Managerial Economics Assignment: Regression, Elasticity & Profit

VerifiedAdded on 2020/04/21

|13

|1199

|82

Homework Assignment

AI Summary

This document provides a comprehensive solution to a managerial economics assignment. The solution includes regression analysis to determine the relationship between average variable cost and quantity, deriving the average variable cost, total variable cost, and marginal cost functions. It also analyzes a demand function, considering factors like price, average household income, and competitor's prices, and calculates the optimal price and quantity for profit maximization. Furthermore, the assignment explores elasticity concepts, including price, income, and cross-price elasticities, and assesses the impact of price changes on demand and revenue. The document also examines the effects of changes in fixed costs and provides insights into revenue maximization strategies.

Running head: MANAGERIAL ECONOMICS

Managerial Economics

Name of the Student

Name of the University

Author note

Managerial Economics

Name of the Student

Name of the University

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGERIAL ECONOMICS

Table of Contents

Answer 1..........................................................................................................................................2

Answer a......................................................................................................................................2

Answer b......................................................................................................................................3

Answer c......................................................................................................................................3

Answer 2..........................................................................................................................................4

Answer a......................................................................................................................................4

Answer b......................................................................................................................................6

Answer c......................................................................................................................................7

Answer 3..........................................................................................................................................8

Answer 4..........................................................................................................................................9

Answer a......................................................................................................................................9

Answer b....................................................................................................................................10

Answer 5........................................................................................................................................10

Answer a....................................................................................................................................10

Answer b....................................................................................................................................10

Answer 6........................................................................................................................................10

Answer 7........................................................................................................................................11

Table of Contents

Answer 1..........................................................................................................................................2

Answer a......................................................................................................................................2

Answer b......................................................................................................................................3

Answer c......................................................................................................................................3

Answer 2..........................................................................................................................................4

Answer a......................................................................................................................................4

Answer b......................................................................................................................................6

Answer c......................................................................................................................................7

Answer 3..........................................................................................................................................8

Answer 4..........................................................................................................................................9

Answer a......................................................................................................................................9

Answer b....................................................................................................................................10

Answer 5........................................................................................................................................10

Answer a....................................................................................................................................10

Answer b....................................................................................................................................10

Answer 6........................................................................................................................................10

Answer 7........................................................................................................................................11

2MANAGERIAL ECONOMICS

Answer 1

Answer a

Regression Statistics

Multiple R

0.8

0

R Square

0.6

3

Adjusted R Square

0.6

0

Standard Error

7.7

3

Observations 26

ANOVA

df SS MS F

Significance

F

Regression 2 2387.498 1193.749 19.975 0.000

Residual 23 1374.541 59.763

Total 25 3762.038

Coefficient

s

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 152.881 6.605 23.146 0.000 139.217 166.544

Q -0.061 0.015 -4.199 0.000 -0.092 -0.031

Q2 0.00002 0.000 2.693 0.013 0.000 0.000

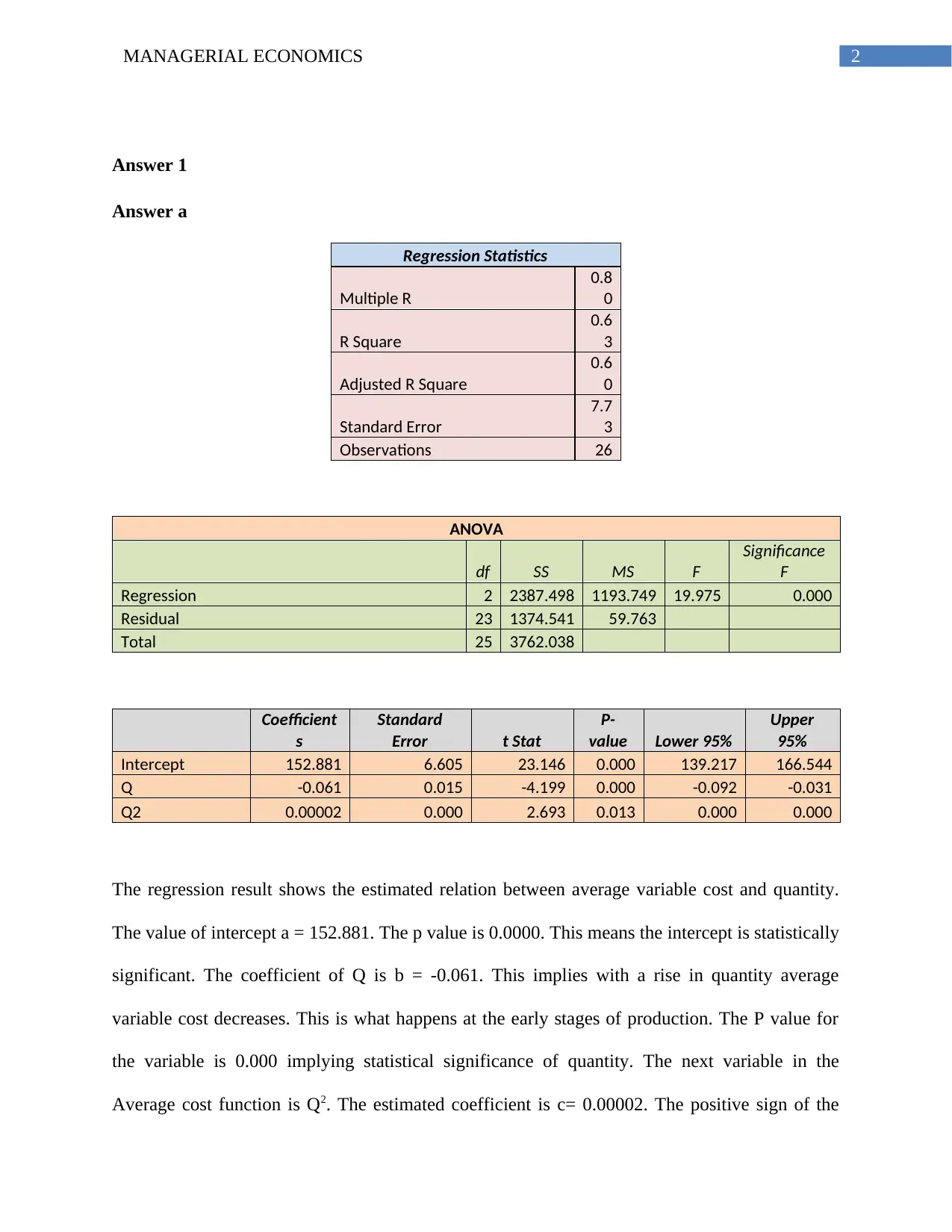

The regression result shows the estimated relation between average variable cost and quantity.

The value of intercept a = 152.881. The p value is 0.0000. This means the intercept is statistically

significant. The coefficient of Q is b = -0.061. This implies with a rise in quantity average

variable cost decreases. This is what happens at the early stages of production. The P value for

the variable is 0.000 implying statistical significance of quantity. The next variable in the

Average cost function is Q2. The estimated coefficient is c= 0.00002. The positive sign of the

Answer 1

Answer a

Regression Statistics

Multiple R

0.8

0

R Square

0.6

3

Adjusted R Square

0.6

0

Standard Error

7.7

3

Observations 26

ANOVA

df SS MS F

Significance

F

Regression 2 2387.498 1193.749 19.975 0.000

Residual 23 1374.541 59.763

Total 25 3762.038

Coefficient

s

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 152.881 6.605 23.146 0.000 139.217 166.544

Q -0.061 0.015 -4.199 0.000 -0.092 -0.031

Q2 0.00002 0.000 2.693 0.013 0.000 0.000

The regression result shows the estimated relation between average variable cost and quantity.

The value of intercept a = 152.881. The p value is 0.0000. This means the intercept is statistically

significant. The coefficient of Q is b = -0.061. This implies with a rise in quantity average

variable cost decreases. This is what happens at the early stages of production. The P value for

the variable is 0.000 implying statistical significance of quantity. The next variable in the

Average cost function is Q2. The estimated coefficient is c= 0.00002. The positive sign of the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGERIAL ECONOMICS

parameter shows a positive relation between average variable cost and Q2. The implication is that

as quantity starts increasing at a rapid rate then cost also increases. The P value is 0.013. As the p

value is less than 0.05, the variable Q2 is statistically significant.

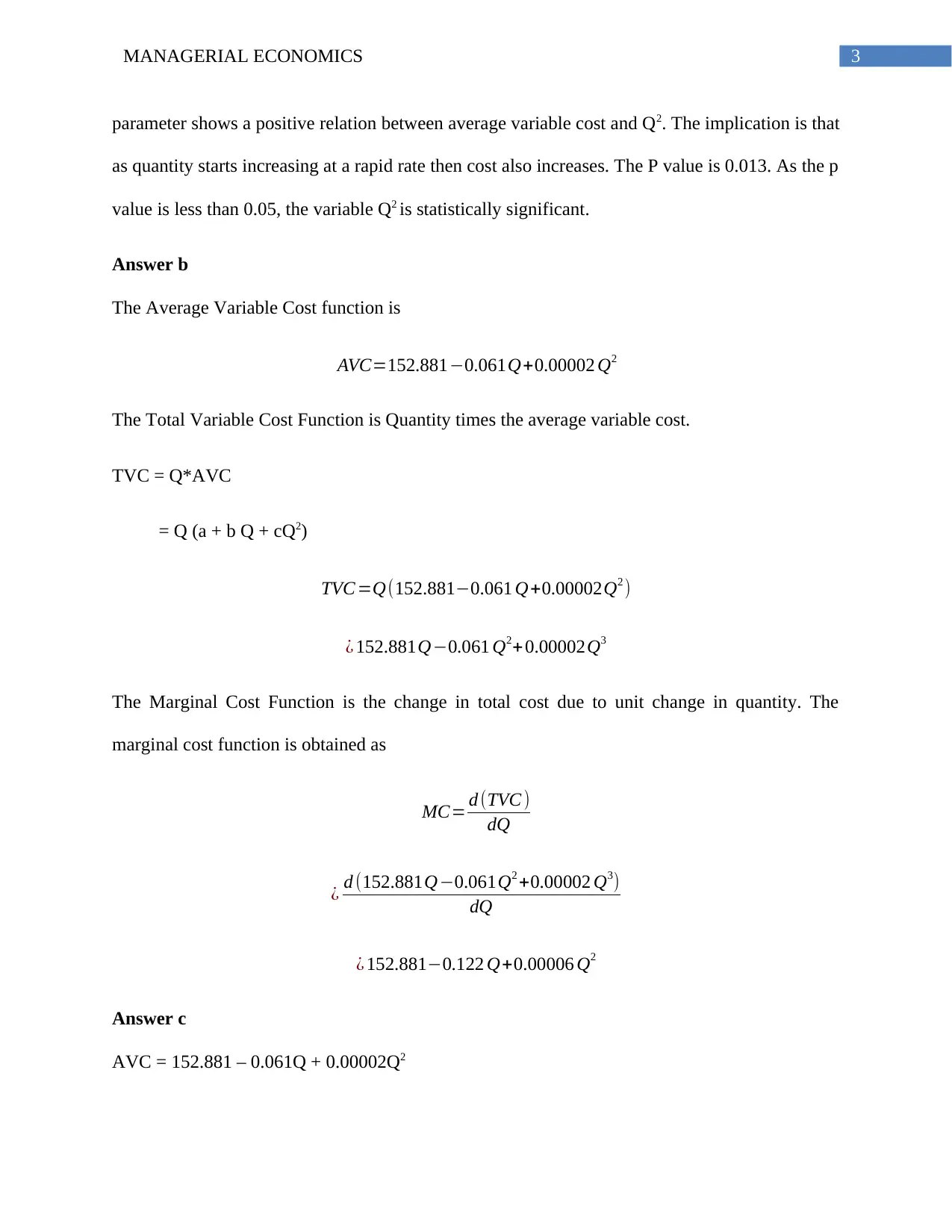

Answer b

The Average Variable Cost function is

AVC=152.881−0.061Q+0.00002 Q2

The Total Variable Cost Function is Quantity times the average variable cost.

TVC = Q*AVC

= Q (a + b Q + cQ2)

TVC =Q(152.881−0.061 Q+0.00002Q2 )

¿ 152.881Q−0.061 Q2+0.00002Q3

The Marginal Cost Function is the change in total cost due to unit change in quantity. The

marginal cost function is obtained as

MC= d (TVC )

dQ

¿ d (152.881Q−0.061Q2 +0.00002 Q3)

dQ

¿ 152.881−0.122 Q+0.00006 Q2

Answer c

AVC = 152.881 – 0.061Q + 0.00002Q2

parameter shows a positive relation between average variable cost and Q2. The implication is that

as quantity starts increasing at a rapid rate then cost also increases. The P value is 0.013. As the p

value is less than 0.05, the variable Q2 is statistically significant.

Answer b

The Average Variable Cost function is

AVC=152.881−0.061Q+0.00002 Q2

The Total Variable Cost Function is Quantity times the average variable cost.

TVC = Q*AVC

= Q (a + b Q + cQ2)

TVC =Q(152.881−0.061 Q+0.00002Q2 )

¿ 152.881Q−0.061 Q2+0.00002Q3

The Marginal Cost Function is the change in total cost due to unit change in quantity. The

marginal cost function is obtained as

MC= d (TVC )

dQ

¿ d (152.881Q−0.061Q2 +0.00002 Q3)

dQ

¿ 152.881−0.122 Q+0.00006 Q2

Answer c

AVC = 152.881 – 0.061Q + 0.00002Q2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGERIAL ECONOMICS

The first order condition for minimization is

d ( AVC )

dQ =0

−0.061+0.00004 Q=0

Or, 0.00004 Q=0.061

Or, Q= 0.061

0.00004

Or, Q = 1525

Q min = 1525

The minimum average variable cost

AVCmin=152.881−0.061 Q+0.00002Q2

¿ 152.881−0.061∗1525+0.00002∗15252

¿ 152.881−93.025+ 46.5125

¿ 106.3685

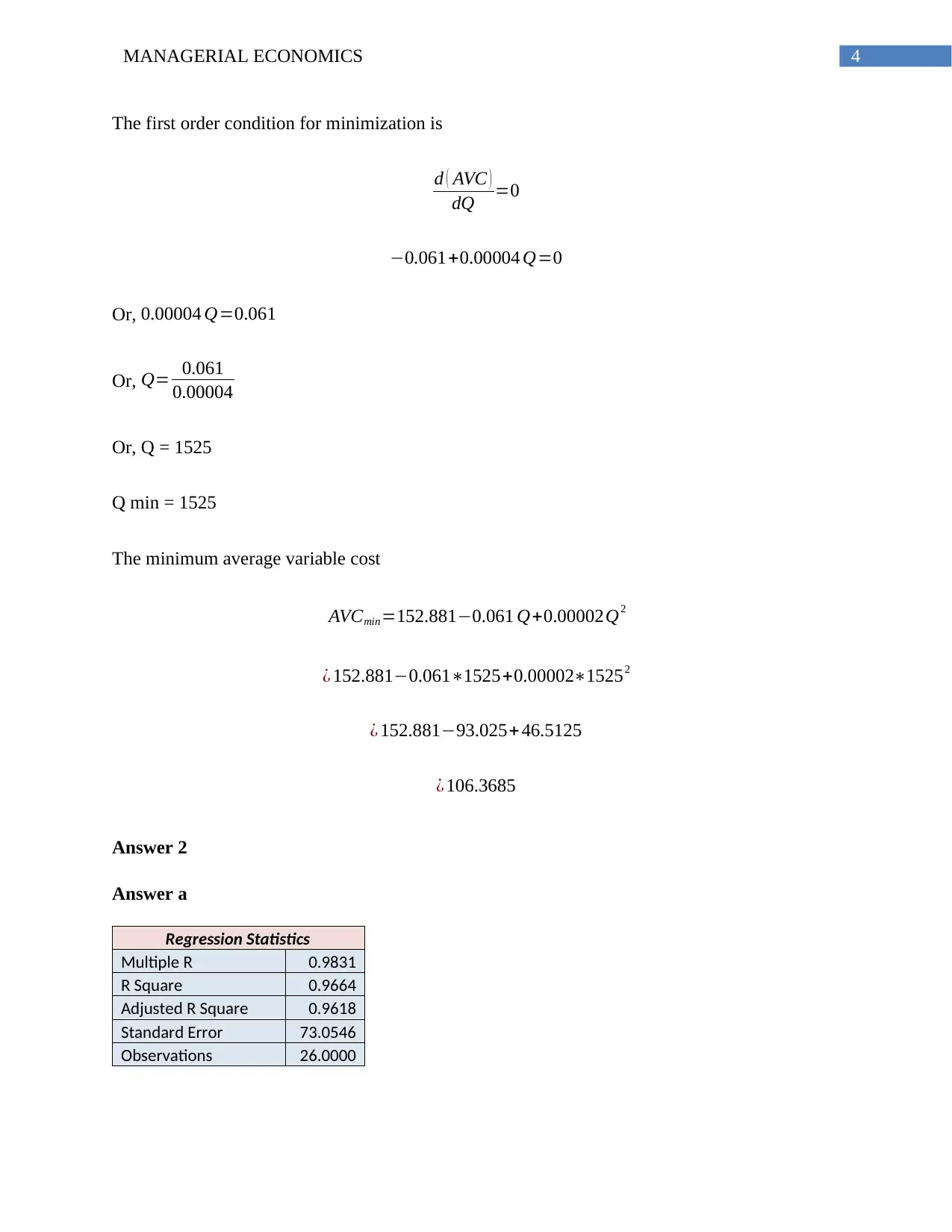

Answer 2

Answer a

Regression Statistics

Multiple R 0.9831

R Square 0.9664

Adjusted R Square 0.9618

Standard Error 73.0546

Observations 26.0000

The first order condition for minimization is

d ( AVC )

dQ =0

−0.061+0.00004 Q=0

Or, 0.00004 Q=0.061

Or, Q= 0.061

0.00004

Or, Q = 1525

Q min = 1525

The minimum average variable cost

AVCmin=152.881−0.061 Q+0.00002Q2

¿ 152.881−0.061∗1525+0.00002∗15252

¿ 152.881−93.025+ 46.5125

¿ 106.3685

Answer 2

Answer a

Regression Statistics

Multiple R 0.9831

R Square 0.9664

Adjusted R Square 0.9618

Standard Error 73.0546

Observations 26.0000

5MANAGERIAL ECONOMICS

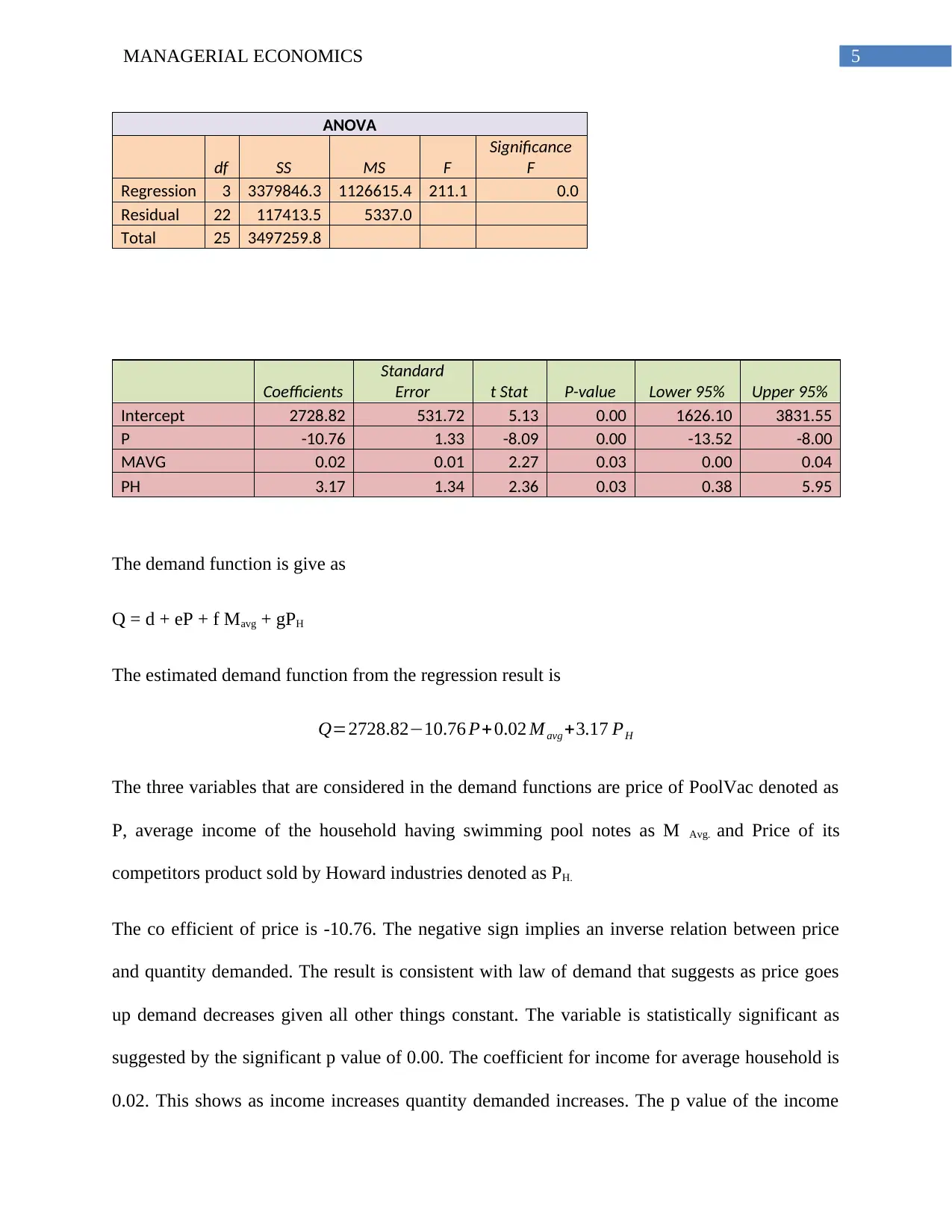

ANOVA

df SS MS F

Significance

F

Regression 3 3379846.3 1126615.4 211.1 0.0

Residual 22 117413.5 5337.0

Total 25 3497259.8

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept 2728.82 531.72 5.13 0.00 1626.10 3831.55

P -10.76 1.33 -8.09 0.00 -13.52 -8.00

MAVG 0.02 0.01 2.27 0.03 0.00 0.04

PH 3.17 1.34 2.36 0.03 0.38 5.95

The demand function is give as

Q = d + eP + f Mavg + gPH

The estimated demand function from the regression result is

Q=2728.82−10.76 P+ 0.02 M avg +3.17 PH

The three variables that are considered in the demand functions are price of PoolVac denoted as

P, average income of the household having swimming pool notes as M Avg. and Price of its

competitors product sold by Howard industries denoted as PH.

The co efficient of price is -10.76. The negative sign implies an inverse relation between price

and quantity demanded. The result is consistent with law of demand that suggests as price goes

up demand decreases given all other things constant. The variable is statistically significant as

suggested by the significant p value of 0.00. The coefficient for income for average household is

0.02. This shows as income increases quantity demanded increases. The p value of the income

ANOVA

df SS MS F

Significance

F

Regression 3 3379846.3 1126615.4 211.1 0.0

Residual 22 117413.5 5337.0

Total 25 3497259.8

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept 2728.82 531.72 5.13 0.00 1626.10 3831.55

P -10.76 1.33 -8.09 0.00 -13.52 -8.00

MAVG 0.02 0.01 2.27 0.03 0.00 0.04

PH 3.17 1.34 2.36 0.03 0.38 5.95

The demand function is give as

Q = d + eP + f Mavg + gPH

The estimated demand function from the regression result is

Q=2728.82−10.76 P+ 0.02 M avg +3.17 PH

The three variables that are considered in the demand functions are price of PoolVac denoted as

P, average income of the household having swimming pool notes as M Avg. and Price of its

competitors product sold by Howard industries denoted as PH.

The co efficient of price is -10.76. The negative sign implies an inverse relation between price

and quantity demanded. The result is consistent with law of demand that suggests as price goes

up demand decreases given all other things constant. The variable is statistically significant as

suggested by the significant p value of 0.00. The coefficient for income for average household is

0.02. This shows as income increases quantity demanded increases. The p value of the income

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGERIAL ECONOMICS

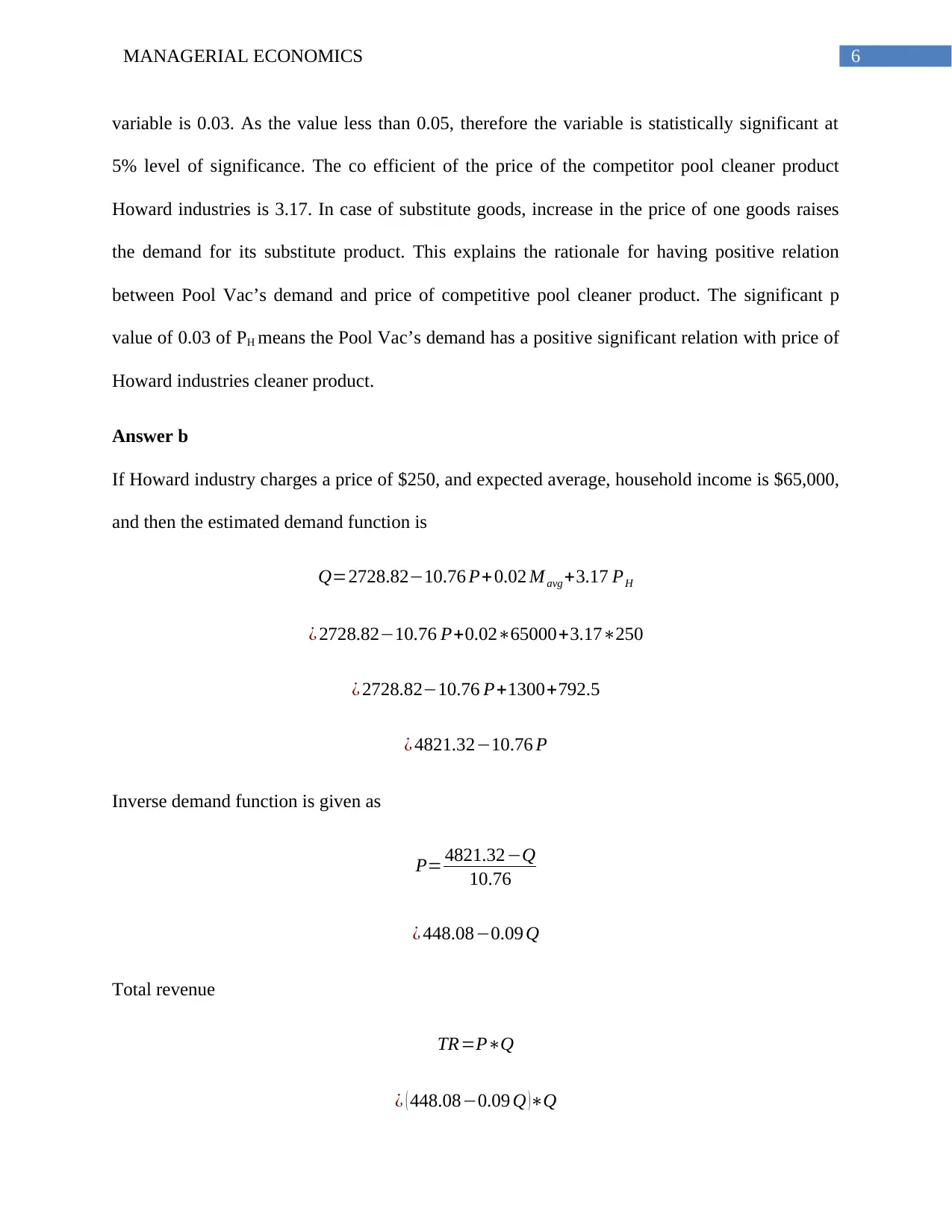

variable is 0.03. As the value less than 0.05, therefore the variable is statistically significant at

5% level of significance. The co efficient of the price of the competitor pool cleaner product

Howard industries is 3.17. In case of substitute goods, increase in the price of one goods raises

the demand for its substitute product. This explains the rationale for having positive relation

between Pool Vac’s demand and price of competitive pool cleaner product. The significant p

value of 0.03 of PH means the Pool Vac’s demand has a positive significant relation with price of

Howard industries cleaner product.

Answer b

If Howard industry charges a price of $250, and expected average, household income is $65,000,

and then the estimated demand function is

Q=2728.82−10.76 P+ 0.02 M avg +3.17 PH

¿ 2728.82−10.76 P+0.02∗65000+3.17∗250

¿ 2728.82−10.76 P+1300+792.5

¿ 4821.32−10.76 P

Inverse demand function is given as

P= 4821.32−Q

10.76

¿ 448.08−0.09 Q

Total revenue

TR=P∗Q

¿ ( 448.08−0.09 Q )∗Q

variable is 0.03. As the value less than 0.05, therefore the variable is statistically significant at

5% level of significance. The co efficient of the price of the competitor pool cleaner product

Howard industries is 3.17. In case of substitute goods, increase in the price of one goods raises

the demand for its substitute product. This explains the rationale for having positive relation

between Pool Vac’s demand and price of competitive pool cleaner product. The significant p

value of 0.03 of PH means the Pool Vac’s demand has a positive significant relation with price of

Howard industries cleaner product.

Answer b

If Howard industry charges a price of $250, and expected average, household income is $65,000,

and then the estimated demand function is

Q=2728.82−10.76 P+ 0.02 M avg +3.17 PH

¿ 2728.82−10.76 P+0.02∗65000+3.17∗250

¿ 2728.82−10.76 P+1300+792.5

¿ 4821.32−10.76 P

Inverse demand function is given as

P= 4821.32−Q

10.76

¿ 448.08−0.09 Q

Total revenue

TR=P∗Q

¿ ( 448.08−0.09 Q )∗Q

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGERIAL ECONOMICS

¿ 448.08 Q−0.09Q2

Marginal Revenue

MR= dTR

dQ

¿ d (448.08 Q−0.09Q2 )

dQ

¿ 448.08−0.18 Q

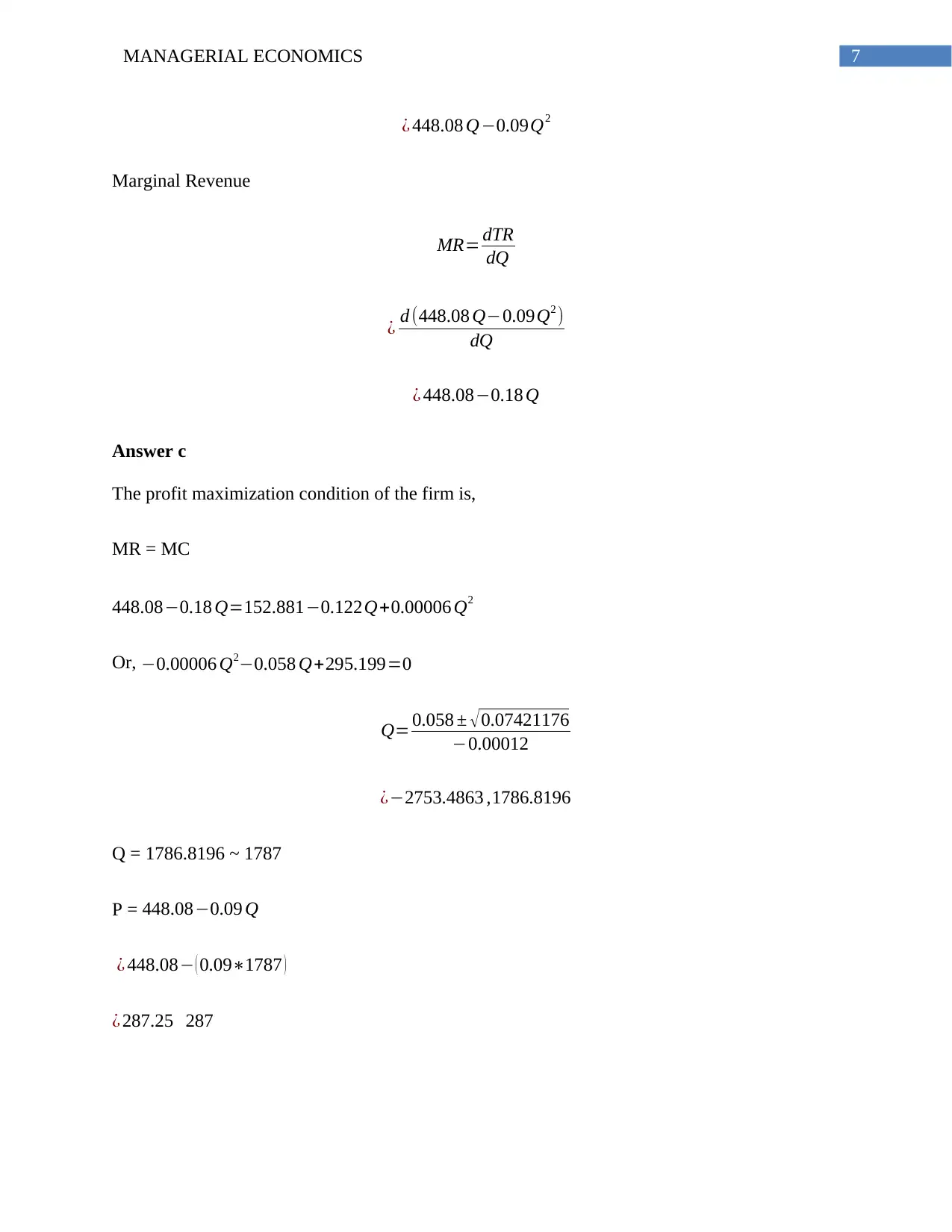

Answer c

The profit maximization condition of the firm is,

MR = MC

448.08−0.18 Q=152.881−0.122Q+0.00006 Q2

Or, −0.00006 Q2−0.058 Q+295.199=0

Q= 0.058 ± √0.07421176

−0.00012

¿−2753.4863 ,1786.8196

Q = 1786.8196 ~ 1787

P = 448.08−0.09 Q

¿ 448.08− ( 0.09∗1787 )

¿ 287.25 287

¿ 448.08 Q−0.09Q2

Marginal Revenue

MR= dTR

dQ

¿ d (448.08 Q−0.09Q2 )

dQ

¿ 448.08−0.18 Q

Answer c

The profit maximization condition of the firm is,

MR = MC

448.08−0.18 Q=152.881−0.122Q+0.00006 Q2

Or, −0.00006 Q2−0.058 Q+295.199=0

Q= 0.058 ± √0.07421176

−0.00012

¿−2753.4863 ,1786.8196

Q = 1786.8196 ~ 1787

P = 448.08−0.09 Q

¿ 448.08− ( 0.09∗1787 )

¿ 287.25 287

8MANAGERIAL ECONOMICS

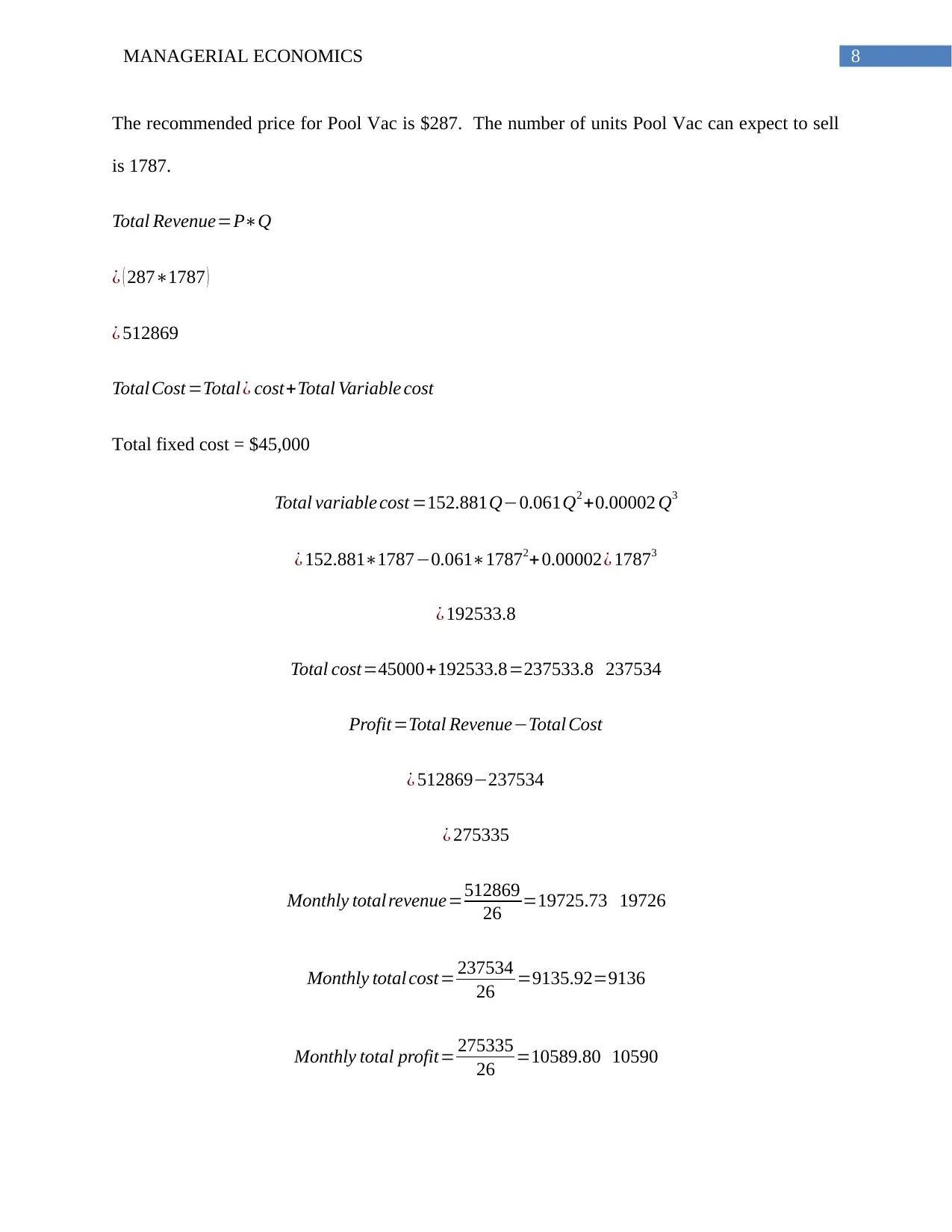

The recommended price for Pool Vac is $287. The number of units Pool Vac can expect to sell

is 1787.

Total Revenue=P∗Q

¿ ( 287∗1787 )

¿ 512869

Total Cost =Total ¿ cost+Total Variable cost

Total fixed cost = $45,000

Total variable cost =152.881Q−0.061Q2 +0.00002 Q3

¿ 152.881∗1787−0.061∗17872+ 0.00002¿ 17873

¿ 192533.8

Total cost=45000+192533.8=237533.8 237534

Profit=Total Revenue−Total Cost

¿ 512869−237534

¿ 275335

Monthly total revenue=512869

26 =19725.73 19726

Monthly total cost= 237534

26 =9135.92=9136

Monthly total profit= 275335

26 =10589.80 10590

The recommended price for Pool Vac is $287. The number of units Pool Vac can expect to sell

is 1787.

Total Revenue=P∗Q

¿ ( 287∗1787 )

¿ 512869

Total Cost =Total ¿ cost+Total Variable cost

Total fixed cost = $45,000

Total variable cost =152.881Q−0.061Q2 +0.00002 Q3

¿ 152.881∗1787−0.061∗17872+ 0.00002¿ 17873

¿ 192533.8

Total cost=45000+192533.8=237533.8 237534

Profit=Total Revenue−Total Cost

¿ 512869−237534

¿ 275335

Monthly total revenue=512869

26 =19725.73 19726

Monthly total cost= 237534

26 =9135.92=9136

Monthly total profit= 275335

26 =10589.80 10590

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGERIAL ECONOMICS

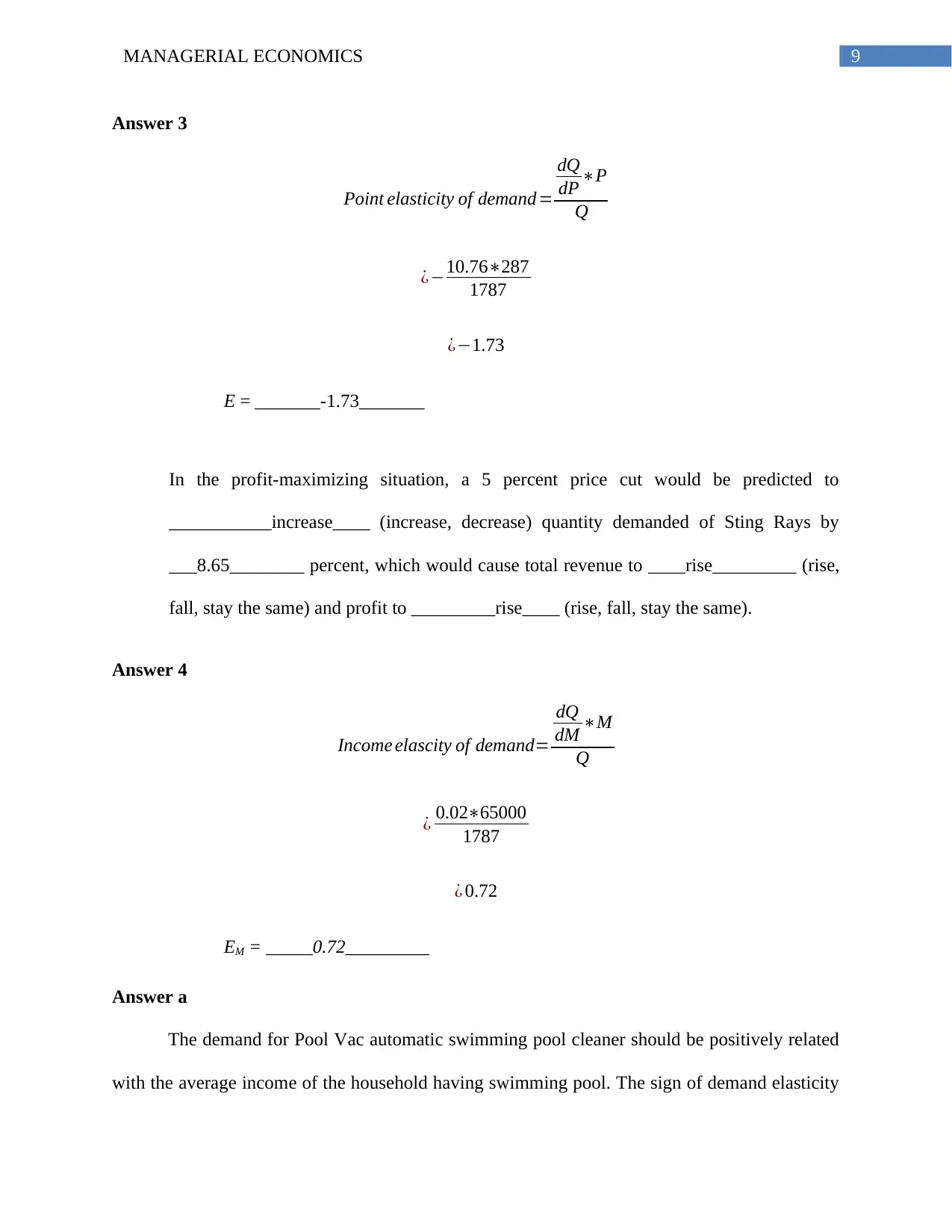

Answer 3

Point elasticity of demand=

dQ

dP ∗P

Q

¿−10.76∗287

1787

¿−1.73

E = _______-1.73_______

In the profit-maximizing situation, a 5 percent price cut would be predicted to

___________increase____ (increase, decrease) quantity demanded of Sting Rays by

___8.65________ percent, which would cause total revenue to ____rise_________ (rise,

fall, stay the same) and profit to _________rise____ (rise, fall, stay the same).

Answer 4

Income elascity of demand=

dQ

dM ∗M

Q

¿ 0.02∗65000

1787

¿ 0.72

EM = _____0.72_________

Answer a

The demand for Pool Vac automatic swimming pool cleaner should be positively related

with the average income of the household having swimming pool. The sign of demand elasticity

Answer 3

Point elasticity of demand=

dQ

dP ∗P

Q

¿−10.76∗287

1787

¿−1.73

E = _______-1.73_______

In the profit-maximizing situation, a 5 percent price cut would be predicted to

___________increase____ (increase, decrease) quantity demanded of Sting Rays by

___8.65________ percent, which would cause total revenue to ____rise_________ (rise,

fall, stay the same) and profit to _________rise____ (rise, fall, stay the same).

Answer 4

Income elascity of demand=

dQ

dM ∗M

Q

¿ 0.02∗65000

1787

¿ 0.72

EM = _____0.72_________

Answer a

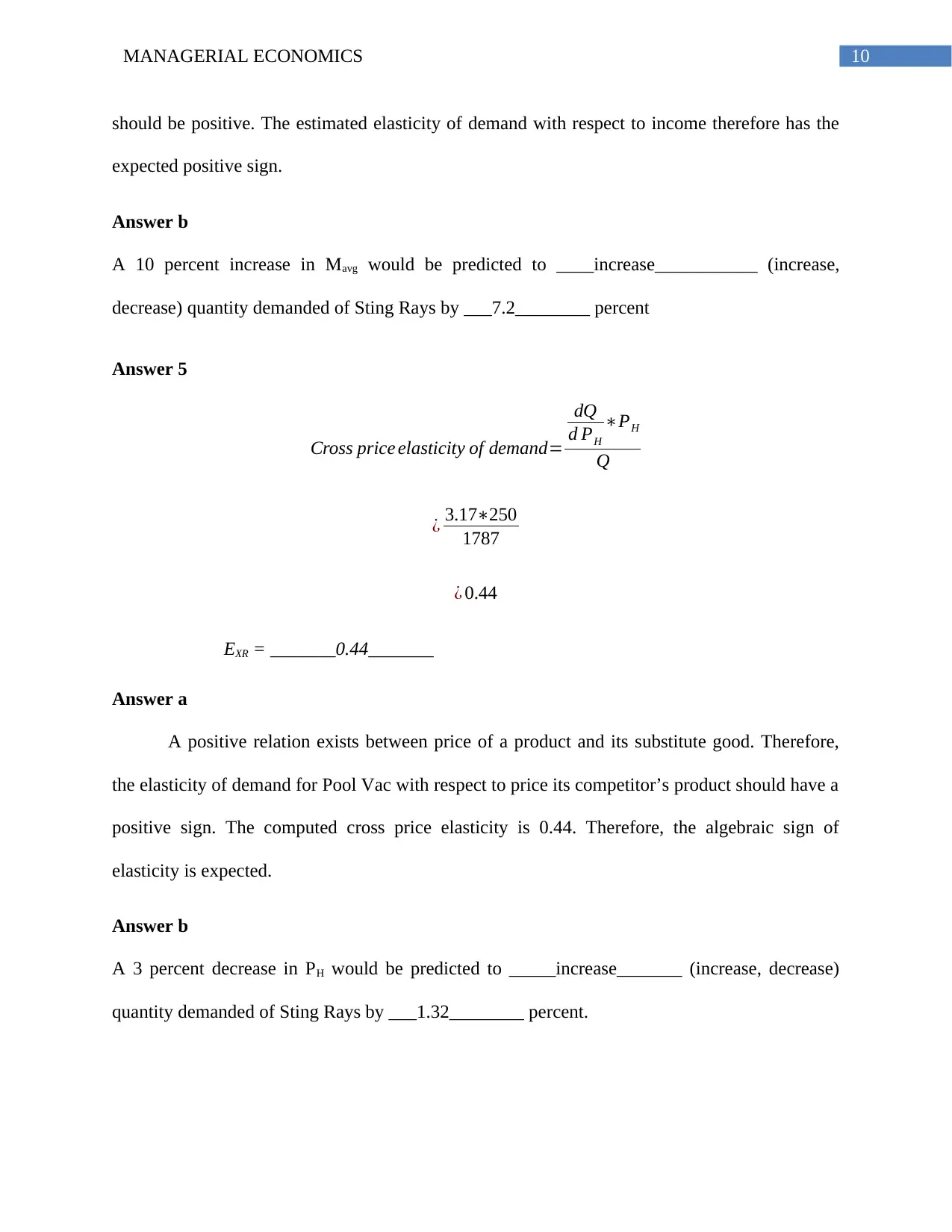

The demand for Pool Vac automatic swimming pool cleaner should be positively related

with the average income of the household having swimming pool. The sign of demand elasticity

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGERIAL ECONOMICS

should be positive. The estimated elasticity of demand with respect to income therefore has the

expected positive sign.

Answer b

A 10 percent increase in Mavg would be predicted to ____increase___________ (increase,

decrease) quantity demanded of Sting Rays by ___7.2________ percent

Answer 5

Cross price elasticity of demand=

dQ

d PH

∗PH

Q

¿ 3.17∗250

1787

¿ 0.44

EXR = _______0.44_______

Answer a

A positive relation exists between price of a product and its substitute good. Therefore,

the elasticity of demand for Pool Vac with respect to price its competitor’s product should have a

positive sign. The computed cross price elasticity is 0.44. Therefore, the algebraic sign of

elasticity is expected.

Answer b

A 3 percent decrease in PH would be predicted to _____increase_______ (increase, decrease)

quantity demanded of Sting Rays by ___1.32________ percent.

should be positive. The estimated elasticity of demand with respect to income therefore has the

expected positive sign.

Answer b

A 10 percent increase in Mavg would be predicted to ____increase___________ (increase,

decrease) quantity demanded of Sting Rays by ___7.2________ percent

Answer 5

Cross price elasticity of demand=

dQ

d PH

∗PH

Q

¿ 3.17∗250

1787

¿ 0.44

EXR = _______0.44_______

Answer a

A positive relation exists between price of a product and its substitute good. Therefore,

the elasticity of demand for Pool Vac with respect to price its competitor’s product should have a

positive sign. The computed cross price elasticity is 0.44. Therefore, the algebraic sign of

elasticity is expected.

Answer b

A 3 percent decrease in PH would be predicted to _____increase_______ (increase, decrease)

quantity demanded of Sting Rays by ___1.32________ percent.

11MANAGERIAL ECONOMICS

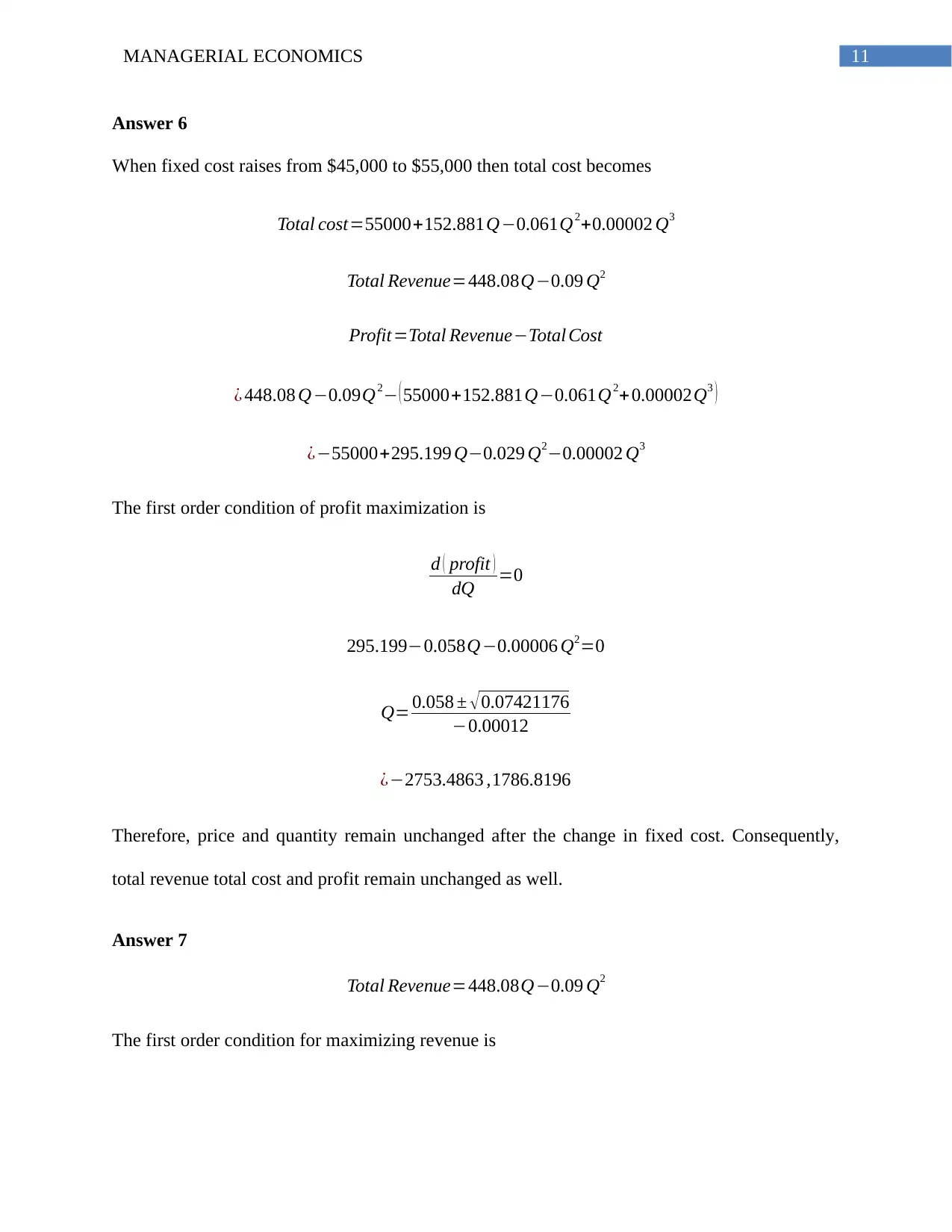

Answer 6

When fixed cost raises from $45,000 to $55,000 then total cost becomes

Total cost=55000+152.881Q−0.061Q2+0.00002 Q3

Total Revenue=448.08Q−0.09 Q2

Profit=Total Revenue−Total Cost

¿ 448.08 Q−0.09Q2− ( 55000+152.881Q−0.061Q2+0.00002Q3 )

¿−55000+295.199 Q−0.029 Q2−0.00002 Q3

The first order condition of profit maximization is

d ( profit )

dQ =0

295.199−0.058Q−0.00006 Q2=0

Q= 0.058 ± √0.07421176

−0.00012

¿−2753.4863 ,1786.8196

Therefore, price and quantity remain unchanged after the change in fixed cost. Consequently,

total revenue total cost and profit remain unchanged as well.

Answer 7

Total Revenue=448.08Q−0.09 Q2

The first order condition for maximizing revenue is

Answer 6

When fixed cost raises from $45,000 to $55,000 then total cost becomes

Total cost=55000+152.881Q−0.061Q2+0.00002 Q3

Total Revenue=448.08Q−0.09 Q2

Profit=Total Revenue−Total Cost

¿ 448.08 Q−0.09Q2− ( 55000+152.881Q−0.061Q2+0.00002Q3 )

¿−55000+295.199 Q−0.029 Q2−0.00002 Q3

The first order condition of profit maximization is

d ( profit )

dQ =0

295.199−0.058Q−0.00006 Q2=0

Q= 0.058 ± √0.07421176

−0.00012

¿−2753.4863 ,1786.8196

Therefore, price and quantity remain unchanged after the change in fixed cost. Consequently,

total revenue total cost and profit remain unchanged as well.

Answer 7

Total Revenue=448.08Q−0.09 Q2

The first order condition for maximizing revenue is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.