Management Accounting Report: Austin Fraser Case Study Analysis

VerifiedAdded on 2020/10/23

|17

|5064

|187

Report

AI Summary

This report delves into the realm of management accounting, focusing on its significance in financial decision-making for businesses, particularly using the case study of Austin Fraser, an international recruitment consultancy. The report covers key aspects of management accounting, including its requirements, different reporting methods such as account receivable, budget, performance, job cost, and accounts payable systems. It then explores costing methods, specifically marginal and absorption costing, with related calculations. Furthermore, the report examines the advantages and disadvantages of various planning tools used for budgetary control. Finally, it draws a comparison between organizations that adapt management accounting systems to address financial problems, concluding with a summary of the key findings and their implications for effective financial management. The report provides a comprehensive overview of how management accounting aids in strategic planning, performance management, and risk mitigation within a business context.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management Accounting and its different requirement........................................................1

P2. Different methods used for management accounting reporting............................................3

TASK 2 ...........................................................................................................................................5

P3 Calculating cost with Absorption and marginal cost.............................................................5

Total £100(over absorbed)...............................................................................................................6

TASK 3............................................................................................................................................9

P4. Advantages and disadvantages of different types of planning tools for budgetary control..9

TASK 4............................................................................................................................................9

P5. Comparison between organisations that adapt management accounting system to solve

financial problems. .....................................................................................................................9

CONCLUSION................................................................................................................................9

REFERENCES................................................................................................................................9

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management Accounting and its different requirement........................................................1

P2. Different methods used for management accounting reporting............................................3

TASK 2 ...........................................................................................................................................5

P3 Calculating cost with Absorption and marginal cost.............................................................5

Total £100(over absorbed)...............................................................................................................6

TASK 3............................................................................................................................................9

P4. Advantages and disadvantages of different types of planning tools for budgetary control..9

TASK 4............................................................................................................................................9

P5. Comparison between organisations that adapt management accounting system to solve

financial problems. .....................................................................................................................9

CONCLUSION................................................................................................................................9

REFERENCES................................................................................................................................9

From: Management Accountant

To: Finance Director

Subject: Details related to management accounting for making an effective decision in

organization.

INTRODUCTION

Management accounting is an essential process that helps in formulation of important

financial information that is carried out in particular business structure. The management account

plays a essential role in this regard as they have to perform all these operations in effective and

efficient manner in order to accomplish final goals and objectives of the company. Every

business organisation have to operate in dynamic environment which keeps on changing with

time and thus companies have to keep in pace with these changes. Management system have to

inculcate modern and advanced technology system which will results in carrying out the work

process in adequate way. The company selected in this report is Austin Fraser, an international

recruitment consultancy that imparts that services related digital technology, automation, life

sciences and many other. The report highlights the various types of management accounting as

well as benefits of it which is enjoyed by the business organisation. It also focuses on usage of

marginal and absorption costing.

TASK 1

P1 Management Accounting and its different requirement.

Management accounting is the dynamic system that is adopted for maintaining important

financial statements like balance sheet, P&L account and other important components. These

components help in finding out the profits and loss for particular financial year hence, proper

steps could be taken so that management accounting process could be performed. These

preparation of financial statements helps in presenting information about financial position of the

company in accurate manner (Albelda, 2011). There are several tools that is introduced in

business organisation in order to plan the whole system in prospective way. In order to furnish

financial condition it is necessary for the financial manager of Austin Fraser to present financial

information in effective way so that proper results can be calculated. These statements delivers

the information regarding sales volume, cash, inventory level, stock and many other activities.

1

To: Finance Director

Subject: Details related to management accounting for making an effective decision in

organization.

INTRODUCTION

Management accounting is an essential process that helps in formulation of important

financial information that is carried out in particular business structure. The management account

plays a essential role in this regard as they have to perform all these operations in effective and

efficient manner in order to accomplish final goals and objectives of the company. Every

business organisation have to operate in dynamic environment which keeps on changing with

time and thus companies have to keep in pace with these changes. Management system have to

inculcate modern and advanced technology system which will results in carrying out the work

process in adequate way. The company selected in this report is Austin Fraser, an international

recruitment consultancy that imparts that services related digital technology, automation, life

sciences and many other. The report highlights the various types of management accounting as

well as benefits of it which is enjoyed by the business organisation. It also focuses on usage of

marginal and absorption costing.

TASK 1

P1 Management Accounting and its different requirement.

Management accounting is the dynamic system that is adopted for maintaining important

financial statements like balance sheet, P&L account and other important components. These

components help in finding out the profits and loss for particular financial year hence, proper

steps could be taken so that management accounting process could be performed. These

preparation of financial statements helps in presenting information about financial position of the

company in accurate manner (Albelda, 2011). There are several tools that is introduced in

business organisation in order to plan the whole system in prospective way. In order to furnish

financial condition it is necessary for the financial manager of Austin Fraser to present financial

information in effective way so that proper results can be calculated. These statements delivers

the information regarding sales volume, cash, inventory level, stock and many other activities.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

On the other hand, these information are materialistic in nature that contain some aims and

objectives to be achieved hence are known as financial information. It uses can be determined on

three key areas of business which are discussed below: '

Performance management: management accounting is directly linked with managing

performance of individual that are working in single business organisation. On the other

hand, it assist in enhancing skills and knowledge of every employees so that they could

contribute to best of their abilities and capacity (Vakalfotis, Ballantine and Wall, 2013).

Strategic management: Strategies are formulated for achieving the future tasks of the

company so that ultimate goals which were framed get accomplished in effective and

efficient manner. Therefore, Austin Fraser will require financial and non financial

information to come to its conclusion and form proper strategies for the company. It is

essential to manage strategies in strategic manner so that it outcomes could be determined

(Arroyo, 2012).

Risk management: Risks are considered as part and parcel of every business

organisation and it is of different nature and types. There are proper system that is

framed to face all these types of risks in proper manner so that effective results can be

accomplished. For example, management have to maintain adequate inventory level in

their system so that proper resources could maintained at significant level in order to

meet demand and supply process. There some risks have to be faced and some can be

ignored therefore, it is necessary to maintain risk level and evaluate its impacts according

to it and take steps to face it.

Different types of management accounting system that is prepared in Austin Fraser

organisation and are as follows:

Cost accounting process: This system is focused upon controlling cost of the company

in order to ascertain the profits and valuation of inventory that take place in the

organisation system. It is very much useful to carry out this procedure in effective way.

The financial manger introduce effective costing system so that overall cost could be

ascertained (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

Inventory accounting system: In this accounting, inventory management is performed

at significant level. Austin Fraser have to carry out this process so that proper inventory

system could be maintained. This company have introduced inventory control software

2

objectives to be achieved hence are known as financial information. It uses can be determined on

three key areas of business which are discussed below: '

Performance management: management accounting is directly linked with managing

performance of individual that are working in single business organisation. On the other

hand, it assist in enhancing skills and knowledge of every employees so that they could

contribute to best of their abilities and capacity (Vakalfotis, Ballantine and Wall, 2013).

Strategic management: Strategies are formulated for achieving the future tasks of the

company so that ultimate goals which were framed get accomplished in effective and

efficient manner. Therefore, Austin Fraser will require financial and non financial

information to come to its conclusion and form proper strategies for the company. It is

essential to manage strategies in strategic manner so that it outcomes could be determined

(Arroyo, 2012).

Risk management: Risks are considered as part and parcel of every business

organisation and it is of different nature and types. There are proper system that is

framed to face all these types of risks in proper manner so that effective results can be

accomplished. For example, management have to maintain adequate inventory level in

their system so that proper resources could maintained at significant level in order to

meet demand and supply process. There some risks have to be faced and some can be

ignored therefore, it is necessary to maintain risk level and evaluate its impacts according

to it and take steps to face it.

Different types of management accounting system that is prepared in Austin Fraser

organisation and are as follows:

Cost accounting process: This system is focused upon controlling cost of the company

in order to ascertain the profits and valuation of inventory that take place in the

organisation system. It is very much useful to carry out this procedure in effective way.

The financial manger introduce effective costing system so that overall cost could be

ascertained (Suomala, Lyly-Yrjänäinen and Lukka, 2014).

Inventory accounting system: In this accounting, inventory management is performed

at significant level. Austin Fraser have to carry out this process so that proper inventory

system could be maintained. This company have introduced inventory control software

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

that keep a full record on the stock level so that no wastage could occur and there is no

proper utilisation of resources that take place (Becker, Messner and Schäffer, 2010).

Managerial accounting: This accounting system is maintained on order to take

decisions in relation to managerial accounting. On the other hand, it also involve taking

proper decision in relation to improving overall operation and working procedure.

Job costing system: It is a type of cost that is incurred while carrying out various job

process. There is proper system that is generated in order to perform all job

responsibilities in accurate manner. Every organisation is having different types of job of

various nature and types, therefore it is essential to consider this job costing system in

order to present overall information in proper format (Parker, 2012).

Profit maximization system: Every business organisation exists for earning huge profits

in the form of high outcomes and revenues. Their main objective is to increase their

profits so that final results could be achieved. On the other hand, it is also important for

the Austin Fraser, which is a small organisation have to adopt several tools and

techniques so that optimum profits can be attained.

From the above discussion, it has been concluded that management accounting is a

proper system that complete financial information could be ascertained that results in carrying

out the work process in adequate way. The other aim for this process is that it also Austin Fraser

to achieve set objectives and aims in efficient way. There are several requirements for

management accounting that has to be fulfilled in efficient way so that the final vision and

mission could be met out. Austin Fraser have to inculcate the managerial system in order to meet

its requirements in effective and adequate way.

P2. Different methods used for management accounting reporting

Management accounting reporting is an essential process that has to be involve number

of interrelated activities and has to be performed in for carrying out the whole work process in

reaching the set objectives and aims. There are number of methods that are utilized for

management accounting reporting in Austin Fraser and is described below as follows:

Account receivable accounting system: in accordance to this system proper inventory

system is maintained by the business organisation (Bennett, Schaltegger and Zvezdov,

2013). This accounting record involve recording of all receivable that is done by the

3

proper utilisation of resources that take place (Becker, Messner and Schäffer, 2010).

Managerial accounting: This accounting system is maintained on order to take

decisions in relation to managerial accounting. On the other hand, it also involve taking

proper decision in relation to improving overall operation and working procedure.

Job costing system: It is a type of cost that is incurred while carrying out various job

process. There is proper system that is generated in order to perform all job

responsibilities in accurate manner. Every organisation is having different types of job of

various nature and types, therefore it is essential to consider this job costing system in

order to present overall information in proper format (Parker, 2012).

Profit maximization system: Every business organisation exists for earning huge profits

in the form of high outcomes and revenues. Their main objective is to increase their

profits so that final results could be achieved. On the other hand, it is also important for

the Austin Fraser, which is a small organisation have to adopt several tools and

techniques so that optimum profits can be attained.

From the above discussion, it has been concluded that management accounting is a

proper system that complete financial information could be ascertained that results in carrying

out the work process in adequate way. The other aim for this process is that it also Austin Fraser

to achieve set objectives and aims in efficient way. There are several requirements for

management accounting that has to be fulfilled in efficient way so that the final vision and

mission could be met out. Austin Fraser have to inculcate the managerial system in order to meet

its requirements in effective and adequate way.

P2. Different methods used for management accounting reporting

Management accounting reporting is an essential process that has to be involve number

of interrelated activities and has to be performed in for carrying out the whole work process in

reaching the set objectives and aims. There are number of methods that are utilized for

management accounting reporting in Austin Fraser and is described below as follows:

Account receivable accounting system: in accordance to this system proper inventory

system is maintained by the business organisation (Bennett, Schaltegger and Zvezdov,

2013). This accounting record involve recording of all receivable that is done by the

3

Austin Fraser from customers in the form of process, consideration that is the form of

money, kinds that assist in maintaining the cash process in proper way.

Use: This system help Austin Fraser to keep record of every transactions that is related to

their customers in relation to amount that is needed to acquire from the customers as well

as amount that have to be achieved from their consumers. Hence, weekly record has to be

maintained in correct order that will supply proper information to the management

system of the company (Otley and Emmanuel, 2013).

Budget reporting system: Budgets are formulated in order to maintaining record of all

cost that has been allocated in different sections that are present in single business

organisation. Budgets helps in forming standard level so that actual level can be

compared with it and any deviation that occur must be solved in proper time.

Use: As being a small scale organisation Austin Fraser have to make optimum utilisation

of all funds in proper way so that best utilisation can take place. There are several uses t

hat are attached in budgets formation.

Performance reporting system: It is very important to record the performance level of

every employees that are working in the company. This is very much important as it

helps the manage to keep record of performances of every individual and find out the key

areas that require improvement (Van der Meer-Kooistra and Vosselman, 2012). As

employees are known as important resources of Austin Fraser in order to align their

personal objectives with organisation's final aims so that it will help the company to

reach set targets in particular time period. It is very much important to keep record of

performance of each and every individual so that problems is it there, can be solved.

Use: This is a important system that is applied in Austin Fraser as it is a consultancy firm

that employee large number of employees and proper system must be introduced to carry

out the whole process in efficient manner so that final goals can be achieved.

Job cost reporting system: This type of report is formed by the manager of Austin

Fraser in which all expenditures that are incurred by the company while carrying out

certain plan of actions that may include carrying out some particular project or

performing some particular activity in order to accomplish set goals and objectives.

Therefore, manager have to maintain this process in efficient way so that proper

evaluation of procedure can be done. Firms always aim in introducing cost effective

4

money, kinds that assist in maintaining the cash process in proper way.

Use: This system help Austin Fraser to keep record of every transactions that is related to

their customers in relation to amount that is needed to acquire from the customers as well

as amount that have to be achieved from their consumers. Hence, weekly record has to be

maintained in correct order that will supply proper information to the management

system of the company (Otley and Emmanuel, 2013).

Budget reporting system: Budgets are formulated in order to maintaining record of all

cost that has been allocated in different sections that are present in single business

organisation. Budgets helps in forming standard level so that actual level can be

compared with it and any deviation that occur must be solved in proper time.

Use: As being a small scale organisation Austin Fraser have to make optimum utilisation

of all funds in proper way so that best utilisation can take place. There are several uses t

hat are attached in budgets formation.

Performance reporting system: It is very important to record the performance level of

every employees that are working in the company. This is very much important as it

helps the manage to keep record of performances of every individual and find out the key

areas that require improvement (Van der Meer-Kooistra and Vosselman, 2012). As

employees are known as important resources of Austin Fraser in order to align their

personal objectives with organisation's final aims so that it will help the company to

reach set targets in particular time period. It is very much important to keep record of

performance of each and every individual so that problems is it there, can be solved.

Use: This is a important system that is applied in Austin Fraser as it is a consultancy firm

that employee large number of employees and proper system must be introduced to carry

out the whole process in efficient manner so that final goals can be achieved.

Job cost reporting system: This type of report is formed by the manager of Austin

Fraser in which all expenditures that are incurred by the company while carrying out

certain plan of actions that may include carrying out some particular project or

performing some particular activity in order to accomplish set goals and objectives.

Therefore, manager have to maintain this process in efficient way so that proper

evaluation of procedure can be done. Firms always aim in introducing cost effective

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

techniques that will allow the organisation to reduce overall cost at significant level

(Macintosh and Quattrone, 2010).

Use: manager of Austin Fraser keeps a complete record of all job cost in correct format

so that they could identify profitability and other conditions that may arise in the

particular financial year. On the other hand, he always aims in earning high amount of

profits and outcomes so that time and cost could be focused on optimum utilisation.

Accounts payable reporting system: It is completely opposite of accounts receivable in

which all details regarding payments that has to be maintained which focuses on making

payments to the particular supplier from the goods and products are purchased. Hence,

this enable the manager to keep complete records in efficient manner so that no problems

could be raised while carrying out the complete work process.

Use: Austin Fraser have a proper accounting system that is maintained in order to keep

complete information and details regarding accounts payable service provider. This helps

them to maintain proper payment system so that complete work process must be

conducted in performing whole work structure in accurate mode. Financial manger

maintains proper books of accounts that contain all details regarding credits and other

parties to whom payment have to be done.

From the above discussion, it has been concluded that there are different methods that are

adopted in order to keep the record of management system so that it could deliver proper

information and details regarding financial and non financial aspects that is consider to be

indispensable in fulfilling final set tasks and objectives.

TASK 2

P3 Calculating cost with Absorption and marginal cost.

Mainly there are two costing method which is used by the management of Austin Fraser,

so that they can calculate the different cost and with the help of such income statement can be

made. Basically, those two method are as marginal and absorption costing (Bodie, 2013).

Marginal Costing: It is being considered as the opportunity cost which is incurred in

firm by having an production of one or more unit in effective way. Moreover, various changes

are there in production which is due to the increase and decrease in unit as well. Generally, it is

such which is used by break even point that is accounted and also attained. Hence, Cost is that

5

(Macintosh and Quattrone, 2010).

Use: manager of Austin Fraser keeps a complete record of all job cost in correct format

so that they could identify profitability and other conditions that may arise in the

particular financial year. On the other hand, he always aims in earning high amount of

profits and outcomes so that time and cost could be focused on optimum utilisation.

Accounts payable reporting system: It is completely opposite of accounts receivable in

which all details regarding payments that has to be maintained which focuses on making

payments to the particular supplier from the goods and products are purchased. Hence,

this enable the manager to keep complete records in efficient manner so that no problems

could be raised while carrying out the complete work process.

Use: Austin Fraser have a proper accounting system that is maintained in order to keep

complete information and details regarding accounts payable service provider. This helps

them to maintain proper payment system so that complete work process must be

conducted in performing whole work structure in accurate mode. Financial manger

maintains proper books of accounts that contain all details regarding credits and other

parties to whom payment have to be done.

From the above discussion, it has been concluded that there are different methods that are

adopted in order to keep the record of management system so that it could deliver proper

information and details regarding financial and non financial aspects that is consider to be

indispensable in fulfilling final set tasks and objectives.

TASK 2

P3 Calculating cost with Absorption and marginal cost.

Mainly there are two costing method which is used by the management of Austin Fraser,

so that they can calculate the different cost and with the help of such income statement can be

made. Basically, those two method are as marginal and absorption costing (Bodie, 2013).

Marginal Costing: It is being considered as the opportunity cost which is incurred in

firm by having an production of one or more unit in effective way. Moreover, various changes

are there in production which is due to the increase and decrease in unit as well. Generally, it is

such which is used by break even point that is accounted and also attained. Hence, Cost is that

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

which is absorbed and also having an variable cost too. Even though, it is such which do help in

allocating the different resources as well and having an achievement in effective way. Therefore,

it can be used by determining the marginal costing and also lead to have an change of cost and in

quantity too. This costing helps in finding out the relation that exist between inputs and costs that

have to be properly considered.

Absorption costing: It is considered as having an necessary in having an costing method

and it is used by company Austin Fraser. Basically, it is used to calculate the cost that is incurred

by the production in the department and also include the direct and indirect expenses too.

Basically, direct cost is that which leads with direct connection related to the production of

product as well, with raw material and labour cost etc.. Moreover the indirect cost do consider

the various expenses that is incurred indirectly and also support the production of product too

(Boyns and Edwards, 2013).

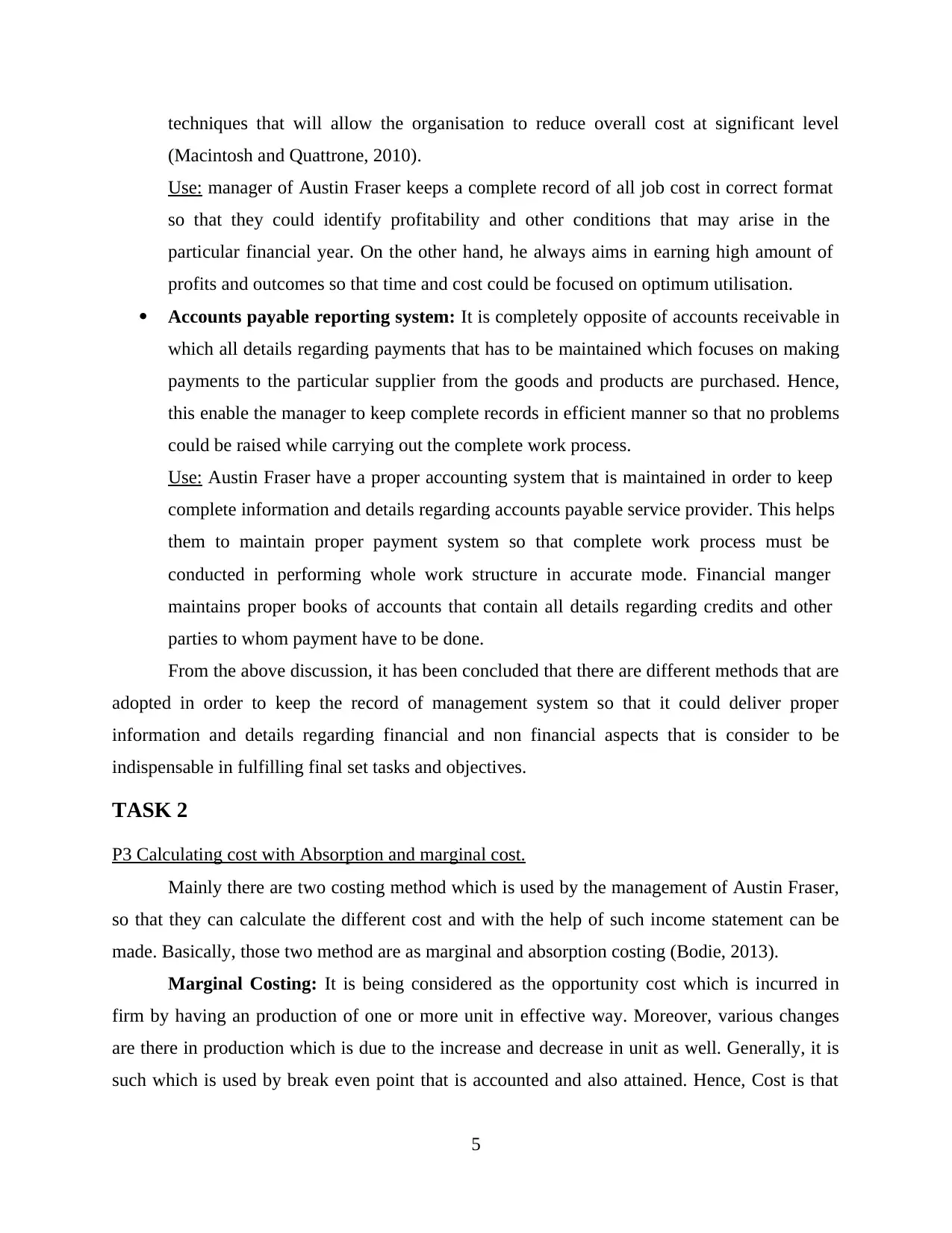

Absorption costing

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: Calculate value of inventory and production

Opening inventory Production amount Closing inventory

0 700*19 = £13300 100*16 = £1600

Working 3: Under/ Over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

Administration cost: In this budget cost the £800 and Actual cost is £700

6

allocating the different resources as well and having an achievement in effective way. Therefore,

it can be used by determining the marginal costing and also lead to have an change of cost and in

quantity too. This costing helps in finding out the relation that exist between inputs and costs that

have to be properly considered.

Absorption costing: It is considered as having an necessary in having an costing method

and it is used by company Austin Fraser. Basically, it is used to calculate the cost that is incurred

by the production in the department and also include the direct and indirect expenses too.

Basically, direct cost is that which leads with direct connection related to the production of

product as well, with raw material and labour cost etc.. Moreover the indirect cost do consider

the various expenses that is incurred indirectly and also support the production of product too

(Boyns and Edwards, 2013).

Absorption costing

Working 1: Calculate full production cost

Direct material £6

Direct labour £5

Variable cost £2

Fixed cost £3

Total £16

Working 2: Calculate value of inventory and production

Opening inventory Production amount Closing inventory

0 700*19 = £13300 100*16 = £1600

Working 3: Under/ Over absorbed fixed production overhead

Actual fixed production: £2100

Fixed overhead: £2000

Total £100(over absorbed)

Administration cost: In this budget cost the £800 and Actual cost is £700

6

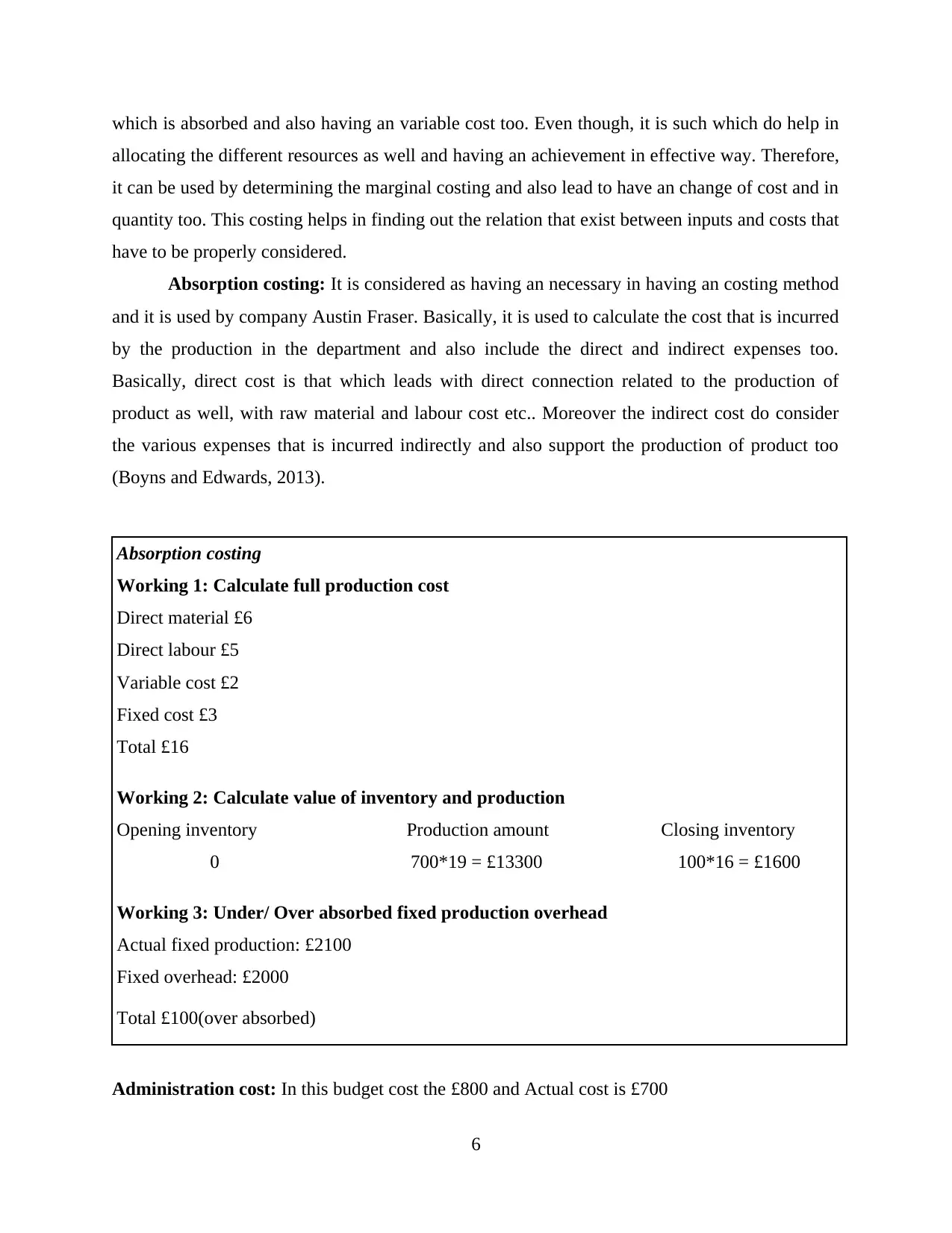

Selling cost: In this budgeted cost is £400 and Actual cost is £600

Net profit using Absorption costing £ £

Sales

(-) Cost of Sales:

Initial stock

Manufacturing (Production)

End stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

Working 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening Stock Production End inventory

7

Net profit using Absorption costing £ £

Sales

(-) Cost of Sales:

Initial stock

Manufacturing (Production)

End stock

(Under)/ Over absorbed fixed prod.

O/h

Gross Profit

Less Expenses

Variable sales expenditure

Fixed administration expenses

Fixed selling expenditure

Over absorption

Net Profit

0

11200

(1600)

600

700

600

(100)

21000

(9600)

11400

(1800)

9600

Working 1: Calculate variable production cost £

Direct material 6

Direct labour 5

Variable production O/h 3

Variable production cost 14

Working 2: Calculate value of inventory and production

Opening Stock Production End inventory

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

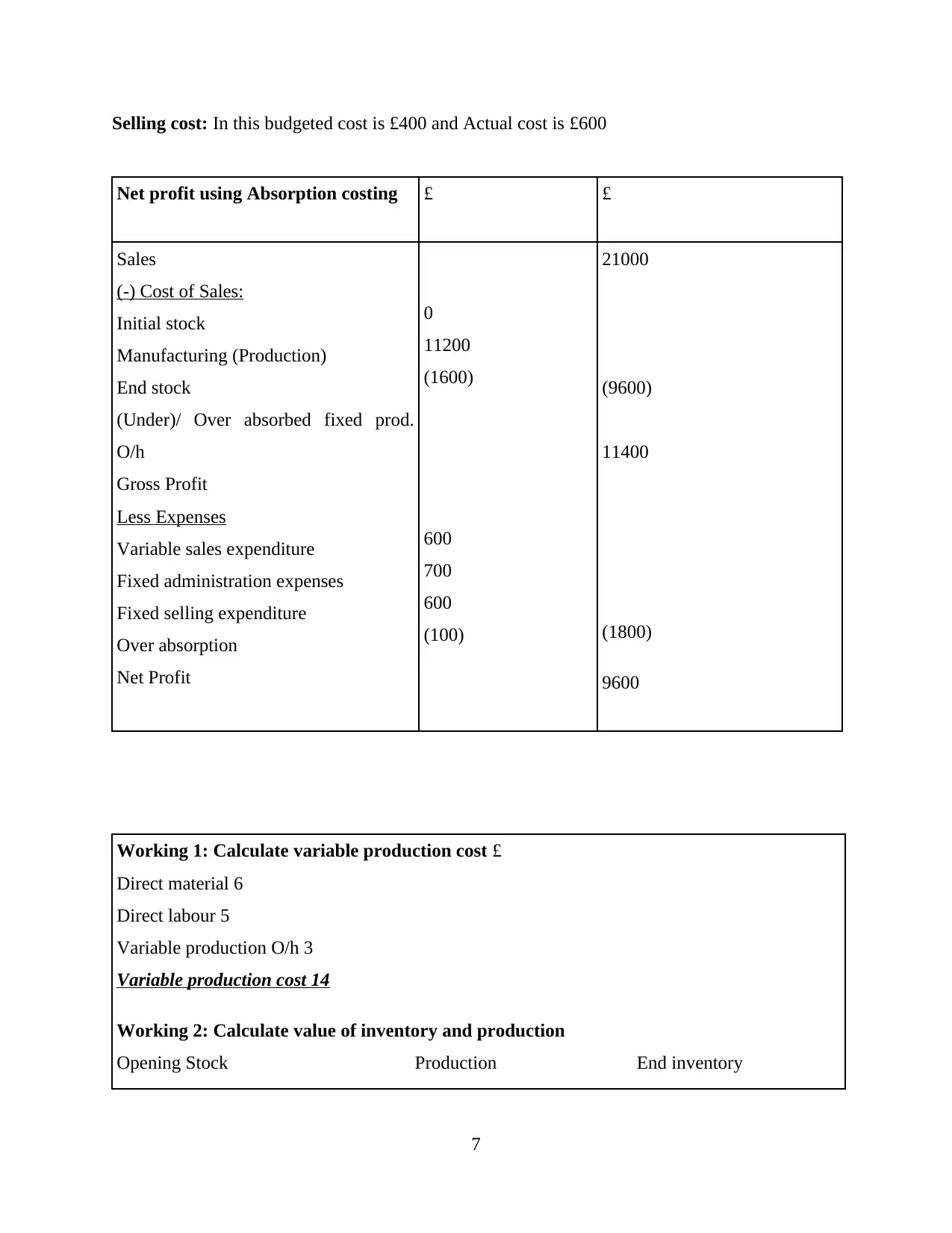

0 700*14 = 9800 100*14 = 1400

Net profit using Marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

Above, statements is such which also conclude the absorption method and also having an

effective marginal costing (Van der Stede, 2011). Moreover the Austin Fraser is that firm who

used the absorption cost method which do show the better result in entity. Basically, in this

criteria- profit is be like approx. £9600 and having an marginal cost that is around the £9300.

Even though, there is a gap £300 and it is considered as the fixed cost in firm too. Generally, it is

interesting to know that these methods are included as internation accounting standards. These

standards are applied with all business organisation so that proper accou8nting system must be

conducted in correct and proper manner.

8

Net profit using Marginal costing £ £

Sales value

Less: Variable costs

Opening stock

Manufacturing

Closing stock

Contribution

Less Fixed costs

Variable Production expenses

Administration cost expenditure

Selling cost

Net Profit

0

9100

(1300)

2000

1300

600

21000

(7800)

13200

3900

9300

Above, statements is such which also conclude the absorption method and also having an

effective marginal costing (Van der Stede, 2011). Moreover the Austin Fraser is that firm who

used the absorption cost method which do show the better result in entity. Basically, in this

criteria- profit is be like approx. £9600 and having an marginal cost that is around the £9300.

Even though, there is a gap £300 and it is considered as the fixed cost in firm too. Generally, it is

interesting to know that these methods are included as internation accounting standards. These

standards are applied with all business organisation so that proper accou8nting system must be

conducted in correct and proper manner.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TASK 3

P4. Advantages and disadvantages of different types of planning tools for budgetary control

Budgetary system: It refers to proper recording of all cost and expenses that are incurred

by the business organisation in particular financial year. Maintenance of budgets helps the

management system to allocate funds in key areas and helps in reducing the wastage that may

occur while conducting particular work process. Hence, preparation of budgets aids in allocating

the overall finance or funds of the company in proper manner (DRURY, 2013).

Budgetary control system: It is a complex process that involve introducing number of

budgetary control tools and techniques so that any wastage of resources can be reduced to

significant level. It is very much important to introduce effective tools so that correct results can

be achieved. It is performed in set process that is described below:

Discussion with superiors: It is a initial step in which employees have to perform

discussion with their managers so that proper conclusion can be formulated. There are

certain effective cost structures that have to be estimated in correct process. It is

important to create the healthy relationship between employees and employer so that both

with together efforts they could attain their final results (Lukka and Vinnari, 2014).

Recording of performance: Strategies that have been formulated after the discussion that

has taken place between superior and subordinates so that effective decision can be made

in regarding formulation of budgets for particular financial year. Each individual is

different from each other on the basis of certain criteria hence distinct system of

performance evaluation procedure must be present.

Comparison between standard and actual performance level: In this step, comparison is

done between actual and standard performance so that deviations can be find out and

actual steps can be taken to remove it in order to reduce the problem of hindrances.

Forecasting Tools: This tools helps the manager to predict the forecasting of the

business operations and transactions so that proper plans can be maintained well in advance. This

assists the manager of the company to prepare themselves to face number of challenges and

issues that may arise in future time. As business have to work in dynamic environment that

involves number of complex activities that have to be carried out in proper time period. Its

advantages and disadvantages are described below:

9

P4. Advantages and disadvantages of different types of planning tools for budgetary control

Budgetary system: It refers to proper recording of all cost and expenses that are incurred

by the business organisation in particular financial year. Maintenance of budgets helps the

management system to allocate funds in key areas and helps in reducing the wastage that may

occur while conducting particular work process. Hence, preparation of budgets aids in allocating

the overall finance or funds of the company in proper manner (DRURY, 2013).

Budgetary control system: It is a complex process that involve introducing number of

budgetary control tools and techniques so that any wastage of resources can be reduced to

significant level. It is very much important to introduce effective tools so that correct results can

be achieved. It is performed in set process that is described below:

Discussion with superiors: It is a initial step in which employees have to perform

discussion with their managers so that proper conclusion can be formulated. There are

certain effective cost structures that have to be estimated in correct process. It is

important to create the healthy relationship between employees and employer so that both

with together efforts they could attain their final results (Lukka and Vinnari, 2014).

Recording of performance: Strategies that have been formulated after the discussion that

has taken place between superior and subordinates so that effective decision can be made

in regarding formulation of budgets for particular financial year. Each individual is

different from each other on the basis of certain criteria hence distinct system of

performance evaluation procedure must be present.

Comparison between standard and actual performance level: In this step, comparison is

done between actual and standard performance so that deviations can be find out and

actual steps can be taken to remove it in order to reduce the problem of hindrances.

Forecasting Tools: This tools helps the manager to predict the forecasting of the

business operations and transactions so that proper plans can be maintained well in advance. This

assists the manager of the company to prepare themselves to face number of challenges and

issues that may arise in future time. As business have to work in dynamic environment that

involves number of complex activities that have to be carried out in proper time period. Its

advantages and disadvantages are described below:

9

Advantages: Adoption of forecasting tools helps the management to prepare themselves

in order to face all challenges and issues that may arise in future time period (Harris and Durden,

2012).

Disadvantage: There are number of conditions that result for incurring losses for the

company. If proper adoption of forecasting tools are not done than, achievement of goals could

not take place.

Scenario Tools: This tools helps in locating the uncertainties for the business

organisation that may occur while conducting business operations and transactions. Therefore, it

is very much necessary to examine all these aspects and make proper decisions as per the

requirement. Its benefits and disadvantages are described below:

Advantages: Risk management system will results in effectively managing the strategies

in order to accomplish set targets.

Disadvantage: the major drawback is that, if there is less usage of tools and techniques

than set results could not be achieved.

Contingency planning tools: Business environment is dynamic in nature that involve

number of change tools in order to maintain all its complexities. There are number of

contingencies that may arise in business life (Herzig and et. al. 2012). Contingencies are some

thing that arises at any time hence, it is very much essential to face all these contingencies so that

no harmful effects could be done. Austin Fraser have to develop such contingency planning tools

so that proper steps must be taken at right and accurate time.

Advantages: In adoption of contingency planning tool, the management of all the extra

cost must be maintained so that wastage must be reduced.

Disadvantage: company have to operate in dynamic environment hence, Austin Fraser

find it difficult to carry out the forecasting process.

TASK 4

P5. Comparison between organisations that adapt management accounting system to solve

financial problems.

Financial issues and aspects are known as problem and issues that affect the overall path

which leads to achieve set objectives and aims of the company. There are number of financial

aspects that get arise so that proper steps must be taken for accomplishing benefits in order to for

10

in order to face all challenges and issues that may arise in future time period (Harris and Durden,

2012).

Disadvantage: There are number of conditions that result for incurring losses for the

company. If proper adoption of forecasting tools are not done than, achievement of goals could

not take place.

Scenario Tools: This tools helps in locating the uncertainties for the business

organisation that may occur while conducting business operations and transactions. Therefore, it

is very much necessary to examine all these aspects and make proper decisions as per the

requirement. Its benefits and disadvantages are described below:

Advantages: Risk management system will results in effectively managing the strategies

in order to accomplish set targets.

Disadvantage: the major drawback is that, if there is less usage of tools and techniques

than set results could not be achieved.

Contingency planning tools: Business environment is dynamic in nature that involve

number of change tools in order to maintain all its complexities. There are number of

contingencies that may arise in business life (Herzig and et. al. 2012). Contingencies are some

thing that arises at any time hence, it is very much essential to face all these contingencies so that

no harmful effects could be done. Austin Fraser have to develop such contingency planning tools

so that proper steps must be taken at right and accurate time.

Advantages: In adoption of contingency planning tool, the management of all the extra

cost must be maintained so that wastage must be reduced.

Disadvantage: company have to operate in dynamic environment hence, Austin Fraser

find it difficult to carry out the forecasting process.

TASK 4

P5. Comparison between organisations that adapt management accounting system to solve

financial problems.

Financial issues and aspects are known as problem and issues that affect the overall path

which leads to achieve set objectives and aims of the company. There are number of financial

aspects that get arise so that proper steps must be taken for accomplishing benefits in order to for

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.