Management Accounting Report: Systems, Techniques and Planning Tools

VerifiedAdded on 2021/02/19

|16

|3806

|32

Report

AI Summary

This report delves into the realm of management accounting, examining its core principles and applications within a construction company, Assael Architecture. It initiates with a definition of management accounting, its systems, and its distinctions from financial accounting. The report then meticulously explores various management accounting systems, including cost accounting, job costing, price optimization, and inventory management, highlighting their significance and practical applications. Furthermore, it elucidates diverse management accounting reporting methods, such as performance reports, accounts receivable aging reports, budget reports, and cost managerial accounting reports. The report also incorporates profit and cost calculations using marginal and absorption costing techniques. Finally, it provides a detailed analysis of different planning tools like budgeting, zero-based budgeting, and incremental budgeting, along with their advantages, disadvantages, and behavioural implications. The report emphasizes how these tools contribute to effective decision-making and operational control within an organization.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Management accounting and it's systems:.............................................................................1

P2: Different methods used for management accounting reporting:...........................................3

TASK 2............................................................................................................................................4

P3 Profit and cost calculation by using appropriate management accounting techniques..........4

TASK 3............................................................................................................................................7

P4 Advantages and disadvantages of various type of planning tools..........................................7

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

...................................................................................................................................................13

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1: Management accounting and it's systems:.............................................................................1

P2: Different methods used for management accounting reporting:...........................................3

TASK 2............................................................................................................................................4

P3 Profit and cost calculation by using appropriate management accounting techniques..........4

TASK 3............................................................................................................................................7

P4 Advantages and disadvantages of various type of planning tools..........................................7

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

...................................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is defined as a process of identifying, measuring, analysing,

interpreting and communicating the information to managers so that they can achieve the targets

of business (Songini, Gnan and Malmi, 2013) It is an application of applying skill and

knowledge in the activities of a business so that it's operations are under control. For this project,

Assael Architecture is chosen which is a construction company in UK. It was established in 1994

and is located in London. This report includes the meaning of management accounting, it's

systems and how it is different from financial accounting.

TASK 1

P1: Management accounting and it's systems:

Management accounting system: It is a systematic process in an organisation where

directors prepare and manage budget reports that are to be presented to the top level

management. This system provides accurate information which helps in conducting different

activities of a business. Management accounting system can be also be defined as a tool used in

planning, organising and providing detailed facts regarding business operations that can help the

managers in effective decision making. It is required by entities to project their goals and

objectives in generating revenue. Assael Architecture ensures that financial security is

maintained in the working of construction contracts with the help of management accounting

systems. Listed below are some of the accounting techniques used in this system:

Cost accounting system: It refers to a system which is used by firms to estimate the cost

associated with products and services that help managers to analyse profits as well as cost

control techniques. They add value by determining measures that can monitor cost of an

organisation such as, fixed, variable, opportunity, incremental etc. This includes two concepts of

job order and process costing. It is required by managers as this helps them in estimating closing

value of raw materials and finished goods for the purpose of preparing accounting records.

Assael Architecture uses cost accounting system to measure the monetary value of different

types of cost like, fixed, variable, direct or indirect etc (Salterio, 2012) .

Job costing system: It is a process which involves collecting information about the cost

related to a product or job. This helps in monitoring and tracking of expenses in an organisation.

To understand the working of this system, it needs to include data related to direct material,

1

Management accounting is defined as a process of identifying, measuring, analysing,

interpreting and communicating the information to managers so that they can achieve the targets

of business (Songini, Gnan and Malmi, 2013) It is an application of applying skill and

knowledge in the activities of a business so that it's operations are under control. For this project,

Assael Architecture is chosen which is a construction company in UK. It was established in 1994

and is located in London. This report includes the meaning of management accounting, it's

systems and how it is different from financial accounting.

TASK 1

P1: Management accounting and it's systems:

Management accounting system: It is a systematic process in an organisation where

directors prepare and manage budget reports that are to be presented to the top level

management. This system provides accurate information which helps in conducting different

activities of a business. Management accounting system can be also be defined as a tool used in

planning, organising and providing detailed facts regarding business operations that can help the

managers in effective decision making. It is required by entities to project their goals and

objectives in generating revenue. Assael Architecture ensures that financial security is

maintained in the working of construction contracts with the help of management accounting

systems. Listed below are some of the accounting techniques used in this system:

Cost accounting system: It refers to a system which is used by firms to estimate the cost

associated with products and services that help managers to analyse profits as well as cost

control techniques. They add value by determining measures that can monitor cost of an

organisation such as, fixed, variable, opportunity, incremental etc. This includes two concepts of

job order and process costing. It is required by managers as this helps them in estimating closing

value of raw materials and finished goods for the purpose of preparing accounting records.

Assael Architecture uses cost accounting system to measure the monetary value of different

types of cost like, fixed, variable, direct or indirect etc (Salterio, 2012) .

Job costing system: It is a process which involves collecting information about the cost

related to a product or job. This helps in monitoring and tracking of expenses in an organisation.

To understand the working of this system, it needs to include data related to direct material,

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

labour and overhead costs. Job costing is used in printing, construction, auto mobile industry etc.

by identifying cost for each unit of organisation, preparing cost sheets for every employee or

using time card system. This adds value to a firm by keeping a record of expenditure during an

accounting year. It is required in determining the accuracy of company's records and quote price

for products to earn profit. Assael Architecture uses job costing system by maintaining a punch

clock machine which displays when the staff is arriving and leaving. The company also tracks

down value of raw material used in construction of a building (Novas, Alves and Sousa, 2017) .

Price optimisation system: It is a system that uses mathematical techniques to determine

how customers will respond to the changing prices in products and services. This helps to

identify the cost by which objectives will meet targets in an organisation. It aims at maximising

the profitability of a firm by keeping control on expenses due to which gross and net profit

margin will increase. This adds value to an organisation by determining value of product for both

buyer as well as seller, implying various pricing strategies such as, penetration, premium, price

skimming etc. The requirement for this system revolves around choosing best techniques to

minimise price while maintaining quality of goods. Assael Architecture uses price optimisation

system to improve revenue figures and ensure that the cost of building is kept under estimated

cost limits issued by the managers.

Inventory management system: It is a system that records inventory of goods and

services for an organisation with the help of software like barcode reader. This method is widely

used in a number of industries which includes manufacturing, healthcare, education etc to

maintain stock count of products used. It consists of placing order for goods before the lead time

to prevent stock-outs. The system adds value to an organisation's activities by keeping a track of

inventory in the warehouse. This is required by directors in shipping of orders and management

of sock etc. By implementing inventory management system, managers at Assael Architecture

can keep a count of materials, workforce, plant & equipment etc. to manage multiple

construction projects (Rossing, 2013)

Management accounting was originated and evolved as a significant activity during

industrial revolution. It arose after coming of financial accounting.

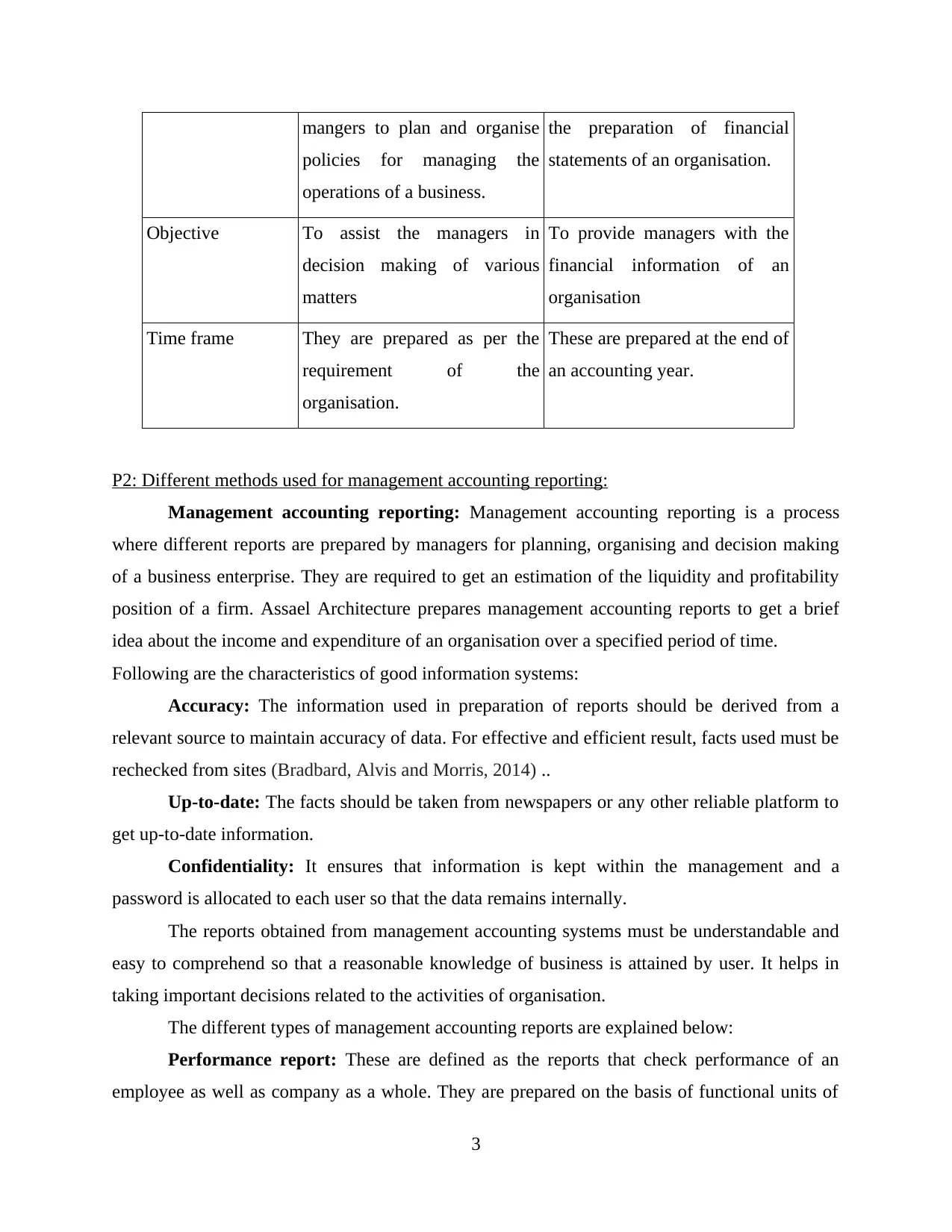

Basis Management accounting Financial accounting

Meaning It is system which allows It is a system which focuses on

2

by identifying cost for each unit of organisation, preparing cost sheets for every employee or

using time card system. This adds value to a firm by keeping a record of expenditure during an

accounting year. It is required in determining the accuracy of company's records and quote price

for products to earn profit. Assael Architecture uses job costing system by maintaining a punch

clock machine which displays when the staff is arriving and leaving. The company also tracks

down value of raw material used in construction of a building (Novas, Alves and Sousa, 2017) .

Price optimisation system: It is a system that uses mathematical techniques to determine

how customers will respond to the changing prices in products and services. This helps to

identify the cost by which objectives will meet targets in an organisation. It aims at maximising

the profitability of a firm by keeping control on expenses due to which gross and net profit

margin will increase. This adds value to an organisation by determining value of product for both

buyer as well as seller, implying various pricing strategies such as, penetration, premium, price

skimming etc. The requirement for this system revolves around choosing best techniques to

minimise price while maintaining quality of goods. Assael Architecture uses price optimisation

system to improve revenue figures and ensure that the cost of building is kept under estimated

cost limits issued by the managers.

Inventory management system: It is a system that records inventory of goods and

services for an organisation with the help of software like barcode reader. This method is widely

used in a number of industries which includes manufacturing, healthcare, education etc to

maintain stock count of products used. It consists of placing order for goods before the lead time

to prevent stock-outs. The system adds value to an organisation's activities by keeping a track of

inventory in the warehouse. This is required by directors in shipping of orders and management

of sock etc. By implementing inventory management system, managers at Assael Architecture

can keep a count of materials, workforce, plant & equipment etc. to manage multiple

construction projects (Rossing, 2013)

Management accounting was originated and evolved as a significant activity during

industrial revolution. It arose after coming of financial accounting.

Basis Management accounting Financial accounting

Meaning It is system which allows It is a system which focuses on

2

mangers to plan and organise

policies for managing the

operations of a business.

the preparation of financial

statements of an organisation.

Objective To assist the managers in

decision making of various

matters

To provide managers with the

financial information of an

organisation

Time frame They are prepared as per the

requirement of the

organisation.

These are prepared at the end of

an accounting year.

P2: Different methods used for management accounting reporting:

Management accounting reporting: Management accounting reporting is a process

where different reports are prepared by managers for planning, organising and decision making

of a business enterprise. They are required to get an estimation of the liquidity and profitability

position of a firm. Assael Architecture prepares management accounting reports to get a brief

idea about the income and expenditure of an organisation over a specified period of time.

Following are the characteristics of good information systems:

Accuracy: The information used in preparation of reports should be derived from a

relevant source to maintain accuracy of data. For effective and efficient result, facts used must be

rechecked from sites (Bradbard, Alvis and Morris, 2014) ..

Up-to-date: The facts should be taken from newspapers or any other reliable platform to

get up-to-date information.

Confidentiality: It ensures that information is kept within the management and a

password is allocated to each user so that the data remains internally.

The reports obtained from management accounting systems must be understandable and

easy to comprehend so that a reasonable knowledge of business is attained by user. It helps in

taking important decisions related to the activities of organisation.

The different types of management accounting reports are explained below:

Performance report: These are defined as the reports that check performance of an

employee as well as company as a whole. They are prepared on the basis of functional units of

3

policies for managing the

operations of a business.

the preparation of financial

statements of an organisation.

Objective To assist the managers in

decision making of various

matters

To provide managers with the

financial information of an

organisation

Time frame They are prepared as per the

requirement of the

organisation.

These are prepared at the end of

an accounting year.

P2: Different methods used for management accounting reporting:

Management accounting reporting: Management accounting reporting is a process

where different reports are prepared by managers for planning, organising and decision making

of a business enterprise. They are required to get an estimation of the liquidity and profitability

position of a firm. Assael Architecture prepares management accounting reports to get a brief

idea about the income and expenditure of an organisation over a specified period of time.

Following are the characteristics of good information systems:

Accuracy: The information used in preparation of reports should be derived from a

relevant source to maintain accuracy of data. For effective and efficient result, facts used must be

rechecked from sites (Bradbard, Alvis and Morris, 2014) ..

Up-to-date: The facts should be taken from newspapers or any other reliable platform to

get up-to-date information.

Confidentiality: It ensures that information is kept within the management and a

password is allocated to each user so that the data remains internally.

The reports obtained from management accounting systems must be understandable and

easy to comprehend so that a reasonable knowledge of business is attained by user. It helps in

taking important decisions related to the activities of organisation.

The different types of management accounting reports are explained below:

Performance report: These are defined as the reports that check performance of an

employee as well as company as a whole. They are prepared on the basis of functional units of

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

an organisation. Assael Architecture uses performance report to check conduct of an individual

employee. The benefits can be improved decision making among the managers and evaluation of

employee performance.

Account Receivable Aging report: Accounts receivable aging is a type of report which

shows amounts that are owed by a customer and credit facilities offered to them. This ensures

that bad debts have been recovered. The company offers additional discount to debtors so that

they are able to pay the amount due on time. The advantages are that it helps to improve

collection from suppliers and customers, maintain fund for the day to day operations of business

etc.

Budget report: These are internal reports maintained by management to get an

estimation of income and expenses of an organisation. They include projection of sale figures

which help managers in preparing budgets. Assael Architecture prepare budget reports for

separate departments and allocate funds for their working. The benefits of this type of reporting

is that errors can be easily identified and corrected, maintains stability in the liquidity position of

a firm (Chan, Tong and Zhang, 2012) .

Cost managerial accounting report: These refer to the reports that measure cost of

products and services of a company. It keeps in track of raw materials used to make finished

products. Assael Architecture prepares cost accounting report to calculate the closing value of

material used, estimate cost associated with manufacturing of products and services. The

advantages of this can be that it measures and improves efficiency of cost, helps in restocking of

raw materials etc.

TASK 2

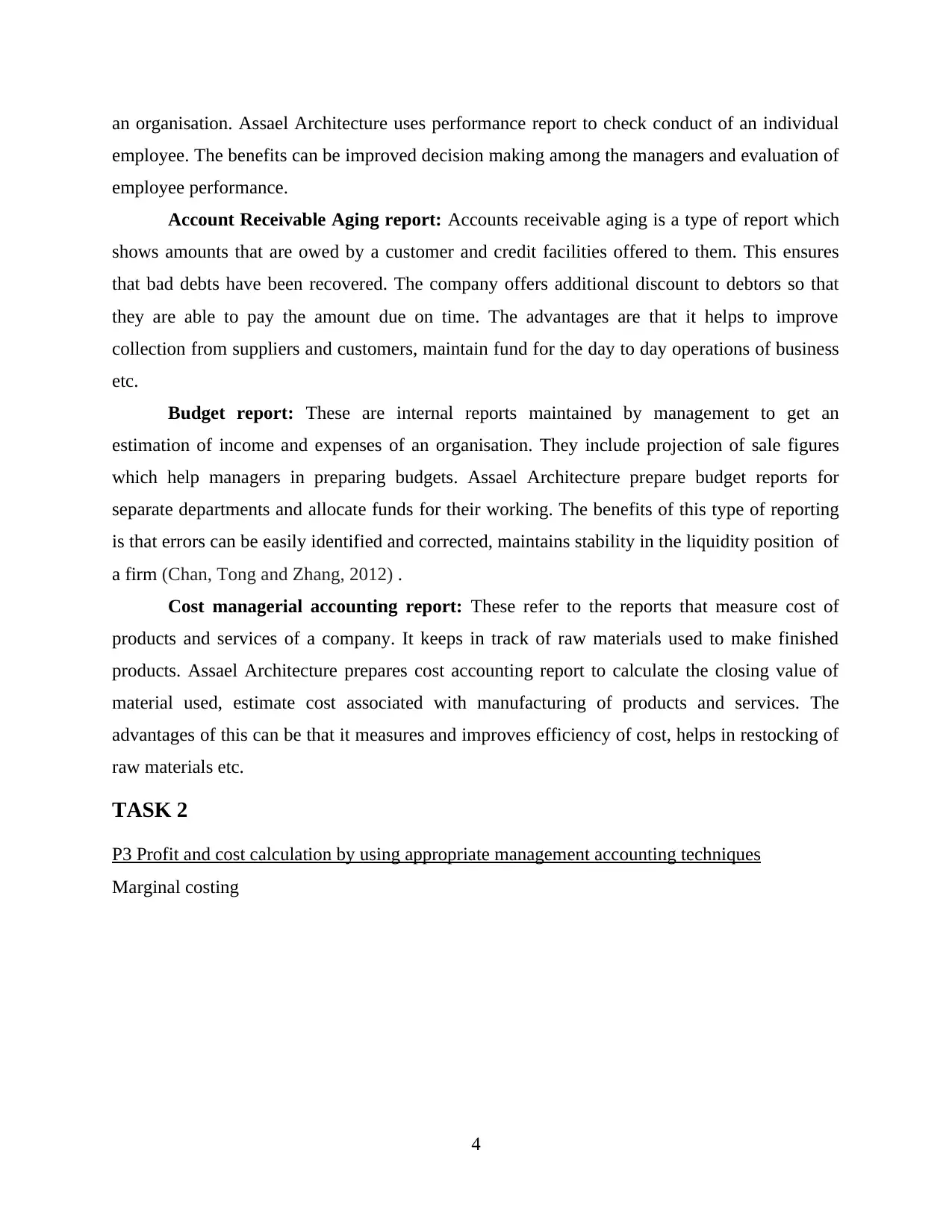

P3 Profit and cost calculation by using appropriate management accounting techniques

Marginal costing

4

employee. The benefits can be improved decision making among the managers and evaluation of

employee performance.

Account Receivable Aging report: Accounts receivable aging is a type of report which

shows amounts that are owed by a customer and credit facilities offered to them. This ensures

that bad debts have been recovered. The company offers additional discount to debtors so that

they are able to pay the amount due on time. The advantages are that it helps to improve

collection from suppliers and customers, maintain fund for the day to day operations of business

etc.

Budget report: These are internal reports maintained by management to get an

estimation of income and expenses of an organisation. They include projection of sale figures

which help managers in preparing budgets. Assael Architecture prepare budget reports for

separate departments and allocate funds for their working. The benefits of this type of reporting

is that errors can be easily identified and corrected, maintains stability in the liquidity position of

a firm (Chan, Tong and Zhang, 2012) .

Cost managerial accounting report: These refer to the reports that measure cost of

products and services of a company. It keeps in track of raw materials used to make finished

products. Assael Architecture prepares cost accounting report to calculate the closing value of

material used, estimate cost associated with manufacturing of products and services. The

advantages of this can be that it measures and improves efficiency of cost, helps in restocking of

raw materials etc.

TASK 2

P3 Profit and cost calculation by using appropriate management accounting techniques

Marginal costing

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

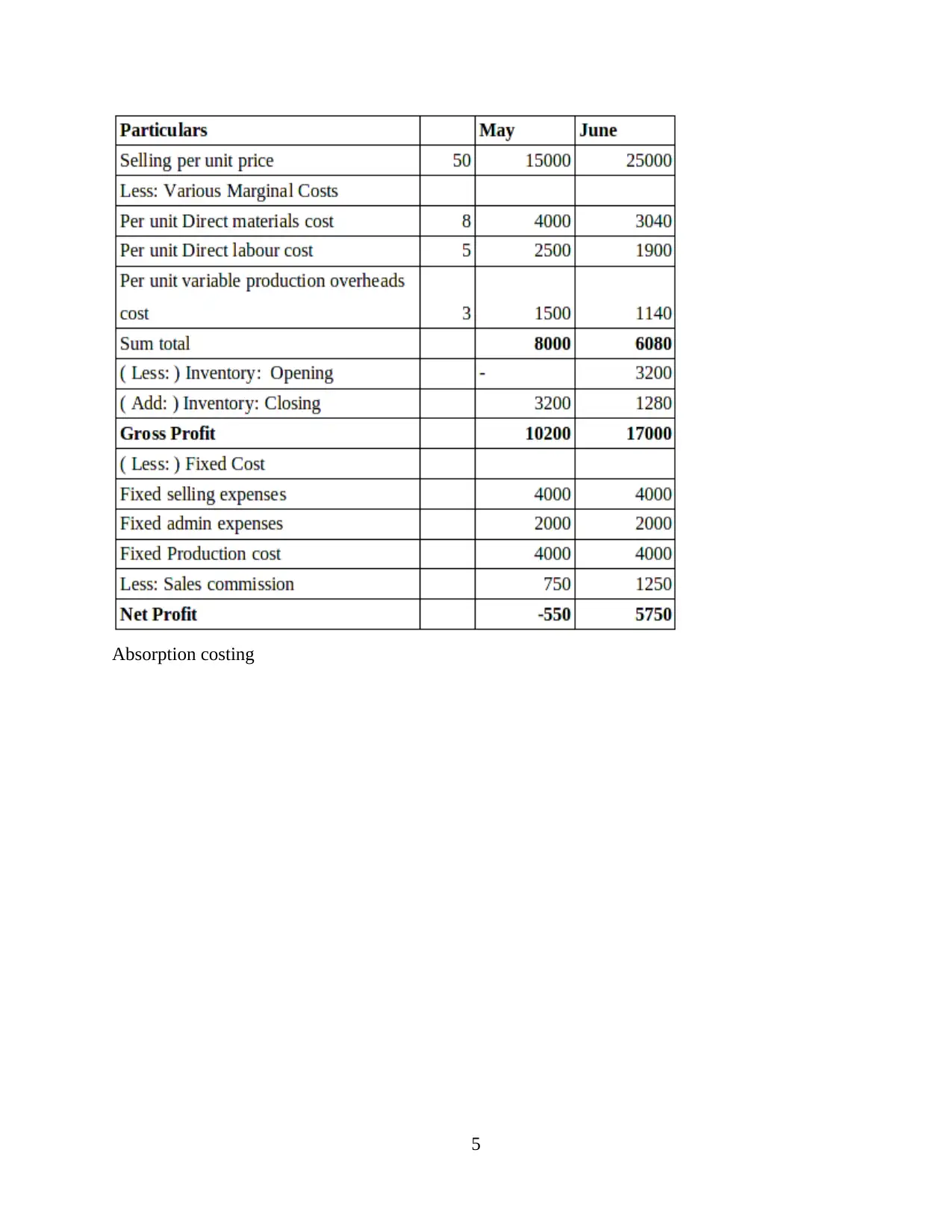

Absorption costing

5

5

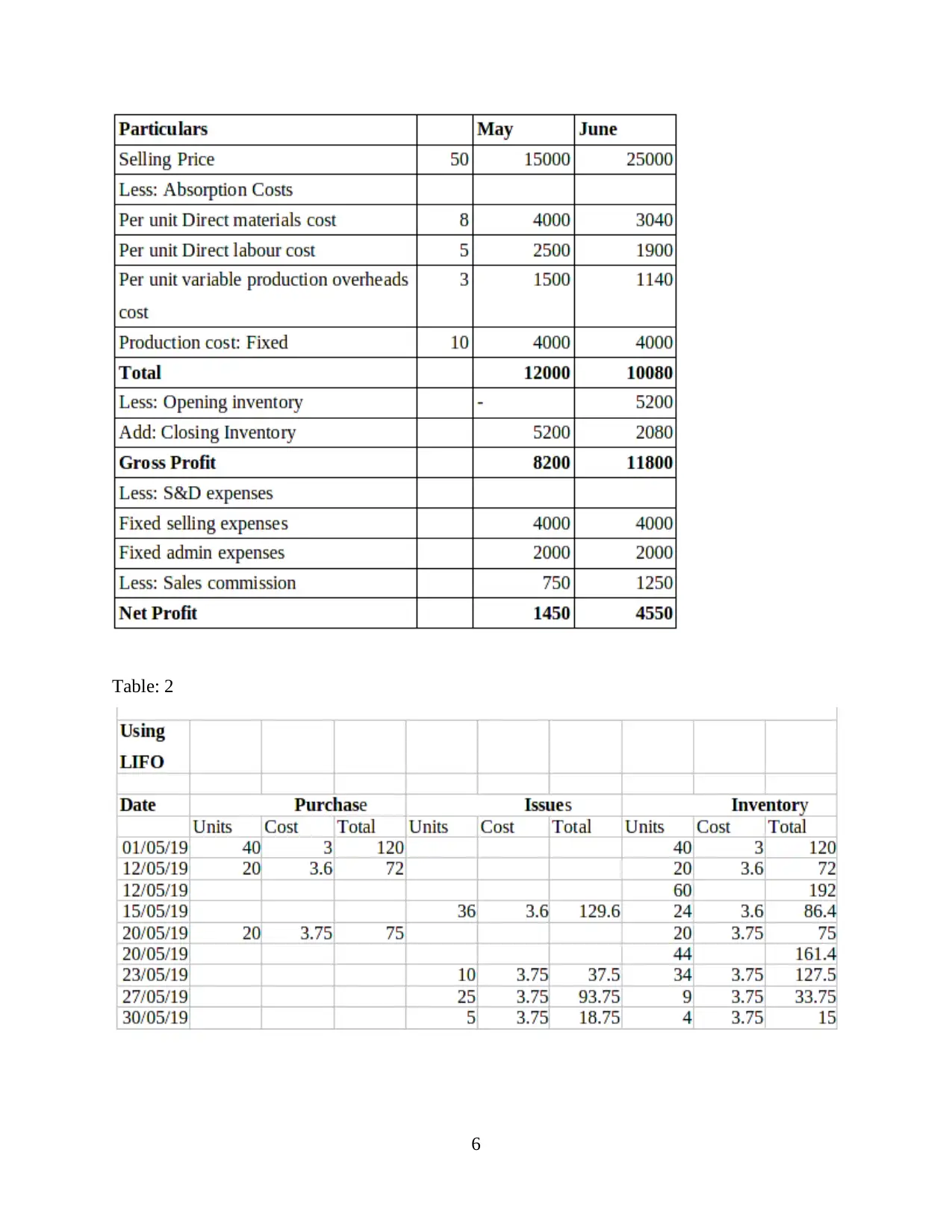

Table: 2

6

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

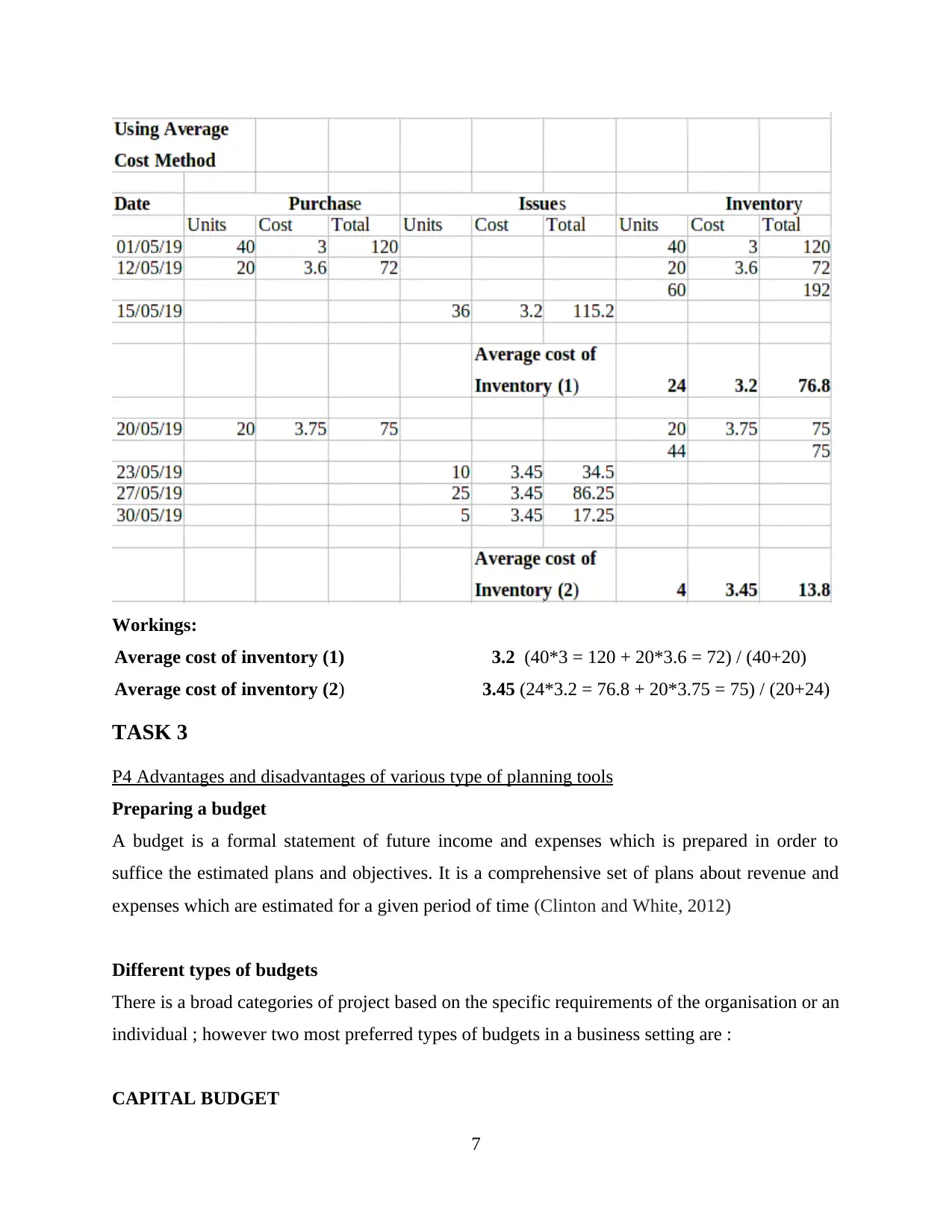

Workings:

Average cost of inventory (1) 3.2 (40*3 = 120 + 20*3.6 = 72) / (40+20)

Average cost of inventory (2) 3.45 (24*3.2 = 76.8 + 20*3.75 = 75) / (20+24)

TASK 3

P4 Advantages and disadvantages of various type of planning tools

Preparing a budget

A budget is a formal statement of future income and expenses which is prepared in order to

suffice the estimated plans and objectives. It is a comprehensive set of plans about revenue and

expenses which are estimated for a given period of time (Clinton and White, 2012)

Different types of budgets

There is a broad categories of project based on the specific requirements of the organisation or an

individual ; however two most preferred types of budgets in a business setting are :

CAPITAL BUDGET

7

Average cost of inventory (1) 3.2 (40*3 = 120 + 20*3.6 = 72) / (40+20)

Average cost of inventory (2) 3.45 (24*3.2 = 76.8 + 20*3.75 = 75) / (20+24)

TASK 3

P4 Advantages and disadvantages of various type of planning tools

Preparing a budget

A budget is a formal statement of future income and expenses which is prepared in order to

suffice the estimated plans and objectives. It is a comprehensive set of plans about revenue and

expenses which are estimated for a given period of time (Clinton and White, 2012)

Different types of budgets

There is a broad categories of project based on the specific requirements of the organisation or an

individual ; however two most preferred types of budgets in a business setting are :

CAPITAL BUDGET

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Capital budget is typically a budget prepared to evaluate major investments and potential

proposals. Generally they are long term in nature and are prepared for long term investments. Eg:

purchase of a new plant or a fixed asset.

Advantages

Helps in mitigating risk & its effects.

Helps in abstaining over or under investing.

Disadvantages

Since decisions are long term hence makes them irreversible in nature.

Uncertainty and expensive (Nilsson and Stockenstrand, 2015) ..

OPERATING BUDGET

An operating budget is a formal statement of revenue & expenditure for a given period of time

which is used generally for upcoming financial year.

Advantages

Keeps track of the entire business. Prepares business for financial responsibilities.

Disadvantages

Difficulty in expense allocation.

Leads to rigidity in decision making.

ALTERNATIVE METHODS OF BUDGETING

There are specific budgets devised as per the objectivity of the results however prominent

budgets used in the modern context are:

ZERO BASED BUDGETING (ZBB)

The process of zero based budgeting starts from a “zero base” and is a method of

budgeting in which all expenses must be justified for each new period.

Advantages of ZBB :

It differs from traditional budget & calls for justification of old, recurring expenses in

addition to new expenses (Halbouni and Nour,2014) . Keeps legacy expenses in check.

8

proposals. Generally they are long term in nature and are prepared for long term investments. Eg:

purchase of a new plant or a fixed asset.

Advantages

Helps in mitigating risk & its effects.

Helps in abstaining over or under investing.

Disadvantages

Since decisions are long term hence makes them irreversible in nature.

Uncertainty and expensive (Nilsson and Stockenstrand, 2015) ..

OPERATING BUDGET

An operating budget is a formal statement of revenue & expenditure for a given period of time

which is used generally for upcoming financial year.

Advantages

Keeps track of the entire business. Prepares business for financial responsibilities.

Disadvantages

Difficulty in expense allocation.

Leads to rigidity in decision making.

ALTERNATIVE METHODS OF BUDGETING

There are specific budgets devised as per the objectivity of the results however prominent

budgets used in the modern context are:

ZERO BASED BUDGETING (ZBB)

The process of zero based budgeting starts from a “zero base” and is a method of

budgeting in which all expenses must be justified for each new period.

Advantages of ZBB :

It differs from traditional budget & calls for justification of old, recurring expenses in

addition to new expenses (Halbouni and Nour,2014) . Keeps legacy expenses in check.

8

Disadvantages of ZBB :

Rewards short term thinking which leaves sidelines major decision making factors aside

Subject to manipulation by savvy managers.

INCREMENTAL BUDGETING (IB)

Incremental budgeting is a method in which there is slight changes from preceding

periods budgeted results or actual results. It is accounted in traditional form of budgeting.

Advantages of IB :

It simplifies the budget making process. Provides operational stability to the processes.

Disadvantages of IB :

It fosters an attitude of “use it or loose it”.

Variability from actual results.

BEHAVIOURAL IMPLICATIONS OF BUDGETS

While preparing a budget a series of technical aspects coincides with the approaches of

budget making however in broader perspective behavioural tendencies of managers instrumental

in preparing budgets leads to irrationality with the subjective parameters. The information will

only be in harmony with the objectives only when used in judicious manner by the managers.

The correct use of control information depends not only on the content of the information but

also on the behaviour of the receiver of information. The attitude to control information will

colour the managers view about the budgetary decision-making (Boyns, Edwards and Nikitin,

2013) .

PRICING STRATEGIES

Pricing is one of the most important element of marketing mix and is instrumental in

generating revenues for the organisation. Various types of pricing strategies used in modern day

businesses are :-

1. Penetration pricing

2. Price skimming

3. Competitive pricing

4. Loss leader

5. Predatory pricing

9

Rewards short term thinking which leaves sidelines major decision making factors aside

Subject to manipulation by savvy managers.

INCREMENTAL BUDGETING (IB)

Incremental budgeting is a method in which there is slight changes from preceding

periods budgeted results or actual results. It is accounted in traditional form of budgeting.

Advantages of IB :

It simplifies the budget making process. Provides operational stability to the processes.

Disadvantages of IB :

It fosters an attitude of “use it or loose it”.

Variability from actual results.

BEHAVIOURAL IMPLICATIONS OF BUDGETS

While preparing a budget a series of technical aspects coincides with the approaches of

budget making however in broader perspective behavioural tendencies of managers instrumental

in preparing budgets leads to irrationality with the subjective parameters. The information will

only be in harmony with the objectives only when used in judicious manner by the managers.

The correct use of control information depends not only on the content of the information but

also on the behaviour of the receiver of information. The attitude to control information will

colour the managers view about the budgetary decision-making (Boyns, Edwards and Nikitin,

2013) .

PRICING STRATEGIES

Pricing is one of the most important element of marketing mix and is instrumental in

generating revenues for the organisation. Various types of pricing strategies used in modern day

businesses are :-

1. Penetration pricing

2. Price skimming

3. Competitive pricing

4. Loss leader

5. Predatory pricing

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.