Analysis of Financial Reports and Statements: Marshall Motor Holdings

VerifiedAdded on 2020/04/13

|21

|4181

|84

Project

AI Summary

This project report provides a comprehensive financial analysis of Marshall Motor Holdings PLC, focusing on its financial statements and performance within the automotive industry. The report begins with an introduction and company overview, followed by an industry analysis highlighting trends and market dynamics. The core of the report involves a detailed financial statement analysis, including calculations of sales, operating profit, earnings, and cash flow changes from 2015 to 2016. Ratio analysis is performed to evaluate liquidity, solvency, debt, and profitability positions, with data spanning several years. The analysis includes key metrics like net profit margin, return on equity, current ratio, acid test ratio, and debt-to-equity ratio. The report's findings reveal improvements in sales, operating profit, and other financial indicators, reflecting the company's enhanced market position and profitability. The report uses data from financial statements to provide a thorough evaluation of Marshall Motor Holdings PLC's financial health and performance.

Running Head: Financial reports and statements

1

Project Report: Financial reports and statements

1

Project Report: Financial reports and statements

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial reports and statements 2

Contents

Introduction.......................................................................................................................3

Company overview...........................................................................................................3

Industry Overview............................................................................................................3

Financial statement analysis.............................................................................................4

Ratio analysis................................................................................................................5

Horizontal analysis.....................................................................................................10

Conclusion......................................................................................................................14

References.......................................................................................................................15

Appendix.........................................................................................................................17

Contents

Introduction.......................................................................................................................3

Company overview...........................................................................................................3

Industry Overview............................................................................................................3

Financial statement analysis.............................................................................................4

Ratio analysis................................................................................................................5

Horizontal analysis.....................................................................................................10

Conclusion......................................................................................................................14

References.......................................................................................................................15

Appendix.........................................................................................................................17

Financial reports and statements 3

Introduction:

This report has been prepared to evaluate and identify the impact of the financial

statement of a company over various aspects and the variables of the company. Financial

statement is the main reports to analyze the performance and the position of the company in

terms of finance. Financial statement analysis is done by the financial analyst, chief financial

officer and the investors of the company to analyze and evaluate the position of the company

so that a better decision could be made. This analysis also assists the companies to evaluate

their market position so that the new diversifications, strategies and policies could be made.

In this report, automotive industry has been taken into the concern. This report has

been prepared over Marshall Motor Holdings plc. For this analysis, firstly an overview study

has been done over the company and the automotive industry. Further, various financial

analysis methods have been used to identify the changes into the financial position of the

company so that it could be evaluated that how the position of the company has been

enhanced.

Company overview:

Marshall Motor holdings plc is operating its business into international market. The

analysis over company depict that the primarily, this company evaluates and performs the

automotive industry’s work. This company is selling and repairing numerous vehicles related

to commercial and passenger’s purpose. Currently, this company has diversified its market

into 25 countries. 103 franchises of this company have contracted with 25 brands of

automotive industry to transport the vehicles into the global market (Home, 2017). This

company has 28 sites to manage and administer the operations and the performance of the

company. Through the analysis over the internal and external factors of the company, it has

been evaluated that the performance of the company has been enhanced and it assist the

company to manage the position of the company in the industry as well as in international

market.

Industry Overview:

Further, the overview study over the industry depict that the automotive industry is

growing up rapidly. The automotive industry share has been enhanced in the economy share.

Through the analysis over automotive industry, it has been found that the global presence of

the automotive industry is enhancing and due to it the performance of the companies which

Introduction:

This report has been prepared to evaluate and identify the impact of the financial

statement of a company over various aspects and the variables of the company. Financial

statement is the main reports to analyze the performance and the position of the company in

terms of finance. Financial statement analysis is done by the financial analyst, chief financial

officer and the investors of the company to analyze and evaluate the position of the company

so that a better decision could be made. This analysis also assists the companies to evaluate

their market position so that the new diversifications, strategies and policies could be made.

In this report, automotive industry has been taken into the concern. This report has

been prepared over Marshall Motor Holdings plc. For this analysis, firstly an overview study

has been done over the company and the automotive industry. Further, various financial

analysis methods have been used to identify the changes into the financial position of the

company so that it could be evaluated that how the position of the company has been

enhanced.

Company overview:

Marshall Motor holdings plc is operating its business into international market. The

analysis over company depict that the primarily, this company evaluates and performs the

automotive industry’s work. This company is selling and repairing numerous vehicles related

to commercial and passenger’s purpose. Currently, this company has diversified its market

into 25 countries. 103 franchises of this company have contracted with 25 brands of

automotive industry to transport the vehicles into the global market (Home, 2017). This

company has 28 sites to manage and administer the operations and the performance of the

company. Through the analysis over the internal and external factors of the company, it has

been evaluated that the performance of the company has been enhanced and it assist the

company to manage the position of the company in the industry as well as in international

market.

Industry Overview:

Further, the overview study over the industry depict that the automotive industry is

growing up rapidly. The automotive industry share has been enhanced in the economy share.

Through the analysis over automotive industry, it has been found that the global presence of

the automotive industry is enhancing and due to it the performance of the companies which

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial reports and statements 4

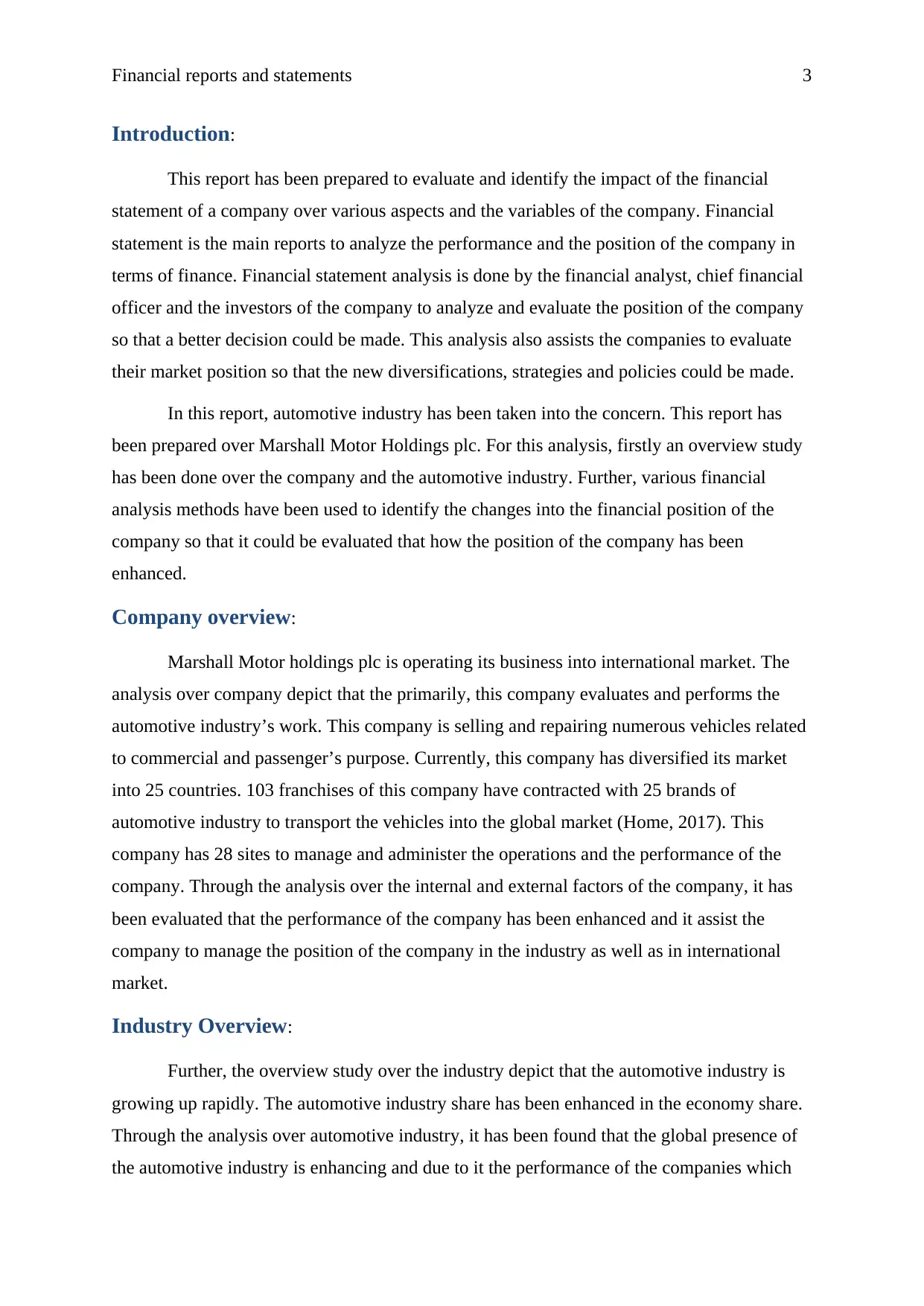

are performing their business under this industry is enhancing rapidly (Schlichting, 2013).

Further, it has been analyzed that the trends of 2017 express that the performance of the

companies in this industry have been enhanced:

(Strategy&, 2017)

The above graph depict that the operating margin of the industry has been enhanced

and depict about the better position of the industry in the market. Further, it has also been

analyzed that the total shareholder return of automotive industry has also been enhanced in

last 55 years. Through the study over an article, it has also been evaluated that the industry is

planning to set a new road map. This analysis depict that the various new changes have taken

place into the position and the performance of the company.

Further, it has also been analyzed that the companies of automotive industry have

planned various new strategies and the vehicles to enhance their market. The manufacturing

and the design of the vehicles are designed by the company in such a manner that the entire

clients of this industry could be satisfied and thus the revenue of the industry could also be

higher (Phillips and Stawarski, 2016). Currently the automobile rate of the international

market has also been enhanced.

Financial statement analysis:

For analyzing the performance of the MARSHALL MOTOR HOLDINGS PLC in a

better way, study has been done over the financial statement of the company. More, it has

also been analyzed that how much changes and what changes have taken place into the

performance and the position of the company. Further, it has also been analyzed that how

are performing their business under this industry is enhancing rapidly (Schlichting, 2013).

Further, it has been analyzed that the trends of 2017 express that the performance of the

companies in this industry have been enhanced:

(Strategy&, 2017)

The above graph depict that the operating margin of the industry has been enhanced

and depict about the better position of the industry in the market. Further, it has also been

analyzed that the total shareholder return of automotive industry has also been enhanced in

last 55 years. Through the study over an article, it has also been evaluated that the industry is

planning to set a new road map. This analysis depict that the various new changes have taken

place into the position and the performance of the company.

Further, it has also been analyzed that the companies of automotive industry have

planned various new strategies and the vehicles to enhance their market. The manufacturing

and the design of the vehicles are designed by the company in such a manner that the entire

clients of this industry could be satisfied and thus the revenue of the industry could also be

higher (Phillips and Stawarski, 2016). Currently the automobile rate of the international

market has also been enhanced.

Financial statement analysis:

For analyzing the performance of the MARSHALL MOTOR HOLDINGS PLC in a

better way, study has been done over the financial statement of the company. More, it has

also been analyzed that how much changes and what changes have taken place into the

performance and the position of the company. Further, it has also been analyzed that how

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial reports and statements 5

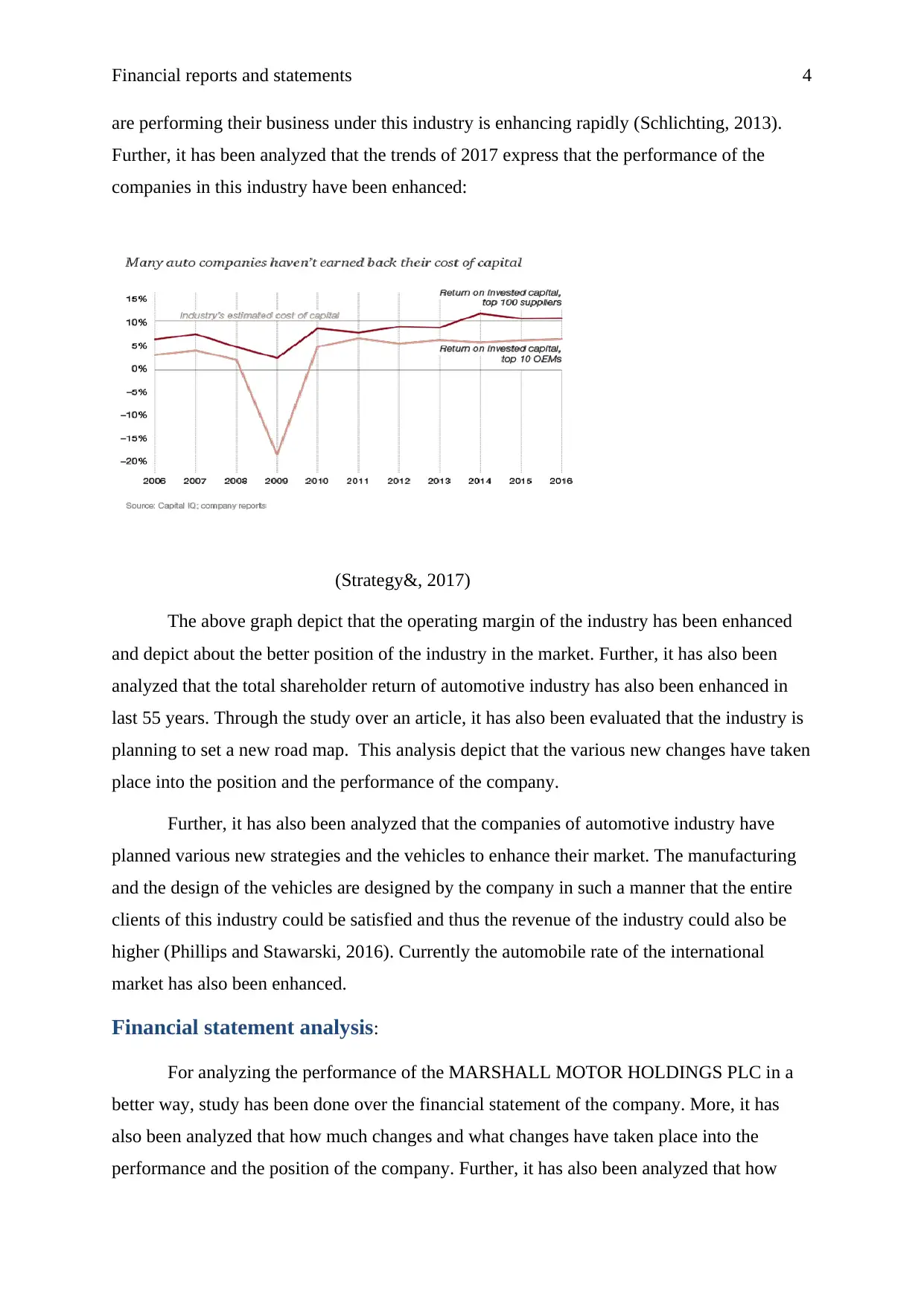

these changes have impacted the position of the company. Following are the few changes

which have taken place into the position of the company:

Calculation of the increment

2016 2015

Sales 1899405000 1232761000 54.08%

Operating profit 29054000 18246000 59.23%

Earnings 17762000 11721000 51.54%

Dividend payment 3251000 15448000 -78.96%

Market

capitalization 145638000 129884000 12.13%

Operating cash flow 80309000 25493000 215.02%

Capital expenditure 40754000 -2169000

-

1978.93%

Debt increment 85444000 28642000 198.32%

(Palicka, 2011)

The above statement and the table depict that various changes have taken place into

the position and the performance of the company. Through this analysis, it has been evaluated

that how this position have impacted the performance of the company. From the above table,

it has been found that the sales of the company have been enhanced in 2016 from 2015 by

54.08%. Further, it has also been found that the operating profit has also been enhanced with

the increment in the sales. More, the earnings of the company have also been enhanced due to

good increment in the total revenue of the company (Madhura, 2014).

More, it has also been found that the company has reduced the level of the dividend

payment to manage the funds in the organization. This has helped the comapny to raise the

funds through internal sources. More, the cash flow of the company in terms of operating

aspects has also been enhanced by 215.02%. And lastly, the study over capital expenditure

and debt increment depict that the organization has enhanced the funds through debt to

diversify the market and the expenditure of the company has also been enhanced.

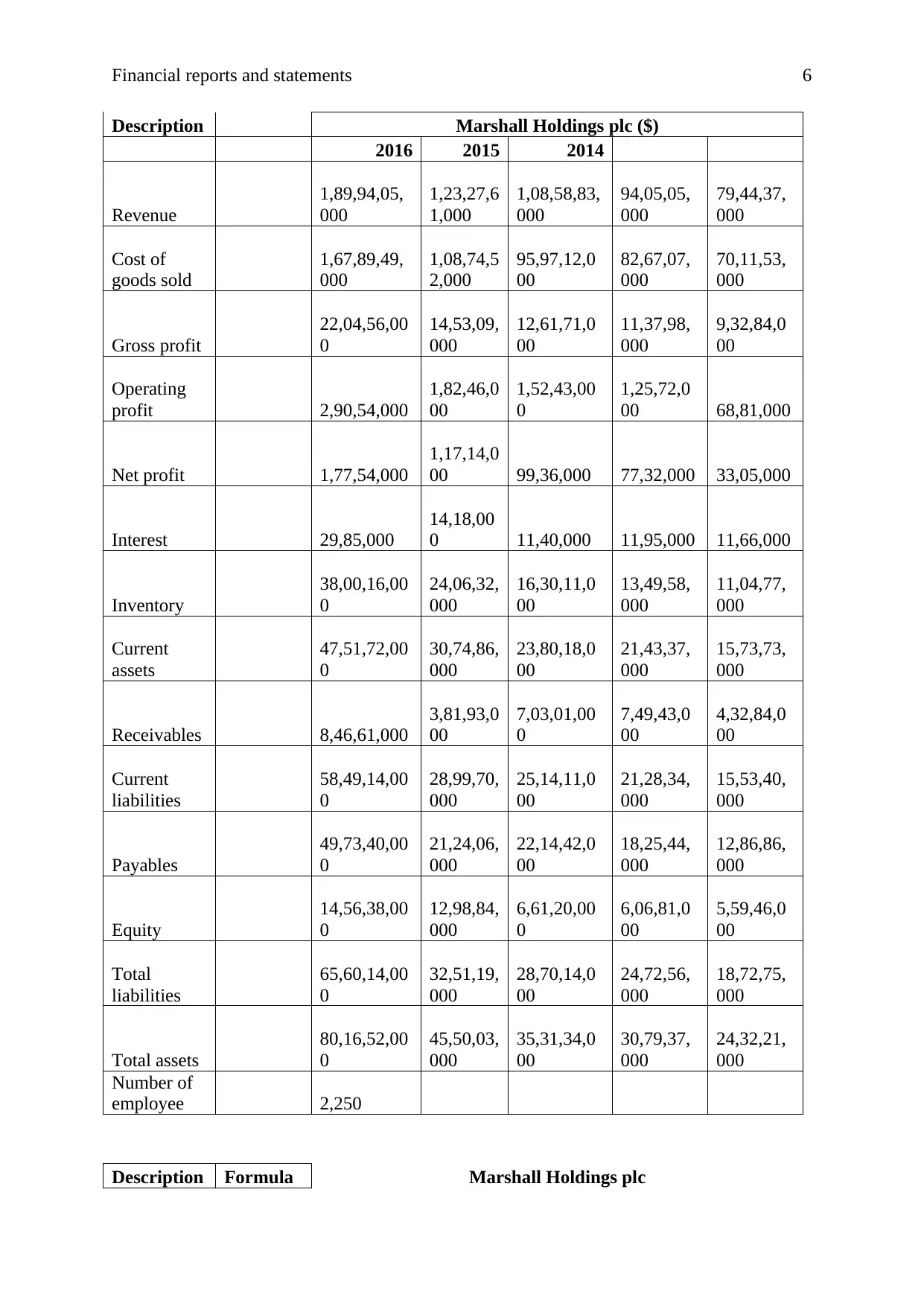

Ratio analysis:

Further, the study has been done over the liquidity position; solvency position, debt

position and the profitability position of the organization to identify the changes which have

taken place into the organization of the company. Following are the calculations of the ratio

analysis of the company:

Financial Data

these changes have impacted the position of the company. Following are the few changes

which have taken place into the position of the company:

Calculation of the increment

2016 2015

Sales 1899405000 1232761000 54.08%

Operating profit 29054000 18246000 59.23%

Earnings 17762000 11721000 51.54%

Dividend payment 3251000 15448000 -78.96%

Market

capitalization 145638000 129884000 12.13%

Operating cash flow 80309000 25493000 215.02%

Capital expenditure 40754000 -2169000

-

1978.93%

Debt increment 85444000 28642000 198.32%

(Palicka, 2011)

The above statement and the table depict that various changes have taken place into

the position and the performance of the company. Through this analysis, it has been evaluated

that how this position have impacted the performance of the company. From the above table,

it has been found that the sales of the company have been enhanced in 2016 from 2015 by

54.08%. Further, it has also been found that the operating profit has also been enhanced with

the increment in the sales. More, the earnings of the company have also been enhanced due to

good increment in the total revenue of the company (Madhura, 2014).

More, it has also been found that the company has reduced the level of the dividend

payment to manage the funds in the organization. This has helped the comapny to raise the

funds through internal sources. More, the cash flow of the company in terms of operating

aspects has also been enhanced by 215.02%. And lastly, the study over capital expenditure

and debt increment depict that the organization has enhanced the funds through debt to

diversify the market and the expenditure of the company has also been enhanced.

Ratio analysis:

Further, the study has been done over the liquidity position; solvency position, debt

position and the profitability position of the organization to identify the changes which have

taken place into the organization of the company. Following are the calculations of the ratio

analysis of the company:

Financial Data

Financial reports and statements 6

Description Marshall Holdings plc ($)

2016 2015 2014

Revenue

1,89,94,05,

000

1,23,27,6

1,000

1,08,58,83,

000

94,05,05,

000

79,44,37,

000

Cost of

goods sold

1,67,89,49,

000

1,08,74,5

2,000

95,97,12,0

00

82,67,07,

000

70,11,53,

000

Gross profit

22,04,56,00

0

14,53,09,

000

12,61,71,0

00

11,37,98,

000

9,32,84,0

00

Operating

profit 2,90,54,000

1,82,46,0

00

1,52,43,00

0

1,25,72,0

00 68,81,000

Net profit 1,77,54,000

1,17,14,0

00 99,36,000 77,32,000 33,05,000

Interest 29,85,000

14,18,00

0 11,40,000 11,95,000 11,66,000

Inventory

38,00,16,00

0

24,06,32,

000

16,30,11,0

00

13,49,58,

000

11,04,77,

000

Current

assets

47,51,72,00

0

30,74,86,

000

23,80,18,0

00

21,43,37,

000

15,73,73,

000

Receivables 8,46,61,000

3,81,93,0

00

7,03,01,00

0

7,49,43,0

00

4,32,84,0

00

Current

liabilities

58,49,14,00

0

28,99,70,

000

25,14,11,0

00

21,28,34,

000

15,53,40,

000

Payables

49,73,40,00

0

21,24,06,

000

22,14,42,0

00

18,25,44,

000

12,86,86,

000

Equity

14,56,38,00

0

12,98,84,

000

6,61,20,00

0

6,06,81,0

00

5,59,46,0

00

Total

liabilities

65,60,14,00

0

32,51,19,

000

28,70,14,0

00

24,72,56,

000

18,72,75,

000

Total assets

80,16,52,00

0

45,50,03,

000

35,31,34,0

00

30,79,37,

000

24,32,21,

000

Number of

employee 2,250

Description Formula Marshall Holdings plc

Description Marshall Holdings plc ($)

2016 2015 2014

Revenue

1,89,94,05,

000

1,23,27,6

1,000

1,08,58,83,

000

94,05,05,

000

79,44,37,

000

Cost of

goods sold

1,67,89,49,

000

1,08,74,5

2,000

95,97,12,0

00

82,67,07,

000

70,11,53,

000

Gross profit

22,04,56,00

0

14,53,09,

000

12,61,71,0

00

11,37,98,

000

9,32,84,0

00

Operating

profit 2,90,54,000

1,82,46,0

00

1,52,43,00

0

1,25,72,0

00 68,81,000

Net profit 1,77,54,000

1,17,14,0

00 99,36,000 77,32,000 33,05,000

Interest 29,85,000

14,18,00

0 11,40,000 11,95,000 11,66,000

Inventory

38,00,16,00

0

24,06,32,

000

16,30,11,0

00

13,49,58,

000

11,04,77,

000

Current

assets

47,51,72,00

0

30,74,86,

000

23,80,18,0

00

21,43,37,

000

15,73,73,

000

Receivables 8,46,61,000

3,81,93,0

00

7,03,01,00

0

7,49,43,0

00

4,32,84,0

00

Current

liabilities

58,49,14,00

0

28,99,70,

000

25,14,11,0

00

21,28,34,

000

15,53,40,

000

Payables

49,73,40,00

0

21,24,06,

000

22,14,42,0

00

18,25,44,

000

12,86,86,

000

Equity

14,56,38,00

0

12,98,84,

000

6,61,20,00

0

6,06,81,0

00

5,59,46,0

00

Total

liabilities

65,60,14,00

0

32,51,19,

000

28,70,14,0

00

24,72,56,

000

18,72,75,

000

Total assets

80,16,52,00

0

45,50,03,

000

35,31,34,0

00

30,79,37,

000

24,32,21,

000

Number of

employee 2,250

Description Formula Marshall Holdings plc

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial reports and statements 7

2016 2015 2014 2013 2012

Profitabilit

y

Net margin

Net

profit/reve

nues 0.93% 0.95% 0.92% 0.82% 0.42%

Return on

equity

Net

profit/Equ

ity 12.19% 9.02% 15.03% 12.74% 5.91%

Sales

employee

Sales /

number of

employee 844180

Liquidity

Current ratio

Current

assets/curr

ent

liabilities 0.81 1.06 0.95 1.01 1.01

Acid test

Current

assets-

Inventory/

current

liabilities 0.16 0.23 0.30 0.37 0.30

Efficiency

Receivables

collection

period

Receivabl

es/ Total

sales*365 16.27 11.31 23.63 29.08 19.89

Payables

collection

period

Payables/

Cost of

sales*365 108.12 71.29 84.22 80.60 66.99

Asset

turnover

ratio

Total

sales/

Total

assets 2.37 2.71 3.07 3.05 3.27

Solvency

Debt to

Equity Ratio

Debt/

Equity 4.50 2.50 4.34 4.07 3.35

Debt to

assets

Debt/

Total

assets 0.82 0.71 0.81 0.80 0.77

Interest

cover

EBIT /

interest

expenses 9.73 12.87 13.37 10.52 5.90

2016 2015 2014 2013 2012

Profitabilit

y

Net margin

Net

profit/reve

nues 0.93% 0.95% 0.92% 0.82% 0.42%

Return on

equity

Net

profit/Equ

ity 12.19% 9.02% 15.03% 12.74% 5.91%

Sales

employee

Sales /

number of

employee 844180

Liquidity

Current ratio

Current

assets/curr

ent

liabilities 0.81 1.06 0.95 1.01 1.01

Acid test

Current

assets-

Inventory/

current

liabilities 0.16 0.23 0.30 0.37 0.30

Efficiency

Receivables

collection

period

Receivabl

es/ Total

sales*365 16.27 11.31 23.63 29.08 19.89

Payables

collection

period

Payables/

Cost of

sales*365 108.12 71.29 84.22 80.60 66.99

Asset

turnover

ratio

Total

sales/

Total

assets 2.37 2.71 3.07 3.05 3.27

Solvency

Debt to

Equity Ratio

Debt/

Equity 4.50 2.50 4.34 4.07 3.35

Debt to

assets

Debt/

Total

assets 0.82 0.71 0.81 0.80 0.77

Interest

cover

EBIT /

interest

expenses 9.73 12.87 13.37 10.52 5.90

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial reports and statements 8

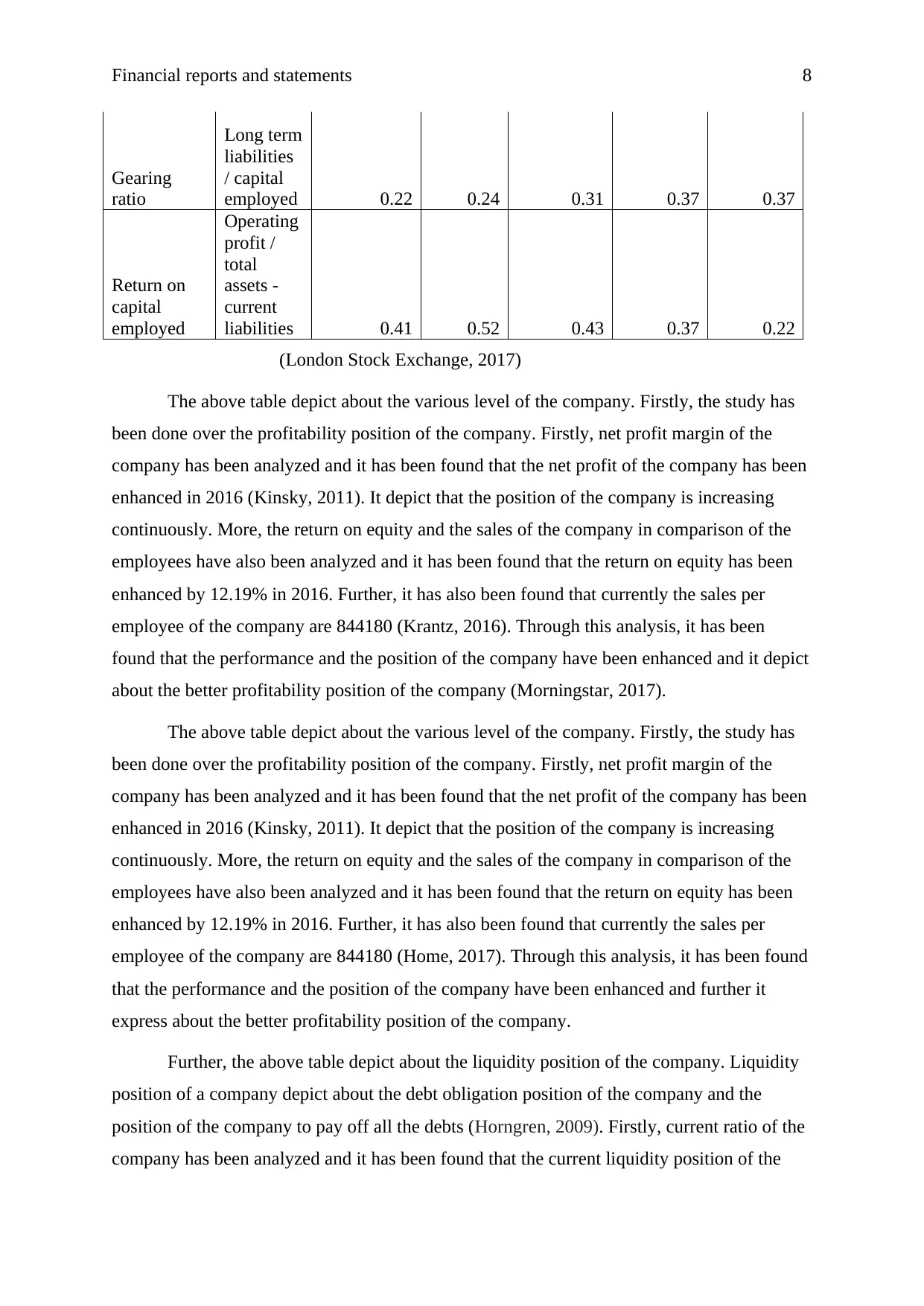

Gearing

ratio

Long term

liabilities

/ capital

employed 0.22 0.24 0.31 0.37 0.37

Return on

capital

employed

Operating

profit /

total

assets -

current

liabilities 0.41 0.52 0.43 0.37 0.22

(London Stock Exchange, 2017)

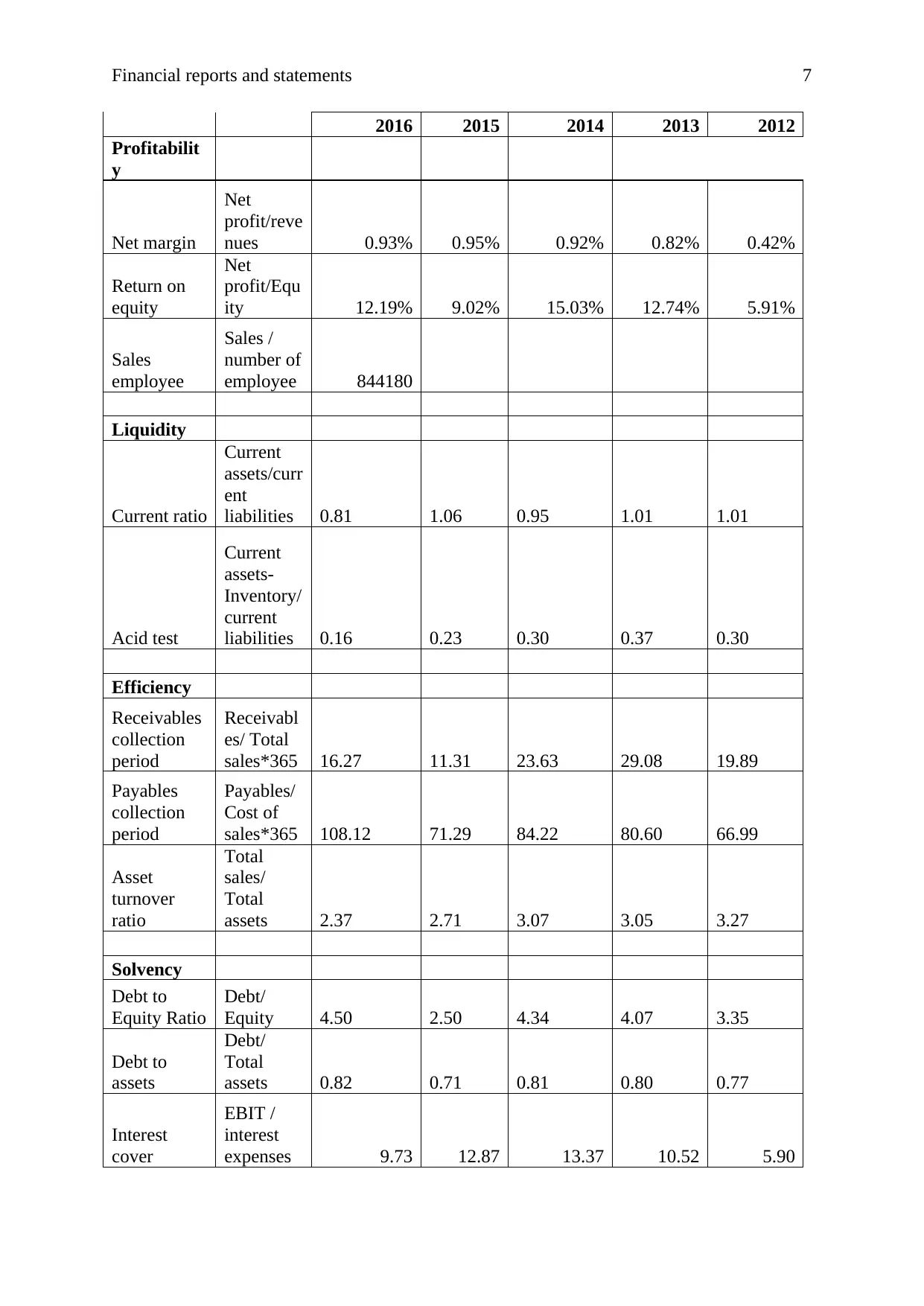

The above table depict about the various level of the company. Firstly, the study has

been done over the profitability position of the company. Firstly, net profit margin of the

company has been analyzed and it has been found that the net profit of the company has been

enhanced in 2016 (Kinsky, 2011). It depict that the position of the company is increasing

continuously. More, the return on equity and the sales of the company in comparison of the

employees have also been analyzed and it has been found that the return on equity has been

enhanced by 12.19% in 2016. Further, it has also been found that currently the sales per

employee of the company are 844180 (Krantz, 2016). Through this analysis, it has been

found that the performance and the position of the company have been enhanced and it depict

about the better profitability position of the company (Morningstar, 2017).

The above table depict about the various level of the company. Firstly, the study has

been done over the profitability position of the company. Firstly, net profit margin of the

company has been analyzed and it has been found that the net profit of the company has been

enhanced in 2016 (Kinsky, 2011). It depict that the position of the company is increasing

continuously. More, the return on equity and the sales of the company in comparison of the

employees have also been analyzed and it has been found that the return on equity has been

enhanced by 12.19% in 2016. Further, it has also been found that currently the sales per

employee of the company are 844180 (Home, 2017). Through this analysis, it has been found

that the performance and the position of the company have been enhanced and further it

express about the better profitability position of the company.

Further, the above table depict about the liquidity position of the company. Liquidity

position of a company depict about the debt obligation position of the company and the

position of the company to pay off all the debts (Horngren, 2009). Firstly, current ratio of the

company has been analyzed and it has been found that the current liquidity position of the

Gearing

ratio

Long term

liabilities

/ capital

employed 0.22 0.24 0.31 0.37 0.37

Return on

capital

employed

Operating

profit /

total

assets -

current

liabilities 0.41 0.52 0.43 0.37 0.22

(London Stock Exchange, 2017)

The above table depict about the various level of the company. Firstly, the study has

been done over the profitability position of the company. Firstly, net profit margin of the

company has been analyzed and it has been found that the net profit of the company has been

enhanced in 2016 (Kinsky, 2011). It depict that the position of the company is increasing

continuously. More, the return on equity and the sales of the company in comparison of the

employees have also been analyzed and it has been found that the return on equity has been

enhanced by 12.19% in 2016. Further, it has also been found that currently the sales per

employee of the company are 844180 (Krantz, 2016). Through this analysis, it has been

found that the performance and the position of the company have been enhanced and it depict

about the better profitability position of the company (Morningstar, 2017).

The above table depict about the various level of the company. Firstly, the study has

been done over the profitability position of the company. Firstly, net profit margin of the

company has been analyzed and it has been found that the net profit of the company has been

enhanced in 2016 (Kinsky, 2011). It depict that the position of the company is increasing

continuously. More, the return on equity and the sales of the company in comparison of the

employees have also been analyzed and it has been found that the return on equity has been

enhanced by 12.19% in 2016. Further, it has also been found that currently the sales per

employee of the company are 844180 (Home, 2017). Through this analysis, it has been found

that the performance and the position of the company have been enhanced and further it

express about the better profitability position of the company.

Further, the above table depict about the liquidity position of the company. Liquidity

position of a company depict about the debt obligation position of the company and the

position of the company to pay off all the debts (Horngren, 2009). Firstly, current ratio of the

company has been analyzed and it has been found that the current liquidity position of the

Financial reports and statements 9

company has been lowered in 2016. It depict that the position of the company and the

policies of reducing the level of the current assets in comparison of the current liabilities is a

great step. It would help the company to reduce the level of the extra expenditure. The

position of current liquidity position is better according to the industry debt obligation level

(Hopper, Northcott and Scapens, 2007). More, the quick liquidity ratio of the company has

been analyzed and it has been found that the quick position of the company has also been

lowered in 2016 in comparison of last 5years. Through this analysis, it has also been found

that the company is required to manage the level of the current assets except the inventories

of the company. Through this analysis, it has been found that the performance and the

position of the company have been enhanced and it depict about the better liquidity position

of the company, company is just required to enhance the level of the quick assets of the

company (Hansen, Mowen and Guan, 2007).

Further, the above table depict about the efficiency position of the company.

Efficiency position of a company depict about the total cash conversion process of the

company and the position of the company to manage all the operations and current assets and

liabilities in a perfect manner (Garrison, Noreen, Brewer and McGowan, 2010). Firstly,

receivable collection period of the company has been analyzed and it has been found that the

company has reduce the level of the collection period to get the debtors amount quickly. It

depict that the position of the company and the policies of collecting the debt amount has

been changed and it assist the company to manage the better position. It would help the

company to reduce the level of the extra expenditure (Elton, Gruber, Brown and Goetzmann,

2009). The position of cash collection position is better according to the industry and the

obligation of the company. More, the payment payable days of the company has also been

analyzed and it has been found that the total payment days of the company has also been

enhanced in 2016 in comparison of last 5years. Through this analysis, it has also been found

that the company has reduced the payment cycle to enhance the level of the cash in the

business (Hansen, Mowen and Madison, 2010). Through this analysis, it has been found that

the performance and the position of the company have been enhanced and the cash

conversion cycle of the company has also been better.

Lastly, the above table depict about the solvency position of the company. Solvency

position of a company depict about the total capital structure and the debt of the company in

comparison of various other variables of the company (DRURY, 2013). Firstly, debt to equity

ratio of the company has been analyzed and it has been found that the company has enhanced

company has been lowered in 2016. It depict that the position of the company and the

policies of reducing the level of the current assets in comparison of the current liabilities is a

great step. It would help the company to reduce the level of the extra expenditure. The

position of current liquidity position is better according to the industry debt obligation level

(Hopper, Northcott and Scapens, 2007). More, the quick liquidity ratio of the company has

been analyzed and it has been found that the quick position of the company has also been

lowered in 2016 in comparison of last 5years. Through this analysis, it has also been found

that the company is required to manage the level of the current assets except the inventories

of the company. Through this analysis, it has been found that the performance and the

position of the company have been enhanced and it depict about the better liquidity position

of the company, company is just required to enhance the level of the quick assets of the

company (Hansen, Mowen and Guan, 2007).

Further, the above table depict about the efficiency position of the company.

Efficiency position of a company depict about the total cash conversion process of the

company and the position of the company to manage all the operations and current assets and

liabilities in a perfect manner (Garrison, Noreen, Brewer and McGowan, 2010). Firstly,

receivable collection period of the company has been analyzed and it has been found that the

company has reduce the level of the collection period to get the debtors amount quickly. It

depict that the position of the company and the policies of collecting the debt amount has

been changed and it assist the company to manage the better position. It would help the

company to reduce the level of the extra expenditure (Elton, Gruber, Brown and Goetzmann,

2009). The position of cash collection position is better according to the industry and the

obligation of the company. More, the payment payable days of the company has also been

analyzed and it has been found that the total payment days of the company has also been

enhanced in 2016 in comparison of last 5years. Through this analysis, it has also been found

that the company has reduced the payment cycle to enhance the level of the cash in the

business (Hansen, Mowen and Madison, 2010). Through this analysis, it has been found that

the performance and the position of the company have been enhanced and the cash

conversion cycle of the company has also been better.

Lastly, the above table depict about the solvency position of the company. Solvency

position of a company depict about the total capital structure and the debt of the company in

comparison of various other variables of the company (DRURY, 2013). Firstly, debt to equity

ratio of the company has been analyzed and it has been found that the company has enhanced

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Financial reports and statements 10

the level of the debt in comparison on the equity to reduce the level of the cost in the

company. It depict that the position of the company and the policies of managing the debt and

equity has been changed but it has impacted over the risk level of the company (Bhimani,

Horngren, Datar and Foster, 2008). Further, the debt to assets level of the company has also

been analyzed and it has been found that the debt level of the company has enhanced in

comparison of total assets in last 5 years. Through this analysis, it has also been found that

the company has managed the debt, equity and total assets level to manage the performance

and the position of the company. Through this analysis, it has been found that the

performance and the position of the company have been enhanced and the company is

required to reduce the level of the debt and equity.

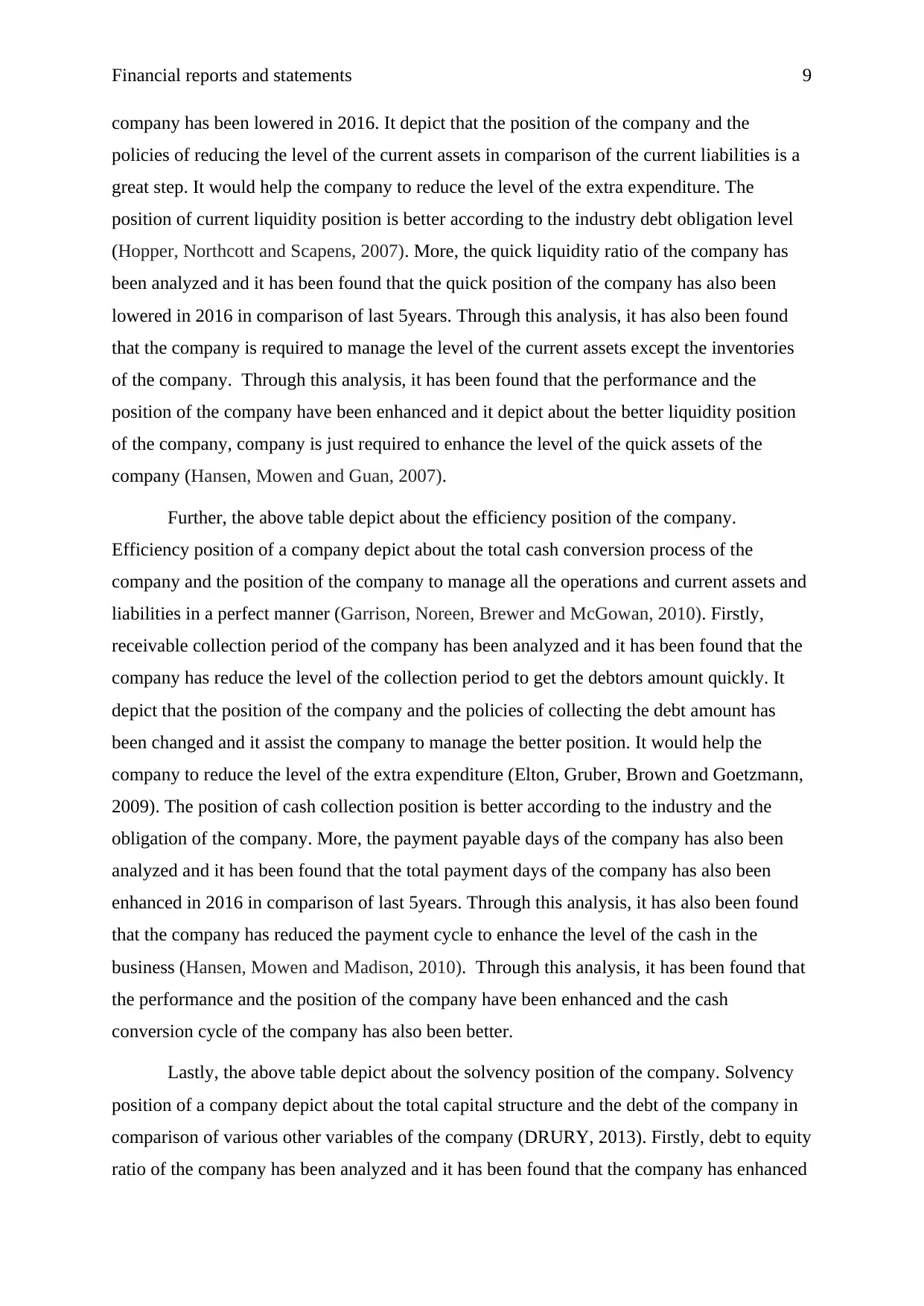

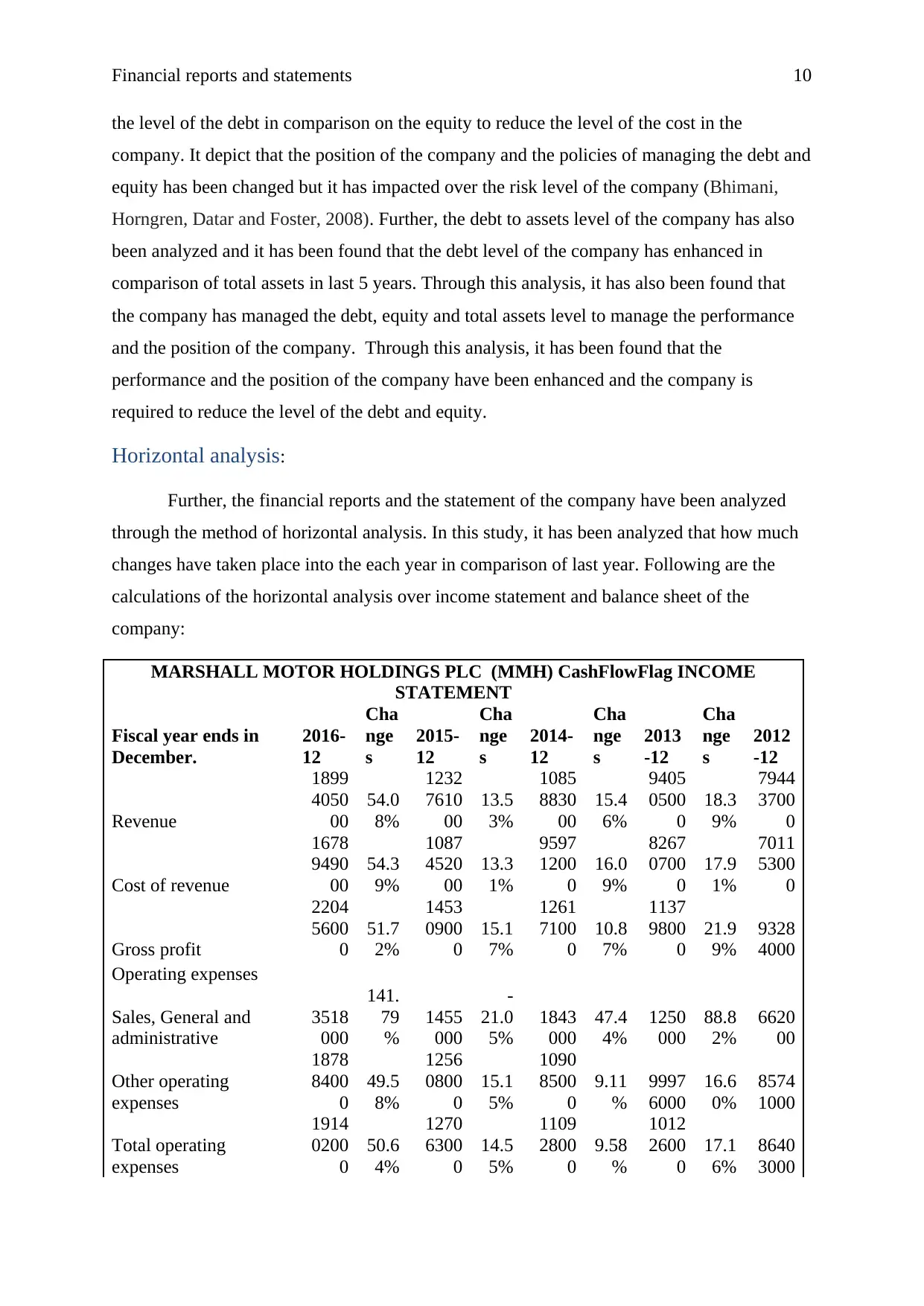

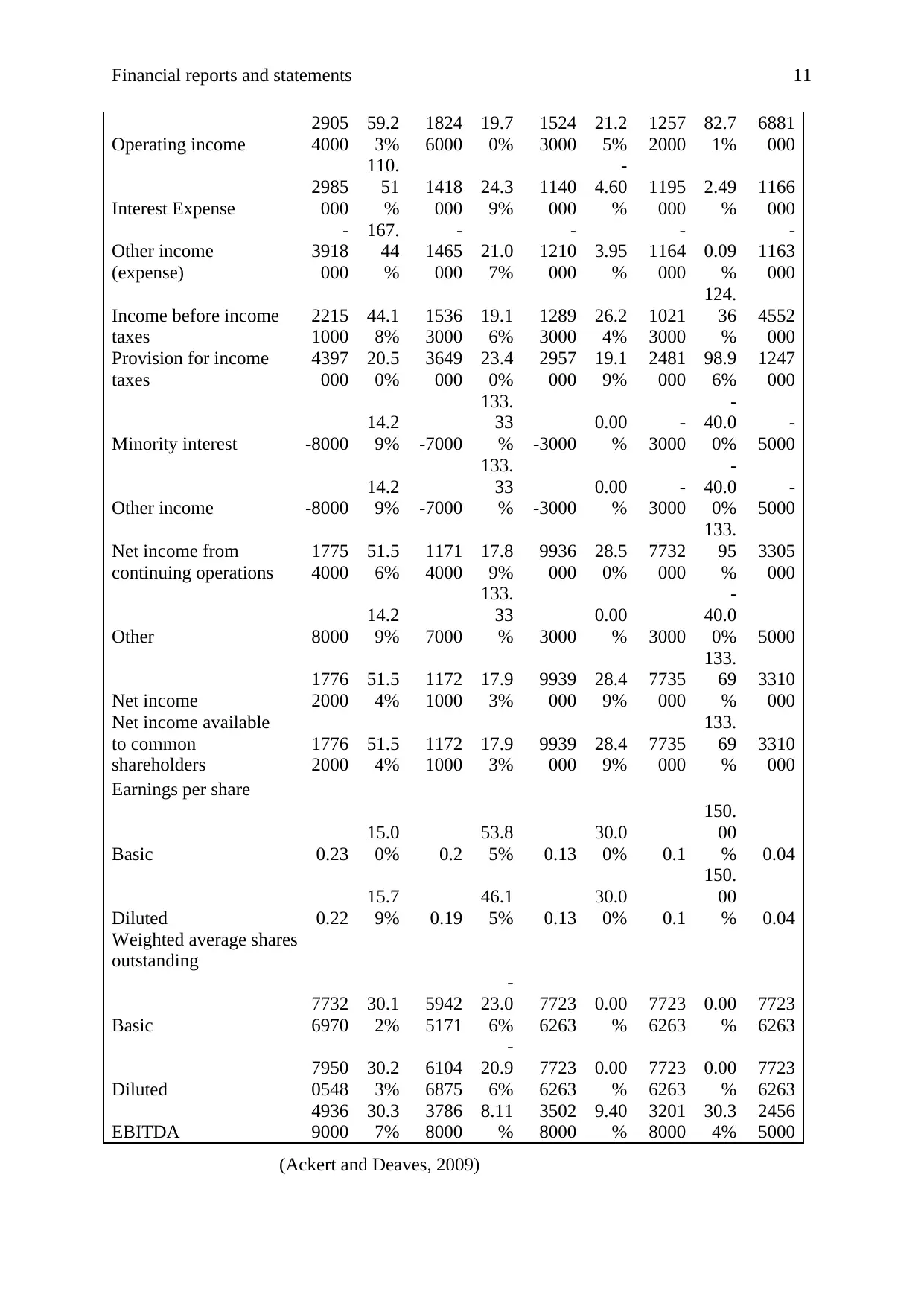

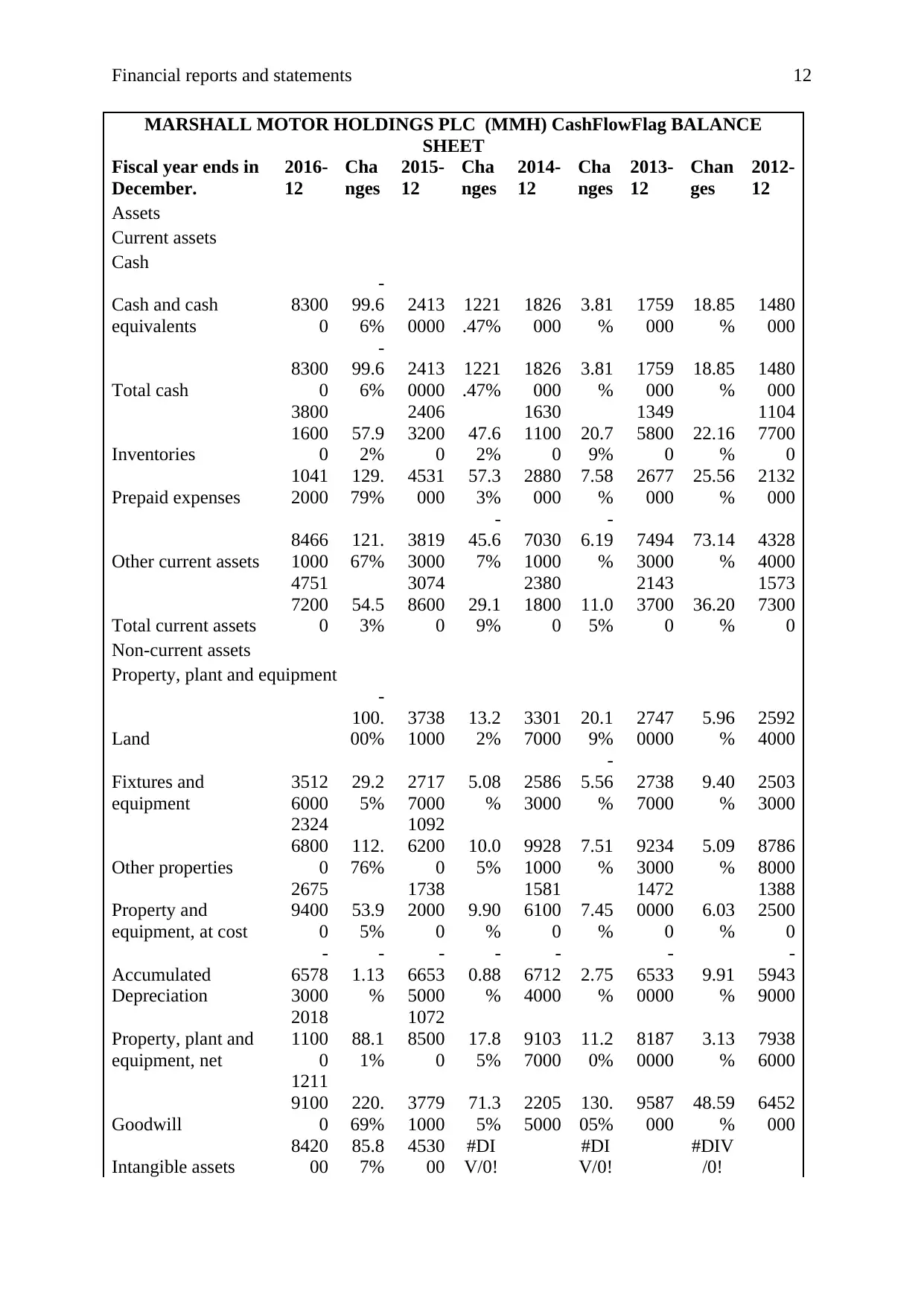

Horizontal analysis:

Further, the financial reports and the statement of the company have been analyzed

through the method of horizontal analysis. In this study, it has been analyzed that how much

changes have taken place into the each year in comparison of last year. Following are the

calculations of the horizontal analysis over income statement and balance sheet of the

company:

MARSHALL MOTOR HOLDINGS PLC (MMH) CashFlowFlag INCOME

STATEMENT

Fiscal year ends in

December.

2016-

12

Cha

nge

s

2015-

12

Cha

nge

s

2014-

12

Cha

nge

s

2013

-12

Cha

nge

s

2012

-12

Revenue

1899

4050

00

54.0

8%

1232

7610

00

13.5

3%

1085

8830

00

15.4

6%

9405

0500

0

18.3

9%

7944

3700

0

Cost of revenue

1678

9490

00

54.3

9%

1087

4520

00

13.3

1%

9597

1200

0

16.0

9%

8267

0700

0

17.9

1%

7011

5300

0

Gross profit

2204

5600

0

51.7

2%

1453

0900

0

15.1

7%

1261

7100

0

10.8

7%

1137

9800

0

21.9

9%

9328

4000

Operating expenses

Sales, General and

administrative

3518

000

141.

79

%

1455

000

-

21.0

5%

1843

000

47.4

4%

1250

000

88.8

2%

6620

00

Other operating

expenses

1878

8400

0

49.5

8%

1256

0800

0

15.1

5%

1090

8500

0

9.11

%

9997

6000

16.6

0%

8574

1000

Total operating

expenses

1914

0200

0

50.6

4%

1270

6300

0

14.5

5%

1109

2800

0

9.58

%

1012

2600

0

17.1

6%

8640

3000

the level of the debt in comparison on the equity to reduce the level of the cost in the

company. It depict that the position of the company and the policies of managing the debt and

equity has been changed but it has impacted over the risk level of the company (Bhimani,

Horngren, Datar and Foster, 2008). Further, the debt to assets level of the company has also

been analyzed and it has been found that the debt level of the company has enhanced in

comparison of total assets in last 5 years. Through this analysis, it has also been found that

the company has managed the debt, equity and total assets level to manage the performance

and the position of the company. Through this analysis, it has been found that the

performance and the position of the company have been enhanced and the company is

required to reduce the level of the debt and equity.

Horizontal analysis:

Further, the financial reports and the statement of the company have been analyzed

through the method of horizontal analysis. In this study, it has been analyzed that how much

changes have taken place into the each year in comparison of last year. Following are the

calculations of the horizontal analysis over income statement and balance sheet of the

company:

MARSHALL MOTOR HOLDINGS PLC (MMH) CashFlowFlag INCOME

STATEMENT

Fiscal year ends in

December.

2016-

12

Cha

nge

s

2015-

12

Cha

nge

s

2014-

12

Cha

nge

s

2013

-12

Cha

nge

s

2012

-12

Revenue

1899

4050

00

54.0

8%

1232

7610

00

13.5

3%

1085

8830

00

15.4

6%

9405

0500

0

18.3

9%

7944

3700

0

Cost of revenue

1678

9490

00

54.3

9%

1087

4520

00

13.3

1%

9597

1200

0

16.0

9%

8267

0700

0

17.9

1%

7011

5300

0

Gross profit

2204

5600

0

51.7

2%

1453

0900

0

15.1

7%

1261

7100

0

10.8

7%

1137

9800

0

21.9

9%

9328

4000

Operating expenses

Sales, General and

administrative

3518

000

141.

79

%

1455

000

-

21.0

5%

1843

000

47.4

4%

1250

000

88.8

2%

6620

00

Other operating

expenses

1878

8400

0

49.5

8%

1256

0800

0

15.1

5%

1090

8500

0

9.11

%

9997

6000

16.6

0%

8574

1000

Total operating

expenses

1914

0200

0

50.6

4%

1270

6300

0

14.5

5%

1109

2800

0

9.58

%

1012

2600

0

17.1

6%

8640

3000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial reports and statements 11

Operating income

2905

4000

59.2

3%

1824

6000

19.7

0%

1524

3000

21.2

5%

1257

2000

82.7

1%

6881

000

Interest Expense

2985

000

110.

51

%

1418

000

24.3

9%

1140

000

-

4.60

%

1195

000

2.49

%

1166

000

Other income

(expense)

-

3918

000

167.

44

%

-

1465

000

21.0

7%

-

1210

000

3.95

%

-

1164

000

0.09

%

-

1163

000

Income before income

taxes

2215

1000

44.1

8%

1536

3000

19.1

6%

1289

3000

26.2

4%

1021

3000

124.

36

%

4552

000

Provision for income

taxes

4397

000

20.5

0%

3649

000

23.4

0%

2957

000

19.1

9%

2481

000

98.9

6%

1247

000

Minority interest -8000

14.2

9% -7000

133.

33

% -3000

0.00

%

-

3000

-

40.0

0%

-

5000

Other income -8000

14.2

9% -7000

133.

33

% -3000

0.00

%

-

3000

-

40.0

0%

-

5000

Net income from

continuing operations

1775

4000

51.5

6%

1171

4000

17.8

9%

9936

000

28.5

0%

7732

000

133.

95

%

3305

000

Other 8000

14.2

9% 7000

133.

33

% 3000

0.00

% 3000

-

40.0

0% 5000

Net income

1776

2000

51.5

4%

1172

1000

17.9

3%

9939

000

28.4

9%

7735

000

133.

69

%

3310

000

Net income available

to common

shareholders

1776

2000

51.5

4%

1172

1000

17.9

3%

9939

000

28.4

9%

7735

000

133.

69

%

3310

000

Earnings per share

Basic 0.23

15.0

0% 0.2

53.8

5% 0.13

30.0

0% 0.1

150.

00

% 0.04

Diluted 0.22

15.7

9% 0.19

46.1

5% 0.13

30.0

0% 0.1

150.

00

% 0.04

Weighted average shares

outstanding

Basic

7732

6970

30.1

2%

5942

5171

-

23.0

6%

7723

6263

0.00

%

7723

6263

0.00

%

7723

6263

Diluted

7950

0548

30.2

3%

6104

6875

-

20.9

6%

7723

6263

0.00

%

7723

6263

0.00

%

7723

6263

EBITDA

4936

9000

30.3

7%

3786

8000

8.11

%

3502

8000

9.40

%

3201

8000

30.3

4%

2456

5000

(Ackert and Deaves, 2009)

Operating income

2905

4000

59.2

3%

1824

6000

19.7

0%

1524

3000

21.2

5%

1257

2000

82.7

1%

6881

000

Interest Expense

2985

000

110.

51

%

1418

000

24.3

9%

1140

000

-

4.60

%

1195

000

2.49

%

1166

000

Other income

(expense)

-

3918

000

167.

44

%

-

1465

000

21.0

7%

-

1210

000

3.95

%

-

1164

000

0.09

%

-

1163

000

Income before income

taxes

2215

1000

44.1

8%

1536

3000

19.1

6%

1289

3000

26.2

4%

1021

3000

124.

36

%

4552

000

Provision for income

taxes

4397

000

20.5

0%

3649

000

23.4

0%

2957

000

19.1

9%

2481

000

98.9

6%

1247

000

Minority interest -8000

14.2

9% -7000

133.

33

% -3000

0.00

%

-

3000

-

40.0

0%

-

5000

Other income -8000

14.2

9% -7000

133.

33

% -3000

0.00

%

-

3000

-

40.0

0%

-

5000

Net income from

continuing operations

1775

4000

51.5

6%

1171

4000

17.8

9%

9936

000

28.5

0%

7732

000

133.

95

%

3305

000

Other 8000

14.2

9% 7000

133.

33

% 3000

0.00

% 3000

-

40.0

0% 5000

Net income

1776

2000

51.5

4%

1172

1000

17.9

3%

9939

000

28.4

9%

7735

000

133.

69

%

3310

000

Net income available

to common

shareholders

1776

2000

51.5

4%

1172

1000

17.9

3%

9939

000

28.4

9%

7735

000

133.

69

%

3310

000

Earnings per share

Basic 0.23

15.0

0% 0.2

53.8

5% 0.13

30.0

0% 0.1

150.

00

% 0.04

Diluted 0.22

15.7

9% 0.19

46.1

5% 0.13

30.0

0% 0.1

150.

00

% 0.04

Weighted average shares

outstanding

Basic

7732

6970

30.1

2%

5942

5171

-

23.0

6%

7723

6263

0.00

%

7723

6263

0.00

%

7723

6263

Diluted

7950

0548

30.2

3%

6104

6875

-

20.9

6%

7723

6263

0.00

%

7723

6263

0.00

%

7723

6263

EBITDA

4936

9000

30.3

7%

3786

8000

8.11

%

3502

8000

9.40

%

3201

8000

30.3

4%

2456

5000

(Ackert and Deaves, 2009)

Financial reports and statements 12

MARSHALL MOTOR HOLDINGS PLC (MMH) CashFlowFlag BALANCE

SHEET

Fiscal year ends in

December.

2016-

12

Cha

nges

2015-

12

Cha

nges

2014-

12

Cha

nges

2013-

12

Chan

ges

2012-

12

Assets

Current assets

Cash

Cash and cash

equivalents

8300

0

-

99.6

6%

2413

0000

1221

.47%

1826

000

3.81

%

1759

000

18.85

%

1480

000

Total cash

8300

0

-

99.6

6%

2413

0000

1221

.47%

1826

000

3.81

%

1759

000

18.85

%

1480

000

Inventories

3800

1600

0

57.9

2%

2406

3200

0

47.6

2%

1630

1100

0

20.7

9%

1349

5800

0

22.16

%

1104

7700

0

Prepaid expenses

1041

2000

129.

79%

4531

000

57.3

3%

2880

000

7.58

%

2677

000

25.56

%

2132

000

Other current assets

8466

1000

121.

67%

3819

3000

-

45.6

7%

7030

1000

-

6.19

%

7494

3000

73.14

%

4328

4000

Total current assets

4751

7200

0

54.5

3%

3074

8600

0

29.1

9%

2380

1800

0

11.0

5%

2143

3700

0

36.20

%

1573

7300

0

Non-current assets

Property, plant and equipment

Land

-

100.

00%

3738

1000

13.2

2%

3301

7000

20.1

9%

2747

0000

5.96

%

2592

4000

Fixtures and

equipment

3512

6000

29.2

5%

2717

7000

5.08

%

2586

3000

-

5.56

%

2738

7000

9.40

%

2503

3000

Other properties

2324

6800

0

112.

76%

1092

6200

0

10.0

5%

9928

1000

7.51

%

9234

3000

5.09

%

8786

8000

Property and

equipment, at cost

2675

9400

0

53.9

5%

1738

2000

0

9.90

%

1581

6100

0

7.45

%

1472

0000

0

6.03

%

1388

2500

0

Accumulated

Depreciation

-

6578

3000

-

1.13

%

-

6653

5000

-

0.88

%

-

6712

4000

2.75

%

-

6533

0000

9.91

%

-

5943

9000

Property, plant and

equipment, net

2018

1100

0

88.1

1%

1072

8500

0

17.8

5%

9103

7000

11.2

0%

8187

0000

3.13

%

7938

6000

Goodwill

1211

9100

0

220.

69%

3779

1000

71.3

5%

2205

5000

130.

05%

9587

000

48.59

%

6452

000

Intangible assets

8420

00

85.8

7%

4530

00

#DI

V/0!

#DI

V/0!

#DIV

/0!

MARSHALL MOTOR HOLDINGS PLC (MMH) CashFlowFlag BALANCE

SHEET

Fiscal year ends in

December.

2016-

12

Cha

nges

2015-

12

Cha

nges

2014-

12

Cha

nges

2013-

12

Chan

ges

2012-

12

Assets

Current assets

Cash

Cash and cash

equivalents

8300

0

-

99.6

6%

2413

0000

1221

.47%

1826

000

3.81

%

1759

000

18.85

%

1480

000

Total cash

8300

0

-

99.6

6%

2413

0000

1221

.47%

1826

000

3.81

%

1759

000

18.85

%

1480

000

Inventories

3800

1600

0

57.9

2%

2406

3200

0

47.6

2%

1630

1100

0

20.7

9%

1349

5800

0

22.16

%

1104

7700

0

Prepaid expenses

1041

2000

129.

79%

4531

000

57.3

3%

2880

000

7.58

%

2677

000

25.56

%

2132

000

Other current assets

8466

1000

121.

67%

3819

3000

-

45.6

7%

7030

1000

-

6.19

%

7494

3000

73.14

%

4328

4000

Total current assets

4751

7200

0

54.5

3%

3074

8600

0

29.1

9%

2380

1800

0

11.0

5%

2143

3700

0

36.20

%

1573

7300

0

Non-current assets

Property, plant and equipment

Land

-

100.

00%

3738

1000

13.2

2%

3301

7000

20.1

9%

2747

0000

5.96

%

2592

4000

Fixtures and

equipment

3512

6000

29.2

5%

2717

7000

5.08

%

2586

3000

-

5.56

%

2738

7000

9.40

%

2503

3000

Other properties

2324

6800

0

112.

76%

1092

6200

0

10.0

5%

9928

1000

7.51

%

9234

3000

5.09

%

8786

8000

Property and

equipment, at cost

2675

9400

0

53.9

5%

1738

2000

0

9.90

%

1581

6100

0

7.45

%

1472

0000

0

6.03

%

1388

2500

0

Accumulated

Depreciation

-

6578

3000

-

1.13

%

-

6653

5000

-

0.88

%

-

6712

4000

2.75

%

-

6533

0000

9.91

%

-

5943

9000

Property, plant and

equipment, net

2018

1100

0

88.1

1%

1072

8500

0

17.8

5%

9103

7000

11.2

0%

8187

0000

3.13

%

7938

6000

Goodwill

1211

9100

0

220.

69%

3779

1000

71.3

5%

2205

5000

130.

05%

9587

000

48.59

%

6452

000

Intangible assets

8420

00

85.8

7%

4530

00

#DI

V/0!

#DI

V/0!

#DIV

/0!

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.