Managerial Finance Report: Funding, Investment, and Company Evaluation

VerifiedAdded on 2020/06/04

|16

|3806

|28

Report

AI Summary

This report provides a detailed analysis of managerial finance, encompassing various critical aspects. It begins by exploring different sources of funding, both internal and external, along with their respective advantages and disadvantages. The report then delves into investment proposal techniques, including their limitations, and provides a comprehensive overview of accounting rate of return, internal rate of return, and payback period. The importance and usage of management tools such as budgets and break-even analysis are thoroughly discussed, with calculations for break-even analysis and cash budgets over a three-month period. Furthermore, the report evaluates company performance, conducts a literature review of budgets and break-even analysis, and highlights their significance to an organization. Finally, it addresses key issues that management must consider for survival and profit generation, concluding with recommendations for effective financial management.

Managerial Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

1.Sources of funding and advantages and disadvantages.......................................................1

2. Investment proposal techniques and limitations.................................................................2

3. Usage of management tools such as Budgets and Break even analysis.............................7

4. Calculation of break even analysis and cash budget for 3 months.....................................8

5. Evaluation of company performance................................................................................10

6. Literature review of Budgets and Break even analysis and significance to organisation 10

7. Issues to consider by management for survival and make profit.....................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................12

INTRODUCTION...........................................................................................................................1

1.Sources of funding and advantages and disadvantages.......................................................1

2. Investment proposal techniques and limitations.................................................................2

3. Usage of management tools such as Budgets and Break even analysis.............................7

4. Calculation of break even analysis and cash budget for 3 months.....................................8

5. Evaluation of company performance................................................................................10

6. Literature review of Budgets and Break even analysis and significance to organisation 10

7. Issues to consider by management for survival and make profit.....................................11

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................12

INTRODUCTION

Managerial finance is the most vital branch of finance that is totally concerned itself with

the managerial importance of all the finance techniques and it is especially focused on the

assessment more than technique. It considers all the financial techniques to improve or raise the

standard of the company and the changes where company can prevent losses. In this report there

is a brief description about the sources of funding the company, major they are external and

internal source of funding with the merits and demerits. With these they can expand the program

and in the same series there are investment proposal techniques with its limitations. Break even

analysis is important for every organisation but yes it has demerits also which are discussed in

detail in this report with the budget and the proper calculations of same. Recommendations are

also given for the management to survive and to make a profit.

1.Sources of funding and advantages and disadvantages

Sources of Finance

Internal Sources can be raised from within the organisation and external sources which can be

raised from outside source.

Internal source :

Retained profits

Debt collection

Retained profit- The part of profits which is not shared among the shareholders but retained and

used in business is known as retained profit (Habib, Bhuiyan and Islam, 2013).

Advantages - It is cheaper source of funding which does not involve any of the acquisition cost

and in this the organisation does not have any obligation to pay in terms of retained earning. It

makes strong the financial position of the business and gives the financial stability and it directly

increases the market value of the shares.

Disadvantages – It does not utilise the funds if the purpose is not specific then it leads to misuse

of the funds. If the dividend policy is conservative then it may lead to over capitalization.

Debt Financing- In this term, when any organisation raises money from the working capital or

capex by selling the debt instruments to institutional investors or any individual (Matemilola,

Bany-Ariffin and McGowan, 2013).

1

Managerial finance is the most vital branch of finance that is totally concerned itself with

the managerial importance of all the finance techniques and it is especially focused on the

assessment more than technique. It considers all the financial techniques to improve or raise the

standard of the company and the changes where company can prevent losses. In this report there

is a brief description about the sources of funding the company, major they are external and

internal source of funding with the merits and demerits. With these they can expand the program

and in the same series there are investment proposal techniques with its limitations. Break even

analysis is important for every organisation but yes it has demerits also which are discussed in

detail in this report with the budget and the proper calculations of same. Recommendations are

also given for the management to survive and to make a profit.

1.Sources of funding and advantages and disadvantages

Sources of Finance

Internal Sources can be raised from within the organisation and external sources which can be

raised from outside source.

Internal source :

Retained profits

Debt collection

Retained profit- The part of profits which is not shared among the shareholders but retained and

used in business is known as retained profit (Habib, Bhuiyan and Islam, 2013).

Advantages - It is cheaper source of funding which does not involve any of the acquisition cost

and in this the organisation does not have any obligation to pay in terms of retained earning. It

makes strong the financial position of the business and gives the financial stability and it directly

increases the market value of the shares.

Disadvantages – It does not utilise the funds if the purpose is not specific then it leads to misuse

of the funds. If the dividend policy is conservative then it may lead to over capitalization.

Debt Financing- In this term, when any organisation raises money from the working capital or

capex by selling the debt instruments to institutional investors or any individual (Matemilola,

Bany-Ariffin and McGowan, 2013).

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

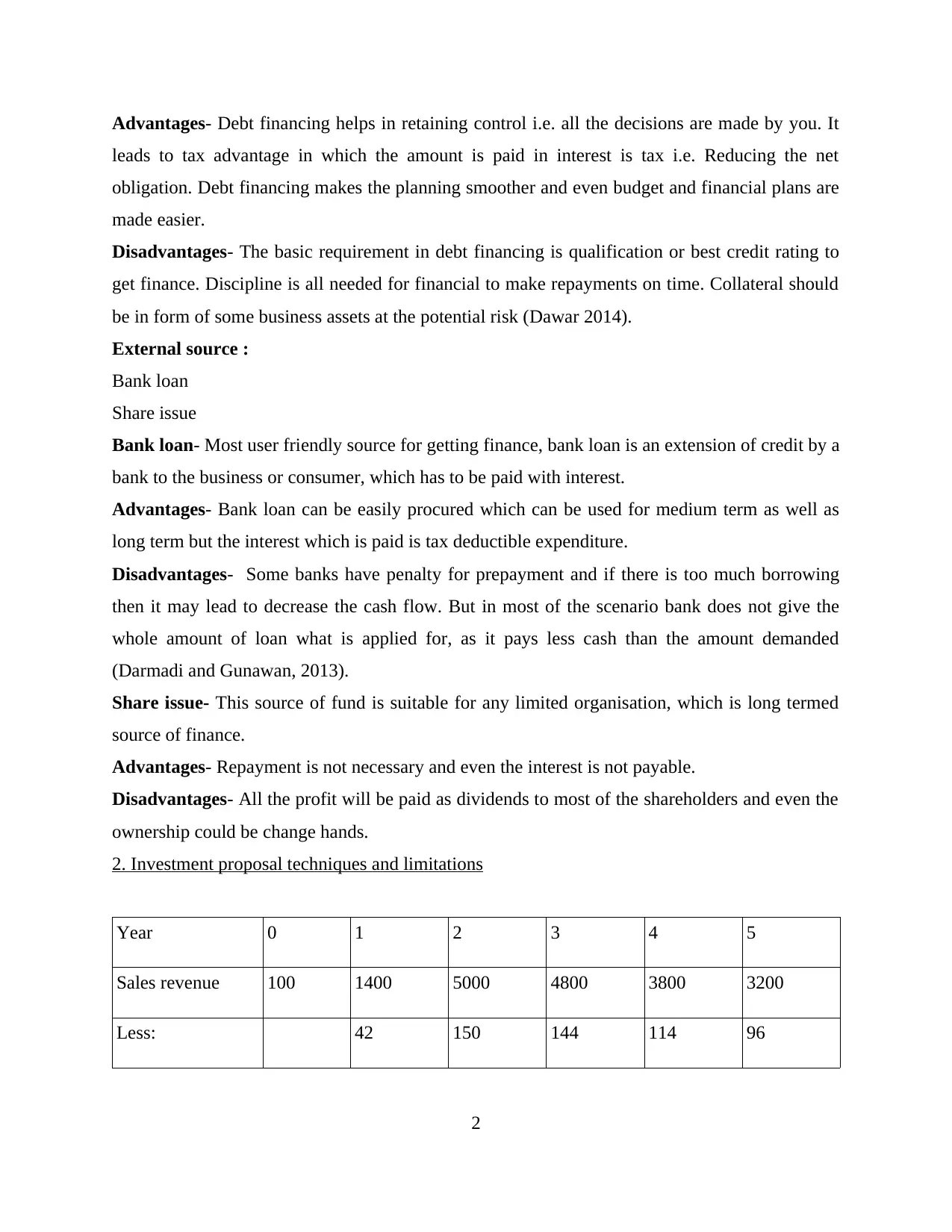

Advantages- Debt financing helps in retaining control i.e. all the decisions are made by you. It

leads to tax advantage in which the amount is paid in interest is tax i.e. Reducing the net

obligation. Debt financing makes the planning smoother and even budget and financial plans are

made easier.

Disadvantages- The basic requirement in debt financing is qualification or best credit rating to

get finance. Discipline is all needed for financial to make repayments on time. Collateral should

be in form of some business assets at the potential risk (Dawar 2014).

External source :

Bank loan

Share issue

Bank loan- Most user friendly source for getting finance, bank loan is an extension of credit by a

bank to the business or consumer, which has to be paid with interest.

Advantages- Bank loan can be easily procured which can be used for medium term as well as

long term but the interest which is paid is tax deductible expenditure.

Disadvantages- Some banks have penalty for prepayment and if there is too much borrowing

then it may lead to decrease the cash flow. But in most of the scenario bank does not give the

whole amount of loan what is applied for, as it pays less cash than the amount demanded

(Darmadi and Gunawan, 2013).

Share issue- This source of fund is suitable for any limited organisation, which is long termed

source of finance.

Advantages- Repayment is not necessary and even the interest is not payable.

Disadvantages- All the profit will be paid as dividends to most of the shareholders and even the

ownership could be change hands.

2. Investment proposal techniques and limitations

Year 0 1 2 3 4 5

Sales revenue 100 1400 5000 4800 3800 3200

Less: 42 150 144 114 96

2

leads to tax advantage in which the amount is paid in interest is tax i.e. Reducing the net

obligation. Debt financing makes the planning smoother and even budget and financial plans are

made easier.

Disadvantages- The basic requirement in debt financing is qualification or best credit rating to

get finance. Discipline is all needed for financial to make repayments on time. Collateral should

be in form of some business assets at the potential risk (Dawar 2014).

External source :

Bank loan

Share issue

Bank loan- Most user friendly source for getting finance, bank loan is an extension of credit by a

bank to the business or consumer, which has to be paid with interest.

Advantages- Bank loan can be easily procured which can be used for medium term as well as

long term but the interest which is paid is tax deductible expenditure.

Disadvantages- Some banks have penalty for prepayment and if there is too much borrowing

then it may lead to decrease the cash flow. But in most of the scenario bank does not give the

whole amount of loan what is applied for, as it pays less cash than the amount demanded

(Darmadi and Gunawan, 2013).

Share issue- This source of fund is suitable for any limited organisation, which is long termed

source of finance.

Advantages- Repayment is not necessary and even the interest is not payable.

Disadvantages- All the profit will be paid as dividends to most of the shareholders and even the

ownership could be change hands.

2. Investment proposal techniques and limitations

Year 0 1 2 3 4 5

Sales revenue 100 1400 5000 4800 3800 3200

Less: 42 150 144 114 96

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

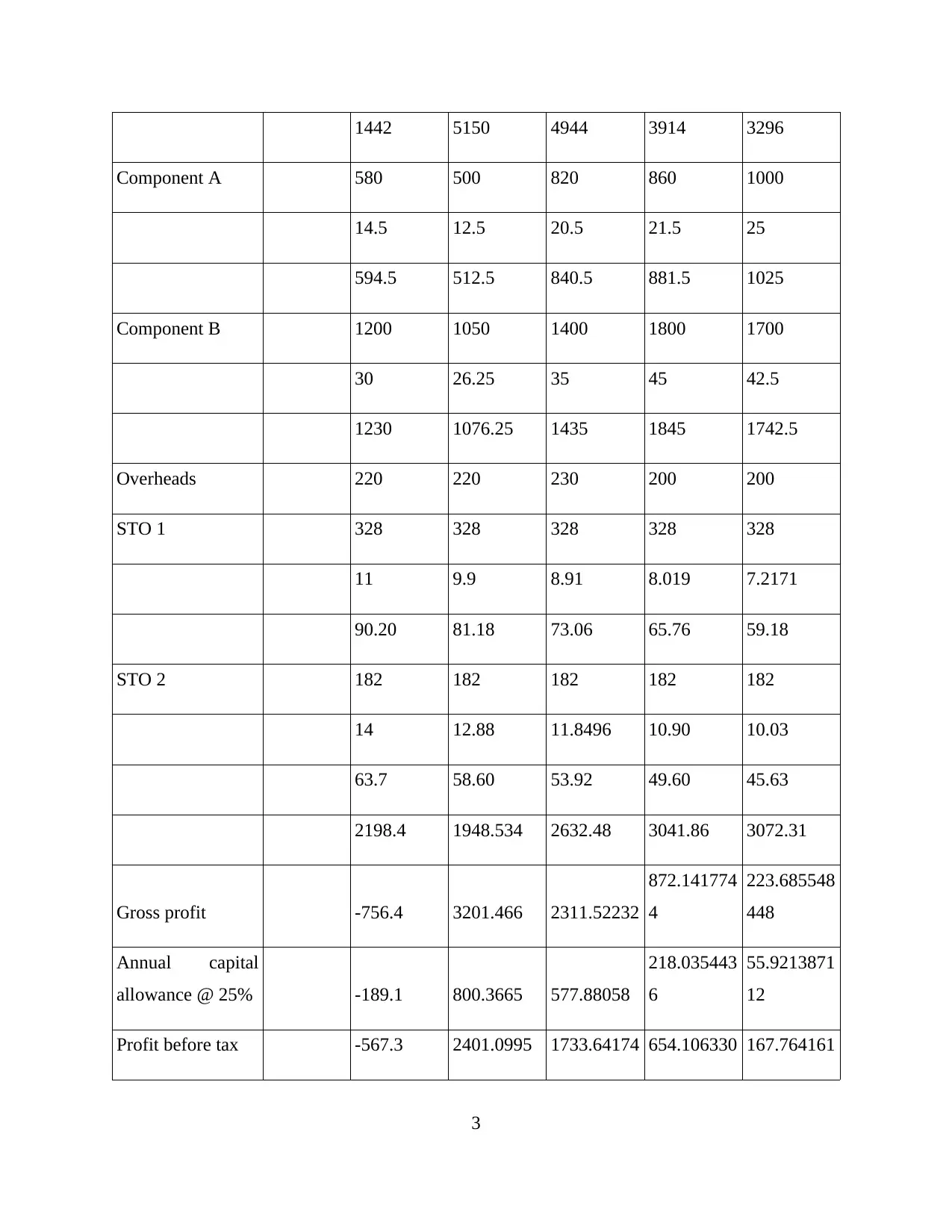

1442 5150 4944 3914 3296

Component A 580 500 820 860 1000

14.5 12.5 20.5 21.5 25

594.5 512.5 840.5 881.5 1025

Component B 1200 1050 1400 1800 1700

30 26.25 35 45 42.5

1230 1076.25 1435 1845 1742.5

Overheads 220 220 230 200 200

STO 1 328 328 328 328 328

11 9.9 8.91 8.019 7.2171

90.20 81.18 73.06 65.76 59.18

STO 2 182 182 182 182 182

14 12.88 11.8496 10.90 10.03

63.7 58.60 53.92 49.60 45.63

2198.4 1948.534 2632.48 3041.86 3072.31

Gross profit -756.4 3201.466 2311.52232

872.141774

4

223.685548

448

Annual capital

allowance @ 25% -189.1 800.3665 577.88058

218.035443

6

55.9213871

12

Profit before tax -567.3 2401.0995 1733.64174 654.106330 167.764161

3

Component A 580 500 820 860 1000

14.5 12.5 20.5 21.5 25

594.5 512.5 840.5 881.5 1025

Component B 1200 1050 1400 1800 1700

30 26.25 35 45 42.5

1230 1076.25 1435 1845 1742.5

Overheads 220 220 230 200 200

STO 1 328 328 328 328 328

11 9.9 8.91 8.019 7.2171

90.20 81.18 73.06 65.76 59.18

STO 2 182 182 182 182 182

14 12.88 11.8496 10.90 10.03

63.7 58.60 53.92 49.60 45.63

2198.4 1948.534 2632.48 3041.86 3072.31

Gross profit -756.4 3201.466 2311.52232

872.141774

4

223.685548

448

Annual capital

allowance @ 25% -189.1 800.3665 577.88058

218.035443

6

55.9213871

12

Profit before tax -567.3 2401.0995 1733.64174 654.106330 167.764161

3

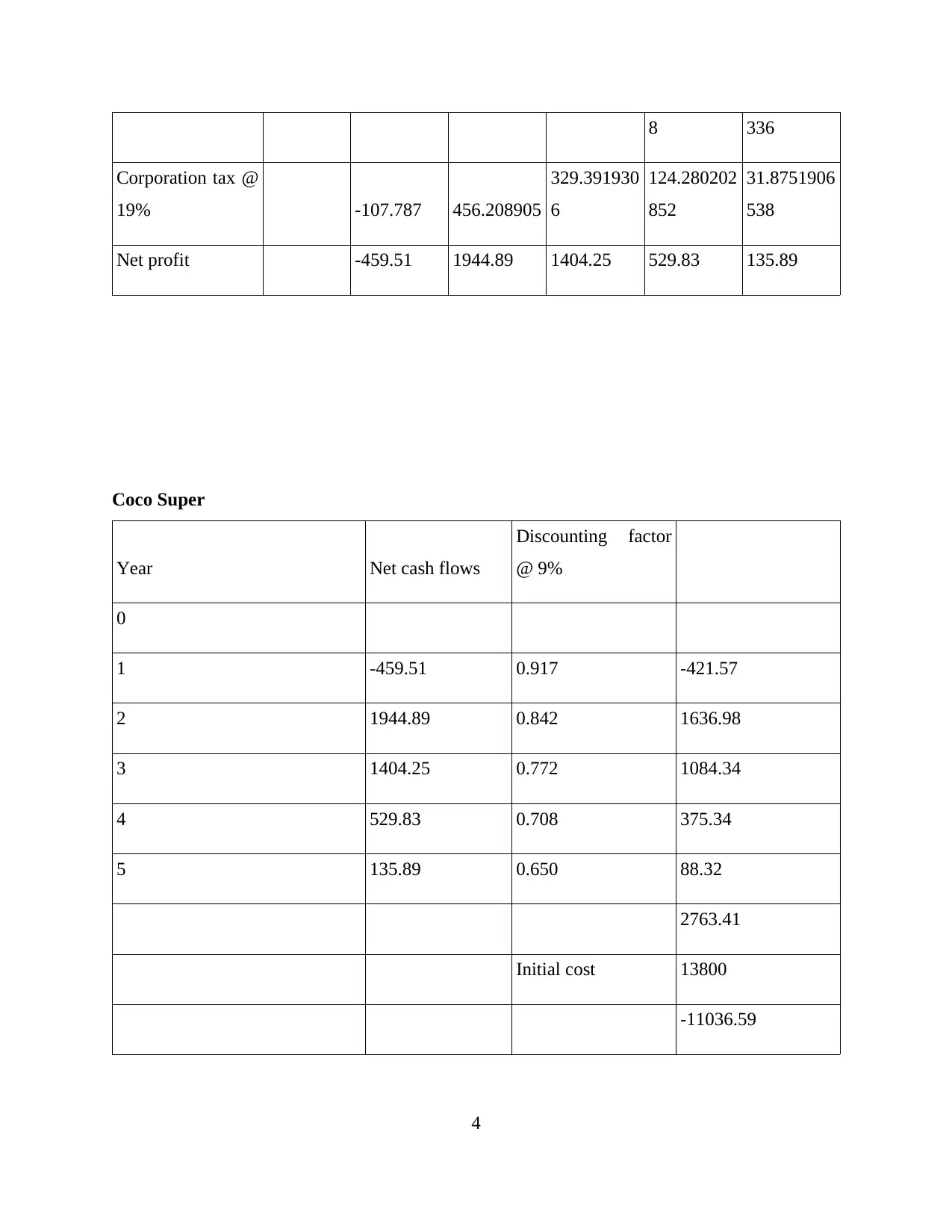

8 336

Corporation tax @

19% -107.787 456.208905

329.391930

6

124.280202

852

31.8751906

538

Net profit -459.51 1944.89 1404.25 529.83 135.89

Coco Super

Year Net cash flows

Discounting factor

@ 9%

0

1 -459.51 0.917 -421.57

2 1944.89 0.842 1636.98

3 1404.25 0.772 1084.34

4 529.83 0.708 375.34

5 135.89 0.650 88.32

2763.41

Initial cost 13800

-11036.59

4

Corporation tax @

19% -107.787 456.208905

329.391930

6

124.280202

852

31.8751906

538

Net profit -459.51 1944.89 1404.25 529.83 135.89

Coco Super

Year Net cash flows

Discounting factor

@ 9%

0

1 -459.51 0.917 -421.57

2 1944.89 0.842 1636.98

3 1404.25 0.772 1084.34

4 529.83 0.708 375.34

5 135.89 0.650 88.32

2763.41

Initial cost 13800

-11036.59

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

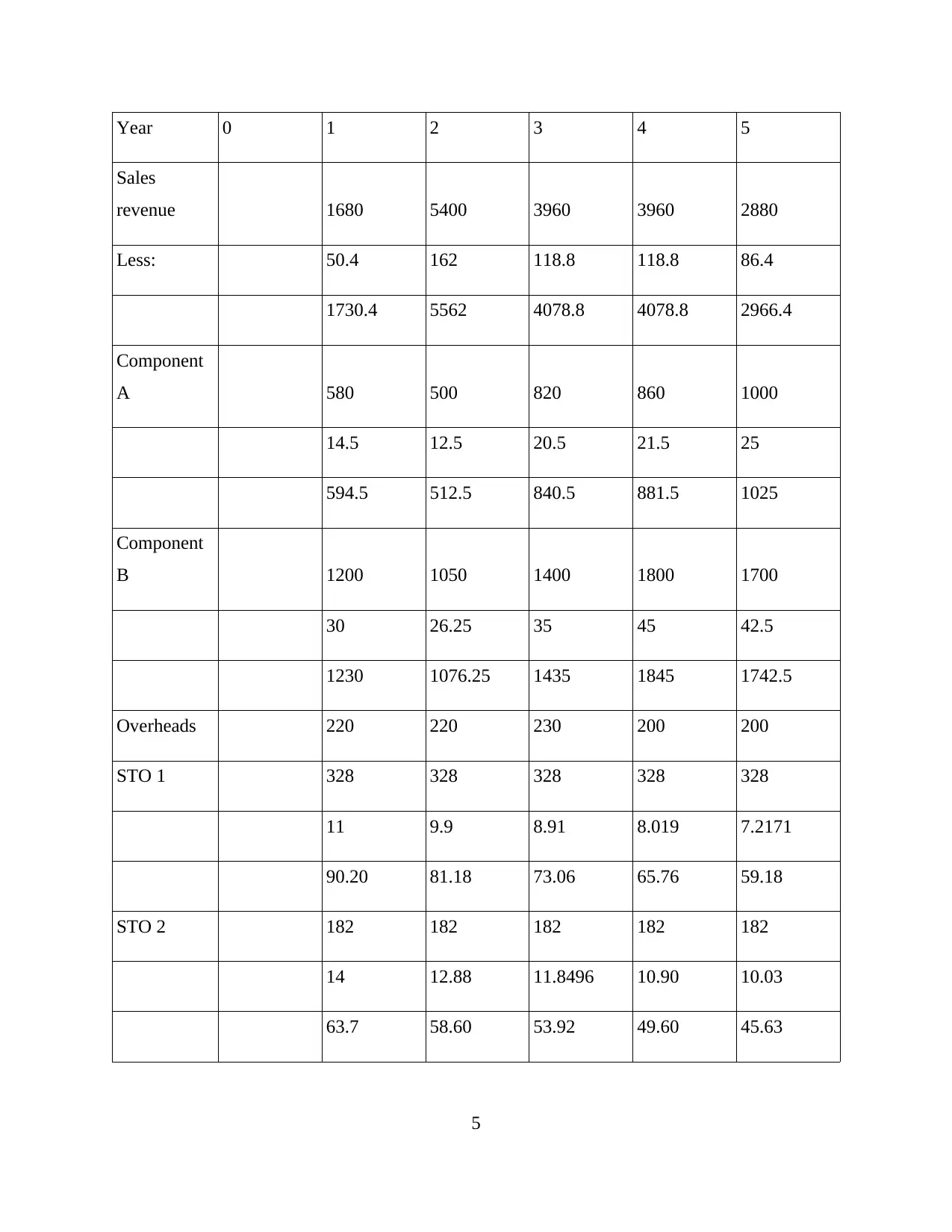

Year 0 1 2 3 4 5

Sales

revenue 1680 5400 3960 3960 2880

Less: 50.4 162 118.8 118.8 86.4

1730.4 5562 4078.8 4078.8 2966.4

Component

A 580 500 820 860 1000

14.5 12.5 20.5 21.5 25

594.5 512.5 840.5 881.5 1025

Component

B 1200 1050 1400 1800 1700

30 26.25 35 45 42.5

1230 1076.25 1435 1845 1742.5

Overheads 220 220 230 200 200

STO 1 328 328 328 328 328

11 9.9 8.91 8.019 7.2171

90.20 81.18 73.06 65.76 59.18

STO 2 182 182 182 182 182

14 12.88 11.8496 10.90 10.03

63.7 58.60 53.92 49.60 45.63

5

Sales

revenue 1680 5400 3960 3960 2880

Less: 50.4 162 118.8 118.8 86.4

1730.4 5562 4078.8 4078.8 2966.4

Component

A 580 500 820 860 1000

14.5 12.5 20.5 21.5 25

594.5 512.5 840.5 881.5 1025

Component

B 1200 1050 1400 1800 1700

30 26.25 35 45 42.5

1230 1076.25 1435 1845 1742.5

Overheads 220 220 230 200 200

STO 1 328 328 328 328 328

11 9.9 8.91 8.019 7.2171

90.20 81.18 73.06 65.76 59.18

STO 2 182 182 182 182 182

14 12.88 11.8496 10.90 10.03

63.7 58.60 53.92 49.60 45.63

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

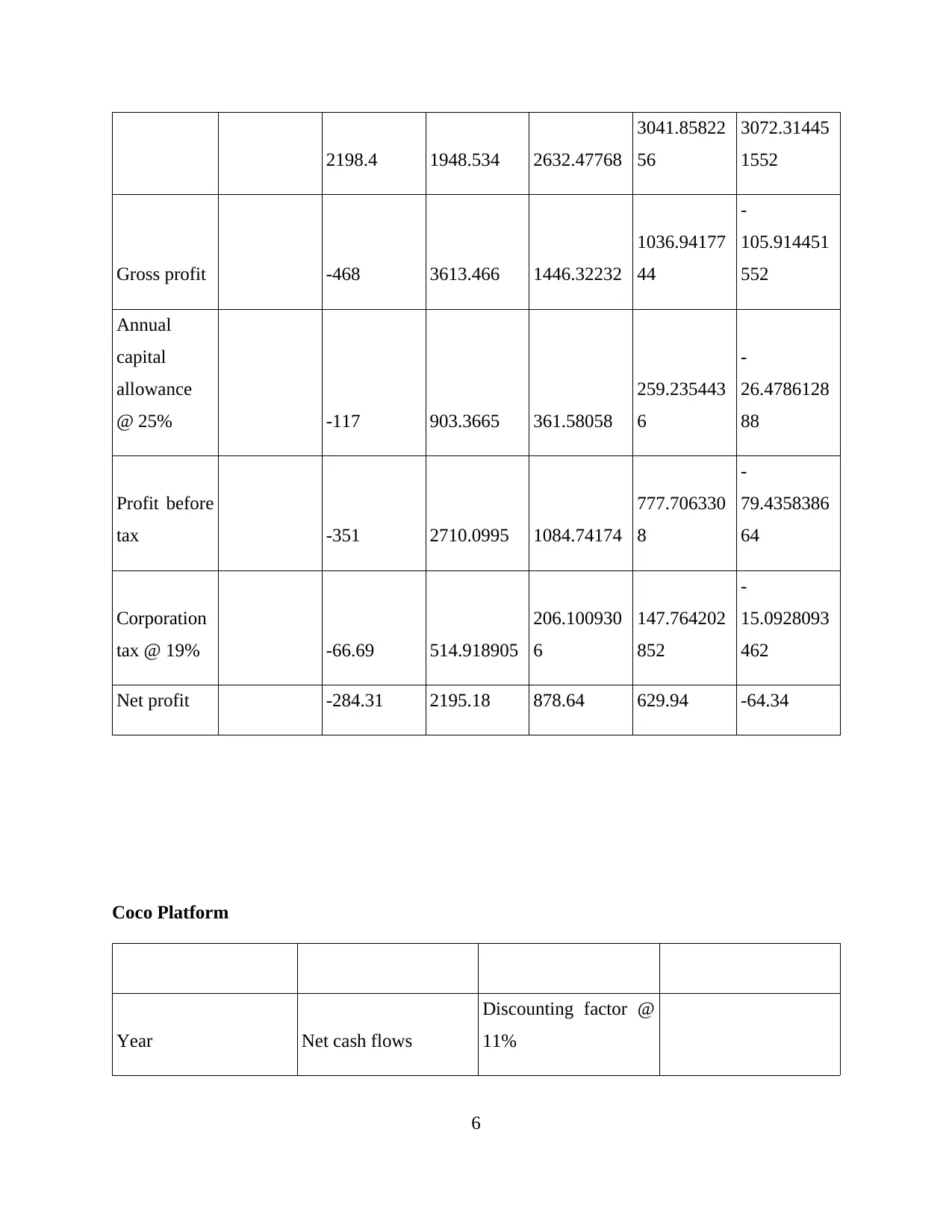

2198.4 1948.534 2632.47768

3041.85822

56

3072.31445

1552

Gross profit -468 3613.466 1446.32232

1036.94177

44

-

105.914451

552

Annual

capital

allowance

@ 25% -117 903.3665 361.58058

259.235443

6

-

26.4786128

88

Profit before

tax -351 2710.0995 1084.74174

777.706330

8

-

79.4358386

64

Corporation

tax @ 19% -66.69 514.918905

206.100930

6

147.764202

852

-

15.0928093

462

Net profit -284.31 2195.18 878.64 629.94 -64.34

Coco Platform

Year Net cash flows

Discounting factor @

11%

6

3041.85822

56

3072.31445

1552

Gross profit -468 3613.466 1446.32232

1036.94177

44

-

105.914451

552

Annual

capital

allowance

@ 25% -117 903.3665 361.58058

259.235443

6

-

26.4786128

88

Profit before

tax -351 2710.0995 1084.74174

777.706330

8

-

79.4358386

64

Corporation

tax @ 19% -66.69 514.918905

206.100930

6

147.764202

852

-

15.0928093

462

Net profit -284.31 2195.18 878.64 629.94 -64.34

Coco Platform

Year Net cash flows

Discounting factor @

11%

6

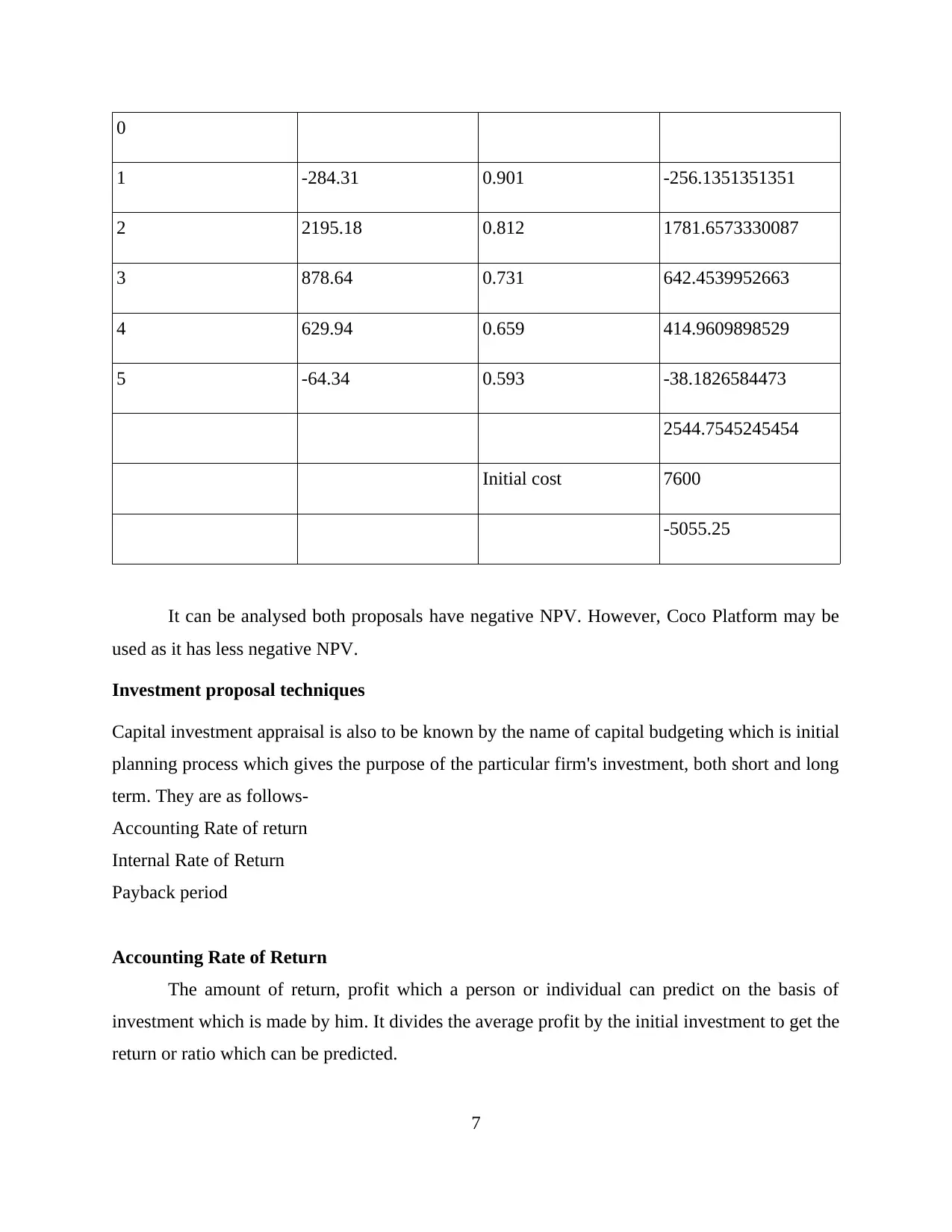

0

1 -284.31 0.901 -256.1351351351

2 2195.18 0.812 1781.6573330087

3 878.64 0.731 642.4539952663

4 629.94 0.659 414.9609898529

5 -64.34 0.593 -38.1826584473

2544.7545245454

Initial cost 7600

-5055.25

It can be analysed both proposals have negative NPV. However, Coco Platform may be

used as it has less negative NPV.

Investment proposal techniques

Capital investment appraisal is also to be known by the name of capital budgeting which is initial

planning process which gives the purpose of the particular firm's investment, both short and long

term. They are as follows-

Accounting Rate of return

Internal Rate of Return

Payback period

Accounting Rate of Return

The amount of return, profit which a person or individual can predict on the basis of

investment which is made by him. It divides the average profit by the initial investment to get the

return or ratio which can be predicted.

7

1 -284.31 0.901 -256.1351351351

2 2195.18 0.812 1781.6573330087

3 878.64 0.731 642.4539952663

4 629.94 0.659 414.9609898529

5 -64.34 0.593 -38.1826584473

2544.7545245454

Initial cost 7600

-5055.25

It can be analysed both proposals have negative NPV. However, Coco Platform may be

used as it has less negative NPV.

Investment proposal techniques

Capital investment appraisal is also to be known by the name of capital budgeting which is initial

planning process which gives the purpose of the particular firm's investment, both short and long

term. They are as follows-

Accounting Rate of return

Internal Rate of Return

Payback period

Accounting Rate of Return

The amount of return, profit which a person or individual can predict on the basis of

investment which is made by him. It divides the average profit by the initial investment to get the

return or ratio which can be predicted.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

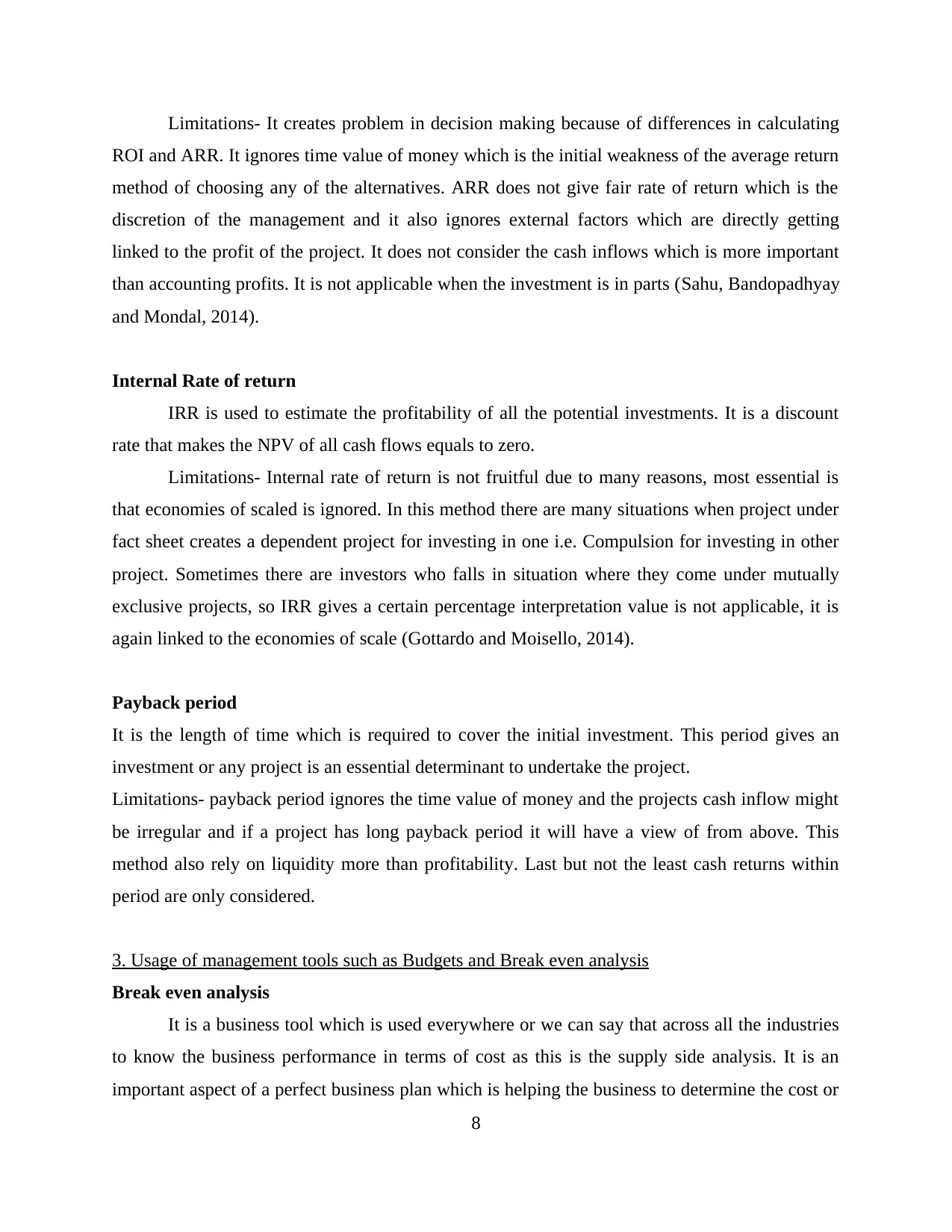

Limitations- It creates problem in decision making because of differences in calculating

ROI and ARR. It ignores time value of money which is the initial weakness of the average return

method of choosing any of the alternatives. ARR does not give fair rate of return which is the

discretion of the management and it also ignores external factors which are directly getting

linked to the profit of the project. It does not consider the cash inflows which is more important

than accounting profits. It is not applicable when the investment is in parts (Sahu, Bandopadhyay

and Mondal, 2014).

Internal Rate of return

IRR is used to estimate the profitability of all the potential investments. It is a discount

rate that makes the NPV of all cash flows equals to zero.

Limitations- Internal rate of return is not fruitful due to many reasons, most essential is

that economies of scaled is ignored. In this method there are many situations when project under

fact sheet creates a dependent project for investing in one i.e. Compulsion for investing in other

project. Sometimes there are investors who falls in situation where they come under mutually

exclusive projects, so IRR gives a certain percentage interpretation value is not applicable, it is

again linked to the economies of scale (Gottardo and Moisello, 2014).

Payback period

It is the length of time which is required to cover the initial investment. This period gives an

investment or any project is an essential determinant to undertake the project.

Limitations- payback period ignores the time value of money and the projects cash inflow might

be irregular and if a project has long payback period it will have a view of from above. This

method also rely on liquidity more than profitability. Last but not the least cash returns within

period are only considered.

3. Usage of management tools such as Budgets and Break even analysis

Break even analysis

It is a business tool which is used everywhere or we can say that across all the industries

to know the business performance in terms of cost as this is the supply side analysis. It is an

important aspect of a perfect business plan which is helping the business to determine the cost or

8

ROI and ARR. It ignores time value of money which is the initial weakness of the average return

method of choosing any of the alternatives. ARR does not give fair rate of return which is the

discretion of the management and it also ignores external factors which are directly getting

linked to the profit of the project. It does not consider the cash inflows which is more important

than accounting profits. It is not applicable when the investment is in parts (Sahu, Bandopadhyay

and Mondal, 2014).

Internal Rate of return

IRR is used to estimate the profitability of all the potential investments. It is a discount

rate that makes the NPV of all cash flows equals to zero.

Limitations- Internal rate of return is not fruitful due to many reasons, most essential is

that economies of scaled is ignored. In this method there are many situations when project under

fact sheet creates a dependent project for investing in one i.e. Compulsion for investing in other

project. Sometimes there are investors who falls in situation where they come under mutually

exclusive projects, so IRR gives a certain percentage interpretation value is not applicable, it is

again linked to the economies of scale (Gottardo and Moisello, 2014).

Payback period

It is the length of time which is required to cover the initial investment. This period gives an

investment or any project is an essential determinant to undertake the project.

Limitations- payback period ignores the time value of money and the projects cash inflow might

be irregular and if a project has long payback period it will have a view of from above. This

method also rely on liquidity more than profitability. Last but not the least cash returns within

period are only considered.

3. Usage of management tools such as Budgets and Break even analysis

Break even analysis

It is a business tool which is used everywhere or we can say that across all the industries

to know the business performance in terms of cost as this is the supply side analysis. It is an

important aspect of a perfect business plan which is helping the business to determine the cost or

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to make a profit. This analysis is usually performed as a part of a business plan to observe the

practicality of the states business idea that whether to do or not to do. It can be determined by

calculating the point at which there is no profit and no loss associated with production of services

or goods.

Budgets

Budget predicts the financial position and financial results of an organisation for one or

more future period. This is used for performance and planning measurement purposes, which can

involve expenses for fixed assets, training employees, bonus plans and so on (Budget definition.

2017). It contains forecasted income statement for future and for more complexity sales forecast,

cost of good sold and expenditures are required to find the forecasted sales, working capital

requirement, and as estimate of funding need. It should be presented in the form of top down

format, and a qualified budget contains a glimpse of whole budget document. Preparations of

budget is on spreadsheet (electronic), and as big as organisation they prefer to use specific

technology or software which is more structured and is less liable to contain technology errors.

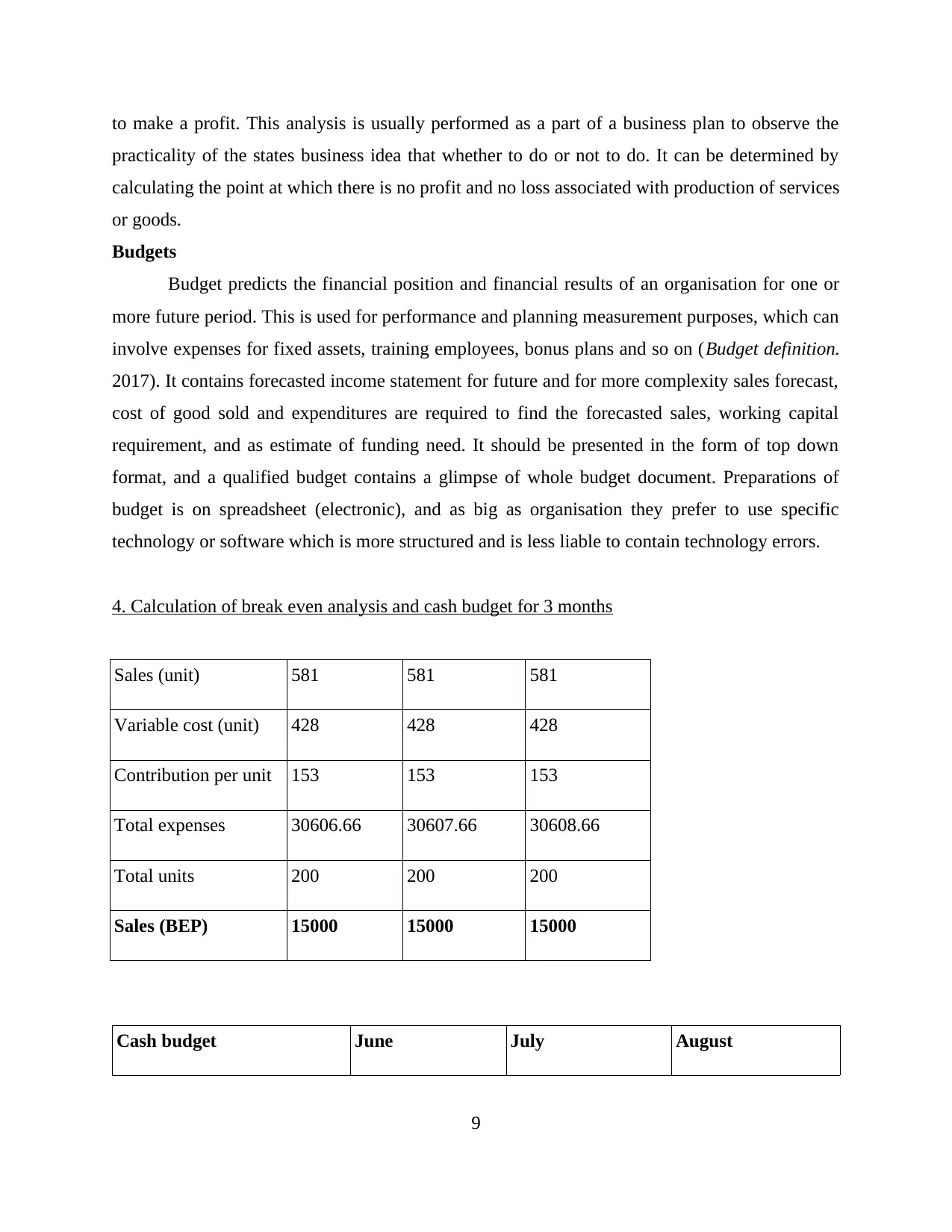

4. Calculation of break even analysis and cash budget for 3 months

Sales (unit) 581 581 581

Variable cost (unit) 428 428 428

Contribution per unit 153 153 153

Total expenses 30606.66 30607.66 30608.66

Total units 200 200 200

Sales (BEP) 15000 15000 15000

Cash budget June July August

9

practicality of the states business idea that whether to do or not to do. It can be determined by

calculating the point at which there is no profit and no loss associated with production of services

or goods.

Budgets

Budget predicts the financial position and financial results of an organisation for one or

more future period. This is used for performance and planning measurement purposes, which can

involve expenses for fixed assets, training employees, bonus plans and so on (Budget definition.

2017). It contains forecasted income statement for future and for more complexity sales forecast,

cost of good sold and expenditures are required to find the forecasted sales, working capital

requirement, and as estimate of funding need. It should be presented in the form of top down

format, and a qualified budget contains a glimpse of whole budget document. Preparations of

budget is on spreadsheet (electronic), and as big as organisation they prefer to use specific

technology or software which is more structured and is less liable to contain technology errors.

4. Calculation of break even analysis and cash budget for 3 months

Sales (unit) 581 581 581

Variable cost (unit) 428 428 428

Contribution per unit 153 153 153

Total expenses 30606.66 30607.66 30608.66

Total units 200 200 200

Sales (BEP) 15000 15000 15000

Cash budget June July August

9

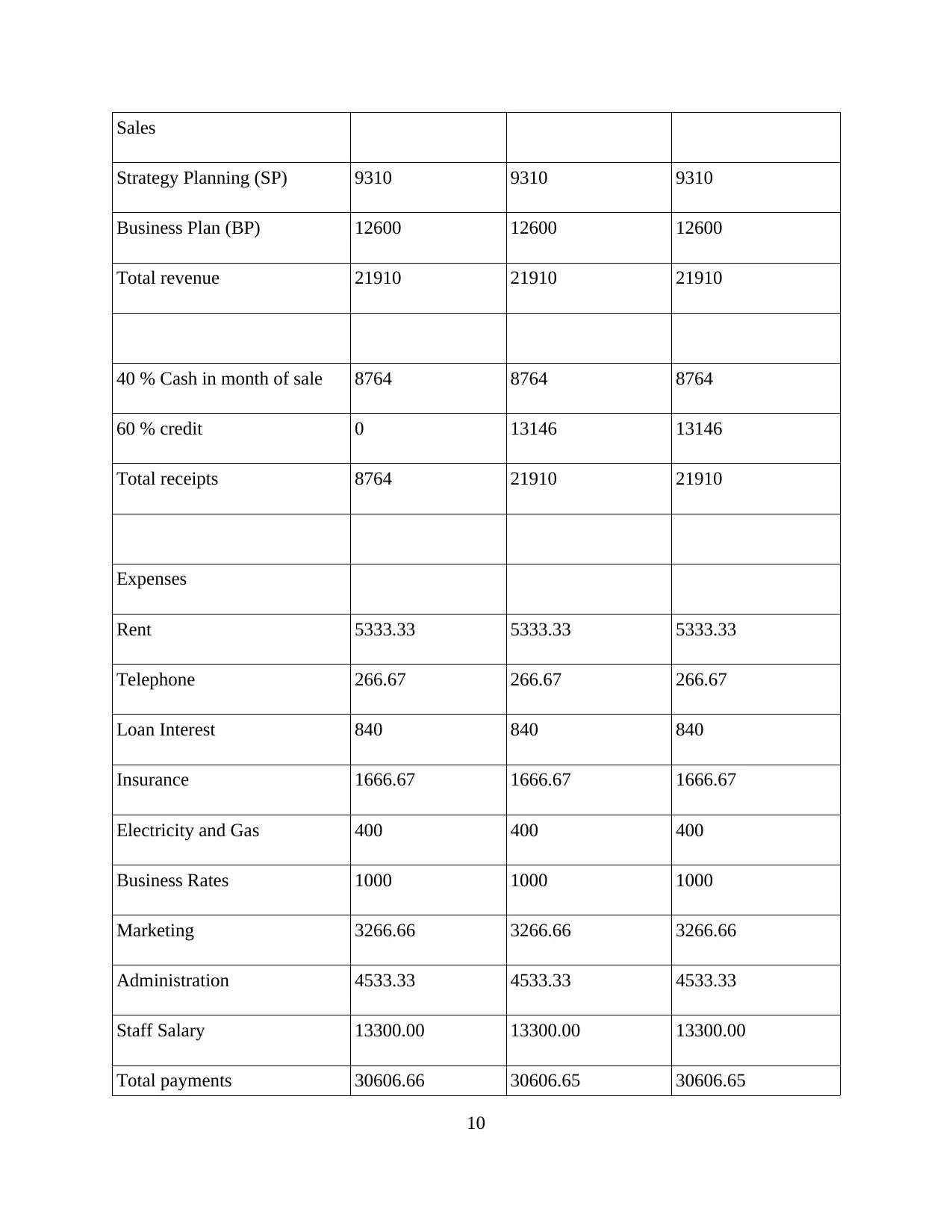

Sales

Strategy Planning (SP) 9310 9310 9310

Business Plan (BP) 12600 12600 12600

Total revenue 21910 21910 21910

40 % Cash in month of sale 8764 8764 8764

60 % credit 0 13146 13146

Total receipts 8764 21910 21910

Expenses

Rent 5333.33 5333.33 5333.33

Telephone 266.67 266.67 266.67

Loan Interest 840 840 840

Insurance 1666.67 1666.67 1666.67

Electricity and Gas 400 400 400

Business Rates 1000 1000 1000

Marketing 3266.66 3266.66 3266.66

Administration 4533.33 4533.33 4533.33

Staff Salary 13300.00 13300.00 13300.00

Total payments 30606.66 30606.65 30606.65

10

Strategy Planning (SP) 9310 9310 9310

Business Plan (BP) 12600 12600 12600

Total revenue 21910 21910 21910

40 % Cash in month of sale 8764 8764 8764

60 % credit 0 13146 13146

Total receipts 8764 21910 21910

Expenses

Rent 5333.33 5333.33 5333.33

Telephone 266.67 266.67 266.67

Loan Interest 840 840 840

Insurance 1666.67 1666.67 1666.67

Electricity and Gas 400 400 400

Business Rates 1000 1000 1000

Marketing 3266.66 3266.66 3266.66

Administration 4533.33 4533.33 4533.33

Staff Salary 13300.00 13300.00 13300.00

Total payments 30606.66 30606.65 30606.65

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.