University Finance: Managerial Accounting and Finance Assignment

VerifiedAdded on 2023/06/10

|15

|3474

|93

Homework Assignment

AI Summary

This document presents a comprehensive solution to a managerial accounting and finance assignment. It begins with multiple-choice questions covering financial accounting principles, budgeting, costing methods (traditional and activity-based), cost flows, and ethical considerations. The solution then delves into in-depth questions, including explanations of relevant and opportunity costs, calculations and distinctions of operating profit, and the application of ABC costing. Further, the assignment addresses fixed and variable costs, break-even analysis, and investment appraisal techniques, including payback period and net present value (NPV) calculations for project selection. The document provides detailed answers and calculations, offering a thorough understanding of managerial accounting and finance concepts. It provides a detailed breakdown of the answers and the thought process involved.

MANAGERIAL

ACCOUNTING AND

FINANCE

ACCOUNTING AND

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

SECTION A.........................................................................................................................................4

Question A1 (2 marks)..........................................................................................................................4

Question A2 (2 marks)..........................................................................................................................4

Question A3 (2 marks)..........................................................................................................................4

Question A4 (2 marks)..........................................................................................................................4

Question A5 (2 marks)..........................................................................................................................5

Question A6 (2 marks)..........................................................................................................................5

Question A7 (2 marks)..........................................................................................................................5

Question A8 (2 marks)..........................................................................................................................5

Question A9 (2 marks)..........................................................................................................................6

Question A10 (2 marks)........................................................................................................................7

Question A11 (2 marks)........................................................................................................................7

Question A12 (3 marks)........................................................................................................................8

Question A13........................................................................................................................................8

Explain, with examples, the following terms:..................................................................................8

QUESTION B1.....................................................................................................................................9

A) Operating profit ..........................................................................................................................9

B) ABC Costing:..............................................................................................................................9

C) Calculation of Cost of each statement: -......................................................................................9

D) Distinction between the profit obtained....................................................................................10

QUESTION B2...................................................................................................................................10

Define and distinguish the terms ‘fixed costs’ and ‘variable costs’ and explain the importance

(relevance) of the distinction for short – term cost planning purposes...........................................10

b) Compute the following:..............................................................................................................11

QUESTION B3...................................................................................................................................11

a) Calculate the payback period for each of the projects. Based upon the payback criterion which

project should be chosen?...............................................................................................................11

SECTION A.........................................................................................................................................4

Question A1 (2 marks)..........................................................................................................................4

Question A2 (2 marks)..........................................................................................................................4

Question A3 (2 marks)..........................................................................................................................4

Question A4 (2 marks)..........................................................................................................................4

Question A5 (2 marks)..........................................................................................................................5

Question A6 (2 marks)..........................................................................................................................5

Question A7 (2 marks)..........................................................................................................................5

Question A8 (2 marks)..........................................................................................................................5

Question A9 (2 marks)..........................................................................................................................6

Question A10 (2 marks)........................................................................................................................7

Question A11 (2 marks)........................................................................................................................7

Question A12 (3 marks)........................................................................................................................8

Question A13........................................................................................................................................8

Explain, with examples, the following terms:..................................................................................8

QUESTION B1.....................................................................................................................................9

A) Operating profit ..........................................................................................................................9

B) ABC Costing:..............................................................................................................................9

C) Calculation of Cost of each statement: -......................................................................................9

D) Distinction between the profit obtained....................................................................................10

QUESTION B2...................................................................................................................................10

Define and distinguish the terms ‘fixed costs’ and ‘variable costs’ and explain the importance

(relevance) of the distinction for short – term cost planning purposes...........................................10

b) Compute the following:..............................................................................................................11

QUESTION B3...................................................................................................................................11

a) Calculate the payback period for each of the projects. Based upon the payback criterion which

project should be chosen?...............................................................................................................11

(b) Calculate the net present value (NPV) of each project. Based upon the NPV criterion which

project should be chosen?...............................................................................................................12

(c) Based on your calculations in (a) and (b) above, what is the final decision concerning which

project should be chosen?...............................................................................................................12

(d) Discuss the advantages and disadvantages of the NPV and IRR methods of investment

appraisal..........................................................................................................................................12

REFERENCES...................................................................................................................................15

project should be chosen?...............................................................................................................12

(c) Based on your calculations in (a) and (b) above, what is the final decision concerning which

project should be chosen?...............................................................................................................12

(d) Discuss the advantages and disadvantages of the NPV and IRR methods of investment

appraisal..........................................................................................................................................12

REFERENCES...................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

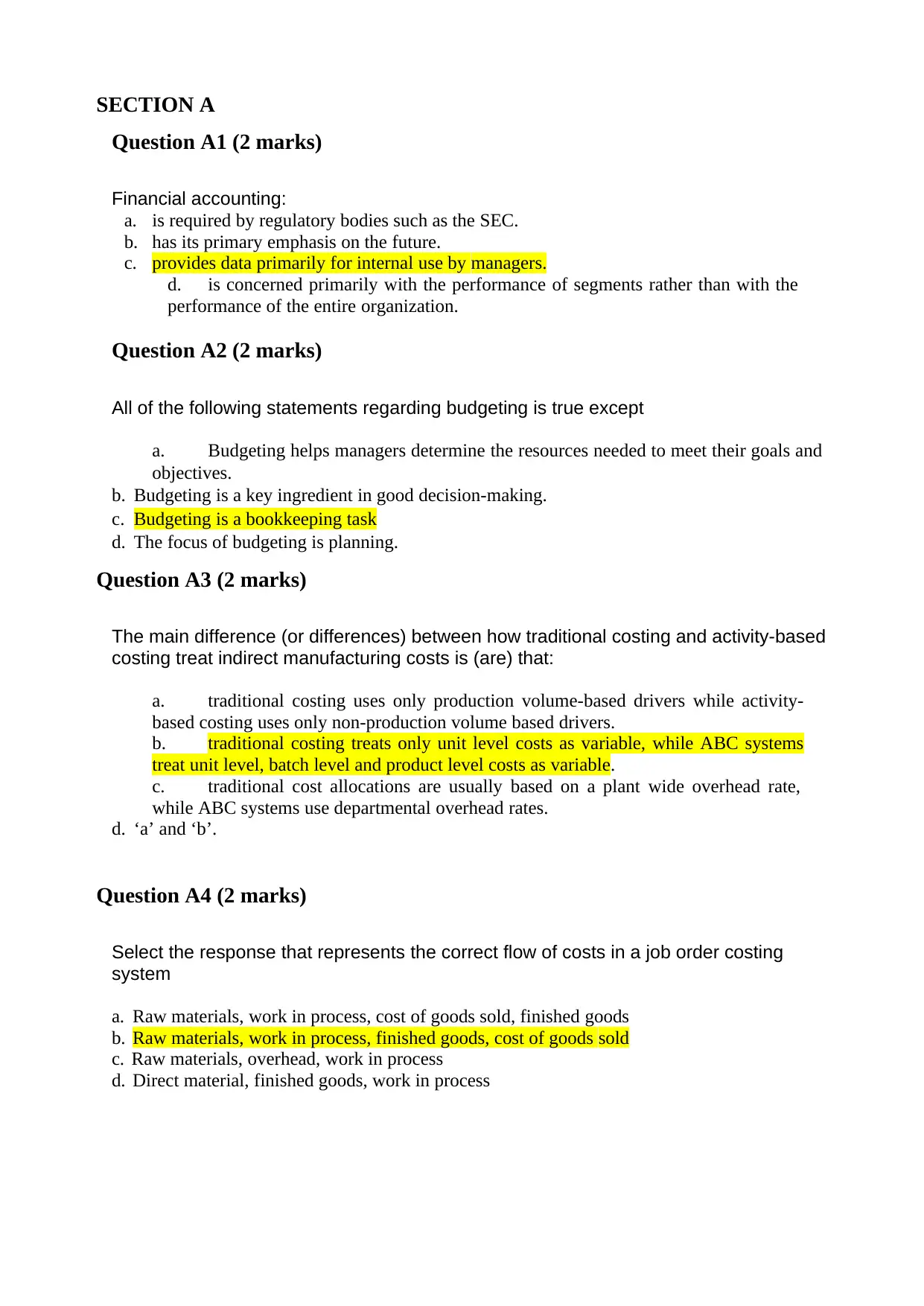

SECTION A

Question A1 (2 marks)

Financial accounting:

a. is required by regulatory bodies such as the SEC.

b. has its primary emphasis on the future.

c. provides data primarily for internal use by managers.

d. is concerned primarily with the performance of segments rather than with the

performance of the entire organization.

Question A2 (2 marks)

All of the following statements regarding budgeting is true except

a. Budgeting helps managers determine the resources needed to meet their goals and

objectives.

b. Budgeting is a key ingredient in good decision-making.

c. Budgeting is a bookkeeping task

d. The focus of budgeting is planning.

Question A3 (2 marks)

The main difference (or differences) between how traditional costing and activity-based

costing treat indirect manufacturing costs is (are) that:

a. traditional costing uses only production volume-based drivers while activity-

based costing uses only non-production volume based drivers.

b. traditional costing treats only unit level costs as variable, while ABC systems

treat unit level, batch level and product level costs as variable.

c. traditional cost allocations are usually based on a plant wide overhead rate,

while ABC systems use departmental overhead rates.

d. ‘a’ and ‘b’.

Question A4 (2 marks)

Select the response that represents the correct flow of costs in a job order costing

system

a. Raw materials, work in process, cost of goods sold, finished goods

b. Raw materials, work in process, finished goods, cost of goods sold

c. Raw materials, overhead, work in process

d. Direct material, finished goods, work in process

Question A1 (2 marks)

Financial accounting:

a. is required by regulatory bodies such as the SEC.

b. has its primary emphasis on the future.

c. provides data primarily for internal use by managers.

d. is concerned primarily with the performance of segments rather than with the

performance of the entire organization.

Question A2 (2 marks)

All of the following statements regarding budgeting is true except

a. Budgeting helps managers determine the resources needed to meet their goals and

objectives.

b. Budgeting is a key ingredient in good decision-making.

c. Budgeting is a bookkeeping task

d. The focus of budgeting is planning.

Question A3 (2 marks)

The main difference (or differences) between how traditional costing and activity-based

costing treat indirect manufacturing costs is (are) that:

a. traditional costing uses only production volume-based drivers while activity-

based costing uses only non-production volume based drivers.

b. traditional costing treats only unit level costs as variable, while ABC systems

treat unit level, batch level and product level costs as variable.

c. traditional cost allocations are usually based on a plant wide overhead rate,

while ABC systems use departmental overhead rates.

d. ‘a’ and ‘b’.

Question A4 (2 marks)

Select the response that represents the correct flow of costs in a job order costing

system

a. Raw materials, work in process, cost of goods sold, finished goods

b. Raw materials, work in process, finished goods, cost of goods sold

c. Raw materials, overhead, work in process

d. Direct material, finished goods, work in process

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

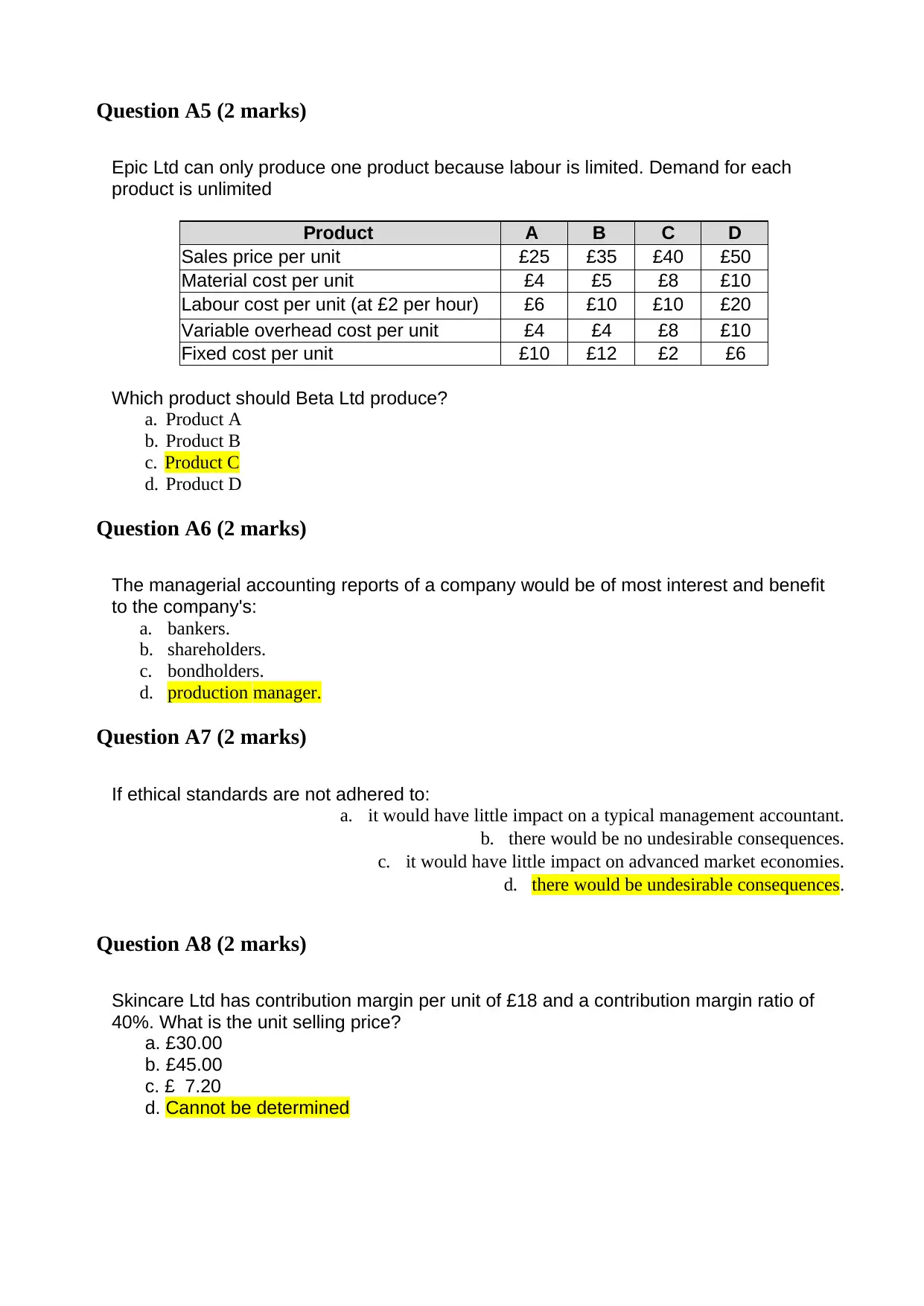

Question A5 (2 marks)

Epic Ltd can only produce one product because labour is limited. Demand for each

product is unlimited

Product A B C D

Sales price per unit £25 £35 £40 £50

Material cost per unit £4 £5 £8 £10

Labour cost per unit (at £2 per hour) £6 £10 £10 £20

Variable overhead cost per unit £4 £4 £8 £10

Fixed cost per unit £10 £12 £2 £6

Which product should Beta Ltd produce?

a. Product A

b. Product B

c. Product C

d. Product D

Question A6 (2 marks)

The managerial accounting reports of a company would be of most interest and benefit

to the company's:

a. bankers.

b. shareholders.

c. bondholders.

d. production manager.

Question A7 (2 marks)

If ethical standards are not adhered to:

a. it would have little impact on a typical management accountant.

b. there would be no undesirable consequences.

c. it would have little impact on advanced market economies.

d. there would be undesirable consequences.

Question A8 (2 marks)

Skincare Ltd has contribution margin per unit of £18 and a contribution margin ratio of

40%. What is the unit selling price?

a. £30.00

b. £45.00

c. £ 7.20

d. Cannot be determined

Epic Ltd can only produce one product because labour is limited. Demand for each

product is unlimited

Product A B C D

Sales price per unit £25 £35 £40 £50

Material cost per unit £4 £5 £8 £10

Labour cost per unit (at £2 per hour) £6 £10 £10 £20

Variable overhead cost per unit £4 £4 £8 £10

Fixed cost per unit £10 £12 £2 £6

Which product should Beta Ltd produce?

a. Product A

b. Product B

c. Product C

d. Product D

Question A6 (2 marks)

The managerial accounting reports of a company would be of most interest and benefit

to the company's:

a. bankers.

b. shareholders.

c. bondholders.

d. production manager.

Question A7 (2 marks)

If ethical standards are not adhered to:

a. it would have little impact on a typical management accountant.

b. there would be no undesirable consequences.

c. it would have little impact on advanced market economies.

d. there would be undesirable consequences.

Question A8 (2 marks)

Skincare Ltd has contribution margin per unit of £18 and a contribution margin ratio of

40%. What is the unit selling price?

a. £30.00

b. £45.00

c. £ 7.20

d. Cannot be determined

Question A9 (2 marks)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

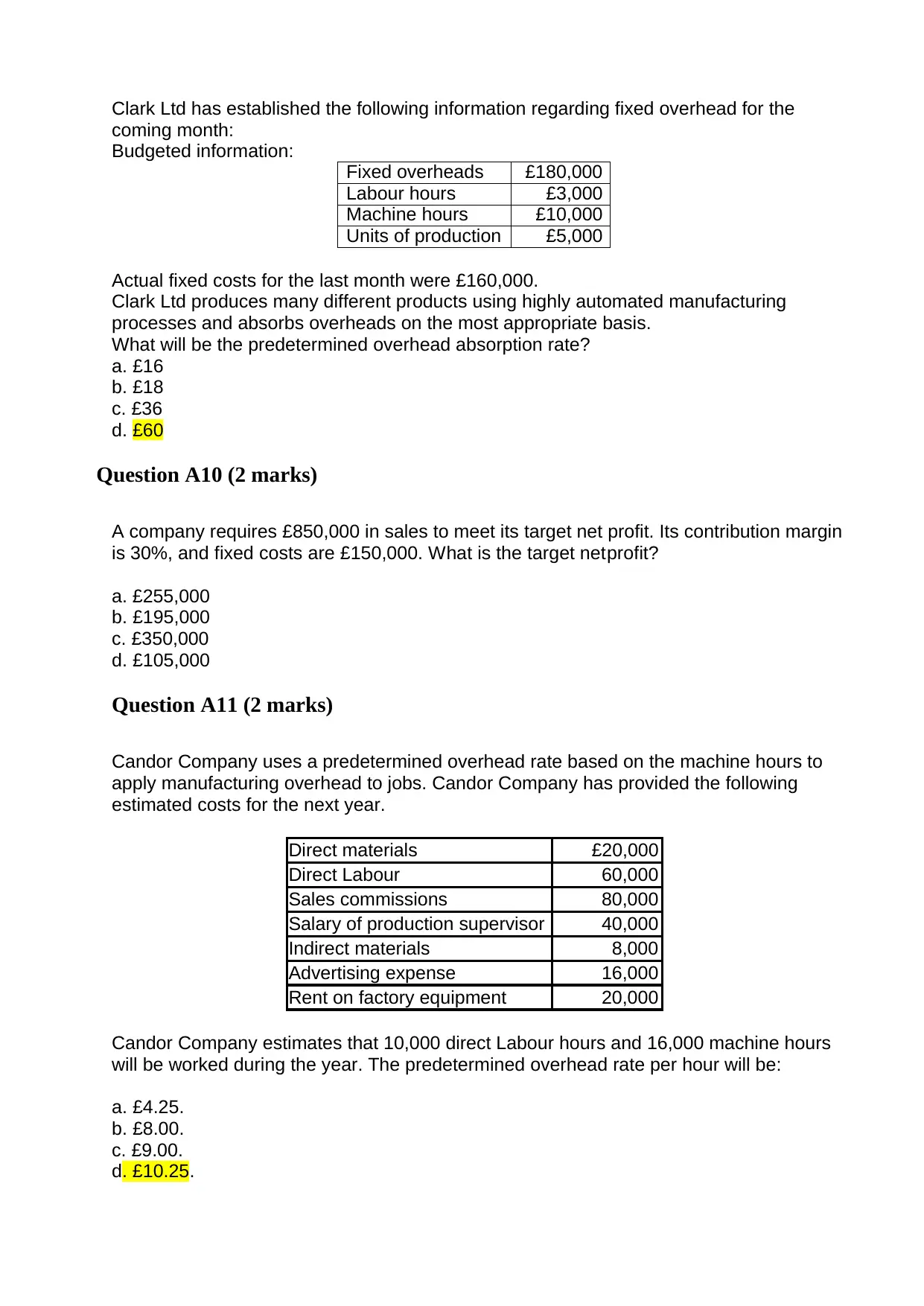

Clark Ltd has established the following information regarding fixed overhead for the

coming month:

Budgeted information:

Fixed overheads £180,000

Labour hours £3,000

Machine hours £10,000

Units of production £5,000

Actual fixed costs for the last month were £160,000.

Clark Ltd produces many different products using highly automated manufacturing

processes and absorbs overheads on the most appropriate basis.

What will be the predetermined overhead absorption rate?

a. £16

b. £18

c. £36

d. £60

Question A10 (2 marks)

A company requires £850,000 in sales to meet its target net profit. Its contribution margin

is 30%, and fixed costs are £150,000. What is the target net profit?

a. £255,000

b. £195,000

c. £350,000

d. £105,000

Question A11 (2 marks)

Candor Company uses a predetermined overhead rate based on the machine hours to

apply manufacturing overhead to jobs. Candor Company has provided the following

estimated costs for the next year.

Direct materials £20,000

Direct Labour 60,000

Sales commissions 80,000

Salary of production supervisor 40,000

Indirect materials 8,000

Advertising expense 16,000

Rent on factory equipment 20,000

Candor Company estimates that 10,000 direct Labour hours and 16,000 machine hours

will be worked during the year. The predetermined overhead rate per hour will be:

a. £4.25.

b. £8.00.

c. £9.00.

d. £10.25.

coming month:

Budgeted information:

Fixed overheads £180,000

Labour hours £3,000

Machine hours £10,000

Units of production £5,000

Actual fixed costs for the last month were £160,000.

Clark Ltd produces many different products using highly automated manufacturing

processes and absorbs overheads on the most appropriate basis.

What will be the predetermined overhead absorption rate?

a. £16

b. £18

c. £36

d. £60

Question A10 (2 marks)

A company requires £850,000 in sales to meet its target net profit. Its contribution margin

is 30%, and fixed costs are £150,000. What is the target net profit?

a. £255,000

b. £195,000

c. £350,000

d. £105,000

Question A11 (2 marks)

Candor Company uses a predetermined overhead rate based on the machine hours to

apply manufacturing overhead to jobs. Candor Company has provided the following

estimated costs for the next year.

Direct materials £20,000

Direct Labour 60,000

Sales commissions 80,000

Salary of production supervisor 40,000

Indirect materials 8,000

Advertising expense 16,000

Rent on factory equipment 20,000

Candor Company estimates that 10,000 direct Labour hours and 16,000 machine hours

will be worked during the year. The predetermined overhead rate per hour will be:

a. £4.25.

b. £8.00.

c. £9.00.

d. £10.25.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

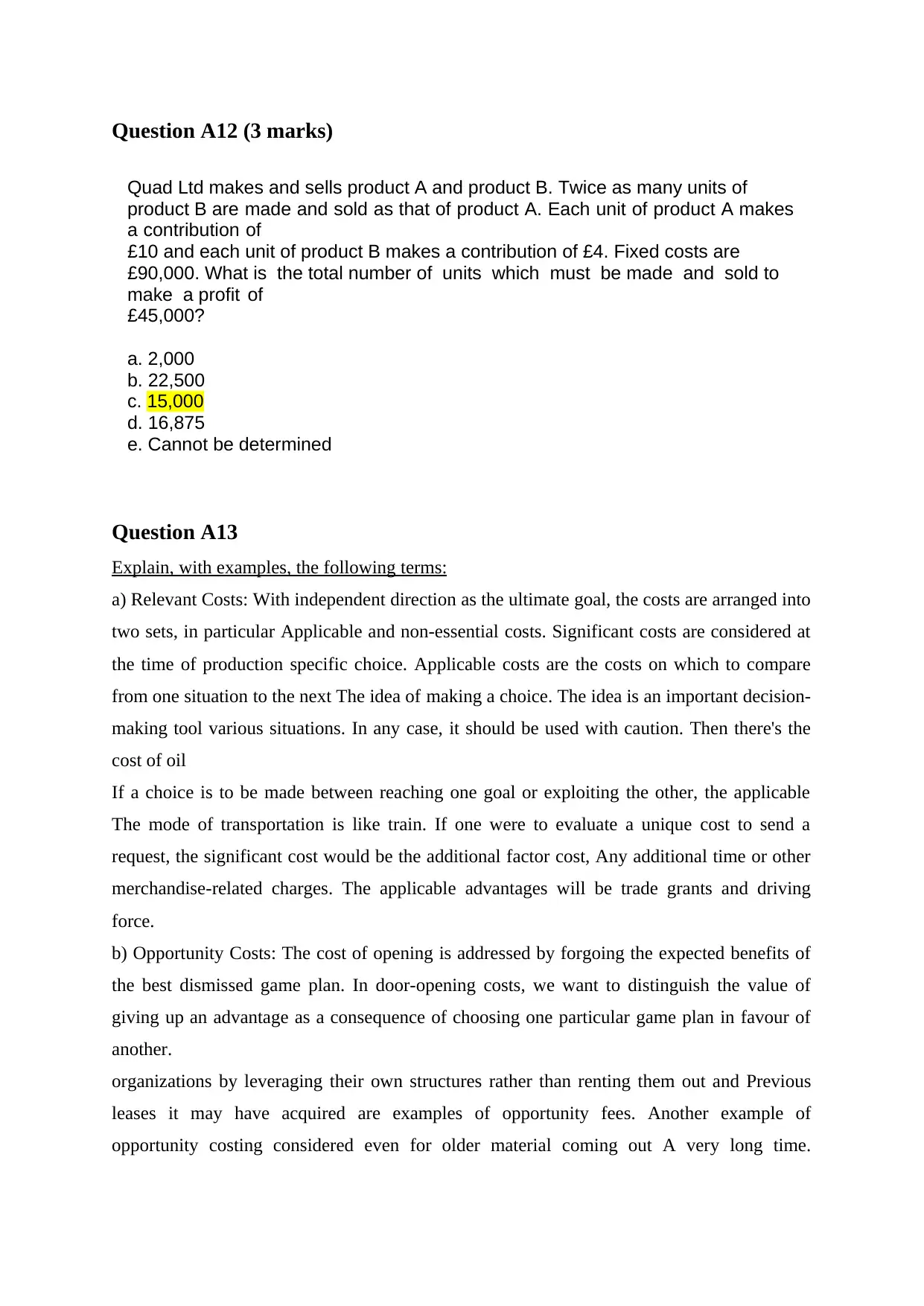

Question A12 (3 marks)

Quad Ltd makes and sells product A and product B. Twice as many units of

product B are made and sold as that of product A. Each unit of product A makes

a contribution of

£10 and each unit of product B makes a contribution of £4. Fixed costs are

£90,000. What is the total number of units which must be made and sold to

make a profit of

£45,000?

a. 2,000

b. 22,500

c. 15,000

d. 16,875

e. Cannot be determined

Question A13

Explain, with examples, the following terms:

a) Relevant Costs: With independent direction as the ultimate goal, the costs are arranged into

two sets, in particular Applicable and non-essential costs. Significant costs are considered at

the time of production specific choice. Applicable costs are the costs on which to compare

from one situation to the next The idea of making a choice. The idea is an important decision-

making tool various situations. In any case, it should be used with caution. Then there's the

cost of oil

If a choice is to be made between reaching one goal or exploiting the other, the applicable

The mode of transportation is like train. If one were to evaluate a unique cost to send a

request, the significant cost would be the additional factor cost, Any additional time or other

merchandise-related charges. The applicable advantages will be trade grants and driving

force.

b) Opportunity Costs: The cost of opening is addressed by forgoing the expected benefits of

the best dismissed game plan. In door-opening costs, we want to distinguish the value of

giving up an advantage as a consequence of choosing one particular game plan in favour of

another.

organizations by leveraging their own structures rather than renting them out and Previous

leases it may have acquired are examples of opportunity fees. Another example of

opportunity costing considered even for older material coming out A very long time.

Quad Ltd makes and sells product A and product B. Twice as many units of

product B are made and sold as that of product A. Each unit of product A makes

a contribution of

£10 and each unit of product B makes a contribution of £4. Fixed costs are

£90,000. What is the total number of units which must be made and sold to

make a profit of

£45,000?

a. 2,000

b. 22,500

c. 15,000

d. 16,875

e. Cannot be determined

Question A13

Explain, with examples, the following terms:

a) Relevant Costs: With independent direction as the ultimate goal, the costs are arranged into

two sets, in particular Applicable and non-essential costs. Significant costs are considered at

the time of production specific choice. Applicable costs are the costs on which to compare

from one situation to the next The idea of making a choice. The idea is an important decision-

making tool various situations. In any case, it should be used with caution. Then there's the

cost of oil

If a choice is to be made between reaching one goal or exploiting the other, the applicable

The mode of transportation is like train. If one were to evaluate a unique cost to send a

request, the significant cost would be the additional factor cost, Any additional time or other

merchandise-related charges. The applicable advantages will be trade grants and driving

force.

b) Opportunity Costs: The cost of opening is addressed by forgoing the expected benefits of

the best dismissed game plan. In door-opening costs, we want to distinguish the value of

giving up an advantage as a consequence of choosing one particular game plan in favour of

another.

organizations by leveraging their own structures rather than renting them out and Previous

leases it may have acquired are examples of opportunity fees. Another example of

opportunity costing considered even for older material coming out A very long time.

Whenever it is seen as helpful for a new position, even scrap, the transaction value of the

material Acceptance as a new position involves the cost of opening the door for the material.

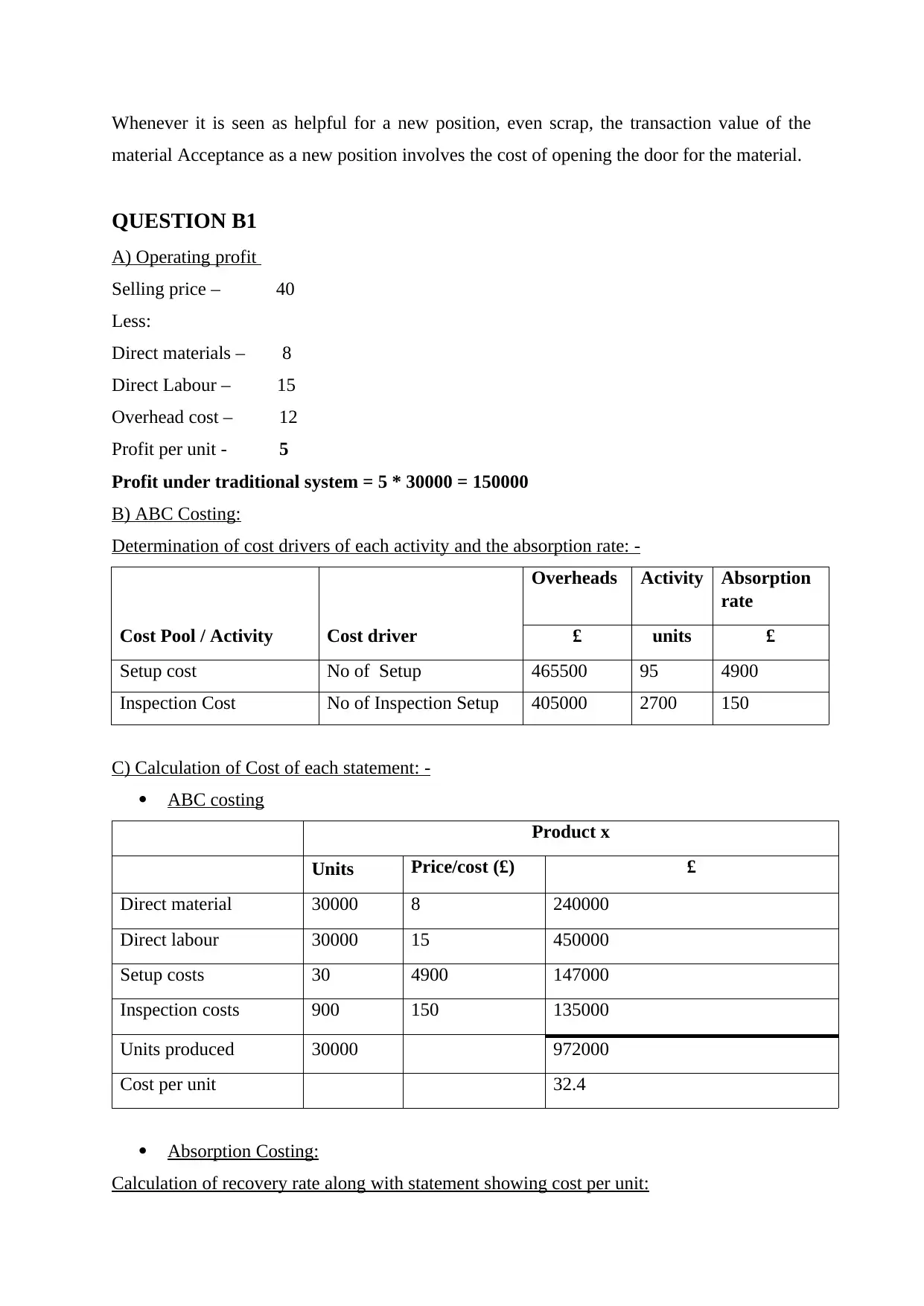

QUESTION B1

A) Operating profit

Selling price – 40

Less:

Direct materials – 8

Direct Labour – 15

Overhead cost – 12

Profit per unit - 5

Profit under traditional system = 5 * 30000 = 150000

B) ABC Costing:

Determination of cost drivers of each activity and the absorption rate: -

Cost Pool / Activity Cost driver

Overheads Activity Absorption

rate

£ units £

Setup cost No of Setup 465500 95 4900

Inspection Cost No of Inspection Setup 405000 2700 150

C) Calculation of Cost of each statement: -

ABC costing

Product x

Units Price/cost (£) £

Direct material 30000 8 240000

Direct labour 30000 15 450000

Setup costs 30 4900 147000

Inspection costs 900 150 135000

Units produced 30000 972000

Cost per unit 32.4

Absorption Costing:

Calculation of recovery rate along with statement showing cost per unit:

material Acceptance as a new position involves the cost of opening the door for the material.

QUESTION B1

A) Operating profit

Selling price – 40

Less:

Direct materials – 8

Direct Labour – 15

Overhead cost – 12

Profit per unit - 5

Profit under traditional system = 5 * 30000 = 150000

B) ABC Costing:

Determination of cost drivers of each activity and the absorption rate: -

Cost Pool / Activity Cost driver

Overheads Activity Absorption

rate

£ units £

Setup cost No of Setup 465500 95 4900

Inspection Cost No of Inspection Setup 405000 2700 150

C) Calculation of Cost of each statement: -

ABC costing

Product x

Units Price/cost (£) £

Direct material 30000 8 240000

Direct labour 30000 15 450000

Setup costs 30 4900 147000

Inspection costs 900 150 135000

Units produced 30000 972000

Cost per unit 32.4

Absorption Costing:

Calculation of recovery rate along with statement showing cost per unit:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

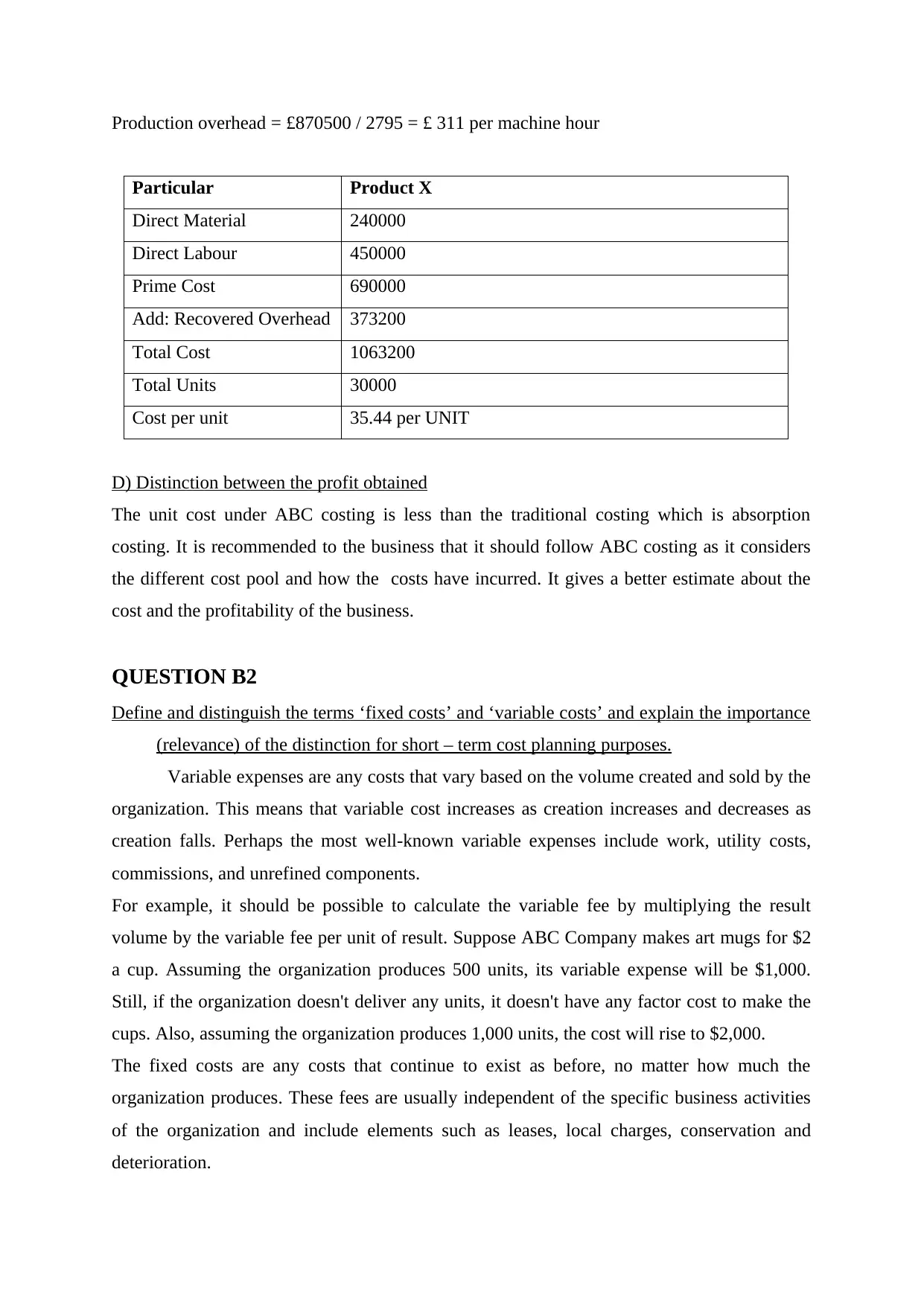

Production overhead = £870500 / 2795 = £ 311 per machine hour

Particular Product X

Direct Material 240000

Direct Labour 450000

Prime Cost 690000

Add: Recovered Overhead 373200

Total Cost 1063200

Total Units 30000

Cost per unit 35.44 per UNIT

D) Distinction between the profit obtained

The unit cost under ABC costing is less than the traditional costing which is absorption

costing. It is recommended to the business that it should follow ABC costing as it considers

the different cost pool and how the costs have incurred. It gives a better estimate about the

cost and the profitability of the business.

QUESTION B2

Define and distinguish the terms ‘fixed costs’ and ‘variable costs’ and explain the importance

(relevance) of the distinction for short – term cost planning purposes.

Variable expenses are any costs that vary based on the volume created and sold by the

organization. This means that variable cost increases as creation increases and decreases as

creation falls. Perhaps the most well-known variable expenses include work, utility costs,

commissions, and unrefined components.

For example, it should be possible to calculate the variable fee by multiplying the result

volume by the variable fee per unit of result. Suppose ABC Company makes art mugs for $2

a cup. Assuming the organization produces 500 units, its variable expense will be $1,000.

Still, if the organization doesn't deliver any units, it doesn't have any factor cost to make the

cups. Also, assuming the organization produces 1,000 units, the cost will rise to $2,000.

The fixed costs are any costs that continue to exist as before, no matter how much the

organization produces. These fees are usually independent of the specific business activities

of the organization and include elements such as leases, local charges, conservation and

deterioration.

Particular Product X

Direct Material 240000

Direct Labour 450000

Prime Cost 690000

Add: Recovered Overhead 373200

Total Cost 1063200

Total Units 30000

Cost per unit 35.44 per UNIT

D) Distinction between the profit obtained

The unit cost under ABC costing is less than the traditional costing which is absorption

costing. It is recommended to the business that it should follow ABC costing as it considers

the different cost pool and how the costs have incurred. It gives a better estimate about the

cost and the profitability of the business.

QUESTION B2

Define and distinguish the terms ‘fixed costs’ and ‘variable costs’ and explain the importance

(relevance) of the distinction for short – term cost planning purposes.

Variable expenses are any costs that vary based on the volume created and sold by the

organization. This means that variable cost increases as creation increases and decreases as

creation falls. Perhaps the most well-known variable expenses include work, utility costs,

commissions, and unrefined components.

For example, it should be possible to calculate the variable fee by multiplying the result

volume by the variable fee per unit of result. Suppose ABC Company makes art mugs for $2

a cup. Assuming the organization produces 500 units, its variable expense will be $1,000.

Still, if the organization doesn't deliver any units, it doesn't have any factor cost to make the

cups. Also, assuming the organization produces 1,000 units, the cost will rise to $2,000.

The fixed costs are any costs that continue to exist as before, no matter how much the

organization produces. These fees are usually independent of the specific business activities

of the organization and include elements such as leases, local charges, conservation and

deterioration.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

For example, to illustrate, it should use a similar model from higher up. For this case, assume

that ABC Company has an appropriate monthly fee of $10,000 to rent the machine it uses to

deliver the cups. If the organization did not make any cups this month, it would actually have

to pay $10,000 to rent the machines. In any case, its normal expenses continue as before,

whether it makes 1,000,000 mugs or not. In this model, variable costs go from zero to $2

million.

b) Compute the following:

1. The contribution / sales ratio (C/S %):

= (16.5 / 30) * 100

= 55 %

2. The product break – even point (in units and £s sales)

Fixed Costs / Contribution

= 28000 / 16.5 = 1696.97 Units.

3. The production capacity (in units)

= Current level of activity / Activity level Capacity

= 2000 / 80% = 2500 units per months

So, 30000 units the organisation has the production capacity of.

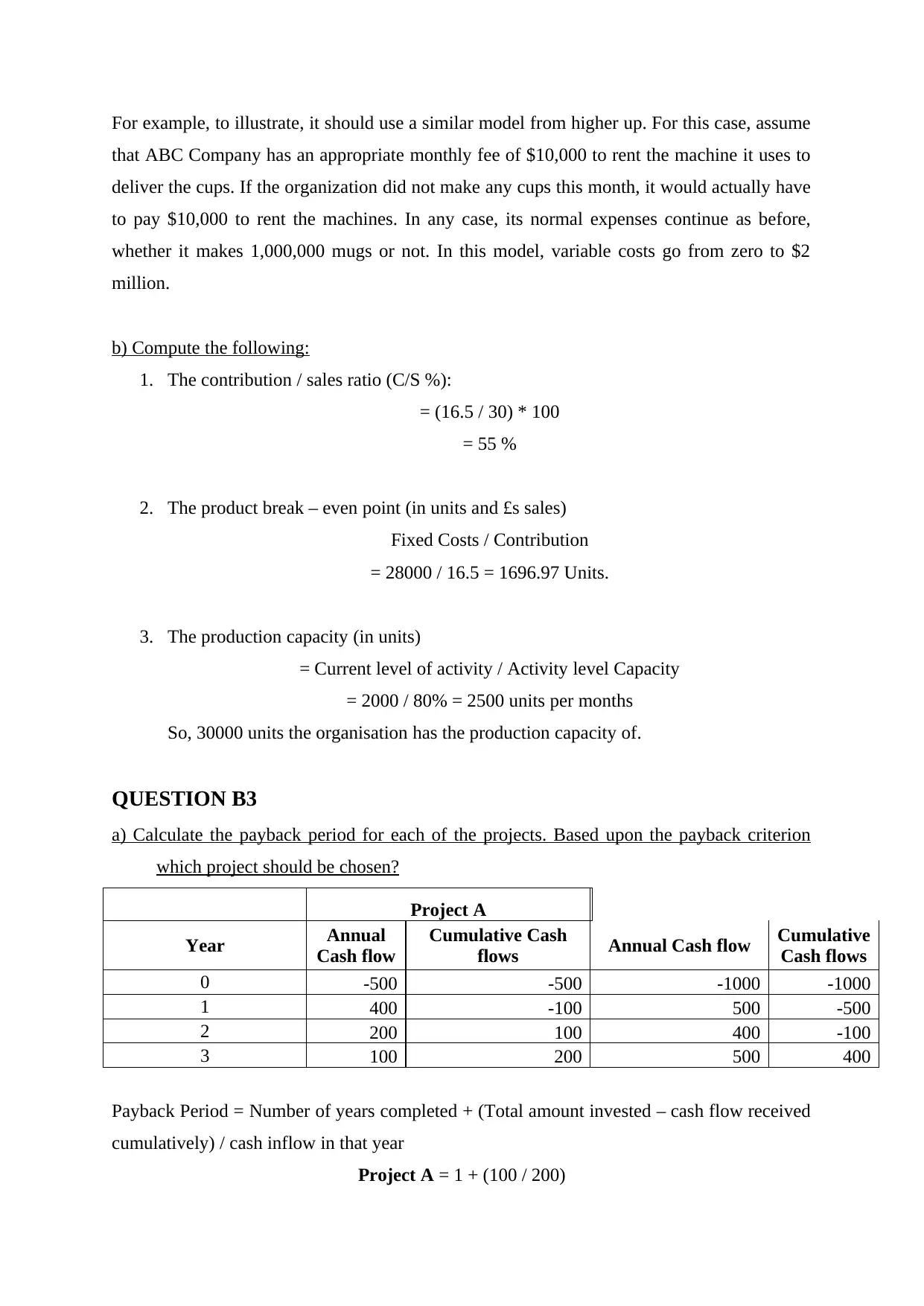

QUESTION B3

a) Calculate the payback period for each of the projects. Based upon the payback criterion

which project should be chosen?

Project A

Year Annual

Cash flow

Cumulative Cash

flows Annual Cash flow Cumulative

Cash flows

0 -500 -500 -1000 -1000

1 400 -100 500 -500

2 200 100 400 -100

3 100 200 500 400

Payback Period = Number of years completed + (Total amount invested – cash flow received

cumulatively) / cash inflow in that year

Project A = 1 + (100 / 200)

that ABC Company has an appropriate monthly fee of $10,000 to rent the machine it uses to

deliver the cups. If the organization did not make any cups this month, it would actually have

to pay $10,000 to rent the machines. In any case, its normal expenses continue as before,

whether it makes 1,000,000 mugs or not. In this model, variable costs go from zero to $2

million.

b) Compute the following:

1. The contribution / sales ratio (C/S %):

= (16.5 / 30) * 100

= 55 %

2. The product break – even point (in units and £s sales)

Fixed Costs / Contribution

= 28000 / 16.5 = 1696.97 Units.

3. The production capacity (in units)

= Current level of activity / Activity level Capacity

= 2000 / 80% = 2500 units per months

So, 30000 units the organisation has the production capacity of.

QUESTION B3

a) Calculate the payback period for each of the projects. Based upon the payback criterion

which project should be chosen?

Project A

Year Annual

Cash flow

Cumulative Cash

flows Annual Cash flow Cumulative

Cash flows

0 -500 -500 -1000 -1000

1 400 -100 500 -500

2 200 100 400 -100

3 100 200 500 400

Payback Period = Number of years completed + (Total amount invested – cash flow received

cumulatively) / cash inflow in that year

Project A = 1 + (100 / 200)

= 1 + 0.5 = 1.5 Years

Project B = 2 + (100 / 500)

= 2 + 0.2 = 2.2 Years

Upon the above calculations, both the investment amount in both the project were

different. This is the reason that there is difficulty in choosing one project. But, assesses the

above figures, it can be said that project A will be beneficial as it will give a return on about

1.5 years.

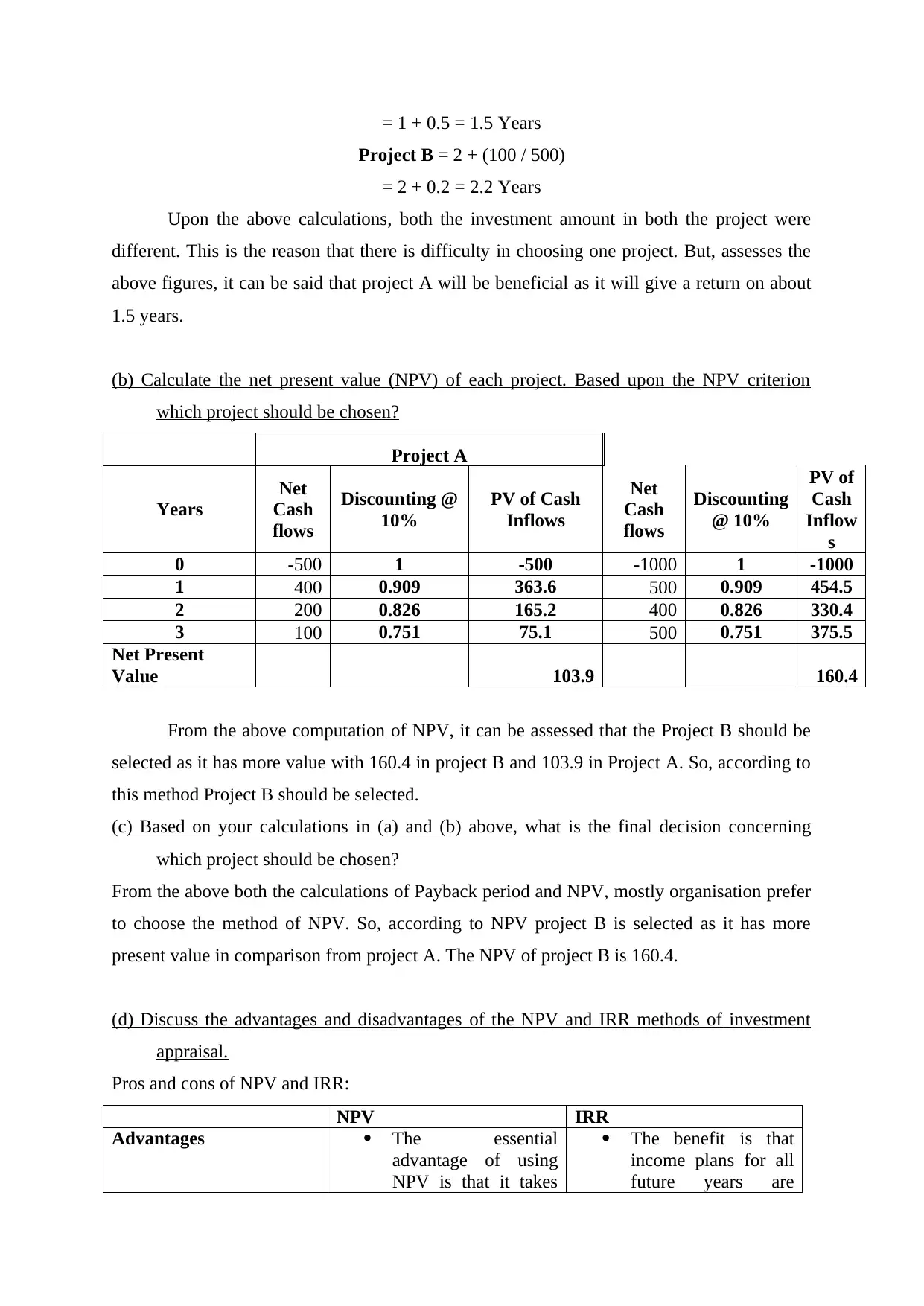

(b) Calculate the net present value (NPV) of each project. Based upon the NPV criterion

which project should be chosen?

Project A

Years

Net

Cash

flows

Discounting @

10%

PV of Cash

Inflows

Net

Cash

flows

Discounting

@ 10%

PV of

Cash

Inflow

s

0 -500 1 -500 -1000 1 -1000

1 400 0.909 363.6 500 0.909 454.5

2 200 0.826 165.2 400 0.826 330.4

3 100 0.751 75.1 500 0.751 375.5

Net Present

Value 103.9 160.4

From the above computation of NPV, it can be assessed that the Project B should be

selected as it has more value with 160.4 in project B and 103.9 in Project A. So, according to

this method Project B should be selected.

(c) Based on your calculations in (a) and (b) above, what is the final decision concerning

which project should be chosen?

From the above both the calculations of Payback period and NPV, mostly organisation prefer

to choose the method of NPV. So, according to NPV project B is selected as it has more

present value in comparison from project A. The NPV of project B is 160.4.

(d) Discuss the advantages and disadvantages of the NPV and IRR methods of investment

appraisal.

Pros and cons of NPV and IRR:

NPV IRR

Advantages The essential

advantage of using

NPV is that it takes

The benefit is that

income plans for all

future years are

Project B = 2 + (100 / 500)

= 2 + 0.2 = 2.2 Years

Upon the above calculations, both the investment amount in both the project were

different. This is the reason that there is difficulty in choosing one project. But, assesses the

above figures, it can be said that project A will be beneficial as it will give a return on about

1.5 years.

(b) Calculate the net present value (NPV) of each project. Based upon the NPV criterion

which project should be chosen?

Project A

Years

Net

Cash

flows

Discounting @

10%

PV of Cash

Inflows

Net

Cash

flows

Discounting

@ 10%

PV of

Cash

Inflow

s

0 -500 1 -500 -1000 1 -1000

1 400 0.909 363.6 500 0.909 454.5

2 200 0.826 165.2 400 0.826 330.4

3 100 0.751 75.1 500 0.751 375.5

Net Present

Value 103.9 160.4

From the above computation of NPV, it can be assessed that the Project B should be

selected as it has more value with 160.4 in project B and 103.9 in Project A. So, according to

this method Project B should be selected.

(c) Based on your calculations in (a) and (b) above, what is the final decision concerning

which project should be chosen?

From the above both the calculations of Payback period and NPV, mostly organisation prefer

to choose the method of NPV. So, according to NPV project B is selected as it has more

present value in comparison from project A. The NPV of project B is 160.4.

(d) Discuss the advantages and disadvantages of the NPV and IRR methods of investment

appraisal.

Pros and cons of NPV and IRR:

NPV IRR

Advantages The essential

advantage of using

NPV is that it takes

The benefit is that

income plans for all

future years are

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.