Management Accounting Report: Costing, Profitability, and Budgeting

VerifiedAdded on 2023/06/18

|20

|3843

|277

Report

AI Summary

This management accounting report provides a detailed analysis of costing methods, break-even points, and variance analysis. It includes solutions to questions related to Plaistead Plc and Crawford Plc, covering topics such as contribution per unit, break-even sales revenue, margin of safety, profit estimation, and pricing strategies. The report also explores cost allocation methods for different departments, overhead recovery rates, and full job cost calculations. Additionally, it discusses the advantages and disadvantages of absorption costing and provides estimations of budgets and variances for Jayrod Plc. This comprehensive report offers valuable insights into management accounting principles and their practical applications.

Introduction to

management accounting

management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Contents................................................................................................................................................2

Part 1.....................................................................................................................................................3

Question 2: Plaistead Plc..................................................................................................................3

Part 2.....................................................................................................................................................8

Question 3: Crawford Plc.................................................................................................................8

Part 3.....................................................................................................................................................3

Question 4:........................................................................................................................................3

REFERENCES...................................................................................................................................10

Contents................................................................................................................................................2

Part 1.....................................................................................................................................................3

Question 2: Plaistead Plc..................................................................................................................3

Part 2.....................................................................................................................................................8

Question 3: Crawford Plc.................................................................................................................8

Part 3.....................................................................................................................................................3

Question 4:........................................................................................................................................3

REFERENCES...................................................................................................................................10

Part 1

Question 2: Plaistead Plc.

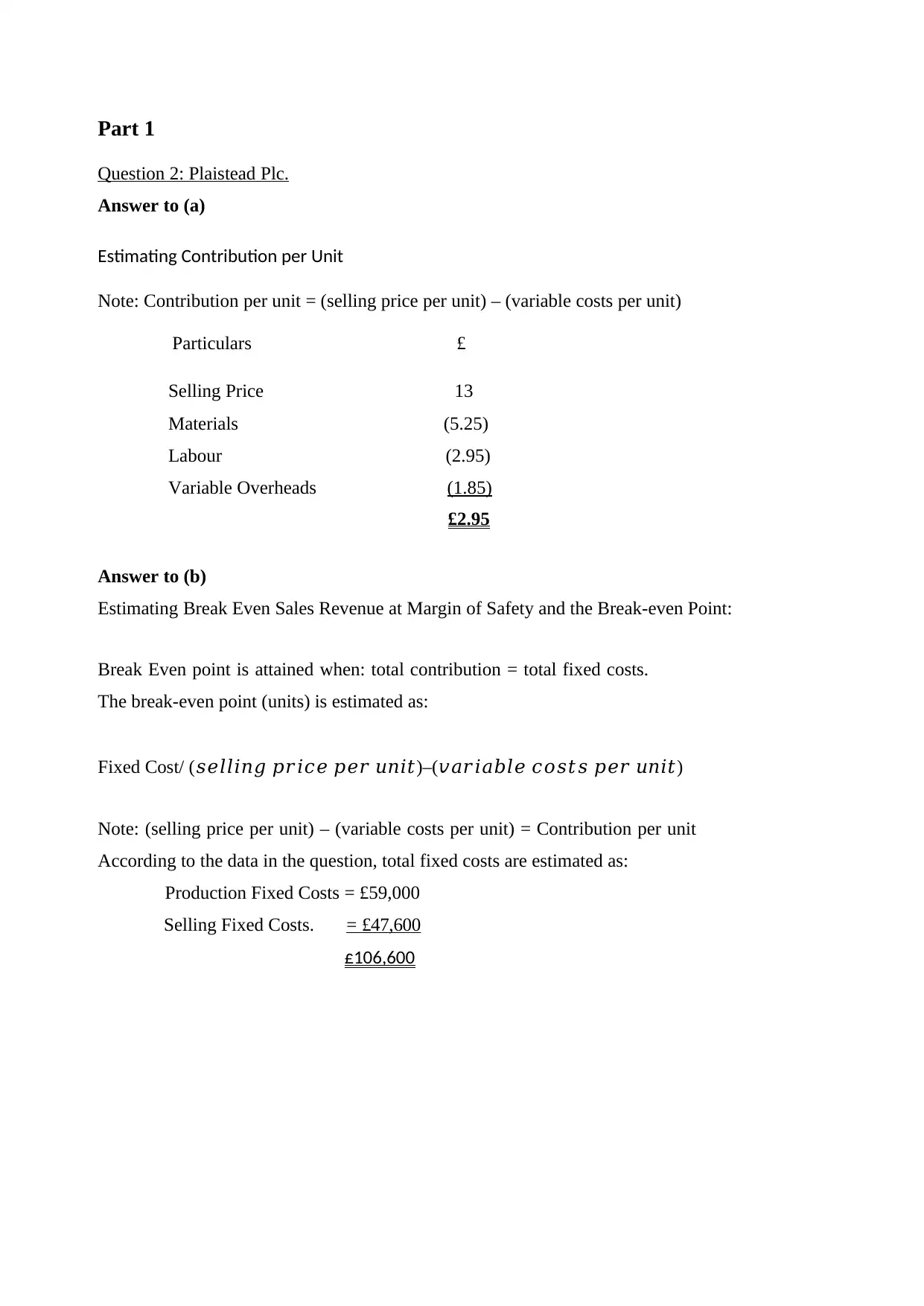

Answer to (a)

Estimating Contribution per Unit

Note: Contribution per unit = (selling price per unit) – (variable costs per unit)

Particulars £

Selling Price 13

Materials (5.25)

Labour (2.95)

Variable Overheads (1.85)

£2.95

Answer to (b)

Estimating Break Even Sales Revenue at Margin of Safety and the Break-even Point:

Break Even point is attained when: total contribution = total fixed costs.

The break-even point (units) is estimated as:

Fixed Cost/ (𝑠𝑒𝑙𝑙𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)–(𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡𝑠 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)

Note: (selling price per unit) – (variable costs per unit) = Contribution per unit

According to the data in the question, total fixed costs are estimated as:

Production Fixed Costs = £59,000

Selling Fixed Costs. = £47,600

£106,600

Question 2: Plaistead Plc.

Answer to (a)

Estimating Contribution per Unit

Note: Contribution per unit = (selling price per unit) – (variable costs per unit)

Particulars £

Selling Price 13

Materials (5.25)

Labour (2.95)

Variable Overheads (1.85)

£2.95

Answer to (b)

Estimating Break Even Sales Revenue at Margin of Safety and the Break-even Point:

Break Even point is attained when: total contribution = total fixed costs.

The break-even point (units) is estimated as:

Fixed Cost/ (𝑠𝑒𝑙𝑙𝑖𝑛𝑔 𝑝𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)–(𝑣𝑎𝑟𝑖𝑎𝑏𝑙𝑒 𝑐𝑜𝑠𝑡𝑠 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡)

Note: (selling price per unit) – (variable costs per unit) = Contribution per unit

According to the data in the question, total fixed costs are estimated as:

Production Fixed Costs = £59,000

Selling Fixed Costs. = £47,600

£106,600

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

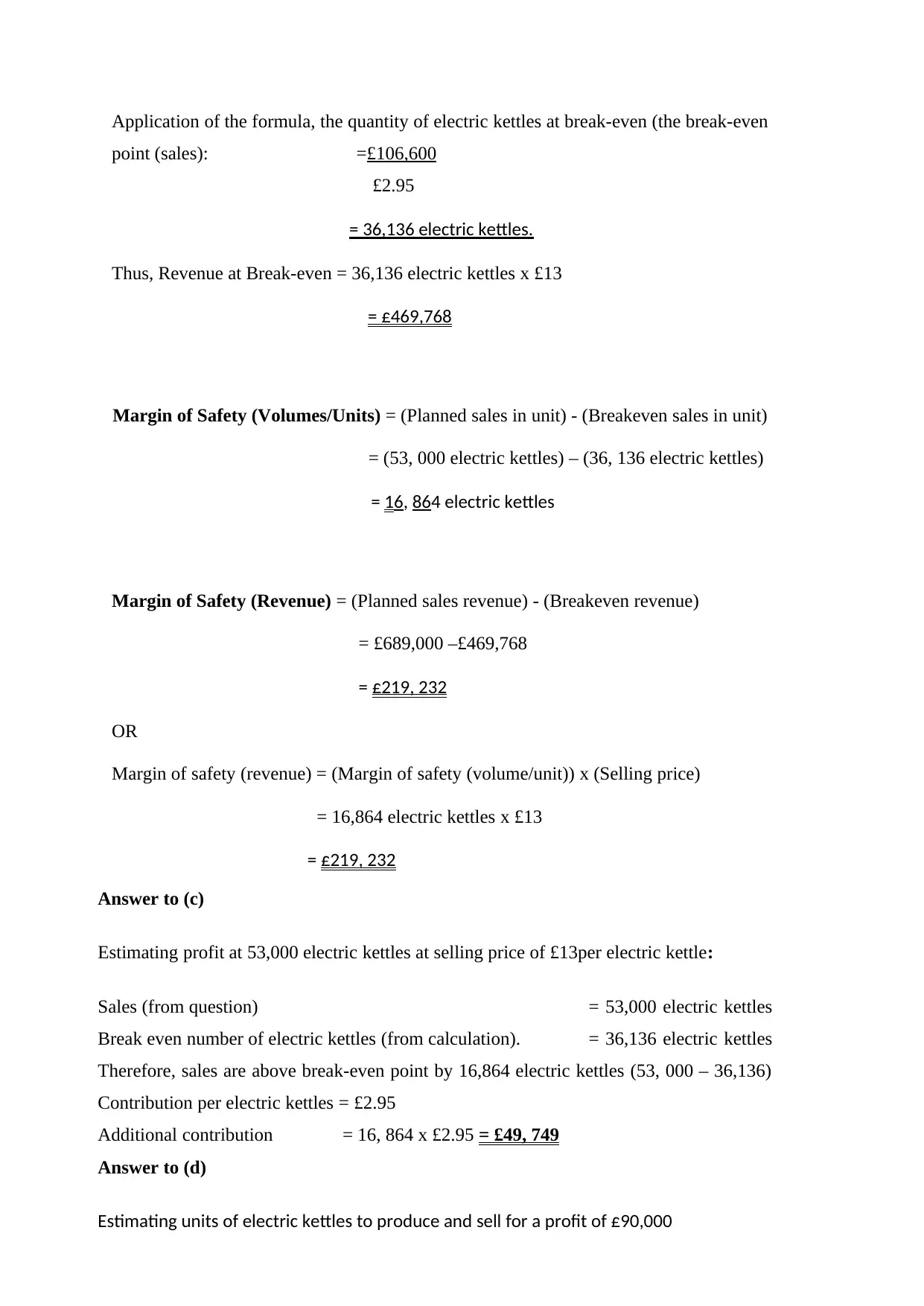

Application of the formula, the quantity of electric kettles at break-even (the break-even

point (sales): =£106,600

£2.95

= 36,136 electric kettles.

Thus, Revenue at Break-even = 36,136 electric kettles x £13

= £469,768

Margin of Safety (Volumes/Units) = (Planned sales in unit) - (Breakeven sales in unit)

= (53, 000 electric kettles) – (36, 136 electric kettles)

= 16, 864 electric kettles

Margin of Safety (Revenue) = (Planned sales revenue) - (Breakeven revenue)

= £689,000 –£469,768

= £219, 232

OR

Margin of safety (revenue) = (Margin of safety (volume/unit)) x (Selling price)

= 16,864 electric kettles x £13

= £219, 232

Answer to (c)

Estimating profit at 53,000 electric kettles at selling price of £13per electric kettle:

Sales (from question) = 53,000 electric kettles

Break even number of electric kettles (from calculation). = 36,136 electric kettles

Therefore, sales are above break-even point by 16,864 electric kettles (53, 000 – 36,136)

Contribution per electric kettles = £2.95

Additional contribution = 16, 864 x £2.95 = £49, 749

Answer to (d)

Estimating units of electric kettles to produce and sell for a profit of £90,000

point (sales): =£106,600

£2.95

= 36,136 electric kettles.

Thus, Revenue at Break-even = 36,136 electric kettles x £13

= £469,768

Margin of Safety (Volumes/Units) = (Planned sales in unit) - (Breakeven sales in unit)

= (53, 000 electric kettles) – (36, 136 electric kettles)

= 16, 864 electric kettles

Margin of Safety (Revenue) = (Planned sales revenue) - (Breakeven revenue)

= £689,000 –£469,768

= £219, 232

OR

Margin of safety (revenue) = (Margin of safety (volume/unit)) x (Selling price)

= 16,864 electric kettles x £13

= £219, 232

Answer to (c)

Estimating profit at 53,000 electric kettles at selling price of £13per electric kettle:

Sales (from question) = 53,000 electric kettles

Break even number of electric kettles (from calculation). = 36,136 electric kettles

Therefore, sales are above break-even point by 16,864 electric kettles (53, 000 – 36,136)

Contribution per electric kettles = £2.95

Additional contribution = 16, 864 x £2.95 = £49, 749

Answer to (d)

Estimating units of electric kettles to produce and sell for a profit of £90,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

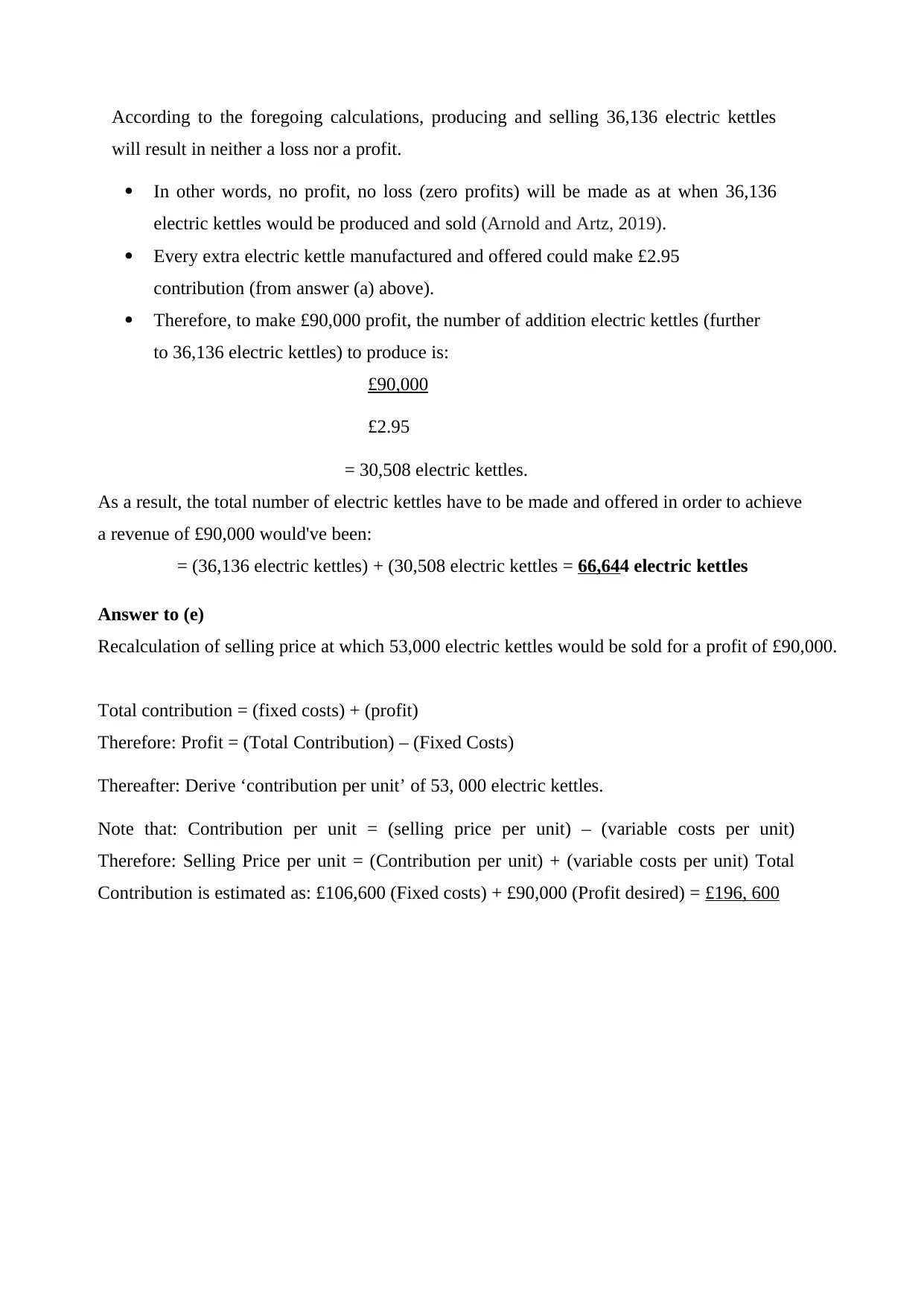

According to the foregoing calculations, producing and selling 36,136 electric kettles

will result in neither a loss nor a profit.

In other words, no profit, no loss (zero profits) will be made as at when 36,136

electric kettles would be produced and sold (Arnold and Artz, 2019).

Every extra electric kettle manufactured and offered could make £2.95

contribution (from answer (a) above).

Therefore, to make £90,000 profit, the number of addition electric kettles (further

to 36,136 electric kettles) to produce is:

£90,000

£2.95

= 30,508 electric kettles.

As a result, the total number of electric kettles have to be made and offered in order to achieve

a revenue of £90,000 would've been:

= (36,136 electric kettles) + (30,508 electric kettles = 66,644 electric kettles

Answer to (e)

Recalculation of selling price at which 53,000 electric kettles would be sold for a profit of £90,000.

Total contribution = (fixed costs) + (profit)

Therefore: Profit = (Total Contribution) – (Fixed Costs)

Thereafter: Derive ‘contribution per unit’ of 53, 000 electric kettles.

Note that: Contribution per unit = (selling price per unit) – (variable costs per unit)

Therefore: Selling Price per unit = (Contribution per unit) + (variable costs per unit) Total

Contribution is estimated as: £106,600 (Fixed costs) + £90,000 (Profit desired) = £196, 600

will result in neither a loss nor a profit.

In other words, no profit, no loss (zero profits) will be made as at when 36,136

electric kettles would be produced and sold (Arnold and Artz, 2019).

Every extra electric kettle manufactured and offered could make £2.95

contribution (from answer (a) above).

Therefore, to make £90,000 profit, the number of addition electric kettles (further

to 36,136 electric kettles) to produce is:

£90,000

£2.95

= 30,508 electric kettles.

As a result, the total number of electric kettles have to be made and offered in order to achieve

a revenue of £90,000 would've been:

= (36,136 electric kettles) + (30,508 electric kettles = 66,644 electric kettles

Answer to (e)

Recalculation of selling price at which 53,000 electric kettles would be sold for a profit of £90,000.

Total contribution = (fixed costs) + (profit)

Therefore: Profit = (Total Contribution) – (Fixed Costs)

Thereafter: Derive ‘contribution per unit’ of 53, 000 electric kettles.

Note that: Contribution per unit = (selling price per unit) – (variable costs per unit)

Therefore: Selling Price per unit = (Contribution per unit) + (variable costs per unit) Total

Contribution is estimated as: £106,600 (Fixed costs) + £90,000 (Profit desired) = £196, 600

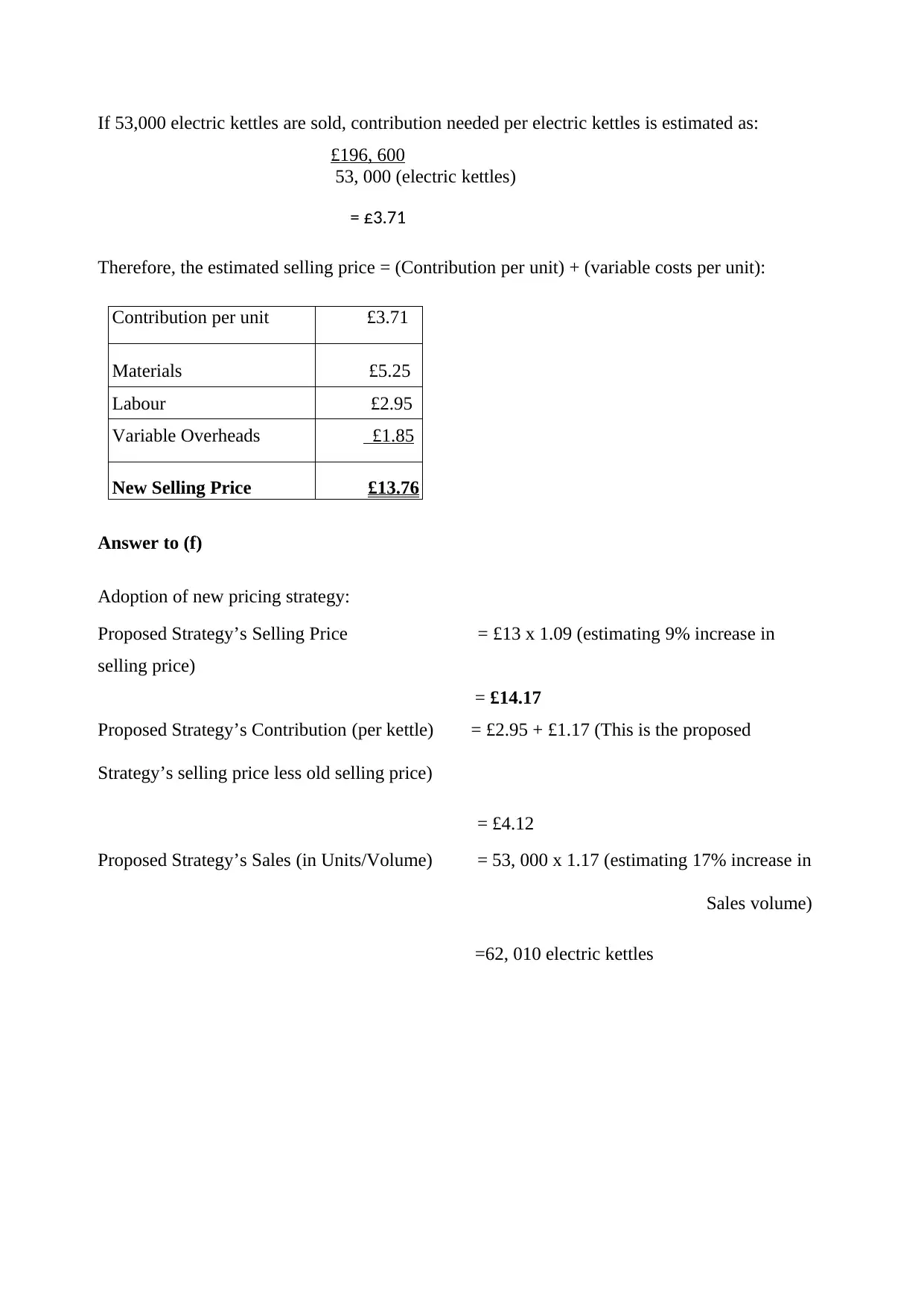

If 53,000 electric kettles are sold, contribution needed per electric kettles is estimated as:

£196, 600

53, 000 (electric kettles)

= £3.71

Therefore, the estimated selling price = (Contribution per unit) + (variable costs per unit):

Contribution per unit £3.71

Materials £5.25

Labour £2.95

Variable Overheads £1.85

New Selling Price £13.76

Answer to (f)

Adoption of new pricing strategy:

Proposed Strategy’s Selling Price = £13 x 1.09 (estimating 9% increase in

selling price)

= £14.17

Proposed Strategy’s Contribution (per kettle) = £2.95 + £1.17 (This is the proposed

Strategy’s selling price less old selling price)

= £4.12

Proposed Strategy’s Sales (in Units/Volume) = 53, 000 x 1.17 (estimating 17% increase in

Sales volume)

=62, 010 electric kettles

£196, 600

53, 000 (electric kettles)

= £3.71

Therefore, the estimated selling price = (Contribution per unit) + (variable costs per unit):

Contribution per unit £3.71

Materials £5.25

Labour £2.95

Variable Overheads £1.85

New Selling Price £13.76

Answer to (f)

Adoption of new pricing strategy:

Proposed Strategy’s Selling Price = £13 x 1.09 (estimating 9% increase in

selling price)

= £14.17

Proposed Strategy’s Contribution (per kettle) = £2.95 + £1.17 (This is the proposed

Strategy’s selling price less old selling price)

= £4.12

Proposed Strategy’s Sales (in Units/Volume) = 53, 000 x 1.17 (estimating 17% increase in

Sales volume)

=62, 010 electric kettles

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

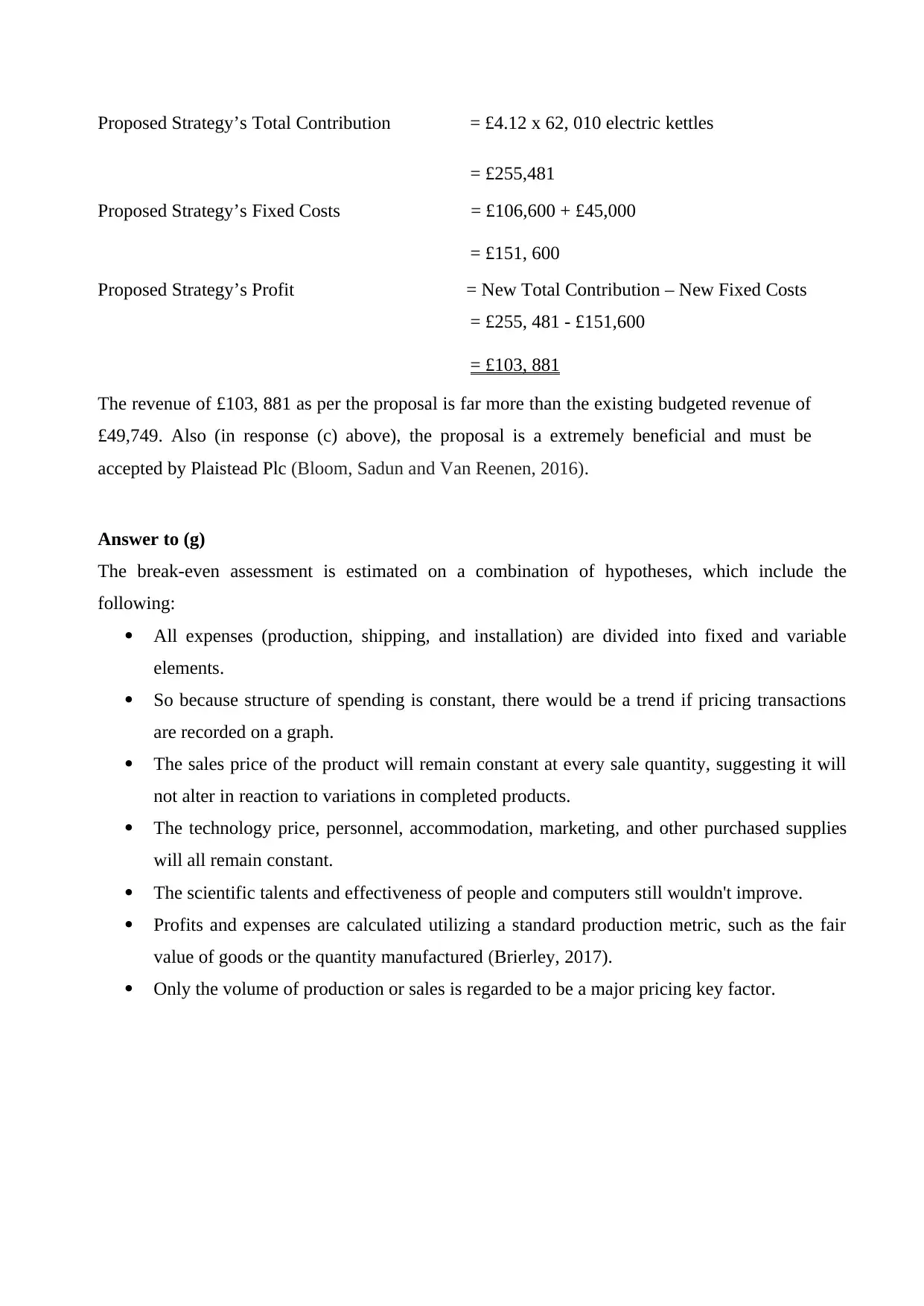

Proposed Strategy’s Total Contribution = £4.12 x 62, 010 electric kettles

= £255,481

Proposed Strategy’s Fixed Costs = £106,600 + £45,000

= £151, 600

Proposed Strategy’s Profit = New Total Contribution – New Fixed Costs

= £255, 481 - £151,600

= £103, 881

The revenue of £103, 881 as per the proposal is far more than the existing budgeted revenue of

£49,749. Also (in response (c) above), the proposal is a extremely beneficial and must be

accepted by Plaistead Plc (Bloom, Sadun and Van Reenen, 2016).

Answer to (g)

The break-even assessment is estimated on a combination of hypotheses, which include the

following:

All expenses (production, shipping, and installation) are divided into fixed and variable

elements.

So because structure of spending is constant, there would be a trend if pricing transactions

are recorded on a graph.

The sales price of the product will remain constant at every sale quantity, suggesting it will

not alter in reaction to variations in completed products.

The technology price, personnel, accommodation, marketing, and other purchased supplies

will all remain constant.

The scientific talents and effectiveness of people and computers still wouldn't improve.

Profits and expenses are calculated utilizing a standard production metric, such as the fair

value of goods or the quantity manufactured (Brierley, 2017).

Only the volume of production or sales is regarded to be a major pricing key factor.

= £255,481

Proposed Strategy’s Fixed Costs = £106,600 + £45,000

= £151, 600

Proposed Strategy’s Profit = New Total Contribution – New Fixed Costs

= £255, 481 - £151,600

= £103, 881

The revenue of £103, 881 as per the proposal is far more than the existing budgeted revenue of

£49,749. Also (in response (c) above), the proposal is a extremely beneficial and must be

accepted by Plaistead Plc (Bloom, Sadun and Van Reenen, 2016).

Answer to (g)

The break-even assessment is estimated on a combination of hypotheses, which include the

following:

All expenses (production, shipping, and installation) are divided into fixed and variable

elements.

So because structure of spending is constant, there would be a trend if pricing transactions

are recorded on a graph.

The sales price of the product will remain constant at every sale quantity, suggesting it will

not alter in reaction to variations in completed products.

The technology price, personnel, accommodation, marketing, and other purchased supplies

will all remain constant.

The scientific talents and effectiveness of people and computers still wouldn't improve.

Profits and expenses are calculated utilizing a standard production metric, such as the fair

value of goods or the quantity manufactured (Brierley, 2017).

Only the volume of production or sales is regarded to be a major pricing key factor.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

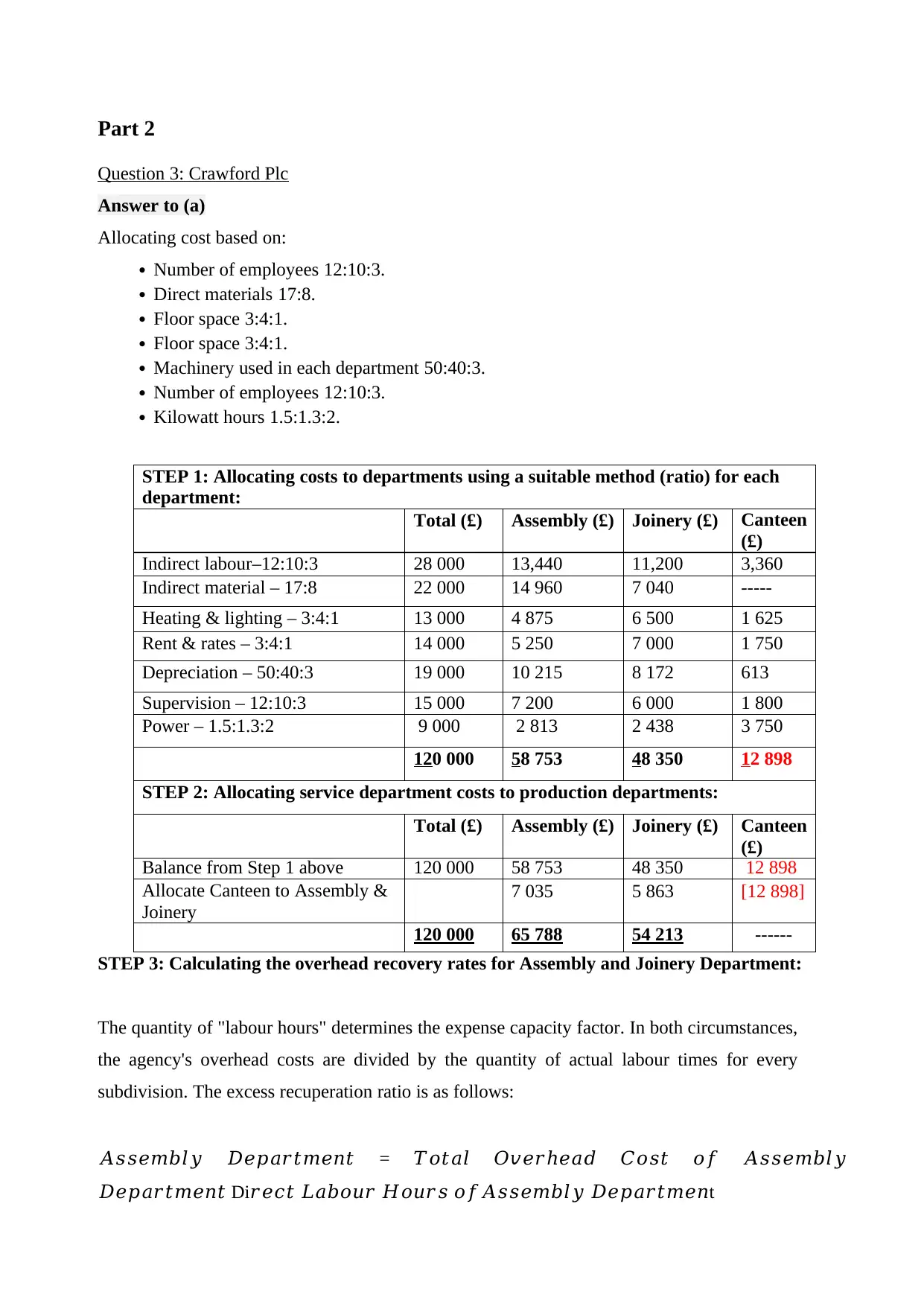

Part 2

Question 3: Crawford Plc

Answer to (a)

Allocating cost based on:

Number of employees 12:10:3.

Direct materials 17:8.

Floor space 3:4:1.

Floor space 3:4:1.

Machinery used in each department 50:40:3.

Number of employees 12:10:3.

Kilowatt hours 1.5:1.3:2.

STEP 1: Allocating costs to departments using a suitable method (ratio) for each

department:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Indirect labour–12:10:3 28 000 13,440 11,200 3,360

Indirect material – 17:8 22 000 14 960 7 040 -----

Heating & lighting – 3:4:1 13 000 4 875 6 500 1 625

Rent & rates – 3:4:1 14 000 5 250 7 000 1 750

Depreciation – 50:40:3 19 000 10 215 8 172 613

Supervision – 12:10:3 15 000 7 200 6 000 1 800

Power – 1.5:1.3:2 9 000 2 813 2 438 3 750

120 000 58 753 48 350 12 898

STEP 2: Allocating service department costs to production departments:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Balance from Step 1 above 120 000 58 753 48 350 12 898

Allocate Canteen to Assembly &

Joinery

7 035 5 863 [12 898]

120 000 65 788 54 213 ------

STEP 3: Calculating the overhead recovery rates for Assembly and Joinery Department:

The quantity of "labour hours" determines the expense capacity factor. In both circumstances,

the agency's overhead costs are divided by the quantity of actual labour times for every

subdivision. The excess recuperation ratio is as follows:

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦

𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 Di𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

Question 3: Crawford Plc

Answer to (a)

Allocating cost based on:

Number of employees 12:10:3.

Direct materials 17:8.

Floor space 3:4:1.

Floor space 3:4:1.

Machinery used in each department 50:40:3.

Number of employees 12:10:3.

Kilowatt hours 1.5:1.3:2.

STEP 1: Allocating costs to departments using a suitable method (ratio) for each

department:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Indirect labour–12:10:3 28 000 13,440 11,200 3,360

Indirect material – 17:8 22 000 14 960 7 040 -----

Heating & lighting – 3:4:1 13 000 4 875 6 500 1 625

Rent & rates – 3:4:1 14 000 5 250 7 000 1 750

Depreciation – 50:40:3 19 000 10 215 8 172 613

Supervision – 12:10:3 15 000 7 200 6 000 1 800

Power – 1.5:1.3:2 9 000 2 813 2 438 3 750

120 000 58 753 48 350 12 898

STEP 2: Allocating service department costs to production departments:

Total (£) Assembly (£) Joinery (£) Canteen

(£)

Balance from Step 1 above 120 000 58 753 48 350 12 898

Allocate Canteen to Assembly &

Joinery

7 035 5 863 [12 898]

120 000 65 788 54 213 ------

STEP 3: Calculating the overhead recovery rates for Assembly and Joinery Department:

The quantity of "labour hours" determines the expense capacity factor. In both circumstances,

the agency's overhead costs are divided by the quantity of actual labour times for every

subdivision. The excess recuperation ratio is as follows:

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦

𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 Di𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

= 65,788 = £31.33 per labour hour

2 100 hours

𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡

𝐷𝑖𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

= £54,202 =38.72 per labour hour

1 400 hours

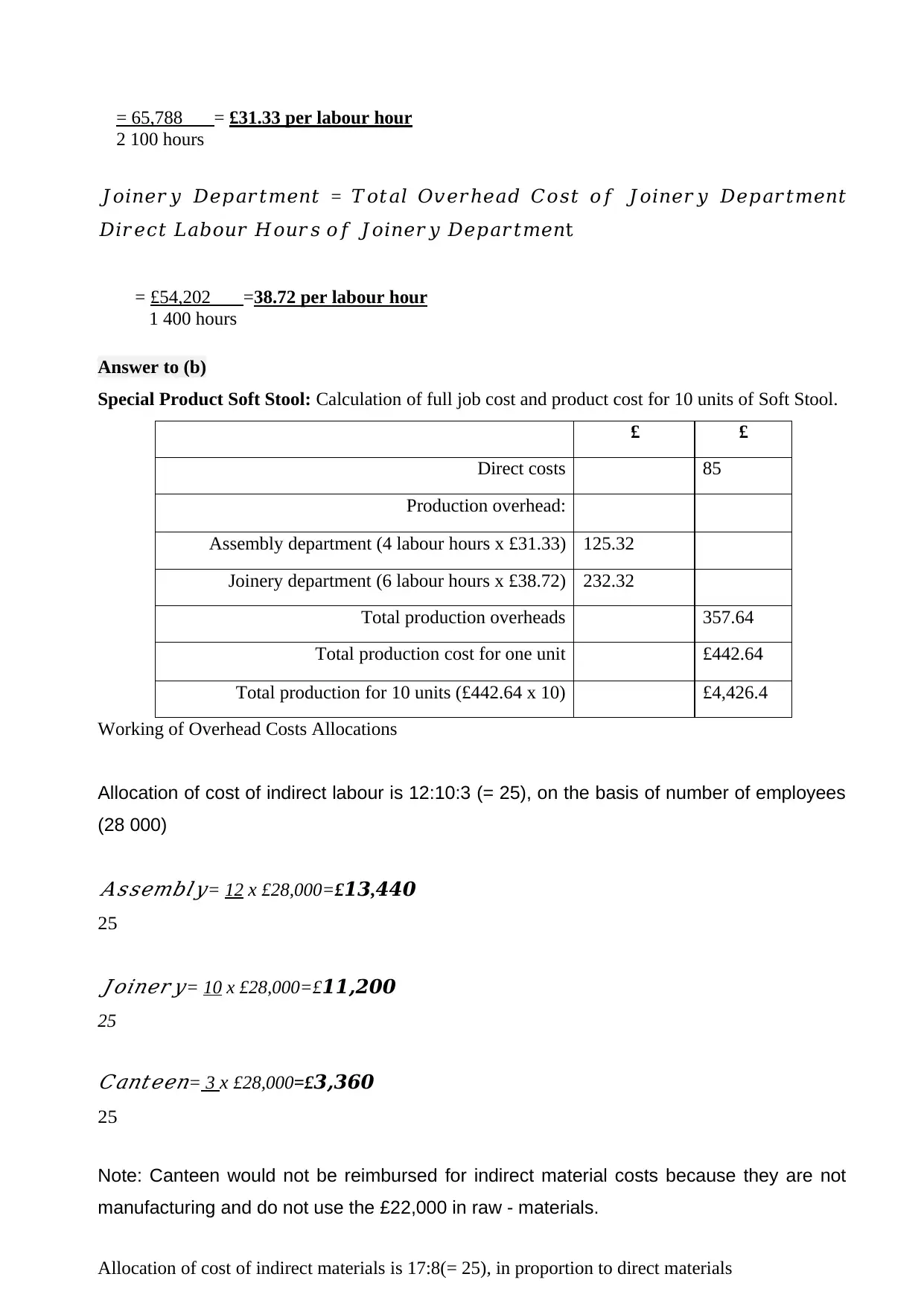

Answer to (b)

Special Product Soft Stool: Calculation of full job cost and product cost for 10 units of Soft Stool.

£ £

Direct costs 85

Production overhead:

Assembly department (4 labour hours x £31.33) 125.32

Joinery department (6 labour hours x £38.72) 232.32

Total production overheads 357.64

Total production cost for one unit £442.64

Total production for 10 units (£442.64 x 10) £4,426.4

Working of Overhead Costs Allocations

Allocation of cost of indirect labour is 12:10:3 (= 25), on the basis of number of employees

(28 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦= 12 x £28,000=£13,440

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 10 x £28,000=£11,200

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 3 x £28,000=£3,360

25

Note: Canteen would not be reimbursed for indirect material costs because they are not

manufacturing and do not use the £22,000 in raw - materials.

Allocation of cost of indirect materials is 17:8(= 25), in proportion to direct materials

2 100 hours

𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡 = 𝑇𝑜𝑡𝑎𝑙 𝑂𝑣𝑒𝑟ℎ𝑒𝑎𝑑 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛𝑡

𝐷𝑖𝑟𝑒𝑐𝑡 𝐿𝑎𝑏𝑜𝑢𝑟 𝐻𝑜𝑢𝑟𝑠 𝑜𝑓 𝐽𝑜𝑖𝑛𝑒𝑟𝑦 𝐷𝑒𝑝𝑎𝑟𝑡𝑚𝑒𝑛t

= £54,202 =38.72 per labour hour

1 400 hours

Answer to (b)

Special Product Soft Stool: Calculation of full job cost and product cost for 10 units of Soft Stool.

£ £

Direct costs 85

Production overhead:

Assembly department (4 labour hours x £31.33) 125.32

Joinery department (6 labour hours x £38.72) 232.32

Total production overheads 357.64

Total production cost for one unit £442.64

Total production for 10 units (£442.64 x 10) £4,426.4

Working of Overhead Costs Allocations

Allocation of cost of indirect labour is 12:10:3 (= 25), on the basis of number of employees

(28 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦= 12 x £28,000=£13,440

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 10 x £28,000=£11,200

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 3 x £28,000=£3,360

25

Note: Canteen would not be reimbursed for indirect material costs because they are not

manufacturing and do not use the £22,000 in raw - materials.

Allocation of cost of indirect materials is 17:8(= 25), in proportion to direct materials

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦= 17x £22,000=£1

𝟒,960

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 8 x£22,000=£7,4

𝟎

25

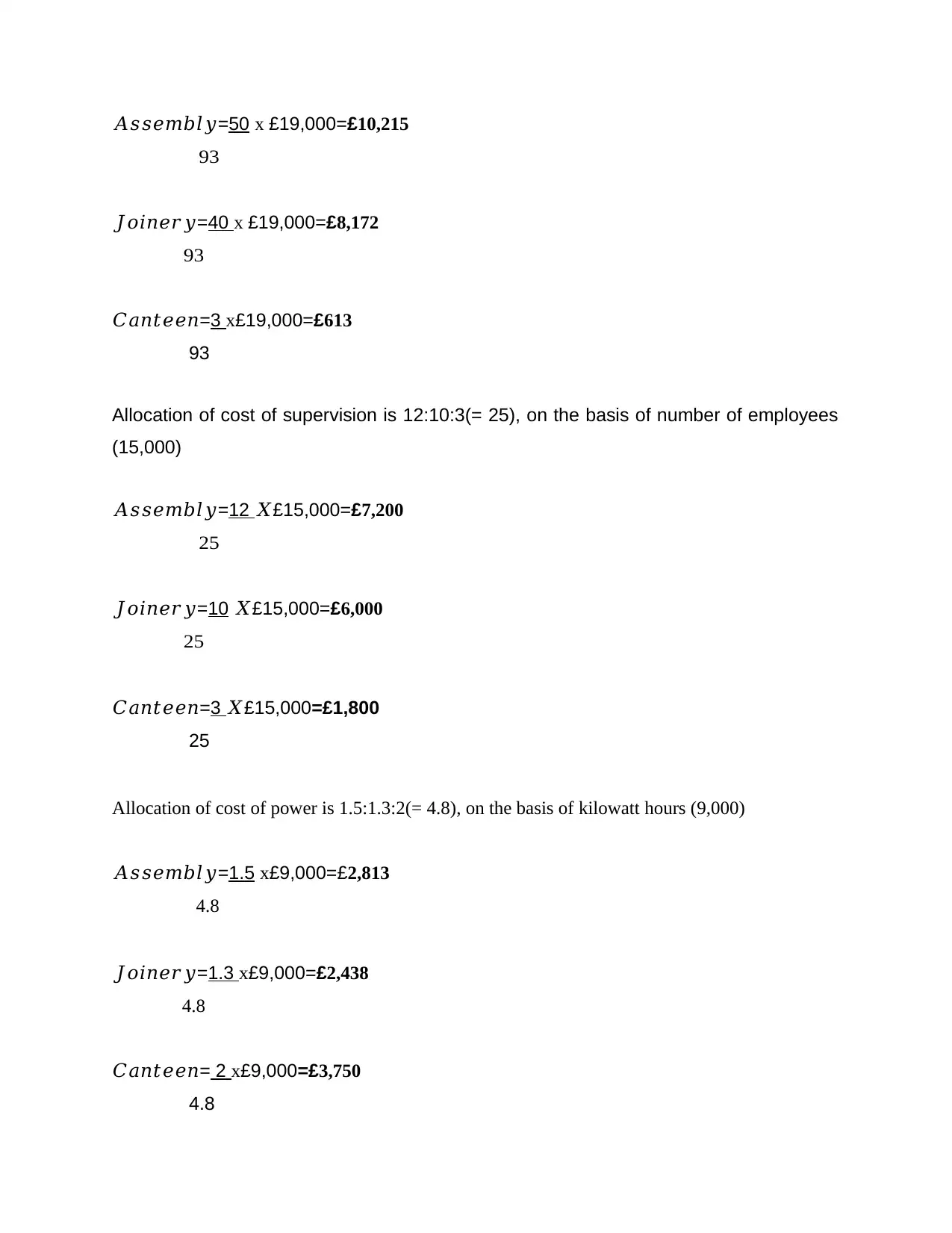

Allocation of cost of heating and lighting is 3:4:1(= 8), in proportion to floor space (13 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £13,000=£4,875

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 4 x £13,000=£6,500

8𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 1 x £13,000=£1,25

8

Allocation of cost of rent and rates is 3:4:1(= 8), in proportion to floor space (14 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £14,000=£5,250

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦. =4x £14,000=£7,000

8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=1 x£14,000=£1,750

8

Allocation of depreciation cost is 50:40:3(= 93), according to the value of machinery used in each

department (19 000)

𝟒,960

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 8 x£22,000=£7,4

𝟎

25

Allocation of cost of heating and lighting is 3:4:1(= 8), in proportion to floor space (13 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £13,000=£4,875

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦= 4 x £13,000=£6,500

8𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 1 x £13,000=£1,25

8

Allocation of cost of rent and rates is 3:4:1(= 8), in proportion to floor space (14 000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=3 x £14,000=£5,250

8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦. =4x £14,000=£7,000

8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=1 x£14,000=£1,750

8

Allocation of depreciation cost is 50:40:3(= 93), according to the value of machinery used in each

department (19 000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=50 x £19,000=£10,215

93

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=40 x £19,000=£8,172

93

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 x£19,000=£613

93

Allocation of cost of supervision is 12:10:3(= 25), on the basis of number of employees

(15,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 𝑋£15,000=£7,200

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋£15,000=£6,000

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 𝑋£15,000=£1,800

25

Allocation of cost of power is 1.5:1.3:2(= 4.8), on the basis of kilowatt hours (9,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=1.5 x£9,000=£2,813

4.8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=1.3 x£9,000=£2,438

4.8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 2 x£9,000=£3,750

4.8

93

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=40 x £19,000=£8,172

93

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 x£19,000=£613

93

Allocation of cost of supervision is 12:10:3(= 25), on the basis of number of employees

(15,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 𝑋£15,000=£7,200

25

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋£15,000=£6,000

25

𝐶𝑎𝑛𝑡𝑒𝑒𝑛=3 𝑋£15,000=£1,800

25

Allocation of cost of power is 1.5:1.3:2(= 4.8), on the basis of kilowatt hours (9,000)

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=1.5 x£9,000=£2,813

4.8

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=1.3 x£9,000=£2,438

4.8

𝐶𝑎𝑛𝑡𝑒𝑒𝑛= 2 x£9,000=£3,750

4.8

Absorption of canteen cost is 12:10(=22), on the basis of kilowatt hours

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 x£12,898=£7,035

22

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋 £12,898 =£5,863

22

Answer to (c)

Operating at a constant absorbing level is substantially better efficient and certainly less

costly (plant-wide rate). However, if manufacture techniques differ greatly between

sections (labor-intensive versus machine-intensive), utilising a fixed amount is likely to

overstate operating costs. It could have been increased if the results are vastly different

from one another (Christ and Burritt, 2017).

Advantages of Absorption Costing:

GAAP Compliance– It has the benefit of conforming to Generally Accepted

Accounting Principles (GAAP), which really is necessary for filing with the Tax

Authorities (IRS).

Accounting for All Production Costs– Adjustable pricing only looks at immediate

expenses, whilst this factors into consideration all manufacturing costs. Fixed

running costs, like personnel, land rents, and electricity bills, are accounted for

using absorbing pricing. This give employee a much more full view of how much a

company spends on every product, enabling them to execute order to boost the

economy and sales choices (Christensen and et, 2015).

Tracking Profits- Absorbing pricing, as opposed to adjustable pricing, provides a

far more accurate fiscal situation, especially if all products are not really provided

in same bookkeeping period. If a company boosts production in expectation of a

regular revenue boom, this becomes a huge issue.

Disadvantages of Absorption Costing:

𝐴𝑠𝑠𝑒𝑚𝑏𝑙𝑦=12 x£12,898=£7,035

22

𝐽𝑜𝑖𝑛𝑒𝑟𝑦=10 𝑋 £12,898 =£5,863

22

Answer to (c)

Operating at a constant absorbing level is substantially better efficient and certainly less

costly (plant-wide rate). However, if manufacture techniques differ greatly between

sections (labor-intensive versus machine-intensive), utilising a fixed amount is likely to

overstate operating costs. It could have been increased if the results are vastly different

from one another (Christ and Burritt, 2017).

Advantages of Absorption Costing:

GAAP Compliance– It has the benefit of conforming to Generally Accepted

Accounting Principles (GAAP), which really is necessary for filing with the Tax

Authorities (IRS).

Accounting for All Production Costs– Adjustable pricing only looks at immediate

expenses, whilst this factors into consideration all manufacturing costs. Fixed

running costs, like personnel, land rents, and electricity bills, are accounted for

using absorbing pricing. This give employee a much more full view of how much a

company spends on every product, enabling them to execute order to boost the

economy and sales choices (Christensen and et, 2015).

Tracking Profits- Absorbing pricing, as opposed to adjustable pricing, provides a

far more accurate fiscal situation, especially if all products are not really provided

in same bookkeeping period. If a company boosts production in expectation of a

regular revenue boom, this becomes a huge issue.

Disadvantages of Absorption Costing:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.