A Marketing Report on the ANZ Bank Cash Passport Product and Tourism

VerifiedAdded on 2022/12/30

|17

|3866

|44

Report

AI Summary

This report provides a comprehensive analysis of the ANZ Cash Passport product, focusing on its marketing strategies within the context of the travel and tourism industry. It begins with an introduction to ANZ Bank and the Cash Passport, a prepaid travel card designed for international use. The literature review explores the history of banking products, the competitive landscape, the nature of competitor products, and the evolution of travel payment methods, including traveler's cheques and the modern use of travel cards. The report delves into the marketing efforts of ANZ Bank, highlighting how the Cash Passport is promoted to attract customers and facilitate secure international transactions. Furthermore, the report includes an analysis of competitor products and the role of Cash Passport in the tourism sector, the report also examines customer satisfaction, evaluating the product's features, convenience, and benefits for travelers. The report concludes by summarizing the key findings and providing recommendations for enhancing the product's marketing and customer appeal.

Running head: MARKETING

Travel and Tourism

Name of the Student:

Name of the University:

Author Note:

Travel and Tourism

Name of the Student:

Name of the University:

Author Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MANAGEMENT

Table of Contents

Part B:..............................................................................................................................................3

1. Introduction:................................................................................................................................3

2. Literature Review:.......................................................................................................................4

3. Analysis of the Competitors Product:........................................................................................11

4. Discussion about Customer Satisfaction with Cash Passport Product, Service and Quality.....13

4. Conclusion.................................................................................................................................14

References:....................................................................................................................................15

Table of Contents

Part B:..............................................................................................................................................3

1. Introduction:................................................................................................................................3

2. Literature Review:.......................................................................................................................4

3. Analysis of the Competitors Product:........................................................................................11

4. Discussion about Customer Satisfaction with Cash Passport Product, Service and Quality.....13

4. Conclusion.................................................................................................................................14

References:....................................................................................................................................15

2MANAGEMENT

Part B:

1. Introduction:

The report aims at providing an insight into the ANZ Bank where I work as a service

consultant as part of the project that deals with Cash Passport Product. It is one of the leading

banks of Australia and New Zealand serving close to over 5 million customers. The bank

employees over 28,000 people and have assets close to about AUD$ 247 billion. The history of

the bank dated back to 1835 and operated based on building sustainable future for not only the

business but also the staff, shareholders, staff, communities and customers. The bank also makes

an effort of achieving and maintaining highest standards of continuous disclosure and corporate

governance. The bank offers various products that cater to the personal, business and the

corporate sectors. This particular report however concentrates on the Cash Passport Product of

the bank. The project concerning the Cash Passport Product is crucial for the not only the bank

but also the customers who takes immense interest in knowing more about the product.

Cash Passport Product is a reloadable prepaid money card used for the purposes of travel

allowing a person to top up currencies anytime and anywhere. The card can be reloaded online

either through the transfer of funds through debit card, bank transfer and Bpay. The Cash

Passport Product is also comes with various features like lock in rates of exchange, no fees, finds

acceptance at millions of locations and provides 24/7 assistance globally. The report focuses on

the how the product benefits the customers along with an analysis of the competitors product.

Part B:

1. Introduction:

The report aims at providing an insight into the ANZ Bank where I work as a service

consultant as part of the project that deals with Cash Passport Product. It is one of the leading

banks of Australia and New Zealand serving close to over 5 million customers. The bank

employees over 28,000 people and have assets close to about AUD$ 247 billion. The history of

the bank dated back to 1835 and operated based on building sustainable future for not only the

business but also the staff, shareholders, staff, communities and customers. The bank also makes

an effort of achieving and maintaining highest standards of continuous disclosure and corporate

governance. The bank offers various products that cater to the personal, business and the

corporate sectors. This particular report however concentrates on the Cash Passport Product of

the bank. The project concerning the Cash Passport Product is crucial for the not only the bank

but also the customers who takes immense interest in knowing more about the product.

Cash Passport Product is a reloadable prepaid money card used for the purposes of travel

allowing a person to top up currencies anytime and anywhere. The card can be reloaded online

either through the transfer of funds through debit card, bank transfer and Bpay. The Cash

Passport Product is also comes with various features like lock in rates of exchange, no fees, finds

acceptance at millions of locations and provides 24/7 assistance globally. The report focuses on

the how the product benefits the customers along with an analysis of the competitors product.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MANAGEMENT

2. Literature Review:

Theme 1: History of Banking Products and How its Change

Australia and New Zealand Bank also known as ANZ Bank represent the third largest

bank in Australia in terms of the market capitalization and is positioned after the Westpac

Banking Corporation and the Commonwealth Bank (anz.com, 2019). ANZ has several years of

experience across complete range of the banking products and services. Right from the

management of the cash flow to the financing of the complicated deals, ANZ is known for its

reliability and expertise (anz.com, 2019).

As far as the products are concerned, the Bank offers personal and business loans, credit

cards, insurance, foreign exchange, international payments and travel money (anz.com, 2019).

As report aims at providing an insight into tourism so the focus is primarily on the travel

products. The travel products of the bank included ANZ Travel Card, Foreign Currency Cash

and the ANZ Cash Packs.

ANZ Travel Card is a multicurrency prepaid Visa card that lets you access your own

money easily and securely while you're overseas. Load the currencies you want and lock in your

exchange rate for peace of mind. This travel card comes with the following features (anz.com,

2019)

It locks the rate once the funds are loaded

It comes with an additional back up card so that individuals can access money

even when the card gets lost

2. Literature Review:

Theme 1: History of Banking Products and How its Change

Australia and New Zealand Bank also known as ANZ Bank represent the third largest

bank in Australia in terms of the market capitalization and is positioned after the Westpac

Banking Corporation and the Commonwealth Bank (anz.com, 2019). ANZ has several years of

experience across complete range of the banking products and services. Right from the

management of the cash flow to the financing of the complicated deals, ANZ is known for its

reliability and expertise (anz.com, 2019).

As far as the products are concerned, the Bank offers personal and business loans, credit

cards, insurance, foreign exchange, international payments and travel money (anz.com, 2019).

As report aims at providing an insight into tourism so the focus is primarily on the travel

products. The travel products of the bank included ANZ Travel Card, Foreign Currency Cash

and the ANZ Cash Packs.

ANZ Travel Card is a multicurrency prepaid Visa card that lets you access your own

money easily and securely while you're overseas. Load the currencies you want and lock in your

exchange rate for peace of mind. This travel card comes with the following features (anz.com,

2019)

It locks the rate once the funds are loaded

It comes with an additional back up card so that individuals can access money

even when the card gets lost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MANAGEMENT

It does not require an issuance or reload fees.

It allows an individual to travel with confidence as it comes with a PIN for

security.

Foreign Currency Cash: It represents wide range of the popular currencies and is a

convenient means of making money overseas (Belghitar, Clark & Mefteh, 2013). It however

comes with the following features:

It offers a wider range of the popular overseas currencies

It requires no exchange fees for the ANZ customers

It offers lucrative exchange rates

It allows conversion back to the Australian Dollars once an individual returns

ANZ Cash Packs are products that comprises of the pre –packaged mix of the foreign d

denominations for taking out the stress related to the exchange of the foreign currency. Some

of the features include(anz.co.nz , 2019):

Convenience in pre-packaging

Allows start enjoying the holiday without standing in a queue and waiting for exchange

money

It offers smart exchange rates

It does not require an issuance or reload fees.

It allows an individual to travel with confidence as it comes with a PIN for

security.

Foreign Currency Cash: It represents wide range of the popular currencies and is a

convenient means of making money overseas (Belghitar, Clark & Mefteh, 2013). It however

comes with the following features:

It offers a wider range of the popular overseas currencies

It requires no exchange fees for the ANZ customers

It offers lucrative exchange rates

It allows conversion back to the Australian Dollars once an individual returns

ANZ Cash Packs are products that comprises of the pre –packaged mix of the foreign d

denominations for taking out the stress related to the exchange of the foreign currency. Some

of the features include(anz.co.nz , 2019):

Convenience in pre-packaging

Allows start enjoying the holiday without standing in a queue and waiting for exchange

money

It offers smart exchange rates

5MANAGEMENT

The Cash Packs are available for multiple currencies like United States Dollars (USD),

Pounds, Euros, Thai Baht and Chinese Reinmimbi.

Over the years, banks have undergone a transformation in their products and ANZ being in this

category is no different. ANZ have now introduced Cash Passport Platinum Mastercard which is

basically a prepaid business card for expenses that could be used at innumerable number of ATMs

as well as merchants across the world for withdrawal of local currency or the purchase of the goods

or the services. It allows the companies in efficiently monitoring and managing the travel expenses

by centralizing all the expenditures (cashpassport.co.nz, 2019).

Theme 2: Competition with Other Company

How it’s Related to Tourism

Description: Cash Passport Platinum represents a reloadable and prepaid pay facility

mostly for the domestic, online and the travel use which allows in accessing the money

loaded into the Cash Passport Platinum for either making purchase or withdrawing cash

in an overseas location or locally within New Zealand. An individual can use the money

by using the cash (Sarkar, 2017).

Status: It is an unsubordinated and unsecured debt security

Application: To apply for the card it is important to acquire a residential address in New

Zealand.

Charges and Fees: It involves fees and charges. Fees mostly includes cash out fees,

withdrawal fees of ATM, administrative fees, fees for currency conversion, transaction

fees of the individual merchant(Swartz, 2017).

Interest: An individual will earn on any amount of money loaded in the platinum card.

The Cash Packs are available for multiple currencies like United States Dollars (USD),

Pounds, Euros, Thai Baht and Chinese Reinmimbi.

Over the years, banks have undergone a transformation in their products and ANZ being in this

category is no different. ANZ have now introduced Cash Passport Platinum Mastercard which is

basically a prepaid business card for expenses that could be used at innumerable number of ATMs

as well as merchants across the world for withdrawal of local currency or the purchase of the goods

or the services. It allows the companies in efficiently monitoring and managing the travel expenses

by centralizing all the expenditures (cashpassport.co.nz, 2019).

Theme 2: Competition with Other Company

How it’s Related to Tourism

Description: Cash Passport Platinum represents a reloadable and prepaid pay facility

mostly for the domestic, online and the travel use which allows in accessing the money

loaded into the Cash Passport Platinum for either making purchase or withdrawing cash

in an overseas location or locally within New Zealand. An individual can use the money

by using the cash (Sarkar, 2017).

Status: It is an unsubordinated and unsecured debt security

Application: To apply for the card it is important to acquire a residential address in New

Zealand.

Charges and Fees: It involves fees and charges. Fees mostly includes cash out fees,

withdrawal fees of ATM, administrative fees, fees for currency conversion, transaction

fees of the individual merchant(Swartz, 2017).

Interest: An individual will earn on any amount of money loaded in the platinum card.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MANAGEMENT

Term: The Cash Passport Platimum will continue until the Travelex Card Services

Limited (TCSL) is asked for closing it and paying its balance to the concerned individual

or when either the balance on the Cash Passport Platinum becomes nil or the card is

expired (Selbach & Lana, 2015). Nevertheless, the card remains active for close to five

years and its validity is shown in the front of the card. Individuals will not be able to

access the card once it expires even when the card is loaded. In such instances, a

replacement card needed be requested to which the balance can be transferred.

Guarantee: The Cash Passport Platinum card is guaranteed solely by the TCSL for

repaying the money loaded into the card (Shaik, 2013).

Restrictions of Transfer: This particular card cannot be transferred.

Competitor Nature of Product

The competitor Nature of the product is as follows:

Convenience: The Cash Passport Platinum represents a convenient means of

taking multiple currencies and spending the money overseas thereby enabling an

individual in managing money while being away from the home (Kizgin et al. 2013). It

can either be used online or used for directly paying goods and services or withdrawing

the local currency from the ATM displaying the acceptance mark of the Mastercard. With

this card there is no need for worrying about the bank hours or standing in the lengthy

queues.

Contactless Feature Enabled: The card is Mastercard contactless-enabled. It

represents a faster means of paying for the purchases under the mentioned limit of the

transaction without the PIN or signature (Roland & Langer, 2013). The transaction limit

Term: The Cash Passport Platimum will continue until the Travelex Card Services

Limited (TCSL) is asked for closing it and paying its balance to the concerned individual

or when either the balance on the Cash Passport Platinum becomes nil or the card is

expired (Selbach & Lana, 2015). Nevertheless, the card remains active for close to five

years and its validity is shown in the front of the card. Individuals will not be able to

access the card once it expires even when the card is loaded. In such instances, a

replacement card needed be requested to which the balance can be transferred.

Guarantee: The Cash Passport Platinum card is guaranteed solely by the TCSL for

repaying the money loaded into the card (Shaik, 2013).

Restrictions of Transfer: This particular card cannot be transferred.

Competitor Nature of Product

The competitor Nature of the product is as follows:

Convenience: The Cash Passport Platinum represents a convenient means of

taking multiple currencies and spending the money overseas thereby enabling an

individual in managing money while being away from the home (Kizgin et al. 2013). It

can either be used online or used for directly paying goods and services or withdrawing

the local currency from the ATM displaying the acceptance mark of the Mastercard. With

this card there is no need for worrying about the bank hours or standing in the lengthy

queues.

Contactless Feature Enabled: The card is Mastercard contactless-enabled. It

represents a faster means of paying for the purchases under the mentioned limit of the

transaction without the PIN or signature (Roland & Langer, 2013). The transaction limit

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MANAGEMENT

for the contactless however changes with time and different limits of transaction apply

for the different countries.

Easier to Budget: The Cash Passport enables an individual in loading foreign as

well as local currencies into a single payment facility. This implies that individuals can

exchange the New Zealand dollars into one or more currencies that might be required

before the travel (Friman, Ettema & Olsson, 2018). With the prepaid facility of payment,

an individual is able to track his spending while being away from the home.

Reloadable: This Cash Passport Platinum card can be reloaded innumerable

times within its application limit at any distribution outlet of New Zealand by providing a

valid photo identity. While travelling, the card can be re-loaded with additional funds by

undertaking a Bank Transfer.

Emergency Assistance On Global Scale: On losing the card or in an instance of

stealing, individuals become eligible for receiving emergency cash disbursement. For

accessing the emergency assistance the individual needs to make a call to the in the

helpline number. Once the representative of the customer service establishes that the

individual have sufficient ways of payment, TCSL arranges for the money at the

convenient location of disbursement

Theme 3: Evolution of People Use

Traveler’s cheque, Thomas Cook who invented: Traveler’s cheque referred to the

exchange medium that could be used instead of the harder currency (Abbas & Abd Kadir,

2013). These are fixated amount cheque designed for allowing the person to sign in order

to make unconditional payment to an individual thereby paying the issuer for the

for the contactless however changes with time and different limits of transaction apply

for the different countries.

Easier to Budget: The Cash Passport enables an individual in loading foreign as

well as local currencies into a single payment facility. This implies that individuals can

exchange the New Zealand dollars into one or more currencies that might be required

before the travel (Friman, Ettema & Olsson, 2018). With the prepaid facility of payment,

an individual is able to track his spending while being away from the home.

Reloadable: This Cash Passport Platinum card can be reloaded innumerable

times within its application limit at any distribution outlet of New Zealand by providing a

valid photo identity. While travelling, the card can be re-loaded with additional funds by

undertaking a Bank Transfer.

Emergency Assistance On Global Scale: On losing the card or in an instance of

stealing, individuals become eligible for receiving emergency cash disbursement. For

accessing the emergency assistance the individual needs to make a call to the in the

helpline number. Once the representative of the customer service establishes that the

individual have sufficient ways of payment, TCSL arranges for the money at the

convenient location of disbursement

Theme 3: Evolution of People Use

Traveler’s cheque, Thomas Cook who invented: Traveler’s cheque referred to the

exchange medium that could be used instead of the harder currency (Abbas & Abd Kadir,

2013). These are fixated amount cheque designed for allowing the person to sign in order

to make unconditional payment to an individual thereby paying the issuer for the

8MANAGEMENT

privilege. They were mostly used by the people in the foreign countries instead of the

cash. Traveler’s cheque has been first issued in the January 1st 1772 by London Credit

Exchange Company for the use in close to 90 countries. In the year 1874, Thomas Cook

issued circular notes that had similar operation like that of traveler’s cheques.

History of Travel: Travel refereed to movement of the people in the distant geographic

locations. Reasons for travel included tourism, vacationing, recreation and the research

travel. Travelers might use human-powered transport like the automobiles, trains, public

transport and the airplanes(Wang, 2018). The motives behind the travel included

relaxation, exploration and discovery, knowing other cultures and building the

interpersonal relationships. During this time people either opted for traveler’s cheque or

carried sufficient liquid cash for meeting the travelers need.

What People use nowadays: People have nowadays completely become technology

freak and makes use of various travel apps. Nowadays every single person not only

carries a Smartphone, laptop, camera or tablet (Brynjolfsson & McAfee, 2014). People

have however opted ebooks in the form of travel guides and prefer reading books in the

Kindle format. Besides, people have also becomes smarter and prefer using cash passport

cards or travel card for financing their passports.

Cash Passport: It is a prepaid money card used for the travel. Cash Passports can be

used for paying services and goods, in store, online and in million locations across the

world (anz.com, 2019). While buying the card, individuals have the option for paying

either via the debit card or BPay. Individuals can however use the Cash Passport in

making purchase and withdrawing overseas cash. It can be used either over phone or

online at the merchants that uses accept only Master Card. The Cash Passport can be

privilege. They were mostly used by the people in the foreign countries instead of the

cash. Traveler’s cheque has been first issued in the January 1st 1772 by London Credit

Exchange Company for the use in close to 90 countries. In the year 1874, Thomas Cook

issued circular notes that had similar operation like that of traveler’s cheques.

History of Travel: Travel refereed to movement of the people in the distant geographic

locations. Reasons for travel included tourism, vacationing, recreation and the research

travel. Travelers might use human-powered transport like the automobiles, trains, public

transport and the airplanes(Wang, 2018). The motives behind the travel included

relaxation, exploration and discovery, knowing other cultures and building the

interpersonal relationships. During this time people either opted for traveler’s cheque or

carried sufficient liquid cash for meeting the travelers need.

What People use nowadays: People have nowadays completely become technology

freak and makes use of various travel apps. Nowadays every single person not only

carries a Smartphone, laptop, camera or tablet (Brynjolfsson & McAfee, 2014). People

have however opted ebooks in the form of travel guides and prefer reading books in the

Kindle format. Besides, people have also becomes smarter and prefer using cash passport

cards or travel card for financing their passports.

Cash Passport: It is a prepaid money card used for the travel. Cash Passports can be

used for paying services and goods, in store, online and in million locations across the

world (anz.com, 2019). While buying the card, individuals have the option for paying

either via the debit card or BPay. Individuals can however use the Cash Passport in

making purchase and withdrawing overseas cash. It can be used either over phone or

online at the merchants that uses accept only Master Card. The Cash Passport can be

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MANAGEMENT

reloaded by completion of bill payment, via transfer of cash or by visiting the branch of

ANZ bank.

Travel Card: This represents a card that allowed the individuals to lead international

currency so as to use it during the overseas travel (Ma et al. 2013). It allows withdrawing

cash from the ATM, online, in store and over phone. It can be used across thirty six

million locations across the world simply by choosing credit option.

Theme 4: Travel & Tourism Marketing

In order to ensure success in the tourism business, business relies on the

marketing professionals for linking the potential customers to the necessary operations and

service (Hudson & Thal, 2013). Nevertheless marketing for the travel and the tourism operations

involves the designing of the advertisements or the promotional offers that would attract the

customers towards the travel business.

ANZ Bank has promoted travelling international through easy, faster and secure money.

The bank thus undertakes the following steps(anz.com, 2019).

Sending the money securely and quickly with the International Money Transfer

Making payments to close to 99 countries across the word.

Sending of the foreign currency via the internet banking of ANZ without any

charges for making payments of $ 10,000 and more. However, charges of $12

apply for payment under the $10,000.

Ensures a reduced transfer fees for international money transfer from Australia to

all the other countries available on the Internet Banking

However, the tools and apps put forward by the bank include:

reloaded by completion of bill payment, via transfer of cash or by visiting the branch of

ANZ bank.

Travel Card: This represents a card that allowed the individuals to lead international

currency so as to use it during the overseas travel (Ma et al. 2013). It allows withdrawing

cash from the ATM, online, in store and over phone. It can be used across thirty six

million locations across the world simply by choosing credit option.

Theme 4: Travel & Tourism Marketing

In order to ensure success in the tourism business, business relies on the

marketing professionals for linking the potential customers to the necessary operations and

service (Hudson & Thal, 2013). Nevertheless marketing for the travel and the tourism operations

involves the designing of the advertisements or the promotional offers that would attract the

customers towards the travel business.

ANZ Bank has promoted travelling international through easy, faster and secure money.

The bank thus undertakes the following steps(anz.com, 2019).

Sending the money securely and quickly with the International Money Transfer

Making payments to close to 99 countries across the word.

Sending of the foreign currency via the internet banking of ANZ without any

charges for making payments of $ 10,000 and more. However, charges of $12

apply for payment under the $10,000.

Ensures a reduced transfer fees for international money transfer from Australia to

all the other countries available on the Internet Banking

However, the tools and apps put forward by the bank include:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MANAGEMENT

Currency converter: It is used for keeping a track on the currency conversions and the

exchange rates and thereby adopting strategies for aiding in travel and tourism marketing

(Blanc & Fare, 2013).

Internet Banking: It is necessary to order the foreign currency while an individual travels and

then checking and making international payments with the internet banking of ANZ.( Martins,

Oliveira & Popovič, 2014)

Currency through ANZ app: It is intuitive and simple and is a must have application for the

information related to foreign exchange information and conversion of currency (anz.com,

2019). It is also an important determinant of the strategies adopted for the travel and tourism

marketing.

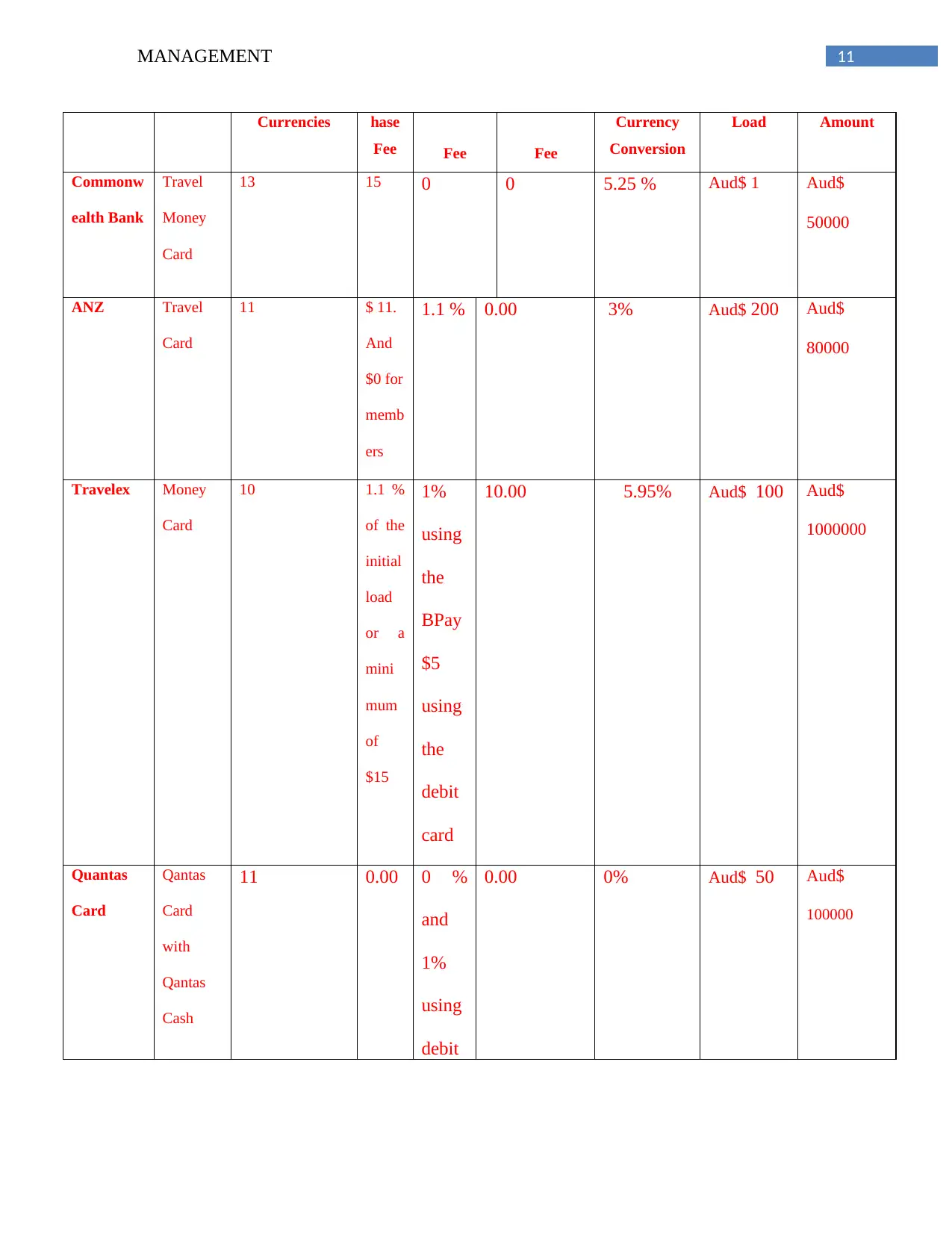

3. Analysis of the Competitors Product:

Travel money card like the Cash Passport product of ANZ Bank is a hassle free, safe,

prepaid reloadable card that is accepted by the shops, restaurants and the bars across the world.

Such cards can be ordered online or can be picked up from the branches of the local Post Office.

Prepaid travel card can store close to thirteen currencies. If an individual is travelling and is

planning for money then the travel card serves as the good idea.

In this report, a competitor analysis of Cash Passport is undertaken taking into

consideration similar travel cards of Commonwealth Bank, Qantas Card, Travelex, Australia

Post and Velocity Frequent Flyer. This can be represented in a tabular form as mentioned below:

Provider Product Available Purc Reload Closure Cross Minimum Maximum

Currency converter: It is used for keeping a track on the currency conversions and the

exchange rates and thereby adopting strategies for aiding in travel and tourism marketing

(Blanc & Fare, 2013).

Internet Banking: It is necessary to order the foreign currency while an individual travels and

then checking and making international payments with the internet banking of ANZ.( Martins,

Oliveira & Popovič, 2014)

Currency through ANZ app: It is intuitive and simple and is a must have application for the

information related to foreign exchange information and conversion of currency (anz.com,

2019). It is also an important determinant of the strategies adopted for the travel and tourism

marketing.

3. Analysis of the Competitors Product:

Travel money card like the Cash Passport product of ANZ Bank is a hassle free, safe,

prepaid reloadable card that is accepted by the shops, restaurants and the bars across the world.

Such cards can be ordered online or can be picked up from the branches of the local Post Office.

Prepaid travel card can store close to thirteen currencies. If an individual is travelling and is

planning for money then the travel card serves as the good idea.

In this report, a competitor analysis of Cash Passport is undertaken taking into

consideration similar travel cards of Commonwealth Bank, Qantas Card, Travelex, Australia

Post and Velocity Frequent Flyer. This can be represented in a tabular form as mentioned below:

Provider Product Available Purc Reload Closure Cross Minimum Maximum

11MANAGEMENT

Currencies hase

Fee Fee Fee

Currency

Conversion

Load Amount

Commonw

ealth Bank

Travel

Money

Card

13 15 0 0 5.25 % Aud$ 1 Aud$

50000

ANZ Travel

Card

11 $ 11.

And

$0 for

memb

ers

1.1 % 0.00 3% Aud$ 200 Aud$

80000

Travelex Money

Card

10 1.1 %

of the

initial

load

or a

mini

mum

of

$15

1%

using

the

BPay

$5

using

the

debit

card

10.00 5.95% Aud$ 100 Aud$

1000000

Quantas

Card

Qantas

Card

with

Qantas

Cash

11 0.00 0 %

and

1%

using

debit

0.00 0% Aud$ 50 Aud$

100000

Currencies hase

Fee Fee Fee

Currency

Conversion

Load Amount

Commonw

ealth Bank

Travel

Money

Card

13 15 0 0 5.25 % Aud$ 1 Aud$

50000

ANZ Travel

Card

11 $ 11.

And

$0 for

memb

ers

1.1 % 0.00 3% Aud$ 200 Aud$

80000

Travelex Money

Card

10 1.1 %

of the

initial

load

or a

mini

mum

of

$15

1%

using

the

BPay

$5

using

the

debit

card

10.00 5.95% Aud$ 100 Aud$

1000000

Quantas

Card

Qantas

Card

with

Qantas

Cash

11 0.00 0 %

and

1%

using

debit

0.00 0% Aud$ 50 Aud$

100000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.