Financial Risk Analysis and Management Report for OZPRTS Co.

VerifiedAdded on 2021/04/21

|16

|3223

|69

Report

AI Summary

This report examines the financial risks faced by OZPRTS Co., focusing on managing aluminum price volatility and currency exchange rate fluctuations. It identifies the company's exposure to USD for aluminum purchases and analyzes the variability of aluminum prices and the AUD/USD exchange rate from 2015 to 2018. The report evaluates derivative-based hedging strategies, including futures and options contracts, to mitigate these risks. It uses diagrams to illustrate these hedging techniques, identifies potential problems with their implementation, and recommends specific hedging instruments for aluminum purchases and currency exposure related to engine casing sales. Furthermore, the report identifies the currency exposure on the revenue side for OZPRTS Co. and discusses the conditions under which exposures may act as an offset.

Running head: MANAGING FINANCIAL RISK

Managing Financial Risk

Name of the Student:

Name of the University:

Authors Note:

Managing Financial Risk

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING FINANCIAL RISK

1

Table of Contents

a) Identifying and discussing the exposures that OZPRTS Co. faces over the next three years:

....................................................................................................................................................2

i) Identifying the currency in which aluminum is priced and stating the exchange rate

OZPRTS Co. is exposed due to purchase of aluminium:...........................................................2

ii) Collecting data and discussing variability on both aluminum prices and appropriate

exchange rate:.............................................................................................................................3

iii) Depicting the exposure of OZPRTS Co. on purchases of aluminium and exchange rate:...5

b) Critically evaluating the use of option or futures to hedge against the risk that OZPRTS

Co. faces from the purchase of aluminium:...............................................................................6

i) Using the appropriate diagram to identify derivative-based hedges on the cost of aluminium

and the relevant exchange rate:..................................................................................................6

ii) Identifying and explaining problems that might be faced by derivative-based hedging

strategies:....................................................................................................................................9

iii) Choosing one the derivative-based hedge instruments for each of the exposure of

OZPRTS Co.:.............................................................................................................................9

c.i) Identifying the currency exposure on revenue side that is faced by OZPRTS Co. on its

sale of engine casings:..............................................................................................................10

c.ii) Choosing whether to use option or futures hedge against currency exposure that

OZPRTS Co. conducts:............................................................................................................11

c.iii) Discussing the conditions under which the exposure may act as an offset:....................12

References:...............................................................................................................................14

1

Table of Contents

a) Identifying and discussing the exposures that OZPRTS Co. faces over the next three years:

....................................................................................................................................................2

i) Identifying the currency in which aluminum is priced and stating the exchange rate

OZPRTS Co. is exposed due to purchase of aluminium:...........................................................2

ii) Collecting data and discussing variability on both aluminum prices and appropriate

exchange rate:.............................................................................................................................3

iii) Depicting the exposure of OZPRTS Co. on purchases of aluminium and exchange rate:...5

b) Critically evaluating the use of option or futures to hedge against the risk that OZPRTS

Co. faces from the purchase of aluminium:...............................................................................6

i) Using the appropriate diagram to identify derivative-based hedges on the cost of aluminium

and the relevant exchange rate:..................................................................................................6

ii) Identifying and explaining problems that might be faced by derivative-based hedging

strategies:....................................................................................................................................9

iii) Choosing one the derivative-based hedge instruments for each of the exposure of

OZPRTS Co.:.............................................................................................................................9

c.i) Identifying the currency exposure on revenue side that is faced by OZPRTS Co. on its

sale of engine casings:..............................................................................................................10

c.ii) Choosing whether to use option or futures hedge against currency exposure that

OZPRTS Co. conducts:............................................................................................................11

c.iii) Discussing the conditions under which the exposure may act as an offset:....................12

References:...............................................................................................................................14

MANAGING FINANCIAL RISK

2

a) Identifying and discussing the exposures that OZPRTS Co. faces over the next three

years:

i) Identifying the currency in which aluminum is priced and stating the exchange rate

OZPRTS Co. is exposed due to purchase of aluminium:

From the overall evaluation, the prices level of aluminum could be identified, which

trades in USD in the global market. In addition, USD is the major accepted current, which

has been used after the demise of GBP, as the world currency after world war 2. Moreover,

the aluminum market mainly trades in USD, which increases the exposure of OZPRTS in

USD currency. Therefore, OZPRTS needs to increase their exposure in USD/AUD trading

for conducting relevant trades in commodity market. In this context, Li, Ng and Chan (2015)

stated that the exposure of currency market needs to be maintained by adequate hedging

process, which helps in reducing the volatility from the currency market. However, OZPRTS

needs relevant aluminium in the current pricing to fulfil the commitment of producing

200,000 aluminium transmission casings per annum. Hence, it could be understood that

OZPRTS needs to increase its exposure in USD, which is used to trade aluminium in the

global market.

2

a) Identifying and discussing the exposures that OZPRTS Co. faces over the next three

years:

i) Identifying the currency in which aluminum is priced and stating the exchange rate

OZPRTS Co. is exposed due to purchase of aluminium:

From the overall evaluation, the prices level of aluminum could be identified, which

trades in USD in the global market. In addition, USD is the major accepted current, which

has been used after the demise of GBP, as the world currency after world war 2. Moreover,

the aluminum market mainly trades in USD, which increases the exposure of OZPRTS in

USD currency. Therefore, OZPRTS needs to increase their exposure in USD/AUD trading

for conducting relevant trades in commodity market. In this context, Li, Ng and Chan (2015)

stated that the exposure of currency market needs to be maintained by adequate hedging

process, which helps in reducing the volatility from the currency market. However, OZPRTS

needs relevant aluminium in the current pricing to fulfil the commitment of producing

200,000 aluminium transmission casings per annum. Hence, it could be understood that

OZPRTS needs to increase its exposure in USD, which is used to trade aluminium in the

global market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGING FINANCIAL RISK

3

ii) Collecting data and discussing variability on both aluminum prices and appropriate

exchange rate:

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1,300.00

1,500.00

1,700.00

1,900.00

2,100.00

2,300.00

2,500.00

Allumunium Close

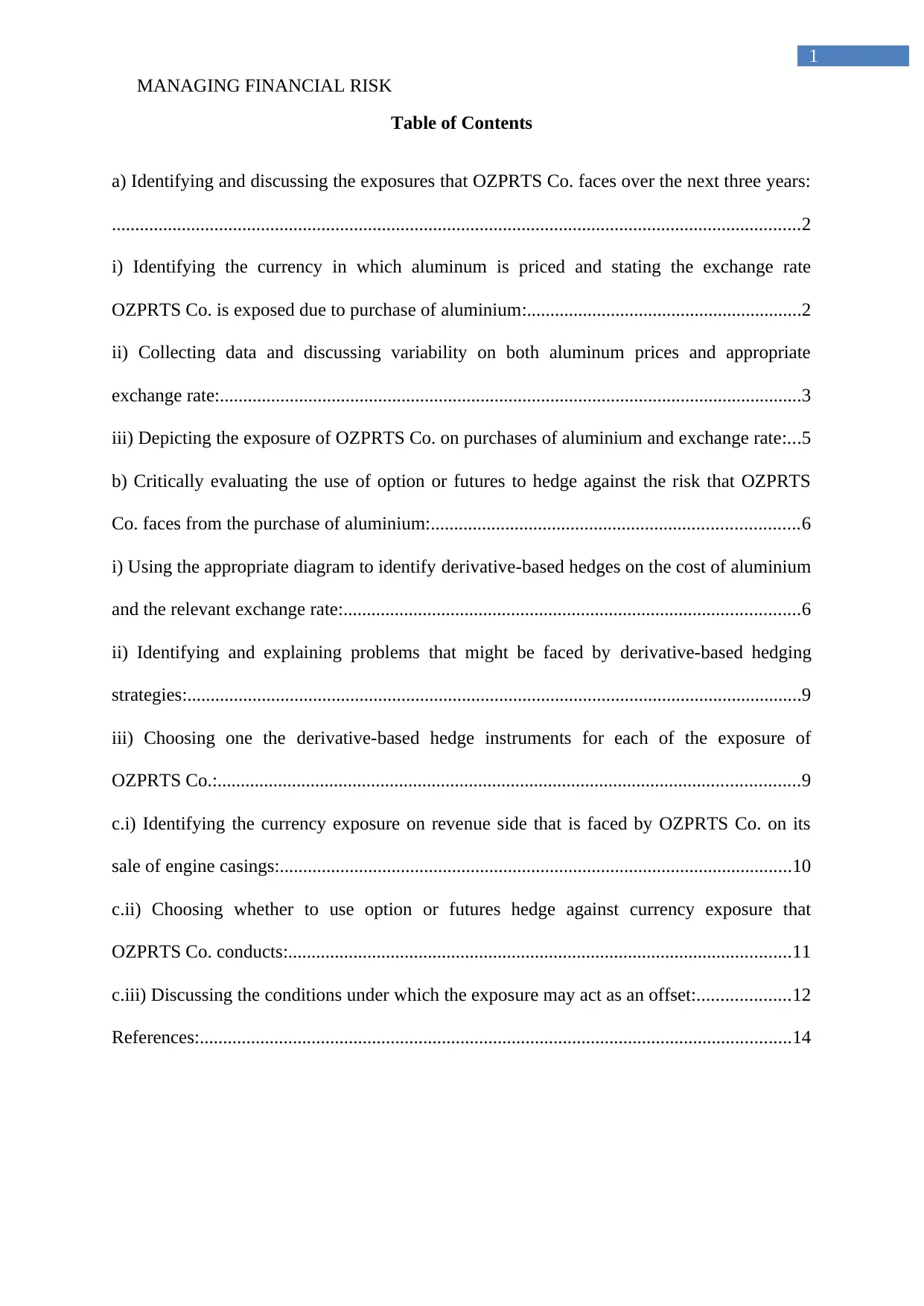

Figure 1: Depicting the Aluminum price from March 2015 to March 2018

(Source: Au.investing.com 2018)

The above chart mainly helps in depicting the oval aluminum prices from March 2015

to 2018, which provides an in-depth price movement of the commodity within the range of

three years. In addition, the evaluation of chart mainly depicts the rising price of aluminum in

the global market, which is due to the high demand of the commodity with in the automobile

industry. From the overall evaluation the prices of aluminum have increased by 12.34% in 3

years, which directly indicates the demand of the community with the consumers. In this

context, Renz and Herman (2016) stated that use of hedging measure could also companies to

reduce the excess cost of their community, which is used in their production system. The

current price of aluminum has relevantly increased over the period of 3 fiscal years, which

indicates the relevant loses that might incur by the company. The rising prices of aluminum

in the period of three year depicts an estimation of future prices, which could increase due to

the continuous demand of the commodity in the international market.

3

ii) Collecting data and discussing variability on both aluminum prices and appropriate

exchange rate:

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1,300.00

1,500.00

1,700.00

1,900.00

2,100.00

2,300.00

2,500.00

Allumunium Close

Figure 1: Depicting the Aluminum price from March 2015 to March 2018

(Source: Au.investing.com 2018)

The above chart mainly helps in depicting the oval aluminum prices from March 2015

to 2018, which provides an in-depth price movement of the commodity within the range of

three years. In addition, the evaluation of chart mainly depicts the rising price of aluminum in

the global market, which is due to the high demand of the commodity with in the automobile

industry. From the overall evaluation the prices of aluminum have increased by 12.34% in 3

years, which directly indicates the demand of the community with the consumers. In this

context, Renz and Herman (2016) stated that use of hedging measure could also companies to

reduce the excess cost of their community, which is used in their production system. The

current price of aluminum has relevantly increased over the period of 3 fiscal years, which

indicates the relevant loses that might incur by the company. The rising prices of aluminum

in the period of three year depicts an estimation of future prices, which could increase due to

the continuous demand of the commodity in the international market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING FINANCIAL RISK

4

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

0.68

0.7

0.72

0.74

0.76

0.78

0.8

0.82

AUD/USD Close

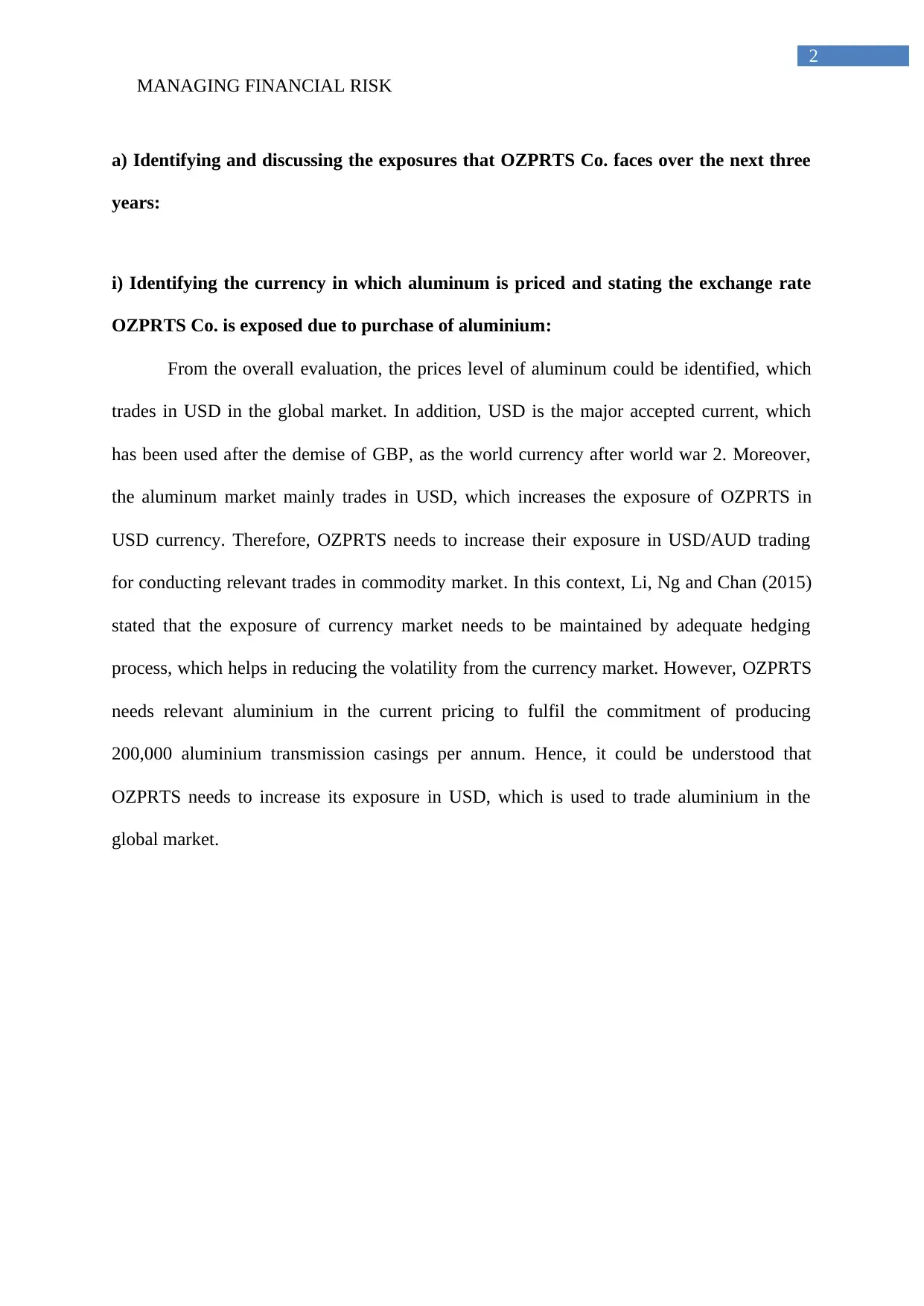

Figure 2: Depicting the AUD/USD price from March 2015 to March 2018

(Source: Au.investing.com 2018)

The above figure mainly depicts the overall volatile currency validation of

AUD/USD, which has strengthened over the period of three years. The AUD has gained

ground over USD, which it lost within the period of 3 years. This relevantly indicates that

current trend of AUD/USD might increase the chance of loss, which might increase profits of

the company. In addition, from the overall evaluation it could be understood that value of

AUD/USD over the three period is at the level of 0.95%. This indicates that steadily USD has

increased its valuation against AUD, which raises the level of expenses that will be

conducted by the company for obtaining aluminum commodity for its production process.

Hillson and Murray-Webster (2017) argued that without the evaluation of current market the

trades conducted for hedging against the volatility exposure can hamper the actual financial

performance of the company. The combination where aluminum pricing rises in valuation

and USD strength increases in comparison to AUD directly affects the actual cost of

aluminum over the period.

4

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

0.68

0.7

0.72

0.74

0.76

0.78

0.8

0.82

AUD/USD Close

Figure 2: Depicting the AUD/USD price from March 2015 to March 2018

(Source: Au.investing.com 2018)

The above figure mainly depicts the overall volatile currency validation of

AUD/USD, which has strengthened over the period of three years. The AUD has gained

ground over USD, which it lost within the period of 3 years. This relevantly indicates that

current trend of AUD/USD might increase the chance of loss, which might increase profits of

the company. In addition, from the overall evaluation it could be understood that value of

AUD/USD over the three period is at the level of 0.95%. This indicates that steadily USD has

increased its valuation against AUD, which raises the level of expenses that will be

conducted by the company for obtaining aluminum commodity for its production process.

Hillson and Murray-Webster (2017) argued that without the evaluation of current market the

trades conducted for hedging against the volatility exposure can hamper the actual financial

performance of the company. The combination where aluminum pricing rises in valuation

and USD strength increases in comparison to AUD directly affects the actual cost of

aluminum over the period.

MANAGING FINANCIAL RISK

5

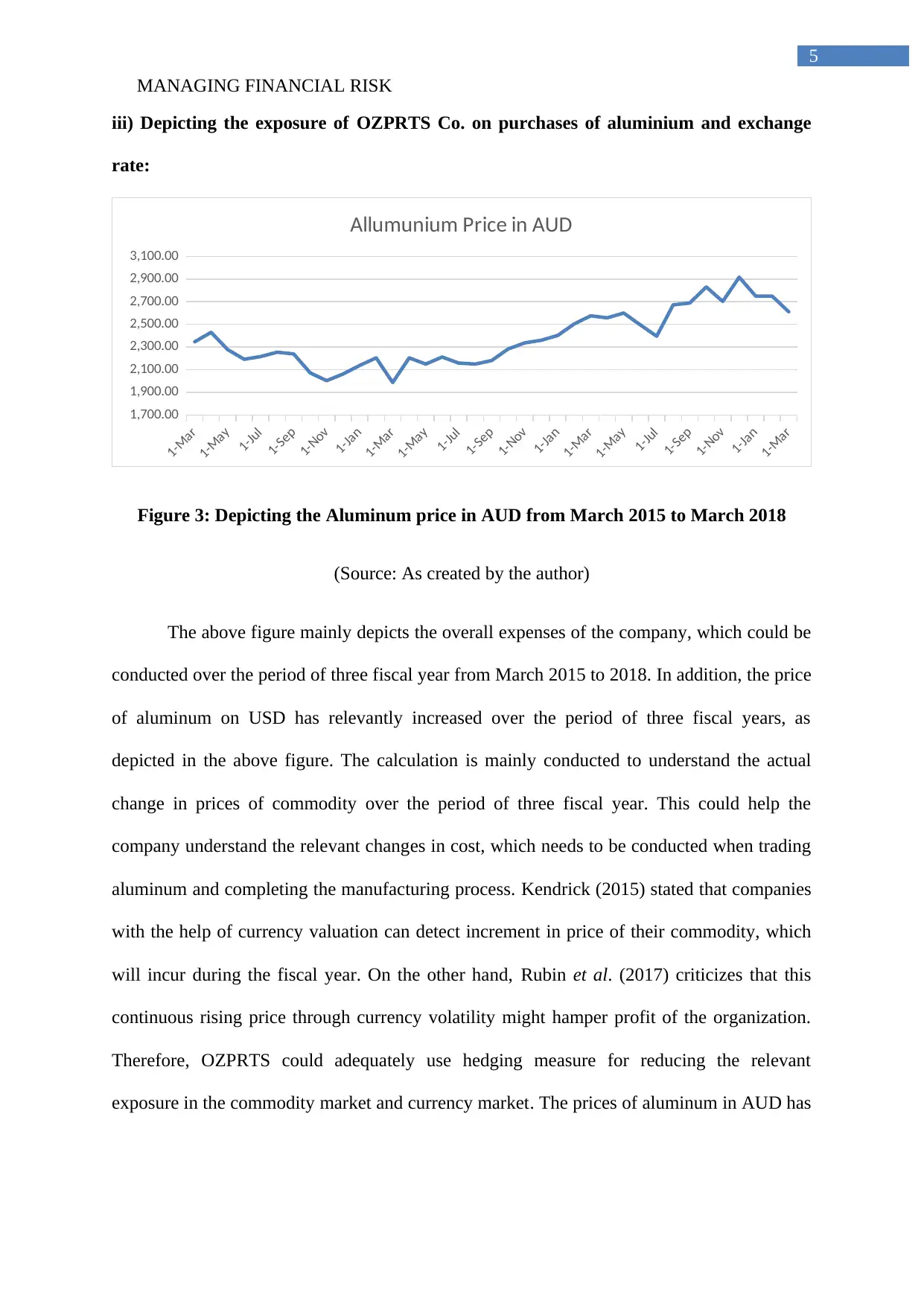

iii) Depicting the exposure of OZPRTS Co. on purchases of aluminium and exchange

rate:

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1,700.00

1,900.00

2,100.00

2,300.00

2,500.00

2,700.00

2,900.00

3,100.00

Allumunium Price in AUD

Figure 3: Depicting the Aluminum price in AUD from March 2015 to March 2018

(Source: As created by the author)

The above figure mainly depicts the overall expenses of the company, which could be

conducted over the period of three fiscal year from March 2015 to 2018. In addition, the price

of aluminum on USD has relevantly increased over the period of three fiscal years, as

depicted in the above figure. The calculation is mainly conducted to understand the actual

change in prices of commodity over the period of three fiscal year. This could help the

company understand the relevant changes in cost, which needs to be conducted when trading

aluminum and completing the manufacturing process. Kendrick (2015) stated that companies

with the help of currency valuation can detect increment in price of their commodity, which

will incur during the fiscal year. On the other hand, Rubin et al. (2017) criticizes that this

continuous rising price through currency volatility might hamper profit of the organization.

Therefore, OZPRTS could adequately use hedging measure for reducing the relevant

exposure in the commodity market and currency market. The prices of aluminum in AUD has

5

iii) Depicting the exposure of OZPRTS Co. on purchases of aluminium and exchange

rate:

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1,700.00

1,900.00

2,100.00

2,300.00

2,500.00

2,700.00

2,900.00

3,100.00

Allumunium Price in AUD

Figure 3: Depicting the Aluminum price in AUD from March 2015 to March 2018

(Source: As created by the author)

The above figure mainly depicts the overall expenses of the company, which could be

conducted over the period of three fiscal year from March 2015 to 2018. In addition, the price

of aluminum on USD has relevantly increased over the period of three fiscal years, as

depicted in the above figure. The calculation is mainly conducted to understand the actual

change in prices of commodity over the period of three fiscal year. This could help the

company understand the relevant changes in cost, which needs to be conducted when trading

aluminum and completing the manufacturing process. Kendrick (2015) stated that companies

with the help of currency valuation can detect increment in price of their commodity, which

will incur during the fiscal year. On the other hand, Rubin et al. (2017) criticizes that this

continuous rising price through currency volatility might hamper profit of the organization.

Therefore, OZPRTS could adequately use hedging measure for reducing the relevant

exposure in the commodity market and currency market. The prices of aluminum in AUD has

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

+$

-$

Decrease in price

Current price

Increase in price Long Futures

Short Futures

MANAGING FINANCIAL RISK

6

relevantly increased from 2,.345.87 to 2,610.69, which indicates high demand of the product

over the time.

b) Critically evaluating the use of option or futures to hedge against the risk that

OZPRTS Co. faces from the purchase of aluminium:

i) Using the appropriate diagram to identify derivative-based hedges on the cost of

aluminium and the relevant exchange rate:

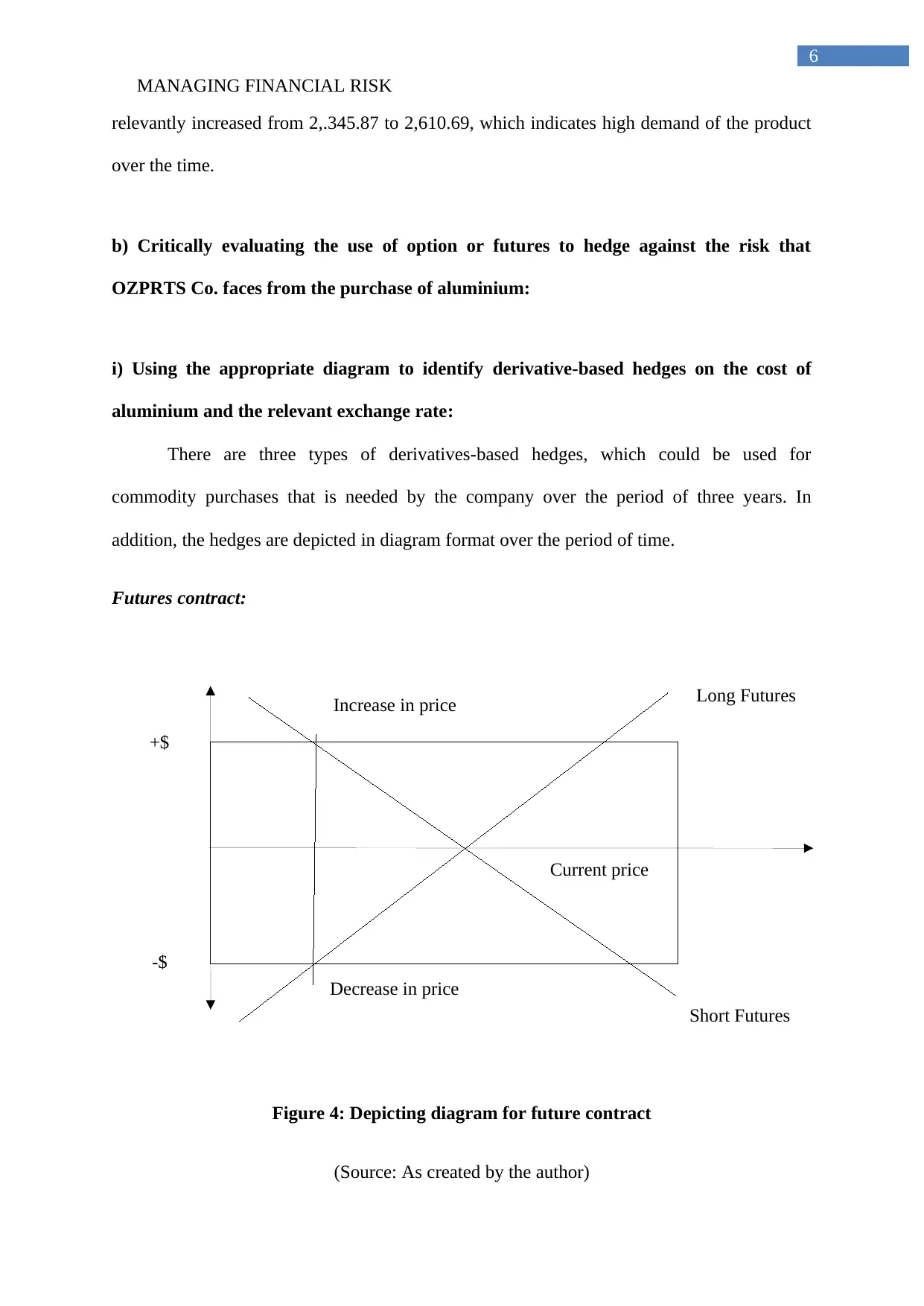

There are three types of derivatives-based hedges, which could be used for

commodity purchases that is needed by the company over the period of three years. In

addition, the hedges are depicted in diagram format over the period of time.

Futures contract:

Figure 4: Depicting diagram for future contract

(Source: As created by the author)

-$

Decrease in price

Current price

Increase in price Long Futures

Short Futures

MANAGING FINANCIAL RISK

6

relevantly increased from 2,.345.87 to 2,610.69, which indicates high demand of the product

over the time.

b) Critically evaluating the use of option or futures to hedge against the risk that

OZPRTS Co. faces from the purchase of aluminium:

i) Using the appropriate diagram to identify derivative-based hedges on the cost of

aluminium and the relevant exchange rate:

There are three types of derivatives-based hedges, which could be used for

commodity purchases that is needed by the company over the period of three years. In

addition, the hedges are depicted in diagram format over the period of time.

Futures contract:

Figure 4: Depicting diagram for future contract

(Source: As created by the author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Loss limited

Profit Unlimited

Strike price

Long Call

MANAGING FINANCIAL RISK

7

The above diagram mainly depicts the overall payoff and layout of future contract,

which could be used by the company to hedge its exposure in the market. Future contracts

mainly help in reducing the risk from investment, which could generate high level of returns

from investment. Therefore, with the help of future contract companies are able to reduce the

risk from changing volatile commodity prices and fix their actual cost for the purchase. this

helps in maintaining the level of returns and profits that is estimated by the organization

before commencing the production. Hence, with the help of future contracts aluminium

purchases can be conducted adequately by fixing the price of the commodity before the

Purchase date. This could help the company to reduce the excessive burden on capital, due to

volatile prices of aluminium. The spread generated from future contract would eventually

help in reducing the excessive cost of aluminium by purchasing the product from the

international market. Pfaff (2016) stated that with the help of futures contract companies can

hedge their exposure in the commodity market by fixing the overall purchase price and

reducing the negative impact of price volatility.

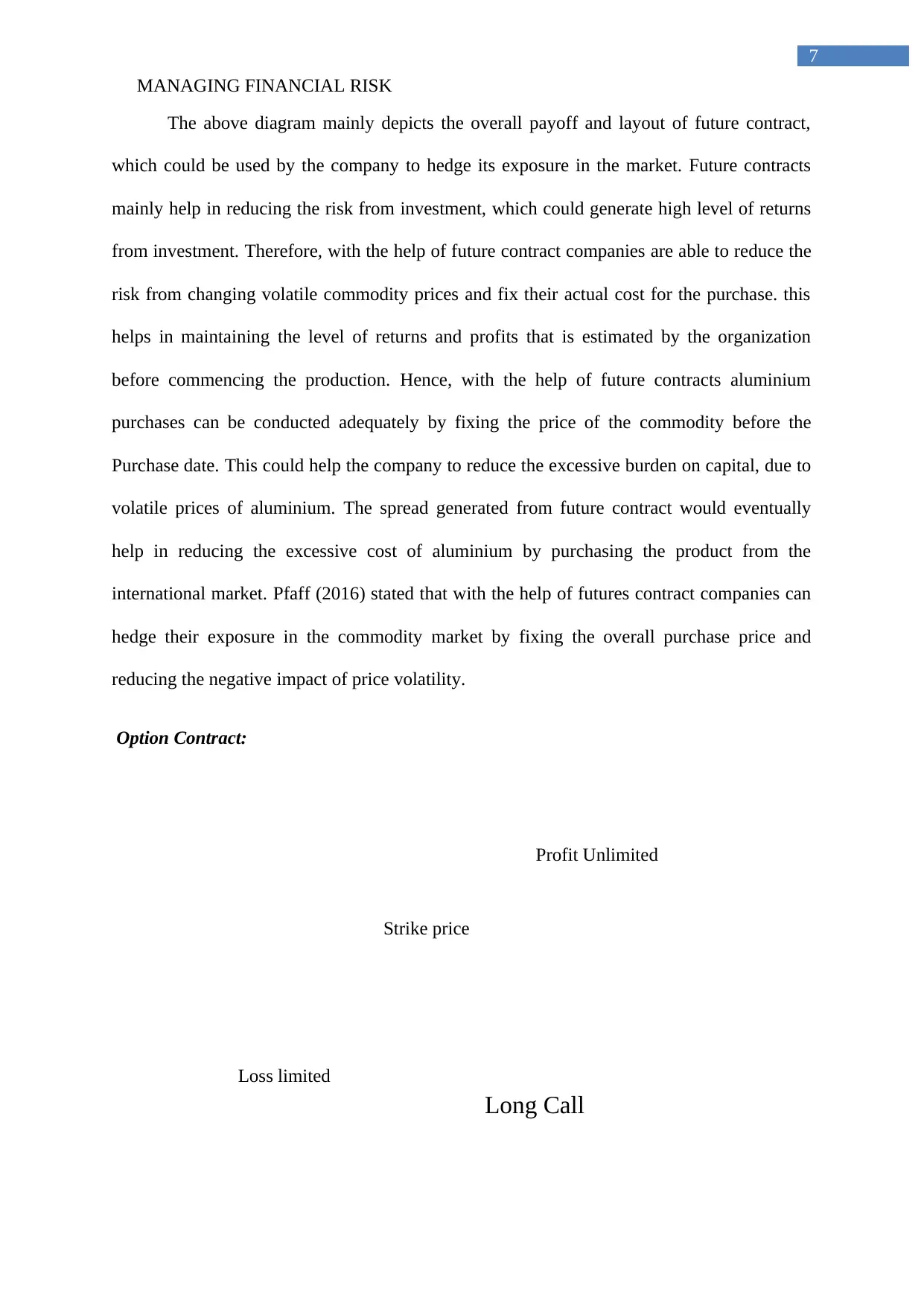

Option Contract:

Profit Unlimited

Strike price

Long Call

MANAGING FINANCIAL RISK

7

The above diagram mainly depicts the overall payoff and layout of future contract,

which could be used by the company to hedge its exposure in the market. Future contracts

mainly help in reducing the risk from investment, which could generate high level of returns

from investment. Therefore, with the help of future contract companies are able to reduce the

risk from changing volatile commodity prices and fix their actual cost for the purchase. this

helps in maintaining the level of returns and profits that is estimated by the organization

before commencing the production. Hence, with the help of future contracts aluminium

purchases can be conducted adequately by fixing the price of the commodity before the

Purchase date. This could help the company to reduce the excessive burden on capital, due to

volatile prices of aluminium. The spread generated from future contract would eventually

help in reducing the excessive cost of aluminium by purchasing the product from the

international market. Pfaff (2016) stated that with the help of futures contract companies can

hedge their exposure in the commodity market by fixing the overall purchase price and

reducing the negative impact of price volatility.

Option Contract:

Loss

Profit

Strike price

Long Put

MANAGING FINANCIAL RISK

8

Figure 5: Depicting diagram for option contract- Long Call

(Source: As created by the author)

The above contract depicts the option hedging process that could be used by

organizations to fix its overall purchase of aluminum commodity. The contract could

eventually help in reducing the excessive prices of aluminum in the international market by

using hedging measures. The option contract would eventually help in going the loss that

might be incurred by the company due to the changing prices of aluminum in the

international market. Brooks (2015) mentioned that option contracts mainly help

multinational corporations to conduct hedging process by providing below premiums on the

trade in comparison to future contracts.

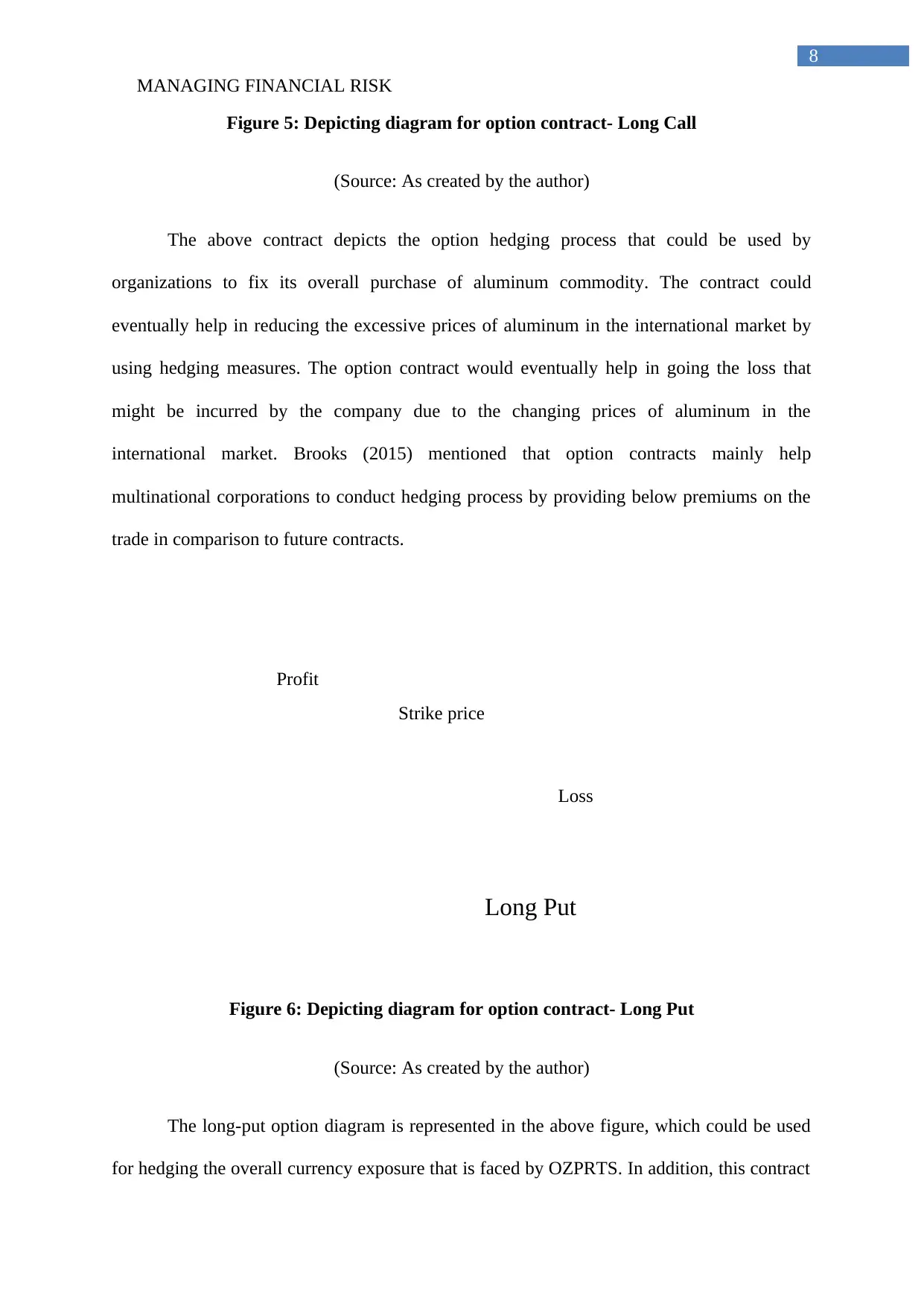

Figure 6: Depicting diagram for option contract- Long Put

(Source: As created by the author)

The long-put option diagram is represented in the above figure, which could be used

for hedging the overall currency exposure that is faced by OZPRTS. In addition, this contract

Profit

Strike price

Long Put

MANAGING FINANCIAL RISK

8

Figure 5: Depicting diagram for option contract- Long Call

(Source: As created by the author)

The above contract depicts the option hedging process that could be used by

organizations to fix its overall purchase of aluminum commodity. The contract could

eventually help in reducing the excessive prices of aluminum in the international market by

using hedging measures. The option contract would eventually help in going the loss that

might be incurred by the company due to the changing prices of aluminum in the

international market. Brooks (2015) mentioned that option contracts mainly help

multinational corporations to conduct hedging process by providing below premiums on the

trade in comparison to future contracts.

Figure 6: Depicting diagram for option contract- Long Put

(Source: As created by the author)

The long-put option diagram is represented in the above figure, which could be used

for hedging the overall currency exposure that is faced by OZPRTS. In addition, this contract

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

MANAGING FINANCIAL RISK

9

would eventually help in reducing the laws that is generated from currency conversion that

needs to be conducted by the company for buying aluminum from the international market

(McNeil, Frey and Embrechts 2015). Buying a long-put option would eventually help in

reducing the loss that increases from strengthening USD against AUD.

ii) Identifying and explaining problems that might be faced by derivative-based hedging

strategies:

The different types of problems that could be identified while implementing the

derivative based hedging strategies identified in the above segment. Moreover, for starting

the hatching process OZPRTS will need to have adequate trading account and other amenities

to hedge its overall exposure. The problems such a accuracy of the trade can be a major

problem for the hedging process, as losses incurred from commodity and currency market

could be hedged. However, the profit that could be generated from reducing commodity

prices and strengthening AUD will also be lost from the hedging process. Therefore, the

accuracy of identifying the accurate hedging price is the major problem faced by companies.

Cost of the hedging could also increase relevant losses for the organization if price remains

stagnant, which could increase expenses of the organization. The combined hedging process

needs adequate strategy which could help in reducing the losses of the organization. using

futures and option contracts would immensely increase the capital requirement of the

company, which will be used as a Collateral for the trade, as mandated by maximum

exchanges (Bessis 2015).

iii) Choosing one the derivative-based hedge instruments for each of the exposure of

OZPRTS Co.:

From the overall evaluation of different ages future contract could be used for

aluminum purchase, while option contract such as long put can be used for hedging

9

would eventually help in reducing the laws that is generated from currency conversion that

needs to be conducted by the company for buying aluminum from the international market

(McNeil, Frey and Embrechts 2015). Buying a long-put option would eventually help in

reducing the loss that increases from strengthening USD against AUD.

ii) Identifying and explaining problems that might be faced by derivative-based hedging

strategies:

The different types of problems that could be identified while implementing the

derivative based hedging strategies identified in the above segment. Moreover, for starting

the hatching process OZPRTS will need to have adequate trading account and other amenities

to hedge its overall exposure. The problems such a accuracy of the trade can be a major

problem for the hedging process, as losses incurred from commodity and currency market

could be hedged. However, the profit that could be generated from reducing commodity

prices and strengthening AUD will also be lost from the hedging process. Therefore, the

accuracy of identifying the accurate hedging price is the major problem faced by companies.

Cost of the hedging could also increase relevant losses for the organization if price remains

stagnant, which could increase expenses of the organization. The combined hedging process

needs adequate strategy which could help in reducing the losses of the organization. using

futures and option contracts would immensely increase the capital requirement of the

company, which will be used as a Collateral for the trade, as mandated by maximum

exchanges (Bessis 2015).

iii) Choosing one the derivative-based hedge instruments for each of the exposure of

OZPRTS Co.:

From the overall evaluation of different ages future contract could be used for

aluminum purchase, while option contract such as long put can be used for hedging

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

MANAGING FINANCIAL RISK

10

AUD/USD. The Futures contract for Aluminum purchase might help the company in

controlling the extra cost, which might increase due to demand and supply of the commodity.

On the other hand, with the use of Option Contract-Long Put for hedging AUD/USD the

company could adequately reduce the losses, which will incur with the strengthening of USD

against AUD. This option contract would eventually help in controlling the excess payment

that could be conducted by the company due to low AUD power against USD

(Markets.businessinsider.com 2018).

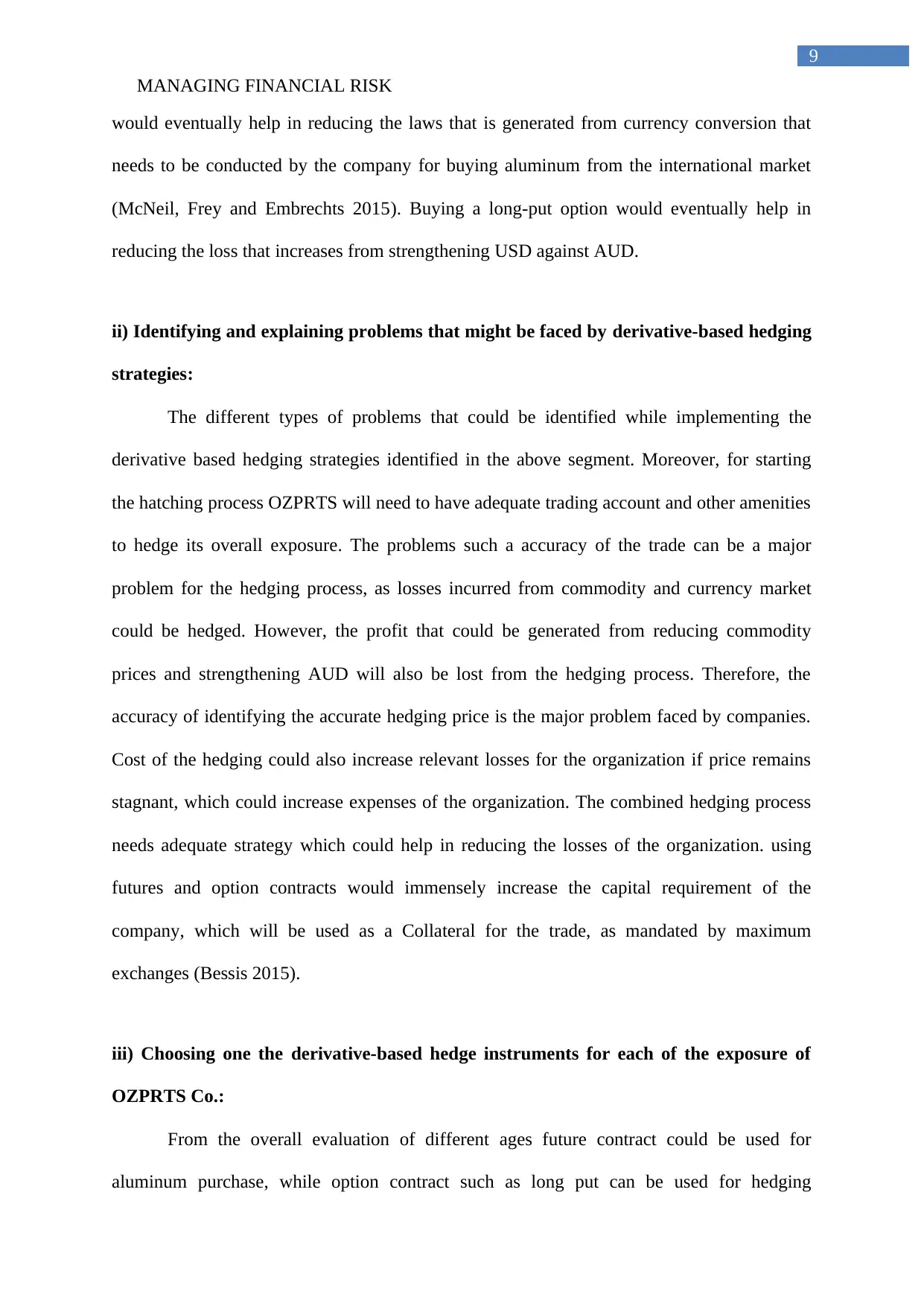

c.i) Identifying the currency exposure on revenue side that is faced by OZPRTS Co. on

its sale of engine casings:

The evaluation of case study helps in identifying the exposure of currency on revenue

side that is faced by OZPRTS. The company will mainly sell the aluminum transmission

casings to EU-based automotive manufacturer. Therefore, the exposure of euro currency is

relatively high, which could help in generating high level of returns from investment.

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1.25

1.3

1.35

1.4

1.45

1.5

1.55

1.6

1.65

EUR/AUD

Figure 7: Depicting the EUR/AUD price from March 2015 to March 2018

10

AUD/USD. The Futures contract for Aluminum purchase might help the company in

controlling the extra cost, which might increase due to demand and supply of the commodity.

On the other hand, with the use of Option Contract-Long Put for hedging AUD/USD the

company could adequately reduce the losses, which will incur with the strengthening of USD

against AUD. This option contract would eventually help in controlling the excess payment

that could be conducted by the company due to low AUD power against USD

(Markets.businessinsider.com 2018).

c.i) Identifying the currency exposure on revenue side that is faced by OZPRTS Co. on

its sale of engine casings:

The evaluation of case study helps in identifying the exposure of currency on revenue

side that is faced by OZPRTS. The company will mainly sell the aluminum transmission

casings to EU-based automotive manufacturer. Therefore, the exposure of euro currency is

relatively high, which could help in generating high level of returns from investment.

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1-May

1-Jul

1-Sep

1-Nov

1-Jan

1-Mar

1.25

1.3

1.35

1.4

1.45

1.5

1.55

1.6

1.65

EUR/AUD

Figure 7: Depicting the EUR/AUD price from March 2015 to March 2018

Loss

Profit

Strike price

Long Put

MANAGING FINANCIAL RISK

11

(Source: Au.investing.com 2018)

The above figure mainly helps in identifying the overall currency valuation for

EUR/AUD from March 2015 to 2018. This evaluation of the historical currency valuation

could eventually help in depicting the selling price, which will generate high level of returns

for the company. Valuation of Euro currency is relatively increasing in comparison to AUD,

which indicates the profits that could be generated by OZPRTS from selling aluminum

transmission casings to EU-based automotive manufacturer. From the evaluation chances of

increasing AUD value against euro is estimated from the graph represented in figure 7.

Therefore, with the help of adequate hedging instruments any kind of loss that might income

from Currency conversion might be reduced (Titman et al. 2017).

c.ii) Choosing whether to use option or futures hedge against currency exposure that

OZPRTS Co. conducts:

Figure 8: Depicting diagram for Revenue currency hedge Long Put

(Source: As created by the author)

Profit

Strike price

Long Put

MANAGING FINANCIAL RISK

11

(Source: Au.investing.com 2018)

The above figure mainly helps in identifying the overall currency valuation for

EUR/AUD from March 2015 to 2018. This evaluation of the historical currency valuation

could eventually help in depicting the selling price, which will generate high level of returns

for the company. Valuation of Euro currency is relatively increasing in comparison to AUD,

which indicates the profits that could be generated by OZPRTS from selling aluminum

transmission casings to EU-based automotive manufacturer. From the evaluation chances of

increasing AUD value against euro is estimated from the graph represented in figure 7.

Therefore, with the help of adequate hedging instruments any kind of loss that might income

from Currency conversion might be reduced (Titman et al. 2017).

c.ii) Choosing whether to use option or futures hedge against currency exposure that

OZPRTS Co. conducts:

Figure 8: Depicting diagram for Revenue currency hedge Long Put

(Source: As created by the author)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.