: Based on above, it can be said that for attaining the position of break even

point, the company requires to sell 12727 units of product which will be amounted to

£763636.36.

PART 3

Advantages and disadvantages of various types of planning tools used for budgetary control

Budgetary control is recognised as process by which budgets are prepared for varied future

periods and are used for comparison with actual performance metrics for finding out various

variances. Comparison can be easily done by using budgetary figures which enables

management to find out varied variances, take corrective actions without any delay which

enables to develop strong synergy of functional growth scenarios

Current sales 1200000

Break even sales 763636

Margin of safety (in amount) (1200000-763636) 436364

0

3181

6363

9545

12727

15909

19090

22272

25454

28636

0

200000

400000

600000

800000

1000000

1200000

1400000

1600000

1800000

2000000

Break even point analysis

Sales Revenues

Fixed Costs

Total Cost

Interpretation: Based on above, it can be said that for attaining the position of break even

point, the company requires to sell 12727 units of product which will be amounted to

£763636.36.

PART 3

Advantages and disadvantages of various types of planning tools used for budgetary control

Budgetary control is recognised as process by which budgets are prepared for varied future

periods and are used for comparison with actual performance metrics for finding out various

variances. Comparison can be easily done by using budgetary figures which enables

management to find out varied variances, take corrective actions without any delay which

enables to develop strong synergy of functional growth scenarios

To ensure structural planning within future for setting up budgets and requirements

for wider expected performance metrics which enables enterprise to anticipate future

growth goals and operate costs within departments with efficiency.

To eliminate wastes and anticipate capital expenditure within business which enables

to increase profitability by also centralizing control system , where top management is

able to yield focus on how varied growth operations can be reached on.

There are various types of planning tools used for budgetary control which enables to form

wide functional presentation of how various financial information can be analysed to develop

accurate budgetary control information which are widely different and dynamically shifting

from time to time. . Planning tools used within budgetary control enable companies to reach

at formed functional objectives which can be understood as follows (Jakobsen, Mitchell, and

Trenca, 2019).

Cost volume profit analysis: The cost volume profit analysis can be understood as one of the

major accounting procedure tool used for developing analysing focus how sales volume and

product costs on operating profits within business are correlated. The cost volume also

functionally holds assumption that all costs can be classified as fixed or variable which are

constant and units are produced for selling effectively. This is used by management as one of

the most important planning tool for estimating business revenue standards from sales, costs

and profits by operating advanced mathematical tools and working advancement to reach on

desired results. Innocent drinks will be able to develop to determine breakeven points in

business formats where this point enables us to analyse working parameters of new reflected

growth goals and at what points innovation can be built on by bringing on wider scenarios

productively.

Advantages: Ease of calculations with use of set standards, formulas and numbers

which changes quickly based on working paradigms and planning by analysing the

break even points helps managers to estimate working future spending objectives of

business. This has also been recognised to enable managers for deciding prices of

products with highest and lowest prices that offer various opportunities within

business and budget preparation parameters for gaining scope onto how new goals

will be formed.

for wider expected performance metrics which enables enterprise to anticipate future

growth goals and operate costs within departments with efficiency.

To eliminate wastes and anticipate capital expenditure within business which enables

to increase profitability by also centralizing control system , where top management is

able to yield focus on how varied growth operations can be reached on.

There are various types of planning tools used for budgetary control which enables to form

wide functional presentation of how various financial information can be analysed to develop

accurate budgetary control information which are widely different and dynamically shifting

from time to time. . Planning tools used within budgetary control enable companies to reach

at formed functional objectives which can be understood as follows (Jakobsen, Mitchell, and

Trenca, 2019).

Cost volume profit analysis: The cost volume profit analysis can be understood as one of the

major accounting procedure tool used for developing analysing focus how sales volume and

product costs on operating profits within business are correlated. The cost volume also

functionally holds assumption that all costs can be classified as fixed or variable which are

constant and units are produced for selling effectively. This is used by management as one of

the most important planning tool for estimating business revenue standards from sales, costs

and profits by operating advanced mathematical tools and working advancement to reach on

desired results. Innocent drinks will be able to develop to determine breakeven points in

business formats where this point enables us to analyse working parameters of new reflected

growth goals and at what points innovation can be built on by bringing on wider scenarios

productively.

Advantages: Ease of calculations with use of set standards, formulas and numbers

which changes quickly based on working paradigms and planning by analysing the

break even points helps managers to estimate working future spending objectives of

business. This has also been recognised to enable managers for deciding prices of

products with highest and lowest prices that offer various opportunities within

business and budget preparation parameters for gaining scope onto how new goals

will be formed.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.