Management Accounting Systems, Costing, and Planning Analysis

VerifiedAdded on 2023/01/18

|19

|6050

|97

Report

AI Summary

This report provides a comprehensive overview of management accounting, focusing on its systems, reporting methods, and application in financial decision-making. It begins by outlining different types of management accounting systems, such as inventory management, cost accounting, and price optimization, and their relevance to organizations like Alpha Ltd. The report then discusses various methods for preparing management accounting reports, including inventory management, accounts receivable, performance, and budget reports. It also examines the benefits and applicability of these systems. Furthermore, the report delves into different costing techniques, including marginal and absorption costing, with practical calculations and examples. Planning tools and their advantages and disadvantages are also analyzed, along with their application in forecasting and budgeting. Finally, the report explores how companies adopt management accounting systems to respond to financial problems and how management accounting leads to sustainable success, emphasizing its role in integrating financial and non-financial information for strategic business decisions.

Management

accounting

accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

Task 1...............................................................................................................................................1

P1 Types of system of management accounting and its application ..........................................1

P2 Different methods to prepare management accounting reports..............................................3

M1 Benefits of system with its applicability ..............................................................................5

Task 2...............................................................................................................................................5

P3 Calculation of cost with different costing techniques ............................................................5

......................................................................................................................................................9

M2 Diverse techniques of management accounting..................................................................10

Task 3.............................................................................................................................................11

P4 Advantage and disadvantages of different planning tools ...................................................11

M3 Use of planning tools and its application for preparing and forecasting ............................12

Task 4 ............................................................................................................................................13

P5 Companies are adopting different management accounting system to respond the financial

problem .....................................................................................................................................13

M4 Management accounting is leading sustainable success.....................................................16

CONCLUSION..............................................................................................................................16

REFERENCE.................................................................................................................................17

INTRODUCTION...........................................................................................................................1

Task 1...............................................................................................................................................1

P1 Types of system of management accounting and its application ..........................................1

P2 Different methods to prepare management accounting reports..............................................3

M1 Benefits of system with its applicability ..............................................................................5

Task 2...............................................................................................................................................5

P3 Calculation of cost with different costing techniques ............................................................5

......................................................................................................................................................9

M2 Diverse techniques of management accounting..................................................................10

Task 3.............................................................................................................................................11

P4 Advantage and disadvantages of different planning tools ...................................................11

M3 Use of planning tools and its application for preparing and forecasting ............................12

Task 4 ............................................................................................................................................13

P5 Companies are adopting different management accounting system to respond the financial

problem .....................................................................................................................................13

M4 Management accounting is leading sustainable success.....................................................16

CONCLUSION..............................................................................................................................16

REFERENCE.................................................................................................................................17

INTRODUCTION

To run a business and making strategic business decision collection of accounts, financial

and non financial information is important which is possible only management accounting. A

profession of integrating the financial and non financial statement in order to get useful

information is consider as management accounting. Different types of principles and rules are

involved in to prepare the income statement and financial statement. Therefore, accountant is

playing major role in organisation who collects the information and allocate them properly which

helps to make right business decision (Bol, Kramer and Maas, 2016). Scope of management

accounting is wider which contain all accounting information related to particular organisation.

To understand about management accounting Alpha Ltd has been selected that is manufacturing

company. This is medium size organisation where number of employees are 50. This

organisation was started of small Pizza company in growing continuously. This project report is

signify in to several topics such as what is management accounting and its essentialism,

calculation of cost by using appropriate technique, planning tools to control budget with their

advantages and disadvantages, budget reports and application of management accounting system

in order to respond finance related problems etc.

Task 1

P1 Types of system of management accounting and its application

Management accounting contains financial and non financial information that is used to

make right business decision. This provide relevant data and information to business operation

which increases organisational productivity. For any business, management accounting is

important which helps to perform all function such as planning, organising, controlling and

decision making in order attain the organisational objectives. The main aim of business is use

proper resources and select an appropriate option to make the decisions. For instance, Alpha Ltd

is using management accounting by collecting, analysing and monitoring the financial

information. This is consider as systematic analysis of financial and business data which helps to

solve the problems and maintain the profits (Senftlechner and Hiebl, 2015).

Difference between management accounting and financial accounting

Basis Management accounting Financial accounting

To run a business and making strategic business decision collection of accounts, financial

and non financial information is important which is possible only management accounting. A

profession of integrating the financial and non financial statement in order to get useful

information is consider as management accounting. Different types of principles and rules are

involved in to prepare the income statement and financial statement. Therefore, accountant is

playing major role in organisation who collects the information and allocate them properly which

helps to make right business decision (Bol, Kramer and Maas, 2016). Scope of management

accounting is wider which contain all accounting information related to particular organisation.

To understand about management accounting Alpha Ltd has been selected that is manufacturing

company. This is medium size organisation where number of employees are 50. This

organisation was started of small Pizza company in growing continuously. This project report is

signify in to several topics such as what is management accounting and its essentialism,

calculation of cost by using appropriate technique, planning tools to control budget with their

advantages and disadvantages, budget reports and application of management accounting system

in order to respond finance related problems etc.

Task 1

P1 Types of system of management accounting and its application

Management accounting contains financial and non financial information that is used to

make right business decision. This provide relevant data and information to business operation

which increases organisational productivity. For any business, management accounting is

important which helps to perform all function such as planning, organising, controlling and

decision making in order attain the organisational objectives. The main aim of business is use

proper resources and select an appropriate option to make the decisions. For instance, Alpha Ltd

is using management accounting by collecting, analysing and monitoring the financial

information. This is consider as systematic analysis of financial and business data which helps to

solve the problems and maintain the profits (Senftlechner and Hiebl, 2015).

Difference between management accounting and financial accounting

Basis Management accounting Financial accounting

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

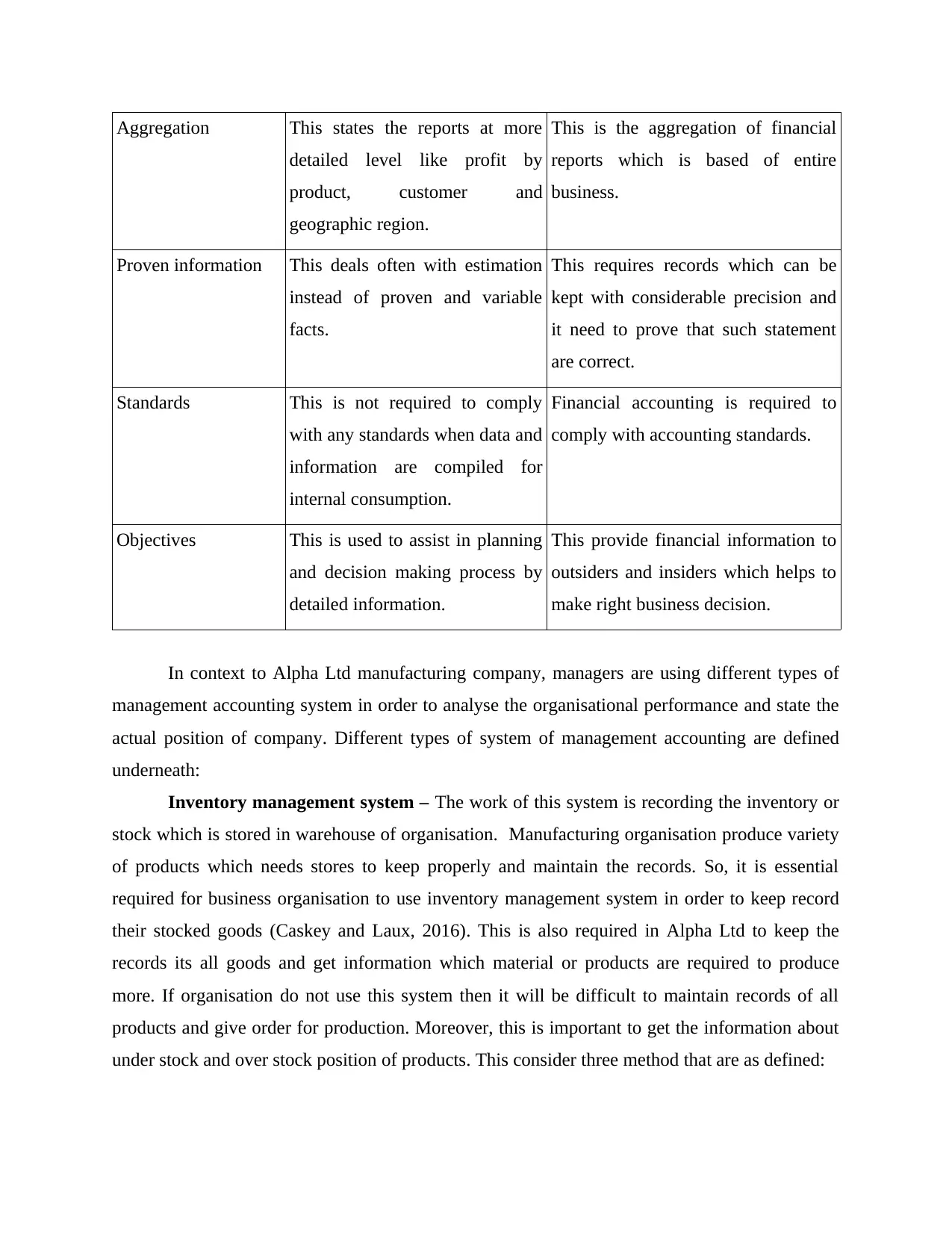

Aggregation This states the reports at more

detailed level like profit by

product, customer and

geographic region.

This is the aggregation of financial

reports which is based of entire

business.

Proven information This deals often with estimation

instead of proven and variable

facts.

This requires records which can be

kept with considerable precision and

it need to prove that such statement

are correct.

Standards This is not required to comply

with any standards when data and

information are compiled for

internal consumption.

Financial accounting is required to

comply with accounting standards.

Objectives This is used to assist in planning

and decision making process by

detailed information.

This provide financial information to

outsiders and insiders which helps to

make right business decision.

In context to Alpha Ltd manufacturing company, managers are using different types of

management accounting system in order to analyse the organisational performance and state the

actual position of company. Different types of system of management accounting are defined

underneath:

Inventory management system – The work of this system is recording the inventory or

stock which is stored in warehouse of organisation. Manufacturing organisation produce variety

of products which needs stores to keep properly and maintain the records. So, it is essential

required for business organisation to use inventory management system in order to keep record

their stocked goods (Caskey and Laux, 2016). This is also required in Alpha Ltd to keep the

records its all goods and get information which material or products are required to produce

more. If organisation do not use this system then it will be difficult to maintain records of all

products and give order for production. Moreover, this is important to get the information about

under stock and over stock position of products. This consider three method that are as defined:

detailed level like profit by

product, customer and

geographic region.

This is the aggregation of financial

reports which is based of entire

business.

Proven information This deals often with estimation

instead of proven and variable

facts.

This requires records which can be

kept with considerable precision and

it need to prove that such statement

are correct.

Standards This is not required to comply

with any standards when data and

information are compiled for

internal consumption.

Financial accounting is required to

comply with accounting standards.

Objectives This is used to assist in planning

and decision making process by

detailed information.

This provide financial information to

outsiders and insiders which helps to

make right business decision.

In context to Alpha Ltd manufacturing company, managers are using different types of

management accounting system in order to analyse the organisational performance and state the

actual position of company. Different types of system of management accounting are defined

underneath:

Inventory management system – The work of this system is recording the inventory or

stock which is stored in warehouse of organisation. Manufacturing organisation produce variety

of products which needs stores to keep properly and maintain the records. So, it is essential

required for business organisation to use inventory management system in order to keep record

their stocked goods (Caskey and Laux, 2016). This is also required in Alpha Ltd to keep the

records its all goods and get information which material or products are required to produce

more. If organisation do not use this system then it will be difficult to maintain records of all

products and give order for production. Moreover, this is important to get the information about

under stock and over stock position of products. This consider three method that are as defined:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

LIFO: Last in first out states that recently products added to organisation's inventory

should be sold first.

FIFO: First in first out states that first goods or products purchased are first one should

be remover from inventory or sold first.

Average: This method is used to sale the products on the basis of total cost of goods

purchased or produced.

Cost accounting system – When ever organisation is going to produce something and

running its business by providing products it need to manage the cost which helps to make the

profits. It is used to estimate the accurate cost of products which states which is profitable or not.

This is required to examine the cost of related products and operations in order to make

profitability. This is helps to eliminate the unnecessary cost which is identify by managers. This

is also required for in Alpha Ltd as manager used this to know the actual expenditure of Pizza

and other products. Moreover, it manage all expenditure by eliminating the unnecessary cost of

products. So, organisation should use cost accounting system in order to get appropriate cost of

operations (Dillard, Yuthas and Baudot, 2016).

Price optimisation system – This is also known as numerical assessment which is using

by business company in different sectors for the purpose of determining how a customer reacts

for setting the prices of products. As prices of products and services are set by managers by

considering all cost and expenditure to manufacture and carry out. In other words, price is the

sensitive factor that encourages people to purchase products and services. This is essential

required for Alpha Ltd to set the prices of its products which is suitable for customers and

organisation. By using this system organisation can attain the profits and goals effectively.

P2 Different methods to prepare management accounting reports

Reports are the written format which is prepared by managers by using its skills and

accounting knowledge in order to make profits and strategic decision. This is important for

business organisation to understand the information and make accounting reports. Reports are

used to maintain the records of all cash and non cash transaction and then converted in to useful

information to make the profits. Presentation of reports are represented in to statistics, facts, and

other information in business industry (Maas, Schaltegger and Crutzen, 2016). The management

of Alpha Ltd are preparing accounting reports in order to analyse the performance and make

should be sold first.

FIFO: First in first out states that first goods or products purchased are first one should

be remover from inventory or sold first.

Average: This method is used to sale the products on the basis of total cost of goods

purchased or produced.

Cost accounting system – When ever organisation is going to produce something and

running its business by providing products it need to manage the cost which helps to make the

profits. It is used to estimate the accurate cost of products which states which is profitable or not.

This is required to examine the cost of related products and operations in order to make

profitability. This is helps to eliminate the unnecessary cost which is identify by managers. This

is also required for in Alpha Ltd as manager used this to know the actual expenditure of Pizza

and other products. Moreover, it manage all expenditure by eliminating the unnecessary cost of

products. So, organisation should use cost accounting system in order to get appropriate cost of

operations (Dillard, Yuthas and Baudot, 2016).

Price optimisation system – This is also known as numerical assessment which is using

by business company in different sectors for the purpose of determining how a customer reacts

for setting the prices of products. As prices of products and services are set by managers by

considering all cost and expenditure to manufacture and carry out. In other words, price is the

sensitive factor that encourages people to purchase products and services. This is essential

required for Alpha Ltd to set the prices of its products which is suitable for customers and

organisation. By using this system organisation can attain the profits and goals effectively.

P2 Different methods to prepare management accounting reports

Reports are the written format which is prepared by managers by using its skills and

accounting knowledge in order to make profits and strategic decision. This is important for

business organisation to understand the information and make accounting reports. Reports are

used to maintain the records of all cash and non cash transaction and then converted in to useful

information to make the profits. Presentation of reports are represented in to statistics, facts, and

other information in business industry (Maas, Schaltegger and Crutzen, 2016). The management

of Alpha Ltd are preparing accounting reports in order to analyse the performance and make

improvement accordingly. Description of different types of management accounting reports are

as defined:

Inventory management reports – This is consider as a report which is used to to keep

record of information about inventory and finished goods is contain in to inventory management

report. This is important for business organisation to manage the stock and get information how

much stock they are having in hand or in warehouse. It helps to keep the proper information

about raw material and finished goods and give order to produce products accordingly. For

instance, Alpha Ltd is manufacturing organisation that uses inventory management system to

keep records of all material and optimise it properly which helps to make the profits.

Account receivable report – All businesses are depend on credit, which is given by

them to its regular customers in order to increase the sale and profitability. To run a business

successfully credit is also important which helps to retain the existing customers and adds new

one. Some time organisation forget to get payment and received less amount than given which

reduced the productivity and profitability. Therefore, this report is required for all organisation to

keep records of unpaid customers and make profits. In context to Alpha Ltd, managers prepare

account receivable report to get credit payment from unpaid customers. Credit is allows to

customers for 30 days, 60 days and 90 days under credit policy which helps to receive the

payment at maturity period (Brief, 2018).

Performance report – This kind of report is prepared to review the whole performance

of company and each employees who are working. Employees are engage in all business

activities which helps to increase the production and profitability. This report is required to

awarding the employees by analysing their performance. If employees are performing well then

organisation should motivate them by giving awards and performance appraisals in front of all

that make employees happy. In context to Alpha Ltd, managers are preparing this report for the

purpose of giving rewards to employees for well performance and commitment to complete the

target. Therefore, this report is using by organisation to motivate employees and work

effectively for long period of time.

Budget report – This reports is used to keep records of business activity's results and

cost. Budget is prepared by management by analysing all information and data efficaciously.

This report is used to set the budget and increase organisational productivity and profitability.

This states the financial success of any business which is running by organisation. This is

as defined:

Inventory management reports – This is consider as a report which is used to to keep

record of information about inventory and finished goods is contain in to inventory management

report. This is important for business organisation to manage the stock and get information how

much stock they are having in hand or in warehouse. It helps to keep the proper information

about raw material and finished goods and give order to produce products accordingly. For

instance, Alpha Ltd is manufacturing organisation that uses inventory management system to

keep records of all material and optimise it properly which helps to make the profits.

Account receivable report – All businesses are depend on credit, which is given by

them to its regular customers in order to increase the sale and profitability. To run a business

successfully credit is also important which helps to retain the existing customers and adds new

one. Some time organisation forget to get payment and received less amount than given which

reduced the productivity and profitability. Therefore, this report is required for all organisation to

keep records of unpaid customers and make profits. In context to Alpha Ltd, managers prepare

account receivable report to get credit payment from unpaid customers. Credit is allows to

customers for 30 days, 60 days and 90 days under credit policy which helps to receive the

payment at maturity period (Brief, 2018).

Performance report – This kind of report is prepared to review the whole performance

of company and each employees who are working. Employees are engage in all business

activities which helps to increase the production and profitability. This report is required to

awarding the employees by analysing their performance. If employees are performing well then

organisation should motivate them by giving awards and performance appraisals in front of all

that make employees happy. In context to Alpha Ltd, managers are preparing this report for the

purpose of giving rewards to employees for well performance and commitment to complete the

target. Therefore, this report is using by organisation to motivate employees and work

effectively for long period of time.

Budget report – This reports is used to keep records of business activity's results and

cost. Budget is prepared by management by analysing all information and data efficaciously.

This report is used to set the budget and increase organisational productivity and profitability.

This states the financial success of any business which is running by organisation. This is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

consider as internal report which is used by organisation by comparing the project with other

project. In context to Alpha Ltd, manager prepare estimated budget for constructing and

comparing with actual results which helps to make profits (Efferin and Hartono, 2015).

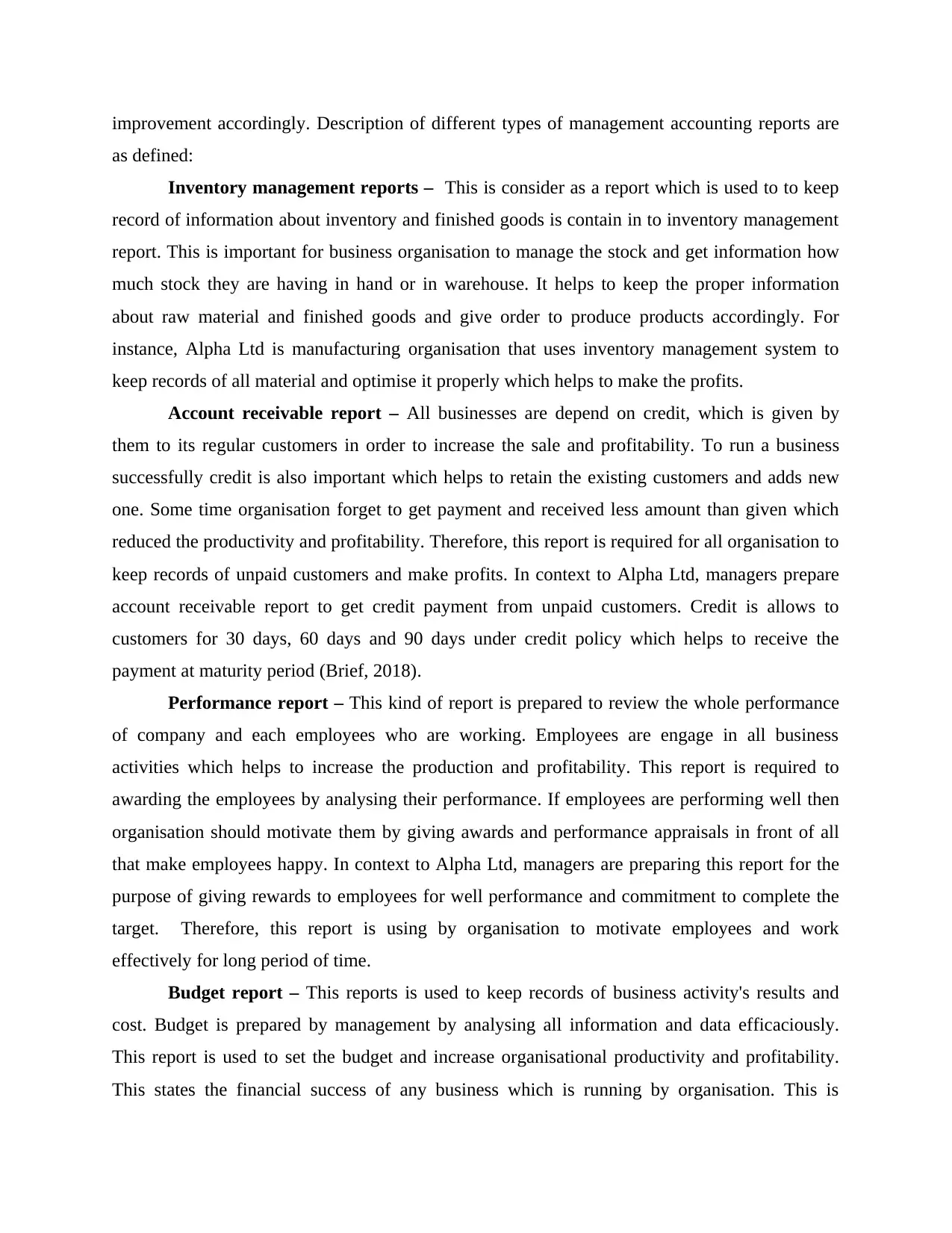

M1 Benefits of system with its applicability

The benefits of management accounting system for organisation that is defined as:

System Benefits and application

Cost accounting system This system is beneficial for organisation to get the accurate cost of

products and services. By application of cost accounting Alpha Ltd

can get accurate cost of its products which are manufacturing by

them. Moreover, it helps to improve the cost which make profits.

Inventory management

system

This is beneficial to track the inventory and get information about

under stock and over stock material. Alpha Ltd uses this system to

get the benefit of maintaining inventory which save time and cost

also (Esmeray, 2016).

Price optimisation system This system give benefits of setting the price of products and

services which are manufactured by organisation and make profits.

Alpha Ltd is using this system to set the prices of their products

which make profits by selling them effectively.

Task 2

P3 Calculation of cost with different costing techniques

Cost – This is consider as consideration which is taken by seller from its buyers by

selling the products and services. This is determined by managers which helps to cover all

expenses which incurred within organisation. In other words, cost is required to pay the amount

for particular product and services which are provided by business (Chiarini and Vagnoni, 2015).

Marginal costing system: This is a system which determine the cost of additional units,

manufactured in accounting period. In this system variable cost of units are charged to cost units

and fixed cost by written off in against the contribution. By using this Alpha Ltd can get the

additional cost of making pizza.

project. In context to Alpha Ltd, manager prepare estimated budget for constructing and

comparing with actual results which helps to make profits (Efferin and Hartono, 2015).

M1 Benefits of system with its applicability

The benefits of management accounting system for organisation that is defined as:

System Benefits and application

Cost accounting system This system is beneficial for organisation to get the accurate cost of

products and services. By application of cost accounting Alpha Ltd

can get accurate cost of its products which are manufacturing by

them. Moreover, it helps to improve the cost which make profits.

Inventory management

system

This is beneficial to track the inventory and get information about

under stock and over stock material. Alpha Ltd uses this system to

get the benefit of maintaining inventory which save time and cost

also (Esmeray, 2016).

Price optimisation system This system give benefits of setting the price of products and

services which are manufactured by organisation and make profits.

Alpha Ltd is using this system to set the prices of their products

which make profits by selling them effectively.

Task 2

P3 Calculation of cost with different costing techniques

Cost – This is consider as consideration which is taken by seller from its buyers by

selling the products and services. This is determined by managers which helps to cover all

expenses which incurred within organisation. In other words, cost is required to pay the amount

for particular product and services which are provided by business (Chiarini and Vagnoni, 2015).

Marginal costing system: This is a system which determine the cost of additional units,

manufactured in accounting period. In this system variable cost of units are charged to cost units

and fixed cost by written off in against the contribution. By using this Alpha Ltd can get the

additional cost of making pizza.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Problem 1 (1):

Cost card:

Income Statement:

Working Notes:

Absorption costing: This method is used to accumulate the cost which is related to

production process and apportioning them in to individual products. It absorb all cost of

organisation which helps to make the profits accordingly. Alpha Ltd is using this system to

calculate the accurate cost of its products which is manufacture by organisation.

Problem 1 (2):

Cost card:

(Provided in Excel)

Working Notes:

(Provided in Excel)

Problem 2/ 1 (a)

(Provided in Excel)

Problem 2/ 1 (b)

(Provided in Excel)

Problem 2/ 2 (a)

(Provided in Excel)

Problem 2/ 2 (b)

(Provided in Excel)

M2 Diverse techniques of management accounting

To get the actual and appropriate profits there are different technique which is sued by

business organisation to make profits. Marginal costing is a technique which is used in

calculation of profits with the help of financial report. Absorption costing technique is to used by

business organisation to get the appropriate profits by making reports and financial statement.

Cost card:

Income Statement:

Working Notes:

Absorption costing: This method is used to accumulate the cost which is related to

production process and apportioning them in to individual products. It absorb all cost of

organisation which helps to make the profits accordingly. Alpha Ltd is using this system to

calculate the accurate cost of its products which is manufacture by organisation.

Problem 1 (2):

Cost card:

(Provided in Excel)

Working Notes:

(Provided in Excel)

Problem 2/ 1 (a)

(Provided in Excel)

Problem 2/ 1 (b)

(Provided in Excel)

Problem 2/ 2 (a)

(Provided in Excel)

Problem 2/ 2 (b)

(Provided in Excel)

M2 Diverse techniques of management accounting

To get the actual and appropriate profits there are different technique which is sued by

business organisation to make profits. Marginal costing is a technique which is used in

calculation of profits with the help of financial report. Absorption costing technique is to used by

business organisation to get the appropriate profits by making reports and financial statement.

Alpha Ltd is using both techniques to know the profits and loss in their organisation by using

appropriate and relevant technique. This helps to evaluate the income and expenditure of

business organisation and make profits accordingly (Friis, Hansen and Vámosi, 2015).

Financial reports that apply accurately and interpretation of data

Financial report are those report which is prepared by managers in order to know the

financial position of company. This states that how much organisation is earning profits and

which method is best to get higher productivity. It is important for businesses to know their

financial status by formulating the income statement and cash flow statement. Alpha Ltd that is

manufacturing organisation prepare financial report by evaluating all income and expenses of

business and take decision according. This is used to control the over expenses with the help of

proper management. This helps to make the profits for long period of time with the help of

marginal and absorption costing system. In above calculation it has been interpreted that Alpha

Ltd is getting profits higher with the help of absorption costing technique.

Task 3

P4 Advantage and disadvantages of different planning tools

Operational Budgetary Control: It is a process of planning and controlling about

functions of organisation through comparing actual results with the standard results. This also

covers the revenue and operating expenses which are required to run day to day activities.

Further it helps in achieving control over earning before interest taxes depreciation and

amortization. Similarity Alpha limited maintain the records of comparison between the actual

output versus standard output to see how daily working are preformed in the organisation. To

perform daily activities smoothly, management prepare this operational budget to control the

efficiency of the employees and motivate them to achieve the pre-determine results. It is a

process of planning and controlling about functions of organisation through comparing actual

results with the standard results.

Forecasting analysis: It is a technique which uses historic data to inter predicts the

future trends. The management uses such forecasting to determine how to allocate their expenses

over particular time.

Variance analysis: Under this, actual variance are compared to standard variance so that

cost can be control efficiently. This also provide management with the reason for difference in

appropriate and relevant technique. This helps to evaluate the income and expenditure of

business organisation and make profits accordingly (Friis, Hansen and Vámosi, 2015).

Financial reports that apply accurately and interpretation of data

Financial report are those report which is prepared by managers in order to know the

financial position of company. This states that how much organisation is earning profits and

which method is best to get higher productivity. It is important for businesses to know their

financial status by formulating the income statement and cash flow statement. Alpha Ltd that is

manufacturing organisation prepare financial report by evaluating all income and expenses of

business and take decision according. This is used to control the over expenses with the help of

proper management. This helps to make the profits for long period of time with the help of

marginal and absorption costing system. In above calculation it has been interpreted that Alpha

Ltd is getting profits higher with the help of absorption costing technique.

Task 3

P4 Advantage and disadvantages of different planning tools

Operational Budgetary Control: It is a process of planning and controlling about

functions of organisation through comparing actual results with the standard results. This also

covers the revenue and operating expenses which are required to run day to day activities.

Further it helps in achieving control over earning before interest taxes depreciation and

amortization. Similarity Alpha limited maintain the records of comparison between the actual

output versus standard output to see how daily working are preformed in the organisation. To

perform daily activities smoothly, management prepare this operational budget to control the

efficiency of the employees and motivate them to achieve the pre-determine results. It is a

process of planning and controlling about functions of organisation through comparing actual

results with the standard results.

Forecasting analysis: It is a technique which uses historic data to inter predicts the

future trends. The management uses such forecasting to determine how to allocate their expenses

over particular time.

Variance analysis: Under this, actual variance are compared to standard variance so that

cost can be control efficiently. This also provide management with the reason for difference in

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

outcome. Likewise, Alpha limited prepare such analysis to see how outcomes are treated and

how they arises in the management

Standard costing: IT is accounting system to see the difference between actual cost of

production and actual cost incurred to produce such product and serves. Similarly Alpha limited

use stranded costing to revalued the differs in the production.

Flexible budgets: These budget keeps changed due to changes in volume or in activity.

Likewise Alpha limited uses flexible budget to maintain frequent changes in the activities from

time to time (Askarany, 2015).

Advantages:

Control and coordination: It helps management to control each functions and

coordination between different departments for a organisation to performance properly.

Management responsibility : It provide manager to clearly define the responsibility of

each employees to that work can be completed on time.

Disadvantages:

Based on estimates: The budget are prepared on forecast and on estimates bases, so

absolute is not possible in budgets.

Rigidity: The budget are not flexible because of the dynamic and constant change in

business condition.

Capital budgeting: It is a process of forming capital structure of the firms, to evaluate

which projects will provide good investment for the firms in the long term. To maintain the

lower levels of cash outflows in the firms , capital budget is prepared. Similarly Alpha limited

make use of this budget to examine which investment should be chosen to gain profits in long

run.

Net present value( NPV): It is value which is the difference between net present

outflow and net present value of cash inflows. If the difference is positive then that project is

selected by the manager.

Annual rate of return( ARR): It is rate where investment are evaluated on annual rate

on its cash inflows and average investment period.

Internal rate of return(IRR): It is rate which equal the zero when it is evolved for the

rate NPV is equal to its IRR .

Advantages:

how they arises in the management

Standard costing: IT is accounting system to see the difference between actual cost of

production and actual cost incurred to produce such product and serves. Similarly Alpha limited

use stranded costing to revalued the differs in the production.

Flexible budgets: These budget keeps changed due to changes in volume or in activity.

Likewise Alpha limited uses flexible budget to maintain frequent changes in the activities from

time to time (Askarany, 2015).

Advantages:

Control and coordination: It helps management to control each functions and

coordination between different departments for a organisation to performance properly.

Management responsibility : It provide manager to clearly define the responsibility of

each employees to that work can be completed on time.

Disadvantages:

Based on estimates: The budget are prepared on forecast and on estimates bases, so

absolute is not possible in budgets.

Rigidity: The budget are not flexible because of the dynamic and constant change in

business condition.

Capital budgeting: It is a process of forming capital structure of the firms, to evaluate

which projects will provide good investment for the firms in the long term. To maintain the

lower levels of cash outflows in the firms , capital budget is prepared. Similarly Alpha limited

make use of this budget to examine which investment should be chosen to gain profits in long

run.

Net present value( NPV): It is value which is the difference between net present

outflow and net present value of cash inflows. If the difference is positive then that project is

selected by the manager.

Annual rate of return( ARR): It is rate where investment are evaluated on annual rate

on its cash inflows and average investment period.

Internal rate of return(IRR): It is rate which equal the zero when it is evolved for the

rate NPV is equal to its IRR .

Advantages:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It helps in understanding risks and its effects, this helps management to prevent from

unwanted risks in the investment.

It helps in making sound business decision in the investment opportunities.

Disadvantages:

sometimes uncertainly lead to unprofitable investment chosen by the management.

Management uses various technique which are assumed on certain assumption.

M3 Use of planning tools and its application for preparing and forecasting

Planning tools are uses by business industry to control its budget appropriately. By using

this future plans are set by management which helps to make profits. This mainly used in

budgeting and forecasting which states how much organisation is earning profits. Financial plans

are prepared by using standard costing, variance analysis and flexible budget which helps to

make the future plans. Moreover, different type of capital budgeting technique are used by

business organisation such as NPV, ARR and IRR which states return on expenses. For instance,

Alpha Ltd is using planning tools to set the future goals and attaining them in short period of

time. Main motive behind using planning tools is increase the production and profitability by

attaining the future goals and objectives. So, planning tools are important for business

organisation which helps to control over cost and making profits (Dekker, 2016).

Task 4

P5 Companies are adopting different management accounting system to respond the financial

problem

Financial problems are those problem which can arise any time at any place whether

running a business and in personal life which affected the operation negatively. To run a business

successfully it is important for business organisation to understand the problem and get a proper

solution of such problems. There are different financial problems which is facing by Alpha Ltd

while running a business due to lack of finance and loosing money. To get the profits and

solution of financial problem is important which is only possible through managing the funds

and cash within organisation (Leitner and Wall, 2015). Description of different types of financial

problems are as discussed:

Expenses are more than incomes – This is defined as organisation are having many

expenses which occurred at the time of running a business. This refers as organisation expenses

unwanted risks in the investment.

It helps in making sound business decision in the investment opportunities.

Disadvantages:

sometimes uncertainly lead to unprofitable investment chosen by the management.

Management uses various technique which are assumed on certain assumption.

M3 Use of planning tools and its application for preparing and forecasting

Planning tools are uses by business industry to control its budget appropriately. By using

this future plans are set by management which helps to make profits. This mainly used in

budgeting and forecasting which states how much organisation is earning profits. Financial plans

are prepared by using standard costing, variance analysis and flexible budget which helps to

make the future plans. Moreover, different type of capital budgeting technique are used by

business organisation such as NPV, ARR and IRR which states return on expenses. For instance,

Alpha Ltd is using planning tools to set the future goals and attaining them in short period of

time. Main motive behind using planning tools is increase the production and profitability by

attaining the future goals and objectives. So, planning tools are important for business

organisation which helps to control over cost and making profits (Dekker, 2016).

Task 4

P5 Companies are adopting different management accounting system to respond the financial

problem

Financial problems are those problem which can arise any time at any place whether

running a business and in personal life which affected the operation negatively. To run a business

successfully it is important for business organisation to understand the problem and get a proper

solution of such problems. There are different financial problems which is facing by Alpha Ltd

while running a business due to lack of finance and loosing money. To get the profits and

solution of financial problem is important which is only possible through managing the funds

and cash within organisation (Leitner and Wall, 2015). Description of different types of financial

problems are as discussed:

Expenses are more than incomes – This is defined as organisation are having many

expenses which occurred at the time of running a business. This refers as organisation expenses

more amount on business activities and performance which are unnecessary and increases

organisation cost and revenues are less that creates financial problems. Managers of business

organisation needed to focus on their expenses and make efforts to control them. For instance,

Alpha Ltd is spending money on purchasing raw material and decorating the infrastructure which

increases organisational cost, due to financial problem if facing by business organisation

(Richardson, 2015).

Unmatch cash flow statement – Cash flow is prepared by all organisation to know the

profits and all activities of business industry. When all activities of cash flow statement with

each one then financial problem arises within organisation (Ghasemi and et. al., 2016).

Moreover, financial problem due to unmatch cash flow states that there is a gap between

activities which are creating the financial issues within organisation. For instance, Alpha Ltd is

preparing cash flow statement by involving all activities but such organisation is facing the

financial problem due to not matching all activities which is financial problem for organisation.

Unforeseen expenses – This means in business organisation there are different types of

expenses which origin suddenly which are requited to fill them by using monetary resources

properly. This increases the financial problem at the time of running business. For instance,

Alpha Ltd is require to repair its machine and other equipment, stationary and other expenses

which is important to fill that creates problems in organisation (Gimbar, Hansen and Ozlanski,

2016).

Different techniques to used the financial problems

Benchmarking – This technique is used to get solution of financial problem which are

facing by business organisation in operations. The main use of benchmarking is comparison with

other business organisation and make decision accordingly. For instance, Alpha Ltd is

manufacturing organisation that has realised that the profit margin of business organisation is

reducing on continual basis. It is facing more expenses and low income financial problem which

is identified by managers. This technique helps Alpha Ltd to find the problem by comparing with

other organisation and measure the actual position of company (Luft, Shields and Thomas,

2016).

KPI – This refers as Key performance indicator that covers two type of performance

indicator such as financial indicator and non financial indicator. It states internal and external

performance of business industry by analysing the information which are based on financial and

organisation cost and revenues are less that creates financial problems. Managers of business

organisation needed to focus on their expenses and make efforts to control them. For instance,

Alpha Ltd is spending money on purchasing raw material and decorating the infrastructure which

increases organisational cost, due to financial problem if facing by business organisation

(Richardson, 2015).

Unmatch cash flow statement – Cash flow is prepared by all organisation to know the

profits and all activities of business industry. When all activities of cash flow statement with

each one then financial problem arises within organisation (Ghasemi and et. al., 2016).

Moreover, financial problem due to unmatch cash flow states that there is a gap between

activities which are creating the financial issues within organisation. For instance, Alpha Ltd is

preparing cash flow statement by involving all activities but such organisation is facing the

financial problem due to not matching all activities which is financial problem for organisation.

Unforeseen expenses – This means in business organisation there are different types of

expenses which origin suddenly which are requited to fill them by using monetary resources

properly. This increases the financial problem at the time of running business. For instance,

Alpha Ltd is require to repair its machine and other equipment, stationary and other expenses

which is important to fill that creates problems in organisation (Gimbar, Hansen and Ozlanski,

2016).

Different techniques to used the financial problems

Benchmarking – This technique is used to get solution of financial problem which are

facing by business organisation in operations. The main use of benchmarking is comparison with

other business organisation and make decision accordingly. For instance, Alpha Ltd is

manufacturing organisation that has realised that the profit margin of business organisation is

reducing on continual basis. It is facing more expenses and low income financial problem which

is identified by managers. This technique helps Alpha Ltd to find the problem by comparing with

other organisation and measure the actual position of company (Luft, Shields and Thomas,

2016).

KPI – This refers as Key performance indicator that covers two type of performance

indicator such as financial indicator and non financial indicator. It states internal and external

performance of business industry by analysing the information which are based on financial and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.