Financial Performance Analysis: Tesco and Sainsbury Report

VerifiedAdded on 2023/01/05

|20

|3892

|75

Report

AI Summary

This report delves into managerial finance, focusing on a comparative financial analysis of Tesco and Sainsbury, two major players in the UK supermarket sector. The first portfolio employs financial ratio analysis to assess their performance, examining ratios such as current, quick, net profit, gross profit, gearing, P/E, earnings per share, return on capital employed, stock turnover, and dividend payout. The report analyzes these ratios from 2018 to 2019, providing a detailed comparison of the two companies' financial health and performance. The second portfolio explores investment appraisal techniques, discussing their relevance and limitations in making informed investment decisions. The report concludes with a comparative analysis, highlighting the strengths and weaknesses of each company, and offering insights into their financial strategies and performance.

MANAGERIAL

FINANCE

FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................2

PORTFOLIO 1.................................................................................................................................3

a. calculation of ratio....................................................................................................................3

b. Analysis of financial performance of Tesco & Sainsbury.......................................................4

c. Reason of poor performance of business...............................................................................11

d. Limitations of measuring financial performance by using financial ratio method................12

PORTFOLIO 2...............................................................................................................................13

a. Use of capital budgeting technique for taking investment decision.....................................13

b. Limitations of investment appraisal techniques.....................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................2

PORTFOLIO 1.................................................................................................................................3

a. calculation of ratio....................................................................................................................3

b. Analysis of financial performance of Tesco & Sainsbury.......................................................4

c. Reason of poor performance of business...............................................................................11

d. Limitations of measuring financial performance by using financial ratio method................12

PORTFOLIO 2...............................................................................................................................13

a. Use of capital budgeting technique for taking investment decision.....................................13

b. Limitations of investment appraisal techniques.....................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Managerial finance is consider as branch of finance, which managers use to

systematically collect and allocate their financial resource for systematic run business activities.

This will useful in create value for the organization. To understand this concept this report has

been formulate. It divided in two part. This first portfolio is related with measuring financial

performance of Sainsbury and Tesco, by using financial ratio. Tesco and Sainsbury both run their

business in super market sector. This report define which organization is beneficial for investors

for investment purpose. In second portfolio relevance and limitations of investment appraisal

technique has been define in systematic manner.

PORTFOLIO 1

a. calculation of ratio

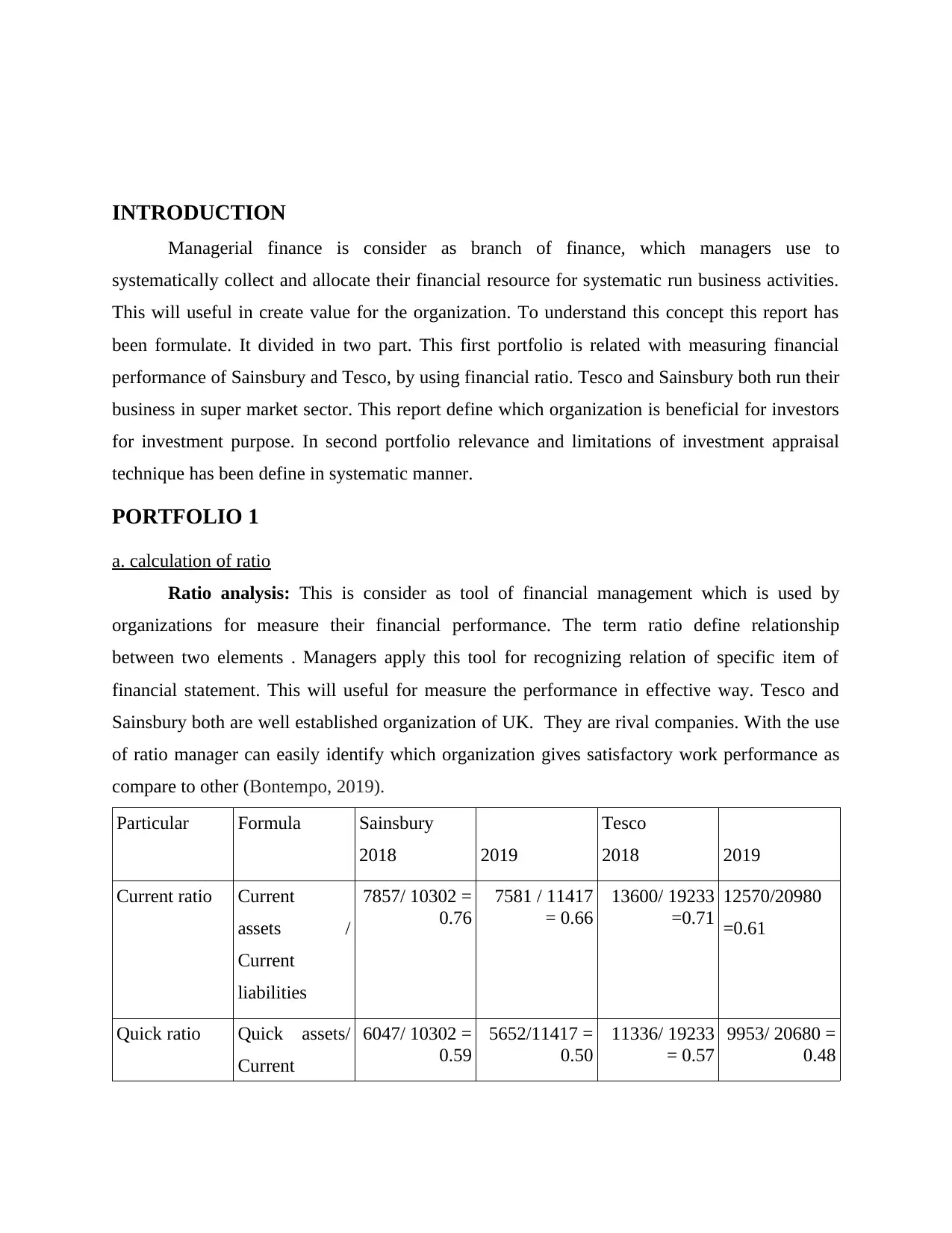

Ratio analysis: This is consider as tool of financial management which is used by

organizations for measure their financial performance. The term ratio define relationship

between two elements . Managers apply this tool for recognizing relation of specific item of

financial statement. This will useful for measure the performance in effective way. Tesco and

Sainsbury both are well established organization of UK. They are rival companies. With the use

of ratio manager can easily identify which organization gives satisfactory work performance as

compare to other (Bontempo, 2019).

Particular Formula Sainsbury

2018 2019

Tesco

2018 2019

Current ratio Current

assets /

Current

liabilities

7857/ 10302 =

0.76

7581 / 11417

= 0.66

13600/ 19233

=0.71

12570/20980

=0.61

Quick ratio Quick assets/

Current

6047/ 10302 =

0.59

5652/11417 =

0.50

11336/ 19233

= 0.57

9953/ 20680 =

0.48

Managerial finance is consider as branch of finance, which managers use to

systematically collect and allocate their financial resource for systematic run business activities.

This will useful in create value for the organization. To understand this concept this report has

been formulate. It divided in two part. This first portfolio is related with measuring financial

performance of Sainsbury and Tesco, by using financial ratio. Tesco and Sainsbury both run their

business in super market sector. This report define which organization is beneficial for investors

for investment purpose. In second portfolio relevance and limitations of investment appraisal

technique has been define in systematic manner.

PORTFOLIO 1

a. calculation of ratio

Ratio analysis: This is consider as tool of financial management which is used by

organizations for measure their financial performance. The term ratio define relationship

between two elements . Managers apply this tool for recognizing relation of specific item of

financial statement. This will useful for measure the performance in effective way. Tesco and

Sainsbury both are well established organization of UK. They are rival companies. With the use

of ratio manager can easily identify which organization gives satisfactory work performance as

compare to other (Bontempo, 2019).

Particular Formula Sainsbury

2018 2019

Tesco

2018 2019

Current ratio Current

assets /

Current

liabilities

7857/ 10302 =

0.76

7581 / 11417

= 0.66

13600/ 19233

=0.71

12570/20980

=0.61

Quick ratio Quick assets/

Current

6047/ 10302 =

0.59

5652/11417 =

0.50

11336/ 19233

= 0.57

9953/ 20680 =

0.48

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

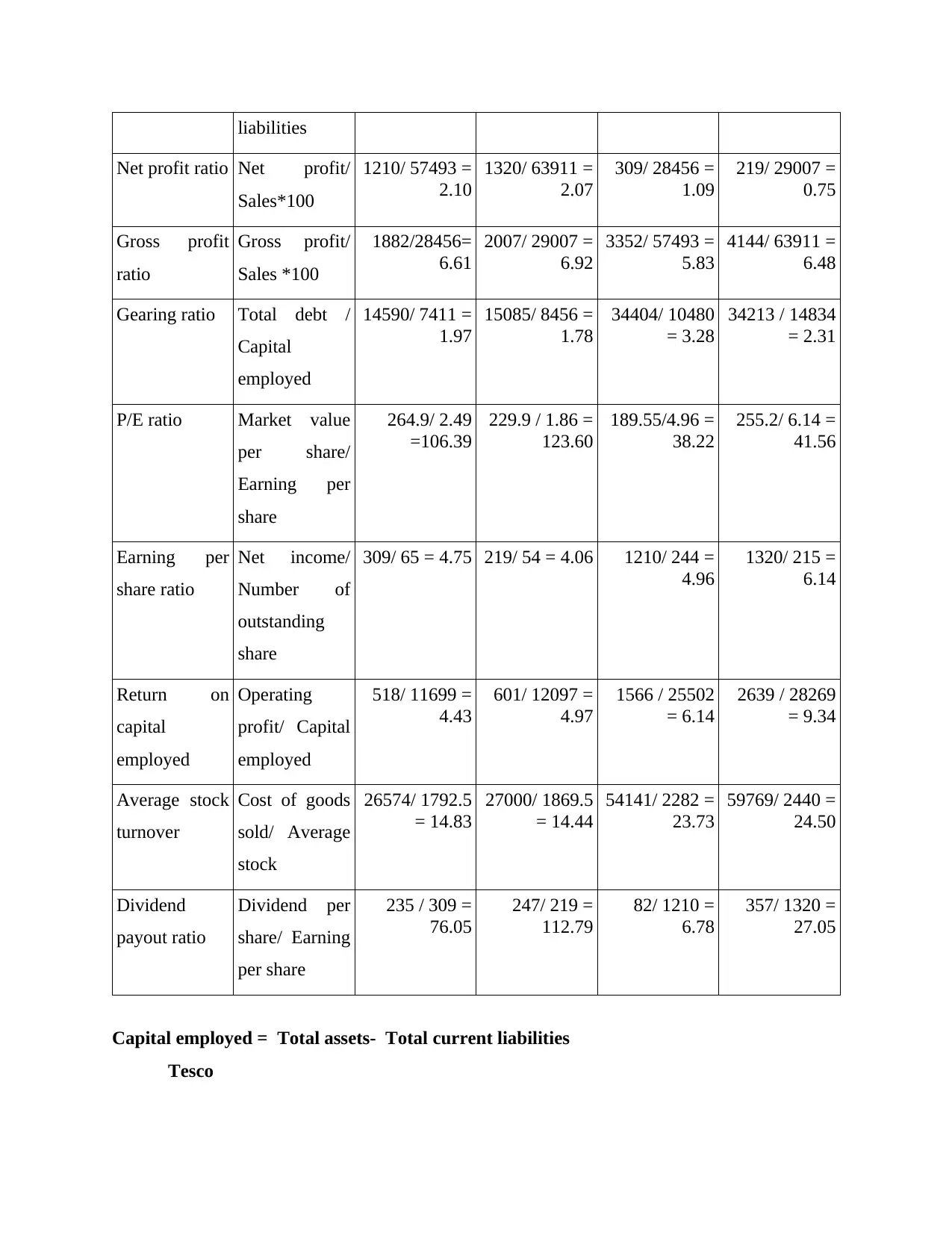

liabilities

Net profit ratio Net profit/

Sales*100

1210/ 57493 =

2.10

1320/ 63911 =

2.07

309/ 28456 =

1.09

219/ 29007 =

0.75

Gross profit

ratio

Gross profit/

Sales *100

1882/28456=

6.61

2007/ 29007 =

6.92

3352/ 57493 =

5.83

4144/ 63911 =

6.48

Gearing ratio Total debt /

Capital

employed

14590/ 7411 =

1.97

15085/ 8456 =

1.78

34404/ 10480

= 3.28

34213 / 14834

= 2.31

P/E ratio Market value

per share/

Earning per

share

264.9/ 2.49

=106.39

229.9 / 1.86 =

123.60

189.55/4.96 =

38.22

255.2/ 6.14 =

41.56

Earning per

share ratio

Net income/

Number of

outstanding

share

309/ 65 = 4.75 219/ 54 = 4.06 1210/ 244 =

4.96

1320/ 215 =

6.14

Return on

capital

employed

Operating

profit/ Capital

employed

518/ 11699 =

4.43

601/ 12097 =

4.97

1566 / 25502

= 6.14

2639 / 28269

= 9.34

Average stock

turnover

Cost of goods

sold/ Average

stock

26574/ 1792.5

= 14.83

27000/ 1869.5

= 14.44

54141/ 2282 =

23.73

59769/ 2440 =

24.50

Dividend

payout ratio

Dividend per

share/ Earning

per share

235 / 309 =

76.05

247/ 219 =

112.79

82/ 1210 =

6.78

357/ 1320 =

27.05

Capital employed = Total assets- Total current liabilities

Tesco

Net profit ratio Net profit/

Sales*100

1210/ 57493 =

2.10

1320/ 63911 =

2.07

309/ 28456 =

1.09

219/ 29007 =

0.75

Gross profit

ratio

Gross profit/

Sales *100

1882/28456=

6.61

2007/ 29007 =

6.92

3352/ 57493 =

5.83

4144/ 63911 =

6.48

Gearing ratio Total debt /

Capital

employed

14590/ 7411 =

1.97

15085/ 8456 =

1.78

34404/ 10480

= 3.28

34213 / 14834

= 2.31

P/E ratio Market value

per share/

Earning per

share

264.9/ 2.49

=106.39

229.9 / 1.86 =

123.60

189.55/4.96 =

38.22

255.2/ 6.14 =

41.56

Earning per

share ratio

Net income/

Number of

outstanding

share

309/ 65 = 4.75 219/ 54 = 4.06 1210/ 244 =

4.96

1320/ 215 =

6.14

Return on

capital

employed

Operating

profit/ Capital

employed

518/ 11699 =

4.43

601/ 12097 =

4.97

1566 / 25502

= 6.14

2639 / 28269

= 9.34

Average stock

turnover

Cost of goods

sold/ Average

stock

26574/ 1792.5

= 14.83

27000/ 1869.5

= 14.44

54141/ 2282 =

23.73

59769/ 2440 =

24.50

Dividend

payout ratio

Dividend per

share/ Earning

per share

235 / 309 =

76.05

247/ 219 =

112.79

82/ 1210 =

6.78

357/ 1320 =

27.05

Capital employed = Total assets- Total current liabilities

Tesco

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2018 2019

44735 – 19233 = 25502 48949 – 20680 = 28269

Sainsbury

2018 2019

22001 – 10302 = 11699 23514 – 11417 = 12097

b. Analysis of financial performance of Tesco & Sainsbury

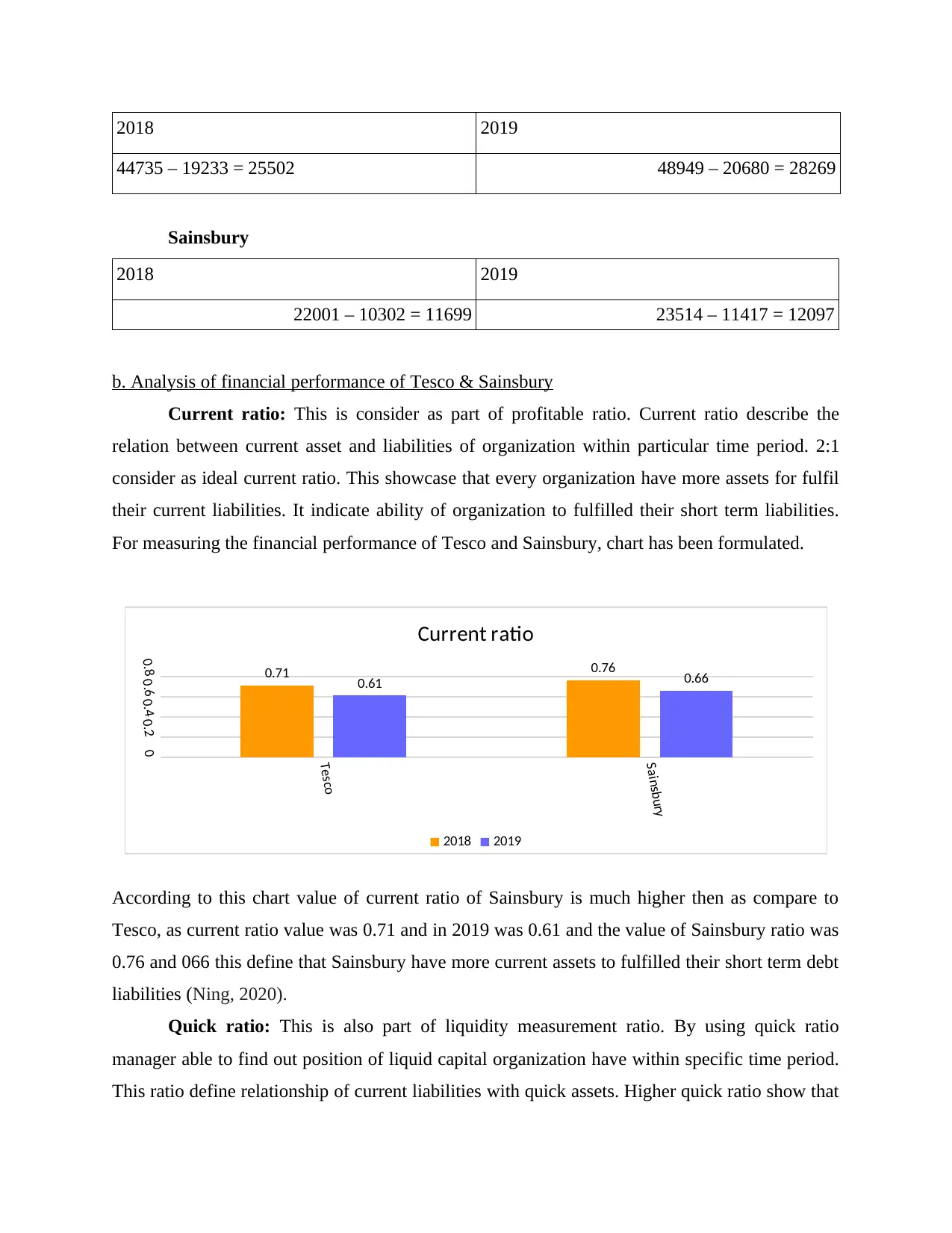

Current ratio: This is consider as part of profitable ratio. Current ratio describe the

relation between current asset and liabilities of organization within particular time period. 2:1

consider as ideal current ratio. This showcase that every organization have more assets for fulfil

their current liabilities. It indicate ability of organization to fulfilled their short term liabilities.

For measuring the financial performance of Tesco and Sainsbury, chart has been formulated.

According to this chart value of current ratio of Sainsbury is much higher then as compare to

Tesco, as current ratio value was 0.71 and in 2019 was 0.61 and the value of Sainsbury ratio was

0.76 and 066 this define that Sainsbury have more current assets to fulfilled their short term debt

liabilities (Ning, 2020).

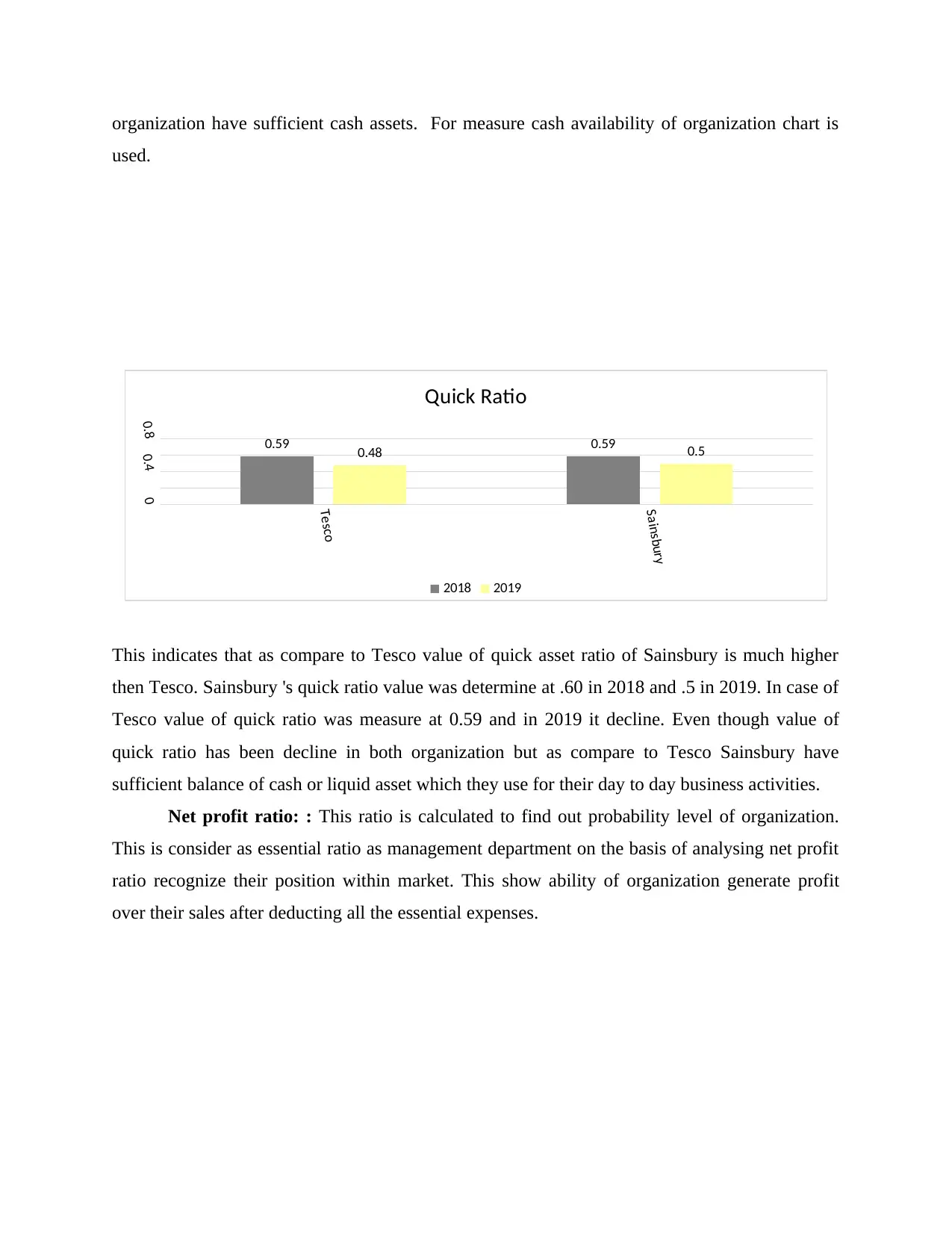

Quick ratio: This is also part of liquidity measurement ratio. By using quick ratio

manager able to find out position of liquid capital organization have within specific time period.

This ratio define relationship of current liabilities with quick assets. Higher quick ratio show that

Tesco

Sainsbury

00.20.40.60.8 0.71 0.76

0.61 0.66

Current ratio

2018 2019

44735 – 19233 = 25502 48949 – 20680 = 28269

Sainsbury

2018 2019

22001 – 10302 = 11699 23514 – 11417 = 12097

b. Analysis of financial performance of Tesco & Sainsbury

Current ratio: This is consider as part of profitable ratio. Current ratio describe the

relation between current asset and liabilities of organization within particular time period. 2:1

consider as ideal current ratio. This showcase that every organization have more assets for fulfil

their current liabilities. It indicate ability of organization to fulfilled their short term liabilities.

For measuring the financial performance of Tesco and Sainsbury, chart has been formulated.

According to this chart value of current ratio of Sainsbury is much higher then as compare to

Tesco, as current ratio value was 0.71 and in 2019 was 0.61 and the value of Sainsbury ratio was

0.76 and 066 this define that Sainsbury have more current assets to fulfilled their short term debt

liabilities (Ning, 2020).

Quick ratio: This is also part of liquidity measurement ratio. By using quick ratio

manager able to find out position of liquid capital organization have within specific time period.

This ratio define relationship of current liabilities with quick assets. Higher quick ratio show that

Tesco

Sainsbury

00.20.40.60.8 0.71 0.76

0.61 0.66

Current ratio

2018 2019

organization have sufficient cash assets. For measure cash availability of organization chart is

used.

This indicates that as compare to Tesco value of quick asset ratio of Sainsbury is much higher

then Tesco. Sainsbury 's quick ratio value was determine at .60 in 2018 and .5 in 2019. In case of

Tesco value of quick ratio was measure at 0.59 and in 2019 it decline. Even though value of

quick ratio has been decline in both organization but as compare to Tesco Sainsbury have

sufficient balance of cash or liquid asset which they use for their day to day business activities.

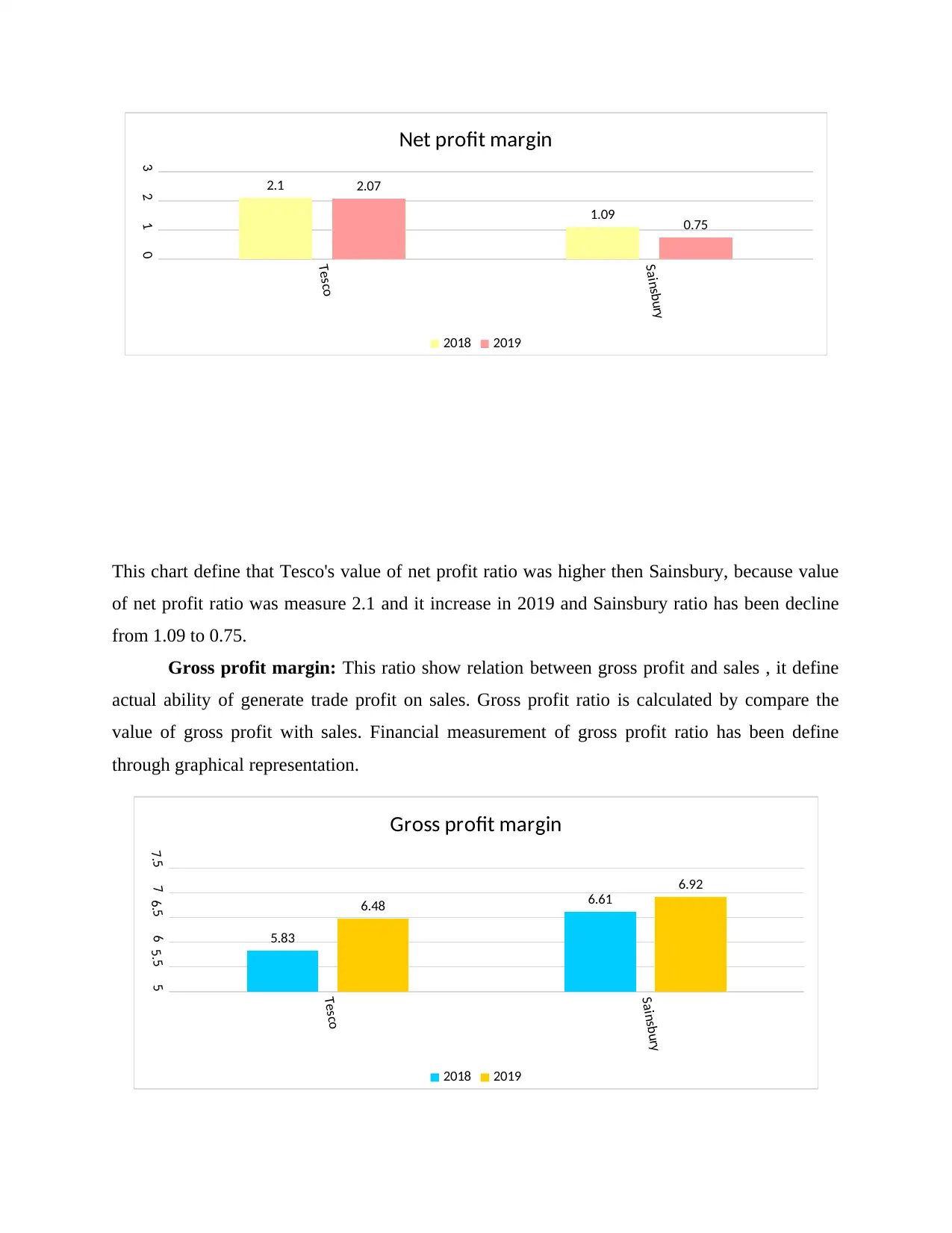

Net profit ratio: : This ratio is calculated to find out probability level of organization.

This is consider as essential ratio as management department on the basis of analysing net profit

ratio recognize their position within market. This show ability of organization generate profit

over their sales after deducting all the essential expenses.

Tesco

Sainsbury

00.40.8 0.59 0.59

0.48 0.5

Quick Ratio

2018 2019

used.

This indicates that as compare to Tesco value of quick asset ratio of Sainsbury is much higher

then Tesco. Sainsbury 's quick ratio value was determine at .60 in 2018 and .5 in 2019. In case of

Tesco value of quick ratio was measure at 0.59 and in 2019 it decline. Even though value of

quick ratio has been decline in both organization but as compare to Tesco Sainsbury have

sufficient balance of cash or liquid asset which they use for their day to day business activities.

Net profit ratio: : This ratio is calculated to find out probability level of organization.

This is consider as essential ratio as management department on the basis of analysing net profit

ratio recognize their position within market. This show ability of organization generate profit

over their sales after deducting all the essential expenses.

Tesco

Sainsbury

00.40.8 0.59 0.59

0.48 0.5

Quick Ratio

2018 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This chart define that Tesco's value of net profit ratio was higher then Sainsbury, because value

of net profit ratio was measure 2.1 and it increase in 2019 and Sainsbury ratio has been decline

from 1.09 to 0.75.

Gross profit margin: This ratio show relation between gross profit and sales , it define

actual ability of generate trade profit on sales. Gross profit ratio is calculated by compare the

value of gross profit with sales. Financial measurement of gross profit ratio has been define

through graphical representation.

Tesco

Sainsbury

0123

2.1

1.09

2.07

0.75

Net profit margin

2018 2019

Tesco

Sainsbury

55.566.577.5

5.83

6.616.48

6.92

Gross profit margin

2018 2019

of net profit ratio was measure 2.1 and it increase in 2019 and Sainsbury ratio has been decline

from 1.09 to 0.75.

Gross profit margin: This ratio show relation between gross profit and sales , it define

actual ability of generate trade profit on sales. Gross profit ratio is calculated by compare the

value of gross profit with sales. Financial measurement of gross profit ratio has been define

through graphical representation.

Tesco

Sainsbury

0123

2.1

1.09

2.07

0.75

Net profit margin

2018 2019

Tesco

Sainsbury

55.566.577.5

5.83

6.616.48

6.92

Gross profit margin

2018 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The value of gross profit ratio of Sainsbury is as much better then Tesco. This indicates

that Sainsbury generate more gross profit as compare to Tesco.

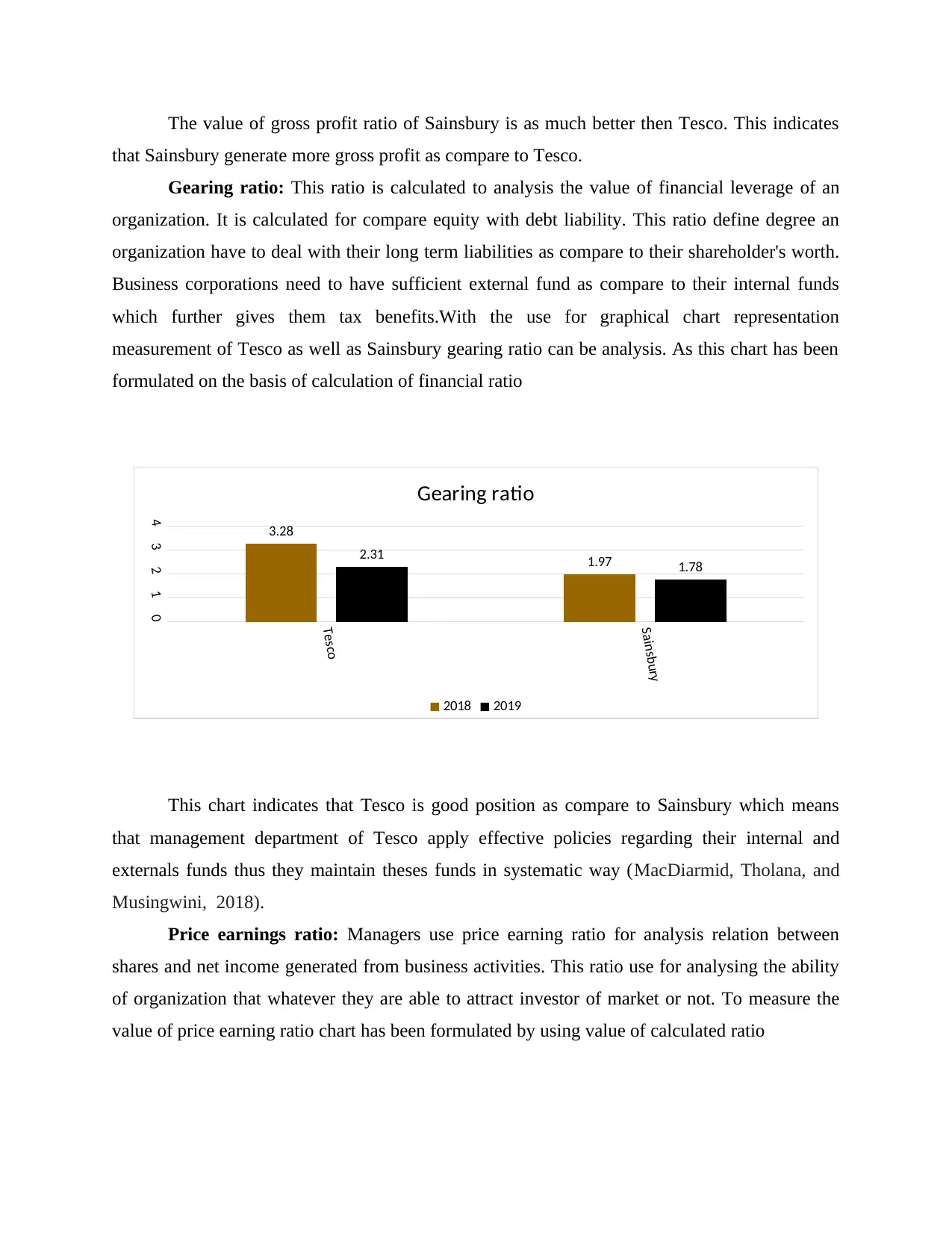

Gearing ratio: This ratio is calculated to analysis the value of financial leverage of an

organization. It is calculated for compare equity with debt liability. This ratio define degree an

organization have to deal with their long term liabilities as compare to their shareholder's worth.

Business corporations need to have sufficient external fund as compare to their internal funds

which further gives them tax benefits.With the use for graphical chart representation

measurement of Tesco as well as Sainsbury gearing ratio can be analysis. As this chart has been

formulated on the basis of calculation of financial ratio

This chart indicates that Tesco is good position as compare to Sainsbury which means

that management department of Tesco apply effective policies regarding their internal and

externals funds thus they maintain theses funds in systematic way (MacDiarmid, Tholana, and

Musingwini, 2018).

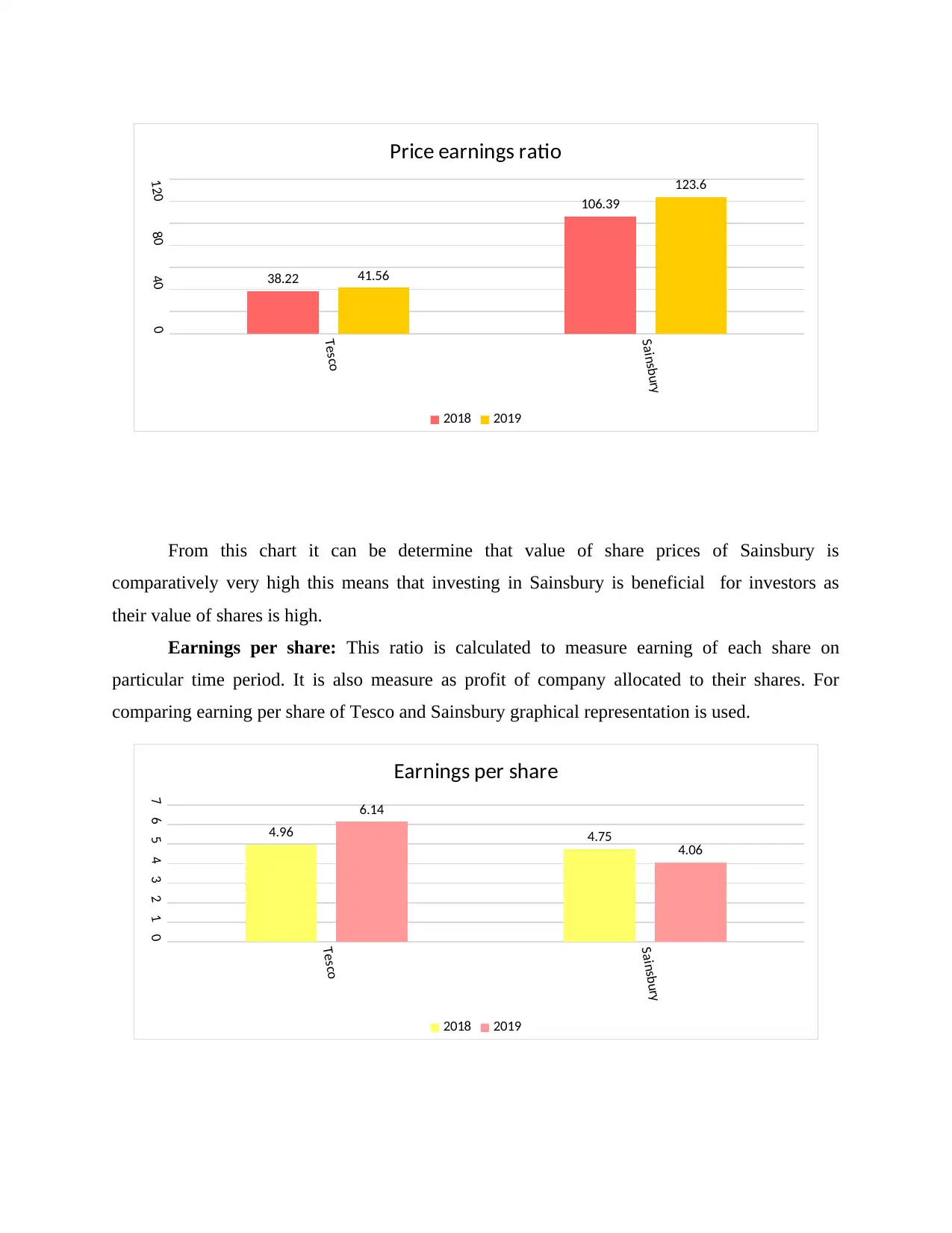

Price earnings ratio: Managers use price earning ratio for analysis relation between

shares and net income generated from business activities. This ratio use for analysing the ability

of organization that whatever they are able to attract investor of market or not. To measure the

value of price earning ratio chart has been formulated by using value of calculated ratio

Tesco

Sainsbury

01234 3.28

1.97

2.31 1.78

Gearing ratio

2018 2019

that Sainsbury generate more gross profit as compare to Tesco.

Gearing ratio: This ratio is calculated to analysis the value of financial leverage of an

organization. It is calculated for compare equity with debt liability. This ratio define degree an

organization have to deal with their long term liabilities as compare to their shareholder's worth.

Business corporations need to have sufficient external fund as compare to their internal funds

which further gives them tax benefits.With the use for graphical chart representation

measurement of Tesco as well as Sainsbury gearing ratio can be analysis. As this chart has been

formulated on the basis of calculation of financial ratio

This chart indicates that Tesco is good position as compare to Sainsbury which means

that management department of Tesco apply effective policies regarding their internal and

externals funds thus they maintain theses funds in systematic way (MacDiarmid, Tholana, and

Musingwini, 2018).

Price earnings ratio: Managers use price earning ratio for analysis relation between

shares and net income generated from business activities. This ratio use for analysing the ability

of organization that whatever they are able to attract investor of market or not. To measure the

value of price earning ratio chart has been formulated by using value of calculated ratio

Tesco

Sainsbury

01234 3.28

1.97

2.31 1.78

Gearing ratio

2018 2019

From this chart it can be determine that value of share prices of Sainsbury is

comparatively very high this means that investing in Sainsbury is beneficial for investors as

their value of shares is high.

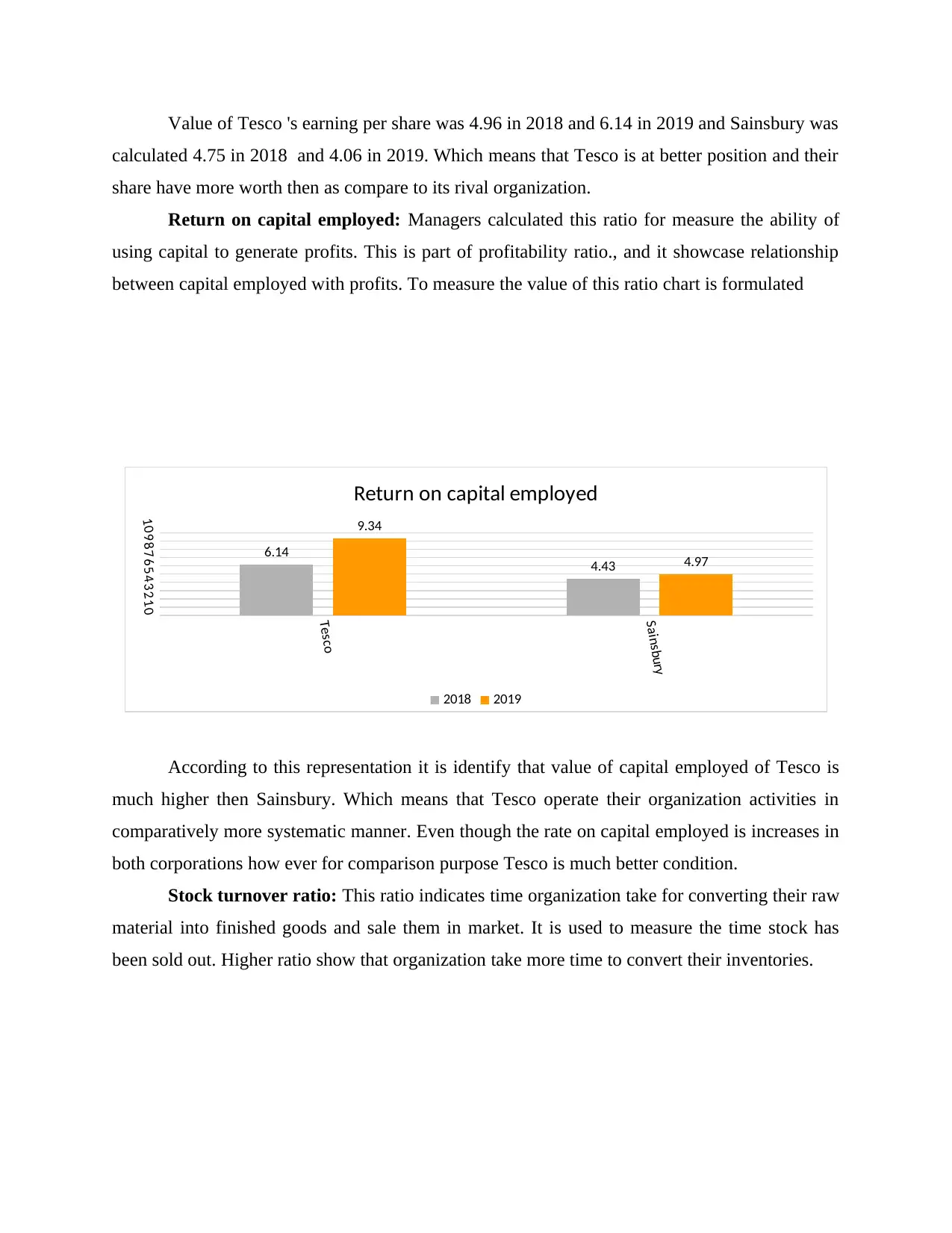

Earnings per share: This ratio is calculated to measure earning of each share on

particular time period. It is also measure as profit of company allocated to their shares. For

comparing earning per share of Tesco and Sainsbury graphical representation is used.

Tesco

Sainsbury

0

40

80

120

38.22

106.39

41.56

123.6

Price earnings ratio

2018 2019

Tesco

Sainsbury

01234567

4.96 4.75

6.14

4.06

Earnings per share

2018 2019

comparatively very high this means that investing in Sainsbury is beneficial for investors as

their value of shares is high.

Earnings per share: This ratio is calculated to measure earning of each share on

particular time period. It is also measure as profit of company allocated to their shares. For

comparing earning per share of Tesco and Sainsbury graphical representation is used.

Tesco

Sainsbury

0

40

80

120

38.22

106.39

41.56

123.6

Price earnings ratio

2018 2019

Tesco

Sainsbury

01234567

4.96 4.75

6.14

4.06

Earnings per share

2018 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Value of Tesco 's earning per share was 4.96 in 2018 and 6.14 in 2019 and Sainsbury was

calculated 4.75 in 2018 and 4.06 in 2019. Which means that Tesco is at better position and their

share have more worth then as compare to its rival organization.

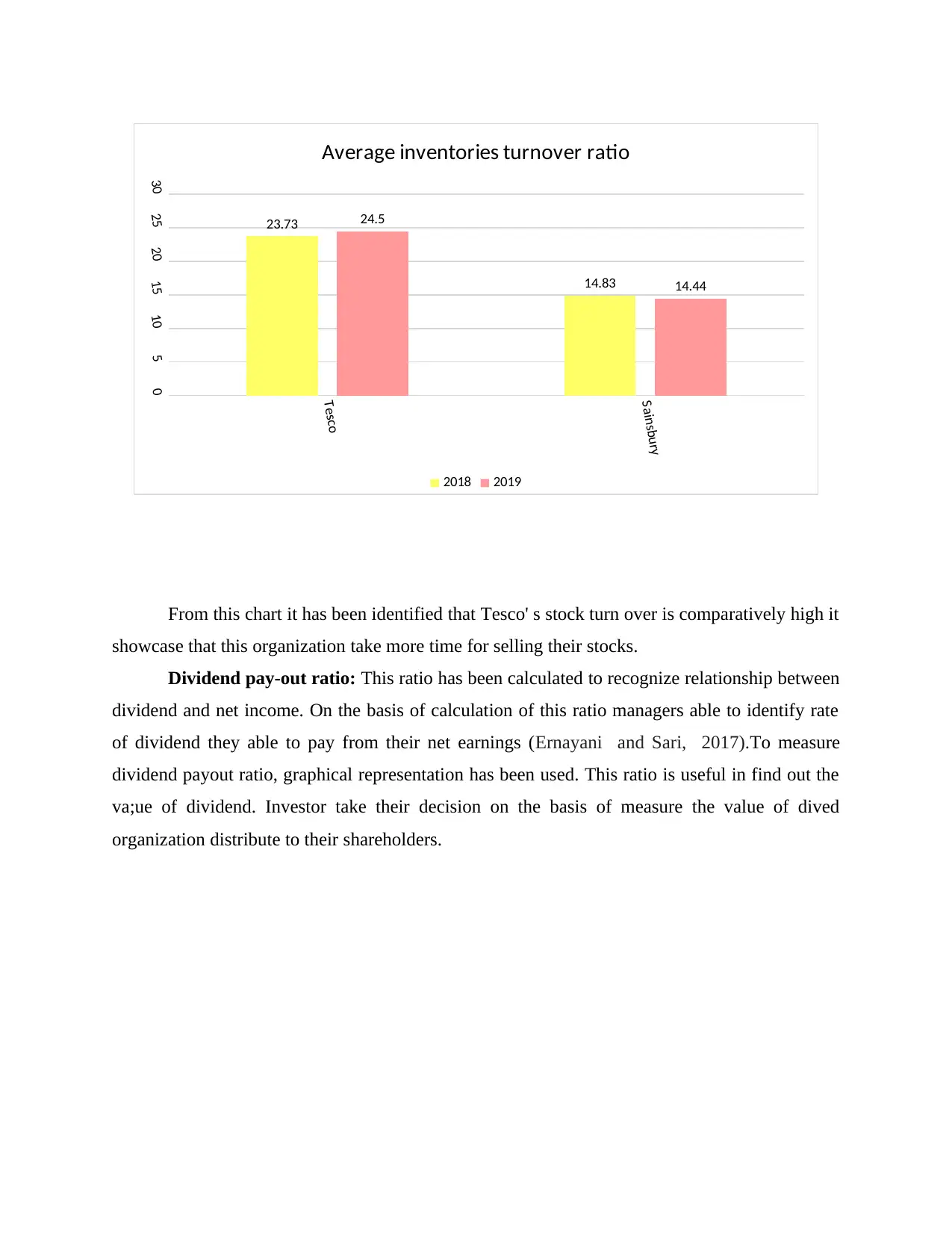

Return on capital employed: Managers calculated this ratio for measure the ability of

using capital to generate profits. This is part of profitability ratio., and it showcase relationship

between capital employed with profits. To measure the value of this ratio chart is formulated

According to this representation it is identify that value of capital employed of Tesco is

much higher then Sainsbury. Which means that Tesco operate their organization activities in

comparatively more systematic manner. Even though the rate on capital employed is increases in

both corporations how ever for comparison purpose Tesco is much better condition.

Stock turnover ratio: This ratio indicates time organization take for converting their raw

material into finished goods and sale them in market. It is used to measure the time stock has

been sold out. Higher ratio show that organization take more time to convert their inventories.

Tesco

Sainsbury

012345678910

6.14

4.43

9.34

4.97

Return on capital employed

2018 2019

calculated 4.75 in 2018 and 4.06 in 2019. Which means that Tesco is at better position and their

share have more worth then as compare to its rival organization.

Return on capital employed: Managers calculated this ratio for measure the ability of

using capital to generate profits. This is part of profitability ratio., and it showcase relationship

between capital employed with profits. To measure the value of this ratio chart is formulated

According to this representation it is identify that value of capital employed of Tesco is

much higher then Sainsbury. Which means that Tesco operate their organization activities in

comparatively more systematic manner. Even though the rate on capital employed is increases in

both corporations how ever for comparison purpose Tesco is much better condition.

Stock turnover ratio: This ratio indicates time organization take for converting their raw

material into finished goods and sale them in market. It is used to measure the time stock has

been sold out. Higher ratio show that organization take more time to convert their inventories.

Tesco

Sainsbury

012345678910

6.14

4.43

9.34

4.97

Return on capital employed

2018 2019

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

From this chart it has been identified that Tesco' s stock turn over is comparatively high it

showcase that this organization take more time for selling their stocks.

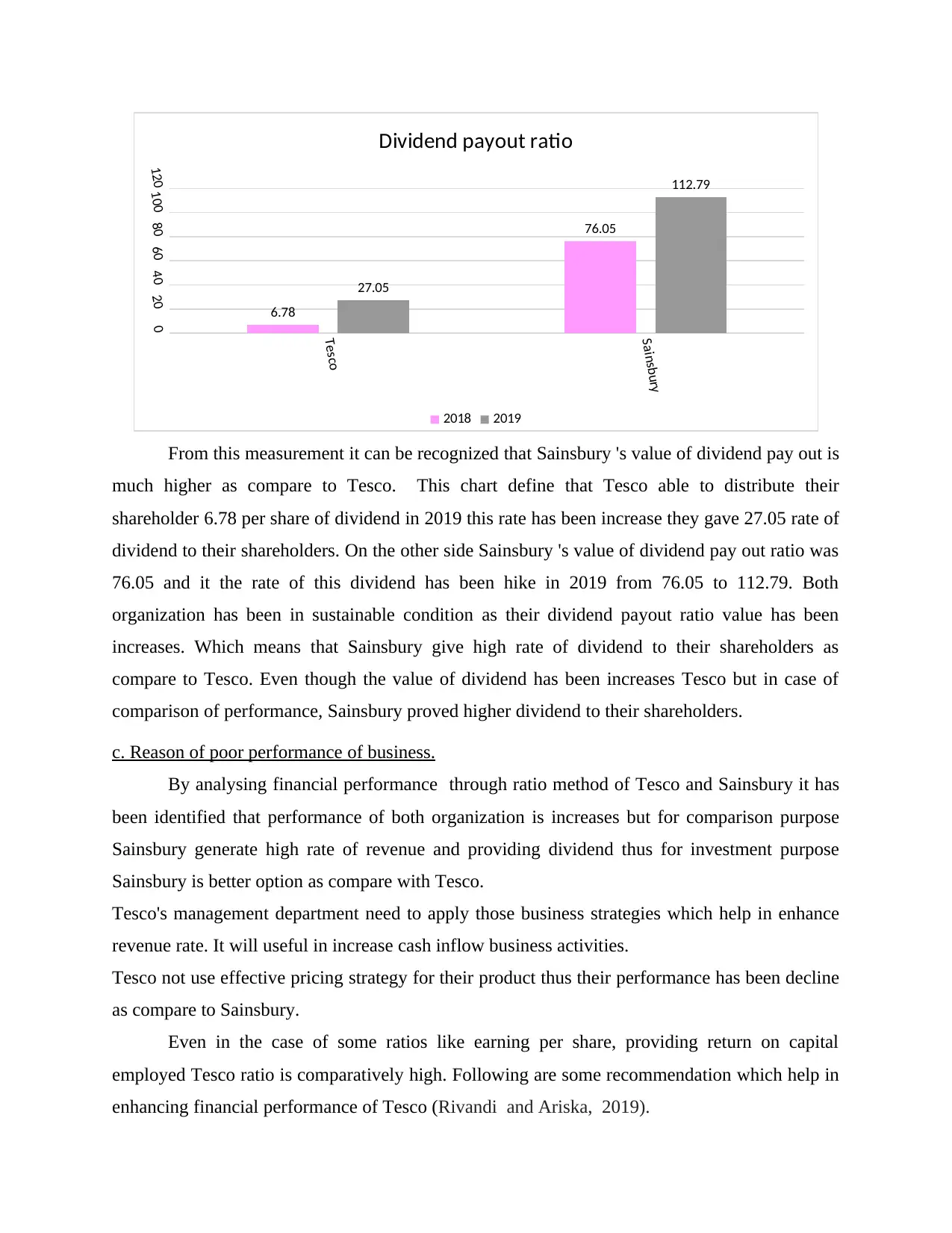

Dividend pay-out ratio: This ratio has been calculated to recognize relationship between

dividend and net income. On the basis of calculation of this ratio managers able to identify rate

of dividend they able to pay from their net earnings (Ernayani and Sari, 2017).To measure

dividend payout ratio, graphical representation has been used. This ratio is useful in find out the

va;ue of dividend. Investor take their decision on the basis of measure the value of dived

organization distribute to their shareholders.

Tesco

Sainsbury

051015202530

23.73

14.83

24.5

14.44

Average inventories turnover ratio

2018 2019

showcase that this organization take more time for selling their stocks.

Dividend pay-out ratio: This ratio has been calculated to recognize relationship between

dividend and net income. On the basis of calculation of this ratio managers able to identify rate

of dividend they able to pay from their net earnings (Ernayani and Sari, 2017).To measure

dividend payout ratio, graphical representation has been used. This ratio is useful in find out the

va;ue of dividend. Investor take their decision on the basis of measure the value of dived

organization distribute to their shareholders.

Tesco

Sainsbury

051015202530

23.73

14.83

24.5

14.44

Average inventories turnover ratio

2018 2019

From this measurement it can be recognized that Sainsbury 's value of dividend pay out is

much higher as compare to Tesco. This chart define that Tesco able to distribute their

shareholder 6.78 per share of dividend in 2019 this rate has been increase they gave 27.05 rate of

dividend to their shareholders. On the other side Sainsbury 's value of dividend pay out ratio was

76.05 and it the rate of this dividend has been hike in 2019 from 76.05 to 112.79. Both

organization has been in sustainable condition as their dividend payout ratio value has been

increases. Which means that Sainsbury give high rate of dividend to their shareholders as

compare to Tesco. Even though the value of dividend has been increases Tesco but in case of

comparison of performance, Sainsbury proved higher dividend to their shareholders.

c. Reason of poor performance of business.

By analysing financial performance through ratio method of Tesco and Sainsbury it has

been identified that performance of both organization is increases but for comparison purpose

Sainsbury generate high rate of revenue and providing dividend thus for investment purpose

Sainsbury is better option as compare with Tesco.

Tesco's management department need to apply those business strategies which help in enhance

revenue rate. It will useful in increase cash inflow business activities.

Tesco not use effective pricing strategy for their product thus their performance has been decline

as compare to Sainsbury.

Even in the case of some ratios like earning per share, providing return on capital

employed Tesco ratio is comparatively high. Following are some recommendation which help in

enhancing financial performance of Tesco (Rivandi and Ariska, 2019).

Tesco

Sainsbury

020406080100120

6.78

76.05

27.05

112.79

Dividend payout ratio

2018 2019

much higher as compare to Tesco. This chart define that Tesco able to distribute their

shareholder 6.78 per share of dividend in 2019 this rate has been increase they gave 27.05 rate of

dividend to their shareholders. On the other side Sainsbury 's value of dividend pay out ratio was

76.05 and it the rate of this dividend has been hike in 2019 from 76.05 to 112.79. Both

organization has been in sustainable condition as their dividend payout ratio value has been

increases. Which means that Sainsbury give high rate of dividend to their shareholders as

compare to Tesco. Even though the value of dividend has been increases Tesco but in case of

comparison of performance, Sainsbury proved higher dividend to their shareholders.

c. Reason of poor performance of business.

By analysing financial performance through ratio method of Tesco and Sainsbury it has

been identified that performance of both organization is increases but for comparison purpose

Sainsbury generate high rate of revenue and providing dividend thus for investment purpose

Sainsbury is better option as compare with Tesco.

Tesco's management department need to apply those business strategies which help in enhance

revenue rate. It will useful in increase cash inflow business activities.

Tesco not use effective pricing strategy for their product thus their performance has been decline

as compare to Sainsbury.

Even in the case of some ratios like earning per share, providing return on capital

employed Tesco ratio is comparatively high. Following are some recommendation which help in

enhancing financial performance of Tesco (Rivandi and Ariska, 2019).

Tesco

Sainsbury

020406080100120

6.78

76.05

27.05

112.79

Dividend payout ratio

2018 2019

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.