Management Accounting: Costing and Budgeting Analysis

VerifiedAdded on 2020/09/08

|17

|5324

|59

Report

AI Summary

This report provides a comprehensive analysis of management accounting principles, focusing on costing methods, budgetary planning, and financial problem-solving. It begins by defining management accounting and its key requirements, contrasting it with financial accounting, and highlighting essential management accounting systems such as cost accounting, inventory management, job costing, and price optimization. The report then explores various management accounting reporting methods, including receivable reports, job cost reports, budgetary reports, inventory management reports, and manufacturing reports. The core of the report delves into cost measurement techniques, comparing and contrasting absorption and marginal costing methods, with detailed unit cost calculations and profitability analysis for Unicorn Ltd. Finally, the report addresses the advantages and limitations of budgetary planning tools and underscores the significance of managerial accounting systems in combating financial problems, offering insights into how businesses can leverage these tools for effective decision-making and financial stability. The report emphasizes the practical application of these concepts for a small UK retailer.

Management accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION................................................................................................................................1

TASK 1.................................................................................................................................................1

P1 Management Accounting and key requirements.........................................................................1

P2 Methods for management accounting reporting..........................................................................4

TASK 2.................................................................................................................................................5

P3 Computation of cost measurements in accordance with absorption and marginal costing.........5

TASK 3.................................................................................................................................................8

P4 Advantages and limitation of budgetary planning tools..............................................................8

TASK 4...............................................................................................................................................11

P5 Significance of managerial accounting systems to combat financial problems........................11

CONCLUSION..................................................................................................................................13

REFERENCES...................................................................................................................................15

Table of Figures

Figure 1 Financial and management accounting..................................................................................2

Figure 2 Key performance indicators.................................................................................................12

INTRODUCTION................................................................................................................................1

TASK 1.................................................................................................................................................1

P1 Management Accounting and key requirements.........................................................................1

P2 Methods for management accounting reporting..........................................................................4

TASK 2.................................................................................................................................................5

P3 Computation of cost measurements in accordance with absorption and marginal costing.........5

TASK 3.................................................................................................................................................8

P4 Advantages and limitation of budgetary planning tools..............................................................8

TASK 4...............................................................................................................................................11

P5 Significance of managerial accounting systems to combat financial problems........................11

CONCLUSION..................................................................................................................................13

REFERENCES...................................................................................................................................15

Table of Figures

Figure 1 Financial and management accounting..................................................................................2

Figure 2 Key performance indicators.................................................................................................12

INTRODUCTION

With the changing and volatile market factors at international competitive world, companies

are require to keep their eye on regular activities and functions to better inform themselves and

make informed decisions. Making good quality decisions and strategic plans aligning with

organizational goals helps in improving competitive position. The proposed investigation here lay

emphasizes upon examining the importance of different managerial accounting systems and

analysing their contribution towards business decisions. Although managerial accounting includes

both quantitative and qualitative assessment, still, there are some key factors on which managers are

strongly focuses such as cost, inventory and others. Although, in previous times, there are few cost

measurements techniques like absorption, however, with the change in period, new cost

measurement methods came into force. Thus, the paper will clearly presents cost calculation for a

small sized UK retailer, Unicorn Ltd under both the absorption and full costing method. Finally, it

will discuss several important tools that establishments can use to make successfully combat their

financial turbulence and problems.

TASK 1

P1 Management Accounting and key requirements

Managerial accounting (MA) is a system which is about using accounting information of the

enterprise to better inform top-managers of the firm to aids in strong management and put control

functions. The concept came first in 19th Century after internationalization when enterprises focuses

expanding their business on international market to maximize their scale of operations and derive

benefits of economies of scale. In simple words, MA can be defined as a provisions of giving

financial as well as non-financial information to the managers for competitive plans and decisions.

IMA (Institute of Management Accountant) defined it as a profession which includes planning,

decisions, performance management system, expertise in annual account reporting and rationale

controlling plans to facilitate firm in quality decisions.

1 | P a g e

With the changing and volatile market factors at international competitive world, companies

are require to keep their eye on regular activities and functions to better inform themselves and

make informed decisions. Making good quality decisions and strategic plans aligning with

organizational goals helps in improving competitive position. The proposed investigation here lay

emphasizes upon examining the importance of different managerial accounting systems and

analysing their contribution towards business decisions. Although managerial accounting includes

both quantitative and qualitative assessment, still, there are some key factors on which managers are

strongly focuses such as cost, inventory and others. Although, in previous times, there are few cost

measurements techniques like absorption, however, with the change in period, new cost

measurement methods came into force. Thus, the paper will clearly presents cost calculation for a

small sized UK retailer, Unicorn Ltd under both the absorption and full costing method. Finally, it

will discuss several important tools that establishments can use to make successfully combat their

financial turbulence and problems.

TASK 1

P1 Management Accounting and key requirements

Managerial accounting (MA) is a system which is about using accounting information of the

enterprise to better inform top-managers of the firm to aids in strong management and put control

functions. The concept came first in 19th Century after internationalization when enterprises focuses

expanding their business on international market to maximize their scale of operations and derive

benefits of economies of scale. In simple words, MA can be defined as a provisions of giving

financial as well as non-financial information to the managers for competitive plans and decisions.

IMA (Institute of Management Accountant) defined it as a profession which includes planning,

decisions, performance management system, expertise in annual account reporting and rationale

controlling plans to facilitate firm in quality decisions.

1 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

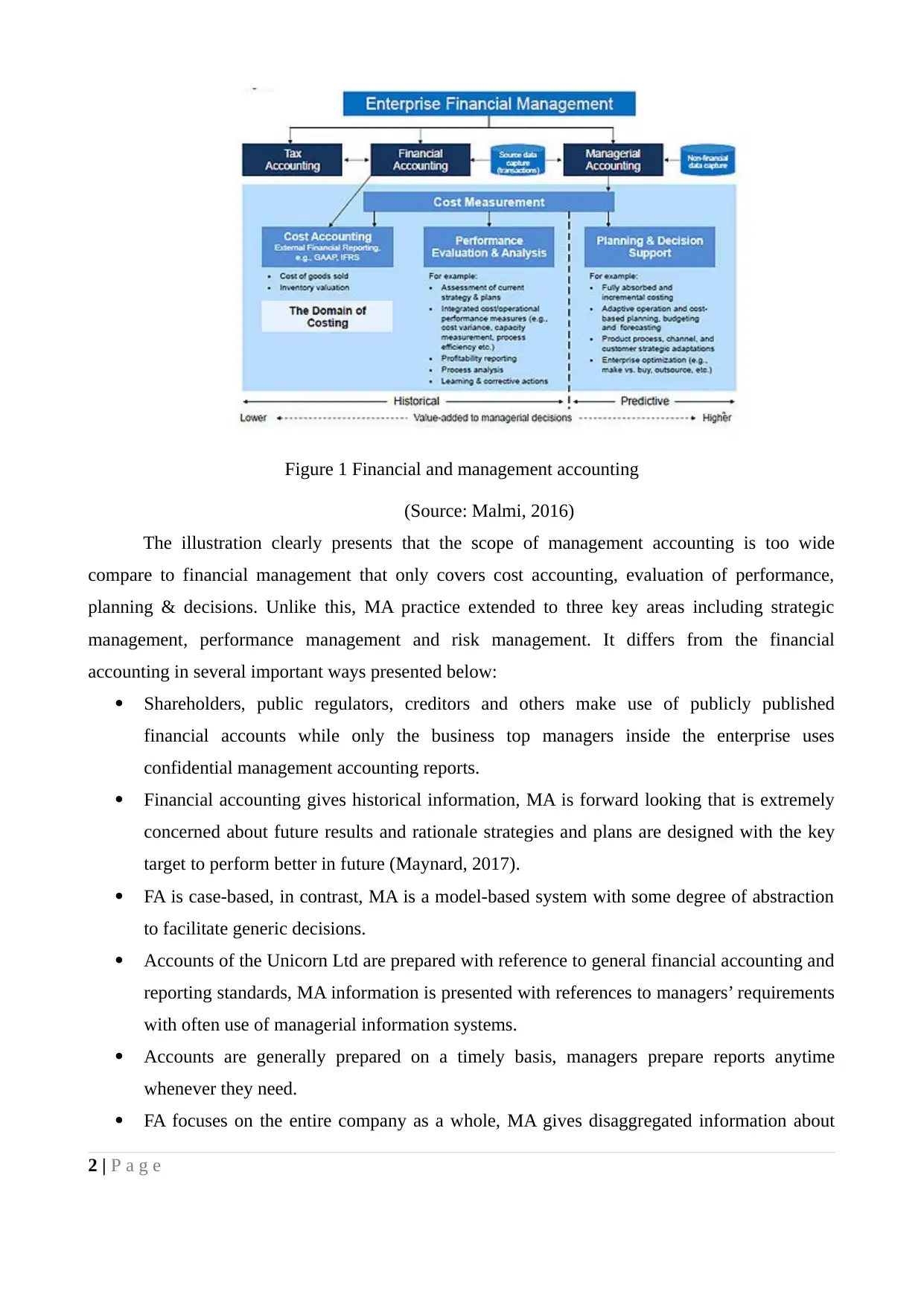

Figure 1 Financial and management accounting

(Source: Malmi, 2016)

The illustration clearly presents that the scope of management accounting is too wide

compare to financial management that only covers cost accounting, evaluation of performance,

planning & decisions. Unlike this, MA practice extended to three key areas including strategic

management, performance management and risk management. It differs from the financial

accounting in several important ways presented below:

Shareholders, public regulators, creditors and others make use of publicly published

financial accounts while only the business top managers inside the enterprise uses

confidential management accounting reports.

Financial accounting gives historical information, MA is forward looking that is extremely

concerned about future results and rationale strategies and plans are designed with the key

target to perform better in future (Maynard, 2017).

FA is case-based, in contrast, MA is a model-based system with some degree of abstraction

to facilitate generic decisions.

Accounts of the Unicorn Ltd are prepared with reference to general financial accounting and

reporting standards, MA information is presented with references to managers’ requirements

with often use of managerial information systems.

Accounts are generally prepared on a timely basis, managers prepare reports anytime

whenever they need.

FA focuses on the entire company as a whole, MA gives disaggregated information about

2 | P a g e

(Source: Malmi, 2016)

The illustration clearly presents that the scope of management accounting is too wide

compare to financial management that only covers cost accounting, evaluation of performance,

planning & decisions. Unlike this, MA practice extended to three key areas including strategic

management, performance management and risk management. It differs from the financial

accounting in several important ways presented below:

Shareholders, public regulators, creditors and others make use of publicly published

financial accounts while only the business top managers inside the enterprise uses

confidential management accounting reports.

Financial accounting gives historical information, MA is forward looking that is extremely

concerned about future results and rationale strategies and plans are designed with the key

target to perform better in future (Maynard, 2017).

FA is case-based, in contrast, MA is a model-based system with some degree of abstraction

to facilitate generic decisions.

Accounts of the Unicorn Ltd are prepared with reference to general financial accounting and

reporting standards, MA information is presented with references to managers’ requirements

with often use of managerial information systems.

Accounts are generally prepared on a timely basis, managers prepare reports anytime

whenever they need.

FA focuses on the entire company as a whole, MA gives disaggregated information about

2 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

company’s products, divisions, operations and activities (Arnold and Artz, 2015).

Systems of management accounting

Cost Accounting system: Now-a-days, manufacturing companies use it to capture their total

costs of manufacturing by detailed assessment of all the input costs at every stage of production.

Initially, the method track such costs individually, and afterwards compare the results to output to

aid in decisive actions to measure and improve the financial results. It typically includes five key

elements that are input measurement, stock valuation, accumulating costs, cash flow analysing and

recording flow of inventory.

Unicorn Ltd can use it to know that to what extent, actual manufacturing costs were under

the limit of budgeted costs. If actual costs exceeds target then, it alert managers about financial

difficulties and aids in qualitative cost control decisions.

Inventory management system:Tracking level of inventory is important not only for the

manufacturers but also equally important for the trading firms engage in buying and selling variety

of goods. The software track order, deliveries and sales to present the outstanding stock balance at

the ending of accounting year. However, manufacturers use it to create work orders, bills and other

documents subject to production activities. Unicorn Ltd must use such system to avoid overstocking

and outage problem. Currently, Enterprise Resource Planning is used by enterprise to record the

inflow and outflow and know the net stock by entering the data. However, these systems run

automatically as per barcode & RFID (Radio Frequency Identification) and does not require

entering data. Thus, it helps in saving staffing costs and assign people to other tasks which improve

productivity (Management accounting system, 2017).

Job costing system: When some unit of products are produced together in a single slot,

called job, these system can be used to determine total job costs. Thus, it is of crucial significance

for the Unicorn Ltd to track how much costs have been incurred till the percentage of work

completion and match it against standard to respond timely to keep costs under control.

Price optimization: The method is used for performing sensitivity analysis which determines

future demand at different selling prices charged for deliveries of Unicorn Ltd. In the field of

economics, consumers often prefer less demand when prices are too high, and demand higher

quantity at less charges. With the help of these software, company can know sensitivity of sales

volume that how it will be affect with the rise or decline in chargeable rates. It is especially used by

selling divisions to set an accurate charge which manage sales volume at right level without

affecting sales quantity.

Essential requirements

3 | P a g e

Systems of management accounting

Cost Accounting system: Now-a-days, manufacturing companies use it to capture their total

costs of manufacturing by detailed assessment of all the input costs at every stage of production.

Initially, the method track such costs individually, and afterwards compare the results to output to

aid in decisive actions to measure and improve the financial results. It typically includes five key

elements that are input measurement, stock valuation, accumulating costs, cash flow analysing and

recording flow of inventory.

Unicorn Ltd can use it to know that to what extent, actual manufacturing costs were under

the limit of budgeted costs. If actual costs exceeds target then, it alert managers about financial

difficulties and aids in qualitative cost control decisions.

Inventory management system:Tracking level of inventory is important not only for the

manufacturers but also equally important for the trading firms engage in buying and selling variety

of goods. The software track order, deliveries and sales to present the outstanding stock balance at

the ending of accounting year. However, manufacturers use it to create work orders, bills and other

documents subject to production activities. Unicorn Ltd must use such system to avoid overstocking

and outage problem. Currently, Enterprise Resource Planning is used by enterprise to record the

inflow and outflow and know the net stock by entering the data. However, these systems run

automatically as per barcode & RFID (Radio Frequency Identification) and does not require

entering data. Thus, it helps in saving staffing costs and assign people to other tasks which improve

productivity (Management accounting system, 2017).

Job costing system: When some unit of products are produced together in a single slot,

called job, these system can be used to determine total job costs. Thus, it is of crucial significance

for the Unicorn Ltd to track how much costs have been incurred till the percentage of work

completion and match it against standard to respond timely to keep costs under control.

Price optimization: The method is used for performing sensitivity analysis which determines

future demand at different selling prices charged for deliveries of Unicorn Ltd. In the field of

economics, consumers often prefer less demand when prices are too high, and demand higher

quantity at less charges. With the help of these software, company can know sensitivity of sales

volume that how it will be affect with the rise or decline in chargeable rates. It is especially used by

selling divisions to set an accurate charge which manage sales volume at right level without

affecting sales quantity.

Essential requirements

3 | P a g e

It is necessary for all the systems or software to deliver them highly relevant and accurate

information to the Unicorn Ltd.

All the system needs to be updated timely to provide the best quality set of information to

the organization.

It is necessary for the enterprise to provide customized reports according to the requirements

of business managers.

All the system secure data with high level of security and confidentiality.

P2 Methods for management accounting reporting

As discussed earlier, managers use different type of records as a key source of quantitative

information and its thorough and deeply examination applying managers’ skills and knowledge

helps in decisive actions and strategic formulation. The most frequently used reports by the business

managers are summarized as follows:

Receivable reports: Unicorn Ltd merchandise their goods and other services either on

prompt basis which generates cash quickly or on credit by allowing final user to pay money after

some time. It facilitate users to pay later while companies receive benefit through higher sales

volume and consumer base. However, many-time, it is possible that customer did not make timely

payment of their credit, it can bring significant financial or liquidity trouble for the business

(Kaplan and Atkinson, 2015). Receivable reports provide clear set of information about total credit

sale, outstanding payments that still need to be received. It alert managers about several customers

who remains overdue for a longer period and reminded by the company for many time, still, they

did not make payment. Such reports helps credit collection departments to take immediate strong

action against customer who has been delayed in payment for a long period and also helps in

decisive credit decisions.

Job cost reports:Job costing system is of crucial importance for preparing such reports that

provides clearly the details about costs of all the inputs including material, contribution paid to

labourers for their efforts and other expenses. Continue evaluation and comparison with the targets

helps Unicorn Ltd in putting control measures to reduce the possibility of overspending. Sound cost

control mechanism helps in correct price fixation by charging appropriate margin percentage

considering customers’ ability or willingness to pay and profitability targets of the enterprise.

Budgetary reports:In business, budget is designed to set challenges for every worker or staff

members which company expects them to achieve by putting wonderful and genuine efforts.

Unicorn Ltd operates through purchase, sales, marketing, production and other divisions. Setting

targets aware and alert all the department managers to create necessary divisional plans and policies

4 | P a g e

information to the Unicorn Ltd.

All the system needs to be updated timely to provide the best quality set of information to

the organization.

It is necessary for the enterprise to provide customized reports according to the requirements

of business managers.

All the system secure data with high level of security and confidentiality.

P2 Methods for management accounting reporting

As discussed earlier, managers use different type of records as a key source of quantitative

information and its thorough and deeply examination applying managers’ skills and knowledge

helps in decisive actions and strategic formulation. The most frequently used reports by the business

managers are summarized as follows:

Receivable reports: Unicorn Ltd merchandise their goods and other services either on

prompt basis which generates cash quickly or on credit by allowing final user to pay money after

some time. It facilitate users to pay later while companies receive benefit through higher sales

volume and consumer base. However, many-time, it is possible that customer did not make timely

payment of their credit, it can bring significant financial or liquidity trouble for the business

(Kaplan and Atkinson, 2015). Receivable reports provide clear set of information about total credit

sale, outstanding payments that still need to be received. It alert managers about several customers

who remains overdue for a longer period and reminded by the company for many time, still, they

did not make payment. Such reports helps credit collection departments to take immediate strong

action against customer who has been delayed in payment for a long period and also helps in

decisive credit decisions.

Job cost reports:Job costing system is of crucial importance for preparing such reports that

provides clearly the details about costs of all the inputs including material, contribution paid to

labourers for their efforts and other expenses. Continue evaluation and comparison with the targets

helps Unicorn Ltd in putting control measures to reduce the possibility of overspending. Sound cost

control mechanism helps in correct price fixation by charging appropriate margin percentage

considering customers’ ability or willingness to pay and profitability targets of the enterprise.

Budgetary reports:In business, budget is designed to set challenges for every worker or staff

members which company expects them to achieve by putting wonderful and genuine efforts.

Unicorn Ltd operates through purchase, sales, marketing, production and other divisions. Setting

targets aware and alert all the department managers to create necessary divisional plans and policies

4 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

to make sure that every member perform excellent and achieve the results successfully. It includes

collection of resources, its proper allocation, workers monitoring and necessary control that will be

retained to accomplish the targets successfully.

Inventory management reports:Inventory management systems which run on barcode

scanning system and RFID system provides customized stock reports presenting the details about

opening stock, inflow and outflow of goods during the year and closing inventory level as well

(Cooper, Ezzamel and Qu, 2017). Managers can use it to retain their stock at a right level without

any possibility of outage or over-stocking that unnecessarily leads to increase holding and ordering

costs.

Manufacturing reports: As name itself, it gives details about expenditures paid on material

acquisition, consideration in the form of wages to labor every hour and other production or non-

production overheads. It will enable organization to make decisive actions and strategies

comprising inventory control, warehousing and various preventive measures to combat the risk of

obsolescence (Van der Stede, 2011). Using such reports and matching the targets with actual

outcome, managers can also find out the reasons behind high cost occurrence whether they make

poor projections or volatile market resultant adverse variances like high price charged for material,

high demand of per hour wages by people, excessive usage of material and any other reasons. Thus,

with the help of it, manufacturing team would be able to come up with right strategy and to control

costs under the restricted standard limit.

TASK 2

P3 Computation of cost measurements in accordance with absorption and marginal costing

In earlier times, firms allocate or assign their overheads using overhead absorption rates

(OAR) taking direct material usage or direct labor hours as a basis. However, now-a-days, new

techniques have been emerged such as activity-based budgeting wherein cost of each and every

component is allocated as per their cost element or driver. However, due to its complexity and

expertise requirements, many companies in today’s time uses still absorption and marginal costing

that are explained below:

Marginal costing: The method differentiate two kind of cost behaviour that are fixed and

variable. Former does not fluctuate or vary according to outcome, variable directly changes with the

level of production as it rises or declines with the increase or decrease in total production

(Narasimhan, 2017). Applying the method, Unicorn Ltd need to subtract their total variable costs

against turnover to represent contribution. However, total fixed costs is charged against contribution

5 | P a g e

collection of resources, its proper allocation, workers monitoring and necessary control that will be

retained to accomplish the targets successfully.

Inventory management reports:Inventory management systems which run on barcode

scanning system and RFID system provides customized stock reports presenting the details about

opening stock, inflow and outflow of goods during the year and closing inventory level as well

(Cooper, Ezzamel and Qu, 2017). Managers can use it to retain their stock at a right level without

any possibility of outage or over-stocking that unnecessarily leads to increase holding and ordering

costs.

Manufacturing reports: As name itself, it gives details about expenditures paid on material

acquisition, consideration in the form of wages to labor every hour and other production or non-

production overheads. It will enable organization to make decisive actions and strategies

comprising inventory control, warehousing and various preventive measures to combat the risk of

obsolescence (Van der Stede, 2011). Using such reports and matching the targets with actual

outcome, managers can also find out the reasons behind high cost occurrence whether they make

poor projections or volatile market resultant adverse variances like high price charged for material,

high demand of per hour wages by people, excessive usage of material and any other reasons. Thus,

with the help of it, manufacturing team would be able to come up with right strategy and to control

costs under the restricted standard limit.

TASK 2

P3 Computation of cost measurements in accordance with absorption and marginal costing

In earlier times, firms allocate or assign their overheads using overhead absorption rates

(OAR) taking direct material usage or direct labor hours as a basis. However, now-a-days, new

techniques have been emerged such as activity-based budgeting wherein cost of each and every

component is allocated as per their cost element or driver. However, due to its complexity and

expertise requirements, many companies in today’s time uses still absorption and marginal costing

that are explained below:

Marginal costing: The method differentiate two kind of cost behaviour that are fixed and

variable. Former does not fluctuate or vary according to outcome, variable directly changes with the

level of production as it rises or declines with the increase or decrease in total production

(Narasimhan, 2017). Applying the method, Unicorn Ltd need to subtract their total variable costs

against turnover to represent contribution. However, total fixed costs is charged against contribution

5 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to determine net profit.

Absorption costing: This method do not differentiate fixed and variable costs and charge

total costs against total sales to find out net profit (Jager and et.al., 2014). However, the main

downfall side of the method is that it does not use an appropriate cost allocation basis and produce

misleading financial results which may result in poor quality decisions.

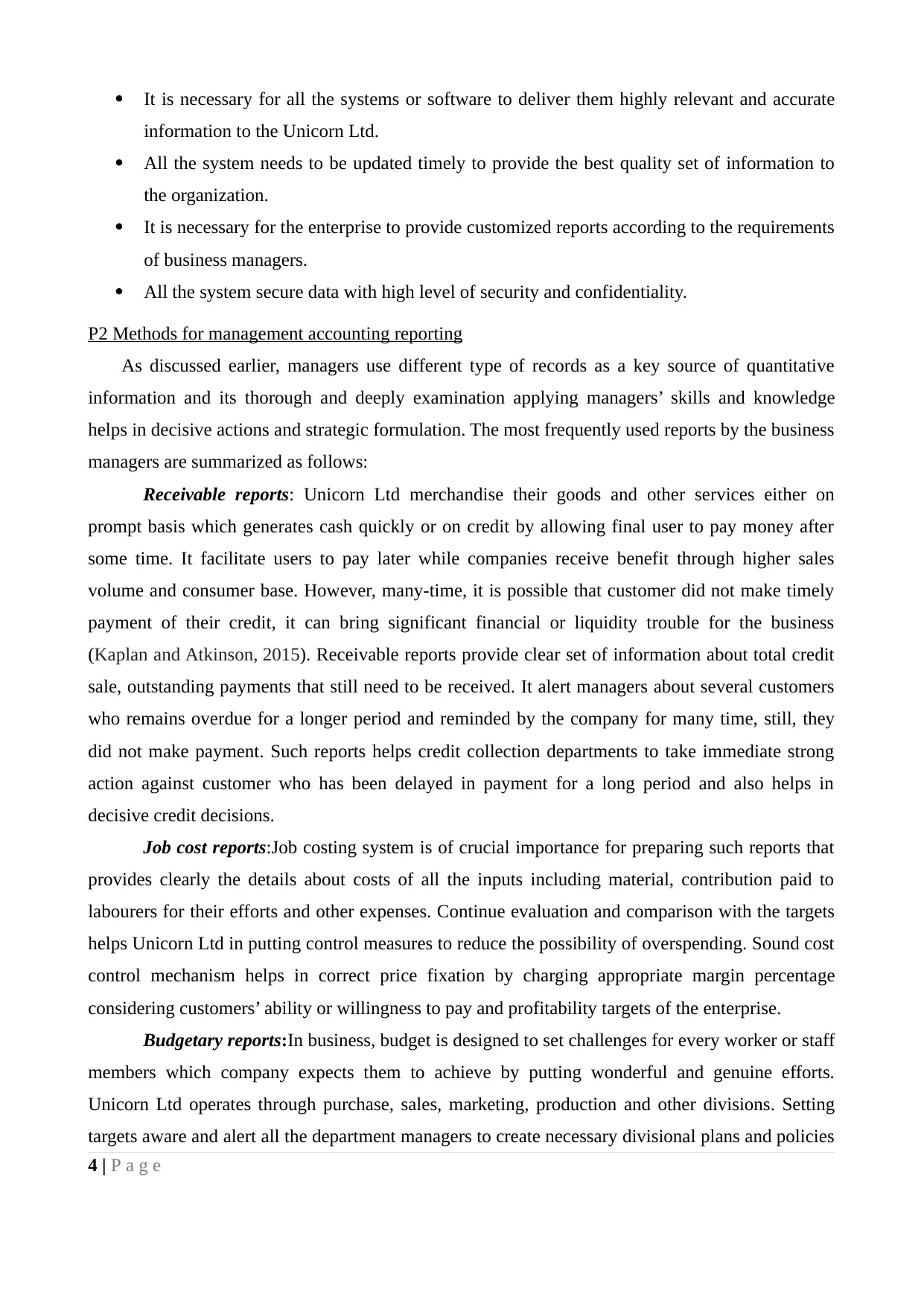

Unit cost calculation

Marginal costing (GBP) Full costing (GBP)

Material cost 6 6

Wages paid 5 5

Production overheads

Fixed/Static 2 2

Variable overheads (GBP2100/700 units ) 3

Total costs 13 16

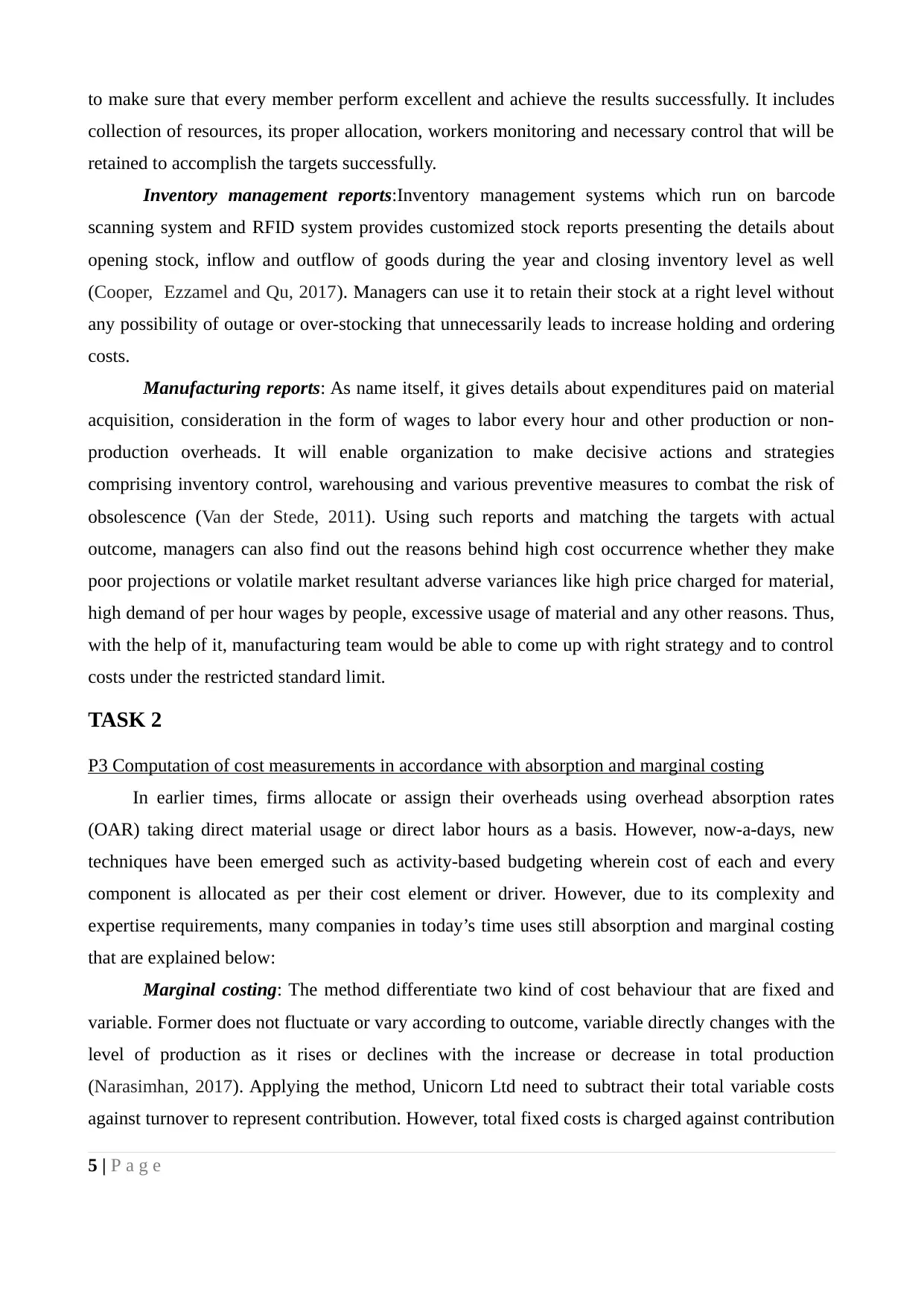

Calculation of profitability

Particulars Amount Amount

Sales for the year (600*@ 35/item)

Less: Cost of goods sold

Inventory available at the beginning of the period

Costs of goods manufacturing (700 @13/item)

Inventory at the ending of the year (100U@13)

Cost of goods sold/cost of sales

Variable sales overheads (600*1)

Total variable costs

Total contribution for the current year

Less: Fixed costs

Fixed manufacturing cost

Administration cost

Fixed selling costs

Total fixed costs incurred in production

Net Profit of the company for current year

0

9,100

(1,300)

(7,800)

(600)

2000

700

600

21000

(8,400)

12,600

(3,300)

9,300

6 | P a g e

Absorption costing: This method do not differentiate fixed and variable costs and charge

total costs against total sales to find out net profit (Jager and et.al., 2014). However, the main

downfall side of the method is that it does not use an appropriate cost allocation basis and produce

misleading financial results which may result in poor quality decisions.

Unit cost calculation

Marginal costing (GBP) Full costing (GBP)

Material cost 6 6

Wages paid 5 5

Production overheads

Fixed/Static 2 2

Variable overheads (GBP2100/700 units ) 3

Total costs 13 16

Calculation of profitability

Particulars Amount Amount

Sales for the year (600*@ 35/item)

Less: Cost of goods sold

Inventory available at the beginning of the period

Costs of goods manufacturing (700 @13/item)

Inventory at the ending of the year (100U@13)

Cost of goods sold/cost of sales

Variable sales overheads (600*1)

Total variable costs

Total contribution for the current year

Less: Fixed costs

Fixed manufacturing cost

Administration cost

Fixed selling costs

Total fixed costs incurred in production

Net Profit of the company for current year

0

9,100

(1,300)

(7,800)

(600)

2000

700

600

21000

(8,400)

12,600

(3,300)

9,300

6 | P a g e

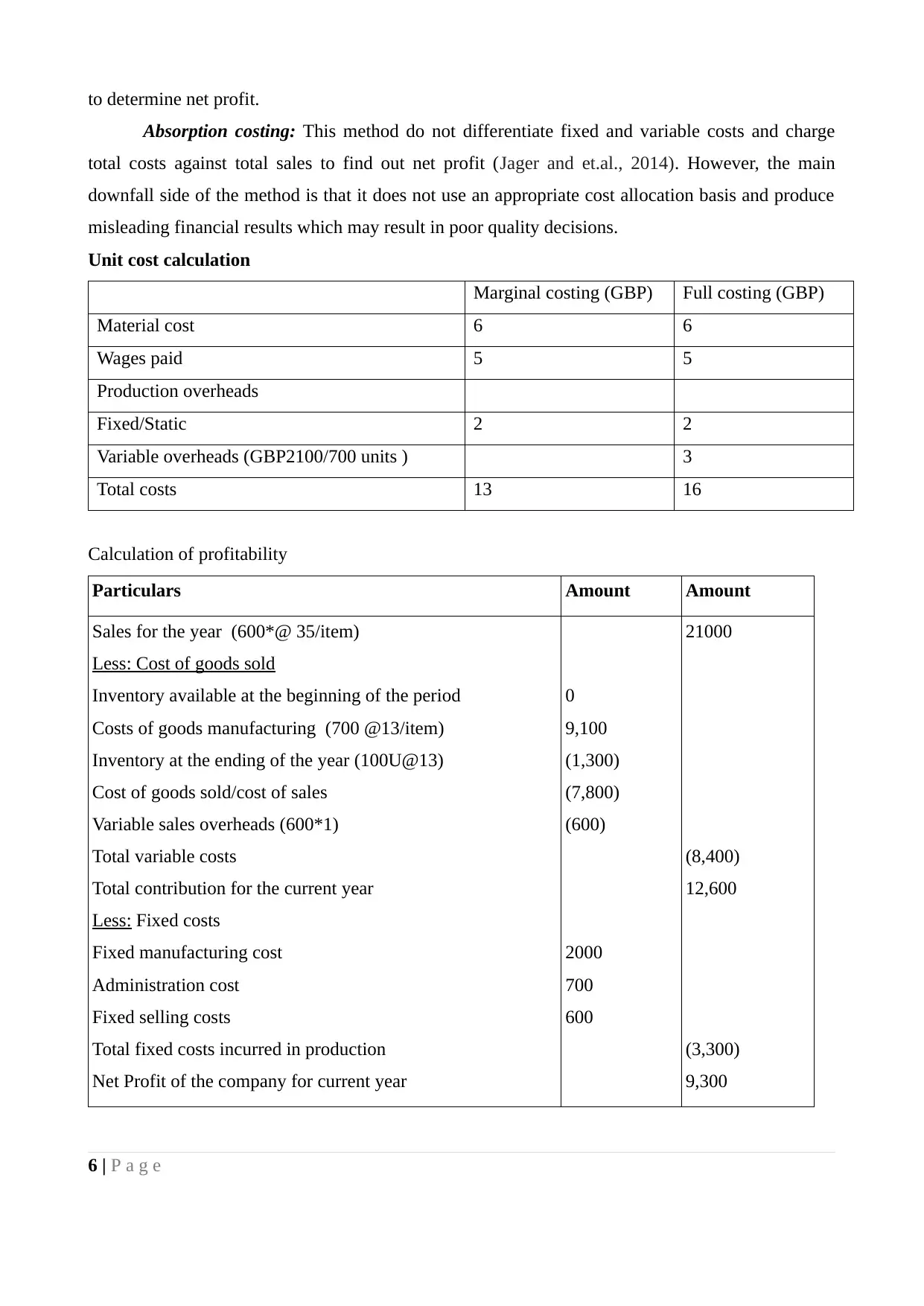

Particulars Amount Amount

Sales for the current year (600*@ 35/item )

Less

Inventory balance at the beginning of the year

Cost of production (700 @GBP16/item)

Inventory balance at the ending of the year

(100@GBP16/item)

Cost of sales/cost of goods sale

Less: over-absorbed fixed production overheads

Costs of goods sold/cost of sales

Gross profit

Less: Fixed costs

Administration cost

Sales overheads

Selling costs

Total fixed costs paid during the year

Net Profit received in the year

0

11,200

(1,600)

700

600

600

21000

(9,600)

100

9,500

11,500

(1,900)

9,600

Over-absorbed fixed overheads:

Actual fixed overheads: 2,000

Budgeted overheads: 2,100

Over-absorbed: 2,000 -2,100

= 100

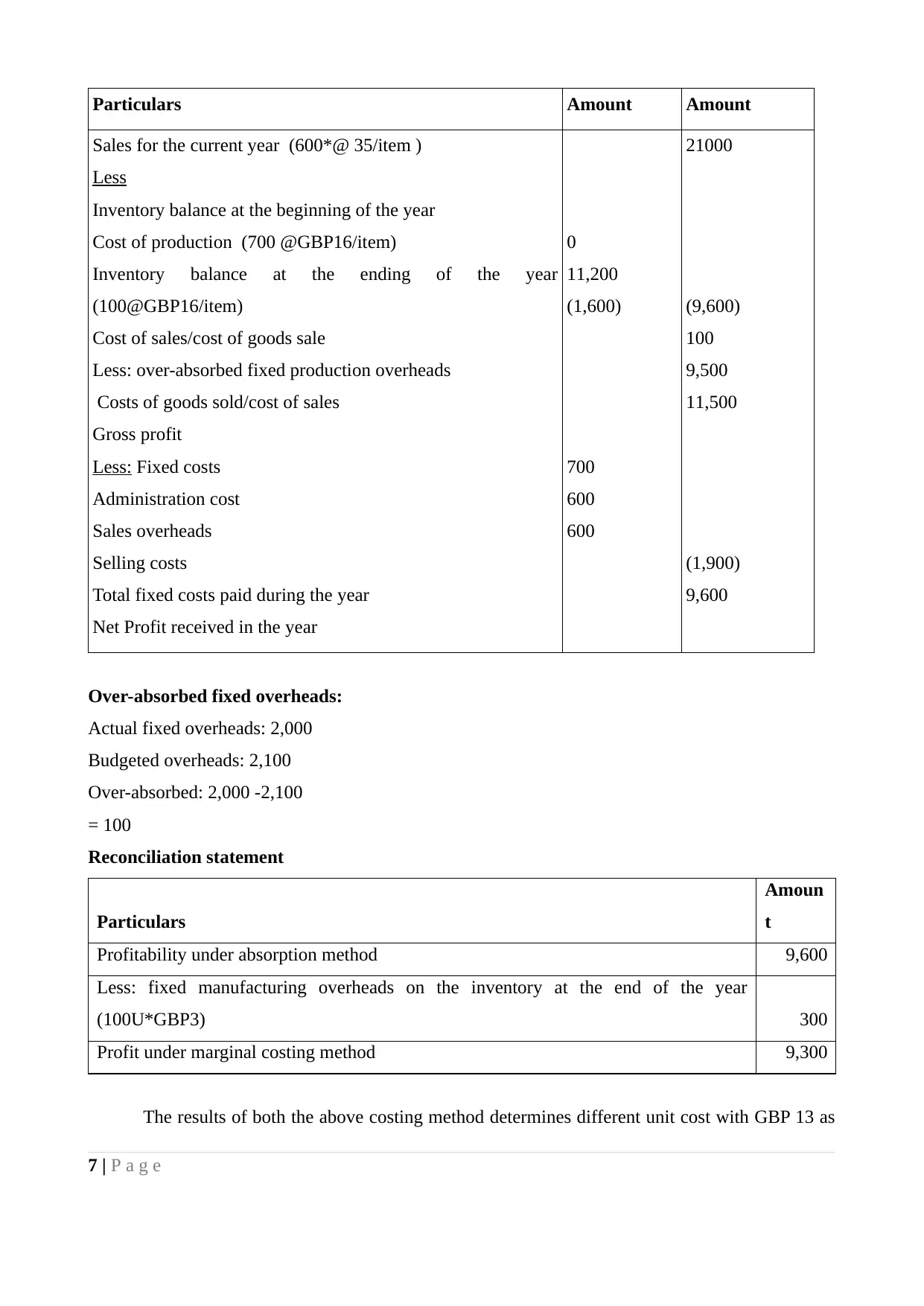

Reconciliation statement

Particulars

Amoun

t

Profitability under absorption method 9,600

Less: fixed manufacturing overheads on the inventory at the end of the year

(100U*GBP3) 300

Profit under marginal costing method 9,300

The results of both the above costing method determines different unit cost with GBP 13 as

7 | P a g e

Sales for the current year (600*@ 35/item )

Less

Inventory balance at the beginning of the year

Cost of production (700 @GBP16/item)

Inventory balance at the ending of the year

(100@GBP16/item)

Cost of sales/cost of goods sale

Less: over-absorbed fixed production overheads

Costs of goods sold/cost of sales

Gross profit

Less: Fixed costs

Administration cost

Sales overheads

Selling costs

Total fixed costs paid during the year

Net Profit received in the year

0

11,200

(1,600)

700

600

600

21000

(9,600)

100

9,500

11,500

(1,900)

9,600

Over-absorbed fixed overheads:

Actual fixed overheads: 2,000

Budgeted overheads: 2,100

Over-absorbed: 2,000 -2,100

= 100

Reconciliation statement

Particulars

Amoun

t

Profitability under absorption method 9,600

Less: fixed manufacturing overheads on the inventory at the end of the year

(100U*GBP3) 300

Profit under marginal costing method 9,300

The results of both the above costing method determines different unit cost with GBP 13 as

7 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

per variable costing method while the same in absorption method is GBP 16 as it also incorporated

fixed costs of manufacturing. The income statement determines net profit of £9,600 in full costing

method and the same in marginal method is £9,300 with total contribution of £12,600.

TASK 3

P4 Advantages and limitation of budgetary planning tools

Budget is a financial statements that presents projected sales and various costs elements of the

enterprise. It set challenges for all the workers of Unicorn Ltd and everyone work for putting their

genuine efforts and the best contribution in order to meet out targets. Company’s departmental

managers make various plans and strategies to supervise, administrate and control their workers

activities. Budgetary control is a procedure, in which, firm managers tries to control costs with the

maximum set limit and put efforts to maximize their revenues with the key focus to increase return

(De Campos and Rodrigues, 2016). There are some important budgetary planning tools which firm

must use for business that are presented below:

Incremental budgeting: This is a traditional method which need slightly changes in the budget

that was prepared last year to arrive budget for the new year. The method uses same resource

allocation basis used in the preceding year (Lennox and et.al., 2017). For example: By making

increments in the existing monetary framework Unicorn can develop competent financial plan for

the upcoming time period.

Benefits:

This method retain stability and helps Unicorn Ltd departments in consistent evaluation of

their functionality.

Relatively easy and simple to understand

Avoid conflicts as treat all the divisions equally.

Easy to maintain coordination

Drawbacks:

It is not useful as it fails to consider changing market circumstances.

Do not offer internal team members to come up with creative thoughts.

No incentive for cost reduction

Outdated budget

Every year, expenditures are increased

Budgetary slack through overestimation

Zero-based budgeting: Under ZBB, requested budget is prepared after evaluating thoroughly

8 | P a g e

fixed costs of manufacturing. The income statement determines net profit of £9,600 in full costing

method and the same in marginal method is £9,300 with total contribution of £12,600.

TASK 3

P4 Advantages and limitation of budgetary planning tools

Budget is a financial statements that presents projected sales and various costs elements of the

enterprise. It set challenges for all the workers of Unicorn Ltd and everyone work for putting their

genuine efforts and the best contribution in order to meet out targets. Company’s departmental

managers make various plans and strategies to supervise, administrate and control their workers

activities. Budgetary control is a procedure, in which, firm managers tries to control costs with the

maximum set limit and put efforts to maximize their revenues with the key focus to increase return

(De Campos and Rodrigues, 2016). There are some important budgetary planning tools which firm

must use for business that are presented below:

Incremental budgeting: This is a traditional method which need slightly changes in the budget

that was prepared last year to arrive budget for the new year. The method uses same resource

allocation basis used in the preceding year (Lennox and et.al., 2017). For example: By making

increments in the existing monetary framework Unicorn can develop competent financial plan for

the upcoming time period.

Benefits:

This method retain stability and helps Unicorn Ltd departments in consistent evaluation of

their functionality.

Relatively easy and simple to understand

Avoid conflicts as treat all the divisions equally.

Easy to maintain coordination

Drawbacks:

It is not useful as it fails to consider changing market circumstances.

Do not offer internal team members to come up with creative thoughts.

No incentive for cost reduction

Outdated budget

Every year, expenditures are increased

Budgetary slack through overestimation

Zero-based budgeting: Under ZBB, requested budget is prepared after evaluating thoroughly

8 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the market environment considering commencement from zero as base. It works on the principle

that, projected income and expenditures for every programme must commence from fresh point

through performing cost-benefit analysis. For example: According to this budgeting tool, by making

evaluation of all the activities that need to be done during specific time frame Unicorn can develop

financial plan effectually.

Benefits:

It focuses on the activities instead of functional divisions of Unicorn Ltd.

It is the most popular way for discretionary costs i.e. research, advertisement, training costs.

Unicorn Ltd policymakers can use it to assure cost-effectiveness of various decision

packages (Sehgal, 2017).

It begin from lowest activity level and moves upward.

Cost-benefit analysis allows efficient resource allocation strategy.

Limitations:

It is a bottom up budgeting, hence, the process is so bureaucratic and also takes a lot of time.

ZBB method requires trained personnel with fully aware of the method who are skilled

enough to perform cost-effectiveness analysis (Jager and et.al., 2014).

It requires too much paperwork and determine too much unmanageable.

ZBB is based on hierarchical structure that reinforces functional difficulties.

Fixed budgeting: As its name, budget that is not easy to adjust or flex when any other

activity is changed, is called fixed or static budget. Thus, the method determines exact money that

Unicorn Ltd needs to spent and income level only at a given volume.

Benefits:

The method allows enterprise allocating limited capital towards essential business

requirements i.e. overheads and money left represents profitability.

The technique helps owners to keep track of daily activities and pursue positive

improvements in the business financial outcome (Montoya, 2016).

It keep spending level down abiding by the set of strict rules and regulations.

Drawback:

No flexibility to adjust target at different level.

It does not help Unicorn Ltd in allocating more resources to the underperforming activities

to introduce improvements.

In current era, where external forces changes quickly, the method is not useful to experience

year-to-year fluctuations.

9 | P a g e

that, projected income and expenditures for every programme must commence from fresh point

through performing cost-benefit analysis. For example: According to this budgeting tool, by making

evaluation of all the activities that need to be done during specific time frame Unicorn can develop

financial plan effectually.

Benefits:

It focuses on the activities instead of functional divisions of Unicorn Ltd.

It is the most popular way for discretionary costs i.e. research, advertisement, training costs.

Unicorn Ltd policymakers can use it to assure cost-effectiveness of various decision

packages (Sehgal, 2017).

It begin from lowest activity level and moves upward.

Cost-benefit analysis allows efficient resource allocation strategy.

Limitations:

It is a bottom up budgeting, hence, the process is so bureaucratic and also takes a lot of time.

ZBB method requires trained personnel with fully aware of the method who are skilled

enough to perform cost-effectiveness analysis (Jager and et.al., 2014).

It requires too much paperwork and determine too much unmanageable.

ZBB is based on hierarchical structure that reinforces functional difficulties.

Fixed budgeting: As its name, budget that is not easy to adjust or flex when any other

activity is changed, is called fixed or static budget. Thus, the method determines exact money that

Unicorn Ltd needs to spent and income level only at a given volume.

Benefits:

The method allows enterprise allocating limited capital towards essential business

requirements i.e. overheads and money left represents profitability.

The technique helps owners to keep track of daily activities and pursue positive

improvements in the business financial outcome (Montoya, 2016).

It keep spending level down abiding by the set of strict rules and regulations.

Drawback:

No flexibility to adjust target at different level.

It does not help Unicorn Ltd in allocating more resources to the underperforming activities

to introduce improvements.

In current era, where external forces changes quickly, the method is not useful to experience

year-to-year fluctuations.

9 | P a g e

Flexible budgeting: Many establishments use flexible budgetary technique to adapt changes and

introduce necessary adjustments for external market forces such as inflation etc. It offers flexibility

to Unicorn Ltd to flex targets as per the level of activity.

Benefits:

It adapt changes according to the market circumstances or changes.

It enable Unicorn Ltd in creating an efficient fund allocation plan.

It is obvious, that company can face variations subjected to material costs, production

overheads, selling price and others. These variations plays a decisive role just by simply

comparing planned outcomes against actual results (Novas and et.al., 2017) .

Drawbacks:

Managers must be able to introduce changes accurately, however, continual monitoring and

examination of business environment is time-consuming.

Although, it helps in adjusting targets for material price, competition, technology efficiency,

interest rates, however, continue adjustments may not be necessarily beneficial for Unicorn

Ltd.

In order to put sound control, various techniques are used by the business including variance

analysis and responsibility budgeting that are discussed here as follows:

Variance analysis/Standard costing: Budgets prepared by any method is used to evaluate

actual performance. In this method, at the end of the period, actual performance outcome are

matched against challenged targets set earlier in the budget. It helps deriving deviations, also called

variances (Sehgal, 2017). Finding out the correct reasons of such variances assists Unicorn Ltd’s

policymakers in making informed decisions to control the impact of these factors in future by

proper advance planning. For instance, if competitor may offer quality goods at cheaper prices, then

it is obvious that demand for Unicorn Ltd goods will be decrease, as a result, its sales volume will

be affected negatively. The technique is crucially important in order to respond negative deviations

by corrective measures and thereby attain goals.

Benefits:

Performance analysis

Align all the managers and workers effort to the strategic goals.

Helps in corrective decisions to respond unfavourable results

Limitations:

Comparative analysis of actual and budget takes time, which in turn, it is probable that

Unicorn Ltd managers can make delayed measures to combat variance occurrence.

10 | P a g e

introduce necessary adjustments for external market forces such as inflation etc. It offers flexibility

to Unicorn Ltd to flex targets as per the level of activity.

Benefits:

It adapt changes according to the market circumstances or changes.

It enable Unicorn Ltd in creating an efficient fund allocation plan.

It is obvious, that company can face variations subjected to material costs, production

overheads, selling price and others. These variations plays a decisive role just by simply

comparing planned outcomes against actual results (Novas and et.al., 2017) .

Drawbacks:

Managers must be able to introduce changes accurately, however, continual monitoring and

examination of business environment is time-consuming.

Although, it helps in adjusting targets for material price, competition, technology efficiency,

interest rates, however, continue adjustments may not be necessarily beneficial for Unicorn

Ltd.

In order to put sound control, various techniques are used by the business including variance

analysis and responsibility budgeting that are discussed here as follows:

Variance analysis/Standard costing: Budgets prepared by any method is used to evaluate

actual performance. In this method, at the end of the period, actual performance outcome are

matched against challenged targets set earlier in the budget. It helps deriving deviations, also called

variances (Sehgal, 2017). Finding out the correct reasons of such variances assists Unicorn Ltd’s

policymakers in making informed decisions to control the impact of these factors in future by

proper advance planning. For instance, if competitor may offer quality goods at cheaper prices, then

it is obvious that demand for Unicorn Ltd goods will be decrease, as a result, its sales volume will

be affected negatively. The technique is crucially important in order to respond negative deviations

by corrective measures and thereby attain goals.

Benefits:

Performance analysis

Align all the managers and workers effort to the strategic goals.

Helps in corrective decisions to respond unfavourable results

Limitations:

Comparative analysis of actual and budget takes time, which in turn, it is probable that

Unicorn Ltd managers can make delayed measures to combat variance occurrence.

10 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.