Management Accounting Report: System and Reporting Analysis

VerifiedAdded on 2020/12/09

|19

|4931

|240

Report

AI Summary

This report analyzes management accounting systems and their application to Excite Entertainment Limited, a company involved in promoting concerts and festivals. It differentiates between management and financial accounting, exploring various management accounting systems like cost accounting, inventory management, and job costing systems, highlighting their benefits. The report emphasizes the integration of these systems with management accounting reporting, explaining different reporting methods such as budget reports, accounts receivable aging reports, performance reports, and cost managerial accounting reports. It also examines the advantages and disadvantages of planning tools used for budgetary control and compares how organizations use management accounting systems to address financial problems. The report underscores how these systems can be used to make effective decisions, improve operational efficiency, and enhance overall business performance. It provides insights into cost control, inventory management, job profitability, and forecasting, making it a comprehensive guide for understanding and applying management accounting principles.

Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

SCENARIO 1 ..................................................................................................................................3

Management accounting system .................................................................................................3

Integration of management account systems and management accounting reporting ................5

Explaining different methods of the management accounting reporting.....................................6

SCENARIO 2 ..................................................................................................................................8

Income statement as per marginal costing and absorption costing..............................................8

SCENARIO 3.................................................................................................................................11

Advantage & Disadvantage of Planning Tools used for Budgetary Control.............................11

SCENARIO 4.................................................................................................................................12

Comparing how organisation adopts management accounting systems in responding to

financing problems.....................................................................................................................12

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................3

MAIN BODY...................................................................................................................................3

SCENARIO 1 ..................................................................................................................................3

Management accounting system .................................................................................................3

Integration of management account systems and management accounting reporting ................5

Explaining different methods of the management accounting reporting.....................................6

SCENARIO 2 ..................................................................................................................................8

Income statement as per marginal costing and absorption costing..............................................8

SCENARIO 3.................................................................................................................................11

Advantage & Disadvantage of Planning Tools used for Budgetary Control.............................11

SCENARIO 4.................................................................................................................................12

Comparing how organisation adopts management accounting systems in responding to

financing problems.....................................................................................................................12

CONCLUSION .............................................................................................................................16

REFERENCES..............................................................................................................................18

INTRODUCTION

Management accounting assist in preparation of the internal report on the basis of which

organisation is able to determine their performance and the profit margin and is able to make

forecast for the future. In this assignment Excite Entertainment limited will be considered which

is involved in the promotion of concerts and festivals. This assignment will provide information

regarding different management accounting system. It will include the information the

management accounting reporting which helps in making effective decision for the firm.

Moreover, the report will provide understanding about the benefits of using the management

accounting systems. It will also assist in identifying the different planning tools used in

budgetary control. Also, the report will helps in determining the cost using different techniques.

Furthermore, it will contain the information regarding the management accounting system used

by organisation in order to respond to the various financial problems. This study will also include

the discussion regarding the integration of management accounting systems and management

accounting reports.

MAIN BODY

SCENARIO 1

Management accounting system

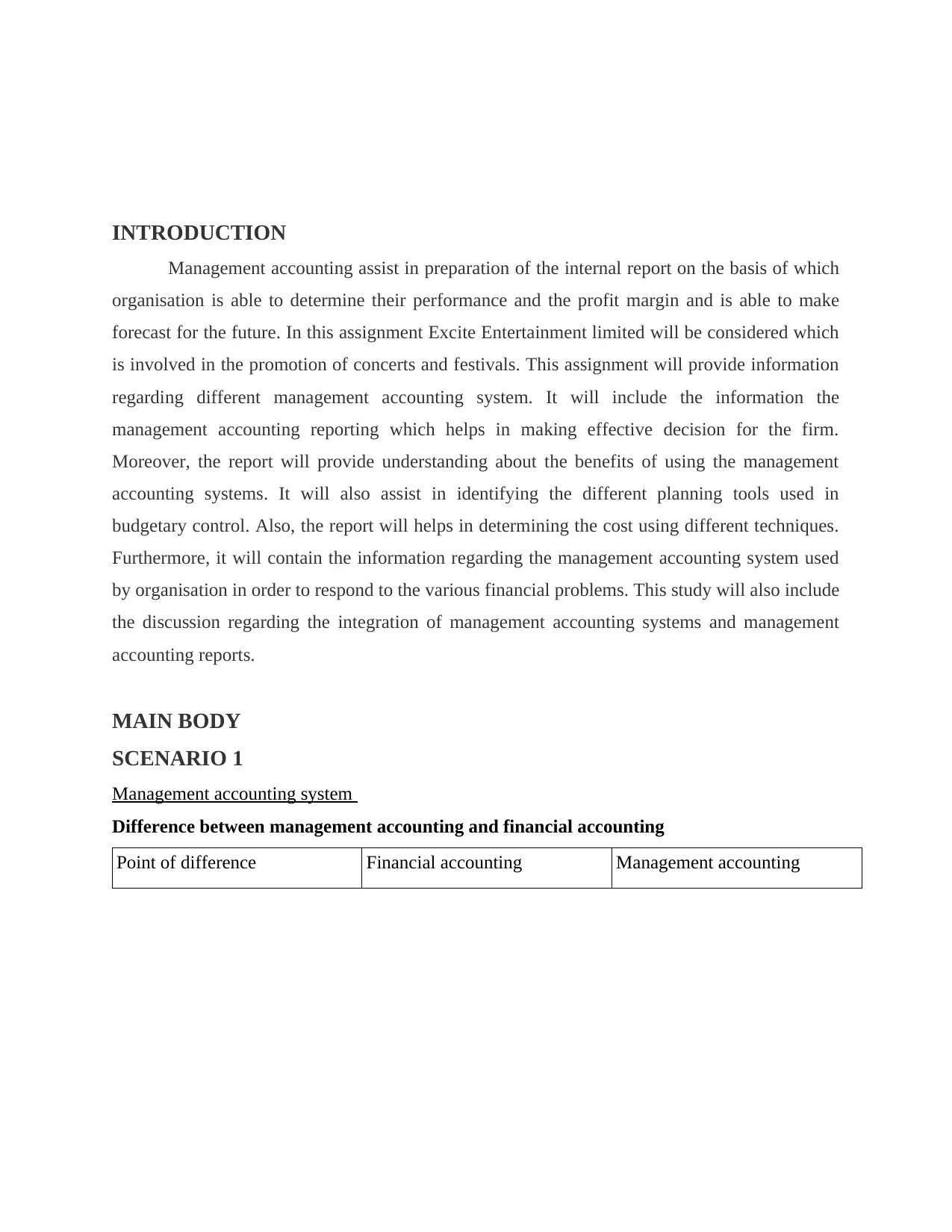

Difference between management accounting and financial accounting

Point of difference Financial accounting Management accounting

Management accounting assist in preparation of the internal report on the basis of which

organisation is able to determine their performance and the profit margin and is able to make

forecast for the future. In this assignment Excite Entertainment limited will be considered which

is involved in the promotion of concerts and festivals. This assignment will provide information

regarding different management accounting system. It will include the information the

management accounting reporting which helps in making effective decision for the firm.

Moreover, the report will provide understanding about the benefits of using the management

accounting systems. It will also assist in identifying the different planning tools used in

budgetary control. Also, the report will helps in determining the cost using different techniques.

Furthermore, it will contain the information regarding the management accounting system used

by organisation in order to respond to the various financial problems. This study will also include

the discussion regarding the integration of management accounting systems and management

accounting reports.

MAIN BODY

SCENARIO 1

Management accounting system

Difference between management accounting and financial accounting

Point of difference Financial accounting Management accounting

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Meaning It is process of preparing the

financial statement for

identifying the profitability and

performance of the organisation

and to provide the financial

information to the firm (Hopper

and Bui, 2016).

Management accounting is the

system the provide information

to the managers in order to

formulate strategies and make

plans for running the operations

of the business in the effective

and efficient manner.

Compulsion Yes it is compulsory to prepare

the financial reporting

No, it is not compulsory to

prepare the managerial reports

Goal To provide financial

information to the outsiders

To provide management

regarding the information for

planning in order to make the

effective decision for the

organisation (Chenhall and

Moers, 2015).

Users Internal and external Internal

Management accounting systems

The management accounting systems assist in achieving the goals and objective so the

organisation in the effective and efficient manner. There are various management accounting

systems which are implemented by the firm for performing their operation properly and to have

the string internal controls.

Cost accounting systems : It is the systems which is implemented in the organisation in

order to allocate the cost to the products and services. This system of management accounting

assist in controlling the cost which helps in increasing the profitability of the firm and also the

performance of the organisation is improved to a great extent. The cost accounting system helps

in providing the cost information to the management of organisation on the basis of which the

managers are able to make the effective decision regarding the organisation (Quattrone, 2016). It

assist in estimating the cost of product for analysis of the profitability and cost analysis in order

to control the cost. It consist of direct costing and standard costing. direct costing is related to

financial statement for

identifying the profitability and

performance of the organisation

and to provide the financial

information to the firm (Hopper

and Bui, 2016).

Management accounting is the

system the provide information

to the managers in order to

formulate strategies and make

plans for running the operations

of the business in the effective

and efficient manner.

Compulsion Yes it is compulsory to prepare

the financial reporting

No, it is not compulsory to

prepare the managerial reports

Goal To provide financial

information to the outsiders

To provide management

regarding the information for

planning in order to make the

effective decision for the

organisation (Chenhall and

Moers, 2015).

Users Internal and external Internal

Management accounting systems

The management accounting systems assist in achieving the goals and objective so the

organisation in the effective and efficient manner. There are various management accounting

systems which are implemented by the firm for performing their operation properly and to have

the string internal controls.

Cost accounting systems : It is the systems which is implemented in the organisation in

order to allocate the cost to the products and services. This system of management accounting

assist in controlling the cost which helps in increasing the profitability of the firm and also the

performance of the organisation is improved to a great extent. The cost accounting system helps

in providing the cost information to the management of organisation on the basis of which the

managers are able to make the effective decision regarding the organisation (Quattrone, 2016). It

assist in estimating the cost of product for analysis of the profitability and cost analysis in order

to control the cost. It consist of direct costing and standard costing. direct costing is related to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the direct cost associated with the product manufacturing. standard costing uses the ratios in

order to compare the efficient use of labour and materials in order to produce the goods and

services. It is associated with the manufacturing cost of direct material, labour and overhead

expenses (Dekker, 2016). If the actual cost of manufacturing is less or more than standards than

the variance is identified.

Benefits of cost accounting system

It helps in controlling the cost of organisation which assist in increasing the profitability

level of firm.

It provide cost information to the management which is helpful in making effective

decision.

Inventory management systems : It assist in minimizing the wastage of inventory and

helps in controlling the flow of inventory as per the demand in the market. With the

implementation of inventory management system the firm is able to reduce their cost of

maintaining inventory and increases their profitability level (Maas, Schaltegger and Crutzen,

2016). The inventory management system in beneficial and helps in reducing the closing stock

which is left at the end of the period as the firm is able to manage the inventory in the effective

and efficient way by maintaining the level of inventory as pert he demand of customers.

Benefits of inventory management system

It assist in improving the accuracy of inventory in organisation.

It helps in reducing the cost of maintaining inventory.

Job costing system : It helps in accumulating the information about the cost which is

related ton the specific job on the basis of which the organisation is able to identify the profit

associated with each job and determine the level of success and growth in the job it is involved

(Otley, 2016). The job costing system accumulate the cost related to direct material, direct

labour and overhead cost. This system of management accounting is effective because it helps in

providing the information to the management regarding the cost which is involved in completing

each job and profit which is derived by successful completion of the job (Malmi, 2016). The job

costing system is useful for the management as it helps in making the effective decision for the

organisation through which the firm is able to achieve their targeted goals and objectives in the

effective and efficient manner.

Benefits

order to compare the efficient use of labour and materials in order to produce the goods and

services. It is associated with the manufacturing cost of direct material, labour and overhead

expenses (Dekker, 2016). If the actual cost of manufacturing is less or more than standards than

the variance is identified.

Benefits of cost accounting system

It helps in controlling the cost of organisation which assist in increasing the profitability

level of firm.

It provide cost information to the management which is helpful in making effective

decision.

Inventory management systems : It assist in minimizing the wastage of inventory and

helps in controlling the flow of inventory as per the demand in the market. With the

implementation of inventory management system the firm is able to reduce their cost of

maintaining inventory and increases their profitability level (Maas, Schaltegger and Crutzen,

2016). The inventory management system in beneficial and helps in reducing the closing stock

which is left at the end of the period as the firm is able to manage the inventory in the effective

and efficient way by maintaining the level of inventory as pert he demand of customers.

Benefits of inventory management system

It assist in improving the accuracy of inventory in organisation.

It helps in reducing the cost of maintaining inventory.

Job costing system : It helps in accumulating the information about the cost which is

related ton the specific job on the basis of which the organisation is able to identify the profit

associated with each job and determine the level of success and growth in the job it is involved

(Otley, 2016). The job costing system accumulate the cost related to direct material, direct

labour and overhead cost. This system of management accounting is effective because it helps in

providing the information to the management regarding the cost which is involved in completing

each job and profit which is derived by successful completion of the job (Malmi, 2016). The job

costing system is useful for the management as it helps in making the effective decision for the

organisation through which the firm is able to achieve their targeted goals and objectives in the

effective and efficient manner.

Benefits

It assist in determining the cost associated with the specific job.

It help in identifying the job which is most profitable for the business (Bromwich and

Scapens, 2016).

The management accounting system provide cost information to the management which

helps them in making the right decision for the future on the basis of which they are bale to

improve the operational efficiency of the firm.

Integration of management account systems and management accounting reporting

Management accounting reporting and management accounting systems are integrated

because without the help of management accounting systems the management accountants are

not able to prepare the reports for making the decisions (Renz, 2016). The job costing system

assist in preparing the job cot report as it helps in identifying the information related to the

specific job on the basis of which the firm is able to effective decision for the organisation. The

organisation through the help of management accounting system in able to identify the

information regarding organisation operations which are being included in the reports on the

basis of which the firm is able to make the effective decision for improving the future

performance and profitability of the organisation. The cost accounting system helps in

preparation of the reports.

With the help of management accounting system the managers of Excite limited is able

to prepare the management accounting reports which will be helpful for determining the profit

margin and other financial and non financial information regarding the organisation and it

activities which will assist in improving the future performance and profitability if the firm

(Kaplan and Atkinson, 2015). The cost accounting system the Excite entertainment limited is

able to prepare the cost report on the basis of which it is bale to make the forecast for the future

and can reduce the future cost of products and services which will assist in enhancing the

profitability of the firm. Organisation through the use of using the integrated management

accounting accounting system is able to improve the operational efficiency of the firm.

Explaining different methods of the management accounting reporting.

Management Accounting reporting is defined as a process of preparing of internal managerial

reports and accounts by including all the statistical as well as financial information of the

company for a specific period. With the help of this report, the management and its stakeholders

It help in identifying the job which is most profitable for the business (Bromwich and

Scapens, 2016).

The management accounting system provide cost information to the management which

helps them in making the right decision for the future on the basis of which they are bale to

improve the operational efficiency of the firm.

Integration of management account systems and management accounting reporting

Management accounting reporting and management accounting systems are integrated

because without the help of management accounting systems the management accountants are

not able to prepare the reports for making the decisions (Renz, 2016). The job costing system

assist in preparing the job cot report as it helps in identifying the information related to the

specific job on the basis of which the firm is able to effective decision for the organisation. The

organisation through the help of management accounting system in able to identify the

information regarding organisation operations which are being included in the reports on the

basis of which the firm is able to make the effective decision for improving the future

performance and profitability of the organisation. The cost accounting system helps in

preparation of the reports.

With the help of management accounting system the managers of Excite limited is able

to prepare the management accounting reports which will be helpful for determining the profit

margin and other financial and non financial information regarding the organisation and it

activities which will assist in improving the future performance and profitability if the firm

(Kaplan and Atkinson, 2015). The cost accounting system the Excite entertainment limited is

able to prepare the cost report on the basis of which it is bale to make the forecast for the future

and can reduce the future cost of products and services which will assist in enhancing the

profitability of the firm. Organisation through the use of using the integrated management

accounting accounting system is able to improve the operational efficiency of the firm.

Explaining different methods of the management accounting reporting.

Management Accounting reporting is defined as a process of preparing of internal managerial

reports and accounts by including all the statistical as well as financial information of the

company for a specific period. With the help of this report, the management and its stakeholders

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

are able to make decision effectively. This report assist company in measuring the performance

level, formulating plans and business strategies for the betterment of organisation and its

employees as a whole.

Excite Entertainment Ltd with the help of different types of management accounting reports can

improves its performance and make more profit. Following are report types:

1. Budget Report – The term budget is also known as financial plan which assist every

business organization in measuring its performance level. Budgeting is a tool in which

estimates are made related to the amount of future business expenses and revenue from

carrying on business operations. With the help of budget, forecasting is done for a

specific period of time (Cardinaels, Dierynck and Zhang, 2018). With the help of Budget

report, Excite Entertainment Ltd can make estimates about its future business expenses to

be incurred for conducting of business operations or expenses associated with the new

business operations. This report also helps in evaluating the estimated amount of revenue

to be earned form a specific future business operations. With the budget report, Excite

Entertainment Ltd can make comparison between actual outcome and estimation made.

This report helps manager in determining the areas which is incurring more cost expenses

and controlling such cost expenses by eradicating unnecessary business operations.

2. Account Receivable Aging Report – This report is best suited for those business

organization which is relying heavily on the credit basis for conducting of their business

operations. Account Receivable Aging report helps the company in assessing the time

period in which the company will be able to complete its collection process. This report

helps in determining defaulters in case of cash flow process. With the help of this report,

Excite Entertainment Ltd. Can easily evaluate as well as identify the remaining balance

of its clients from whom the amount of money has been due. It also helps the managers in

identifying the issues as well problems faced by Excite Entertainment Ltd related to the

money and cash collection process. This report can provide a detail about defaulters who

are delaying the cash collection process of the company. It is required by Excite Ltd to

formulate a strict credit policies and norms so as to improve its cash flow process and

minimizes the bad debt chances.

3. Performance Report – One of the most important report for every business organization

is the performance report. With the help of this report, company can measure the

level, formulating plans and business strategies for the betterment of organisation and its

employees as a whole.

Excite Entertainment Ltd with the help of different types of management accounting reports can

improves its performance and make more profit. Following are report types:

1. Budget Report – The term budget is also known as financial plan which assist every

business organization in measuring its performance level. Budgeting is a tool in which

estimates are made related to the amount of future business expenses and revenue from

carrying on business operations. With the help of budget, forecasting is done for a

specific period of time (Cardinaels, Dierynck and Zhang, 2018). With the help of Budget

report, Excite Entertainment Ltd can make estimates about its future business expenses to

be incurred for conducting of business operations or expenses associated with the new

business operations. This report also helps in evaluating the estimated amount of revenue

to be earned form a specific future business operations. With the budget report, Excite

Entertainment Ltd can make comparison between actual outcome and estimation made.

This report helps manager in determining the areas which is incurring more cost expenses

and controlling such cost expenses by eradicating unnecessary business operations.

2. Account Receivable Aging Report – This report is best suited for those business

organization which is relying heavily on the credit basis for conducting of their business

operations. Account Receivable Aging report helps the company in assessing the time

period in which the company will be able to complete its collection process. This report

helps in determining defaulters in case of cash flow process. With the help of this report,

Excite Entertainment Ltd. Can easily evaluate as well as identify the remaining balance

of its clients from whom the amount of money has been due. It also helps the managers in

identifying the issues as well problems faced by Excite Entertainment Ltd related to the

money and cash collection process. This report can provide a detail about defaulters who

are delaying the cash collection process of the company. It is required by Excite Ltd to

formulate a strict credit policies and norms so as to improve its cash flow process and

minimizes the bad debt chances.

3. Performance Report – One of the most important report for every business organization

is the performance report. With the help of this report, company can measure the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

performance level of its business as well as of its employees as a whole. This report

provides full detail about the success journey of the business operations as undertaken by

Excite Entertainment Ltd. It helps company in reviewing the performance of the

company as well as of each employee for a particular period of time. This report provides

deep insight about the working of the business and provides measures for improving the

overall performance level of the company (Asay, Libby and Rennekamp, 2018). With

this report, managers of Excite Entertainment Ltd can formulate better and key strategic

plans, decision and strategies about future business operations of the company.

Performance report play important role in every company by keeping track of

performance measure related to all the strategies and plans formed and ensures that

whether these are working towards attainment of business goals or not.

4. Cost Managerial Accounting Report – This report of management accounting provides

details about cost factor associated with the business operations of the company. With the

help of this report, the overall expenses incurred for manufacturing and producing a

product can be ascertained. Cost incurred for undertaking production function is

disclosed in the Cost Managerial Accounting Report. This report provides detail

explanation about cost related to raw material, overhead, labor and other business

operations. In short this report is a summary of cost expenses related to undertaking of

production as well as manufacturing business operations of Excite Entertainment Ltd.

This reports help the manager in realizing the cost prices of units produced in comparison

with its selling prices and thus assist Excite Ltd in determining the profit margin. With

this report, excite can make estimates of all future business expenses and can make

proper allocation of business resources accordingly in a cost effective manner.

SCENARIO 2

Income statement as per marginal costing and absorption costing

Marginal Costing- Marginal cost refers to the increase and decrease in the total cost of

production by adding one more unit in the production. These are the variable costs that contains

labour and material cost which adds up to the total cost to produce one more unit. It is used to

find out the impact of variable cost on the total cost of of product. Marginal costing helps to

provides full detail about the success journey of the business operations as undertaken by

Excite Entertainment Ltd. It helps company in reviewing the performance of the

company as well as of each employee for a particular period of time. This report provides

deep insight about the working of the business and provides measures for improving the

overall performance level of the company (Asay, Libby and Rennekamp, 2018). With

this report, managers of Excite Entertainment Ltd can formulate better and key strategic

plans, decision and strategies about future business operations of the company.

Performance report play important role in every company by keeping track of

performance measure related to all the strategies and plans formed and ensures that

whether these are working towards attainment of business goals or not.

4. Cost Managerial Accounting Report – This report of management accounting provides

details about cost factor associated with the business operations of the company. With the

help of this report, the overall expenses incurred for manufacturing and producing a

product can be ascertained. Cost incurred for undertaking production function is

disclosed in the Cost Managerial Accounting Report. This report provides detail

explanation about cost related to raw material, overhead, labor and other business

operations. In short this report is a summary of cost expenses related to undertaking of

production as well as manufacturing business operations of Excite Entertainment Ltd.

This reports help the manager in realizing the cost prices of units produced in comparison

with its selling prices and thus assist Excite Ltd in determining the profit margin. With

this report, excite can make estimates of all future business expenses and can make

proper allocation of business resources accordingly in a cost effective manner.

SCENARIO 2

Income statement as per marginal costing and absorption costing

Marginal Costing- Marginal cost refers to the increase and decrease in the total cost of

production by adding one more unit in the production. These are the variable costs that contains

labour and material cost which adds up to the total cost to produce one more unit. It is used to

find out the impact of variable cost on the total cost of of product. Marginal costing helps to

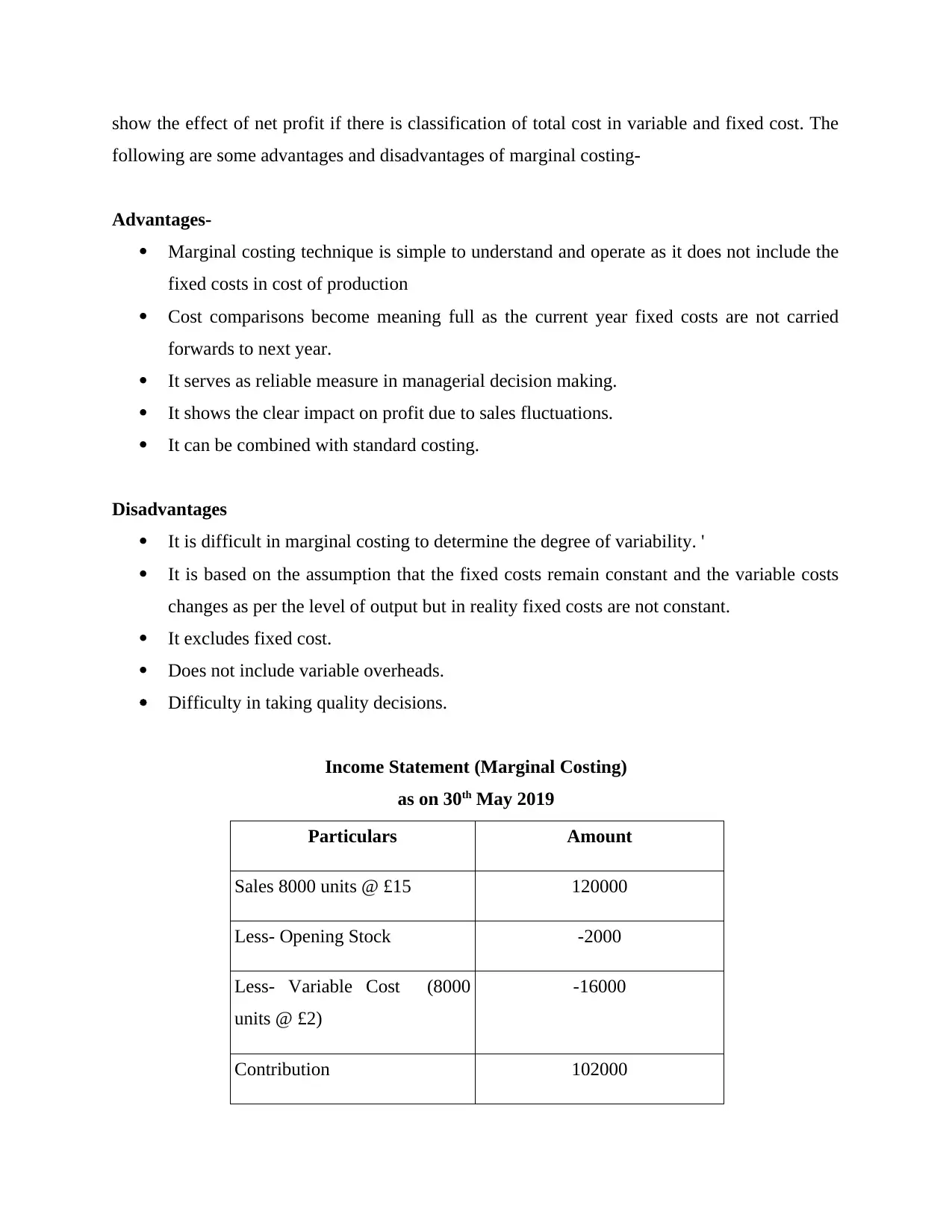

show the effect of net profit if there is classification of total cost in variable and fixed cost. The

following are some advantages and disadvantages of marginal costing-

Advantages-

Marginal costing technique is simple to understand and operate as it does not include the

fixed costs in cost of production

Cost comparisons become meaning full as the current year fixed costs are not carried

forwards to next year.

It serves as reliable measure in managerial decision making.

It shows the clear impact on profit due to sales fluctuations.

It can be combined with standard costing.

Disadvantages

It is difficult in marginal costing to determine the degree of variability. '

It is based on the assumption that the fixed costs remain constant and the variable costs

changes as per the level of output but in reality fixed costs are not constant.

It excludes fixed cost.

Does not include variable overheads.

Difficulty in taking quality decisions.

Income Statement (Marginal Costing)

as on 30th May 2019

Particulars Amount

Sales 8000 units @ £15 120000

Less- Opening Stock -2000

Less- Variable Cost (8000

units @ £2)

-16000

Contribution 102000

following are some advantages and disadvantages of marginal costing-

Advantages-

Marginal costing technique is simple to understand and operate as it does not include the

fixed costs in cost of production

Cost comparisons become meaning full as the current year fixed costs are not carried

forwards to next year.

It serves as reliable measure in managerial decision making.

It shows the clear impact on profit due to sales fluctuations.

It can be combined with standard costing.

Disadvantages

It is difficult in marginal costing to determine the degree of variability. '

It is based on the assumption that the fixed costs remain constant and the variable costs

changes as per the level of output but in reality fixed costs are not constant.

It excludes fixed cost.

Does not include variable overheads.

Difficulty in taking quality decisions.

Income Statement (Marginal Costing)

as on 30th May 2019

Particulars Amount

Sales 8000 units @ £15 120000

Less- Opening Stock -2000

Less- Variable Cost (8000

units @ £2)

-16000

Contribution 102000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Less- Fixed Cost -40000

Profit 62000

Interpretation- From the above income statement it can be observed that the calculation of

contribution does not include the fixed cost of production and is deducted later from the

contribution as it is fixed and is not considered first.

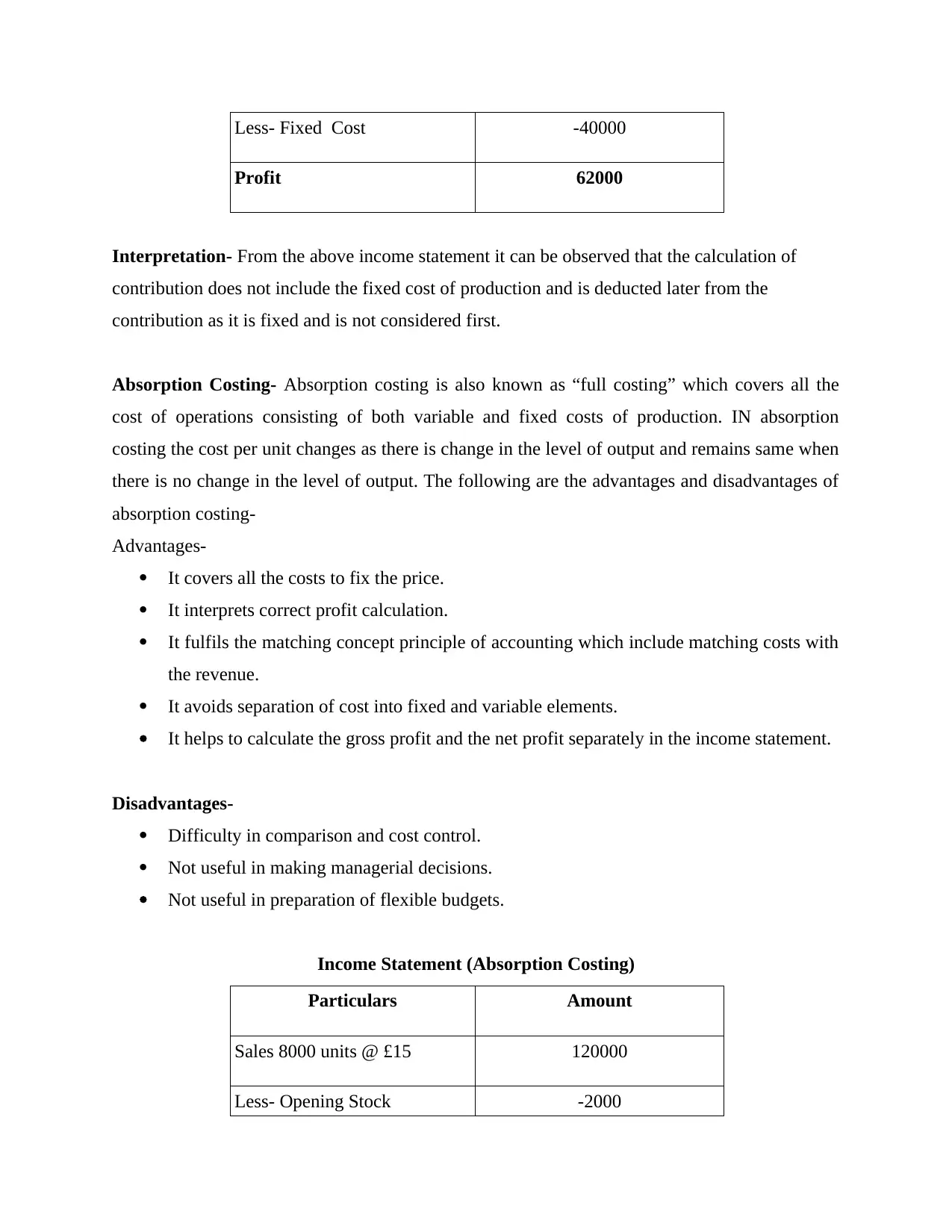

Absorption Costing- Absorption costing is also known as “full costing” which covers all the

cost of operations consisting of both variable and fixed costs of production. IN absorption

costing the cost per unit changes as there is change in the level of output and remains same when

there is no change in the level of output. The following are the advantages and disadvantages of

absorption costing-

Advantages-

It covers all the costs to fix the price.

It interprets correct profit calculation.

It fulfils the matching concept principle of accounting which include matching costs with

the revenue.

It avoids separation of cost into fixed and variable elements.

It helps to calculate the gross profit and the net profit separately in the income statement.

Disadvantages-

Difficulty in comparison and cost control.

Not useful in making managerial decisions.

Not useful in preparation of flexible budgets.

Income Statement (Absorption Costing)

Particulars Amount

Sales 8000 units @ £15 120000

Less- Opening Stock -2000

Profit 62000

Interpretation- From the above income statement it can be observed that the calculation of

contribution does not include the fixed cost of production and is deducted later from the

contribution as it is fixed and is not considered first.

Absorption Costing- Absorption costing is also known as “full costing” which covers all the

cost of operations consisting of both variable and fixed costs of production. IN absorption

costing the cost per unit changes as there is change in the level of output and remains same when

there is no change in the level of output. The following are the advantages and disadvantages of

absorption costing-

Advantages-

It covers all the costs to fix the price.

It interprets correct profit calculation.

It fulfils the matching concept principle of accounting which include matching costs with

the revenue.

It avoids separation of cost into fixed and variable elements.

It helps to calculate the gross profit and the net profit separately in the income statement.

Disadvantages-

Difficulty in comparison and cost control.

Not useful in making managerial decisions.

Not useful in preparation of flexible budgets.

Income Statement (Absorption Costing)

Particulars Amount

Sales 8000 units @ £15 120000

Less- Opening Stock -2000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Less- Variable Cost of

Production 10000 units @ £2

-20000

Less- Fixed Production

Overhead

-40000

Contribution 58000

Profit 58000

Interpretation- From the above income statement of absorption costing it can be observed that

in that the fixed cost of production is included and deducted from the total sales to calculate the

amount of contribution.

SCENARIO 3

Advantage & Disadvantage of Planning Tools used for Budgetary Control

Budget- Budget is a plan made by accountant & manager of a business organisation to

forecast its future financials. With the help of budget a company is able to assess its future

profitability & revenue. Different types of future financial plans are prepared by business to run

each of its business activity in an efficient manner.

Further, Budgetary Control is a technique through which internal managers of an

organisation are able to monitor actual business performance according to future plan and set

new goals accordingly. Managers also make decisions for performance improvement if there is a

difference between actual & budgeted performance. Thus, this play a significant role in

management decision making process.

Different types of budget

Sales Budget- An estimation related to futures sales volume of a company is made

marketing & sales manager of company is known as Sales Budget. With the help of this budget

managers of Excite Entertainment Ltd are able to make decision related to production and make

investment decisions. Further, this budget is prepared on the basis sales volume, price per unit

and discount. Objective behind formation of this Budget is Sales Maximisation which in turn

Production 10000 units @ £2

-20000

Less- Fixed Production

Overhead

-40000

Contribution 58000

Profit 58000

Interpretation- From the above income statement of absorption costing it can be observed that

in that the fixed cost of production is included and deducted from the total sales to calculate the

amount of contribution.

SCENARIO 3

Advantage & Disadvantage of Planning Tools used for Budgetary Control

Budget- Budget is a plan made by accountant & manager of a business organisation to

forecast its future financials. With the help of budget a company is able to assess its future

profitability & revenue. Different types of future financial plans are prepared by business to run

each of its business activity in an efficient manner.

Further, Budgetary Control is a technique through which internal managers of an

organisation are able to monitor actual business performance according to future plan and set

new goals accordingly. Managers also make decisions for performance improvement if there is a

difference between actual & budgeted performance. Thus, this play a significant role in

management decision making process.

Different types of budget

Sales Budget- An estimation related to futures sales volume of a company is made

marketing & sales manager of company is known as Sales Budget. With the help of this budget

managers of Excite Entertainment Ltd are able to make decision related to production and make

investment decisions. Further, this budget is prepared on the basis sales volume, price per unit

and discount. Objective behind formation of this Budget is Sales Maximisation which in turn

helps Excite Limited in increasing its Brand Image & Customer Base(van Helden and Uddin,

2016).

Advantages

Excite Limited is able to allocate its resources and able to utilise its resources in an

effective way with the help of Sales Budget.

All the business activities of company such as marketing, distribution and production can

be improved with the help of future sales estimation. Thus, Excite Limited is able to

achieve its financial target with this budget.

Disadvantages

Sales Estimation is made on the basis of historical trend than sometimes this may give

inappropriate results. This method is costly and take much time.

Cash Flow Budget- A future plan which involve detailed information of future cash

outflow & inflow of a company. Thus, this planning tool benefits Excite Limited in managing its

cash.

Advantages

Cash Budget benefits Excite Limited in determining its income & expenditures and on

that basis managers make decisions related to elimination of unnecessary cost.

Company never face problem of shortage of funds if a appropriate future cash plan is

made.

Disadvantages Various economic factors such as Exchange Rate, Interest Rate and Tax Rate changes

according time to time and that negatively effect Cash Budget of business organisation.

Thus, managers of Excite Limited are required to monitor these economic factors.

Production Budget- Production Budget is prepared by production manager of company

in which estimation related to cost like cost of material, labour and overheads are determined so

manager can manufacture product at a lower cost.

Advantages

Production Budget benefits managers in determining high profit margin by reducing

unnecessary cost involved in production process.

2016).

Advantages

Excite Limited is able to allocate its resources and able to utilise its resources in an

effective way with the help of Sales Budget.

All the business activities of company such as marketing, distribution and production can

be improved with the help of future sales estimation. Thus, Excite Limited is able to

achieve its financial target with this budget.

Disadvantages

Sales Estimation is made on the basis of historical trend than sometimes this may give

inappropriate results. This method is costly and take much time.

Cash Flow Budget- A future plan which involve detailed information of future cash

outflow & inflow of a company. Thus, this planning tool benefits Excite Limited in managing its

cash.

Advantages

Cash Budget benefits Excite Limited in determining its income & expenditures and on

that basis managers make decisions related to elimination of unnecessary cost.

Company never face problem of shortage of funds if a appropriate future cash plan is

made.

Disadvantages Various economic factors such as Exchange Rate, Interest Rate and Tax Rate changes

according time to time and that negatively effect Cash Budget of business organisation.

Thus, managers of Excite Limited are required to monitor these economic factors.

Production Budget- Production Budget is prepared by production manager of company

in which estimation related to cost like cost of material, labour and overheads are determined so

manager can manufacture product at a lower cost.

Advantages

Production Budget benefits managers in determining high profit margin by reducing

unnecessary cost involved in production process.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.